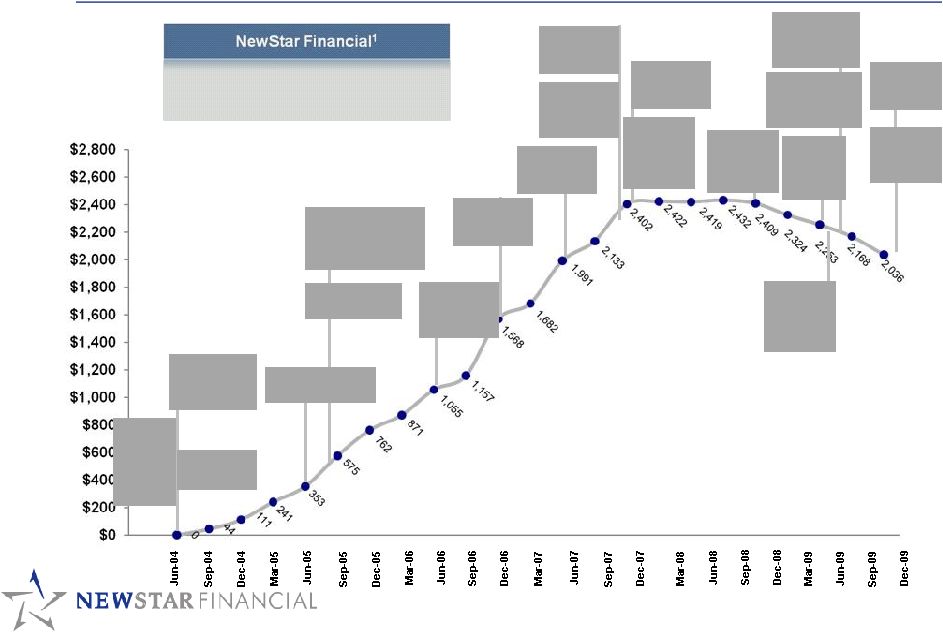

16 House values peak Record M&A and capital markets activity Tightening credit spreads Loose credit standards (2 nd lien, Covevent lite, PIK Toggle) Easy access to capital / New entrants in loan markets Subprime Crisis Financial Crisis Recession Asset Bubble 2005-2006 2007 2009 2008 Housing bubble bursts Massive writedowns of MBS / CDOs Other credit markets peak SIVs begin to unwind and ABCP market collapses Syndicated loan and CLO market shuts down in second half Banks begin to pull warehouse lines Macro Environment Access to capital severely constrained as markets freeze Banks forced to de-lever and build reserves High profile failures of top tier banks and other non-bank lenders Government coordinates massive intervention and bailout Economy contracts sharply Banking system stabilizes and congress passes economic stimulus bill Credit losses worsen as CRE markets collapse and consumer markets weaken further Over 100 banks fail Credit spreads begin to tighten as market conditions improve Financial industry consolidation gains momentum Overview Managing through the financial crisis Raised $850 million through two CLOs Raised $100 million of corporate debt Raised $235 million in IPO Added over $1 bn of warehouse line borrowing capacity Substantial growth through direct origination Focused on senior debt Reduced scale of planned CRE and Structured Products lending platforms Completed $600 million CLO to fund balance sheet and $560 million CLO to fund NCOF Completed $300 million term debt financing Raised $125 mn of equity capital in PIPE transaction Maintained growth trajectory and warehouse lines, but curtailed syndications activity Sold securities portfolio and exited structured products segment Began to assess alternative funding models Shifted to defensive posture to preserve liquidity and protect balance sheet Slowed origination activity and began to pursue depository strategy Increased term debt by $100 million Maintained profitability, while increasing reserves Entered agreement to acquire commercial bank and explored opportunities to participate in government programs Completed extensive regulatory review process before withdrawing applications and terminating bank acquisition Restructured balance sheet, reducing short-term debt by 82% and total debt by $340 million Experienced elevated credit costs, but outperformed benchmarks Right-sized cost base Positioned company to be survivor and capitalize on emerging opportunities Issued first CLO since market collapsed Issued $75 million of revolving Holdco credit notes |