| | |

| |  |

| |

| | Stacie S. Aarestad +1 617 239 0314 saarestad@edwardswildman.com |

April 1, 2014

BY EDGAR SUBMISSION

Securities and Exchange Commission

100 F Street, N.E.

Mail Stop 4720

Washington, D.C. 20549

Attention: Michael Volley, Staff Accountant

| | |

| Re: | | NewStar Financial, Inc. |

| | Form10-K for the fiscal year ended December 31, 2012 |

| | Filed March 1, 2013 |

| | Form 10-Q for quarterly period ended September 30, 2013 |

| | Filed November 6, 2013 |

| | File No.001-33211 |

Dear Mr. Volley:

On behalf of NewStar Financial, Inc. (“NewStar” or the “Company”), we submit this letter in response to the comment provided to NewStar from the staff of the Securities and Exchange Commission (the “Staff”), in a letter dated March 13, 2014 (the “Letter”), relating to NewStar’s Form10-K for the fiscal year ended December 31, 2012 (the “Form10-K”) andForm 10-Q for the period ended September 30, 2013 (collectively, the “Reports”). Set forth below is the Staff’s comment followed by the Company’s response. The response is keyed to the numbering of the comment in the Letter and appears following the comment, which is restated below in italics. The factual statements and information set forth below are based entirely on information furnished to us by the Company and its representatives, which we have not independently verified. All statements of belief are the belief of the Company.

Form10-Q for the quarterly period ended September 30, 2013

Financial Statements (Unaudited)

Notes to Condensed Consolidated Financial Statements

Note 10. Consolidated Variable Interest Entity, page 29

| 1. | We note your response to comment 1 in your letter dated March 10, 2014 and, in particular, your determination that the loans held in the Arlington Fund are classified and accounted for as held for investment. In order for us to better understand your accounting for these loans, please: |

| | a. | Explain in more detail, the structure of thetwo-step warehouse to CLO financing arrangement. Specifically, identify the entities that own the loan from origination to the final securitization and indicate which of these entities are or would be consolidated based on your current expectations. |

Securities and Exchange Commission

April 1, 2014

Page 2

RESPONSE:

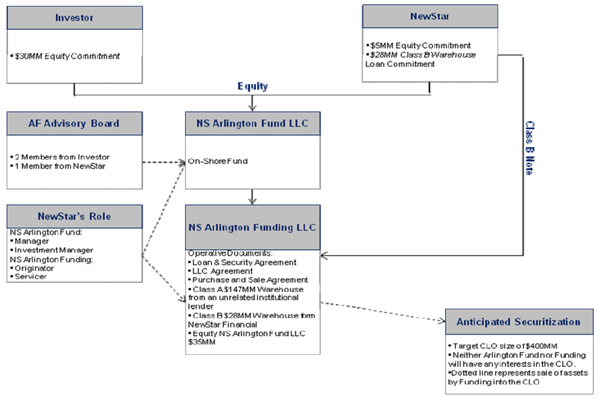

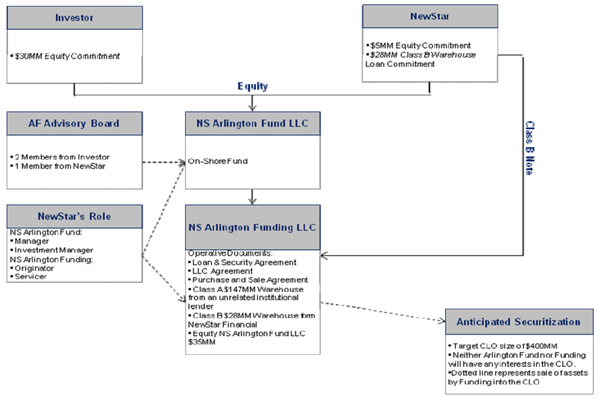

Below is a schematic of the various entities involved with the Arlington Fund and their respective roles in the arrangement:

NewStar closed a leveraged credit fund, Arlington Fund (as defined below), in April 2013 with a third-party institutional investor providing a $30 million capital commitment and a $5 million capital commitment from NewStar. Leverage was also provided through a warehouse credit facility funded by an unrelated institutional lender (the “Class A Notes”) and NewStar (the “Class B Notes”), (collectively, the “Warehouse Facilities”) in the amount of $147 million and $28 million, respectively.

Securities and Exchange Commission

April 1, 2014

Page 3

The investment objective of the Arlington Fund is to invest in loans originated by NewStar’s Leveraged Finance lending group and to generate leveraged returns through an investment strategy focused on the acquisition, directly or indirectly, of a portfolio of senior, secured term loan debt of middle market companies (collectively, the “Portfolio Investments”). NewStar is the Managing Member of the Arlington Fund, as well as its Investment Manager. Together with all other assets, such as cash and receivables, owned by the Arlington Fund, the Portfolio Investments provide eligible collateral for financing that are employed by the Arlington Fund to enhance the size of the investment portfolio and magnify the returns generated by the Portfolio Investments.

The Arlington Fund structure was established with NewStar Arlington Fund LLC and its wholly owned subsidiary NewStar Arlington Funding LLC (collectively referred to as “Arlington Fund”). The Portfolio Investments may consist of, among other assets, loans originated or acquired by NewStar directly or through club, syndicated transactions, in which Arlington Fund participates as a lender at origination or by assignment, or purchased in the secondary market by NewStar on behalf of the Arlington Fund. NewStar Arlington Funding LLC is the legal entity that holds the Portfolio Investments of the Arlington Fund.

As of September 30, 2013 and December 31, 2013, the gross outstanding loan balance in the Arlington Fund was $130.1 million and $172.6 million, respectively. The Arlington Fund had a target initial size of $200 million, and is currently preparing to structure a commercial loan securitization (“NewStar Arlington CLO 2014-1”, or “CLO”) of up to $400 million in the second quarter of 2014. NewStar, in its capacity as the Investment Manager of the Arlington Fund, will use commercially reasonable efforts to cause the Warehouse Facilities to be recapitalized through the issuance of securities by the CLO.

Upon the issuance of the CLO securities, NewStar expects the CLO to acquire the Portfolio Investments held in NewStar Arlington Funding LLC, such that the CLO will then own the Portfolio Investments. In exchange, the Arlington Fund will receive cash and equity in the CLO. NewStar anticipates that the cash received will be used to repay the Warehouse Facilities and to return NewStar’s equity interest in the Arlington Fund. The current institutional equity investor in the fund is expected to receive equity in the CLO in exchange for its interest in the Arlington Fund. NewStar is not expected to have any equity or any securities issued by the CLO. NewStar expects to be the Investment Manager of the CLO, but not the primary beneficiary of the VIE, consequently, the expected CLO transaction and current business plan would result in the Portfolio Investments no longer being consolidated by NewStar.

| | b. | Explain how you determined that you had the intent and ability to hold these loans for the foreseeable future or until maturity. Specifically, tell us how you define “foreseeable future.” Refer to ASC 310-10-35-47. |

Securities and Exchange Commission

April 1, 2014

Page 4

RESPONSE:

From inception, NewStar’s intention has been that the Portfolio Investments would remain in the two-step warehouse to CLO financing arrangement described above. There is currently no plan to sell the Portfolio Investments to a third party, except in connection with the expected sale of the Portfolio Investments to the CLO. The Portfolio Investments are intended to provide a return to the Arlington Fund (and subsequently, to the CLO) over the life of the Portfolio Investments. Accordingly, we defined “foreseeable future” as the intent and ability to hold the Portfolio Investments to maturity, meaning from loan origination or acquisition by NewStar Arlington Funding LLC through the anticipated maturity of the CLO. Accordingly, the Portfolio Investments were carried at the amortized cost basis.

| | c. | Tell us how you considered whether you should classify the loans as held for sale and report them at the lower of cost or fair value. Refer to ASC 310-10-35-48. |

RESPONSE:

The Arlington Fund (and consequently NewStar) did not consider the Portfolio Investments to be loans held for sale, as the Portfolio Investments were originated or acquired with the intent to hold to maturity as discussed above and to provide economic return to the Arlington Fund (and subsequently to the CLO) through interest income. If the contemplated CLO is not completed as expected, the Portfolio Investments would remain in the Arlington Fund and continue to be consolidated in NewStar’s financial statements.

We had considered classifying the loans as held for sale on NewStar’s consolidated balance sheet. We concluded, however, that the classification of held to maturity was the appropriate classification of the Arlington Fund’s Portfolio Investments given the intent and business plan previously discussed.

However, we acknowledge that the steps necessary to complete the CLO securitization will likely result in the Portfolio Investments no longer being consolidated on NewStar’s Consolidated Balance Sheet. If, based on the expected steps required to complete the two-step warehouse to CLO financing, the Staff concludes that the held for sale classification is more appropriate for the Portfolio Investments, we would not object to presenting, classifying, and disclosing the Portfolio Investments as held for sale under the guidance in ASC 310-10-35- 48 beginning with our Form 10-Q for the period ended March 31, 2014.

| | d. | Tell us how your December 31, 2013 financial statements would have been impacted had you accounted for these loans as held for sale upon origination. Additionally, provide us with a materiality analysis addressing all the key quantitative and qualitative considerations. Refer to SAB 99. |

Securities and Exchange Commission

April 1, 2014

Page 5

RESPONSE:

As of December 31, 2013, the Arlington Fund’s Portfolio Investments had a carrying value of $171.4 million. The fair market value of the Portfolio Investments at December 31, 2013 was approximately $175.9 million. If NewStar had accounted for the Portfolio Investments as held for sale since origination or acquisition by the Arlington Fund, as applicable, the loans would have been presented at the lower of cost or market value. As fair value was in excess of the cost basis at September 30, 2013 and December 31, 2013, there would have been no change to the carrying value of these assets, or impact to our statement of operations, except for an immaterial amortization of loan deferred fees, amounting approximately $281 thousand. All assets and liabilities, as well as the impact to the statement of operations, in the Arlington Fund have been separately disclosed on the NewStar consolidated balance sheet and statement of operations as of December 31, 2013 in its Form 10-K filed on March 14, 2014 (the “2013 Form 10-K”), identified as “Results of Consolidated Variable Interest Entity” in the consolidated financial statements, and further discussed in Note 12 to the consolidated financial statements.

In regards to quantitative and qualitative considerations in relation to SAB 99, we considered the following:

| | • | | Significance: The Portfolio Investments had a carrying amount of $171.4 million as of December 31, 2013, as compared to our total assets of $2.61 billion, thereby representing 6.6% of our total assets. |

| | • | | Disclosure: The Portfolio Investments are separately presented on NewStar’s consolidated balance sheet. In addition, Note 12 to the consolidated financial statements included in the 2013 Form10-K provides a breakdown of the Portfolio Investments, including the business plan and management’s intent with regards to the Portfolio Investments. |

| | • | | Earnings: If NewStar had accounted for these loans as held for sale since origination or acquisition by the Arlington Fund, as applicable, the only impact to earnings would have been in relation to the amortized loan deferred fees related to the Portfolio Investments, amounting to $281 thousand, or 0.7% of our pretax income for the year ended December 31, 2013, which is inconsequential and did not affect our earnings per share. |

Securities and Exchange Commission

April 1, 2014

Page 6

| | • | | Covenants: No covenants or any regulatory requirements of which we are aware would have been affected if we were to account for the Portfolio Investments as held for sale. |

| | • | | Compensation: The Portfolio Investments have no impact on Management’s compensation irrespective of the classification as held for sale or as currently presented in NewStar’s financial statements. |

* * *

In connection with responding to the Staff’s comment, the Company acknowledges that (i) it is responsible for the adequacy and accuracy of the disclosure in the Reports, (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the Reports and (iii) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please contact me at (617) 239-0314 if you have any questions or require any additional information.

Thank you for your attention to this matter.

|

| Very truly yours, |

|

| /s/ Stacie S. Aarestad |

|

| Stacie S. Aarestad |

| | |

| cc: | | John K. Bray, Chief Financial Officer |

| | NewStar Financial, Inc. |