Green Brick Partners Fourth Quarter 2015 Investor Call Presentation March 10, 2016 Exhibit 99.2

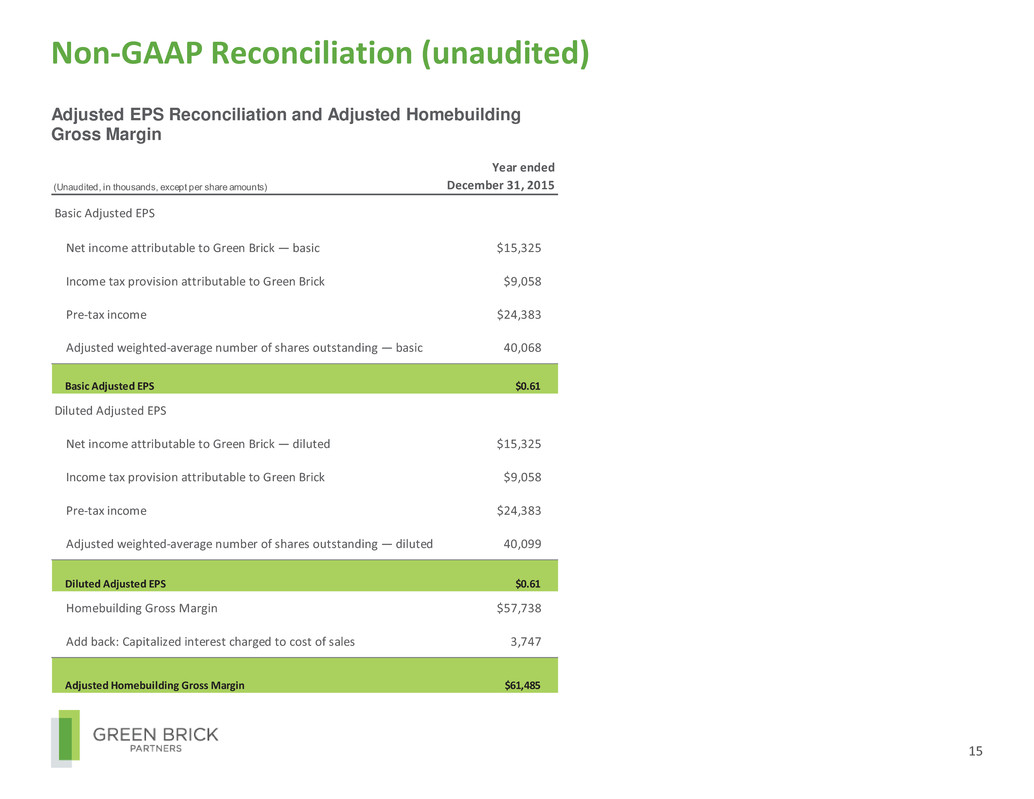

1 Forward-looking statements This presentation and the oral statements made by representatives of the Company during the course of this presentation that are not historical facts are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “outlook,” “strategy,” “positioned,” “intends,” “plans,” “believes,” “projects,” “estimates” and similar expressions, as well as statements in the future tense. Although the Company believes that the assumptions underlying these statements are reasonable, individuals considering such statements for any purpose are cautioned that such forward-looking statements are inherently uncertain and necessarily involve risks that may affect the Company’s business prospects and performance, causing actual results to differ from those discussed during the presentation, and any such difference may be material. Factors that could cause actual results to differ from those anticipated are discussed in the Company’s annual and quarterly reports filed with the SEC. Any forward-looking statements made are subject to risks and uncertainties, many of which are beyond management’s control. These risks include the risks described in the Company’s filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are made only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. The Company presents Basic Adjusted EPS and Diluted Adjusted EPS and Basic and Diluted Adjusted weighted-average number of shares outstanding, Income before taxes attributable to GRBK and Adjusted Homebuilding Gross Margin. The Company believes these and similar measures are useful to management and investors in evaluating its operating performance and financing structure. The Company also believes these measures facilitate the comparison of their operating performance and financing structure with other companies in the industry. Because these measures are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”), they may not be comparable to other similarly titled measures of other companies and should not be considered in isolation or as a substitute for, or superior to, financial measures prepared in accordance with GAAP. The unaudited results are based on management’s review of operations for the fourth quarter and year ended December 31, 2015, and remain subject to change. Due to the Company’s transition from being a “smaller reporting company” to an “accelerated filer”, the Company has not finished its internal control testing or the evaluation of its compliance and reporting processes and, accordingly, the audit of its financial information is still in process.

Jim Brickman − Chief Executive Officer − Over 35 years in real estate development and homebuilding − Co-founded JBGL with Greenlight Capital in 2008. JBGL was merged into Green Brick in 2014 − Previously served as Chairman and CEO of Princeton Homes and Princeton Realty Corp. Rick Costello − Chief Financial Officer − Over 25 years of financial and operating experience in all aspects of real estate management − Previously served as CFO and COO of GL Homes, as AVP of finance of Paragon Group and as an auditor for KPMG Jed Dolson − Head of Land Acquisition and Development − Managed all Dallas land development for JBGL/GRBK since 2009 − Over 15 years in real estate development Management presenters 2

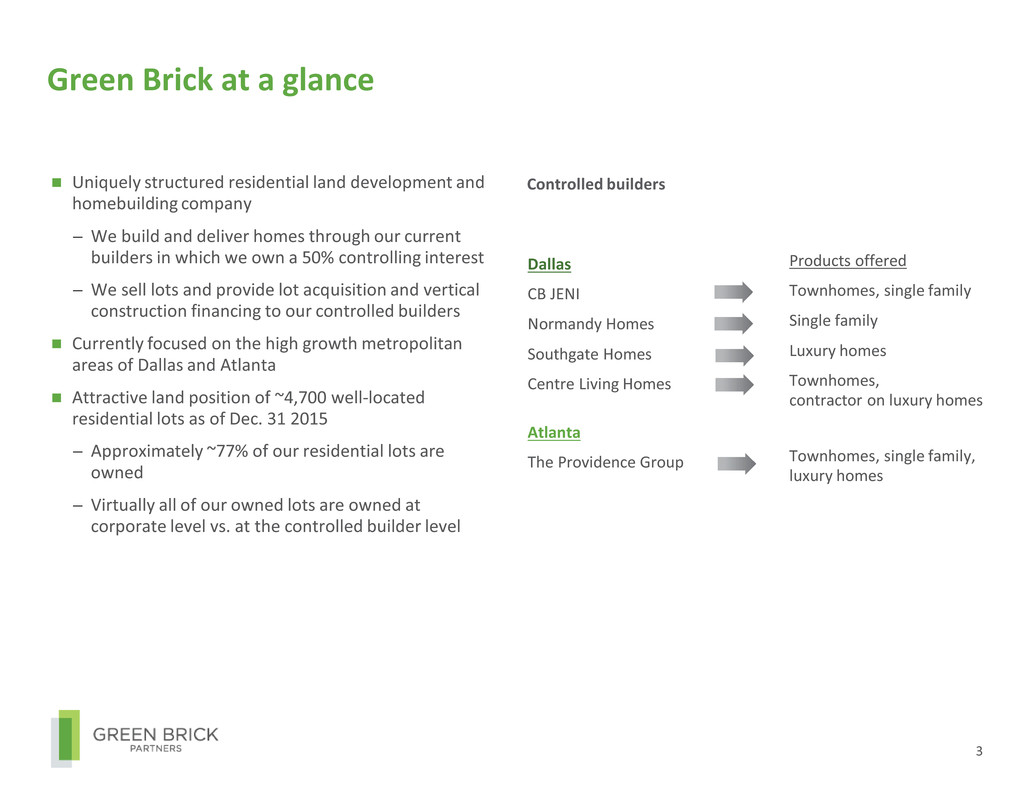

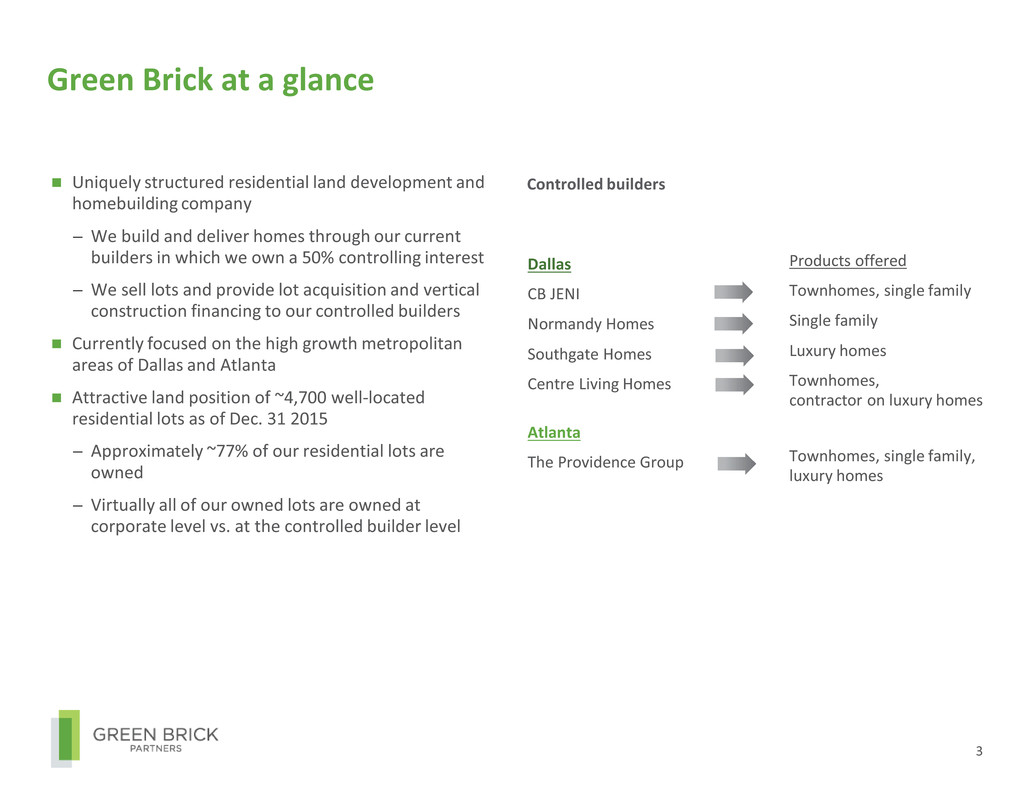

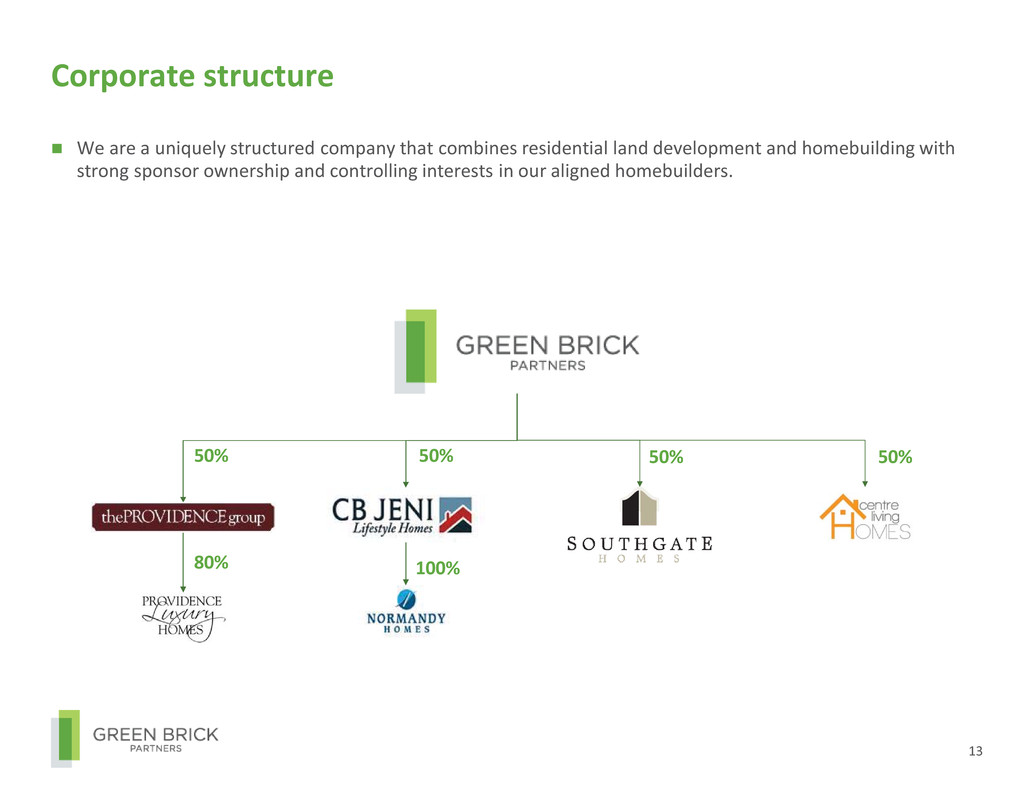

TX G Green Brick at a glance Uniquely structured residential land development and homebuilding company − We build and deliver homes through our current builders in which we own a 50% controlling interest − We sell lots and provide lot acquisition and vertical construction financing to our controlled builders Currently focused on the high growth metropolitan areas of Dallas and Atlanta Attractive land position of ~4,700 well-located residential lots as of Dec. 31 2015 − Approximately ~77% of our residential lots are owned − Virtually all of our owned lots are owned at corporate level vs. at the controlled builder level Products offered Townhomes, single family Single family Luxury homes Townhomes, contractor on luxury homes Townhomes, single family, luxury homes 3 Dallas CB JENI Normandy Homes Southgate Homes Centre Living Homes Atlanta The Providence Group Controlled builders

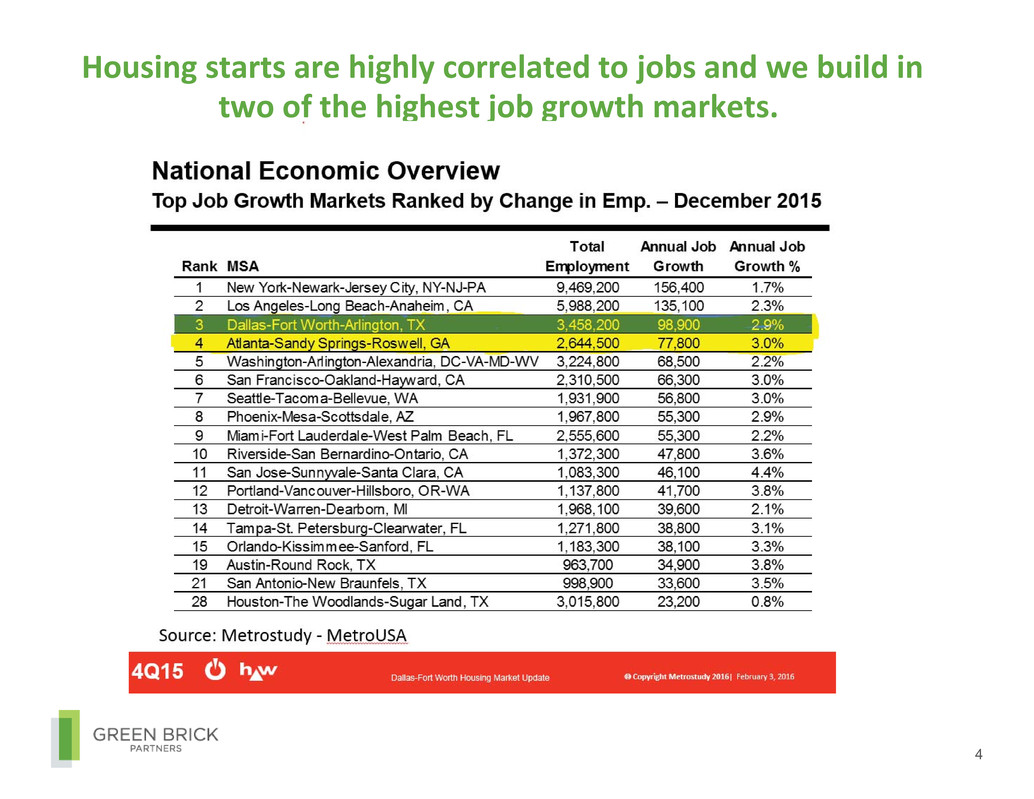

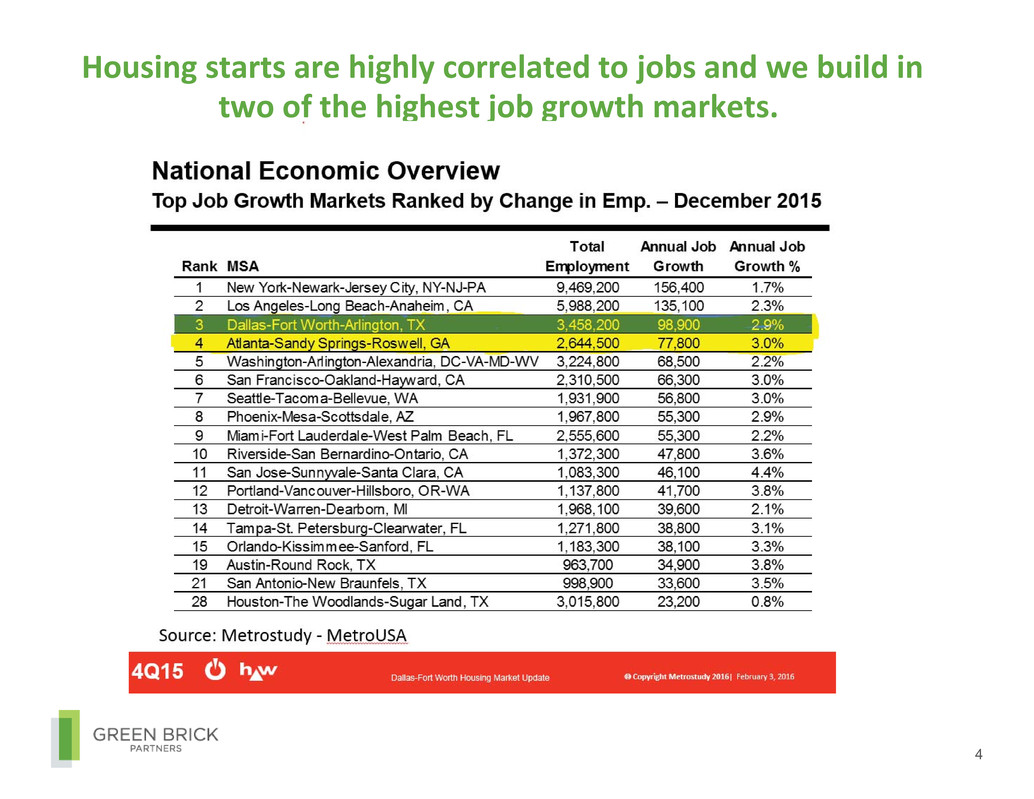

4 Housing starts are highly correlated to jobs and we build in two of the highest job growth markets.

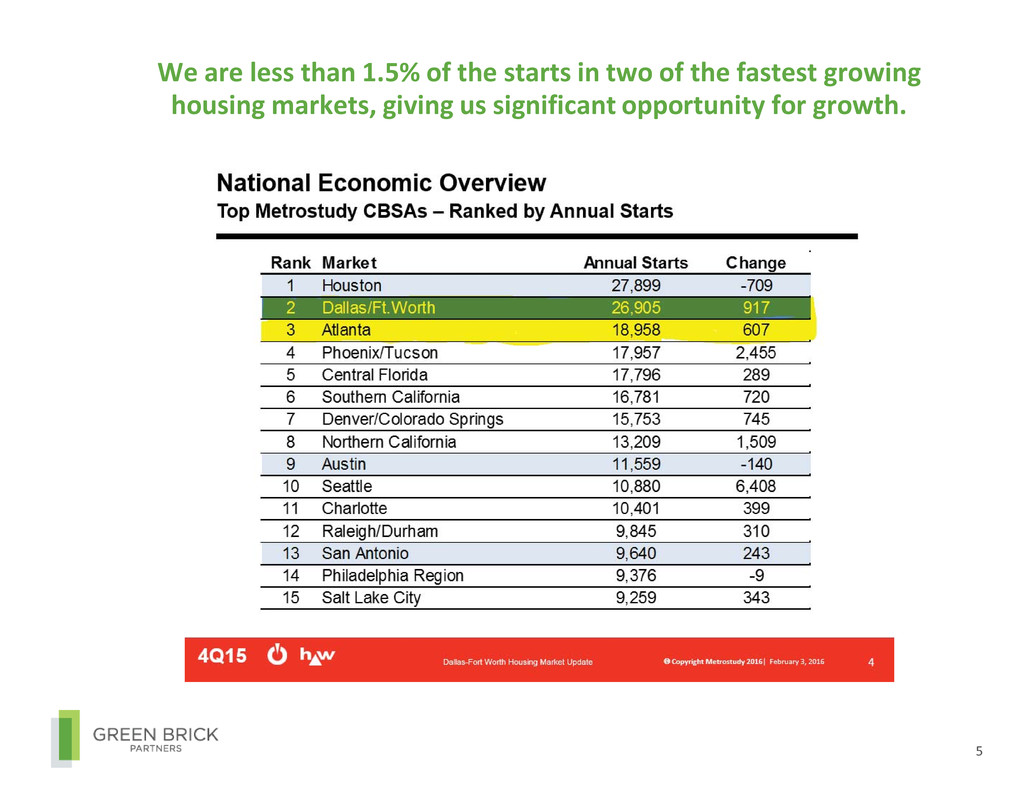

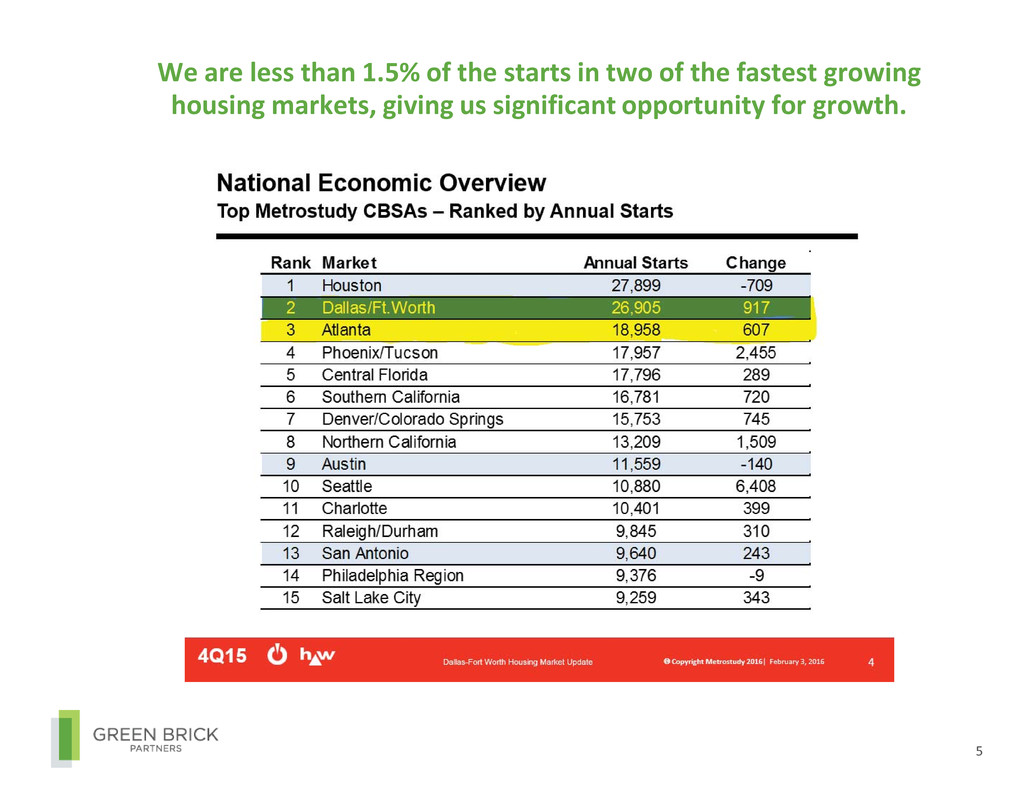

We are less than 1.5% of the starts in two of the fastest growing housing markets, giving us significant opportunity for growth. 5

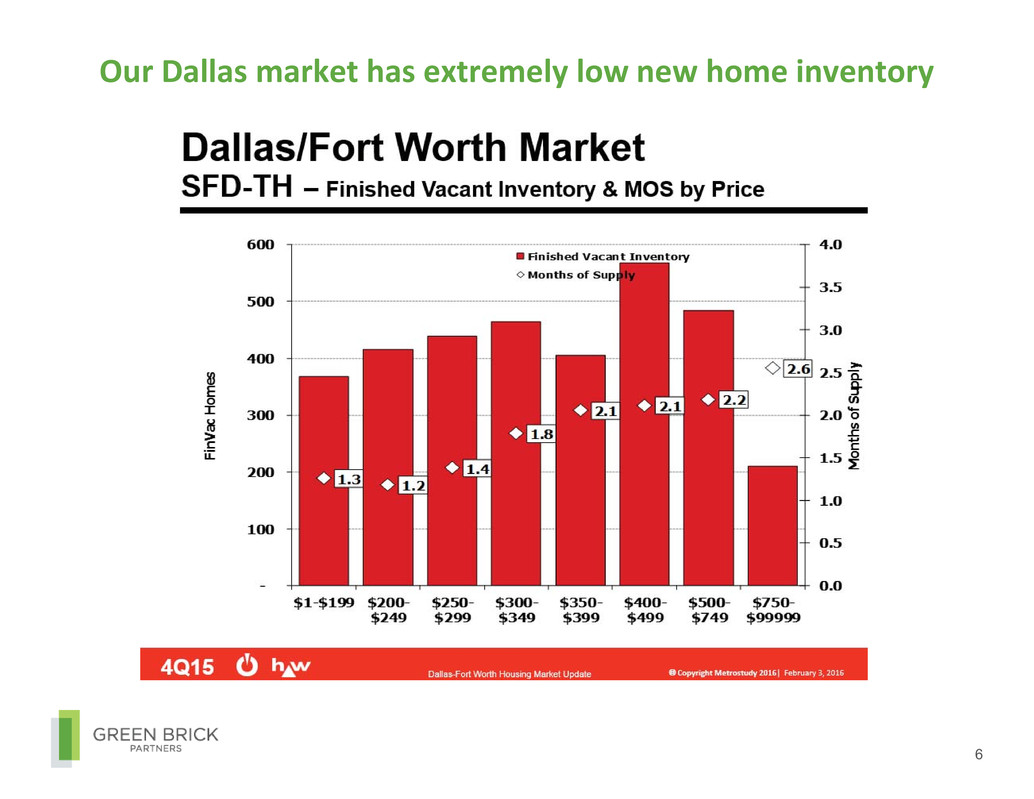

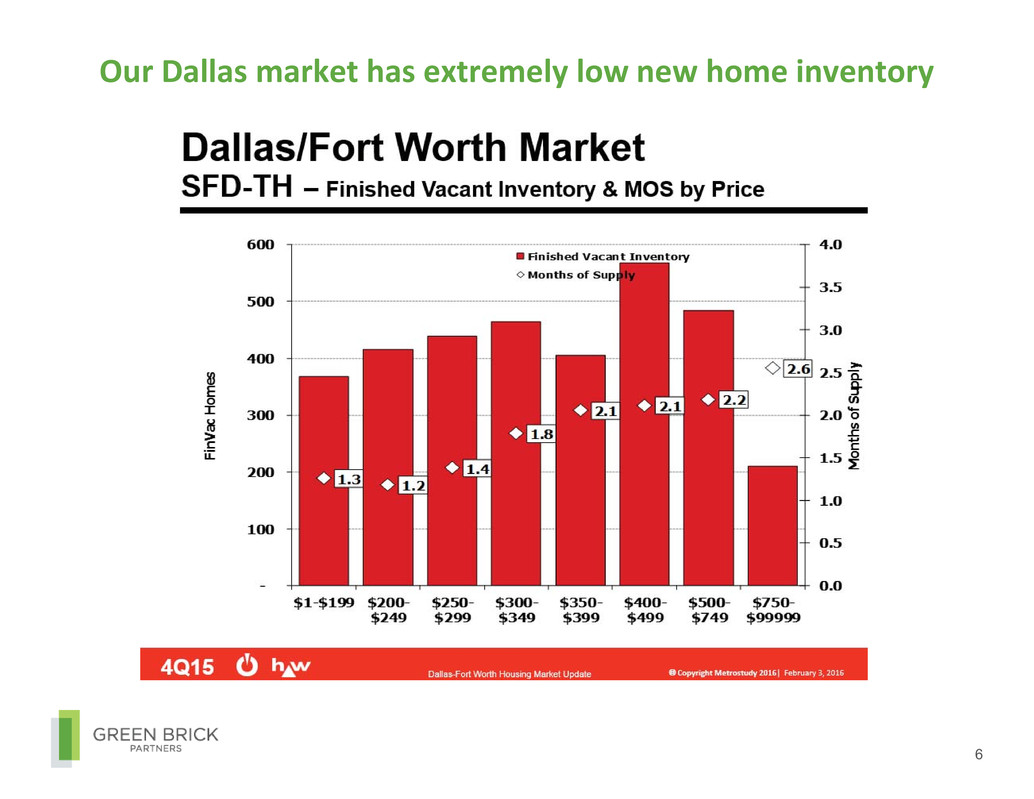

6 Our Dallas market has extremely low new home inventory

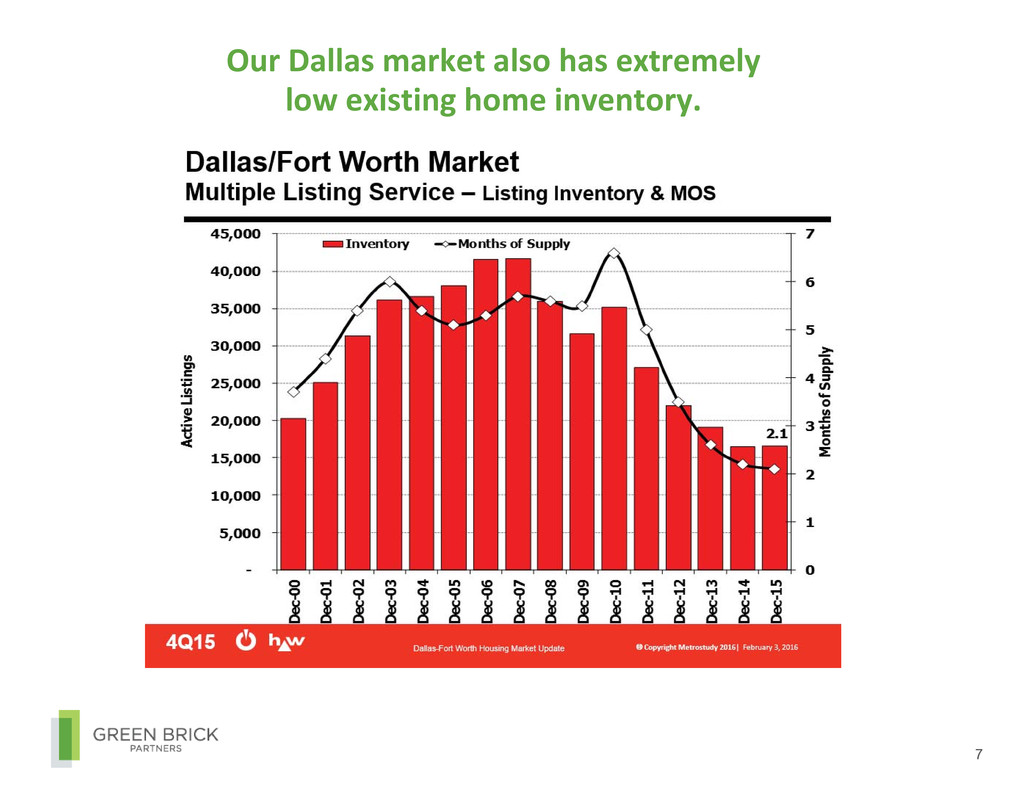

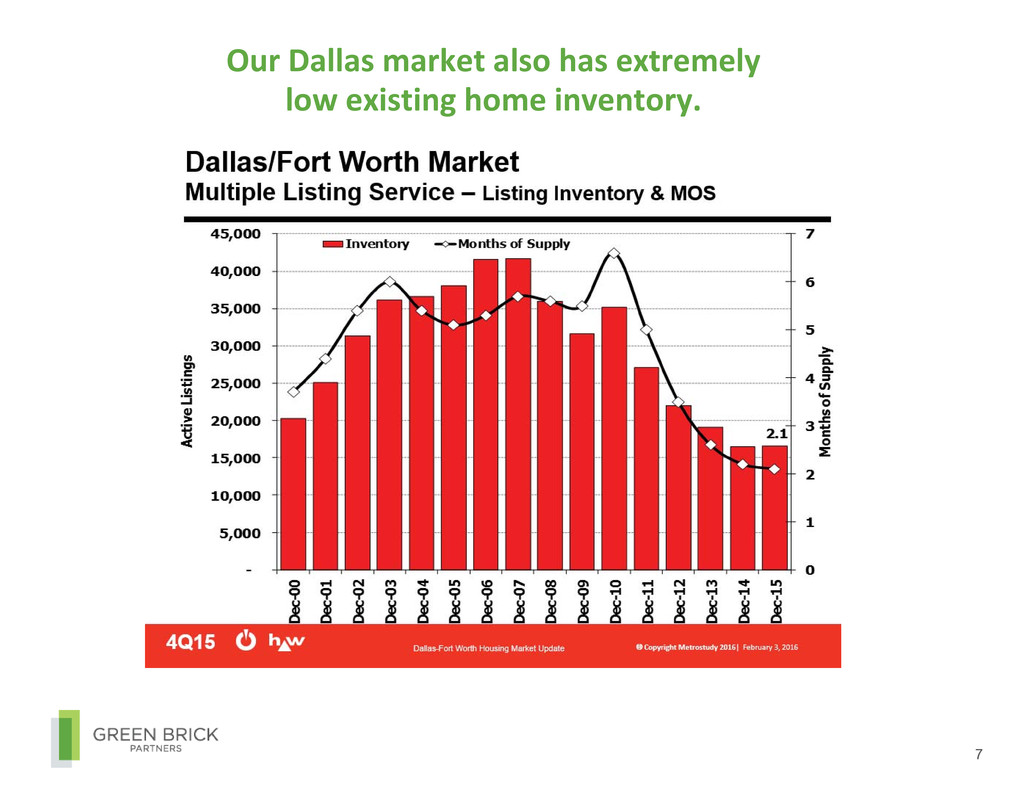

7 Our Dallas market also has extremely low existing home inventory.

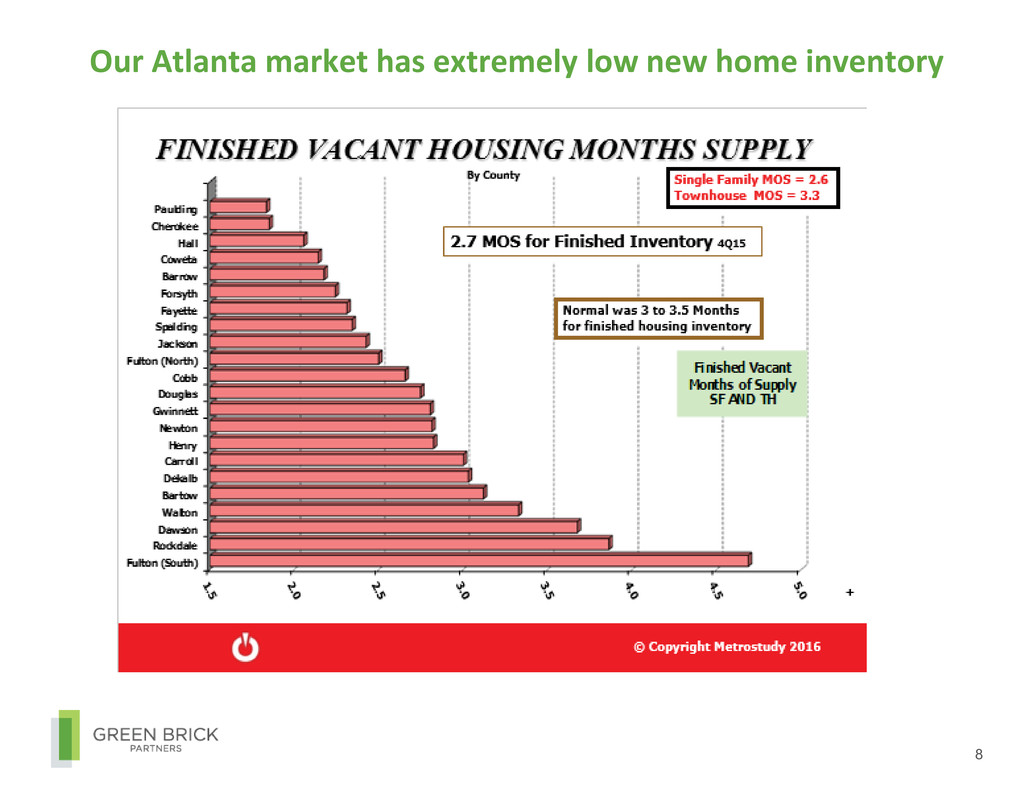

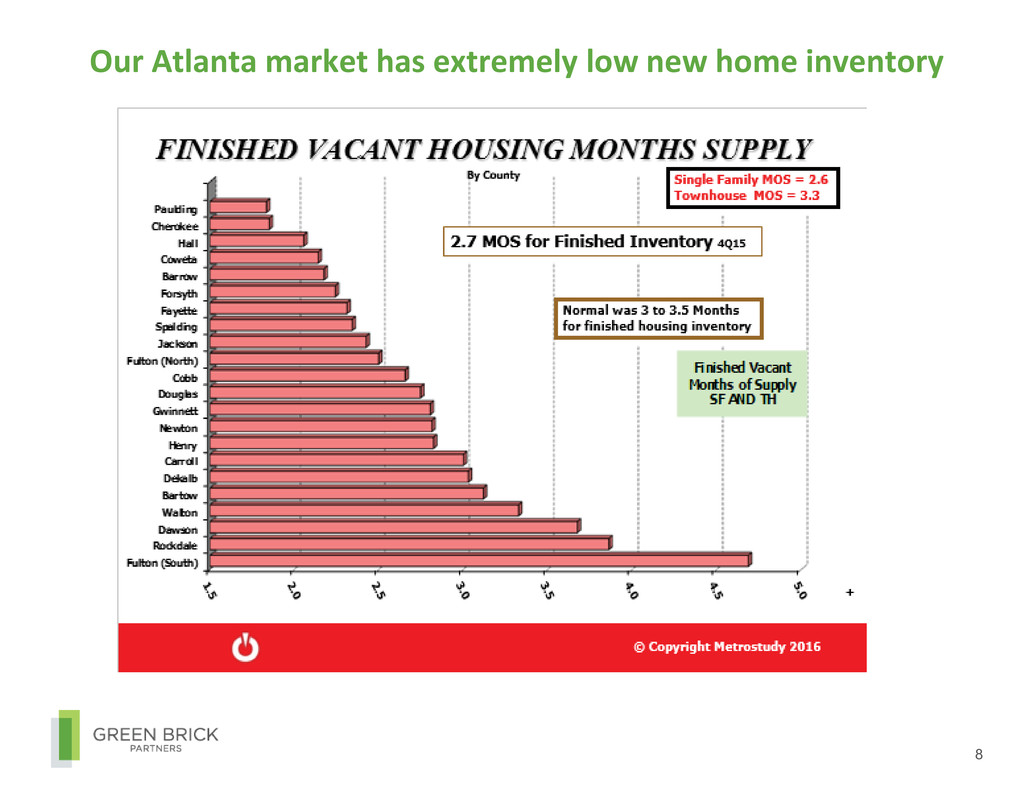

8 Our Atlanta market has extremely low new home inventory

9 Our Atlanta market also has record low existing home inventory

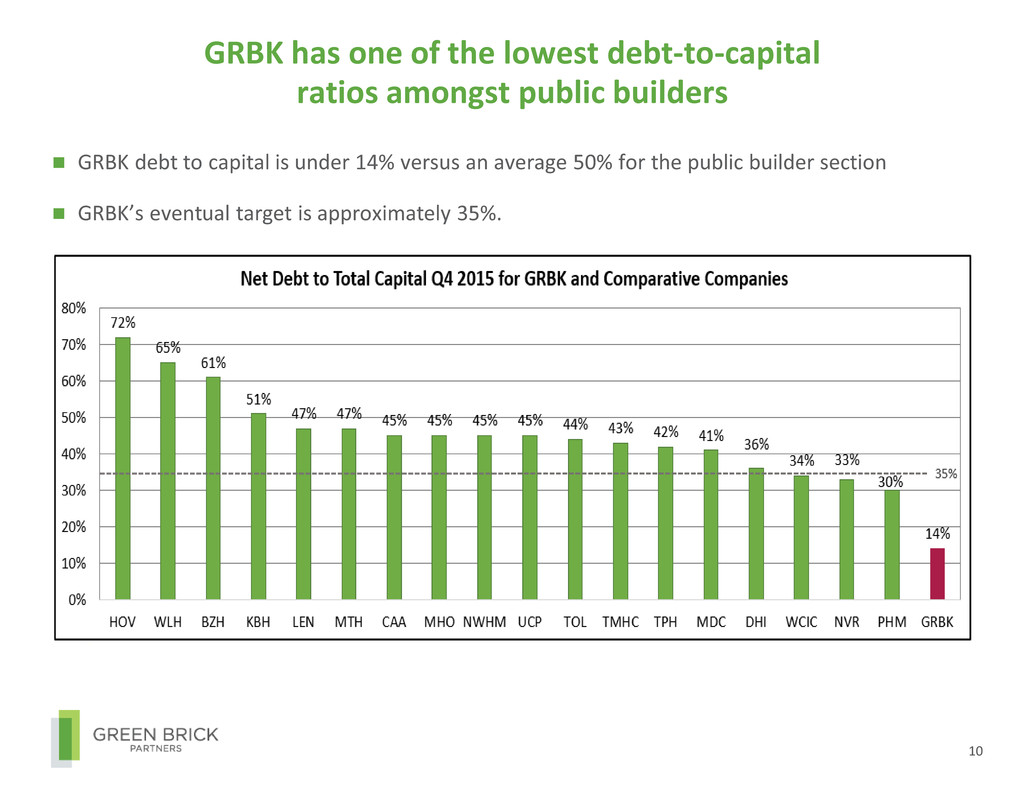

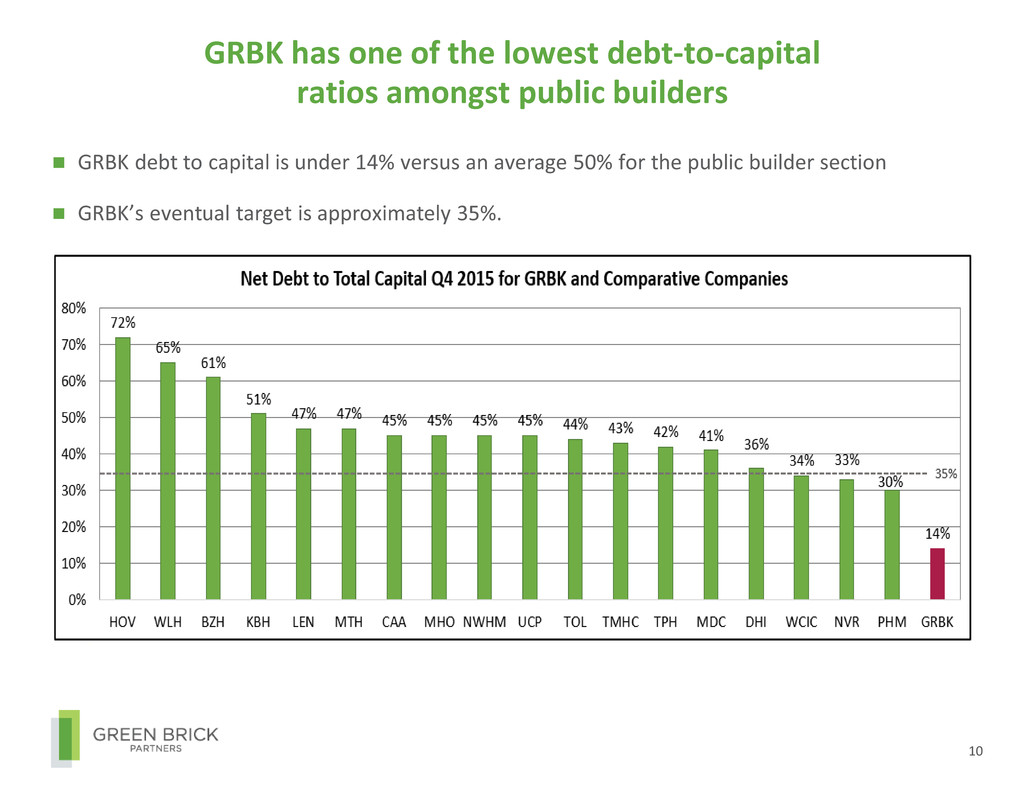

GRBK has one of the lowest debt-to-capital ratios amongst public builders GRBK debt to capital is under 14% versus an average 50% for the public builder section GRBK’s eventual target is approximately 35%. 10

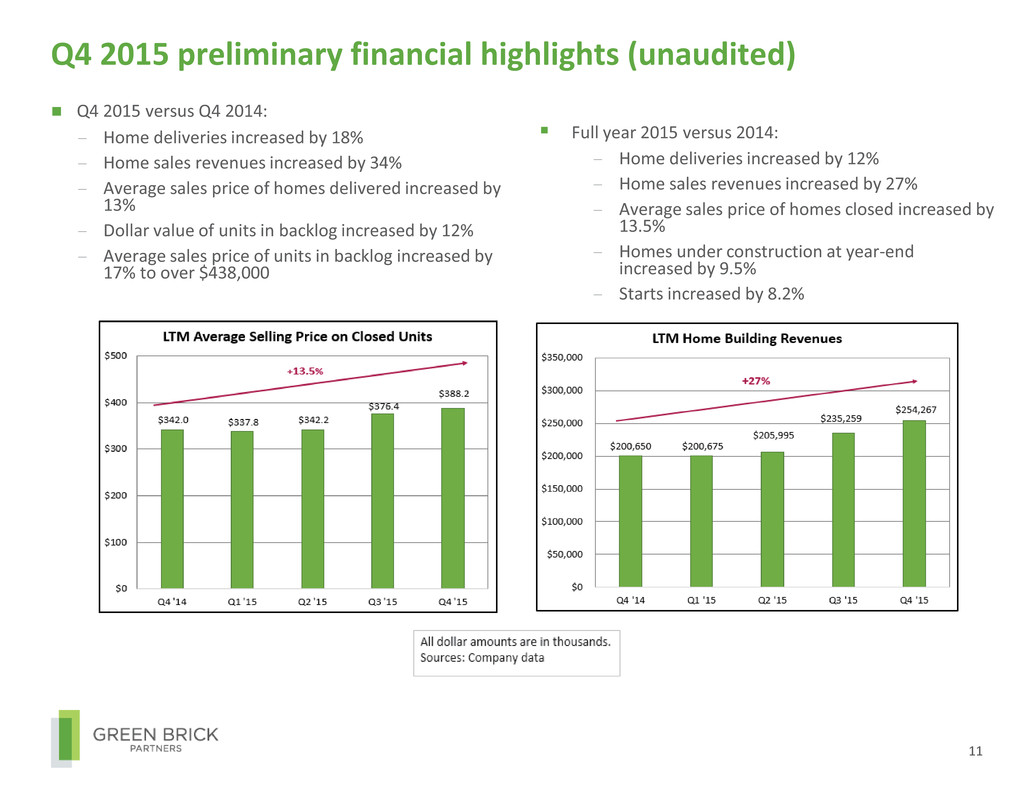

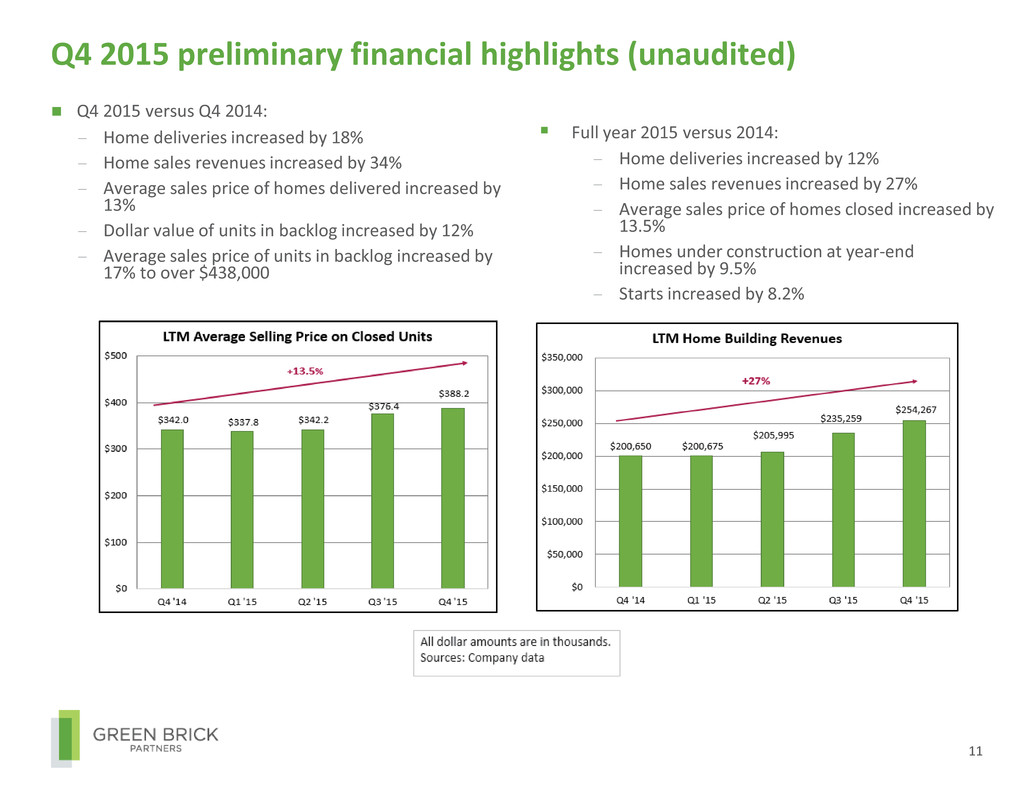

Q4 2015 preliminary financial highlights (unaudited) Q4 2015 versus Q4 2014: - Home deliveries increased by 18% - Home sales revenues increased by 34% - Average sales price of homes delivered increased by 13% - Dollar value of units in backlog increased by 12% - Average sales price of units in backlog increased by 17% to over $438,000 Full year 2015 versus 2014: - Home deliveries increased by 12% - Home sales revenues increased by 27% - Average sales price of homes closed increased by 13.5% - Homes under construction at year-end increased by 9.5% - Starts increased by 8.2% 11

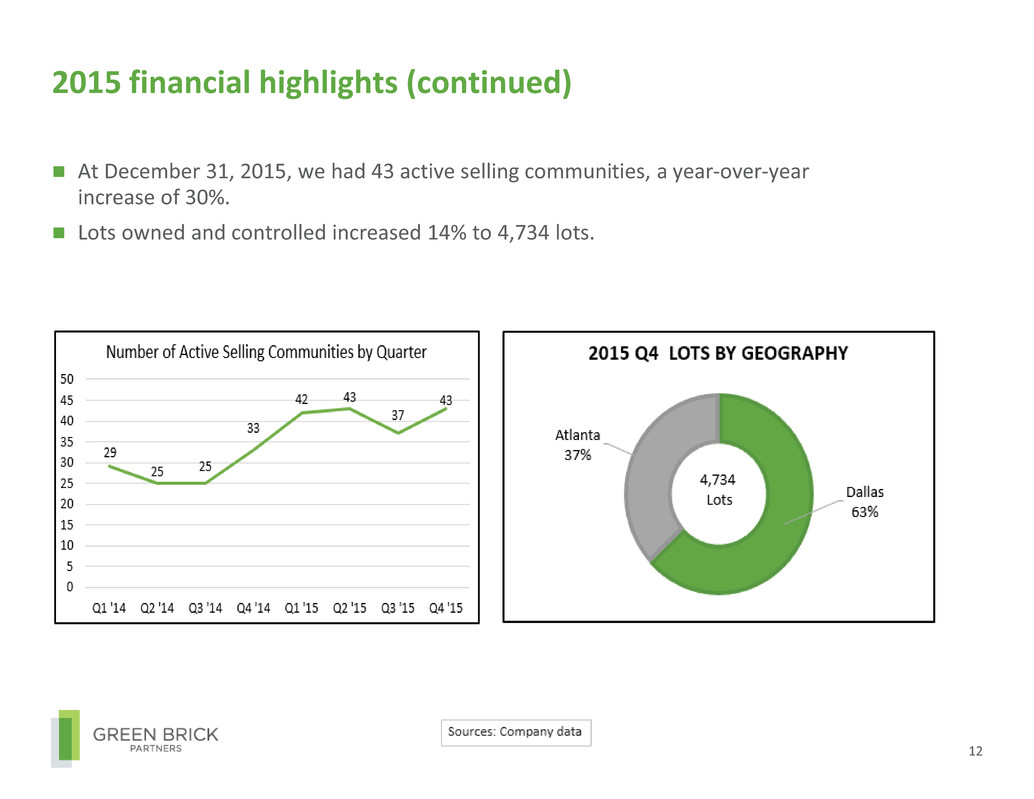

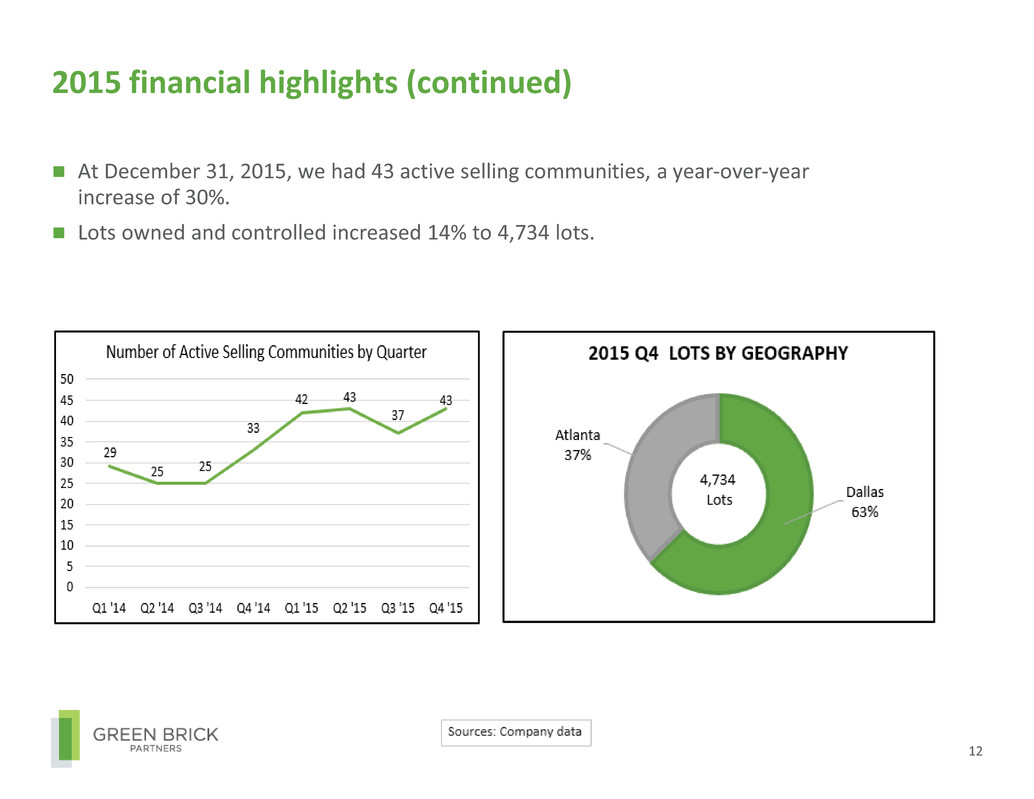

2015 financial highlights (continued) At December 31, 2015, we had 43 active selling communities, a year-over-year increase of 30%. Lots owned and controlled increased 14% to 4,734 lots. 12

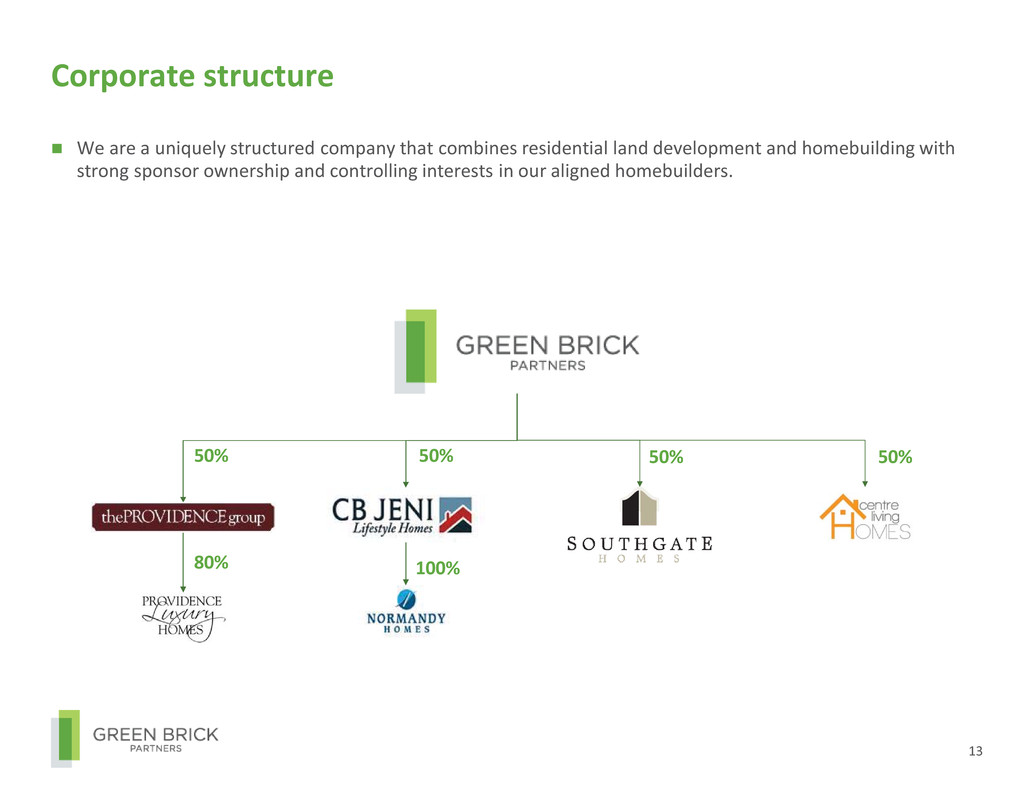

We are a uniquely structured company that combines residential land development and homebuilding with strong sponsor ownership and controlling interests in our aligned homebuilders. Corporate structure 13 50%50%50%50% 80% 100%

Key takeaways We had a record fourth quarter, with growing backlog and we are staged for significant growth in 2016 and beyond. Significant growth opportunities exist in Dallas and Atlanta ̶ two of the most attractive homebuilder markets in the U.S. We have the balance sheet and management team to support significant growth Proven success in executing our growth strategy with our controlled and aligned builders Our operating model and low leverage results in superior risk adjusted returns. 14

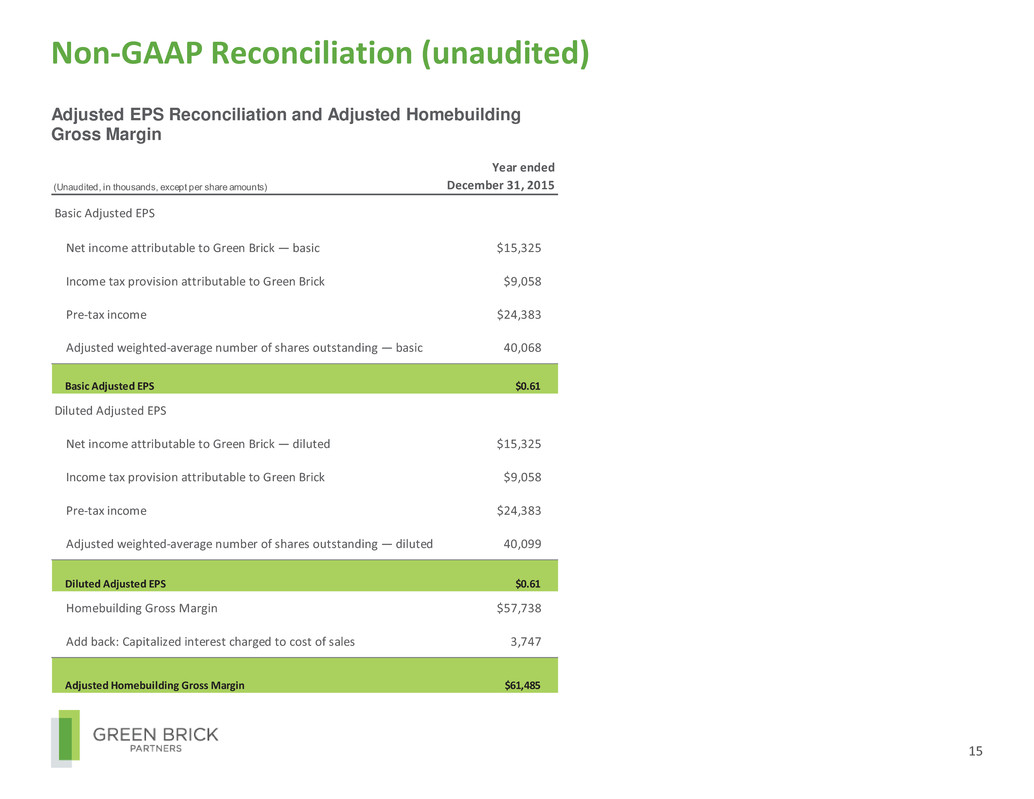

Non-GAAP Reconciliation (unaudited) 15 (Unaudited, in thousands, except per share amounts) Year ended December 31, 2015 Basic Adjusted EPS Net income attributable to Green Brick — basic $15,325 Income tax provision attributable to Green Brick $9,058 Pre-tax income $24,383 Adjusted weighted-average number of shares outstanding — basic 40,068 Basic Adjusted EPS $0.61 Diluted Adjusted EPS Net income attributable to Green Brick — diluted $15,325 Income tax provision attributable to Green Brick $9,058 Pre-tax income $24,383 Adjusted weighted-average number of shares outstanding — diluted 40,099 Diluted Adjusted EPS $0.61 Homebuilding Gross Margin $57,738 Add back: Capitalized interest charged to cost of sales 3,747 Adjusted Homebuilding Gross Margin $61,485 Adjusted EPS Reconciliation and Adjusted Homebuilding Gross Margin