Trophy Signature Homes | Hollyhock, Frisco, TX Exhibit 99.2 Move-Up Series SECOND QUARTER INVESTOR CALL PRESENTATION 2019

FORWARD-LOOKING STATEMENTS This presentation and the oral statements made by representatives of the Company during the course of this presentation that are not historical facts are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “outlook,” “strategy,” “positioned,” “intends,” “plans,” “believes,” “projects,” “estimates” and similar expressions, as well as statements in the future tense. Although the Company believes that the assumptions underlying these statements are reasonable, individuals considering such statements for any purpose are cautioned that such forward-looking statements are inherently uncertain and necessarily involve risks that may affect the Company’s business prospects and performance, causing actual results to differ from those discussed during the presentation, and any such difference may be material. Factors that could cause actual results to differ from those anticipated are discussed in the Company’s annual and quarterly reports filed with the SEC. Any forward-looking statements made are subject to risks and uncertainties, many of which are beyond management’s control. These risks include the risks described in the Company’s filings with the SEC. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are made only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. The Company presents Adjusted Pre-tax Income Attributable to Green Brick, Adjusted Pre-tax Income Attributable to Green Brick as a Percentage of Total Revenues, Pre-tax Income Return on Average Invested Capital (annualized), EBITDA, Net Income Return on Average Equity (annualized), and Adjusted Homebuilding Gross Margin. The Company believes these and similar measures are useful to management and investors in evaluating its operating performance and financing structure. The Company also believes these measures facilitate the comparison of their operating performance and financing structure with other companies in the industry. Because these measures are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”), they may not be comparable to other similarly titled measures of other companies and should not be considered in isolation or as a substitute for, or superior to, financial measures prepared in accordance with GAAP. Beginning in the first quarter of 2019, the Company reclassified its sales commission expenses from cost of residential units to selling, general and administrative expense in the consolidated statements of income. There was no impact to net income from the reclassification in any period. 2

MANAGEMENT PRESENTERS Jim Brickman Rick Costello Jed Dolson Chief Executive Officer Chief Financial Officer President of Texas Region • Over 40 years in real estate development and • Over 26 years of financial and operating • Over 15 years of land development and homebuilding. experience in all aspects of real estate property acquisition. management. • Co-founded JBGL with Greenlight Capital in • Head of GRBK land acquisitions since 2010. 2008. JBGL was merged into Green Brick in • Previously served as CFO and COO of GL 2014. Homes, as AVP of finance of Paragon Group • Masters Degree in Engineering, Stanford and as an auditor for KPMG. University, and Registered Engineer, State of • Previously served as Chairman and CEO of Texas. Princeton Homes and Princeton Realty Corp. • M.B.A from Northwestern University’s Kellogg School. BUILDING COMMUNITIES | DEVELOPING DREAMS 3

GREEN BRICK IS A DIVERSIFIED BUILDER WITH 8 BRANDS IN 4 MAJOR MARKETS Team Builders Market Products Offered Price Range Structure Townhomes $320k - $880k Atlanta, GA Single Family Consolidated(1) $340k - $840k Condominiums Financial Services Townhomes $240k - $430k Consolidated(1) / Dallas, TX Single Family $320k - $620k Townhomes Consolidated(1) Dallas, TX $350k - $800k 49% ownership Single Family Consolidated(1) Dallas, TX Luxury Homes $550k - $750k 100% ownership Single Family Consolidated(2) Vero Beach, FL $200k - $675k Patio Homes Colorado Springs, Townhomes $250k - $600k Equity Interest(3) CO Single Family Consolidated(4) Dallas, TX Single Family $199k - $500k (1) GRBK receives lot sale profits and lending profits before non-controlling interests participate in profits (2) 80% ownership (3) 49.9% ownership with contractual pathway to control (4) 100% ownership BUILDING COMMUNITIES | DEVELOPING DREAMS 4

MARKET UPDATE – JOB GROWTH National Economic Overview Top Job Growth Markets Ranked by Change in Employment, TTM May 2019 Rank MSA Employment Growth Growth % 1 New York-Newark-Jersey City, NY-NJ-PA 9,982,400 114,000 1.2% 2 Dallas-Fort Worth-Arlington, TX 3,780,000 107,000 2.9% 3 Houston-The Woodlands-Sugar Land, TX 3,163,600 79,800 2.6% 4 Los Angeles-Long Beach-Anaheim, CA 6,228,500 77,500 1.3% 5 Phoenix-Mesa-Scottsdale, AZ 2,161,000 66,500 3.2% 6 San Francisco-Oakland-Hayward, CA 2,502,500 66,400 2.7% 7 Chicago-Naperville-Elgin, IL-IN-WI 4,816,100 65,000 1.4% 8 Seattle-Tacoma-Bellevue, WA 2,101,400 56,000 2.7% 9 Miami-Fort Lauderdale-West Palm Beach, FL 2,731,900 54,300 2.0% 10 Atlanta-Sandy Springs-Roswell, GA 2,835,900 52,400 1.9% 11 Orlando-Kissimmee-Sanford, FL 1,330,900 40,600 3.1% 12 Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 2,983,000 34,700 1.2% 13 Charlotte-Concord-Gastonia, NC-SC 1,240,400 30,000 2.5% 14 Las Vegas-Henderson-Paradise, NV 1,035,700 29,500 2.9% 15 San Jose-Sunnyvale-Santa Clara, CA 1,153,000 28,000 2.5% Source: Metrostudy BUILDING COMMUNITIES | DEVELOPING DREAMS 5

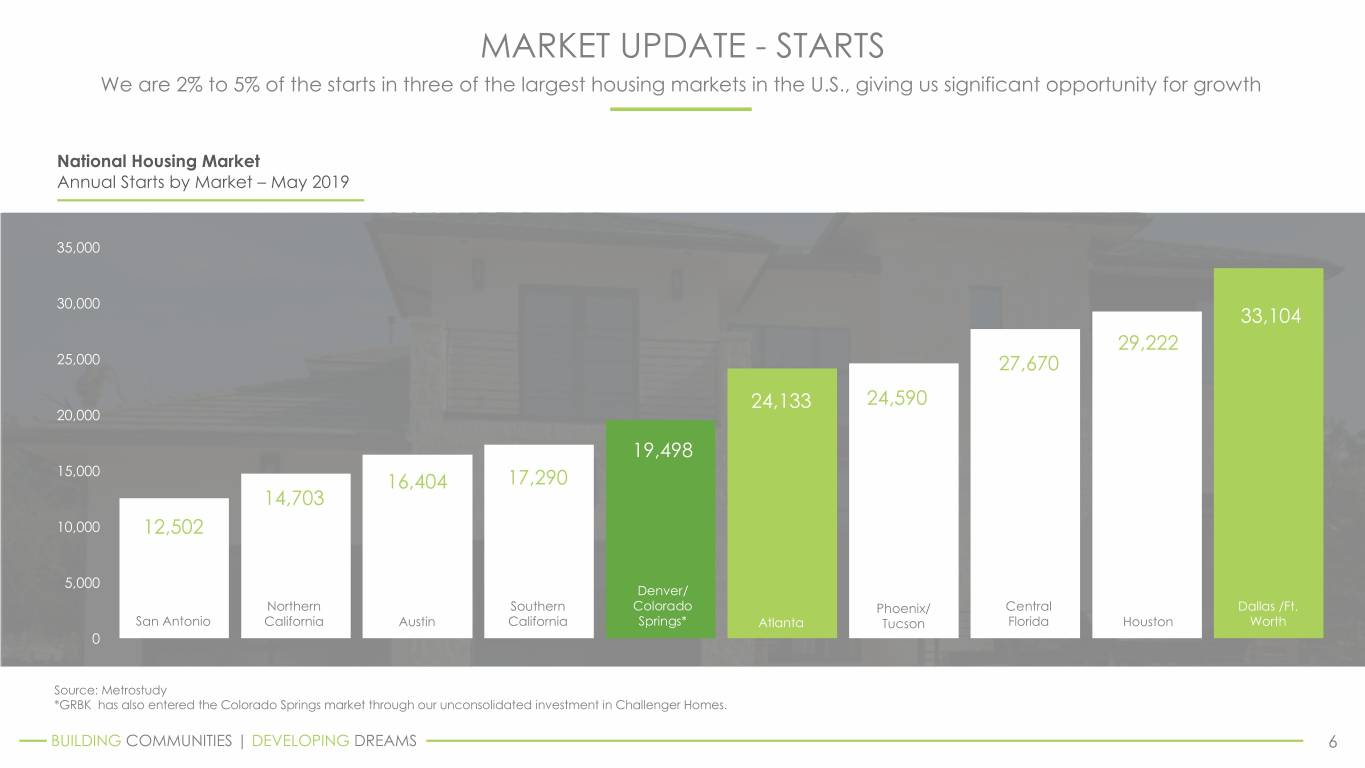

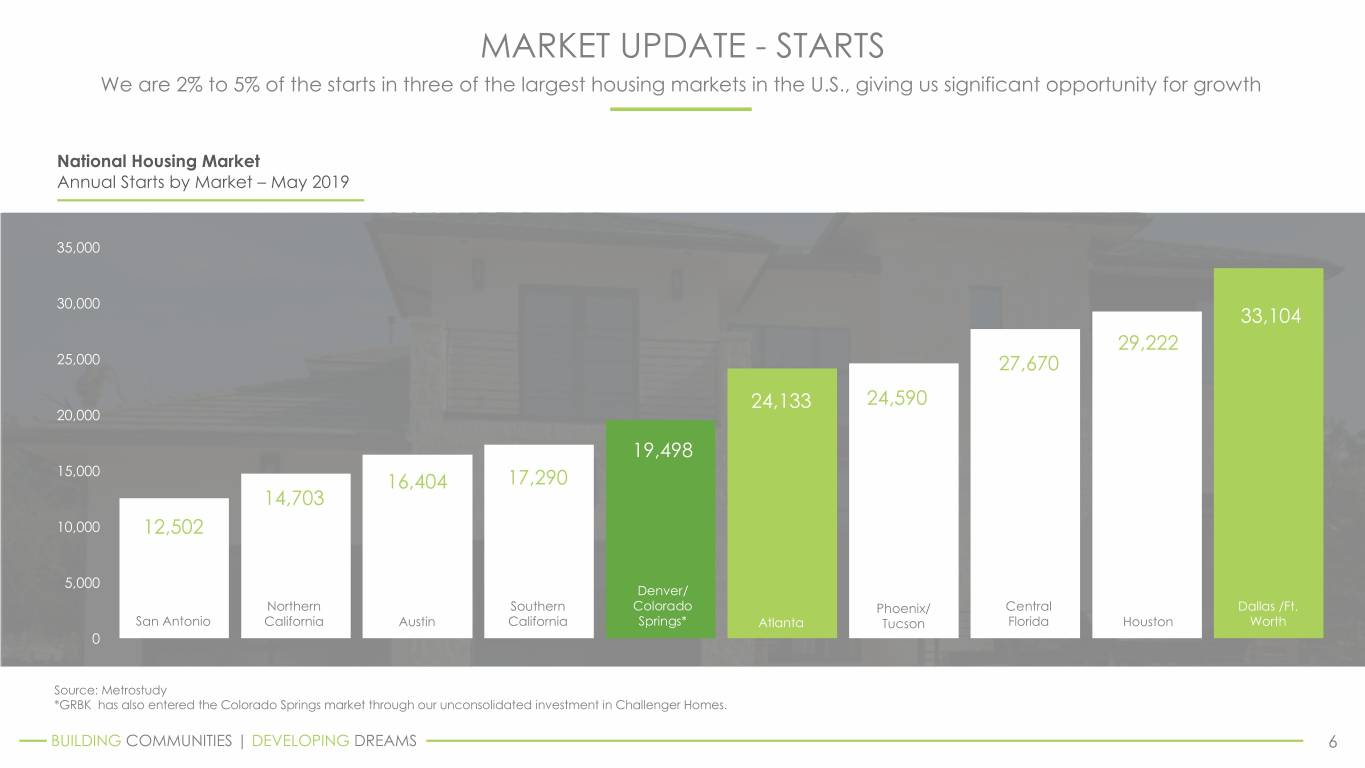

MARKET UPDATE - STARTS We are 2% to 5% of the starts in three of the largest housing markets in the U.S., giving us significant opportunity for growth National Housing Market Annual Starts by Market – May 2019 35,000 30,000 33,104 29,222 25,000 27,670 24,133 24,590 20,000 19,498 15,000 16,404 17,290 14,703 10,000 12,502 5,000 Denver/ Northern Southern Colorado Phoenix/ Central Dallas /Ft. San Antonio California Austin California Springs* Atlanta Tucson Florida Houston Worth 0 Source: Metrostudy *GRBK has also entered the Colorado Springs market through our unconsolidated investment in Challenger Homes. BUILDING COMMUNITIES | DEVELOPING DREAMS 6

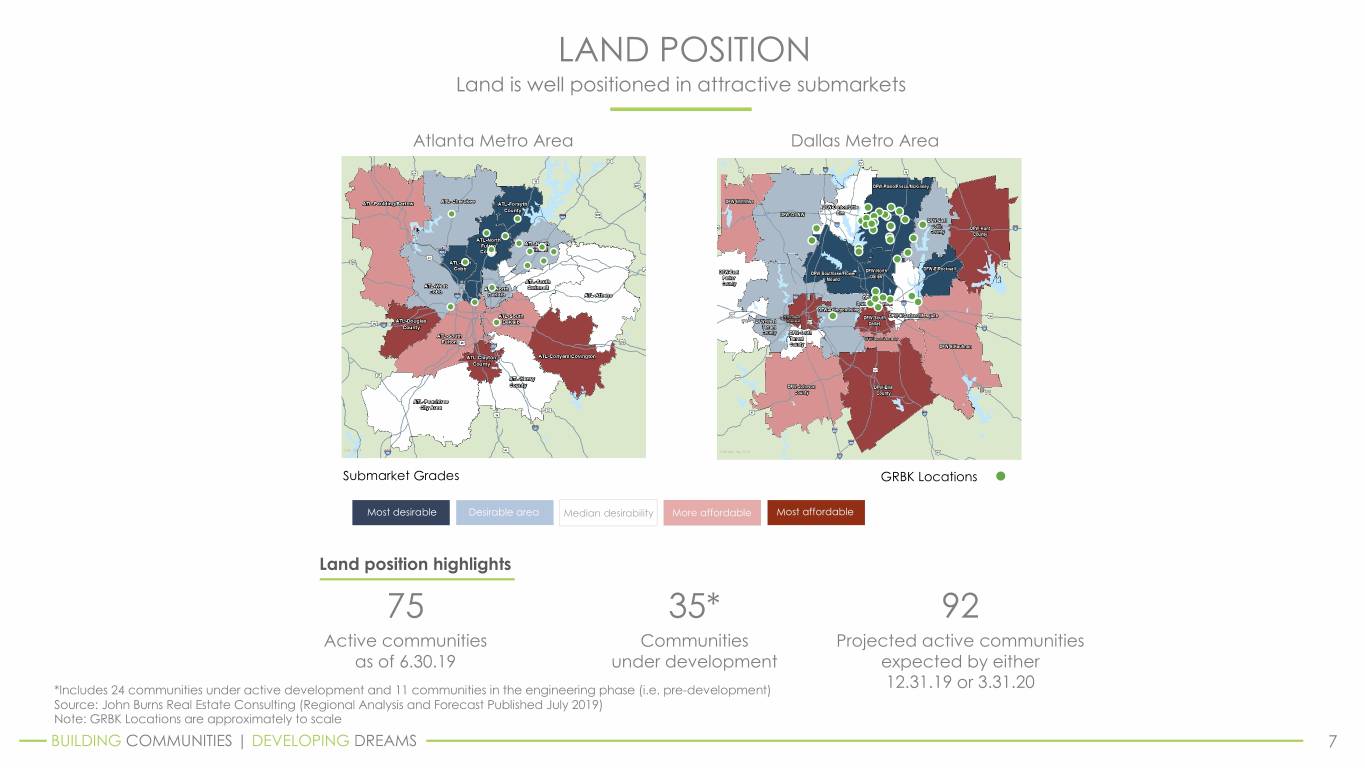

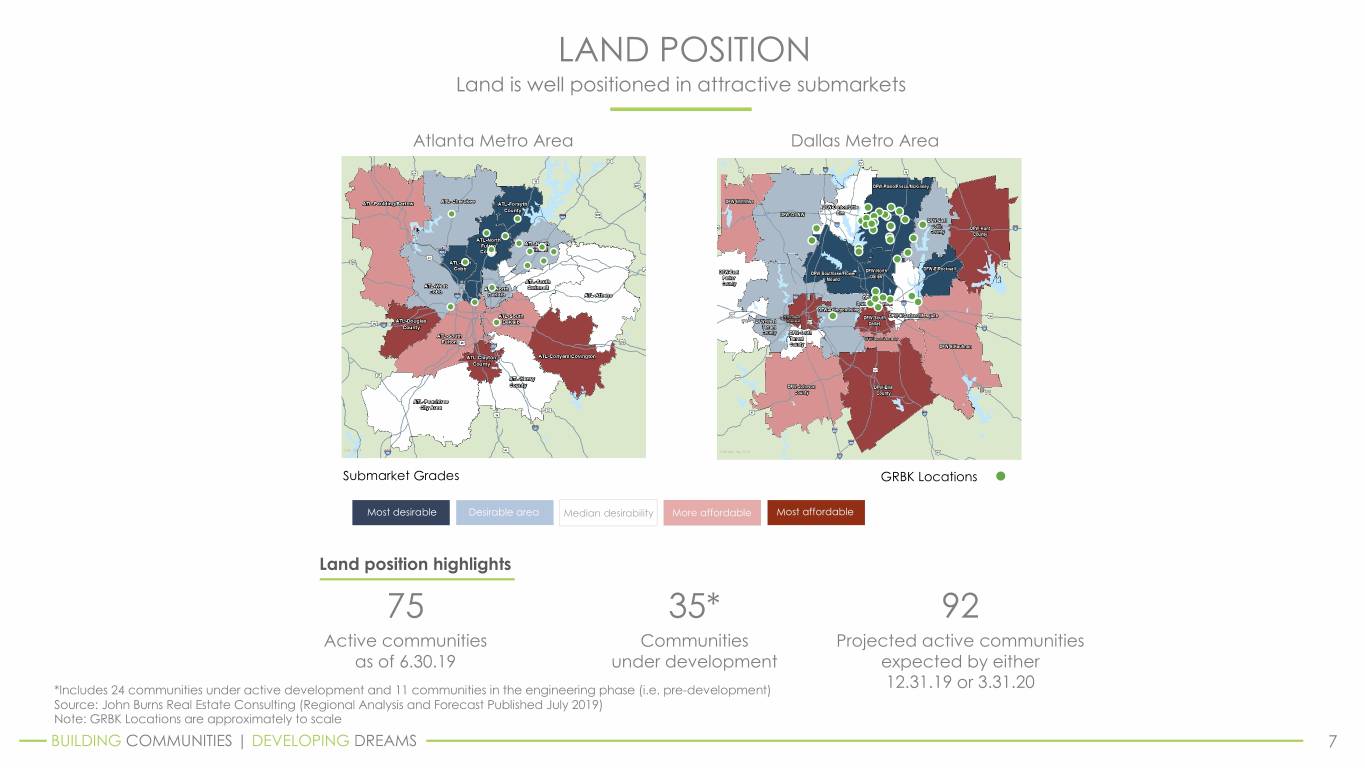

LAND POSITION Land is well positioned in attractive submarkets Atlanta Metro Area Dallas Metro Area Submarket Grades GRBK Locations Most desirable Desirable area Median desirability More affordable Most affordable Land position highlights 75 35* 92 Active communities Communities Projected active communities as of 6.30.19 under development expected by either *Includes 24 communities under active development and 11 communities in the engineering phase (i.e. pre-development) 12.31.19 or 3.31.20 Source: John Burns Real Estate Consulting (Regional Analysis and Forecast Published July 2019) Note: GRBK Locations are approximately to scale BUILDING COMMUNITIES | DEVELOPING DREAMS 7

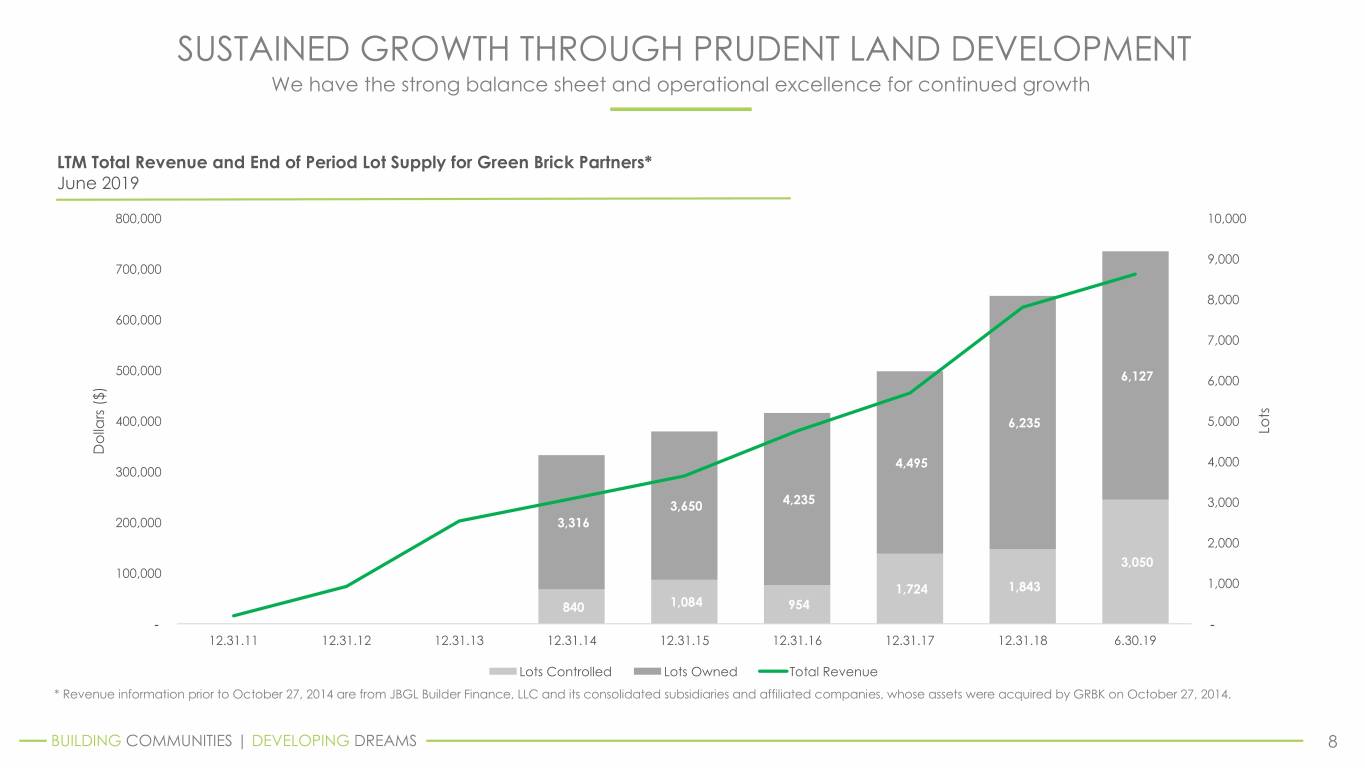

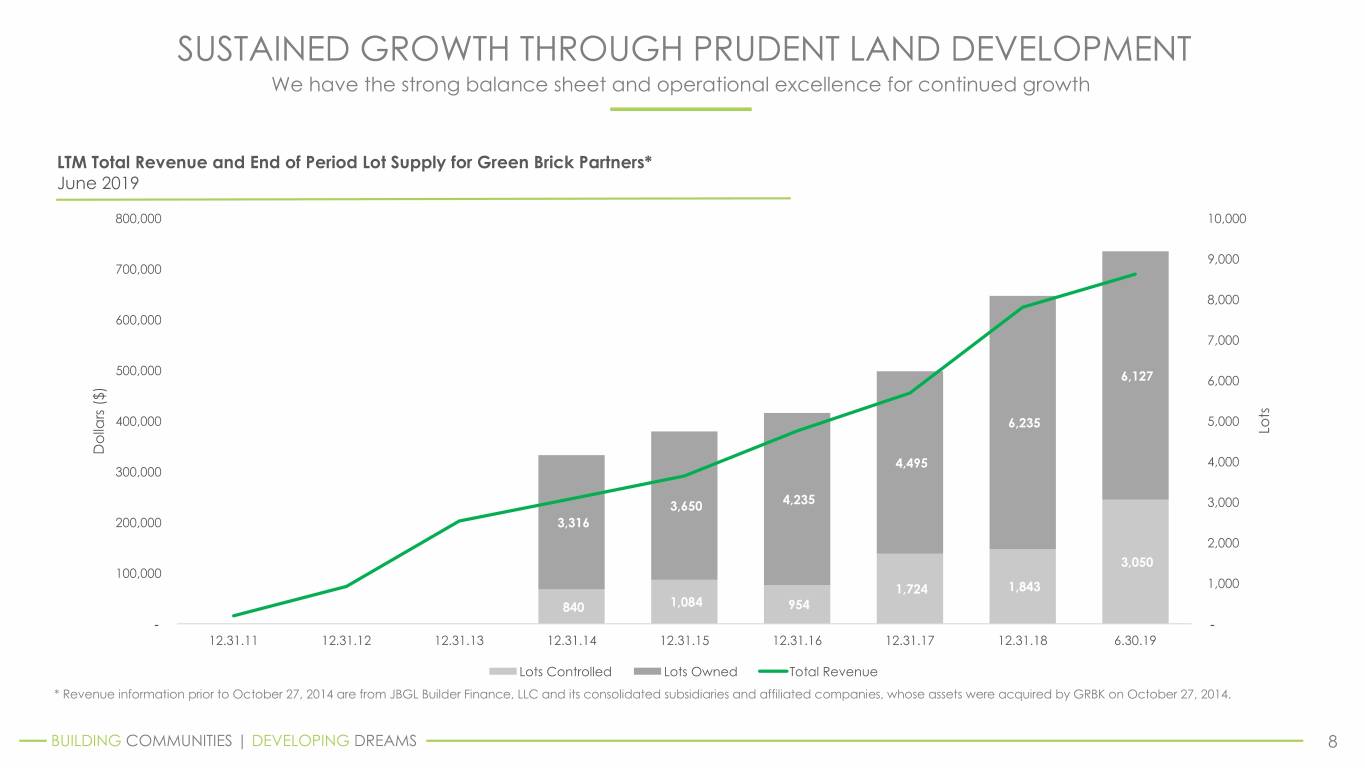

SUSTAINED GROWTH THROUGH PRUDENT LAND DEVELOPMENT We have the strong balance sheet and operational excellence for continued growth LTM Total Revenue and End of Period Lot Supply for Green Brick Partners* June 2019 800,000 10,000 9,000 700,000 8,000 600,000 7,000 500,000 6,127 6,000 400,000 6,235 5,000 Lots Dollars ($) 4,495 4,000 300,000 4,235 3,650 3,000 200,000 3,316 2,000 3,050 100,000 1,724 1,843 1,000 840 1,084 954 - - 12.31.11 12.31.12 12.31.13 12.31.14 12.31.15 12.31.16 12.31.17 12.31.18 6.30.19 Lots Controlled Lots Owned Total Revenue * Revenue information prior to October 27, 2014 are from JBGL Builder Finance, LLC and its consolidated subsidiaries and affiliated companies, whose assets were acquired by GRBK on October 27, 2014. BUILDING COMMUNITIES | DEVELOPING DREAMS 8

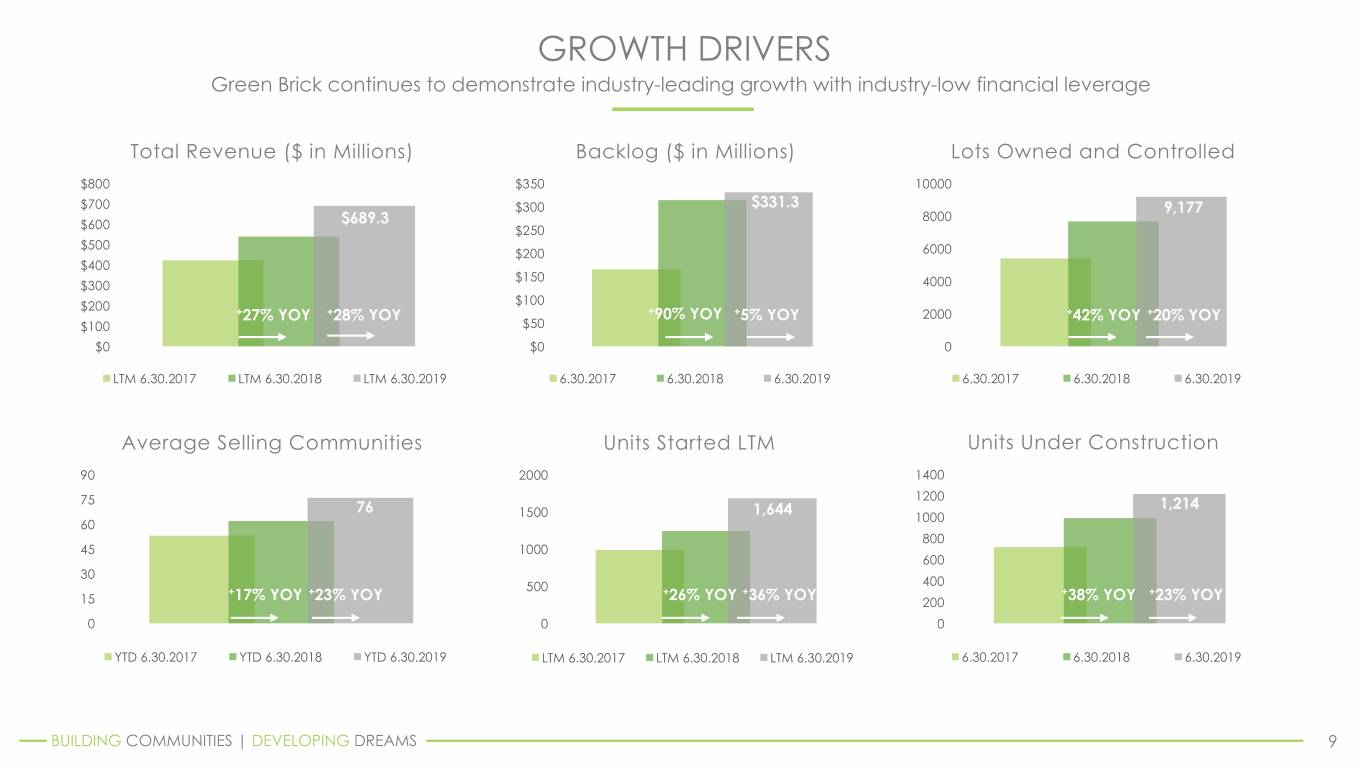

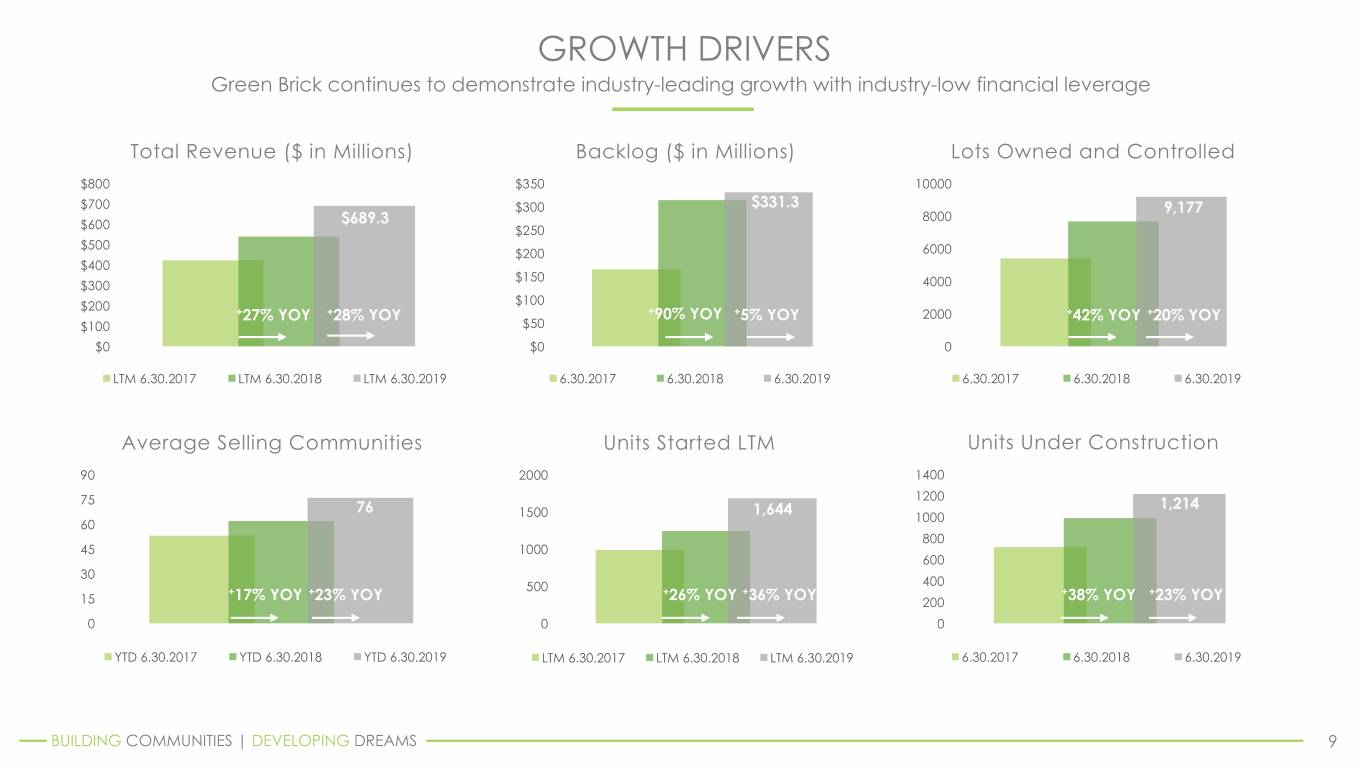

GROWTH DRIVERS Green Brick continues to demonstrate industry-leading growth with industry-low financial leverage Total Revenue ($ in Millions) Backlog ($ in Millions) Lots Owned and Controlled $800 $350 10000 $700 $300 $331.3 9,177 $689.3 8000 $600 $250 $500 $200 6000 $400 $150 $300 4000 $200 $100 +27% YOY +28% YOY +90% YOY +5% YOY 2000 +42% YOY +20% YOY $100 $50 $0 $0 0 LTM 6.30.2017 LTM 6.30.2018 LTM 6.30.2019 6.30.2017 6.30.2018 6.30.2019 6.30.2017 6.30.2018 6.30.2019 Average Selling Communities Units Started LTM Units Under Construction 90 2000 1400 75 1200 76 1,644 1,214 1500 1000 60 800 45 1000 600 30 400 + + 500 + + + + 15 17% YOY 23% YOY 26% YOY 36% YOY 200 38% YOY 23% YOY 0 0 0 YTD 6.30.2017 YTD 6.30.2018 YTD 6.30.2019 LTM 6.30.2017 LTM 6.30.2018 LTM 6.30.2019 6.30.2017 6.30.2018 6.30.2019 BUILDING COMMUNITIES | DEVELOPING DREAMS 9

GREEN BRICK IS A DIVERSIFIED BUILDER Rapidly expanding into entry-level and first-time move-up homes with over 1,600 newly acquired homesites for Trophy Signature Homes Home Closings Revenue Growth Revenue in Millions, ASP in Thousands Townhomes, Condominium, Single-Family Total and Attached Homes $450 $450 $700 $400 $400 $600 $638.7 $383.1 $350 $350 $500 $300 $300 $506.1 $400 $250 $250 $252.6 $255.6 $253.5 $398.5 $231.4 $200 $200 $300 + + +51% YOY +1% YOY + 10% YOY +51% YOY 27% YOY 26% YOY $150 $167.2 $150 $200 $100 $100 $100 $50 $50 $0 $0 $0 LTM 2Q17 (42% of total) LTM 2Q18 (50% of total) LTM 2Q19 (40% of total) LTM 2Q17 (58% of total) LTM 2Q18 (50% of total) LTM 2Q19 (60% of total) LTM 2Q17 (ASP $426.7) LTM 2Q18 (ASP $451.5) LTM 2Q19 (ASP $438.6) BUILDING COMMUNITIES | DEVELOPING DREAMS 10

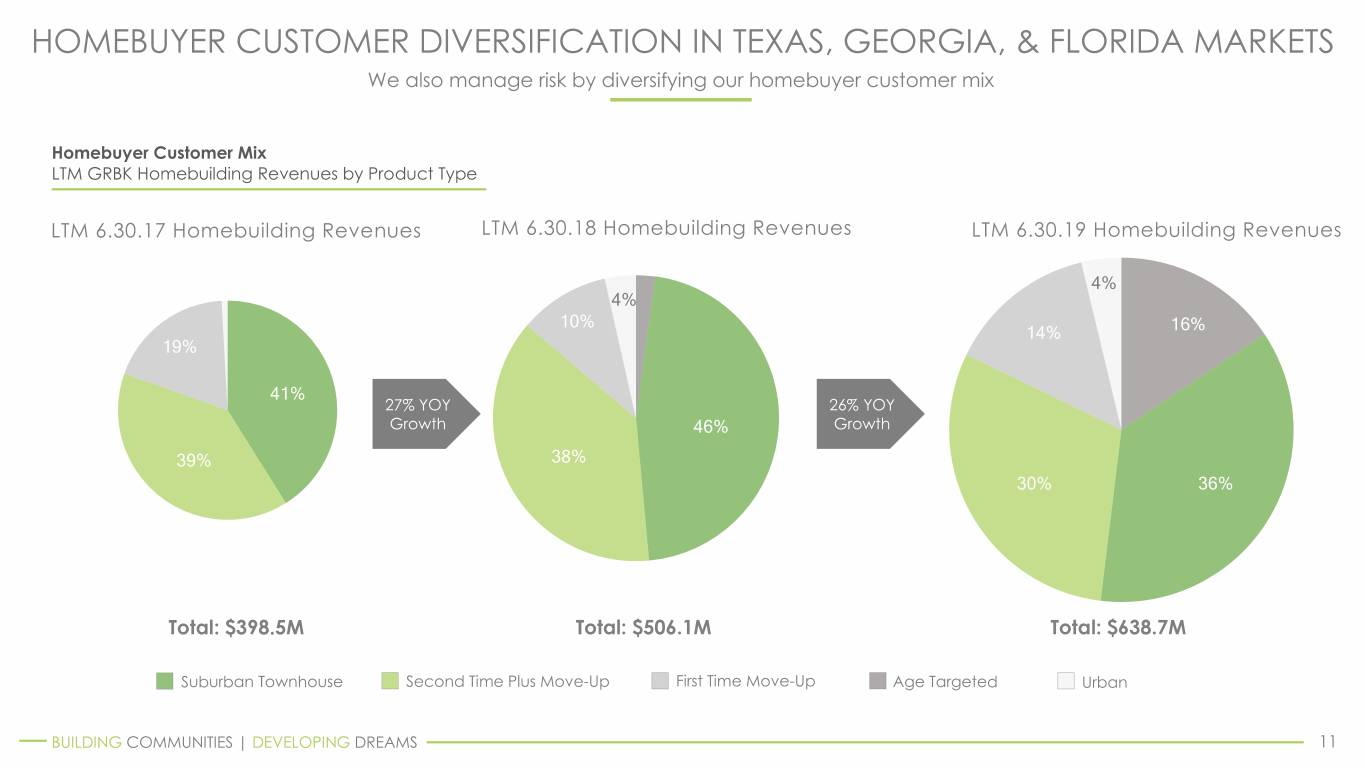

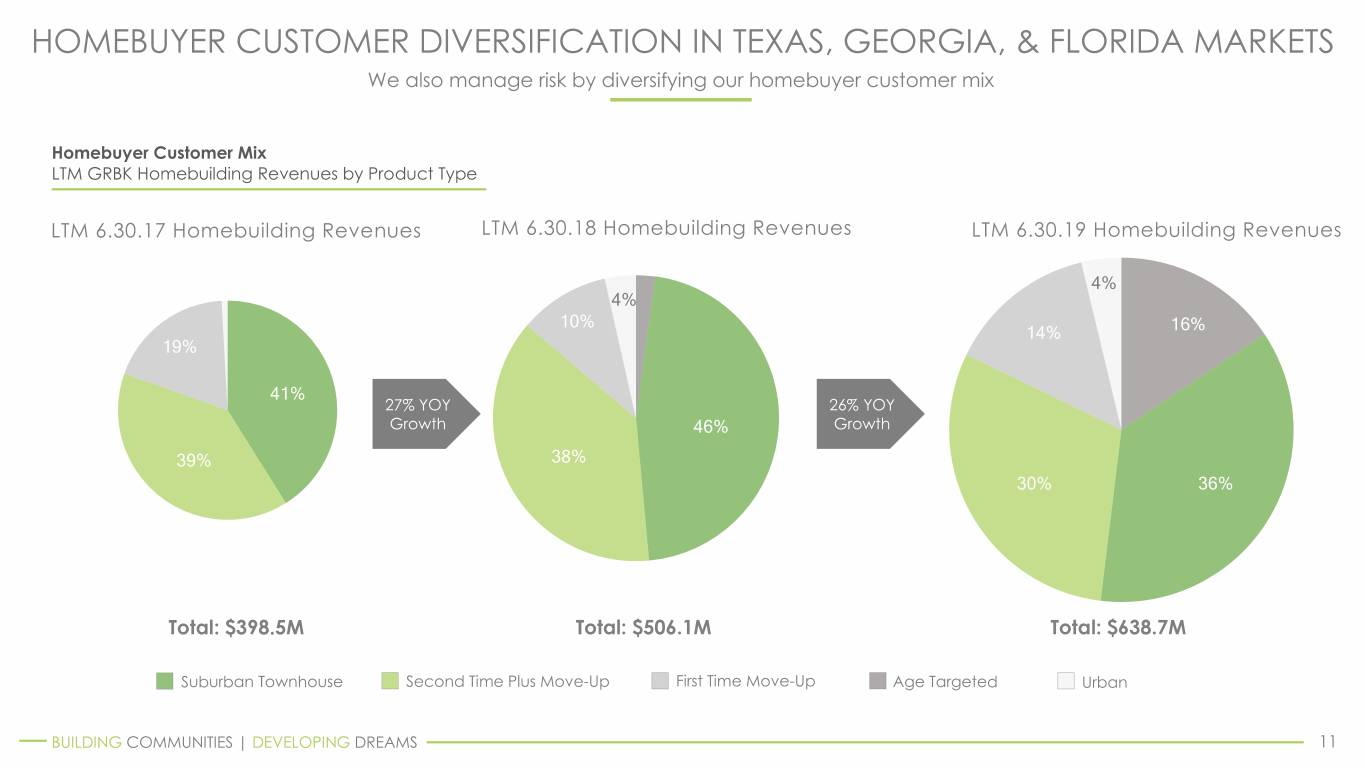

HOMEBUYER CUSTOMER DIVERSIFICATION IN TEXAS, GEORGIA, & FLORIDA MARKETS We also manage risk by diversifying our homebuyer customer mix Homebuyer Customer Mix LTM GRBK Homebuilding Revenues by Product Type LTM 6.30.17 Homebuilding Revenues LTM 6.30.18 Homebuilding Revenues LTM 6.30.19 Homebuilding Revenues 4% 4% 10% 16% 14% 19% 41% 27% YOY 26% YOY Growth 46% Growth 39% 38% 30% 36% Total: $398.5M Total: $506.1M Total: $638.7M Suburban Townhouse Second Time Plus Move-Up First Time Move-Up Age Targeted Urban BUILDING COMMUNITIES | DEVELOPING DREAMS 11

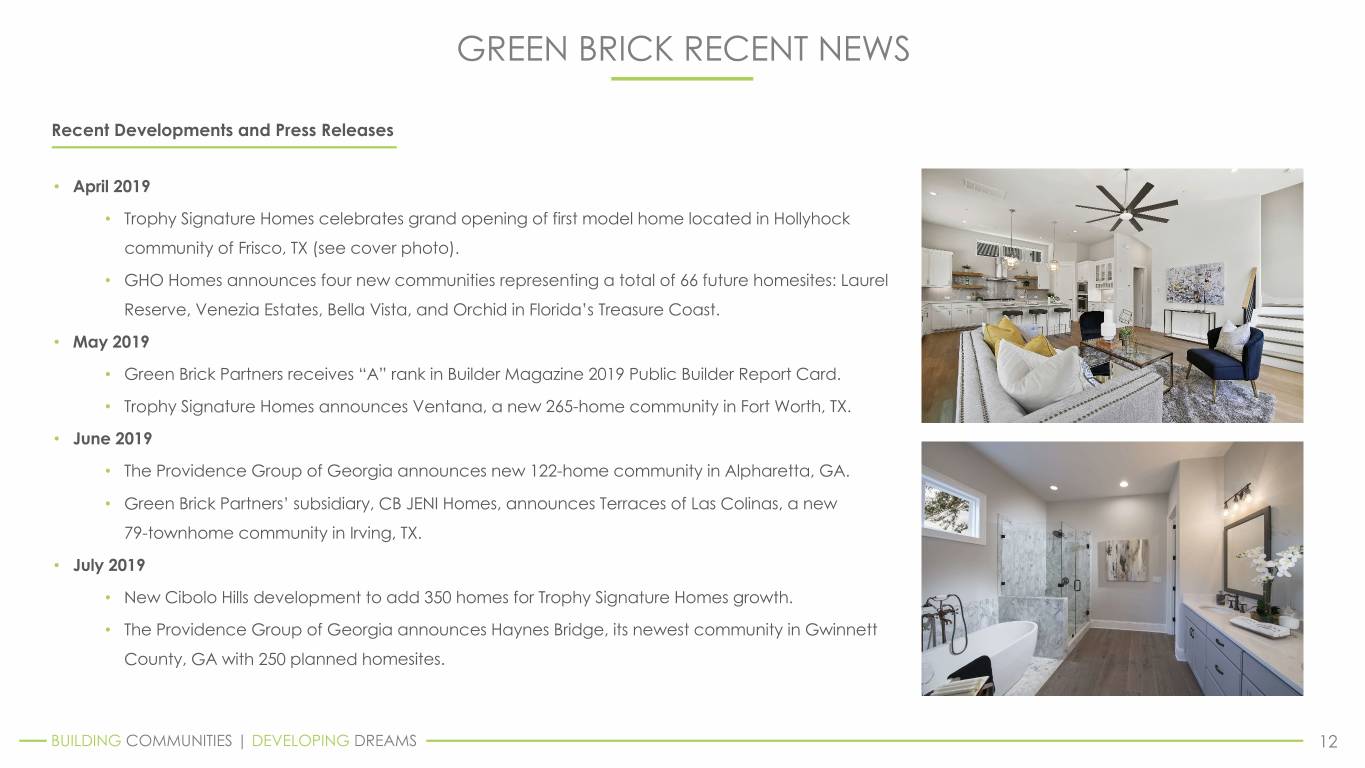

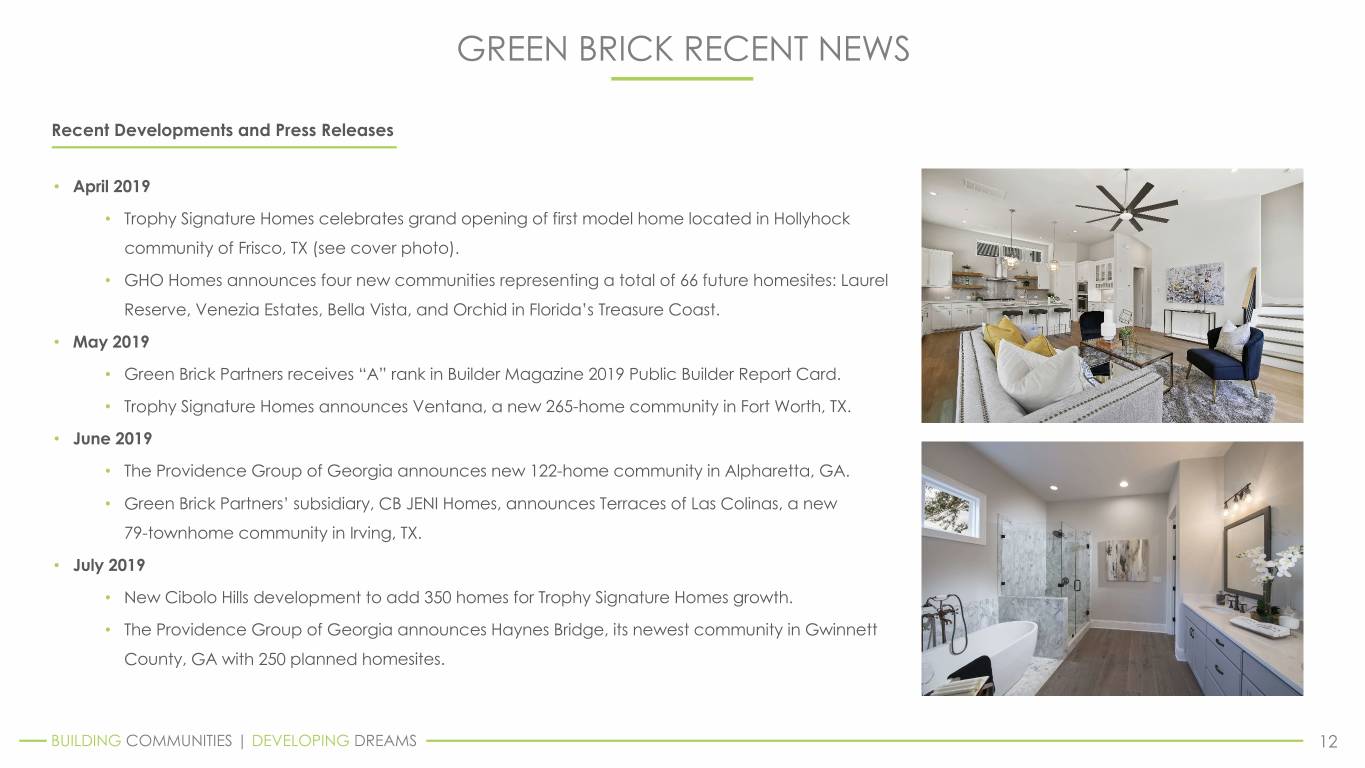

GREEN BRICK RECENT NEWS Recent Developments and Press Releases • April 2019 • Trophy Signature Homes celebrates grand opening of first model home located in Hollyhock community of Frisco, TX (see cover photo). $610.0 • GHO Homes announces four new communities representing a total of 66 future homesites: Laurel Reserve, Venezia Estates, Bella Vista, and Orchid in Florida’s Treasure Coast. $462.6 • May 2019 $391.9 • Green Brick Partners receives “A” rank in Builder Magazine 2019 Public Builder Report Card. • Trophy Signature Homes announces Ventana, a new 265-home community in Fort Worth, TX. • June 2019 +18% YOY +32% YOY • The Providence Group of Georgia announces new 122-home community in Alpharetta, GA. • Green Brick Partners’ subsidiary, CB JENI Homes, announces Terraces of Las Colinas, a new 79-townhome community in Irving, TX. • July 2019 • New Cibolo Hills development to add 350 homes for Trophy Signature Homes growth. • The Providence Group of Georgia announces Haynes Bridge, its newest community in Gwinnett County, GA with 250 planned homesites. BUILDING COMMUNITIES | DEVELOPING DREAMS 12

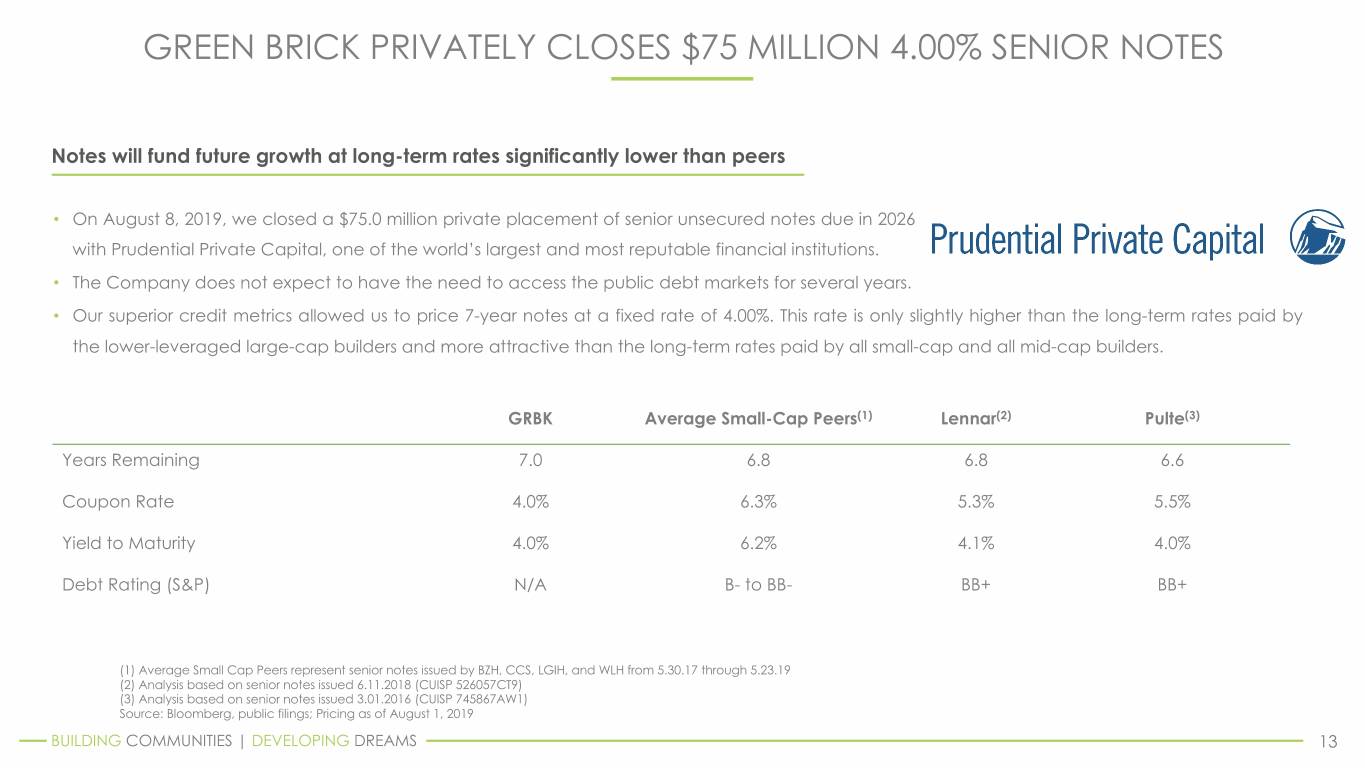

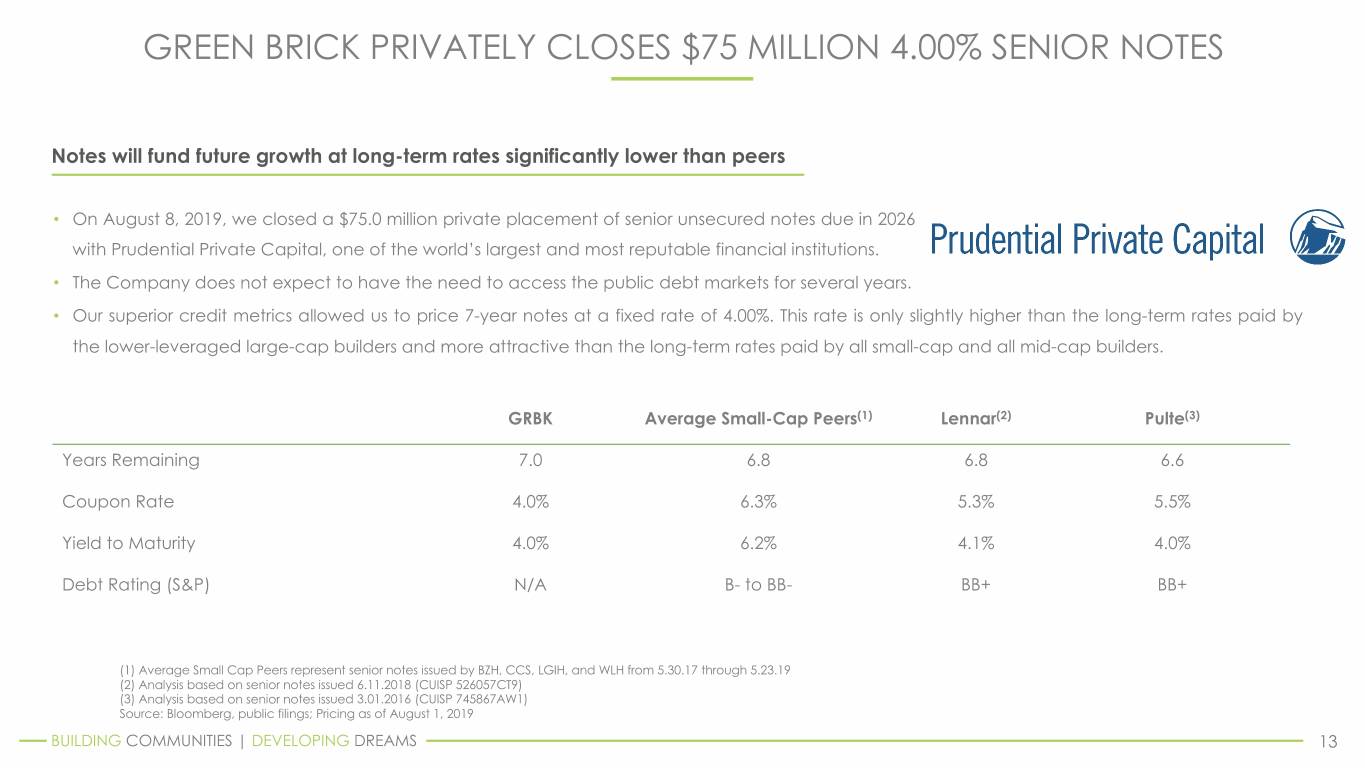

GREEN BRICK PRIVATELY CLOSES $75 MILLION 4.00% SENIOR NOTES Notes will fund future growth at long-term rates significantly lower than peers • On August 8, 2019, we closed a $75.0 million private placement of senior unsecured notes due in 2026 with Prudential Private Capital, one of the world’s largest and most reputable financial institutions. • The Company does not expect to have the need to access the public debt markets for several years. • Our superior credit metrics allowed us to price 7-year notes at a fixed rate of 4.00%. This rate is only slightly higher than the long-term rates paid by the lower-leveraged large-cap builders and more attractive than the long-term rates paid by all small-cap and all mid-cap builders. GRBK Average Small-Cap Peers(1) Lennar(2) Pulte(3) +51% YOY Years Remaining 7.0 6.8 6.8 6.6 +32% YOY Coupon Rate 4.0% 6.3% 5.3% 5.5% Yield to Maturity 4.0% 6.2% 4.1% 4.0% Debt Rating (S&P) N/A B- to BB- BB+ BB+ (1) Average Small Cap Peers represent senior notes issued by BZH, CCS, LGIH, and WLH from 5.30.17 through 5.23.19 (2) Analysis based on senior notes issued 6.11.2018 (CUISP 526057CT9) (3) Analysis based on senior notes issued 3.01.2016 (CUISP 745867AW1) Source: Bloomberg, public filings; Pricing as of August 1, 2019 BUILDING COMMUNITIES | DEVELOPING DREAMS 13

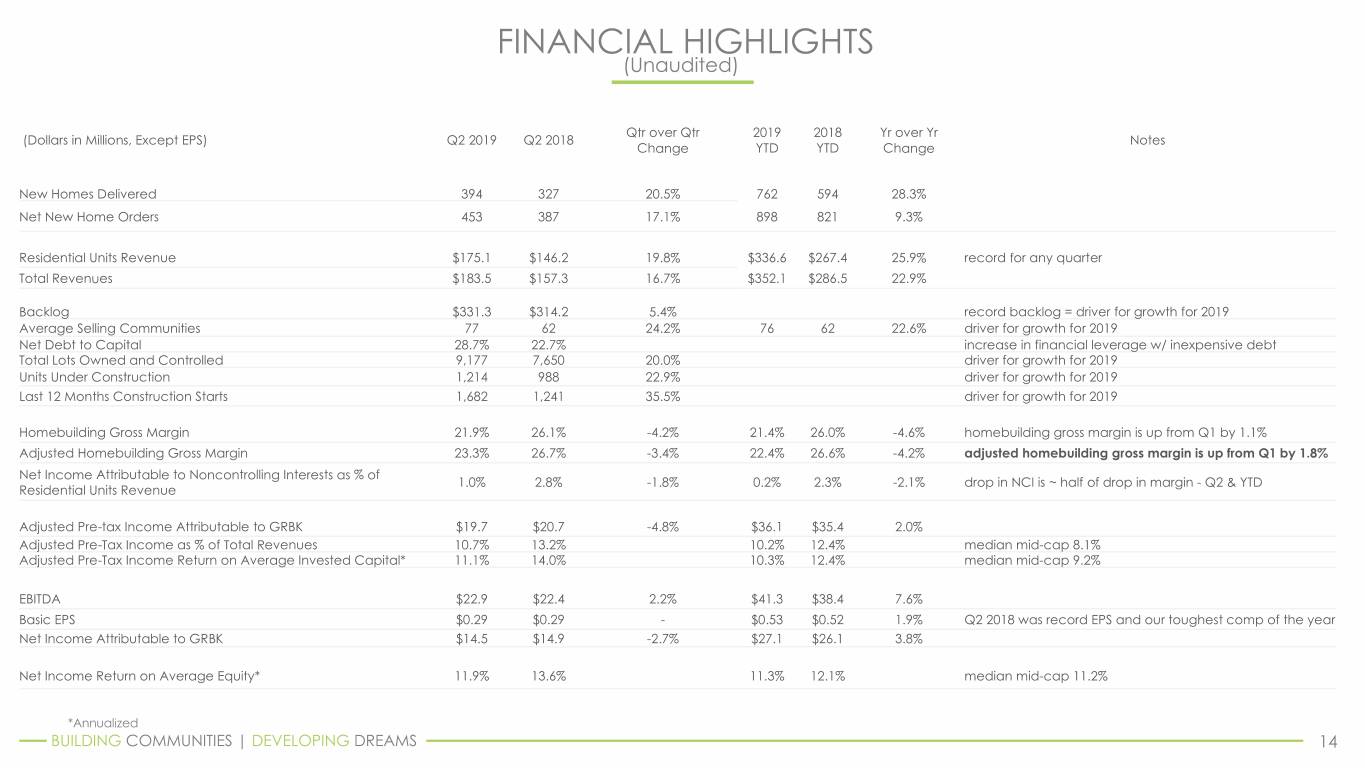

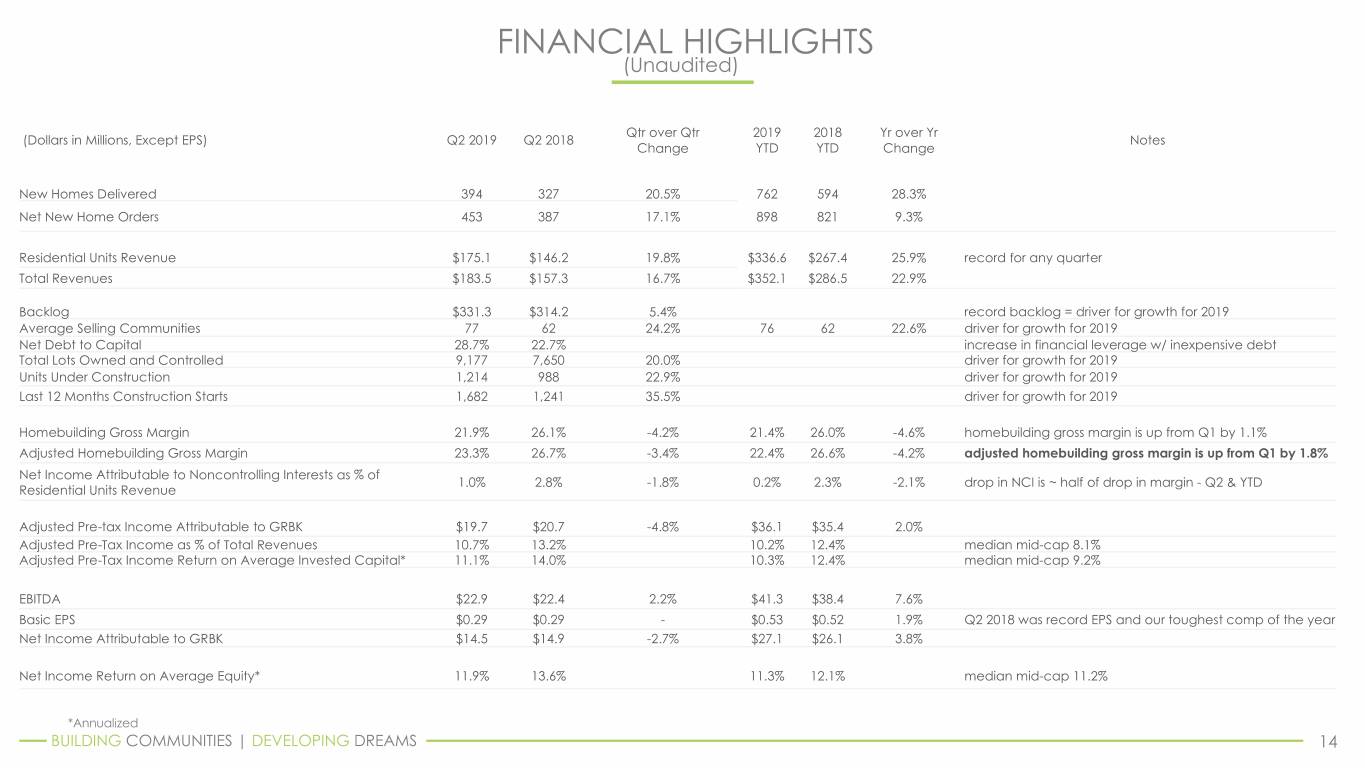

FINANCIAL HIGHLIGHTS (Unaudited) Qtr over Qtr 2019 2018 Yr over Yr (Dollars in Millions, Except EPS) Q2 2019 Q2 2018 Notes Change YTD YTD Change New Homes Delivered 394 327 20.5% 762 594 28.3% Net New Home Orders 453 387 17.1% 898 821 9.3% Residential Units Revenue $175.1 $146.2 19.8% $336.6 $267.4 25.9% record for any quarter Total Revenues $183.5 $157.3 16.7% $352.1 $286.5 22.9% Backlog $331.3 $314.2 5.4% record backlog = driver for growth for 2019 Average Selling Communities 77 62 24.2% 76 62 22.6% driver for growth for 2019 Net Debt to Capital 28.7% 22.7% increase in financial leverage w/ inexpensive debt Total Lots Owned and Controlled 9,177 7,650 20.0% driver for growth for 2019 Units Under Construction 1,214 988 22.9% driver for growth for 2019 Last 12 Months Construction Starts 1,682 1,241 35.5% driver for growth for 2019 Homebuilding Gross Margin 21.9% 26.1% -4.2% 21.4% 26.0% -4.6% homebuilding gross margin is up from Q1 by 1.1% Adjusted Homebuilding Gross Margin 23.3% 26.7% -3.4% 22.4% 26.6% -4.2% adjusted homebuilding gross margin is up from Q1 by 1.8% Net Income Attributable to Noncontrolling Interests as % of 1.0% 2.8% -1.8% 0.2% 2.3% -2.1% drop in NCI is ~ half of drop in margin - Q2 & YTD Residential Units Revenue Adjusted Pre-tax Income Attributable to GRBK $19.7 $20.7 -4.8% $36.1 $35.4 2.0% Adjusted Pre-Tax Income as % of Total Revenues 10.7% 13.2% 10.2% 12.4% median mid-cap 8.1% Adjusted Pre-Tax Income Return on Average Invested Capital* 11.1% 14.0% 10.3% 12.4% median mid-cap 9.2% EBITDA $22.9 $22.4 2.2% $41.3 $38.4 7.6% Basic EPS $0.29 $0.29 - $0.53 $0.52 1.9% Q2 2018 was record EPS and our toughest comp of the year Net Income Attributable to GRBK $14.5 $14.9 -2.7% $27.1 $26.1 3.8% Net Income Return on Average Equity* 11.9% 13.6% 11.3% 12.1% median mid-cap 11.2% *Annualized BUILDING COMMUNITIES | DEVELOPING DREAMS 14

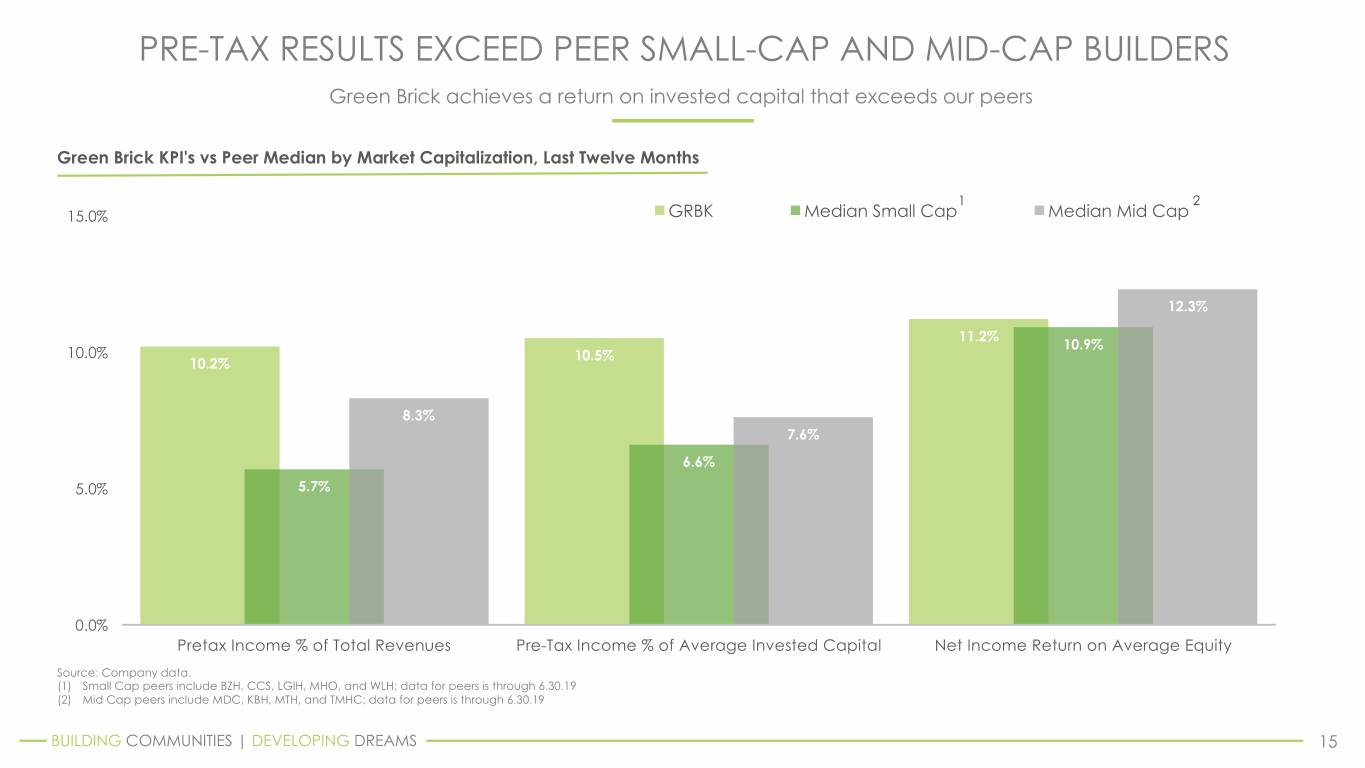

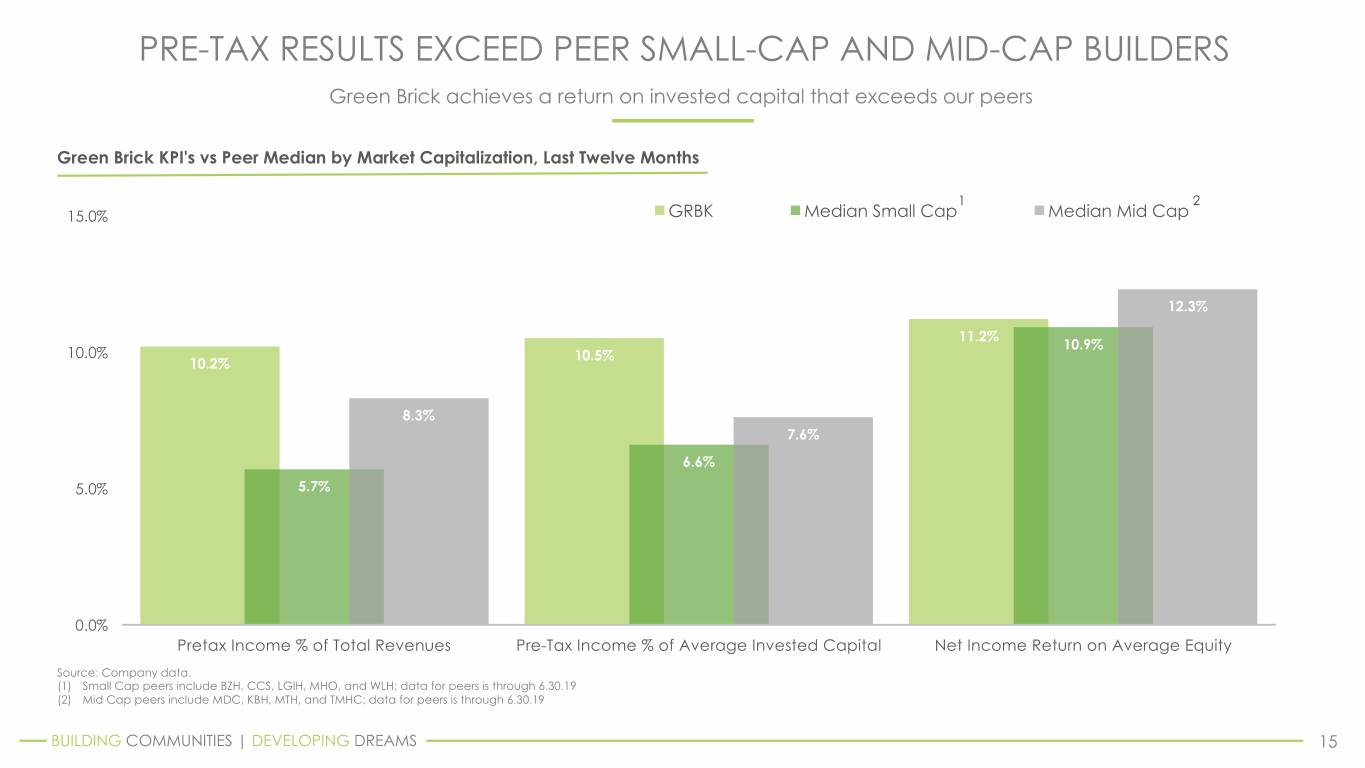

PRE-TAX RESULTS EXCEED PEER SMALL-CAP AND MID-CAP BUILDERS Green Brick achieves a return on invested capital that exceeds our peers Green Brick KPI's vs Peer Median by Market Capitalization, Last Twelve Months 1 2 15.0% GRBK Median Small Cap Median Mid Cap 12.3% 11.2% 10.9% 10.0% 10.5% 10.2% 8.3% 7.6% 6.6% 5.0% 5.7% 0.0% Pretax Income % of Total Revenues Pre-Tax Income % of Average Invested Capital Net Income Return on Average Equity Source: Company data. (1) Small Cap peers include BZH, CCS, LGIH, MHO, and WLH; data for peers is through 6.30.19 (2) Mid Cap peers include MDC, KBH, MTH, and TMHC; data for peers is through 6.30.19 BUILDING COMMUNITIES | DEVELOPING DREAMS 15

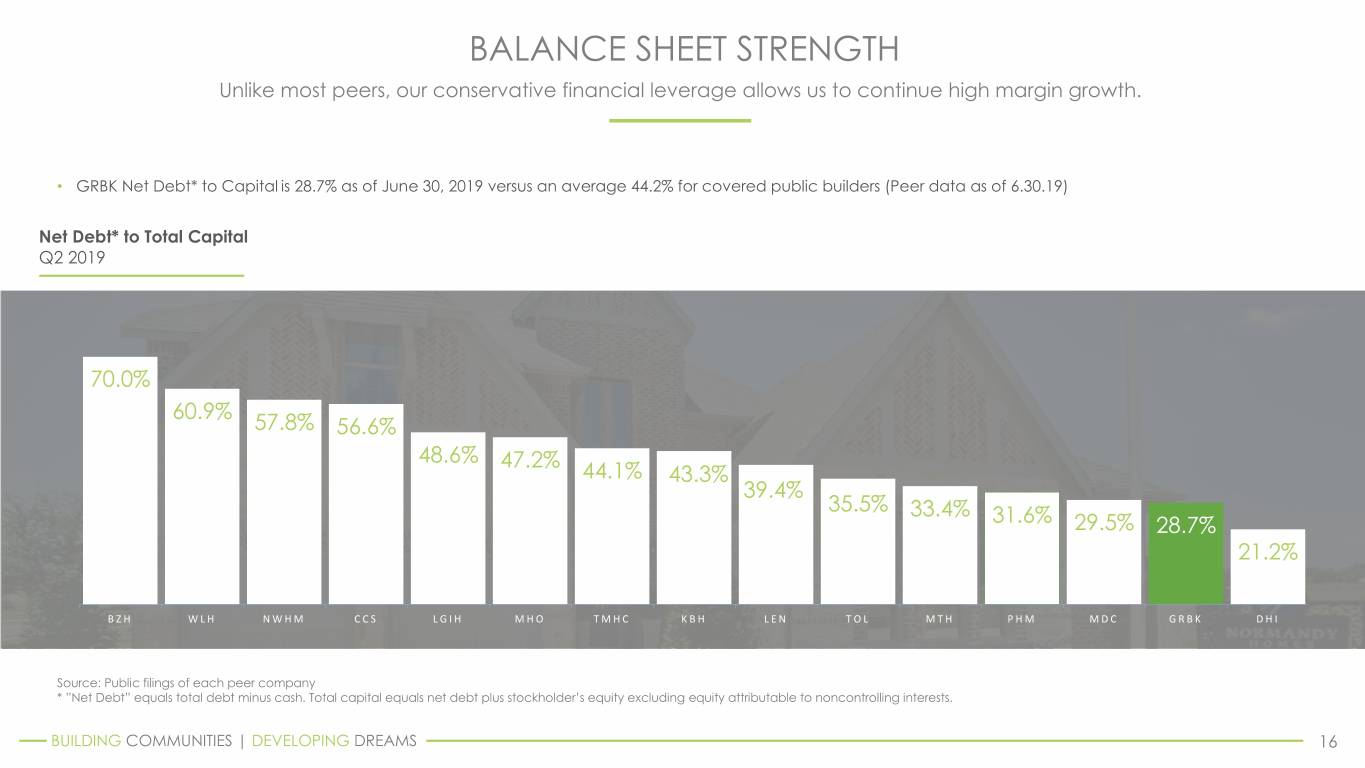

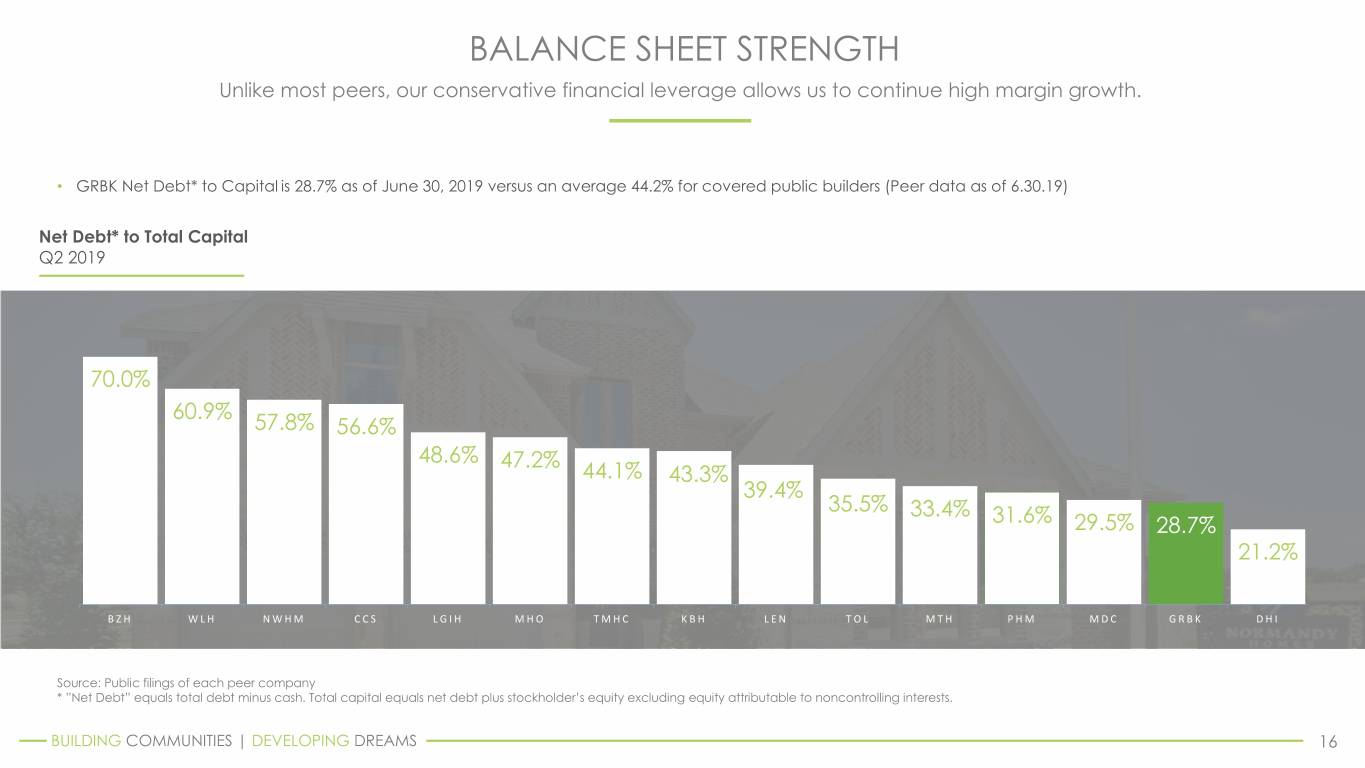

BALANCE SHEET STRENGTH Unlike most peers, our conservative financial leverage allows us to continue high margin growth. • GRBK Net Debt* to Capital is 28.7% as of June 30, 2019 versus an average 44.2% for covered public builders (Peer data as of 6.30.19) Net Debt* to Total Capital Q2 2019 70.0% 60.9% 57.8% 56.6% 48.6% 47.2% 44.1% 43.3% 39.4% 35.5% 33.4% 31.6% 29.5% 28.7% 21.2% BZH WLH NWHM CCS LGIH MHO TMHC KBH LEN TOL MTH PHM MDC GRBK DHI Source: Public filings of each peer company * ”Net Debt” equals total debt minus cash. Total capital equals net debt plus stockholder’s equity excluding equity attributable to noncontrolling interests. BUILDING COMMUNITIES | DEVELOPING DREAMS 16

DRIVERS FOR INCREASE IN RETURN ON EQUITY With significant growth drivers in place, Green Brick can enhance future returns on equity through: • Modest increase in debt to capital up to 35%. Consolidated debt is priced significantly less than small-cap peers and mid-cap peers. • Scale our SG&A leverage by controlling corporate overhead growth while our Team Builders experience top-line growth. • Expand the breadth of our existing financial services platforms. • Increase operating efficiencies at the Team Builder level. BUILDING COMMUNITIES | DEVELOPING DREAMS 17

APPENDIX BUILDING COMMUNITIES | DEVELOPING DREAMS 18

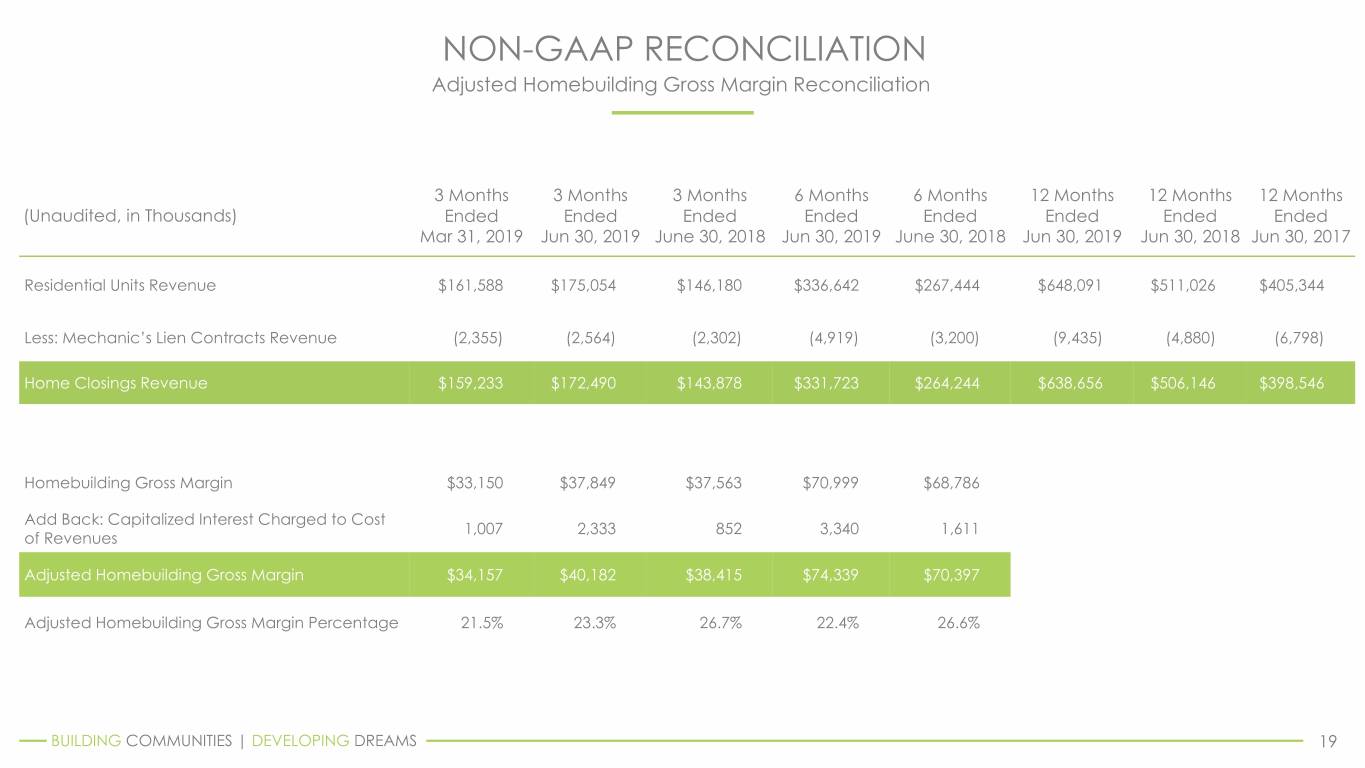

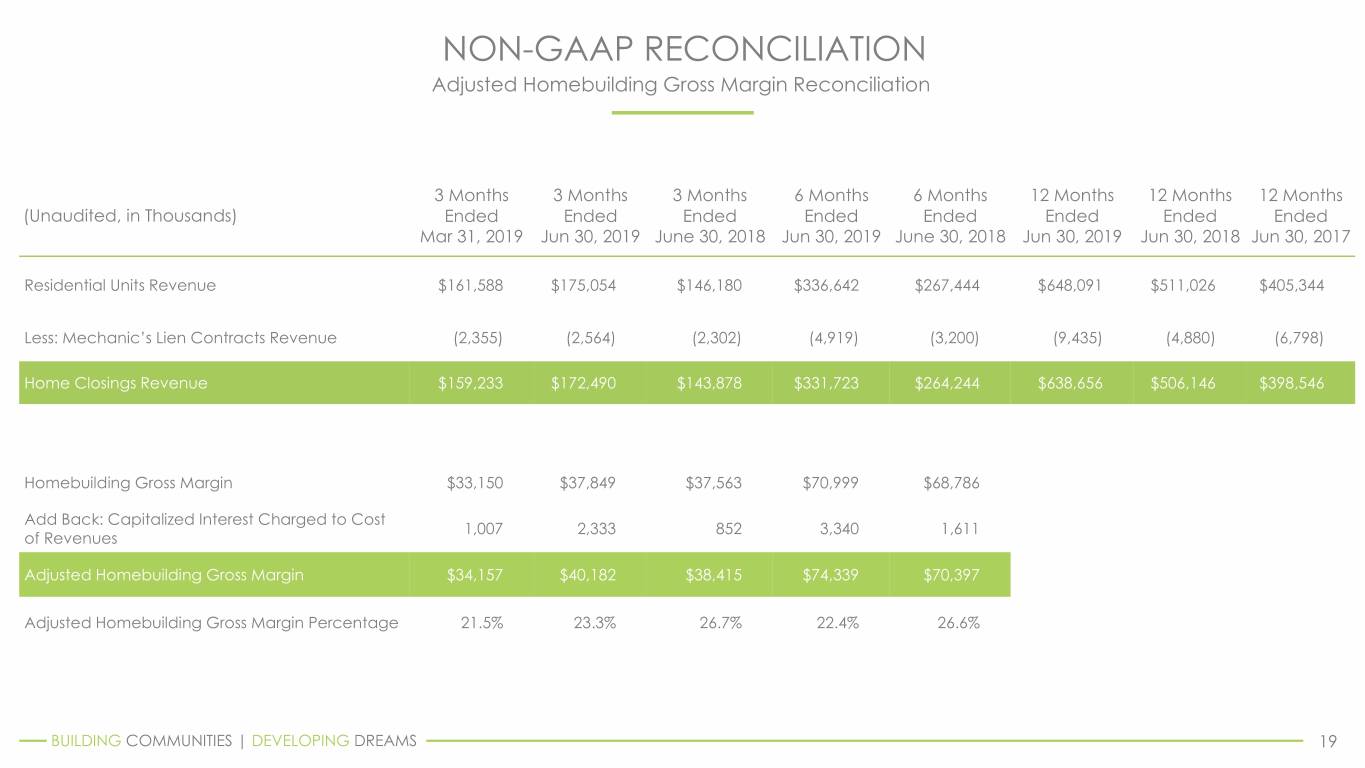

NON-GAAP RECONCILIATION Adjusted Homebuilding Gross Margin Reconciliation 3 Months 3 Months 3 Months 6 Months 6 Months 12 Months 12 Months 12 Months (Unaudited, in Thousands) Ended Ended Ended Ended Ended Ended Ended Ended Mar 31, 2019 Jun 30, 2019 June 30, 2018 Jun 30, 2019 June 30, 2018 Jun 30, 2019 Jun 30, 2018 Jun 30, 2017 Residential Units Revenue $161,588 $175,054 $146,180 $336,642 $267,444 $648,091 $511,026 $405,344 Less: Mechanic’s Lien Contracts Revenue (2,355) (2,564) (2,302) (4,919) (3,200) (9,435) (4,880) (6,798) Home Closings Revenue $159,233 $172,490 $143,878 $331,723 $264,244 $638,656 $506,146 $398,546 Homebuilding Gross Margin $33,150 $37,849 $37,563 $70,999 $68,786 Add Back: Capitalized Interest Charged to Cost 1,007 2,333 852 3,340 1,611 of Revenues Adjusted Homebuilding Gross Margin $34,157 $40,182 $38,415 $74,339 $70,397 Adjusted Homebuilding Gross Margin Percentage 21.5% 23.3% 26.7% 22.4% 26.6% BUILDING COMMUNITIES | DEVELOPING DREAMS 19

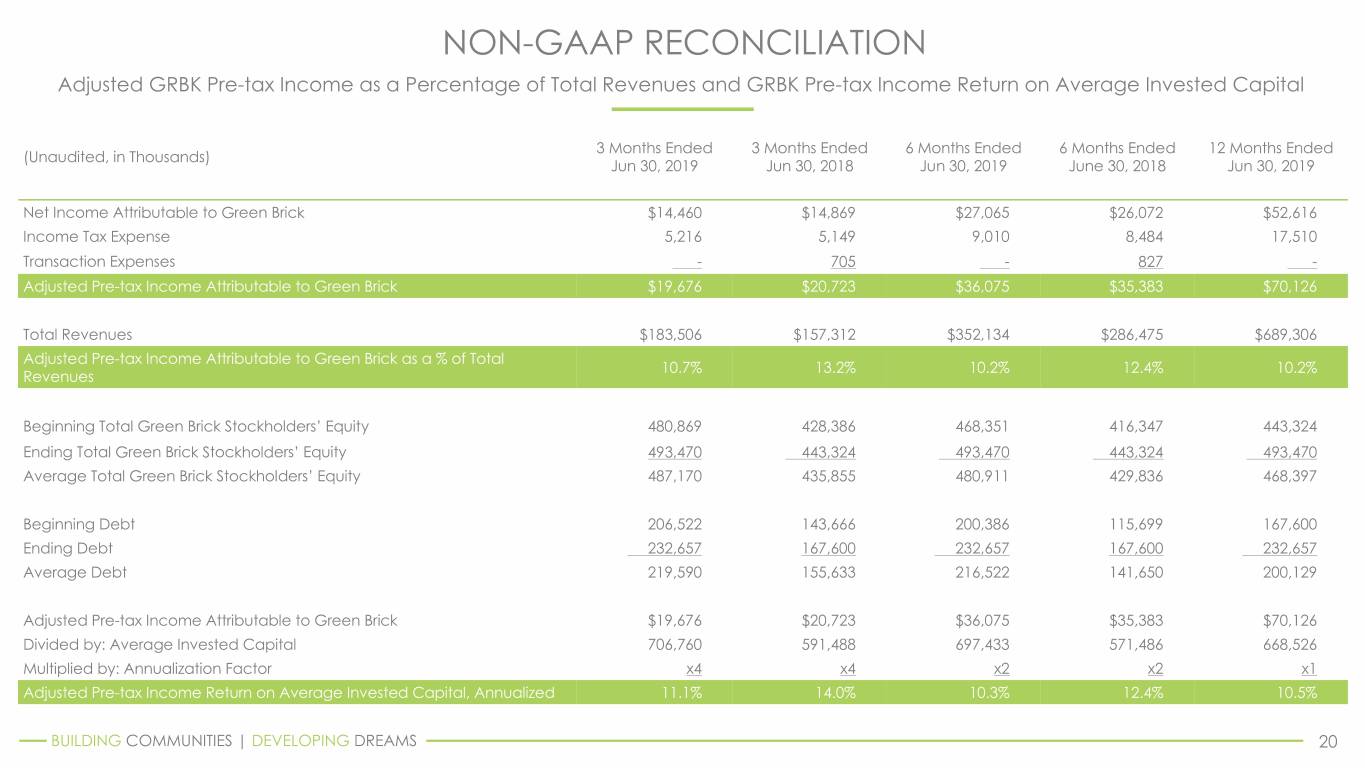

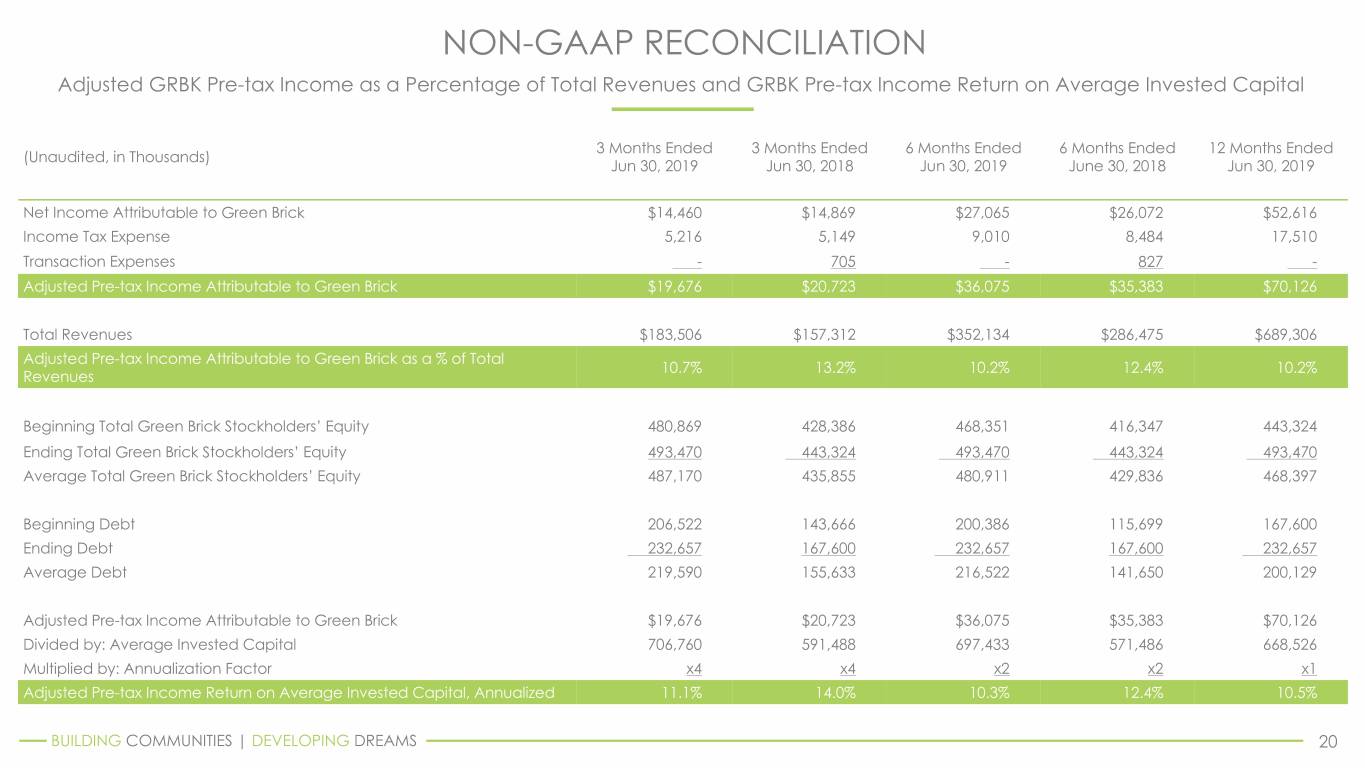

NON-GAAP RECONCILIATION Adjusted GRBK Pre-tax Income as a Percentage of Total Revenues and GRBK Pre-tax Income Return on Average Invested Capital 3 Months Ended 3 Months Ended 6 Months Ended 6 Months Ended 12 Months Ended (Unaudited, in Thousands) Jun 30, 2019 Jun 30, 2018 Jun 30, 2019 June 30, 2018 Jun 30, 2019 Net Income Attributable to Green Brick $14,460 $14,869 $27,065 $26,072 $52,616 Income Tax Expense 5,216 5,149 9,010 8,484 17,510 Transaction Expenses - 705 - 827 - Adjusted Pre-tax Income Attributable to Green Brick $19,676 $20,723 $36,075 $35,383 $70,126 Total Revenues $183,506 $157,312 $352,134 $286,475 $689,306 Adjusted Pre-tax Income Attributable to Green Brick as a % of Total 10.7% 13.2% 10.2% 12.4% 10.2% Revenues Beginning Total Green Brick Stockholders’ Equity 480,869 428,386 468,351 416,347 443,324 Ending Total Green Brick Stockholders’ Equity 493,470 443,324 493,470 443,324 493,470 Average Total Green Brick Stockholders’ Equity 487,170 435,855 480,911 429,836 468,397 Beginning Debt 206,522 143,666 200,386 115,699 167,600 Ending Debt 232,657 167,600 232,657 167,600 232,657 Average Debt 219,590 155,633 216,522 141,650 200,129 Adjusted Pre-tax Income Attributable to Green Brick $19,676 $20,723 $36,075 $35,383 $70,126 Divided by: Average Invested Capital 706,760 591,488 697,433 571,486 668,526 Multiplied by: Annualization Factor x4 x4 x2 x2 x1 Adjusted Pre-tax Income Return on Average Invested Capital, Annualized 11.1% 14.0% 10.3% 12.4% 10.5% BUILDING COMMUNITIES | DEVELOPING DREAMS 20

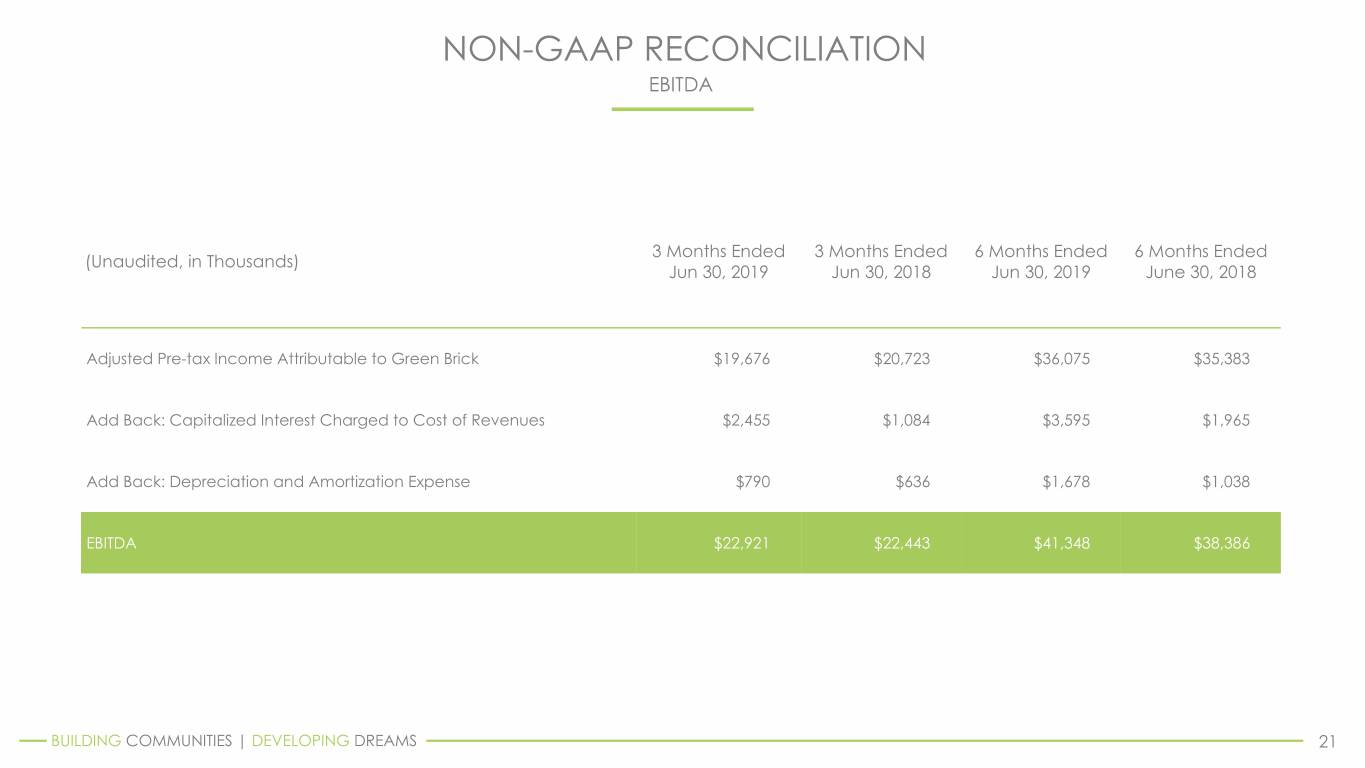

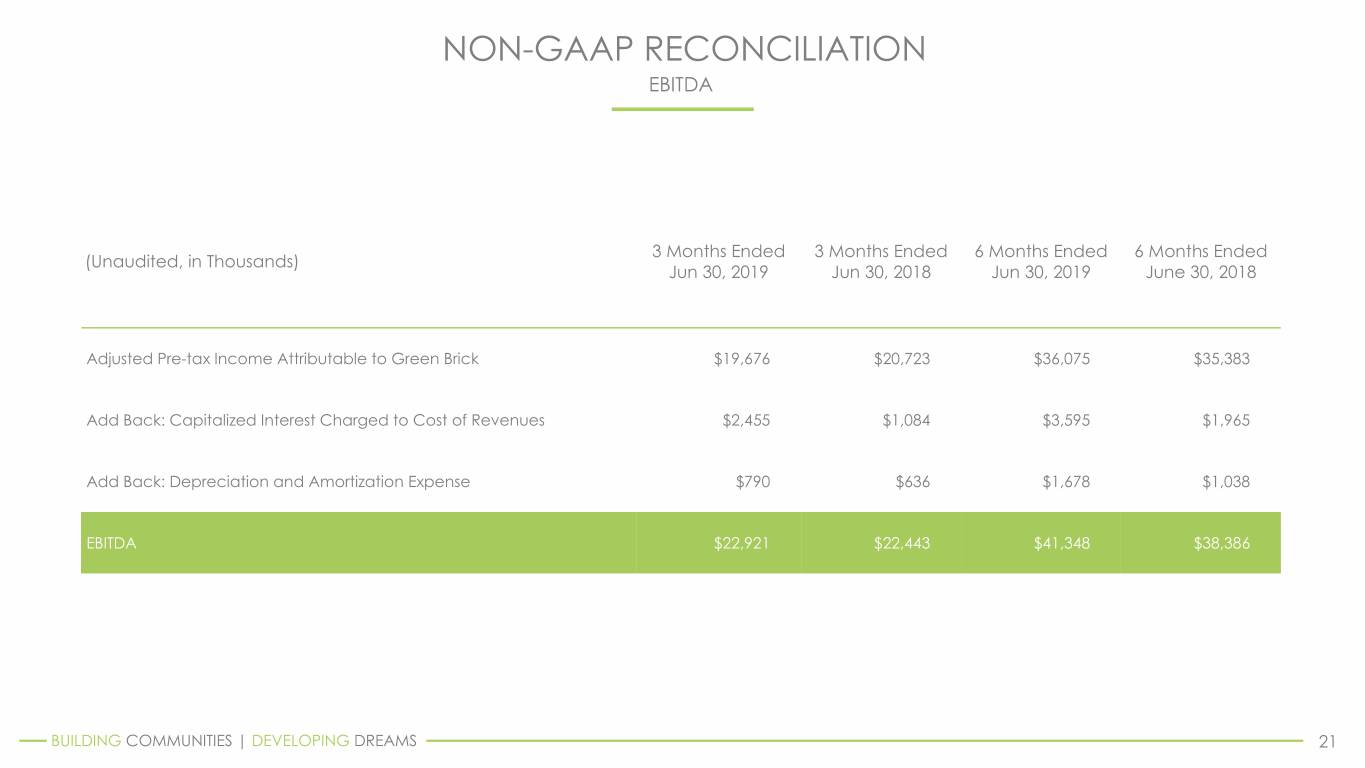

NON-GAAP RECONCILIATION EBITDA 3 Months Ended 3 Months Ended 6 Months Ended 6 Months Ended (Unaudited, in Thousands) Jun 30, 2019 Jun 30, 2018 Jun 30, 2019 June 30, 2018 Adjusted Pre-tax Income Attributable to Green Brick $19,676 $20,723 $36,075 $35,383 Add Back: Capitalized Interest Charged to Cost of Revenues $2,455 $1,084 $3,595 $1,965 Add Back: Depreciation and Amortization Expense $790 $636 $1,678 $1,038 EBITDA $22,921 $22,443 $41,348 $38,386 BUILDING COMMUNITIES | DEVELOPING DREAMS 21

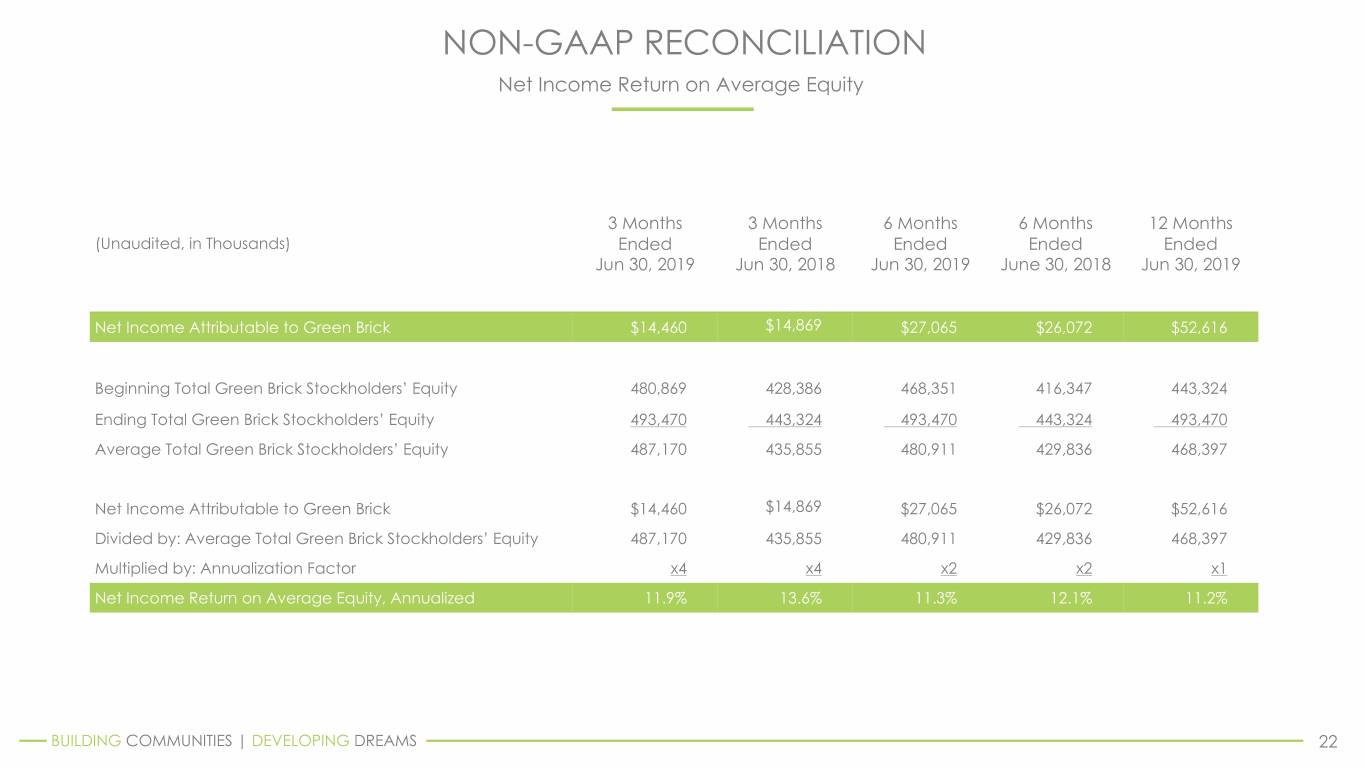

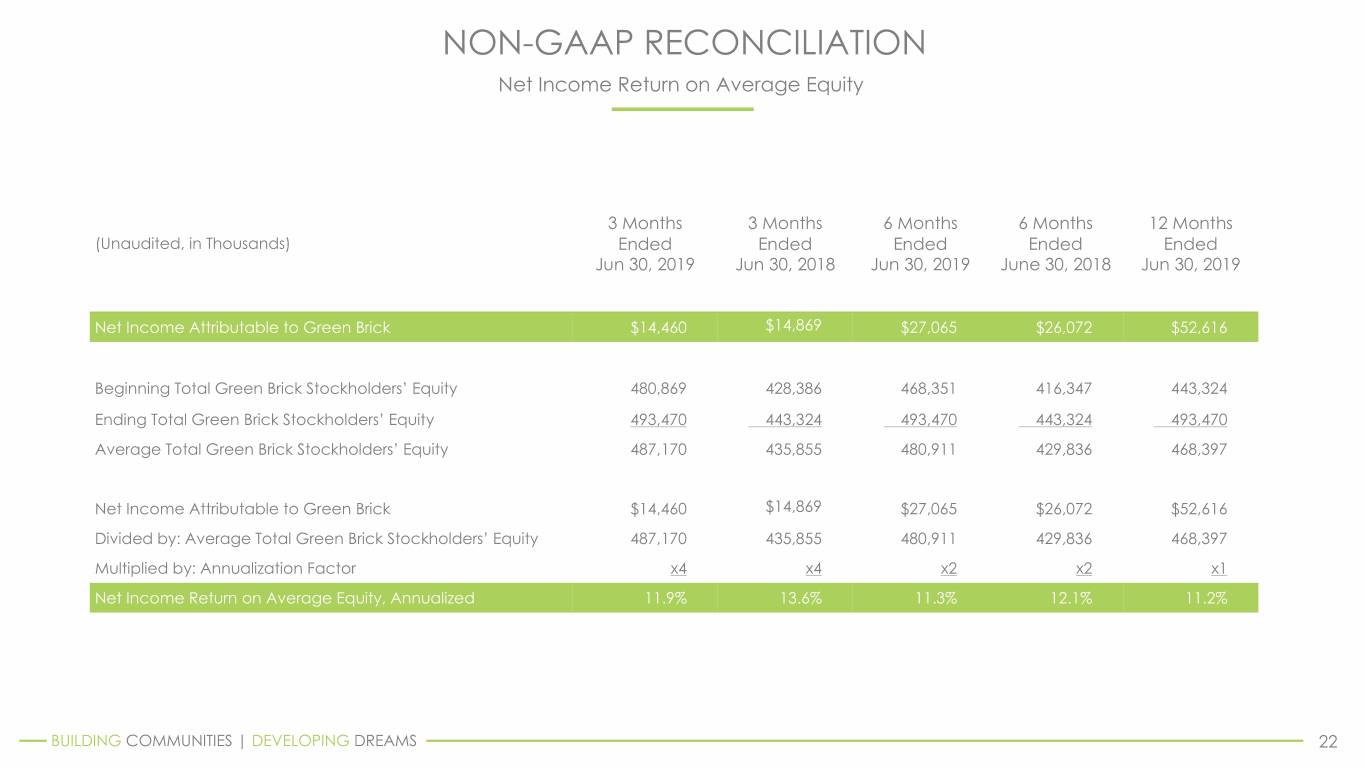

NON-GAAP RECONCILIATION Net Income Return on Average Equity 3 Months 3 Months 6 Months 6 Months 12 Months (Unaudited, in Thousands) Ended Ended Ended Ended Ended Jun 30, 2019 Jun 30, 2018 Jun 30, 2019 June 30, 2018 Jun 30, 2019 Net Income Attributable to Green Brick $14,460 $14,869 $27,065 $26,072 $52,616 Beginning Total Green Brick Stockholders’ Equity 480,869 428,386 468,351 416,347 443,324 Ending Total Green Brick Stockholders’ Equity 493,470 443,324 493,470 443,324 493,470 Average Total Green Brick Stockholders’ Equity 487,170 435,855 480,911 429,836 468,397 Net Income Attributable to Green Brick $14,460 $14,869 $27,065 $26,072 $52,616 Divided by: Average Total Green Brick Stockholders’ Equity 487,170 435,855 480,911 429,836 468,397 Multiplied by: Annualization Factor x4 x4 x2 x2 x1 Net Income Return on Average Equity, Annualized 11.9% 13.6% 11.3% 12.1% 11.2% BUILDING COMMUNITIES | DEVELOPING DREAMS 22

The Providence Group of Georgia| East of Main, Alpharetta, GA Award-Winning Luxury Single-Family and Townhomes SECOND QUARTER INVESTOR CALL PRESENTATION 2019 2805 Dallas Parkway, Suite 400 Plano, Texas 75093 | www.greenbrickpartners.com