UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Isilon Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

April 26, 2010

Dear Isilon Stockholder:

You are cordially invited to attend the 2010 annual meeting of stockholders of Isilon Systems, Inc., which will be held on Wednesday, May 19, 2010, at 10:00 a.m. at 3101 Western Avenue, Seattle, Washington 98121.

Details of the business to be conducted at the meeting are contained in the notice of annual meeting and the proxy statement that follow.

Whether or not you plan to attend the annual meeting, your vote will ensure that your shares are represented. We hope that you will vote your shares as soon as possible. You may vote via the Internet, by telephone, or by mailing a completed proxy card in the enclosed envelope. If you decide to attend the annual meeting, you will be able to vote in person, even if you have previously submitted your proxy.

We urge you to carefully review the proxy materials and to vote FOR the director nominees, FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2010 fiscal year and FOR the approval of our 2006 Equity Incentive Plan (As Amended).

Thank you for your interest in Isilon.

|

| Sincerely, |

|

|

| Sujal M. Patel |

| President and Chief Executive Officer |

ISILON SYSTEMS, INC.

3101 Western Avenue

Seattle, Washington 98121

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2010

To the Stockholders of Isilon Systems, Inc.:

The 2010 annual meeting of stockholders of Isilon Systems, Inc. will be held at 3101 Western Avenue, Seattle, Washington 98121 on Wednesday, May 19, 2010, at 10:00 a.m., local time, for the following purposes:

| | 1. | To elect as Class I directors the two nominees named in the attached proxy statement. |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2010 fiscal year. |

| | 3. | To approve the 2006 Equity Incentive Plan (As Amended). |

The stockholders will also act on any other business that may properly come before the meeting.

The foregoing items of business are more fully described in the proxy statement accompanying this notice. The board of directors has fixed the close of business on March 23, 2010, as the record date for the determination of stockholders entitled to notice of and to vote at the meeting. A list of stockholders will be available for inspection at least ten days prior to the annual meeting at our principal executive offices at 3101 Western Avenue, Seattle, Washington 98121.

The proxy statement for this annual meeting and the annual report to stockholders for the fiscal year ended December 31, 2009, are available atwww.RRDEZProxy.com/2010/ISLN.

|

| By Order of the Board of Directors, |

|

|

| Keenan M. Conder |

Vice President, General Counsel and Corporate Secretary |

Seattle, Washington

April 26, 2010

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE TO ENSURE THAT YOUR VOTE IS RECORDED PROMPTLY. MOST STOCKHOLDERS HAVE THREE OPTIONS FOR SUBMITTING THEIR VOTES: (1) VIA THE INTERNET; (2) BY TELEPHONE; OR (3) BY MAIL. WE ENCOURAGE YOU TO RECORD YOUR VOTE VIA THE INTERNET. IT IS CONVENIENT AND SAVES US SIGNIFICANT POSTAGE AND PROCESSING COSTS. YOUR COMPLETED PROXY, OR YOUR TELEPHONE OR INTERNET VOTE, WILL NOT PREVENT YOU FROM ATTENDING THE MEETING AND VOTING IN PERSON SHOULD YOU SO CHOOSE.

TABLE OF CONTENTS

ISILON SYSTEMS, INC.

3101 Western Avenue

Seattle, Washington 98121

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

This proxy statement contains information about the 2010 annual meeting of stockholders of Isilon Systems, Inc., to be held at 3101 Western Avenue, Seattle, Washington 98121 on Wednesday, May 19, 2010, commencing at 10:00 a.m., local time. Our telephone number is (206) 315-7500. You may obtain directions to the location of the annual meeting by visiting our website atwww.isilon.com.

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors of Isilon Systems, Inc. (which is also referred to as Isilon, the company, we, us or our in this proxy statement), for use at the annual meeting and any adjournment of that meeting.

| | • | | THIS PROXY STATEMENT summarizes information about the proposals to be considered at the annual meeting and other information you may find useful in determining how to vote. |

| | • | | THE PROXY CARD is the means by which you authorize designated persons to vote your shares in accordance with your instructions. |

We mailed this proxy statement and the enclosed proxy card to stockholders for the first time on or about April 26, 2010. In the mailing, we included copies of our annual report to stockholders for the fiscal year ended December 31, 2009.

In addition, you may request to receive future proxy materials in printed form by mail or electronically. Your election to receive future proxy materials by mail or electronically will remain in effect until you terminate such election.

Who is entitled to vote at the meeting?

The board set March 23, 2010, as the record date for the 2010 annual meeting of stockholders. You can vote if you were a registered or beneficial stockholder of Isilon at the close of business on the record date. At the close of business on the record date, we had 65,196,306 shares of our common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter presented. There is no cumulative voting.

How do I vote my shares?

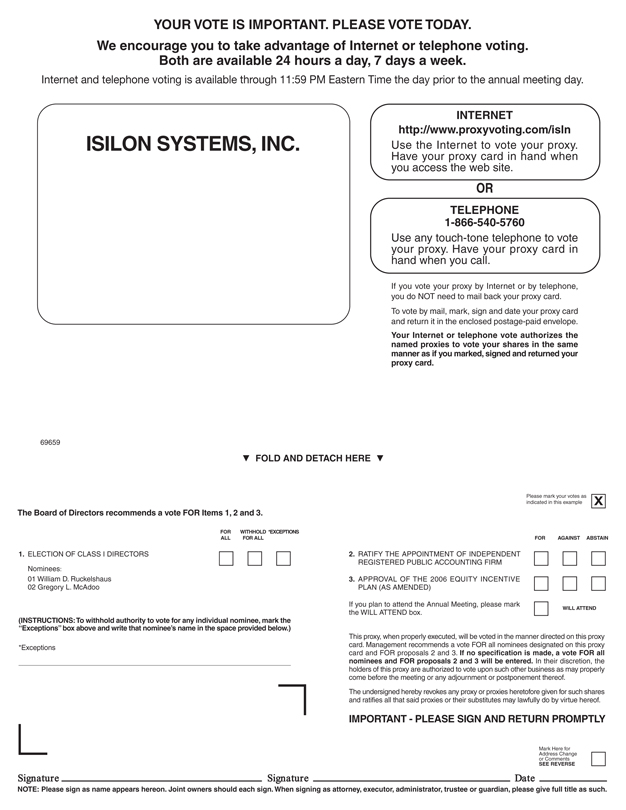

If you are a “registered stockholder,” meaning that you own your shares in your own name and not through a bank or brokerage firm, you may vote in one of four ways:

| | 1. | Vote over the Internet.You may vote your shares over the Internet by following the instructions included on your proxy card; |

| | 2. | Vote by telephone.You may vote your shares by telephone by following the instructions included on your proxy card; |

| | 3. | Vote by mail.You may vote by completing and signing the proxy card enclosed with this proxy statement and promptly mailing it in the enclosed postage-prepaid envelope; or |

| | 4. | Vote in person. If you attend the meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot. Ballots will be available at the meeting. |

If you are a registered stockholder and you do not cast your vote,no votes will be cast on your behalf on any of the items of business at the annual meeting.

1

If you are a “beneficial stockholder,” meaning that your shares are held in “street name” by a brokerage firm, your brokerage firm is considered the record holder of the shares and is required to vote your shares according to your instructions. You may vote as follows:

| | 1. | Voting, generally. You will need to follow the directions your brokerage firm provides you. If you are a beneficial stockholder and do not submit voting instructions to your broker, New York Stock Exchange, or NYSE, member brokers may only vote your shares as described below. |

| | • | | Routine Items.Proposals 2 and 3 are considered “routine” items. NYSE member brokers that do not receive instructions from beneficial stockholders may vote on these proposals in their discretion, subject to any voting policies adopted by the broker holding your shares. |

| | • | | Non-routine Items.Proposal 1 is considered a “non-routine” item.NYSE member brokers that do not receive instructions from beneficial owners may not vote on this proposal. |

| | 2. | Vote in person. If you want to vote in person and be admitted to the annual meeting, you must (a) obtain a legal proxy from your broker and present it at the annual meeting and (b) bring an account statement or letter from your bank or brokerage firm showing that you are the beneficial owner of the shares as of the March 23, 2010, record date. |

If you do not submit voting instructions and your broker does not have discretion to vote your shares on a matter, your broker will return the proxy card to us without voting on that matter (referred to as “broker non-votes”) andyour shares will not be counted in determining the outcome of the vote on that matter. Therefore, if you hold your shares through a broker, it is critically important that you submit your voting instructions if you want your shares to count on Proposal 1.

How does the board recommend that I vote?

The board recommends a FOR vote on the following proposals:

| | • | | Proposal No. 1: Election of the two nominees named in this proxy statement as Class I directors; |

| | • | | Proposal No. 2: Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2010 fiscal year; and |

| | • | | Proposal No. 3: Approval of our 2006 Equity Incentive Plan (As Amended). |

What vote is required to approve each of the proposals?

| | • | | Proposal No. 1: The affirmative vote of a plurality, or the largest number, of the shares of common stock present in person or by proxy at the meeting and entitled to vote is required for the election of each director. This means that the two director nominees who receive the highest number of affirmative “FOR” votes will be elected to the board. |

| | • | | Proposal Nos. 2 and 3: The affirmative vote of the holders of shares of common stock, having a majority of the votes present in person or represented by proxy at the annual meeting and entitled to vote on the matter, are necessary to ratify the appointment of PricewaterhouseCoopers and to approve our 2006 Equity Incentive Plan (As Amended). |

How are votes counted?

| | • | | Proposal No. 1: You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the board. In the election of directors, the two director nominees receiving the highest number of affirmative “FOR” votes will be elected to the board. |

2

| | • | | Proposal Nos. 2 and 3: You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to ratify our independent registered accounting firm and the proposal to approve our 2006 Equity Incentive Plan (As Amended). Abstentions will not be counted as voting on a proposal and has the same effect as a vote against that proposal. |

If you do not provide voting instructions to your broker or other nominee on non-routine items (our Proposal 1), such shares cannot be voted and will be considered “broker non-votes,” rather than votes “for” or “against.”

Is there a minimum number of shares that must be represented in person or by proxy to hold the annual meeting?

A majority of our outstanding shares as of the record date must be present at the annual meeting in order to hold the annual meeting and conduct business. This is called a “quorum.” Shares are counted as present at the annual meeting if you are present and vote in person at the annual meeting, or you vote by telephone or via the Internet, or if you properly submit a proxy card. Abstentions, withhold and broker non-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

Who will count the vote?

Representatives of BNY Mellon Shareowner Services, our transfer agent, will tabulate votes and act as independent inspectors of election.

Expenses of soliciting proxies

We will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by the use of mail, certain directors, officers and regular employees may solicit proxies by telephone or personal interview. No additional compensation will be paid to our directors, officers or employees for such services. Currently, we do not intend to retain any person to assist in the solicitation of proxies. We may request brokerage firms and custodians, nominees and other record holders to forward soliciting materials to the beneficial owners of our stock and will reimburse them for their reasonable out-of-pocket expenses in forwarding these materials.

Can I change my vote after I have mailed in my proxy card?

| | • | | Registered Stockholders: You can revoke your proxy before it is voted in one of three ways: |

| | • | | sign a later-dated proxy card and submit it so that it is received prior to the meeting in accordance with the instructions included on the proxy card; |

| | • | | vote by telephone or via the Internet by following the instructions included on your proxy card; or |

| | • | | attend the meeting and deliver your completed proxy card or complete a ballot in person. |

| | • | | Beneficial Stockholders: If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the annual meeting if you obtain a legal proxy from the institution holding your shares. Please contact the institution holding your shares for information. |

Attending the meeting will not, by itself, revoke a proxy unless you specifically request it.

What does it mean if I receive more than one package of proxy materials?

This means that you have multiple accounts holding Isilon shares. These may include: accounts with our transfer agent, BNY Mellon Shareowner Services; accounts holding shares that you have purchased under our

3

stock option or employee stock purchase plans; and accounts with a broker, bank or other holder of record.Please vote all proxy cards and voting instruction forms that you receive with each package of proxy materials to ensure that all of your shares are voted.

How can I access Isilon’s proxy materials and annual report electronically?

The proxy statement and our annual report to stockholders for the fiscal year ended December 31, 2009, are available at eitherwww.RRDEZProxy.com/2010/ISLN or on our website atwww.isilon.com, by clicking on “Company,” then “Investor Relations,” and then “SEC Filings.”

What is “householding” and how does it affect me?

The Securities and Exchange Commission, or the SEC, has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement or annual report, as applicable, addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. Although we do not household for our registered stockholders, some brokers household Isilon proxy materials and annual reports, delivering a single proxy statement and annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement or annual report, or if you are receiving multiple copies of either document and wish to receive only one, please notify your broker. We will deliver promptly upon written or oral request a separate copy of our annual report and/or proxy statement to a stockholder at a shared address to which a single copy of either document was delivered. For copies of either or both documents, stockholders should write to Investor Relations, Isilon Systems, Inc., 3101 Western Avenue, Seattle, Washington 98121, or call (206) 315-7500.

Attending the annual meeting

Our annual meeting will begin promptly at 10:00 a.m., local time, on Wednesday, May 19, 2010, at 3101 Western Avenue, Seattle, Washington 98121. You may obtain directions to the location of the annual meeting by visiting our website atwww.isilon.com.

All stockholders should be prepared to present photo identification for admission to the annual meeting. If you are a beneficial stockholder and hold your shares in “street name,” you will be asked to present proof of ownership of your shares as of the record date. Examples of acceptable evidence of ownership include your most recent brokerage statement showing ownership of shares prior to the record date or a photocopy of your voting instruction form. Persons acting as proxies must bring a valid proxy from a stockholder of record as of the record date. Your late arrival or failure to comply with these procedures could affect your ability to participate in the annual meeting.

Adjournment of meeting

If a quorum is not present to transact business at the meeting or if we do not receive sufficient votes in favor of the proposals by the date of the meeting, the persons named as proxies may propose one or more adjournments of the meeting to permit solicitation of proxies. Any adjournment would require the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the annual meeting. The final voting results will be reported in a form 8-K within four business days after the end of our annual meeting.

4

PROPOSALS (MATTERS REQUIRING STOCKHOLDER ACTION)

PROPOSAL 1 — ELECTION OF CLASS I DIRECTORS

Our amended and restated certificate of incorporation provides for a classified board divided into three classes. The members of each class are elected to serve a three-year term with the term of office for each class ending in consecutive years. We currently have authorized eight directors, with seven directors serving. Vacancies may be filled by a majority of the directors then in office or by a sole remaining director. Alternatively, our bylaws provide that the board, at its option, may increase or decrease the authorized number of directors.

At this year’s annual meeting, the terms of our Class I directors will expire. William D. Ruckelshaus and Gregory L. McAdoo are the current Class I directors who have been nominated for re-election to the board to serve until the 2013 annual meeting or until their successors are elected and qualified. Each of the nominees has agreed to serve as a director if elected. Proxies may not be voted for more than two directors. A director nominee must receive the vote of a plurality, or the largest number, of the voting power of shares present at the meeting in order to be elected. Unless the board reduces the number of directors, the enclosed proxy will be voted to elect the replacement nominee designated by the board in the event that a nominee is unable or unwilling to serve.

The current composition of the board is:

| | |

| |

| Class I Directors(term expiring at this meeting) | | William D. Ruckelshaus Gregory L. McAdoo |

| |

| Class II Directors(serving until the 2011 meeting) | | Barry J. Fidelman Elliott H. Jurgensen, Jr. Sujal M. Patel |

| |

| Class III Directors(serving until the 2012 meeting) | | Matthew S. McIlwain Peter H. van Oppen |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” ELECTION OF THE TWO NOMINATED CLASS I DIRECTORS.

The board of directors believes that it is necessary for each of the company’s directors to possess many qualities and skills. When searching for new candidates, our nominating and governance committee considers the evolving needs of the board and searches for candidates that fill any current or anticipated gap. The board also believes that all directors must possess a considerable amount of relevant business management and related industry experience (such as experience as a chief executive or chief financial officer or other executive position in a technology or growth-oriented enterprise), as well as related educational experience. When considering director candidates, the nominating and governance committee considers a variety of factors, including character, management experience, issues of judgment, background, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value. The nominating and governance committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The nominating and governance committee does not have a formal policy with respect to diversity, however, the board and the nominating and governance committee believe that it is essential that the board members represent diverse viewpoints. In considering candidates for the board, the nominating and governance committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the board are also considered.

All of our directors bring to our board a wealth of executive leadership experience derived from their service as executives and, in some cases chief executive officers, of large and growth-oriented corporations. They also all bring extensive board experience. The process undertaken by the nominating and governance committee

5

in recommending qualified director candidates is further described below under “Director Nomination Process” (see page 23 of this proxy statement). Certain individual qualifications and skills of our directors that contribute to the board’s effectiveness as a whole are described in the following paragraphs.

Set forth below is the principal occupation and other information about the particular experience, qualifications, attributes or skills that qualify the nominees for election as directors, and the directors whose terms of office will continue after the 2010 annual meeting, including their ages, as of April 26, 2010.

Nominees for Election to the Board of Directors for a Three-Year Term Expiring in 2013

| | |

William D. Ruckelshaus Age: 77 Director since October 2004 Board Committees: Audit and Nominating and Governance | | Mr. Ruckelshaus has served as Chairman of our board since August 2006. Mr. Ruckelshaus has served in a consulting capacity to the Madrona Venture Group as a non-management strategic director since 1999. From 1988 to 1995, Mr. Ruckelshaus served as Chairman and Chief Executive Officer of Browning-Ferris Industries, and from 1995 to 1999 he served as Chairman. Mr. Ruckelshaus served as the founding Administrator of the U.S. Environmental Protection Agency in 1970 and has served as Acting Director of the Federal Bureau of Investigation and Deputy Attorney General of the U.S. Department of Justice. Mr. Ruckelshaus served as Senior Vice President for Law and Corporate Affairs for the Weyerhaeuser Company and again served as EPA Administrator in the mid-1980s before joining Perkins Coie LLP, a private law firm, where he worked as an attorney. Mr. Ruckelshaus has previously served on the boards of directors of several corporations, including Cummins Engine Company, Nordstrom and the Weyerhaeuser Company. Mr. Ruckelshaus is currently Chairman of the Leadership Council of the Partnership for Puget Sound, a state agency, and a member emeritus of the board of directors of World Resources Institute in Washington, D.C. Mr. Ruckelshaus received a Bachelor of Arts degree in politics from Princeton University and a Juris Doctorate degree from Harvard Law School. Mr. Ruckelshaus’ qualifications to serve on our board include his many years of public company and corporate governance experience, including his experience as CEO, as well as his extensive legal and regulatory background with the U.S. government and various corporate enterprises. |

| |

Gregory L. McAdoo Age: 45 Director since July 2002 Board Committees: Compensation and Nominating and Governance | | Mr. McAdoo has been a Partner of Sequoia Capital, a venture capital firm, since 2000. Prior to Sequoia Capital, Mr. McAdoo served as President and Chief Executive Officer of Sentient Networks, a circuit emulation company that was acquired by Cisco Systems, Inc. in 1999. Mr. McAdoo has more than 17 years of engineering and management experience in the networking industry and has held senior engineering and executive level management positions at Cisco Systems, Inc., Sourcecom, Micom Communications and Datability Systems. Mr. McAdoo also serves on the boards of directors of several private companies. Mr. McAdoo received a Bachelor of Science degree in electrical engineering from Stevens Institute of Technology. |

6

| | |

| | Mr. McAdoo’s qualifications to serve on our board include his extensive experience in leading and advising growth-oriented technology companies, including his experience as a CEO, as well as his management and engineering experience with various leading technology enterprises. In addition to extensive experience as an operating executive, Mr. McAdoo also currently serves as a member of the boards of directors of several high growth technology companies across a wide range of business sectors from consumer services to enterprise IT infrastructure to clean technology. Mr. McAdoo brings a breadth of business and technical perspectives to our board room as a result of his involvement with these diverse businesses. |

Members of the Board of Directors Continuing in Office

The following directors will continue to serve until 2011:

| | |

Barry J. Fidelman Age: 69 Director since May 2003 Board Committees: Nominating and Governance | | Mr. Fidelman has been a Partner of Atlas Venture, a venture capital firm, since 1988. Prior to Atlas Venture, Mr. Fidelman held senior executive positions at Data General, Apollo Computer and Alliant Computer. Mr. Fidelman also currently serves on the boards of directors of several private companies. Mr. Fidelman received a Bachelor of Science degree in electrical engineering from Massachusetts Institute of Technology and a Master of Business Administration degree from Harvard Business School. Mr. Fidelman’s qualifications to serve on our board include his years of senior executive experience in high technology industries, both operationally and as a board member. |

| |

Elliott H. Jurgensen, Jr. Age: 65 Director since April 2006 Board Committees: Audit and Compensation | | Mr. Jurgensen retired from KPMG LLP, an accounting firm, in January 2003 after 32 years as an auditor, including 23 years as a partner. Mr. Jurgensen held a number of leadership roles at KPMG, including national partner in charge of its hospitality industry practice from 1981 to 1993, Managing Partner of the Bellevue office from 1982 to 1991 and Managing Partner of the Seattle office from 1993 to October 2002. Mr. Jurgensen currently serves on the boards of directors of BSquare Corporation, McCormick & Schmick’s Seafood Restaurants, Inc., and Varolii Corporation. Mr. Jurgensen received a Bachelor of Science degree in accounting from San Jose State University. Mr. Jurgensen’s qualifications to serve on our board include his extensive experience with public company financial accounting matters, from the perspective of over 30 years experience in public accounting as an auditor and as the chairman of the audit committee of several public companies. |

7

| | |

Sujal M. Patel Age: 35 Director since January 2001 No Board Committees | | Mr. Patel is one of our founders and has served as our President and Chief Executive Officer since October 2007. Mr. Patel also served as our Chief Technology Officer from 2001 to March 2008 and as President and Chief Executive Officer from the founding of Isilon in 2001 until August 2003. Prior to joining us, from 1996 to January 2001, Mr. Patel served in various engineering roles at RealNetworks, Inc., a provider of Internet media delivery software and services, most recently as Development Manager, RealSystem Products, in which capacity he was the chief architect for the second generation of RealSystem products. Mr. Patel received a Bachelor of Science degree in computer science from the University of Maryland at College Park. Mr. Patel’s qualifications to serve on our board include his hands-on operational and engineering experience in the high technology sector, and in particular the storage sector in which the company operates, including almost a decade as a director and the company’s founder. |

The following directors will continue to serve until 2012:

| | |

Matthew S. McIlwain Age: 45 Director from May 2001 – April 2007 and since February 2008 Board Committees: Compensation | | Mr. McIlwain has served as a Managing Director of Madrona Venture Group, a venture capital firm, since June 2002 after joining in May 2000. Prior to joining Madrona, Mr. McIlwain served as Vice President of Business Process for the Genuine Parts Company. Previously, Mr. McIlwain served as an Engagement Manager at McKinsey & Company, where he focused on strategy and marketing in technology-driven industries, and also worked in investment banking at Credit Suisse First Boston. Mr. McIlwain currently serves on the boards of directors of several private companies. Mr. McIlwain received a Bachelor of Arts degree in government and economics from Dartmouth College, a Master of Arts degree in public policy from Harvard University’s Kennedy School of Government and a Master of Business Administration degree from Harvard Business School. Mr. McIlwain’s qualifications to serve on our board include his extensive experience in leading and advising growth-oriented technology companies as a board member. Mr. McIlwain brings a breadth of business and technical perspectives to our board room as a result of his involvement with these diverse businesses. |

8

| | |

Peter H. van Oppen Age: 57 Director since February 2008 Board Committees: Audit and Nominating and Governance | | Mr. van Oppen has been a partner at Trilogy Partnership, a private investment firm focused on technology and telecommunications, since 2006. Prior to joining Trilogy, Mr. van Oppen served as Chief Executive Officer and Chairman of the Board for Advanced Digital Information Corporation (ADIC), a data storage company, for twelve years, from 1994 through its acquisition by Quantum Corp. in 2006. Prior to ADIC, Mr. van Oppen served as President and Chief Executive Officer of Interpoint, a predecessor company to ADIC, from 1989 until its acquisition by Crane Co. in October 1996, and has also been a consultant at PricewaterhouseCoopers and Bain & Company. Mr. van Oppen currently serves as Vice Chairman of the Board of Trustees and Chair of the Investment Committee at Whitman College and serves on the boards of directors of several private companies. Mr. van Oppen received a Bachelor of Arts degree in political science from Whitman College and a Master of Business Administration degree from Harvard Business School, where he was a Baker Scholar. Mr. van Oppen’s qualifications to serve on our board include his experience as a chairman and CEO of a global data storage company for over a decade, his extensive management and consulting experience, as well as his experience as a director of other public and private companies. Moreover, Mr. van Oppen has served as and supervised public company CFOs and is a member, on inactive status, of the American Institute of Certified Public Accountants. |

9

PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has appointed PricewaterhouseCoopers as our independent registered public accounting firm for the 2010 fiscal year.

While we are not required to do so, Isilon is submitting the appointment of PricewaterhouseCoopers to serve as our independent registered public accounting firm for the 2010 fiscal year for ratification in order to ascertain the views of our stockholders on this appointment. If the appointment is not ratified, the audit committee will reconsider its selection. Representatives of PricewaterhouseCoopers are expected to be present at the annual meeting, where they will be available to answer stockholder questions and will have the opportunity to make a statement if they desire to do so.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FOR THE 2010 FISCAL YEAR.

Independent Registered Public Accounting Firm Fees and Services

The following table sets forth the aggregate audit fees billed to us by our independent registered public accounting firm, PricewaterhouseCoopers, for services in the fee categories indicated below during the fiscal years ended December 31, 2008 and December 31, 2009. The audit committee has considered the scope and fee arrangements for all services provided by PricewaterhouseCoopers, taking into account whether the provision of non-audit services is compatible with maintaining PricewaterhouseCoopers’ independence. The audit committee pre-approved 100% of the services described below.

| | | | | | |

| | | 2008

Fiscal Year | | 2009

Fiscal Year |

Audit Fees(1) | | $ | 529,496 | | $ | 455,962 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees(2) | | | 2,781 | | | 2,486 |

| | | | | | |

Total | | $ | 532,277 | | $ | 458,448 |

| (1) | Consists of fees billed for professional services rendered for the audit of the company’s consolidated financial statements and review of the interim condensed consolidated financial statements included in quarterly reports and services that are normally provided by PricewaterhouseCoopers in connection with statutory and regulatory filings or engagements including consultations related to compliance with the Sarbanes-Oxley Act of 2002. |

| (2) | Includes fees related to subscription services. |

Pre-Approval Policies

The audit committee’s policy on approval of services performed by the independent registered public accounting firm is to pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm during the fiscal year. The audit committee reviews each non-audit service to be provided and assesses the impact of the service on the firm’s independence.

10

Audit Committee Report

Review of Audited Financial Statements

The audit committee has reviewed and discussed our audited financial statements for the fiscal year ended December 31, 2009, with both our management and independent registered public accounting firm, PricewaterhouseCoopers. The audit committee has discussed with PricewaterhouseCoopers the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended, as adopted by the Public Accounting Oversight Board in Rule 3200T. Management has represented to the audit committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The audit committee has received from PricewaterhouseCoopers the written disclosure and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and the audit committee has discussed with PricewaterhouseCoopers their independence. The audit committee has considered the effect of non-audit fees on the independence of PricewaterhouseCoopers and has concluded that such non-audit services are compatible with the independence of PricewaterhouseCoopers.

Based on these reviews and discussions, the audit committee recommended to the board, and the board approved, that the financial statements for fiscal year 2009 be included in our 2009 annual report on form 10-K filed with the SEC.

This report has been furnished by the members of the audit committee.

Elliott H. Jurgensen, Jr., Chair

William D. Ruckelshaus

Peter H. van Oppen

11

PROPOSAL 3 — APPROVAL OF THE 2006 EQUITY INCENTIVE PLAN (AS AMENDED)

Our 2006 Equity Incentive Plan was originally adopted by our board in November 2006 and approved by our stockholders in December 2006. A total of 9,300,000 shares of common stock were initially authorized for issuance thereunder. The authorized amount was thereafter increased pursuant to the evergreen provisions of the 2006 Equity Incentive Plan as well as by shares subject to stock options or similar awards granted under the company’s Amended and Restated 2001 Stock Plan, or the 2001 Stock Plan, that were returned and rolled into the 2006 Equity Incentive Plan pursuant to the terms of the 2006 Equity Incentive Plan. As of January 1, 2010, a total of 20,986,344 shares have been authorized for issuance under the 2006 Equity Incentive Plan.

Our board is now requesting that our stockholders approve the 2006 Equity Incentive Plan (As Amended), or the Amended 2006 Plan. In particular, we are seeking stockholder approval of the material terms of the 2006 Equity Incentive Plan (As Amended) for purposes of complying with Section 162(m) of the Internal Revenue Code of 1986, as amended, or Section 162(m). Our board has approved the Amended 2006 Plan, subject to approval from our stockholders at the 2010 annual meeting. If our stockholders approve the Amended 2006 Plan, it will replace the current version of the 2006 Equity Incentive Plan and will continue in effect through its current term (November 2016), unless terminated earlier by our board. Approval of the Amended 2006 Plan requires the affirmative vote of the holders of a majority of the shares of our common stock that are present in person or by proxy and entitled to vote at the 2010 annual meeting.

The Amended 2006 Plan was amended to allow us to continue to deduct in full for federal income tax purposes the compensation recognized by our executive officers in connection with certain awards granted under the Amended 2006 Plan. Section 162(m) generally denies a corporate tax deduction for annual compensation exceeding $1 million paid to the chief executive officer and other “covered employees” as determined under Section 162(m) and applicable guidance. However, certain types of compensation, including performance-based compensation, are generally excluded from this deductibility limit. To enable compensation in connection with stock options, stock appreciation rights and certain restricted stock grants, restricted stock units, performance shares and performance units awarded under the Amended 2006 Plan to qualify as “performance-based” within the meaning of Section 162(m), the Amended 2006 Plan limits the sizes of such awards as further described below.

The following is a summary of some of the material differences between the Amended 2006 Plan and the 2006 Equity Incentive Plan. This comparative summary is qualified in its entirety by reference to the actual text of the Amended 2006 Plan, set forth as Appendix A.

| | • | | The Amended 2006 Plan has been drafted to include limitations to the number of shares that may be granted on an annual basis through individual awards, which is necessary to allow us to be eligible to receive income tax deductions under Section 162(m), as follows: |

| | |

Award Type | | General Fiscal Year

Limit |

Stock Options | | 3,500,000 shares |

Stock Appreciation Rights | | 1,200,000 shares |

Restricted Stock | | 1,200,000 shares |

Restricted Stock Units | | 1,200,000 shares |

Performance Shares | | 1,200,000 shares |

Performance Units | | $1,000,000 |

| | • | | Specific performance criteria have been added to the Amended 2006 Plan so that certain awards may be granted subject to or conditioned upon the satisfaction of performance objectives, which in turn will allow us to be eligible to receive income tax deductions, notwithstanding the limitations, under Section 162(m). These performance criteria include: attainment of research and development milestones, bookings, cash flow, cash position, contract awards or backlog, customer renewals, earnings (which may include earnings before interest and taxes; earnings before taxes; net earnings; |

12

| | and earnings before interest, taxes, depreciation and amortization), earnings per share, expense reduction, gross margin, growth with respect to any of the foregoing measures, growth in bookings, growth in revenues, growth in stockholder value relative to the moving average of the S&P 500 Index or another index, internal rate of return, market share, net income, net profit, net sales, new product development, new product invention or innovation, number of customers, operating cash flow, operating expenses, operating income (GAAP and non-GAAP), operating margin, pre-tax profit, product release timelines, productivity, profit, return on assets, return on capital, return on stockholder equity, return on investment, return on sales, revenue, revenue growth, sales results, sales growth, stock price increase, time to market, total stockholder return, and working capital. |

Our board believes that the approval of the Amended 2006 Plan is essential to our continued success. We believe that our employees are our most valuable assets and that the awards permitted under the Amended 2006 Plan are vital to our ability to attract and retain outstanding and highly skilled individuals in the competitive labor markets in which we compete. These awards also are crucial to our ability to motivate our employees to achieve our company goals.

Summary of the Amended 2006 Plan

The following is a summary of the principal features of the Amended 2006 Plan and its operation. The summary is qualified in its entirety by reference to the Amended 2006 Plan itself set forth in Appendix A.

The Amended 2006 Plan provides for the grant of the following types of incentive awards: (i) stock options, (ii) stock appreciation rights, (iii) restricted stock, (iv) restricted stock units, and (v) performance shares and performance units. Each of these is referred to individually as an “Award” or collectively as “Awards” and each holder of an Award is referred to as a “participant” or collectively as “participants.” Those eligible for Awards under the Amended 2006 Plan include employees and consultants who provide services to us or our parent or subsidiaries as well as directors of the company. As of January 1, 2010, approximately 361 of our employees, directors and consultants would be eligible to participate in the Amended 2006 Plan.

Number of Shares of Common Stock Available Under the Amended 2006 Plan. The maximum aggregate number of shares that may be awarded and sold under the Amended 2006 Plan as of January 1, 2010, is (A) 20,986,344 shares, which includes shares returned to the Amended 2006 Plan prior to January 1, 2010 pursuant to (B) below and increases pursuant to (C) below which occurred in years 2008, 2009 and 2010;plus (B) any shares subject to stock options granted under our 2001 Stock Plan that expire or otherwise terminate without having been exercised in full up to a maximum of 1,411,562 shares;plus (C) an annual increase to be added on the first day of each fiscal year beginning with the 2011 fiscal year, in an amount equal to the least of 3,500,000 shares, 5% of the outstanding shares on the last date of the immediately preceding fiscal year, or an amount determined by our board. The shares may be authorized, but unissued, or reacquired common stock.

If an Award expires or becomes unexercisable without having been exercised in full, is surrendered pursuant to an exchange program, or, with respect to restricted stock, restricted stock units, performance shares or performance units, is forfeited to or repurchased by us, the unpurchased shares (or for Awards other than options and stock appreciation rights, the forfeited or repurchased shares) which were subject thereto will become available for future grant or sale under the Amended 2006 Plan. Upon exercise of a stock appreciation right settled in shares, only shares actually issued pursuant to the stock appreciation right will cease to be available under the Amended 2006 Plan. Shares used to pay the exercise price of an Award or to satisfy the tax withholding obligations related to an Award will become available for future grant or sale under the Amended 2006 Plan. Shares that have actually been issued under the Amended 2006 Plan under any Award will not be returned to the Amended 2006 Plan and will not become available for future distribution under the Amended 2006 Plan; provided, however, that if shares of restricted stock, restricted stock units, performance shares or performance units are repurchased by us or are forfeited to us, such shares will become available for future grant under the Amended 2006 Plan. To the extent an Award is paid out in cash rather than stock, such cash payment will not reduce the number of shares available for issuance under the Amended 2006 Plan.

13

If we declare a dividend or other distribution or engage in a recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of shares or other securities of Isilon, or other change in the corporate structure of Isilon affecting our shares, the Administrator will adjust the (i) number and class of shares available for issuance under the Amended 2006 Plan, (ii) number, class and price of shares subject to outstanding Awards, and (iii) specified per-person limits on Awards to reflect the change.

Administration of the Amended 2006 Plan. Our board, or its compensation committee, or a committee of directors or of other individuals satisfying applicable laws and appointed by our board, referred to as the “Administrator,” will administer the Amended 2006 Plan. To make grants to certain of our officers and key employees, the members of the committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, or the Exchange Act. To the extent the Administrator determines it desirable to qualify awards granted under the Amended 2006 Plan as “performance-based compensation,” the members of the committee will consist of two or more “outside directors” under Section 162(m) (so that we can receive a federal tax deduction for certain compensation paid under the Amended 2006 Plan).

Subject to the terms of the Amended 2006 Plan, the Administrator has the sole discretion to select the employees, consultants, and directors who will receive Awards, to determine the terms and conditions of Awards, to modify or amend each Award (subject to the restrictions of the Amended 2006 Plan), and to interpret the provisions of the Amended 2006 Plan and outstanding Awards. The Administrator may implement an exchange program under which (i) outstanding Awards are surrendered or cancelled in exchange for Awards of the same type, Awards of a different type and/or cash, (ii) participants would have the opportunity to transfer any outstanding Awards to a financial institution or other person or entity selected by the Administrator, and/or (iii) the exercise price of an outstanding Award could be reduced.

Formula Awards to Outside Directors. The Amended 2006 Plan provides that each person who first becomes an outside director will receive an option to purchase a number of shares as determined by the Administrator in its sole discretion on or about the date the person first becomes an outside director, referred to as an initial option. Outside directors will also automatically receive an option to purchase 20,000 shares on the date of each annual meeting of stockholders, referred to as the annual option, provided he or she will have served on our board for at least the preceding ten months. Each initial option will vest and become exercisable as the Administrator determines in its sole discretion. Each annual option will vest and become exercisable as to 100% of the shares subject to the option on the day prior to the following year’s annual stockholder meeting (but in no event later than December 31 of the calendar year following the calendar year during which the annual option was granted), provided the participant continues to serve as a director through such date.

Options. The Administrator is able to grant nonstatutory stock options and incentive stock options under the Amended 2006 Plan. The Administrator determines the number of shares subject to each option, although the Amended 2006 Plan provides that a participant may not receive options for more than 3,500,000 shares in any fiscal year.

The Administrator determines the exercise price of options granted under the Amended 2006 Plan, provided the exercise price of the incentive stock options and nonstatutory stock options must be at least equal to the fair market value of our common stock on the date of grant. In addition, the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of our outstanding stock must be at least 110% of the fair market value of the common stock on the grant date.

The term of each option will be stated in the Award agreement. The term of an option may not exceed ten years, except that, with respect to any participant who owns more than 10% of the voting power of all classes of Isilon’s outstanding capital stock, the term of an incentive stock option may not exceed five years.

14

After a termination of service with us, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the Award agreement. If no such period of time is stated in the participant’s Award agreement, the participant will generally be able to exercise his or her option for (i) three months following his or her termination for reasons other than death or disability, and (ii) twelve months following his or her termination due to death or disability, but in no event later than the expiration of the option’s term.

Restricted Stock. Awards of restricted stock are rights to acquire or purchase shares of our common stock, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion. For example, the Administrator may set restrictions based on the achievement of specific performance goals. The Administrator, in its discretion, may accelerate the time at which any restrictions will lapse or be removed. On the date set forth in the Award agreement, all unearned shares of restricted stock will be forfeited to us. The Administrator will determine the number of shares granted pursuant to an Award of restricted stock, but no participant will be granted a right to purchase or acquire more than 1,200,000 shares of restricted stock during any fiscal year. Participants holding shares of restricted stock may exercise full voting rights with respect to those shares and generally will be entitled to receive all dividends and other distributions paid with respect to those shares, except that dividends or distributions paid in shares will be subject to the same restrictions on transferability and forfeiture as the shares of restricted stock with respect to which they were paid.

Restricted Stock Units. Awards of restricted stock units result in a payment to a participant only if the vesting criteria the Administrator establishes is satisfied. For example, the Administrator may set vesting criteria based on the achievement of specific performance goals. The restricted stock units will vest at a rate determined by the Administrator; provided, however, that after the grant of restricted stock units, the Administrator, in its sole discretion, may reduce or waive any vesting criteria for such restricted stock units. Upon satisfying the applicable vesting criteria, the participant will be entitled to the payout specified in the Award agreement. The Administrator, in its sole discretion, may only settle earned restricted stock units in cash, shares, or a combination of both. On the date set forth in the Award agreement, all unearned restricted stock units will be forfeited to us. The Administrator determines the number of restricted stock units granted to any participant, but no participant may be granted more than 1,200,000 restricted stock units during any fiscal year.

Stock Appreciation Rights. The Administrator will be able to grant stock appreciation rights, which are the rights to receive the appreciation in fair market value of common stock between the exercise date and the date of grant. We can pay the appreciation in cash, shares of common stock, or a combination thereof. The Administrator, subject to the terms of the Amended 2006 Plan, will have complete discretion to determine the terms and conditions of stock appreciation rights granted under the Amended 2006 Plan; provided, however, that the exercise price may not be less than 100% of the fair market value of a share on the date of grant. No participant will be granted stock appreciation rights covering more than 1,200,000 shares during any fiscal year.

After termination of service with us, a participant will be able to exercise the vested portion of his or her stock appreciation right for the period of time stated in the Award agreement. If no such period of time is stated in a participant’s Award agreement, a participant will generally be able to exercise his or her vested stock appreciation rights for the same period of time as applies to stock options.

Performance Units and Performance Shares. The Administrator will be able to grant performance units and performance shares, which are Awards that will result in a payment to a participant only if the performance goals or other vesting criteria the Administrator may establish are achieved or the Awards otherwise vest. Earned performance units and performance shares will be paid, in the sole discretion of the Administrator, in the form of cash, shares, or in a combination thereof. The Administrator will establish performance or other vesting criteria in its discretion, which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants. The performance units and performance shares will vest as a function of the extent to which the corresponding performance objectives or other vesting provisions have been achieved; provided, however, that after the grant of a performance unit or performance share, the Administrator, in its sole discretion, may reduce or waive any performance objectives or

15

other vesting provisions for such performance unit or performance share. During any fiscal year, no participant will receive more than 1,200,000 performance shares and no participant will receive performance units having an initial value greater than $1,000,000. Performance units will have an initial value established by the Administrator on or before the date of grant. Performance shares will have an initial value equal to the fair market value of a share of our common stock on the grant date.

Performance Goals. Awards of restricted stock, restricted stock units, performance shares, performance units and other incentives under the Amended 2006 Plan may be made subject to the attainment of performance goals relating to one or more business criteria within the meaning of Section 162(m) and may provide for a targeted level or levels of achievement including: attainment of research and development milestones, bookings, cash flow, cash position, contract awards or backlog, customer renewals, earnings (which may include earnings before interest and taxes; earnings before taxes; net earnings; and earnings before interest, taxes, depreciation and amortization), earnings per share, expense reduction, gross margin, growth with respect to any of the foregoing measures, growth in bookings, growth in revenues, growth in stockholder value relative to the moving average of the S&P 500 Index or another index, internal rate of return, market share, net income, net profit, net sales, new product development, new product invention or innovation, number of customers, operating cash flow, operating expenses, operating income (GAAP and non-GAAP), operating margin, pre-tax profit, product release timelines, productivity, profit, return on assets, return on capital, return on stockholder equity, return on investment, return on sales, revenue, revenue growth, sales results, sales growth, stock price increase, time to market, total stockholder return, and working capital. The performance goals may differ from participant to participant and from Award to Award, may be used alone or in combination, may be used to measure our performance as a whole or the performance of one of our business units, and may be measured relative to a peer group or index.

To the extent necessary to comply with the performance-based compensation provisions of Section 162(m), with respect to any Award granted subject to performance goals, within the first 25% of the performance period, but in no event more than ninety days following the commencement of any performance period (or such other time as may be required or permitted by Section 162(m)), the Administrator will, in writing: (i) designate one or more participants to whom an Award will be made, (ii) select the performance goals applicable to the performance period, (iii) establish the performance goals, and amounts of such Awards, as applicable, which may be earned for such performance period, and (iv) specify the relationship between performance goals and the amounts of such Awards, as applicable, to be earned by each participant for such performance period. Following the completion of each performance period, the Administrator will certify in writing whether the applicable performance goals have been achieved for such performance period. In determining the amounts earned by a participant, the Administrator will have the right to reduce or eliminate (but not to increase) the amount payable at a given level of performance to take into account additional factors that the Administrator may deem relevant to the assessment of individual or corporate performance for the performance period. A participant will be eligible to receive payment pursuant to an Award for a performance period only if the performance goals for such period are achieved.

Transferability of Awards. Awards granted under the Amended 2006 Plan are generally not transferable, and all rights with respect to an Award granted to a participant generally will be available during a participant’s lifetime only to the participant.

Change in Control. In the event we experience a merger or change in control, each outstanding Award will be treated as the Administrator determines, including, without limitation, that each Award be assumed or an equivalent option or right substituted by the successor corporation or a parent or subsidiary of the successor corporation. The Administrator shall not be required to treat all Awards similarly in the transaction. In the event that the successor corporation does not assume or substitute for the Award, the participant will fully vest in and have the right to exercise all of his or her outstanding options and stock appreciation rights, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock and restricted stock units will lapse, and, with respect to Awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels and all other terms and conditions

16

met. In addition, if an option or stock appreciation right is not assumed or substituted in the event of a change in control, the Administrator will notify the participant in writing or electronically that the option or stock appreciation right will be fully vested and exercisable for a period of time determined by the Administrator in its sole discretion, and the option or stock appreciation right will terminate upon the expiration of such period

With respect to Awards granted to an outside director that are assumed or substituted for, if on the date of or following such assumption or substitution the participant’s status as a director or a director of the successor corporation, as applicable, is terminated other than upon a voluntary resignation by the participant (unless such resignation is at the request of the acquirer), then the participant will fully vest in and have the right to exercise his or her options and/or stock appreciation rights as to all of the shares subject to the Award, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock and restricted stock units shall lapse, and, with respect to performance shares and performance units, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels and all other terms and conditions met.

Amendment and Termination of the Amended 2006 Plan. Our board will have the authority to amend, alter, suspend or terminate the Amended 2006 Plan, except that stockholder approval will be required for any amendment to the Amended 2006 Plan to the extent required by any applicable laws. No amendment, alteration, suspension or termination of the Amended 2006 Plan will impair the rights of any participant, unless mutually agreed otherwise between the participant and the Administrator and which agreement must be in writing and signed by the participant and us. The Amended 2006 Plan will terminate in November 2016, unless our board terminates it earlier.

Number of Awards Granted to Employees, Consultants and Directors

The number of Awards that an employee or consultant may receive, or that an outside director may initially receive, under the Amended 2006 Plan is in the discretion of the Administrator and therefore cannot be determined in advance. Annual grants are made to outside directors automatically, as described above. The following table sets forth (a) the aggregate number of shares of common stock subject to options granted under the 2006 Equity Incentive Plan during the last fiscal year, (b) the average per share exercise price of such options, and (c) the dollar value of such shares based on $8.67 per share, the fair market value on March 23, 2010:

| | | | | | | | | |

Name of Individual or Group | | Number of

Shares Granted | | | Average Per

Share

Exercise Price | | Dollar Value of

Shares Granted |

All executive officers, as a group | | 1,300,000 | | | $ | 2.5688 | | $ | 11,271,000 |

All directors who are not executive officers, as a group | | 80,000 | | | $ | 2.1600 | | $ | 693,600 |

All employees who are not executive officers, as a group | | 2,456,864 | (1) | | $ | 3.0648 | | $ | 21,301,011 |

| (1) | Of this number, 1,122,407 shares were granted in connection with our offer to exchange certain outstanding stock options. |

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and use of Awards granted under the Amended 2006 Plan. Tax consequences for any particular individual may be different.

Nonstatutory Stock Options. No taxable income is reportable when a nonstatutory stock option with an exercise price at least equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the option. Any taxable

17

income recognized in connection with an option exercise by an employee of Isilon is subject to tax withholding by us. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Incentive Stock Options. No taxable income is reportable when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax, in which case taxation is the same as for nonstatutory stock options). If the participant exercises the option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

Stock Appreciation Rights. No taxable income is reportable when a stock appreciation right with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Restricted Stock, Restricted StockUnits, Performance Units and Performance Shares. A participant generally will not have taxable income at the time an Award of restricted stock, restricted stock units, performance shares or performance units, are granted. Instead, he or she will recognize ordinary income in the first taxable year in which his or her interest in the shares underlying the Award becomes either (i) freely transferable, or (ii) no longer subject to substantial risk of forfeiture. However, the recipient of a restricted stock Award may elect to recognize income at the time he or she receives the Award in an amount equal to the fair market value of the shares underlying the Award (less any cash paid for the shares) on the date the Award is granted.

Tax Effect for Us. We generally will be entitled to a tax deduction in connection with an Award under the Amended 2006 Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to our Chief Executive Officer and to “covered employees” within the meaning of Section 162(m). Under Section 162(m), the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, we can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Amended 2006 Plan, setting limits on the number of Awards that any individual may receive and for Awards other than certain stock options, establishing performance criteria that must be met before the Award actually will vest or be paid. The Amended 2006 Plan has been designed to permit the Administrator to grant Awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting us to continue to receive a federal income tax deduction in connection with such Awards.

Section 409A. Section 409A of the Internal Revenue Code, or Section 409A, which was added by the American Jobs Creation Act of 2004, provides certain new requirements on non-qualified deferred compensation arrangements. These include requirements with respect to an individual’s election to defer compensation and the individual’s selection of the timing and form of distribution of the deferred compensation. Section 409A also generally provides that distributions must be made on or following the occurrence of certain events (e.g., the individual’s separation from service, a predetermined date, or the individual’s death). Section 409A imposes restrictions on an individual’s ability to change his or her distribution timing or form after the compensation has been deferred. For certain individuals who are officers, subject to certain exceptions, Section 409A requires that such individual’s distribution commence no earlier than six months after such officer’s separation from service.

18

Awards granted under the Amended 2006 Plan with a deferral feature, including nonstatutory stock options and stock appreciation rights granted with an exercise price below the fair market value of the underlying stock, will be subject to the requirements of Section 409A. If an Award is subject to and fails to satisfy the requirements of Section 409A, the recipient of that Award may recognize ordinary income on the amounts deferred under the Award, to the extent vested, which may be prior to when the compensation is actually or constructively received. Also, if an Award that is subject to Section 409A fails to comply with Section 409A’s provisions, Section 409A imposes an additional 20% federal income tax on compensation recognized as ordinary income, as well as possible interest charges and penalties. In addition, certain states such as California adopted similar provisions.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECTS OF FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY WITH RESPECT TO AWARDS UNDER THE AMENDED 2006 PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE PARTICIPANT MAY RESIDE.

Purpose for Recommending Approval of the 2006 Equity Incentive Plan (As Amended)

We believe that the amendment of the 2006 Equity Incentive Plan and the approval of its material terms is essential to our continued success. Our employees are our most valuable asset. Stock options and other awards such as those provided under the Amended 2006 Plan will substantially assist us in continuing to attract and retain employees and non-employee directors in the extremely competitive labor markets in which we compete. Such awards also are crucial to our ability to motivate employees to achieve our goals. We will benefit from increased stock ownership by selected executives, other employees and non-employee directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL

OF THE 2006 EQUITY INCENTIVE PLAN (AS AMENDED).

19

CORPORATE GOVERNANCE

Board’s Role in Risk Oversight

The board is actively involved in oversight of risks that could affect the company. This oversight is conducted primarily through committees of the board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees, but the full board has retained responsibility for general oversight of risks. The board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the company.

Board Leadership Structure

Currently, the positions of chief executive officer and chairman of the board are held by two different individuals (Mr. Patel and Mr. Ruckelshaus, respectively). Although the board does not have a policy on whether or not the roles of chief executive officer and chairman of the board should be separate, the current structure allows our chief executive officer to focus on our day-to-day business while our chairman leads the board in its fundamental role of providing advice to and independent oversight of management. The board recognizes the time, effort and energy that the chief executive officer is required to devote to his position given our company’s stage of development and the current business environment, as well as the commitment required to serve as our chairman, particularly as the board’s oversight responsibilities continue to grow. While our bylaws and corporate governance guidelines do not require that our chairman and chief executive officer positions be separate, the board believes that having separate positions and having an independent director serve as chairman is the appropriate leadership structure for our company at this time and demonstrates our commitment to good corporate governance. The board will continue to assess the appropriateness of this structure as part of the board’s broader succession planning process.

Director Independence

The board affirmatively determines the independence of each director and nominee for election as a director in accordance with guidelines it has adopted, which include all elements of independence set forth in applicable Nasdaq listing standards. The company’s director independence standards are set forth in our “Corporate Governance Guidelines” available at the website noted below.

Based on these standards, the board determined that each of the following non-employee directors is independent under all applicable standards of director independence and has no relationship with us, except as a director and stockholder:

| | • | | Elliott H. Jurgensen, Jr. |

| | • | | James G. Richardson (resigned as a director in May 2009) |

In addition, the board determined that Mr. Patel is not independent under applicable Nasdaq listing standards because he is our president and chief executive officer.

20

Board of Director Meetings

Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of his duties and to attend all board of director and committee meetings. The board met ten times during 2009, of which five were regularly scheduled meetings and five were not regularly scheduled. The independent directors met three times in executive session without any officer of the company present. All directors attended at least 75% of the meetings of the board and of the committees on which they served during the fiscal year ended December 31, 2009.

Board Committees

The board has three standing committees to facilitate and assist the board in the execution of its responsibilities. The committees are currently the audit committee, the compensation committee and the nominating and governance committee. In accordance with applicable Nasdaq listing standards, all of the committees are comprised solely of non-employee, independent directors. Charters for each committee are available on our website at www.isilon.com by first clicking on “Company,” then “Investor Relations” and then “Corporate Governance.” The charter of each committee is also available in print to any stockholder who requests it. The following table shows the current members of each of the standing board committees:

| | | | |

Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

| Elliott H. Jurgensen, Jr. (chair) | | Matthew S. McIlwain (chair) | | William D. Ruckelshaus (chair) |

| William D. Ruckelshaus | | Elliott H. Jurgensen, Jr. | | Barry J. Fidelman |

| Peter H. van Oppen | | Gregory L. McAdoo | | Gregory L. McAdoo |

| | | | Peter H. van Oppen |

Audit Committee

At the beginning of fiscal year 2009, the audit committee was composed of Messrs. Jurgensen (committee chair), Ruckelshaus, Richardson and van Oppen. In May 2009, Mr. Richardson resigned as a member of the audit committee. The board has determined that all current members meet the requirements for independence and financial literacy under the current rules of Nasdaq and SEC rules and regulations. Our board has determined that Mr. Jurgensen is an “audit committee financial expert” within the meaning stipulated by the SEC and satisfies the financial sophistication requirements of Nasdaq. Our audit committee met five times during our 2009 fiscal year.

As outlined more specifically in the audit committee charter, the audit committee has, among other duties, the following responsibilities:

| | • | | Review internal controls and hold periodic meetings with our management and our independent registered public accounting firm to review the adequacy of such controls. |

| | • | | Appoint, compensate and oversee the work of the independent registered public accounting firm, including pre-approval of audit and non-audit services. |

| | • | | Review and discuss with management and the independent registered public accounting firm the annual audited financial statements and quarterly unaudited financial statements. |