SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement under Section 14(d)(4) of the

Securities Exchange Act of 1934

ISILON SYSTEMS, INC.

(Name of Subject Company)

ISILON SYSTEMS, INC.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

46432L104

(CUSIP Number of Class of Securities)

Keenan M. Conder

Vice President, General Counsel and Corporate Secretary

Isilon Systems, Inc.

3101 Western Ave.

Seattle, Washington 98121

(206) 315-7500

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the person(s) filing statement)

With copies to:

| | |

Craig E. Sherman, Esq. Wilson Sonsini Goodrich & Rosati Professional Corporation 701 Fifth Avenue Suite 5100 Seattle, Washington 98104-7036 (206) 883-2500 | | Martin W. Korman, Esq. Lawrence M. Chu, Esq. Wilson Sonsini Goodrich & Rosati Professional Corporation 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

| x | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9 filing consists of the following documents relating to the proposed acquisition of Isilon Systems, Inc. (the “Company”) by EMC Corporation pursuant to the terms of an Agreement and Plan of Merger dated November 14, 2010 by and among the Company, EMC and Electron Acquisition Corporation, a wholly-owned subsidiary of EMC:

| | (i) | joint press release of the Company and EMC dated November 15, 2010; |

| | (ii) | presentation slides made available in connection with a conference call hosted by the Company and EMC on November 15, 2010; |

| | (iii) | email from Sujal Patel, the Company’s Chief Executive Officer, to the Company’s employees; |

| | (iv) | “Frequently Asked Questions” sheet sent via email to the Company’s employees; |

| | (v) | “Frequently Asked Questions” sheet sent via email to the Company’s customers; |

| | (vi) | form of letter from Mr. Patel to the Company’s customers; |

| | (vii) | form of letter from Mr. Patel to the Company’s business partners; |

| | (viii) | form of letter from Mr. Patel to the Company’s suppliers; and |

| | (ix) | the transcript of a conference call held on November 15, 2010 by the Company and EMC. |

| | | | |

| | | Contacts: | | Michael Gallant |

| | | | EMC Corporation |

| | | | 508-293-6357 |

| FOR IMMEDIATE RELEASE | | | | michael.gallant@emc.com |

| | |

| | | | Chris Blessington |

| | | | Isilon |

| | | | 206-218-4453 |

| | | | chris.blessington@isilon.com |

EMC TO ACQUIRE ISILON

| | • | | Isilon is a leader in the fast-growing Scale-out Network Attached Storage segment |

| | • | | Combined revenue from Isilon and EMC Atmos is expected to reach $1 billion run-rate during second half of 2012 |

| | • | | Acquisition expected to be accretive to EMC’s non-GAAP EPS in 2011 |

HOPKINTON, Mass. and SEATTLE, Wash. – November 15, 2010 – EMC Corporation (NYSE: EMC) today announced the signing of a definitive agreement under which it will acquire Isilon Systems, Inc. (Nasdaq: ISLN), a fast-growing “Scale-out NAS” (network attached storage) systems company, based in Seattle, Washington. Under terms of the agreement, EMC will pay $33.85 per share in cash in exchange for each share of Isilon for an aggregate purchase price of approximately $2.25 billion, net of Isilon’s existing cash balance.

The boards of directors of both EMC and Isilon have unanimously approved the terms of the agreement. The transaction, which is subject to customary approvals, is expected to be completed late this year, is not expected to have a material impact to EMC’s full-year 2010 GAAP and non-GAAP diluted EPS and is expected to be accretive to EMC’s non-GAAP 2011 diluted EPS.

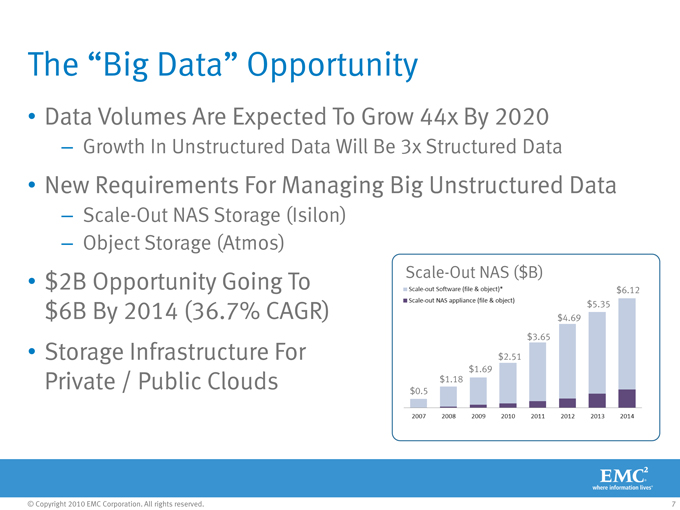

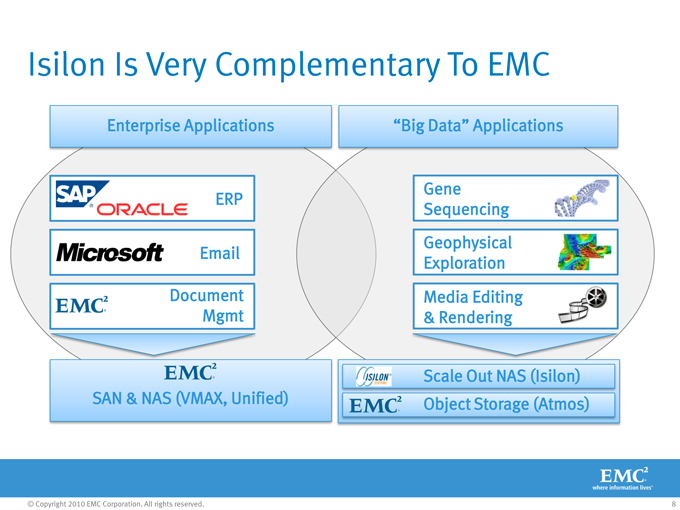

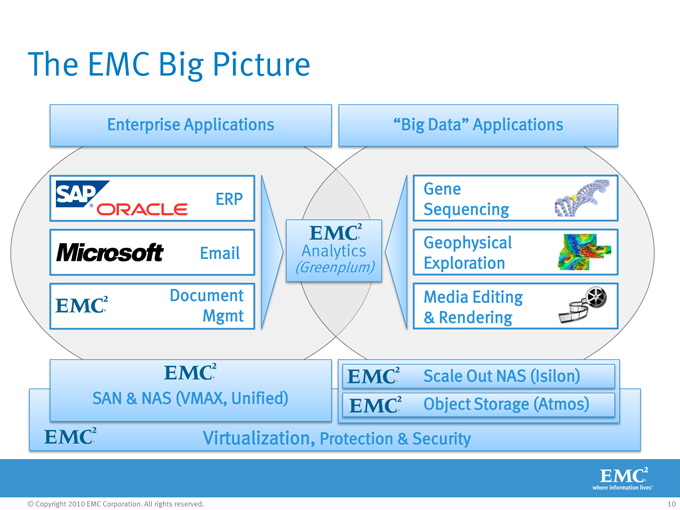

Isilon is known as the leader and momentum player in the fast-growing “Scale-out NAS” segment, which IDC projects will grow on average approximately 36% annually reaching an estimated $6 billion dollars in 2014(1). Together, EMC’s Atmos and Isilon’s solutions will offer customers a highly scalable, low-cost storage infrastructure for managing “Big Data.” Big Data is a term used to describe the massive amount of data produced by a new generation of applications in markets such as life sciences (e.g. gene sequencing), media and entertainment (e.g. online streaming), and oil and gas (e.g. seismic interpretation) to name a few.

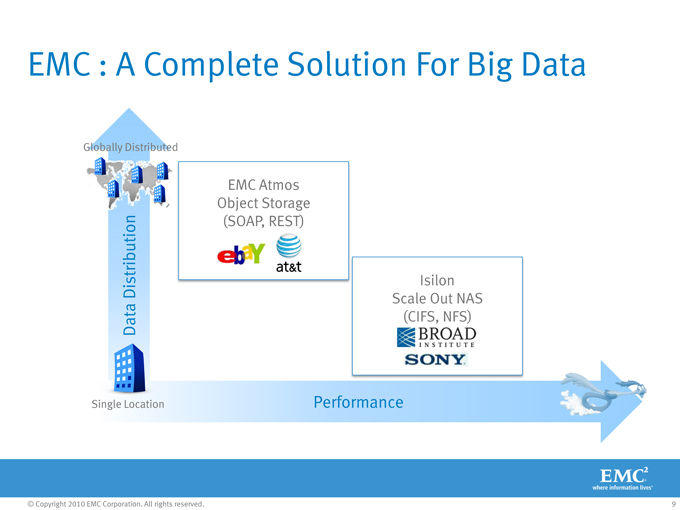

Isilon’s scale-out NAS systems are designed to begin small and scale quickly and non-disruptively up to 10 petabytes in size, with extremely high levels of performance and availability. EMC Atmos object storage provides the perfect complement to Isilon for massive globally distributed environments and object access to data for usages like Web 2.0 applications.

Together, Isilon and EMC Atmos provide customers a complete storage infrastructure solution for managing “Big Data” in private or public cloud environments. EMC expects the combined revenue of these two highly complementary storage offerings to reach a $1 billion run-rate during the second half of 2012.

Joe Tucci, Chairman and CEO, EMC Corporation, said, “The unmistakable waves of cloud computing and ‘Big Data’ are upon us. Customers are looking for new ways to store, protect, secure and add intelligence to the vast amounts of information they will accumulate over the next decade. EMC, in combination with Isilon, sits at the intersection of these trends with leading products, solutions and services to help customers get the absolute most out of what cloud computing has to offer.”

Pat Gelsinger, President and COO, EMC Information Infrastructure Products, said, “EMC brings unique value to Isilon through our highly complementary portfolio, engineering depth, financial strength and global sales reach. Isilon will enable EMC to accelerate our storage revenue growth and serve our customers across a broader range of the storage systems market. EMC will invest in all aspects of Isilon’s business to accelerate growth and take advantage of the fast-growing market opportunity ahead.”

Sujal Patel, CEO of Isilon, said, “Our excitement about the opportunity to become part EMC’s world-class team cannot be overstated. EMC’s track record of successfully acquiring, integrating and growing leading companies and the complementary nature of our technologies are undeniable. I am most excited about Isilon’s ability to now leverage EMC’s unparalleled market reach and portfolio of leading technology assets to build on our already significant success in this fast-growing space. Together, Isilon and EMC are ideally positioned to take our company to the next level and accelerate Isilon’s growth and technology adoption by customers around the world.”

In connection with this announcement, EMC is reaffirming all of its previously issued business outlook for 2010 that it released on October 19, 2010, including the following: For 2010, EMC expects consolidated revenues of $16.9 billion, $0.91 in consolidated GAAP diluted earnings per share, and $1.25 in consolidated non-GAAP diluted earnings per share, which excludes the impact of restructuring and acquisition-related charges, stock-based compensation expense, and intangible asset amortization. For 2010, consolidated restructuring and acquisition-related charges, stock-based compensation expense, and intangible asset amortization are expected to be $0.02, $0.23 and $0.09 per diluted share, respectively.

Full details of EMC’s consolidated business outlook for 2010 may be found at http://www.emc.com/about/news/press/2010/20101019-earnings.htm.

Conference Call

EMC will host a conference call today at 8:30 a.m. Eastern Time. To participate, please dial 1-210-795-1098 at least 10 minutes before start time. The passcode is EMC.

Supporting presentation slides and a live streaming of the conference call audio will be made available on our Web site at http://www.emc.com/about/investor-relations/index.htm. Please log in 10 minutes before the start of the call to register.

To listen to a replay of the call please dial 203-369-1893. The replay will be available through Monday, November 29, 2010.

Presentation slides along with audio of the call will also be available on-line immediately following the call at http://www.emc.com/about/investor-relations/index.htm.

| (1) | IDC: Worldwide File-Based Storage 2010-2014 Forecast |

About ISILON

As a global leader in scale-out storage, Isilon delivers powerful yet simple solutions for enterprises that want to manage their data, not their storage. Isilon’s products are simple to install, manage and scale, at any size. And, unlike traditional architectures, Isilon stays simple no matter how much storage is added, how much performance is required or how business needs change in the future. We’re challenging enterprises to think differently about their storage, because when they do, they’ll recognize there’s a better, simpler way. Learn what we mean at http://www. Isilon.com.

About EMC

EMC Corporation (NYSE: EMC) is the world leader in products, services and solutions for information management and storage that help organizations extract the maximum value from their information, at the lowest total cost, across every point in the information lifecycle. Information about EMC’s products and services can be found at www.EMC.com.

###

EMC and Atmos are either registered trademarks or trademarks of EMC Corporation in the United States and/or other countries. Isilon is a registered trademark of Isilon Systems, Inc. in the United States and/or other countries. All other trademarks used are the property of their respective owners.

Important Information

This press release (this “Statement”) relates to a planned tender offer by Electron Merger Corporation (“Purchaser”), a wholly owned subsidiary of EMC Corporation (“EMC”), for all shares of outstanding common stock of Isilon Systems, Inc. (“Isilon”), to be commenced pursuant to an Agreement and Plan of Merger, dated as of November 14, 2010, by and among EMC, the Purchaser and Isilon.

The tender offer referred to in this Statement has not yet commenced. This Statement is neither an offer to purchase nor a solicitation of an offer to sell any shares of Isilon. The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC and Purchaser intend to file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the tender offer is commenced, EMC and Purchaser intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain

important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Forward-Looking Statements

This release contains “forward-looking statements” as defined under the Federal Securities Laws. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to: (i) adverse changes in general economic or market conditions; (ii) delays or reductions in information technology spending; (iii) our ability to protect our proprietary technology; (iv) risks associated with managing the growth of our business, including risks associated with acquisitions and investments and the challenges and costs of integration, restructuring and achieving anticipated synergies; (v) fluctuations in VMware, Inc.’s operating results and risks associated with trading of VMware stock; (vi) competitive factors, including but not limited to pricing pressures and new product introductions; (vii) the relative and varying rates of product price and component cost declines and the volume and mixture of product and services revenues; (viii) component and product quality and availability; (ix) the transition to new products, the uncertainty of customer acceptance of new product offerings and rapid technological and market change; (x) insufficient, excess or obsolete inventory; (xi) war or acts of terrorism; (xii) the ability to attract and retain highly qualified employees; (xiii) fluctuating currency exchange rates; (xiv) the expected benefits, costs, timing of completion and ability to complete the transaction; and (xv) other one-time events and other important factors disclosed previously and from time to time in EMC’s and/or Isilon’s filings with the U.S. Securities and Exchange Commission. EMC and Isilon disclaim any obligation to update any such forward-looking statements after the date of this release.

This release also contains statements on EMC’s business outlook for 2010. These statements on business outlook are based on current expectations. These statements on business outlook are also forward-looking, and actual results may differ materially. These statements do not give effect to the potential impact of mergers, acquisitions, divestitures or business combinations that may be announced or consummated after the date hereof.

Use of Non-GAAP Financial Measures

This release contains non-GAAP financial measures. These non-GAAP financial measures, which are used as measures of EMC’s performance or liquidity, should be considered in addition to, not as a substitute for, measures of EMC’s financial performance or liquidity prepared in accordance with GAAP. EMC’s non-GAAP financial measures may be defined differently from time to time and may be defined differently than similar terms used by other companies, and accordingly, care should be exercised in understanding how EMC defines its non-GAAP financial measures in this release.

Where specified in this release, certain items noted (including, where noted, amounts relating to restructuring and acquisition-related charges, stock-based compensation expense and intangible asset amortization) are excluded from the non-GAAP financial measures.

EMC’s management uses the non-GAAP financial measures in the release to gain an understanding of EMC’s comparative operating performance (when comparing such results with previous periods or forecasts) and future prospects and excludes the above-listed items from its internal financial statements for purposes of its internal budgets and each reporting segment’s financial goals. These non-GAAP financial measures are used by EMC’s management in their financial and operating decision-making because management believes they reflect EMC’s ongoing business in a manner that allows meaningful period-to-period comparisons. EMC’s management believes that these non-GAAP financial measures provide useful information to investors and others (a) in understanding and evaluating EMC’s current operating performance and future prospects in the same manner as management does, if they so choose, and (b) in comparing in a consistent manner the Company’s current financial results with the Company’s past financial results.

All of the foregoing non-GAAP financial measures have limitations. Specifically, the non-GAAP financial measures that exclude the items noted above do not include all items of income and expense that affect EMC’s operations. Further, these non-GAAP financial measures are not prepared in accordance with GAAP, may not be comparable to non-GAAP financial measures used by other companies and do not reflect any benefit that such items may confer on EMC. Management compensates for these limitations by also considering EMC’s financial results as determined in accordance with GAAP.

EMC to Acquire Isilon

Joe Tucci

Chairman & CEO, EMC Corporation Pat Gelsinger President & COO, EMC Corporation Sujal Patel President & CEO, Isilon David Goulden EVP & CFO, EMC Corporation

Important Information

This presentation (this “Statement”) relates to a planned tender offer by Electron Merger Corporation (“Purchaser”), a wholly owned subsidiary of EMC Corporation (“EMC”), for all shares of outstanding common stock of Isilon Systems, Inc. (“Isilon”), to be commenced pursuant to an Agreement and Plan of Merger, dated as of November 14, 2010, by and among EMC, the Purchaser and Isilon.

The tender offer referred to in this Statement has not yet commenced. This Statement is neither an offer to purchase nor a solicitation of an offer to sell any shares of Isilon. The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC and Purchaser intend to file with the U.S. Securities and Exchange Commission

EMC and Purchaser intend to file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon intends to file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Forward-Looking Statements

This presentation contains “forward-looking statements”as defined under the Federal Securities Laws. Actual results could differ materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to: (i) adverse changes in general economic or market conditions; (ii) delays or reductions in information technology spending; (iii) our ability to protect our proprietary technology; (iv) risks associated with managing the growth of our business, including risks associated with acquisitions and investments and the challenges and costs of integration, restructuring and achieving anticipated synergies; (v) fluctuations in VMware, Inc.’soperating results and risks associated with trading of VMware stock; (vi) competitive factors, including but not limited to pricing pressures and new product introductions; (vii) the relative and varying rates of product price and component cost declines and the volume and mixture of product and services revenues; (viii)

component and product quality and availability; (ix) the transition to new products, the uncertainty of customer acceptance of new product offerings and rapid technological and market change; (x) insufficient, excess or obsolete inventory; (xi) war or acts of terrorism; (xii) the ability to attract and retain highly qualified employees; (xiii) fluctuating currency exchange rates; and (xiv) other one-time events and other important factors disclosed previously and from time to time in EMC’sfilings with the U.S. Securities and Exchange Commission. EMC disclaims any obligation to update any such forward-looking statements after the date of this presentation.

Joe Tucci

Chairman & CEO EMC Corporation

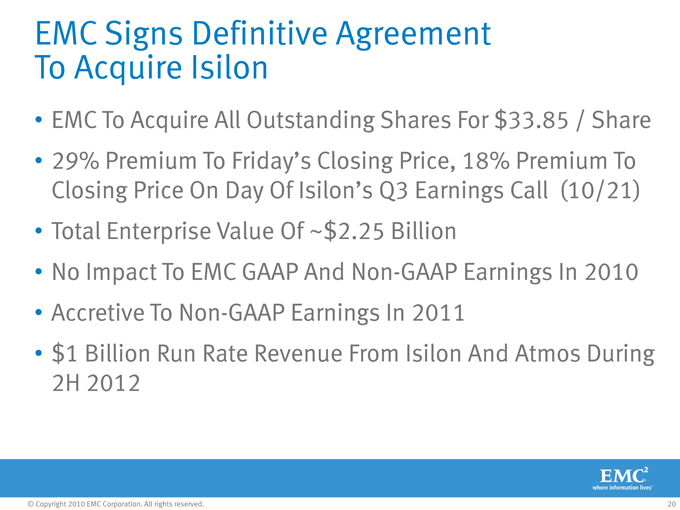

EMC Signs Definitive Agreement

To Acquire Isilon

•EMC To Acquire All Outstanding Shares For $33.85 / Share

•29% Premium To Friday’s

Closing Price On Day Of Isilon’sQ3 Earnings Call (10/21)

•Total Enterprise Value Of ~$2.25 Billion

Pat Gelsinger

President & COO EMC Corporation

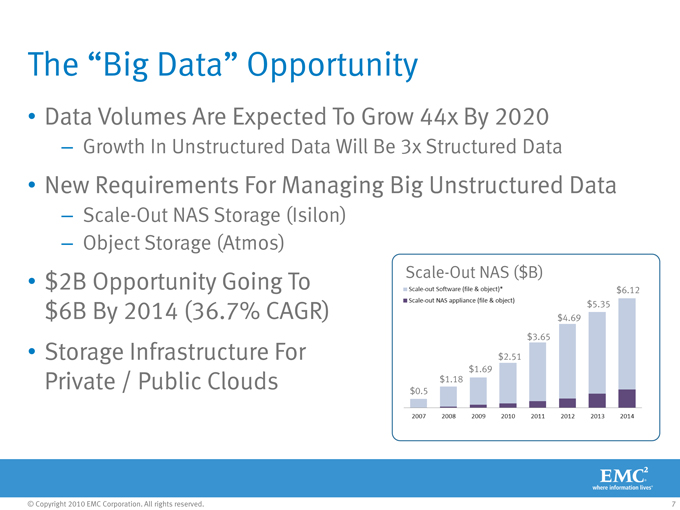

The “Big Data”

• Data Volumes Are Expected To Grow 44x By 2020

–Growth In Unstructured Data Will Be 3x Structured Data

• New Requirements For Managing Big Unstructured Data

–Scale-Out NAS Storage (Isilon)

–Object Storage (Atmos)

•$2B Opportunity Going To $6B By 2014 (36.7% CAGR) •Storage

Infrastructure For Private / Public Clouds

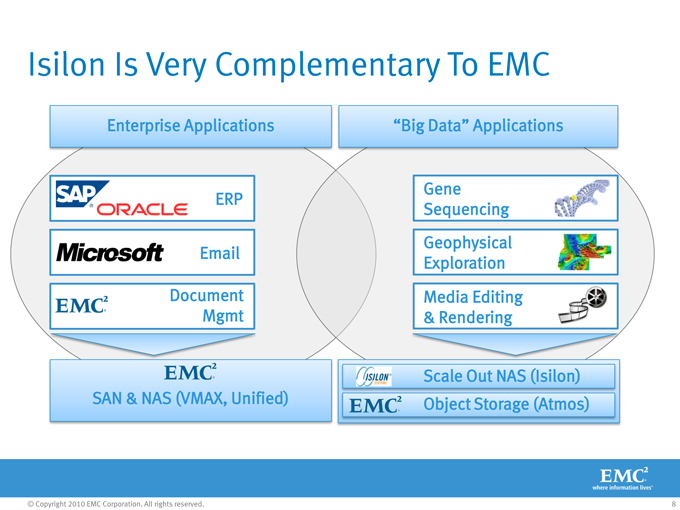

Isilon Is Very Complementary To EMC

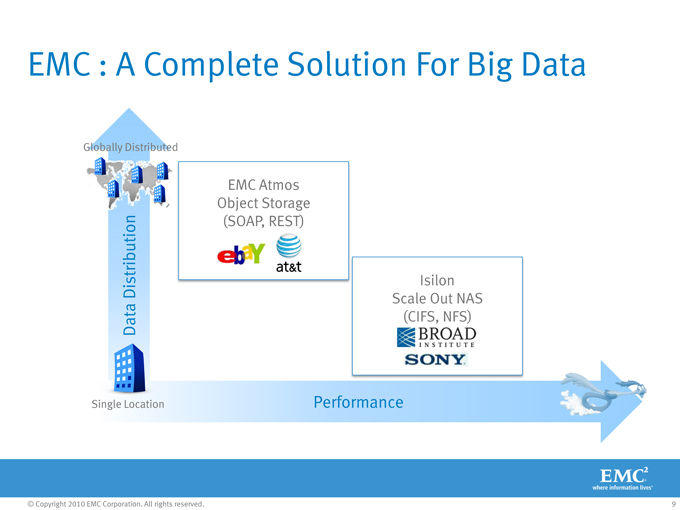

EMC : A CompleteSolution For BigData

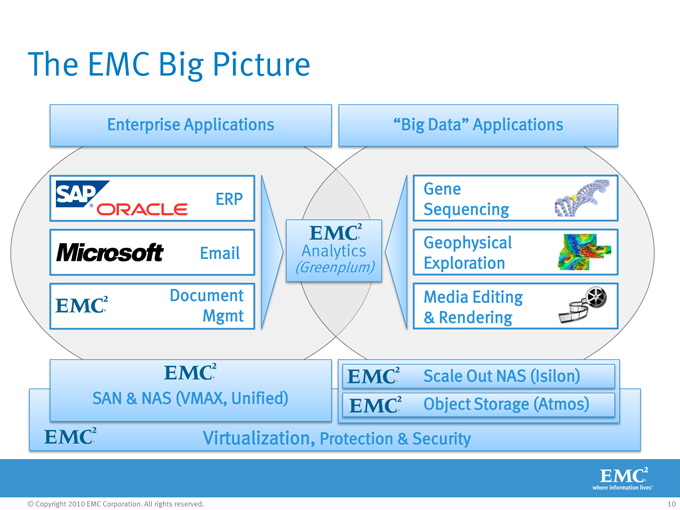

The EMC Big Picture

Sujal Patel

President & CEO Isilon Systems

About Isilon

•Founded In 2001; Headquartered in Seattle, WA •Seasoned Management Team; 500 Employees •Leading Provider Of Scale-Out NAS Storage Solutions •2010 Revenues Forecast At ~$200 Million •77% YOY Growth, 1500 Customers

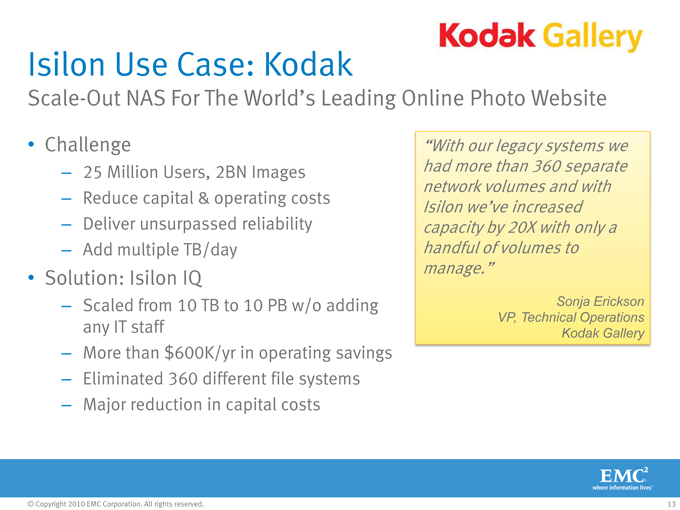

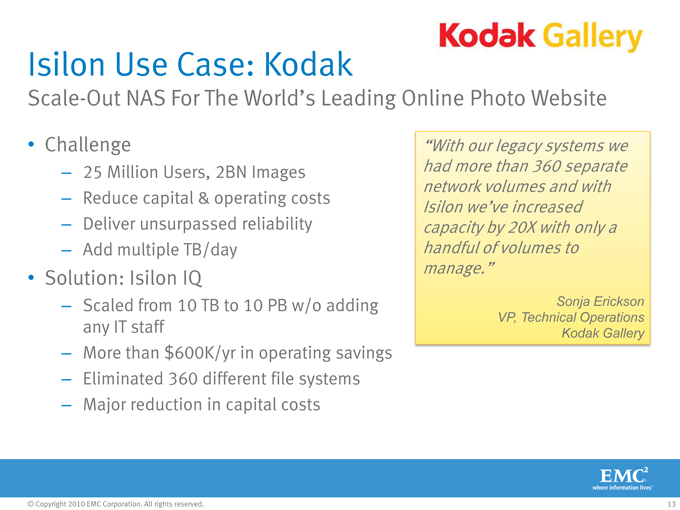

Isilon Use Case: Kodak

Scale-Out NAS For The World’s

•Challenge

– 25 Million Users, 2BN Images

– Reduce capital & operating costs

– Deliver unsurpassed reliability

– Add multiple TB/day

•Solution: Isilon IQ

– Scaled from 10 TB to 10 PB w/o adding any IT staff

– More than $600K/yr in operating savings

– Eliminated 360 different file systems

– Major reduction in capital costs

“With our had more than 360 separate network volumes and with

Isilon we’ve capacity by 20X with only a handful of volumes to manage.”

Sonja Erickson VP, Technical Operations Kodak Gallery

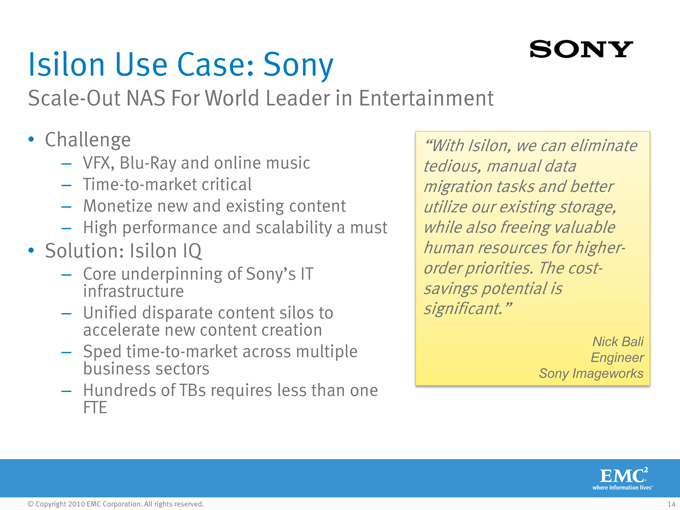

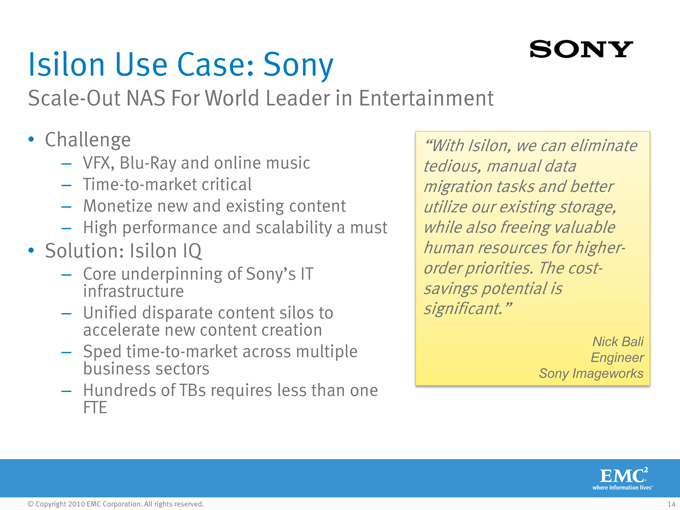

Isilon Use Case: Sony

Scale-Out NAS For World Leader in Entertainment

•Challenge

– VFX, Blu-Ray and online music

– Time-to-market critical

– Monetize new and existing content

– High performance and scalability a must

•Solution: Isilon IQ

– Core underpinning infrastructure

– Unified disparate content silos to accelerate new content creation

– Sped time-to-market across multiple business sectors

– Hundreds of TBs requires less than one FTE

“WithIsilon, we can eliminate tedious, manual data migration tasks and better utilize our existing storage, while also freeing valuable human resources for higher-order Sony’s priorities. The cost- IT savings potential is significant.”

Nick Bali Engineer Sony Imageworks

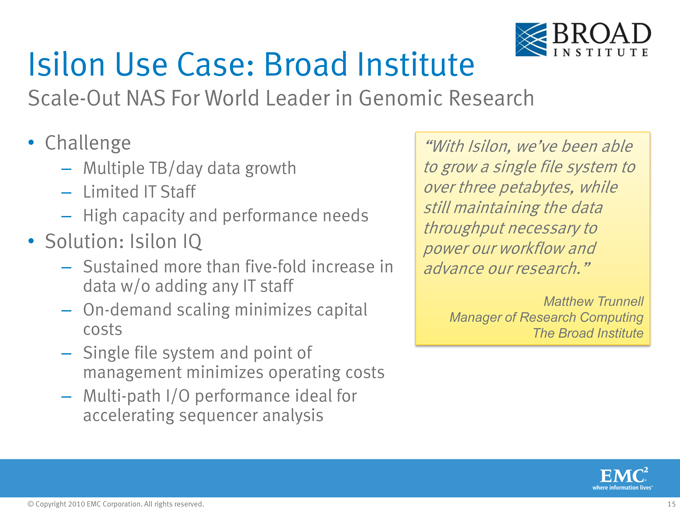

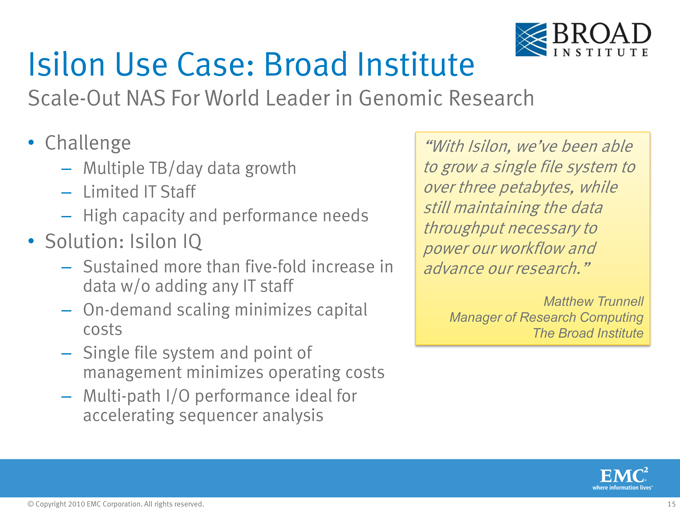

Isilon Use Case: Broad Institute

Scale-Out NAS For World Leader in Genomic Research

•Challenge

– Multiple TB/day data growth

– Limited IT Staff

– High capacity and performance needs

•Solution: Isilon IQ

– Sustained more than five-fold increase in data w/o adding any IT staff

– On-demand scaling minimizes capital costs

– Single file system and point of management minimizes operating costs

– Multi-path I/O performance ideal for accelerating sequencer analysis

“With Isilon, to grow a single file system to over three

petabytes, while still maintaining the data throughput necessary to power our workflow and advance our research.”

Matthew Trunnell Manager of Research Computing The Broad Institute

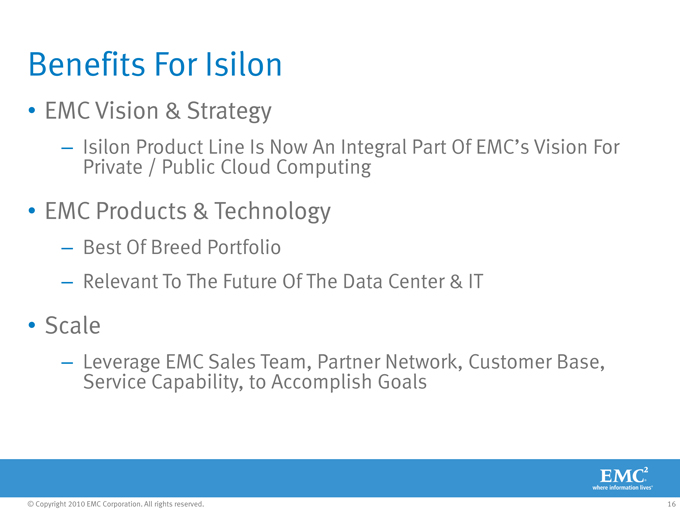

Benefits For Isilon

•EMC Vision & Strategy

–Isilon Product Line Is Now

Private / Public Cloud Computing

•EMC Products & Technology

–Best Of Breed Portfolio

–Relevant To The Future Of The Data Center & IT

•Scale

–Leverage EMC Sales Team, Partner Network, Customer Base, Service Capability, to Accomplish Goals

Pat Gelsinger

President & COO EMC Corporation

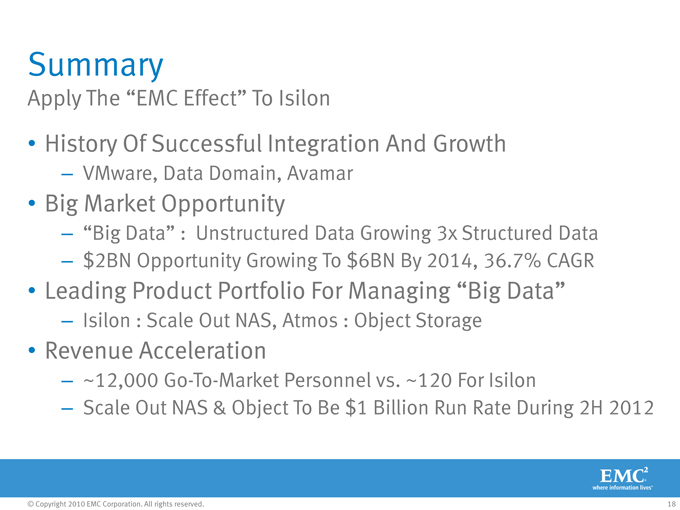

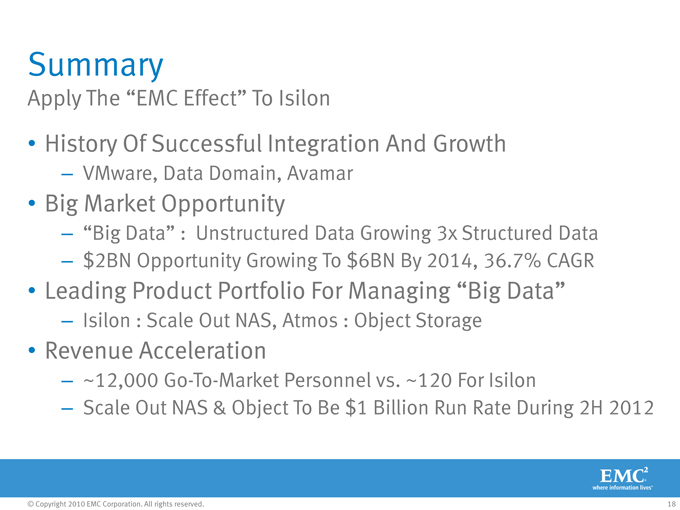

Summary

Apply The “EMC Effect” To

•History Of Successful Integration And Growth

–VMware, Data Domain, Avamar

•Big Market Opportunity

–”Big Data” : Unstructured

–$2BN Opportunity Growing To $6BN By 2014, 36.7% CAGR

•Leading Product Portfolio

–Isilon : Scale Out NAS, Atmos : Object Storage

•Revenue Acceleration

–~12,000 Go-To-Market Personnel vs. ~120 For Isilon

–Scale Out NAS & Object To Be $1 Billion Run Rate During 2H 2012

David Goulden

EVP & CFO EMC Corporation

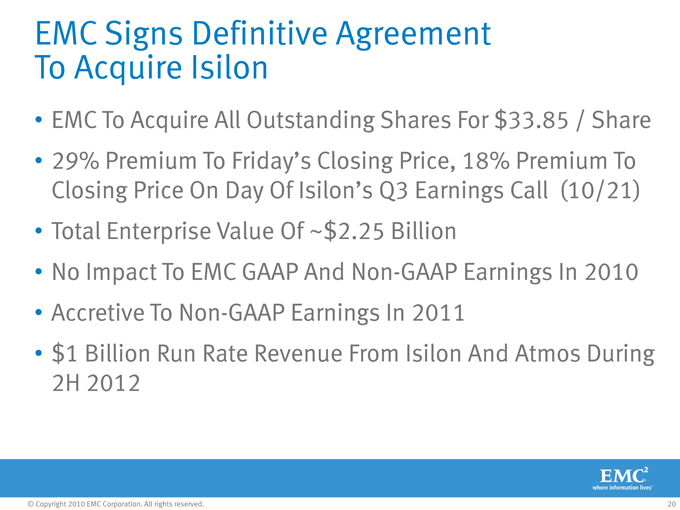

EMC Signs Definitive Agreement To Acquire Isilon

•EMC To Acquire All Outstanding Shares For $33.85 / Share

•29% Premium To Friday’s

Closing Price On Day Of Isilon’sQ3 Earnings Call (10/21) •Total Enterprise Value Of ~$2.25 Billion •No Impact To EMC GAAP And Non-GAAP Earnings In 2010 •Accretive To Non-GAAP Earnings In 2011 •$1 Billion Run Rate Revenue From Isilon And Atmos During

2H 2012

Questions

From: Sujal Patel

Sent: Monday, November 15, 2010 6:34 AM

To: Sujal Patel

Subject: Exciting News This Morning

Team —

This is a truly exciting and historic day for Isilon with the announcement that EMC has agreed to acquire our company for $33.85 per share in cash – a transaction valued at approximately $2.5 billion. This is big news for Isilon, our employees, shareholders, customers and partners, as well as EMC. A copy of the press release issued this morning is attached, as well as a set of FAQ’s that address some of the questions you may have.

Isilon was founded nearly 10 years ago on the core belief that scale-out architectures, and the powerful simplicity they deliver for enterprise data centers, would take root among an ever-broadening set of businesses around the world. Since our inception, we’ve introduced a game-changing portfolio of products, ushered in an entirely new category of storage, and built a strong business model that is well-positioned for the future. Our business momentum and industry-leading revenue growth demonstrate that the strength of our original vision has been matched only by the strength of our execution! You should be proud knowing that this success has been noticed and attracted this interest in our company.

Today’s announcement marks the beginning of a new chapter for Isilon; one that is fueled by a partnership that will enable us to accelerate our ability to capture the expanding opportunity before us. After a number of conversations with the EMC team, it became clear to our executives and Board of Directors that EMC represents an ideal partner for Isilon – the complementary nature of our technologies is simply undeniable. Furthermore, the depth and breadth of EMC’s market reach is unparalleled and will provide us access to new customers and new markets. We join forces with fellow innovators such as VMWare and Data Domain in offering our customers the most comprehensive and compelling set of storage and data management technologies available.

EMC has a strong track record of successful integrations, and I am confident we have made the right move for our company and our shareholders and delivered a transaction that will prove beneficial for employees, customers and partners. Upon the completion of the transaction, Isilon will become a subsidiary of EMC, reporting into the Information Infrastructure Products group.

We anticipate that the transaction will be completed by the end of the calendar year. That said, until the close of the transaction, we remain independent companies and it will be business-as-usual at Isilon. It is crucial that we all continue to stay focused on Isilon’s business execution while this transition process is underway.

As we enter this new chapter, there are many things at Isilon that will remain the same. Our leadership team will remain in place, including myself, and our headquarters will remain in Seattle. Isilon’s entrepreneurial culture and the rapid product innovation that Isilon is known for will continue. Importantly, EMC has made

clear their desire to retain and build upon the employees that have driven Isilon to our current level of success. They recognize that the talented team we have assembled will be a critical asset in moving the business forward.

I appreciate that given today’s announcement, you will likely have questions. You will be receiving a calendar invitation shortly for an all-company meeting to be held today (Monday, November 15) at 10 AM Pacific, on “C” level. In addition, a conference call will take place tonight at 5 PM Pacific for the benefit of our APAC & Japan based employees. Between those meetings, conversations with your manager, and the attached FAQ document, I’m confident we can address many of your questions. Of course, as additional information becomes available, we are committed to keeping you in the loop.

I am personally very excited for all of you and our company. This is a great win for Isilon, and we could have no better partner than EMC as we strive to take our company to the next level of success. I hope you share my excitement in being able to participate in this next phase of Isilon’s continuing evolution! I am confident that working together we will succeed at a scale and at a rate that we could not have achieved on our own.

Sujal

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser”) intend to file with the U.S. Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

Isilon Employee FAQ

1. What was announced today?

This morning we announced that we have reached an agreement under which EMC will purchase all of the outstanding common stock of Isilon for $33.85 per share in cash – a transaction valued at approximately $2.5 billion. This is a truly exciting and historic day for Isilon.

Today’s announcement marks the beginning of a new chapter for Isilon; one that is fueled by a partnership that will enable us to accelerate our ability to capture the expanding opportunity before us. After carefully considering this opportunity, our executive team and Board of Directors strongly believe that EMC represents an ideal partner for Isilon.

2. Who is EMC?

EMC Corporation is the world’s leading developer and provider of information infrastructure technology and solutions that enable organizations of all sizes to transform the way they compete and create value from their information. EMC has a strong track record of successful integrations, and the depth and breadth of EMC’s market reach is unparalleled and will provide Isilon access to new customers and new markets.

3. Why is Isilon entering into this transaction?

Isilon’s executive team and Board of Directors strongly believe that EMC represents an ideal partner for Isilon – the complementary nature of our technologies is simply undeniable. Isilon was founded nearly 10 years ago on the core belief that scale-out architectures, and the powerful simplicity they deliver for enterprise data centers, would take root among an ever-broadening set of businesses around the world. Since our inception, we’ve introduced a game-changing portfolio of products, ushered in an entirely new category of storage, and built a strong business model that is well-positioned for the future. Our business momentum and industry-leading revenue growth demonstrate that the strength of our original vision has been matched only by the strength of our execution!

Importantly, EMC recognizes that the talented team we have assembled will be a critical asset in moving the business forward.

4. Will there be any changes for employees as a result of the proposed transaction? Will my job change as a result of this transaction? Will we have to relocate?

Until the close of the transaction, which we anticipate will be completed by the end of the calendar year, we remain independent companies. Your responsibilities will remain the same and it will be business as usual.

Upon the completion of the transaction, Isilon will become a subsidiary of EMC and part of the Information Infrastructure Products Division. As we enter this new chapter, there are many things at Isilon that will remain the same. Our leadership team will remain in place, including myself, and our headquarters will remain in Seattle. Isilon’s entrepreneurial

culture and the rapid product innovation that Isilon is known for will continue. Importantly, EMC has made clear their desire to retain and build upon the employees that have driven Isilon to our current level of success. They recognize that the talented team we have assembled will be a critical asset in moving the business forward.

5. Do I work for EMC now? Who will I report to? How long before Isilon is integrated into EMC and what is the anticipated timeline?

No. As of today, and until the transaction closes, you will remain an Isilon employee and we will remain independent from EMC. Upon the completion of the transaction, which we anticipate by the end of the calendar year, Isilon will become a subsidiary of EMC as part of the Information Infrastructure Products Division. Until that time your responsibilities will remain the same, you will continue to report to your same supervisor and our internal processes will not change. In short, it will be business as usual at Isilon.

As we move forward, EMC and Isilon will form an integration team comprising executives from both companies to help ensure a seamless transition for our employees and our customers.

6. Will there be any layoffs or other changes for employees as a result of this announcement?

EMC has made clear their desire to retain and build upon the employees that have driven Isilon to our current level of success. They recognize that the talented team we have assembled will be a critical asset in moving the business forward.

7. What can I tell my customers?

The truth – that today’s announcement marks the beginning of a new chapter for Isilon; one that is fueled by a partnership that will enable us to accelerate our ability to capture the expanding opportunity before us. The depth and breadth of EMC’s market reach is unparalleled and will allow us to better serve our customers while providing access to new markets. We join forces with fellow innovators such as VMWare and Data Domain in offering our customers the most comprehensive and compelling set of storage and data management technologies available. Isilon’s entrepreneurial culture and the rapid product innovation that Isilon is known for will continue.

8. What does it mean for Isilon to become a subsidiary of EMC?

As a subsidiary of EMC, Isilon’s stock will no longer be independently traded in the market, although the Company will continue to operate under the Isilon name and will continue to be led my the current management team.

9. How will I know more about the progress of the transaction?

As additional information becomes available, we are committed to keeping you in the loop. We will continue to communicate developments regarding this transaction through town hall meetings, letters and other communications.

10. What should I say if I’m contacted by media, financial community, or other third parties about the transaction?

It is likely that today’s news will lead to increased interest in Isilon and it’s important we speak with one voice on this matter. As per our internal process, if you receive any inquiries from the media, please refer them to our Marketing Communications Group. If you receive inquiries from investors or other financial parties, please refer them to our Legal Department.

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser”) intend to file with the U.S. Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans,

strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

Isilon Customer FAQ

1. What was announced today?

This morning we announced that EMC will acquire our company for $33.85 per share in a cash – a transaction valued at approximately $2.5 billion. This is big news for Isilon, our employees and shareholders – and for you, our valued customers.

2. Who is EMC?

EMC Corporation is the world’s leading developer and provider of information infrastructure technology and solutions that enable organizations of all sizes to transform the way they compete and create value from their information. Importantly, EMC has a strong track record of successful integrations, and I am confident we have made the right move for our company and all of our stakeholders.

Additional information about EMC’s products and services can be found at www.EMC.com.

3. How will this transaction affect customers? Should I expect changes?

We expect that you will see no change as a result of this transaction. Throughout this process and following the close of the transaction, it will be business as usual at Isilon.

Going forward you will remain a critical part of our success, and together, we look forward to continuing to grow our enterprise and providing you with best-in-class products and service for many years to come. We remain committed to providing you with the high quality products and services you have come to expect from us. Upon completion, we will become a subsidiary of EMC, and we expect that you will see no change to the leading technology and service you’ve come to expect from Isilon as a result of this transaction.

4. What will happen to the Isilon brand?

Upon the completion of the transaction, Isilon will become a subsidiary of EMC. We remain committed to providing you with the high quality products and services you have come to expect from us.

5. Should Isilon customers continue to contact their regular representative?

Yes, your day-to-day customer contacts will remain the same, and we expect the integration to be seamless. As always, if you have any questions please do not hesitate to reach out to your regular sales representative. As we move through this process, we will continue to keep you updated on important developments.

6. Will there be changes to corporate contracts as a result of this announcement?

There are no changes to corporate contracts as a result of the announcement.

7. How long before the transaction is completed?

The Company expects the transaction to close by the end of the calendar year.

8. Where can I find additional information?

As we move through this process, we will continue to keep you updated on important developments. As always, if you have any questions please do not hesitate to reach out to your regular sales representative.

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser”) intend to file with the U.S. Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to

maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

November 15, 2010

Dear Valued Customer:

Today is an exciting day for Isilon! This morning we announced that EMC will acquire our company for $33.85 per share in a cash – a transaction valued at approximately$2.5 billion. This is big news for Isilon, our employees and shareholders – and for you, our valued customer. A copy of the press release issued this morning is attached, as well as a set of FAQ’s that will address some of the questions you may have.

EMC Corporation is the world’s leading developer and provider of information infrastructure technology and solutions that enable organizations of all sizes to transform the way they compete and create value from their information. Importantly, EMC has a strong track record of successful integrations, and I am confident we have made the right move for our company and all of our stakeholders.

Isilon was founded nearly 10 years ago on the core belief that scale-out architectures, and the powerful simplicity they deliver for enterprise data centers, would take root among an ever-broadening set of businesses around the world. Since our inception, we’ve introduced a game-changing portfolio of products, ushered in an entirely new category of storage, and built a strong business model that is well-positioned for the future. We believe that now is the right time to join with EMC, a company with the significant resources and technology synergies needed to fully capture the opportunities before us.

Throughout this process and following the close of the transaction, which we expect to occur by the end of the calendar year, it will be business as usual at Isilon. Upon completion, we will become a subsidiary of EMC, and we expect that you will see no change to the leading technology and service you’ve come to expect from Isilon as a result of this transaction. Isilon’s entrepreneurial culture and the rapid product innovation that Isilon is known for will continue. Your day-to-day customer contacts will remain the same, and we expect the integration to be seamless. As always, if you have any questions please do not hesitate to reach out to your regular sales representative.

As we move through this process, we will continue to keep you updated on important developments. We value our relationship with you and appreciate your business. Going forward you will remain a critical part of our success, and together, we look forward to continuing to grow our enterprise and providing you with best-in-class products and service for many years to come.

This is a very exciting time for Isilon. We appreciate your continued support and hope that you share our excitement as we enter this next phase of Isilon’s continuing evolution!

Regards,

Sujal Patel

President and Chief Executive Officer

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon

common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser”) intend to file with the U.S. Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

November 15, 2010

Dear Valued Business Partner:

I am writing to inform you about an exciting development for Isilon.

This morning we announced that EMC has agreed to acquire Isilon for $33.85 per share in cash – a transaction valued at approximately $2.5 billion. A copy of the press release issued this morning is attached.

Together we’ve built a great business and your partnership has been an integral part of our success. The combination of our products and your go-to-market strategies have helped to position and grow Isilon. We believe that now is the right time to join with EMC, a company with the significant resources and technology needed to fully capture the opportunities before us.

Importantly, all contracts will be honored, your day-to-day contact will remain the same, and we expect a seamless integration. Our leadership team will remain in place, including myself as President and Chief Executive Officer, and our headquarters will remain in Seattle.

EMC has a strong track record of successful integrations, and we are confident that this proposed transaction will be seamless for partners, customers and employees. Upon the completion of the transaction, Isilon will become a subsidiary of EMC, and we expect that our partners and customers will see no change to the leading technology and service you have come to expect from Isilon as a result of this transaction.

We strongly believe this transaction is great news for you, our business partners. EMC represents an ideal additional partner for Isilon – the synergies between our technologies are simply undeniable. Furthermore, the depth and breadth of EMC’s market reach is unparalleled and will provide us access to new customers and new markets. Together, we will offer the most comprehensive and compelling set of storage and data management technologies available.

We anticipate that the transaction will be completed by the end of the calendar year. That said, until the close of the transaction, we remain independent companies and it will be business as usual at Isilon.

As we move through this process, as additional information becomes available, we will continue to keep you in the loop. In the meantime, if you have any questions or wish to discuss this matter further, please feel free to contact us directly at 206-315-7500.

At Isilon, we place great value on the relationships we’ve cultivated with our partners and I can assure you that our commitment to innovative storage solutions and support is unchanged. I hope that you share our excitement as we enter this next phase of Isilon’s continuing evolution!

Sincerely,

Sujal Patel

President and Chief Executive Officer

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser���) intend to file with the U.S. Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

November 15, 2010

Dear Valued Business Supplier,

I am writing to let you know that this morning we announced that EMC has agreed to acquire Isilon for $33.85 per share in cash – a transaction valued at approximately $2.5 billion. A copy of the press release issued this morning is attached.

EMC Corporation is the world’s leading developer and provider of information infrastructure technology and solutions that enable organizations of all sizes to transform the way they compete and create value from their information. Importantly, EMC has a strong track record of successful integrations, and I am confident we have made the right move for our company and all of our stakeholders.

We believe this transaction is great news for our suppliers. As part of EMC, we are confident that with increased scale, capabilities, and a stronger financial position, we will be able to drive growth and invest even more in our business than what would be possible as a standalone company. In addition, EMC has a strong track record of successful integrations, and we are confident that this transaction will be seamless for suppliers, customers and employees. Upon the completion of the transaction, Isilon will become a subsidiary of EMC, and we expect that our suppliers and customers will see no significant changes as a result of this transaction.

We place tremendous value on the relationships we’ve cultivated with all our suppliers and we believe this transaction will help to strengthen our partnership with you. All current contracts will be honored, your day-to-day contact will remain the same, and there should be no immediate change in how we conduct business with you.

We anticipate that the transaction will be completed by the end of the calendar year. As we move through this process we will continue to keep you updated on important developments. In the meantime, if you have any questions or wish to discuss this matter further, please feel free to contact your usual Isilon representative.

Your company has been, and remains, a valued and important business partner to us. We appreciate your continued support and hope that you share our excitement as we enter this next phase of Isilon’s continuing evolution!

Sincerely,

Sujal Patel

President and Chief Executive Officer

Important Legal information

The tender offer referred to in this Frequently Asked Questions (“FAQ”) document has not yet commenced. This FAQ is neither an offer to purchase nor a solicitation of an offer to sell any shares of common stock of Isilon Systems, Inc. (“Isilon”). The solicitation and the offer to buy shares of Isilon common stock will be made pursuant to an offer to purchase and related materials that EMC Corporation (“EMC”) and Electron Merger Corporation (“Purchaser”) intend to file with the U.S.

Securities and Exchange Commission (the “SEC”). When the tender offer is commenced, EMC and Purchaser will file a Tender Offer Statement on Schedule TO containing an offer to purchase, forms of letters of transmittal and other documents relating to the tender offer and Isilon will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. EMC, Purchaser and Isilon intend to mail these documents to the stockholders of Isilon. These documents will contain important information about the tender offer and stockholders of Isilon are urged to read them carefully when they become available. Investors and stockholders of Isilon will be able to obtain a free copy of these documents (when they become available) and other documents filed by EMC, Purchaser and Isilon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the tender offer statement and related materials may be obtained for free (when they become available) by directing such requests to EMC Corporation at Attention: Office of the General Counsel, 176 South Street, Hopkinton, MA 01748. Investors and stockholders of Isilon may obtain a free copy of the solicitation/recommendation statement and other documents (when they become available) from Isilon by directing requests to Isilon Systems, Inc. at Attention: Investor Relations Department, 3101 Western Avenue Seattle, Washington 98121.

Statements in this FAQ that relate to future results and events are forward-looking statements based on EMC’s and/or Isilon’s current expectations, respectively. Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of a number of risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including the expected benefits and costs of the transaction; management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; satisfaction of conditions to the consummation of the proposed tender offer, including obtaining antitrust approvals in the U.S.; any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Risks, uncertainties and assumptions include the possibility that expected benefits may not materialize as expected; that the transaction may not be timely completed, if at all; that, prior to the completion of the transaction, Isilon’s business may experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; that the parties are unable to successfully implement integration strategies; and other risks that are described in EMC’s and Isilon’s SEC reports, including but not limited to the risks described in EMC’s and Isilon’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2009. EMC and Isilon assume no obligation and do not intend to update these forward-looking statements.

43

| | |

Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us | |  |

| © 2010 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the | |

| |

FINAL TRANSCRIPT

|

Nov 15, 2010 / 01:30PM GMT, ISLN - EMC Conference Call to Discuss Acquisition of Isilon |

CORPORATE PARTICIPANTS

Tony Takazawa

EMC Corporation - VP of Global IR

Joe Tucci

EMC Corporation - Chairman & CEO

Pat Gelsinger

EMC Corporation - President & COO

Sujal Patel

Isilon Systems, Inc. - President & CEO

David Goulden

EMC Corporation - EVP & CFO

CONFERENCE CALL PARTICIPANTS

Amit Daryanani

RBC Capital Markets - Analyst

Kevin Hunt

Hapoalim Securities - Analyst

Ittai Kidron

Oppenheimer - Analyst

Kaushik Roy

Wedbush - Analyst

Lou Miscioscia

Collins Stewart - Analyst

Daniel Ives

FBR - Analyst

Aaron Rakers

Stifel Nicolaus - Analyst

Keith Bachman

Bank of Montreal - Analyst

Glenn Hanus

Needham - Analyst

Jason Ader

William Blair - Analyst

Jason Maynard

Wells Fargo - Analyst

Ananda Baruah

Brean Murray - Analyst

Ben Reitzes

Barclays Capital - Analyst

44

| | |

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us | |  |

| © 2010 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the | |

| |

FINAL TRANSCRIPT

|

Nov 15, 2010 / 01:30PM GMT, ISLN - EMC Conference Call to Discuss Acquisition of Isilon |

PRESENTATION

Operator

Good morning and thank you for standing by. At this time all participants are in a listen-only mode until the question-and-answer portion of the conference. (Operator Instructions). This conference is being recorded. If you have any objections you may disconnect. I would now like to turn the call over to your host today, Mr. Tony Takazawa. Sir, you may begin.

Tony Takazawa - EMC Corporation - VP of Global IR

Thank you, Stacy. Good morning, welcome to EMC’s call to discuss our proposal to acquire Isilon Systems. On the call today are Joe Tucci, EMC Chairman, President and CEO, and David Goulden, EMC Executive Vice President and CFO. Joining us this morning from Seattle are Sujal Patel, Isilon President and CEO, and Pat Gelsinger, EMC President and COO of EMC Information Infrastructure Products.

Joe will spend a few minutes discussing the agreement and the strategic rationale of this combination. He will be followed by Pat and Sujal who will give you insight into how and why the combination of these two businesses provides very unique value to our customers, partners and shareholders. David will then discuss some of the specifics of the proposed transaction. After the prepared remarks we will open up the lines to take your questions.

I would like to point out that the presentation today does not represent an offer to buy or the solicitation of an offer to sell any securities. Further information about this proposed transaction will be available in EMC and Isilon’s filings with the US Securities and Exchange Commission and we recommend that you refer to these filings for important information including the terms and conditions of the offer.

In addition, the call this morning will contain forward-looking statements and information concerning factors that could cause actual results to differ can be found in EMC’s filings with the SEC. A slide presentation, including important background information on the proposal, is available on the EMC website. And lastly, I will note that an archive of today’s presentation will be available following the call. With that it’s now my pleasure to introduce Joe Tucci. Joe.

Joe Tucci - EMC Corporation - Chairman & CEO

Thanks, Tony. I would like to begin by welcoming and thanking everyone for joining our conference call today on such short notice. This is an exciting day for us here at EMC. As you have undoubtedly heard, EMC has reached an agreement with Isilon under which we will acquire Isilon for $33.85 a share in cash. This represents a 29% premium over Friday night’s close and our plan is to conclude this transaction before year’s end.

I would like to take this opportunity to welcome the 500 talented people at Isilon to the EMC family and congratulate them on their many accomplishments and successes.

Now I’ll spend a few minutes and take you through the opportunity as we see it and articulate why we are so excited about our future prospects. First and foremost the best reason to do any acquisition is to accelerate growth, profitable growth. Bringing Isilon into the EMC family, just as with the case with our Data Domain acquisition, is all about accelerating growth by further focusing and executing on a very large and rapidly growing market opportunity.

In short we believe the combination of the EMC and Isilon Solutions will position us best to help our customers store and manage the vast amounts of Big Data that the transformational cloud computing wave will thrust upon them. This explosion of data will hit all customers, whether they are a private company, a public company, a nonprofit, a government or one of our service provider partners. Simply stated, EMC will be able to offer the most complete portfolio of storage offerings for both the world of today and the rapidly emerging cloud computing world of tomorrow.

And now to the point of today’s announcement. With Isilon we are aggressively extending the reach of our rapidly growing midrange storage product family. Isilon is the market leader in scale-out NAS systems, enabling customers to store and manage data, data like 3-D movies, PACS healthcare data, seismic data, genomic sequencing data, audio and video files, just to name a few.

EMC has the perfect complement to Isilon with our Atmos object storage. When data is increasingly dispersed around the globe and there is a need for access from Web 2.0 application, Atmos technology and capability shine. Together Isilon and Atmos represent a great 1-2 punch for storing and managing Big Data and we have plans to make one plus one equal a lot more than two.

I’ll close my formal remarks with a few items related to our plans to welcome and integrate Isilon into EMC. First we intend to increase R&D investment in Isilon within our Information Infrastructure product group. Second, we intend to leverage our global sales and marketing organization which is over 12,000 strong and operates in over 83 countries around the world. We also intend to leverage our extensive network of channel and alliance partners and our global services organization to ensure even broader adoption of Isilon’s leading portfolio of products.

45

| | |

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us | |  |

| © 2010 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the | |

| |

FINAL TRANSCRIPT

|

Nov 15, 2010 / 01:30PM GMT, ISLN - EMC Conference Call to Discuss Acquisition of Isilon |

Third, this acquisition is all about accelerating growth and rapidly capitalizing on an emerging market opportunity. Fourth, I’d like to remind everyone of EMC’s very good track record of integrating companies, retaining and growing key talent and achieving strong financial results. And finally, we expect the combination of Isilon and Atmos to reach a $1 billion run rate during the second half of 2012 and we expect this acquisition to be non-cap EPS accretive next year.

By adding Isilon to our market-leading product portfolio EMC is very well positioned at the intersection of cloud computing and Big Data. Given what’s going on in the IT world today I can’t think of a better place to be. And now I’ll hand it over to Pat, Sujal and David to provide you more details on this agreement. Pat, you’re up first.

Pat Gelsinger - EMC Corporation - President & COO

Thank you, Joe. This is truly a great day and a thrilling announcement. As Joe has indicated, we see the convergence of two very powerful trends in information technology, that of Big Data and of the cloud. Earlier this year you heard us speak in regards to the IDC report indicating that data would increase 44X over the next decade. This is super Moore’s Law, e.g. data is growing faster than this well-known law of semiconductors resulting in a continued tremendous increase of data.