UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

þ Definitive Additional Materials

o Soliciting Material under §240.14a-12

SERVICENOW, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| |

| 1) | Title of each class of securities to which transaction applies: |

|

| |

| 2) | Aggregate number of securities to which transaction applies: |

|

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| |

| 4) | Proposed maximum aggregate value of transaction: |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

| 1) | Amount Previously Paid: |

|

| |

| 2) | Form, Schedule or Registration Statement No.: |

EXPLANATORY NOTE

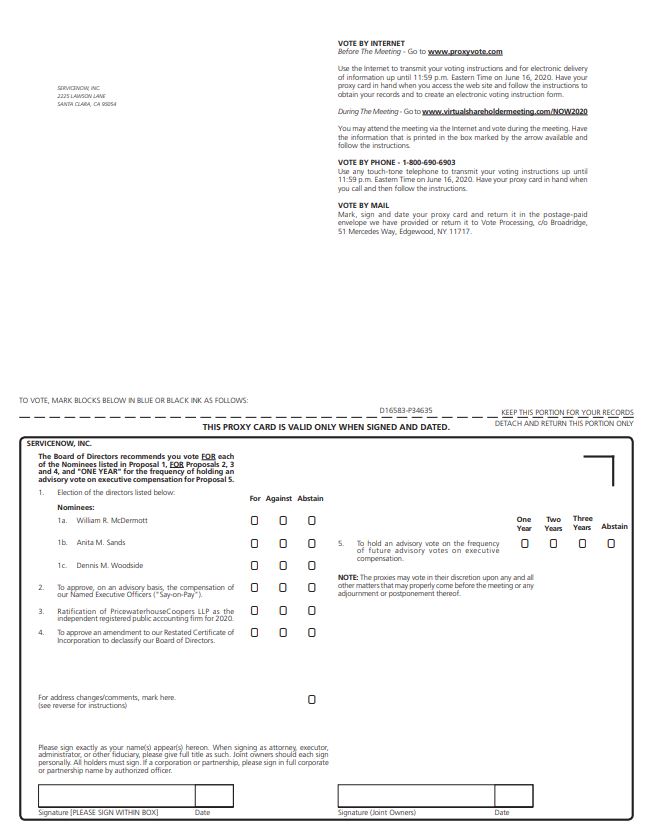

On April 24, 2020, ServiceNow, Inc. (“ServiceNow”) filed its Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) and the related Proxy Card (the “Proxy Card”) for the Company’s 2020 Annual Meeting of Shareholders with the Securities and Exchange Commission (“SEC”). The Proxy Statement was filed in connection with the Company’s 2020 Annual Meeting of Shareholders to be held on June 17, 2020 (together with any adjournments, postponements or other delays thereof, the “Annual Meeting”). This supplement to the Proxy Statement and Proxy Card is being filed to add a new Proposal No. 5 that is soliciting a non-binding advisory vote from Company shareholders on the frequency at which the Company’s shareholders shall have an advisory say-on-pay vote on compensation paid to our named executive officers (“Proposal No. 5”). This Proposal No. 5 was inadvertently omitted from the Proxy Statement and Proxy Card when originally filed with the SEC and this filing corrects this omission. Other than the addition of Proposal No. 5 to the Proxy Statement and the Proxy Card and an updated Notice of the Annual Meeting that adds Proposal No. 5, no other changes have been made to the Proxy Statement or the Proxy Card and they continue to be in full force and effect as originally filed and continue to seek the vote of Company shareholders for all proposals to be voted on at the Annual Meeting.

Capitalized terms used but not otherwise defined in this supplement have the meanings ascribed to them in the Proxy Statement. This supplement should be read together with the Proxy Statement.

PROXY STATEMENT SUPPLEMENT FOR THE 2020 ANNUAL MEETING OF SHAREHOLDERS

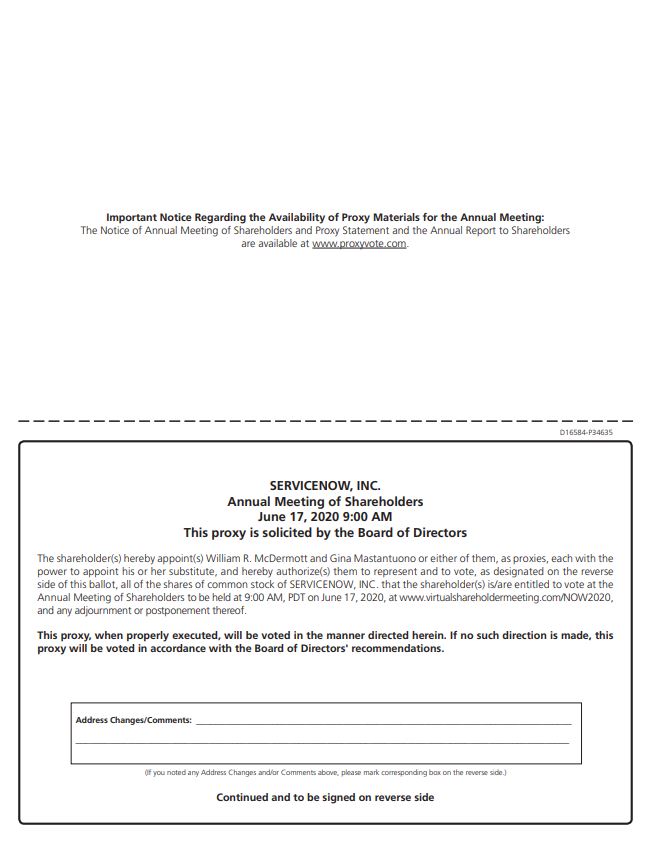

This Proxy Statement Supplement (the “Supplement”) supplements and amends the original definitive proxy statement of ServiceNow, Inc. (the “Company” or “ServiceNow”), dated April 24, 2020 (the “Proxy Statement”) for the Company’s 2020 Annual Meeting of Shareholders (the “Annual Meeting”) to (i) add a new Proposal No. 5 to the Proxy Statement that provides for a non-binding, advisory vote of Company shareholders on the frequency at which the Company’s shareholders shall have the advisory say-on-pay vote on compensation paid to our named executive officers (“Proposal No. 5”) and (ii) update the Notice of the Annual Meeting to add the new Proposal No. 5 (the “Amended Notice”). This Supplement, along with the accompanying Amended Notice, contains additional information about the Annual Meeting. The Annual Meeting will be conducted via a live webcast at www.virtualshareholdermeeting.com/NOW2020 on Wednesday, June 17, 2020 at 9:00 a.m. (Pacific Time).

This Supplement relates to the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting. On or about April 29, 2020, we expect to mail this Supplement, the Proxy Statement, the Amended Notice attached hereto as Appendix A and the enclosed amended proxy card to all stockholders entitled to vote at the Annual Meeting.

PROPOSALS TO BE VOTED UPON BY STOCKHOLDERS

Information contained in this Supplement relates to Proposal No. 5 that will be presented to shareholders at the Annual Meeting. Information regarding Proposals 1, 2, 3 and 4 that will be presented to shareholders at the Annual Meeting can be found in the Proxy Statement, and which is concurrently being made available to you or mailed to you, if you requested a hard copy. We urge you to read this Supplement carefully and in its entirety together with the Proxy Statement.

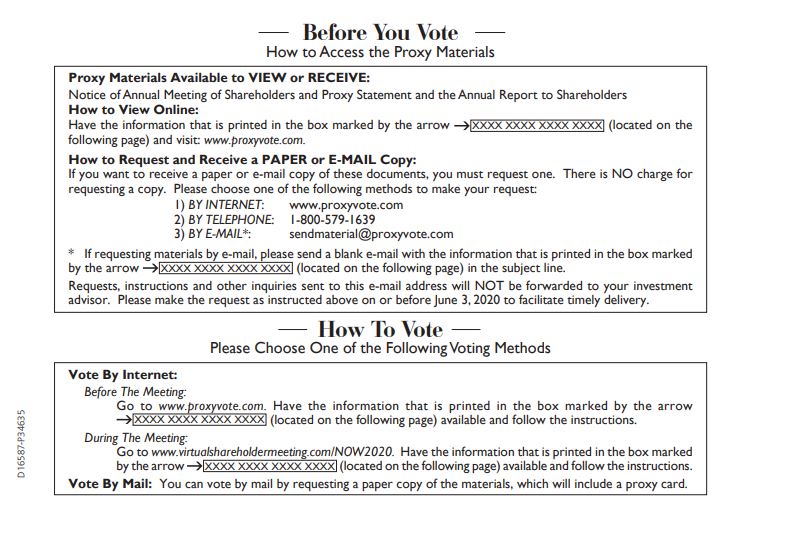

Whether or not you expect to attend the Annual Meeting, we encourage you to read the Proxy Statement and this Supplement and vote over the Internet, by telephone or by requesting and submitting your proxy card as soon as possible, so that your shares may be represented at the Annual Meeting. For specific instructions on how to vote your shares, please refer to the section titled “Questions and Answers” beginning on page 1 of the Proxy Statement and the instructions on the enclosed amended Notice of Internet Availability.

Votes Needed for Approval; Effect of Abstentions and Broker Non-Votes.

|

| | | | |

| Proposal | Votes Required for Approval | How May You Vote? | Will “Broker Non-Votes” impact the outcome? | Will “Abstentions” impact the outcome? |

Proposal No. 5: Advisory vote on the frequency of future advisory votes on executive compensation | Frequency receiving greatest number of votes cast(1) | “One Year,” “Two Years,” “Three Years,” or “Abstain” | No(2) | No, so long as quorum exists |

__________

(1) As an advisory vote, this proposal is not binding. However, our Board and Compensation Committee will take into account the outcome of this vote when making future decisions regarding the frequency of holding future advisory votes on executive compensation.

(2) Under the rules of the NYSE, brokerage firms, banks and other nominees do not have discretionary authority to vote shares with respect to Proposal No. 5.

PROPOSAL NO. 5

ADVISORY VOTE ON THE FREQUENCY OF

FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

General

In accordance with The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we are providing our shareholders with a non-binding, advisory vote on the frequency of future advisory votes on executive compensation. This non-binding, advisory vote must be submitted to shareholders at least once every six years.

Vote Required and Recommendation of the Board

You have four choices for voting on the following resolution. You can choose whether future advisory votes on executive compensation should be conducted every “ONE YEAR,” “TWO YEARS” or “THREE YEARS.” You may also “ABSTAIN” from voting. The frequency that receives the greatest number of votes cast by shareholders on this matter at the meeting will be considered the advisory vote of our shareholders.

After careful consideration, our Compensation Committee and our Board of Directors recommend that future advisory votes on compensation of our named executive officers continue to be held annually. Our Board of Directors believes that holding a vote every year is the most appropriate option because (i) it would enable our shareholders to provide us with input regarding the compensation of our named executive officers on a timely basis; and (ii) it is consistent with our past practice of holding the advisory vote on executive compensation each year, and our practice of engaging with our shareholders, and obtaining their input, on our corporate governance matters and our executive compensation philosophy, policies and practices.

Shareholders are not voting to approve or disapprove the recommendation of our Board of Directors. Instead, shareholders may indicate their preference regarding the frequency of future advisory votes on the compensation of our named executive officers by selecting one year, two years or three years. Shareholders that do not have a preference regarding the frequency of future advisory votes should abstain from voting on the proposal. For the reasons discussed above, we are asking our shareholders to vote for the future of frequency advisory votes on the compensation for our named executive officers to occur every one year.

Your vote on this proposal is advisory, and therefore not binding on ServiceNow, the Board of Directors or the Compensation Committee, and will not be interpreted as overruling a decision by, or creating or implying any additional fiduciary duty for, the Board of Directors or the Compensation Committee. Nevertheless, our Board of Directors and Compensation Committee value the opinions of our shareholders and will take into account the outcome of this vote when making future decisions regarding the frequency of holding future advisory votes on executive compensation.

OUR BOARD OF DIRECTORS

RECOMMENDS A VOTE TO HOLD FUTURE ADVISORY VOTES ON EXECUTIVE

COMPENSATION EVERY “ONE YEAR”

Appendix A

2225 Lawson Lane

Santa Clara, California 95054

UPDATED NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

THIS UPDATED NOTICE IS HEREBY GIVEN that the 2020 Annual Meeting of Shareholders (together with any adjournments, postponements or other delays thereof, the “Annual Meeting”) of ServiceNow, Inc., a Delaware corporation (the “Company”), will continue to be conducted via a live webcast at www.virtualshareholdermeeting.com/NOW2020 on Wednesday, June 17, 2020 at 9:00 a.m. (Pacific Time).

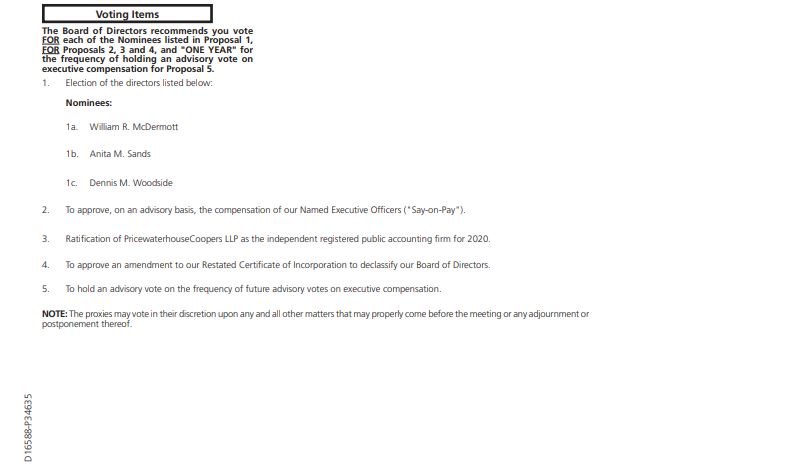

We are holding the Annual Meeting for the following purposes, which now includes a new Proposal No. 5, and which are more fully described in the accompanying proxy statement and the supplement to the proxy statement:

| |

| 1. | To elect three Class II directors, each to serve until the 2023 annual meeting of shareholders and until his or her successor is elected and qualified or his or her earlier death, resignation or removal; |

| |

| 2. | To hold a non-binding advisory vote on a resolution to approve the compensation of our named executive officers (commonly referred to as “Say-on-Pay”); |

| |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2020; |

| |

| 4. | To approve an amendment to our Restated Certificate of Incorporation to declassify our board of directors; and |

| |

| 5. | To hold a non-binding advisory vote on the frequency of future advisory votes on the compensation of our named executive officers. |

In addition, shareholders may be asked to consider and vote upon such other business as may properly come before the Annual Meeting.

The Proxy Statement Supplement contains additional information related to the new Proposal No. 5 to be considered by shareholders at the Annual Meeting. However, the Proxy Statement Supplement does not include all of the information provided in connection with the Annual Meeting. Accordingly, we urge you to read the Proxy Statement Supplement carefully and in its entirety together with the Proxy Statement.

Only shareholders of record at the close of business on April 20, 2020 are entitled to notice of, and to vote at, the Annual Meeting. All shareholders are invited to attend the Annual Meeting. Any shareholder attending the Annual Meeting may vote online at the Annual Meeting even if the shareholder previously voted. The previous votes will be superseded by the vote such shareholder casts online at the Annual Meeting. Thank you for your continued support of ServiceNow.

|

| |

| | |

| | By Order of the Board of Directors |

| | Russell S. Elmer |

| | General Counsel and Secretary |

Santa Clara, California

April 29, 2020

Whether or not you expect to attend the Annual Meeting, we encourage you to read the Proxy Statement and the Proxy Statement Supplement and vote over the Internet, by telephone or by requesting and submitting your proxy card as soon as possible, so that your shares may be represented at the Annual Meeting. For specific instructions on how to vote your shares, please refer to the section titled “Questions and Answers” beginning on page 1 of the Proxy Statement and the instructions on the enclosed Notice of Internet Availability.