UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-35580

SERVICENOW, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-2056195 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

ServiceNow, Inc.

2225 Lawson Lane

Santa Clara, California 95054

(408) 501-8550

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | NOW | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Not applicable

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Based on the closing price of the registrant’s Common Stock on the last business day of the registrant’s most recently completed second fiscal quarter, which was June 30, 2024, the aggregate market value of its shares (based on a closing price of $786.67 per share on June 30, 2024 as reported on the New York Stock Exchange) held by non-affiliates was approximately $135.0 billion.

As of January 23, 2025, there were approximately 206 million shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2025 Annual Meeting of Stockholders (Proxy Statement) to be filed within 120 days of the registrant’s fiscal year ended December 31, 2024, are incorporated by reference in Part III of this Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 1C | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | |

| | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| | |

| | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| | |

| | |

| Item 15 | | |

| Item 16 | | |

| | |

| | |

| | |

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding future events and our future results that are based on our current expectations, estimates, forecasts and projections about our business, our results of operations, the industry in which we operate and the beliefs and assumptions of our management. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “would,” “could,” “should,” “intend” and “expect,” as well as variations of these words and similar expressions, are intended to identify those forward-looking statements. Forward-looking statements are only predictions and are subject to risks, uncertainties, assumptions and other factors that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report under “Risk Factors” in Item 1A of Part I and elsewhere herein and in other reports we file with the Securities and Exchange Commission (“SEC”). While forward-looking statements are based on our management’s reasonable expectations at the time that they are made, you should not rely on those statements. We undertake no obligation to revise or update publicly any forward-looking statements for any reason, whether as a result of new information, future events or otherwise, except as may be required by law.

ServiceNow was founded on a simple premise: to make work flow better. Our intelligent platform—the Now Platform—is a cloud-based solution that helps enterprises and organizations across public and private sectors digitize workflows, in line with our purpose of making the world work better for everyone. Organizations are increasingly turning to digital investments to streamline business-critical processes, drive deeper collaboration, increase employee productivity and power better customer experiences. The Now Platform helps business leaders realize value from these investments by incorporating advanced technology into the flow of work, end-to-end across the enterprise, for every department and persona.

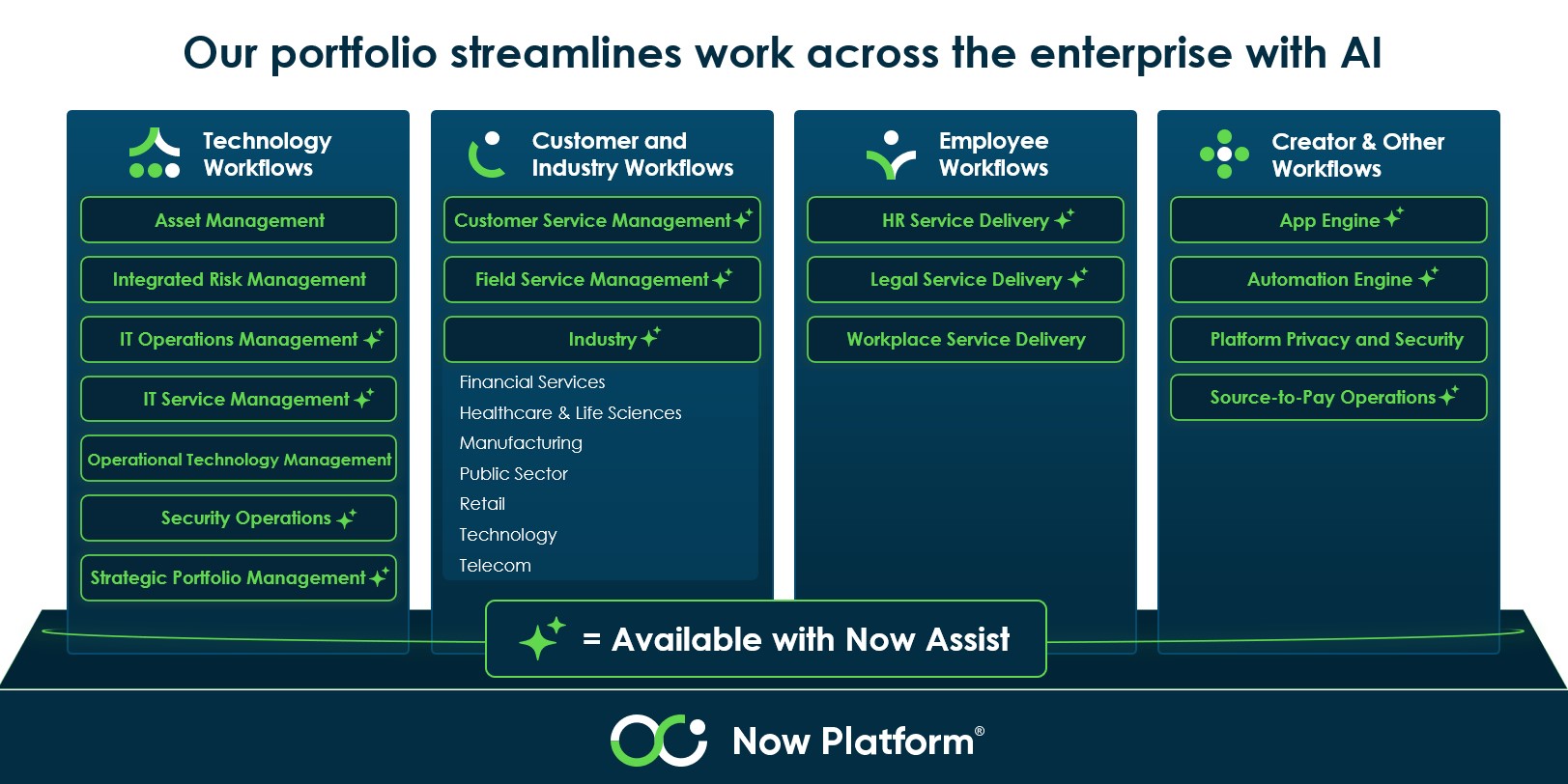

The workflow applications built on the Now Platform are organized in four primary areas: Technology, Customer and Industry, Employee and Creator. Our Technology Workflows empower Information Technology (“IT”) departments to plan, build, operate and service the IT needs of the business enterprise. Our Customer and Industry Workflows help organizations reimagine their customer experience by empowering their customers with personalized self-service and providing organizations with greater ability to anticipate their customer needs by providing real-time insights. Our Employee Workflows help customers simplify how their employees access services they need, creating a consumer-like experience. Our Creator Workflows enable customers to automate processes by quickly creating their own custom workflows on the Now Platform.

Artificial Intelligence (“AI”), particularly Generative AI (“GenAI”) and agentic AI, is driving a new wave of technology transformation. We are an early leader in applying AI to enterprise workflows and are working to remain at the forefront of AI as we continue to execute our product roadmap. As an AI platform for business transformation, the Now Platform has embedded Now Assist, our AI solution available for certain products at an additional cost, to help enhance user productivity and efficiency, thereby accelerating our customers’ return on investment in the Now Platform. For example, with Now Assist, customer service agents can solve customers’ problems quickly with AI-produced case summaries and next step suggestions; employees can obtain faster and more accurate answers using AI-powered self-service, increasing their productivity and engagement; customers can receive enhanced self-service options and improved experiences from live support agents; and developers can generate code and create apps, saving time to focus on more complex matters. We believe that with Now Assist, even customers with limited technical background can leverage AI to meaningfully contribute to their businesses’ digital transformation. Our customers have given us feedback that these enhanced products significantly improve the efficiency and fidelity of their workflows.

Agentic AI, the next evolution of GenAI, involves AI agents that act and interact in smart and autonomous ways with humans providing oversight and guardrails. With agentic AI, humans can be supported by multiple AI agents trained to perform specific tasks, rather than, for example, a single AI assistant or chatbot relying on a human’s specific prompts or queries. Agentic AI is available to our customers as a Now Assist feature, where they can easily create agentic skills tailored to their unique needs. AI agents can use these skills to work together with humans to help augment and accelerate workflow outcomes by performing and completing actions on the human’s behalf.

The Now Platform, utilized by over 85% of the Fortune 500 and nearly 60% of the Global 2000, is a platform of consequence that puts AI to work for people, delivering tangible results while upholding a trustworthy, human‑centered approach to deploying products and services at scale. Many of our customers recognize the advantages of the Now Platform and have developed multi-year digital transformation plans that expand over time the use of ServiceNow products and services for their business. As we gain our customers’ trust by delivering products that provide great experiences and value across our customers’ entire enterprise, we feel immensely proud that “The World Works with ServiceNow.”

Our Products

ServiceNow’s product portfolio—which spans our Technology, Customer and Industry, Employee, Creator and other Workflows—is delivered on the Now Platform. Each year, two major platform upgrades are released, delivering new standard functionality and standalone products to further simplify the way our customers work and enhance productivity. Since launching AI-powered versions of our products, we have continued to expand the Now Assist product portfolio and plan to continue to embed AI capabilities in our portfolio in the future.

The Now Platform

The Now Platform is the AI platform for digital transformation. We help customers leverage emerging AI-based technologies to improve enterprise workflows. We believe AI-enabled workflows allow our customers to enhance their digital transformation and business impact. Transformations enabled by the Now Platform rapidly automate business processes across an entire enterprise by seamlessly connecting disparate departments, systems and silos to unlock productivity and improve experiences for both employees and customers. As the foundation for how we deliver our cross-enterprise digital workflows, the Now Platform orchestrates work across our customers’ cloud platforms and systems of choice, allowing them to get work done regardless of their current and future systems of record and collaboration platforms, across any data and system.

Our one platform, one architecture and one data model approach can provide a “single pane of glass” that connects people, processes, data and devices. It offers a one-stop shop for automation and simplification of manual processes and is highly flexible, scalable and extensible. Enterprises can leverage our platform’s consumer-like user interface to help them deliver seamless experiences. For example, the Now Platform empowers users to independently resolve issues and seek answers through intelligent self-service portals. To illustrate, a customer may need to reset a password or update a shipping address, or an employee may want to know how many vacation days she has remaining. Because the Now Platform contains access to all of this information and the context of the user’s request in a single environment, users can easily access the information or services they need and find their own customized answers without outside help or even knowing which system or department has the answer they need. We believe better service, end-user experience and organizational agility are the ultimate desired outcomes of digital transformation.

The Now Platform is uniquely positioned to bring the full potential of GenAI and agentic AI to the enterprise. With our recent software releases, we have combined the power of the Now Platform with new GenAI and agentic AI features, offered through Now Assist, to provide intelligent workflows throughout our customers’ businesses. Customers have the flexibility to tailor their AI transformation to their unique needs and expand the value of their workflows by using ServiceNow’s large language models (“LLMs”), which include models that can process different types of data, such as text, images, audio and video, and they can incorporate third-party LLMs and their own LLMs. We regularly test these models on platform-representative data to give customers confidence that the models deliver optimal performance for their intended use cases on the Now Platform. We also provide AI governance tools, including built-in monitoring and guardrails, dataset creation management and benchmarking capabilities, and visibility into adoption, usage and performance analytics. These tools are designed to allow customers to securely and responsibly build, test and deploy new use cases and applications leveraging these models. With a single data model and integrated data layer, the Now Platform enables customers to operationalize their AI strategy and transform their business with speed, scale and security. This flexibility helps create more intuitive, efficient and seamless workflows aligned to our customers’ needs. In addition to AI, business process automation on the Now Platform can be further enhanced by other functionality, including machine learning, robotic process automation, process mining, analytics and low-code/no-code development tools.

Technology Workflows

Technology Workflows enable IT departments to serve their customers, manage their IT infrastructure, identify and remediate security vulnerabilities and threats, gain visibility across their IT resources and asset lifecycles, optimize IT costs and reduce time spent on administrative tasks. Our Technology products help companies unite IT, technology, risk management and security operations on a single platform to deliver modern and resilient digital services aligned to our customers’ priorities. These products also drive enterprise-wide outcomes, as well as power our Customer and Industry and Employee Workflows.

Asset Management

Our Asset Management product suite includes IT Asset Management and Enterprise Asset Management. IT Asset Management inventories and automates customers’ software, hardware and cloud asset lifecycles with workflows and analytics to track the financial, contractual and inventory details of these IT assets from end-to-end. Enterprise Asset Management inventories and automates processes across the lifecycle of a customer’s physical business assets from planning, deployment, inventory management and maintenance through retirement.

Integrated Risk Management

Our Integrated Risk Management (“IRM”) product capabilities include policy and compliance management, regulatory change management, compliance case management, IT and operational risk management and audit management. IRM helps customers manage risk and resilience in real time. IRM also includes ESG Management, which helps customers more effectively administer their environmental, social and governance (“ESG”) programs. For example, it can streamline data collection, provide on-demand progress monitoring against key goals and automate reporting.

IT Operations Management

Our IT Operations Management (“ITOM”) product identifies, monitors and manages a customer’s physical and cloud-based IT infrastructure. The ITOM product’s ability to identify a customer’s IT infrastructure (e.g., physical servers) and digital components (e.g., email) allows it to detect whether issues occurring on one or more of those assets

may interfere with business services. It also maintains a single data record for all IT configurable items, allowing our customers to exercise control over their on-premises or cloud-based infrastructures, while orchestrating key processes and tasks. ITOM also includes Cloud Observability, which provides real-time visibility into cloud-native and monolithic environments that power our customers’ internal- and external-facing products and services.

Now Assist for ITOM, our AI solution, simplifies complex technical language into easy-to-understand descriptions and provides quick resolution recommendations to IT operations issues. By doing so, this solution lowers the risk of outages, enhances customer productivity and increases overall service reliability.

IT Service Management

Our IT Service Management (“ITSM”) product is capable of, among others, predictive intelligence, incident management and response, routine task and request automation, performance analytics and process optimization. It also provides a Virtual Agent feature, a chatbot that can answer common questions. ITSM intelligently delivers resilient IT services, reduces costs, boosts IT productivity and provides exceptional experiences to employees, customers and partners.

Now Assist for ITSM, our AI solution, can summarize change requests or enable natural language Virtual Agent interactions and incident history summaries so customer service agents can efficiently resolve incidents. For example, upon incident closure, solution notes or knowledge-based articles can be generated to speed wrap times and adhere to incident management best practices, thereby improving agent productivity and employee experience with faster, more seamless resolutions.

Operational Technology Management

Our Operational Technology (“OT”) Management product suite provides visibility and context into connected devices and technology assets deployed for operational purposes. It enables industrial companies to prioritize, remediate and patch OT vulnerabilities, respond to issues with OT service management capabilities and automate OT asset management throughout the full device lifecycle. For example, when an OT issue is discovered, this product suite provides operators with the business context needed to strategically prioritize its criticality. OT Management will trigger an incident management process that ensures the issue is handled by the appropriate team at the right time.

Security Operations

Our Security Operations product suite connects an organization’s security function with the rest of the enterprise, integrating internal and third-party security and vulnerability data to quickly respond to security incidents and vulnerabilities, prioritized according to their potential impact on a customer’s business. It simplifies and automates threat and vulnerability management and response, while reducing risks to our customers’ organizations.

Now Assist for Security Operations, our AI solution, enhances security operations by providing AI-generated insights through automated workflows. It boosts security analysts’ productivity, accelerates issue resolution and equips chief information security officers and other security leaders with valuable insights for transforming their security operations.

Strategic Portfolio Management

Our Strategic Portfolio Management (“SPM”) product helps customers plan, visualize and track value realization across their portfolio of projects, initiatives and digital products, all on one platform. It enables customers to drive business outcomes by aligning their strategy with investments and execution.

Now Assist for SPM, our AI solution, helps ensure that business demands, related task documentations and feedback, are communicated clearly, efficiently and effectively.

Customer and Industry Workflows

Customer and Industry Workflows help organizations integrate front-end customer service capabilities with operations, order fulfillment and field service resources and can deliver industry-specific use cases. Customer and Industry Workflows help customers create a seamless customer experience from request to resolution by connecting

digital workflows that deliver fast support on a customer’s channel of choice, reducing costs, and modernizing customer experiences. Organizations can elevate their customer service with enhanced resolution efficiency and improved service quality made possible with workflows, automation, AI and task management. Customer service departments no longer need to rely on agents searching multiple systems to find a single resolution to customer requests.

Customer Service Management

Our Customer Service Management (“CSM”) product allows companies to route work to the right agent based on priority and category, which decreases errors by leveraging recommended solutions from prior cases and interactions. It optimizes customer service experiences with workflows that help organizations accelerate customer self-service, boost agent productivity and speed up resolution time. For example, CSM can automate the routing of customer requests to appropriate departments, provide self-service options for customers to troubleshoot common issues, empower agents with access to comprehensive customer data for efficient problem-solving and facilitate timely follow-ups to ensure quick resolution. As a result, organizations can shorten resolution times and increase customer satisfaction—all while reducing costs.

Now Assist for CSM, our AI solution, rapidly generates summaries for cases and chats, reduces manual work and allows agents to resolve customer issues faster. This solution helps accelerate time to resolution, reduce case volume and personalize service, which reduces the effort required by customers.

Field Service Management

Our Field Service Management (“FSM”) product provides work planning, scheduling, resource management and job execution capabilities all in one, which allows field service agents to be assigned and dispatched on the same underlying customer service management platform that created and managed the customer incident. It streamlines field service processes with automation to increase technician productivity, improve first time fix rates and optimize scheduling and dispatching. Organizations can use data-driven insights to enhance operations, identify trends and remove service bottlenecks to maximize efficiency and effectiveness, while also creating great customer and employee experiences.

Now Assist for FSM, our AI solution, helps customers quickly summarize key takeaways for pre-work triage and job completion, minimizing time spent searching through conversation histories. It accelerates productivity by simplifying work order task summarization and knowledge generation.

Industry

We offer industry solutions to better address the unique needs for specific industries, including, for example, financial services, healthcare and life sciences, manufacturing, public sector, retail, technology and telecommunications. We expect the number of industry-specific solutions to grow as we gain adoption in new industries.

| | | | | |

Financial Services | Financial Services Operations allows banking and insurance institutions to reduce contact center volumes with Now Assist. It provides frictionless service experiences that use AI across teams and systems and ensures compliance with embedded controls. |

Healthcare and Life Sciences | Healthcare and Life Sciences Service Management uses Now Assist to allow organizations to enhance patient care, unlock productivity and streamline operations. Clinical Device Management provides a single dashboard from which healthcare providers may efficiently manage and service clinical devices, while also improving their ability to meet compliance requirements. |

Manufacturing | Manufacturing Commercial Operations uses Now Assist and automated workflows to streamline sales, support and service processes, accelerate order fulfillment, optimize customer experiences and drive revenue growth for manufacturers. |

Public Sector | Public Sector Digital Services uses Now Assist to empower governments of all sizes to build seamless experiences at scale. Agencies can share a single instance to facilitate complete collaboration, thereby increasing the speed of service delivery and adding transparency. |

Retail | Retail Operations and Retail Service Management leverages Now Assist and automated workflows to streamline retail store operations by simplifying store tasks and day-to-day activities, while providing headquarters with visibility into in-store performance. These solutions improve employee and customer experiences and reduce costs. |

Technology | Technology Product Service Management with Now Assist and Sales & Order Management for Technology Providers brings customer service, service delivery and customer operations together on a single, intelligent system of action and enables technology providers to reduce time to market and increase customer satisfaction at reduced operational cost. |

Telecom | Telecom Service Management, Sales & Order Management for Telecom, Network Inventory Management and Telecom Service Operations Management offer communication service providers the ability to leverage automation and AI to streamline the end-to-end service experience and accelerate growth while reducing costs. Workflows use Now Assist to help maximize technology investments, scale sales and order management processes, launch telecom services quickly, enhance customer care, automate service assurance and optimize network management on a single platform. |

Employee Workflows

Employee Workflows help organizations transform the employee experience, improve productivity, increase employee satisfaction and fuel business growth. ServiceNow makes it easy for employees to answer their own questions, while automating mundane tasks for agents. With the Now Platform, organizations can empower career growth, make smarter talent decisions, modernize workplace management and experiences to create more collaborative in-office spaces, and streamline contract management and legal operations.

HR Service Delivery

Our HR Service Delivery (“HRSD”) product helps organizations transform the employee experience by providing a portal that makes it easy for employees to conveniently access answers, actions and guidance. It helps employees navigate key career milestones and life events with step-by-step guidance.

Now Assist for HRSD, our AI solution, enables employees to quickly obtain answers to common HR questions and take action directly through Virtual Agent, while also reducing redundant manual tasks for service agents, thereby helping HR leaders drive productivity and operational efficiency. From payroll discrepancies to employee information updates, service agents can resolve issues faster with instant summaries of case topics, chat history, Virtual Agent interactions and previous resolutions. With Now Assist and prompts that use AI, organizations can quickly generate knowledge-based articles to deflect similar cases in the future and drive proactive employee behavior such as reminders, tasks and approvals.

Legal Service Delivery

Our Legal Service Delivery (“LSD”) product suite replaces individual legal requests received through email with automated workflows that not only allow practitioners to keep track of the status of requests but also provide them visibility into interconnected legal requests. In addition, LSD’s Virtual Agent feature can automate responses to common questions. Using LSD real-time reports and dashboards, organizations can make data-driven decisions, anticipate demand for legal services, and drive continuous improvement for a company’s legal department. LSD helps organizations increase practitioner productivity, reduce risk and accelerate business outcomes through more efficient legal operations. For example, the LSD product suite includes Contract Management Pro, which helps legal, procurement, sales and IT teams streamline contract lifecycle management through a self-service portal for contract intake requests, driving operational efficiency and reducing risk.

Now Assist for LSD, our AI solution, provides practitioners with auto-generated summaries of their legal requests and matters, thereby allowing them to more easily track and manage these workstreams.

Workplace Service Delivery

Our Workplace Service Delivery product helps organizations manage workplace services, facilities and real estate. With Workplace Service Delivery, companies can optimize their workspace with real-time analytics and indoor mapping capabilities, and can automate workplace requests, reservations and repairs, and track health and safety incidents to keep workplaces running smoothly.

Creator & Other Workflows

Creator Workflows help customers quickly build and manage cross-enterprise workflows with a low-code development experience that safely delivers agile services at scale and with features that allow customers to manage security and storage. As organizations digitally transform, they need to adapt faster with new processes and business models. This requires fast and agile execution with more automation delivered throughout an organization’s business processes. With Creator Workflows, citizen developers have access to pre-built templates, low-code tools and modular building blocks created by professional developers. We enable Creator Workflows through App Engine and Automation Engine, among other products.

App Engine

Our App Engine product empowers our customers’ employees to create enterprise-class workflows using low-code and no-code development tooling and does not require formal coding experience. App Engine delivers intuitive and intelligent development experiences, designed for speed, security and scale. Examples of the types of workflows our customers have developed using App Engine include applications for:

•a healthcare institution to streamline health research for providers and patients to share and track health data in a private and secure manner;

•a retailer to manage the workflow for loss prevention, fraud protection and asset protection in retail locations;

•the management of licensing, contracting and compliance examinations and financial reviews, replacing a months-long, manual process with a 30-minute automated process; and

•providing overnight loans in different currencies for central banks.

App Engine can also be used in conjunction with Now Assist for Creator, our AI solution, to quickly create and scale apps on the Now Platform. Trained on code from ServiceNow engineering, results generated with Now Assist for Creator are generally higher quality and more scalable and secure than other code generation technology. This solution includes text-to-code, which converts natural language text into high-quality code suggestions, and in some cases into complete code, enabling faster development and increased productivity.

Automation Engine

Our Automation Engine product helps workflows integrate by connecting or automating systems, documents or tasks with minimal code. Integration to data in third-party systems is executed and secured using application programming interfaces (or “APIs”), while manual work can be eliminated by leveraging robotic process automation and intelligent document processing capabilities. Automation Engine includes process mining capabilities that can uncover trends and patterns in business processes and help eliminate redundancies and drive process optimization along with cost and productivity efficiencies.

Automation Engine can also be used in conjunction with Now Assist for Creator, our AI solution, to automate essential functions, including flow generation, code generation and app generation, allowing developers to create complex workflows and applications using natural language prompts. This automation can significantly boost productivity by reducing development time and enabling both novice and experienced developers to build more reliable applications.

To help customers in key business functions, we also enable other workflows through Platform Privacy and Security and Source-to-Pay Operations, among other products.

Platform Privacy and Security

Our Platform Privacy and Security products provide premium security, privacy and encryption controls to help our customers protect and control their sensitive data in the cloud.

Source-to-Pay Operations

Our Source-to-Pay Operations suite connects to customers’ existing enterprise resource planning and procurement systems, delivering a guided experience and highly automated processes that reduce cycle time and cuts costs across procurement, supplier management and accounts payable processes.

Now Assist for Source-to-Pay Operations, our AI solution, delivers simple experiences that can turn conversations into requisitions, making it easy for new or occasional users to follow the right process and reduce rogue spend.

Customer Support, Professional Services and ServiceNow Impact

Customer Support

We offer our customers standard and enhanced support, from technical resources located around the globe, on a subscription-based model, as well as self-service technical support through our support portal, which provides access to documentation, knowledge-based articles, online training, online support forums and online case creation.

Professional Services

Our Professional Services, offered by ServiceNow directly and through our network of partners, include process design, implementation, configuration, architecture and optimization services that help our customers maximize the value of their ServiceNow investment. With a strong implementation methodology at the core of its foundation, our Professional Services help customers succeed by giving them access to ServiceNow product experts and technical best practices. Our training services include programs for all our products.

ServiceNow Impact

ServiceNow Impact helps our customers accelerate the value they realize with our products and solutions. Through our subscription-based model, we offer our customers software tools and AI-driven recommendations that help increase adoption of ServiceNow solutions within their organizations, as well as with their customers. It also proactively monitors platform health, and tracks and reports on key platform metrics. In addition, ServiceNow Impact customers have access to designated experts, on-demand training, technical support and other services.

Our Technology and Operations

We operate a multi-instance architecture that provides each customer with its own dedicated application logic and databases. This architecture is designed to deliver high-availability, scalability, performance, security and control. Our cloud infrastructure primarily consists of industry-standard servers, networks and storage components. We host our full software-as-a-service (“SaaS”) experience on our own private cloud or customers may elect to use public cloud service providers.

Our data centers operate in paired configurations to enable replication for high-availability and redundancy. We currently operate data centers in North America, South America, Europe, Asia and Australia, and we continuously evaluate our data center operations and capacity in existing and new geographies.

We offer customers the option to deploy our services on dedicated hardware in our data centers. Our architecture also gives us the added flexibility to allow customers to deploy our services internally in their own data centers, with public cloud service providers, or with a third party to support unique regulatory or security requirements. While there are some limitations on agility and flexibility as compared to our cloud offering, a minority of our customers have elected the third-party alternative. The standard and enhanced customer support we provide to customers that deploy our services outside of our data centers is similar to the support we provide to customers deployed in our managed data centers.

Sales and Marketing

We market and sell our products and services to enterprises across a wide variety of industries. We sell our product offerings and services through subscription services primarily through our global direct sales organization. We also sell services through managed service providers and resale partners.

Our marketing efforts and lead generation activities consist primarily of customer referrals, digital advertising (including via our website), trade shows, industry events, brand campaigns and press releases. We also host our annual Knowledge user conference, webinars and other user forums, including regional forums, which we call World Forums, where customers and partners both participate in and present on a variety of programs designed to educate them on industry best practices and help accelerate their success.

We continue to expand our sales capabilities in new geographies, including through investments in direct and indirect sales channels, professional services capabilities, customer support resources, post-sales customer support resources, strategic alliances and partnerships, implementation partners and advisory councils. We also plan to increase our investment in our existing locations in order to achieve scale efficiencies in our sales and marketing efforts.

Partner Ecosystem

In addition to our global direct sales organization, we have a strong and growing ecosystem of partners that helps accelerate our customers’ digital transformation initiatives and deliver customer value at scale. They play a critical role in helping companies digitally transform their businesses. We have reimagined our program to include more flexibility and choice and are empowering partners worldwide to help us reach new markets and industries while innovating faster and together. Our industry and workflow capabilities paired with our partners’ industry and functional domain expertise help customers of all sizes. Together with our partners, we offer industry and domain-focused solutions at scale and are accelerating digital transformation as we help companies drive new approaches in engaging their end users and employees.

We are seeing continued momentum across the partner ecosystem. For example, we have expanded our relationships with a number of technology companies to enhance enterprise AI capabilities. Our latest initiative with NVIDIA, for example, focuses on co-developing native AI agents on the Now Platform, using NVIDIA Agent Blueprints, which are AI

workflow templates built on NVIDIA NIM microservices software, tailored for specific use cases. We have also expanded our relationships with cloud providers to enhance cloud capabilities. For example, our security incident response product can integrate with Amazon Web Service’s Security Hub to automate the creation of security incident records. Additionally, Now Assist and Microsoft 365 Copilot can be integrated such that both agents provide an elevated AI experience for our joint customers. Through these relationships, users can leverage their existing spending commitments with cloud providers to procure ServiceNow products. Further, our relationships with global system integrators such Accenture, Cognizant, Deloitte, EY and KPMG continue to help us expand our business by offering ServiceNow solutions to their customers.

Customers

We primarily sell our services to large enterprise customers, and we host and support large, enterprise-wide deployments for our customers. As of December 31, 2024, we had approximately 8,400 customers. Our customers operate in a wide variety of industries. The portion of our revenues generated by sales to government customers has also increased over time. See “Risk Factors—Doing business with the public sector and heavily-regulated entities subjects us to risks related to the government procurement process, regulations, and contracting requirements” for additional information about our sales to government customers.

Research and Development

Our research and development organization is responsible for the design, development, testing and validation of our solutions. We focus on innovating and developing new services and core technologies and further enhancing the functionality, reliability and performance of our existing solutions. Using emerging technologies, we can anticipate customer demands and then bring new services and new versions of existing services to market quickly in order to remain competitive in the marketplace. We have made, and will continue to make, significant investments in research and development to broaden our platform capabilities, strengthen our existing applications, expand the number of applications on our platform, enhance our user experience and develop additional mobile, automation, AI and machine intelligence technologies.

Acquisitions and Investments

We have acquired and invested in companies and technologies as part of our business strategy and will continue to evaluate and enter into potential strategic transactions, including, among other things, acquisitions of or investments in businesses, technologies, services, products and other assets. These transactions are intended to, among other things, expand or improve our service offerings and functionality, go-to-market and sales efforts, our operations or our ability to source necessary expertise and provide services in international locations.

Competition

Our business is highly competitive, rapidly evolving and fragmented, and subject to disruptive technologies with low barriers to entry, to shifting customer needs and to frequent introductions of new products and services. As our business expands and the industries in which we operate evolve, we increasingly find ourselves in competition with solutions and alternative approaches to solving customer needs, including, among others:

•enterprise application software vendors (including cloud-based and traditional on-premises vendors) such as Oracle, SAP, Salesforce and Workday;

•new technologies and entrants (including both point-solutions and platform solutions covering a wide range of functionalities);

•custom development and in-house solutions;

•technology consultants;

•systems integrators; and

•software resellers.

For additional information about competition, see “Risk Factors—A failure to innovate in response to rapidly evolving technological changes and in the midst of an intensely competitive market may harm our competitive position and business prospects.”

Intellectual Property

We rely upon a combination of U.S. and international copyright, trade secret, patent and trademark laws and confidentiality procedures and contractual rights and restrictions to establish, protect and grow our intellectual property (“IP”) rights. We enter into confidentiality and proprietary rights agreements with our employees, partners, vendors, consultants and other third parties and limit access to our IP and other proprietary information. We also purchase or license IP and technology that we incorporate into our products or services.

We continue to grow our global patent portfolio and IP rights that relate to our business. Our success depends in part upon our ability to protect our core technology and IP. As of December 31, 2024, we had over 2,000 U.S. and foreign patents, including patents acquired from third parties, and over 600 pending patent applications. We do not believe that our proprietary technology is dependent on any single patent or group of related patents. See “Risk Factors—We may not be able to protect or enforce our intellectual property rights.”

Our Ambition, Values and Corporate Purpose

Our ambition to become the defining enterprise software company of the 21st century is the driving force behind our overall business strategy and is guided by our values:

•Wow our customers: Customers are the center of our world. We strive to deliver the best customer experiences and innovations.

•Win as a team: We share the same goals and have clear roles in achieving them. We deliver results as a team and enjoy the journey.

•Create belonging: We lead with empathy, which means listening and acting to make everyone feel they belong with ServiceNow.

•Stay hungry and humble: We do not take success for granted. We are always ready to learn and evolve. We grow together, bringing fresh ideas and new perspectives.

These values have endured even as our headcount has rapidly increased over the years and we have continued to grow our business. By prioritizing these values, we are able to gain the trust of our employees and customers and work towards fulfilling our corporate purpose to “make the world work better for everyone.”

Environmental, Social and Governance

Our ESG strategy is aligned to our corporate purpose. We continue to build on our commitments and capabilities to sustain our planet (environmental), create equitable opportunities (social) and act with integrity (governance). Our year-over-year progress is included in our annual Global Impact Report, which details our ESG strategy, initiatives and performance. Our Global Impact Report is aligned with globally-recognized ESG reporting standards.

Human Capital Management

Our People Pact

Our People Pact is pivotal to our ability to fulfill our corporate purpose and is a commitment to helping each other live our best lives, do our best work and fulfill our purpose together. To deliver on this promise, we follow a Global People Strategy that serves as the foundation for how we plan and deliver on employee programming and experiences:

| | | | | | | | | | | | | | | | | | | | |

| People Led | | Data Driven | | AI Powered |

| | | | |

| Deliver on the People Pact through a product mindset that puts the user at the center of all program, process, and service delivery design | | Recruit and retain an inclusive and agile workforce through data use that accelerates growth and mitigates bias | | Make it easy to create and use AI to maximize talent impact and value |

Culture and Inclusion

Our culture is grounded in our values. We live our culture by regularly listening to our people and gathering feedback directly from our workforce to inform our programs and meet employee needs globally. Our Employee Voice Survey (“EVS”) measures and analyzes employee engagement, including inclusion and belonging, learning and development, recognition, compensation and wellbeing. EVS insights are used to create action plans at all levels of the organization and inform the assessment of our human capital management approach and its alignment with our purpose and business strategy.

“Create Belonging” is one of our four company values that guides our ambition. We aim to create a safe, seen, heard and connected workplace for our employees of all backgrounds and experiences so that they can work together to create better products and services that serve our equally diverse and global customer base and ultimately better business outcomes for ServiceNow. To build a strong culture, we have implemented initiatives that weave inclusion throughout the employee experience - from hiring, to learning and development and career advancement. Our global inclusion framework focuses on three key areas:

| | | | | | | | | | | | | | |

| Business | | Community | | Strategic Partnerships |

| | | | |

| Enable each function to build the most innovative teams possible through a global and data-driven approach that drives structural inclusion and improves equitable outcomes for all | | Strengthen and expand our inclusive culture throughout the industry through RiseUp with ServiceNow | | Engage strategic partners to provide a wide variety of development opportunities that meet the evolving needs and skills of our employees and the communities we reach |

As a technology leader, we believe in broadening our reach to underserved communities, providing them with access to technology and training, helping them unlock new opportunities. To help achieve this objective, we created RiseUp with ServiceNow – a training, certification, upskilling and career placement program. This initiative reflects our commitment to building career pathways for non-traditional tech talent by removing barriers and improving access to technology, knowledge and opportunity.

Learning and Development

Our global learning and development programs, under the ServiceNow University (“SNU”) umbrella, deliver skilling tools and processes, and technical AI, industry, professional and leadership programs. SNU empowers employees, customers, partners and future talent with advanced skills. SNU combines education and experience, leveraging the Now Platform to fuel continuous growth in talent.

Total Rewards and Pay Equity

Our total rewards are designed to help us attract and retain the best talent. We believe that our rewards should be competitive and equitable, and we are committed to recognizing exceptional performance. In support of this, all our employees are eligible to participate in our annual cash bonus plan or, for those in quota-carrying roles, our sales commission plan, in addition to their base pay. We also have a broad-based discretionary equity incentive program and an employee stock purchase plan, which enable employees to share in our success.

We understand that our employees perform their best when they have the resources they need to feel healthy, supported and secure. To support this, we offer a comprehensive range of benefits and wellbeing programs that cover physical, emotional, social and financial wellbeing. Additionally, we provide our employees with additional time away through “Wellbeing Days” to pause, recharge and further support their health and wellbeing.

We continue to maintain systematic gender pay equity for our employees across the globe and, in the U.S., on the basis of race, ethnicity, as well as gender. Every year, we partner with an independent third-party expert to examine whether any statistically significant differences in compensation exist after considering factors such as experience, role, location and performance and make adjustments, as warranted.

Ways of Working

While we value in-person activities, we are committed to embracing ways of working that promote flexibility and inclusion, support employee wellbeing and drive innovation. A substantial portion of our employees work partially or fully remote. We believe such an environment will only serve to strengthen our company.

Workforce Metrics

As of December 31, 2024, we employed 26,293 people on a full-time basis, 13,193 in the United States and 13,100 internationally. None of our U.S. employees are represented by a labor union. Employees in certain countries are represented by workers’ councils or employee representatives or have the benefits of collective bargaining arrangements at the national and/or sector level. We have not experienced interruptions of operations or work stoppages due to labor disagreements.

Available Information

You can obtain copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, and all amendments to these filings, free of charge from our website at www.servicenow.com/company/investor-relations/sec-filings.html as soon as reasonably practicable after we file or furnish them with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of, or accessible through, these websites are not incorporated into this filing. Our references to the URLs for these websites are intended to be inactive textual references only.

Investors and others should note that we announce material financial information to our investors using our investor relations website (https://www.servicenow.com/company/investor-relations.html), SEC filings, press releases, public conference calls, webcasts and social media. We use these channels, including our website and social media, to communicate with our investors and the public about our company, our products and solutions and other issues. It is possible that the information we post on social media could be deemed to be material information. Therefore, we encourage investors, the media and others interested in our company to review the information we make available on our website and the social media channels listed on our website.

Investing in our securities involves risks. You should carefully consider the risks and uncertainties described below, together with the other information in this Annual Report on Form 10-K, before making an investment decision. The occurrence of any of the following risks, or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, could materially and adversely affect our business, financial condition, results of operations, stock price or reputation. The following risks have been grouped by categories and are not in order of significance or probability of occurrence.

Risk Factors Summary

This summary provides an overview of the risks we face and should not be considered a substitute for the more fulsome risk factors discussed immediately following this summary.

•Risks Related to Our Ability to Grow Our Business

•Laws, regulations and customer expectations regarding the use, storage and movement of data may restrict our ability to continue to optimize our platform.

•A failure to innovate in response to rapidly evolving technological changes and in the midst of an intensely competitive market may harm our competitive position and business prospects.

•We may not successfully increase our penetration of international markets or manage risks associated with foreign markets.

•Incorporating AI technology into our offerings may result in operational, legal, regulatory, ethical and other challenges.

•We rely on our network of partners for an increasing portion of our revenues, and if these partners fail to perform, our business may be harmed.

•Doing business with the public sector and heavily-regulated entities subjects us to risks related to government procurement processes, regulations and contracting requirements.

•If we fail to comply with applicable anti-corruption and anti-bribery laws, export control laws, economic and trade sanctions laws, or other global trade laws, we could be subject to penalties and civil and/or criminal sanctions and our business could be materially adversely affected.

•Our customer deals are becoming more complex, which tend to involve longer and more expensive sales cycles, increased pricing pressure and implementation and configuration challenges.

•As we acquire or invest in companies and technologies, we may not realize the expected business or financial benefits and the acquisitions and investments may divert our management’s attention and result in additional shareholder dilution or costs.

•Risks Related to the Operation of Our Business

•Actual or perceived cybersecurity events experienced by us or our third-party service providers may create the perception that our platform is not secure, and we may lose customers or incur significant liabilities.

•We may lose key members of our management team or qualified employees or may not be able to attract and retain employees we need.

•Delays in the release of, or actual or perceived defects in, our products may slow the adoption of our latest technologies, reduce our ability to efficiently provide services, decrease customer satisfaction, and adversely impact future product sales.

•Disruptions or defects in our services could damage our customers’ businesses, subject us to substantial liability and harm our business.

•Delays in improving our information systems and processes could interfere with our ability to support our existing and growing customer and employee base as we scale.

•We may not be able to protect or enforce our intellectual property rights.

•Our use of open-source software could harm our ability to sell our products and services and subject us to possible litigation.

•Various factors, including our customers’ business, integration, migration, compliance and security requirements, or errors by us, our partners, or our customers, may cause implementations of our products to be delayed, inefficient or otherwise unsuccessful.

•Our failure or perceived failure to achieve our ESG goals or maintain ESG practices that meet evolving stakeholder expectations could adversely affect us.

•We may face natural disasters, including climate change, and other events beyond our control.

•Risks Related to the Financial Performance or Financial Position of Our Business

•Because we generally recognize revenues from our subscription service over the subscription term, a decrease in new subscriptions or renewals may not be immediately reflected in our operating results.

•As our business grows, we expect our revenue growth rate to decline over the long term.

•Changes in our effective tax rate or disallowance of our tax positions may adversely affect our business.

•We may be adversely affected by our debt service obligations.

•Risks Related to General Economic Conditions

•Our industry and business may be harmed by global economic conditions.

•We may be harmed by foreign currency exchange rate fluctuations.

•Risks Related to Ownership of Our Common Stock

•Our stock price is likely to continue to be volatile.

•Provisions in our governing documents or Delaware law might discourage, delay or prevent a change of control or changes in our management and, therefore, depress our stock price.

Risks Related to Our Ability to Grow Our Business

Laws, regulations and customer expectations regarding the use, storage and movement of data may restrict our ability to continue to optimize our platform.

Governments have adopted, and likely will continue to adopt, laws and regulations affecting the use, storage and movement of data, including laws related to data privacy and security, the use of machine learning and artificial intelligence (“AI”), and data sovereignty or residency requirements. Changing laws, regulations and standards applying to the collection, storage, use, sharing, portability, transfer or other control or processing of data, including personal data, could affect our ability to efficiently and cost-effectively offer our services and to develop our products and services for maximum utility, as well as our customers’ ability to use data or share data. Such changes may restrict our ability to use, store or otherwise process customer data in connection with providing services and could alter or increase our compliance requirements. In some cases, this could impact our ability to offer our services in certain locations or our customers’ ability to deploy our services globally. For example, the EU Data Act has significant requirements regarding data portability, interoperability and accessibility and unclear data transfer restrictions, any of which could impact our operations. In addition, the relatively new Trans-Atlantic Data Privacy Framework, which facilitates the transfer of data between the United States (“U.S.”) and European Union (“EU”), may be subject to legal challenges and regulatory interpretations that could create uncertainties and impact our operations and compliance obligations.

We offer region-specific services, by which customer data is hosted locally and customers may elect to receive support from locally-based ServiceNow teams. Setting up and maintaining these region-specific services require significant investment, including to comply with applicable laws and regulations. Actual or perceived non-compliance with those laws and regulations could result in proceedings or investigations against us by regulatory authorities or others, lead to significant fines, damages, orders, litigation or reputational harm and may otherwise adversely impact our business.

We will also need to continually adapt to customer privacy and security requirements as they change over time. For example, as customers increasingly adopt a hybrid (on-premises and off-premises/hyperscale cloud) approach for their IT workloads, our cloud services may fail to address evolving customer requirements, including data localization. Further, due to heightened concerns relating to privacy and security regulatory matters, our customers may request certain certifications and failure to obtain, or consistently maintain, those certifications may adversely impact our reputation and business.

A failure to innovate in response to rapidly evolving technological changes and in the midst of an intensely competitive market may harm our competitive position and business prospects.

We compete in markets that evolve rapidly. The pace of innovation will continue to accelerate as customers recognize the advantages of acquiring leading digital technologies and adopting modern cloud-based infrastructure. Cutting-edge capabilities such as AI, machine learning, hyper automation, low-code/no-code application development, system observability and predictive insights become increasingly relevant to the customer’s evolving needs. With this rapid evolution, we are increasingly competing with alternative solutions and approaches to solve customer needs, and we expect additional competition as we shift our products and services to compete with providers in new and adjacent markets.

Competitors, regardless of their size, may be able to respond more quickly and effectively to new or changing opportunities, technologies, standards, customer requirements and buying practices. They may introduce new technology, solve similar problems in different ways or more effectively utilize existing technology that reduces demand for our services. They may utilize acquisitions, integrations or consolidations to offer integrated or bundled products, enhanced

functionality or other advantages. Some of our existing competitors and potential competitors are larger and have greater name recognition, the ability to more efficiently scale their business, more established operations and customer relationships, and greater financial and technical resources than we do. “Systems of record” operators may attempt to create technology solutions or other mechanisms that would prevent our systems from integrating with theirs. They may create pricing pressures by reducing the price of competing products, services or subscriptions or bundling their offerings causing our offerings to appear relatively more expensive. Competition from cloud-based vendors may increase as they build business applications or AI powered automation solutions that compete with our products and services. We may also encounter customer reluctance or unwillingness to migrate away from their current solutions.

If we are not able to compete successfully, we could experience reduced sales and margins, losses or failure of our products to achieve or maintain market acceptance. Accordingly, to compete effectively, we must:

•identify and innovate in the right technologies;

•keep pace with rapidly changing technological developments, such as AI, which may disrupt resource and talent needs and the enterprise software marketplace;

•accurately predict and meet our customers’ changing digital transformation needs, priorities and adoption practices, including their technology infrastructures and buying and budgetary practices;

•invest in and continually optimize our own technology platform so that we continue to meet the very high-performance expectations of our customers;

•successfully deliver and promote new, scalable technologies and products to meet customer needs and priorities;

•efficiently integrate with technologies within our customers’ digital environments;

•expand our offerings into new and adjacent industries and comply with regulations in such industries;

•successfully sell to buyers who are not familiar with our offerings;

•profitably and efficiently market and sell our new and existing products;

•effectively scale our business processes and operations as we grow;

•successfully adapt new pricing models;

•promote ongoing customer relationships and customer value realization;

•effectively secure our platform, data and customers’ data; and

•effectively deliver, directly or through our partner ecosystem, the digital transformation process planning, IT systems architecture planning, and product implementation services that our customers require to be successful.

Further, in response to evolving customer needs, we may make significant investments in changing how we offer our products or services, such as bundling offerings or shifting to consumption-based pricing for support services or how our services are delivered or priced. However, customers may not be satisfied with these changes and, therefore, may not grow or maintain their business with us.

We may not successfully increase our penetration of international markets or manage risks associated with foreign markets.

Sales outside of North America represented 37% and 36% of our total revenues for the years ended December 31, 2024 and 2023, respectively. The growth of our business depends on our ability to increase our sales outside of the U.S. as a percentage of our total revenues. Additionally, operating in international markets requires significant investment and management attention and subjects us to varying regulatory, political and economic risks. We have made, and will continue to make, substantial investments in data centers, geographic-specific service delivery models, advisory councils, cloud computing infrastructure, sales, marketing, partnership arrangements, personnel and facilities in new geographic markets. When we make these investments, it is typically unclear when we will see a return on our investment, and we may significantly underestimate the level of investment and time required to be successful. Our rate of acquisition of new large enterprise customers, a factor affecting our growth, has been generally lower in territories where we are less established and where there may be heightened or evolving regulations and operational and IP risks. We have experienced, and may continue to experience, difficulties in new geographic markets, including hiring qualified sales management personnel, penetrating the target market, and managing local operations. Risks associated with making our products and services available in international markets include, for example:

•compliance with multiple, conflicting and changing governmental laws and regulations;

•requirements to have local partner(s), local entity ownership limitations or technology transfer or sharing requirements, or to comply with data residency and transfer laws and regulations, privacy and data protection laws and regulations, which may increase operational costs and restrictions;

•the possibility that illegal or unethical activities of our local employees or business partners will be attributed to us or cause us harm;

•longer and potentially more complex sales and payment receipt cycles and other collection difficulties;

•different pricing and distribution environments;

•potential changes in international trade policies, tariffs, agreements and practices, including the adoption and expansion of formal or informal trade restrictions or regulatory frameworks that may favor local competitors;

•governmental direction, business practices and/or cultural norms that may favor local competitors;

•more prevalent cybersecurity, intellectual property and AI risks; and

•localization of our services, including translation into foreign languages and associated expenses.

If we are unable to manage these risks, our business will be adversely affected.

Incorporating AI technology into our offerings may result in operational, legal, regulatory, ethical and other challenges.

We are increasingly innovating and expanding offerings on our platform by integrating AI technology. We expect AI to be an increasingly important driver of future growth, although, like many innovations, it presents risks and uncertainties that may impact our ability to realize its desired or anticipated benefits for our business.

AI technology is rapidly evolving and to remain competitive, we will need to make significant investments to continue to successfully develop and incorporate the technology into our products. Our ability to incorporate AI technology into our products depends on the availability and pricing of third-party hardware and software equipment and technical infrastructure. Our competitors or other third parties may develop or incorporate AI into their products more quickly or successfully than us. Other companies may also have or in the future may obtain intellectual proprietary rights that would prevent, limit, or interfere with our ability to make, use, or sell our AI products. For these reasons, among others, we may not be able to compete effectively in the evolving AI market.

Our business model may be affected by global trends and laws that govern the use of AI and machine learning. For example, the EU AI Act places new requirements on providers of AI technologies that will need to be addressed in alignment with various deadlines in the coming years. These and other laws or regulations may cause us to modify our data handling and compliance practices, which could be costly or disruptive to our operations, and may also impact our ability to use certain data to support our products or our product development efforts or hinder our customers’ ability to adopt or continue to use our products.

We may face new or heightened legal, ethical and other challenges arising out of the perceived or actual impact of AI on human rights, intellectual property, privacy and employment, among other areas. For example, our use of AI could lead to copyright infringement or other intellectual property claims, potentially requiring us to pay compensation or licensing fees to third parties. Additionally, social and ethical concerns surrounding the use of AI in our offerings could harm our brand and may cause us to incur additional costs. Failure by us or others in our industry to adequately address these concerns could erode public confidence in AI and slow adoption of AI in our products.

We rely on our network of partners for an increasing portion of our revenues, and if these partners fail to perform, our business may be harmed.

An increasing portion of our revenues is generated by sales through our network of partners, including resellers, distributors and managed service providers. Increasingly, we and our customers rely on our partners to provide professional services, including custom implementations, and there may be insufficient qualified implementation partners available to meet customer demand. While we provide our partners with training and programs, including accreditations and certifications, these programs may not be effective or utilized consistently by partners. In addition, new partners may require extensive training and/or significant time and resources to become productive. Additionally, our relationships with partners may require us, along with our partners, to comply with complex regulations, contractual requirements and government procurement rules. Failure to adhere to these requirements could result in the loss of business opportunities, potential liabilities or penalties. For example, our partners could misrepresent to our customers the functionality of our platform or products, fail to perform services to our customers’ expectations, or violate laws or our corporate policies. Further, changes to our direct go-to-market models may cause friction with our partners. Our partners may also use our platform to develop products and services that compete with our products and services, which could raise IP ownership concerns and strain these partnerships. If we fail to effectively manage and grow our network of partners, our ability to sell our products and efficiently provide our services may be impacted and our business may be harmed.

Doing business with the public sector and heavily-regulated entities subjects us to risks related to government procurement processes, regulations and contracting requirements.

We provide products and services to governmental and heavily-regulated entities directly and through our partners. We have made, and may continue to make, significant investments to support our efforts to sell to those entities. Processes to obtain authorizations and certifications required for us to provide our products and services to those entities often are lengthy and encounter delays, and we may not be able to satisfy, or maintain compliance with, the associated requirements.

A substantial majority of our sales to government entities in the U.S. have been made indirectly through our distributors, resellers or service provider partners. Doing business with government entities presents a variety of risks. The procurement process for governments and their agencies is highly competitive and time-consuming, may be subject to political influence and may involve different rules and conditions on the offering or pricing of products and services. We incur significant up-front time and expense without any assurance that we (or a third-party distributor, reseller or service provider) will win a contract. Beyond this, demand for our products and services may be adversely impacted by public sector budgetary cycles and funding availability that in any given fiscal cycle may be reduced or delayed, including in connection with an extended federal government shutdown, partisan gridlock or changes to government policy. Further, if we or our partners are successful in receiving a contract award, that award could be challenged during a bid protest process. Bid protests may result in an increase in expenses related to obtaining contract awards or an unfavorable modification or loss of an award. Even if a bid protest were unsuccessful, the delay in the startup and funding of the work under these contracts may cause our actual results to differ materially and adversely from those anticipated.

Our customers also include non-U.S. governments, to which government procurement risks similar to those present in U.S. government contracting and regulatory compliance also apply, particularly in certain emerging markets where our customer base is less established. Across the globe, we have seen political volatility increase, with rapid changes in governments and increased partisanship affecting many aspects of government, including the ability to approve budgets and make commitments. This can significantly delay or impair a government’s ability to contract for software and services such as ours. We have also seen challenges to successful awards through bid protest procedures in jurisdictions outside the U.S. As our non-U.S. government business grows, we may see an increase in bid protests as part of the standard government procurement legal procedures that exist in many jurisdictions. In addition, compliance with complex regulations and contracting provisions in a variety of jurisdictions can be expensive and consume significant management resources. In certain jurisdictions, our ability to win business may be constrained by political and other factors unrelated to our competitive position in the market.