Table of Contents

UNITED STATES

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11 |

SPECTRA ENERGY CORP

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

March 21, 2008

Dear Spectra Energy Shareholder:

It is my pleasure to invite you to Spectra Energy Corp’s 2008 Annual Meeting of Shareholders. This year’s meeting will be held on Thursday, May 8, 2008 at 10:00 a.m. local time, at our headquarters located at 5400 Westheimer Court, Houston, Texas. At the meeting, we will focus on the business items listed in the notice of the meeting, which follows on the next page.

This year we are taking advantage of a new Securities and Exchange Commission rule that allows companies to furnish proxy materials to their shareholders electronically. We believe that this new e-proxy process will expedite our shareholders receipt of proxy materials and lower the costs and reduce the environmental impact of our annual meeting. On March 21, 2008, we mailed to our U.S. and Canadian shareholders a Notice containing instructions on how to access our 2008 Proxy Statement and Annual Report and vote online. Shareholders that have requested hard copies will continue to receive a copy of the Proxy Statement and Annual Report by mail. The proxy statement contains instructions on how you can request a hard copy of the Proxy Statement and Annual Report if you only received a Notice by mail, and how you can elect to receive your Proxy Statement and Annual Report over the Internet, if you received them by mail this year.

Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote promptly. You may vote your shares via a toll-free telephone number or over the Internet. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding all three methods of voting are contained on the proxy card.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Paul M. Anderson

Chairman of the Board

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 8, 2008

To Our Shareholders:

Notice is hereby given that the 2008 Annual Meeting of the Shareholders of Spectra Energy Corp, a Delaware corporation, will be held at Spectra Energy’s headquarters at 5400 Westheimer Court, Houston, Texas 77056, on Thursday, May 8, 2008, at 10:00 a.m., local time. At the Annual Meeting, shareholders will be asked to take action on the following:

| 1. | Election of four Class II directors to our Board of Directors; |

| 2. | Approval of our Long-Term Incentive Plan; |

| 3. | Approval of our Short-Term Incentive Plan; |

| 4. | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2008; and |

| 5. | Such other business as may properly come before such meeting. |

Only shareholders of record at the close of business on March 10, 2008 are entitled to notice of and to vote at the Annual Meeting. For specific voting information, see “General Information about the Annual Meeting” beginning on page 2 of the enclosed proxy statement. Even if you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card as promptly as possible to ensure that your shares are represented. If you attend the Annual Meeting, you may withdraw any previously submitted proxy and vote in person.

By Order of the Board of Directors

William S. Garner, Jr., Group Executive

General Counsel and Secretary

March 21, 2008

Houston, Texas

Table of Contents

| 2 | ||

| 5 | ||

| 9 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| 32 | ||

| 47 | ||

PROPOSAL 2—APPROVAL OF THE SPECTRA ENERGY CORP 2007 LONG-TERM INCENTIVE PLAN | 50 | |

PROPOSAL 3—APPROVAL OF THE SPECTRA ENERGY CORP EXECUTIVE SHORT-TERM INCENTIVE PLAN | 54 | |

| 55 | ||

| 56 |

Table of Contents

Spectra Energy Corp

5400 Westheimer Court

Houston, Texas 77056

These proxy materials are being furnished to you in connection with the solicitation of proxies by the Board of Directors of Spectra Energy Corp, a Delaware corporation, for use at the 2008 Annual Meeting of Shareholders and any adjournments or postponements of the meeting (the “Annual Meeting”). The Annual Meeting will be held at Spectra Energy’s headquarters at 5400 Westheimer Court, Houston, Texas on Thursday, May 8, 2008, at 10:00 a.m., local time.

Notice of Electronic Availability of Proxy Statement and Annual Report.As permitted by rules adopted by the Securities and Exchange Commission, we are making this proxy statement, our Summary Annual Report for 2007 and our Annual Report on Form 10-K for 2007 available to shareholders electronically via the Internet. On March 21, 2008, we began mailing to our U.S. and Canadian shareholders of record as of the close of business on March 10, 2008 a Notice containing instructions on how to access this proxy statement and our Summary Annual Report for 2007 and our Annual Report on Form 10-K for 2007 and vote online. We also began mailing these proxy materials to shareholders outside the U.S. and Canada and to shareholders who have requested hard copies of the materials.

If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

1

Table of Contents

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

| Q: | Why did I receive these proxy materials? |

| A: | You received these proxy materials from us in connection with the solicitation by our Board of proxies to be voted at the Annual Meeting because you owned our common stock as of March 10, 2008. We refer to this date as the “record date.” This proxy statement contains important information for you to consider when deciding how to vote your shares at the Annual Meeting. Please read this proxy statement carefully. In addition, as required by the proxy rules, we have included with these materials a copy of our Summary Annual Report for 2007 and our Annual Report on Form 10-K for 2007, which contains additional information about Spectra Energy. You can also access our public filings with the Securities and Exchange Commission on our website at www. spectraenergy.com or on the SEC’s website atwww.sec.gov. |

| Q: | What is a proxy? |

| A: | A proxy is your legal designation of another person to vote the shares that you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. |

| Q: | On what am I voting? |

| A: | • The election of four Class II directors; |

| • | The approval of our Long-Term Incentive Plan; |

| • | The approval of our Short-Term Incentive Plan; and |

| • | Ratification of Deloitte & Touche LLP as Spectra Energy’s independent public accountant for 2008. |

| Q: | Who can vote? |

| A: | Holders of Spectra Energy’s common stock as of the close of business on the record date, March 10, 2008, are entitled to vote at the Annual Meeting, either in person or by proxy. Each share of Spectra Energy common stock has one vote. |

| Q: | How do I vote? |

| A: | By Proxy—Before the Annual Meeting, you can give a proxy to vote your shares of Spectra Energy common stock in one of the following ways: |

| • | by telephone—shareholders located in the United States can vote by telephone by calling and following the instructions on the proxy card; |

| • | by Internet—you can vote over the Internet atwww.proxyvote.com by following the instructions on the proxy card; or |

| • | by mail—if you received your proxy materials by mail, you can vote by mail by completing and signing your proxy card and mailing it in time to be received prior to the Annual Meeting. |

The telephone and Internet voting procedures are designed to confirm your identity, to allow you to give your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by telephone or Internet, please follow the instructions that are printed on your enclosed proxy card.

If you mail us your properly completed and signed proxy card, or vote by telephone or Internet, your shares of Spectra Energy common stock will be voted according to the choices that you specify. If you sign and mail your proxy card without marking any choices, your proxy will be voted:

| • | FOR the election of all nominees for director; |

| • | FOR the approval of our Long-Term Incentive Plan; |

2

Table of Contents

| • | FOR the approval of our Short-Term Incentive Plan; and |

| • | FOR the ratification of the selection of Deloitte & Touche LLP as Spectra Energy’s independent public accountant for 2008. |

We do not expect that any other matters will be brought before the Annual Meeting. However, by giving your proxy, you appoint the persons named as proxies as your representatives at the Annual Meeting. If an issue should arise for vote at the Annual Meeting that is not included in the proxy material, the proxy holders will vote your shares in accordance with their best judgment.

In Person—You may come to the Annual Meeting and cast your vote there. If your shares are held in the name of your broker, bank or other nominee and you wish to vote at the Annual Meeting, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on March 10, 2008.

| Q: | What does it mean if I receive more than one proxy card? |

| A: | If you receive more than one proxy card, then you own our common stock through multiple accounts at the transfer agent and/or with stockbrokers. Please sign and return all proxy cards to ensure that all of your shares are voted at the Annual Meeting. |

| Q: | May I change or revoke my vote? |

| A: | You may change your vote or revoke your proxy at any time by: |

| • | notifying Spectra Energy’s Corporate Secretary in writing that you are revoking your proxy; |

| • | providing another signed proxy that is dated after the proxy you wish to revoke; |

| • | using the telephone or Internet voting procedures; or |

| • | attending the Annual Meeting and voting in person. |

| Q: | Will my shares be voted if I do not provide my proxy? |

| A: | It depends on whether you hold your shares in your own name or in the name of a brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at the meeting. Brokerage firms generally have the authority to vote customers’ unvoted shares on certain “routine” matters. If your shares are held in the name of a brokerage firm, the brokerage firm can vote your shares for the election of directors and for Proposal 4 if you do not timely provide your proxy because these matters are considered “routine” under the applicable rules. The other proposals are not considered routine and therefore may not be voted by your broker without instruction. |

| Q: | As a participant in the Spectra Energy Retirement Savings Plan, how do I vote shares held in my plan account? |

| A: | If you are a participant in the Spectra Energy Retirement Savings Plan, you have the right to provide voting directions to the plan trustee for those shares of Spectra Energy common stock that are held by the plan and allocated to your account. Plan participant proxies are treated confidentially. |

If you elect not to provide voting directions to the plan trustee, the plan trustee will vote the Spectra Energy shares allocated to your plan account in the same proportion as those shares held by the plan for which the plan trustee has received voting directions from other plan participants. The plan trustee will follow participants’ voting directions and the plan procedure for voting in the absence of voting directions, unless it determines that to do so would be contrary to the Employee Retirement Income Security Act of 1974. Because the plan trustee must process voting instructions from participants before the date of the Annual Meeting, you are urged to deliver your instructions well in advance of the Annual Meeting so that the instructions are received no later than May 5, 2008.

3

Table of Contents

| Q: | What constitutes a quorum? |

| A: | As of the record date 632,864,333 shares of Spectra Energy common stock were issued and outstanding and entitled to vote at the Annual Meeting. In order to conduct the Annual Meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a “quorum.” If you submit a properly executed proxy card or vote by telephone or on the Internet, you will be considered part of the quorum. Abstentions and broker “non-votes” will be counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under New York Stock Exchange listing standards, does not have discretionary authority to vote on a proposal. |

| Q: | What vote is needed for these proposals to be adopted? |

| A: | Directors are elected by a plurality of the votes cast at the meeting. “Plurality” means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. The affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting is required to approve each of the other proposals described in this proxy statement. In tabulating the vote on any matter other than the election of directors, abstentions will have the same effect as votes against the matter and shares that are the subject of a broker “non-vote” will be deemed absent and will have no effect on the outcome of the vote. |

| Q: | Who conducts the proxy solicitation and how much will it cost? |

| A: | Spectra Energy is requesting your proxy for the Annual Meeting and will pay all the costs of requesting shareholder proxies. We have hired Broadridge Financial Solutions, Inc. to assist in mailing proxy materials, providing electronic access to the proxy materials and requesting proxies. Broadridge’s fee for these services is approximately $60,000, plus out-of-pocket expenses. We can request proxies through the mail or personally by telephone, telegram, fax or other means. We can use directors, officers and other employees of Spectra Energy to request proxies. These people do not receive additional compensation for these services. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Spectra Energy common stock. |

4

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

General

Pursuant to our certificate of incorporation and by-laws, our Board of Directors is divided into three classes with staggered terms, which means that the directors in one of these classes will be elected each year for a new three-year term. Our Chairman of the Board, Paul M. Anderson, Austin A. Adams, Roger Agnelli and F. Anthony Comper are designated as our Class II directors, whose term of office expires at our 2008 Annual Meeting. The term of office for our Class I directors, Fred J. Fowler, President and Chief Executive Officer, William T. Esrey, Dennis R. Hendrix and Pamela L. Carter, expires at our 2010 Annual Meeting. The term of office for our Class III directors, Martha B. Wyrsch, President and Chief Executive Officer—Spectra Energy Transmission; Peter B. Hamilton and Michael E.J. Phelps, expires at our 2009 Annual Meeting.

Based on the recommendations from the Corporate Governance Committee, our Board of Directors has nominated its current Class II directors, other than Mr. Agnelli, for election to the Board of Directors as Class II directors with their term of office expiring at our 2011 Annual Meeting. Mr. Agnelli is retiring from the Board of Directors at the Annual Meeting and has requested not to be nominated for reelection. Mr. Agnelli has advised the Board that due to increasing time commitments from his other activities, he will be unable to serve as a director after the 2008 Annual Meeting. Mr. Agnelli has served as a Spectra Energy director since our spin-off from Duke Energy, and Spectra Energy sincerely appreciates his contributions to our successful first year as a public company. In light of Mr. Agnelli’s retirement, our Board of Directors has also nominated Michael McShane as a new Class II director.

If any director is unable to stand for election, the Board of Directors may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH NOMINEE.

Director Nominees

The principal occupations and other information about the Board nominees for director and our incumbent Board members are set forth below:

Class II Directors—Nominated for Election | ||

| Paul M. Anderson Director since 2006 Chairman of the Board of Directors Spectra Energy Corp Age 62

Mr. Anderson served as Chairman of the Board of Duke Energy from April 2006 until assuming his current position upon the separation of Spectra Energy from Duke Energy in January 2007. From November 2003 until the merger of Duke Energy and Cinergy Corp. in April 2006, Mr. Anderson served as Chairman of the Board and Chief Executive Officer of Duke Energy. Prior to such time, Mr. Anderson served as Managing Director and Chief Executive Officer of BHP Billiton Ltd and BHP Billiton PLC, which operate on a combined basis as BHP Billiton, the world’s largest diversified resources company, from 1998 until his retirement in July 2002. Mr. Anderson also served on the Board of Directors of Fluor Corporation from March 2003 until October 2003, the Board of Directors of Temple Inland Inc. from August 2002 to May 2004, the Board of Directors of Qantas Airways from September 2002 to the present, and the Board of Directors of BHP Billiton Limited and BHP Billiton PLC from June 2006 to the present. | |

5

Table of Contents

| Austin A. Adams Director since 2007 Retired Chief Information Officer JPMorgan Chase Age 64

Mr. Adams is the retired Executive Vice President and corporate Chief Information Officer of JPMorgan Chase. He assumed that role upon the merger of JPMorgan Chase and Bank One Corporation in July 2004 and served in that position until he retired in October 2006. Before joining Bank One in 2001, Mr. Adams served as Chief Information Officer at First Union Corporation, now Wachovia Corp. He is currently a director of NCO Group, which is owned by JPMorgan Private Equity, and has served as a director of Dun & Bradstreet Corporation since April 2007, and serves as a senior advisor to GMAC. | |

| F. Anthony Comper Director since 2007 Retired President and Chief Executive Officer BMO Financial Group Age 62

Mr. Comper is the retired President and Chief Executive Officer of BMO Financial Group. He was appointed to that position in February 1999 and served as Chairman from July 1999 to May 2004. Mr. Comper previously served on the Board of Directors of the Bank of Montreal. | |

| Michael McShane Director Nominee Chairman, President and Chief Executive Officer Grant Prideco, Inc. Age 54

Mr. McShane has served as a director and as President and Chief Executive Officer of Grant Prideco Inc. since June 2002 and assumed the role of Chairman of the Board of Grant Prideco Inc. beginning in May 2004. Prior to joining Grant Prideco, Mr. McShane was Senior Vice President-Finance and Chief Financial Officer and director of BJ Services Company from 1998, and Vice President-Finance and Chief Financial Officer of that company from 1990 to 1998. Mr. McShane is also a director of Complete Energy Services, Inc. | |

6

Table of Contents

Class I Directors—Terms Expiring at the 2010 Annual Meeting | ||

| Fred J. Fowler Director since 2006 President and Chief Executive Officer Spectra Energy Corp Age 62

Mr. Fowler served as Group Executive and President of Duke Energy Gas from April 2006 until assuming his current position in connection with the separation of Spectra Energy from Duke Energy Corporation in January 2007. Prior to then, Mr. Fowler served as President and Chief Operating Officer of Duke Energy Corporation from November 2002 until April 2006. Mr. Fowler also serves as the Chairman of the Board of DCP Midstream Partners, LP. | |

| William T. Esrey Director since 2006 Chairman Emeritus Sprint Corporation Age 68

Mr. Esrey was elected as Chairman Emeritus of Sprint Corporation, a diversified telecommunications holding company, upon his retirement in May 2003. Prior to that, he served as its Chief Executive Officer from 1985 to March 2003, and as its Chairman from 1990 to May 2003. He also served as Chairman of Japan Telecom from November 2003 until its sale in July 2004. Mr. Esrey is a director of General Mills, Inc. | |

| Dennis R. Hendrix Director since 2006 Retired Chairman of the Board PanEnergy Corp Age 67

Mr. Hendrix is the retired Chairman of the Board of PanEnergy Corp. He was Chairman of the Board of PanEnergy Corp from 1990 to 1997, Chief Executive Officer from 1990 to 1995 and President from 1990 to 1993. From 1997 to 2002 and from 2004 to 2007, Mr. Hendrix served as a director of Duke Energy. Mr. Hendrix serves on the boards of Newfield Exploration Company and Grant Prideco, Inc. | |

| Pamela L. Carter Director since 2007 President, Cummins Distribution Business Age 58

Ms. Carter is President of Cummins Distribution Business. She previously served as Vice President and Manager of Europe, Middle East and Africa business and operations for Cummins Inc. since 1999 and as President of Cummins Filtration since May 2005. Ms. Carter served as Vice President and General Counsel of Cummins Inc. from 1997 to 1999. Prior to joining Cummins Inc., she served as the Attorney General for the State of Indiana from 1993 to 1997. | |

7

Table of Contents

Class III Directors—Terms Expiring at the 2009 Annual Meeting | ||

| Martha B. Wyrsch Director since 2006 President and Chief Executive Officer Spectra Energy Transmission, LLC Age 50

Ms. Wyrsch served as President of Duke Energy Gas Transmission from March 2005 until assuming her current position. Ms. Wyrsch served as Group Vice President and General Counsel of Duke Energy Corporation from January 2004 until March 2005. Prior to then, Ms. Wyrsch served in various senior legal roles for Duke Energy Corporation from September 1999 until January 2004. Ms. Wyrsch also currently serves as Chairman of the Board of Trustees of Spectra Energy Income Fund and Chairman of the Board of Directors of Spectra Energy Partners GP, LLC. Prior to joining Duke Energy, Ms. Wyrsch served as Vice President, General Counsel and Secretary for KN Energy, Inc. from August 1997 until September 1999. | |

| Peter B. Hamilton Director since 2007 Retired Vice Chairman Brunswick Corporation Age 61

Mr. Hamilton is the retired Vice Chairman of Brunswick Corporation, a position he held from 2000 to January, 2007. While at Brunswick, he also served as President—Brunswick Boat Group in 2006; President—Life Fitness Division, 2005 to 2006; President—Brunswick Bowling & Billiards, 2000 to 2005; and Chief Financial Officer of Brunswick, 1995 to 2000. | |

| Michael E.J. Phelps Director since 2006 Former Chairman and CEO Westcoast Energy Inc. Age 60

Mr. Phelps is Chairman of Dornoch Capital Inc., a private investment company. In February 2003, the Canadian government appointed Mr. Phelps as Chairman of “the Wise Persons’ Committee,” a panel developed to review Canada’s system of securities regulation. From January 1988 to March 2002, he served as President and Chief Executive Officer, and subsequently as Chairman and Chief Executive Officer, of Westcoast Energy Inc., Vancouver, BC. Mr. Phelps sits on the Board of Directors of Canadian Pacific Railway Company, Fairborne Energy Trust, The Kodiak Exploration Foundation, The Globe Foundation and The Vancouver Hospital Foundation. He also is a member of the Vancouver Organizing Committee for 2010 Olympic and Paralympic Games. | |

8

Table of Contents

INFORMATION ON THE BOARD OF DIRECTORS

Board Meetings and Attendance

Our Board of Directors held seven meetings during 2007. All of the directors who were then members of the Board attended at least 75% of the meetings of the Board and all meetings of the Board committees on which he or she served during fiscal year 2007, other than Mr. Agnelli, who attended 65% of the meetings of the Board and committees on which he served. Directors are encouraged to attend the Annual Meeting.

Independence of Directors

The Board of Directors may determine a director to be independent if the Board has affirmatively determined that the director has no material relationship with Spectra Energy or its consolidated subsidiaries, either directly or as a shareholder, director, officer or employee of an organization that has a relationship with Spectra Energy or its subsidiaries. Independence determinations are made on an annual basis at the time the Board of Directors approves director nominees for inclusion in the annual proxy statement and, if a director joins the Board between Annual Meetings, at such time.

The Board of Directors has determined that none of Messrs. Adams, Agnelli, Comper, Esrey, Hamilton, Hendrix and Phelps and Ms. Carter, has a material relationship with Spectra Energy or its subsidiaries, and they are, therefore, independent under the listing standards of the New York Stock Exchange. In reaching this conclusion, the Board of Directors considered all transactions and relationships between each director or any member of his or her immediate family and Spectra Energy and its subsidiaries. Based on the criteria set forth below, Mr. McShane, if elected, will also be an independent director under the listing standards of the New York Stock Exchange.

To assist in this determination, the Board of Directors adopted the following categorical standards for relationships that are deemed not to impair a director’s independence:

Relationship | Requirements for Immateriality of Relationship | |

| Personal Relationships | ||

| The director or immediate family member resides within a service area of, and is provided with utility service by, Spectra Energy or its subsidiaries. | • Utility services must be provided in the ordinary course of the provider’s business and at rates or charges fixed in conformity with law or governmental authority, or if the service is unregulated, on arm’s-length terms. | |

| The director or immediate family member holds securities issued publicly by Spectra Energy or its subsidiaries. | • The director or immediate family member can receive no extra benefit not shared on a pro rata basis. | |

| The director or immediate family member receives pension or other forms of deferred compensation for prior service, or other compensation unrelated to director or meeting fees, from Spectra Energy or its subsidiaries. | • The compensation cannot be contingent in any way on continued service, and

• The director has not been employed by Spectra Energy or any company that was a subsidiary of Spectra Energy at the time of such employment for at least three years, or the immediate family member has not been an executive officer of Spectra Energy for at least three years and any such compensation that is not pension or other forms of deferred compensation for prior service cannot exceed $10,000 per year. | |

9

Table of Contents

Relationship | Requirements for Immateriality of Relationship | |

| Business Relationships | ||

| Payments for property or services are made between Spectra Energy or its subsidiaries and a company associated* with the director or immediate family member who is an executive officer of the associated company. | • Payment amounts must not exceed the greater of $1,000,000 or 2% of the associated company’s revenues in any of its last three fiscal years, and

• Relationship must be in the ordinary course of Spectra Energy’s or its subsidiary’s business and on arm’s-length terms. | |

| Indebtedness is outstanding between Spectra Energy or its subsidiaries and a company associated* with the director or immediate family member. | • Indebtedness amounts must not exceed 5% of the associated company’s assets in any of its last three fiscal years, and

• Relationship must be in the ordinary course of Spectra Energy’s or its subsidiary’s business and on arm’s-length terms. | |

| The director or immediate family member is a nonmanagement director of a company that does business with Spectra Energy or its subsidiaries or in which Spectra Energy or its subsidiaries have an equity interest. | • The business must be done in the ordinary course of Spectra Energy’s or its subsidiary’s business and on arm’s-length terms. | |

| An immediate family member is an employee (other than an executive officer) of a company that does business with Spectra Energy or its subsidiaries or in which Spectra Energy or its subsidiaries have an equity interest. | • If the immediate family member lives in the director’s home, the business must be done in the ordinary course of Spectra Energy’s or its subsidiary’s business and on arm’s-length terms. | |

| The director and his or her immediate family members together own 5% or less of a company that does business with Spectra Energy or its subsidiaries or in which Spectra Energy or its subsidiaries have an equity interest. | • None | |

| Charitable Relationships | ||

| Charitable donations or pledges are made by Spectra Energy or its subsidiaries to a charity associated* with the director or immediate family member. | • Donations and pledges must not result in payments exceeding the greater of $100,000 and 2% of the charity’s revenues in any of its last three fiscal years. | |

| A charity associated* with the director or immediate family member is located within a service area of, and is provided with utility service by, Spectra Energy or its subsidiaries. | • Utility service must be provided in the ordinary course of the provider’s business and at rates or charges fixed in conformity with law or governmental authority, or if the service is unregulated, on arm’s-length terms. | |

10

Table of Contents

Relationship | Requirements for Immateriality of Relationship | |

| Payments for property or services are made between Spectra Energy or its subsidiaries and a charity associated* with the director or immediate family member. | • Relationships must be in the ordinary course of Spectra Energy’s or its subsidiary’s business and on arm’s-length terms or subject to competitive bidding. | |

| * | An “associated” company is one (a) for which the director or immediate family member is general partner, principal or employee, or (b) of which the director and immediate family members together own more than 5%. An “associated” charity is one for which the director or immediate family member serves as an officer, director, advisory board member or trustee. |

For purposes of these standards, immediate family members include a director’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers-and sisters-in-law, and anyone (other than domestic employees) who shares the director’s home. For purposes of the contribution relationship described under “Charitable Relationships” above, payments exclude amounts contributed or pledged to match employee contributions or pledges.

Board Committees

The Board of Directors has four standing committees, which are described below. Each committee operates under a written charter adopted by the Board of Directors. The charters are posted on our website atwww.spectraenergy.com/investors/governance and are available in print to any shareholder upon request. In addition, our non-management directors regularly meet in executive sessions over which Mr. Anderson presides.

Name | Audit | Compensation | Corporate Governance | Finance and Risk Management | ||||

A. Adams | X | X | ||||||

R. Agnelli | X | X | ||||||

P. Anderson | • | |||||||

P. Carter | X | X | ||||||

F. Comper | X | X | ||||||

W. Esrey | • | X | ||||||

F. Fowler | ||||||||

P. Hamilton | X | X | X | |||||

D. Hendrix | X | • | ||||||

M. Phelps | • | X | ||||||

M. Wyrsch |

| • | Committee Chair |

Audit Committee

The Audit Committee selects and retains a firm of independent public accountants to conduct audits of the accounts of Spectra Energy and its subsidiaries. It also reviews with the independent public accountants the scope and results of their audits, as well as the accounting procedures, internal controls, and accounting and financial reporting policies and practices of Spectra Energy and its subsidiaries, and makes reports and recommendations to the Board as it deems appropriate. The Audit Committee is responsible for approving all audit and permissible non-audit services provided to Spectra Energy by its independent public accountants. See “Independent Public Accountants” for additional information on the Audit Committee’s pre-approval policy.

Each of the members of the Audit Committee has been determined to be “independent” within the meaning of the NYSE’s listing standards, Rule 10A-3 of the Securities Exchange Act of 1934 and Spectra Energy’s categorical standards for independence. In addition, each of the members meets the expertise requirements for

11

Table of Contents

audit committee membership under the NYSE’s rules and the rules and regulations of the SEC. The Board has determined that Messrs. Esrey and Hamilton are “audit committee financial experts” as defined under SEC rules.

Compensation Committee

The Compensation Committee establishes and reviews the overall compensation philosophy, reviews and approves the salaries and other compensation of certain employees, including all executive officers of Spectra Energy and the executive officers of the general partner of Spectra Energy Partners, LP, reviews and approves compensatory agreements with executive officers, approves equity grants and reviews the effectiveness of, and approves changes to, the compensation program. This Committee also makes recommendations to the Board of Directors on compensation for outside directors.

Each member of the Compensation Committee is considered to be (1) “independent” under the currently applicable listing standards of the NYSE; (2) a “non-employee director” within the meaning of Rule 16b-3 under the Securities and Exchange Act of 1934, as amended; and (3) an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended.

Corporate Governance Committee

The Corporate Governance Committee considers matters related to corporate governance and formulates and periodically revises governance principles. It recommends the size and composition of the Board of Directors and its committees and recommends potential successors to the Chief Executive Officer. This committee also recommends to the Board the slate of nominees, including any nominees recommended by shareholders, for director for each year’s Annual Meeting and, when vacancies occur, names of individuals who would make suitable directors of Spectra Energy. This committee may engage an external search firm or third party to identify or evaluate or to assist in identifying or evaluating a potential nominee. The Committee also performs an annual evaluation of the performance of the Chief Executive Officer with input from the full Board of Directors.

Each member of the Corporate Governance Committee has been determined to be “independent” within the meaning of the NYSE’s listing standards and Spectra Energy’s categorical standards for independence.

Finance and Risk Management Committee

The Finance and Risk Management Committee reviews Spectra Energy’s financial and fiscal affairs and makes recommendations to the Board of Directors regarding dividends, financing and fiscal policies. It reviews the financial exposure of Spectra Energy, as well as mitigating strategies, reviews Spectra Energy’s risk exposure as related to overall company portfolio and impact on earnings and reviews the financial impacts of major transactions as related to mergers, acquisitions, reorganizations and divestitures.

12

Table of Contents

Directors’ Compensation

Directors who are Spectra Energy employees do not receive compensation for their services as directors. The following is a description of Spectra Energy’s compensation program for non-employee directors for 2007.

| Meeting Fees | ||||||||||||

Type of Fee | Fee (Other Than for Meetings) | In-Person Attendance at Meetings Held in Conjunction With a Regular Board Meeting | In-Person Meetings Not Held in Conjunction With a Regular Board Meeting | Telephonic Participation in Meetings | ||||||||

Annual Board Retainer (Cash) | $ | 50,000 | ||||||||||

Annual Board Retainer (Stock) | $ | 75,000 | ||||||||||

Board Meeting Fees | $ | 2,000 | $ | 2,500 | $ | 2,000 | ||||||

Annual Audit Committee Chair Retainer | $ | 20,000 | ||||||||||

Annual Chair Retainer (Other Committees) | $ | 8,500 | ||||||||||

Audit Committee Meeting Fees | $ | 3,000 | $ | 2,500 | $ | 2,000 | ||||||

Other Committee Meeting Fees | $ | 2,000 | $ | 2,500 | $ | 2,000 | ||||||

Annual Stock Retainer for 2007. In 2007, each director received a grant of a number of shares of Spectra Energy stock (or units of Spectra Energy Partners, LP, at the director’s option) equal to $75,000 divided by the closing price of Spectra Energy’s common stock on the NYSE on the date of grant. Effective as of the closing of the initial public offering by Spectra Energy Partners, LP, directors were offered the opportunity to receive 25% of their stock retainer in units of Spectra Energy Partners, LP.

Compensation of the Chairman of the Board. Our Compensation Committee has determined that an amount of $500,000 is an appropriate level of compensation for our Chairman of the Board for the first 18 months following the spin-off, given Mr. Anderson’s significant role in setting the strategic direction of Spectra Energy. Compensation paid to Mr. Anderson in his role as Chairman is made through stock awards delivered in the same form as annual grants to Spectra Energy’s leadership employees. Under this arrangement, Mr. Anderson does not receive any cash retainer or meeting fees while fulfilling his role as Chairman but is eligible to participate in the Directors’ deferral plan and Matching Gifts Program described below. Beginning in July 2008, Mr. Anderson’s compensation will be on the same basis as our other non-employee directors with no additional retainer for his role as Chairman.

During 2007, stock awards were granted to leadership employees as follows: (1) 50% of executive’s grant value was delivered in the form of nonqualified stock options that vest ratably over a three-year period, have a term of ten years and have an exercise price equal to the closing price of Spectra Energy shares on the date of grant; and (2) 50% of the executive’s grant value was delivered in the form of phantom stock units that cliff vest on the third anniversary of the date of the award with dividend equivalents accumulated and paid when the underlying phantom stock units vest. Accordingly, Mr. Anderson was awarded 64,400 nonqualified stock options valued at $250,000 and 11,100 phantom stock units (with tandem dividend equivalents) valued at $250,000. In June 2007, Mr. Anderson’s options were amended as determined by the Compensation Committee to be appropriate to provide for cliff vesting on August 31, 2008, subject to continuous director service, and Mr. Anderson’s phantom stock awards were replaced with a like number of phantom stock units that vest on August 31, 2008, subject to continuous director service.

Deferral Plans and Stock Purchases. In 2007, each director received a grant of a number of shares of Spectra Energy Stock (or units of Spectra Energy Partners, LP, at the director’s option) equal to $75,000 divided by the closing price of Spectra Energy common stock on the NYSE on the date of the grant. Effective at the closing of the initial public offering by Spectra Energy Partners, LP, directors were offered the opportunity to receive 25% of their stock retainer in units of Spectra Energy Partners, LP.

13

Table of Contents

Charitable Giving Program. Spectra Energy maintains a Directors’ Charitable Giving Program under which one of our current directors remains eligible. Eligibility for this program has been frozen and no director who is not currently eligible may become eligible in the future. Under this program, the Spectra Energy Foundation will make, upon the director’s death, donations of up to $1,000,000 to charitable organizations selected by the director. A director may request that donations be made under this program during the director’s lifetime, in which case the maximum donation will be reduced on an actuarially-determined net present value basis. The only eligible director is Mr. Esrey. In addition, Spectra Energy maintains The Spectra Energy Foundation Matching Gifts Program under which all directors (and employees) are eligible for matching contributions of up to $5,000 per director per calendar year to qualifying institutions.

Expense Reimbursement and Insurance. Spectra Energy reimburses outside directors for expenses reasonably incurred in connection with attendance and participation at Board and Committee meetings and special functions.

Gifts.Spectra Energy presented a holiday gift in 2007 to each director on the Board as of December 31, 2007. The aggregate cost of all the gifts was $1,036. In addition, Spectra Energy presented a board service gift to each director on the Board at the June, 2007 meeting of the Board. The aggregate cost of all these gifts was $6,717.

Stock Ownership Guidelines. Outside directors are subject to stock ownership guidelines which establish a target level of ownership of Spectra Energy common stock (or common stock equivalents) of 4,000 shares. The Chairman of the Board is subject to a target level of ownership of 50,000 shares. Up to 25% of an individual ownership level may be met with equity in the Spectra Energy Income Fund, Spectra Energy Partners, LP, or a combination thereof. At the end of 2007, the targeted ownership level had been met by all but two directors who, having joined the Board of Directors in 2007, have five years to meet the target level.

The following table describes the compensation earned during 2007 by each individual who served as an outside director during 2007.

DIRECTOR COMPENSATION

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Options Awards ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||

A. Adams | 119,000 | 75,000 | — | — | 5,766 | 199,766 | ||||||

R. Agnelli | 74,000 | 107,277 | — | — | 766 | 182,043 | ||||||

P. Anderson | 0 | 131,600 | 272,700 | — | 5,766 | 410,066 | ||||||

P. Carter | 65,500 | 75,000 | — | — | 766 | 141,266 | ||||||

F. Comper | 43,000 | 37,500 | — | — | 95 | 80,595 | ||||||

W. Esrey | 127,000 | 88,344 | — | — | 766 | 216,110 | ||||||

P. Hamilton | 121,000 | 75,000 | — | — | 766 | 196,766 | ||||||

D. Hendrix | 115,500 | 86,351 | — | — | 766 | 202,617 | ||||||

M. Phelps | 102,500 | 109,271 | — | — | 766 | 212,537 |

14

Table of Contents

As described in the following table, All Other Compensation for 2007 includes matching gift contributions made by the Spectra Energy Foundation in the director’s name to a charitable organization, a holiday gift and a board service gift.

Name | Matching Charitable Contributions ($) | Charitable Contribution Under the Legacy Spectra Energy Corp Charitable Giving Program ($) | Holiday and Service Gift ($) | Total ($) | ||||

A. Adams | 5,000 | 0 | 766 | 5,766 | ||||

R. Agnelli | 0 | 0 | 766 | 766 | ||||

P. Anderson | 5,000 | 0 | 766 | 5,766 | ||||

P. Carter | 0 | 0 | 766 | 766 | ||||

F. Comper | 0 | 0 | 95 | 95 | ||||

W. Esrey | 0 | 0 | 766 | 766 | ||||

P. Hamilton | 0 | 0 | 766 | 766 | ||||

D. Hendrix | 0 | 0 | 766 | 766 | ||||

M. Phelps | 0 | 0 | 766 | 766 |

15

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table indicates the amount of Spectra Energy common stock beneficially owned by the directors, the executive officers listed in the Summary Compensation Table under “Executive Compensation” below (referred to as the Named Executive Officers), and by all directors and executive officers as a group as of March 10, 2008. In addition, the table shows the number of common units of Spectra Energy Partners, LP, or SEP, beneficially owned by such individuals. SEP is a publicly traded master limited partnership of which Spectra Energy owns approximately 83% of the outstanding equity interests.

Name or Identity of Group | Total Shares Beneficially Owned (1) | Percent of Class | Total Units of SEP Beneficially Owned | ||||

Austin A. Adams | 15,933 | * | 909 | ||||

Roger Agnelli | 6,859 | * | 909 | ||||

Paul M. Anderson | 807,506 | * | 0 | ||||

Pamela L. Carter | 2,117 | * | 909 | ||||

F. Anthony Comper | 3,074 | * | 348 | ||||

Gregory L. Ebel | 61,769 | * | 2,000 | ||||

William T. Esrey | 25,461 | * | 909 | ||||

Fred J. Fowler | 950,930 | * | 9,400 | ||||

William S. Garner, Jr. | 23,784 | * | 0 | ||||

Peter B. Hamilton | 6,117 | * | 909 | ||||

Alan N. Harris | 99,152 | * | 0 | ||||

Dennis R. Hendrix | 229,127 | * | 8,709 | ||||

Michael E.J. Phelps | 67,327 | * | 909 | ||||

Martha B. Wyrsch | 183,003 | * | 5,000 | ||||

Directors and executive officers as a group | 2,482,159 | 30,911 |

| * | Represents less than 1%. |

| (1) | Includes the following number of shares with respect to which directors and executive officers have the right to acquire beneficial ownership within 60 days of March 10, 2008 through the exercise of stock options: P.M. Anderson-550,000; G.L. Ebel-41,300; W.T. Esrey-9,800; F.J. Fowler-601,350; W.S. Garner-20,634; A.N. Harris-42,209; D.R. Hendrix-4,000; M.E.J. Phelps-2,000; M.B. Wyrsch-107,318. Includes the following number of shares underlying vested phantom units held under Spectra Energy’s Director Savings Plans: A.A. Adams-1,504; W.T. Esrey-13,568; M.E.J. Phelps-9,772. |

The following table lists the beneficial owners of 5% or more of Spectra Energy’s outstanding shares of common stock as of March 10, 2008. This information is based on the most recently available reports filed with the SEC and provided to us by the company listed.

| Shares of common stock | |||||

Name and Address of Beneficial Owner | Beneficially Owned | Percentage | |||

State Street Bank and Trust Company (1) | 48,283,914 | 7.6 | % | ||

One Lincoln Street, Boston, MA. 02111 | |||||

Barrow, Hanley, Mewhinney & Strauss, Inc. (2) | 48,219,215 | 7.6 | % | ||

| 2200 Ross Avenue, 31st Floor, Dallas, TX 75201-2761 | |||||

Vanguard Windsor Funds—Vanguard Windsor II Fund (3) | 32,337,100 | 5.1 | % | ||

| 100 Vanguard Blvd., Malvern, PA. 19355 | |||||

| (1) | According to the Schedule 13G filed on February 12, 2008 by State Street Bank and Trust Company, these shares are beneficially owned by its clients, and it has sole voting power with respect to 26,075,226 shares, shared voting power with respect to 22,208,688 shares, and shared dispositive power with respect to all of these shares. |

| (2) | According to the Schedule 13G filed on February 13, 2008 by Barrow, Hanley, Mewhinney & Strauss, Inc., these shares are beneficially owned by its clients, and it has sole voting power with respect to 8,866,544 |

16

Table of Contents

shares, shared voting power with respect to 39,352,671 shares, and sole dispositive power with respect to all of these shares. |

| (3) | According to the Schedule 13G filed on February 14, 2008 by Vanguard Windsor Funds, these shares are beneficially owned by its clients, and it has sole voting power with respect to all of these shares. |

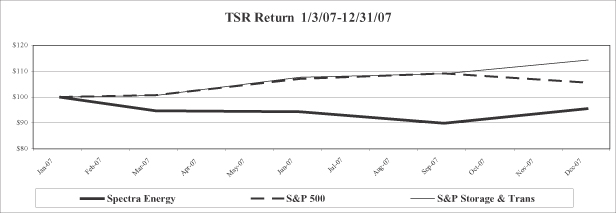

Stock Performance Graph. The following graph reflects the comparative changes in the value from January 3, 2007, the first trading day of Spectra Energy common stock on the NYSE, through December 31, 2007 of $100 invested in (1) Spectra Energy’s common stock, (2) the Standard & Poor’s 500 Stock Index, and (3) the Standard & Poor’s 500 Oil & Gas Storage & Transportation Index. The amounts included in the table were calculated assuming the reinvestment of dividends as the time dividends were paid.

| 1/3/07 | 3/31/07 | 6/30/07 | 9/30/07 | 12/31/07 | |||||||||||

Spectra Energy Corp | $ | 100.00 | $ | 94.61 | $ | 94.28 | $ | 89.77 | $ | 95.54 | |||||

S&P 500 Stock Index | $ | 100.00 | $ | 100.64 | $ | 106.96 | $ | 109.13 | $ | 105.49 | |||||

S&P 500 Oil & Gas Storage & Transportation Index | $ | 100.00 | $ | 100.52 | $ | 107.64 | $ | 108.98 | $ | 114.24 | |||||

17

Table of Contents

The following is the report of the Audit Committee with respect to Spectra Energy’s audited financial statements for the fiscal year ended December 31, 2007.

The purpose of the Audit Committee is to assist the Board in its general oversight of Spectra Energy’s financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of the Committee and is available on our website atwww.spectraenergy.com/investors/governance.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and Deloitte & Touche LLP (“Deloitte”), Spectra Energy’s independent public accountants. Management is responsible for the preparation, presentation and integrity of Spectra Energy’s financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. Deloitte is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States, as well as expressing an opinion on the effectiveness of internal control over financial reporting.

We reviewed Spectra Energy’s audited financial statements with management and Deloitte, and met separately with both management and Deloitte to discuss and review those financial statements and reports prior to issuance. These discussions also addressed the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. Management has represented, and Deloitte has confirmed, that the financial statements were prepared in accordance with generally accepted accounting principles.

The Audit Committee has discussed with Deloitte the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and PCAOB Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting That is Integrated with an Audit of Financial Statements.” In addition, Deloitte has provided the Audit Committee with the written disclosures and the letter required by the Independence Standards Board Standard No. 1, as amended, “Independence Discussions with Audit Committees,” that relate to Deloitte’s independence from Spectra Energy and its subsidiaries and the Audit Committee has discussed with Deloitte the firm’s independence.

Based on its review of the consolidated financial statements and discussions with and representations from management and Deloitte referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Spectra Energy’s 2007 Form 10-K, for filing with the SEC.

Audit Committee

William T. Esrey (Chair)

Austin A. Adams

Peter B. Hamilton

Dennis R. Hendrix

18

Table of Contents

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee has reviewed and discussed the following Compensation Discussion and Analysis with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

Compensation Committee

Michael E. J. Phelps (Chair)

Pamela L. Carter

F. Anthony Comper

Peter B. Hamilton

Roger Agnelli

19

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The purpose of this Compensation Discussion and Analysis is to provide information about Spectra Energy’s objectives and policies regarding compensation for the officers of Spectra Energy listed in the Summary Compensation Table. We refer to these officers as the named executive officers. Prior to the spin-off of Spectra Energy to the shareholders of Duke Energy on January 2, 2007, Spectra Energy was a wholly owned subsidiary of Duke Energy and its executive officers were employees of Duke Energy. In connection with the spin-off, Duke Energy’s Compensation Committee established an initial framework for the 2007 compensation for the named executive officers. In establishing 2007 compensation levels for our named executive officers, the Duke Energy Compensation Committee engaged Frederic W. Cook & Company, Inc., an outside consultant, to advise it on matters related to compensation. On December 19, 2006, prior to Spectra Energy becoming a stand-alone public entity, the Compensation Committee of the Spectra Energy Board of Directors was named to take responsibility for establishing the compensation of Spectra Energy’s executive officers. The Spectra Energy Compensation Committee met on that date and reviewed and approved the initial framework of executive compensation that was established by Duke Energy.

Committee Advisors

In 2007, the Spectra Energy Compensation Committee engaged ExeQuity, LLP, an independent consulting firm, to report directly to the Spectra Energy Compensation Committee with respect to matters related to executive compensation and best practices and analysis of meeting materials prepared by management. ExeQuity generally confers with the Compensation Committee and discusses compensation matters with management on a limited basis.

In 2007, ExeQuity reviewed materials provided to the Compensation Committee by management, consulted with the chairman prior to meetings regarding agenda items and attended meetings of the Compensation Committee. ExeQuity also provided consulting services as Spectra Energy conducted a detailed study of the appropriate structure of its long-term incentive program and the appropriate measures that would determine vesting of performance awards.

Management’s Role in the Compensation-Setting Process

Members of Spectra Energy’s management participate in various aspects of the compensation setting process including:

| • | recommending compensation programs, compensation policies, compensation levels and incentive opportunities; |

| • | compiling, preparing and distributing materials for Spectra Energy Compensation Committee meetings, including market data; |

| • | recommending performance targets and objectives; and |

| • | assisting in the evaluation of employee performance, other than the performance of the CEO, which is reviewed by the Board of Directors. |

In developing its recommendations regarding compensation, management utilizes outside consulting organizations, including Towers Perrin.

Objectives of the Compensation Program

The objective of our compensation program is to link compensation to both individual and company performance, on both a short and long term basis, with significant percentages of potential earning opportunities based on the achievement of predetermined performance targets. The structure is designed to both reward

20

Table of Contents

performance and to retain key executives. As such, our compensation program is a valuable tool that assists Spectra Energy in attracting, retaining and motivating well qualified executives.

The level of base salaries, short-term incentive opportunities and long-term incentive opportunities established for our named executive officers is intended to provide total target pay opportunities in the range of the market median for individuals in comparable positions and markets in which we compete for executive talent.See —“Factors Considered when Determining Total Compensation.” Consistent with our objectives, an average of 69% of the 2007 compensation opportunity provided to our named executive officers was in the form of short-term and long-term incentives, and an average of 48% of named executive officers’ compensation opportunity was in the form of long-term incentives alone.

The following table shows the dollar values of our 2007 target direct pay opportunities for our named executive officers.

2007 Target Pay Opportunity

Name | Salary | Short Term Incentive Target Opportunity | Long Term Incentive Target Opportunity | Total Target Pay Opportunity | ||||||||

Fred J. Fowler | $ | 950,000 | $ | 855,000 | $ | 2,090,000 | $ | 3,895,000 | ||||

Gregory L. Ebel | $ | 425,000 | $ | 276,250 | $ | 595,000 | $ | 1,296,250 | ||||

Martha B. Wyrsch | $ | 570,000 | $ | 456,000 | $ | 1,140,000 | $ | 2,166,000 | ||||

Alan N. Harris | $ | 400,000 | $ | 200,000 | $ | 480,000 | $ | 1,080,000 | ||||

William S. Garner, Jr. | $ | 412,500 | $ | 233,750 | $ | 480,000 | $ | 1,126,250 | ||||

Elements of the Compensation Plan

The following table sets forth the principal components of compensation for our named executive officers during 2007:

Component | Description | Rationale | ||

| Salary | Compensation paid in cash throughout the year. | Provides compensation for ongoing service. | ||

| Short-Term Incentive | Annual cash payment based on the achievement of defined financial and individual performance goals. | Rewards performance based on the achievement of objectives required to attain strategic goals. | ||

| Long-Term Incentive | Stock options and phantom awards. | Rewards long-term company performance, establishes economic alignment of executives with shareholders and provides retention incentive. | ||

| Retirement | Company sponsored retirement and savings plans. | Provides additional retention incentive through retirement-related payments. | ||

| Perquisites | Personal use of company aircraft. | Limited benefit consistent with market practice designed to promote time efficiencies. | ||

| Severance | Change of control agreements that provide benefits upon termination following a change of control of Spectra Energy. | Achieves management continuity and focus on best results for shareholders in the event of a change of control of the company. | ||

21

Table of Contents

Salary. Salaries were paid to compensate our executives for their service throughout the year. 2007 salaries for the named executive officers were based upon job responsibilities, level of experience, individual performance, and comparisons to the salaries of executives or employees in similar positions obtained from market surveys and internal comparisons. Generally, salaries were set considering, among many factors, the median salaries of individuals in comparable positions and markets.See“—Factors Considered When Determining Total Compensation.”

Short-Term Incentives. Short-term incentive opportunities are awarded under the Spectra Energy Executive Short-Term Incentive (STI) Plan and are designed to compensate executives for individual and company performance during the year based on goals set at the beginning of the year. The threshold, target and maximum incentive opportunities for each participant in the STI Plan during 2007 were established as a percentage of his or her base salary. Bonuses were earned based on the achievement of individual, corporate and/or business unit goals as determined by the Compensation Committee.

Target STI awards expressed as a percentage of base annual salary for our named executive officers in 2007 were:

Name | Percentage of Salary | ||

Fred J. Fowler | 90 | % | |

Gregory L. Ebel | 65 | % | |

Martha B. Wyrsch | 80 | % | |

Alan N. Harris | 50 | % | |

William S. Garner, Jr. | 55 | %* |

| * | Mr. Garner’s STI target award was increased from 50% to 60% effective July 1, 2007. The number in the table reflects the pro rata STI target for entire year. |

Depending on actual performance, participants are eligible to receive up to 190% of the amount of their STI target. Up to 200% of the target bonus amount based upon any financial or operational measure may be paid if performance at a specified maximum level is achieved. The maximum that may be earned for performance on individual measures is 150% of target. The amount that may be paid for performance at a specified minimum level for any measure is 50% of the target amount. Performance below minimum specified levels results in none of the compensation opportunity being earned.

STI payments for Messrs. Fowler and Ebel were based on the achievement of individual goals and financial objectives including Spectra Energy’s ongoing earnings per share, or EPS, earnings before interest, taxes, depreciation and amortization, or EBITDA, of Spectra Energy Transmission, our primary operating subsidiary, Spectra Energy Transmission return on capital employed and measures related to the financial performance of DCP Midstream as shown in the following table. The amounts set forth below show the percentage of target for achieving the threshold, target and maximum levels established for each category as well as the actual result. The corresponding dollar value for the EPS and EBITDA goals are also shown in parentheses.

Target Incentive Payment Opportunity

Measures | Weight | Threshold | Target | Maximum | Actual | |||||

| Spectra Energy EPS | 30% | 50% ($1.25) | 100% ($1.40) | 200% ($1.60) | 165% ($1.53) | |||||

| Spectra Energy Transmission EBITDA** | 20% | 50% ($1,810.0) | 100% ($1,847.0) | 200% ($1,902.0) | 200% ($2,005.8) | |||||

| Spectra Energy Transmission Return on Capital Employed | 20% | 50% | 100% | 200% | 200% | |||||

| DCP Midstream Measures | 10% | 50% | 100% | 200% | 74.5% | |||||

| Individual | 20% | * | * | * | * |

| * | The target individual goals for the named executive officers is discussed under “—Determination of Short Term Incentive Payments.” |

| ** | Amounts shown in millions. |

22

Table of Contents

STI incentives for Ms. Wyrsch and Messrs. Garner and Harris were based on the achievement of individual goals and corporate financial and operational objectives including Spectra Energy EPS, Spectra Energy Transmission EBITDA and Spectra Energy Transmission return on capital employed as follows:

Target Incentive Payment Opportunity

Measures | Weight | Threshold | Target | Maximum | Actual | |||||

Spectra Energy EPS | 30% | 50% ($1.25) | 100% ($1.40) | 200% ($1.60) | 165% ($1.53) | |||||

Spectra Energy Transmission EBITDA | 25% | 50% ($1,810.0) | 100% ($1,847.0) | 200% ($1,902.0) | 200% ($2,005.8) | |||||

Spectra Energy Transmission Return on Capital Employed | 25% | 50% | 100% | 200% | 200% | |||||

| Individual | 20% | * | * | * | * |

| * | The target individual goals for the named executive officers is discussed under “—Determination of Short Term Incentive Payments.” |

Payments for 2007 awards to Spectra Energy executives under the STI Plan were approved by the Compensation Committee in February 2008 based on evaluations of 2007 performance. The following table is a summary of the payments made to each of our named executive officers:

2007 STI Award Table

Name | Short-Term Incentive Award | Actual Payout As a Percent of Salary | Actual Payout as a Percent of Target Short-Term Incentive Award | ||||||

Fred J. Fowler | $ | 1,152,771 | 121 | % | 135 | % | |||

Gregory L. Ebel | $ | 393,797 | 93 | % | 143 | % | |||

Martha B. Wyrsch | $ | 693,741 | 122 | % | 152 | % | |||

Alan N. Harris | $ | 307,890 | 77 | % | 154 | % | |||

William S. Garner, Jr. | $ | 358,689 | 84 | % | 153 | % | |||

Determination of Short Term Incentive Payments

The level of STI payments made to each of the named executive officers was based on the achievement of company and individual goals approved by the Compensation Committee. The objectives were considered to be appropriate measures of the business imperatives that are necessary to begin building a solid record of financial success and operational excellence.

Ongoing EPS was chosen as a measure because we believe that it is one of the primary measures used by the investment community in valuing Spectra Energy. The EPS target of $1.40 was established as an estimate of the earnings expected for 2007 in the event Spectra Energy’s financial and strategic goals were achieved. The EPS amount corresponding to the payout maximum was set at 14.3% above the target and was judged to be an earnings level that was possible but only if there was extraordinary financial performance. The EPS level corresponding to the payout minimum was set at approximately 10% below the target level and was deemed to be an amount of earnings that, though below expectations, still warranted consideration for incentive pay.

Spectra Energy Transmission EBITDA was chosen as a measure of the effectiveness of the gas pipeline business’s ability to generate earnings without considering interest, taxes, depreciation and amortization. Sixty

23

Table of Contents

percent of the effect of exchange rate fluctuations in Canadian currency and any contributions to earnings by DCP Midstream were excluded from the calculation of EBITDA in an attempt to make this measure a clear gauge of the performance of Spectra Energy’s three core gas pipeline business units. Target performance was set at a level that matched our corporate forecasts. Maximum payout level was set at a level judged to be difficult to achieve, and minimum payout was set at a level considered to be the lowest level of performance that would justify a reduced payout.

Spectra Energy Transmission Return on Capital Employed was chosen because it is deemed to be a measure of the efficiency and effectiveness of capital deployment in our core business. Target performance was set at a level consistent with corporate forecasts. Similar to other measures, maximum and minimum performance were set, respectively, at levels deemed by the Compensation Committee in its judgment to be significant challenges or minimally acceptable.

Because Messrs. Fowler and Ebel must devote a portion of their time to the affairs of DCP Midstream, a partnership in which Spectra Energy shares a 50% ownership interest along with ConocoPhillips, and because the performance of DCP Midstream affects the financial performance of Spectra Energy, the Compensation Committee deemed it appropriate to base 10% of their STI payments on financial measures applicable to DCP Midstream. The DCP Midstream measures applicable to Messrs. Fowler and Ebel are the measures that were set by the DCP Midstream Board of Directors for purposes of the annual incentive plan generally applicable to the CEO of that organization. DCP Midstream chose measures deemed to be indicators of the quality of the execution of corporate strategy and include management of total costs and return on capital employed excluding the effect of fluctuations in commodity prices.

At the end of the year, management prepares a report on the achievement of company and individual goals, including a calculation of the percentage achievement of each for purposes of the STI program. These results are reviewed and approved by the Compensation Committee at its first meeting of the year. Relative performance for each individual objective is calculated by the CEO, the CEO’s recommendation is reviewed by the Compensation Committee, which then approves the final performance results. In the case of the CEO, recommended bonus earnings, including performance scores on financial and individual objectives, are reviewed and approved by the Compensation Committee prior to final review and approval by the Board prior to payment of his annual short term incentive. We believe that it is important that each executive also be accountable for achieving certain financial and non-financial objectives relating not only to corporate operations but also to social responsibility goals.

The following table describes the individual objectives and the weighting for 2007 in summary form.

Objective | Mr. Fowler | Mr. Ebel | Ms. Wyrsch | Mr. Harris | Mr. Garner | ||||||||||

Achievement of a zero injury culture | 15 | % | — | 15 | % | — | — | ||||||||

Leadership development, diversity and a high performance culture | 15 | % | — | 15 | % | — | — | ||||||||

Success in deploying growth capital | 15 | % | — | 20 | % | — | — | ||||||||

Achievement of strategic transactions including the initial public offering of Spectra Energy Partners, LP. | 15 | % | 15 | % | 20 | % | 25 | % | 20 | % | |||||

Establish and enhance Company identity with all stakeholders | 20 | % | — | 15 | % | — | — | ||||||||

Cost management initiatives at the corporate and Spectra Energy Transmission levels | 20 | % | 15 | % | 15 | % | 25 | % | — | ||||||

Financial reporting goals | — | 20 | % | — | — | — | |||||||||

Enhanced shareholder value for Spectra Energy from ownership in DCP Midstream | — | 25 | % | — | 25 | % | — |

24

Table of Contents

Objective | Mr. Fowler | Mr. Ebel | Ms. Wyrsch | Mr. Harris | Mr. Garner | ||||||||

Achievement of relative shareholder returns compared to peer companies | — | 25 | % | — | — | — | |||||||

Evaluate and monitor strategic initiative opportunities | — | — | — | 25 | % | — | |||||||

Resolution of outstanding litigation matters and managing outside counsel fees | — | — | — | — | 25 | % | |||||||

Establish protocols for managing potential corporate transactions | — | — | — | — | 20 | % | |||||||

Effective Board meetings | — | — | — | — | 20 | % | |||||||

Staffing of corporate, legal and audit staffing functions | — | — | — | — | 15 | % |

In calculating final bonus amounts, the Compensation Committee implemented a 15%, 10%, 12.5%, 10% and 10% reduction in the earned amounts for Mr. Fowler, Mr. Ebel, Ms. Wyrsch, Mr. Harris and Mr. Garner, respectively, associated with a work related fatality of an employee of DCP Midstream and other corporate factors.

Long-Term Incentives. We provide long-term incentive opportunities to our executive officers to demonstrate an alignment of executive and shareholder interests that we believe will, over time, maximize shareholder value.

Using analyses prepared at Duke Energy’s request by Towers Perrin, an outside compensation consultant, prior to the spin-off, our Compensation Committee studied the structure of awards made to executives of companies in connection with and immediately following the time they were spun-off from a larger parent corporation. The Compensation Committee also considered the long-term incentive grant structures of other midstream natural gas companies as well as the prevailing grant practices among companies comparable to Spectra Energy’s size. The grant structures and practices reviewed by the Spectra Energy Compensation Committee were generally designed to compensate both continued employment and performance of Spectra Energy as measured by growth in the market value of our common stock.

Based on the foregoing, the Compensation Committee determined that the most appropriate structure for long-term incentive awards to its executive officers in 2007 would be one in which one-half of intended grant value is delivered in stock options with an exercise price set at the market price of Spectra Energy as of the date of grant, and one-half of the intended grant value is delivered in phantom shares that will vest in their entirety on the third anniversary of the date of grant. Stock options granted in 2007 vest ratably over a three-year period and have a ten-year term. Dividend equivalents will accumulate on phantom shares granted in 2007 but will not be paid until the end of the three-year vesting period. This structure was adopted to provide both significant incentives for retention and meaningful ownership in a new public company to create an economic alignment of management’s interests with that of shareholders.

The 2007 long-term incentive awards to our named executive officers are:

Name | Expected Value of LTI/Equity Grants as a Percentage of Base Salary | Number of Options Granted | Number of Phantom Shares Granted | |||

Fred J. Fowler | 220% | 269,400 | 46,400 | |||

Gregory L. Ebel | 140% | 76,700 | 13,200 | |||

Martha B. Wyrsch | 200% | 146,900 | 25,300 | |||

Alan N. Harris | 120% | 61,900 | 10,700 | |||

William S. Garner, Jr. | 120% | 61,900 | 10,700 |

In calculating the number of stock options and phantom shares granted in accordance with the above, options were valued using an expected value model calculated at management’s request by Towers Perrin.

25

Table of Contents

In July 2007, in connection with the initial public offering of Spectra Energy Partners, the Compensation Committee, which also serves as the compensation committee of the partnership, discussed the importance attributed by potential investors to management’s ownership stake in the partnership. Based on a belief that it would be important for certain executives of Spectra Energy who have management or supervisory responsibilities for the operation of Spectra Energy Partners to have a meaningful ownership stake in the partnership, the Compensation Committee determined that it would be appropriate to award phantom partnership units to those executives. In order for the awards to achieve their intended objectives, the Committee decided that their value should be approximately 25% of the target value of previously approved long term award opportunities. Because the Compensation Committee did not want the grant of phantom units to result in a level of compensation above previously established compensation targets, it decided that 25% of the 2007 long-term incentive value would be deducted from the value of the long-term awards that executives would receive in 2008. Accordingly, on July 2, 2007 Messrs. Fowler and Ebel, Ms. Wyrsch and Messrs. Harris and Garner were granted awards of 26,100, 7,500, 14,250, 6,000, and 6,000 phantom common units of Spectra Energy Partners, LP, respectively.