Table of Contents

UNITED STATES

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

SPECTRA ENERGY CORP

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Table of Contents

Table of Contents

To Our

Shareholders

Dear Shareholders,

In 2014, Spectra Energy delivered strong financial and business results and remained committed to creating value for our investors. We will again highlight some of those results during our Annual Meeting of Shareholders in Houston on April 28, 2015, and invite you to attend either in person or via our webcast.

Our financial and strategic plans, reviewed and approved by our directors, support continued earnings, cash and dividend growth. We have expanded our portfolio of assets, which helped in securing $3.5 billion of new growth projects supported by firm, fee-based contracts.

We have been rigorous in our assessment of both the opportunities and risks facing our business in the current and longer-term environment. We have worked diligently to buffer your company from the volatility that accompanies commodity, currency and economic cycles.

We believe the primary fundamentals driving the current period of midstream infrastructure build-out are still strong: increasing supplies of natural gas, natural gas liquids and crude oil require paths to growing markets. Our expansive North American asset footprint allows us to efficiently connect supply to demand, customers to service and solutions, and investors to value growth.

The directors, executives and employees of Spectra Energy are dedicated to serving our investors’ needs and expectations with excellence over the long term.

Sincerely,

Gregory L. Ebel

CHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER |

Dear Shareholders,

Spectra Energy is a company deeply grounded in sound governance principles. Those principles are designed and continually assessed to ensure that we operate our business responsibly, ethically and in a manner aligned with the interests of our investors and stakeholders.

The governance structure of our board is focused within four committees: audit, compensation, corporate governance, and finance and risk management – all comprised solely of independent directors.

The rapidly shifting dynamics of our business and world make risk management a key imperative, and each year the board reviews prioritized risks across four areas: financial, strategic, operational and legal. Additionally, at every meeting, the board is updated on risk trends, changes to previously identified risks and emerging risks.

Spectra Energy’s Audit Committee oversees the quality and integrity of the Company’s financial statements and internal controls and compliance with legal and regulatory requirements.

The Compensation Committee of the board ensures that Spectra Energy executives are compensated in a manner that is fair, equitable, performance-based and guided by the long-term interests of investors.

Through our Corporate Governance Committee, we continuously review and refine the structure, composition, principles and guidelines of our board to serve your needs now and into the future. The Finance and Risk Management Committee provides oversight of the company’s financial affairs and risk management, and oversight on environmental, health, safety and sustainability issues affecting the company.

As Lead Director, it is my privilege to work alongside committed and engaged board members who bring exceptional knowledge, perspective and accountability to their roles, and oversee Spectra Energy’s talented executive team.

Sincerely,

F. Anthony Comper

LEAD DIRECTOR |

SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

of Shareholders

Where:

Spectra Energy Corp Headquarters 5400 Westheimer Court Houston, Texas 77056

When: Tuesday, April 28, 2015 10:00 a.m. Central Time | At our Annual Meeting, shareholders will:

u Vote on the election of all directors for the coming year

u Vote to approve the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2015

u Vote on an advisory resolution to approve our executive compensation

u Vote on the two shareholder proposals described in this proxy statement, if properly presented at the meeting

u Transact other business that may properly come before the meeting

| |||||||

You are entitled to vote if you were a shareholder of record at the close of business on March 2, 2015.Even if you plan to attend the Annual Meeting in person, please cast your vote as soon as possible. You may vote by Internet, by telephone, or by completing and mailing your proxy card. If you attend the Annual Meeting and wish to change your vote at that time, you will be able to withdraw any previously submitted proxy and vote in person.

By Order of the Board of Directors

Patricia M. Rice

Vice President, Deputy General Counsel and Secretary

March 19, 2015

Houston, Texas

For specific voting information, see “Annual Meeting Information” beginning on page 59 of this proxy statement.

Your vote is important. Please complete, sign, date and return your proxy or submit your vote by telephone or the Internet. See page 1 for the weblink and the toll-free telephone number for shareholder voting.

SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

Annual Meeting Information

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 28, 2015. The proxy statement, our 2014 Annual Report to Shareholders and our 2014 Annual Report on Form 10-K are available at www.proxyvote.com.

SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

Unless stated otherwise or the context otherwise requires, all references in this proxy statement to “us,” “we,” “our,” “Company” or “Spectra Energy” are to Spectra Energy Corp.

In this summary, we highlight certain information you will find in this proxy statement. Please review the entire proxy statement carefully before casting your vote. Distribution of this proxy statement and form of proxy to shareholders began on or about March 19, 2015.

Spectra Energy 2015 Annual Meeting of Shareholders

Tuesday, April 28, 2015

10:00 a.m. Central Time

Spectra Energy Corp Headquarters

5400 Westheimer Court

Houston, Texas 77056

Who May Vote: You are entitled to vote if you held Spectra Energy shares as of the record date for this meeting, which was March 2, 2015.

Admission to the Meeting: Spectra Energy shareholders as of the record date are entitled to attend the Annual Meeting. In accordance with our security procedures, you must present a government-issued photo identification to attend the meeting.

If your shares are held in the name of your broker, bank or other nominee and you wish to vote at the Annual Meeting, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares as of March 2, 2015.

Meeting Webcast: If you cannot attend in person, we invite you to access a live webcast of the meeting via the Investors section of Spectra Energy’s website. You may also listen in by conference call at 888-252-3715 (United States or Canada) or706-634-8942 (international callers). The conference code is 6697521. Please call 5 to 10 minutes prior to the scheduled start time.

VOTING RECOMMENDATIONS

| Proposal Number | Subject of Proposal | Recommended Vote | For details see pages starting on | |||

| 1 | Election of directors for the coming year | FOR the proposal | 4 | |||

| 2 | Approval of the Board’s selection of independent auditor | FOR the proposal | 20 | |||

| 3 | Non-binding approval of executive compensation | FOR the proposal | 23 | |||

| 4 | Shareholder proposal – political contributions | AGAINST the proposal | 53 | |||

| 5 | Shareholder proposal – lobbying disclosures | AGAINST the proposal | 55 |

Your vote is important, so please cast your vote as soon as possible by: |

Internet at www.proxyvote.com

|

Toll-free call from the or Canada at 1-800-690-6903 |

Mailing your signed proxy or voting instruction form |

Scanning this QR code to vote with your mobile device | ||||

SPECTRA ENERGY CORP2015 PROXY STATEMENT 1

Table of Contents

| PROXY SUMMARY

| |

Board Nominees

| Name | Principal Occupation | Director Since | Committee Service | |||

Gregory L. Ebel Chairman | President and Chief Executive Officer, Spectra Energy Corp | 2008 | W

W | |||

F. Anthony Comper Independent Lead Director | Retired President and Chief Executive Officer, BMO Financial Group | 2007 | • Audit

• Corporate Governance | |||

Austin A. Adams | Retired Executive Vice President and Chief Information Officer, JPMorgan Chase & Co. | 2007 | • Audit

• Corporate Governance | |||

Joseph Alvarado | Chairman, President and Chief Executive Officer, Commercial Metals Company | 2011 | • Compensation

• Finance and Risk Management | |||

Pamela L. Carter | President, Cummins Distribution Business | 2007 | • Compensation

• Corporate Governance(Chair) | |||

Clarence P. Cazalot Jr | Retired Executive Chairman, President and Chief Executive Officer, Marathon Oil Corporation | 2013 | • Compensation

• Finance and Risk Management | |||

Peter B. Hamilton | Retired Senior Vice President and Chief Financial Officer, Brunswick Corporation | 2007 | • Audit(Chair)

• Corporate Governance | |||

Miranda C. Hubbs* | Former Executive Vice President and Managing Director, McLean Budden | — | W

W | |||

Michael McShane | Former Chairman, President and Chief Executive Officer, Grant Prideco, Inc. | 2008 | • Audit

• Finance and Risk Management (Chair) | |||

Michael G. Morris | Retired Chairman, President and Chief Executive Officer, American Electric Power | 2013 | • Compensation

• Finance and Risk Management | |||

Michael E.J. Phelps | Chairman, Dornoch Capital Inc. | 2006 | • Compensation(Chair)

• Finance and Risk Management | |||

* First-time director nominee. | ||||||

Governance Highlights

We are committed to strong and sustainable corporate governance, which promotes the long-term interests of our shareholders, strengthens Board and management accountability, and helps build public trust in the Company. Highlights of our commitment to strong corporate governance include:

| • | Annual Election of all Directors |

| • | Majority Voting for Directors |

| • | 10 out of 11 Director Nominees are Independent |

| • | Independent Lead Director |

| • | Independent Audit, Compensation and Corporate Governance Committees |

| • | Independent Financial and Risk Management Committee |

| • | Regular Executive Sessions of Independent Directors |

| • | Risk Oversight by Board and Committees |

| • | Annual Board and Committee Self-Evaluations |

| • | Annual Shareholder Advisory Approval of Executive Compensation |

| • | Political Contributions Policy |

| • | Long-standing Active Shareholder Engagement |

| • | Transparent Public Policy Engagement |

| • | Executive Compensation Driven by Pay-For Performance Philosophy |

| • | Share Ownership Guidelines for Directors and Executives |

| • | Equity Awards with Clawback Provisions |

| • | No Shareholder Rights Plan or “Poison Pill” |

| • | Initiatives on Sustainability, Environmental Matters and Social Responsibility |

2 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| PROXY SUMMARY

| |

Performance Overview

2014 Highlights

| „ | Exceeded earnings targets |

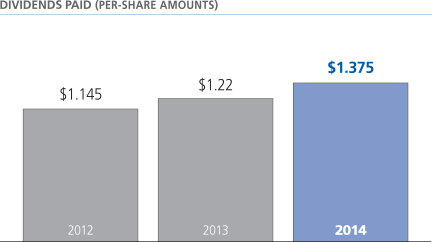

| „ | Continued increase in annual dividend |

| „ | More than 10% increase in quarterly dividend effective in the last quarter |

| „ | Placed $800 million of growth projects into service |

| „ | Secured $3.5 billion of new growth projects |

| „ | Growth projects supported by firm, fee-based contracts |

SPECTRA ENERGY CORP2015 PROXY STATEMENT 3

Table of Contents

| ||

Election of Directors

Based on recommendations from the Corporate Governance Committee, our Board has nominated the following 11 individuals for election to the Board:

| • | Gregory L. Ebel, our Chairman, President and Chief Executive Officer; |

| • | F. Anthony Comper, our Lead Director (independent); and |

| • | our other independent nominees: Austin A. Adams, Joseph Alvarado, Pamela L. Carter, Clarence P. Cazalot Jr, Peter B. Hamilton, Miranda C. Hubbs, Michael McShane, Michael G. Morris and Michael E. J. Phelps. |

Presently, the size of our Board is fixed at 10 members. Prior to the Annual Meeting, the Board will amend the Company’s By-Laws to increase the size of the Board to 11 members. All the nominees (other than Ms. Hubbs) are current members of our Board. Each nominee is standing for election to a one-year term that will expire at the 2016 Annual Meeting. If any nominee is unable to stand for election, the Board may either reduce the number of directors or designate a substitute. If the Board chooses to designate a substitute, shares represented by proxies may be voted for that substitute. We do not expect that any nominee will be unavailable or unable to serve.

We believe that all nominees are well qualified to fulfill their responsibilities. Their qualifications include strong leadership ability, global business experience, financial and industry expertise and experience in law and public policy. The characteristics we look for in any director candidate include intelligence, perceptiveness, good judgment, maturity, high ethical standards, integrity and fairness, professional compatibility with our other directors and executives, and diversity that enhances the perspective and experience of our Board.

This year, our nominees include Ms. Hubbs, a seasoned financial services professional in the Canadian energy industry. Ms. Hubbs brings significant financial and business experience to our Board, having served as an Executive Vice President and Managing Director of a large Canadian financial services company.

| Gregory L. Ebel Chairman, President and Chief Executive Officer, Spectra Energy | ||||

| SKILLS AND QUALIFICATIONS: | |||

• Serves as our Chairman, President and CEO

• Served as our Chief Financial Officer and in other leadership positions in operations, strategic development, and government and investor relations | • Served as President of Union Gas Limited, one of our Canadian subsidiaries | |||

Age 50 | KEY EXPERIENCE: | |||

Director since 2008 | Before assuming his current position on January 1, 2009, Mr. Ebel had served as Spectra Energy’s Group Executive and Chief Financial Officer since January 2007. Prior to that time, he served as President of Union Gas Limited from January 2005 until January 2007, and Vice President, Investor & Shareholder Relations of Duke Energy Corporation from November 2002 until January 2005. Mr. Ebel joined Duke Energy in March 2002 as Managing Director of Mergers and Acquisitions in connection with Duke Energy’s acquisition of Westcoast Energy Inc. Mr. Ebel is Chairman, President and Chief Executive Officer of our master limited partnership, Spectra Energy Partners, LP (“SEP”), and he is also a director of our joint venture entity, DCP Midstream, LLC. | |||

OTHER PUBLIC DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

The Mosaic Company (current).

| ||||

4 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS Information on Our Nominees

| |

| F. Anthony Comper Retired President and Chief Executive Officer, BMO Financial Group | ||||

Age 69 | SKILLS AND QUALIFICATIONS: | |||

• Experience as both chairman and CEO of a large global financial institution

• Financial expertise, including extensive experience with capital markets transactions and risk management | • Significant knowledge of the Canadian marketplace and Canadian political and regulatory environments

• Has served as Lead Director of Spectra Energy since 2014 | |||

KEY EXPERIENCE: | ||||

Director since 2007 and Lead Director since 2014 | Mr. Comper is the retired President and Chief Executive Officer and former director of BMO Financial Group, a diversified financial services organization and one of the largest banks in North America. He was appointed to those positions in February 1999 and served as Chairman from July 1999 to May 2004. He previously served on the Board of Directors of BMO Financial Group. | |||

| Austin A. Adams Retired Executive Vice President and Chief Information Officer, JPMorgan Chase & Co. | ||||

Age 71 | SKILLS AND QUALIFICATIONS: | |||

• Expertise in information technology and security, risk management and strategy, and human resources

• Experience leading and collaborating with senior management teams

• Strategic expertise, including extensive involvement with mergers and acquisitions | • Experience that enables him to help the Audit Committee and Board assess technology, security and other types of risk, which is particularly helpful given the importance of these issues in our daily operations | |||

Director since | KEY EXPERIENCE: | |||

| Mr. Adams is the retired Executive Vice President and Chief Information Officer of JPMorgan Chase & Co., a global financial services firm. He assumed that role upon the 2004 merger of JPMorgan Chase and Bank One Corporation and served in that position until he retired in October 2006. Before joining Bank One in 2001, Mr. Adams served as Chief Information Officer at First Union Corporation, now Wells Fargo Corp. | ||||

OTHER PUBLIC DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

Dun & Bradstreet Corporation (current); CommScope Holding Company, Inc. (current); First Niagara Financial Group (current); and CommunityONE Bank, N.A. (former).

| ||||

SPECTRA ENERGY CORP2015 PROXY STATEMENT 5

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS Information on Our Nominees

| |

| Joseph Alvarado Chairman, President and Chief Executive Officer, Commercial Metals Company | ||||

Age 62 | SKILLS AND QUALIFICATIONS: | |||

• Current CEO of Commercial Metals Company, a major corporation with international operations

• Variety of executive management positions provide our Board excellent perspective | • As an active CEO, deals with many of the same issues we face at Spectra Energy, including highly competitive industries, operational and manufacturing issues, safety, and diverse and changing regulatory environments | |||

Director since 2011 | KEY EXPERIENCE: | |||

| Mr. Alvarado is Chairman, President and Chief Executive Officer of Commercial Metals Company (“CMC”), a manufacturer, recycler and marketer of steel and other metals and related products. Mr. Alvarado joined CMC in April 2010 as Executive Vice President and Chief Operating Officer, was named President and Chief Operating Officer in April 2011, and became President and CEO in September 2011. He has been a member of CMC’s board since September 2011 and Chairman since January 2013. Prior to joining CMC, he was President and Chief Operating Officer of Lone Star Technologies, Inc. from 2004 to 2007. In 2007, following the acquisition of Lone Star Technologies, Inc. by United States Steel Corporation, Mr. Alvarado was named President of U.S. Steel Tubular Products, Inc., a division of United States Steel Corporation. | ||||

| Pamela L. Carter President, Cummins Distribution Business | ||||

Age 65 | SKILLS AND QUALIFICATIONS: | |||

• A diverse background that includes experience in law, government, politics and business

• Knowledge of macro-economic global conditions

• A valuable and dynamic international business perspective | • First woman and first African-American to serve as Attorney General of Indiana

• Significant experience in, and insight into, global operations, government relations, governance and public policy issues (especially valuable in her role as Chair of our Corporate Governance Committee) | |||

Director since 2007 | KEY EXPERIENCE: | |||

| Ms. Carter is President of Cummins Distribution Business, a division of Cummins Inc., a global manufacturer of diesel engines and related technologies, a position she assumed in 2008. She previously served as President – Cummins Filtration, then as Vice President and General Manager of Europe, Middle East and Africa business and operations for Cummins Inc. since 1999. Ms. Carter served as Vice President and General Counsel of Cummins Inc. from 1997 to 1999. Prior to joining Cummins Inc., she served as the Attorney General for the State of Indiana from 1993 to 1997. In 2010, Ms. Carter was appointed to the Export-Import Bank of the United States’ sub-Saharan Africa Advisory Council. | ||||

OTHER PUBLIC DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

CSX Corporation (current).

| ||||

6 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS Information on Our Nominees

| |

| Clarence P. Cazalot Jr Retired Executive Chairman, President and Chief Executive Officer, Marathon Oil Corporation | ||||

| SKILLS AND QUALIFICATIONS: | |||

• A highly respected energy executive with more than 40 years of industry experience

• Extensive exploration and production expertise (a valuable addition as we establish a strong footprint in the transportation and storage of crude oil) | • Experience as a board member of public companies with international operations | |||

Age 64

| KEY EXPERIENCE: | |||

Director since 2013 | Mr. Cazalot is the retired Executive Chairman, President and Chief Executive Officer of Marathon Oil Corporation (“Marathon”). He was Executive Chairman of Marathon from August 2013 to December 2013; Chairman from 2011 to 2013; and President, Chief Executive Officer and director from 2002 to August 2013. From 2000 to 2001, he served as Vice Chairman of USX Corporation and President of Marathon. Mr. Cazalot held various executive positions with Texaco Inc. from 1972 to 2000. He is a member of the Advisory Board of the James A. Baker III Institute for Public Policy, the Board of visitors of Texas M.D. Anderson Cancer Center, the Memorial Hermann Health Care Systems Board and the LSU Foundation. | |||

OTHER PUBLIC DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

Baker Hughes Incorporated (current) and FMC Technologies (current).

| ||||

| Peter B. Hamilton Retired Senior Vice President and Chief Financial Officer, Brunswick Corporation | ||||

Age 68 | SKILLS AND QUALIFICATIONS: | |||

• An experienced senior executive with sound business acumen and experience that includes legal and regulatory matters, finance and operations

• Well-versed in the operations of a large diversified corporation, with a particular focus on manufacturing, operations, supply chain, labor relations and customer issues | • His experience in finance and public-company governance enables him to make valuable contributions to our Board’s Audit and Corporate Governance committees (especially valuable in his role as Chair of our Audit Committee) | |||

Director since 2007 | KEY EXPERIENCE: | |||

| Mr. Hamilton is the retired Senior Vice President and Chief Financial Officer of Brunswick Corporation, a global designer, manufacturer and marketer of recreation products. He held that position from September 2008 to February 2013. He previously served as a director of Brunswick Corporation. He retired from the Brunswick Corporation Board in 2007. He was Vice Chairman of Brunswick Corporation from 2000 to January 2007; President – Brunswick Boat Group in 2006; President – Life Fitness Division from 2005 to 2006; and President – Brunswick Bowling & Billiards from 2000 to 2005. | ||||

OTHER PUBLIC DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

SunCoke Energy, Inc. (current) and Oshkosh Corporation (current).

| ||||

SPECTRA ENERGY CORP2015 PROXY STATEMENT 7

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS Information on Our Nominees

| |

| Miranda C. Hubbs Former Executive Vice President and Managing Director, McLean Budden | ||||

| SKILLS AND QUALIFICATIONS: | |||

• Significant financial, accounting and business experience in Canadian energy markets

• Former Executive Vice President and Managing Director of a large Canadian financial services company | • Former energy research analyst and investment banker with a large Canadian brokerage firm | |||

Age 48

|

KEY EXPERIENCE: | |||

| Director Nominee | Ms. Hubbs is a former Executive Vice President and Managing Director of McLean Budden, one of Canada’s largest institutional asset managers, with over $30 billion in assets under management prior to its sale in 2011 to Sun Life Financial. Before joining McLean Budden in 2002, she served as an energy research analyst and investment banker with Gordon Capital, a large Canadian brokerage firm. Ms. Hubbs received Brendan Wood International TopGun Awards in 2010 as one of the Top 50 Portfolio Managers in Canada and in 2011 as one of the TopGun Investment Minds in Oil and Gas in Canada.

Ms. Hubbs is a member of the Canadian Red Cross National Audit and Finance Committee as well as a founding member and the National Co-Chair of the Canadian Red Cross Tiffany Circle Society of Women Leaders. | |||

| Michael McShane Former Chairman, President and Chief Executive Officer, Grant Prideco, Inc. | ||||

Age 60 | SKILLS AND QUALIFICATIONS: | |||

• A seasoned leader and chief financial officer within the energy industry, with expansive knowledge of the oil and gas sectors

• Relationships with chief executives and other senior management at oil and natural gas companies and oilfield service companies around the world

• Former chairman and CEO of a leading North American drill bit technology and drill pipe manufacturer | • Brings to the Board a producer perspective that enhances strategic discussions

• His significant financial and accounting experience makes him highly qualified to serve on our Audit Committee and as Chair of our Finance and Risk Management Committee | |||

Director since 2008 |

KEY EXPERIENCE: | |||

| Mr. McShane served as a director and as President and Chief Executive Officer of Grant Prideco, Inc. from June 2002 and assumed the role of Chairman of the Board of Grant Prideco beginning in May 2004. Mr. McShane retired from Grant Prideco following its acquisition by National Oilwell Varco, Inc. in April 2008. Prior to joining Grant Prideco, Mr. McShane was Senior Vice President-Finance and Chief Financial Officer and director of BJ Services Company LLC beginning in 1998. Mr. McShane serves as an Advisor to Advent International Corporation, a global private equity firm. Mr. McShane also serves as an advisor to TPH Asset Management, LLC. | ||||

OTHER PUBLIC COMPANY DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

Superior Energy Services, Inc. (current); Forum Energy Technologies Inc. (current); and Oasis Petroleum Inc. (current).

| ||||

8 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| PROPOSAL 1: ELECTION OF DIRECTORS Information on Our Nominees

| |

Michael G. Morris Retired Chairman, President and Chief Executive Officer, American Electric Power Company, Inc. | ||||

| SKILLS AND QUALIFICATIONS: | |||

• A seasoned executive responsible for the management of complex, regulated business operations, with significant experience in areas relevant to our business

• Considerable knowledge of the energy industry | • Extensive experience in corporate governance and leadership

• Experience as a senior executive with multi-state gas and electric utility companies | |||

Age 68 | KEY EXPERIENCE: | |||

Director since 2013 | Mr. Morris is the retired Chairman, President and Chief Executive Officer of American Electric Power Company, Inc. (“AEP”). He retired as Chairman of AEP in December 2013 and as Chief Executive Officer of AEP in November 2011. He served as a director of AEP until April 2014. Mr. Morris joined AEP as Chairman, President and Chief Executive Officer in January 2004. Prior to joining AEP, Mr. Morris was Chairman, President and Chief Executive Officer of Northeast Utilities System from 1997 to 2003. Prior to joining Northeast Utilities, Mr. Morris was President and Chief Executive Officer of Consumers Energy, a principal subsidiary of CMS Energy, and President of CMS Marketing, Services and Trading. He was previously President of Colorado Interstate Gas Co. and Executive Vice President of marketing, transportation and gas supply for ANR Pipeline Co., both subsidiaries of El Paso Energy. | |||

OTHER PUBLIC COMPANY DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

Alcoa Inc. (current); L Brands, Inc. (current); and The Hartford Financial Services Group (current). | ||||

| Michael E.J. Phelps Chairman, Dornoch Capital Inc. | ||||

| SKILLS AND QUALIFICATIONS: | |||

• Extensive management, finance and industry experience

• Deep knowledge of the North American energy industry and the political/regulatory environment

• Energy-development experience in Indonesia, China and Mexico

| • Prior experience as chairman and CEO of Westcoast Energy Inc., a Canadian subsidiary of Spectra Energy, is valuable in the development of our business in North America and internationally and in managing cross-border relationships

• Appointed by the Government of Canada to chair a committee to review the regulation of securities markets. | |||

Age 67

Director since 2006 | • Brings a valuable Canadian perspective that is particularly helpful since a substantial portion of our assets and employees are in Canada | |||

KEY EXPERIENCE: | ||||

| Mr. Phelps is Chairman and founder of Dornoch Capital Inc., a private investment company. Prior to forming Dornoch in 2002, he served as President and Chief Executive Officer, and as Chairman and Chief Executive Officer, of Westcoast Energy Inc., Vancouver, BC. He previously served as a director of Canadian Imperial Bank of Commerce, Duke Energy Corporation, Prodigy Gold Incorporated (formerly Kodiak Exploration Ltd.) and Canadian Forest Products. Mr. Phelps has been actively involved in the Interstate Natural Gas Association of America, the North American association representing interstate and interprovincial natural gas pipeline companies. | ||||

OTHER PUBLIC COMPANY DIRECTORSHIPS DURING PAST FIVE YEARS: | ||||

Marathon Oil Corporation (current) and Canadian Pacific Railway Company (former). | ||||

SPECTRA ENERGY CORP2015 PROXY STATEMENT 9

Table of Contents

| ||

Our Board recognizes that excellence in corporate governance is essential to carrying out its responsibilities to our shareholders. The framework for our corporate governance can be found in our Principles for Corporate Governance, our Code of Business Ethics, and the charters of the Audit Committee, the Compensation Committee, the Corporate Governance Committee and the Finance and Risk Management Committee. You can access these governance materials on our website athttp://investors.spectraenergy.com. Click on the “Corporate Governance” link. You can receive printed copies upon request.

In exercising their duties to our shareholders, our Board members should not be conflicted in any way. To minimize potential conflicts, the only member of our Board who is not independent is our Chairman, President and Chief Executive Officer.

In accordance with the standards for companies listed on the New York Stock Exchange (“NYSE”), the Board considers a director to be independent if it has affirmatively determined that the director has no material relationship with Spectra Energy or its consolidated subsidiaries, either directly or as a shareholder, director, officer or employee of an organization that has a relationship with us or our subsidiaries. The Board makes independence determinations when it approves director nominees for election at the Annual Meeting and also whenever a new director joins the Board between Annual Meetings.

For 2014, the Board determined that none of Spectra Energy’s independent directors and Ms. Hubbs as an independent director nominee, nor any member of their immediate families, had a material relationship with our Company or its subsidiaries. All of these independent director nominees (Messrs. Adams, Alvarado, Cazalot, Comper, Hamilton, McShane, Morris, Phelps, and Mses. Carter and Hubbs) are therefore independent under the NYSE’s listing standards. In reaching this conclusion, the Board considered all transactions and relationships between each such nominee (or any member of his or her immediate family) and our Company and its subsidiaries.

To assist in its independence determinations, the Board has adopted specific standards under which certain relationships are deemed not to impair a director’s independence. Please see “Other Information” beginning on page 57 of this proxy statement for more details.

One of the Board’s key responsibilities is determining the appropriate leadership structure for the Board, which helps ensure its effective and independent oversight of management on behalf of the Company’s shareholders. The Board has chosen one independent director, F. Anthony Comper, to serve as its Lead Director, while our President and Chief Executive Officer, Gregory L. Ebel, serves as Chairman of the Board.

We believe that our Board leadership structure is appropriate for Spectra Energy because it allows one person to speak for and lead both the Company and the Board, while also providing for effective oversight by an independent board through an independent lead director. The Board reviews its leadership structure and has the flexibility to revise it at any time as it deems appropriate.

In his role as Lead Director, Mr. Comper has broad authority and responsibility over Board governance and operations. His responsibilities, described in our Principles for Corporate Governance, include:

| • | presiding at Board meetings at which the Chairman is not present, including executive sessions of the independent directors, which are held after each Board meeting; |

| • | consulting with the Chairman on Board meeting agendas; |

| • | calling meetings of independent directors and setting agendas for executive sessions; |

10 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| CORPORATE GOVERNANCE Risk Oversight

| |

| • | serving as a liaison between the Chairman and the independent directors; |

| • | approving meeting schedules to ensure that there is sufficient time for discussions; and |

| • | representing the Board from time to time in consultations or direct communications with shareholders. |

The Board is responsible for overseeing our risk management process. Acting as a whole, the Board exercises its oversight responsibility with respect to certain business risks that we face, including strategic and competitive risks and risks related to succession of our Chief Executive Officer and other members of management. The Board exercises additional risk oversight responsibilities through its committees, which are comprised solely of independent directors. Each such committee has primary risk oversight responsibility with respect to all matters within the scope of its duties as contemplated by its charter and as described in the table below.

| Board Committee | Areas of Risk Oversight | Additional Information | ||

Audit Committee | Financial reporting, internal control, legal, compliance and technology risks | Receives regular reports from management regarding risks faced in our business, including operational and project risks. As noted below, the Finance and Risk Management Committee also receives these types of reports. | ||

| Compensation Committee | Compensation programs | Management has undertaken, and the Compensation Committee has reviewed, an evaluation of any incentives created by our compensation programs that may encourage our employees to take risks. Based upon that evaluation, the Committee has concluded that Spectra Energy’s compensation programs do not encourage unnecessary or excessive risks that are reasonably likely to result in a material adverse effect on the Company. | ||

| Finance and Risk Management Committee | Credit, commodity, environment, health & safety, financial risks; and overseeing company-wide risk management and risk management governance structure | Together with the Audit Committee, receives regular reports from management regarding risks our business faces, including operational and project risks. |

Our Board held seven meetings during 2014 and the committees of the Board met a total of 26 times. All of the directors attended at least 90% of the meetings of the Board and meetings of the committees on which they served during fiscal year 2014. Directors are encouraged to attend the Annual Meeting, and all Board members attended our 2014 Annual Meeting.

SPECTRA ENERGY CORP2015 PROXY STATEMENT 11

Table of Contents

| CORPORATE GOVERNANCE Board Committees

| |

The Board has four standing committees – Audit; Compensation; Corporate Governance; and Finance and Risk Management. Each committee operates under a written charter adopted by the Board. The charters are posted on our website athttp://investors.spectraenergy.com in the “Corporate Governance” section. The charters are available in print to any shareholder upon request.

| Audit Committee | ||||

Chair Hamilton

Other Members Adams Comper McShane

9 Meetings Held in 2014 | The Audit Committee’s responsibilities include:

| |||

• selecting and hiring an independent public accounting firm to conduct audits of our accounting and financial reporting activities and those of our subsidiaries

• approving all audit and permissiblenon-audit services that our accounting firm provides

• reviewing with the accounting firm the scope and results of its audits | • reviewing with the accounting firm our accounting procedures, internal controls, and accounting and financial reporting policies and practices, as well as those of our subsidiaries

• reporting and making recommendations to the Board as it deems appropriate

• providing oversight for all matters related to the security of information technology systems and procedures

• overseeing our ethics and compliance activities

| |||

See page 21 for additional information on the Audit Committee’s pre-approval policy.

The Board has determined that each member of the Audit Committee is “independent” under the NYSE’s listing standards, applicable securities regulations, and the Company’s categorical standards for independence. The Board has also determined that Messrs. Comper, Hamilton and McShane are “audit committee financial experts” as defined by the Securities and Exchange Commission (“SEC”).

| ||||

| Compensation Committee | ||||

Chair Phelps

Other Members Alvarado Carter Cazalot Morris

5 Meetings Held in 2014 | The Compensation Committee’s responsibilities include:

| |||

• establishing and reviewing our overall executive compensation philosophy and approving changes to our compensation program

• reviewing and approving corporate goals and objectives relevant to our CEO’s compensation and evaluating his performance in light of those goals and objectives

• reviewing and approving annual salaries, short-term and long-term incentive opportunities, and results and other benefits for our CEO and other executive officers

• reviewing and approving any agreement that we enter into with an executive officer | • approving equity grants under our Long-Term Incentive Plan

• reviewing and discussing with management our compensation-related disclosures | |||

The Board has determined that each member of the Compensation Committee is “independent” under the NYSE’s listing standards and the Company’s categorical standards for independence, a “non-employee director” under the Securities Exchange Act Rule 16b-3, and an “outside director” as defined in Section 162(m) of the Internal Revenue Code.

| ||||

12 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| CORPORATE GOVERNANCE Board and Committee Performance Evaluations

| |

| Corporate Governance Committee | ||||

Chair Carter

Other Members Adams Comper Hamilton

5 Meetings Held in 2014 | The Corporate Governance Committee’s responsibilities include:

| |||

• making recommendations on the size and composition of the Board and its committees

• making recommendations on the compensation of independent directors

• recommending potential CEO candidates as part of our succession-planning process

• recommending qualified and suitable individuals to fill Board vacancies when they occur (and hiring external search firms or other third parties to help identify and evaluate potential nominees) | • recommending the slate of director nominees for each year’s Annual Meeting, including any nominees recommended by shareholders

• overseeing the self-evaluation of the Board and its committees

• reviewing any conflict of interest involving officers and directors | |||

The Board has determined that each member of the Corporate Governance Committee is “independent” under the NYSE’s listing standards and the Company’s categorical standards for independence.

| ||||

| Finance and Risk Management Committee | ||||

Chair McShane

Other Members Alvarado Cazalot Morris Phelps

6 Meetings Held in 2014 | The Finance and Risk Management Committee’s responsibilities include:

| |||

• reviewing our overall financial and fiscal affairs and making recommendations to the Board regarding dividends, financing and fiscal policies

• reviewing our financial exposure and the strategies used to mitigate risk

• reviewing our risk exposure as it relates to earnings and to the overall corporate portfolio

• reviewing the financial impacts of major transactions such as mergers, acquisitions, reorganizations and divestitures | • overseeing enterprise risk management

• overseeing management of environmental, health and safety matters | |||

Board and Committee Performance Evaluations

In 2014, as they do each year, the Board and its standing committees conducted self-evaluations of their performance. The Corporate Governance Committee oversaw these performance evaluations, which were also discussed with the full Board. These self-evaluations did not suggest a need for any material changes to the processes and governance procedures of the Board or its Committees.

SPECTRA ENERGY CORP2015 PROXY STATEMENT 13

Table of Contents

| CORPORATE GOVERNANCE Transactions with Related Persons

| |

Transactions with Related Persons

The Board is responsible for the oversight and approval (or ratification) of any “related-person transactions.” These are transactions, relationships or arrangements involving the Company in which any “related person” has a direct or indirect material interest. For this purpose, the following persons are considered “related” to the Company:

| • | our directors, director nominees, executive officers, and their immediate family members; |

| • | beneficial owners of more than 5% of our common stock and their immediate family members; and |

| • | entities in which a person described above is employed, has a substantial interest, or holds a position such as general partner or principal. |

Under the Board’s written procedures for the reporting, review and approval of related-person transactions, the Corporate Governance Committee evaluates these transactions and approves only those that it believes are consistent with the best interests of the Company and its shareholders as the Committee determines in good faith. The Committee bases this evaluation on all relevant factors, including:

| • | the benefits of the transaction to the Company; |

| • | the terms of the transaction and whether they were made on an arm’s-length basis and in the ordinary course of the Company’s business; |

| • | the direct or indirect nature of the related person’s interest in the transaction; |

| • | the size and expected term of the transaction; and |

| • | other facts and circumstances that bear on the materiality of the transaction under applicable laws and listing standards. |

14 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

Report of the Corporate Governance Committee

The following report of the Corporate Governance Committee describes its philosophy, its responsibilities, and certain of its policies relating to the Board.

Philosophy

The Corporate Governance Committee believes that sound corporate governance has three components:

| • | Board independence; |

| • | processes and practices that foster solid decision-making by both management and the Board; and |

| • | balancing the interests of all of our stakeholders – our investors, customers, employees, the communities we serve and the environment. |

The Committee’s charter is available on our website athttp://investors.spectraenergy.com/ in the “Corporate Governance” section. The Committee’s charter is summarized below.

Membership

The Corporate Governance Committee must have three or more members, all of whom must qualify as independent directors under the listing standards of the NYSE and other applicable rules and regulations.

Responsibilities

The Committee’s responsibilities include, among other things:

| • | implementing policies regarding corporate governance matters; |

| • | assessing the Board’s membership needs and recommending nominees; |

| • | recommending to the Board those directors to be selected for membership on, or removal from, the various Board committees and those directors to be designated as chairs of Board committees; |

| • | recommending compensation of independent directors; |

| • | reviewing or approving related party transactions; and |

| • | sponsoring and overseeing performance evaluations for the various Board committees, the Board as a whole, and the directors and management, including the Chief Executive Officer. |

The Committee may conduct or authorize investigations or studies of matters within the scope of the Committee’s duties and responsibilities, and may retain, at the Company’s expense and at the Committee’s sole discretion, consultants and attorneys to assist in such work as the Committee deems necessary. In addition, the Committee has the sole authority to retain or terminate any search firm to be used to identify director candidates, including the sole authority to approve the search firm’s fees and other retention terms, with such fees to be borne by the Company. Finally, the Committee conducts an annual self-evaluation of its performance.

SPECTRA ENERGY CORP2015 PROXY STATEMENT 15

Table of Contents

| REPORT OF THE CORPORATE GOVERNANCE COMMITTEE Director Candidates

| |

Director Candidates

Profile

While the Committee has not prescribed standards for considering diversity, as a matter of practice, the Committee looks for diverse nominees who can enhance perspective and experience through diversity in gender, ethnic background, geographic origin and professional experience. The Committee looks for the following characteristics in any candidate for nominee to serve on our Board:

| • | fundamental qualities of intelligence, perceptiveness, good judgment, maturity, high ethics and standards, integrity and fairness; |

| • | a genuine interest in the Company and a recognition that, as a member of the Board, one is accountable to the Company’s shareholders as a whole; |

| • | a background that includes broad business experience or demonstrates an understanding of business and financial affairs and the complexities of a large, multifaceted, global business organization; |

| • | experience as a present or former chief executive officer, chief operating officer, or substantially equivalent level executive officer of a highly complex organization such as a corporation, university or major unit of government, or as a professional who regularly advises such organizations; |

| • | no conflict of interest or impediment that would interfere with the duty of loyalty owed to the Company and its shareholders; |

| • | the ability and willingness to spend the time required to function effectively as a director; |

| • | compatibility and ability to work well with other directors and executives in a team effort with a view to a long-term relationship with the Company as a director; |

| • | independent judgment and willingness to express views in a constructive manner; and |

| • | diversity and the extent to which the nominee would fill a present need on the Board. |

Identifying Nominees

As noted above, the Committee may engage a third party from time to time to assist it in identifying and evaluating new director candidates. Based on surveys of the then-current Board members and the profile described above, the Committee will advise the third party of the characteristics, skills and experiences that may complement those of our existing members. The third party will then recommend nominees having such attributes. All of the nominees on the proxy card are current members of our Board and were recommended by the Committee, except for Ms. Hubbs, who was nominated by the Committee for her initial election at the Annual Meeting. Ms Hubbs was recommended by a current member of the Board.

Nominations by Shareholders

The Committee considers nominees recommended by shareholders on a similar basis as it does nominees recommended by other third parties, taking into account, among other things, the profile criteria described above and the nominee’s experiences and skills. In addition, the Committee considers the shareholder nominee’s independence with respect to both the Company and the nominating shareholder. Shareholders interested in submitting nominees for the Board will need to provide timely written notice to the Corporate Governance Committee, c/o Corporate Secretary, Spectra Energy Corp, 5400 Westheimer Court, Houston, Texas 77056. Our Corporate Secretary must receive this notice not less than 90 or more than 120 days prior to the anniversary of the Annual Meeting.

Under our By-Laws, the notice must include certain information about the nominee. You can access the By-Laws on our website athttp://investors.spectraenergy.com. Click on the “Corporate Governance” link.

16 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| REPORT OF THE CORPORATE GOVERNANCE COMMITTEE Resignation Policy

| |

Resignation Policy

In an uncontested election, any nominee for director who receives a greater number of votes “against” his or her election than votes “for” such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance Committee is then required to make recommendations to the Board with respect to any such letter of resignation. The Board is required to take action with respect to this recommendation and to disclose its decision-making process. Full details of this policy are set out in our Principles for Corporate Governance, which is posted on our website athttp://investors.spectraenergy.com/ in the “Corporate Governance” section.

Communications with Directors

Interested parties can communicate with any of our directors by writing to our Corporate Secretary at the following address:

Corporate Secretary

Spectra Energy Corp

5400 Westheimer Court

Houston, TX 77056

Our Corporate Secretary will distribute communications to the Board, to an individual director or to selected directors, depending on the content of the communication. In accordance with rules of the NYSE, interested parties wishing to communicate only with the non-management or independent directors can address their communications to “Independent Directors, c/o Corporate Secretary” at the above-mentioned address. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board be excluded, such as: spam; junk mail and mass mailings; service complaints; resumes and other forms of job inquiries; surveys; and business solicitations or advertisements. In addition, material that is unduly hostile, threatening, obscene or similarly unsuitable will be excluded. However, any communication that is so excluded remains available to any director upon request.

Corporate Governance Committee

Pamela L. Carter (Chair)

Austin A. Adams

F. Anthony Comper

Peter B. Hamilton

SPECTRA ENERGY CORP2015 PROXY STATEMENT 17

Table of Contents

| ||

Compensation Structure for Non-Employee Directors

We use a combination of cash and stock-based compensation to attract and retain qualified candidates to serve on our Board. In making its recommendation on independent director compensation, the Corporate Governance Committee considers peer and general industry data, including an analysis of director compensation provided by an independent consultant. Under our stock ownership policy, outside directors are required to own 15,000 shares of the Company’s common stock (or common stock equivalents) within five years after becoming subject to the policy. At the end of 2014, all directors had met the targeted ownership level, except for Messrs. Alvarado and Cazalot, who are on track to reach the targeted ownership level within the five-year period. Our Chairman, President and Chief Executive Officer does not receive compensation for his services as a director.

2014 DIRECTOR COMPENSATION STRUCTURE

| Type | Amount | |

| Annual retainer for all non-employee directors | $120,000 in Spectra Energy shares* $105,000 in cash | |

| Retainers for Committee Chairs | Corporate Governance Committee: $10,000 (cash) All other committees: $15,000 (cash) | |

Retainer for Lead Director | $30,000 (cash) |

| * | Valued at the NYSE closing price on the date of grant. |

Charitable Giving Program. Under the Spectra Energy Foundation Matching Gifts Program, the Company will match contributions to qualifying institutions of up to $7,500 per director per calendar year. In 2014, the Spectra Energy Foundation made matching charitable contributions on behalf of Messrs. Adams, Alvarado, Comper, Esrey, Hamilton, Morris and Phelps,respectively.

Expense Reimbursement. The Company reimburses non-employee directors for expenses they reasonably incur in connection with attending and participating in Board and Committee meetings, director education conferences and seminars, and special functions.

2014 COMPENSATION OF NON-EMPLOYEE DIRECTORS

| Name | Fees Earned or ($) | Stock Awards ($)(2) | Options Awards ($) | Change in Compensation Earnings ($) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||||

A. Adams | 105,000 | 120,006 | — | — | 4,000 | 229,006 | ||||||||||||||||||

J. Alvarado | 105,000 | 120,006 | — | — | 4,500 | 229,506 | ||||||||||||||||||

P. Carter | 115,000 | 120,006 | — | — | — | 235,006 | ||||||||||||||||||

C. Cazalot | 105,000 | 120,006 | — | — | — | 225,006 | ||||||||||||||||||

F. Comper | 125,000 | 120,006 | — | — | 5,000 | 250,006 | ||||||||||||||||||

W. Esrey(1) | 118,333 | — | — | — | 610,750 | (4) | 729,083 | |||||||||||||||||

P. Hamilton | 120,000 | 120,006 | — | — | 4,750 | 244,756 | ||||||||||||||||||

D. Hendrix(1) | 35,000 | — | — | — | — | 35,000 | ||||||||||||||||||

M. McShane | 120,000 | 120,006 | — | — | — | 240,006 | ||||||||||||||||||

M. Morris | 105,000 | 120,006 | — | — | 5,000 | 230,006 | ||||||||||||||||||

M. Phelps | 120,000 | 120,006 | — | — | 15,000 | (5) | 255,006 | |||||||||||||||||

| (1) | Messrs. Esrey and Hendrix retired from the Board at the 2014 Annual Meeting. |

| (2) | This column reflects the aggregate grant date fair value of the stock awarded, computed in accordance with FASB ASC Topic 718. |

| (3) | This column reflects matching charitable contributions made in 2014 pursuant to the Spectra Energy Foundation Matching Gifts Program, which matches contributions made by our directors to qualifying institutions up to $7,500 per director per calendar year. |

| (4) | $601,000 of which relates to a charitable contribution made on behalf of Mr. Esrey under the Director’s Charitable Program upon his retirement. Under this program, the Company could make charitable donations of up to $1,000,000 upon Mr. Esrey’s death, or at Mr. Esrey’s request, during his lifetime. The maximum donation made upon his retirement was reduced to an actuarially-determined net present value basis. |

| (5) | $7,500 of which related to a 2013 charitable contribution. |

The value of all perquisites and other personal benefits or property received by each non-employee director in 2014 was less than $5,000 and is not included in the above table.

18 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

The following table shows, as of January 31, 2015, the amount of our common stock beneficially owned by our directors, the executive officers listed in the Summary Compensation Table under “Compensation Tables” on page 43 (referred to as the “Named Executive Officers”), and by all directors and executive officers as a group. The table also shows the number of common units of SEP beneficially owned by these individuals. SEP is a publicly traded master limited partnership in which Spectra Energy Corp owns approximately 82% of the outstanding equity interest.

| Name or Beneficial Owner | Number of Shares Held | Number of Shares Acquirable within 60 days | Total Shares Beneficially Owned | Percent of Class | Total Units of SEP Beneficially Owned | |||||||||||||||

Dorothy M. Ables | 138,328 | 41,500 | 179,828 | * | 4,353 | |||||||||||||||

Austin A. Adams | 46,676 | — | 46,676 | * | 909 | |||||||||||||||

Joseph Alvarado | 14,215 | — | 14,215 | * | — | |||||||||||||||

Pamela L. Carter | 32,344 | — | 32,344 | * | 909 | |||||||||||||||

Clarence P. Cazalot Jr | 4,941 | — | 4,941 | * | — | |||||||||||||||

F. Anthony Comper | 34,151 | — | 34,151 | * | 348 | |||||||||||||||

Gregory L. Ebel | 207,921 | 131,672 | 339,593 | (1) | * | 5,766 | ||||||||||||||

Peter B. Hamilton | 31,374 | — | 31,374 | * | 909 | |||||||||||||||

Reginald D. Hedgebeth | 107,795 | 11,600 | 119,395 | * | — | |||||||||||||||

Miranda C. Hubbs | — | — | — | — | ||||||||||||||||

Michael McShane | 25,257 | — | 25,257 | * | — | |||||||||||||||

Michael G. Morris | 16,287 | — | 16,287 | * | 11,900 | |||||||||||||||

Michael E. J. Phelps | 86,716 | — | 86,716 | * | — | |||||||||||||||

J. Patrick Reddy | 85,502 | 13,200 | 98,702 | (1) | * | — | ||||||||||||||

William T. Yardley | 53,020 | 32,300 | 85,320 | * | 540 | |||||||||||||||

Directors and executive | 884,527 | 230,272 | 1,114,799 | * | 25,634 | |||||||||||||||

| * | Represents less than 1%. |

| (1) | Messrs. Ebel and Reddy beneficially own additional 1,400 and 88,801 shares, respectively, in a Company-sponsored deferred compensation plan. Generally, those shares will be paid out six months following their separation from service. |

The following table lists the beneficial owners of more than 5% of the outstanding shares of Spectra Energy common stock as of March 10, 2015. This information is based on the most recently available reports filed with the SEC.

| Shares of common stock | ||||||||

| Name and Address of Beneficial Owner | Beneficially Owned | Percentage | ||||||

The Vanguard Group(1) 100 Vanguard Blvd., Malvern, PA 19355 | 37,111,669 | 5.53% | ||||||

BlackRock, Inc.(2) 55 East 52nd Street, New York, NY 10022 | 42,464,367 | 6.3% | ||||||

| (1) | According to the Schedule 13G filed on February 11, 2015 by The Vanguard Group, these shares are beneficially owned by its clients, and it has sole voting power with respect to 1,194,838 shares, sole dispositive power with respect to 36,025,350 shares and shared dispositive power with respect to 1,086,319 shares. |

| (2) | According to the Schedule 13G/A filed on February 9, 2015 by BlackRock Inc., these shares are beneficially owned by its clients, and it has sole voting power with respect to 36,396,747 shares and sole dispositive power with respect to all the shares. |

SPECTRA ENERGY CORP2015 PROXY STATEMENT 19

Table of Contents

| ||

Ratification of Appointment of Independent Registered Public Accounting Firm for Fiscal Year 2015

Although our By-Laws do not require that the Company’s shareholders ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, the Board is submitting the appointment of Deloitte & Touche LLP to the Company’s shareholders for ratification as a matter of good corporate governance. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Deloitte & Touche LLP.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.

The following table presents fees for professional services rendered by Deloitte & Touche LLP, and the member firms of Deloitte Touche Tohmatsu and their respective affiliates (collectively, “Deloitte”) to the Company for 2014 and 2013:

| Type of Fees (in millions) | 2014 | 2013 | ||||||

Audit Fees(a) | $8.4 | $8.2 | ||||||

Audit-Related Fees(b) | $0.8 | $1.7 | ||||||

Tax Fees(c) | $1.0 | $1.7 | ||||||

All Other Fees(d) | $0.1 | $0.1 | ||||||

Total | $10.3 | $11.7 | ||||||

| (a) | Audit Fees are fees billed or expected to be billed by Deloitte for professional services for the audit of our Consolidated Financial Statements (including associated fees for our consolidated master limited partnership, SEP) included in our Annual Report on Form 10-K and review of financial statements included in our quarterly reports on Form 10-Q, services that are normally provided by Deloitte in connection with statutory, regulatory or other filings or engagements or any other service performed by Deloitte to comply with generally accepted auditing standards. Audit Fees also include fees billed or expected to be billed by Deloitte for professional services for the audit of our internal controls under the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. |

| (b) | Audit-Related Fees are fees billed by Deloitte for assurance and other services that are reasonably related to the performance of an audit or review of our financial statements, including assistance with acquisitions and divestitures, and internal control reviews. Audit-Related Fees also include comfort and consent letters in connection with SEC filings and financing transactions. |

| (c) | Tax Fees are fees billed by Deloitte for tax-return assistance and preparation, tax-examination assistance, and professional services related to tax planning and tax strategy. |

| (d) | All Other Fees are fees billed by Deloitte for any services not included in the first three categories, primarily translation of audited financials into foreign languages. |

20 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2015

| |

| To safeguard the continued independence of our independent auditor, our Audit Committee adopted a policy that prevents our independent auditor from providing services to us and our subsidiaries that are prohibited under Section 10A(g) of the Securities Exchange Act of 1934 (“Exchange Act”). This policy also provides that the independent auditor is only permitted to provide services to us and our subsidiaries that have been pre-approved by our Audit Committee or the Audit Committee of SEP. Pursuant to the policy, all audit services require advance approval by these audit committees. | Our Audit Committee’s Charter describes its responsibilities and is available on our website at http://investors.spectraenergy.com/ in the“Corporate Governance” section

|

All other services by the independent auditor that fall within certain designated dollar thresholds, both per engagement as well as annual aggregate, have been pre-approved under the policy. Different dollar thresholds apply to the three categories of pre-approved services specified in the policy (Audit-Related services, Tax services and Other services). All services that exceed the dollar thresholds must be approved in advance by our Audit Committee or the Audit Committee of SEP. Pursuant to applicable provisions of the Exchange Act, the audit committees have delegated approval authority to the Chairman of each audit committee. The Chairman has presented all approval decisions to the full audit committee. All engagements performed by the independent auditor were approved by the audit committee pursuant to its pre-approval policy.

SPECTRA ENERGY CORP2015 PROXY STATEMENT 21

Table of Contents

| ||

The Audit Committee assists the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions. Management has the primary responsibility for establishing and maintaining adequate internal financial controls, for preparing the financial statements and for the public reporting process. Deloitte is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States, as well as expressing an opinion on the effectiveness of internal control over financial reporting.

In this context:

| • | the Audit Committee has reviewed and discussed with management and Deloitte the Company’s audited financial statements for the year ended December 31, 2014 and Deloitte’s evaluation of the Company’s internal controls over financial reporting; |

| • | the Audit Committee has discussed with Deloitte the matters that are required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standards No. 16,Communications with Audit Committee; |

| • | Deloitte has provided the Audit Committee with written disclosures and the PCAOB-required letter regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with Deloitte that firm’s independence; and |

| • | the Audit Committee has concluded that Deloitte’s provision of audit and non-audit services to the Company and its affiliates is compatible with Deloitte’s independence. |

Based on the review and discussions referenced above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s 2014 Annual Report on Form 10-K, for filing with the SEC.

This report is provided by the following independent directors who comprise the Audit Committee:

Peter B. Hamilton (Chair)

Austin A. Adams

F. Anthony Comper

Michael McShane

22 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

Advisory Vote Approving Executive Compensation

As required by Section 14A of the Exchange Act, we are asking our shareholders to provide an advisory, non-binding vote to approve the compensation of our Named Executive Officers. We conduct an advisory vote approving executive compensation at each year’s Annual Meeting. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and our compensation-related policies and practices as described in this proxy statement.

We ask that, as you consider your vote, you review the Compensation Discussion and Analysis on the following pages and the compensation tables that begin on page 43. We designed our compensation programs to attract, retain and incentivize executives of high caliber who create value for our shareholders.

We therefore ask that you vote to approve the compensation of our Named Executive Officers as disclosed in this proxy statement. This vote is advisory and not binding on the Company, the Compensation Committee or the Board. However, the Board and the Compensation Committee value the opinions of the Company’s shareholders and expect to consider the outcome of the vote, along with other relevant factors, when considering future executive compensation decisions.

RESOLVED, that the shareholders approve the compensation awarded to the Company’s Named Executive Officers for 2014, as disclosed under SEC rules, including the Compensation Discussion and Analysis, the Compensation Tables and related material included in this proxy statement.

SPECTRA ENERGY CORP2015 PROXY STATEMENT 23

Table of Contents

| ||

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the following Compensation Discussion and Analysis with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement. This report is provided by the following independent directors who comprise the Compensation Committee:

Michael E. J. Phelps (Chair)

Joseph Alvarado

Pamela L. Carter

Clarence P. Cazalot Jr

Michael G. Morris

24 SPECTRA ENERGY CORP2015 PROXY STATEMENT

Table of Contents

| ||

Compensation Discussion and Analysis

In this section, we describe the design and purpose of the compensation programs that apply to the executive officers of Spectra Energy who are listed in the Summary Compensation Table on page 43. We refer to these officers as our Named Executive Officers. They are:

| • | Gregory L. Ebel, Chairman, President and Chief Executive Officer |

| • | J. Patrick Reddy, Chief Financial Officer |

| • | Reginald D. Hedgebeth, General Counsel and Chief Ethics & Compliance Officer |

| • | William T. Yardley, President, U.S. Transmission |

| • | Dorothy M. Ables, Chief Administrative Officer |

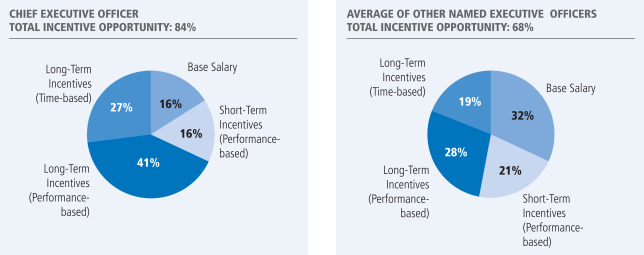

| u | Target pay opportunities for our executives are established within range of the median of Peer Group information and the markets in which we compete for talent. |

| u | Our direct compensation program consists of 1) base salary, 2) short-term incentives and 3) long-term incentives, with the incentive compensation elements representing a clear alignment with pay for performance. |

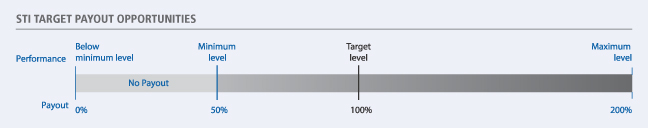

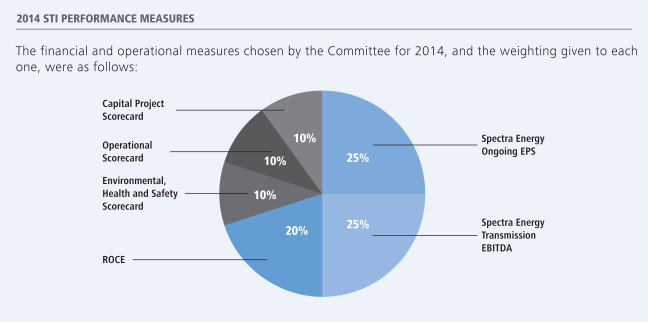

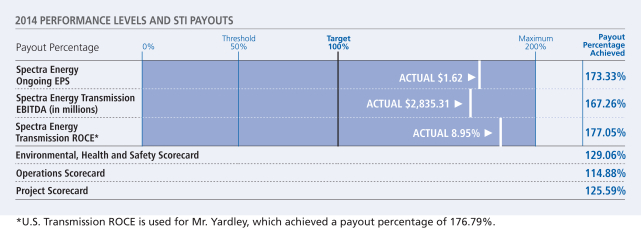

| u | The financial and operating objectives in our short-term incentive program focus management on critical performance levers that drive shareholder value. For 2014, we exceeded all of our short-term objectives by generating strong earnings and cash flows from our fee-based assets, executing on capital expansion plans, operating our assets reliably and achieving an all-time |

high in our safety results. Please see pages 34-37 for more information about our short-term incentive objectives and results. |

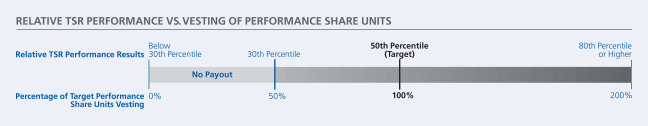

| u | In spite of excellent 2014 financial and operational results, our share price was more sensitive to energy price volatility than many of our peers and in the last quarter of 2014, total shareholder return for our 2012-2014 long-term performance cycle fell from 41.42% to 34.60%. This last quarter change resulted in goal achievement moving from an above-target payout of approximately 140% tono payout for performance shares. |

| u | As a result, consistent with our pay for performance philosophy and alignment with our shareholders, we achieved above-target payout on short-term incentives and zero payout on performance shares. |

Summary of Compensation Philosophy

We believe that the successful execution of our strategy should result in enhanced shareholder value. Our executive compensation programs are designed to attract and retain executives who are highly qualified to carry out our strategy and to create incentives that link to our strategic direction.

To achieve these objectives, we design compensation opportunities for executives based on the following principles:

| u | Compensation programs should support the accomplishment of our strategic goals. |

| u | The majority of compensation available for our Named Executive Officers should be contingent on the Company’s attainment of pre-established performance objectives, both short-term and long-term. |

| u | Compensation opportunities should be aligned with the interests of shareholders, and incentive programs should be designed in consideration of their impact on shareholders, both immediately and in the long-term. |

| u | Compensation opportunities – as measured by the sum of salary, short-term cash incentive target, and the targeted value of long-term compensation awards – should be sufficiently competitive (in relation to the median of the markets in which we compete for executives) to attract, retain and incentivize Spectra Energy’s executives. |

| u | Fringe benefits, perquisite programs and other forms of indirect compensation should be minimized. |

SPECTRA ENERGY CORP2015 PROXY STATEMENT 25

Table of Contents

| COMPENSATION DISCUSSION AND ANALYSIS Summary of Compensation Philosophy

| |

Overview of 2014 Company Performance

Throughout 2014, we continued to successfully execute the long-term strategies we outlined for our shareholders – meeting the needs of our customers, generating strong earnings and cash flows from our fee-based assets, executing capital expansion plans that underlie our growth objectives, and maintaining a strong balance sheet. Again in 2014, these results, combined with future growth opportunities, led our Board of Directors to approve an increase in our quarterly dividend effective with the last quarter of 2014 to $0.37 per share, or $1.48 per share annually. The new dividend level represents an increase of more than 10% from the previous quarter.

Many additional accomplishments marked our success in 2014. We successfully delivered a slate of new projects into service. In total during 2014, we placed $800 million of growth projects into service. Also, we supplemented our backlog of new projects by securing $3.5 billion in new fee-based projects with long-term contracts.

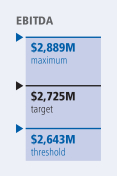

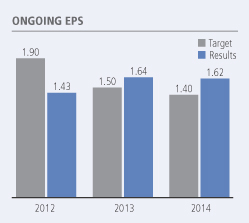

Successful execution of our 2014 projects allowed us to continue to achieve aggregate returns over the last eight years consistent with our targeted return on capital employed or ROCE range, having invested $2.3 billion of capital and investment expenditures in 2014, including $1.5 billion of expansion capital expenditures. We delivered EPS, earnings before interest taxes depreciation and amortization (“EBITDA”) and ROCE that exceeded our targeted amounts under our 2014 Short-Term Incentive Plan as well as exceeded the target for our operational and project results. We are pleased with our record of operating our assets reliably and safely, achieving an all-time record result for safety in 2014.