Enbridge Inc. and Spectra Energy Corp Combine to Create North America’s Premier Energy Infrastructure Company Investor Presentation September 6, 2016 All figures presented in Canadian dollars, unless otherwise specified Filed by Enbridge Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Spectra Energy Corp (Commission File No. 1-33007)

Legal Disclaimer This presentation includes certain forward looking statements and information (FLI) to provide Enbridge and Spectra Energy shareholders and potential investors with information about Enbridge, Spectra Energy and their respective subsidiaries and affiliates, including each company’s management’s respective assessment of Enbridge, Spectra Energy and their respective subsidiaries’ future plans and operations, which FLI may not be appropriate for other purposes. FLI is typically identified by words such as “anticipate”, “expect”, “project”, “estimate”, “forecast”, “plan”, “intend”, “target”, “believe”, “likely” and similar words suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact may be FLI. In particular, this news release contains FLI pertaining to, but not limited to, information with respect to the following: the Transaction; the combined company’s scale, financial flexibility and growth program; future business prospects and performance; annual cost, revenue and financing benefits; the expectation that the Transaction will be neutral to expected ACFFO per share growth guidance through 2019 and additive to the growth rate beyond that timeframe; future shareholder returns; annual dividend growth and anticipated dividend increases; payout of distributable cash flow; financial strength and ability to fund capital program and compete for growth projects; run-rate and tax synergies; leadership and governance structure; and head office and business center locations. Although we believe that the FLI is reasonable based on the information available today and processes used to prepare it, such statements are not guarantees of future performance and you are cautioned against placing undue reliance on FLI. By its nature, FLI involves a variety of assumptions, which are based upon factors that may be difficult to predict and that may involve known and unknown risks and uncertainties and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by these FLI, including, but not limited to, the following: the timing and completion of the Transaction, including receipt of regulatory and shareholder approvals and the satisfaction of other conditions precedent; interloper risk; the realization of anticipated benefits and synergies of the Transaction and the timing thereof; the success of integration plans; the focus of management time and attention on the Transaction and other disruptions arising from the Transaction; expected future ACFFO; estimated future dividends; financial strength and flexibility; debt and equity market conditions, including the ability to access capital markets on favourable terms or at all; cost of debt and equity capital; potential changes in the Enbridge share price which may negatively impact the value of consideration offered to Spectra Energy shareholders; expected supply and demand for crude oil, natural gas, natural gas liquids and renewable energy; prices of crude oil, natural gas, natural gas liquids and renewable energy; economic and competitive conditions; expected exchange rates; inflation; interest rates; tax rates and changes; completion of growth projects; anticipated in-service dates; capital project funding; success of hedging activities; the ability of management of Enbridge, its subsidiaries and affiliates to execute key priorities, including those in connection with the Transaction; availability and price of labour and construction materials; operational performance and reliability; customer, shareholder, regulatory and other stakeholder approvals and support; regulatory and legislative decisions and actions; public opinion; and weather. We caution that the foregoing list of factors is not exhaustive. Additional information about these and other assumptions, risks and uncertainties can be found in applicable filings with Canadian and U.S. securities regulators, including any proxy statement, prospectus or registration statement to be filed in connection with the Transaction. Due to the interdependencies and correlation of these factors, as well as other factors, the impact of any one assumption, risk or uncertainty on FLI cannot be determined with certainty. Except to the extent required by law, we assume no obligation to publicly update or revise any FLI, whether as a result of new information, future events or otherwise. All FLI in this news release is expressly qualified in its entirety by these cautionary statements. This presentation makes reference to non-GAAP measures, including ACFFO and ACFFO per share. ACFFO is defined as cash flow provided by operating activities before changes in operating assets and liabilities (including changes in environmental liabilities) less distributions to non-controlling interests and redeemable non-controlling interests, preference share dividends and maintenance capital expenditures, and further adjusted for unusual, non-recurring or non-operating factors. Management of Enbridge believes the presentation of these measures gives useful information to investors and shareholders as they provide increased transparency and insight into the performance of Enbridge. Management of Enbridge uses ACFFO to assess performance and to set its dividend payout target. These measures are not measures that have a standardized meaning prescribed by generally accepted accounting principles in the United States of America (U.S. GAAP) and may not be comparable with similar measures presented by other issuers. Additional information on Enbridge’s use of non-GAAP measures can be found in Enbridge’s Management’s Discussion and Analysis (MD&A) available on Enbridge’s website and www.sedar.com. Enbridge will file with the U.S. Securities and Exchange Commission (SEC) a registration statement on Form F-4, which will include a proxy statement of Spectra Energy that also constitutes a prospectus of Enbridge, and any other documents in connection with the Transaction. The definitive proxy statement/prospectus will be sent to the shareholders of Spectra Energy. INVESTORS AND SHAREHOLDERS OF SPECTRA ENERGY ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT Enbridge, Spectra Energy, THE TRANSACTION AND RELATED MATTERS. The registration statement and proxy statement/prospectus and other documents filed by Enbridge and Spectra Energy with the SEC, when filed, will be available free of charge at the SEC's website at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents which will be filed with the SEC by Enbridge on Enbridge’s website at www.Enbridge.com or upon written request to Enbridge’s Investor Relations department, 200, 425 First St. SW, Calgary, AB T2P 3L8 or by calling 800.481.2804 within North America and 403.231.5957 from outside North America, and will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by Spectra Energy upon written request to Spectra Energy, Investor Relations, 5400 Westheimer Ct. Houston, TX 77056 or by calling 713.627.4610. You may also read and copy any reports, statements and other information filed by Spectra Energy and Enbridge with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 800.732.0330 or visit the SEC's website for further information on its public reference room. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is not a solicitation of proxies in connection with the Transaction. However, Enbridge, Spectra Energy, certain of their respective directors and executive officers and certain other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies in connection with the Transaction. Information about Enbridge’s directors and executive officers may be found in its Management Information Circular dated March 8, 2016 available on its website at www.Enbridge.com and at www.sedar.com. Information about Spectra Energy's directors, executive officers and other members of management and employees may be found in its 2015 Annual Report on Form 10-K filed with the SEC on February 25, 2016, and definitive proxy statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on March 16, 2016. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the Transaction will be included in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

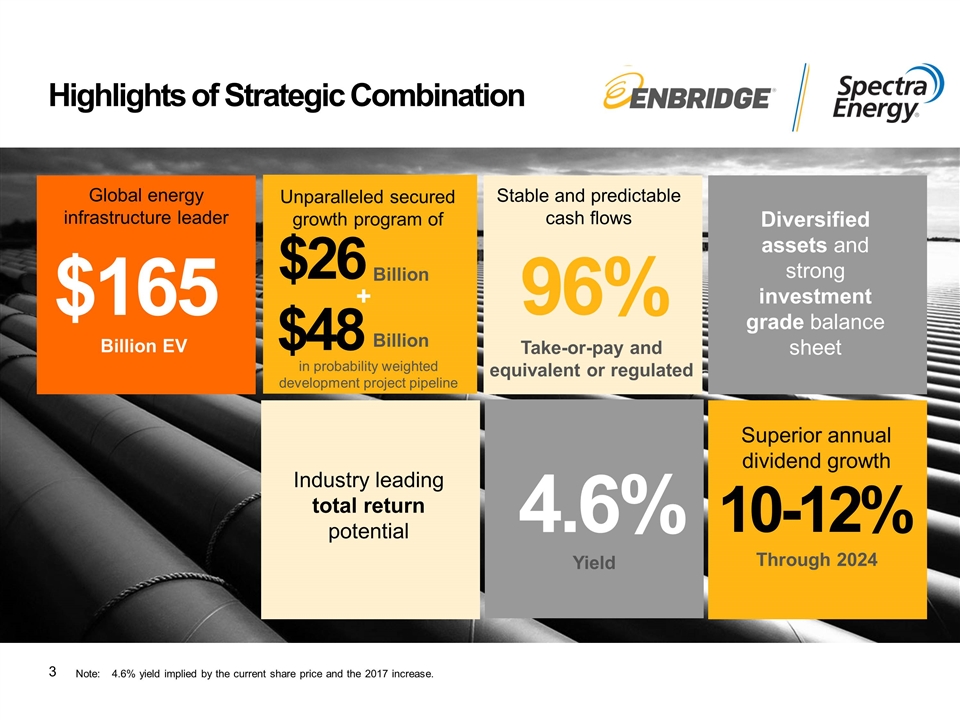

Highlights of Strategic Combination $165 Billion EV 10-12% Through 2024 Global energy infrastructure leader Superior annual dividend growth Unparalleled secured growth program of $26 Billion Industry leading total return potential 96% Take-or-pay and equivalent or regulated Stable and predictable cash flows Yield 4.6% Diversified assets and strong investment grade balance sheet $48 Billion in probability weighted development project pipeline + Note:4.6% yield implied by the current share price and the 2017 increase.

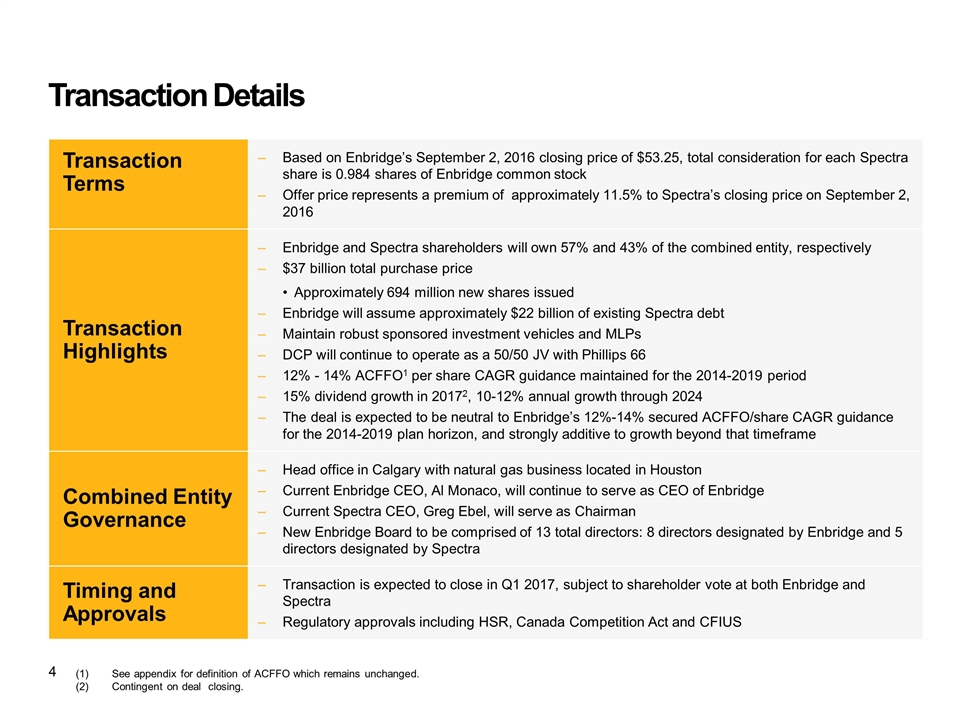

Transaction Details Transaction Terms Based on Enbridge’s September 2, 2016 closing price of $53.25, total consideration for each Spectra share is 0.984 shares of Enbridge common stock Offer price represents a premium of approximately 11.5% to Spectra’s closing price on September 2, 2016 Transaction Highlights Enbridge and Spectra shareholders will own 57% and 43% of the combined entity, respectively $37 billion total purchase price Approximately 694 million new shares issued Enbridge will assume approximately $22 billion of existing Spectra debt Maintain robust sponsored investment vehicles and MLPs DCP will continue to operate as a 50/50 JV with Phillips 66 12% - 14% ACFFO1 per share CAGR guidance maintained for the 2014-2019 period 15% dividend growth in 20172, 10-12% annual growth through 2024 The deal is expected to be neutral to Enbridge’s 12%-14% secured ACFFO/share CAGR guidance for the 2014-2019 plan horizon, and strongly additive to growth beyond that timeframe Combined Entity Governance Head office in Calgary with natural gas business located in Houston Current Enbridge CEO, Al Monaco, will continue to serve as CEO of Enbridge Current Spectra CEO, Greg Ebel, will serve as Chairman New Enbridge Board to be comprised of 13 total directors: 8 directors designated by Enbridge and 5 directors designated by Spectra Timing and Approvals Transaction is expected to close in Q1 2017, subject to shareholder vote at both Enbridge and Spectra Regulatory approvals including HSR, Canada Competition Act and CFIUS (1)See appendix for definition of ACFFO which remains unchanged. (2)Contingent on deal closing.

Compelling Benefits to Enbridge and Spectra Shareholders Diversifies Enbridge to be balanced between crude and natural gas “Best-in-class” assets and commercial underpinning Adds three new strategic platforms with immense scale for organic growth More than doubles total growth program and visibly extends premium dividend growth through 2024 Reinforces 12-14% ACFFO1 per share growth CAGR for 2014-2019 by diversifying secured capital program Launches Enbridge into a unique global investment category Delivers upfront premium and participation in significant value uplift potential Intended to qualify as a tax deferred transaction for Spectra shareholders Increases and extends future dividend growth from approximately 8% to 15% in year 12 and 10-12% annually through 2024; enhances DCF coverage Materially diversifies company by adding industry-leading liquids pipeline, utility and power assets Allows for the continued development of Spectra's existing, attractive expansion program Creates significant cost and tax synergies Enbridge Spectra Combination provides step-change growth opportunities, scale, strength (1)See appendix for definition of ACFFO. Growth rate only includes impact of existing businesses secured growth programs (2)Contingent on deal closing.

Right Combination; Right Time Two Premium Franchises Positioning for the Future Increasing opportunities for large scale infrastructure investments Converging gas and liquids markets Changing global financial and commodity market conditions Acting proactively from positions of strength ü ü ü ü Now is the right time to act

Best-In-Class Value Proposition 4.6% yield implied by the current share price and anticipated 2017 dividend. 2014-2019 planning horizon Highest quality liquids and gas infrastructure assets in North America, all housed under one roof Largest and most secure program of diversified organic growth projects in the industry Unparalleled commercial underpinning drives highly predictable and growing ACFFO per share in the range of 12% – 14% annually2 Adds scale, balance sheet strength, financial flexibility and free cash flow to comfortably fund growth Attractive 4.6%1 dividend yield with visible organic 10% - 12% annual dividend growth through at least 2024 ü ü ü ü ü

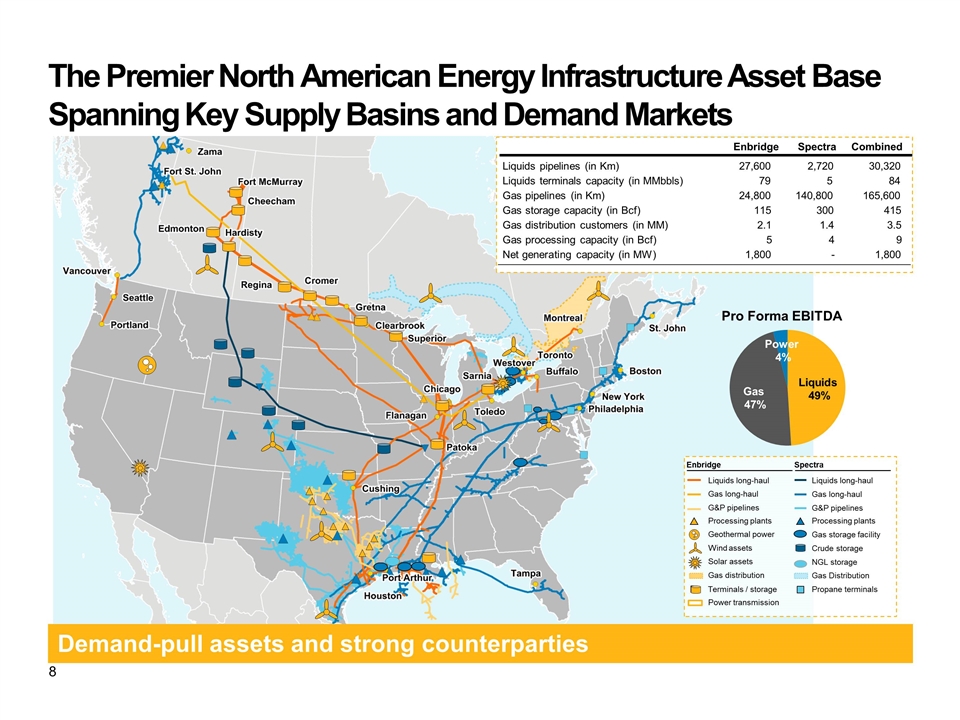

The Premier North American Energy Infrastructure Asset Base Spanning Key Supply Basins and Demand Markets Demand-pull assets and strong counterparties Processing plants Terminals / storage Liquids long-haul Gas long-haul G&P pipelines Wind assets Geothermal power Gas distribution Solar assets Enbridge Processing plants Propane terminals Gas long-haul NGL storage Crude storage Gas storage facility Gas Distribution Liquids long-haul Spectra G&P pipelines Power transmission Enbridge Spectra Combined Liquids pipelines (in Km) 27,600 2,720 30,320 Gas pipelines (in Km) 24,800 140,800 165,600 Gas storage capacity (in Bcf) 115 300 415 Gas distribution customers (in MM) 2.1 1.4 3.5 Gas processing capacity (in Bcf) 5 4 9 Net generating capacity (in MW) 1,800 1,800 - Liquids terminals capacity (in MMbbls) 79 5 84

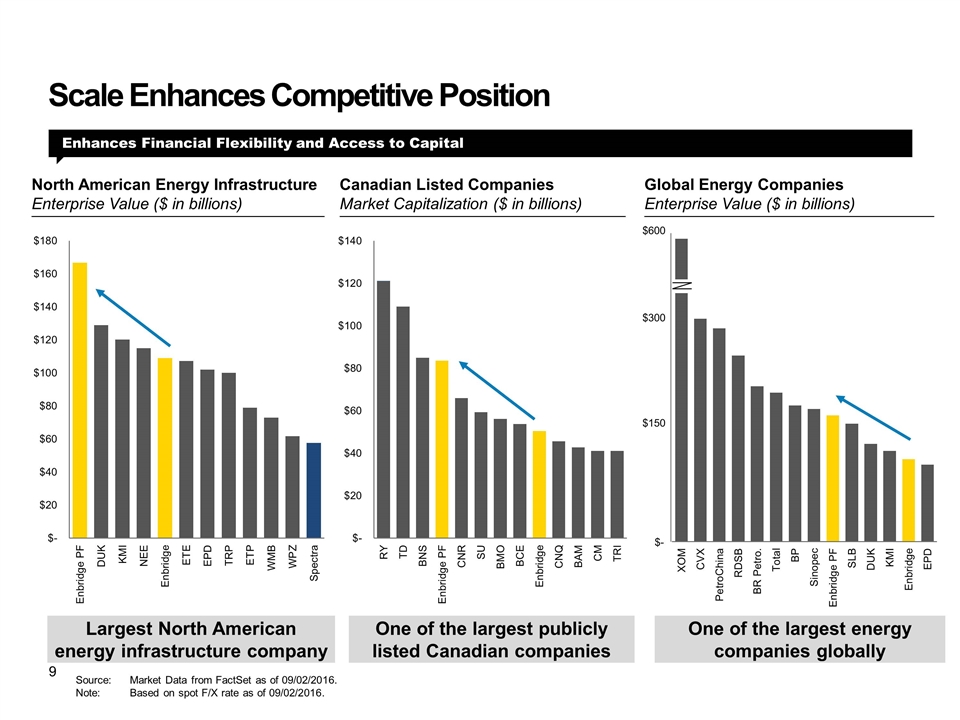

Scale Enhances Competitive Position Enhances Financial Flexibility and Access to Capital North American Energy Infrastructure Enterprise Value ($ in billions) Canadian Listed Companies Market Capitalization ($ in billions) Global Energy Companies Enterprise Value ($ in billions) Largest North American energy infrastructure company One of the largest energy companies globally One of the largest publicly listed Canadian companies Source:Market Data from FactSet as of 09/02/2016. Note:Based on spot F/X rate as of 09/02/2016. $600 $300 $150 $-

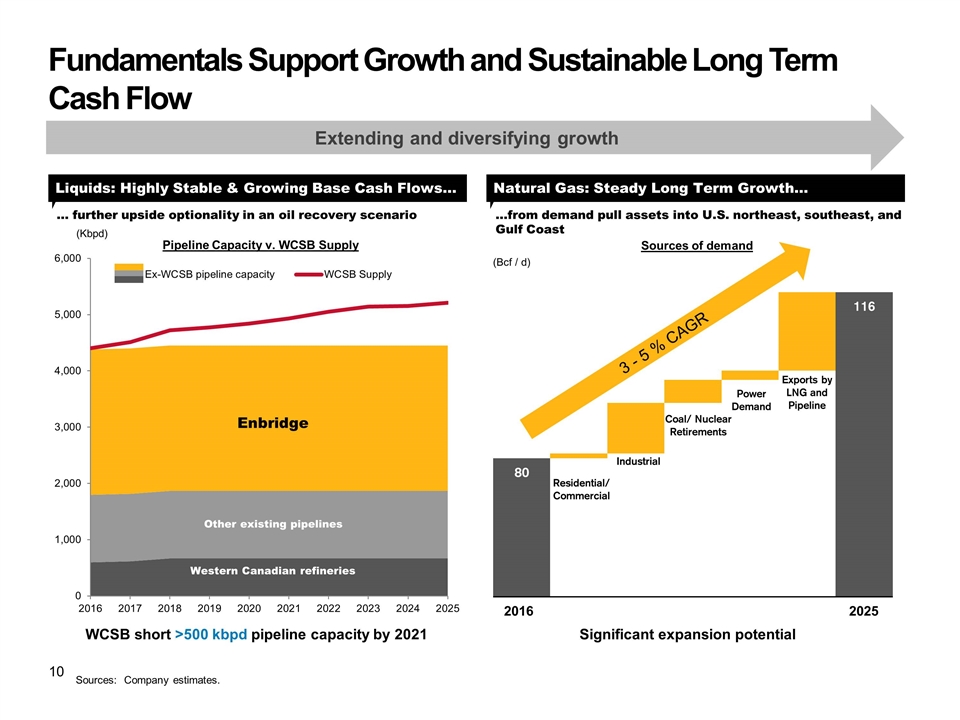

Fundamentals Support Growth and Sustainable Long Term Cash Flow Liquids: Highly Stable & Growing Base Cash Flows… Natural Gas: Steady Long Term Growth… Extending and diversifying growth … further upside optionality in an oil recovery scenario …from demand pull assets into U.S. northeast, southeast, and Gulf Coast Pipeline Capacity v. WCSB Supply WCSB short >500 kbpd pipeline capacity by 2021 (Bcf / d) 2016 2025 (Kbpd) 3 - 5 % CAGR Significant expansion potential Sources: Company estimates.

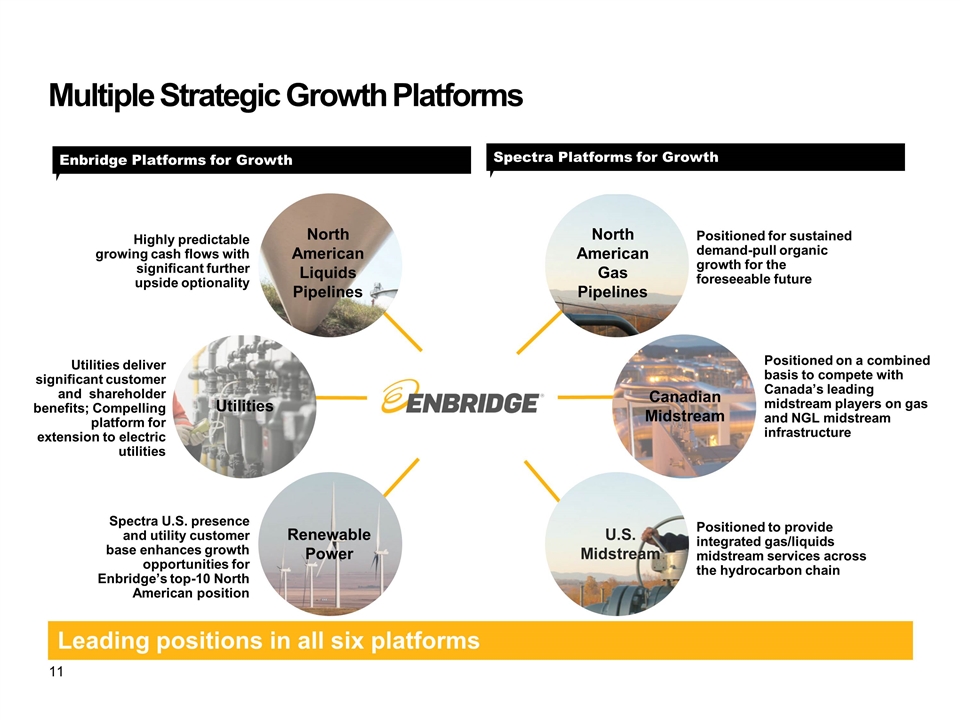

Positioned for sustained demand-pull organic growth for the foreseeable future Positioned on a combined basis to compete with Canada’s leading midstream players on gas and NGL midstream infrastructure Positioned to provide integrated gas/liquids midstream services across the hydrocarbon chain Highly predictable growing cash flows with significant further upside optionality Leading positions in all six platforms Enbridge Platforms for Growth Spectra Platforms for Growth Utilities deliver significant customer and shareholder benefits; Compelling platform for extension to electric utilities Spectra U.S. presence and utility customer base enhances growth opportunities for Enbridge’s top-10 North American position Canadian Midstream North American Liquids Pipelines North American Gas Pipelines Utilities Renewable Power U.S. Midstream Multiple Strategic Growth Platforms

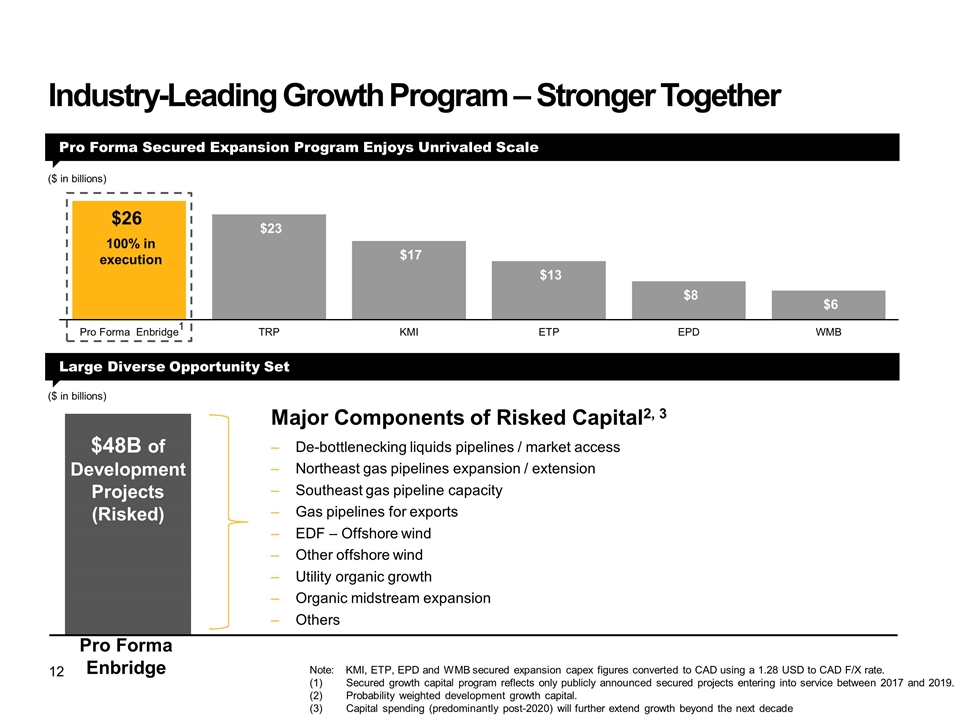

Industry-Leading Growth Program – Stronger Together Note:KMI, ETP, EPD and WMB secured expansion capex figures converted to CAD using a 1.28 USD to CAD F/X rate. Secured growth capital program reflects only publicly announced secured projects entering into service between 2017 and 2019. Probability weighted development growth capital. Capital spending (predominantly post-2020) will further extend growth beyond the next decade ($ in billions) Risked Pro Forma Secured Expansion Program Enjoys Unrivaled Scale [xxx] ($ in billions) Major Components of Risked Capital2, 3 De-bottlenecking liquids pipelines / market access Northeast gas pipelines expansion / extension Southeast gas pipeline capacity Gas pipelines for exports EDF – Offshore wind Other offshore wind Utility organic growth Organic midstream expansion Others [xxx] Large Diverse Opportunity Set Pro Forma Enbridge 100% in execution $48B of Development Projects (Risked) 1

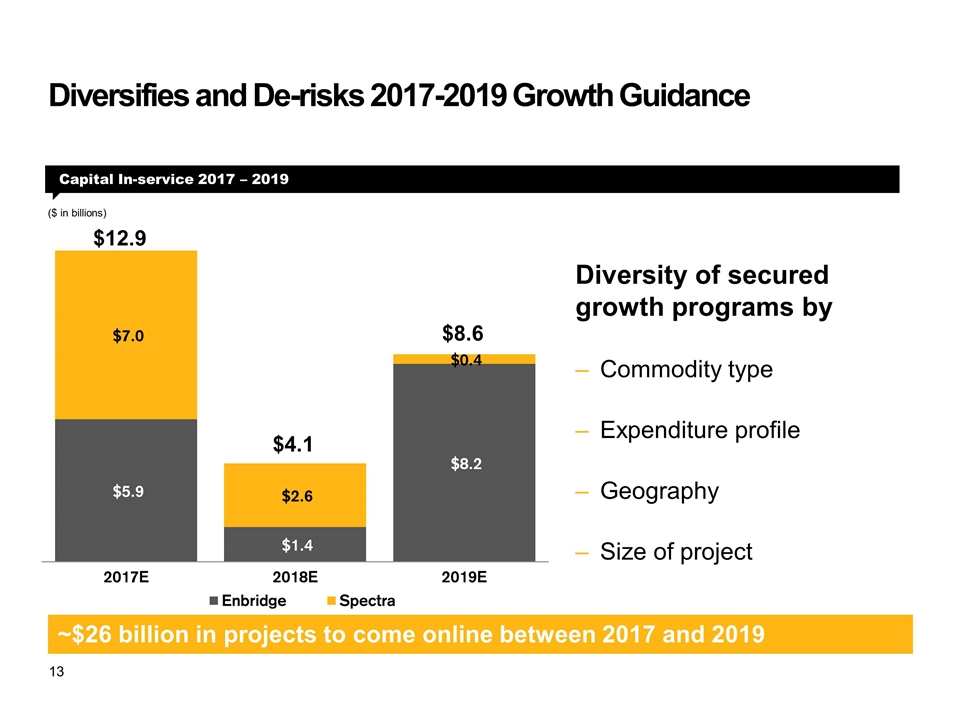

Diversifies and De-risks 2017-2019 Growth Guidance ($ in billions) Capital In-service 2017 – 2019 Diversity of secured growth programs by Commodity type Expenditure profile Geography Size of project $12.9 $4.1 $8.6 ~$26 billion in projects to come online between 2017 and 2019

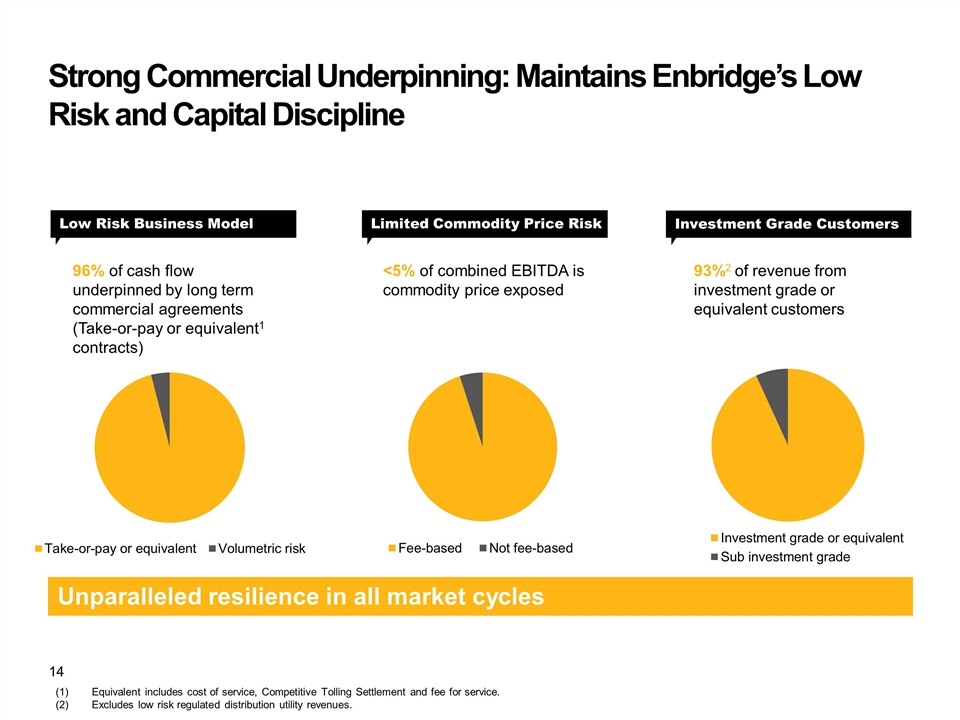

Strong Commercial Underpinning: Maintains Enbridge’s Low Risk and Capital Discipline Low Risk Business Model Investment Grade Customers 96% of cash flow underpinned by long term commercial agreements (Take-or-pay or equivalent1 contracts) <5% of combined EBITDA is commodity price exposed 93%2 of revenue from investment grade or equivalent customers Limited Commodity Price Risk Unparalleled resilience in all market cycles (1)Equivalent includes cost of service, Competitive Tolling Settlement and fee for service. (2)Excludes low risk regulated distribution utility revenues.

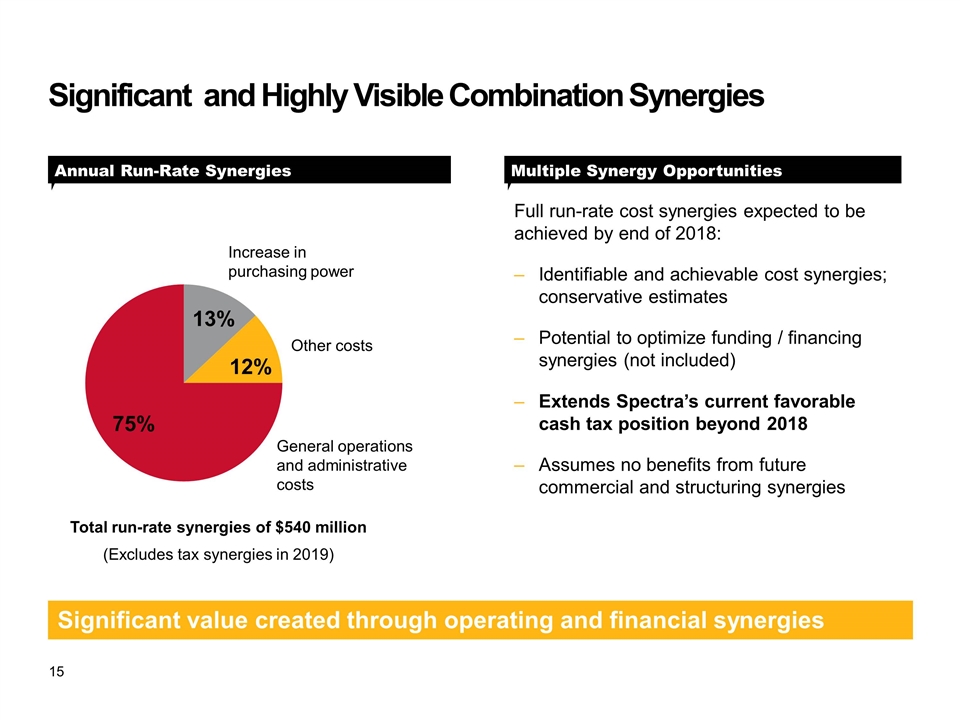

Significant and Highly Visible Combination Synergies Annual Run-Rate Synergies Multiple Synergy Opportunities General operations and administrative costs Full run-rate cost synergies expected to be achieved by end of 2018: Identifiable and achievable cost synergies; conservative estimates Potential to optimize funding / financing synergies (not included) Extends Spectra’s current favorable cash tax position beyond 2018 Assumes no benefits from future commercial and structuring synergies Other costs Increase in purchasing power Significant value created through operating and financial synergies Total run-rate synergies of $540 million (Excludes tax synergies in 2019)

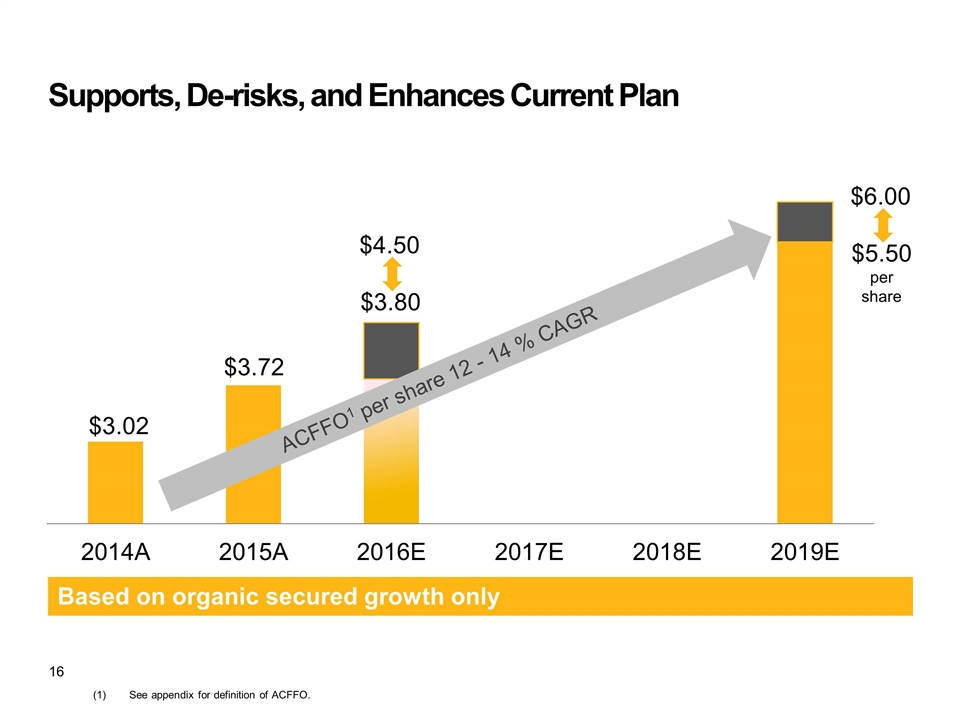

Supports, De-risks, and Enhances Current Plan Based on organic secured growth only ACFFO1 per share 12 - 14 % CAGR $5.50 per share $6.00 $3.80 $4.50 (1)See appendix for definition of ACFFO.

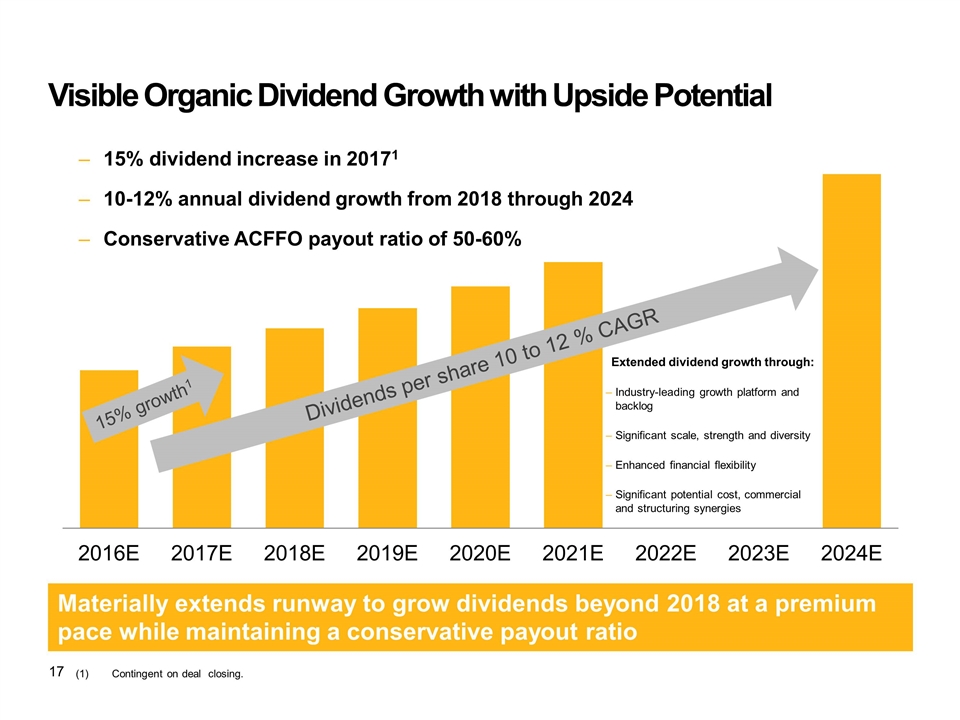

Visible Organic Dividend Growth with Upside Potential Materially extends runway to grow dividends beyond 2018 at a premium pace while maintaining a conservative payout ratio Extended dividend growth through: Industry-leading growth platform and backlog Significant scale, strength and diversity Enhanced financial flexibility Significant potential cost, commercial and structuring synergies (1)Contingent on deal closing. 15% growth1 15% dividend increase in 20171 10-12% annual dividend growth from 2018 through 2024 Conservative ACFFO payout ratio of 50-60% Dividends per share 10 to 12 % CAGR

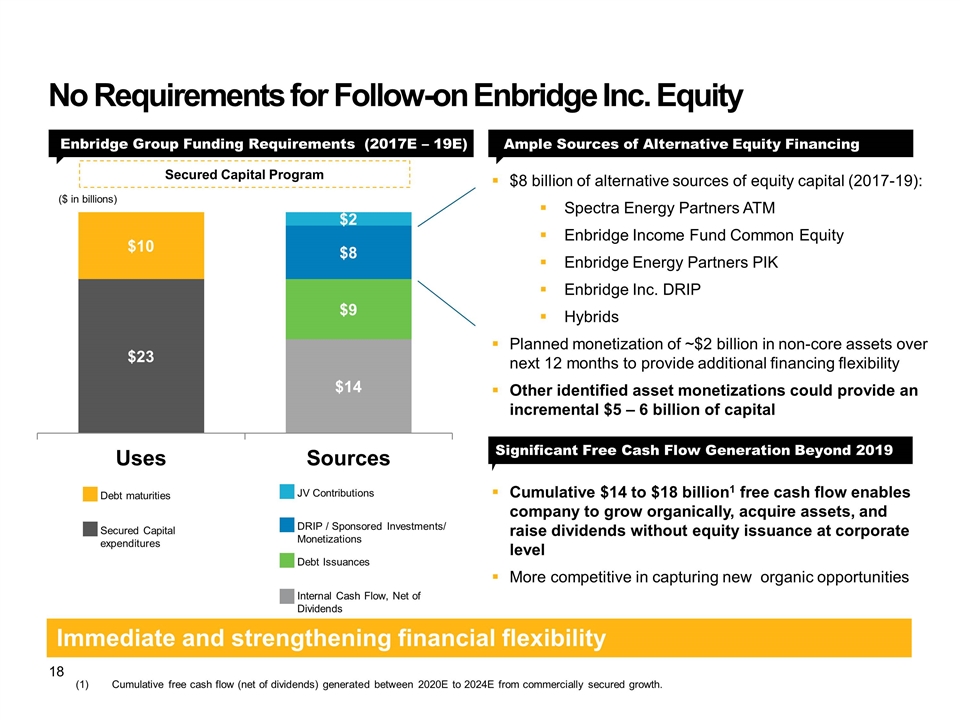

No Requirements for Follow-on Enbridge Inc. Equity Enbridge Group Funding Requirements (2017E – 19E) Ample Sources of Alternative Equity Financing Joint Benefits ($ in billions) Secured Capital Program Immediate and strengthening financial flexibility Debt maturities Secured Capital expenditures DRIP / Sponsored Investments/ Monetizations Debt Issuances Internal Cash Flow, Net of Dividends (1)Cumulative free cash flow (net of dividends) generated between 2020E to 2024E from commercially secured growth. Cumulative $14 to $18 billion1 free cash flow enables company to grow organically, acquire assets, and raise dividends without equity issuance at corporate level More competitive in capturing new organic opportunities JV Contributions Significant Free Cash Flow Generation Beyond 2019 $8 billion of alternative sources of equity capital (2017-19): Spectra Energy Partners ATM Enbridge Income Fund Common Equity Enbridge Energy Partners PIK Enbridge Inc. DRIP Hybrids Planned monetization of ~$2 billion in non-core assets over next 12 months to provide additional financing flexibility Other identified asset monetizations could provide an incremental $5 – 6 billion of capital

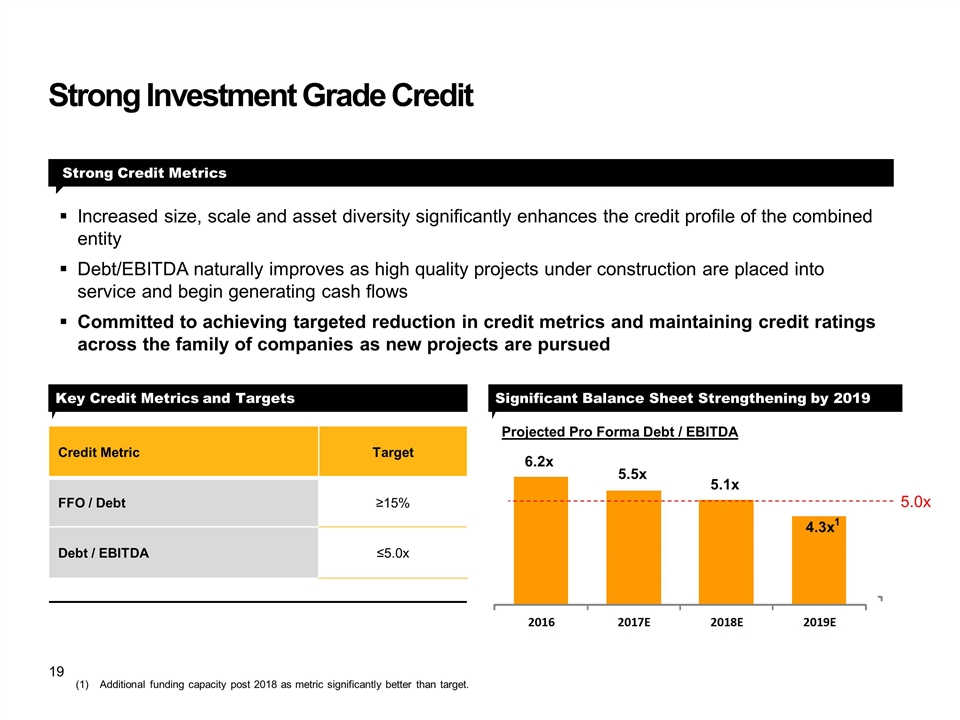

Strong Investment Grade Credit Increased size, scale and asset diversity significantly enhances the credit profile of the combined entity Debt/EBITDA naturally improves as high quality projects under construction are placed into service and begin generating cash flows Committed to achieving targeted reduction in credit metrics and maintaining credit ratings across the family of companies as new projects are pursued Strong Credit Metrics Key Credit Metrics and Targets Credit Metric Target FFO / Debt ≥15% Debt / EBITDA ≤5.0x Significant Balance Sheet Strengthening by 2019 Projected Pro Forma Debt / EBITDA 1 (1)Additional funding capacity post 2018 as metric significantly better than target. 5.0x 4.3x 5.1x 5.5x 6.2x

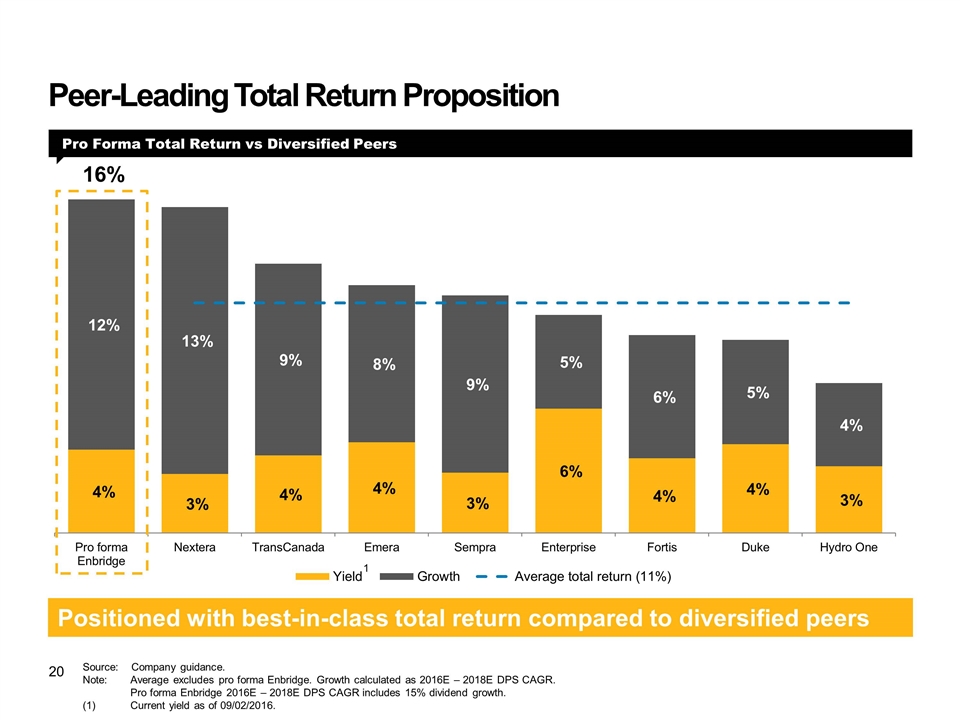

Peer-Leading Total Return Proposition Pro Forma Total Return vs Diversified Peers Dividends Positioned with best-in-class total return compared to diversified peers Source:Company guidance. Note: Average excludes pro forma Enbridge. Growth calculated as 2016E – 2018E DPS CAGR. Pro forma Enbridge 2016E – 2018E DPS CAGR includes 15% dividend growth. (1) Current yield as of 09/02/2016. 1 16%

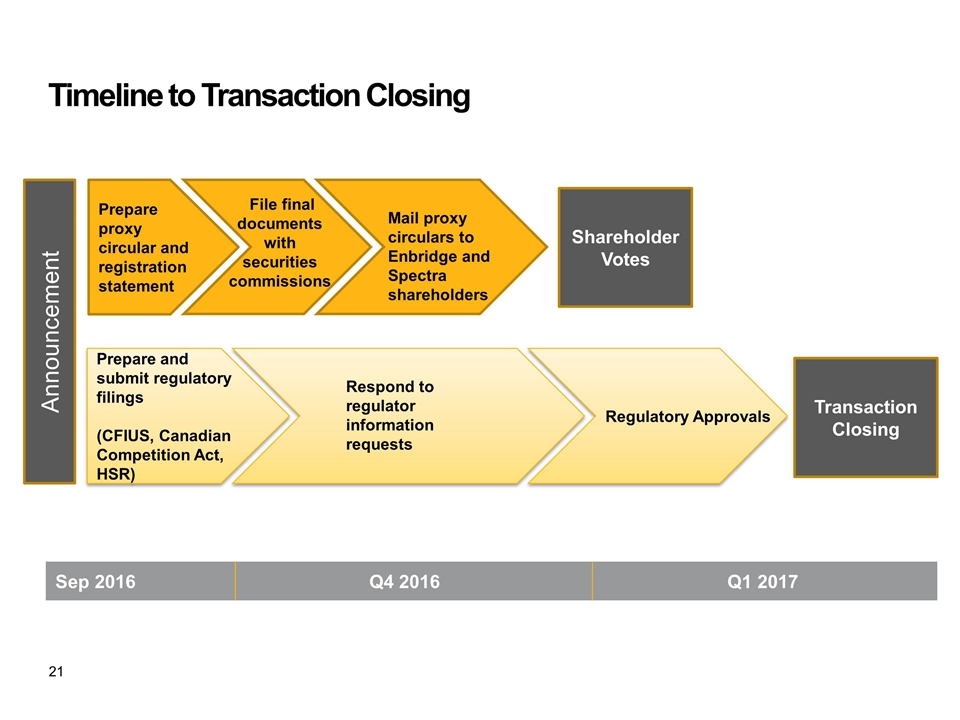

Timeline to Transaction Closing Sep 2016 Q4 2016 Q1 2017 Prepare proxy circular and registration statement Prepare and submit regulatory filings (CFIUS, Canadian Competition Act, HSR) Announcement Shareholder Votes Mail proxy circulars to Enbridge and Spectra shareholders File final documents with securities commissions Regulatory Approvals Respond to regulator information requests Transaction Closing Shareholder Votes

Key Takeaways Highest quality liquids and natural gas infrastructure assets in North America Largest and most secure program of diversified organic growth projects in the industry Six leading strategic growth platforms Ample access to capital and strong balance sheet to fund large capital program Secure, low-risk commercial structure with stable long-term cash flow visibility Premium total return proposition with 4%+ current yield plus 10%-12% annual long-term dividend growth ü ü ü ü ü ü Premier N.A. Energy Infrastructure Company Must Own Investment

Appendix North American Liquids Pipelines North American Gas Pipelines Utilities Canadian Midstream U.S. Midstream Renewable Power Secured Growth Program Detail Pro forma Funding Strategy Available Cash Flow from Operations

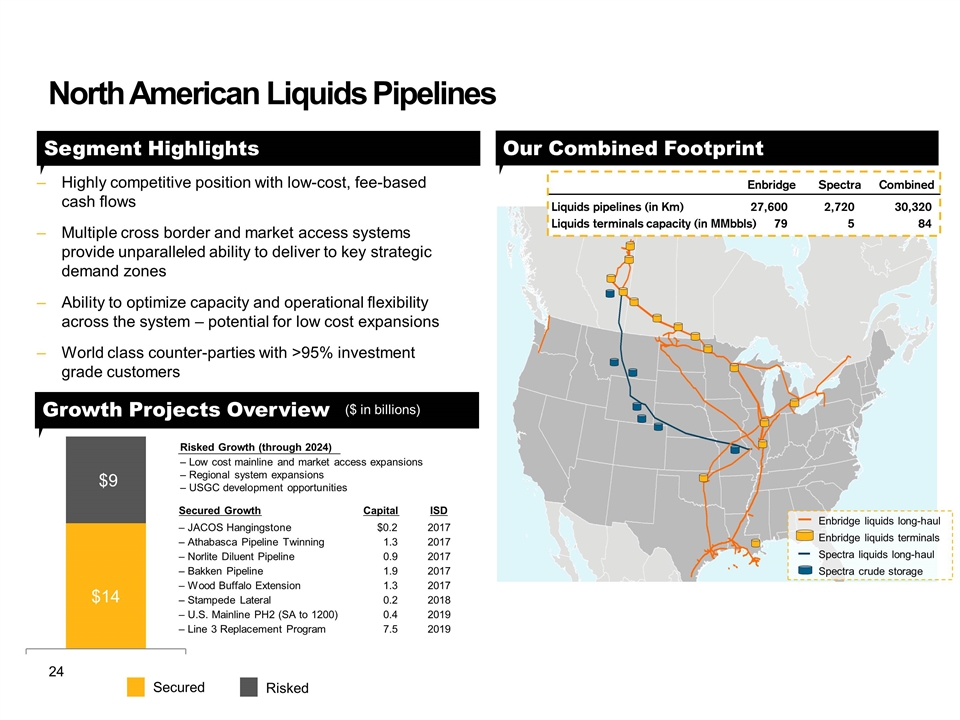

North American Liquids Pipelines Enbridge liquids long-haul Spectra liquids long-haul Enbridge liquids terminals Spectra crude storage Highly competitive position with low-cost, fee-based cash flows Multiple cross border and market access systems provide unparalleled ability to deliver to key strategic demand zones Ability to optimize capacity and operational flexibility across the system – potential for low cost expansions World class counter-parties with >95% investment grade customers Segment Highlights Growth Projects Overview ($ in billions) Secured Risked Our Combined Footprint Secured Growth Capital ISD – JACOS Hangingstone $0.2 2017 – Athabasca Pipeline Twinning 1.3 2017 – Norlite Diluent Pipeline 0.9 2017 – Wood Buffalo Extension 1.3 2017 – Stampede Lateral 0.2 2018 – U.S. Mainline PH2 (SA to 1200) 0.4 2019 – Line 3 Replacement Program 7.5 2019 Risked Growth (through 2024) – Low cost mainline and market access expansions – Regional system expansions – USGC development opportunities Enbridge Spectra Combined Liquids pipelines (in Km) 27,600 2,720 30,320 Liquids terminals capacity (in MMbbls) 79 5 84 – Bakken Pipeline 1.9 2017

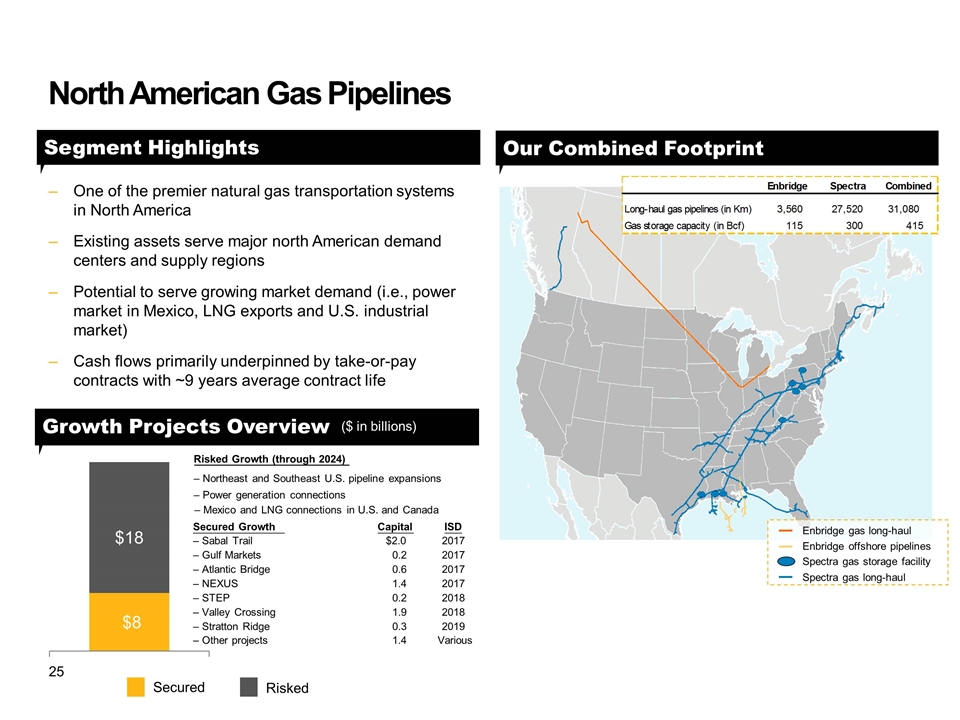

Growth Projects Overview North American Gas Pipelines Enbridge gas long-haul Enbridge offshore pipelines Spectra gas long-haul Spectra gas storage facility Segment Highlights ($ in billions) Our Combined Footprint One of the premier natural gas transportation systems in North America Existing assets serve major north American demand centers and supply regions Potential to serve growing market demand (i.e., power market in Mexico, LNG exports and U.S. industrial market) Cash flows primarily underpinned by take-or-pay contracts with ~9 years average contract life Secured Growth Capital ISD – Sabal Trail $2.0 2017 – STEP 0.2 2018 – Atlantic Bridge 0.6 2017 – NEXUS 1.4 2017 – Valley Crossing 1.9 2018 Risked Growth (through 2024) – Northeast and Southeast U.S. pipeline expansions – Mexico and LNG connections in U.S. and Canada Secured Risked – Power generation connections – Gulf Markets 0.2 2017 – Stratton Ridge 0.3 2019 – Other projects 1.4 Various

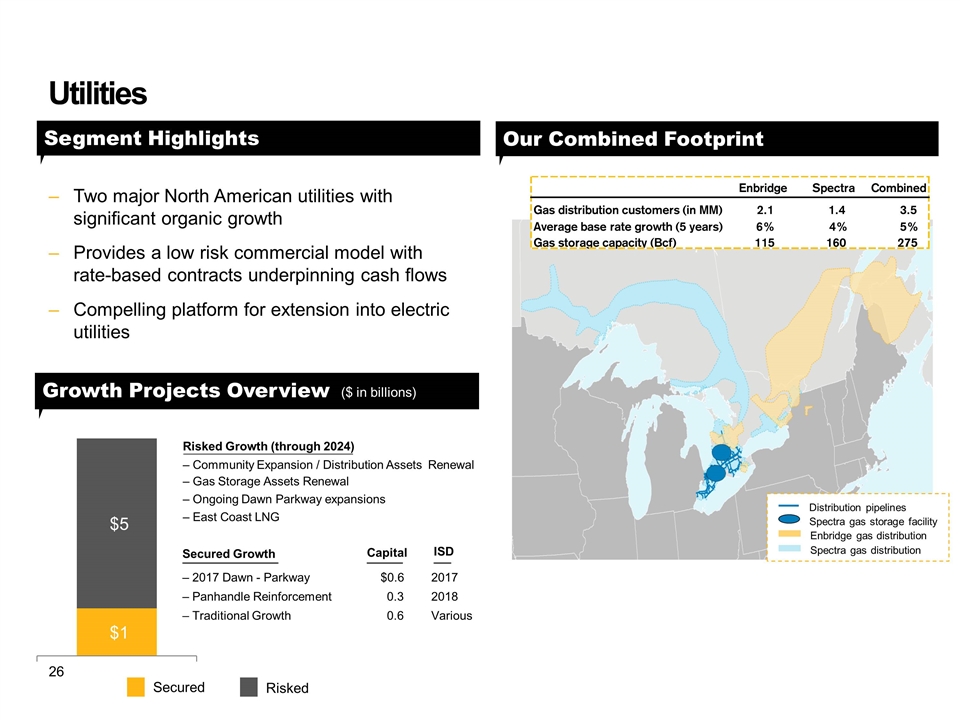

Utilities Enbridge gas distribution Spectra gas distribution Spectra gas storage facility Distribution pipelines Growth Projects Overview Segment Highlights Our Combined Footprint Two major North American utilities with significant organic growth Provides a low risk commercial model with rate-based contracts underpinning cash flows Compelling platform for extension into electric utilities ($ in billions) Risked Growth (through 2024) – Community Expansion / Distribution Assets Renewal – Gas Storage Assets Renewal – Ongoing Dawn Parkway expansions – East Coast LNG Secured Growth Capital ISD – 2017 Dawn - Parkway $0.6 2017 – Panhandle Reinforcement 0.3 2018 – Traditional Growth 0.6 Various Enbridge Spectra Combined Gas distribution customers (in MM) 2.1 1.4 3.5 Average base rate growth (5 years) 6% 4% 5% Gas storage capacity (Bcf) 115 160 275 Secured Risked

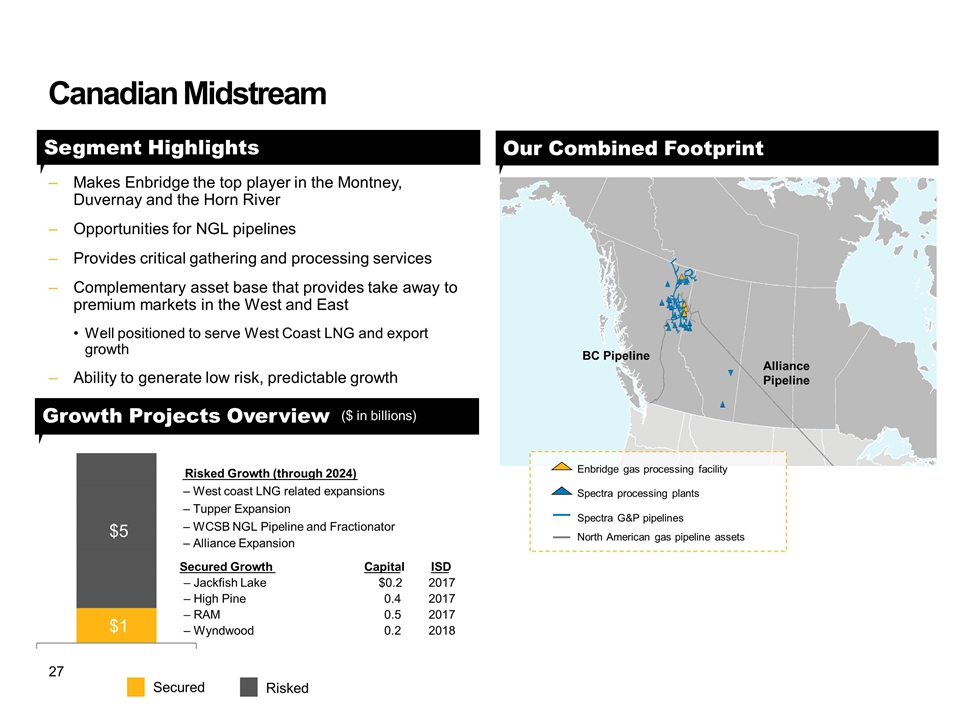

Canadian Midstream Alliance Pipeline BC Pipeline Enbridge gas processing facility Spectra processing plants Spectra G&P pipelines North American gas pipeline assets Growth Projects Overview Segment Highlights ($ in billions) Our Combined Footprint Makes Enbridge the top player in the Montney, Duvernay and the Horn River Opportunities for NGL pipelines Provides critical gathering and processing services Complementary asset base that provides take away to premium markets in the West and East Well positioned to serve West Coast LNG and export growth Ability to generate low risk, predictable growth Secured Growth Capital ISD – Jackfish Lake $0.2 2017 – RAM 0.5 2017 – Wyndwood 0.2 2018 Risked Growth (through 2024) – West coast LNG related expansions – Tupper Expansion – WCSB NGL Pipeline and Fractionator – Alliance Expansion Secured Risked – High Pine 0.4 2017

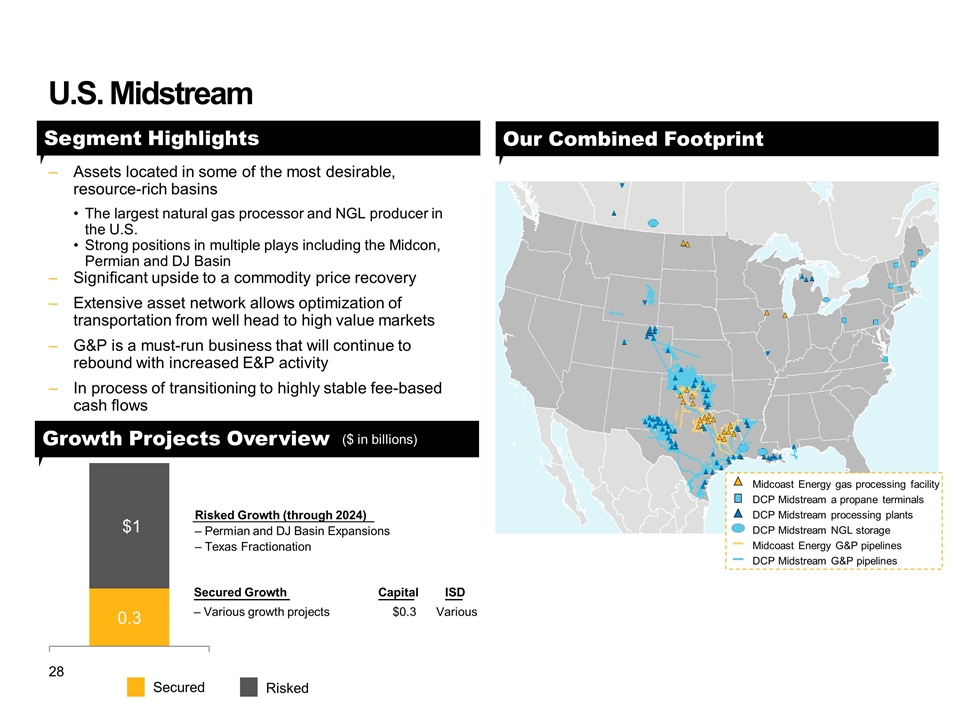

U.S. Midstream DCP Midstream processing plants DCP Midstream NGL storage Midcoast Energy gas processing facility DCP Midstream a propane terminals Midcoast Energy G&P pipelines DCP Midstream G&P pipelines Growth Projects Overview Segment Highlights Our Combined Footprint Assets located in some of the most desirable, resource-rich basins The largest natural gas processor and NGL producer in the U.S. Strong positions in multiple plays including the Midcon, Permian and DJ Basin Significant upside to a commodity price recovery Extensive asset network allows optimization of transportation from well head to high value markets G&P is a must-run business that will continue to rebound with increased E&P activity In process of transitioning to highly stable fee-based cash flows ($ in billions) Secured Risked Risked Growth (through 2024) – Permian and DJ Basin Expansions – Texas Fractionation Secured Growth Capital ISD – Various growth projects $0.3 Various

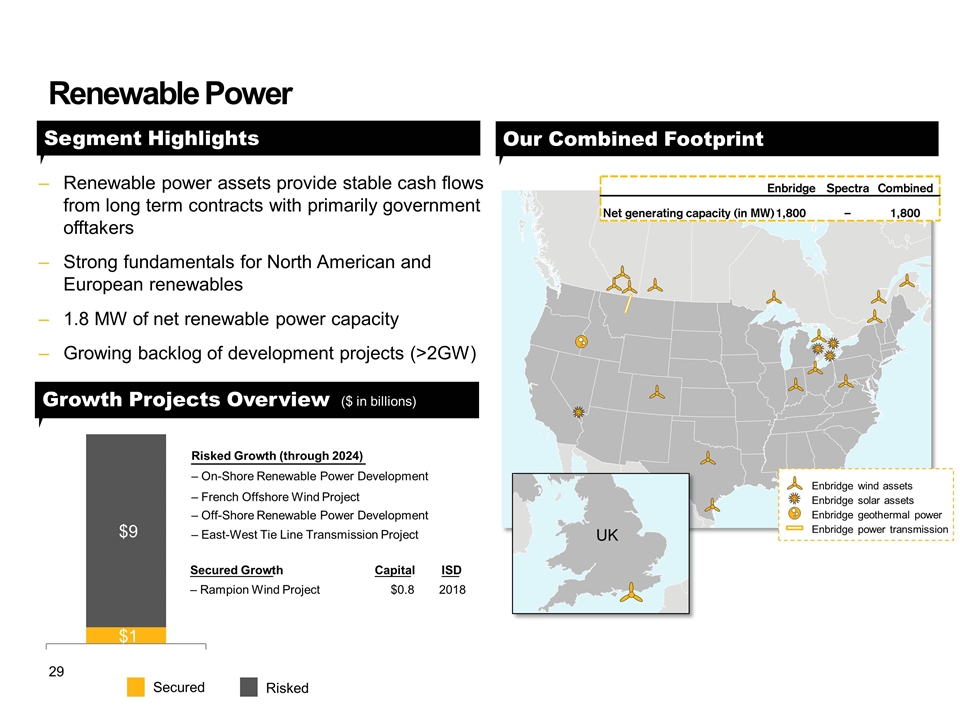

Growth Projects Overview Renewable Power Enbridge wind assets Enbridge geothermal power Enbridge solar assets Enbridge power transmission UK Segment Highlights Our Combined Footprint Renewable power assets provide stable cash flows from long term contracts with primarily government offtakers Strong fundamentals for North American and European renewables 1.8 MW of net renewable power capacity Growing backlog of development projects (>2GW) ($ in billions) Risked Growth (through 2024) – On-Shore Renewable Power Development – French Offshore Wind Project – Off-Shore Renewable Power Development – East-West Tie Line Transmission Project Secured Growth Capital ISD – Rampion Wind Project $0.8 2018 Secured Risked Enbridge Spectra Combined Net generating capacity (in MW) 1,800 – 1,800

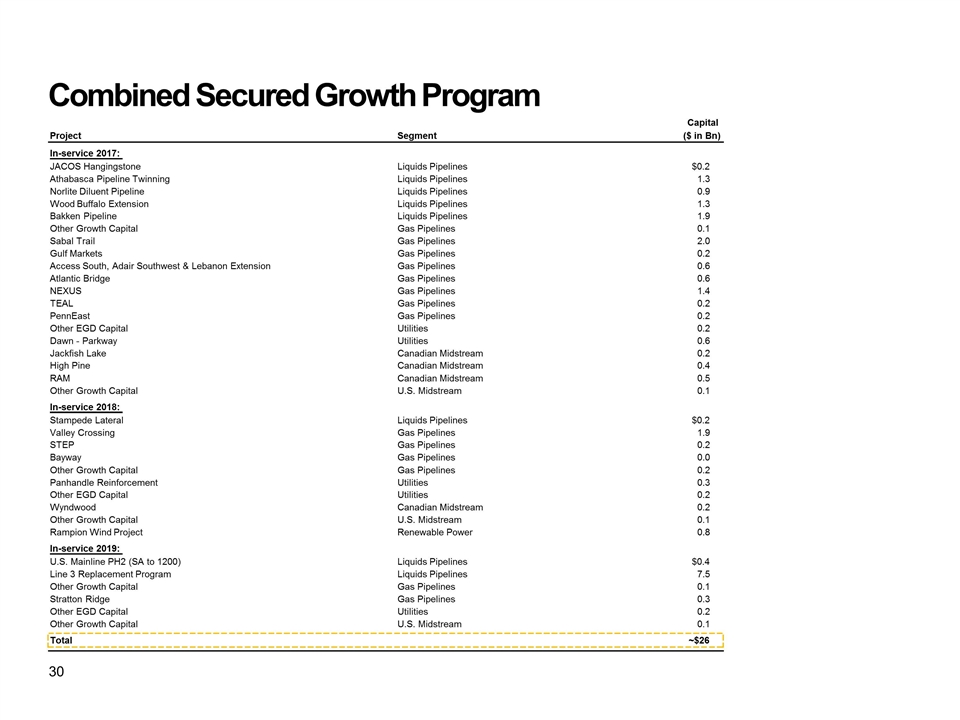

Combined Secured Growth Program Capital Project Segment ($ in Bn) In-service 2017: JACOS Hangingstone Liquids Pipelines $0.2 Athabasca Pipeline Twinning Liquids Pipelines 1.3 Norlite Diluent Pipeline Liquids Pipelines 0.9 Wood Buffalo Extension Liquids Pipelines 1.3 Bakken Pipeline Liquids Pipelines 1.9 Other Growth Capital Gas Pipelines 0.1 Sabal Trail Gas Pipelines 2.0 Gulf Markets Gas Pipelines 0.2 Access South, Adair Southwest & Lebanon Extension Gas Pipelines 0.6 Atlantic Bridge Gas Pipelines 0.6 NEXUS Gas Pipelines 1.4 TEAL Gas Pipelines 0.2 PennEast Gas Pipelines 0.2 Other EGD Capital Utilities 0.2 Dawn - Parkway Utilities 0.6 Jackfish Lake Canadian Midstream 0.2 High Pine Canadian Midstream 0.4 RAM Canadian Midstream 0.5 Other Growth Capital U.S. Midstream 0.1 In-service 2018: Stampede Lateral Liquids Pipelines $0.2 Valley Crossing Gas Pipelines 1.9 STEP Gas Pipelines 0.2 Bayway Gas Pipelines 0.0 Other Growth Capital Gas Pipelines 0.2 Panhandle Reinforcement Utilities 0.3 Other EGD Capital Utilities 0.2 Wyndwood Canadian Midstream 0.2 Other Growth Capital U.S. Midstream 0.1 Rampion Wind Project Renewable Power 0.8 In-service 2019: U.S. Mainline PH2 (SA to 1200) Liquids Pipelines $0.4 Line 3 Replacement Program Liquids Pipelines 7.5 Other Growth Capital Gas Pipelines 0.1 Stratton Ridge Gas Pipelines 0.3 Other EGD Capital Utilities 0.2 Other Growth Capital U.S. Midstream 0.1 Total ~$26

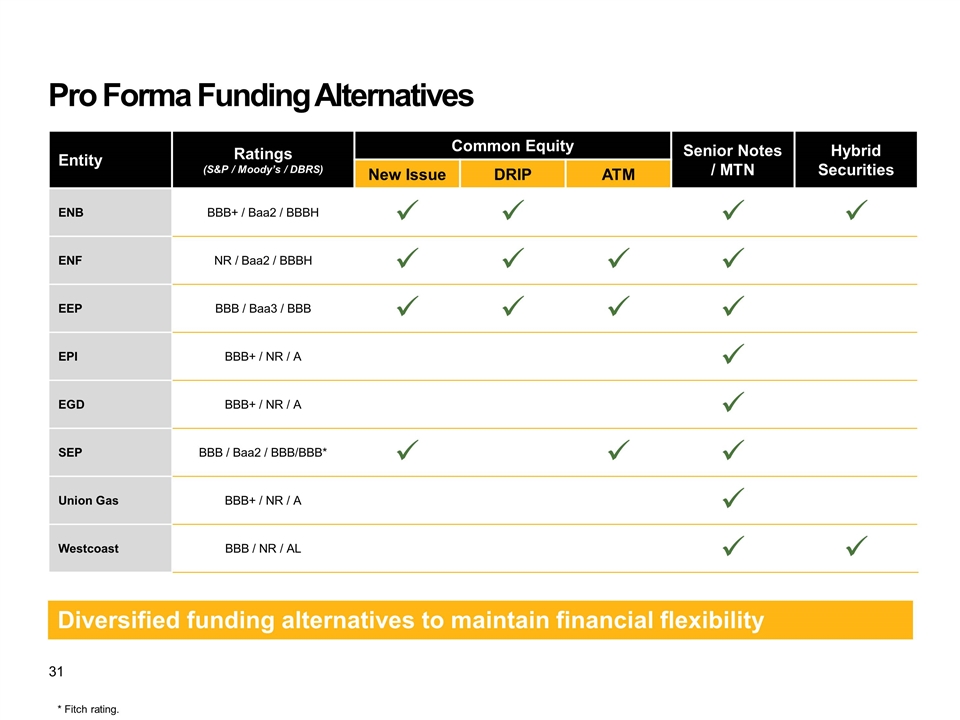

Pro Forma Funding Alternatives Entity Ratings (S&P / Moody’s / DBRS) Common Equity Senior Notes / MTN Hybrid Securities New Issue DRIP ATM ENB BBB+ / Baa2 / BBBH ü ü ü ü ENF NR / Baa2 / BBBH ü ü ü ü EEP BBB / Baa3 / BBB ü ü ü ü EPI BBB+ / NR / A ü EGD BBB+ / NR / A ü SEP BBB / Baa2 / BBB/BBB* ü ü ü Union Gas BBB+ / NR / A ü Westcoast BBB / NR / AL ü ü Diversified funding alternatives to maintain financial flexibility * Fitch rating.

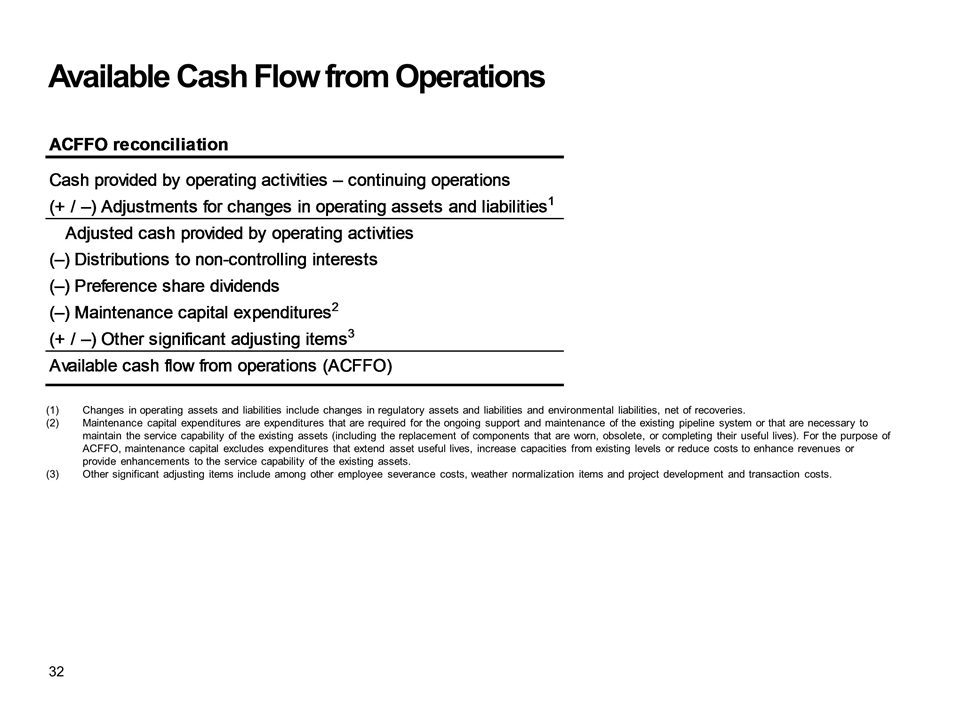

Available Cash Flow from Operations (1) Changes in operating assets and liabilities include changes in regulatory assets and liabilities and environmental liabilities, net of recoveries. (2)Maintenance capital expenditures are expenditures that are required for the ongoing support and maintenance of the existing pipeline system or that are necessary to maintain the service capability of the existing assets (including the replacement of components that are worn, obsolete, or completing their useful lives). For the purpose of ACFFO, maintenance capital excludes expenditures that extend asset useful lives, increase capacities from existing levels or reduce costs to enhance revenues or provide enhancements to the service capability of the existing assets. (3)Other significant adjusting items include among other employee severance costs, weather normalization items and project development and transaction costs.