UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

HEELYS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

3200 Belmeade Drive, Ste 100

Carrollton, TX 75006

www.heelys.com

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 9, 2011

To the Stockholders of Heelys, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Heelys, Inc. will be held on Thursday, June 9, 2011 at 10:00 a.m. Central Daylight Saving Time at the Crowne Plaza Hotel, 14315 Midway Road, Addison, Texas 75001, for the following purposes:

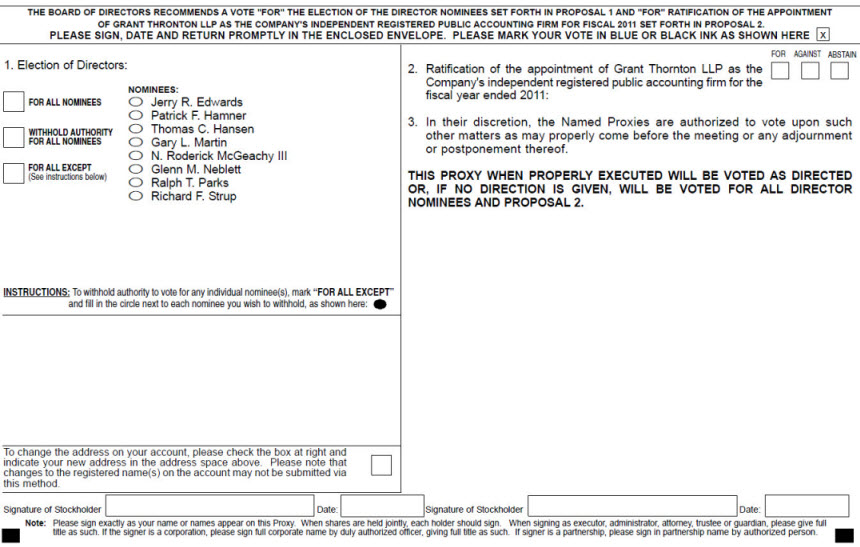

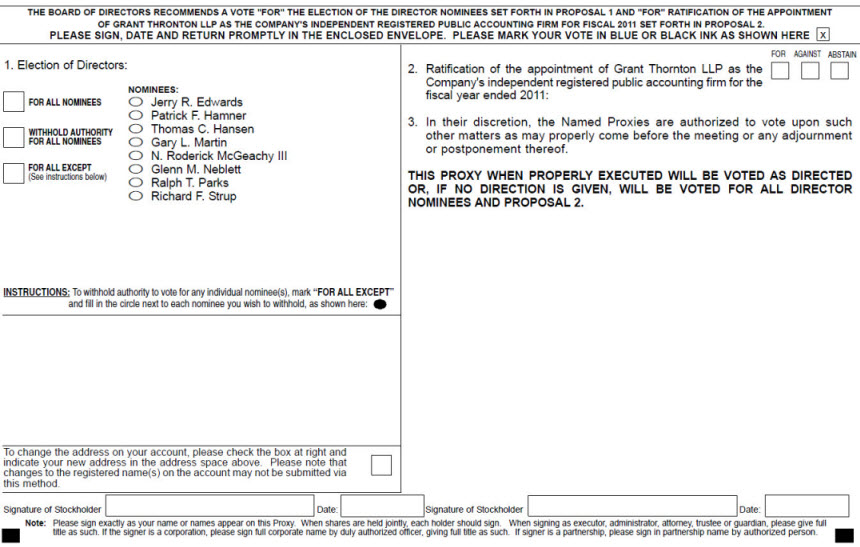

| | 1. | To elect eight directors to hold office until the 2012 annual meeting of stockholders. |

| | 2. | To ratify the appointment of Grant Thornton LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2011. |

| | 3. | To take action on any other business that may properly come before the meeting and any adjournment or postponement thereof. |

Only stockholders who owned our common stock at the close of business on April 15, 2011 can vote at this meeting or any adjournment or postponement that may take place.

All stockholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to mark, sign and return the enclosed proxy as promptly as possible in the postage-prepaid envelope for that purpose. If you later desire to revoke your proxy for any reason, you may do so in the manner provided in the attached proxy statement. Your stock will be voted in accordance with the instructions you have given. You will find more instructions on how to vote in the attached proxy statement.

| | By order of the Board of Directors, |

| | |

| |  |

| | Barbara A. Nagy Corporate Secretary |

| | |

Carrollton, Texas April 19, 2011 | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting

to be Held on June 9, 2011:

This Notice of Annual Meeting, Proxy Statement and the accompanying Annual Report to Stockholders

are available on our website at http://investors.heelys.com

| | |

| | Page |

| 2 |

| 5 |

| 5 |

| 10 |

| 11 |

| 13 |

| 14 |

| 20 |

| 22 |

| 28 |

| 30 |

| 34 |

| 35 |

| 36 |

| 37 |

| 37 |

| 38 |

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies from the holders of shares of voting common stock of Heelys, Inc. to be voted at our 2011 Annual Meeting of Stockholders (the "Annual Meeting") to be held on June 9, 2011, at 10:00 a.m. Central Daylight Saving Time, at the Crowne Plaza Hotel, 14315 Midway Road, Addison, Texas 75001.

The enclosed proxy is solicited by the Board of Directors of the Company (the "Board"). These proxy materials have been prepared by our management for our Board. This Proxy Statement, the proxy card and our Annual Report are first being mailed to stockholders entitled to vote at the meeting on or about May 4, 2011.

The mailing address of our principal executive office is 3200 Belmeade Drive, Ste 100, Carrollton, Texas 75006.

The terms "we," "our," "us," "Heelys" or the "Company" refer to Heelys, Inc. and its subsidiaries.

What is the purpose of the meeting?

At our Annual Meeting, stockholders will act on the matters disclosed in the Notice of Annual Meeting of Stockholders that preceded this Proxy Statement. There are two proposals scheduled to be voted on at the meeting:

| | ● | elect eight directors; and |

| | ● | ratify the appointment of Grant Thornton LLP to serve as our independent registered public accounting firm. |

We will also consider any other business that may be properly presented at the meeting and respond to questions from stockholders.

Our Board is asking you to vote on the proposed items of business. This Proxy Statement and form of proxy, along with our Annual Report, are first being sent to stockholders on or about May 4, 2011.

How does the Board recommend that I vote?

The Board recommends a vote:

| | ● | FOR all of the nominees for director; and |

| | ● | FOR the ratification of the appointment of Grant Thornton LLP to serve as our independent registered public accounting firm for the fiscal year ended December 31, 2011. |

Who is entitled to vote at the meeting?

The Board has set April 15, 2011 as the record date for the meeting. If you were a stockholder of record at the close of business on April 15, 2011, you are entitled to vote at the meeting. You have one vote for each share of common stock you held on the record date.

As of the record date, 27,571,052 shares of Heelys common stock were outstanding. Heelys does not have any other class of capital stock outstanding.

How many shares must be present to hold the meeting?

A quorum is necessary to hold the meeting and conduct business. The presence, either in person or represented by proxy, of stockholders who can direct the vote (with respect to the election of directors) of at least a majority of the outstanding shares of common stock as of the record date is considered a quorum. A stockholder is counted present at the meeting if:

| | ● | the stockholder is present and votes in person at the meeting; or |

| | ● | the stockholder has properly submitted a proxy. |

Shares that are not voted by the broker who is the record holder of the shares because the broker is not instructed to vote and does not have discretionary authority to vote (i.e., broker non-votes) and shares that are not voted in other circumstances in which proxy authority is defective or has been withheld, will be counted for purposes of establishing a quorum.

If a quorum is not present, the annual meeting will be adjourned until a quorum is obtained.

What is the difference between a stockholder of record and a "street name" holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are still considered the beneficial owner of the shares, but your shares are held in "street name."

How do I vote my shares?

If you are a stockholder of record, you can vote your shares without having to attend the meeting by providing a proxy. This can be done by mailing your signed proxy card to us before the meeting. You may also vote in person at the meeting.

If you hold your shares in street name, you must vote your shares following the procedures indicated to you by your broker or nominee on the enclosed voting instruction card.

What if multiple stockholders have the same address?

If you and other residents at your mailing address own shares of common stock in street name, your broker or bank may have sent you a notice that your household will receive only one annual report and proxy statement. This practice is known as "householding," and is designed to reduce our printing and postage costs. However, if any stockholder residing at such an address wishes to receive a separate annual report or proxy statement, he or she may send a request to our Corporate Secretary or by calling toll free at 866-433-5464.

What does it mean if I receive more than one proxy card?

It means you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card you receive. If you wish to consolidate your accounts, please contact our stock transfer agent, American Stock Transfer & Trust Company, LLC, 6201 - 15th Avenue, Brooklyn, New York 11219 or by telephone at either 718-921-8200 or toll-free at 800-937-5449.

In addition to a proxy card, you may also receive a "voting instructions" card which looks very similar to a proxy card. Voting instructions are prepared by brokers, banks or other nominees for stockholders who hold shares in street name.

Can I vote my shares in person at the meeting?

Yes. If you are a stockholder of record, you may vote your shares at the meeting by completing a ballot at the meeting. However, even if you currently plan to attend the meeting, we recommend that you submit your proxy ahead of time so that your vote will be counted if, for whatever reason, you later decide not to attend the meeting.

If you hold your shares in street name, you may vote your shares in person at the meeting only if you obtain a signed proxy from your broker, bank or other nominee giving you the right to vote such shares at the meeting.

What vote is required to elect directors?

Directors are elected by a plurality of votes cast. This means that the eight nominees receiving the highest number of "FOR" votes from our shares entitled to vote, present in person or represented by proxy, will be elected, provided that a quorum is present at the meeting.

What vote is required on proposals other than the election of directors?

With respect to each item of business to be voted on at the meeting, other than the election of directors, the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting that are entitled to vote with respect to that item is required for the approval of the item.

What are broker non-votes?

If your shares are held by a broker, the broker may require your instructions in order to vote your shares. If you give the broker instructions, your shares will be voted as you direct. If you do not give instructions, your shares will be considered to be “broker non-votes” and will not be voted on any proposal on which your broker does not have discretionary authority to vote.

Broker non-votes and other non-voted shares will not be deemed to be entitled to vote for purposes of determining whether stockholder approval of that matter has been obtained and thus will have no effect on the outcome of such matter.

How are votes counted?

Stockholders may either vote "FOR" or "WITHHOLD" authority to vote for the nominees for the Board. Stockholders may also vote "FOR," "AGAINST" or "ABSTAIN" on the other proposals.

If you vote ABSTAIN or WITHHOLD, your shares will be counted as present at the meeting for the purposes of determining a quorum.

If you ABSTAIN from voting on the proposals, your abstention has the same effect as a vote against those proposals. If you WITHHOLD authority to vote for one or more of the directors, this has the same effect as a vote against the director or directors for which you WITHHOLD your authority.

If you hold your shares in street name and do not provide voting instructions to your broker, they will be counted as present at the meeting for the purpose of determining a quorum but will not be voted on any proposal on which your broker does not have discretionary authority to vote.

What if I do not specify on my proxy card how I want my shares voted?

If you do not specify on your returned proxy card how you want to vote your shares, the proxies will vote them as recommended by our Board:

| | ● | FOR the election of all of the nominees for director; and |

| | ● | FOR the ratification of the appointment of Grant Thornton LLP to serve as Heelys' independent registered public accounting firm for the fiscal year ended December 31, 2011. |

Can I change my vote?

Yes. You may change your vote and revoke your proxy at any time before it is voted at the meeting in any of the following ways:

| | ● | by delivering a written notice of revocation to Heelys' Corporate Secretary; |

| | ● | by submitting another properly signed proxy card at a later date to our Corporate Secretary; or |

| | ● | by attending and voting in person at the Annual Meeting. |

Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Who pays the cost of proxy preparation and solicitation?

The Company pays for the cost of proxy preparation and solicitation, including the charges and expenses of brokerage firms or other nominees for forwarding proxy materials to beneficial owners.

We are soliciting proxies by mail. In addition, proxies may be solicited personally by some of our directors, officers and regular employees. These individuals receive no additional compensation beyond their regular salaries for these services.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

Our stockholders are being asked to elect eight directors for the ensuing year or until the election and qualification of their respective successors. Directors are elected at each annual meeting of stockholders and hold office until their successors are duly elected and qualified at the next annual meeting of stockholders. Our Amended and Restated By-Laws ("By-Laws") provide that our Board will consist of not less than one, and not more than eight, members, with the exact number of directors determined by our Board. Our Board has set the number of directors at eight.

Under our By-Laws, each of our directors holds office for one-year terms or until his successor has been elected and qualified or until his earlier death, resignation, disqualification or removal. Directors need not be stockholders.

The Board believes the combined business and professional experience of the Company's directors make them a useful resource to management and qualify them for service as a director. Many of the Company's directors have served on the Board for a significant period of time. During their tenures, these directors have gained considerable knowledge about the Company and its operations. Continuity of service and the development of knowledge help make the Board more efficient and effective at developing long-range plans. The Board seeks directors who it believes can make significant contributions to the Board and the Company, based upon, among others, business and financial experience, business contacts, relationship skills, knowledge of the Company and its competitors, and diversity in experiences, perspectives and skills that are most appropriate to meet the Company's needs.

Nominees for Election

Capital Southwest Venture Corporation ("CSVC") has the right to designate two nominees for director to be included in management's slate of director nominees, so long as it owns at least 15% of the outstanding shares of our common stock, and one such nominee so long as it owns at least 10%, but less than 15%. CSVC has designated Messrs. Martin and Neblett, both of whom are currently directors, as its designees for nomination to our Board.

Each of the eight individuals listed has consented to being named as a nominee in this Proxy Statement and has indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the proxy.

The following persons have been nominated by our Board to be elected to serve on the Board at the 2011 Annual Meeting of Stockholders. All of the nominees are current directors. The following information is as of April 15, 2011.

Jerry R. Edwards

Age 64

Mr. Edwards has served as one of our directors since March 12, 2008. Mr. Edwards has been President, CEO and Chairman of the board of directors of Great Circle Ventures Holdings, LLC ("GCVH") since 2008, which is a private investment company formed by Mr. Edwards to acquire and operate Tail Activewear, Inc., which is a women’s golf and tennis apparel company that distributes through pro shops and specialty retailers. Since 2005, Mr. Edwards has been Managing Director of Great Circle Ventures, LLC, a private investment firm founded in 2006 and a leading investor in GCVH. From 1998 until 2006, Mr. Edwards served as the Chief Executive Officer, President and acting Chairman of the board of directors of DASHAMERICA, Inc., doing business as Pearl Izumi USA, a brand of hi-tech, performance apparel and footwear for cycling, running, fitness and other active outdoor sports. In July 2005, Pearl Izumi USA was sold to Nautilus, Inc. (NYSE: NLS) at which time Mr. Edwards was appointed Vice President of Nautilus and President of the Nautilus Apparel and Footwear Division. From 1996 until 1998, Mr. Edwards served as Chief Operating Officer and President of Rodeer Systems, Inc., a transcription services business. Prior to that Mr. Edwards served as an executive of Lee Apparel Company, a division of VF Corporation, and Sales Technologies, Inc., a provider of field sales automation software and services, and in various capacities at Blue Bell, Inc., an apparel company. Mr. Edwards is a director and member of the compensation committee of ChartLogic, Inc. Mr. Edwards received a Bachelor of Science from East Carolina University, completed the USAF Meteorology Officer Program at Texas A&M University and received a Master of Science in systems management from the University of Southern California.

Mr. Edwards has over 25 years of experience managing high performing apparel and information technology operations. His extensive experience in the apparel industry, as well as his executive experience, is a valuable resource to our Board.

Patrick F. Hamner

Age 55

Mr. Hamner has served as one of our directors since May 2000 and was our Chairman of the Board until August 21, 2007. Mr. Hamner became a full-time employee of the Company in May 2006 and was one of our Senior Vice Presidents until May 1, 2008. Mr. Hamner provided the Company consulting services from April 2008 through June 2010. Since January 2009, Mr. Hamner has served as a Managing Director of Valesco Industries, which manages Valesco Commerce Street Capital, L.P., a Small Business Investment Company based in Dallas, Texas. Prior to May 2006, Mr. Hamner was a Senior Vice President of Capital Southwest Corporation, a publicly traded business development company (Nasdaq: CSWC), and its SBIC subsidiary CSVC, a firm with which he served for 24 years. From July 1998 to July 2007, Mr. Hamner served on the board of directors of Blue Magic, Inc., Jet-Lube, Inc., The RectorSeal Corporation and The Whitmore Manufacturing Company, all of which are chemical or lubricant manufacturing companies and are wholly owned by Capital Southwest Corporation. From October 2001 to October 2002, Mr. Hamner served as Chairman of the National Association of Small Business Investment Companies. Mr. Hamner received a Bachelor of Science in mechanical engineering, cum laude, from Southern Methodist University and a Master of Business Administration from The University of Texas at Austin.

Mr. Hamner served as our founding Chairman of the Board and was instrumental in financing the startup of our business, recruiting management and setting strategic direction. As Chairman, Mr. Hamner was also involved with acquisition activities, financing our growth and developing our corporate governance. Mr. Hamner has over 30 years of private equity, business start-up and development experience. Mr. Hamner's service as one of our directors since 2000 and his service as our Senior Vice President provide our Board with an in-depth source of knowledge regarding our historical strategies, operations, management team and governance issues.

Thomas C. Hansen

Age 54

Mr. Hansen has served as one of our directors since September 24, 2009. Mr. Hansen has served as our Chief Executive Officer since August 1, 2009. Mr. Hansen joined Heelys after more than 30 years in advertising and marketing. From October 2005 to July 2009, Mr. Hansen served as President of TM Advertising and was its Chief Marketing Officer from September 2004 to October 2005. From November 2002 to September 2004, Mr. Hansen served as the President, Chief Executive Officer and a Founding Partner of Gigasphere Group of Companies, a Dallas-based broadband-content delivery service. Mr. Hansen received a Bachelor of Science from the University of Kansas.

Mr. Hansen's more than 30 years of experience creating well known advertising and strategic product positioning for clients ranging from Hallmark and McDonald's to Miller Brewing Company, and his experience both building and restoring operations to their potential, is a valuable resource to our Board. Mr. Hansen's current position with us as Chief Executive Officer provides our Board with an in-depth source of knowledge regarding our current operations and management team.

Gary L. Martin

Age 64

Mr. Martin has served as one of our directors and Chairman of the Board since August 21, 2007. Mr. Martin is President and Chief Executive Officer of Capital Southwest Corporation, a business development company (Nasdaq: CSWC). Mr. Martin, who has been associated with Capital Southwest Corporation or its subsidiaries since 1972, has served on its board of directors since 1988 and was named President and Chief Executive Officer in July 2007 and Chairman of the board of directors in July 2008. Previously, he was Chief Executive Officer of The Whitmore Manufacturing Company of Rockwall, Texas, a producer of industrial lubricants and a key portfolio company of Capital Southwest Corporation. Mr. Martin also serves on the board of directors of several of Capital Southwest Corporation's portfolio companies including Alamo Group Inc., a manufacturer, distributer and servicer of equipment for right-of-way maintenance and agriculture (NYSE: ALG) where he serves on the compensation committee. He earned a Bachelor of Business in finance and accounting from the University of Oklahoma. CSVC, which is a wholly owned subsidiary of Capital Southwest Corporation, beneficially owns more than 5% of our outstanding common stock.

Mr. Martin's more than 38 years of management experience across a broad range of industries is a valuable resource to our Board.

N. Roderick McGeachy, III

Age 42

Mr. McGeachy has served as one of our directors since November 11, 2009. Mr. McGeachy has been President and Chief Executive Officer (October 2008), director (December 2008) and Chairman of the board of directors (May 2009) of Tandy Brands Accessories, Inc., a designer and marketer of branded accessories (NASDAQ: TBAC). From May 2006 to September 2008, Mr. McGeachy was the Vice President of Strategy & Business Development for the Jeanswear Americas coalition of VF Corporation, a worldwide branded lifestyle apparel and related products company (NYSE: VFC). From May 2005 to April 2006, Mr. McGeachy served as the Director, Corporate Strategy for VF Corporation and from January 1999 to April 2005, he served in senior marketing, strategy and general management roles for Russell Corporation, an athletic and sporting goods company, which was acquired by Berkshire Hathaway in 2005. Mr. McGeachy was a Morehead-Cain Scholar at the University of North Carolina and earned a Master of Business Administration from Harvard University. He is also a member of the Young Presidents’ Organization.

Mr. McGeachy's extensive functional and industry experience in the retail industry, sporting goods and equipment, new product development and innovation, marketing and brand building provides our Board with insight into important issues the Company faces.

Glenn M. Neblett

Age 39

Mr. Neblett joined our Board on August 25, 2010. Mr. Neblett is a Vice President at Capital Southwest Corporation, a business development company (Nasdaq: CSWC). Immediately prior to joining Capital Southwest Corporation in May 2010, Mr. Neblett was an investment banker with Houlihan Lokey for 10 years, advising clients in connection with mergers and acquisitions, leveraged buyouts, restructurings and capital-raising activities. He holds undergraduate (Bachelor of Business, accounting) and graduate (Master of Business Administration, finance) degrees from Baylor University and is a Chartered Financial Analyst and Certified Public Accountant. Mr. Neblett serves on the board of directors of the Capital Southwest Corporation portfolio companies Balco, Inc., KBI Biopharma Inc., PalletOne, Inc. and Trax Holdings, Inc. CSVC, which is a wholly-owned subsidiary of Capital Southwest Corporation, beneficially owns more than 5% of the Company’s outstanding common stock.

Mr. Neblett has over 10 years of experience in the investment banking industry and brings a unique perspective to strategic corporate finance opportunities and initiatives that may be considered by the Company.

Ralph T. Parks

Age 65

Mr. Parks has served as one of our directors since January 30, 2008 and served as our Interim Chief Executive Officer from February 1, 2008 until May 20, 2008. Mr. Parks has been involved in the footwear industry since 1965 in various capacities, including sales, management and consulting. Mr. Parks retired in 1999 after a 34-year career in the retail industry, including eight years as Chief Executive Officer of Footaction USA, an athletic footwear and apparel retailer and was inducted into the Sporting Goods Industry Hall of Fame in May 2000. Since 2002, he has served as President of RT Parks, Inc., a retailer of New Balance® footwear and apparel. Since 2002, Mr. Parks has also served on the board of directors of Hibbett Sports, Inc. (NASDAQ: HIBB), an operator of sporting goods stores. Mr. Parks is on the audit committee and serves as chairman of the compensation committee of the board of directors of Hibbett Sports, Inc. Mr. Parks has served on the board of directors of Kirklands, Inc. (NASDAQ: KIRK), a retailer of home décor items, since 2005 and currently serves on the audit committee and is the chairman of the governance committee. Mr. Parks attended Southern State College in Arkansas (now Southern Arkansas University).

Mr. Parks' more than 34 years of experience in the retail industry, his service as our Interim Chief Executive Officer, as well as his service as Chief Executive Officer of Footaction USA, provides our Board with in-depth insight into the retail and footwear industry.

Richard F. Strup

Age 58

Mr. Strup was elected to our Board December 9, 2010. Mr. Strup is the Senior Vice President, Corporate Strategy of Reyes Holdings, L.L.C., a leading food and beverage wholesale distributor serving customers throughout the U.S., Canada, and Latin America. His responsibilities at Reyes Holdings include working with senior management to determine overall corporate strategies and assessment of acquisitions. Following an extensive career in the consumer packaged goods industry, where he held various executive-level marketing, finance, and strategy positions, he joined Reyes Holdings in 2003. Previously, Mr. Strup was an executive at the Miller Brewing Company for 14 years where he spearheaded the commercial agreement and integration into South African Breweries, oversaw the company's International Division, and was the Global Chief Marketing Officer. Prior to Miller Brewing Company, he held various marketing and financial positions in both the domestic and international divisions of Frito Lay, PepsiCo and General Foods Corp. His marketing expertise was acknowledged with “Ad Campaign of the Year” honors in 1993 for Miller Genuine Draft in the U.S. and again in 1996 for Miller Pilsner in the U.K. Mr. Strup also received the prestigious Gold Lion Award from the Cannes Film Festival in 1994 for the Miller Lite “Combinations” advertising campaign and is considered one of the country’s premier sports marketers being recognized six times in The Sporting News magazine’s “Top 100 Most Powerful People” in sports. Mr. Strup serves on the board of directors of Atlantica, Inc. (OTC: ATTC) and served on the board of directors of The Radiate Group, a division of Omincom Group, Inc. (NYSE: OMC) from 2004 through 2010. He is also a member of Northwestern University's Kellogg School of Management Alumni Board and is on the board of directors of the Maryland Baseball Holding Company (owner of several minor league teams) and the Big Shoulders Fund (a non-profit organization whose mission is to provide support to Catholic schools in the neediest areas of inner-city Chicago). Mr. Strup earned a Bachelor of Arts degree in economics from Denison University, and a Master of Business Administration in marketing and finance from Northwestern University.

Mr. Strup’s extensive background in consumer marketing/advertising, corporate strategic planning and international business development, as well as his executive experience, is a valuable resource to the Company.

The Board recommends that you vote "FOR" the election of each nominee named above.

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee is directly responsible for the appointment, termination, compensation and replacement of Heelys' independent registered public accounting firm. Our Board dismissed Deloitte & Touche LLP ("Deloitte") as the Company's independent registered public accounting firm on June 22, 2009. The dismissal of Deloitte was approved and recommended by our Audit Committee. The decision to dismiss Deloitte was based primarily on cost considerations. Our principal accountants’ reports on the consolidated financial statements of the Company for the past two fiscal years did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits of the Company’s consolidated financial statements for the fiscal year ended December 31, 2008, and in the subsequent interim period through June 22, 2009, which was the date of dismissal of Deloitte, there were no disagreements between the Company and Deloitte on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of Deloitte would have caused Deloitte to make reference to the matter in its report.

The Company previously provided a copy of the foregoing disclosures to Deloitte and requested that Deloitte furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not Deloitte agreed with the above statements. A copy of the letter from Deloitte furnished in response to that request, dated June 26, 2009, was filed as Exhibit 16.1 to the Company's Current Report on Form 8-K filed with the Securities and Exchange Commission on June 26, 2009.

The Company engaged Grant Thornton LLP ("Grant Thornton") as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2009 to replace Deloitte. The engagement of Grant Thornton was effective as of June 30, 2009.

During the Company's two fiscal years prior to the engagement of Grant Thornton, and in the subsequent interim period though June 30, 2009, neither the Company nor anyone on its behalf consulted with Grant Thornton regarding (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company's financial statements, and Grant Thornton did not provide either a written report or oral advice to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions, or a reportable event, as defined in Item 304(a)(1)(v) of Regulation S-K.

We are not required to submit this appointment to the stockholders for ratification, but the Board believes it is desirable as a matter of good corporate governance practice. If our stockholders fail to ratify the appointment, the Audit Committee may, but is not required to, reconsider whether to retain Grant Thornton. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the fiscal year if it determines that such a change is in the best interests of the Company and its stockholders.

The Company expects that representatives of Grant Thornton will be present at the Annual Meeting, will have an opportunity to make a statement if they wish and will be available to respond to appropriate questions.

The Board recommends that you vote "FOR" the ratification of the appointment of Grant Thornton LLP as Heelys' independent registered public accounting firm.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company with respect to beneficial ownership of our common stock as of April 15, 2011 by (i) each stockholder that the Company knows is the beneficial owner of more than 5% of our common stock, (ii) each director and nominee for director, (iii) each of the executive officers named in the Summary Compensation Table (the "Named Executive Officers"), (iv) each of our other officers and (v) all executive officers, other officers and directors as a group. The Company has relied upon information provided to the Company by its directors, Named Executive Officers and other officers and copies of documents sent to the Company that have been filed with the Securities and Exchange Commission by others for purposes of determining the number of shares each person beneficially owns.

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission and generally includes those persons who have voting or investment power with respect to the securities. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares of the Company's common stock beneficially owned by them. Shares of the Company's common stock subject to options that are exercisable within 60 days of April 15, 2011 are also deemed outstanding for purposes of calculating the percentage ownership of that person, and if applicable, the percentage ownership of Named Executive Officers, other officers and directors as a group, but are not treated as outstanding for the purpose of calculating the percentage ownership of any other person. Unless otherwise indicated, the address for each stockholder listed in the table below is c/o Heelys, Inc., 3200 Belmeade Drive, Ste 100, Carrollton, Texas 75006.

| Name of Beneficial Owner | | Shares Beneficially Owned | | | Percentage | |

| | | | | | | |

| 5% Holders Not Listed Below: | | | | | | |

| Capital Southwest Venture Corporation(4)(6) | | | 9,317,310 | | | | 33.79 | % |

| Hodges Capital Management, Inc.(12) | | | 1,410,000 | | | | 5.11 | % |

| Directors and named Executive Officers: | | | | | | | | |

| Jerry R. Edwards(1) | | | 15,000 | | | | * | |

| Patrick F. Hamner(2) | | | 1,153,150 | | | | 4.07 | % |

| Thomas C. Hansen(3) | | | 108,000 | | | | * | |

| Gary L. Martin(4) | | | 9,322,310 | | | | 33.81 | % |

| N. Roderick McGeachy, III(5) | | | 6,000 | | | | * | |

| Glenn M. Neblett(6) | | | 9,317,310 | | | | 33.79 | % |

| Ralph T. Parks(7) | | | 15,000 | | | | * | |

| Richard F. Strup(8) | | | 5,000 | | | | * | |

| Craig D. Storey | | | 11,000 | | | | * | |

| Richard C. Groesch, III(9) | | | 8,000 | | | | * | |

| John W. O'Neil(10) | | | 33,750 | | | | * | |

| All directors, Named Executive Officers and other officers as a group(11 persons)(11): | | | 10,677,210 | | | | 37.44 | % |

* Less than 1 percent.

(1) Includes options to purchase an aggregate of 15,000 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(2) Includes options to purchase an aggregate of 790,000 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(3) Includes options to purchase an aggregate of 87,500 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(4) Includes 9,317,310 shares of common stock owned by CSVC. Mr. Martin is President, Chief Executive Officer and Chairman of the board of directors of Capital Southwest Corporation. CSVC, which is a wholly owned subsidiary of Capital Southwest Corporation, beneficially owns more than 5% of our outstanding common stock. Mr. Martin may be deemed to share voting power and investment power with respect to the shares of common stock beneficially owned by CSVC. Mr. Martin disclaims beneficial ownership of such shares. The address for Mr. Martin and CSVC is 12900 Preston Road, Suite 700, Dallas, Texas 75230.

(5) Includes options to purchase an aggregate of 5,000 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(6) Includes 9,317,310 shares of common stock owned by CSVC. Mr. Neblett is a Vice President at Capital Southwest Corporation. CSVC, which is a wholly owned subsidiary of Capital Southwest Corporation, beneficially owns more than 5% of our outstanding common stock. Mr. Neblett may be deemed to share voting power and investment power with respect to the shares of common stock beneficially owned by CSVC. Mr. Neblett disclaims beneficial ownership of such shares. The address for Mr. Neblett and CSVC is 12900 Preston Road, Suite 700, Dallas, Texas 75230.

(7) Includes options to purchase an aggregate of 15,000 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(8) All of Mr. Strup’s shares of common stock are owned by the Richard F. and Cindy D. Strup Revocable Trust UAD 11/12/96.

(9) Includes options to purchase an aggregate of 5,000 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(10) Includes options to purchase an aggregate of 28,750 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(11) Includes options to purchase an aggregate of 946,250 shares of common stock that are currently exercisable or exercisable within 60 days of April 15, 2011.

(12) The mailing address for Hodges Capital Management, Inc. is 2905 Maple Avenue, Dallas, Texas 75201.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and related regulations, require Heelys' directors, officers, and any persons holding more than 10 percent of Heelys' common stock (collectively, "Reporting Persons") to report their initial ownership of Heelys' securities and any subsequent changes in that ownership to the Securities and Exchange Commission. The Securities and Exchange Commission has established specific due dates for these reports, and Heelys is required to disclose in this Proxy Statement any failure of a Reporting Person to file a required report by the applicable due date.

| | ● | On April 6, 2010, Roger Adams sold common stock of the Company. Mr. Adam’s report of sale was filed on Form 4 on April 9, 2010. |

| | ● | On August 25, 2010, Thomas C. Hansen was awarded restricted stock units. Mr. Hansen’s report of this award was filed on Form 4 on December 17, 2010. |

Except for the late filings listed above, and based solely on a review of copies of the reports filed and written representations submitted by the Reporting Persons, we believe that all Reporting Persons timely filed all required Section 16(a) reports for the most recent fiscal year.

The following sets forth, as of April 15, 2011, our executive officers.

Thomas C. Hansen, age 54, has served as our Chief Executive Officer since August 1, 2009. His biography is contained in the section of this Proxy Statement entitled "Election of Directors."

Craig D. Storey, age 43, has served as our Chief Operating Officer and Chief Financial Officer since June 7, 2010. Prior to joining Heelys, Mr. Storey was the Chief Executive Officer and Chief Financial Officer of Sprig Toys, a preschool toy company which he cofounded and then later sold to Wham-O in February 2010. Prior to Sprig, Mr. Storey spent twelve years with Radica Games, a NASDAQ traded electronic toy and game company headquartered in Hong Kong with offices in Dallas, Pasadena, Hertfordshire, UK and Dongguan China. Mr. Storey began his career at Radica as the Assistant to the President in 1995, providing financial analysis and implementing process controls. In 1996, he was promoted to Controller of the US Division, where he served until he was promoted to Chief Accounting Officer for the parent company in Hong Kong in 1999. In 2002, Mr. Storey was promoted to Worldwide Chief Accounting Officer and Vice President of Finance and Operations, US Division, a position he retained until Radica was sold to Mattel in 2006. Mr. Storey remained with Mattel until he joined Sprig in 2007. Mr. Storey has a Bachelor of Science in finance from Arizona State University and is a certified public accountant in the State of Nevada. He also serves on the board of directors for Sprig Toys.

John W. O'Neil, age 65, has served as our Vice President, International since July 2007. Mr. O'Neil joined us from Dunham Bootmakers, a division of New Balance AS Inc., where he served as International Business Manager since 2005. In that role, Mr. O'Neil established business operations in Eastern Europe, Israel, Japan and Australia/New Zealand. From 1999 to 2004, Mr. O'Neil held the position of Regional General Manager at New Balance where he managed 3 subsidiaries and 18 distributors throughout Europe, the Middle East and Africa. Mr. O'Neil also spent 14 years at Converse, Inc., now a division of Nike, Inc. and served in various senior capacities including Regional Director for the United Kingdom and emerging markets and Director, International Marketing & Operations. Mr. O'Neil received a Bachelor of Science degree in mechanical engineering from Tufts University and a Master of Business Administration from American International College.

Richard C. Groesch, III, age 37, served as our Vice President, Brand Engagement from February 2010 until February 2011 when he was named our Chief Commercial Officer. Mr. Groesch comes to Heelys after holding various marketing positions throughout his 16 year career helping blue chip corporations realize their business and marketing goals. Mr. Groesch spent the 3 years prior to joining Heelys consulting and working on sports, event and entertainment properties for Verizon and Samsung as Vice President of Global Consulting for Gaylord Sports Group. From 2004 until 2007, he served in the Samsung family of businesses as the Global Sports Marketing Director, residing in Seoul, South Korea. While at Samsung, he worked on licensing agreements, global sports properties such as the Olympics and negotiated key market global sponsorships such as the partnership with Chelsea Football Club out of the United Kingdom. Mr. Groesch started his career working with General Motors as a client within the IPG family of advertising and marketing agencies. Throughout his 10+ years working at General Motors with Buick, Oldsmobile and Chevrolet, Mr. Groesch rose from the Account Executive to Director level working primarily in the sports, event and entertainment side of the business. Mr. Groesch has a Bachelor of Science in journalism and advertising, from the University of Nevada.

Board of Directors' Leadership, Structure and Risk Oversight

The business and affairs of Heelys is managed by or under the direction of our Board. The Board derives its power and governance guidelines from our By-Laws and our Governance Principles. The complete text of our By-Laws and our Governance Principles are posted on the Investor Relations page of our website at www.heelys.com under the heading "Governance" and the sub-heading "Committees & Charters." In providing this oversight, the Board adheres to general guidelines designed to ensure that the Board has access to relevant information, and is structured and operates in a manner allowing it to exercise independent business judgment. The Board performs a number of functions for Heelys and its stockholders, including:

| | ● | reviewing and approving Heelys' long-term strategic plans; |

| | ● | monitoring and evaluating management's systems for internal control, financial reporting and public disclosure; |

| | ● | establishing corporate governance standards; |

| | ● | planning for the effective succession of the Chief Executive Officer and other senior management; |

| | ● | monitoring management's performance to ensure that the Company operates in an ethical manner; and |

| | ● | reviewing and approving annual operating budgets. |

According to our By-Laws, the Chairman of the Board may not be the Chief Executive Officer. The Board believes that the separation of these positions strengthens the independence of our Board and its ability to carry out its roles and responsibilities on behalf of our stockholders. In addition, the separation of the offices allows the Chairman of the Board to focus on the leadership of the Board while allowing our Chief Executive Officer to focus his time and energy on managing our operations.

The Board is actively involved in the oversight of risks that could affect the Company. This oversight is conducted primarily through the Audit Committee of the Board but also through the other committees of the Board, as appropriate. Our Chief Executive Officer brings members of our management from various business or administrative areas into meetings of the Board from time to time to make presentations and to provide insight to the Board, including insight into areas of potential risk. The Board and its committees, including the Audit Committee, satisfy this responsibility through reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Independence

The listing rules of the Nasdaq Stock Market require that our Board be comprised of a majority of independent directors. In addition to the definition of independent director set forth in the listing rules of the Nasdaq Stock Market, Section 1 of Article III of our By-Laws sets forth additional requirements for a director or nominee to be considered "independent." Our By-Laws are posted on the Investor Relations page on our website at www.heelys.com under the heading "Governance" and the sub-heading "Committees & Charters."

The Board has determined that Messrs. Edwards, Martin, McGeachy, Neblett, Parks and Strup are independent directors as set forth in the listing rules of the Nasdaq Stock Market. The Board also determined that each member of the Company's Audit Committee and Compensation Committee is an independent director in accordance with those standards and applicable Securities and Exchange Commission rules and regulations.

On an annual basis, each director and executive officer provides information to the Company pursuant to a Director and Officer Questionnaire. The information provided includes the identification of any transactions with the Company in which the director or executive officer, or any member of his immediate family, has a direct or indirect material interest. The information provided indicated that none of the directors has any material relationship (other than being a director or stockholder of the Company or as otherwise described herein) with the Company (either directly or indirectly).

Mr. Martin is President, Chief Executive Officer and Chairman of the board of directors of Capital Southwest Corporation and Mr. Neblett is a Vice President at Capital Southwest Corporation. CSVC, which is a wholly owned subsidiary of Capital Southwest Corporation, beneficially owns more than 5% of our outstanding common stock and has the right to designate up to two nominees of management's slate of directors. The Board has determined that, in its opinion, Mr. Martin's and Mr. Neblett’s relationship with Capital Southwest Corporation would not interfere with their exercise of independent judgment in carrying out their responsibilities as directors. Mr. Martin and Mr. Neblett were designated for nomination to our Board by CSVC.

Mr. Parks has served as one of our directors since January 30, 2008 and served as our Interim Chief Executive Officer from February 1, 2008 until May 20, 2008. The Board has determined that, in its opinion, Mr. Parks' service as the Company's Interim Chief Executive Officer would not interfere with his exercise of independent judgment in carrying out his responsibilities as a director.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to all directors, executive officers and employees. Each of our directors, executive officers and employees are expected to conduct the business and affairs of the Company with honesty and integrity and are expected to adhere to high standards of conduct. The Company's objective is that all persons who deal with us believe that we not only scrupulously follow the law, but also act ethically and honestly. The Code sets out general principles to guide our directors, executive officers and employees in determining proper business conduct and in making ethical decisions as they perform their duties.

The complete text of our Code of Business Conduct and Ethics is posted on the Investor Relations page of our website at www.heelys.com under the heading "Code of Business Conduct and Ethics."

Policy Regarding Board Attendance at Stockholder Meetings

All of our directors and senior management are encouraged to attend every Company annual meeting of stockholders so that our stockholders will have the opportunity to meet and question a representative group of our directors and senior executives. All of our then current directors, with the exception of Jeffrey G. Peterson, attended our 2010 annual meeting of stockholders. We expect all of our current directors to attend the 2011 annual meeting.

Related Party Transaction Policy and Procedures

Pursuant to resolutions adopted by our Board on August 29, 2006, all transactions between the Company and its officers, directors, principal stockholders and their affiliates must be consummated on terms no less favorable to the Company than could be obtained by the Company from unrelated third parties and must be approved by a majority of the outside independent and disinterested directors.

Board Meetings

The Board held 6 meetings during 2010. Each director attended at least 75 percent of the aggregate of all meetings of the Board and its committees on which he served. Pursuant to our By-Laws, the Board is not required to hold meetings on any regular schedule. Regular meetings may be held without notice at such time and at such place as may from time to time be determined by the Board. Special meetings may be called by the Chairman of the Board, the President, or any two or more directors or by one director in the event that there is only a single director in office. Directors must be notified of meetings at least 72 hours before the meeting.

Communication with the Board

Stockholders of the Company may communicate with our Board or any director by writing to the Board in a communication sent to our Corporate Secretary at 3200 Belmeade Drive, Ste 100, Carrollton, Texas 75006. Our Corporate Secretary will conduct an initial review of any such communication and will forward the communication to the director or directors to whom it is addressed, except only for communications that are (1) advertisements or promotional communications, (2) solely related to complaints regarding ordinary-course-of-business product or customer service or satisfaction issues or (3) clearly unrelated to the Company's business, industry, management or Board or committee matters. The Corporate Secretary also will make all such communications available to each member of the Board at the Board's next regularly scheduled meeting.

Board Committees

Our Board has established an Audit Committee and a Compensation Committee. Each of these committees has a written charter approved by the Board establishing the authority and responsibilities of such committee. Each committee's charter is posted on the Investor Relations page of our website at www.heelys.com under the heading "Governance" and the sub-heading "Committees & Charters."

Audit Committee

The Audit Committee, established in accordance with Section 3(a)(58)(A) of the Exchange Act, reviews and monitors (i) our corporate financial reporting and our internal and external audits, including our internal audit and control functions, the results and scope of our annual audit and other services provided by our independent registered public accounting firm and (ii) our compliance with legal matters that have a significant impact on our financial reports. The Audit Committee also consults with management and our independent registered public accounting firm before the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into aspects of our financial affairs. In addition, the Audit Committee has the responsibility to consider and appoint, and determine the services of and the fee arrangements with, our independent registered public accounting firm.

The Audit Committee has the power to establish subcommittees and delegate powers to such subcommittees. The Audit Committee has not established any such subcommittee or delegated any of its powers and has no current plans to do so.

The current members of the Audit Committee are Messrs. Edwards, McGeachy and Strup, each of whom has been determined to be independent by our Board. Our Board has determined that Mr. Edwards, the current chairman of our Audit Committee, is an "audit committee financial expert" under applicable Securities and Exchange Commission rules and has the required financial sophistication pursuant to the listing rules of the Nasdaq Stock Market. The Audit Committee met 7 times during 2010.

Compensation Committee

The Compensation Committee determines, or reviews and approves, forms of compensation provided to our executive officers and our directors, including stock compensation. In addition, the Compensation Committee administers, and oversees the administration of the stock and other incentive compensation plans or programs for all of our other employees. As part of these responsibilities, the Compensation Committee administers the Heelys, Inc. 2006 Stock Incentive Plan, as amended and restated as of May 20, 2010 (the “2006 Plan”). Under the Compensation Committee's charter, the Compensation Committee may delegate the day-to-day administration of the compensation plan and programs to employees of the Company.

In addition, the Compensation Committee may establish subcommittees consisting of one or more members of the Compensation Committee, and delegate its authority and responsibilities to such subcommittees as it deems appropriate. The Compensation Committee has not established any subcommittees and currently has no plans to do so.

The current members of the Compensation Committee are Messrs. McGeachy, Martin and Neblett, each of whom has been determined to be independent by our Board. Mr. McGeachy is the current chairman of our Compensation Committee. The Compensation Committee met 6 times during 2010.

Director Nomination Process

As permitted under the listing rules of the Nasdaq Stock Market, the Company does not have a separate nominating committee or other committee performing a similar function. Instead of such nominating committee, the Company has adopted a Director-Nomination Process by which the Company's independent directors, acting as a majority, are authorized to recommend individuals to the Board for the Board's selection as director nominees. A copy of the Director-Nomination Process is posted on the Investor Relations page of our website at www.heelys.com under the heading "Governance" and the sub-heading "Committees & Charters."

The independent directors review and interview candidates who are qualified to satisfy the requirements for directors set forth in our By-Laws, make recommendations to the Board for nominations and select the management nominees for the directors to be elected by the Company's stockholders. The independent directors may take into account all factors they consider appropriate in fulfilling their responsibilities to identify and recommend individuals to the Board as director nominees. Those factors may include, but are not necessarily limited to:

| | ● | an individual’s business or professional experience, accomplishments, education, judgment, understanding of the business and the industry in which the Company operates, specific skills and talents, independence, time commitments, reputation, general business acumen and personal and professional integrity or character; |

| | ● | the size and composition of the Board and the interaction of its members, in each case with respect to the needs of the Company and its stockholders; |

| | ● | regarding any individual who has served as a director of the Company, his or her past preparation for, attendance at and participation in meetings and other activities of the Board or its committees and his or her overall contributions to the Board and the Company; and |

| | ● | the length of such individual’s service on the Board (it being the policy of the Company not to permit an individual to serve more than 15 years on the Board). |

Under our Director-Nomination Process, the independent directors may use multiple sources for identifying and evaluating nominees for directors, including referrals from the Company's directors and management and input from third parties, such as executive-search firms retained by the Board. The independent directors are required to interview candidates and obtain background information. The Company’s other directors are given the opportunity to meet and interview candidates.

While the Director-Nomination Process does not specifically include a formal diversity policy, when considering director candidates the skills and characteristics of the candidate are considered in context of the current make-up of the Board, including, among other factors, diversity. This consideration may include diversity in experiences, perspectives and skills that are most appropriate to meet the Company’s needs.

Our Director-Nomination Process requires the independent directors to consider qualified nominees recommended by the Company's stockholders. Nominees for directors who are recommended by any of the Company's stockholders are evaluated in the same manner as any other nominee for director except that the Company's Chairman of the Board must chair the meeting(s) of the independent directors conducting the evaluation and making the recommendation to the Board. Stockholders may submit recommendations to the independent directors, in care of the Board, through a written notice addressed to the Company's Secretary at the Company's principal executive offices, not less than 120 days nor more than 150 days before the anniversary of the date on which the Company's proxy statement was released to its stockholders in connection with the previous year's annual meeting of stockholders, or as otherwise provided in the Company's By-Laws.

A stockholder's written recommendation of a nominee must include or be accompanied by (1) all information relating to the recommended person that is required to be disclosed in solicitations of proxies for election of directors under the proxy rules of the Securities and Exchange Commission and such other information as the Company requires regarding the selection of directors, (2) all information regarding the proposed nominee, if required pursuant to our By-Laws, (3) a description of all compensation, agreements and relationships during the last three years between or among the proposing person, on the one hand, and the proposed nominee, his respective affiliates and associates and any other persons with whom the proposed nominee is acting in concert, on the other hand, including all information required to be disclosed pursuant to Item 404 of Regulation S-K if the proposing person were a "registrant" and the proposed nominee were a director or executive officer of such registrant, (4) a completed and signed questionnaire, representation and agreement (in form provided by our Corporate Secretary) that such proposed nominee (i) is not and will not become a party to (A) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how such proposed nominee, if elected as a director of the Company, will act or vote on any issue or question (a "Voting Commitment") that has not been disclosed to the Company or (B) any Voting Commitment that could limit or interfere with such proposed nominee's ability to comply, if elected as a director of the Company, with such proposed nominee's fiduciary duties under applicable law, (ii) is not, and will not become a party to, any agreement, arrangement or understanding with any person or entity other than the Company with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed to the Company, (iii) such proposed nominee meets all of the qualifications for an independent director set forth in paragraphs (b) and (c) of Section 1 of Article III of our By-Laws, and (iii) in such proposed nominee's individual capacity and on behalf of the stockholder (or the beneficial owner, if different) on whose behalf the nomination is made, would be in compliance, if elected as a director of the Company, and will comply, with applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of the Company, and (5) a written statement from the recommended person that he or she is willing to be named in the proxy statement as a nominee and to serve as a director if elected. In addition, such written recommendation must set forth as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made and any affiliate or associate of such stockholder or beneficial owners and any other person with whom such stockholder or beneficial owner is acting in concert (the "Proposing Person"), (1) the name and address of such Proposing Person, including, as applicable, as they appear on the Company's books; (2) the class and number of shares of the Company that are directly or indirectly owned of record or beneficially owned by such Proposing Person; (3) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the

meeting to propose such business or nomination; (4) as to each Proposing Person, (A) any derivative, swap or other transaction or series of transactions engaged in, directly or indirectly, by such Proposing Person, the purpose or effect of which is to give such Proposing Person economic risk similar to ownership of shares of any class or series of the Company, or which provide, directly or indirectly, the opportunity to profit from any increase in the price or value of shares of any class or series of the Corporation ("Synthetic Equity Interests"), which Synthetic Equity Interests shall be disclosed without regard to whether (x) the derivative, swap or other transactions convey any voting rights in such shares to such Proposing Person, (y) the derivative, swap or other transactions are required to be, or are capable of being, settled through delivery of such shares or (z) such Proposing Person may have entered into other transactions that hedge or mitigate the economic effect of such derivative, swap or other transactions, (B) any proxy (other than a revocable proxy or consent given in response to a solicitation made pursuant to, and in accordance with, Section 14(a) of the Exchange Act by way of a solicitation statement filed on Schedule 14A), agreement, arrangement, understanding or relationship pursuant to which such Proposing Person has or shares a right to vote any shares of any class or series of the Company, (C) any agreement, arrangement, understanding or relationship, including any repurchase or similar so-called "stock borrowing" agreement or arrangement, engaged in, directly or indirectly, by such Proposing Person, the purpose or effect of which is to mitigate loss to, reduce the economic risk (of ownership or otherwise) of shares of any class or series of the Company by, manage the risk of share price changes for, or increase or decrease the voting power of such Proposing Person with respect to the shares of any class or series of the Company, or which provides, directly or indirectly, the opportunity to profit from any decrease in the price or value of the shares of an class or series of the Company ("Short Interests"), (D) any rights to dividends on the shares of any class or series of the Company owned beneficially by such Proposing Person that are separated or separable from the underlying shares of the Company, (E) any performance related fees (other than an asset based fee) that such Proposing Person is entitled to based on any increase or decrease in the price or value of shares of any class or series of the Company, or any Synthetic Equity Interests or Short Interests, if any, and (F) any other information relating to such Proposing Person that would be required to be disclosed in a proxy statement or other filing required to be made in connection with solicitations of proxies or consents by such Proposing Person in support of the business proposed to be brought before the meeting pursuant to Section 14(a) of the Exchange Act (the disclosures to be made pursuant to the foregoing clauses (A) through (F) are referred to as "Disclosable Interests"); provided, however, that Disclosable Interests shall not include any such disclosures with respect to the ordinary course business activities of any broker, dealer, commercial bank, trust company or other nominee who is a Proposing Person solely as a result of being the stockholder directed to prepare and submit the notice required by our By-Laws on behalf of a beneficial owner; and (5) a representation whether the Proposing Person intends or is part of a group which intends (x) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Company's outstanding shares of capital stock required to approve or adopt the proposal or elect the nominee; and/or (y) otherwise to solicit proxies from stockholders in support of such proposal or nomination. Furthermore, if the stockholder (or a qualified representative of the stockholder) does not appear at the meeting of stockholders of the Company to present a nomination, such nomination shall be disregarded, notwithstanding that proxies in respect of such vote may have been received by the Company.

The independent directors must also consider each individual designated in accordance with the Company's agreement with CSVC and certain of the Company's other stockholders pursuant to which CSVC has the contractual right to designate (i) two persons to be included in management's slate of director nominees so long as it owns at least 15% of the outstanding shares of Heelys' common stock, and (ii) one such nominee so long as it owns at least 10%, but less than 15%, of the outstanding shares of Heelys' common stock. CSVC has designated Messrs. Martin and Neblett to be nominated as directors of the Company at our 2011 Annual Meeting of Stockholders.

Limitation of Liability and Indemnification

Our Certificate of Incorporation includes a provision that eliminates the personal liability of our directors for monetary damages for breach of fiduciary duty as a director, except for liability:

| | ● | for any breach of the director's duty of loyalty to us or our stockholders; |

| | ● | for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| | ● | under Section 174 of the Delaware General Corporation Law regarding unlawful dividends and stock purchases; or |

| | ● | for any transaction from which the director or officer derived an improper personal benefit. |

Our By-Laws provide that:

| | ● | we must indemnify our directors and officers to the fullest extent permitted by Delaware law, subject to very limited exceptions; |

| | ● | we may indemnify our other employees and agents to the same extent that we indemnify our directors and officers; and |

| | ● | we must advance expenses, as incurred, to our directors and officers in connection with a legal proceeding to the fullest extent permitted by Delaware law, subject to very limited exceptions. |

We have also entered into an indemnification agreement with each of our directors and officers containing provisions that require us to indemnify our directors and officers against liabilities that may arise by reason of their status or service as directors or officers, other than liabilities arising from willful misconduct of a culpable nature, to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified and to obtain directors' and officers' insurance if available on reasonable terms.

In accordance with our By-Laws, our directors are entitled to compensation for their services as determined by our Compensation Committee. In addition, our directors may be entitled to the issuance of equity-based compensation awards under our 2006 Plan, from time to time, as determined by our Compensation Committee. Members of special or standing committees of the Board may be provided compensation for service as committee members, as determined by the Compensation Committee.

Currently, directors who receive compensation are paid $18,000 per year for serving on our Board, $5,000 per year, if applicable, for chairing a committee of our Board and, subject to an $8,000 per year maximum, $750 and $500 for each Board meeting and committee meeting, respectively, attended.

Currently, only Messrs. Edwards, McGeachy, Parks and Strup receive compensation for duties performed as directors. Messrs. Martin, Hamner and Neblett are not compensated. Directors who are also our officers or employees do not receive compensation for duties performed as directors. All directors are entitled to reimbursement of reasonable out-of-pocket expenses incurred in connection with their attendance at Board and committee meetings.

The following table summarizes compensation earned by our directors during 2010.

DIRECTOR COMPENSATION TABLE

| | | Fees Earned or Paid in Cash | | | | | | | | | | |

| Name | | Director Fees | | | Meeting Attendance | | | Option Awards(7) | | | Other | | | Total | |

| Jerry R. Edwards(1) | | $ | 18,417 | | | $ | 4,500 | | | $ | - | | | $ | - | | | $ | 22,917 | |

| Patrick F. Hamner(2) | | | - | | | | - | | | | - | | | | 65,000 | | | | 65,000 | |

| Thomas C. Hansen(3) | | | - | | | | - | | | | - | | | | - | | | | - | |

| Samuel B. Ligon(4) | | | 21,083 | | | | 6,500 | | | | 25,800 | | | | - | | | | 53,383 | |

| Gary L. Martin | | | - | | | | - | | | | - | | | | - | | | | - | |

| N. Roderick McGeachy, III(5) | | | 21,125 | | | | 6,500 | | | | - | | | | - | | | | 27,625 | |

| Glenn M. Neblett | | | - | | | | - | | | | - | | | | - | | | | - | |

| Ralph T. Parks | | | 18,000 | | | | 4,500 | | | | - | | | | - | | | | 22,500 | |

| Richard F. Strup(6) | | | 1,500 | | | | 750 | | | | 31,200 | | | | - | | | | 33,450 | |

| | | $ | 80,125 | | | $ | 22,750 | | | $ | 57,000 | | | $ | 65,000 | | | $ | 224,875 | |

(1) Mr. Edwards was appointed Chairman of the Audit Committee December 9, 2010.

(2) During 2010, Mr. Hamner was paid $65,000 for consulting services provided to the Company. Refer to the “Certain Relationships and Related Transactions” section of this Proxy Statement for further discussion. Mr. Hamner does not receive compensation for duties performed as a director.

(3) Because Mr. Hansen is a Company officer and employee he is not compensated for duties performed as a director.

(4) Mr. Ligon resigned from the Board December 9, 2010.

(5) Mr. McGeachy is Chairman of the Compensation Committee.

(6) Mr. Strup was elected to the Board December 9, 2010.

(7) Dollar amounts in the Stock Option awards column reflect the aggregate grant date fair value of awards granted during the fiscal year. Mr. Ligon was granted a stock option to purchase 20,000 shares of common stock in March 2010. Mr. Strup was granted a stock option to purchase 20,000 shares of common stock in December 2010. Stock options granted vest and become exercisable in four equal cumulative installments on each successive anniversary date of the grant and have a contractual term of ten years. The Company computes the fair value of stock option awards using the Black-Scholes option pricing model. The following assumptions were made for purposes of calculating the grant date fair value of options: options granted to Mr. Ligon: expected volatility: 50.16%; dividend yield: 0.0%; risk-free interest rate: 3.14%; and expected life: 6.25 years; options granted to Mr. Strup: expected volatility: 49.41%; dividend yield: 0.0%; risk-free interest rate: 2.62%; and expected life: 6.25 years. For additional discussion of assumptions used to value stock option grants, refer to Note 11 to the Company's consolidated financial statements for the fiscal year ended December 31, 2010 in the Company's Form 10-K filed with the Securities and Exchange Commission on March 10, 2011.

The following table sets forth the number of shares underlying stock options held by each non-employee director as of December 31, 2010. No stock options have been granted to either Mr. Martin or Mr. Neblett. Refer to the section “Executive Compensation” in this Proxy Statement for discussion regarding stock options granted to Mr. Hansen.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2010

| Name | | Date of Grant | | Number of Shares Granted(3) | | | Exercise Price | | | Number of Shares Vested | | | Number of Shares Unvested | | | Number of Shares Outstanding | |

| Jerry R. Edwards | | 5/30/2008 | | | 20,000 | | | $ | 4.39 | | | | 10,000 | | | | 10,000 | | | | 20,000 | |

| Patrick F. Hamner(1) | | 6/23/2006 | | | 790,000 | | | $ | 4.05 | | | | 790,000 | | | | - | | | | 790,000 | |

| Samuel B. Ligon(2) | | 3/18/2010 | | | 20,000 | | | $ | 2.47 | | | | - | | | | - | | | | - | |

| N. Roderick McGeachy, III | | 11/17/2009 | | | 20,000 | | | $ | 2.15 | | | | 5,000 | | | | 15,000 | | | | 20,000 | |

| Ralph T. Parks | | 3/6/2008 | | | 20,000 | | | $ | 4.26 | | | | 10,000 | | | | 10,000 | | | | 20,000 | |

| Richard F. Strup | | 12/9/2010 | | | 20,000 | | | $ | 3.37 | | | | - | | | | 20,000 | | | | 20,000 | |

(1) Stock options were granted to Mr. Hamner when Mr. Hamner was an officer of the Company. Mr. Hamner resigned his position with the Company effective as of April 30, 2008. Options continued to vest in accordance with the 2006 Plan so long as Mr. Hamner remained a member of the Board. As of June 30, 2010, all options granted to Mr. Hamner had fully vested. Contractual term of the grant is ten years.

(2) Mr. Ligon resigned from the Board December 9, 2010. At the time of Mr. Ligon’s resignation, Mr. Ligon’s stock options (all unvested) were forfeited.

(3) All stock options granted, with the exception of stock options granted to Mr. Hamner, vest and become exercisable in four equal installments on each successive anniversary date of the grant and have a contractual term of ten years.

Introduction

The following discussion should be read in conjunction with the various tables and accompanying narrative disclosures appearing in this Proxy Statement. Those tables and narrative provide more detailed information regarding the compensation and benefits awarded to, earned by, or paid to our Chief Executive Officer and the other executive officers named in the Summary Compensation Table.

The Compensation Committee determines, or reviews and approves, forms of compensation provided to our Named Executive Officers, including stock compensation, to ensure that total compensation paid to those officers is fair, reasonable and competitive.

Philosophy

Our philosophy is to align our executives’ compensation with the Company’s business strategies in an effort to drive overall organizational success and stockholder value. The Compensation Committee works with the Company to design compensation programs that are designed to, among other things:

| | ● | attract and retain highly qualified executives; |