Essex Rental Corp. Proxy Advisory Presentation 1

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is an outline of matters for discussion only. Some of the statements in this presentation and other written and oral statements made from time to time by the Company and its representatives are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent and belief or current expectations of Essex and its management team and may be identified by the use of words like "anticipate", "believe", "estimate", "expect", "intend", "may", "plan", "will", "should", "seek", the negative of these terms or other comparable terminology. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from Essex’s expectations include, without limitation, the continued ability of Essex to successfully execute its business plan, the possibility of a change in demand for the products and services that Essex provides, intense competition which may require us to lower prices or offer more favorable terms of sale, our reliance on third party suppliers, our indebtedness which could limit our operational and financial flexibility, global economic factors including interest rates, general economic conditions, geopolitical events and regulatory changes, our dependence on our management team and key personnel, as well as other relevant risks detailed in our Annual Report on Form 10-K and subsequent periodic reports filed with the Securities and Exchange Commission and available on our website, www.essexrentalcorp.com. The factors listed here are not exhaustive. Many of these uncertainties and risks are difficult to predict and beyond management’s control. Forward-looking statements are not guarantees of future performance, results or events. Essex assumes no obligation to update or supplement forward-looking information in this presentation whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results or financial conditions, or otherwise. This presentation contains unaudited non-GAAP financial measures, including Adjusted EBITDA. Management believes that the presentation of these non-GAAP financial measures serves to enhance understanding of Essex’s individual operating and financial performance. These non-GAAP financial measures should be considered in addition to, but not as substitutes for, the most directly comparable U.S. GAAP measures. A reconciliation of Adjusted EBITDA to net loss for the three month period ended March 31, 2015 can be found in Essex’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 7, 2015. We believe the non-Company information provided herein is reliable, as of the date hereof, but do not warrant its accuracy or completeness. In preparing these materials, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Except as required by law, the Company, Essex and their respective directors, officers, employees, agents and consultants make no representation or warranty as to the accuracy or completeness of the non-Company information contained in this document, and take no responsibility under any circumstances for any loss or damage suffered as a result of any omission, inadequacy, or inaccuracy in this document. The Company does not guaranty the performance or return of capital from investments. ©2011 Essex Rental Corp. 2

3 Background Dissident shareholders Lee Keddie and Kevin Casey have distributed materials regarding a purported contested director election at the June 4, 2015 Annual Meeting of Essex Rental Corp. (“Essex” or the “Company”). The Company has repeatedly advised Messrs. Keddie and Casey that because they have failed to comply with the advance notice provisions of the Company's bylaws they will not be permitted to make nominations at the Annual Meeting, and that votes cast for directors on their gold proxy card will not be counted at the Annual Meeting. Messrs. Keddie and Casey nonetheless continue to solicit stockholder votes on their gold proxy card without disclosing to stockholders that votes for directors on the gold card will not be counted at the Annual Meeting. Accordingly, the Company has advised its stockholders intending to vote for the election of directors at the Annual Meeting, by the granting of a proxy, that only votes for directors cast on the Company's WHITE proxy card will be counted at the Annual Meeting, and that votes for directors cast on the gold proxy card solicited by Lee Keddie and Kevin Casey, will not be counted. Notwithstanding the inability of Messrs. Keddie and Casey to make nominations at the Annual Meeting for failure to comply with the Company's bylaws, the Board has invited Mr. Keddie and his fellow purported nominee, John Climaco (who collectively own 500 shares of ESSX stock), to join the Board on June 4, 2015. Mr. Keddie has refused to communicate with Company representatives other than through his counsel. Essex’s Board of Directors has also taken action to be responsive to Messrs. Keddie and Casey’s other demands (see page 14).

4 Essex Rental Communication Although the dissidents will not be entitled to nominate directors at the Annual Meeting, and notwithstanding that gold proxy cards will not be counted for the purposes of electing members of our Board of Directors, we feel it is important to provide a response to the dissident shareholders’ claims. The dissident shareholders claim the following: Company has underperformed; Board has failed to identify financial irregularities; Various related party transactions are concerning from a corporate governance perspective; Director and executive compensation is very high and does not reflect poor performance; and If successful, dissident shareholders’ strategy is to elect new directors with “significant industry experience”, reduce compensation, renegotiate debt terms and explore strategic alternatives.

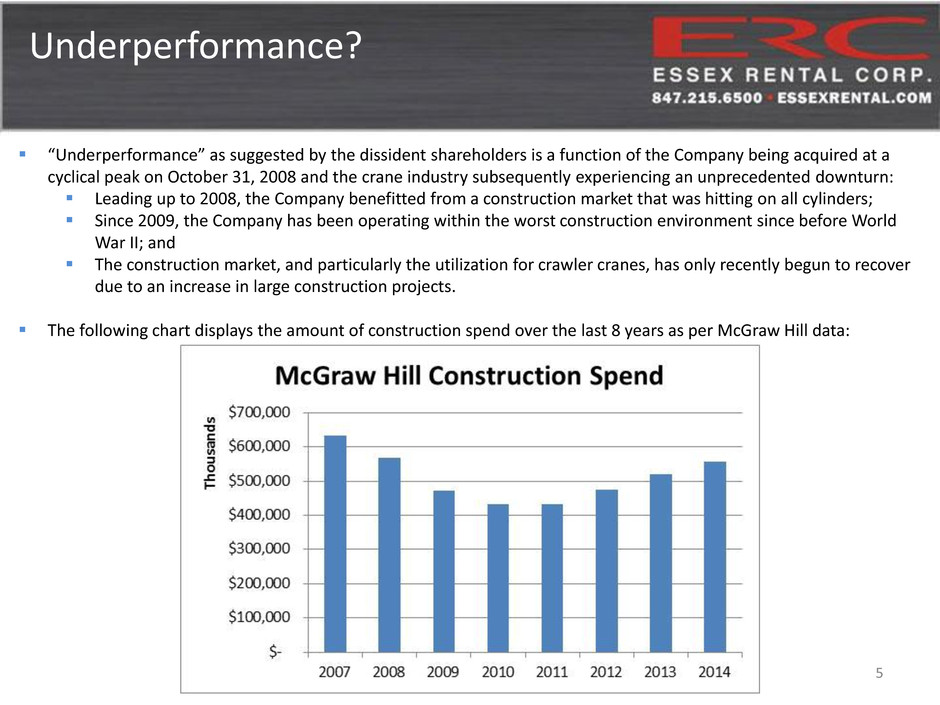

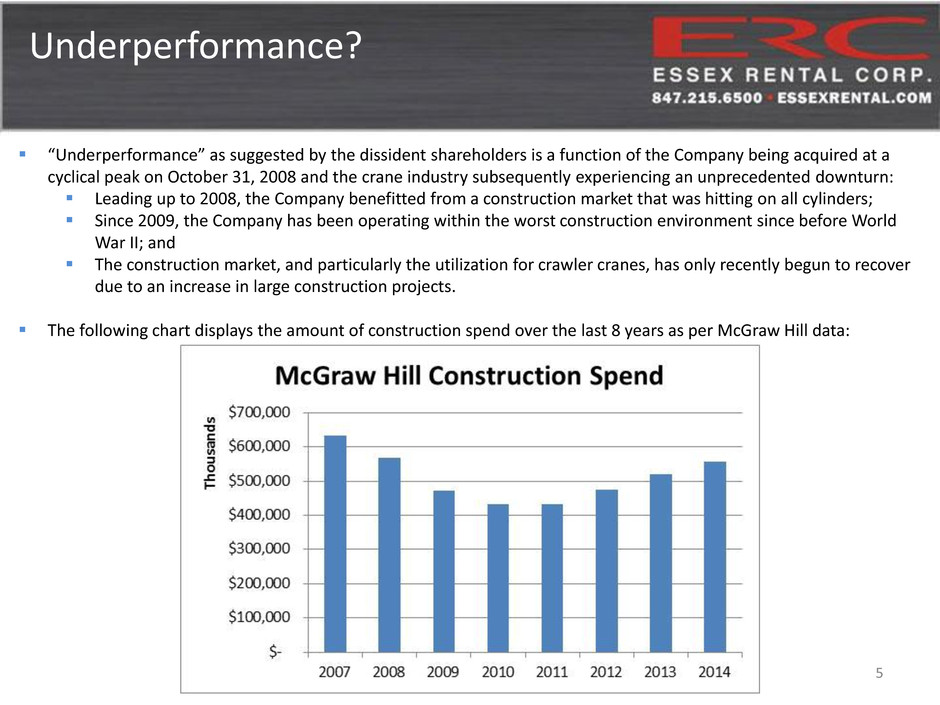

5 Underperformance? “Underperformance” as suggested by the dissident shareholders is a function of the Company being acquired at a cyclical peak on October 31, 2008 and the crane industry subsequently experiencing an unprecedented downturn: Leading up to 2008, the Company benefitted from a construction market that was hitting on all cylinders; Since 2009, the Company has been operating within the worst construction environment since before World War II; and The construction market, and particularly the utilization for crawler cranes, has only recently begun to recover due to an increase in large construction projects. The following chart displays the amount of construction spend over the last 8 years as per McGraw Hill data:

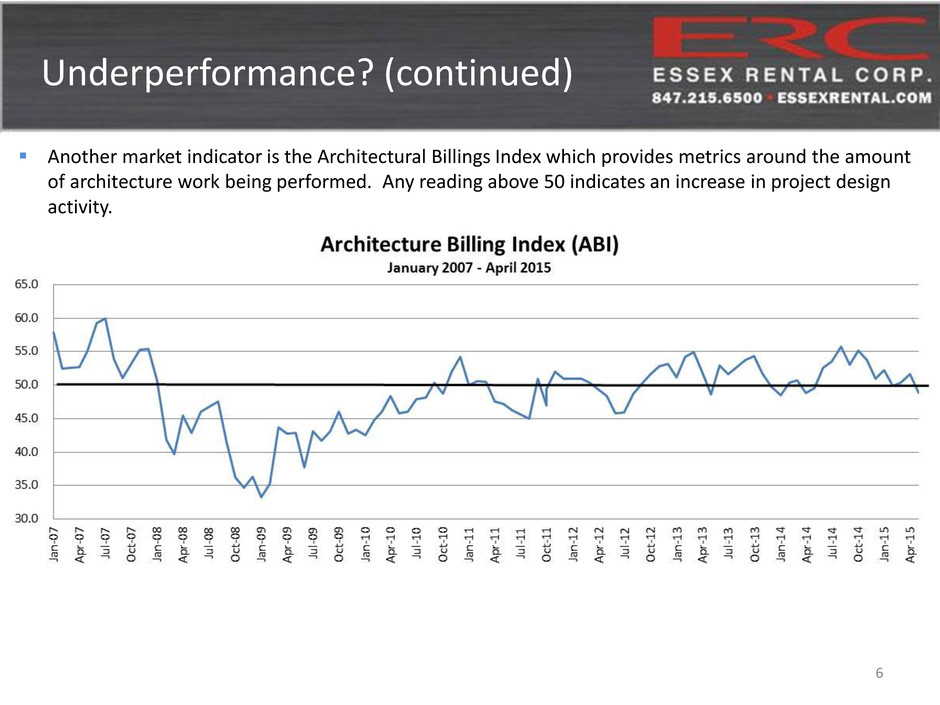

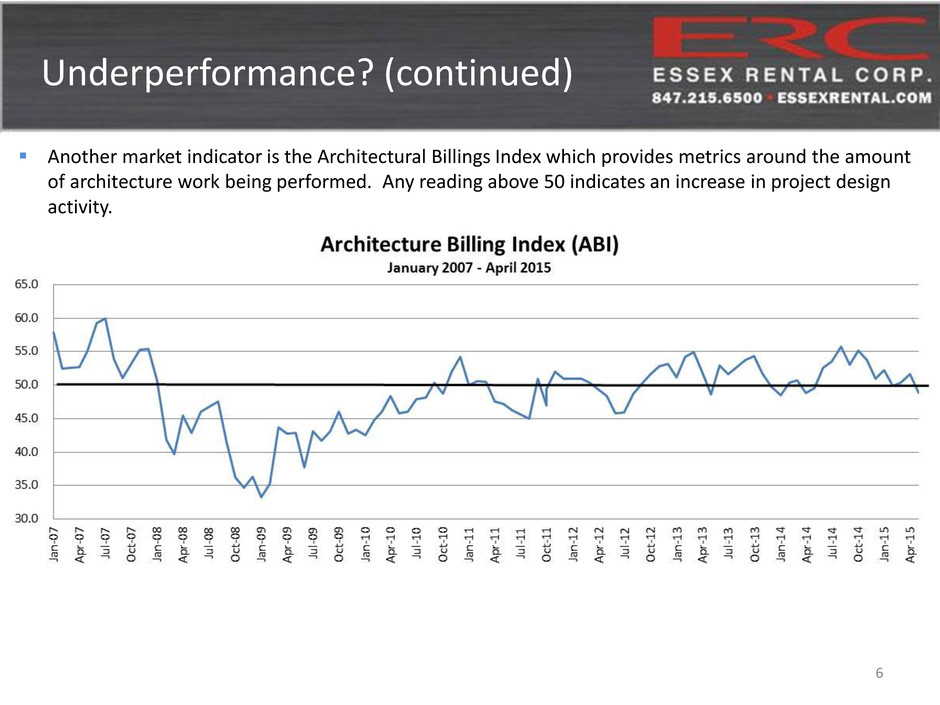

Underperformance? (continued) 6 Another market indicator is the Architectural Billings Index which provides metrics around the amount of architecture work being performed. Any reading above 50 indicates an increase in project design activity.

Underperformance? (continued) 7 Pending these improved market indicators suggesting that we are finally starting to experience an increase in large construction project activity, the Board has been actively improving Company management, business practices and asset mix while also guiding the Company and its financing arrangements through the prolonged down business cycle: The Board has recently revamped the Senior Management Team: In June of 2013, Nick Matthews was hired as Chief Operating Officer; In June of 2013, Kory Glen was hired as Chief Financial Officer; and In November of 2013, the prior Chief Executive Officer resigned. In March of 2014, Nick Matthews was promoted to Chief Executive Officer. The Board has also continued to refresh Board members by adding new members with crane and/or rental experience: In February of 2014, Bill Fox was added to the Board of Directors. Bill has over 40 years of experience in the crane industry and previously worked for Manitowoc and H&E Equipment Services, Inc. The new Senior Management Team, led by Nick Matthews has made significant improvements in the business in order to achieve the following goals: improve quality; reshape our asset portfolio and reposition the fleet; develop a more customer centric service oriented culture throughout the company to improve customer relationships; and improve asset utilization.

Underperformance? (continued) 8 Improve quality; Hired continuous improvement and lean practice professionals to improve the quality of equipment provided to customers on rent Reshape our asset portfolio and reposition the fleet; Executed a trade transaction to sell 15 underutilized legacy assets and significantly improved the amount of sold underutilized assets Develop a more customer centric service oriented culture throughout the company to improve customer relationships; Met with customers to understand their perception of the Company’s performance and signed orders with expected rental revenues of over $4 million from “churned customers” that had previously been dissatisfied with the Company. Improve asset utilization Utilization of equipment increased significantly throughout 2014. Crawler crane rental backlog based on expected rental revenues as of March 31, 2015 increased by 40.8% compared to the backlog as of March 31, 2014. The foundation in in place for significant operational improvement!!

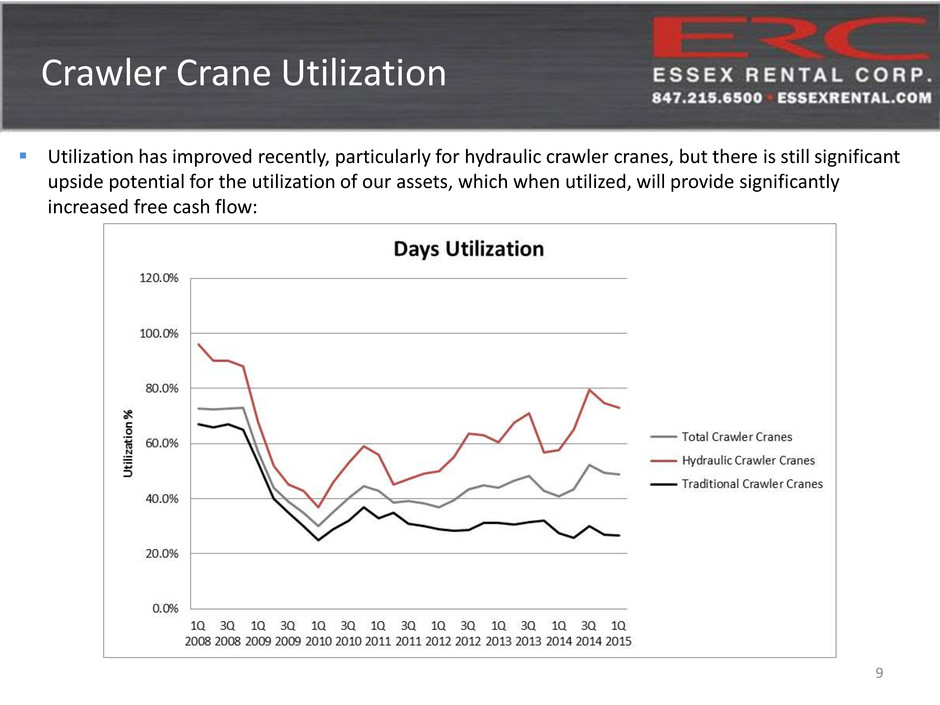

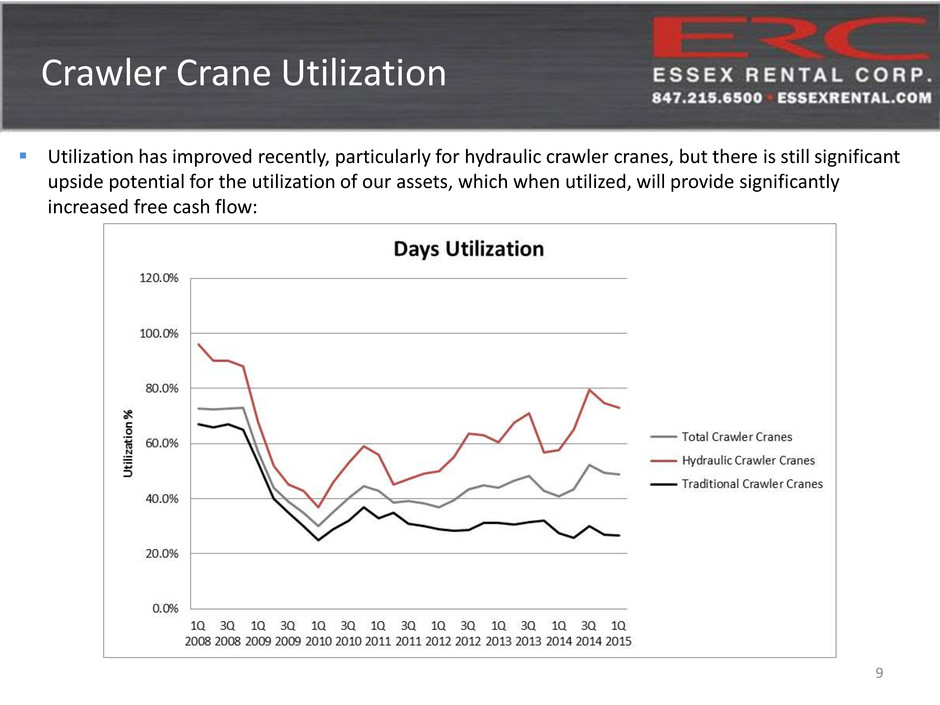

Crawler Crane Utilization 9 Utilization has improved recently, particularly for hydraulic crawler cranes, but there is still significant upside potential for the utilization of our assets, which when utilized, will provide significantly increased free cash flow:

Financial Irregularities 10 The Company recently restated historical financial statements related to two accounting issues: Essex’s auditors, Grant Thornton LLP, had signed-off on Management’s former presentation of the two accounting issues for 8 years and 3 years, respectively. For the first time, while completing the December 31, 2014 audit, Grant Thornton LLP changed their view of how the two issues should be have been treated; Neither restatement issue resulted in changes to the Company’s net income, EBITDA, cash flows or cash position; and The dissident shareholders’ claims that the Audit Committee should have caught these errors are unreasonable.

Corporate Governance and Director Compensation 11 Laurence Levy and Edward Levy, the two primary members of Essex’s Strategic, Planning and Finance Committee, each receive $125,000 per annum in this role. Additionally, approximately $100,000 per annum of their office rent is reimbursed by Essex. The decision to utilize the capabilities of the members of the Strategic, Planning and Finance Committee and the Committee fees associated therewith, was approved by the independent Board members and continues to be viewed as extremely beneficial to stockholders.

Corporate Governance and Director Compensation (continued) 12 Members of the Strategic, Planning and Finance Committee of our Board of Directors are extremely engaged and provide tremendous value to the Company, including but not limited to the following: Regularly holding meetings with current and prospective shareholders, lenders, analysts and other stakeholders at their New York offices; Engineered and led efforts in many capital market transactions, without the retention of investment bankers, including but not limited to: Acquiring Coast Crane’s assets out of bankruptcy in November 2010 for approximately $100 million; Financing the acquisition of Coast Crane’s assets of out bankruptcy in November 2010 raising approximately $75 million of debt; Refinancing Essex Crane’s revolving credit facility in March 2013 for about $150 million of debt; and Refinancing Essex Crane’s revolving credit facility in May 2014 by sourcing junior debt of $30 million; Assisted in efforts to remediate various financial covenant defaults Assisted in the evaluation of several potential acquisition opportunities including two very large transactions that were not executed in the fall of 2013 and the summer of 2014 The compensation earned by the members of the Board of Directors is much less than the Company would incur if the Company was to use outside professionals to assist in these capital market endeavors.

Dissident Change 13 If successful, the dissident shareholders’ stated strategy is to elect new directors with “significant industry experience”, reduce compensation, renegotiate debt terms and explore strategic alternatives. Lee Keddie and John Climaco do not have anywhere near the experience in the crane or rental industry as the current Board Members; Collectively, they own only 500 shares of common stock as compared to approximately 1.2 million shares owned by the Company nominated directors; A reduction in Board compensation will likely significantly increase the Company’s overall costs due to an increase in the amount of reliance on third-party advisors and consultants; Neither Lee Keddie or John Climaco will have any greater negotiating power with our lenders than the current Management Team or the current board members, nor do they have anywhere near the same level of experience; and The Board of Directors already engaged RBC Capital Markets early in 2015 to evaluate strategic alternatives.

Our Responsiveness 14 The Company has been extremely responsive to the dissidents’ demands. We have: Invited the two nominees to join the Board of Directors; Agreed to cease the Hyde Park rent reimbursement effective as of the end of the current agreement which expires in February 2016; Already engaged RBC Capital Markets to explore strategic alternatives prior to the dissidents’ demanding it; and Volunteered to hire a compensation consultant to review director compensation.