Purchase of Common Stock from Employees

The Company purchased 2,667 and 5,179 shares that were not part of the publicly announced share repurchase authorization from employees for an average price paid per share of $100.68 and $105.21 during the three months ended June 30, 2020 and 2019, respectively. These shares consisted of shares retained to cover payroll withholding taxes or option costs in connection with the vesting of RSAs, RSUs, PSUs, and stock option exercises.

Preferred Stock

The Company has authorized the issuance of 20,000,000 shares of preferred stock, par value $0.01 per share, issuable from time to time in one or more series. As of June 30, 2020, and December 31 2019, the Company had 0 shares of preferred stock issued or outstanding.

Dividends

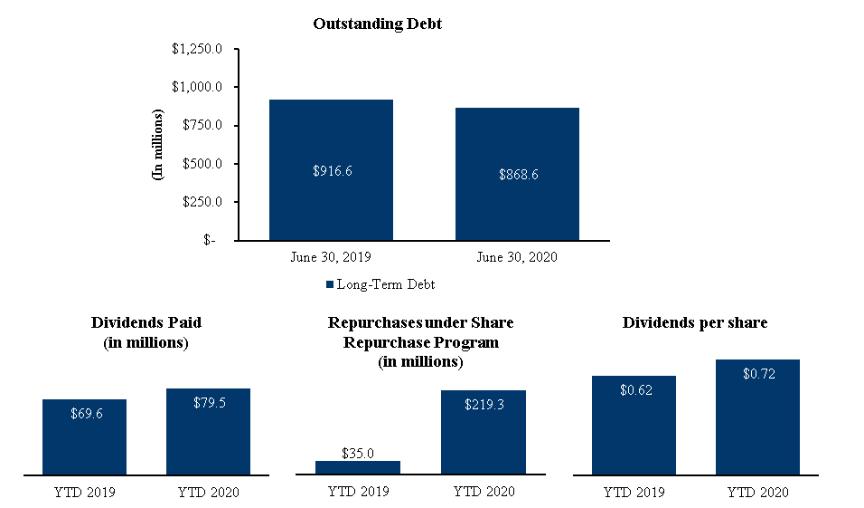

During the three months ended June 30, 2020, the Company declared and paid cash dividends per share of $0.36 for an aggregate payout of $39.5 million. During the three months ended June 30, 2019, the Company declared and paid cash dividends per share of $0.31 for an aggregate payout of $34.8 million.

Each share of common stock, including RSAs, RSUs, and PSUs, is entitled to receive dividend and dividend equivalents, respectively, if, as and when declared by the board of directors of the Company. The Company’s expectation is to continue to pay dividends. The decision to pay a dividend, however, remains within the discretion of the Company’s board of directors and may be affected by various factors, including our earnings, financial condition, capital requirements, level of indebtedness and other considerations our board of directors deems relevant. Future debt obligations and statutory provisions, among other things, may limit, or in some cases prohibit, our ability to pay dividends.

As a holding company, the Company’s ability to declare and continue to pay dividends in the future with respect to its common stock will also be dependent upon the ability of its subsidiaries to pay dividends to it under applicable corporate law.

19. INCOME TAXES

The Company records income tax expense during interim periods based on the best estimate of the full year’s income tax rate as adjusted for discrete items, if any, that are taken into account in the relevant interim period. Each quarter, the Company updates its estimate of the annual effective income tax rate and any change in the estimated rate is recorded on a cumulative basis.

The effective income tax rate from continuing operations was 27.5% and 29.3% for the three months ended June 30, 2020 and 2019, respectively, and 27.6% and 27.5% for the six months ended June 30, 2020 and 2019, respectively. For the three months ended June 30, 2020, the Company recognized a lower effective tax rate due to the benefit of foreign-derived intangible income compared to the same period in 2019. The effective tax rate for the six months ended June 30, 2020 was higher than the comparable period the prior year due to excess tax benefits recognized in 2019.

The Company petitioned the Tax Court on January 13, 2017, May 7, 2018 and November 29, 2018 for a redetermination of IRS notices of deficiency for Cboe and certain of its subsidiaries for tax years 2011 through 2015 related to its Section 199 claims. The Company also filed a complaint on October 5, 2018 with the Court of Federal Claims for a refund of Section 199 claims related to tax years 2008 through 2010. The U.S. Tax Court set the trial to start on April 20, 2020, but due to the COVID-19 public emergency, the U.S. Tax Court struck the April 20, 2020 trial date and suspended all other deadlines. The Company believes the aggregate amount of any additional liabilities that may result from these examinations, if any, will not have a material adverse effect on the financial position, results of operations, or cash flows of the Company. As of June 30, 2020, we have not resolved these matters, and proceedings continue in Tax Court and the Court of Federal Claims.