Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the accompanying unaudited condensed consolidated financial statements and the notes thereto, included in Item 1 in this Quarterly Report on Form 10-Q, and the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and as contained in that report, the information under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” This discussion contains forward-looking information. Please see “Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements.

Overview

Cboe Global Markets, Inc. (“Cboe” or “the Company”), a leading provider of market infrastructure and tradable products, delivers cutting-edge trading, clearing and investment solutions to market participants around the world. The Company is committed to operating a trusted, inclusive global marketplace, providing leading products, technology and data solutions that enable participants to define a sustainable financial future. Cboe provides trading solutions and products in multiple asset classes, including equities, derivatives, FX, and digital assets, across North America, Europe, and Asia Pacific.

Cboe’s subsidiaries include the largest options exchange and the third largest stock exchange operator in the U.S. In addition, the Company operates one of the largest stock exchanges by value traded in Europe, and owns EuroCCP, a leading pan-European equities and derivatives clearinghouse, BIDS Trading, a leading block-trading ATS by volume in the U.S., MATCHNow, a leading equities ATS in Canada, Cboe Australia, an operator of trading venues in Australia, and Cboe Japan, an operator of trading venues in Japan. Cboe also is a leading market globally for exchange-traded products (“ETPs”) listings and trading. On May 2, 2022, the Company completed its acquisition of ErisX, subsequently rebranded to Cboe Digital, an operator of a U.S. based digital asset spot market, a regulated futures exchange and a regulated clearinghouse. On June 1, 2022, the Company completed its acquisition of NEO, which is a fintech organization that is comprised of a fully registered Canadian securities exchange.

The Company is headquartered in Chicago with offices in Amsterdam, Belfast, Hong Kong, Kansas City, London, Manila, New York, San Francisco, Sarasota Springs, Singapore, Sydney, Tokyo, and Toronto.

Recent Developments

Acquisition of Cboe Digital

On October 20, 2021, the Company announced it entered into a definitive agreement to acquire ErisX, which was subsequently rebranded Cboe Digital. Cboe Digital operates a U.S. based digital asset spot market, a regulated futures exchange, and a regulated clearinghouse. Ownership of Cboe Digital allows the Company to enter the digital asset spot and derivatives marketplaces through a digital-first platform developed with industry partners to focus on robust regulatory compliance, data and transparency. The transaction closed on May 2, 2022.

Acquisition of NEO

On November 15, 2021, the Company announced it entered into a definitive agreement to acquire NEO. NEO is a fintech organization that is comprised of a fully registered Canadian securities exchange with a diverse product and services set ranging from corporate listings to cash equities trading and a non-listed securities distribution platform. With ownership of NEO, the Company expects to further grow Canada as a hub for global equities trading. The transaction closed on June 1, 2022.

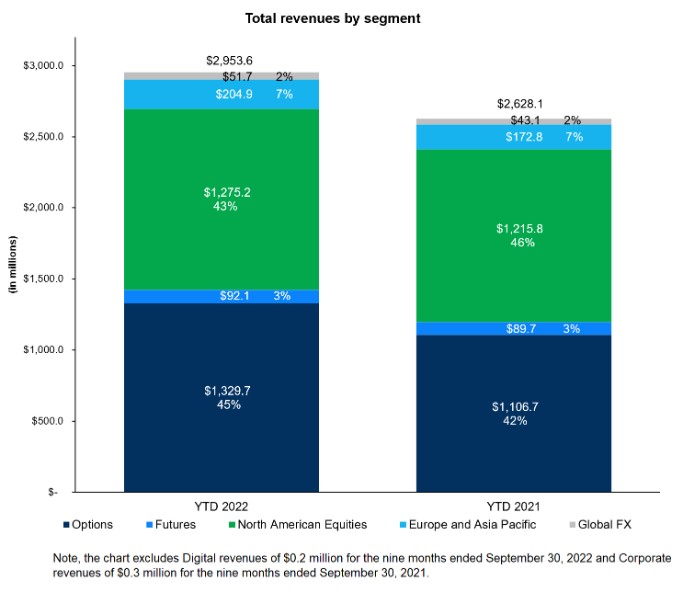

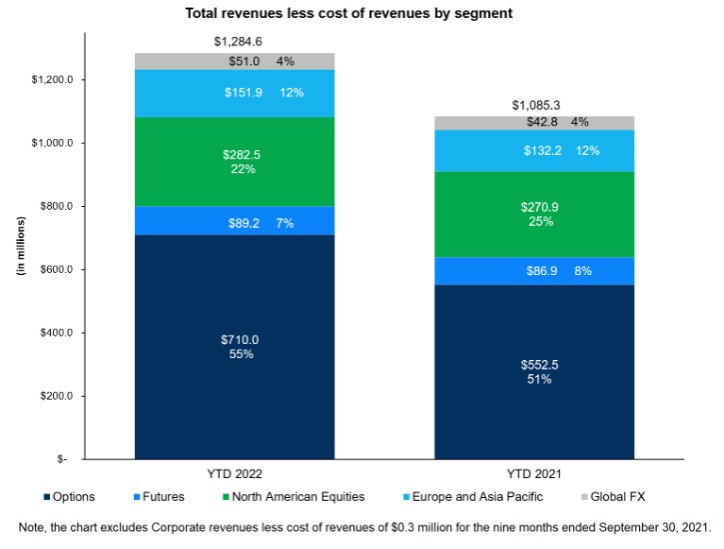

Business Segments

The Company previously operated as five reportable business segments prior to the quarter ended June 30, 2022. As a result of the ErisX acquisition during the quarter ended June 30, 2022, which was subsequently rebranded to Cboe Digital. the Company operates as six reportable segments: Options, North American Equities, Europe and Asia Pacific, Futures, Global FX, and Digital, which is reflective of how the Company's chief operating decision-maker reviews and operates the business, as discussed in Note 1 (“Organization and Basis of Presentation”). Segment performance is primarily evaluated based on operating income (loss). The Company’s chief operating decision-maker does not use segment-level assets or income and expenses below operating income (loss) as key performance metrics; therefore, such information is not presented below. The Company has aggregated all of its corporate costs, as well as other business