UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number: 001-34774

Cboe Global Markets, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Delaware | 20-5446972 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification Number) |

| | | | | |

| 433 West Van Buren Street | |

| Chicago, Illinois | 60607 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code

(312) 786-5600

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol (s) | Name of Exchange on Which Registered |

| Common Stock, par value $0.01 per share | CBOE | CboeBZX |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2024, the aggregate market value of the Registrant's outstanding voting common equity held by non-affiliates was approximately $17.8 billion based on the closing price of $170.06 per share of common stock.

The number of outstanding shares of the registrant's common stock as of February 14, 2025 was 104,701,695 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Cboe Global Market’s Definitive Proxy Statement for the 2025 Annual Meeting of Stockholders, which will be filed no later than 120 days after December 31, 2024, are incorporated by reference in Part III.

TABLE OF CONTENTS

CBOE GLOBAL MARKETS, INC.

2024 FORM 10-K

CERTAIN DEFINED TERMS

Throughout this document, unless otherwise specified or the context so requires:

•“Cboe,” “we,” “us,” “our” or “the Company” refers to Cboe Global Markets, Inc. and its subsidiaries.

•“ADV” means average daily volume.

•“ADNV” means average daily notional value.

•“AFM” refers to the Netherlands Authority for the Financial Markets.

•“ATS” refers to an alternative trading system.

•“Bats Global Markets” and “Bats” refer to our wholly-owned subsidiary Bats Global Markets, Inc., now known as Cboe Bats, LLC, and its subsidiaries.

•“BIDS Trading” refers to BIDS Trading L.P., a wholly-owned subsidiary of Cboe Global Markets, Inc. The ATS operated by BIDS Trading is not a registered national securities exchange or a facility thereof.

•“BYX” refers to Cboe BYX Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“BZX” refers to Cboe BZX Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“C2” refers to Cboe C2 Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Asia Pacific” refers to Cboe Asia Pacific Holdings Limited (formerly known as Chi-X Asia Pacific Holdings Limited), a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Australia” refers to Cboe Australia Pty Ltd. (formerly known as Chi-X Australia Pty. Ltd.), a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Canada” refers to the former Aequitas Innovations, Inc. and Neo Exchange Inc. (commonly referred to as “NEO Exchange”), which were wholly-owned subsidiaries of Cboe Global Markets, Inc. As of January 1, 2024, the Cboe Canada and MATCHNow entities have been amalgamated into Cboe Canada Inc.

•“Cboe Canada Inc.” is a wholly-owned subsidiary of Cboe Global Markets, Inc. and a recognized Canadian securities exchange. As of January 1, 2024, the Cboe Canada and MATCHNow entities have been amalgamated into Cboe Canada Inc.

•“Cboe Chi-X Europe” refers to Cboe Chi-X Europe Limited, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Clear Europe” refers to Cboe Clear Europe N.V. (formerly known as European Central Counterparty N.V., formerly defined as “EuroCCP”), a wholly-owned subsidiary of Cboe Global Markets, Inc.

•"Cboe Clear U.S." refers to Cboe Clear U.S., LLC (formerly known as Cboe Clear Digital, LLC, formerly defined as “Cboe Clear Digital”), a wholly-owned subsidiary of Cboe Global Markets, Inc.

•"Cboe Data Vantage" refers to the Company's Cboe Data Vantage business (formerly known as Data and Access Solutions, and subsequently referred to as Data Vantage throughout the remainder of this document).

•“Cboe Digital” refers to Cboe Digital Intermediate Holdings, LLC (formerly known as Eris Digital Holdings, LLC) and its subsidiaries.

•“Cboe Digital Exchange” refers to Cboe Digital Exchange, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Europe Equities and Derivatives” refers to the combined businesses of Cboe Europe and Cboe NL.

•“Cboe Europe” refers to Cboe Europe Limited, a wholly-owned subsidiary of Cboe Global Markets, Inc., the UK operator of our Multilateral Trading Facility (“MTF”), our Regulated Market (“RM”), and our Approved Publication Arrangement (“APA”) under its Recognized Investment Exchange (“RIE”) status.

•“Cboe Fixed Income” refers to Cboe Fixed Income Markets, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe FX” refers to Cboe FX Markets, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Japan” refers to Cboe Japan Ltd. (formerly known as Chi-X Japan Ltd.), a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe NL” refers to Cboe Europe BV, a wholly-owned subsidiary of Cboe Global Markets, Inc., the Netherlands operator of our MTF, RM, and APA.

•“Cboe Options” refers to Cboe Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe SEF” refers to Cboe SEF, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“Cboe Trading” refers to Cboe Trading, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“CFE” refers to Cboe Futures Exchange, LLC, a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“CFTC” refers to the U.S. Commodity Futures Trading Commission.

•“CSD Br” refers to CSD Central de Serviços de Registro e Depósito aos Mercados Financeiro e de Capitais S.A., a Brazilian trade repository.

•“CIRO” refers to the Canadian Investment Regulatory Organization.

•“EDGA” refers to Cboe EDGA Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“EDGX” refers to Cboe EDGX Exchange, Inc., a wholly-owned subsidiary of Cboe Global Markets, Inc.

•“ESMA” refers to the European Securities and Markets Authority.

•“Exchanges” refers to Cboe Options, C2, BZX, BYX, EDGX, and EDGA.

•“FASB” refers to the Financial Accounting Standards Board.

•“FCA” refers to the UK Financial Conduct Authority.

•“FINRA” refers to the Financial Industry Regulatory Authority.

•“GAAP” refers to Generally Accepted Accounting Principles in the United States.

•“MATCHNow” refers to the former TriAct Canada Marketplace LP, a wholly-owned subsidiary of Cboe Global Markets, Inc., which was the operator of a Canadian ATS. As of January 1, 2024, the Cboe Canada and MATCHNow entities have been amalgamated into Cboe Canada Inc.

•“Merger” refers to our acquisition of Bats Global Markets, completed on February 28, 2017.

•“OCC” refers to The Options Clearing Corporation.

•“OPRA” refers to Options Price Reporting Authority, LLC.

•“PTS” refers to a proprietary trading system.

•“SEC” refers to the U.S. Securities and Exchange Commission.

•"SFT" refers to Securities Financing Transaction(s).

•“SPX” refers to our S&P 500 Index exchange-traded options products.

•“TPH” refers to either a Trading Permit Holder or a Trading Privilege Holder.

•“VIX futures,” or “VIX options,” or "Options on VIX futures" refers, as applicable, to our Cboe Volatility Index exchange-traded options and futures products.

TRADEMARK AND OTHER INFORMATION

Cboe®, Cboe Global Markets®, Cboe Volatility Index®, Cboe Clear®, Cboe Datashop®, Cboe Futures Exchange®, Cboe Digital®, Cboe Hanweck®, Cboe LIS®, Bats®, BIDS Trading®, BYX®, BZX®, CFE®, EDGA®, EDGX®, Hybrid®, LiveVol®, MATCHNow®, NANO®, Options Institute®, Silexx®, The Exchange for the World Stage®, VIX®, VIX1D®, and XSP® are registered trademarks, and Cboe BIDS EuropeSM, C2SM, Cboe Data VantageSM, Cboe TitaniumSM, Cboe TiSM, f(t)optionsSM, Trade AlertSM, and VIXEQSM are service marks of Cboe Global Markets, Inc. and its subsidiaries. Standard & Poor's®, S&P®, S&P 100®, S&P 500® and SPX® are registered trademarks and DSPXSM is a service mark of Standard & Poor's Financial Services LLC and have been licensed for use by Cboe Exchange, Inc. Dow Jones®, Dow Jones Industrial Average®, DJIA® and Dow Jones Indices are registered trademarks or service marks of Dow Jones Trademark Holdings, LLC, used under license. Russell® and the Russell index names are registered trademarks of Frank Russell Company, used under license. FTSE® and the FTSE indices are trademarks and service marks of FTSE International Limited, used under license. All other trademarks and service marks are the property of their respective owners.

MSCI and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates and have been licensed for use by us. Any derivative indices and any financial products based on the derivative indices (“MCSI-Based Products”) are not sponsored, guaranteed or endorsed by MSCI, its affiliates or any other party involved in, or related to, making or compiling such MSCI index. Neither MSCI, its affiliates nor any other party involved in, or related to, making or compiling any MSCI index makes any representations regarding the advisability of investing in such MSCI-Based Products; makes any warranty, express or implied; or bears any liability as to the results to be obtained by any person or any entity from the use of any such MSCI index or any data included therein. No purchaser, seller or holder of any MSCI-Based Product, or any other person or entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote any security without first contacting MSCI to determine whether MSCI’s permission is required.

This Annual Report on Form 10-K includes market share and industry data that we obtained from industry publications and surveys, reports of governmental agencies and internal company surveys. Industry publications and surveys generally state that the information they contain has been obtained from sources believed to be reliable, but we cannot assure you that this information is accurate or complete. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on the most currently available market data. While we are not aware of any misstatements regarding industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors. Please refer to the “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and our other filings with the SEC.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve a number of risks and uncertainties. You can identify these statements by forward-looking words such as "may," "might," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," and the negative of these terms and other comparable terminology. All statements that reflect our expectations, assumptions or projections about the future other than statements of historical fact are forward-looking statements, including statements in "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied by the forward-looking statements. In particular, you should consider the risks and uncertainties described under "Risk Factors" in this Annual Report and other filings with the SEC.

While we believe we have identified material risks, these risks and uncertainties are not exhaustive. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Some factors that could cause actual results to differ include:

•the loss of our right to exclusively list and trade certain index options and futures products;

•economic, political and market conditions;

•compliance with legal and regulatory obligations;

•price competition and consolidation in our industry;

•decreases in trading or clearing volumes, market data fees or a shift in the mix of products traded on our exchanges;

•legislative or regulatory changes or changes in tax regimes;

•our ability to protect our systems and communication networks from security vulnerabilities and breaches;

•our ability to attract and retain skilled management and other personnel;

•increasing competition by foreign and domestic entities;

•our dependence on and exposure to risk from third parties;

•factors that impact the quality and integrity of our and other applicable indices;

•our ability to manage our global operations, growth, and strategic acquisitions or alliances effectively;

•our ability to operate our business without violating the intellectual property rights of others and the costs associated with protecting our intellectual property rights;

•our ability to minimize the risks, including our credit, counterparty, investment, and default risks, associated with operating our clearinghouses;

•our ability to accommodate trading and clearing volume and transaction traffic, including significant increases, without failure or degradation of performance of our systems;

•misconduct by those who use our markets or our products or for whom we clear transactions;

•challenges to our use of open source software code;

•our ability to meet our compliance obligations, including managing our business interests and our regulatory responsibilities;

•the loss of key customers or a significant reduction in trading or clearing volumes by key customers;

•our ability to maintain BIDS Trading as an independently managed and operated trading venue, separate from and not integrated with our registered national securities exchanges;

•damage to our reputation;

•the ability of our compliance and risk management methods to effectively monitor and manage our risks;

•restrictions imposed by our debt obligations and our ability to make payments on or refinance our debt obligations;

•our ability to maintain an investment grade credit rating;

•impairment of our goodwill, long-lived assets, investments or intangible assets;

•the accuracy of our estimates and expectations; and

•litigation risks and other liabilities.

For a detailed discussion of these and other factors that might affect our performance, see Part I, Item 1A of this Report. We do not undertake, and expressly disclaim, any duty to update any forward-looking statement whether as a result of new information, future events or otherwise, except as required by law. We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this filing.

PART I

Item 1. Business

The following description of the business should be read in conjunction with the information included elsewhere in this Annual Report on Form 10-K for the year ended December 31, 2024. This description contains forward-looking statements that involve risks and uncertainties. Actual results could differ significantly from the results discussed in the forward-looking statements due to the factors set forth in “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

Overview

Cboe Global Markets, Inc., the world's leading derivatives and securities exchange network, delivers cutting-edge trading, clearing and investment solutions to people around the world. Cboe provides trading solutions and products in multiple asset classes, including equities, derivatives, and FX, across North America, Europe, and Asia Pacific. Above all, the Company is committed to building a trusted, inclusive global marketplace that enables people to pursue a sustainable financial future.

Cboe’s subsidiaries include the largest options exchange and the third largest equities exchange operator in the U.S. In addition, the Company operates Cboe Europe, one of the largest equities exchanges by value traded in Europe, and owns Cboe Clear Europe, a leading pan-European equities and derivatives clearinghouse, BIDS Holdings, which owns a leading block-trading ATS by volume in the U.S., and provides block-trading services with Cboe market operators in Europe, Canada, Australia, and Japan, Cboe Australia, an operator of trading venues in Australia, Cboe Japan, an operator of trading venues in Japan, Cboe Clear U.S., an operator of a regulated clearinghouse, and Cboe Canada Inc., a recognized Canadian securities exchange. Cboe subsidiaries also serve collectively as a leading market globally for exchange-traded products (“ETPs”) listings and trading.

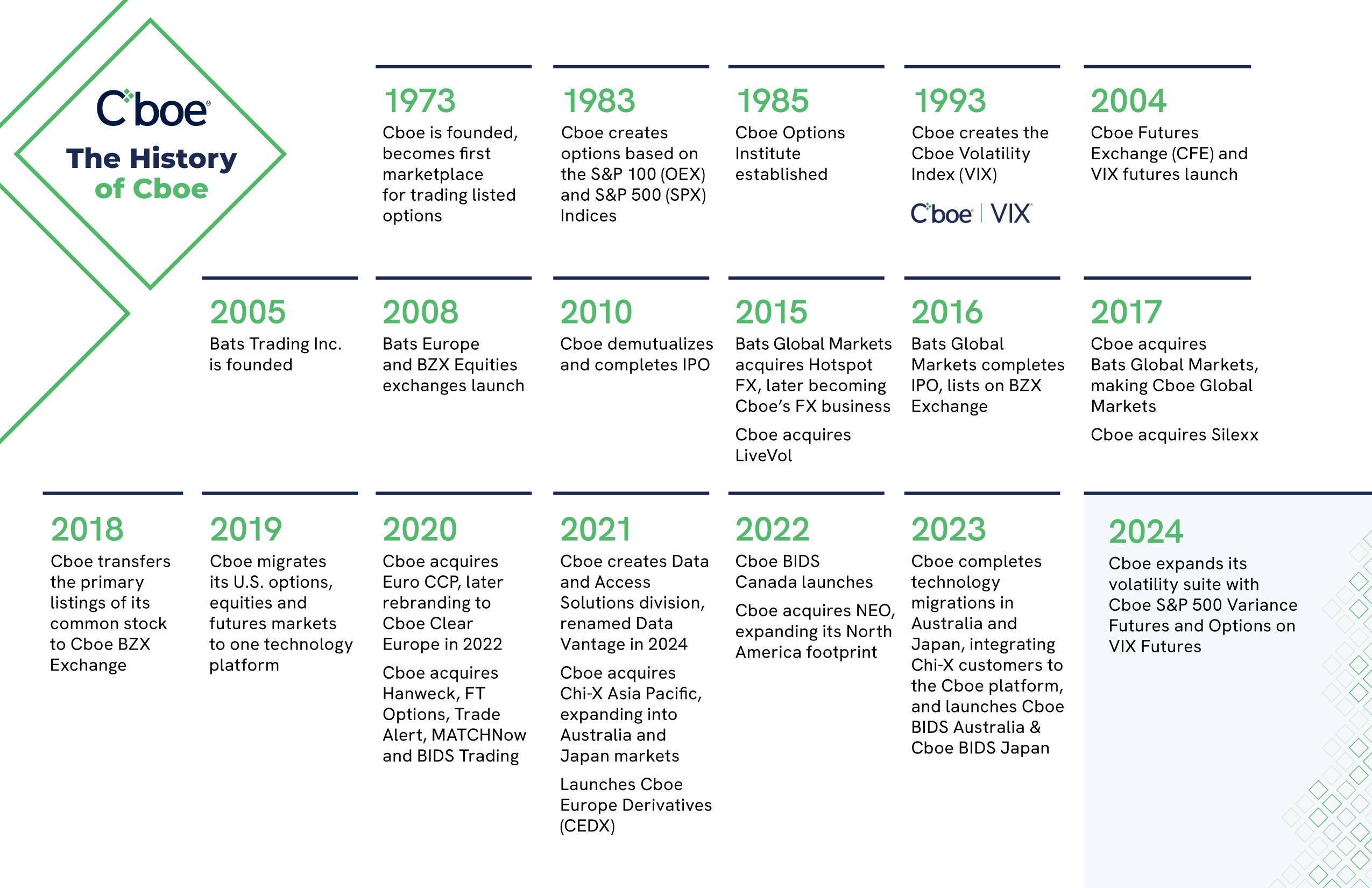

The graphic below provides a brief overview of Cboe’s history:

Our Business

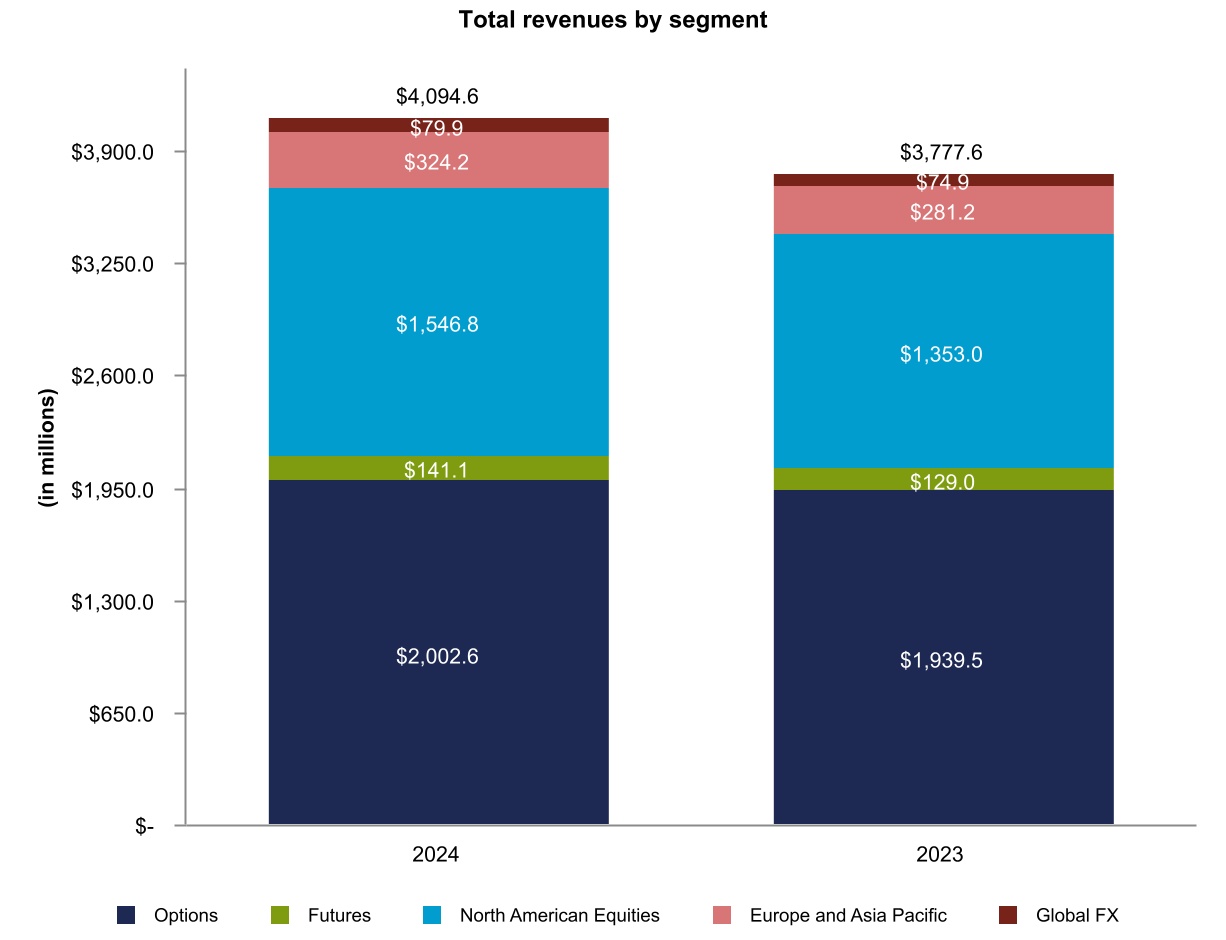

Cboe reports on the following six business segments:

•Options. The Options segment includes options on market indices (“index options”), as well as on the stocks of individual corporations (“equity options”) and on ETPs such as exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), which are “multi-listed” options and listed on a non-exclusive basis. These options are eligible to trade, as applicable, on Cboe Options, C2, BZX, EDGX, and/or other U.S. national security exchanges. Cboe Options is the Company’s primary options market and offers trading in listed options through a single system that integrates electronic trading and traditional open outcry trading on the Cboe Options trading floor in Chicago. C2 Options, BZX Options, and EDGX Options are all-electronic options exchanges, and typically operate with different market models and fee structures than Cboe Options. The Options segment also includes applicable market data fees revenues generated from the consolidated tape plans, the licensing of proprietary options market data, index licensing, routing services, and access and capacity services.

•North American Equities. The North American Equities segment includes U.S. equities and ETP transaction services that occur on fully electronic exchanges owned and operated by BZX, BYX, EDGX, and EDGA, equities transactions that occur on the BIDS Trading platform in the U.S. and Canada, and Canadian equities and other transaction services that occur on or through Cboe Canada Inc.’s order books. The North American Equities segment also includes corporate listing services on Cboe Canada Inc., ETP listings on BZX, the Cboe Global Markets, Inc. common stock listing, and applicable market data fees revenues generated from the consolidated tape plans, the licensing of proprietary equities market data, routing services, and access and capacity services.

•Europe and Asia Pacific. The Europe and Asia Pacific segment includes the pan-European listed equities and derivatives transaction services, ETPs, including exchange traded funds, exchange traded notes, and exchange traded commodities, and international depository receipts that are hosted on MTFs operated by Cboe Europe Equities (Cboe Europe and Cboe NL equities exchanges) and Cboe Europe Derivatives (“CEDX”). It also includes the ETP listings business on RMs and clearing activities of Cboe Clear Europe, as well as the equities transaction services of Cboe Australia and Cboe Japan, operators of trading venues in Australia and Japan, respectively, along with equities transactions that occur on the BIDS Trading platform in Australia and Japan. Cboe Europe operates lit and dark books, a periodic auctions book, a closing cross book, and two BIDS orderbooks; a Large-in-Scale (“LIS”) trading negotiation facility and - predominantly for UK and Swiss symbols - a volume-weighted average price (“VWAP”) trajectory crossing facility. Cboe NL, based in Amsterdam, operates similar business functionality to that offered by Cboe Europe (with exception of Trajectory Crossing), and provides for trading only in European Economic Area (“EEA”) symbols. Cboe Europe Derivatives, a pan-European derivatives platform, offers futures and options based on Cboe Europe equity indices, and single stock options. Cboe Clear Europe offers the clearing of equity and equity-like instruments for Cboe-operated and other regulated trading venues, the clearing of derivative transactions executed on CEDX, and has recently introduced a service to clear Securities Financing Transactions. This segment also includes Cboe Europe, Cboe NL, CEDX, Cboe Australia and Cboe Japan revenue generated from the licensing of proprietary market data and from access and capacity services.

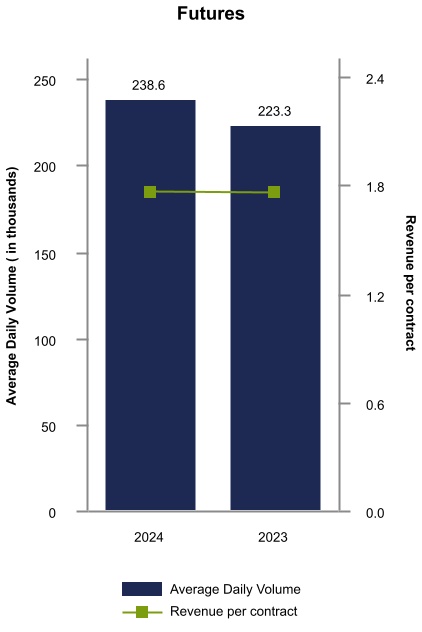

•Futures. The Futures segment includes transaction services provided by CFE, a fully electronic futures exchange, which includes offerings for trading of VIX futures and other futures products, the licensing of proprietary market data, as well as access and capacity services. On April 25, 2024, the Company announced plans to transition the cash-settled margin Bitcoin and Ether futures contracts, currently available for trading on the Cboe Digital Exchange, to CFE in the first half of 2025, pending regulatory review.

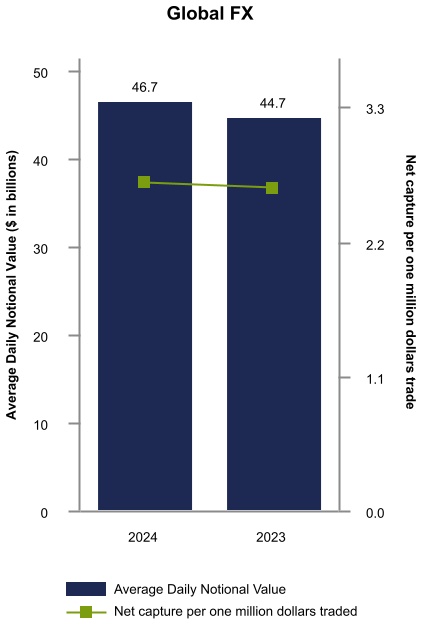

•Global FX. The Global FX segment includes institutional FX trading services that occur on the Cboe FX fully electronic trading platform, non-deliverable forward FX transactions (“NDFs”) offered for execution on Cboe SEF, as well as revenue generated from the licensing of proprietary market data and from access and capacity services. The segment includes transaction services for U.S. government securities executed on the Cboe Fixed Income fully electronic trading platform.

•Digital. The Digital segment includes a regulated futures exchange (Cboe Digital Exchange) and a regulated clearinghouse (Cboe Clear U.S.), as well as revenue generated from the licensing of proprietary market data and from access and capacity services. Prior to May 31, 2024, the Digital segment also included a U.S.-based spot digital asset trading market (“Cboe Digital spot market”). As of May 31, 2024, the Cboe Digital spot market is closed for all participant and trading purposes. In addition, the Company plans to transition the cash-settled margin Bitcoin and Ether futures contracts, currently available for trading on the Cboe Digital Exchange, to CFE in the first half of 2025, pending regulatory review. The Company expects that Digital will cease to be a distinct reportable business segment in the first quarter of 2025.

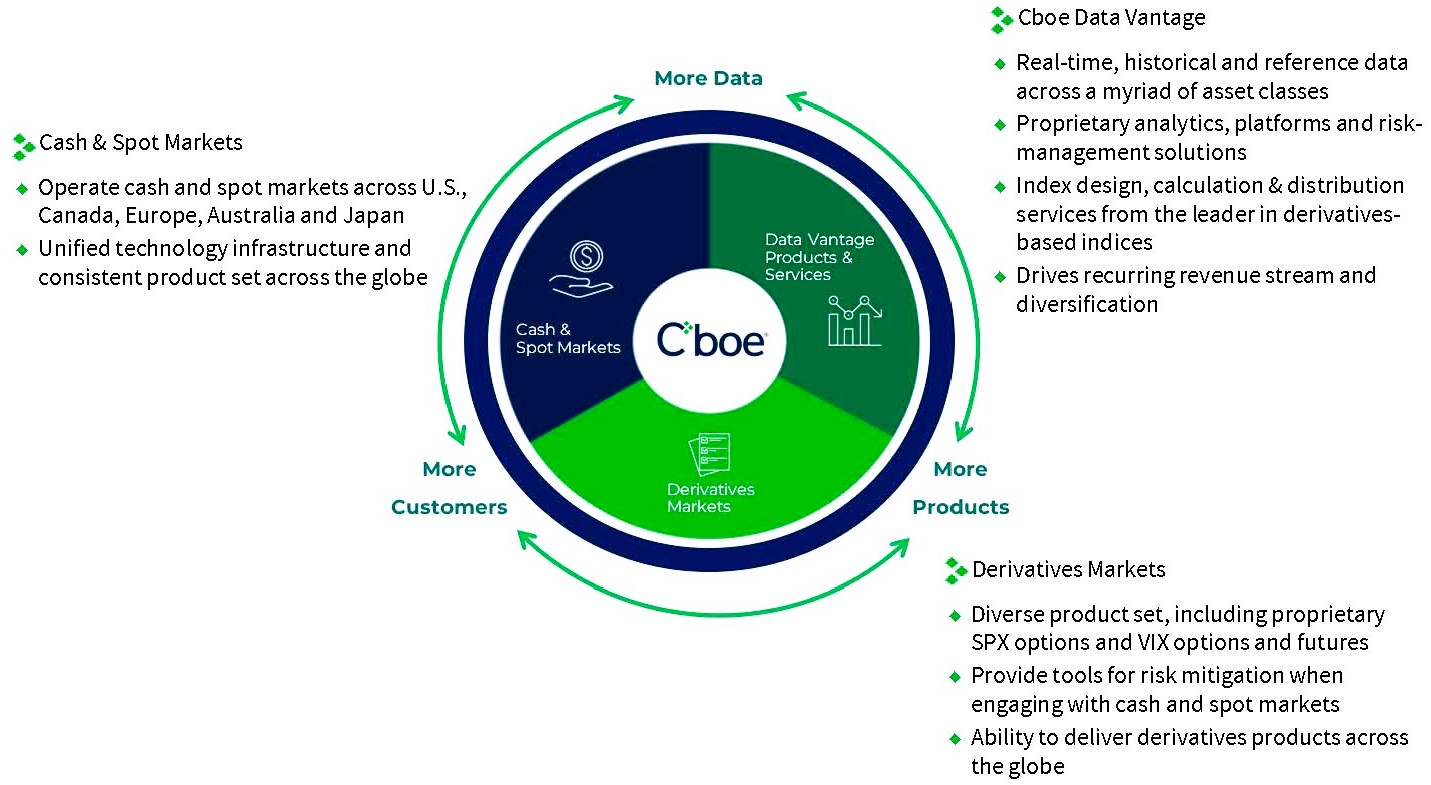

Cboe also presents three financial statement revenue captions that reflect the Company’s diversified products, expansive geographical reach, and overall business strategy. Below is a summary of Cboe’s financial statement revenue caption businesses:

•Cash and spot markets. This includes associated transaction and clearing fees on our equities and FX markets and clearing business, the portion of market data fees relating to associated U.S. tape plan market data fees, associated regulatory fees, and associated other revenue from Cboe’s North American Equities, Europe and Asia Pacific, Global FX, and Digital segments. The key sources of these revenues are our equities and FX markets, the U.S. tape plans, and our clearing and listings businesses, which are described in more detail below.

•Cboe Data Vantage (f/k/a Data and Access Solutions, subsequently referred to as Data Vantage). The Cboe Data Vantage business includes access and capacity fees to our markets, proprietary market data fees from various licensing agreements and proprietary indices, and associated other revenue across Cboe’s six segments. The key sources of these revenues are our markets, the proprietary products underlying the market data, the licensing agreements, proprietary indices, and other data and access products and services, which are described in more detail below.

•Derivatives markets. This includes associated transaction and clearing fees, the portion of market data fees relating to associated U.S. tape plan market data fees, associated regulatory fees, and associated other revenue from Cboe’s Options, Futures, Europe and Asia Pacific, and Digital segments. The key sources of these revenues are proprietary products, including our flagship products SPX options and VIX options and futures, our derivatives markets, and U.S. tape plans, which are described in more detail below.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, Note 4 ("Revenue Recognition"), and Note 16 ("Segment Reporting") in the notes to our consolidated financial statements for discussion of revenues and certain operational and financial metrics, and operating income (or loss) by business segment. Certain activities within our segments operate globally. For information regarding risks related to our international operations see “Risk Factors.”

Competitive Strengths

Cboe is a leading provider of market infrastructure and tradable products across cash and spot markets, derivatives markets, and Cboe Data Vantage products and services. Cboe delivers cutting-edge trading, clearing and investment solutions across the globe through a comprehensive ecosystem that helps drive innovation and growth.

Strategic Focus

Our strategy is to build one of the world’s largest global derivatives and securities networks to create value and drive growth by:

•Investing in the continued growth of our core business in Global Derivatives;

•Enhancing recurring revenue opportunities through Cboe Data Vantage (f/k/a Data and Access Solutions);

•Harnessing our global network to expand product reach & access;

•Capitalizing on the demand for access to the U.S. capital markets;

•Leveraging our superior technology to drive innovations; and

•Allocating capital and resources to areas where we expect to see the strongest long-term returns for shareholders.

Key Business Highlights

The following is a brief summary of our key 2024 business highlights:

•Launched new products and indices such as cash-settled margin Bitcoin and Ether Futures, Options on VIX Futures, Cboe S&P 500 Variance Futures, Cboe Bitcoin U.S. ETF Index and options thereon, and U.S. Treasury Market Volatility Index.

•Enhanced existing collaborations with S&P Dow Jones Indices with plans to launch the Cboe S&P 500 Constituent Volatility Index.

•Drove FTSE Russell innovation in digital asset derivatives and with MSCI to offer new index options and volatility indices.

•Worked to expand retail access to index options.

•Introduced dedicated cores in our equities markets.

•Built out our technology offerings in each of the U.S. and our international markets.

•Introduced a central counterparty clearing service for European SFT.

•Continued to expand our geographic footprint with a minority stake in Japannext Co., Ltd.

•Reallocated technology resources from integration efforts to organic revenue opportunities.

•Realigned the digital asset business to leverage our core strengths in derivatives, technology and product innovation.

Derivatives Markets

We are one of the largest U.S. derivatives market operators, operating four options markets, Cboe Options, BZX Options, EDGX Options and C2 Options, operating a futures market, CFE, as well as operating a pan-European derivatives market, Cboe Europe Derivatives (“CEDX”). The key products traded on our derivatives markets are proprietary products, including our flagship products SPX options and VIX options and futures, and multi-listed products.

Our U.S. derivatives options market, Cboe Options, is a hybrid market combining open outcry floor trading with electronic trading. For multi-listed products, depending on the product, we utilize public customer priority, market turner, participation rights and pro-rata allocation market models, as well as the “classic” pricing model (known as payment for order flow). For proprietary products, we use price-time or pro-rata allocation, alongside public customer priority in certain instances, and market turner, combined with a pricing model where all market participants generally pay fees. Our other three options markets, BZX, EDGX and C2, are fully electronic and utilize a mix of price-time, customer priority, participation rights, pro-rata allocation, maker-taker and classic pricing market models.

CFE’s U.S. derivatives futures market, which is fully electronic, utilizes a price-time market model, combined with a pricing model where all market participants generally pay fees, subject to specified exceptions.

CEDX, which is fully electronic, utilizes a pro-rata allocation market model.

Proprietary Products

We are a leader in the volatility space with the volatility-based proprietary products we offer for trading. These volatility-based proprietary products are built through Cboe Labs, a dedicated team centered on the creation, development, and implementation of new ideas and our strategic relationships and license agreements with index providers, which are both described below in further detail. We offer proprietary products on our proprietary indices and indices owned by other index providers. Our most frequently traded proprietary products include SPX options and VIX options and futures.

SPX Options

The S&P 500 Index is an index comprised of 500 large-cap U.S. listed companies. It is one of the most commonly followed indices and is considered a bellwether for the U.S. economy. The SPX options we offer on the S&P 500 Index are exclusive to Cboe and contribute substantially to our volumes and transaction fee revenues. Because of the S&P 500 Index’s status as a bellwether, SPX options are used in many different trading strategies by customers with different goals, including pension funds hedging their equity exposure by buying put options, asset managers seeking enhanced returns by selling covered call options and hedge funds using risk-managed strategies to capture so-called “risk premia” embedded in option prices. We also offer zero days to expiry (0-DTE) products, Long Term Equity AnticiPation Securities (LEAPs), Mini- and Nano-SPX options, FLEX- and FLEX micro-SPX options, and SPX Weeklys options, which have settlements on Mondays, Tuesdays, Wednesdays, Thursdays, Fridays and on the last trading day of each month and 24x5 trading in SPX options. We believe these additional expirations provide customers with more precision when hedging overall portfolio risk.

Volatility Trading

Cboe pioneered the trading of exchange-traded volatility products with its introduction of VIX futures in 2004 and VIX options in 2006. The VIX Index (as defined below), although not directly tradable, is based on the mid-point of real-time quotes of SPX options and is designed to reflect investors’ consensus view of future 30-day expected stock market volatility. The VIX Index methodology provides the basis for the creation of VIX options and futures. The final settlement value of VIX options and futures is determined on their expiration date through a Special Opening Quotation (“SOQ”) of the VIX Index. The SOQ calculation uses opening trade prices of selected options; unless there is no opening price, in which case the opening price used in the SOQ calculation is the midpoint of the highest bid and lowest offer at the time of the opening. Since we started offering these products, we have seen trading from a number of different customer segments utilizing a number of different trading strategies, including hedging extreme stock market declines, also known as “tail risk” hedging, and risk-managed strategies that seek to capture the relative price changes of expected volatility at different times in the future.

To help investors better manage market volatility, we also offer the 1-Day Volatility Index (VIX1D), the U.S. Treasury Market Volatility Index (VIXTLT), VIX Weeklys options and futures, mini VIX futures, nearly 24x5 trading in VIX options and futures, Cboe S&P 500 Variance Futures, and Options on VIX futures.

Proprietary Indices

We also calculate and disseminate proprietary indices that are licensed for use by third parties or are used as the basis for Cboe proprietary products. These proprietary indices are built through our in-house Cboe Labs research and development and Cboe Data Vantage business teams, often in connection with our strategic relationships and license agreements with index providers, which are both described below in further detail. Our proprietary indices include:

•volatility indices based on broad-based market indices, such as the S&P 500 and the Russell 2000,

•volatility indices based on ETFs,

•indices based on Bitcoin ETFs, and

•options strategy benchmark indices, such as the Cboe BuyWrite, PutWrite, and Collar indices based on the S&P 500 and Russell 2000, BuyWrite and PutWrite indices based on MSCI EAFE and MSCI Emerging Markets indices, and BuyWrite indices based on other broad-based market indices.

In addition to any transaction fee revenue generated from trading of products based on these indices on Cboe exchanges, we distribute these indices through the Cboe Global Index Feed index data subscription service and, together with index providers with whom we have strategic relationships, we license proprietary indices for third parties to use to create third-party indices and products. Accordingly, we generate revenue from proprietary indices by distributing them for reference purposes, using them as the basis for proprietary products and licensing them for use for third-party indices and products.

Index Provider Relationships

The Company has long-term business relationships with several providers of market indices. We license their indices, including on an exclusive basis, as the foundation for indices, index options and other products. The Company also has agreements in place to work jointly with key providers to develop new indices and products and services that are expected to capitalize on our core competencies and diversify our sources of revenue. Of particular note are the following:

•S&P Dow Jones Indices (“S&P”). We have the following licensing arrangements with S&P:

◦S&P Indices. We have the exclusive right to offer exchange-listed options contracts in the United States on the S&P 500 Index, the S&P 100 Index, the S&P 500 ESG Index, and the S&P Select Sector Indices as a result of a licensing arrangement with S&P. Our license from S&P is through December 31, 2033, with an exclusive license to trade options on the S&P 500 Index through December 31, 2032. We use the market data from the trading of options on the S&P 500 Index and S&P 100 Index for the creation of Cboe volatility indices, such as the Cboe Volatility Index (“VIX Index”), and to create tradable products on those volatility indices.

◦Markit Indices. We have a worldwide license through August 22, 2025 to offer futures, options, and options on futures on indices designed to reflect values of investment grade and high-yield U.S. corporate bonds. Unless either party elects otherwise, this agreement auto-renews for successive two-year periods. Pursuant to our license, we offer futures and options on futures on high yield and investment grade corporate bond indices.

◦Dow Jones Indices. We have the exclusive right during standard U.S. trading hours to offer listed options contracts in the United States on the Dow Jones Industrial Average and Dow 10 Index, and non-exclusive rights to offer listed options on several other Dow Jones indices including the Dow Jones Utilities Average and Dow Jones Transportation Average. This licensing arrangement extends through December 31, 2033. We use market data from the trading of options on these indices to create Cboe volatility indices, variance indicators and BuyWrite indices, and we trade options and other products on these indices.

•FTSE Russell. Under our license agreement with the London Stock Exchange Group’s (“LSEG”) leading global index franchises, Frank Russell Company and FTSE International Limited (together “FTSE Russell”), we have the exclusive or first right in the United States to offer listed options on more than two dozen FTSE Russell indices, which represent a diverse group of domestic and global equities with international appeal. Our exclusive license from FTSE Russell is through April 1, 2030. We offer options on the Russell 2000, Russell 1000, Russell 1000 Value and Russell 1000 Growth indices and mini-options on the Russell 2000 Index.

•MSCI. We have an agreement with MSCI Inc. (“MSCI”) in which we have the right to offer U.S.-listed options on several of MSCI’s indices including the MSCI EAFE, MSCI Emerging Markets, MSCI World, MSCI ACWI, and MSCI USA indices. The agreement term extends until December 31, 2031, but our license to list options on the MSCI indices contained in the agreement could expire on September 30, 2026 if either party elects not to extend. We use

market data from the trading of the MSCI EAFE and MSCI Emerging Markets index options (among other inputs) to calculate volatility indices and several versions of BuyWrite and PutWrite strategy indices.

Cboe Data Vantage

The Cboe Data Vantage business provides an offering of market data and information solutions products across multiple asset classes and geographic regions that are designed to suit our customers’ diverse needs. The Cboe Data Vantage business consists of three product groups:

•Market Data and Access Services. Data products include real-time depth of book quotation information, auction and complex option information, top of book quotes and trades, last sale information, and consolidated equity feeds. Our market data offerings include proprietary data derived from our derivatives and cash and spot markets as well as data relating to Cboe’s proprietary products, such as VIX futures. In addition to market data, access services include all access and capacity products including connectivity, terminal and other equipment rights, maintenance services, trading floor space, permits for the opportunity to trade, and telecommunications services.

•Cboe Global Indices. Services include index creation, calculation, licensing, and data dissemination. In addition to index data dissemination through the Cboe Global Indices Feed ("CGIF") platform, we distribute real-time cryptocurrency prices and indicative net asset values. See above for additional information regarding our proprietary indices.

•Risk and Market Analytics. Services include analytics and historical data with three areas of focus:

◦Data and Market Analytics. Services include aggregated equity and derivative market statistics, theoretical values, trading indicators, portfolio and margin risk, scenarios, and historical data from Cboe’s markets as well as third-party consolidated data.

◦Front-End Platforms. Cboe provides multiple trading solutions and services including Cboe Silexx, LiveVol Pro, FT Options, and Trade Alert.

◦Connectivity. Services include FIX Order Routing, Trade Drop Copy Network, Consolidated Audit Trail (“CAT”) reporting, and broker connectivity.

We provide data services to market participants globally through a number of distribution channels including direct, via our vendor partners and Cboe Global Cloud, which is our global cloud data distribution service.

U.S. Tape Plans

We also derive a portion of our revenue from market data fees from U.S. tape plans, including Unlisted Trading Privileges (“UTPs”), the Consolidated Tape Association (“CTA”) and OPRA. Fees, net of plan costs, from UTP, CTA, and OPRA are allocated and distributed to plan participants like us according to their share of tape fees based on a formula, required by Regulation NMS, which may take into account both trading and quoting activity.

Cash and Spot Markets

We are one of the largest equities market operators, operating four U.S. equities exchanges, international exchanges in Europe, Canada, Japan and Australia, as well as a number of alternative trading systems and an FX platform.

Our four U.S. equities exchanges, BZX, EDGX, BYX and EDGA, which are fully electronic, operate various market and pricing models including price-time, and price-time with retail priority, as well as various pricing models, including maker-taker and taker-maker fee structures. In addition to these market models, each of the U.S. equity exchanges provides numerous specific order types that are designed to enhance their respective market models.

BIDS Trading, the U.S. equities ATS market, which is fully electronic and is an independently managed and operated trading venue, separate from and not integrated with the Exchanges, utilizes a sponsored access model to provide anonymous executions in NMS stocks. Cboe and BIDS Trading collaborate in operating similar venues with our cash and spot markets in Australia, Canada, Europe, and Japan.

Our fully electronic Canadian securities exchange, Cboe Canada Inc., offers four order books, NEO-L, NEO-N, NEO-D and MATCHNow, which operate various market models including maker-taker, taker-maker, large order priority, and frequent call matches with continuous execution opportunities, among others.

In Europe, we operate a number of market models, including continuous Lit orderbooks, periodic auction orderbooks, dark midpoint orderbooks, a post-closing cross, as well as two BIDS Europe orderbooks.

Cboe Australia is a regulated stock exchange that is fully electronic. Cboe Australia utilizes a model that charges a different ad valorem fee rate depending on whether a participant is making or taking liquidity.

Cboe Japan offers two fully electronic displayed markets, Cboe-Alpha and Cboe-Select. Cboe Japan also offers two fully electronic non-displayed markets, Cboe-Match, which matches VWAP orders during pre-market hours and Cboe BIDS Japan, which utilizes a price-time market model aiming for primary market mid-point trades.

The Cboe FX platform provides institutional FX trading services and utilizes a price-firmness-time priority market model. For our FX NDF markets, Cboe SEF utilizes a price-firmness-time priority market model.

Listing

Cboe operates five listing venues across the globe that are structured and designed, in the U.S. and Canada, for all types of equity instruments, such as ETPs, corporate securities, warrants and depositary receipts, while in the UK and European Union ("EU") they support ETPs only. In Australia, both ETPs and warrants are supported. Over the course of 2024, Cboe added approximately 730 listings across the globe and had approximately 2,460 listings as of December 31, 2024. Cboe also offers intralisting on its different equities markets through Cboe Global Listings, the first-of-its-kind, global listing network facilitating worldwide access to capital and secondary liquidity for companies and ETFs.

Clearing

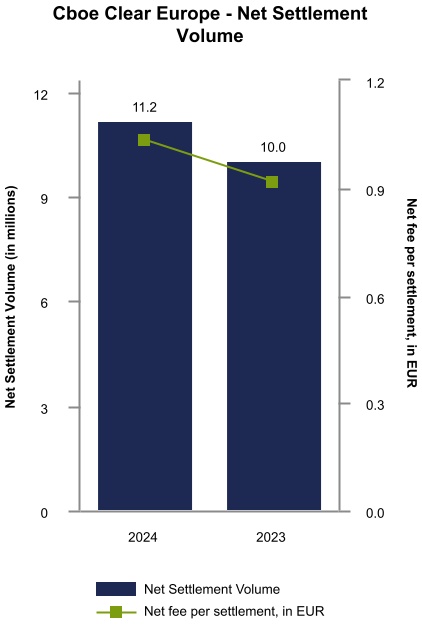

Our subsidiary Cboe Clear Europe, a European central counterparty (“CCP”), provides post-trade clearing services, to stock exchanges, multilateral trading facilities and for over-the-counter equities trades and exchange-traded derivatives trades. Cboe Clear Europe acts as a central counterparty that, for its clearing participants, becomes the buyer to every seller and the seller to every buyer. As a result, it guarantees the timely performance of the settlement obligations of buyers and sellers and takes on the risk of the performance of the transactions that it clears. Additionally, as a Financial Market Infrastructure, Cboe Clear Europe is subject to strict business continuity requirements and regulatory oversight. Cboe Clear Europe clears equities and equity like instruments traded on 47 European trading segments. Cboe Clear Europe also clears equity derivative instruments traded on Cboe NL. In 2024, Cboe Clear Europe provided CCP protection for an average of €49 billion of cleared value on a daily basis. Through the process of netting, in 2024, Cboe Clear Europe eliminated 70%, or €34 billion of the average daily cleared value, leaving an average daily settlement value of €15 billion. In 2023, Cboe Clear Europe provided CCP protection for an average of €44 billion of cleared value on a daily basis. Through the process of netting, in 2023, Cboe Clear Europe eliminated 71%, or €31 billion of the average daily cleared value, leaving an average daily settlement value of €13 billion. As of November 25, 2024, Cboe Clear Europe also launched a first-of-its-kind service for SFT in cash equities and ETFs, which includes central clearing, settlement and post-trade lifecycle management.

Cboe Clear U.S. is a CFTC-registered derivatives clearing organization (“DCO”) that provides clearing and settlement of cash-settled margin Bitcoin and Ether futures contracts for its affiliate, Cboe Digital Exchange.

Customers

Our customers generally include financial institutions, trading platforms, institutional and individual investors, and professional traders. Our equities and options customers in the United States include trading permit holders and members (as applicable) of Cboe Options, C2, BZX, BYX, EDGX, and EDGA, which are SEC-registered broker-dealers, and the customers of those broker-dealers. Our Canadian equities customers include members of Cboe Canada Inc., which are Canadian registered investment dealers. Our Australian customers include trading participants of Cboe Australia, which are Australian registered investment dealers, and certain clients of those dealers. Our Japanese customers include participants of Cboe-Alpha, Cboe-Select, Cboe-Match and Cboe BIDS Japan, which are Japanese registered broker-dealers, and certain clients of those dealers. Our ATS equities participants in the United States include subscribers of BIDS Trading, which are SEC-registered broker-dealers, and certain customers of those broker-dealers. Our futures customers include banks, futures commission merchants and their customers, hedge funds, asset managers, proprietary trading firms, and Commodity Trading Advisors. Similarly, our equities customers in Europe are EU regulated brokerage and proprietary trading firms, as well as sponsored access clients of these brokerage firms and certain non-EU regulated and unregulated direct access participants. Cboe Clear Europe clearing participants include EEA regulated banks and brokerage trading firms. Our institutional global FX customers include banks, broker-dealers, hedge funds, asset managers, proprietary trading firms, Commodity Trading Advisors, and corporates. Access to our markets and trading rights and privileges depend upon the nature of the customer, such as whether the individual or firm is (or is eligible to become) a trading permit holder, trading privilege holder, member, participant, or subscriber of one of our markets. For information regarding risks related to our customers see “Risk Factors.”

Competition

The industry in which we operate is intensely competitive. We believe we face competition on a number of factors, including:

•price, quality and speed of our trade and clearing execution;

•functionality and ease of use of our trading and clearing platforms;

•reliability, integrity, depth of book, liquidity, range and functionality of our products and services;

•integrity of our marketplaces;

•technological innovation and adoption;

•our brand awareness; and

•our reputation.

We believe that we compete favorably with respect to these factors through a variety of methods, including:

•offering access to a broad array of products and services, including proprietary products and market data;

•offering fee schedules and pricing models that both attract order flow and provide incentives to liquidity providers;

•providing advanced technology that offers broad functionality, low latency, fast execution, ease of use, scalability, reliability, and security;

•offering efficient, transparent and liquid marketplaces;

•offering deep and liquid markets with opportunities for price improvement;

•offering broad trading platform access in the EU;

•offering efficient and transparent clearing services designed to help maximize netting opportunities;

•maintaining close relationships with customers; and

•providing customers with a comprehensive source of information on options and ETPs as well as extensive options education.

In our proprietary products, we compete against other futures exchanges and swap execution facilities that offer similar products, as well as against financial market participants that offer similar over-the-counter derivatives. We also compete against certain multi-listed options products, such as SPY options and cash settled index options, which may offer similar market exposure of our proprietary products, such as SPX options.

The listed options industry is extremely competitive. As of December 31, 2024, our four options exchanges compete with 14 other U.S. options exchanges, in large part due to existing exchange holding companies opening new exchanges that offer different markets and pricing models on existing technology. Most of the equity and ETP options listed and traded on our exchanges are also listed and traded on the other exchanges. In addition, the options exchanges that we compete with set fees and rebates to attract multi-listed options business to their exchanges, which has historically reduced the net revenue per contract that we generate from multi-listed options, and the options exchanges that we compete with structure their options businesses in partnership with established market participants, such as consolidators, and other order flow providers, to increase their volume traded.

Our U.S. equities and the BIDS Trading ATS compete against 12 other equities exchanges as of December 31, 2024, and over 25 other ATSs and single dealer platforms. Market participants have multiple venues for the execution of orders, including national securities exchanges and numerous off-exchange venues, including other ATSs and broker-dealers that internalize orders off-exchange. Additionally, corporate and ETP issuers have multiple venues they can choose from in the listing of their products. In Canada, our recognized Canadian securities exchange, Cboe Canada Inc., competes with several Canadian exchanges and ATSs. In Australia, our exchange, Cboe Australia, competes with other Australian exchanges and crossing systems. In Japan, our equities exchanges and PTSs, compete with several Japanese exchanges and other PTSs.

The market for execution and clearing services in Europe became more competitive following the introduction of MiFID II and the Regulation on Markets in Financial Instruments (Regulation (EU) No 600/2014) (“MiFIR”). Our major competitors in Europe include national stock exchanges, other pan-European MTFs, systematic internalizers, and other European clearinghouses.

The global FX market remains severely fragmented, with transparent automated marketplaces such as Cboe FX challenging a small number of similarly situated competitors. While the global FX market has experienced a shift from competing interbank platforms to ECNs, the electronification of the spot and NDF FX market may encounter resistance from customers that still prefer to utilize the phone, instant chats, terminals and key banking relationships for price discovery and trading. Furthermore, levels of electronification of the FX market have remained relatively static. The electronic spot FX market is also intensely competitive, with over 10 other venues competing for market share as of December 31, 2024. Cboe measures and reports on market share against a narrower set of competitors, included in those venues.

In addition, Cboe Data Vantage faces competition from other securities exchanges, technology companies, third-party market data providers, and information and software vendors, which have their own substantial market data distribution capabilities that serve as alternative means for receiving open market data feeds instead of connecting directly to our exchanges or trading venues. The sale of our proprietary data products is also under competitive threat from ATSs and trading venues that offer similar products. Distributors and consumers of our market data may also use our market data as an input into a product that competes against one of our traded or cleared products.

Technology

Cboe's Trading Technology

The trading platform for our equities, options, and futures markets is built upon our Cboe Titanium technology platform. It is developed, owned, and operated in-house and is designed to optimize reliability, speed, scalability, and versatility. Using common protocols and features, Cboe’s unified Cboe Titanium technology platform is designed to offer customers an efficient, consistent experience regardless of where they are in the world. Our exchanges provide different market models, appealing to different user bases, and the trading technologies support all of them. Further, the technologies are designed to support many specialized features for each of the markets, such as: dark pools, trade reporting facility, systematic internalizer, Large-in-Scale, smart order routing, FLEX options, 24x5 trading, and hybrid trading (combining electronic and open outcry). In addition, Cboe and its applicable subsidiaries operate separate trading and/or clearing platforms, as applicable, for BIDS Trading, certain Cboe Canada Inc. order books, Cboe Digital Exchange, Cboe Clear U.S., Cboe Clear Europe, and Cboe FX.

Our trading platforms have generally experienced very low operational downtime and low latency. We have undertaken significant efforts to upgrade our Cboe Titanium technology platform to help meet increased performance and capacity requirements and help ensure competitiveness, support growth and advance a consistent world class platform globally. The trading platforms use readily available hardware, thereby minimizing capital outlays required for each new market entry. Also, in order to continue to implement new enhancements to our trading platforms, new releases of software are generally deployed routinely in all of the applicable markets.

Disaster Recovery

We operate and maintain geographically diverse disaster recovery facilities for all of our markets. We expect that, in certain instances, the disaster recovery facilities can be up and running in a short period of time and in certain instances we may also work with our market participants to try to quickly reopen marketplaces. We regularly test our data center recovery plans and periodically carry out weekend tests using our back-up data centers, as well as an annual test with our U.S. trading participants. Cboe Canada Inc., as required by local regulations, conducts internal testing of its disaster recovery data processing capabilities at least annually, and participates in the bi-annual testing coordinated by CIRO. Cboe Australia and Cboe Japan conduct internal testing of their disaster recovery data processing capabilities at least annually. In Europe, we also regularly test our data center recovery plans and periodically carry out weekend tests which use our back-up data center, as well as an annual test with our European trading participants. We continue to work to improve both the availability of our technology and our disaster recovery facilities.

Emerging Technologies

We are exploring the potential use of new technologies, such as artificial intelligence (“AI”), machine learning, blockchain, distributed ledger technology, quantum computing, the cloud, and other emerging technologies to potentially help drive new products, increase productivity, improve our self-regulatory oversight responsibilities, and increase automation of tasks.

Routing and Clearing

OCC is the sole provider of clearing on all of our U.S. options exchanges and CFE. National Securities Clearing Corporation (“NSCC”), a subsidiary of the Depository Trust and Clearing Corporation (“DTC”), is the sole provider of clearing on our U.S. listed equity exchanges. The Canadian Depository for Securities (“CDS”) is the sole provider of clearing on all equities transactions occurring on Cboe Canada Inc. With respect to Australian equities and derivatives, Cboe Australia delivers matched trades of its customers to ASX Clear Pty Ltd and ASX Settlement Pty Ltd. ASX Clear Pty Ltd acts as a central counterparty on all transactions occurring on Cboe Australia. The Japan Securities Clearing Corporation (“JSCC”) is the sole provider of clearing on all equities transactions occurring on Cboe Japan’s Cboe-Alpha, Cboe-Select, Cboe-Match and Cboe BIDS Japan. BofA Securities, Inc. (“BOA”) is the sole provider of clearing on all equities transactions occurring on BIDS Trading. Cboe Europe Equities relies on LCH Limited and LCH SA (“LCH”), Cboe Clear Europe, and SIX x-clear Ltd (“SIX x-clear”) to clear trades in European listed equity securities and exchange traded products as part of an interoperable clearing model. For derivatives, Cboe NL relies on Cboe Clear Europe to clear both index and single stock derivative contracts. With respect to U.S. government securities transactions executed on Cboe Fixed Income, we use Mirae Asset Securities (USA) Inc. to deliver matched trades to the Fixed Income Clearing Corporation (FICC) Government Securities Division (GSD), which acts as a central counterparty on all transactions occurring on Cboe Fixed Income and, as such, guarantees clearance and settlement of all of those matched trades. For SFT in cash equities and ETFs, Cboe Clear Europe provides central clearing, settlement and post-trade lifecycle management. Cboe Clear U.S. is the sole provider of clearing and settlement of all digital asset transactions occurring on Cboe Digital Exchange in cash-settled margin futures on Bitcoin and Ether.

Cboe Trading is a routing broker-dealer used by our four U.S. equities exchanges and our four U.S. options exchanges, including the electronic platform portion of Cboe Options. Cboe Trading’s clearing firms are Wedbush Securities, Inc. (“Wedbush”) and Morgan Stanley & Co. LLC (“Morgan Stanley”).

Digital Assets and Recent Developments

Cboe Digital is an operator of a CFTC-regulated futures exchange (Cboe Digital Exchange) and a CFTC-regulated clearinghouse (Cboe Clear U.S.). Prior to May 31, 2024, Cboe Digital Exchange and Cboe Clear U.S. also operated a U.S.-based spot digital asset trading market (“Cboe Digital spot market”), but as of May 31, 2024, the Cboe Digital spot market is closed for all participant and trading purposes. Cboe Digital does not engage in proprietary trading activities and does not maintain a trading entity. Cboe Digital does not maintain any digital assets, does not itself trade digital assets, does not trade on its own exchange, and does not maintain an affiliate trading entity for purposes of trading, market making, or liquidity provision on its exchange. Cboe Clear U.S. maintains its own operating funds in separate bank accounts from its customer funds.

Regulatory Environment and Compliance

Various aspects of our business are subject to regulation by the SEC, CFTC, FINRA, various state regulators, CIRO, the Canadian Securities Administrators (and, in particular, the Ontario Securities Commission or “OSC”), the Australian Securities & Investments Commission (“ASIC”), JFSA, JSDA, ESMA, FCA, the Central Bank of the Netherlands (“DNB”), AFM, Bank of England, and other international regulatory authorities where our exchanges or Cboe Clear Europe may be authorized to act as foreign exchanges or provide clearing services, and market participants may be subject to regulation by the SEC, CFTC, FINRA, National Futures Association (“NFA”), FCA, Board of Governors of the Federal Reserve, U.S. Department of the Treasury and/or foreign regulators.

Recent Developments

Laws and regulations regarding our business are frequently modified or changed to address perceived problems, new products, or competition or at the request of market participants. In particular, both the SEC and CFTC will be under new leadership as part of the transition to President Trump's administration which adds additional uncertainty to the regulatory environment. The following is a brief discussion of recent regulatory developments that may significantly impact our business.

United States

Equity Market Structure

In December 2022, the SEC released four proposals that could impact equity market structure: (1) Disclosure of Order Execution Information ("Rule 605"); (2) Regulation NMS Amendments: Tick Size, Access Fees, and Transparency (“Tick Size/Access Fee Cap”); (3) Regulation Best Execution; and (4) Proposed Rule to Enhance Order Competition. Each of these proposals have been noticed for public comment, and in 2024, Rule 605 and the Tick Size/Access Fee Cap proposals were approved by the SEC and await implementation. Rule 605 may result in increased technology and compliance costs to Cboe. The Tick Size/Access Fee Cap rule is also likely to result in increased technology and compliance costs to Cboe, as well as potential adverse impact to Cboe’s trading volume and transaction fee revenue. The SEC has yet to take any additional action on Regulation Best Execution and Order Competition, but if adopted as-is, these proposals could result in market technology changes and additional compliance costs to Cboe. Further, it is possible that additional proposals or changes to the existing equity market structure could have a negative impact on our operations. In addition, bills are sometimes introduced in the U.S. Congress that also could potentially impact equity market structure and adversely impact our volumes and operations. See “Risk Factors” for more information.

Volume Based Pricing Proposal

On October 18, 2023, the SEC released a proposed rule that would impact the way in which volume based discounts are applied (“Volume Based Proposal”). If adopted as-is, this Volume Based Proposal would prohibit national securities exchanges, including Cboe’s equities exchanges, BZX, BYX, EDGX, and EDGA, from offering volume-based transaction pricing in connection with the execution of agency or riskless principal orders in NMS stocks, and likely inhibit Cboe’s ability to attract liquidity and offer competitive pricing to differentiate Cboe from our competitor exchanges. Although the proposed new rules do not appear likely to have a potential near term material impact, the new rules, if adopted as-is, may have a long term material impact on our business, financial condition, and operating results if, for example, there is a reduction of overall volumes, liquidity, or market share on Cboe’s equities exchanges, BZX, BYX, EDGX, and EDGA. See “Risk Factors” for more information.

Europe

OTC Derivatives, Central Counterparties and Trade Repositories

Regulation (EU) No 648/2012 of the European Parliament and of the Council of July 4, 2012 on OTC derivatives, central counterparties and trade repositories (the “European Market Infrastructure Regulation” or “EMIR”) sets out rules relating to over-the-counter (“OTC”) derivatives markets, central counterparties and trade repositories. EMIR was enhanced

and amended by EMIR REFIT and EMIR 2.2. The final text on EMIR 3.0 entered into force on December 24, 2024. Further supporting regulatory technical standards are expected to be published over the course of 2025.

EU Transparency Rules

On November 11, 2021, the European Council (“E.C.”) published its proposal for a review of EU market structure legislation, including proposed amendments to MiFIR and Directive 2014/65/EU on markets in financial instruments (“MiFID II”). The legislative phase of the review is now complete and revised MiFIR rules came into effect on March 28, 2024. The deadline for transposing MiFID II amendments is September 29, 2025. The final text includes, among other provisions, provision for a consolidated tape for the EU, a ban on payment for order flow, replacement of the double volume cap with a single volume cap for trades executed under certain trade waivers and changes to the transparency regime for equities. These provisions are expected to be implemented in the second half of 2025 through a number of level 2 measures. The legislation, as drafted, does not appear likely to have a material adverse effect on our business, financial condition, and operating results. However, there are review clauses contained in the legislation which provide a further opportunity to review the effectiveness of the transparency regime, at which point, potential changes may have a material adverse effect on our business, financial condition, and operating results. See “Risk Factors” for more information.

Compliance

U.S. Securities Industry

Federal securities laws have established a two-tiered system for the regulation of securities exchanges and market participants. The first tier consists of the SEC, which has primary responsibility for enforcing federal securities laws. The second tier consists of self-regulatory organizations (“SROs”), which are non-governmental entities that must register with and are regulated by the SEC. The Exchanges are SROs, each registered under Section 6 of the Exchange Act of 1934, as amended (“Exchange Act”) as a “national securities exchange,” and are subject to oversight by the SEC.

SROs are an essential component of the regulatory scheme of the Exchange Act for providing fair and orderly markets and protecting investors. To be registered as a national securities exchange, an exchange must successfully undergo an application and review process with the SEC prior to beginning operations. Among other things, the SEC must determine that the SRO has the ability to comply with the Exchange Act and to enforce compliance by its members and persons associated with its members with the provisions of the Exchange Act, the rules and regulations thereunder and the rules of the exchange.

In general, an exchange SRO is responsible for operating its trading platforms consistent with its rules, and regulating its members through the adoption and enforcement of rules governing the business conduct of its members. The rules of the exchange must also assure fair representation of its members in the selection of its directors and administration of its affairs and, among other things, provide that one or more directors be representative of issuers or investors and not be associated with a member of the exchange or with a broker or dealer. Additionally, the rules of the exchange must be adequate to ensure fair dealing and to protect investors and may not impose any burden on competition not necessary or appropriate in furtherance of the purposes of the Exchange Act.

As registered national securities exchanges, virtually all facets of our Exchange operations are subject to the SEC’s oversight, as prescribed by the Exchange Act. The Exchange Act and the rules thereunder impose on us many regulatory and operational responsibilities, including record keeping and the day-to-day responsibilities for market operations and broker-dealer oversight. Furthermore, as SROs, the Exchanges are potentially subject to regulatory or legal action by the SEC or other interested parties. The SEC also has broad enforcement powers to censure, fine, issue cease-and-desist orders, prohibit us from engaging in some of our businesses, suspend or revoke our designation as a registered securities exchange, or remove or censure any of our officers or directors who violate applicable laws or regulations. For example, in the past we have entered into consent orders with the SEC, under which our subsidiaries were censured, ordered to cease and desist from violating certain sections of the Exchange Act, paid fines, and completed certain undertakings.

As part of its regulatory oversight, the SEC conducts periodic reviews and inspections of exchanges, and the Exchanges have been subject to such routine reviews and inspections. To the extent such reviews and inspections result in regulatory or other changes, we may be required to modify the manner in which we conduct our business, which may adversely affect our business. We collect certain fees to cover Section 31 fees charged to the Exchanges by the SEC and certain fees derived from our regulatory function and fines in connection with our disciplinary proceedings. The Exchanges are responsible for the ultimate payment of Section 31 fees to the SEC. Additionally, under the rules of each of our exchanges, as required by the SEC, any revenue derived from the regulatory fees and fines cannot be used for non-regulatory purposes.

Section 19 of the Exchange Act also provides that we must submit to the SEC proposed changes to any of the Exchanges’ rules, including revisions of their certificates of incorporation, bylaws, or other governing documents of the SROs or their parent companies. The SEC will typically publish the proposal for public comment, following which the SEC may approve or disapprove the proposal, as it deems appropriate. Certain categories of rule changes, like fee changes, can be effective on filing, but the SEC retains the ability to suspend or reject such filings within a prescribed period of time.

Canadian Securities Industry

Cboe Canada Inc. is subject to comprehensive regulation and oversight by its primary provincial securities regulatory authority, the OSC. In addition, Cboe Canada Inc. is a Marketplace Member of, and subject to a regulation services agreement with, CIRO. The regulations applicable to Cboe Canada Inc. cover a wide array of areas, including, but not limited to, marketplace operations (which include corporate governance, fair access, systems compliance and integrity, and conflict management requirements), trading rules, electronic trading risk management, and financial viability.

Australian Securities Industry

Cboe Australia is subject to comprehensive regulation and oversight by ASIC. The regulations applicable to Cboe Australia cover a wide array of areas, including, but not limited to, marketplace operations (which include corporate governance, fair access, systems compliance and integrity, and conflict management requirements), trading rules, electronic trading risk management, and financial viability.

Japanese Securities Industry

Cboe Japan is subject to comprehensive regulation and oversight by the JFSA and the JSDA. The regulations applicable to Cboe Japan cover a wide array of areas, including, but not limited to, marketplace operations (which include corporate governance, fair access, systems compliance and integrity, and conflict management requirements), trading rules, electronic trading risk management, and financial viability.

Futures and Swaps Industry-CFE and Cboe SEF

The operations of each of CFE and Cboe SEF are subject to regulation by the CFTC under the Commodity Exchange Act (“CEA”). The CEA generally requires that futures trading in the United States be conducted on a designated contract market and, in some cases, requires swaps trading to be conducted on a swap execution facility (“SEF”) or designated contract market (“DCM”). The CEA and CFTC regulations establish criteria for an exchange to be designated as a contract market on which futures and futures options contracts may be traded, and for a trading platform to be designated as a swap execution facility on which certain swaps may be traded. Designation as a contract market or swap execution facility for the trading of specified futures or swaps contracts is non-exclusive. This means that the CFTC may permit additional exchanges or trading platforms to be contract markets or swap execution facilities for trading the same or similar contracts.

CFE is a designated contract market, and Cboe SEF is a swap execution facility, each of which is subject to the oversight of the CFTC and to a variety of ongoing regulatory and reporting responsibilities under the CEA. As a designated contract market, CFE is required to comply with the applicable core principles and regulations under the CEA, as is Cboe SEF as a swap execution facility. Each of CFE and Cboe SEF has surveillance and regulatory operations and procedures to monitor and enforce compliance by trading privilege holders with CFE rules, and by participants with Cboe SEF rules, as applicable. If CFE or Cboe SEF fails to comply with applicable laws, rules or regulations, it may be subject to: censure, fines, cease-and-desist orders, suspension of its business, and removal of personnel or other sanctions, including revocation of CFE’s designation as a contract market or Cboe SEF’s designation as a swap execution facility.

Digital Assets

Cboe Digital Exchange is a CFTC-registered designated contract market, and Cboe Clear U.S. is a CFTC-registered derivatives clearing organization, each of which is subject to the oversight of the CFTC and to a variety of ongoing regulatory and reporting responsibilities under the CEA. As a designated contract market, Cboe Digital Exchange is required to comply with the applicable core principles and regulations under the CEA, as is Cboe Clear U.S. as a derivatives clearing organization. Each of Cboe Digital Exchange and Cboe Clear U.S. has surveillance and regulatory operations and procedures to monitor and enforce compliance by trading privilege holders with Cboe Digital Exchange rules, and by clearing members with Cboe Clear U.S. rules. If Cboe Digital Exchange or Cboe Clear U.S. fails to comply with applicable laws, rules or regulations, it may be subject to censure, fines, cease-and-desist orders, suspension of its business, removal of personnel or other sanctions, including revocation of Cboe Digital Exchange’s designation as a contract market or Cboe Clear U.S.’s designation as a derivatives clearing organization.

Cboe Clear U.S. has surrendered or is in the process of surrendering its money transmitter licenses in the states where such licenses or equivalent were required to conduct business in connection with the Cboe Digital spot market, which closed on May 31, 2024. In addition, Cboe Clear U.S. has surrendered its BitLicense from the New York Department of Financial Services (“NYDFS”).

Europe

Cboe Europe is located in London and is subject to regulation in the UK and to certain European regulations. The current UK regulatory system was established by the Financial Services Act 2012 (“FSA12”), which amended the Financial Services and Markets Act 2000. The legislation replaced the previous financial services regulator, the Financial Services