Use these links to rapidly review the document

Table of Contents

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 13, 2006

REGISTRATION NO. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PETRIE PARKMAN & CO., INC.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction of

Incorporation or Organization) | | 6199

(Primary Standard Industrial

Classification Code Number) | | 84-1108632

(I.R.S. Employer

Identification Number) |

475 17th STREET

SUITE 1100

DENVER, COLORADO 80202

(303) 292-3877

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

THOMAS A. PETRIE

CHIEF EXECUTIVE OFFICER

PETRIE PARKMAN & CO., INC.

475 17th STREET

SUITE 1100

DENVER, COLORADO 80202

(303) 292-3877

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies To: |

FRANK ED BAYOUTH II

SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

1000 LOUISIANA STREET, SUITE 6800

HOUSTON, TEXAS 77002-5026

(713) 655-5100 | | BARBARA L. BECKER

GIBSON, DUNN & CRUTCHER LLP

200 PARK AVENUE

NEW YORK, NEW YORK 10166-0193

(212) 351-4000 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Proposed Maximum

Aggregate

Offering price(1)(2)

| | Amount of

Registration Fee

|

|---|

|

| Common Stock, par value $0.01 per share | | $115,000,000.00 | | $12,305.00 |

|

- (1)

- Includes shares issuable upon exercise of the underwriters' option to purchase additional shares of common stock.

- (2)

- Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus — Subject to completion, dated September 13, 2006.

Shares

PETRIE PARKMAN & Co.

Common Stock

This is an initial public offering of shares of common stock of Petrie Parkman & Co., Inc. We are offering shares of our common stock, and the selling stockholders identified in this prospectus are offering an additional shares of common stock. See "Principal and Selling Stockholders." We and the selling stockholders have also granted the underwriters a 30-day option to purchase an additional shares at the initial public offering price less the underwriting discount. We will not receive any proceeds from the sale of any shares by the selling stockholders.

Prior to this offering, there has been no public market for our common stock. The initial public offering price per share of our common stock is expected to be between $ and $ . We intend to apply to list our common stock on the New York Stock Exchange under the symbol "PDP."

See "Risk Factors" beginning on page 10 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share

| | Total

|

|---|

| Initial public offering price | | $ | | | $ | |

| Underwriting discount | | $ | | | $ | |

| Proceeds, before expenses, to us | | $ | | | $ | |

| Proceeds, before expenses, to the selling stockholders | | $ | | | $ | |

The underwriters expect to deliver the shares against payment in New York, New York on , 2006.

| Keefe, Bruyette & Woods | | Petrie Parkman & Co.

|

The date of this prospectus is , 2006

Table of Contents

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus.

As used in this prospectus, the terms "Petrie Parkman," "we," "our," or "us" refer to Petrie Parkman & Co., Inc. and its consolidated subsidiaries, taken as a whole, unless the context indicates otherwise. All industry and statistical information included in this prospectus, other than information derived from our financial and accounting records is presented as of June 30, 2006, unless otherwise indicated. Financial results and information derived from our accounting records which are presented as "current" are as of June 30, 2006, the date of our most recently available quarterly financial statements. Except as otherwise indicated, all amounts with respect to the volume, number and market share of merger and acquisition, divestiture and capital-raising transactions and related ranking information included in this prospectus have been derived from information compiled and classified from proprietary Petrie Parkman databases or byThomson Financial Services andBloomberg L.P., providers of financial and research information. Although we believe that all third party sources we have used are reliable, we have not independently verified and do not guarantee the accuracy and completeness of this information.

In August 2006, we amended our certificate of incorporation to effect a 5,000 to 1 stock split of our common stock and to reclassify the par value of our common stock from $1.00 per share to $0.01 per share. All share and related per share amounts have been adjusted to reflect the stock split and to reclassify par value, in each case for the periods presented. Unless indicated otherwise, the information included in this prospectus assumes no exercise by the underwriters of the option to purchase up to an additional shares of common stock from us and the selling stockholders and that the shares of common stock to be sold in this offering are sold at $ per share, which is the midpoint of the range indicated on the front cover of this prospectus.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under "Risk Factors" and the historical financial statements and related notes included elsewhere in this prospectus, before you decide to invest in our common stock.

Petrie Parkman & Co., Inc.

We are an investment bank specializing in the energy industry. Over the past 17 years, we have grown to become a leading energy investment bank with a strong reputation for serving our corporate clients as a trusted advisor on merger and acquisition, divestiture and capital-raising transactions. We believe our extensive advisory experience and industry specialization enable us to deliver differentiated advice that our clients require and appreciate when addressing complex problems and making important strategic and financial decisions. We serve our clients as a highly specialized alternative to larger, diversified financial services institutions.

We provide strategic and advisory investment banking services to our corporate and governmental clients. We also provide equity research and equity sales and trading services, which we refer to as capital markets services, to our institutional clients. Our business is currently focused on serving clients and investors that are active in the following sectors of the energy industry:

- •

- oil and natural gas exploration and production, or E&P;

- •

- oilfield services and equipment;

- •

- hydrocarbon gathering and processing; and

- •

- refining, marketing and transportation.

Since our founding in 1989, we have advised our clients on more than 200 energy industry merger, acquisition and divestiture transactions representing an aggregate value of approximately $84 billion. According toBloomberg L.P., we were ranked first based on the total number of merger and acquisition transactions in the domestic E&P sector in 2005. We have advised on a significant number of mergers involving publicly traded U.S. oil and gas companies for the three years ending June 30, 2006. We are also very active in the divestiture business. Recent transactions include the sale of Western Gas Resources to Anadarko Petroleum for approximately $5.3 billion and the sale of oil and gas properties and gathering and processing assets of Chief Holdings to Devon Energy and Crosstex Energy for approximately $2.7 billion.

We began underwriting equity offerings in 1992. According toThomson Financial, we are the second most active underwriter of public offerings for domestic E&P companies for the period inclusive of 1992 through June 30, 2006. During this period, we co-managed 80 public offerings for energy companies, representing gross proceeds of approximately $14 billion. Recent experience includes serving as co-manager on the $141 million initial public offering of Calumet Specialty Products Partners, LP in January 2006 and the company's $109 million follow-on equity offering in June 2006.

We differentiate ourselves from our competitors, which include some of the largest diversified investment banks in the world as well as other independent firms, on the basis of the following:

- •

- our specialization in the energy industry, which is large, complex, highly technical and undergoing significant structural change resulting from evolving economic and geopolitical conditions;

1

- •

- our extensive knowledge and expertise gained through providing strategic and financial advisory and divestiture services for many years and through a wide range of industry cycles and market conditions;

- •

- our historical concentration on the strategic advisory and financing needs of independent oil and gas companies;

- •

- the high degree of involvement in client assignments by our senior professionals, including senior management; and

- •

- our principal offices strategically located in major oil and gas centers, which place us in close physical proximity to many of our clients.

For the year ended December 31, 2005, we generated revenues of $74.3 million, net income of $4.2 million and pro forma net income of $17.3 million, representing a 28% increase in revenues, an 18% increase in net income and a 33% increase in pro forma net income compared to 2004. Since 1990, our first full year of operations, we have grown our revenues at a compound annual growth rate of 23%. For additional information on the pro forma amounts and the related pro forma adjustments, see "Unaudited Pro Forma Condensed Consolidated Financial Information" included elsewhere in this prospectus.

As of June 30, 2006, we had 53 employees. Immediately following this initial public offering, our employees and directors will own approximately % of our fully diluted common shares. We are headquartered in Denver, Colorado with a major office in Houston, Texas. We also maintain a correspondent office in London, England. Our headquarters are located at 475 17th Street, Suite 1100, Denver, Colorado 80202. Our telephone number is (303) 292-3877. Our website address is www.petrieparkman.com. The information contained or referenced on our website does not constitute a part of, nor is it incorporated into, this prospectus.

Energy Industry Overview

According to Platts, a leading provider of energy information, the largest 250 energy companies in the world generated revenues of more than $3.5 trillion in 2004, making the production and supply of energy one of the world's largest industrial activities.

The global energy industry includes companies that produce, transport, convert and distribute fuels for heat, light and propulsion. These companies are supported by a variety of equipment providers, service firms and investors. The trends in global population and economic growth, along with a maturing conventional hydrocarbon production base are combining to create an extended period of challenges for energy consumers and traditional suppliers. At the same time, opportunities have emerged for new energy sources, producers, distributors and capital investment. Capacity shortages at various stages of production and distribution have contributed significantly to the recent price increases in global commodities, such as oil and natural gas. Numerous previously uneconomic resources are now becoming attractive for development as a result of these higher commodity prices, combined with advances in oil field technology. These factors have contributed to increased investments by traditional energy companies throughout the energy supply chain in an attempt to increase exploration and production. This expansion in capital development should result in increased opportunities for merger, acquisition, divestiture and capital-raising transactions in the energy industry.

2

Market Opportunity

A combination of economic and market factors have presented significant opportunities for us as a specialized energy investment bank to increase our revenues and market share within our current lines of business. These factors also offer the potential for us to expand into new lines of business and geographic markets while remaining focused on the energy industry.

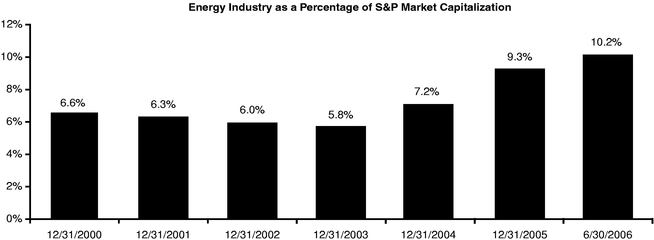

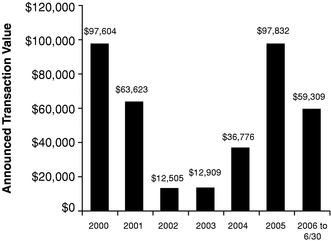

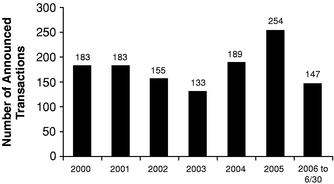

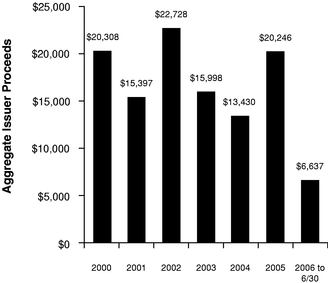

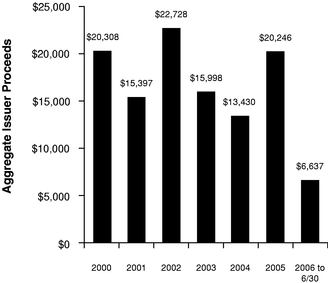

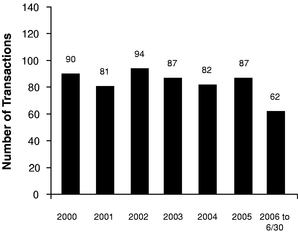

- •

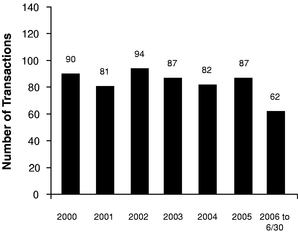

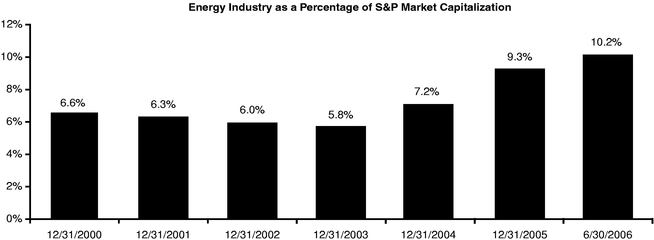

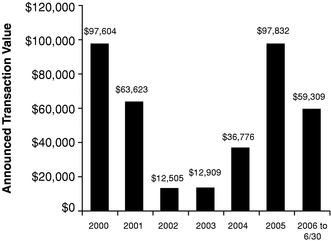

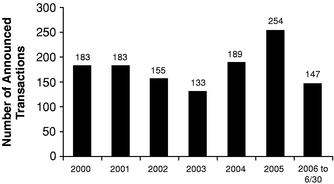

- Large, complex, capital intensive nature of the energy industry, which is subject to significant ongoing structural change. We believe these characteristics will continue to drive the financing needs of energy industry participants and will result in ongoing consolidation in the form of merger, acquisition and divestiture transactions. In 2005, the energy industry represented $98 billion in announced U.S. merger and acquisition transaction value, or 10% of all U.S. merger and acquisition transactions. This represented an increase of approximately 166% from the $37 billion of announced U.S. energy industry transaction value in 2004. The energy industry also accounted for approximately $20 billion in aggregate equity proceeds to issuing companies, or 17% of the total proceeds from domestic initial public offerings and follow-on equity offerings in 2005, representing an increase of 51% compared to the year ended 2004.

- •

- Trends favoring independent advisory investment banks. The consolidation that characterized the financial services industry in the late 1990s following the repeal of the Glass-Steagall Act resulted in fewer independent investment banks, thus enhancing the market opportunity available to experienced industry specialists like us. We believe specialized independent investment banks represent attractive environments for experienced senior level financial industry professionals. We also believe that recent increases in merger and acquisition market share by independent advisory firms is a trend that will continue to accrue to our benefit, particularly as we believe corporate boards and company managements increasingly seek conflict-free, independent advice on their most important corporate initiatives.

- •

- Increasing private equity investment in the energy industry. We view the growing level of venture capital and private equity investment in the energy industry as an important leading indicator of future merger, acquisition, asset divestiture and capital markets activity. In recent years, the amount of capital invested in private equity funds targeting the energy industry has grown, as has the number of funds, the number of investments and the aggregate amount of capital invested privately in energy companies.

Principal Business Lines

Our primary line of business is investment banking, which includes our merger and acquisition, divestiture, and restructuring advisory services and our corporate finance activities. In addition, for our institutional investor clients, we provide equity research and equity sales and trading services, which we collectively refer to as our capital markets business. We also manage a recently formed merchant banking fund that is focused on making principal investments, typically as a co-investor, in small, emerging private companies within the energy sector.

Investment Banking

Since inception, the primary focus of our investment banking activities has been strategic and financing advisory services to corporations, partnerships, governments and other clients, both domestically and abroad. These advisory services are generally characterized by high margins and low capital requirements relative to other investment banking lines of business. We provide investment banking services in the following areas:

- •

- Mergers and Acquisitions. Our merger and acquisition services include advising our corporate clients, including boards of directors and special committees, on the sale of public companies,

3

mergers, acquisitions, spin-offs and takeover defenses, providing fairness and adequacy opinions, and assisting clients in evaluating strategic alternatives designed to enhance stockholder value.

- •

- Divestitures. In our divestiture advisory business, we provide advice and transaction execution services to energy industry clients seeking to sell certain assets or entire private companies. These services include evaluating properties, developing a "roadmap to value," designing and implementing a customized marketing process, soliciting acquisition proposals, and structuring, negotiating and closing transactions. We believe we provide our clients with an effective combination of strategic insights and tactical execution. Through more than 140 completed transactions, we have developed substantial experience along with an extensive proprietary database of transaction related information that we utilize to assist us in providing superior valuation and transaction perspectives.

- •

- Restructurings. Our restructuring advisory business includes advising debtor companies or creditors involved with bankruptcies, recapitalizations, reorganizations and restructurings.

- •

- Corporate Finance. We assist our energy clients in meeting their capital needs through initial public offerings and follow-on equity offerings, private equity placements, including 144A offerings, convertible debt and preferred stock offerings, and public and private debt offerings. Our extensive industry and financial experience combined with the firm's specialized equity sales, trading and energy research expertise assist us in providing knowledgeable and prudent advice on capital-raising transactions.

For the year ended December 31, 2005, we generated $63.9 million in investment banking revenues, an increase of $17.5 million or 38% compared to the year ended December 31, 2004. For the six months ended June 30, 2006, our investment banking revenues totaled $57.2 million, an increase of $27.3 million or 91% compared to the corresponding period in 2005. Investment banking revenues represented approximately 86% and 92% of our total revenues for the year ended December 31, 2005 and the six months ended June 30, 2006, respectively.

Capital Markets

We provide equity research and equity sales and trading services to our institutional investor clients in the United States and the United Kingdom.

- •

- Equity Research. Our research analysts currently provide proprietary investment research on industry trends and more than 60 energy companies. This coverage includes small, middle and large capitalization E&P companies, oilfield services companies, independent refining, marketing and transportation companies and domestic integrated major oil companies.

- •

- Equity Sales and Trading. Our sales professionals provide investment ideas to institutional investor clients in both the United States and the United Kingdom. From our office in Denver, we provide approximately 600 mutual funds, hedge funds and traditional institutional investors with our specialized equity research, in-depth perspectives on the energy industry, and investment trends and related services.

For the year ended December 31, 2005, we generated revenues of $8.1 million from our capital markets business, comprised of sales and trading commissions and research fees. This represented an increase of $926,000 or 13% compared to the year ended December 31, 2004. For the six months ended June 30, 2006, capital markets revenues totaled $3.9 million, an increase of $58,000 or 2% compared to the corresponding period in 2005. Commissions and research fee revenues represented approximately 11% and 6% of our revenues for the year ended December 31, 2005 and the six months ended June 30, 2006, respectively.

4

Competitive Strengths

We believe we have a number of strengths that differentiate us from our competitors and will enable us to continue to grow our business.

- •

- Specialization—Focus on Energy. We are specialists within the large, complex and technically sophisticated energy industry. We believe this specialization produces an uncommon combination of financial and technical expertise, allowing us to better understand and service the strategic and financing needs of our clients. This expertise has been gained by our professionals through years of experience at Petrie Parkman, diversified investment banks, major and independent energy producing corporations, service providers and engineering firms. Our deep understanding of the financial and structural challenges facing our clients enables us to compete effectively for business, and provide knowledgeable advice to clients and helps us make prudent judgments on their behalf.

- •

- Long-Term Client Relationships. Our investment banking professionals have a long history of serving clients in the energy industry through multiple industry cycles and have established relationships with senior executives that, in many cases, span several decades. Since our founding, our core principles have included delivering high quality client service and developing long-term relationships. Our success is evidenced by our significant amount of repeat business. In 2005, more than 65% of our investment banking transactions were with companies or management teams for which we had executed one or more transactions in the previous year. We strive to build lasting relationships with clients by providing services appropriate to each stage of a company's development.

- •

- Senior-Level Attention. Our senior professionals are actively involved in all facets of client relationship management and transaction execution. By involving our most senior and experienced professionals, we apply the collective judgment and experience of our firm to achieve an optimal result in the context of a client's objectives.

- •

- Independence. Our status as an independent investment bank allows us to avoid many of the conflicts typically encountered by larger and more diversified financial institutions. Our independence results in new business referrals from satisfied clients as well as competitors upon their recognition of an inherent or potential conflict, and it provides both our employees and clients with confidence in the integrity of our platform.

- •

- Recognized and Well Respected Brand. The Petrie Parkman brand is well recognized and highly regarded in the energy sector. In both 2005 and 2006,Global Finance magazine named Petrie Parkman the world's best investment bank for the oil and gas industry. Our research analysts have been recognized and ranked by various industry publications and polls, includingThe Wall Street Journal andForbes Magazine. Through our extensive experience advising our clients, we believe we have earned a reputation for quality execution and strict adherence to high ethical and professional standards in providing objective advice to our clients.

- •

- Offices in Major Domestic Energy Corridors. Our offices are located in Denver and Houston. Both cities are major centers for commerce in the energy industry. These offices afford us ready access to both companies in these regions and other major energy producing regions in the United States.

5

Strategy

We intend to grow our business by continuing to establish and deepen long-term client relationships through our energy focused investment banking and capital markets services. Our strategy is to leverage our competitive strengths to increase market share, grow revenues and enhance profitability, while raising our profile by:

- •

- Expanding the depth and breadth of our energy advisory business;

- •

- Increasing our level of participation in public and private equity offerings;

- •

- Broadening our equity research, sales and trading footprint;

- •

- Expanding our business into complementary geographic regions; and

- •

- Selectively pursuing strategic acquisitions.

Why We Are Going Public

We have decided to become a public company for the following principal reasons:

- •

- To provide capital to expand our business;

- •

- To give our employees the opportunity to own equity in our firm and enable us to provide equity-based incentive compensation to retain and recruit professionals;

- •

- To enhance our profile and recognition as an energy-focused investment bank; and

- •

- To permit the realization over time of equity value by our principal owners.

6

The Offering

| Common stock offered by us | | shares |

Common stock offered by the selling stockholders |

|

shares |

Common stock to be outstanding after this offering |

|

shares(a) |

Underwriters' option to purchase additional shares from us and the selling stockholders |

|

shares |

Voting rights |

|

One vote per share |

Use of proceeds |

|

We will receive net proceeds from this offering of approximately $ million, assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover of this prospectus, and after deducting underwriting discounts and commissions and estimated offering costs and expenses. We expect to use the net proceeds to expand our business and for general corporate purposes. Pending specific application of the net proceeds, we expect to use them to purchase U.S. Government securities, other short-term, highly-rated debt securities and money market funds. We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders. |

Dividend policy |

|

We currently intend to declare quarterly dividends on all outstanding shares of common stock, beginning with a quarterly dividend of approximately $ per share with respect to the quarter of 2006. The declaration of this and any other dividends will be subject to our actual future earnings and capital requirements and to the discretion of our board of directors. For a discussion of the factors that will affect the determination by our board of directors to declare dividends, see "Dividend Policy." |

Proposed New York Stock Exchange Symbol |

|

PDP |

- (a)

- The total common stock to be outstanding after this offering does not take into account the shares of common stock reserved for issuance pursuant to future grants under the Equity Incentive Plan (see "Management—Equity Incentive Plan").

7

Summary Consolidated Financial Data

The following summary consolidated financial data should be read in conjunction with, and is qualified by reference to, the disclosures set forth under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Unaudited Pro Forma Condensed Consolidated Financial Information" as well as the disclosures in our consolidated financial statements and their notes. Our summary historical financial data reflects our historical operations as a subchapter S corporation, and as such, our income has not been subject to federal income taxes. Effective prior to the closing of this offering, our status as an S corporation will terminate, and thereafter we will be subject to taxation as a C corporation. In addition, in connection with this offering, we intend to adopt a policy of setting our compensation and benefits expenses such that they do not exceed 55% of total revenues each year (although we retain the ability to change this policy in the future).

The consolidated financial statements as of and for the years ended December 31, 2003, 2004, and 2005 have been restated as discussed in Note 2 to our consolidated financial statements included elsewhere in this prospectus. This restatement had no impact on our consolidated statements of financial condition, consolidated statements of income, or cash and equivalents at the beginning or end of the periods presented in our consolidated statements of cash flows.

The summary consolidated statements of income data for the years ended December 31, 2003, 2004 and 2005 and the summary consolidated statements of financial condition data as of December 31, 2004 and 2005 are derived from, and qualified by reference to, the audited consolidated financial statements of Petrie Parkman & Co., Inc. included elsewhere in this prospectus and should be read in conjunction with those consolidated financial statements and notes thereto. The summary consolidated statements of income data for the years ended December 31, 2001 and 2002 and the summary consolidated statements of financial condition data as of December 31, 2001, 2002 and 2003 have been derived from audited consolidated financial statements of Petrie Parkman & Co., Inc. not included in this prospectus. The summary consolidated statements of income data for the six months ended June 30, 2005 and 2006 and the summary consolidated statements of financial condition data as of June 30, 2005 and 2006 have been derived from our unaudited consolidated financial statements and include all adjustments, consisting of normal and recurring adjustments, that we consider necessary for a fair statement of our results of operations and financial position as of and for such periods.

The unaudited pro forma data set forth below for the year ended December 31, 2005 and the six months ended June 30, 2006 have been derived from the data set forth in "Unaudited Pro Forma Condensed Consolidated Financial Information" included elsewhere in this prospectus. The unaudited pro forma data for the other periods presented have been calculated based on assumptions consistent with those used in the 2005 unaudited pro forma condensed consolidated financial information.

The following pro forma adjustments to the statement of income give effect to the following:

- •

- the implementation of a policy on compensation which limits total compensation and benefits expense to 55% of our total annual revenues (see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Operating Expenses—Compensation and Benefits Expense"); and

- •

- a provision for corporate income taxes at an effective tax rate of 38% due to the termination of our status as an S corporation.

The following pro forma adjustments to the statement of financial condition give effect to the following:

- •

- payments of discretionary bonuses to our employees for services rendered prior to completion of this offering; and

8

- •

- a payment to Mr. James E. Parkman, Jr. pursuant to the separation agreement entered into by us and Mr. Parkman in June 2006 (see "Management—Senior Professional Departure").

The unaudited pro forma financial data is included for informational purposes only and should not be considered indicative of actual results that would have been achieved had these events actually occurred on the dates indicated and does not purport to indicate the results of operations for any future period.

| | As of or for the Year Ended December 31,

| | As of or for the

Six Months Ended

June 30,

|

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| | 2005

| | 2006

|

|---|

| | (in thousands except per share amounts)

|

|---|

| Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | |

| | Investment banking | | $ | 50,071 | | $ | 22,378 | | $ | 34,198 | | $ | 46,442 | | $ | 63,917 | | $ | 29,907 | | $ | 57,190 |

| | Commissions and research fees | | | 5,922 | | | 6,115 | | | 6,355 | | | 7,187 | | | 8,113 | | | 3,839 | | | 3,897 |

| | Net gains on marketable securities | | | 51 | | | (54 | ) | | (5 | ) | | 4,296 | | | 25 | | | (74 | ) | | — |

| | Interest and dividend income | | | 915 | | | 121 | | | 113 | | | 231 | | | 826 | | | 150 | | | 411 |

| | Other | | | — | | | — | | | — | | | — | | | 1,378 | | | 1,000 | | | 755 |

| | |

| |

| |

| |

| |

| |

| |

|

| | Total revenues | | | 56,959 | | | 28,560 | | | 40,661 | | | 58,156 | | | 74,259 | | | 34,822 | | | 62,253 |

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Compensation and benefits | | | 53,188 | | | 22,694 | | | 34,940 | | | 49,408 | | | 64,566 | | | 31,951 | | | 58,981 |

| | Other expenses | | | 3,994 | | | 4,414 | | | 5,706 | | | 5,146 | | | 5,456 | | | 2,508 | | | 3,255 |

| | |

| |

| |

| |

| |

| |

| |

|

| | Total expenses | | | 57,182 | | | 27,108 | | | 40,646 | | | 54,554 | | | 70,022 | | | 34,459 | | | 62,236 |

Net income (loss) |

|

$ |

(223 |

) |

$ |

1,452 |

|

$ |

15 |

|

$ |

3,602 |

|

$ |

4,237 |

|

$ |

363 |

|

$ |

17 |

| | |

| |

| |

| |

| |

| |

| |

|

| Earnings per common share: | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | $ | (0.00 | ) | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | 0.10 | | $ | 0.01 | | $ | 0.00 |

| | |

| |

| |

| |

| |

| |

| |

|

| | Diluted | | $ | (0.00 | ) | $ | 0.02 | | $ | 0.00 | | $ | 0.06 | | $ | 0.10 | | $ | 0.01 | | $ | 0.00 |

| | |

| |

| |

| |

| |

| |

| |

|

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 61,775 | | | 60,255 | | | 61,545 | | | 61,775 | | | 43,806 | | | 61,775 | | | 19,751 |

| | Diluted | | | 61,775 | | | 60,255 | | | 61,545 | | | 61,775 | | | 43,806 | | | 61,775 | | | 19,751 |

Statement of Financial Condition Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets | | $ | 6,832 | | $ | 7,902 | | $ | 12,174 | | $ | 18,349 | | $ | 10,721 | | $ | 24,392 | | $ | 65,085 |

| Total liabilities | | | 502 | | | 352 | | | 4,321 | | | 8,394 | | | 3,640 | | | 14,413 | | | 59,598 |

| Total stockholders' equity | | | 6,330 | | | 7,550 | | | 7,853 | | | 9,955 | | | 7,081 | | | 9,979 | | | 5,487 |

Pro Forma Data(a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Pro forma income before tax | | $ | 21,637 | | $ | 8,438 | | $ | 12,591 | | $ | 21,024 | | $ | 27,960 | | $ | 13,162 | | $ | 24,759 |

| | Pro forma net income | | | 13,415 | | | 5,232 | | | 7,807 | | | 13,035 | | | 17,335 | | | 8,161 | | | 15,351 |

(a) Historical net income before tax has been adjusted to reflect compensation and benefits on a pro forma basis equal to 55% of total revenues. Historical net income has been adjusted to reflect compensation and benefits on a pro forma basis equal to 55% of total revenues and applying a 38% effective tax rate to reflect the federal, state and local taxes we expect to pay as a C corporation. See "Unaudited Pro Forma Condensed Consolidated Financial Information" for more information on how these amounts were calculated.

9

RISK FACTORS

You should carefully consider the following risks and all of the other information set forth in this prospectus before deciding to invest in shares of our common stock. If any of the events or developments described below actually occurs, our business, financial condition or results of operations will suffer. In that case, the trading price of our common stock would likely decline, and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We focus our investment banking and capital markets activities principally on the energy industry, and deterioration in the business environment of this industry could materially adversely affect our business.

We focus our investment banking and capital markets activities principally on the energy industry. Therefore, volatility in the business environment in this industry could substantially affect our financial results and the market value of our common stock. The business environment for companies in the energy industry has been subject to substantial volatility, and our financial results have consequently been subject to substantial variations from year to year. Such volatility results from factors that are beyond our control and can affect the prices of oil and natural gas and the general business prospects of companies operating in the energy industry. These factors include, but are not limited, to:

- •

- demand for oil, natural gas and natural gas liquids;

- •

- geopolitical and economic uncertainty, socio-political unrest and acts of terrorism;

- •

- production restraints mandated by the Organization of Petroleum Exporting Countries, or OPEC;

- •

- severe weather;

- •

- nationalization of oil and gas reserves;

- •

- the price and availability of alternative fuels; and

- •

- governmental regulations and taxes.

A deterioration in the business environment for companies engaged in the energy industry may cause our investment banking business to suffer due to a lack of demand for our services, which would materially adversely affect our business, financial condition and results of operations.

We derive most of our revenues from transaction advisory fees.

In 2004, 2005 and the six months ended June 30, 2006, we earned 80%, 86%, and 92% of our revenues, respectively, from investment banking advisory fees paid to us by our clients, primarily from the successful completion of our clients' merger, acquisition or divestiture transactions. We expect that our reliance on investment banking advisory fees as a substantial source of our revenues will continue for the foreseeable future and a decline in our advisory engagements or the market for advisory services generally would have a material adverse effect on our business, financial condition and results of operations.

A high percentage of our total revenues are derived from a small number of advisory clients and the termination of any one advisory engagement could reduce our revenues and harm our operating results.

Each year, we advise a limited number of clients. Our top ten clients accounted for approximately 47% and 60% of our total revenues in 2004 and 2005, respectively, and our single largest client accounted for approximately 14% of our total revenues in 2005. While the composition of the group comprising our largest clients varies significantly from year to year, we expect that our advisory

10

engagements will continue to be limited to a relatively small number of clients and that an even smaller number of those clients will account for a high percentage of revenues in any particular year. As a result, the adverse impact on our results of operations of one lost mandate or the failure of one transaction on which we are advising to be completed can be significant.

Our financial results may fluctuate substantially from period to period, which may impair our stock price.

We have experienced, and expect to experience in the future, significant periodic variations in our revenues and results of operations. These variations may be attributed in part to the fact that our investment banking revenues are typically earned upon the successful completion of a transaction, the timing of which is uncertain and beyond our control. In most cases, we receive little or no payment for investment banking engagements that do not result in the successful completion of a transaction. As a result, our business is highly dependent on market conditions as well as the decisions and actions of our clients and interested third parties. For example, a client's acquisition transaction may be delayed or terminated because of a failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or stockholder approvals, failure to secure necessary financing, adverse market conditions or unexpected financial or other problems in the client's or counterparty's business. During a restructuring transaction, anticipated bidders for assets of a client may not materialize or our client may not be able to restructure its operations or indebtedness due to a failure to reach agreement with its principal creditors.

Compared to our larger, more diversified competitors in the financial services industry, we generally experience greater variations in our revenues and profits. This unpredictability is due to our dependence on a smaller number of transactions for most of our revenues, with the result that earnings can be significantly affected if any particular transaction is not completed successfully, and our lack of other, more stable sources of revenue in material amounts, such as brokerage and asset management fees, which could moderate some of the volatility in advisory revenues. As a result, we are unlikely to achieve steady and predictable earnings on a quarterly basis and our revenues for a quarter may fall below our expectations, which could in turn adversely affect our stock price. For more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations."

We depend on our senior employees and the loss of their services would have a material adverse effect on the success of our business.

Our ability to obtain and successfully execute the investment banking mandates that generate most of our revenues depends upon the personal reputation, judgment, business generation capabilities and project execution skills of our senior employees, particularly Thomas A. Petrie, our Chief Executive Officer and President, Jon C. Hughes and Randall E. King, our Heads of Investment Banking, and Michael E. Bock, our Head of Corporate Finance. Our senior employees' personal reputations and relationships with our clients are a critical element in obtaining and maintaining client engagements. Accordingly, the retention of our senior employees is particularly crucial to our future success. From time to time, we have experienced departures of investment banking and other professionals, and losses of our key personnel may occur in the future. The departure or other loss of any senior employees, each of whom manages substantial client relationships and possesses substantial experience and expertise, could materially adversely affect our ability to secure and successfully complete engagements, which would materially adversely affect our business, financial condition and results of operations.

If any of our senior employees were to join an existing competitor or form a competing company, some of our clients could choose to use the services of that competitor instead of our services. There is no guarantee that the compensation arrangements, non-competition agreements or lock-up agreements we have entered into with certain of our senior employees are sufficiently broad or effective to prevent them from resigning to join our competitors or that the non-competition agreements would be upheld

11

if we were to seek to enforce our rights under these agreements. See "Management—Employment, Non-Competition and Pledge Agreements" and "Management—Transfer Rights Agreements."

One of our senior professionals has recently departed and may compete against us.

In June 2006, we entered into a separation and release agreement with James E. Parkman, Jr., a co-founder of the firm. Mr. Parkman, who is a member of the board of directors and will be the beneficial owner of approximately % of the outstanding shares of our common stock following this offering (or % if the underwriters' option to purchase additional shares is exercised in full), served as President of the company from its inception through April 2006. The separation agreement provides that Mr. Parkman will be subject to non-competition and non-solicitation arrangements through December 31, 2006. After this period, Mr. Parkman will be able to join an existing competitor or form a competing company. As Mr. Parkman managed client relationships and possesses substantial experience and expertise, some of our clients could choose to use his services instead of our services. Mr. Parkman's departure could materially adversely affect our ability to secure and successfully complete current and future engagements, which would materially adversely affect our business, financial condition and results of operations. For more information, see "Management—Senior Professional Departure."

Petrie Parkman will be controlled by its senior employees whose interests may differ from those of other stockholders.

Upon completion of this offering, our senior employees, including Messrs. Petrie, Hughes, King and Bock, will collectively own over % of the total shares of common stock outstanding (or % if the underwriters' option to purchase additional shares is exercised in full). As a result of these shareholdings, our senior employees initially will be able to elect a majority of our entire board of directors, control the management and policies of Petrie Parkman and, in general, determine without the consent of the other stockholders the outcome of any corporate transaction or other matter submitted to the stockholders for approval, including mergers, consolidations and the sale of all or substantially all of the assets of Petrie Parkman. Our senior employees initially will be able to prevent or cause a change in control of Petrie Parkman.

Our transition from a private to a publicly traded corporation may adversely affect our ability to recruit, retain and motivate key employees.

Our performance is largely dependent on the talents and efforts of highly skilled individuals. Competition for qualified employees in the financial services industry is intense. Our ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees. The impact of this offering on our key employees and other employee retention and recruitment is uncertain.

Prior to this offering, contractual commitments provided that for some of our senior employees, the ownership of and the ability to realize value from our common stock was dependent upon their continued employment by us. Upon consummation of this offering, these restrictions will be removed and our senior employees will no longer be restricted from leaving Petrie Parkman by the potential loss of all of the value of their ownership in our company. Following this offering, the shares of common stock owned by certain of our senior employees will be subject to restrictions on transfer and a portion will be pledged to secure the liquidated damages provision in each employment, non-competition and pledge agreement. However, these agreements will survive for only a limited period and will permit our employees to leave Petrie Parkman without losing any of their shares of common stock if they comply with these agreements. Consequently, the steps we have taken to encourage the continued service of these individuals after this offering may not be effective.

We expect that our senior employees will receive less overall compensation than they would have otherwise received prior to this offering as a result of target compensation levels following this offering.

12

A key driver of our profitability is our ability to generate revenue while achieving our target compensation levels. Following this offering, our policy will be to set our total employee compensation and benefits expense at a level not to exceed 55% of our total revenue each year and we initially expect to accrue compensation and benefits expense equal to 55% of our total revenue following this offering. However, we will record compensation and benefits expense in excess of this percentage in connection with the restricted stock awards to be received by our employees at the time of this offering, and we may record compensation and benefits expense in excess of this percentage if we significantly expand our business. Moreover, we retain the ability to change this policy in the future. As a result, our senior employees will receive less cash compensation than they otherwise would have received prior to this offering and may receive less compensation than they otherwise would receive at other firms. Such a reduction in compensation (or the belief that a reduction may occur) could make it more difficult to retain our senior employees.

While we believe this offering should promote retention and recruitment by enhancing our profile and giving us the ability to create equity based compensation plans, some employees may be more attracted to the benefits of working at a private company. For a description of the compensation plan for our senior employees to be implemented after this offering, see "Management—Employment, Non-Competition and Pledge Agreements," "Management—Transfer Rights Agreement" and "Management—Equity Incentive Plan."

We face strong competition from larger firms.

The investment banking and brokerage industries are intensely competitive, and we expect them to remain so. We compete on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, market focus and the relative quality and price of our services and products. We have experienced intense competition over obtaining engagements for advisory services, particularly as some of our competitors seek to increase their market share by reducing fees. In addition, the trends toward multiple financial advisors, bookrunners and co-managers could adversely affect our investment banking revenues. We have also experienced intense price competition, reflected in lower trading commissions and narrower spreads, in our brokerage business primarily due to the growth of electronic brokerages and alternative trading systems.

We are a relatively small investment bank with 53 employees on June 30, 2006 and net revenues of $74.3 million in 2005. Many of our competitors have a broader range of products and services, greater financial resources including sizeable balance sheets, larger customer bases, greater name recognition and marketing resources, a larger number of senior professionals to serve their clients' needs, greater global reach and more established relationships with clients than we have. These larger and better capitalized competitors may be better able to respond to changes in the investment banking and brokerage industries, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally.

The scale of our competitors has increased in recent years as a result of substantial consolidation among companies in the investment banking and brokerage industries. In addition, a number of large commercial banks and other broad-based financial services firms have established or acquired underwriting or financial advisory practices and broker-dealers or have merged with other financial institutions. These firms have the ability to offer a wider range of products than we do which may enhance their competitive position. They also have the ability to support their investment banking groups with commercial banking and other financial services in an effort to gain market share, which has resulted, and could further result, in pricing pressure in our businesses. In particular, the ability to provide debt financing has become an important advantage for some of our larger competitors, and because we do not provide such financing, we may be unable to compete as effectively for clients in a significant part of the investment banking market. If we are unable to compete effectively with our competitors, our business and results of operations will be adversely affected.

13

Our investment banking engagements are singular in nature and do not generally provide for subsequent engagements.

Our investment banking clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific merger and acquisition, divestiture or capital-raising transactions, rather than on a recurring basis under long-term contracts. As these transactions are typically singular in nature and our engagements with these clients may not recur, we must seek out new engagements when our current engagements are successfully completed or are terminated. As a result, high activity levels in any period are not necessarily indicative of continued high levels of activity in any subsequent period. If we are unable to generate a substantial number of new engagements that generate fees from new or existing clients, our business and results of operations will be adversely affected. In addition, when an engagement is terminated, whether due to the cancellation of a transaction due to market reasons or otherwise, we may earn limited or no fees and may not be able to recoup the costs that we incurred prior to that termination.

Larger and more frequent capital commitments in our underwriting and brokerage businesses increase the potential for significant losses.

There is a trend toward larger and more frequent commitments of capital by financial services firms in many of their activities. For example, in order to win business, investment banks are increasingly committing to purchase large blocks of stock from publicly traded issuers or significant stockholders, instead of the more traditional marketed underwriting process in which marketing is typically completed before an investment bank commits to purchase securities for resale. We anticipate participating in this trend and, as a result, we will be subject to increased risk as we commit capital to facilitate business. Furthermore, we may suffer losses as a result of the positions taken in these transactions even when economic and market conditions are generally favorable for others in the industry.

We may enter into large transactions in which we commit our own capital as part of our trading business to facilitate client trading activities. The number and size of these large transactions may materially affect our results of operations in a given period. We may also incur significant losses from our trading activities due to market fluctuations and volatility in our results of operations. Although we generally do not engage in proprietary trading, we occasionally maintain trading positions in the equity markets to facilitate client trading activities. To the extent that we own assets,i.e., have long positions, in any of those markets, a downturn in the value of those assets or in those markets could result in losses. Conversely, to the extent that we have sold assets we do not own,i.e., have short positions, in any of those markets, an upturn in those markets could expose us to potentially large losses as we attempt to cover our short positions by acquiring assets in a rising market.

Limitations on our access to capital could impair our liquidity and our ability to conduct our businesses.

Liquidity, or ready access to funds, is essential to financial services firms. Failures of financial institutions have often been attributable in large part to insufficient liquidity. Liquidity is of particular importance to our trading business and perceived liquidity issues may affect our clients' and counterparties' willingness to engage in brokerage transactions with us. Our liquidity could be impaired due to circumstances that we may be unable to control, such as a general market disruption or an operational problem that affects our trading clients, third parties or us.

As a broker-dealer, we are subject to the net capital requirements of the Securities and Exchange Commission, or the SEC. These requirements typically specify the minimum level of net capital a broker-dealer must maintain and also mandate that a significant part of its assets be kept in relatively liquid form. Any failure to comply with these net capital requirements could impair our ability to conduct our sales and trading business. See "Business—Regulation" for a further discussion of broker-dealer regulations.

14

Our operations and infrastructure may malfunction or fail, which would have a material adverse effect on our sales and trading business.

Our sales and trading business is highly dependent on our ability to process, on a daily basis, a large number of transactions across diverse markets, and the transactions we process have become increasingly complex. The inability of our systems to accommodate an increasing volume of transactions could also constrain our ability to expand our sales and trading businesses. If any of these systems do not operate properly or are disabled, or if there are other shortcomings or failures in our internal processes, people or systems, we could suffer impairments, financial loss, a disruption of our businesses, liability to clients, regulatory intervention or damage to our reputation.

Interruptions or delays in service from our third-party technology providers could impair our operations and harm our business.

We have outsourced certain aspects of our technology infrastructure including data centers, disaster recovery systems and wide area networks, as well as some trading applications. We are dependent on our technology providers to manage and monitor those functions. A disruption of any of the outsourced services would be out of our control and could negatively impact our business. We have experienced disruptions on occasion, none of which has been material to our business or results of operations. However, there can be no guarantee that future material disruptions with these providers will not occur.

We also face the risk of operational failure of, or termination of relations with, any of the clearing agents, exchanges, clearing houses or other financial intermediaries we use to facilitate our securities transactions. Any such failure or termination could adversely affect our ability to effect transactions and to manage our exposure to risk.

Unauthorized disclosure of data, whether through breach of our computer system or otherwise, could expose us to protracted and costly litigation or cause us to lose clients.

Our operations also rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Although we take protective measures and endeavor to modify them as circumstances warrant, our computer systems, software and networks may be vulnerable to unauthorized access, computer viruses or other malicious code and other events that could have a security impact. If one or more of such events occur, this could jeopardize our or our clients' or counterparties' confidential and other information processed and stored in, and transmitted through, our computer systems and networks, or otherwise cause interruptions or malfunctions in our, our clients', our counterparties' or third parties' operations. We may be required to expend significant additional resources to modify our protective measures, to investigate and remediate vulnerabilities or other exposures or to make required notifications, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us.

Strategic investments or acquisitions and joint ventures, or our entry into new business areas, may result in additional risks and uncertainties in our business.

We intend to grow our core businesses both through internal expansion and through strategic investments, acquisitions or joint ventures. When we make strategic investments or acquisitions or enter into joint ventures, we expect to face numerous risks and uncertainties in combining or integrating the relevant businesses and systems, including the need to combine accounting and data processing systems and management controls and to integrate relationships with customers and business partners. We may also experience difficulties in realizing projected efficiencies, synergies and cost savings. In the case of joint ventures, we are subject to additional risks and uncertainties because we may be dependent upon, and subject to liability, losses or reputation damage relating to, systems, controls and personnel that are not under our control. In addition, conflicts or disagreements between us and the other members of a joint venture may negatively impact our businesses. In addition, future acquisitions or joint ventures

15

may involve the issuance of additional shares of our common stock, which may dilute your ownership of our firm.

Any future growth of our existing lines of business, such as our further expansion into merchant banking, or a future expansion into new lines of business, product offerings or geographic markets, may require significant resources and/or result in significant unanticipated losses, costs or liabilities. In addition, expansions, acquisitions or joint ventures may require significant managerial attention, which may be diverted from our other operations. These capital, equity and managerial commitments may impair the operation of our businesses.

We have restated our consolidated statements and determined that a material weakness existed in our internal controls.

The accompanying consolidated financial statements for the years ended December 31, 2003, 2004 and 2005 included elsewhere in this registration statement have been restated to correct an error in our classification of sales of marketable securities. The restatement reclassifies the sales from investing activities to operating activities in our consolidated statements of cash flows. The classification of marketable securities sales as operating activities in the statements of cash flows is consistent with the accounting treatment for trading securities. This restatement had no impact on our consolidated statements of financial condition, consolidated statements of income, or cash and cash equivalents at the beginning or end of any period presented in our consolidated statements of cash flows.

As a result of the aforementioned adjustments, management evaluated the controls we have in place over the classification and financial statement presentation of marketable securities sold and determined that a material weakness existed. As defined in Statement on Auditing Standards (SAS) No. 112, Communicating Internal Control Related Matters Identified in an Audit, a material weakness is a significant control deficiency or combination of significant control deficiencies that adversely affects an entity's ability to report financial data and results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected. We have revised our policies and procedures in connection with financial reporting oversight. We cannot assure you, however, that similar internal control weaknesses or restatements will not arise again in the future.

We will soon be required to evaluate our internal controls under Section 404 of the Sarbanes-Oxley Act of 2002 and any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on our stock price.

As a result of this offering, we will become subject to reporting and other obligations under the Securities Exchange Act of 1934, as amended. Beginning with the year ending December 31, 2007, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we will be required to furnish a report by our management on our internal control over financial reporting, and our auditors will be required to deliver an attestation report on management's assessment of and operating effectiveness of internal controls. The report by our management must contain, among other matters, an assessment of the effectiveness of our internal control over financial reporting and audited consolidated financial statements as of the end of our fiscal year. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by management.

We are not presently in compliance with Section 404's internal control requirements. We have substantial effort ahead of us to complete documentation of our internal control system and financial processes, information systems, assessment of their design, remediation of control deficiencies identified in these efforts and management testing of the designs and operation of internal controls. We anticipate that we will need to hire additional accounting and finance staff to achieve appropriate segregation of duties. We are reviewing the adequacy of our systems, financial and management controls and reporting systems and procedures, and we intend to make any necessary changes. We may not be able to complete the required management assessment by our reporting deadline or may not meet applicable standards in following years. An inability to complete and document this assessment or

16

to comply in following years could result in our receiving less than an unqualified report from our auditors with respect to our internal controls. This could cause investors to lose confidence in the accuracy and completeness of our financial reports, which could decrease the price of our common stock. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the New York Stock Exchange, or the NYSE, regulatory investigations and civil or criminal sanctions.

We may be required to make substantial payments under certain indemnification agreements.

In connection with this offering and our conversion from an S corporation to a C corporation, we will enter into agreements that provide for the indemnification of our directors, officers, senior employees and other persons authorized to act on our behalf against certain losses that may arise out of this offering and certain tax liabilities. We may be required to make substantial payments under these indemnification agreements, which could adversely affect our financial condition. For more information on our indemnification arrangements, see "Certain Relationships and Related Transactions—Director and Officer Indemnification" and "Certain Relationships and Related Transactions—Tax Indemnification Agreement and Related Matters."

Risks Related to Our Industry

Difficult market conditions could adversely affect our business in many ways.

Difficult market and economic conditions and geopolitical uncertainties have in the past adversely affected and may in the future adversely affect our business and profitability in many ways. Such adverse market and economic conditions would likely affect the size and number of mergers and acquisitions, divestitures and underwritings, and therefore have an adverse effect on our business as we have historically generated a significant portion of our revenues in these areas. Weakness in equity markets and diminished trading volume of securities could also adversely impact our sales and trading business. In addition, reductions in the trading prices for equity securities also tend to reduce the dollar value of investment banking transactions, such as mergers and acquisitions, divestitures and underwriting transactions, which in turn may reduce the fees we earn from these transactions. As we may be unable to reduce expenses correspondingly, our profits and profit margins may decline. The future market and economic climate may deteriorate because of factors beyond our control, including rising interest rates or inflation, terrorism or political uncertainty.

Increases in regulation of the capital markets may have an adverse impact on our business.

Highly publicized financial scandals in recent years have led to investor concerns over the integrity of the U.S. financial markets, and have prompted Congress, the SEC, the NYSE and the National Association of Securities Dealers, Inc., or NASD, to significantly expand corporate governance and public disclosure requirements. To the extent that private companies, in order to avoid becoming subject to these new requirements, decide to forgo initial public offerings, our equity underwriting business may be adversely affected. In addition, provisions of the Sarbanes-Oxley Act and the corporate governance rules imposed by self-regulatory organizations have diverted many companies' attention away from capital markets transactions, including securities offerings. In particular, companies that are or are planning to be public are incurring significant expenses and are allocating significant resources in complying with the SEC and accounting standards relating to internal control over financial reporting, and companies that disclose material weaknesses in such controls under the new standards may have greater difficulty accessing the capital markets. These factors, in addition to recently adopted or proposed accounting and disclosure changes, may have an adverse effect on our business.

17

Financial services firms have been subject to increased scrutiny over the last several years, increasing the risk of financial liability and reputational harm resulting from adverse regulatory actions.

Firms in the financial services industry have been subject to an increasingly regulated environment in recent years. The industry has experienced increased scrutiny from a variety of regulators, including the SEC, the NYSE, the NASD and state attorneys general. Penalties and fines sought by regulatory authorities have increased substantially over the last several years. This regulatory and enforcement environment has created uncertainty with respect to a number of transactions that historically had been entered into by financial services firms and that were generally believed to be permissible and appropriate. We may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations. We also may be adversely affected as a result of new or revised legislation or regulations imposed by the SEC, other United States or foreign governmental regulatory authorities or self-regulatory organizations that supervise the financial markets. Among other things, we could be fined, prohibited from engaging in some of our business activities or subjected to limitations or conditions on our business activities. Substantial legal liability or significant regulatory action against us could have material adverse financial effects or cause significant reputational harm to us, which could seriously harm our business prospects.

In addition, financial services firms are subject to numerous conflicts of interests or perceived conflicts, which have drawn scrutiny from the SEC and other federal and state regulators. While we have adopted various policies, controls and procedures to address or limit actual or perceived conflicts and regularly seek to review and update our policies, controls and procedures, appropriately dealing with conflicts of interest is complex and difficult, and our reputation could be damaged if we fail, or appear to fail, to deal appropriately with conflicts of interest. Our policies and procedures to address or limit actual or perceived conflicts may also result in increased costs, additional operational personnel and increased regulatory risk. Failure to adhere to these policies and procedures may result in regulatory sanctions or client litigation. For example, the research areas of investment banks have been and remain the subject of heightened regulatory scrutiny which has led to increased restrictions on the interaction between equity research analysts and investment banking personnel at securities firms.

Our exposure to legal liability is significant, and damages that we may be required to pay and the reputational harm that could result from legal action against us could materially adversely affect our business or results of operations.

As an investment banking firm, we depend to a large extent on our reputation for integrity and high-caliber professional services to attract and retain clients. As a result, if a client is not satisfied with our services, it may be more damaging in our business than in other businesses. Moreover, our role as advisor to our clients on important merger, acquisition, divestiture or underwriting transactions involves complex analysis and the exercise of professional judgment, including rendering "fairness opinions" in connection with mergers and other transactions. Therefore, our activities may subject us to the risk of significant legal liabilities to our clients and aggrieved third parties, including stockholders of our clients who could bring securities class actions against us. In recent years, the volume of claims and amounts of damages claimed in litigation and regulatory proceedings against financial intermediaries have been increasing. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. Although our investment banking engagements typically include broad indemnities from our clients and provisions to limit our exposure to legal claims relating to our services, these provisions may not protect us or may not be enforceable in all cases. As a result, we may incur significant legal and other expenses in defending against litigation and may be required to pay substantial damages for settlements and adverse judgments. Substantial legal liability or significant regulatory action against us could have a material adverse effect on our results of operations or cause significant reputational harm to us, which could seriously harm our business and prospects.

18

Employee misconduct could harm us and is difficult to detect and deter.

There have been a number of highly publicized cases involving fraud or other misconduct by employees in the financial services industry in recent years and we run the risk that employee misconduct could occur at our company. For example, misconduct by employees could involve the improper use or disclosure of confidential information, which could result in regulatory sanctions and serious reputational or financial harm to us. It is not always possible to deter employee misconduct. The precautions we take to detect and prevent this activity may not be effective in all cases, and we may suffer significant reputational harm for any misconduct by our employees.

Our equity sales and trading and equity research businesses may be adversely affected by potential changes in industry practices.