UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-33209

ALTRA INDUSTRIAL MOTION CORP.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 61-1478870 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 300 Granite Street, Suite 201 Braintree, MA | | 02184 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(781) 917-0600

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer þ | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant based on the closing price (as reported by the NASDAQ Global Market) of such common stock on the last business day of the registrant’s most recently completed second fiscal quarter (June 29, 2013) was approximately $712.2 million.

As of February 19, 2014, there were 27,053,037 shares of Common Stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the following document are incorporated herein by reference into the Part of the Form 10-K indicated.

| | |

Document | | Part of Form 10-K into which Incorporated |

Altra Industrial Motion Corp. Proxy Statement for the 2014 Annual Meeting of Stockholders | | Part III |

TABLE OF CONTENTS

2

Our Company

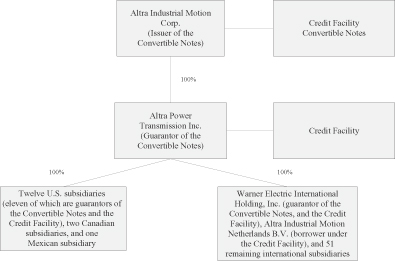

Altra Industrial Motion Corp. (“Altra” or the “Company”) (formerly Altra Holdings, Inc.) is the parent company of Altra Power Transmission, Inc. (“APT”) (formerly Altra Industrial Motion, Inc.) and owns 100% of APT’s outstanding capital stock. APT, directly or indirectly, owns 100% of the capital stock of 68 of its subsidiaries and 85% of the capital stock of one of its subsidiaries located in Brazil. The following chart illustrates a summary of our corporate structure:

We are a leading global designer, producer and marketer of a wide range of mechanical power transmission, or MPT, and products serving customers in a diverse group of industries, including energy, general industrial, material handling, mining, transportation, and turf and garden. Our product portfolio includes industrial clutches and brakes, enclosed gear drives, open gearing, belted drives, couplings, engineered bearing assemblies, linear components, gear motors, electronic drives, and other related products. Our products are used in a wide variety of high-volume manufacturing processes, where the reliability and accuracy of our products are critical in both avoiding costly down time and enhancing the overall efficiency of manufacturing operations. Our products are also used in non-manufacturing applications where product quality and reliability are especially critical, such as clutches and brakes for elevators and residential and commercial lawnmowers. For the year ended December 31, 2013, we had net sales of $722.2 million and net income attributable to Altra Industrial Motion Corp. of $40.3 million.

We market our products under well recognized and established brands, many of which have been in existence for over 50 years. We believe many of our brands, when taken together with our brands in the same product category have achieved the number one or number two position in terms of consolidated market share and brand awareness in their respective product categories. Our products are either incorporated into products sold by original equipment manufacturers, (“OEMs”), sold to end users directly, or sold through industrial distributors.

We are led by a highly experienced management team that has established a proven track record of execution, successfully completing and integrating major strategic acquisitions and delivering significant growth in both revenue and profits. We employ a comprehensive business process called the Altra Business System, or ABS, which focuses on eliminating inefficiencies from business processes to improve quality, delivery, and cost.

In this Annual Report on Form 10-K, the terms “Altra”, “Altra Industrial Motion,” “the Company,” “we,” “us” and “our” refer to Altra Industrial Motion Corp. and its subsidiaries, except where the context otherwise requires or indicates.

3

We file reports and other documents with the Securities and Exchange Commission. You may read and copy documents we file at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You should call 1-800-SEC-0330 for more information on the public reference room. Our SEC Filings are also available to you on the SEC’s internet site at http://www.sec.gov.

Our internet address is www.altramotion.com. By following the link “Investor Relations” and then “SEC filings” on our Internet website, we make available, free of charge, our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after such forms are filed with or furnished to the SEC. We are not including information contained on or available through our website as a part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

History and Acquisitions

Although Altra was incorporated in Delaware in 2004, much of our current business has its roots with the prior acquisition by Colfax Corporation, or Colfax, of the MPT (mechanical power transmission) group of Zurn Technologies, Inc. in December 1996. Colfax subsequently acquired Industrial Clutch Corp. in May 1997, Nuttall Gear Corp. in July 1997 and the Boston Gear and Delroyd Worm Gear brands in August 1997 as part of Colfax’s acquisition of Imo Industries, Inc. In February 2000, Colfax acquired Warner Electric, Inc., which sold products under the Warner Electric, Formsprag Clutch, Stieber, and Wichita Clutch brands. Colfax formed Power Transmission Holding, LLC or “PTH” in June 2004 to serve as a holding company for all of these power transmission businesses. Boston Gear was established in 1877, Warner Electric, Inc. in 1927, and Wichita Clutch in 1949.

On November 30, 2004, we acquired our original core business through the acquisition of PTH from Colfax. We refer to this transaction as the PTH Acquisition.

On October 22, 2004, The Kilian Company, or Kilian, a company formed at the direction of Genstar Capital, then the largest stockholder of Altra, acquired Kilian Manufacturing Corporation from Timken U.S. Corporation. At the completion of the PTH Acquisition, (i) all of the outstanding shares of Kilian capital stock were exchanged for shares of our capital stock and (ii) Kilian and its subsidiaries were transferred to APT.

On February 10, 2006, we purchased all of the outstanding share capital of Hay Hall Holdings Limited, or Hay Hall. Hay Hall was a UK-based holding company established in 1996 that was focused primarily on the manufacture of couplings and clutch brakes. Hay Hall consisted of five main businesses that were niche focused and had strong brand names and established reputations within their primary markets. Through Hay Hall, we acquired 15 strong brands in complementary product lines, improved customer leverage and expanded geographic presence in over 11 countries.

On May 18, 2006, we acquired substantially all of the assets of Bear Linear Inc., now known as Warner Linear. Warner Linear manufactures high value-added linear actuators which are electromechanical power transmission devices designed to move and position loads linearly for mobile off-highway and industrial applications.

On April 5, 2007, we acquired all of the outstanding shares of TB Wood’s Corporation, or TB Wood’s. TB Wood’s is an established designer, manufacturer and marketer of mechanical industrial power transmission products. In December 2007, the Company divested the TB Wood’s electronics division.

On October 5, 2007, we acquired substantially all of the assets of All Power Transmission Manufacturing, Inc., or All Power, a manufacturer of universal joints.

On May 29, 2011, we acquired substantially all of the assets and liabilities of Danfoss Bauer GmbH relating to its gear motor business, or Bauer. We refer to this transaction as the Bauer Acquisition. Bauer is a European manufacturer of high-quality gear motors, offering engineered solutions to a variety of industries, including material handling, metals, food processing, and energy.

4

On July 11, 2012, we acquired 85% of privately held Lamiflex do Brasil Equipamentos Industriais Ltda., now known as Lamiflex Do Brasil Equipamentos Industriais S.A., or Lamiflex. Lamiflex is one of the premier Brazilian manufacturer of high-speed disc couplings, providing engineered solutions to a variety of industries, including oil and gas, power generation, metals and mining.

On November 22, 2013, we changed our legal corporate name from Altra Holdings, Inc. to Altra Industrial Motion Corp.

On December 17, 2013, we completed the acquisition of Svendborg Brakes A/S and S.B. Patent Holding ApS (together “Svendborg”). We acquired all the issued and outstanding shares of Svendborg from Friction Holding A/S. Svendborg is the leading global manufacturer of premium quality caliper brakes.

Our Industry

Based on industry data supplied by the Power Transmission Distributors Association in collaboration with Industrial Market Information, we estimate that industrial power transmission products generated sales in the United States of approximately $36.5 billion in 2013. These products are used to generate, transmit, control and transform mechanical energy. The industrial power transmission industry can be divided into three areas: MPT products; motors and generators; and adjustable speed drives. We compete primarily in the MPT area which, based on industry data, we estimate was a $21.9 billion market in the United States in 2013.

The global MPT market is highly fragmented, with over 1,000 small manufacturers. While smaller companies tend to focus on regional niche markets with narrow product lines, larger companies that generate annual sales of over $100 million generally offer a much broader range of products and have global capabilities. Buyers of MPT products are broadly diversified across many sectors of the economy and typically place a premium on factors such as quality, reliability, availability, and design and application engineering support. We believe the most successful industry participants are those that leverage their distribution network, their products’ reputations for quality and reliability and their service and technical support capabilities to maintain attractive margins on products and gain market share.

Our Strengths

Leading Market Shares and Brand Names. We believe we hold the number one or number two market position in key products across many of our core platforms. We believe that almost 50% of our sales are derived from products where we hold the number one or number two share and brand recognition, assuming our brands in the same product category are taken together, in the markets we serve. In addition, we believe we have recently captured additional market share in several product lines due to our innovative product development efforts and exceptional customer service and product delivery.

Customized, Engineered Products Serving Niche Markets. We employ approximately 296 non-manufacturing engineers involved with product design, research and development, testing and technical customer support, and we often participate in lengthy design and qualification processes with our customers. Many of our product lines involve a large number of unique parts, are delivered in small order quantities with short lead times, and require varying levels of technical support and responsive customer service. As a result of these characteristics, as well as the essential nature of our products to the efficient operations of our customers, we generate a significant amount of recurring sales with repeat customers.

Aftermarket Sales Supported by Large Installed Base. With a history dating back to 1857 with the formation of TB Wood’s, we believe we benefit from one of the largest installed customer bases in the industry. The moving, wearing nature of our products necessitates regular replacement and our large installed base of products generates significant aftermarket replacement demand. This has created a recurring revenue stream from a diversified group of end-user customers. For 2013, we estimate that approximately 42% of our revenues were derived from aftermarket sales.

Diversified End Markets. Our revenue base has a balanced exposure across a diverse mix of end-user industries, including energy, food processing, general industrial, material handling, mining, transportation, and turf and garden. We believe our diversified end markets insulate us from volatility in any single industry or type

5

of end-user. In 2013, no single industry represented more than 10.8% of our total sales. In addition, we are geographically diversified with approximately 40% of our sales coming from outside North America during 2013.

Strong Relationships with Distributors and OEMs. We have over 1,000 direct OEM customers and enjoy established, long-term relationships with the leading industrial MPT distributors, critical factors that contribute to our high base of recurring aftermarket revenues. We sell our products through more than 3,000 distributor outlets worldwide. We believe our scale, expansive product lines and end-user preference for our products make our product portfolio attractive to both large and multi-branch distributors, as well as regional and independent distributors in our industry.

Experienced, High-Caliber Management Team. We are led by a highly experienced management team with over 250 years of cumulative industrial business experience and an average of 15 years with our companies. Our CEO, Carl Christenson, has over 30 years of experience in the MPT industry, while our CFO, Christian Storch, has approximately 25 years of experience. Our management team has established a proven track record of execution, successfully completing and integrating major strategic acquisitions and delivering significant growth and profitability.

The Altra Business System. We benefit from an established culture of lean management emphasizing quality, delivery and cost through the Altra Business System, or ABS. ABS is at the core of our performance-driven culture and drives both our strategic development and operational improvements. We continually evaluate every aspect of our business to identify productivity improvements and cost savings.

Our Business Strategy

Our long-term strategy is to increase our sales through organic growth, expand our geographic reach and product offerings through strategic acquisitions and improve our profitability through cost reduction initiatives. We seek to achieve these objectives through the following strategies:

Leverage Our Sales and Distribution Network. We intend to continue to leverage our established, long-term relationships with the industry’s leading national and regional distributors to help maintain and grow our revenues. We seek to capitalize on customer brand preferences for our products to generate pull-through aftermarket demand from our distribution channel. We believe this strategy also allows our distributors to achieve higher profit margins, further enhancing our preferred position with them.

Focus Our Strategic Marketing on New Growth Opportunities. We intend to expand our emphasis on strategic marketing to focus on new growth opportunities in key end-user and OEM markets. Through a systematic process that leverages our core brands and products, we seek to identify attractive markets and product niches, collect customer and market data, identify market drivers, tailor product and service solutions to specific market and customer requirements, and deploy resources to gain market share and drive future sales growth.

Accelerate New Product and Technology Development. We focus on aggressively developing new products across our business in response to customer needs in various markets. Our extensive application-engineering know-how drives both new and repeat sales and we have an established history of innovation with over 200 granted patents and pending patent applications worldwide. In total, new products developed by us during the past three years generated approximately $74 million in revenues during 2013.

Capitalize on Growth and Sourcing Opportunities in the Asia-Pacific Market. We intend to leverage our established sales offices in the Asia Pacific region and expand into regions where we currently do not have sales representation. In 2012, we expanded our manufacturing presence in Asia beyond our current plant in Shenzhen, China, with the addition of our new manufacturing facility in Changzhou, China. In addition, with the Svendborg Acquisition in 2013, we acquired a leased production facility in Shanghai, China. During 2013, we sourced approximately 25.1% of our purchases from low-cost countries, resulting in average cost reductions of approximately 23.1% for these products. Within the next several years, we intend to utilize our sourcing resources in China to increase our current level of low-cost country sourced purchases. We may also consider additional opportunities to outsource some of our production from North American and Western European locations to Asia or lower cost regions.

6

Continue to Improve Operational and Manufacturing Efficiencies through ABS. We believe we can continue to improve profitability through cost control, overhead rationalization, global process optimization, continued implementation of lean manufacturing techniques and strategic pricing initiatives. Our operating plan, based on manufacturing centers of excellence, provides additional opportunities to consolidate purchasing processes and reduce costs by sharing best practices across geographies and business lines.

Selectively Pursue Strategic Acquisitions that Complement Our Strong Platform. We have a successful track record of identifying, acquiring and integrating acquisitions. We believe that in the future there may be a number of attractive potential acquisition candidates, in part due to the fragmented nature of the industry. We plan to continue our disciplined pursuit of strategic acquisitions to strengthen our product portfolio, enhance our industry leadership, leverage fixed costs, expand our global footprint, and create value in products and markets that we know and understand.

Products

We, through our subsidiaries, are a leading global designer, producer and marketer of a wide range of electromechanical power transmission products. The Company brings together strong brands covering over 40 product lines with production facilities in eleven countries. Altra’s leading brands include Ameridrives Couplings, Bauer Gear Motor, Bibby Turboflex, Boston Gear, Delroyd Worm Gear, Formsprag Clutch, Huco, Industrial Clutch, Inertia Dynamics, Kilian Manufacturing, Lamiflex Couplings, Marland Clutch, Matrix, Nuttall Gear, Stieber Clutch, Svendborg Brakes, TB Wood’s, Twiflex, Warner Electric, Warner Linear, and Wichita Clutch. Our products serve a wide variety of end markets including aerospace, energy, food processing, general industrial, material handling, mining, petrochemical, transportation and turf and garden. We primarily sell our products to OEMs and through long-standing relationships with the industry’s leading industrial distributors such as Motion Industries, Applied Industrial Technologies, Kaman Industrial Technologies and W.W. Grainger. The following discussion of our products does not include detailed product category revenue because such information is not individually tracked by our financial reporting system and is not separately reported by our general purpose financial statements. Conducting a detailed product revenue internal assessment and audit would involve unreasonable effort and expense as revenue information by product line is not available. We maintain sales information by operating facility, but do not maintain any accounting sales data by product line.

Our products, principal brands and markets and sample applications are set forth below:

| | | | | | |

Products | | Principal Brands | | Principal Markets | | Sample Applications |

Clutches and Brakes | | Warner Electric, Wichita Clutch, Formsprag Clutch, Stieber Clutch, Svendborg Brakes, Matrix, Inertia Dynamics, Twiflex, Industrial Clutch, Marland Clutch | | Aerospace, energy,

material handling,

metals, turf and

garden, mining | | Elevators, forklifts,

lawn mowers, oil well

draw works, punch

presses, conveyors |

Gearing | | Boston Gear, Nuttall Gear, Delroyd, Bauer Gear Motor | | Food processing,

material handling,

metals, transportation | | Conveyors, ethanol

mixers, packaging

machinery, metal

processing equipment |

Engineered Couplings | | Ameridrives, Bibby Transmissions, TB Wood’s, Lamiflex | | Energy, metals,

plastics, chemical | | Extruders, turbines,

steel strip mills, pumps |

7

| | | | | | |

Products | | Principal Brands | | Principal Markets | | Sample Applications |

Engineered Bearing Assemblies | | Kilian | | Aerospace, material

handling,

transportation | | Cargo rollers, seat

storage systems,

conveyors |

Power Transmission Components | | Warner Electric, Boston Gear, Huco Dynatork, Warner Linear, Matrix, TB Wood’s | | Material handling,

metals, turf and garden | | Conveyors, lawn

mowers, machine tools |

Engineered Belted Drives | | TB Wood’s | | Aggregate, HVAC,

material handling | | Pumps, sand and gravel

conveyors, industrial fans |

Our products are used in a wide variety of high-volume manufacturing processes, where the reliability and accuracy of our products are critical in both avoiding costly down time and enhancing the overall efficiency of manufacturing operations. Our products are also used in non-manufacturing applications where product quality and reliability are especially critical, such as clutches and brakes for elevators and residential and commercial lawnmowers.

Clutches and Brakes. Clutches are devices which use mechanical, magnetic, hydraulic, pneumatic, or friction type connections to facilitate engaging or disengaging two rotating members. Brakes are combinations of interacting parts that work to slow or stop machinery. We manufacture a variety of clutches and brakes in three main product categories: electromagnetic, overrunning and heavy duty. Our core clutch and brake manufacturing facilities are located in Connecticut, Indiana, Illinois, Michigan, Texas, the United Kingdom, Germany, France, Denmark and China.

| | • | | Electromagnetic Clutches and Brakes. Our industrial products include clutches and brakes with specially designed controls for material handling, forklift, elevator, medical mobility, mobile off-highway, baggage handling and plant productivity applications. We also offer a line of clutch and brake products for walk-behind mowers, residential lawn tractors and commercial mowers. While industrial applications are predominant, we also manufacture several vehicular niche applications including on-road refrigeration compressor clutches and agricultural equipment clutches. We market our electromagnetic products under the Warner Electric, Inertia Dynamics and Matrix brand names. |

| | • | | Overrunning Clutches. Specific product lines include indexing and backstopping clutches. Primary industrial applications include conveyors, gear reducers, hoists and cranes, mining machinery, machine tools, paper machinery, packaging machinery, pumping equipment and other specialty machinery. We market and sell these products under the Formsprag, Marland, and Stieber brand names. |

| | • | | Heavy Duty Clutches and Brakes. Our heavy duty clutch and brake product lines serve various markets including metal forming, off-shore and land-based oil and gas drilling platforms, mining, material handling, marine applications and various off-highway and construction equipment segments. Our line of heavy duty pneumatic, hydraulic and caliper clutches and brakes are marketed under the Wichita Clutch, Twiflex, Industrial Clutch and Svendborg Brakes brand names. |

Gearing. Gears reduce the output speed and increase the torque of an electric motor or engine to the level required to drive a particular piece of equipment. These products are used in various industrial, material handling, mixing, transportation and food processing applications. Specific product lines include vertical and horizontal gear drives, speed reducers and increasers, high-speed compressor drives, enclosed custom gear drives, various enclosed gear drive and gear motor configurations and open gearing products such as spur, helical, worm and miter/bevel gears. We design and manufacture a broad range of gearing products under the Boston Gear, Nuttall Gear, Delroyd, and Bauer Gear Motor brand names. We manufacture our gearing products at our facilities in New York, North Carolina, Germany, Slovakia, and China, and sell to a variety of end markets.

8

Engineered Couplings. Couplings are the interface between two shafts, which enable power to be transmitted from one shaft to the other. Because shafts are often misaligned, we design our couplings with a measure of flexibility that accommodates various degrees of misalignment. Our coupling product line includes gear couplings, high-speed disc and diaphragm couplings, elastomeric couplings, grid couplings, universal joints, jaw couplings and spindles. Our coupling products are used in a wide range of markets including power generation, steel and custom machinery industries. We manufacture a broad range of coupling products under the Ameridrives, Bibby, Lamiflex and TB Wood’s brand names. Our engineered couplings are manufactured in our facilities in China, Brazil, Mexico, Pennsylvania, Texas, the United Kingdom and Wisconsin.

Engineered Bearing Assemblies. Bearings are components that support, guide and reduce friction of motion between fixed and moving machine parts. Our engineered bearing assembly product line includes ball bearings, roller bearings, thrust bearings, track rollers, stainless steel bearings, polymer assemblies, housed units and custom assemblies. We manufacture a broad range of engineered bearing products under the Kilian brand name. We sell bearing products to a wide range of end markets, including the general industrial and automotive markets, with a particularly strong OEM customer focus. We manufacture our bearing products at our facilities in New York, Canada and China.

Power Transmission Components. Power transmission components are used in a number of industries to generate, transfer or control motion from a power source to an application requiring rotary or linear motion. Power transmission products are applicable in most industrial markets, including, but not limited to metals processing, turf and garden and material handling applications. Specific product lines include linear actuators, miniature and small precision couplings, air motors, friction materials, hydrostatic drives and other various items. We manufacture or market a broad array of power transmission components under several businesses including Warner Linear, Huco Dynatork, Boston Gear, Warner Electric, TB Wood’s and Matrix. Our core power transmission component manufacturing facilities are located in Illinois, Pennsylvania, North Carolina, the United Kingdom and China.

| | • | | Warner Linear. Warner Linear is a designer and manufacturer of rugged service electromechanical linear actuators for off-highway vehicles, agriculture, turf care, special vehicles, medical equipment, industrial and marine applications. |

| | • | | Huco Dynatork. Huco Dynatork is a leading manufacturer and supplier of a complete range of precision couplings, universal joints, rod ends and linkages. |

| | • | | Other Accessories. Our Boston Gear, Warner Electric, Matrix and TB Wood’s businesses make or market several other accessories such as sensors, sleeve bearings, AC/DC motors, shaft accessories, face tooth couplings, mechanical variable speed drives, and fluid power components that are used in numerous end markets. |

Engineered Belted Drives. Belted drives incorporate both a rubber-based belt and at least two sheaves or sprockets. Belted drives typically change the speed of an electric motor or engine to the level required for a particular piece of equipment. Our belted drive line includes three types of v-belts, three types of synchronous belts, standard and made-to-order sheaves and sprockets, and split taper bushings. We sell belted drives to a wide range of end markets, including aggregate, energy, chemical and material handling. Our engineered belted drives are primarily manufactured under the TB Wood’s brand in our facilities in Pennsylvania and Mexico.

Research and Development and Product Engineering

We closely integrate new product development with marketing, manufacturing and product engineering in meeting the needs of our customers. We have product engineering teams that work to enhance our existing products and develop new product applications for our growing base of customers that require custom solutions. We believe these capabilities provide a significant competitive advantage in the development of high quality industrial power transmission products. Our product engineering teams focus on:

| | • | | lowering the cost of manufacturing our existing products; |

| | • | | redesigning existing product lines to increase their efficiency or enhance their performance; and |

| | • | | developing new product applications. |

9

Our continued investment in new product development is intended to help drive customer growth as we address key customer needs.

Sales and Marketing

We sell our products in over 70 countries to over 1,000 direct OEM customers and over 3,000 distributor outlets. We offer our products through our direct sales force comprised of 172 company-employed sales associates as well as independent sales representatives. Our worldwide sales and distribution presence enables us to provide timely and responsive support and service to our customers, many of which operate globally, and to capitalize on growth opportunities in both developed and emerging markets around the world.

We employ an integrated sales and marketing strategy concentrated on both key industries and individual product lines. We believe this dual vertical market and horizontal product approach distinguishes us in the marketplace allowing us to quickly identify trends and customer growth opportunities and deploy resources accordingly. Within our key industries, we market to OEMs, encouraging them to incorporate our products into their equipment designs, to distributors and to end-users, helping to foster brand preference. With this strategy, we are able to leverage our industry experience and product breadth to sell MPT and motion control solutions for a host of industrial applications.

Distribution

Our MPT components are either incorporated into end products sold by OEMs or sold through industrial distributors as aftermarket products to end users and smaller OEMs. We operate a geographically diversified business. For the year ended December 31, 2013, we derived approximately 60% of our net sales from customers in North America, 28% from customers in Europe and 12% from customers in Asia and the rest of the world. Our global customer base is served by an extensive global sales network comprised of our sales staff as well as our network of over 3,000 distributor outlets.

Rather than serving as passive conduits for delivery of product, our industrial distributors are active participants in influencing product purchasing decisions in the MPT industry. In addition, distributors play a critical role through stocking inventory of our products, which amplifies the accessibility of our products to aftermarket buyers. It is for this reason that distributor partner relationships are so critical to the success of the business. We enjoy strong established relationships with the leading distributors as well as a broad, diversified base of specialty and regional distributors.

Competition

We operate in highly fragmented and very competitive markets within the MPT market. Some of our competitors have achieved substantially more market penetration in certain of the markets in which we operate, such as helical gear drives, and some of our competitors are larger than us and have greater financial and other resources. In particular, we compete with Emerson Power Transmission Manufacturing LP, Rexnord Corporation., and Regal-Beloit Corporation. In addition, with respect to certain of our products, we compete with divisions of our OEM customers. Competition in our business lines is based on a number of considerations including quality, reliability, pricing, availability and design and application engineering support. Our customers increasingly demand a broad product range and we must continue to develop our expertise in order to manufacture and market these products successfully. To remain competitive, regular investment in manufacturing, customer service, and support, marketing, sales, research and development and intellectual property protection is required. We may have to adjust the prices of some of our products to stay competitive. In addition, some of our larger, more sophisticated customers are attempting to reduce the number of vendors from which they purchase in order to increase their efficiency. There is substantial and continuing pressure on major OEMs and larger distributors to reduce costs, including the cost of products purchased from outside suppliers such as us. As a result of cost pressures from our customers, our ability to compete depends in part on our ability to generate production cost savings and, in turn, find reliable, cost-effective outside component suppliers or manufacturers for our products. See “Risk Factors — Risks Related to our Business — We operate in the highly competitive mechanical power transmission industry and if we are not able to compete successfully our business may be significantly harmed.”

10

Intellectual Property

We rely on a combination of patents, trademarks, copyright, and trade secret laws in the United States and other jurisdictions, as well as employee and third-party non-disclosure agreements, license arrangements, and domain name registrations to protect our intellectual property. We sell our products under a number of registered and unregistered trademarks, which we believe are widely recognized in the MPT industry. With the exception of Boston Gear, Warner Electric, TB Wood’s, Svendborg and Bauer we do not believe any single patent, trademark or trade name is material to our business as a whole. Any issued patents that cover our proprietary technology and any of our other intellectual property rights may not provide us with adequate protection or be commercially beneficial to us and, patents applied for, may not be issued. The issuance of a patent is not conclusive as to its validity or its enforceability. Competitors may also be able to design around our patents. If we are unable to protect our patented technologies, our competitors could commercialize technologies or products which are substantially similar to ours.

With respect to proprietary know-how, we rely on trade secret laws in the United States and other jurisdictions and on confidentiality agreements. Monitoring the unauthorized use of our technology is difficult and the steps we have taken may not prevent unauthorized use of our technology. The disclosure or misappropriation of our intellectual property could harm our ability to protect our rights and our competitive position.

Some of our registered and unregistered trademarks include: Warner Electric, Boston Gear, TB Wood’s, Kilian, Nuttall Gear, Ameridrives, Wichita Clutch, Formsprag, Bibby Transmissions, Stieber, Matrix, Inertia Dynamics, Twiflex, Industrial Clutch, Huco Dynatork, Marland, Delroyd, Warner Linear, Bauer Gear Motor, PowerFlex and Svendborg Brakes.

Employees

As of December 31, 2013, we had 3,810 full-time employees, of whom approximately 51% were located in North America (primarily U.S.), 32% in Europe, and 17% in Asia and the rest of the world. Approximately 10% of our full-time factory U.S. employees are represented by labor unions. In addition, approximately 691 employees or 57% of our European employees are represented by labor unions or works councils. Approximately 66 employees in the Kilian production facilities in Toronto, Canada are unionized under a collective bargaining agreement. Approximately 25 employees in the Lamiflex production facilities in Brazil are represented by a works council. Additionally, approximately 47 employees in the TB Wood’s production facilities in Mexico are unionized under collective bargaining agreements that are subject to annual renewals.

We are a party to four U.S. collective bargaining agreements. The agreements will expire in June 2014, July 2014, October 2014 and October 2016.

We are also party to a collective bargaining agreement with union employees at our Toronto, Canada manufacturing facility. That agreement will expire in July 2015.

One of the four U.S. collective bargaining agreements contains provisions for additional, potentially significant, lump-sum severance payments to all employees covered by that agreement who are terminated as the result of a plant closing and one of our collective bargaining agreements contains provisions restricting our ability to terminate or relocate operations. See“Risk Factors — Risks Related to Our Business — We may be subject to work stoppages at our facilities, or our customers may be subjected to work stoppages, which could seriously impact our operations and the profitability of our business.”

Our facilities in Europe and Brazil have employees who are generally represented by local or national social works councils. Social works councils meet with employer industry associations periodically to discuss employee wages and working conditions. Our facilities in Denmark, France, Germany, Slovakia, and Brazil often participate in such discussions and adhere to any agreements reached.

11

Suppliers and Raw Materials

We obtain raw materials, component parts and supplies from a variety of sources, generally from more than one supplier. Our suppliers and sources of raw materials are based in both the United States and other countries and we believe that our sources of raw materials are adequate for our needs for the foreseeable future. We do not believe the loss of any one supplier would have a material adverse effect on our business or results of operations. Our principal raw materials are steel and copper. We generally purchase our materials on the open market, where certain commodities such as steel and copper have fluctuated in price significantly in recent years. We have not experienced any significant shortage of our key materials and have not historically engaged in hedging transactions for commodity suppliers.

Our ability, including manufacturing or distribution capabilities, and that of our suppliers, business partners and contract manufacturers, to make, move and sell products is critical to our success. Damage or disruption to our or their manufacturing or distribution capabilities due to weather, natural disaster, fire or explosion, terrorism, pandemics, strikes, repairs or enhancements at our facilities, excessive demand, raw material shortages, or other reasons, could impair our ability, and that of our suppliers, to manufacture or sell our products. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition and results of operations, as well as require additional resources to restore our supply chain.

Seasonality

We experience seasonality in our turf and garden business, which in recent years has represented approximately 7.4% of our net sales. As our large OEM customers prepare for the spring season, our shipments generally start increasing in December, peak in February and March, and begin to decline in April and May. This allows our customers to have inventory in place for the peak consumer purchasing periods for turf and garden products. The June-through-November period is typically the low season for us and our customers in the turf and garden market. Seasonality can also be affected by weather and the level of housing starts.

Regulation

We are subject to a variety of government laws and regulations that apply to companies engaged in international operations. These include compliance with the Foreign Corrupt Practices Act, U.S. Department of Commerce export controls, local government regulations and procurement policies and practices (including regulations relating to import-export control, investments, exchange controls and repatriation of earnings). We maintain controls and procedures to comply with laws and regulations associated with our international operations. In the event we are unable to remain compliant with such laws and regulations, our business may be adversely affected.

Environmental and Health and Safety Matters

We are subject to a variety of federal, state, local, foreign and provincial environmental laws and regulations, including those governing health and safety requirements, the discharge of pollutants into the air or water, the management and disposal of hazardous substances and wastes and the responsibility to investigate and cleanup contaminated sites that are or were owned, leased, operated or used by us or our predecessors. Some of these laws and regulations require us to obtain permits, which contain terms and conditions that impose limitations on our ability to emit and discharge hazardous materials into the environment and periodically may be subject to modification, renewal and revocation by issuing authorities. Fines and penalties may be imposed for non-compliance with applicable environmental laws and regulations and the failure to have or to comply with the terms and conditions of required permits. From time to time, our operations may not be in full compliance with the terms and conditions of our permits. We periodically review our procedures and policies for compliance with environmental laws and requirements. We believe that our operations generally are in material compliance with applicable environmental laws and requirements and that any non-compliance would not be expected to result in us incurring material liability or cost to achieve compliance. Historically, the costs of achieving and maintaining compliance with environmental laws and requirements have not been material.

12

Certain environmental laws in the United States, such as the federal Superfund law and similar state laws, impose liability for the cost of investigation or remediation of contaminated sites upon the current or, in some cases, the former site owners or operators and upon parties who arranged for the disposal of wastes or transported or sent those wastes to an off-site facility for treatment or disposal, regardless of when the release of hazardous substances occurred or the lawfulness of the activities giving rise to the release. Such liability can be imposed without regard to fault and, under certain circumstances, can be joint and several, resulting in one party being held responsible for the entire obligation. As a practical matter, however, the costs of investigation and remediation generally are allocated among the viable responsible parties on some form of equitable basis. Liability also may include damages to natural resources. We have not been notified that we are a potentially responsible party in connection with any sites we currently or formerly owned or operated. From time to time, we are notified that we are a potentially responsible party and may have liability in connection with off-site disposal facilities. To date, we have generally resolved matters involving off-site disposal facilities for a nominal sum although there can be no assurance that we will be able to resolve pending and future matters in a similar fashion.

Executive Officers of Registrant

The following sets forth certain information with regard to our executive officers as of February 19, 2014 (ages are as of December 31, 2013):

Michael L. Hurt (age 68), P.E. has been our Executive Chairman since January 2009, Prior to his current position, Mr. Hurt served as Chief Executive Officer and a director since our formation in 2004. In November 2006, Mr. Hurt was elected as chairman of our board. During 2004, prior to our formation, Mr. Hurt provided consulting services to Genstar Capital and was appointed Chairman and Chief Executive Officer of Kilian in October 2004. From January 1991 to November 2003, Mr. Hurt was the President and Chief Executive Officer of TB Wood’s Incorporated, a manufacturer of industrial power transmission products. Prior to TB Wood’s, Mr. Hurt spent 23 years in a variety of management positions at the Torrington Company, a major manufacturer of bearings and a subsidiary of Ingersoll Rand. Mr. Hurt holds a B.S. degree in Mechanical Engineering from Clemson University and an M.B.A. from Clemson-Furman University.

Carl R. Christenson (age 54) has been our Chief Executive Officer since January 2009 and a director since July 2007. Prior to his current position, Mr. Christenson served as our President and Chief Operating Officer from January 2005 to December 2008. From 2001 to 2005, Mr. Christenson was the President of Kaydon Bearings, a manufacturer of custom-engineered bearings and a division of Kaydon Corporation. Prior to joining Kaydon, Mr. Christenson held a number of management positions at TB Wood’s Incorporated and several positions at the Torrington Company. Mr. Christenson holds a M.S. and B.S. degree in Mechanical Engineering from the University of Massachusetts and an M.B.A. from Rensselaer Polytechnic.

Christian Storch (age 54) has been our Chief Financial Officer since December 2007. From 2001 to 2007, Mr. Storch was the Vice President and Chief Financial Officer at Standex International Corporation. Mr. Storch also served on the Board of Directors of Standex International from October 2004 to December 2007. Mr. Storch also served as Standex International’s Treasurer from 2003 to April 2006 and Manager of Corporate Audit and Assurance Services from July 1999 to 2001. Prior to Standex International, Mr. Storch was a Divisional Financial Director and Corporate Controller at Vossloh AG, a publicly held German transport technology company. Mr. Storch has also previously served as an Audit Manager with Deloitte & Touche, LLP. Mr. Storch holds a degree in business administration from the University of Passau, Germany.

Glenn Deegan (age 47) has been our Vice President, Legal and Human Resources, General Counsel and Secretary since June 2009. Prior to his current position, Mr. Deegan served as our General Counsel and Secretary since September 2008. From March 2007 to August 2008, Mr. Deegan served as Vice President, General Counsel and Secretary of Averion International Corp., a publicly held global provider of clinical research services. Prior to Averion, from June 2001 to March 2007, Mr. Deegan served as Director of Legal Affairs and then as Vice President, General Counsel and Secretary of

13

MacroChem Corporation, a publicly held specialty pharmaceutical company. From 1999 to 2001, Mr. Deegan served as Assistant General Counsel of Summit Technology, Inc., a publicly held manufacturer of ophthalmic laser systems. Mr. Deegan previously spent over six years engaged in the private practice of law and also served as law clerk to the Honorable Francis J. Boyle in the United States District Court for the District of Rhode Island. Mr. Deegan holds a B.S. from Providence College and a J.D. from Boston College.

Gerald Ferris (age 64) has been our Vice President of Global Sales since May 2007 and held the same position with Power Transmission Holdings, LLC, our Predecessor, since March 2002. He is responsible for the worldwide sales of our broad product platform. Mr. Ferris joined our Predecessor in 1978 and since joining has held various positions. He became the Vice President of Sales for Boston Gear in 1991. Mr. Ferris holds a B.A. degree in Political Science from Stonehill College.

Todd B. Patriacca (age 44) has been our Vice President of Finance, Corporate Controller and Treasurer since February 2010. Prior to his current position, Mr. Patriacca served as our Vice President of Finance, Corporate Controller and Assistant Treasurer since October 2008 and previous to that, as Vice President of Finance and Corporate Controller since May 2007 and as Corporate Controller since May 2005. Prior to joining us, Mr. Patriacca was Corporate Finance Manager at MKS Instrument Inc., a semi-conductor equipment manufacturer since March 2002. Prior to MKS, Mr. Patriacca spent over ten years at Arthur Andersen LLP in the Assurance Advisory practice. Mr. Patriacca is a Certified Public Accountant and holds a B.A. in History from Colby College and an M.B.A. and an M.S. in Accounting from Northeastern University.

Craig Schuele (age 50) has been our Vice President of Marketing and Business Development since May 2007 and held the same position with our Predecessor since July 2004. Prior to his current position, Mr. Schuele has been Vice President of Marketing since March 2002, and previous to that he was a Director of Marketing. Mr. Schuele joined our Predecessor in 1986 and holds a B.S. degree in Management from Rhode Island College.

14

Risks Related to Our Business

We operate in the highly competitive mechanical power transmission industry and if we are not able to compete successfully our business may be significantly harmed.

We operate in highly fragmented and very competitive markets in the MPT industry. Some of our competitors have achieved substantially more market penetration in certain of the markets in which we operate, such as helical gear drives, and some of our competitors are larger than us and have greater financial and other resources. With respect to certain of our products, we compete with divisions of our OEM customers. Competition in our business lines is based on a number of considerations, including quality, reliability, pricing, availability, and design and application engineering support. Our customers increasingly demand a broad product range and we must continue to develop our expertise in order to manufacture and market these products successfully. To remain competitive, regular investment in manufacturing, customer service, and support, marketing, sales, research and development and intellectual property protection is required. In the future we may not have sufficient resources to continue to make such investments and may not be able to maintain our competitive position within each of the markets we serve. We may have to adjust the prices of some of our products to stay competitive.

Additionally, some of our larger, more sophisticated customers are attempting to reduce the number of vendors from which they purchase in order to increase their efficiency. If we are not selected to become one of these preferred providers, we may lose market share in some of the markets in which we compete.

There is substantial and continuing pressure on major OEMs and larger distributors to reduce costs, including the cost of products purchased from outside suppliers. As a result of cost pressures from our customers, our ability to compete depends in part on our ability to generate production cost savings and, in turn, to find reliable, cost effective outside suppliers to source components or manufacture our products. If we are unable to generate sufficient cost savings in the future to offset price reductions, then our gross margin could be materially adversely affected.

Changes in or the cyclical nature of our markets could harm our operations and financial performance.

Our financial performance depends, in large part, on conditions in the markets that we serve and on the U.S. and global economies in general. Some of the markets we serve are highly cyclical, such as the metals, mining, industrial equipment and energy markets. In such an environment, expected cyclical activity or sales may not occur or may be delayed and may result in significant quarter-to-quarter variability in our performance. Any sustained weakness in demand, downturn or uncertainty in cyclical markets may reduce our sales and profitability.

We rely on independent distributors and the loss of these distributors could adversely affect our business.

In addition to our direct sales force and manufacturer sales representatives, we depend on the services of independent distributors to sell our products and provide service and aftermarket support to our customers. We support an extensive distribution network, with over 3,000 distributor locations worldwide. Rather than serving as passive conduits for delivery of product, our independent distributors are active participants in the overall competitive dynamics in the MPT industry. During the year ended December 31, 2013, approximately 34% of our net sales from continuing operations were generated through independent distributors. In particular, sales through our largest distributor accounted for approximately 8% of our net sales for the year ended December 31, 2013. Almost all of the distributors with whom we transact business offer competitive products and services to our customers. In addition, the distribution agreements we have are typically non-exclusive and cancelable by the distributor after a short notice period. The loss of any major distributor or a substantial number of smaller distributors or an increase in the distributors’ sales of our competitors’ products to our customers could materially reduce our sales and profits.

15

We must continue to invest in new technologies and manufacturing techniques; however, our ability to develop or adapt to changing technology and manufacturing techniques is uncertain and our failure to do so could place us at a competitive disadvantage.

The successful implementation of our business strategy requires us to continuously invest in new technologies and manufacturing techniques to evolve our existing products and introduce new products to meet our customers’ needs in the industries we serve and want to serve. For example, motion control products offer more precise positioning and control compared to industrial clutches and brakes. If manufacturing processes are developed to make motion control products more price competitive and less complicated to operate, our customers may decrease their purchases of MPT products.

Our products are characterized by performance and specification requirements that mandate a high degree of manufacturing and engineering expertise. We believe that our customers rigorously evaluate their suppliers on the basis of a number of factors, including:

| | • | | product quality and availability; |

| | • | | technical expertise and development capability; |

| | • | | reliability and timeliness of delivery; |

| | • | | product design capability; |

| | • | | manufacturing expertise; and |

| | • | | sales support and customer service. |

Our success depends on our ability to invest in new technologies and manufacturing techniques to continue to meet our customers’ changing demands with respect to the above factors. We may not be able to make required capital expenditures and, even if we do so, we may be unsuccessful in addressing technological advances or introducing new products necessary to remain competitive within our markets. Furthermore, our own technological developments may not be able to produce a sustainable competitive advantage. If we fail to invest successfully in improvements to our technology and manufacturing techniques, our business may be materially adversely affected.

Our operations are subject to international risks that could affect our operating results.

Our net sales outside North America represented approximately 40% of our total net sales for the year ended December 31, 2013. In addition, we sell products to domestic customers for use in their products sold overseas. We also source a significant portion of our products and materials from overseas, a practice which is increasing. Our business is subject to risks associated with doing business internationally, and our future results could be materially adversely affected by a variety of factors, including:

| | • | | fluctuations in currency exchange rates; |

| | • | | exchange rate controls; |

| | • | | tariffs or other trade protection measures and import or export licensing requirements; |

| | • | | potentially negative consequences from changes in tax laws; |

| | • | | unexpected changes in regulatory requirements; |

| | • | | changes in foreign intellectual property law; |

| | • | | differing labor regulations; |

| | • | | requirements relating to withholding taxes on remittances and other payments by subsidiaries; |

| | • | | restrictions on our ability to own or operate subsidiaries, make investments or acquire new businesses in various jurisdictions; |

16

| | • | | potential political instability and the actions of foreign governments; and |

| | • | | restrictions on our ability to repatriate dividends from our subsidiaries. |

As we continue to expand our business globally, our success will depend, in large part, on our ability to anticipate and effectively manage these and other risks associated with our international operations. However, any of these factors could materially adversely affect our international operations and, consequently, our operating results.

Our operations depend on production facilities throughout the world, many of which are located outside the United States and are subject to increased risks of disrupted production causing delays in shipments and loss of customers and revenue.

We operate businesses with manufacturing facilities worldwide, many of which are located outside the United States including in Brazil, Canada, China, Denmark, France, Germany, Mexico, Russia, Slovakia, and the United Kingdom. Serving a global customer base requires that we place more production in emerging markets to capitalize on market opportunities and cost efficiencies. Our international production facilities and operations could be disrupted by currency fluctuations and devaluation, capital and currency exchange controls, low or negative economic growth rates, natural disaster, labor strike, military activity or war, political unrest, terrorist activity or public health concerns, particularly in emerging countries that are not well-equipped to handle such occurrences. Any production disruptions could materially adversely affect our business.

We rely on estimated forecasts of our OEM customers’ needs, and inaccuracies in such forecasts could materially adversely affect our business.

We generally sell our products pursuant to individual purchase orders instead of under long-term purchase commitments. Therefore, we rely on estimated demand forecasts, based upon input from our customers, to determine how much material to purchase and product to manufacture. Because our sales are based on purchase orders, our customers may cancel, delay or otherwise modify their purchase commitments with little or no consequence to them and with little or no notice to us. For these reasons, we generally have limited visibility regarding our customers’ actual product needs. The quantities or timing required by our customers for our products could vary significantly. Whether in response to changes affecting the industry or a customer’s specific business pressures, any cancellation, delay or other modification in our customers’ orders could significantly reduce our revenue, impact our working capital, cause our operating results to fluctuate from period to period and make it more difficult for us to predict our revenue. In the event of a cancellation or reduction of an order, we may not have enough time to reduce operating expenses to minimize the effect of the lost revenue on our business and we may purchase too much inventory and spend more capital than expected, which may materially adversely affect our business.

From time to time, our customers may experience deterioration of their businesses. In addition, during periods of economic difficulty, our customers may not be able to accurately estimate demand forecasts and may scale back orders in an abundance of caution. As a result, existing or potential customers may delay or cancel plans to purchase our products and may not be able to fulfill their obligations to us in a timely fashion. Such cancellations, reductions or inability to fulfill obligations could significantly reduce our revenue, impact our working capital, cause our operating results to fluctuate adversely from period to period and make it more difficult for us to predict our revenue.

Our inability to efficiently utilize or re-negotiate minimum purchase requirements in certain supply agreements could decrease our profitability.

Our ability to maintain and expand our business depends, in part, on our ability to continue to obtain raw materials and component parts on favorable terms from various suppliers. Agreements with some of our suppliers contain minimum purchase requirements. We can give no assurance that we will be able to utilize the minimum amount of raw materials or component parts that we are required to purchase under certain supply agreements which contain minimum purchase requirements. If we are required to purchase more raw materials or component parts than we are able to utilize in the operation of our business, the costs of providing our products

17

would likely increase, which could decrease our profitability and have a material adverse effect on our business, financial condition and results of operations.

Disruption of our supply chain could have an adverse effect on our business, financial condition and results of operations.

Our ability, including manufacturing or distribution capabilities, and that of our suppliers, business partners and contract manufacturers, to make, move and sell products is critical to our success. Damage or disruption to our or their manufacturing or distribution capabilities due to weather, natural disaster, fire or explosion, terrorism, pandemics, strikes, repairs or enhancements at our facilities, excessive demand, raw material shortages, or other reasons, could impair our ability, and that of our suppliers, to manufacture or sell our products. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition and results of operations, as well as require additional resources to restore our supply chain.

The materials used to produce our products are subject to price fluctuations that could increase costs of production and adversely affect our profitability.

The materials used to produce our products, especially copper and steel, are sourced on a global or regional basis and the prices of those materials are susceptible to price fluctuations due to supply and demand trends, transportation costs, government regulations and tariffs, changes in currency exchange rates, price controls, the economic climate and other unforeseen circumstances. From the first quarter of 2004 to the fourth quarter of 2013, the average price of copper and steel has increased approximately 153% and 75%, respectively. If we are unable to continue to pass a substantial portion of such price increases on to our customers on a timely basis, our future profitability may be materially adversely affected. In addition, passing through these costs to our customers may also limit our ability to increase our prices in the future.

We face potential product liability claims relating to products we manufacture or distribute, which could result in our having to expend significant time and expense to defend these claims and to pay material damages or settlement amounts.

We face a business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other adverse effects. We currently have several product liability claims against us with respect to our products. Although we currently maintain product liability insurance coverage, we may not be able to obtain such insurance on acceptable terms in the future, if at all, or obtain insurance that will provide adequate coverage against potential claims. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could exceed any insurance that we maintain and could have a material adverse effect on our business, financial condition, results of operations or our ability to make payments under our debt obligations when due. In addition, we believe our business depends on the strong brand reputation we have developed. In the event that our reputation is damaged, we may face difficulty in maintaining our pricing positions with respect to some of our products, which would reduce our sales and profitability.

We also risk exposure to product liability claims in connection with products sold by businesses that we acquire. Although in some cases third parties have retained responsibility for product liabilities relating to products manufactured or sold prior to our acquisition of the relevant business and in other cases the persons from whom we have acquired a business may be required to indemnify us for certain product liability claims subject to certain caps or limitations on indemnification, we cannot assure you that those third parties will in fact satisfy their obligations to us with respect to liabilities retained by them or their indemnification obligations. If those third parties become unable to or otherwise do not comply with their respective obligations including indemnity obligations, or if certain product liability claims for which we are obligated were not retained by third parties or are not subject to these indemnities, we could become subject to significant liabilities or other adverse consequences. Moreover, even in cases where third parties retain responsibility for product liabilities or are required to indemnify us, significant claims arising from products that we have acquired could have a material adverse effect on our ability to realize the benefits from an acquisition, could result in our reducing the value of

18

goodwill that we have recorded in connection with an acquisition, or could otherwise have a material adverse effect on our business, financial condition, or operations.

We may be subject to work stoppages at our facilities, or our customers may be subjected to work stoppages, which could seriously impact our operations and the profitability of our business.

As of December 31, 2013, we had 3,810 full-time employees, of whom approximately 51% were located in North America (primarily U.S.), 32% in Europe, and 17% in Asia and the rest of the world. Approximately 10% of our full-time factory U.S. employees are represented by labor unions. In addition, approximately 691 employees or 57% of our European employees are represented by labor unions or works councils. Approximately 66 employees in the Kilian production facilities in Toronto, Canada are unionized under a collective bargaining agreement. Approximately 25 employees in the Lamiflex production facilities in Brazil are represented by a works council. Additionally, approximately 47 employees in the TB Wood’s production facilities in Mexico are unionized under collective bargaining agreements that are subject to annual renewals.

We are a party to four U.S. collective bargaining agreements. The agreements will expire in June 2014, July 2014, October 2014 and October 2016. We may be unable to renew these agreements on terms that are satisfactory to us, if at all.

We are also party to a collective bargaining agreement with union employees at our Toronto, Canada manufacturing facility. That agreement will expire in July 2015.

One of the four U.S. collective bargaining agreements contains provisions for additional, potentially significant, lump-sum severance payments to all employees covered by that agreement who are terminated as the result of a plant closing and one of our collective bargaining agreements contains provisions restricting our ability to terminate or relocate operations

Our facilities in Europe and Brazil have employees who are generally represented by local or national social works councils. Social works councils meet with employer industry associations periodically to discuss employee wages and working conditions. Our facilities in France, Germany, Slovakia, and Brazil often participate in such discussions and adhere to any agreements reached.

If our unionized workers or those represented by a works council were to engage in a strike, work stoppage or other slowdown in the future, we could experience a significant disruption of our operations. Such disruption could interfere with our ability to deliver products on a timely basis and could have other negative effects, including decreased productivity and increased labor costs. In addition, if a greater percentage of our work force becomes unionized, our business and financial results could be materially adversely affected. Many of our direct and indirect customers have unionized work forces. Strikes, work stoppages or slowdowns experienced by these customers or their suppliers could result in slowdowns or closures of assembly plants where our products are used and could cause cancellation of purchase orders with us or otherwise result in reduced revenues from these customers.

Changes in employment laws could increase our costs and may adversely affect our business.

Various federal, state and international labor laws govern our relationship with employees and affect operating costs. These laws include minimum wage requirements, overtime, unemployment tax rates, workers’ compensation rates paid, leaves of absence, mandated health and other benefits, and citizenship requirements. Significant additional government-imposed increases or new requirements in these areas could materially affect our business, financial condition, operating results or cash flow.

In the event our employee-related costs rise significantly, we may have to curtail the number of our employees or shut down certain manufacturing facilities. Any such actions would not only be costly but could also materially adversely affect our business.

We depend on the services of key executives, the loss of whom could materially harm our business.

Our senior executives are important to our success because they are instrumental in setting our strategic direction, operating our business, maintaining and expanding relationships with distributors, identifying,

19

recruiting and training key personnel, identifying expansion opportunities and arranging necessary financing. Losing the services of any of these individuals could adversely affect our business until a suitable replacement could be found. We believe that our senior executives could not easily be replaced with executives of equal experience and capabilities. Although we have entered into employment agreements with certain of our key domestic executives, we cannot prevent our key executives from terminating their employment with us. We do not maintain key person life insurance policies on any of our executives.

If we lose certain of our key sales, marketing or engineering personnel, our business may be adversely affected.

Our success depends on our ability to recruit, retain and motivate highly skilled sales, marketing and engineering personnel. Competition for these persons in our industry is intense and we may not be able to successfully recruit, train or retain qualified personnel. If we fail to retain and recruit the necessary personnel, our business and our ability to obtain new customers, develop new products and provide acceptable levels of customer service could suffer. If certain of these key personnel were to terminate their employment with us, we may experience difficulty replacing them, and our business could be harmed.

We are subject to environmental laws that could impose significant costs on us and the failure to comply with such laws could subject us to sanctions and material fines and expenses.

We are subject to a variety of federal, state, local, foreign and provincial environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances and wastes and the responsibility to investigate and cleanup contaminated sites that are or were owned, leased, operated or used by us or our predecessors. Some of these laws and regulations require us to obtain permits, which contain terms and conditions that impose limitations on our ability to emit and discharge hazardous materials into the environment and periodically may be subject to modification, renewal and revocation by issuing authorities. Fines and penalties may be imposed for non-compliance with applicable environmental laws and regulations and the failure to have or to comply with the terms and conditions of required permits. From time to time, our operations may not be in full compliance with the terms and conditions of our permits. We periodically review our procedures and policies for compliance with environmental laws and requirements. We believe that our operations generally are in material compliance with applicable environmental laws, requirements and permits and that any lapses in compliance would not be expected to result in us incurring material liability or cost to achieve compliance. Historically, the costs of achieving and maintaining compliance with environmental laws, and requirements and permits have not been material; however, the operation of manufacturing plants entails risks in these areas, and a failure by us to comply with applicable environmental laws, regulations, or permits could result in civil or criminal fines, penalties, enforcement actions, third party claims for property damage and personal injury, requirements to clean up property or to pay for the costs of cleanup, or regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, including the installation of pollution control equipment or remedial actions. Moreover, if applicable environmental laws and regulations, or the interpretation or enforcement thereof, become more stringent in the future, we could incur capital or operating costs beyond those currently anticipated.