- AIMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Altra Industrial Motion (AIMC) 8-KOther Events

Filed: 7 Sep 18, 12:00am

Creating A Premier Industrial Company September 2018 Exhibit 99.1

ADDITIONAL INFORMATION This presentation does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of Fortive Corporation (“Fortive”), Stevens Holding Company, Inc. (“Newco”) or Altra Industrial Motion Corp. (“Altra”). In connection with the proposed transaction, Newco filed with the U.S. Securities and Exchange Commission (the “SEC”), and the SEC declared effective, a registration statement on Form S-4/S-1 containing a prospectus and Altra filed with the SEC, and the SEC declared effective, a registration statement on Form S-4 containing a prospectus, in each case, on August 27, 2018 (together, the “registration statements”). Investors and security holders are urged to read the registration statements as well as any other relevant documents to be filed with the SEC when they become available because such documents contain or will contain important information about Altra, Fortive, Newco and the proposed transaction. The registration statements as well as any other relevant documents relating to the proposed transaction can be obtained free of charge from the SEC’s website at www.sec.gov. Such documents can also be obtained free of charge from Fortive upon written request to Fortive Corporation, Investor Relations, 6920 Seaway Blvd., Everett, WA 98203, or by calling (425) 446-5000 or upon written request to Altra Industrial Motion Corp., Investor Relations, 300 Granite St., Suite 201, Braintree, MA 02184 or by calling (781) 917 0527. Forward Looking Statements All statements, other than statements of historical fact included in this presentation are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts," “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed,” “should be,” and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from Altra’s expectations. These statements include, but may not be limited to, the statements under “Business Outlook,” Altra’s expectations regarding its tax rate, Altra’s expectations regarding its acquisition of Fortive’s Automation & Specialty platform (“Fortive A&S”) and Altra’s guidance for full year 2018. SEC Disclosure Rules

Forward Looking Statements (continued): In addition to the risks and uncertainties noted in this presentation, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of Altra’s markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on Altra’s customers, (7) risks associated with a disruption to Altra’s supply chain, (8) fluctuations in the costs of raw materials used in Altra’s products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with Altra’s debt leverage and operating covenants under Altra’s debt instruments, (19) risks associated with restrictions contained in Altra’s Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of Altra’s ERP system, (23) risks associated with the Svendborg and Stromag acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements Altra has with suppliers, (25) risks associated with Altra’s exposure to variable interest rates and foreign currency exchange rates, (26) risks associated with interest rate swap contracts, (27) risks associated with Altra’s exposure to renewable energy markets, (28) risks related to regulations regarding conflict minerals, (29) risks related to restructuring and plant consolidations, (30) risks related to Altra’s pending acquisition of Fortive A&S, including (a) the possibility that the conditions to the consummation of the proposed transaction will not be satisfied, (b) the ability to obtain the anticipated tax treatment of the proposed transaction and related proposed transactions, (c) risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects, (d) the possibility that Altra may be unable to achieve expected synergies and operating efficiencies in connection with the proposed transaction within the expected time-frames or at all and to successfully integrate Fortive A&S, (e) expected or targeted future financial and operating performance and results, (f) operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the proposed transaction, (g) failure to consummate or delay in consummating the proposed transaction for other reasons, (h) Altra’s ability to retain key executives and employees, (i) slowdowns or downturns in economic conditions generally and in the markets Fortive A&S’s businesses participate specifically, (j) slowdowns or downturns in the industrial economy, (k) lower than expected investments and capital expenditures in equipment that utilizes components produced by us or Fortive A&S, (l) lower than expected demand for Altra or Fortive A&S’s repair and replacement businesses, (m) Altra’s relationships with strategic partners, (n) the presence of competitors with greater financial resources than us and their strategic response to Altra’s products, (o) Altra’s ability to offset increased commodity and labor costs with increased prices, (p) Altra’s ability to successfully integrate the merged assets and the associated technology and achieve operational efficiencies, and (q) the integration of Fortive A&S being more difficult, time-consuming or costly than expected and (31) other risks, uncertainties and other factors described in Altra’s quarterly reports on Form 10-Q and annual reports on Form 10-K and in Altra’s other filings with the SEC or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise. SEC Disclosure Rules (Cont.)

Today’s Attendees Carl Christenson Chairman & Chief Executive Officer Altra Pat Murphy Altra Board Member (Fortive Nominee) Senior Vice President Fortive Christian Storch Vice President & Chief Financial Officer Altra Served as Chairman of Altra since 2014, CEO since 2009 and as a Director since 2007 Previously COO of Altra and had leadership roles at Kaydon Corporation, TB Wood’s and Torrington Company 30+ years of experience Served as CFO of Altra since 2007 Previously held executive leadership and finance roles at Standex International and Vossloh AG and served as an Audit Manager at Deloitte & Touche 30+ years of experience Oversees Fortive’s sensing technologies and automation & specialty platforms Joined Danaher in 2014 as group president of automation after over 25 years at Emerson and 3 years as CEO and President of appliance, commercial and industrial motors at Nidec Corporation 30+ years of experience

Transaction Overview * Non-GAAP measure. Please refer to Appendix for a reconciliation of Further Adjusted Pro Forma EBITDA to Net Income. ¹ Based on 31-Aug-2018 Altra closing share price of $39.05. 2 Includes $23mm of pro forma synergies, expected to be achieved by year 2 after closing. 3 Share ownership on a fully-diluted basis On March 7th, Altra announced its intention to combine with Fortive’s Automation and Specialty (“A&S”) business in a tax-efficient transaction. The consideration is comprised of: 35mm new Altra shares issued (~$1.4bn of implied equity value at current market prices)1 Cash proceeds and debt reduction for Fortive ($1.4bn) Transaction creates a premier industrial company with significant scale and attractive margins Market-leader in precision motion control with exposure to high growth, high margin end-markets Doubles LTM Net Sales to $1.9bn, doubles LTM Net Income to $99mm and triples LTM Further Adjusted Pro Forma EBITDA* to $415mm2 Industry-leading EBITDA* margins and very strong cash flow conversion Altra’s CEO will continue to lead the Company with Fortive’s Pat Murphy to join the Altra Board Fortive will “split off” Fortive A&S to Fortive shareholders that choose to participate in the exchange offer, followed by a merger which is expected to close in early October Fortive shareholders whose shares are tendered and accepted will own ~54% of PF Altra3 35mm shares to be issued, resulting in a total of 65m total shares outstanding Fortive is offering Altra’s shares at an 8% discount to their 3-day VWAP on September 19, 20 and 21st, subject to an upper limit cap on the exchange ratio of 2.3203x Closing is expected in early October On September 4th, Altra shareholders voted to approve the common stock issuance in connection with the Transaction All antitrust approvals have been received

Uniquely Compelling Combination Strategic Rationale Creates a Premier Industrial Company with Best-in-Class Financial Metrics Adds Differentiated Technical Capabilities to the Portfolio Increased Exposure to End Markets with Attractive Secular Trends Compelling Value Creation Through >$50mm Synergies A World-Class Business System Automation & Specialty $1.9bn LTM Net Sales $99mm LTM Net Income $415mm¹ LTM Further Adjusted Pro Forma EBITDA* Leading Market Positions AIMC Shareholders Own ~46% FTV Shareholders Own ~54% *Non-GAAP measure. Please refer to Appendix for a reconciliation of Further Adjusted Pro Forma EBITDA to Net Income. Note: Net Sales and EBITDA figures based on LTM Jun-2018. ¹ LTM Jun-2018 PF EBITDA includes $23mm of pro forma synergies, expected to be achieved by year 2 after closing.

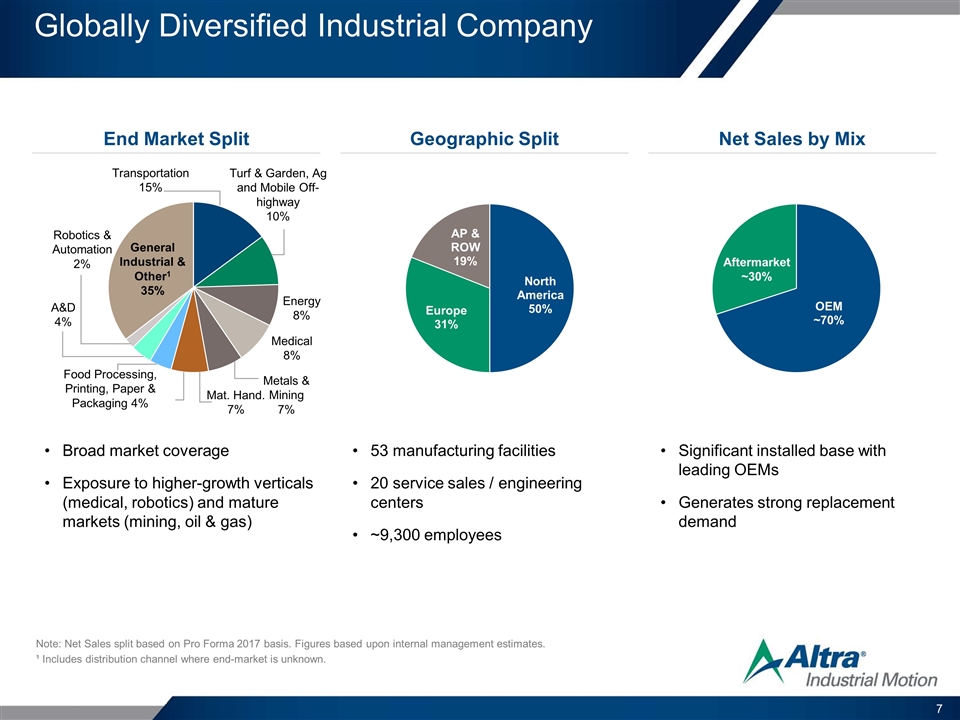

Globally Diversified Industrial Company Net Sales by Mix End Market Split Geographic Split Broad market coverage Exposure to higher-growth verticals (medical, robotics) and mature markets (mining, oil & gas) Significant installed base with leading OEMs Generates strong replacement demand 53 manufacturing facilities 20 service sales / engineering centers ~9,300 employees Note: Net Sales split based on Pro Forma 2017 basis. Figures based upon internal management estimates. ¹ Includes distribution channel where end-market is unknown.

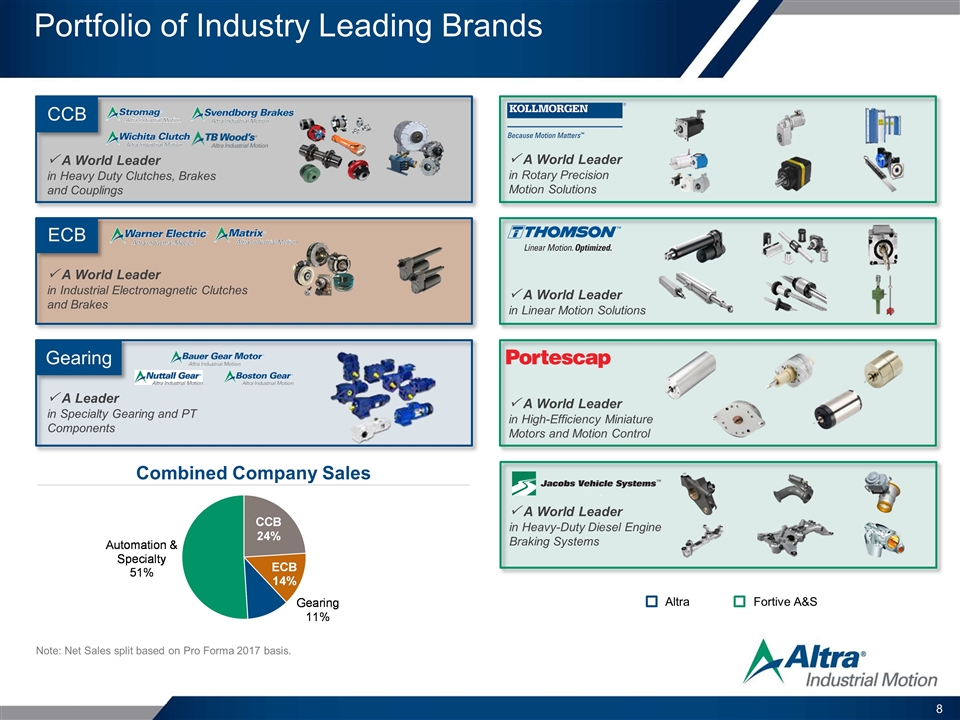

Portfolio of Industry Leading Brands Combined Company Sales Fortive A&S Altra P A World Leader in Rotary Precision Motion Solutions P A World Leader in Linear Motion Solutions P A World Leader in High-Efficiency Miniature Motors and Motion Control P A World Leader in Heavy-Duty Diesel Engine Braking Systems P A World Leader in Heavy Duty Clutches, Brakes and Couplings P A World Leader in Industrial Electromagnetic Clutches and Brakes P A Leader in Specialty Gearing and PT Components Note: Net Sales split based on Pro Forma 2017 basis. CCB ECB Gearing

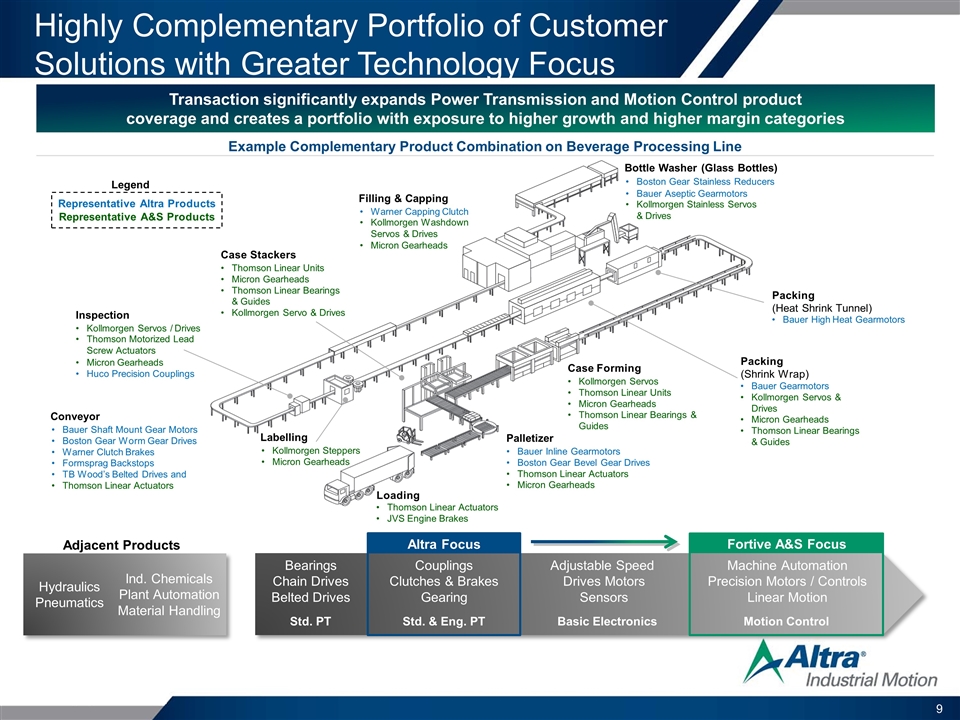

$180B Global PTMC Market Highly Complementary Portfolio of Customer Solutions with Greater Technology Focus Example Complementary Product Combination on Beverage Processing Line Transaction significantly expands Power Transmission and Motion Control product coverage and creates a portfolio with exposure to higher growth and higher margin categories Servo / Miniature Motors / Controls / Linear Motion Systems Clutches & Brakes / Gearing / Couplings Back up of pie chart: \\FIRMWIDE.CORP.GS.COM\IBDROOT\PROJECTS\IBD-NY\ANGUINE2018\614345_1\07. Equity Roadshow\02. Equity Roadshow Presentation\Mark-up\From Altra\Received 13-Aug-2018\RE_ Celtics Draft Equity Roadshow Pres.pdf Transaction significantly expands Power Transmission and Motion Control product coverage and moves Altra into several higher growth and higher margin categories Altra Focus Bearings Chain Drives Belted Drives Adjustable Speed Drives Motors Sensors Std. PT Hydraulics Pneumatics Ind. Chemicals Plant Automation Material Handling Adjacent Products Basic Electronics Couplings Clutches & Brakes Gearing Std. & Eng. PT Machine Automation Precision Motors / Controls Linear Motion Motion Control Fortive A&S Focus Representative Altra Products Representative A&S Products Legend Bottle Washer (Glass Bottles) Boston Gear Stainless Reducers Bauer Aseptic Gearmotors Kollmorgen Stainless Servos & Drives Filling & Capping Warner Capping Clutch Kollmorgen Washdown Servos & Drives Micron Gearheads Case Stackers Thomson Linear Units Micron Gearheads Thomson Linear Bearings & Guides Kollmorgen Servo & Drives Inspection Kollmorgen Servos / Drives Thomson Motorized Lead Screw Actuators Micron Gearheads Huco Precision Couplings Conveyor Bauer Shaft Mount Gear Motors Boston Gear Worm Gear Drives Warner Clutch Brakes Formsprag Backstops TB Wood’s Belted Drives and Thomson Linear Actuators Labelling Kollmorgen Steppers Micron Gearheads Palletizer Bauer Inline Gearmotors Boston Gear Bevel Gear Drives Thomson Linear Actuators Micron Gearheads Case Forming Kollmorgen Servos Thomson Linear Units Micron Gearheads Thomson Linear Bearings & Guides Packing (Shrink Wrap) Bauer Gearmotors Kollmorgen Servos & Drives Micron Gearheads Thomson Linear Bearings & Guides Loading Thomson Linear Actuators JVS Engine Brakes Packing (Heat Shrink Tunnel) Bauer High Heat Gearmotors

Diversified Exposure to Attractive Growth Markets Portfolio with Exposure to High Growth Markets Robotic / Precision surgery Hygienic standards Operator-robot collaboration Autonomous mobile robotics Industry 4.0 Precision control & safety requirements Factory Automation Robotics Medical Health & safety requirements Rising global middle class Precision guidance High power density Miniaturization Electronics / sensors proliferation Electronics Aerospace Food & Bev Other More Mature Markets All Have Positive Outlooks End Market % of 2017A Net Sales¹ Growth Outlook Transportation Turf & Garden, Ag and Mobile Off-highway Energy Metals and Mining Material Handling ¹ Per management estimates.

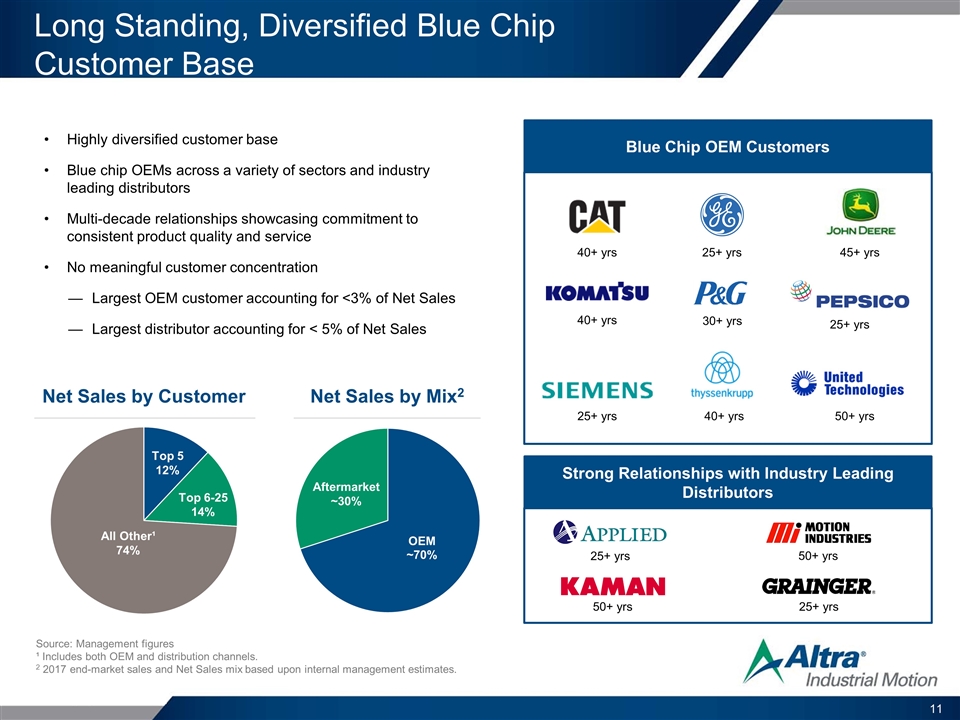

Long Standing, Diversified Blue Chip Customer Base Net Sales by Customer Highly diversified customer base Blue chip OEMs across a variety of sectors and industry leading distributors Multi-decade relationships showcasing commitment to consistent product quality and service No meaningful customer concentration Largest OEM customer accounting for <3% of Net Sales Largest distributor accounting for < 5% of Net Sales Blue Chip OEM Customers 45+ yrs 25+ yrs 40+ yrs 25+ yrs 40+ yrs 40+ yrs Strong Relationships with Industry Leading Distributors 25+ yrs 50+ yrs 50+ yrs 25+ yrs Net Sales by Mix2 Source: Management figures ¹ Includes both OEM and distribution channels. 2 2017 end-market sales and Net Sales mix based upon internal management estimates. 30+ yrs 25+ yrs 50+ yrs

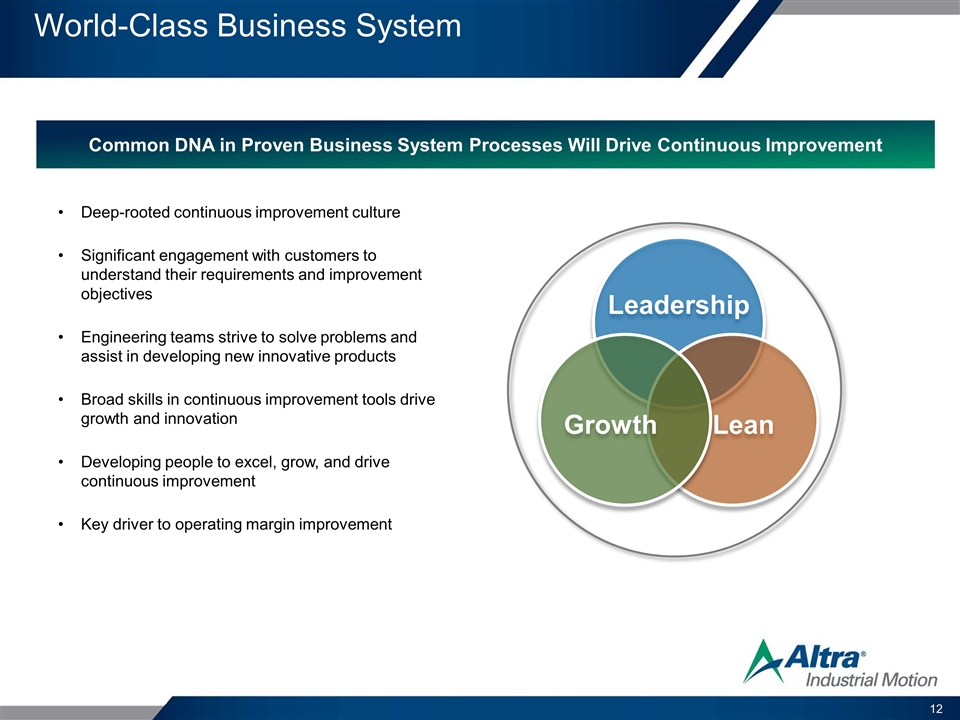

World-Class Business System Common DNA in Proven Business System Processes Will Drive Continuous Improvement Deep-rooted continuous improvement culture Significant engagement with customers to understand their requirements and improvement objectives Engineering teams strive to solve problems and assist in developing new innovative products Broad skills in continuous improvement tools drive growth and innovation Developing people to excel, grow, and drive continuous improvement Key driver to operating margin improvement Leadership Lean Growth

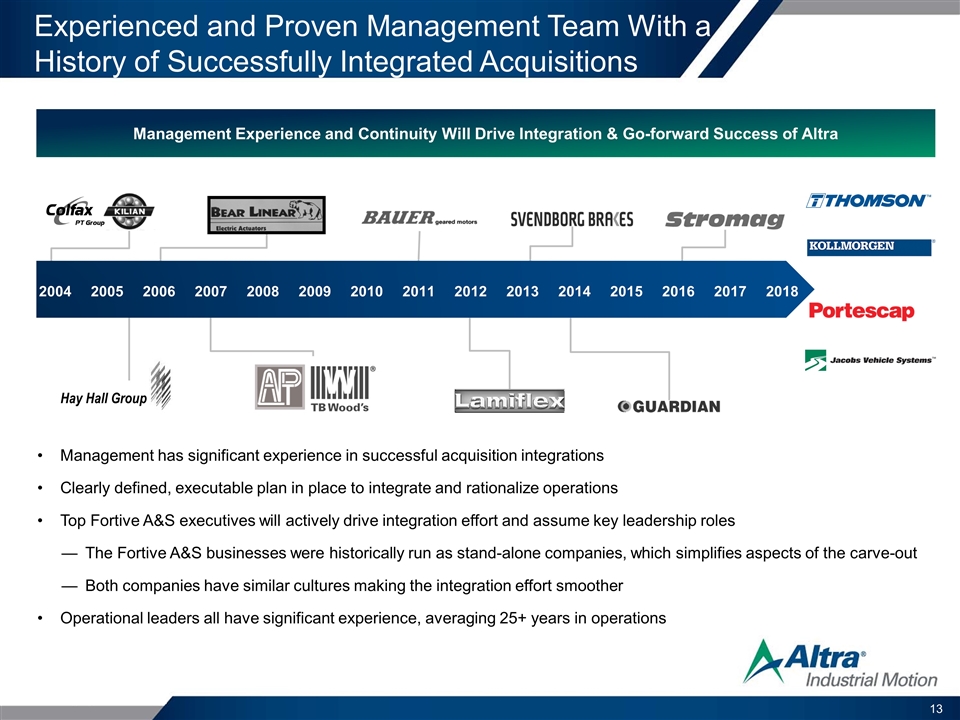

Experienced and Proven Management Team With a History of Successfully Integrated Acquisitions Hay Hall Group Management has significant experience in successful acquisition integrations Clearly defined, executable plan in place to integrate and rationalize operations Top Fortive A&S executives will actively drive integration effort and assume key leadership roles The Fortive A&S businesses were historically run as stand-alone companies, which simplifies aspects of the carve-out Both companies have similar cultures making the integration effort smoother Operational leaders all have significant experience, averaging 25+ years in operations 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Management Experience and Continuity Will Drive Integration & Go-forward Success of Altra

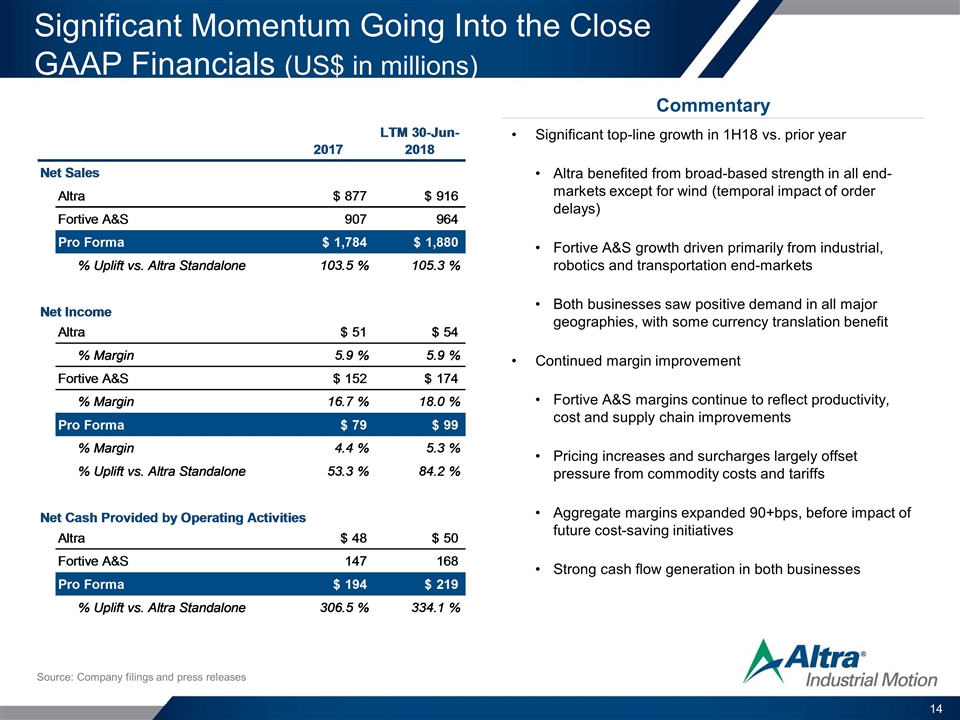

Significant Momentum Going Into the Close GAAP Financials (US$ in millions) Commentary Significant top-line growth in 1H18 vs. prior year Altra benefited from broad-based strength in all end-markets except for wind (temporal impact of order delays) Fortive A&S growth driven primarily from industrial, robotics and transportation end-markets Both businesses saw positive demand in all major geographies, with some currency translation benefit Continued margin improvement Fortive A&S margins continue to reflect productivity, cost and supply chain improvements Pricing increases and surcharges largely offset pressure from commodity costs and tariffs Aggregate margins expanded 90+bps, before impact of future cost-saving initiatives Strong cash flow generation in both businesses Source: Company filings and press releases

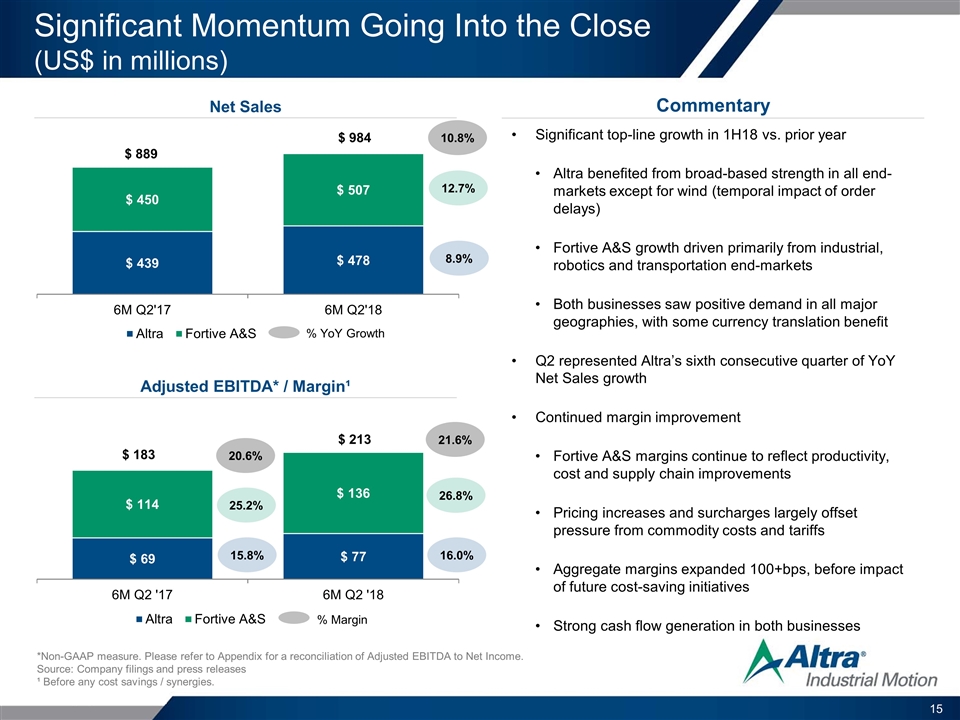

Significant Momentum Going Into the Close (US$ in millions) Commentary Net Sales Adjusted EBITDA* / Margin¹ Significant top-line growth in 1H18 vs. prior year Altra benefited from broad-based strength in all end-markets except for wind (temporal impact of order delays) Fortive A&S growth driven primarily from industrial, robotics and transportation end-markets Both businesses saw positive demand in all major geographies, with some currency translation benefit Q2 represented Altra’s sixth consecutive quarter of YoY Net Sales growth Continued margin improvement Fortive A&S margins continue to reflect productivity, cost and supply chain improvements Pricing increases and surcharges largely offset pressure from commodity costs and tariffs Aggregate margins expanded 100+bps, before impact of future cost-saving initiatives Strong cash flow generation in both businesses 20.6% 25.2% 15.8% 21.6% 26.8% 16.0% % Margin 10.8% 12.7% 8.9% % YoY Growth *Non-GAAP measure. Please refer to Appendix for a reconciliation of Adjusted EBITDA to Net Income. Source: Company filings and press releases ¹ Before any cost savings / synergies.

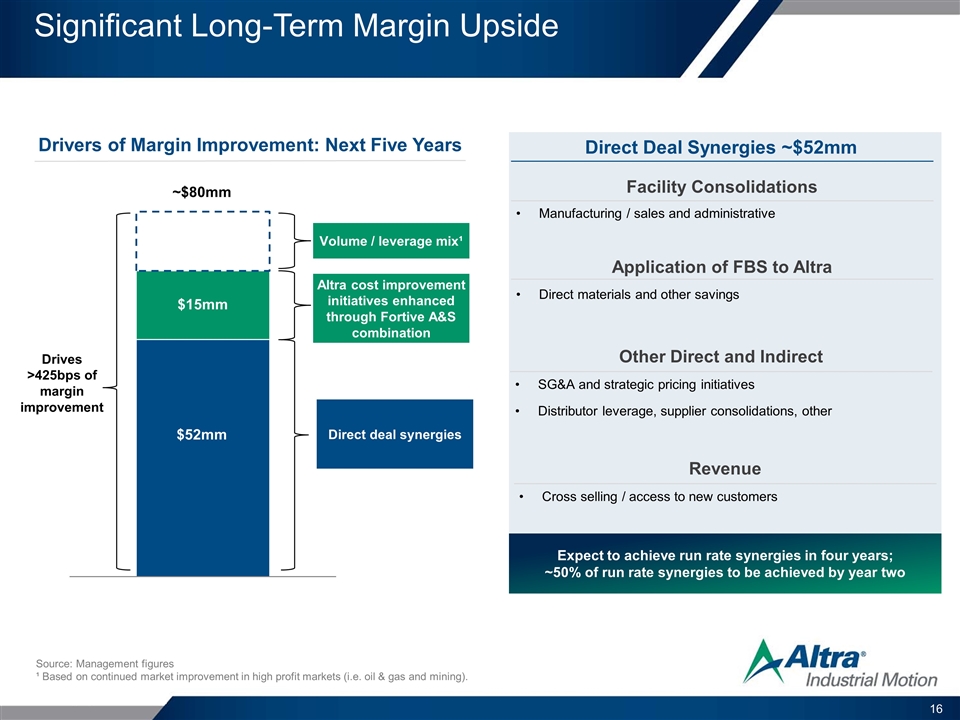

Significant Long-Term Margin Upside Source: Management figures ¹ Based on continued market improvement in high profit markets (i.e. oil & gas and mining). Direct deal synergies Drivers of Margin Improvement: Next Five Years Other Direct and Indirect Facility Consolidations Application of FBS to Altra Direct materials and other savings Manufacturing / sales and administrative SG&A and strategic pricing initiatives Distributor leverage, supplier consolidations, other Altra cost improvement initiatives enhanced through Fortive A&S combination Expect to achieve run rate synergies in four years; ~50% of run rate synergies to be achieved by year two Direct Deal Synergies ~$52mm Volume / leverage mix¹ Drives >425bps of margin improvement Revenue Cross selling / access to new customers

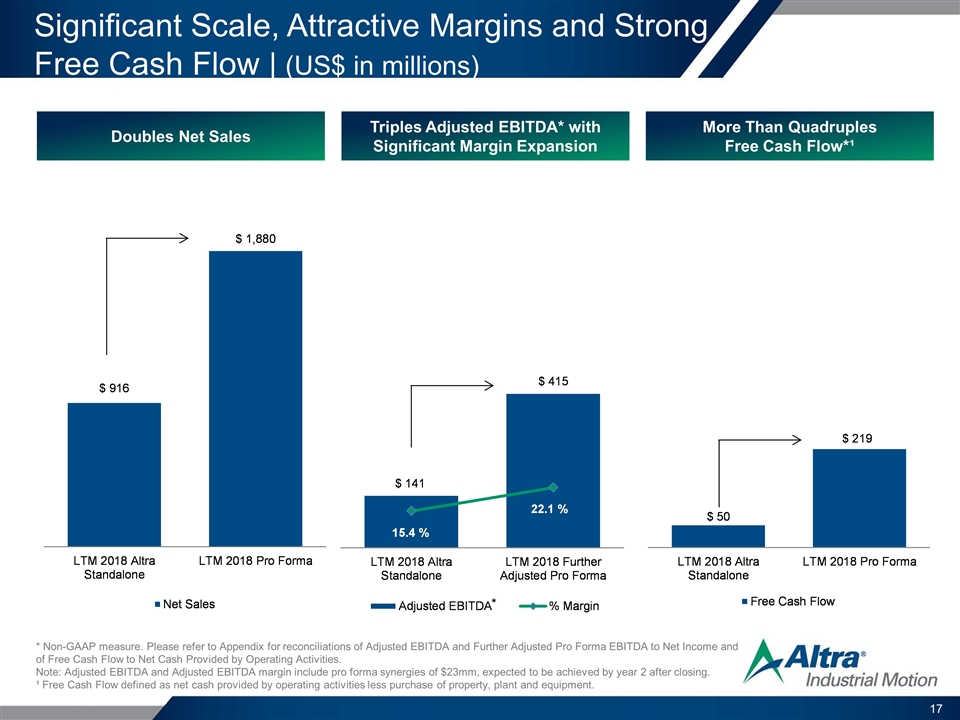

Significant Scale, Attractive Margins and Strong Free Cash Flow | (US$ in millions) Doubles Net Sales Triples Adjusted EBITDA* with Significant Margin Expansion More Than Quadruples Free Cash Flow*¹ * Non-GAAP measure. Please refer to Appendix for reconciliations of Adjusted EBITDA and Further Adjusted Pro Forma EBITDA to Net Income and of Free Cash Flow to Net Cash Provided by Operating Activities. Note: Adjusted EBITDA and Adjusted EBITDA margin include pro forma synergies of $23mm, expected to be achieved by year 2 after closing. ¹ Free Cash Flow defined as net cash provided by operating activities less purchase of property, plant and equipment. *

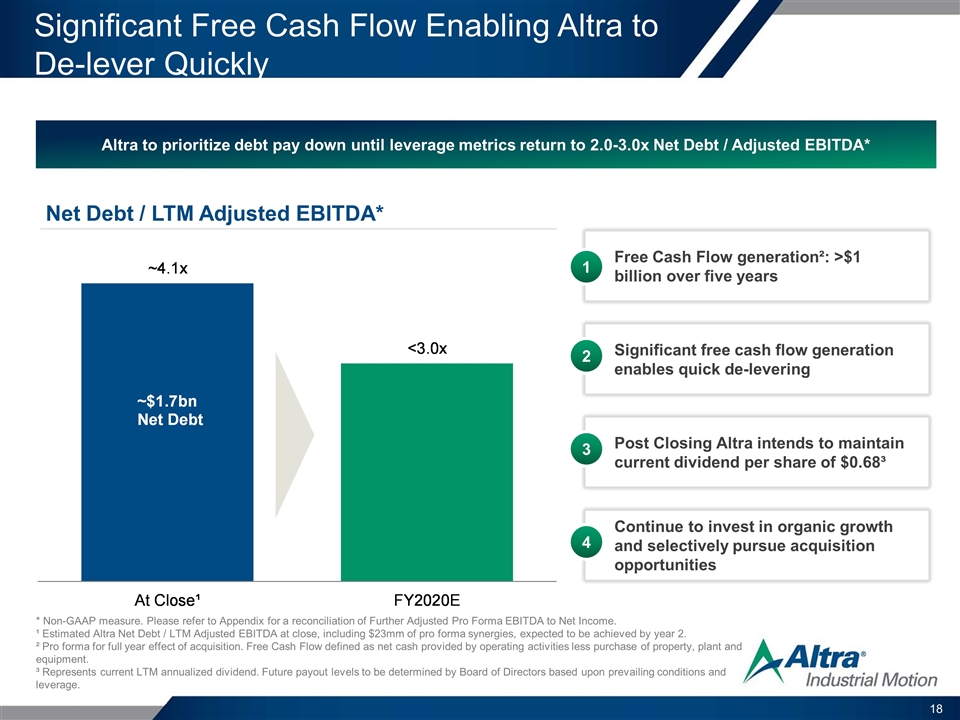

Significant Free Cash Flow Enabling Altra to De-lever Quickly * Non-GAAP measure. Please refer to Appendix for a reconciliation of Further Adjusted Pro Forma EBITDA to Net Income. ¹ Estimated Altra Net Debt / LTM Adjusted EBITDA at close, including $23mm of pro forma synergies, expected to be achieved by year 2. ² Pro forma for full year effect of acquisition. Free Cash Flow defined as net cash provided by operating activities less purchase of property, plant and equipment. ³ Represents current LTM annualized dividend. Future payout levels to be determined by Board of Directors based upon prevailing conditions and leverage. Net Debt / LTM Adjusted EBITDA* Altra to prioritize debt pay down until leverage metrics return to 2.0-3.0x Net Debt / Adjusted EBITDA* Free Cash Flow generation²: >$1 billion over five years 1 Continue to invest in organic growth and selectively pursue acquisition opportunities 4 Significant free cash flow generation enables quick de-levering 2 Post Closing Altra intends to maintain current dividend per share of $0.68³ 3

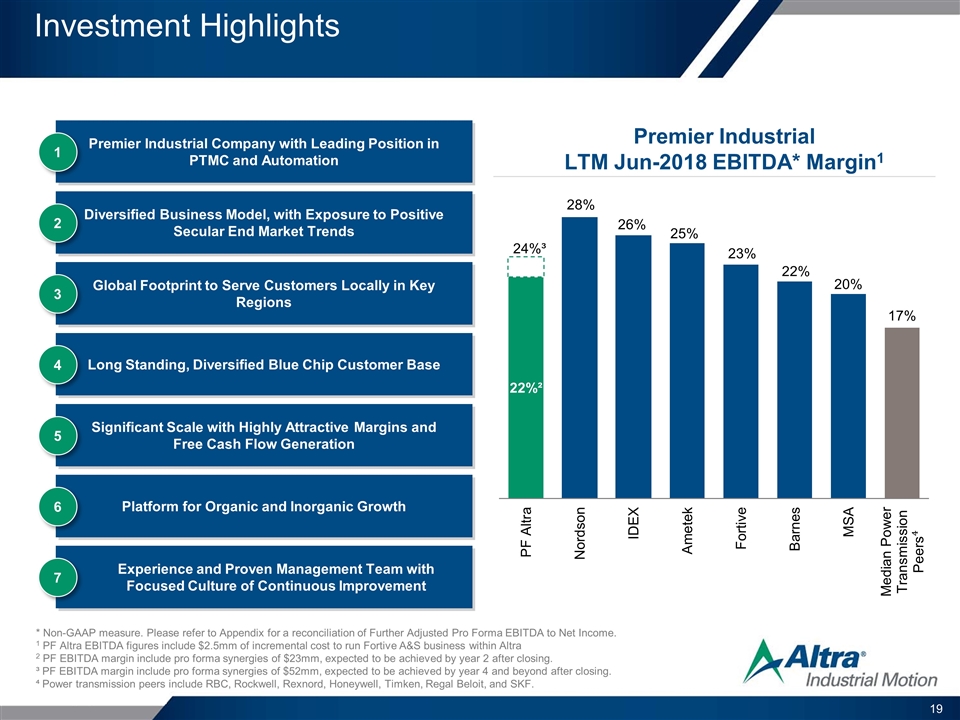

Investment Highlights Premier Industrial LTM Jun-2018 EBITDA* Margin1 Premier Industrial Company with Leading Position in PTMC and Automation 1 Diversified Business Model, with Exposure to Positive Secular End Market Trends 2 Global Footprint to Serve Customers Locally in Key Regions 3 Long Standing, Diversified Blue Chip Customer Base 4 Significant Scale with Highly Attractive Margins and Free Cash Flow Generation 5 Experience and Proven Management Team with Focused Culture of Continuous Improvement 7 Platform for Organic and Inorganic Growth 6 * Non-GAAP measure. Please refer to Appendix for a reconciliation of Further Adjusted Pro Forma EBITDA to Net Income. 1 PF Altra EBITDA figures include $2.5mm of incremental cost to run Fortive A&S business within Altra 2 PF EBITDA margin include pro forma synergies of $23mm, expected to be achieved by year 2 after closing. ³ PF EBITDA margin include pro forma synergies of $52mm, expected to be achieved by year 4 and beyond after closing. ⁴ Power transmission peers include RBC, Rockwell, Rexnord, Honeywell, Timken, Regal Beloit, and SKF.

Appendix

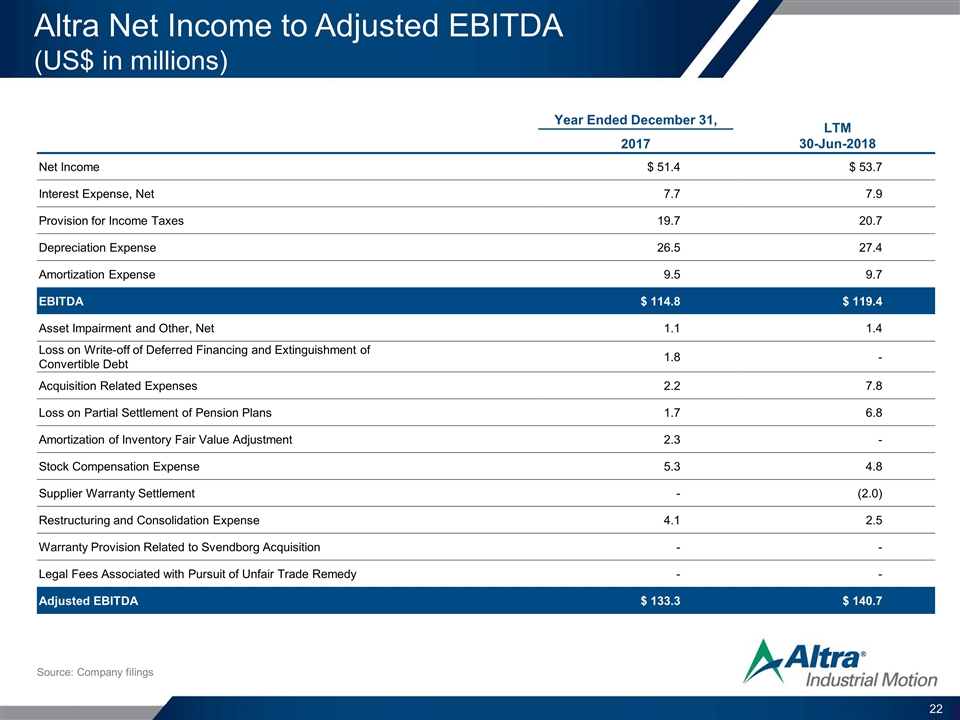

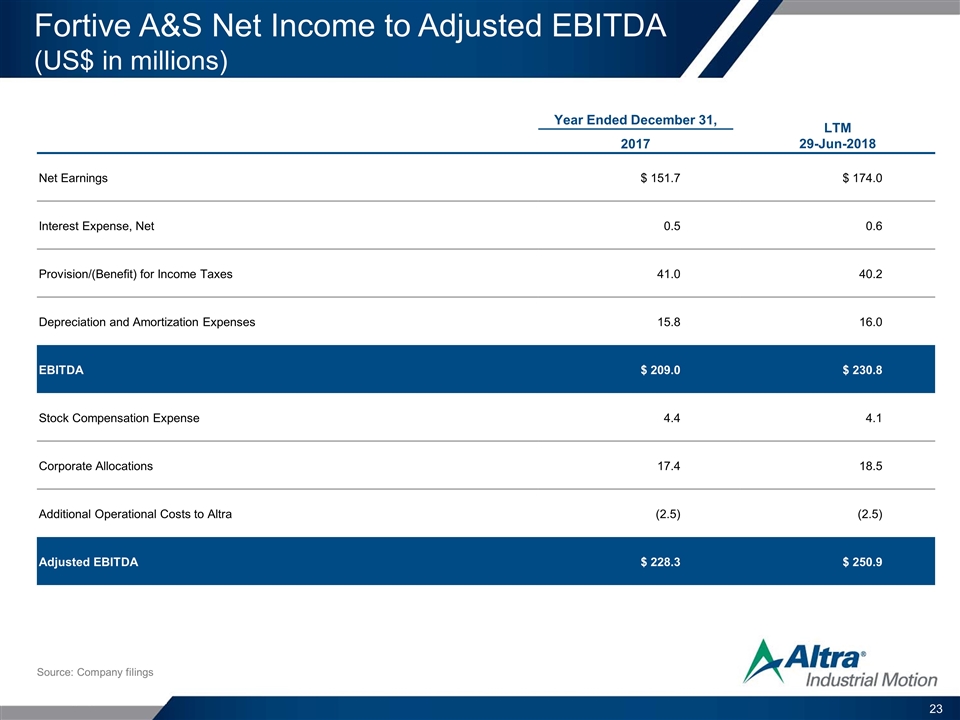

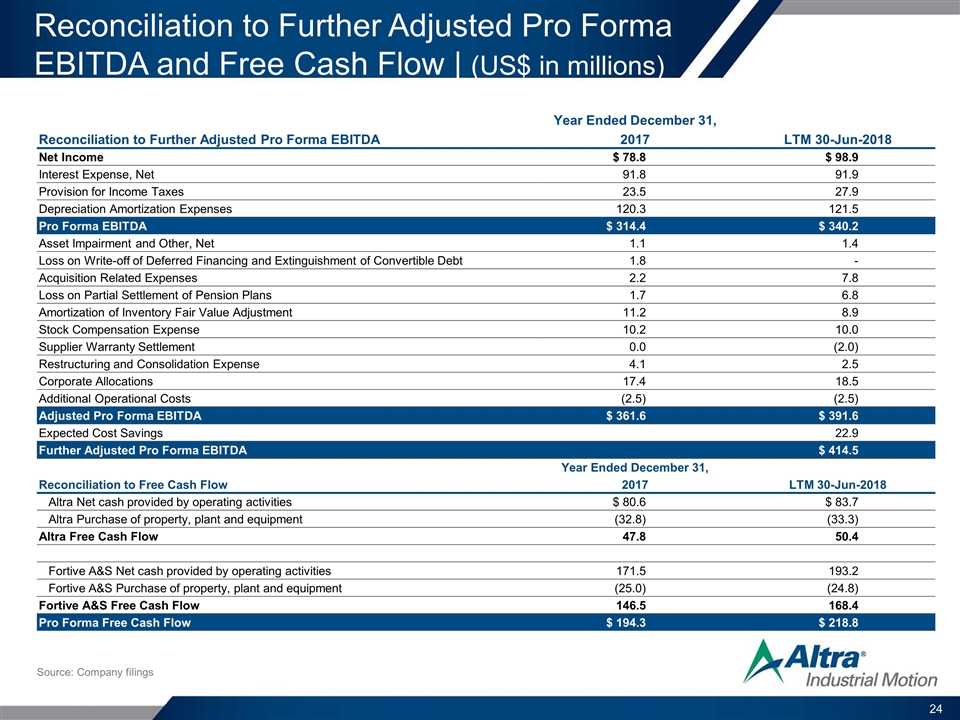

* As used in this presentation, non-GAAP EBITDA is calculated using net income that excludes interest expense (net), provision for income taxes, depreciation expense and amortization expense. Non-GAAP Adjusted EBITDA and non-GAAP Further Adjusted Pro Forma EBITDA is calculated using net income that excludes interest expense (net), provision for income taxes, depreciation expense, amortization expense, acquisition related costs, restructuring costs and other income or charges that management does not consider to be directly related to Altra’s core operating performance. Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment net cash provided by operating activities. Altra believes that the presentation of non-GAAP EBITDA, non-GAAP Adjusted EBITDA, non-GAAP Further Adjusted Pro Forma EBITDA and non-GAAP free cash flow provides important supplemental information to management and investors regarding financial and business trends relating to Altra’s financial condition and results of operations. Discussion of Non-GAAP Measures

Altra Net Income to Adjusted EBITDA (US$ in millions) Year Ended December 31, LTM 30-Jun-2018 2017 Net Income $ 51.4 $ 53.7 Interest Expense, Net 7.7 7.9 Provision for Income Taxes 19.7 20.7 Depreciation Expense 26.5 27.4 Amortization Expense 9.5 9.7 EBITDA $ 114.8 $ 119.4 Asset Impairment and Other, Net 1.1 1.4 Loss on Write-off of Deferred Financing and Extinguishment of Convertible Debt 1.8 - Acquisition Related Expenses 2.2 7.8 Loss on Partial Settlement of Pension Plans 1.7 6.8 Amortization of Inventory Fair Value Adjustment 2.3 - Stock Compensation Expense 5.3 4.8 Supplier Warranty Settlement - (2.0) Restructuring and Consolidation Expense 4.1 2.5 Warranty Provision Related to Svendborg Acquisition - - Legal Fees Associated with Pursuit of Unfair Trade Remedy - - Adjusted EBITDA $ 133.3 $ 140.7 Source: Company filings

Fortive A&S Net Income to Adjusted EBITDA (US$ in millions) Source: Company filings Year Ended December 31, LTM 29-Jun-2018 2017 Net Earnings $ 151.7 $ 174.0 Interest Expense, Net 0.5 0.6 Provision/(Benefit) for Income Taxes 41.0 40.2 Depreciation and Amortization Expenses 15.8 16.0 EBITDA $ 209.0 $ 230.8 Stock Compensation Expense 4.4 4.1 Corporate Allocations 17.4 18.5 Additional Operational Costs to Altra (2.5) (2.5) Adjusted EBITDA $ 228.3 $ 250.9

Reconciliation to Further Adjusted Pro Forma EBITDA and Free Cash Flow | (US$ in millions) Year Ended December 31, Reconciliation to Further Adjusted Pro Forma EBITDA 2017 LTM 30-Jun-2018 Net Income $ 78.8 $ 98.9 Interest Expense, Net 91.8 91.9 Provision for Income Taxes 23.5 27.9 Depreciation Amortization Expenses 120.3 121.5 Pro Forma EBITDA $ 314.4 $ 340.2 Asset Impairment and Other, Net 1.1 1.4 Loss on Write-off of Deferred Financing and Extinguishment of Convertible Debt 1.8 - Acquisition Related Expenses 2.2 7.8 Loss on Partial Settlement of Pension Plans 1.7 6.8 Amortization of Inventory Fair Value Adjustment 11.2 8.9 Stock Compensation Expense 10.2 10.0 Supplier Warranty Settlement 0.0 (2.0) Restructuring and Consolidation Expense 4.1 2.5 Corporate Allocations 17.4 18.5 Additional Operational Costs (2.5) (2.5) Adjusted Pro Forma EBITDA $ 361.6 $ 391.6 Expected Cost Savings 22.9 Further Adjusted Pro Forma EBITDA $ 414.5 Year Ended December 31, Reconciliation to Free Cash Flow 2017 LTM 30-Jun-2018 Altra Net cash provided by operating activities $ 80.6 $ 83.7 Altra Purchase of property, plant and equipment (32.8) (33.3) Altra Free Cash Flow 47.8 50.4 Fortive A&S Net cash provided by operating activities 171.5 193.2 Fortive A&S Purchase of property, plant and equipment (25.0) (24.8) Fortive A&S Free Cash Flow 146.5 168.4 Pro Forma Free Cash Flow $ 194.3 $ 218.8 Source: Company filings