- AIMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Altra Industrial Motion (AIMC) DEF 14ADefinitive proxy

Filed: 24 Mar 22, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

ALTRA INDUSTRIAL MOTION CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

LETTER FROM OUR

CHIEF EXECUTIVE OFFICER

March 24, 2022

Dear Fellow Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Altra Industrial Motion Corp. (“Altra”) to be held remotely at 9:00 a.m. EDT on Tuesday, April 26, 2022 at www.virtualshareholdermeeting.com/AIMC2022. The Notice of Annual Meeting and Proxy Statement describe the matters to be acted upon during the meeting. We will also report on matters of interest to Altra stockholders.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, we encourage you to submit a proxy so that your shares will be represented and voted during the meeting. You may submit a proxy by calling a toll-free telephone number, by accessing the internet or by completing and mailing the enclosed proxy card in the return envelope provided. If you do not vote by one of the methods described above, you still may participate in and vote during the Annual Meeting on the Annual Meeting website.

Thank you for your continued support of Altra.

Sincerely,

Carl R. Christenson

Chairman and Chief Executive Officer

Altra Industrial Motion Corp. | 300 Granite Street, Suite 201 | Braintree, Massachusetts 02184 | www.altramotion.com

NOTICE OF

ANNUAL MEETING

OF STOCKHOLDERS

March 24, 2021

The 2022 Annual Meeting of Stockholders of Altra Industrial Motion Corp. (“Altra”, the “Company”, “we” or “our”) will be held as follows:

PURPOSE:

To consider and act upon the following proposals:

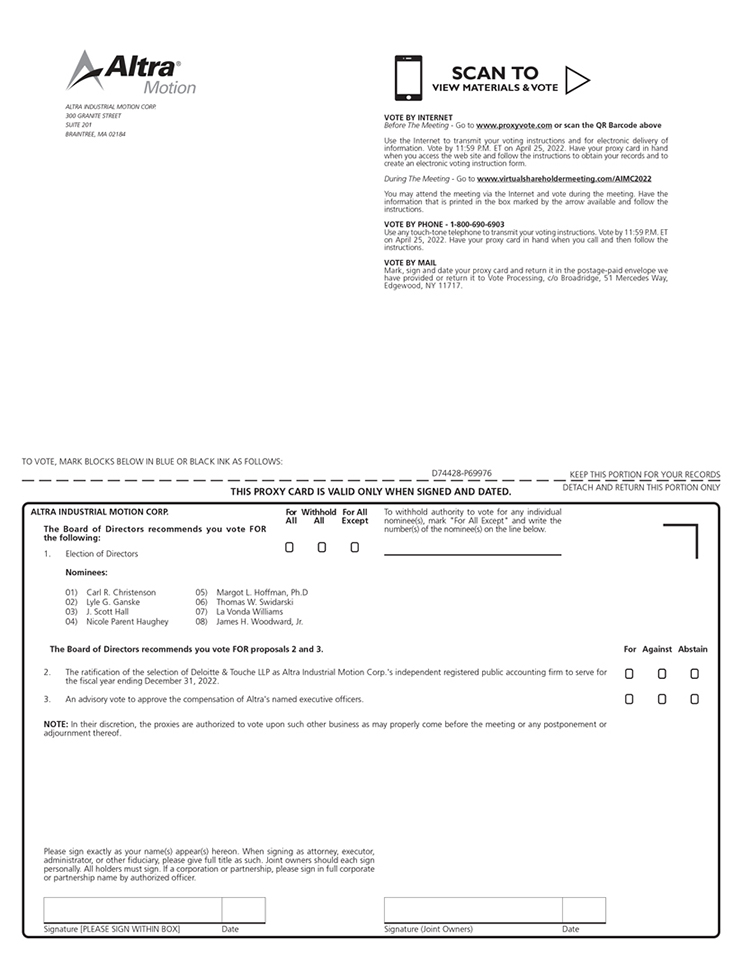

| 1. | The election of the 8 nominees for director named in the accompanying Proxy Statement; |

| 2. | The ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm for 2022; |

| 3. | An advisory vote to approve the compensation of Altra’s named executive officers; and |

| 4. | Such other business as may properly come before the meeting. |

Shares represented by properly executed proxies that are hereby solicited by the Board of Directors of Altra will be voted in accordance with the instructions specified therein. Shares represented by proxies that are not limited to the contrary will be voted in favor of the election as directors of the persons nominated pursuant to Proposal 1 in the accompanying Proxy Statement and in favor of Proposal 2 and Proposal 3.

Stockholders of record at the close of business on March 16, 2022 will be entitled to vote during the meeting.

By order of the Board of Directors,

Glenn E. Deegan

Chief Legal and Human Resources Officer

DATE AND TIME: Tuesday, April 26, 2022 TIME: 9:00 a.m. EDT

LOCATION: Remote at www.virtualshareholdermeeting.com/AIMC2022 In light of the ongoing public health concerns regarding the COVID-19 pandemic, this year’s Annual Meeting will be held solely by remote communication, in a “virtual only” format. The Annual Meeting will not be held at a physical location and you will not be able to attend the Annual Meeting in-person.

|

It is important that your shares be represented and voted, whether or not you plan to attend the meeting.

YOU CAN VOTE:

| BY MAIL: Promptly return your signed and dated proxy/voting instruction card in the enclosed envelope. | |

| BY TELEPHONE: Call toll-free 1-800-690-6903 and follow the instructions. | |

| BY INTERNET: Access “www.proxyvote.com” and follow the on-screen instructions. | |

| DURING MEETING: Participate in the Annual Meeting and follow the instructions available for voting on the Annual Meeting website. | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 26, 2022

Altra’s Proxy Statement, form of Proxy Card and 2021 Annual Report on Form 10-K are available at https://ir.altramotion.com/financials/annual-reports-and-proxies/default.aspx. The information on our website is not incorporated by reference into, or a part of, this Proxy Statement.

IMPORTANT NOTICE Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on April 26, 2022. Altra’s Proxy Statement, form of Proxy Card and 2021 Annual Report on Form 10-K are available at https://ir.altramotion.com/ financials/annual-reports-and-proxies/default.aspx.

PROXY STATEMENT

2022 Annual Meeting of Stockholders

|  |  | ||

TIME AND DATE 9:00 a.m. EDT Tuesday, April 26, 2022 | LOCATION www.virtualshareholdermeeting.com/ | RECORD DATE Close of business on |

Proxy Solicitation

These proxy materials are being mailed or otherwise sent to stockholders of Altra Industrial Motion Corp. (“Altra”, the “Company”, “we” or “our”) on or about March 24, 2022, in connection with the solicitation of proxies by Altra’s Board of Directors (the “Board of Directors” or the “Board”) for the Annual Meeting of Stockholders of Altra to be held remotely at 9:00 a.m. EDT on Tuesday, April 26, 2022, available at www.virtualshareholdermeeting.com/AIMC2022. Directors, officers and other Altra employees also may solicit proxies by telephone or otherwise but will not receive compensation for such services. Altra pays the cost of soliciting your proxy and reimburses brokers and other nominees their reasonable expenses for forwarding proxy materials to you.

Stockholders Entitled to Vote

Stockholders of record at the close of business on March 16, 2022, are entitled to notice of and to vote during the meeting. As of such date, there were 65,059,097 shares of Altra common stock outstanding, each entitled to one vote.

Attending the Annual Meeting

To attend, vote, and submit questions during the Annual Meeting visit www.virtualshareholdermeeting.com/AIMC2022 and enter the 16-digit control number included in your proxy materials or proxy card. Questions may be submitted in the field provided in the web portal at or before the time the matters are before the Annual Meeting for consideration. Online access to the webcast of the Annual Meeting will open approximately 15 minutes prior to commencement of the Annual Meeting.

To submit questions in advance of the Annual Meeting, visit proxyvote.com before 11:59p.m. EDT on April 25, 2022 and enter the 16-digit control number. If you have questions about proxyvote.com or your control number, please contact the bank, broker, or other organization that holds your shares. Availability of online voting may vary based on the voting procedures of the organization that holds your shares. Recording of the Annual Meeting is prohibited, including audio and video recording. A webcast playback will be available at www.virtualshareholdermeeting.com/AIMC2022 within 24 hours of completion of the Annual Meeting.

We encourage you to vote your shares in advance using one of the advance methods described in these proxy materials, even if you plan on attending the Annual Meeting. We reserve the right to eject an attendee or revoke speaking privileges for disruptive behavior or failure to comply with reasonable requests or the rules of conduct for the meeting including time limits applicable to attendees who are permitted to speak.

We will endeavor to answer as many questions as reasonably practicable within the time permitted. We reserve the right to edit profanity, inappropriate language and to exclude questions which are not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Corporate Secretary in their reasonable judgment. If we receive questions which are substantially similar, we may group such questions together and provide a single response.

If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, such matters may be raised separately after the Annual Meeting by contacting Investor Relations at https://ir.altramotion.com/resources/contactus/ default.aspx.

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 1 |

In the event we experience technical difficulties during the Annual Meeting, we expect an announcement will be made on www.virtualshareholdermeeting.com/AIMC2022. Any updated information regarding the Annual Meeting will also be posted on our Investor Relations website at www.ir.altramotion.com.

The information on our website is not incorporated by reference into, or a part of, this Proxy Statement.

How to Vote

Stockholders of record described above may cast their votes by:

| (1) | signing, completing and returning the enclosed proxy card in the enclosed postage-paid envelope; |

| (2) | calling toll-free 1-800-690-6903 and following the instructions; |

| (3) | accessing “www.proxyvote.com” and following the instructions; or |

| (4) | participating in the Annual Meeting and following the instructions on the Annual Meeting website. |

Revocation of Proxies

A proxy may be revoked at any time before it is voted by delivering written notice of revocation to the Corporate Secretary of Altra at the address set forth above, by delivering a proxy bearing a later date, or by voting during the Annual Meeting.

Quorum; Required Vote

The holders of a majority of the shares entitled to vote during the meeting must be present in person or represented by proxy to constitute a quorum. Proxies received but marked as withheld, abstentions, or those treated as broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting in determining a quorum. If a quorum is not present at the Annual Meeting, we will be forced to reconvene the Annual Meeting at a later date.

Your shares may be voted if they are held in the name of a brokerage firm or bank (a “broker”), even if you do not provide the broker with voting instructions. Brokers have the authority, under applicable rules, to vote shares on certain “routine” matters for which their customers do not provide voting instructions. The ratification of the appointment of the independent registered public accounting firm of the Company is considered a routine matter. The election of directors and the advisory vote to approve the compensation of the Company’s named executive officers (“Say on Pay”) are not considered routine matters. Broker non-votes are shares held by brokers or nominees for which instructions have not been received from the beneficial owners, or persons entitled to vote, and the broker is barred from exercising its discretionary authority to vote the shares because the proposal is a non-routine matter.

Election of Directors: Proposal 1. A plurality of the votes cast is required for the election of directors. You may vote “FOR” all or some of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. Votes “WITHHELD” and broker non-votes with respect to the election of directors will have no effect upon election of directors. You may not cumulate your votes for the election of directors.

Ratification of Independent Registered Public Accounting Firm: Proposal 2. Ratification of the selection of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast for or against the matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” in connection with Proposal 2. Abstentions and broker non-votes will have no effect on this proposal.

Advisory Vote to Approve the Compensation of our Named Executive Officers: Proposal 3. The approval of Proposal 3, regarding the compensation of our named executive officers, requires the affirmative vote of a majority of the votes cast for or against the matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” in connection with Proposal 3. Abstentions and broker non-votes will have no effect on this proposal. Because the vote on the Say on Pay proposal is advisory, it will not be binding on the Board of Directors or the Company. However, the Compensation Committee of the Board of Directors will take into account the outcome of the Say on Pay vote when considering future executive compensation arrangements.

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors.

| 2 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

Other Matters

The Board of Directors is not aware of any matters to be presented at the Annual Meeting other than those set forth in the accompanying notice. If any other matters properly come before the Annual Meeting, the persons named in the proxy will vote on such matters in accordance with their best judgment.

Additional Information

Additional information regarding the Company appears in our Annual Report on Form 10-K for the year ended December 31, 2021, a copy of which, including the financial statements and schedules thereto, but not the exhibits, accompanies this Proxy Statement. In addition, such report and the other reports we file with the U.S. Securities and Exchange Commission (“SEC”) are available, free of charge, through the Investor Relations section of our website at https://www.altramotion.com. The information on our website is not incorporated by reference into, or a part of, this Proxy Statement. Printed copies of these documents and any exhibit to our Form 10-K may be obtained, without charge, by contacting the Corporate Secretary, in writing at Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184, or by telephone at (781) 917-0600, and will be provided by first class mail or other equally prompt means within one business day of receipt of such request.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 26, 2022

Altra’s Proxy Statement, form of Proxy Card and 2021 Annual Report on Form 10-K are available at

https://ir.altramotion.com/financials/annual-reports-and-proxies/default.aspx.

The information on our website is not incorporated by reference into, or a part of, this Proxy Statement.

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 3 |

OWNERSHIP OF ALTRA COMMON STOCK

Securities Owned by Certain Beneficial Owners and Management

The following table sets forth certain information as of March 16, 2022, regarding the beneficial ownership of shares of our common stock by: (i) each person or entity known to us to be the beneficial owner of more than 5% of our common stock; (ii) each of our named executive officers; (iii) each member of our Board of Directors, all of which are standing for reelection; and (iv) all members of our Board of Directors and executive officers as a group.

Beneficial ownership is determined in accordance with rules adopted by the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock issuable upon the exercise of stock options or warrants or the conversion of other securities held by that person that are currently exercisable or convertible, or are exercisable or convertible within 60 days of March 16, 2022, are deemed to be issued and outstanding. These shares, however, are not deemed outstanding for the purposes of computing percentage ownership of each other stockholder. Percentage of beneficial ownership is otherwise based on 65,059,097 shares of common stock outstanding as of March 16, 2022.

Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Percentage of Common Stock Outstanding | ||||||

Principal Securityholders: | ||||||||

Wasatch Advisors, Inc. (2) | 6,665,271 | 10.2% | ||||||

The Vanguard Group (3) | 5,914,890 | 9.1% | ||||||

BlackRock, Inc. (4) | 5,761,058 | 8.9% | ||||||

Boston Partners (5) | 3,259,228 | 5.0% | ||||||

Named Executive Officers: | ||||||||

Carl R. Christenson** (1)(6) | 312,905 | * | ||||||

Christian Storch (1)(7) | 93,337 | * | ||||||

Glenn Deegan (1) | 73,716 | * | ||||||

Craig Schuele (1) | 72,581 | * | ||||||

Todd Patriacca (1) | 26,750 | * | ||||||

Directors/Nominees: | ||||||||

Lyle G. Ganske** (1)(8) | 33,992 | * | ||||||

J. Scott Hall** (1) | 3,161 | * | ||||||

Nicole Parent Haughey** (1) | 5,029 | * | ||||||

Margot Hoffman** (1) | 11,392 | * | ||||||

Thomas W. Swidarski** (1) | 19,386 | * | ||||||

La Vonda Williams** (1) | 1,202 | * | ||||||

James H. Woodward Jr.** (1) | 16,900 | * | ||||||

All directors, director nominees and executive officers as a group (11 persons) | 577,014 | * | ||||||

| * | Represents beneficial ownership of less than 1%. |

| ** | Represents director nominees. |

| (1) | Except as otherwise noted below, each of these individuals’ address of record is c/o Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, MA 02184. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons listed in the table have sole investment and voting power with respect to all Company securities owned by them. |

| (2) | The address of Wasatch Advisors, Inc. is 505 Wakara Way, Salt Lake City, UT 84108. Information and share amounts listed are derived from Wasatch Advisors, Inc.’s Schedule 13G/A filed with the SEC on January 10, 2022, in which Wasatch Advisors, Inc. states that it has sole voting power over 6,665,271 shares of Altra’s common stock and sole dispositive power over 6,665,271 shares of Altra’s common stock. |

| (3) | The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. Information and share amounts listed are derived from The Vanguard Group’s Schedule 13G/A filed with the SEC on February 9, 2022, in which The Vanguard Group states that it has shared voting power over 53,981 shares of Altra’s common stock, sole dispositive power over 5,807,314 shares of Altra’s common stock, and shared dispositive power over 107,576 shares of Altra’s common stock. |

| (4) | The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. Shares are held by BlackRock Life Limited, BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., |

| 4 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

| BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Investment Management (Australia) Limited, BlackRock Fund Advisors, and BlackRock Fund Managers Ltd., each of which is a subsidiary of BlackRock, Inc. Information and share amounts listed are derived from BlackRock, Inc.’s Schedule 13G/A filed with the SEC on February 3, 2022, in which BlackRock, Inc. states that it has sole voting power over 5,493,023 shares of Altra’s common stock and sole dispositive power over 5,761,058 shares of Altra’s common stock. |

| (5) | The address of Boston Partners is One Beacon Street, 30th Floor, Boston, MA 02108. Information and share amounts listed are derived from Boston Partners’ Schedule 13G filed with the SEC on February 11, 2022, in which Boston Partners states that it has sole voting power over 2,697,642 shares of Altra’s common stock, shared voting power over 2,128 shares of Altra’s common stock and sole dispositive power over 3,259,228 shares of Altra’s common stock. |

| (6) | Includes 127,438 shares held in trust, for which Mr. Christenson serves as trustee and for which Mr. Christenson shares voting and investment power. Includes 300 shares held by Mr. Christenson’s children for which Mr. Christenson does not have voting or investment power. |

| (7) | Includes 47,788 shares held in trust, for which Mr. Storch serves as trustee and for which Mr. Storch shares voting and investment power. Mr. Storch retired from the Company effective January 31, 2022. |

| (8) | Includes 500 shares held in Mr. Ganske’s wife’s individual retirement account and for which Mr. Ganske shares voting and investment power with his wife and includes 3,486 shares held in trust for the benefit of Mr. Ganske’s daughters, for which Mr. Ganske’s wife serves as trustee and for which Mr. Ganske does not have voting or investment power. |

Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires Altra’s directors, executive officers and beneficial owners of more than 10% of Altra’s equity securities (“10% Owners”) to file initial reports of their ownership of Altra’s equity securities and reports of changes in such ownership with the SEC. Directors, executive officers and 10% Owners are required by SEC regulations to furnish Altra with copies of all Section 16(a) forms they file. Based solely on a review of copies of such forms and written representations from Altra’s directors, executive officers and 10% Owners, Altra believes that for the fiscal year of 2021, all of its directors, executive officers and 10% Owners were in compliance with the disclosure requirements of Section 16(a).

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 5 |

Election of Directors

The current Board of Directors is made up of eight directors. Each director’s term expires at the 2022 Annual Meeting. On October 19, 2021, the Board of Directors approved resolutions increasing the size of the Board from seven to eight and appointing La Vonda Williams to fill the resulting vacancy on the Board effective as of October 19, 2021. The following directors have been nominated by the Company’s Nominating and Corporate Governance Committee for election to serve for a term of one year until the 2023 Annual Meeting and until their successors have been duly elected and qualified.

All of the nominees for election have consented to being named in this Proxy Statement and to serve if elected. All of the nominees are standing for election or re-election. Biographical information for each of the nominees as of the most recent practicable date, is presented below. |

Carl R. Christenson Lyle G. Ganske J. Scott Hall Nicole Parent Haughey Margot L. Hoffman, Ph.D. Thomas W. Swidarski La Vonda Williams James H. Woodward Jr. |

The Board of Directors recommends that stockholders vote FOR the election of Mr. Christenson, Mr. Ganske, Mr. Hall, Ms. Parent Haughey, Dr. Hoffman, Mr. Swidarski, Ms. Williams and Mr. Woodward.

| Board Committee Membership | ||||||||||||

| Director Since | Age | Independent | Audit | Nominating and Corporate Governance | Compensation | |||||||

Carl R. Christenson Chief Executive Officer, Altra Industrial Motion Corp. | 2014 | 62 | ||||||||||

Lyle Ganske* Partner and Partner-in-Charge of the Houston Office at Jones Day | 2007 | 63 | ✔ | ∎ | ∎ | |||||||

J. Scott Hall President and Chief Executive Officer, Mueller Water Products, Inc. | 2020 | 58 | ✔ | ∎ | ||||||||

Nicole Parent Haughey Former Chief Operating Officer, Island Creek Oysters | 2020 | 50 | ✔ | ∎ | ||||||||

Margot L. Hoffman, Ph.D. President and Chief Executive Officer, The Partnership for Excellence | 2018 | 59 | ✔ | ◆ | ∎ | |||||||

Thomas Swidarski Chief Executive Officer, Telos Alliance | 2014 | 63 | ✔ | ∎ | ◆ | |||||||

La Vonda Williams Chief Financial Officer, Onegevity Health | 2021 | 51 | ✔ | |||||||||

James J. Woodward, Jr. Former Senior Vice President and Chief Financial Officer, Accuride Corporation | 2007 | 69 | ✔ | ◆ | ||||||||

Number of Meetings | 6 | 6 | 5 | |||||||||

* Lead Director ◆ Chair ∎ Member

Board Diversity

| ||||||||||||||||||||||||||

| Independence | Diversity* | Board Diversity Matrix (As of March 24, 2022) | ||||||||||||||||||||||||

|

* Directors self-identifying as female and/or African American or Black. | Female | Male | |||||||||||||||||||||||

| Total Number of Directors | 8 | |||||||||||||||||||||||||

| Part I: Gender Identiy | ||||||||||||||||||||||||||

| Directors | 3 | 5 | ||||||||||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||||||||||||

| African American or Black | 1 | 0 | ||||||||||||||||||||||||

| White | 2 | 5 | ||||||||||||||||||||||||

| Part III: Independence | ||||||||||||||||||||||||||

| Directors | 3 | 4 | ||||||||||||||||||||||||

| 6 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

Our Nominee Biographies

| ||||||||||

Carl R. Christenson Chief Executive Officer and Chairman of the Board, Altra Industrial Motion Corp. Carl R. Christenson has been our Chief Executive Officer since January 2009. Prior to his current position, Mr. Christenson served as our President and Chief Operating Officer from January 2005 to December 2008. From 2001 to 2005, Mr. Christenson was the President of Kaydon Bearings, a manufacturer of custom-engineered bearings and a division of Kaydon Corporation. Prior to joining Kaydon, Mr. Christenson held a number of management positions at TB Wood’s Incorporated and several positions at the Torrington Company. Mr. Christenson currently serves as a director at IDEX Corporation, a NYSE listed industrial manufacturer of highly engineered products. Mr. Christenson previously served as a director at Vectra Co., f/k/a OM Group, Inc., a NYSE listed technology-driven diversified industrial company, from 2014 to 2015. Mr. Christenson also is a member of the Board of Trustees of Manufacturers Alliance for Productivity and Innovation. Mr. Christenson holds a M.S. and B.S. degree in Mechanical Engineering from the University of Massachusetts and an M.B.A. from Rensselaer Polytechnic.

Director Qualifications: Mr. Christenson’s years of senior management and executive leadership at Altra offer critical insight and perspective. In addition to more than twenty-five years of experience in manufacturing companies, Mr. Christenson brings vast knowledge of the Company’s business, structure, history, and culture to the Board and the Chief Executive Officer position. |

Director since 2007 Chairman of the Board since 2014 Age 62

| |||||||||

| ||||||||||

Lyle G. Ganske Partner and Partner-in-Charge of the Houston Office at Jones Day Lyle G. Ganske is a Partner and Partner-in-Charge of the Houston Office at Jones Day. Mr. Ganske received his J.D. from Ohio State University and his B.S.B.A. at Bowling Green State University. He currently serves on the Executive Committee of Resilience Capital (private equity); the Advisory Board of Mutual Capital Partners (venture capital); and on the boards of World Affairs Council of Greater Houston and the Western Reserve Land Conservancy. Mr. Ganske is the former chair of Business Volunteers Unlimited and the Commission on Economic Inclusion.

Director Qualifications: Mr. Ganske is an advisor to significant companies, focusing primarily on M&A, takeovers, takeover preparedness, corporate governance, executive compensation, and general corporate counseling. In addition to his substantial legal skills and expertise, Mr. Ganske brings to the Company’s Board well-developed business and financial acumen critical to a dynamic public company. |

Director since 2007 Age 63

| |||||||||

| ||||||||||

J. Scott Hall President and Chief Executive Officer of Mueller Water Products, Inc. J. Scott Hall has served as President and Chief Executive Officer of Mueller Water Products, Inc. since January 2017 served as President and Chief Executive Officer of Textron’s Industrial Segment from December 2009 until January 2017. Mr. Hall joined Textron in 2001 as President of Tempo, a multi-facility roll-up of communication test equipment. He was named president of Greenlee in 2003 when Tempo became part of the Greenlee business unit. Prior to joining Textron, Mr. Hall had several leadership roles at General Cable Company (now Prysmian Group), a leading manufacturer of wire and cable. Mr. Hall ran General Cable’s Canadian businesses before taking over responsibility for General Cable’s Global Communications business. Mr. Hall earned his Bachelor of Commerce degree from Memorial University of Newfoundland and his M.B.A. from the University of Western Ontario Ivey School of Business.

Director Qualifications: As the executive of a publicly traded industrial, Mr. Hall brings to the Company’s Board substantial commercial experience and business leadership skills gained from his past and current positions in management. |

Director since 2020 Age 58

| |||||||||

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 7 |

| ||||||||||

Nicole Parent Haughey Former Chief Operating Officer of Island Creek Oysters Nicole Parent Haughey most recently served as Chief Operating Officer of Island Creek Oysters, a Duxbury, MA shellfish farm and distributor, where she was responsible for driving growth and profitability of the company’s B2B and B2C business and oversaw procurement, operations and sales in pursuit of that mission. Previously, she was the Chief Operating Officer of Mimeo.com, a technology company in printed and digital content management and distribution, from 2016 to 2018 with responsibility for the U.S. Document business, Finance and Human Resources. Prior to that, Ms. Parent Haughey served as Vice President, Corporate Strategy and Business Development at United Technologies Corporation (a publicly-traded diversified industrial Fortune 50 company) from 2013 to 2015. Ms. Parent Haughey was Co-Founder and Managing Partner of Vertical Research Partners, LLC, an equity research and consulting firm, from 2009 to 2013. From 2005-2009, she was Managing Director and Global Sector Head at Credit Suisse with responsibility for industrial research across the Americas, Europe and Asia. Ms. Parent Haughey has served as a Director on the board of Allegion, plc, a NYSE traded global security company, since September 2017.

Director Qualifications: Ms. Parent Haughey has nearly three decades of experience in leadership roles across financial services, manufacturing, technology and hospitality. Ms. Parent Haughey’s experience as a chief operating officer and a senior leader of global companies brings significant expertise to the Board of Directors. Her deep understanding of strategic planning, finance, capital allocation, mergers and acquisitions, and sales and marketing benefits the Board as it oversees and develops the Company’s long-term growth strategies. In addition, Ms. Parent Haughey’s in-depth knowledge of the investment community and markets provides key insights into investors and capital markets. |

Director since 2020 Age 50

| |||||||||

| ||||||||||

Margot L. Hoffman President and Chief Executive Officer for The Partnership for Excellence Margot L. Hoffman, Ph.D. currently serves as the President and Chief Executive Officer for The Partnership for Excellence, the Baldrige-based program for Ohio, Indiana, and West Virginia. Dr. Hoffman was the President of Quest4Leadership, a leadership development firm, from 2011-2014. From 1988 to 2008, Dr. Hoffman held positions in engineering, corporate training, and senior leadership at Dana Corporation, ultimately holding the position of President of its Driveshaft Products Group. Dr. Hoffman holds a Ph.D. in organization and management from Capella University, and an M.B.A. and bachelor of engineering technology degree from the University of Toledo, and serves as a national Baldrige senior examiner.

Director Qualifications: Dr. Hoffman contributes to the Company’s Board significant operational management and leadership development skills. Further Dr. Hoffman’s tenure brings substantial experience in global manufacturing businesses, program management, and new product launches. |

Director since 2018 Age 59

| |||||||||

| ||||||||||

| ||||||||||

Thomas W. Swidarski Chief Executive Officer of Telos Alliance Thomas W. Swidarski is currently Chief Executive Officer of Telos Alliance, a global audio technology company whose products and services help radio and television stations produce better programming. Mr. Swidarski has been a director of Evertec, a publicly traded payment processing company, since 2013 and also serves as a director of several privately held companies. Mr. Swidarski previously served as the Chief Executive Officer and President of Diebold Nixdorf, Incorporated, f/k/a Diebold, Incorporated (“Diebold”), a $3 billion global leader in designing, manufacturing and distributing self-service technologies (ATMs) in over 100 countries, from October 12, 2005 to January 19, 2013. Mr. Swidarski served as Senior Vice President of Financial Self-Service Group of Diebold, from 2001 to September 2005 and served as its Chief Operating Officer from October 12, 2005 to December 2005. Mr. Swidarski also held various strategic development and marketing positions at Diebold since 1996. Prior to Diebold, he held various positions within the financial industry for nearly 20 years focusing on marketing, product management, retail bank profitability, branding, and retail distribution. Mr. Swidarski served as a Director of Diebold from December 12, 2005 to January 8, 2013. He holds a B.A. in marketing from the University of Dayton and an M.B.A. in business management from Cleveland State University.

Director Qualifications: Having served as Chief Executive Officer of a global provider of technology and services to a wide range of businesses, Mr. Swidarski brings to the Company’s Board valuable insight into organizational management, global business, financial matters and marketing matters. |

Director since 2014 Age 63

| |||||||||

|

| 8 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

| ||||||||||

La Vonda Williams Chief Financial Officer of Onegevity Health La Vonda Williams currently serves as Chief Financial Officer of Onegevity Health (acquired by Thorne HealthTech, Inc., in early 2021), a health intelligence company with a precision health and wellness platform, a position she has held since 2019. Before joining Onegevity, she served as Vice President of Equity Derivatives Operations at Goldman Sachs, working there from 2014 to 2019. Prior to that, Ms. Williams served as Chief Operating Officer for Solaire Generation, Inc., a solar energy equipment company. Ms. Williams has spent nearly 20 years in finance and operations in a series of executive roles at early-stage startups, as well as operations, sales, and underwriting positions at leading investment banks. She holds an M.B.A. from Stanford University and a B.S. in Mechanical Engineering from Harvard University.

Director Qualifications: Ms. Williams brings to the Company’s Board highly relevant and valuable financial, operational, and equity markets expertise, as well as deep knowledge of the attractive health end-market. |

Director since 2021 Age 51

| |||||||||

| ||||||||||

James H. Woodward, Jr Former Senior Vice President and Chief Financial Officer of Accuride Corporation James H. Woodward, Jr. served as Senior Vice President and Chief Financial Officer of Accuride Corporation from March 2009 to October 2011. Previously, Mr. Woodward served as Executive Vice President and Chief Financial Officer and Treasurer of Joy Global Inc. from January 2007 until February 2008. Prior to joining Joy Global Inc., Mr. Woodward was Executive Vice President and Chief Financial Officer of JLG Industries, Inc. from August 2000 until its sale in December 2006. Prior to JLG Industries, Inc., Mr. Woodward held various financial and operational positions at Dana Incorporated, f/k/a Dana Corporation, since 1982. Mr. Woodward is a Certified Public Accountant and holds a B.A. degree in Accounting from Michigan State University.

Director Qualifications: Mr. Woodward’s depth and breadth of exposure to complex issues from his long and distinguished career in the manufacturing industry make him a skilled advisor who provides critical insight into organizational and operational management, global business, and financial matters. |

Director since 2007 Age 69

| |||||||||

|

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 9 |

Board of Directors Composition

Our bylaws provide that the size of the Board of Directors shall be determined from time to time by our Board of Directors. Our Board of Directors is currently sized at eight members. On October 19, 2021, the Board of Directors approved resolutions increasing the size of the Board from seven to eight and appointing La Vonda Williams to fill the resulting vacancy on the Board effective as of October 19, 2021. Each of our executive officers and directors, other than non-employee directors, devotes his or her full time to our affairs. Our non-employee directors devote the amount of time to our affairs as necessary to discharge their duties. Lyle G. Ganske, J. Scott Hall, Nicole Parent Haughey, Margot L. Hoffman, Ph.D., Thomas W. Swidarski, La Vonda Williams and James H. Woodward, Jr. are each “independent” within the meaning of the Marketplace Rules of the NASDAQ Global Market (the “NASDAQ Rules”) and the federal securities laws and collectively constitute a majority of our Board of Directors.

Committees of the Board of Directors

Pursuant to our bylaws, our Board of Directors is permitted to establish committees from time to time as it deems appropriate. To facilitate independent director review and to make the most effective use of our directors’ time and capabilities, our Board of Directors has established the following committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The charter of each of the committees discussed below is available on our website at https://ir.altramotion.com/governance/governance-documents/default.aspx. The information on our website is not incorporated by reference into, or a part of, this Proxy Statement. Printed copies of these charters may be obtained, without charge, by contacting the Corporate Secretary, Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184, telephone (781) 917-0600. The membership and function of each committee are described below.

Audit Committee

The primary purpose of the Audit Committee is to assist the Board’s oversight of:

| • | the integrity of our financial statements and reporting; |

| • | our independent auditors’ qualifications, independence, compensation, and performance; |

| • | our internal controls and risk management (including those risks related to information technology, cybersecurity, data protection, data privacy, and disaster recovery) and crisis management plans; |

| • | our compliance with legal and regulatory requirements; |

| • | the performance of our internal audit function; |

| • | the preparation of all reports and disclosure required or appropriate including the disclosure required by Item 407(d)(3)(i) of Regulation S-K; and |

| • | legal, ethical, and regulatory compliance including application of our Code of Business Conduct and Ethics. |

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act and currently consists of Messrs. Woodward, Ganske and Hall, each of whom is a non-employee member of our Board of Directors and independent within the meaning of the NASDAQ Rules. Mr. Woodward serves as chairman of our Audit Committee. Mr. Woodward, Mr. Ganske and Mr. Hall qualify as independent “audit committee financial experts” as such term has been defined by the SEC in Item 407 of Regulation S-K. We believe that the composition of our Audit Committee meets the criteria for independence under, and the functioning of our Audit Committee complies with the applicable requirements of, the NASDAQ Rules and federal securities law.

Compensation Committee

The primary purpose of our Compensation Committee is to establish and review our overall compensation philosophy and policy, to establish and review our director compensation philosophy and policy, and to review and approve corporate goals and objectives relevant to compensation of the Company’s executive officers. In addition, the Compensation Committee oversees our employee benefit plans and practices and produces a report on executive compensation as required by SEC rules. The Compensation Committee may form, and delegate any of its responsibilities to, a subcommittee so long as such subcommittee is solely comprised of one or more members of the Compensation Committee.

The Compensation Committee has the authority, pursuant to its charter, to retain outside counsel, compensation consultants, or other advisors to assist it in carrying out its activities. The Compensation Committee retains Frederic W. Cook & Co., Inc. (“FW Cook”), as the Compensation Committee’s independent compensation consultant.

| 10 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

Mr. Swidarski, Mr. Ganske, and Dr. Hoffman serve on the Compensation Committee, each of whom is a non-employee member of our Board of Directors and independent within the meaning of the NASDAQ Rules. Mr. Swidarski serves as chairman of the Compensation Committee. We believe that the composition of our Compensation Committee meets the criteria for independence under, and the functioning of our Compensation Committee complies with the applicable requirements of, the NASDAQ Rules.

Compensation Policies and Practices Regarding Risk Taking

The Company has considered its compensation policies and practices for its employees and concluded that the policies and practices do not give rise to risks that are reasonably likely to have a material adverse effect on the Company. This conclusion was based on the assessment performed by the Company’s management and was reviewed by the Compensation Committee of the Company’s Board of Directors.

Nominating and Corporate Governance Committee

The primary purpose of the Nominating and Corporate Governance Committee is to:

| • | identify and recommend to the Board individuals qualified to serve as directors of our company and on committees of the Board; |

| • | advise the Board with respect to Board composition, procedures, and committees; |

| • | develop and recommend to the Board a set of corporate governance principles and guidelines applicable to us; |

| • | oversee the evaluation of the Board and our management; and |

| • | provide oversight and guidance with regard to environmental, social, and governance (ESG) matters and the Company’s ESG activities. |

Dr. Hoffman, Ms. Parent Haughey and Mr. Swidarski serve on the Nominating and Corporate Governance Committee, each of whom is a non-employee member of our Board of Directors and independent within the meaning of the NASDAQ Rules. Dr. Hoffman serves as chair of the Nominating and Corporate Governance Committee. We believe that the composition of our Nominating and Corporate Governance Committee meets the criteria for independence under, and the functioning of our Nominating and Corporate Governance Committee complies with the applicable requirements of, the NASDAQ Rules. Please see the section entitled “Corporate Governance” herein for further discussion of the roles and responsibilities of the Nominating and Corporate Governance Committee.

Board, Committee and Annual Meeting Attendance

For the fiscal year ended December 31, 2021, the Board and its Committees held the following aggregate number of regular and special meetings:

Board | 8 | |||

Audit Committee | 6 | |||

Compensation Committee | 5 | |||

Nominating and Corporate Governance Committee | 6 |

Each of our directors then serving attended 75% or more of the aggregate number of the meetings of the Board and of the Committees on which he or she served during the year.

The independent members of the Board, and each of the three standing committees of the Board, met in independent director sessions without the Chairman, Chief Executive Officer, or members of management present at least four (4) times during 2021.

The Board has adopted a policy pursuant to which directors are expected to attend the Annual Meeting of Stockholders in the absence of a scheduling conflict or other valid reason. All of our directors serving at such time attended the 2021 Annual Meeting of Stockholders, which was held by remote communication, in a “virtual only” format.

Board Leadership Structure and Board Oversight of Risk Management

Pursuant to our bylaws, our Board of Directors determines the best board leadership structure for the Company from time to time by appointing the Chairman of the Board. As part of our annual board self-evaluation process, the Board evaluates our leadership structure to ensure that it provides the optimal structure for the Company and stockholders. While we recognize that different board leadership structures may be appropriate for companies in different situations, we believe our current leadership structure, with Mr. Christenson serving as Chairman and CEO and with independent Board leadership provided by the appointment of a Lead Director, is the optimal structure for the Company.

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 11 |

Lyle Ganske , who has served on the Board since 2007, currently serves as the Lead Director. The Board believes that a Lead Director improves the Board’s overall performance by improving the efficiency of the Board’s oversight and governance responsibilities and by enhancing the relationship between the Chief Executive Officer and the independent directors. The Lead Director is expected to ensure that the Board has an open and trustful relationship with the Chief Executive Officer and the Company’s senior management team while optimizing the effectiveness and independence of the Board. Among other things, the Lead Director’s responsibilities include:

| • | helping to establish the highest standards of ethics and integrity; |

| • | calling, presiding over, setting agendas for, and chairing executive sessions and independent director meetings and providing feedback to the Chairman and Chief Executive Officer following such meetings; |

| • | counseling the Chairman and Chief Executive Officer on issues of interest or concern to directors and encouraging all directors to engage the Chairman and Chief Executive Officer with their interests and concerns; |

| • | working with the Chairman and Chief Executive Officer and the Board to develop an appropriate schedule of Board meetings and to set the agenda for Board meetings; |

| • | ensuring an appropriate and timely flow of information from management to allow directors to effectively and responsibly perform their duties and to facilitate director preparation for meetings; |

| • | leading the Board in all deliberations involving the Chief Executive Officer’s employment (including hiring, contract negotiations, performance evaluations and, where appropriate, dismissal) and providing feedback to the Chairman and Chief Executive Officer regarding performance; |

| • | ensuring full participation and engagement of all Board members in deliberations and providing feedback to directors if director contributions are not meeting expectations; and |

| • | working in conjunction with the Nominating and Corporate Governance Committee in compliance with its processes to interview vetted Board candidates. |

The Lead Director is expected to foster a cohesive Board that cooperates with the Chairman and Chief Executive Officer towards the ultimate goal of creating stockholder value.

Our Board of Directors currently has eight members, all of which except the Chairman and Chief Executive Officer, are independent. A number of the members of our Board of Directors are currently serving or have served as members of senior management of other public companies and have served as directors of other public companies. We have three board committees comprised solely of independent directors. We believe that the number of independent, experienced directors that make up our Board of Directors, along with the oversight of the Board of Directors by the Lead Director, provides our management with appropriate oversight, leadership, and guidance. In addition, our non-employee directors meet in executive session, led by our Lead Director, without management present as frequently as they deem appropriate, typically at the time of each regular board meeting.

Our Board is responsible for overseeing our risk management. The Board’s role in the Company’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, environmental, social and governance (ESG), and strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate person within the Company to enable the Board to understand our risk identification, risk management, and risk mitigation strategies. When a committee receives the report, the chairman of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board meeting. This enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. The Audit Committee also discusses guidelines and policies to govern the process by which risk management is handled. The Audit Committee discusses the Company’s major risk exposures and the steps management has taken to monitor and control such exposures. The Board believes that the work undertaken by the full Board, together with the work undertaken by the Audit Committee and the other committees, enables the Board to effectively oversee the Company’s risk management function.

| 12 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

DIRECTOR COMPENSATION

In October 2021, the Compensation Committee engaged the services of FW Cook to review the design and competitiveness of the Company’s non-employee director compensation program. FW Cook’s non-employee director compensation review found that total per-director compensation remained below the median of peer group practice. Following the 2021 FW Cook review, effective as of January 1, 2022, cash compensation for non-employee directors was increased from $85,000 to $90,000 annually and equity compensation for non-employee directors was increased from $115,000 to $130,000 annually.

Standard Board Fees

Our non-employee directors currently receive the following standard cash compensation (payable in equal quarterly installments):

Standard Cash Compensation | Total ($) | |||

Annual Retainer Fee | 90,000 | |||

Lead Director | 25,000 | |||

Chairman of the Audit Committee | 15,000 | |||

Chairman of the Compensation Committee | 15,000 | |||

Chairman of the Nominating and Corporate Governance Committee | 15,000 | |||

Directors may elect to receive, in lieu of their regular cash compensation as outlined above, an amount of shares of Company stock equal in value to the cash compensation that otherwise would be paid at the time such cash compensation would have been payable.

In addition, each of the non-employee directors receives grants of restricted stock with an annual value equal to $130,000 paid in four equal quarterly installments with each such quarterly grant vesting immediately.

All members of our Board of Directors are reimbursed for their usual and customary expenses incurred in connection with attending all Board and other committee meetings.

The following table sets forth information concerning compensation paid to our non-employee directors during the fiscal year ended December 31, 2021.

Non-Employee Director Compensation Table for Fiscal Year 2021

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

Lyle G. Ganske | 103,750 | (3) | 115,000 | — | — | 218,750 | ||||||||||||||

Scott Hall | 85,000 | 115,000 | — | — | 200,000 | |||||||||||||||

Nicole Parent Haughey | 85,000 | 115,000 | — | — | 200,000 | |||||||||||||||

Margot Hoffman | 97,500 | 115,000 | — | — | 212,500 | |||||||||||||||

Michael S. Lipscomb(4) | 27,500 | 28,750 | — | — | 56,250 | |||||||||||||||

Thomas Swidarski | 97,500 | 115,000 | — | — | 212,500 | |||||||||||||||

La Vonda Williams(5) | 21,250 | 28,750 | — | — | 50,000 | |||||||||||||||

James H. Woodward Jr. | 97,500 | 115,000 | — | — | 212,500 | |||||||||||||||

| (1) | These amounts reflect the aggregate grant date fair value of restricted stock awards granted in fiscal year 2021 in accordance with ASC Topic 718. For additional information on the valuation assumptions regarding the restricted stock awards, refer to Note 12 to our financial statements for the year ended December 31, 2021, which is included in our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC. |

| (2) | Stock grants to non-employee directors are paid in four equal quarterly installments. As of December 31, 2021, there were no outstanding unvested stock awards to non-employee directors. |

| (3) | Mr. Ganske has elected to receive, in lieu of regular cash compensation, an amount of shares of Company stock equal in value to the cash compensation that otherwise would be paid at the time such cash compensation would otherwise have been payable. As a result, for 2021, all of Mr. Ganske’s cash retainers were paid in shares of Company stock. |

| (4) | Mr. Lipscomb retired from the Board effective as of April 27, 2021. |

| (5) | Ms. Williams joined the Board effective as of October 19, 2021. |

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 13 |

Stock Ownership Guidelines

Our Board of Directors established stock ownership guidelines applicable to the Company’s non-employee directors pursuant to which each non-employee director should retain the value of Company stock equivalent to five (5) times his annual cash retainer. All of the Company’s non-employee directors have a five (5) year period to accumulate these specific values.

The following categories satisfy a participant’s ownership guidelines: (i) shares of common stock owned directly; (ii) shares of common stock owned indirectly (e.g., by a spouse or a trust); (iii) shares of common stock represented by amounts invested in a 401(k) plan or deferred compensation plan maintained by the Company or an affiliate; and (iv) restricted stock (vested and unvested), earned performance shares (vested and unvested), restricted stock units (vested and unvested), or phantom stock. Unexercised options, unearned performance shares, and pledged shares are not counted toward meeting the guidelines.

The Company’s Board of Directors has the discretion to enforce the stock ownership guidelines on a case-by-case basis. Violations of the Company’s stock ownership guidelines may, without limitation and in the Board’s discretion, result in the participant not receiving future grants of long-term incentive plan awards or annual equity retainer or result in the participant being required to retain all or a portion of future grants of long-term incentive plan awards or annual equity retainers until compliance is achieved.

Compensation Committee Interlocks and Insider Participation.

During our last completed fiscal year, no member of the Compensation Committee was an employee, officer, or former officer of Altra. None of our executive officers served on the board of directors or compensation committee of any entity in 2021 that had an executive officer serving as a member of our Board or Compensation Committee.

Certain Relationships and Related Person Transactions

Transactions with Directors and Management

Under our Code of Business Conduct and Ethics, all transactions involving a conflict of interest, including holding a financial interest in a significant supplier, customer, or competitor of the Company, are generally prohibited. However, holding a financial interest of less than 2% in a publicly held company and other limited circumstances are excluded transactions. Each director and officer is prohibited from using his or her position to influence the Company’s decision relating to a transaction with a significant supplier, customer, or competitor with which he or she is affiliated.

In addition, our Audit Committee Charter provides that the Audit Committee shall review, discuss and approve any transactions or courses of dealing with related parties (e.g., including significant stockholders of the Company, directors, corporate officers or other members of senior management or their family members) that are significant in size (including but not necessarily limited to transactions that exceed $120,000) or involve terms or other aspects that differ from those that would likely be negotiated with independent parties.

In December 2020, Altra invested $5.0 million for a minority equity interest in a privately held manufacturing software company, MTEK Industry AB (“MTEK”), over which the Company does not exert significant influence. During the second and third quarters of 2021, two Altra subsidiaries purchased software licenses, services and hardware from MTEK totaling approximately $367,130.

In September 2021, Alex Christenson (“Mr. A. Christenson”), the son of Carl Christenson, our CEO, began performing consulting services relating to product development, implementation and commercialization for MTEK (the “Engagement”). Mr. A. Christenson has received and continues to receive compensation from MTEK for consulting services at an annualized rate of approximately $142,800 per year, commensurate with market practice and comparable to that of consultants providing similar services.

In accordance with Altra policy, Mr. Christenson disclosed the Engagement which was reviewed and approved by the Audit Committee. The Company anticipates that in the future it may continue to purchase software licenses, services and hardware from MTEK as well as potentially make additional equity investments in MTEK. The Audit Committee will review and approve any such future investments or commercial transactions involving MTEK.

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. We believe that these agreements are necessary to attract and retain qualified persons as directors and executive officers. These agreements require us to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to us, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified. We also intend to enter into indemnification agreements with our future directors and executive officers.

| 14 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

Corporate Governance

The Nominating and Corporate Governance Committee’s Role and Responsibilities

Primary responsibility for Altra’s corporate governance practices rests with the Nominating and Corporate Governance Committee (the “Governance Committee”). The Governance Committee is responsible for, among other things, (i) overseeing the Company’s policies and procedures for the Board’s nomination of persons to stand for election to serve on the Board of Directors by stockholders and consideration of any stockholder nominations of persons to stand for election to the Board of Directors; (ii) identifying, screening and reviewing individuals qualified to serve as directors and recommending candidates for nomination for election or to fill vacancies; (iii) reviewing annually the composition and size of the Board; (iv) aiding the Board and its committees in their annual self-evaluations; (v) developing, recommending and overseeing implementation of the Company’s corporate governance guidelines and principles; (vi) reviewing, monitoring and addressing conflicts of interest of directors and executives officers; (vii) providing oversight and guidance with respect to environmental, social and governance (ESG) matters and the Company’s ESG activities; and (viii) reviewing on a regular basis the overall corporate governance of the Company and recommending improvements when necessary. To learn more about our commitment to corporate social responsibility, please see the “Environmental, Social and Governance” section of our website at https://ir.altramotion.com/corporate-responsibility/default.aspx. The contents of the ESG section of our website are referenced for general information only and are not incorporated into this Proxy Statement. Described below are some of the significant corporate governance practices that have been instituted by the Board of Directors at the recommendation of the Governance Committee.

Director Independence

The Governance Committee annually reviews the independence of all directors and reports its findings to the full Board. The Governance Committee has determined that the following directors are independent within the meaning of the NASDAQ Rules and relevant federal securities laws and regulations: Lyle G. Ganske, J. Scott Hall, Nicole Parent Haughey, Margot L. Hoffman, Ph.D., Thomas W. Swidarski, La Vonda Williams and James H. Woodward, Jr. Additionally, our Board determined that Michael S. Lipscomb, who previously served on our Board during 2021, was independent within the meaning of the NASDAQ Rules and relevant federal securities laws and regulations.

Board Evaluation

The Board of Directors has adopted a policy whereby the Governance Committee will assist the Board and its committees in evaluating their performance and effectiveness on an annual basis. As part of this evaluation, the Governance Committee assesses the progress in the areas targeted for improvement during previous evaluations and develops recommendations to enhance the respective Board or committee effectiveness over the next year.

Director Nomination Process

The Governance Committee reviews the skills, characteristics, and experience of potential candidates for election to the Board of Directors and recommends nominees for director to the full Board for approval. In addition, the Governance Committee assesses the overall composition of the Board of Directors, including factors such as size, composition, diversity, skills, significant experience and time commitment to Altra.

It is the Governance Committee’s policy to utilize a variety of means to identify prospective nominees for the Board, and it considers referrals from other Board members, management, stockholders, and other external sources such as retained executive search firms. The Governance Committee utilizes the same criteria for evaluating candidates irrespective of their source.

The Governance Committee believes that any nominee must meet the following minimum qualifications:

| • | Candidates should be persons of high integrity who possess independence, forthrightness, inquisitiveness, good judgment, and strong analytical skills. |

| • | Candidates should demonstrate a commitment to devote the time required for Board duties including, but not limited to, attendance at meetings. |

| • | Candidates should possess a team-oriented ethic consistent with Altra’s core values and be committed to the interests of all stockholders as opposed to those of any particular constituency. |

The Governance Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation, and backgrounds. Accordingly, when considering director candidates, the Governance Committee will seek individuals with backgrounds and qualities that, when combined with those of Altra’s other directors, provide a blend of skills and experience that will further enhance the Board’s effectiveness. The Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability, or any other basis proscribed by law.

To recommend a candidate for consideration, a stockholder should submit a written statement of the qualifications of the proposed nominee, including full name and address, to the Nominating and Corporate Governance Committee Chairman, c/o Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184.

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 15 |

Corporate Governance Guidelines

The Governance Committee has developed and recommended the Company’s Statement of Governance Principles, Policies and Procedures (the “Governance Principles”) which has been approved by our full Board. Altra’s Governance Principles are available on the Company’s website at https://ir.altramotion.com/governance/governance-documents/default.aspx. The contents of this section of our website are referenced for general information only and are not incorporated into this Proxy Statement .

Majority Voting Policy in Uncontested Director Elections

Our Board has adopted a majority voting policy in uncontested Director elections which is set forth in Altra’s Governance Principles. Under the policy, any nominee for Director who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election in an election of Directors that is not a contested election is expected to tender his or her resignation as a Director to the Board promptly following the certification of the election results. The Governance Committee will consider each resignation tendered under the policy and recommend to the Board whether to accept or reject it. The Board will act on each tendered resignation, taking into account the Governance Committee’s recommendation, within 90 days following the certification of the election results.

Business Conduct and Compliance

Altra maintains a Code of Business Conduct and Ethics (the “Code of Ethics”) that is applicable to all directors, officers and employees of the Company and all subsidiaries and entities controlled by the Company. It sets forth Altra’s policies and expectations on a number of topics, including conflicts of interest, protection and proper use of company assets, relationships with customers and vendors (business ethics), accounting practices, and compliance with laws, rules and regulations. A copy of the Code of Ethics is available on the Company’s website at https://ir.altramotion.com/governance/governance-documents/default.aspx. The information on our website is not incorporated by reference into, or a part of, this Proxy Statement. Individuals can report suspected violations of the Code of Ethics anonymously by contacting the Altra Compliance and Ethics Hotline at 1-866-368-1905 (or at any of the international phone numbers listed in Schedule 2 to the Code of Ethics). In the event the Company amends or waives any of the provisions of the Code of Ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller that relates to any element of the definition of “code of ethics” enumerated in Item 406(b) of Regulation S-K under the Securities Act of 1934, as amended, Altra intends to disclose these actions on the Company’s website.

Altra also maintains policies regarding insider trading and communications with the public (the “Insider Trading Policy”) and procedures for the Audit Committee regarding complaints about accounting matters (the “Whistleblower Policy”). The Insider Trading Policy sets forth the Company’s limitations regarding trading in Company securities and the handling of material non-public information. The Insider Trading Policy is applicable to directors, officers and employees of Altra and its subsidiaries, as well as any agent or consultant who has access to or has received material, non-public information, about the Company in the course of an engagement by or association with the Company, together with certain other persons or entities affiliated with or related to any of the foregoing (collectively, the “Covered Parties”) and is designed to help ensure compliance with federal securities laws.

The Insider Trading Policy contains a strict policy against any Covered Parties engaging in short-term or speculative transactions or hedging or monetization transactions involving the Company’s stock or other securities. All Covered Parties are prohibited from (i) selling the Company’s securities “short” – that is, selling securities that are not owned by the particular director, employee or other Covered Party, (ii) buying or selling puts (i.e., options to sell), calls (i.e., options to purchase), future contracts, or other forms of derivative securities relating to the Company’s securities, and (iii) engaging in hedging, monetization transactions or similar arrangements involving the Company’s securities, such as zero-cost collars and forward sale contracts. Additionally, each Company director and officer is prohibited from purchasing the Company’s securities on margin, borrowing against any account in which the Company’s securities are held, or pledging the Company’s securities as collateral for a loan; however, this prohibition does not apply to pledges of the Company’s securities in effect prior to February 12, 2013. The Insider Trading Policy does require, however, that existing pledges be minimized and terminated as soon as practicable.

The Whistleblower Policy was established to set forth the Audit Committee’s procedures to receive, retain, investigate and act on complaints and concerns of employees and stockholders regarding accounting, internal accounting controls and auditing matters, including complaints regarding attempted or actual circumvention of internal accounting controls. Accounting complaints may be made directly to the Chairman of the Audit Committee in writing as follows: Audit Committee Chairman, c/o Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184. A copy of the Audit Committee’s Whistleblower Policy and procedures may be requested from the Corporate Secretary, Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184.

Succession Planning

The Board of Directors recognizes that a sudden or unexpected change in leadership could cause the Company to experience management transition issues that could adversely affect the Company’s operations, relations with employees and results. Altra strives to create and maintain a respectful, rewarding, diverse, and inclusive work environment that allows our employees to develop meaningful careers. Working with Altra’s management team,

| 16 | 2022 PROXY STATEMENT Altra Industrial Motion Corp. |

the Board and Compensation Committee oversee matters including succession planning and development, compensation, benefits, talent recruiting and retention, employee engagement and diversity, equity and inclusion. Moreover, the Board of Directors and Altra’s management team believe that having a robust succession planning process in place is one critical element of a comprehensive program of good corporate governance. As a result, the Board and the Governance Committee periodically review succession plans for the Chief Executive Officer position and other key executive positions.

Communication with Directors

Stockholders or other interested parties wishing to communicate with the Board, the non-employee directors, or any individual director may do so by contacting the Lead Director of the Board by mail, addressed to Lead Director, c/o Altra Industrial Motion Corp., 300 Granite Street, Suite 201, Braintree, Massachusetts 02184.

All communications to the Board will remain unopened and be promptly forwarded to the Lead Director, who shall in turn forward them promptly to the appropriate director(s). Such items as are unrelated to a director’s duties and responsibilities as a Board member may be excluded from this policy by the Lead Director, including, without limitation, solicitations and advertisements; junk mail; product-related communications; job referral materials such as resumes; surveys; and material that is determined to be illegal or otherwise inappropriate. Before being discarded, the director(s) to whom such information is addressed is generally informed that the information has been removed, and that it will be made available to such director(s) upon request.

Altra Industrial Motion Corp. 2022 PROXY STATEMENT | 17 |

The following table sets forth names, ages and positions of the persons who are our executive officers as of March 16, 2022:

Name | Age | Position | ||||

Carl R. Christenson | 62 | Chairman and Chief Executive Officer | ||||

Todd B. Patriacca | 52 | Executive Vice President, Chief Financial Officer and Treasurer | ||||

Glenn E. Deegan | 55 | Chief Legal and Human Resources Officer | ||||

Craig Schuele | 58 | Executive Vice President of Marketing and Business Development | ||||

Carl R. Christenson, 62, has been our Chairman since April 2014, our Chief Executive Officer since January 2009 and a director since July 2007. Prior to his current position, Mr. Christenson served as our President and Chief Operating Officer from January 2005 to December 2008. From 2001 to 2005, Mr. Christenson was the President of Kaydon Bearings, a manufacturer of custom-engineered bearings and a division of Kaydon Corporation. Prior to joining Kaydon, Mr. Christenson held a number of management positions at TB Wood’s Incorporated and several positions at the Torrington Company. Mr. Christenson currently serves as a director at IDEX Corporation, a NYSE listed industrial manufacturer of highly engineered products. Mr. Christenson previously served as a director at Vectra Co., f/k/a OM Group, Inc., a NYSE listed technology-driven diversified industrial company, from 2014 to 2015. Mr. Christenson also is a member of the Board of Trustees of Manufacturers Alliance for Productivity and Innovation. Mr. Christenson holds a M.S. and B.S. degree in Mechanical Engineering from the University of Massachusetts and an M.B.A. from Rensselaer Polytechnic. In addition to more than twenty-five years of experience in manufacturing companies, Mr. Christenson brings vast knowledge of the Company’s business, structure, history and culture to the Board and the CEO position.

Glenn E. Deegan, 55, has been our Chief Legal and Human Resources Officer since May 2021. Prior to his current position, Mr. Deegan served as Executive Vice President since December 2019, Vice President, Legal and Human Resources since June 2009 and as our General Counsel and Secretary since September 2008. From March 2007 to August 2008, Mr. Deegan served as Vice President, General Counsel and Secretary of Averion International Corp., a publicly held global provider of clinical research services. Prior to Averion, from June 2001 to March 2007, Mr. Deegan served as Director of Legal Affairs and then as Vice President, General Counsel and Secretary of MacroChem Corporation, a publicly held specialty pharmaceutical company. From 1999 to 2001, Mr. Deegan served as Assistant General Counsel of Summit Technology, Inc., a publicly held manufacturer of ophthalmic laser systems. Mr. Deegan previously spent over six years engaged in the private practice of law and also served as law clerk to the Honorable Francis J. Boyle in the United States District Court for the District of Rhode Island. Mr. Deegan holds a B.S. from Providence College and a J.D. from Boston College Law School.

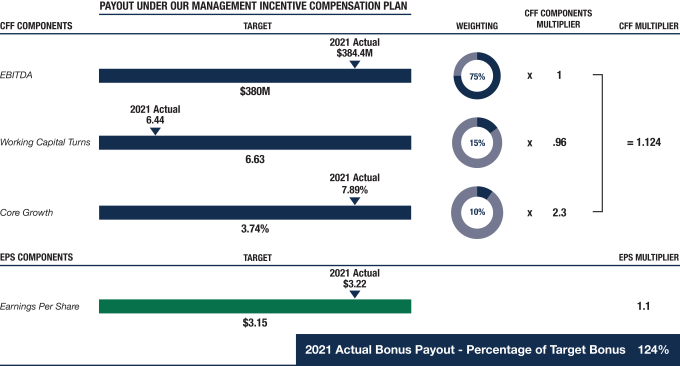

Todd B. Patriacca, 52, has been our Executive Vice President, Chief Financial Officer and Treasurer since February of 2022. Prior to his current position, Mr. Patriacca served as our Vice President of Finance, Corporate Controller and Treasurer since February 2010 and previously also held the role of Assistant Treasurer since October 2008. Previous to that, he served as Vice President of Finance and Corporate Controller since May 2007 and as Corporate Controller since May 2005. Prior to joining us, Mr. Patriacca was Corporate Finance Manager at MKS Instruments Inc. (“MKS”), a semi-conductor equipment manufacturer since March 2002. Prior to MKS, Mr. Patriacca spent over ten years at Arthur Andersen LLP in the Assurance Advisory practice. Mr. Patriacca is a Certified Public Accountant and holds a B.A. in History from Colby College and an M.B.A. and an M.S. in Accounting from Northeastern University.