UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| MSB FINANCIAL CORP. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth

the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1)Amount previously paid: |

(2) Form, Schedule or Registration Statement No.: |

(3) Filing Party: |

(4) Date Filed: |

[MSB Financial Corp. Letterhead]

October 18, 2013

Dear Fellow Stockholders:

On behalf of the Board of Directors and management of MSB Financial Corp. (the “Company”), I cordially invite you to attend our Annual Meeting of Stockholders (the “Meeting”) to be held at the Grain House at The Olde Mill Inn, 225 Route 202 North, Basking Ridge, New Jersey 07920, on November 18, 2013, at 2:00 p.m. The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Meeting.

The business to be conducted at the Meeting consists of (i) the election of four directors; (ii) the ratification of the appointment of independent auditors for the year ending June 30, 2014 (iii) an advisory (non-binding) proposal regarding executive compensation; and (iv) a non-binding advisory proposal regarding the frequency with which stockholders should vote on the Company’s executive compensation.. The Board of Directors recommends a vote “FOR” its nominees for director, “FOR” the ratification of the appointment of BDO USA, LLP as our independent auditors, “FOR” the advisory proposal regarding executive compensation and “FOR” the option that the say on pay proposal be considered every three years.

Even if you plan to attend the meeting, please sign, date and return the proxy card in the enclosed envelope immediately. This will not prevent you from voting in person at the Meeting, but will assure that your vote is counted if you are unable to attend the Meeting.

| | | | Sincerely, /s/ Michael A. Shriner Michael A. Shriner President and Chief Executive Officer |

1902 LONG HILL ROAD

MILLINGTON, NEW JERSEY 07946

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSTO BE HELD ON NOVEMBER 18, 2013

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of MSB Financial Corp. (the “Company”) will be held at the Grain House at The Olde Mill Inn, 225 Route 202 North, Basking Ridge, New Jersey 07920, on November 18, 2013, at 2:00 p.m. The Meeting is for the purpose of considering and acting upon the following matters:

| 1. | The election of four directors of the Company; |

| 2. | The ratification of the appointment of BDO USA, LLP as the Company’s independent auditors for the year ending June 30, 2014; |

| 3. | To approve an advisory (non-binding) proposal regarding our executive compensation; |

| 4. | To vote on a advisory (non-binding) proposal regarding the frequency with which stockholders should vote on the Company’s executive compensation; and |

| 5. | The transaction of such other business as may properly come before the Meeting, or any adjournments thereof. |

The Board of Directors is not aware of any other business to come before the Meeting.

The Board of Directors of the Company has determined that the matters to be considered at the Meeting, described in the Notice of Annual Meeting and accompanying Proxy Statement are in the best interest of the Company and its stockholders. For reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” its nominees for director, “FOR” the ratification of the appointment of BDO USA, LLP as our independent auditors, “FOR” the advisory proposal regarding executive compensation and “FOR” the option that the say on pay proposal be considered every three years.

Action may be taken on any one of the foregoing proposals at the Meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the Meeting may be adjourned. Pursuant to the Company’s bylaws, the Board of Directors has fixed the close of business on September 27, 2013 as the record date for determination of the stockholders entitled to vote at the Meeting and any adjournments thereof.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE REQUESTED TO SIGN, DATE AND RETURN THE PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE. You may revoke your proxy by filing with the Secretary of the Company a written revocation or a duly executed proxy bearing a later date. If you are present at the Meeting, you may revoke your proxy and vote in person on each matter brought before the Meeting. However, if you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your record holder to vote in person at the Meeting.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | /s/ Nancy E. Schmitz |

| | Nancy E. Schmitz Corporate Secretary |

Millington, New Jersey

October 18, 2013

Important Notice Regarding Internet Availability of Proxy Materials For the Stockholder Meeting to be Held on November 18, 2013 The Proxy Statement and Annual Report to Stockholders are available at www.millingtonsb.com/about-us/investor-relations.html |

OF

MSB FINANCIAL CORP.

1902 LONG HILL ROAD

MILLINGTON, NEW JERSEY 07946

ANNUAL MEETING OF STOCKHOLDERS

November 18, 2013

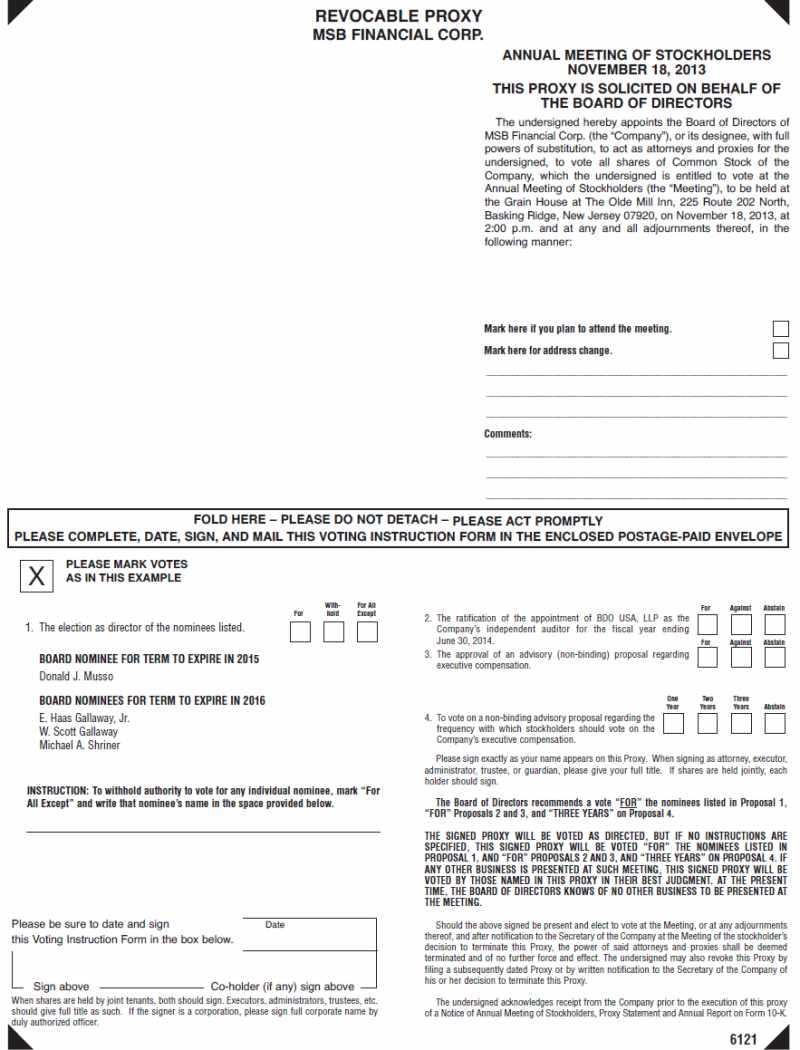

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of MSB Financial Corp. (the “Company”) to be used at the Annual Meeting of Stockholders of the Company which will be held at the Grain House at The Olde Mill Inn, 225 Route 202 North, Basking Ridge, New Jersey 07920, on November 18, 2013, at 2:00 p.m. (the “Meeting”). The accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement are being first mailed to stockholders on or about October 18, 2013.

At the Meeting, stockholders will consider and vote upon (i) the election of four directors; (ii) the ratification of the appointment of BDO USA, LLP (“BDO”), as our independent auditors for the year ending June 30, 2014; (iii) an advisory (non-binding) proposal regarding executive compensation; and (iv) a non-binding advisory proposal regarding the frequency with which stockholders should vote on the Company’s executive compensation. At the time this Proxy Statement is being mailed, the Board of Directors knows of no additional matters that will be presented for consideration at the Meeting. If any other business may properly come before the Meeting or any adjournment thereof, proxies given to the Board of Directors will be voted by its members in accordance with their best judgment. The Company is the parent company of Millington Savings Bank (the “Bank”). The Company is the majority-owned subsidiary of MSB Financial, MHC a federally-chartered mutual holding company.

VOTING AND PROXY PROCEDURES

Who Can Vote at the Meeting

You are only entitled to vote at the Meeting if our records show that you held shares of our common stock, $.10 par value (the “Common Stock”), as of the close of business on September 27, 2013 (the “Record Date”). If your shares are held by a broker or other intermediary, you can only vote your shares in person at the Meeting if you have a properly executed proxy from the record holder of your shares (or their designee). As of the Record Date, a total of 5,010,437 shares of Common Stock were outstanding. Each share of Common Stock has one vote in each matter presented.

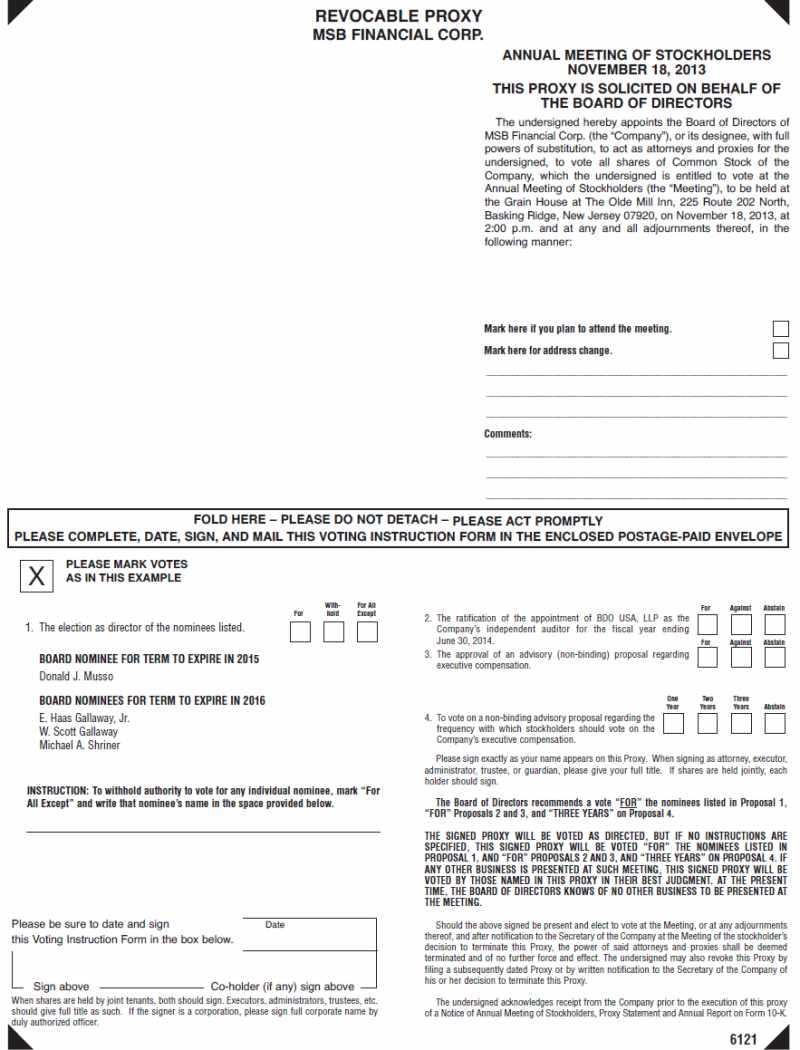

Voting by Proxy

The Board of Directors is sending you this Proxy Statement for the purpose of requesting that you allow your shares of Common Stock to be represented at the Meeting by the persons named in the enclosed Proxy Card. All shares of Common Stock represented at the Meeting by properly executed and dated proxies will be voted according to the instructions indicated on the Proxy Card. If you sign, date and return the Proxy Card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends a vote “FOR” its nominees for director, “FOR” the ratification of the appointment of BDO USA, LLP as our independent auditors, “FOR” the advisory proposal regarding executive compensation and “FOR” the option that the say on pay proposal be considered every three years.

If any matters not described in this Proxy Statement are properly presented at the Meeting, the persons named in the Proxy Card will vote your shares as determined by a majority of the Board of Directors. If the Meeting is postponed or adjourned, your Common Stock may be voted by the persons named in the Proxy Card on the new Meeting dates as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the Meeting.

You may revoke your proxy at any time before the vote is taken at the Meeting. To revoke your proxy you must either advise the Company’s Secretary in writing before your Common Stock has been voted at the Meeting, deliver a later-dated proxy, or attend the Meeting and vote your shares in person. Attendance at the Meeting will not in itself revoke your proxy.

If you hold your Common Stock in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this Proxy Statement. If you wish to change your voting instructions after you have returned a voting instruction form to your broker, bank or other nominee, you must contact your broker, bank or other nominee. Please note that your brokerage firm or other nominee may not vote your shares with respect to Proposal I, III or IV brokers without specific instructions from you as to how to vote because none of these Proposals are considered “routine” matters under New York Stock Exchange rules applicable to.

Internet Access to Proxy Materials

Copies of this Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended June 30, 2013 are available on the internet at www.millingtonsb.com/about-us/investor-relations.html. Stockholders can elect to receive future proxy statements and annual reports over the internet rather than in printed form. Stockholders of record can make this election by calling toll-free to 877-274-2040 or sending an e-mail to investorinfo@millingtonsb.com. If you hold your shares in street name, please refer to the information provided by your broker, bank or other nominee for instructions on how to elect to access future proxy materials over the internet.

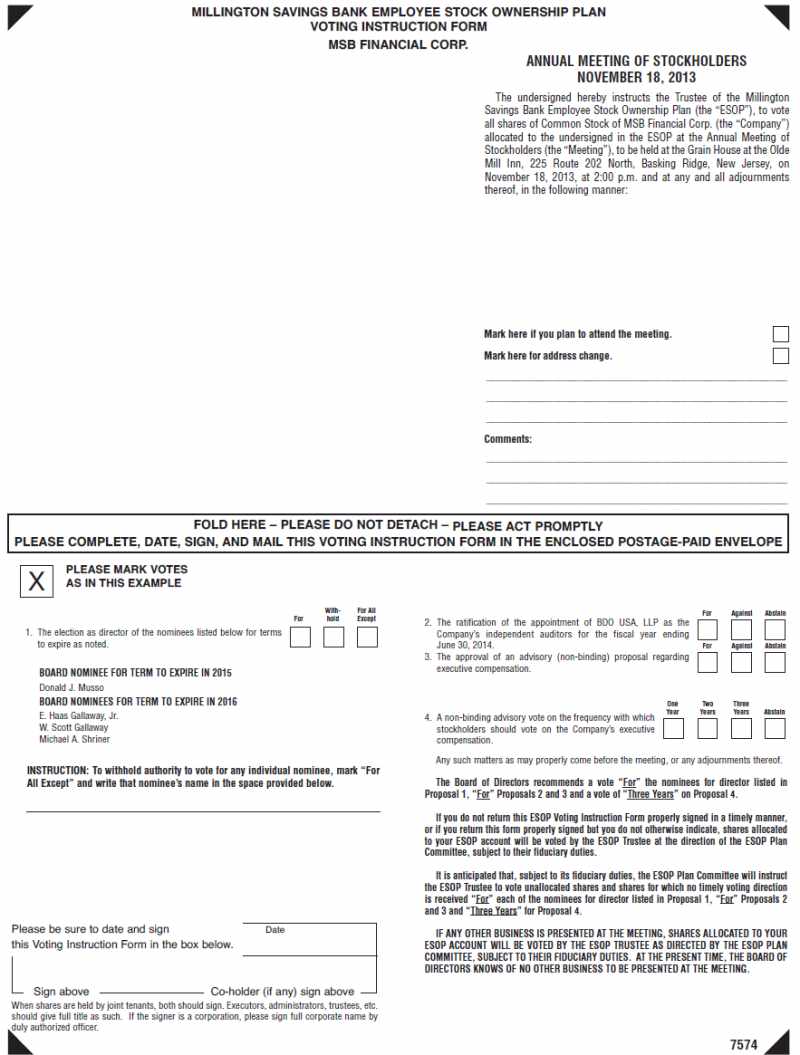

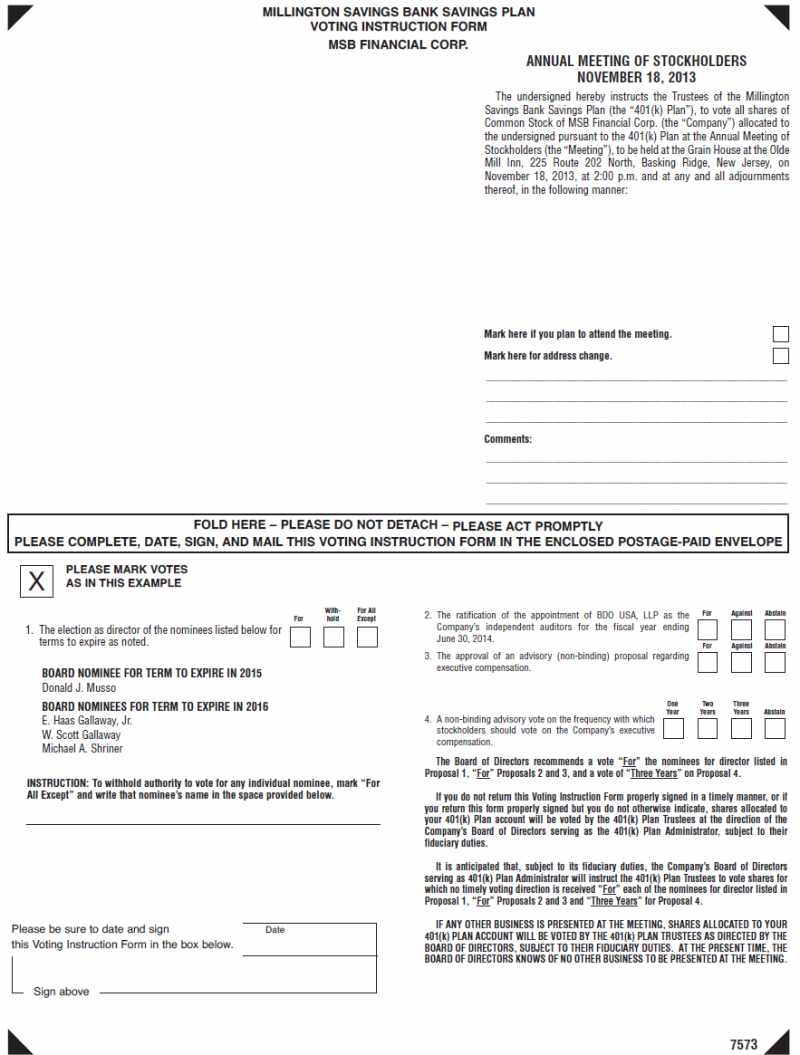

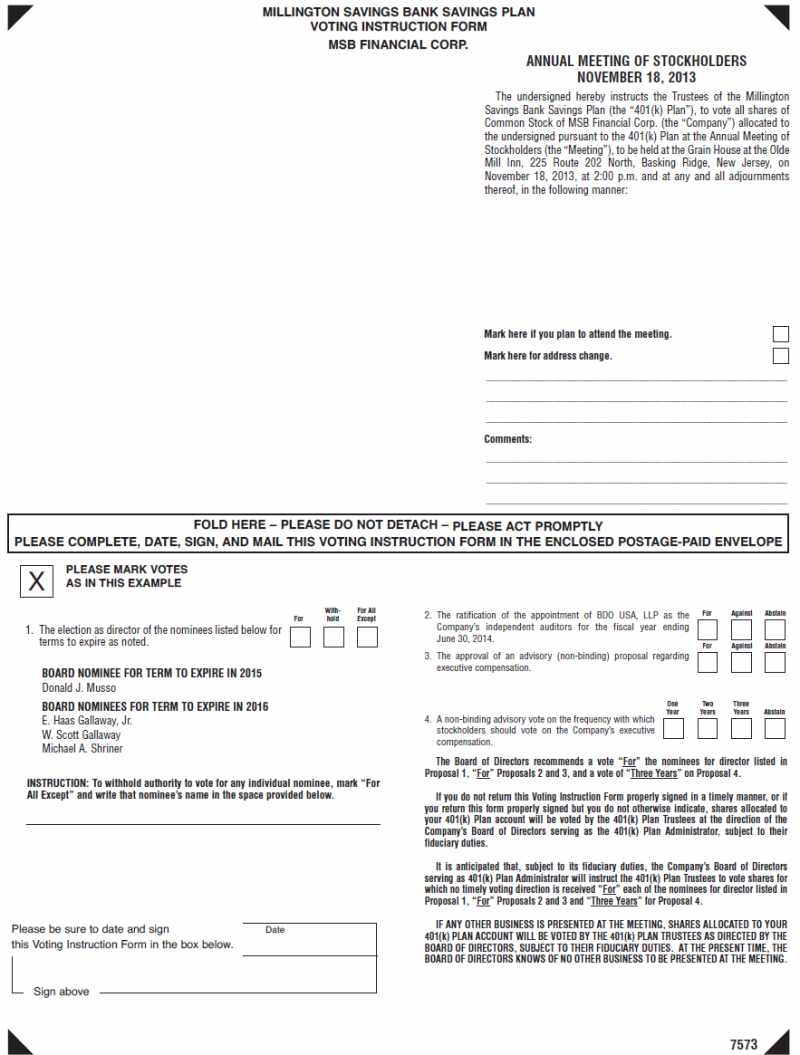

Participants in the Millington Savings Bank Employee Stock Ownership Plan and the Millington Savings Bank Savings Plan

If you are a participant in the Millington Savings Bank Employee Stock Ownership Plan (the “ESOP”) or hold Common Stock through the Millington Savings Bank Savings Plan (the “401(k) Plan”), you will receive a voting instruction form on behalf of each plan that reflects all shares you may vote under these plans. Under the terms of the ESOP, all shares held by the ESOP are voted by the ESOP trustee, but each participant in the ESOP may direct the trustee on how to vote the shares of Common Stock allocated to his or her account. Unallocated shares and allocated shares for which no timely voting instructions are received will be voted by the ESOP trustee as directed by the ESOP Committee consisting of the outside directors of the Board. Under the terms of the 401(k) Plan, you are entitled to direct the trustee how to vote the shares of Common Stock credited to your account in the 401(k) Plan. The 401(k) Plan trustee will vote all shares for which it does not receive timely instructions from participants at the direction of the Company’s Board of Directors or the Plan Committee of the Board. The deadline for returning your voting instruction form is November 13, 2013.

Vote Required

The presence in person or by proxy of at least a majority of the outstanding Common Stock entitled to vote is necessary to constitute a quorum at the Meeting. With respect to any matter, broker

non-votes (i.e., shares for which a broker indicates on the proxy that it does not have discretionary authority as to such shares to vote on such matter) will be considered present for purposes of determining whether a quorum is present.

As to the election of directors, the proxy provided by the Board of Directors allows a stockholder to vote for the election of the nominees, or to withhold authority to vote for the nominees being proposed. Under the Company’s bylaws, directors are elected by a plurality of votes cast, without regard to either (i) broker non-votes or (ii) proxies as to which authority to vote for the nominees being proposed is withheld.

In voting to ratify the appointment of BDO as our independent auditors (Proposal II) and the proposal regarding executive compensation (Proposal III), you may vote in favor of the proposal, against the proposal or abstain from voting. To be approved, these proposals require the affirmative vote of a majority of the votes cast at the Meeting. Broker non-votes and abstentions will not be counted as votes cast and will have no effect on the voting on these proposals. With respect to Proposal IV (the frequency vote), stockholders may vote to consider a say on pay proposal every one year, every two years or every three years, or may abstain from voting. This Proposal will be decided by a plurality of the votes cast without regard to broker non-votes or proxies marked “ABSTAIN” as to that matter.

PRINCIPAL HOLDERS OF OUR COMMON STOCK

The following table sets forth, as of the Record Date, certain information as to those persons who were known to be the beneficial owners of more than five percent (5%) of the Company’s outstanding shares of Common Stock and as to the shares of Common Stock beneficially owned by all executive officers and directors of the Company as a group.

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership (1) | | Percent of Shares of Common Stock Outstanding (2) |

| | | | | | |

PL Capital Group 20 E. Jefferson Avenue Naperville, Illinois 60540 | | 422,973 | (3) | | 8.44% | |

| | | | | | | |

MSB Financial, MHC 1902 Long Hill Road Millington, New Jersey 07946 | | 3,091,344 | | | 61.70% | |

| | | | | | | |

All directors and executive officers as a group (9 persons) | | 402,512 | (4) | | 7.68% | |

____________

| (1) | For purposes of this table, a person is deemed to be the beneficial owner of shares of Common Stock if he or she has or shares voting or investment power with respect to such shares or has a right to acquire beneficial ownership at any time within 60 days from the Record Date. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Except as otherwise noted, ownership is direct, and the named persons or group exercise sole voting and investment power over the shares of the Common Stock. |

| (2) | In calculating the percentage ownership of an individual or group, the number of shares outstanding is deemed to include any shares which the individual or group have the right to acquire through the exercise of options or otherwise within 60 days of the Record Date. |

| (3) | Based on a Schedule 13D/A dated December 11, 2007 and filed on December 17, 2007. |

| (4) | Includes 17,529 shares allocated to the accounts of executive officers under the ESOP. Includes 231,345 shares which the directors and executive officers have the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

PROPOSAL I – ELECTION OF DIRECTORS

The Company’s Charter requires that the Board of Directors be divided into three classes, as nearly equal in number as possible, each class to serve for a three-year period, with approximately one-third of the directors elected each year. The Board of Directors currently consists of seven members. One director will be elected at the Meeting, to serve for a two-year term and three directors will be elected at the Meeting, to serve for three-year terms, in all cases, and until their successors have been elected and qualified.

Donald J. Musso was appointed to the Board of Directors in 2013 to fill the vacancy created by the resignation of Albert N. Olsen. Under the Company’s bylaws any director appointed by the Board of Directors must stand for election at the next annual meeting of stockholders. In order for the classes to be as nearly equal as possible, Mr. Musso has been nominated for a two-year term ending in 2015. E. Haas Gallaway, Jr., W. Scott Gallaway and Michael A. Shriner have each been nominated by the Board of Directors to serve as directors for a three-year term ending in 2016. Each nominee is currently a member of the Board of Directors. It is intended that proxies solicited by the Board of Directors will, unless otherwise specified, be voted for the election of the named nominees. If any of the nominees is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the size of the Board may be reduced to eliminate the vacancy. At this time, the Board of Directors knows of no reason why any of the nominees might be unavailable to serve.

Set forth below is information about the Company’s and the Bank’s directors and executive officers and other senior management employees. Each director serves as a director of the Company and the Bank as well as MSB Financial, MHC.

Name and Positions with Company | | Age | | Year First Elected as Director of the Bank | | Current Term to Expire | | Shares of Common Stock Beneficially Owned (1)(2) | | Percent of

Class (3) | |

| | | | | | | | | | | | |

| BOARD NOMINEE FOR TERM TO EXPIRE IN 2015 |

Donald J. Musso Director | | 54 | | 2013 | | 2013 | | 1,100 | | * | |

| BOARD NOMINEES FOR TERMS TO EXPIRE IN 2016 |

E. Haas Gallaway, Jr. Director | | 72 | | 1987 | | 2013 | | 46,615 | | * | |

W. Scott Gallaway Director | | 67 | | 2000 | | 2013 | | 35,617 | (4) | * | |

Michael A. Shriner President, Chief Executive Officer and Director | | 49 | | 1999 | | 2013 | | 82,949 | (5) | 1.64% | |

| DIRECTORS CONTINUING IN OFFICE |

Thomas G. McCain Director | | 75 | | 1992 | | 2014 | | 44,069 | (4) | * | |

Ferdinand J. Rossi Director | | 71 | | 1975 | | 2014 | | 33,905 | (5) | * | |

Gary T. Jolliffe Director | | 69 | | 1992 | | 2015 | | 107,743 | (6) | 2.12% | |

| EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS |

Jeffrey E. Smith Vice President and Chief Financial Officer | | 63 | | N/A | | N/A | | 29,426 | | * | |

Nancy E. Schmitz Vice President and Corporate Secretary | | 57 | | N/A | | N/A | | 21,088 | (8) | * | |

__________________

| * | Less than 1.0% of shares outstanding. |

| (1) | As of the Record Date. |

| (2) | Includes stock held in joint tenancy; stock owned as tenants in common; stock owned or held by a spouse or other member of the individual’s household; stock allocated through certain employee benefit plans of the Company; stock in which the individual either has or shares voting and/or investment power and shares which the individual has the right to acquire at any time within 60 days of the Record Date. Each person or relative of such person whose shares are included herein exercises sole or shared voting and dispositive power as to the shares reported |

| (3) | In calculating the percentage ownership of an individual or group, the number of shares outstanding is deemed to include any share which the individual or group has the right to acquire through the exercise of options or otherwise within 60 days of the Record Date. |

| (4) | Includes 19,279 shares which the individual has the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

| (5) | Includes 7,572 shares allocated to Mr. Shriner’s account under the ESOP. Includes 55,082 shares which Mr. Shriner has the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

| (6) | Includes 60,590 shares which Mr. Jolliffe has the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

| (7) | Includes 5,393 shares allocated to Mr. Smith’s account under the ESOP. Includes 22,033 shares which Mr. Smith has the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

| (8) | Includes 4,564 shares allocated to Ms. Schmitz’s account under the ESOP. Includes 16,524 shares which Ms. Schmitz has the right to acquire pursuant to the exercise of options within 60 days of the Record Date. |

Biographical Information

Set forth below is the business experience for the past five years of each of the directors and executive officers of the Company. These biographies contain information regarding the person’s service as a director, business experience, other directorships at any point during the last five years with any other public companies, information regarding involvement with certain types of proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Nominating Committee and the Board to nominate the individual for re-election to the Board in 2013 as well as the experience, skills and attributes of the continuing directors that qualify them to serve on the Board.

Nominees for Director:

Donald J. Musso is President of FinPro, Inc., a consulting and financial advisory firm that he founded in 1987. FinPro, Inc., which is located in New Jersey, specializes in providing financial advisory services to the financial institutions industry. In 2012, Mr. Musso also formed FinPro Capital Advisors, Inc. as a wholly owned subsidiary of FinPro to conduct investment banking activities. Mr. Musso has a broad background in strategic planning, asset/liability management, market feasibility assessments, de novo bank formations and investment banking. He has significant experience as a founder, significant stockholder and board member of de novo financial institutions. Mr. Musso is on the faculty of Stonier Graduate School of Banking, the Graduate School of Bank Investments and Financial Management at the University of South Carolina, the Graduate School of Banking at Colorado and the Pacific Coast Banking School. Mr. Musso’s extensive experience in all aspects of banking as well as his knowledge of the market in which the Company operates makes him an extremely valuable member of the Board.

E. Haas Gallaway, Jr. served as president of Gallaway and Crane Funeral Home with principal offices located in Basking Ridge and a branch location located in Bernardsville, New Jersey until his retirement in September 2012. Mr. Gallaway will remain with the company as a Vice President. This firm was founded by his father, E. Haas Gallaway, Sr., in Millington in 1935 and moved to its present location in Basking Ridge in 1936. Mr. Gallaway has been associated with the firm since 1960, purchased a minority position in the firm in 1963 and the remainder of the corporation in 1976. He is a licensed funeral director in the states of New Jersey and Florida. Mr. Gallaway is a member and past president of the Morris County Funeral Directors’ Association, member of The New Jersey State Funeral Directors’ Association, member of National Funeral Directors’ Association, and member and past president of the Bernardsville Rotary Club, former director and past president of the Somerset Hills YMCA, and a past president of the Board of Directors of Honesty House formerly of Stirling. He is the brother of Mr. W. Scott Gallaway. With his extensive business background and knowledge of and stature in the communities in which the Company does business, Mr. Gallaway has been a significant contributor to the Board of Directors of the Company.

W. Scott Gallaway founded Gallaway Associates, a real estate brokerage and appraisal firm in 1975 and sold the brokerage portion to Remax Properties Unlimited in 2000. He is an equity partner and Broker/Salesperson with ReMax Alliance Realtors of Basking Ridge. Mr. Gallaway is also a licensed Real Estate Appraiser in the State of New Jersey. Mr. Gallaway is Past President of the Somerset County Board of Realtors, the Northern New Jersey Chapter of Homes for Living, the New Jersey Chapter of Certified Residential Brokers (CRB), and the Bernardsville Rotary Club. He has also served as Third District Vice President of the New Jersey Association of Realtors and Charter Scoutmaster of Troop 150, BSA, Bernardsville, N.J. He has also served on the Board of Directors of the Patriots Path Council, BSA and the Somerset Hills YMCA. Mr. Gallaway is Past Master of Congdon Overlook Lodge F&AM and Past President of the Masters, Wardens and Past Masters Association of the Eleventh District of New Jersey. Mr. Gallaway was honored as “Outstanding Citizen Volunteer of the Year” by the Borough of Bernardsville in 1993. He is the brother of E. Haas Gallaway, Jr. Mr. Gallaway’s Real Estate and

Appraisal experience and his stature in the community have made him a valuable member of the Board of Directors.

Michael A. Shriner has been employed by the Bank since 1987 and became a vice president in 1990, a senior vice president in 1997, the executive vice president in 2002 and the chief operating officer in 2006. In January 2012 he became President and Chief Executive Officer. He was appointed to the Board of Directors in 1999. Mr. Shriner currently serves and a member of the Enterprise Risk Management Committee with the New Jersey Bankers Association. He has previously served as chairman of the Mortgage Steering Committee of the New Jersey League of Community Bankers and was a member of the Residential Lending and Affordable Housing Committee, Consumer Lending and CRA Committee and Operations and Technology Committee. Mr. Shriner is a graduate of The National School of Banking (Fairfield University). He also serves as a trustee for HomeSharing, Inc. a non-profit organization located in central New Jersey. Mr. Shriner’s 25 years of banking experience, knowledge of Millington Savings Bank and the Company and leadership skills make him an integral part of the Board of Directors.

The Board of Directors unanimously recommends that stockholders vote “FOR” the election of the nominees.

Continuing Directors:

Dr. Thomas G. McCain became principal of the Fairmount Avenue School in Chatham, New Jersey in 1964 after having taught in Berlin, Connecticut. He left Chatham nine years later to become assistant superintendent of schools in Freeport, New York and in 1978 was appointed superintendent of schools in Bernardsville, New Jersey, the district from which he retired from public education in 1988. In 1991, Mr. McCain founded Learning Builders, a firm that provides planning and training services to schools and businesses in several states. After twenty two years as president and sole owner of the firm, Mr. McCain retired in 2013. Dr. McCain’s many years of management experience at the highest levels of public education together with his entrepreneurial experience make him a valued member of the Board of Directors.

Ferdinand (Fred) J. Rossi has recently retired as the township administrator for the Township of Morris in Morris County, New Jersey and had held that office since 1995. Previously, Mr. Rossi served as the county administrator for Morris County, New Jersey for 15 years, and the township clerk and then administrator for the Township of Long Hill (formerly Passaic Township) for 13 years. Mr. Rossi is a lifelong resident of Long Hill Township and has served as a member of the Board for nearly 40 years. He has also served as president of the New Jersey Association of County Administrators and Managers and is a former member and president of the Bernardsville Rotary Club. Mr. Rossi has gained critical knowledge about the communities in which we operate through the positions he has held, both elected and appointed and is an important contributor to the Board of Directors.

Gary T. Jolliffe served as President and Chief Executive Officer of the Company and the Bank until his retirement on December 31, 2011. Mr. Jolliffe joined the Bank in 1986 as its executive vice president and was appointed as its president in 1990. In 1992, he was also appointed to the position of chief executive officer and became a director. Mr. Jolliffe was a member of the Board of Governors of the New Jersey League of Community Bankers from 1999 through 2007 serving in numerous positions, including chairman of the New Jersey League of Community Bankers from 2004 to 2005. Mr. Jolliffe is a past member of the Board of Trustees of Freedom House Foundation, Glen Gardner, New Jersey, and a member of the Bernardsville Rotary Club in which he has held the positions of director, president, vice president and treasurer. Mr. Jolliffe’s 49 years of banking experience including nearly 27 years with the Bank and the Company combined with his knowledge of the communities make him an integral member of the Company’s Board of Directors.

Executive Officers Who Are Not Directors:

Jeffrey E. Smith has been employed by the Bank since 1996. He was appointed as controller for the Bank in 1998, became a Vice President in 2002, and in 2006 became Chief Financial Officer. Mr. Smith previously served as a vice president and the comptroller for United National Bank in Plainfield, New Jersey where he was employed for 12 years.

Nancy E. Schmitz joined the Bank in 1997 as a Commercial Lending Officer and Corporate Secretary. She was promoted to Vice President - Lending in 2006. Ms. Schmitz currently serves as a member of Lending Steering Committee with the New Jersey Bankers. She previously served on the Consumer Lending Committee of the New Jersey League of Community Bankers. Ms. Schmitz was previously employed by Lloyds Bank California for six years, where she completed a formal bank training program in Lending. She also worked at HomeFed Bank, headquartered in San Diego, California in the National Accounts group and with Imperial Corporation of America in their San Diego Corporate Banking Group. She also was a volunteer with the US Agency for International Development in the Republic of Kyrgyzstan.

Director Independence

The Board of Directors has determined that all directors with the exception of Gary T. Jolliffe and Michael A Shriner are considered independent under the independence standards of The Nasdaq Stock Market. In determining which directors are independent, the Board of Directors considered the deposit and other relationships described under “Related Party Transactions” but determined these relationships did not affect their independence. Except as disclosed, all loans and deposits made or accepted were on substantially the same terms that would be granted to other customers with similar credit or deposit balances. There are no members of the Audit Committee, Compensation Committee or Nominating Committee who do not meet the independence standards of The Nasdaq Stock Market for membership on such committees.

Meetings and Committees of the Board of Directors

The Board of Directors conducts its business through meetings of the Board and through activities of its committees. The Board maintains an Audit Committee, an Asset/Liability Management Committee, an Asset/Quality Committee, a Compensation Committee and a Nominating Committee. During the fiscal year ended June 30, 2013, the Board of Directors held 12 meetings. No director attended fewer than 75% of the total meetings of the Board and committees on which such director served during the fiscal year ended June 30, 2013.

The Audit Committee, a standing committee, is comprised of Directors W. Scott Gallaway (Chairman), Thomas G. McCain and Ferdinand J. Rossi. Each of the members of the Audit Committee is an independent director. The Audit Committee does not have an “audit committee financial expert.” However, the Board of Directors believes that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the committee. The committee has the authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Audit Committee recommends engagement of independent auditors, receives the internal and independent audit reports and recommends appropriate action. The Audit Committee met six times during the fiscal year ended June 30, 2013.

The Board of Directors has reviewed, assessed the adequacy of and approved a formal written charter for the Audit Committee, a copy of which can be found on the Company’s website at www.millingtonsb.com/about-us/investor-relations.html.

The Compensation Committee, a standing committee is comprised of Directors Thomas G. McCain (Chairman), E. Haas Gallaway, Jr. and Ferdinand J. Rossi. Each of the members of the Compensation Committee is an independent director within the requirements of NASDAQ. This committee meets annually to review management’s recommendations for management salaries and bonuses. The Compensation Committee met four times during the fiscal year ended June 30, 2013. The Compensation Committee operates under a formal written charter, a copy of which can be found on the Company’s web site at www.millingtonsb.com/about-us/investor-relations.html.

Director Nomination Process

The Nominating Committee, a standing committee, is comprised of Directors E. Haas Gallaway, Jr., W. Scott Gallaway, Thomas G. McCain, Donald J. Musso and Ferdinand J. Rossi. The Nominating Committee recommends to the full Board of Directors persons for selection as the Board’s nominees for election as directors. The Committee met two times during the fiscal year ended June 30, 2013. Members of the Nominating Committee who are nominees did not participate in their selection as nominees. Each member of the committee is an independent director. The responsibilities of the members of the Nominating Committee are set forth in a charter, a copy of which can be found on the Company’s website at www.millingtonsb/about-us/investor-relations.html.

The Company does not pay fees to any third party to identify or evaluate or assist in identifying or evaluating potential nominees. The process for identifying and evaluating potential nominees of the Board includes soliciting recommendations from directors and officers of the Company and the Bank. Additionally, the Board will consider persons recommended by stockholders of the Company in selecting nominees of the Board for election as directors. In the Board’s selection of nominees of the Board, there is no difference in the manner of evaluation of potential nominees who have been recommended by directors or officers of the Company and the Bank versus evaluation of potential nominees who have been recommended by stockholders. The Committee seeks nominees with excellent decision-making ability, business experience, personal integrity and reputation who are knowledgeable about the business activities and market areas in which the Company and the Bank engage. The Board does not have a specific policy regarding diversity of board nominees although it may consider diversity in market knowledge, experience, background, employment and other factors in selecting nominees.

To be considered in the Committee’s selection of individuals the Committee recommends to the Board for selection as the Board’s nominees, recommendations from stockholders must be received by the Company in writing by at least 120 days prior to the date the proxy statement for the previous year’s annual meeting was first distributed to stockholders. Recommendations should identify the submitting stockholder, the person recommended for consideration and the reasons the submitting stockholder believes such person should be considered.

Stockholder Communications

The Board of Directors does not have a formal process for stockholders to send communications to the Board. In view of the infrequency of stockholder communications to the Board of Directors, the Board does not believe that a formal process is necessary. Written communications received by the Company from stockholders are shared with the full Board no later than the next regularly scheduled Board meeting. The Board of Directors does not have a formal written policy regarding director attendance at annual meetings. However, the Board encourages directors to attend all annual meetings. All members of the Board of Directors attended the 2012 Annual Meeting.

Board Leadership Structure

Director Michael A. Shriner serves as President and Chief Executive Officer of the Company and Director W. Scott Gallaway serves as Chairman of the Board. The Board of Directors has determined that the separation of the offices of Chairman of the Board and Chief Executive Officer and President will enhance Board independence and oversight. Moreover, the separation of the Chairman of the Board and Chief Executive Officer and President will allow the Chief Executive Officer and President to better focus on his growing responsibilities of running the Company, enhancing stockholder value and expanding and strengthening our franchise while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management.

Board’s Role in the Risk Management Process

We face a number of risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputation risk. Management is responsible for the day-to-day management of the risks the Company faces, while the Board, as a whole and through its committees, in particular the Audit Committee, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. In addition, the Board has appointed a Chief Risk Officer who reports to the Board at each meeting on risk management issues. Other members of Senior management attend the Board meetings and are available to address any questions or concerns raised by the Board on risk management and any other matters. The Chairman of the Board and independent members of the Board work together to provide strong, independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings of independent directors.

Summary Compensation Table. The following table sets forth the cash and non-cash compensation awarded to or earned during the last two fiscal years by the Chief Executive Officer and the two other executive officers whose total compensation during the fiscal year ended June 30, 2013 exceeded $100,000 for services rendered in all capacities to MSB Financial Corp., Millington Savings Bank and MSB Financial, MHC. We refer to these individuals in this Proxy Statement as the “named executive officers.”

| Name and Principal Position | | Year | | Salary | | Bonus | | Stock

Award | | Option

Award | | Non-Equity

Incentive Plan

Compensation | |

All Other

Compensation | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Michael A. Shriner President, Chief Executive Officer

and Director | | 2013

2012 | | $ | 181,480

178,268 | | $ | 7,500

-- | | $ | --

-- | | $ | --

-- | | $ | --

-- | | $ | 34,419 26,897 | (1) | | $ | 223,399

205,165 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Jeffrey E. Smith Vice President and Chief Financial

Officer | | 2013

2012

| | $ | 129,064

126,116 | | $ | --

-- | | $ | --

-- | | $ | --

-- | | $ | -- -- | | $ | 10,637

11,480 | (2) | | $ | 139,701

137,596 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Nancy E. Schmitz Vice President and Corporate

Secretary | | 2013

2012 | | $

| 108,524

106,087 | | $ | --

-- | | $ | --

-- | | $ | --

-- | | $ | --

-- | | $ | 8,581

9,192 | (3) | | $ | 117,105

115,279 | |

| ____ | _____________________ |

| (1) | All Other Compensation for Mr. Shriner consists of $385 for life insurance, $10,737 for reimbursed auto expense, an employer contribution to the 401(k) Plan in the amount of $5,669 the value of shares allocated to Mr. Shriner’s account under the ESOP in the amount of $8,580, dividends on restricted stock of $397 and Director Pension expense in the amount of $8,651. |

| (2) | All Other Compensation for Mr. Smith consists of $935 for life insurance, an employer contribution to the 401(k) Plan in the amount of $3,797, the value of shares allocated to Mr. Smith’s account under the ESOP in the amount of $5,747 and dividends on restricted stock of $158. |

(3) | All Other Compensation for Ms. Schmitz consists of $437 for life insurance, an employer contribution to the 401(k) Plan in the amount of $3,193, the value of shares allocated to Ms. Schmitz’s account under the ESOP in the amount of $4,832 and dividends on restricted stock of $119. |

Outstanding Equity Awards at Fiscal Year End. The following table sets forth information on an award-by-award basis with respect to options and restricted stock awards held at fiscal year end by each of the named executive officers, as well as the value of such awards held by such persons at the end of the fiscal year.

| | | | Stock Awards | |

| | Option Awards | | | | Market | |

| | | Number of | | Number of | | | | | | Number of | | Value of | |

| | | Securities | | Securities | | | | | | Shares or | | Shares or | |

| | | Underlying | | Underlying | | | | | | Units of | | Units of | |

| | | Unexercised | | Unexercised | | Option | | Option | | Stock That | | Stock That | |

| | | Options | | Options | | Exercise | | Expiration | | Have Not | | Have Not | |

| Name | | Exercisable | | Unexercisable | | Price | | Date | | Vested | | Vested | |

| | | | | | | | | | | | | | | | |

| Michael A. Shriner | | 55,082(1) | | 0 | | $10.75 | | 5/09/18 | | 8,812 (2) | | $ | 64,680 (3) | |

| | | | | | | | | | | | | | | | |

| Jeffrey E. Smith | | 22,033(1) | | 0 | | $10.75 | | 5/09/18 | | 3,524 (2) | | $ | 25,866 (3) | |

| | | | | | | | | | | | | | | | |

| Nancy E. Schmitz | | 16,524(1) | | 0 | | $10.75 | | 5/09/18 | | 2,644 (2) | | | 19,407 (3) | |

_____________

| (1) | The named executive officers received an option grant on May 9, 2008. All options outstanding vest in 20% increments beginning May 9, 2009. |

| (2) | The named executive officers received a grant of restricted stock on December 14, 2009. All awards of restricted stock vest in 20% equal annual increments beginning December 14, 2010. |

| (3) | The market value of the shares of restricted stock that have not yet vested is calculated using the closing sale price for the Common Stock on June 30, 2013 of $7.34. |

Executive Incentive Retirement Plan. The Bank’s executive incentive retirement plan provides for equal annual installments for a period of 15 years commencing on the first day of the calendar month following the termination of employment due to retirement, resignation, disability or death. All payments under the plan are in accordance with Internal Revenue Code Section 409A. The amount payable is based on the vested balance of the executive’s accumulated awards plus interest at the prime rate published in The Wall Street Journal, credited quarterly, but no less than 4% or greater than 12%. The annual awards are based upon the executive’s base salary in effect at the beginning of the plan year and the Bank’s attainment of net income targets for the completed fiscal year as compared to the prior fiscal year. During fiscal year 2013, the executive incentive plan was amended to provide that no award will be made with respect to any fiscal year unless net income for the Company exceeds $1.0 million. The percentage vested is based on the sum of the executive’s age and years of service. The participant becomes fully vested at age 65, death, disability or upon a change in control of the Bank. Upon the death of the participant, the beneficiary shall receive the remaining balance paid in a lump sum.

Split Dollar Life Insurance Agreement. The Bank has entered into Life Insurance Agreements with Messrs. Shriner and Smith and Ms. Schmitz, which provide a death benefit equal to the following: if the executive is: (i) employed by the Bank at the time of his or her death, (ii) has retired from employment with the Bank after completion of not less than twenty (20) years of service with the Bank, or (iii) has retired from employment with the Bank and at such date of retirement the sum of the executive’s age and years of service equals not less than 70, then the executive’s beneficiary is entitled to payment of an amount equal to 200% of the executive’s highest annual base salary (not including bonus, equity compensation, deferred compensation or any other forms of compensation) in effect at the Bank at any time during the three calendar years prior to the date of retirement or death of the executive. The maximum death benefits for Messrs. Shriner and Smith and Ms. Schmitz are approximately $362,960, $258,128 and $217,048, respectively.

If a change in control of the Bank shall occur prior to the executive’s termination of employment or retirement, then the death benefit coverage shall remain in effect until the executive’s death, unless

the agreement is otherwise terminated pursuant to its terms prior to such date of a change in control. Coverage under the agreement for the executive who terminates employment with the Bank (for reasons other than death or a change in control of the Bank) prior to completion of at least ten years of service with the Bank (and prior to the occurrence of a change of control) will cease on his or her last day of employment with the Bank.

401(k) Savings and Profit Sharing Plan (“401(k) Plan”). The Millington Savings Bank 401(k) Plan is a tax-qualified defined contribution savings plan with a profit sharing component for the benefit of all eligible employees. Pursuant to the 401(k) Plan, employees may also voluntarily elect to defer between 1% and 80% of their compensation as 401(k) savings under the 401(k) Plan, not to exceed applicable limits under federal tax laws. In addition, the 401(k) Plan had previously provided for a profit-sharing component and an annual contribution is made by the Bank to the 401(k) Plan for all employees who have completed twelve months of service. This component was suspended effective January 1, 2012. The 401(k) Plan also provides for matching contributions up to a maximum of 50% of the first 6% of a person’s salary for each participant. Employee contributions are immediately fully vested. Matching contributions and any annual profit-sharing contribution are vested at a rate per year after three years of service.

Employee Stock Ownership Plan (“ESOP”). The Bank has established the Millington Savings Bank ESOP for the exclusive benefit of participating employees of Millington Savings Bank. Participating employees are salaried, full-time employees who have completed at least one year of service and have attained the age of 21. Benefits may be paid either in shares of the common stock or in cash. Contributions to the ESOP and shares released from the suspense account will be allocated annually among participants on the basis of compensation. Participant benefits become fully vested in their ESOP allocations following five years of service. Employment service before the adoption of the ESOP is credited for the purposes of vesting. Contributions to the ESOP by Millington Savings Bank are discretionary, but are anticipated to be sufficient in amount necessary for the ESOP to meet the debt service obligations on the ESOP loan. As of June 30, 2013, 101,172 shares had been allocated under the ESOP.

Employment Agreements

The Bank has entered into employment agreements with Messrs. Shriner and Smith and Ms. Schmitz. Mr. Shriner’s, Mr. Smith’s and Ms. Schmitz’ current base salaries are $181,480, $129,064 and $108,524, respectively. Messrs. Shriner’s and Smith’s employment agreements have terms of three years and Ms. Schmitz’ agreement has a one year term. Each of the agreements provides for an annual one-year extension of the term of the agreement upon determination of the Board of Directors that the executive’s performance has met the requirements and standards of the Board, so that the remaining term of the agreement continues to be three years in the case of Messrs. Shriner and Smith, and one year in the case of Ms. Schmitz. If the Bank terminates Messrs. Shriner or Smith or Ms. Schmitz without “just cause” as defined in the agreement, they will be entitled to a continuation of their salary from the date of termination through the remaining term of their agreement, but in no event for a period of less than 12 months and during the same period, the cost of obtaining all health, life, disability, and other benefits at levels substantially equal to those being provided on the date of termination of employment. All of the employment agreements provide that if their employment is terminated without just cause within twenty-four months of a change in control, they will be paid a lump sum amount equal to approximately three times their base salary in the case of Mr. Shriner and Mr. Smith and one times her base salary in the case of Ms. Schmitz. If change in control payments had been made under the agreements as of June 30, 2013, the payments would have equaled approximately $544,440, $387,192 and $108,524 to Mr. Shriner, Mr. Smith and Ms. Schmitz, respectively.

The following table sets forth information regarding the compensation of the Company’s directors for the fiscal year ended June 30, 2013. Mr. Shriner also serves as a director, and his compensation is detailed above under “Executive Compensation.” There were no stock or option awards in the fiscal year ended June 30, 2013.

Director (1)(2) | Board Fees | All Other Compensation (3) | Total |

| | | | |

| Gary Jolliffe | $34,500 | $50,495 | $84,995 |

| E. Haas Gallaway, Jr. | $36,900 | $ 8,704 | $45,604 |

| W. Scott Gallaway | $49,200 | $20,299 | $69,499 |

| Thomas G. McCain | $39,600 | $ 1,592 | $41,192 |

Donald J. Musso (4) Albert N. Olsen (5) | $ 6,000 $29,100 | $ 0 | $ 6,000 |

| Ferdinand J. Rossi | $38,100 | $ 9,161 | $47,261 |

___________________

| (1) | As of June 30, 2013, each director listed on the table above other than Gary Jolliffe and Donald J. Musso held 3,085 shares of restricted common stock. Gary Jolliffe held 9,695 shares of restricted common stock. Donald J. Musso did not hold any shares of restricted common stock. |

(2) | There were no options granted during the fiscal year ended June 30, 2013. As of June 30, 2013, the aggregate number of options held by these individuals (each with an exercise price of $10.75 per share) was as follows: Gary Jolliffe 60,590; E. Haas Gallaway, Jr. 19,279; W. Scott Gallaway 19,279; Thomas G. McCain 19,279; Donald J. Musso 0, and Ferdinand J. Rossi 19,279. |

| (3) | All Other Compensation for all directors other than Director Musso consists of the Bank’s contributions under the Directors Consultation and Retirement Plan as follows: Gary Jolliffe $25,059; E. Haas Gallaway, Jr. $8,565; W. Scott Gallaway $20,160; Thomas G. McCain $1,453; Ferdinand J. Rossi $9,022. For Director Jolliffe, All Other Compensation consisted of $25,000 paid pursuant to the Nonsolicitation and Noncompetition Agreement entered into between Mr. Jolliffe and the Company)(see “ — Nonsolicitation and Noncompetition Agreement” below) and $436 in dividends on shares of restricted stock. In addition, each director, other than Director Musso, listed on the table above received dividends on restricted stock awards of $139. Mr. Musso is not a participant in the Directors Consultation and Retirement Plan. |

| (4) | Donald J. Musso was appointed to the Board of Directors effective April 26, 2013. |

| (5) | Albert N. Olsen retired as a voting member of the Board of Directors effective December 31, 2012. Board fees in the table above reflect all fees paid to Mr. Olsen in his capacity as a voting member of the Board. As a Director Emeritus, he is entitled to receive a fee of $1,000 per meeting attended. |

Board Fees. Directors currently are compensated only for their service as directors of the Bank, and no additional compensation is paid for serving on the Boards of MSB Financial Corp. or MSB Financial, MHC. For the year ended June 30, 2013, the Bank paid a fee of $2,700 per board meeting. The chairman of the Board of Directors currently is paid a fee of $4,200 per board meeting. The Board has regular meetings on a monthly basis for a total of 12 meetings per year. Directors are paid a flat monthly fee of $300 for their committee participation. Directors who serve on the Audit Committee and/or the Compensation Committee also receive an additional payment of $300 per meeting. The Chairmen of the Audit Committee and the Compensation Committee receive a payment of $600 per meeting.

Directors Consultation and Retirement Plan (the “DCRP”). This plan provides retirement benefits to certain directors of the Bank based upon the number of years of service to the Bank’s board. All of the current members of the Board, with the exception of Director Musso, are eligible to participate in the plan. To be eligible to receive benefits under the DCRP, a director must have completed at least 10 years of service and must not retire from the board prior to reaching 65 years of age. If a director agrees to become a consulting director to the Bank’s board upon retirement, he will receive a monthly payment

equal to 30% to 60% of the highest Bank’s board fee and retainer in effect during the three-year period prior to the date of retirement based on the number of years of service as a director. Benefits under the DCRP begin upon a director’s retirement and are paid for 120 months; provided, however, that in the event of a director’s death prior to the receipt of all monthly payments, payments shall continue to the director’s surviving spouse or estate until 120 payments have been made. The retirement benefit amount is payable to the participant for an additional period of 24 months for each additional period of five years of service completed by the director in excess of twenty years of service as of their actual retirement date. In the event there is a change in control (as defined in the DCRP), all directors will be presumed to have a minimum of 20 years of service and attained age 65 under the DCRP and each director will receive a lump sum payment equal to the present value of future benefits payable. All payments under the plan need to be in accordance with Code Section 409A. Benefits under the DCRP are unvested and forfeitable until retirement at or after age 65 with at least 10 years of service, termination of service following a change in control, disability following at least 10 years of service or death.

Nonsolicitation and Noncompetition Agreement. Effective December 31, 2011, in connection with his retirement, the Company entered into a Nonsolicitation and Noncompetition Agreement with Mr. Jolliffe. Pursuant to the terms of the Agreement, for a period of 24 months beginning on the day after Mr. Jolliffe’s retirement as President and Chief Executive Officer of the Company, Mr. Jolliffe has agreed to refrain from engaging in any Competition (as such term is defined in the Agreement) with the Company or any of its subsidiaries. In exchange for such agreement, Mr. Jolliffe will be entitled to receive the payment of $25,000 per year, payable in quarterly installments.

RELATED PARTY TRANSACTIONS

No directors, executive officers or their immediate family members were engaged, directly or indirectly, in transactions with the Company or any subsidiary during any of the three years ended June 30, 2013 that exceeded $120,000 (excluding loans with Millington Savings Bank).

Millington Savings Bank makes loans to its officers, directors and employees in the ordinary course of business. All directors and employees are offered a 50 basis point reduction on interest rates for consumer loans or primary residence mortgage loans. Such loans do not include more than the normal risk of collectibility or present other unfavorable features. Set forth below is a schedule of all loans to directors and executive officers for which a discount on the interest rate has been given:

Name of Related | Nature of Relationship | Net Interest Rate | Largest Amount

Outstanding

During Fiscal Year ended | Current

Balance

as of

6/30/2013 | Amt of

Principal

repaid | Secured or Not Secured |

| E. Haas Gallaway | Director | 4.00% | $ 40,059.24 | $ 0.00 | $ 40,059.24 | Secured |

| E. Haas Gallaway | Director | 2.75% | 0.00 | 0.00 | 0.00 | Secured |

| Gary T. Jolliffe | Director and past CEO & President | 2.75% | 24,568.55 | 0.00 | 24,568.55 | Secured |

| Gary T. Jolliffe | Director and past CEO & President | 5.00% | 181,606.52 | 0.00 | 181,606.52 | Secured |

| Gary T. Jolliffe | Director and past CEO & President | 5.00% | 94,093.60 | 0.00 | 94,093.60 | Secured |

| Albert N. Olsen | Director | 2.75% | 170,938.33 | 0.00 | 170,938.33 | Secured |

| Albert N. Olsen | Director | 2.75% | 450,000.00 | 435,307.55 | 14,692.45 | Secured |

| Albert N. Olsen | Director | 2.75% | 125,000.00 | 124,300.00 | 144,850.00 | Secured |

| Ferdinand J. Rossi | Director | 2.75% | 0.00 | 0.00 | 0.00 | Secured |

| Michael A. Shriner | Director and current CEO & President | 6.75% | 1,100.00 | 0.00 | 1,500.00 | Unsecured |

| Michael A. Shriner | Director and current CEO & President | 2.75% | 9,644.56 | 2,690.82 | 38,759.65 | Secured |

| Michael A. Shriner | Director and current CEO & President | 4.50% | 217,312.88 | 0.00 | 217,312.88 | Secured |

| Michael A. Shriner | Director and current CEO & President | 2.75% | 285,000.00 | 283,719.06 | 1,280.94 | Secured |

| Jeffrey E. Smith | Executive Officer | 2.75% | 67,213.07 | 0.00 | 67,213.07 | Secured |

| Jeffrey E. Smith | Executive Officer | 5.00% | 28,147.51 | 25,218.13 | 2,929.38 | Secured |

| Jeffrey E. Smith | Executive Officer | 2.75% | 67,000.00 | 66,698.86 | 301.14 | Secured |

| Nancy E. Schmitz | Executive Officer | 6.75% | 2,100.00 | 0.00 | 3,550.00 | Unsecured |

| Thomas G. McCain | Director | 6.75% | 0.00 | 0.00 | 0.00 | Unsecured |

| | | | | | | |

Other than Messrs. Shriner and Jolliffe, all of the directors are independent directors.

PROPOSAL II – RATIFICATION OF THE APPOINTMENT OFTHE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On July 2, 2013, the Company dismissed ParenteBeard LLC (“ParenteBeard”), as the Company’s auditors and, with the approval of the Audit Committee of the Company’s Board of Directors, on July 2, 2013, appointed BDO as its independent registered public accounting firm.

The reports of ParenteBeard on the Company’s consolidated financial statements as of and for the fiscal years ended June 30, 2012 and 2011 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s two most recent fiscal years and during the interim period from the end of the most recently completed fiscal year through the date of their dismissal, there were (i) no disagreements with ParenteBeard on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of ParenteBeard would have caused it to make reference to such disagreement in its reports on the Company’s financial statements; and (ii) no “reportable events” (as such term is defined in Item 304(a)(2)(v) of Regulation S-K).

During the Company’s two most recently completed fiscal years and through the date of the Company’s engagement of BDO, the Company did not consult with BDO regarding the application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and no written or oral advice was provided by BDO that was an important factor considered by the Company in reaching a decision as to accounting, auditing or financial reporting issues.

The Company’s independent registered accounting firm, or principal accountant, for the fiscal year ended June 30, 2013 was BDO. The Audit Committee of the Board of Directors of the Company has re-appointed BDO as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014, subject to ratification of such appointment by our stockholders. A representative of BDO is expected to be present at the Meeting, will have the opportunity to make a statement if he or she so desires, and is expected to be available to respond to appropriate questions.

The Board of Directors unanimously recommends that stockholders vote “FOR” the ratification of the appointment of BDO as the Company’s auditors for the 2014 fiscal year.

Principal Accounting Fees and Services

The Securities and Exchange Act of 1934, as amended, requires all auditing services and non-audit services provided by an issuer’s independent auditor to be pre-approved by the issuer’s audit committee. The Company’s Audit Committee has adopted a policy of approving all audit and non-audit services prior to the service being rendered. All of the services provided by the Company’s independent auditor, (BDO for the fiscal year ended June 30, 2013 and ParenteBeard for the fiscal year ended June 30, 2012) were approved by the Audit Committee prior to the service being rendered.

Audit Fees. The fees incurred by the Company for audit services provided by BDO for the fiscal year ended June 30, 2013 and ParenteBeard for the fiscal year ended June 30, 2012 were $55,334 and $99,083, respectively. These fees include professional services rendered for the audit of the Company’s annual consolidated financial statements and review of consolidated financial statements included in the

Company’s Quarterly Reports on Form 10-Q, and services normally provided in connection with statutory and regulatory filings, including administrative and out-of-pocket expenses.

Audit Related Fees. The Company did not incur any audit-related fees for services provided by BDO and ParenteBeard reasonably related to the performance of the audit for the fiscal years ended June 30, 2013 and June 30, 2012, respectively.

Tax Fees. The fees incurred by the Company for services provided by BDO and ParenteBeard related to the preparation of state and federal tax returns for the fiscal years ended June 30, 2013 and 2012, respectively, were $8,750 and $8,400, respectively.

All Other Fees. The Company did not incur any other fees payable to BDO for the fiscal year ended June 30, 2013 and incurred $22,000 in fees for other services provided by ParenteBeard for the fiscal year ended June 30, 2012 related to XBRL compliance.

REPORT OF THE AUDIT COMMITTEE

For the fiscal year ended June 30, 2013, the Audit Committee: (i) reviewed and discussed the Company’s audited consolidated financial statements with management; (ii) discussed with the Company’s independent auditor, BDO, all matters required to be discussed under Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and (iii) received the written disclosures and the letter from BDO as required by applicable requirements of the Public Company Accounting Oversight Board regarding BDO’s communications with the Audit Committee concerning independence and discussed with BDO its independence. Based on the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2013.

| | AUDIT COMMITTEE: | |

| | W. Scott Gallaway, Chairman | |

| | Thomas G. McCain Ferdinand J. Rossi | | |

PROPOSAL III – APPROVAL OF A NON-BINDING ADVISORYVOTE ON EXECUTIVE COMPENSATION

Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and the regulations of the Securities and Exchange Commission thereunder provide that for smaller reporting companies, such as the Company, for the first annual meeting of stockholders on or after January 21, 2013 and not less than once every three years thereafter the Company must include a separate resolution subject to stockholder vote to approve the compensation of the Company’s named executive officers, as disclosed in its Proxy Statement pursuant to Item 402 of Regulation S-K of the Securities and Exchange Commission.

This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to endorse or not endorse the Company’s executive pay program and policies, as disclosed in this Proxy Statement, through the following resolution:

“Resolved, that the compensation paid to the Company’s named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables in this Proxy Statement is hereby approved.”

As provided in the Dodd-Frank Act, this vote will not be binding on the Board of Directors and may not be construed as overruling a decision by the Board, creating or implying any change to the fiduciary duties of the Board or any additional fiduciary duty by the Board or restricting or limiting the ability of stockholders to make proposals for inclusion in proxy materials related to executive compensation. The Compensation Committee, however, may take into account the outcome of the vote when considering future executive compensation arrangements.

In voting to approve the above resolution, stockholders may vote for the resolution, against the resolution or abstain from voting. This matter will be decided by the affirmative vote of a majority of the votes cast at the Meeting. On this matter, abstentions will have no effect on the voting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

PROPOSAL IV – ADVISORY VOTE ON THE FREQUENCYOF ADVISORY VOTES ON EXECUTIVE COMPENSATION

Section 951 of the Dodd-Frank Act and the regulations of the Securities and Exchange Commission thereunder require for smaller reporting companies such as the Company that at the first annual meeting of stockholders held on or after January 21, 2013 and not less frequently than once every six years thereafter the Company must include a separate resolution subject to stockholder vote to determine whether the non-binding stockholder vote on executive compensation that is the subject of Proposal III should occur every one, two or three years.

The Board of Directors welcomes the views of stockholders on executive compensation matters. The Board of Directors, however, does not believe that it is necessary to have the non-binding vote on executive compensation occur every year. The Board believes that a vote once every three years will allow stockholders the time needed to properly assess the impact of changes made in the Company’s executive compensation program in response to stockholder votes on executive compensation. Consequently, the Board recommends that the non-binding vote on executive compensation occur only once every three years.

As provided in the Dodd-Frank Act, this vote will not be binding on the Board of Directors and may not be construed as overruling a decision by the Board, creating or implying any change to the fiduciary duties of the Board or any additional fiduciary duty by the Board or restricting or limiting the ability of stockholders to make proposals for inclusion in proxy materials related to executive compensation.

In voting on the frequency of the non-binding say-on-pay resolution, stockholders may vote to have the vote occur every one, two or three years or abstain from voting. The option which receives the most votes from stockholders will be deemed to be the option selected by stockholders. On this matter, abstentions and broker non-votes will have no effect on the outcome.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE TO HAVE THE NON-BINDING VOTE ON EXECUTIVE COMPENSATION OCCUR EVERY THREE YEARS.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Securities and Exchange Commission regulations require the Company’s officers, directors and persons who own more than 10% of the outstanding Common Stock to file reports detailing their ownership and changes of ownership in the Common Stock, and to furnish the Company with copies of these reports. Based solely on its review of the reports received during the past fiscal year or with respect to the last fiscal year or written representations from these persons that they were not required to file annual reports of change in beneficial ownership, the Company believes that during fiscal year 2013, all of its officers, directors and all of its stockholders owning in excess of 10% of the outstanding Common Stock have complied with these reporting requirements.

Stockholder proposals, in order to be considered for inclusion within the Company’s proxy materials for the next Annual Meeting of Stockholders, must be received at the Company’s executive office at 1902 Long Hill Road, Millington, New Jersey 07946 by June 20, 2014. Any other stockholder proposals will only be considered at such meeting if the stockholder submits notice of the proposal to the Company at least five days before such meeting.

At the time this Proxy Statement is being mailed, the Board of Directors knows of no additional matters that will be presented for consideration at the Meeting. If any other business may properly come before the Meeting or any adjournment thereof less than a reasonable time before the Meeting or any adjournment thereof, proxies given to the Board of Directors will be voted by its members in accordance with their best judgment.

The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Common Stock. In addition to solicitations by mail, directors, officers, and regular employees of the Company may solicit proxies personally or by telephone without additional compensation.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2013 accompanies this Proxy Statement.

[MSB FINANCIAL CORP. LETTERHEAD]

TO: Participants in the Millington Savings Bank Savings Plan

Date: October 18, 2013

As described in the enclosed materials, your voting instructions are being requested as a participant under the Millington Savings Bank Savings Plan (the “401(k) Plan”) in connection with an upcoming Annual Meeting of Stockholders of MSB Financial Corp. (“Company”). The Annual Meeting is for the purpose of considering and acting upon the following matters:

| 1. | The election of four directors of the Company; |

| 2. | The ratification of the appointment of BDO USA, LLP as the Company’s independent auditors for the fiscal year ending June 30, 2014; |

| 3. | To approve an advisory (non-binding) proposal regarding our executive compensation; |

| 4. | To vote on an advisory (non-binding) proposal regarding the frequency with which stockholders should vote on the Company’s executive compensation; and |

| 5. | The transaction of such other business as may properly come before the Annual Meeting, or any adjournments thereof. |

We hope you will take advantage of the opportunity to direct the manner in which shares of Company common stock allocated to your account under the 401(k) Plan will be voted.

Enclosed with this letter are a Proxy Statement, the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2013, and a 401(k) Plan Voting Instruction Form, which will permit you to direct the voting of the shares allocated to your 401(k) Plan account. After you have reviewed these proxy materials, we urge you to vote your shares held pursuant to the 401(k) Plan by marking, dating and signing the enclosed 401(k) Plan Voting Instruction Form and returning it in the enclosed postage-paid envelope to Wells Fargo who is tabulating the results on behalf of the 401(k) Plan Trustees. The 401(k) Plan Trustees will certify the totals to the Company for the purpose of having those shares voted.

We urge each of you to vote as a means of participating in the governance of the affairs of the Company. The Board of Directors of the Company recommends a vote “For” the nominees listed in Proposal 1, “For” Proposals 2 and 3, and a vote of “Three Years” on Proposal 4. If your voting instructions for the 401(k) Plan are not received by NOVEMBER 13, 2013, the shares allocated to your account will be voted by the 401(k) Plan Trustees at the direction of the Company’s Board of Directors serving as the 401(k) Plan Administrator. While I hope that you will vote in the manner recommended by the Board of Directors, the most important thing is that you vote in whatever manner you deem appropriate. Please take a moment to do so.

Please note the enclosed material relates only to those shares that have been allocated to your account under the 401(k) Plan. You will receive other voting material for those shares owned by you individually and not under the 401(k) Plan.

Sincerely,

/s/ Michael A. Shriner

Michael A. Shriner

President and Chief Executive Officer

[MSB FINANCIAL CORP. LETTERHEAD]

TO: Participants in the Employee Stock Ownership Plan of Millington Savings Bank

Date: October 18, 2013

As described in the enclosed materials, your voting instructions are being requested as a participant under the Millington Savings Bank Employee Stock Ownership Plan (the “ESOP”) for the shares of MSB Financial Corp. (“Company”) stock allocated to your ESOP account as of September 27, 2013, in connection with the upcoming Annual Meeting of Stockholders of the Company. The Annual Meeting is for the purpose of considering and acting upon the following matters:

| 1. | The election of four directors of the Company; |

| 2. | The ratification of the appointment of BDO USA, LLP as the Company’s independent auditors for the fiscal year ending June 30, 2014; |

| 3. | To approve an advisory (non-binding) proposal regarding our executive compensation; |

| 4. | To vote on an advisory (non-binding) proposal regarding the frequency with which stockholders should vote on the Company’s executive compensation; and |

| 5. | The transaction of such other business as may properly come before the Annual Meeting, or any adjournments thereof. |

We hope you will take advantage of the opportunity to direct the manner in which shares of Company common stock allocated to your account under the ESOP will be voted.

Enclosed with this letter are a Proxy Statement, the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2013, and an ESOP Voting Instruction Form, which will permit you to direct the voting of the shares allocated to your ESOP account. After you have reviewed these proxy materials, we urge you to vote your shares held pursuant to the ESOP by marking, dating and signing the enclosed ESOP Voting Instruction Form and returning it in the enclosed postage-paid envelope to Registrar and Transfer Company who is tabulating the results on behalf of the ESOP Trustee. The ESOP Trustee will certify the totals to the Company for the purpose of having those shares voted.