UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FILED PURSUANT TO RULE 424(b)(4)

SEC FILE NUMBER 333-137174

PROSPECTUS

September 22, 2006

HOLA COMMUNICATIONS INC.

A NEVADA CORPORATION

2,000,000 SHARES OF COMMON STOCK OF HOLA COMMUNICATIONS INC.

_________________________________

This prospectus relates to the 2,000,000 shares of common stock of Hola Communications Inc., a Nevada corporation, which may be resold by selling stockholders named in this prospectus.

The shares were acquired by the selling stockholders directly from us in private offerings that were exempt from registration under U.S. securities laws. The selling stockholders may sell their shares of our common stock at a price of $0.20 per share until shares of our common stock are quoted on the OTC Bulletin Board, or listed for trading or quoted on any other public market, and thereafter at prevailing market prices or privately negotiated prices. Our common stock is not now, nor has ever been, traded on any market or securities exchange, and we have not applied for listing or quotation on any public market. The purchaser in this offering may be receiving an illiquid security.

We will not receive any proceeds from the resale of shares of common stock by the selling stockholders. We will pay for the expenses of this offering.

In connection with any sales, any selling stockholders or broker or dealer participating in such sales may be deemed to be an underwriter within the meaning of the Securities Act.

Our business is subject to many risks and an investment in our common stock will also involve a high degree of risk. You should invest in our common stock only if you can afford to lose your entire investment. You should carefully consider the various Risk Factors described beginning on page 4 before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until this registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is September 22, 2006.

| 2 |

| | |

| The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus. | |

| |

| TABLE OF CONTENTS |

| | Page |

| | Number |

| PROSPECTUS SUMMARY | 3 |

| RISK FACTORS | 4 |

| USE OF PROCEEDS | 9 |

| DETERMINATION OF OFFERING PRICE | 9 |

| DILUTION | 9 |

| SELLING STOCKHOLDERS | 10 |

| PLAN OF DISTRIBUTION | 11 |

| LEGAL PROCEEDINGS | 13 |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 13 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 15 |

| DESCRIPTION OF SECURITIES | 16 |

| INTEREST OF NAMED EXPERTS AND COUNSEL | 17 |

| DISCLOSURE OF SEC POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 17 |

| DESCRIPTION OF BUSINESS | 17 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 22 |

| DESCRIPTION OF PROPERTY | 24 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 24 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 24 |

| EXECUTIVE COMPENSATION | 25 |

| FINANCIAL STATEMENTS | 27 |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND | 43 |

| FINANCIAL DISCLOSURE | |

3

As used in this prospectus, the terms “we”, “us”, “our”, and “Hola Communications” means Hola Communications Inc, unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

PROSPECTUS SUMMARY

Our Business

We were incorporated under the name of Hola Communications Inc. under the laws of the State of Nevada on October 10, 2005. Our principal executive office is located at Suite #103 - 3065 Beyer Boulevard, San Diego, California, U.S.A. 92154. Our telephone number is 619-690-2622. We maintain a website at www.hola-communications.com Information contained on our website does not form part of this prospectus.

We were formed to provide wireless broadband internet access in northern Mexico and south-western California, starting in Tijuana, Mexico with plans to expand to Mexicali, Mexico and other cities in the region. We plan to adopt WiMAX technology for our network to offer customers a wide coverage, high speed, and inexpensive internet service.

Number of Shares Being Offered

This prospectus covers the resale by the selling stockholders named in this prospectus of up to 2,000,000 shares of our common stock. The offered shares were acquired by the selling stockholders in a private placement transaction, which was exempt from the registration and prospectus delivery requirements of the Securities Act of 1933 provided by Regulation S.

The selling stockholders may sell their shares of our common stock at a fixed price of $0.20 per share per share until shares of our common stock are quoted on the OTC Bulletin Board, or listed for trading or quoted on any other public market, and thereafter at prevailing market prices or privately negotiated prices. Our common stock is presently not traded, and never has been traded, on any market or securities exchange and we have not applied for listing or quotation on any public market.

The selling stockholders may sell these shares of common stock in the public market or through privately negotiated transactions or otherwise. The selling stockholders may sell these shares of common stock through ordinary brokerage transactions, directly to market makers or through any other means described in the section entitled “Plan of Distribution” beginning on page 11 of this prospectus.

Number of Shares Outstanding

There are 6,000,000 shares of our common stock issued and outstanding as of August 31, 2006.

Estimated Use of Proceeds

We will not receive any of the proceeds from the sale of those shares of common stock being offered for sale by the selling stockholders.

Summary of Financial Data

The summarized financial data presented below is derived from and should be read in conjunction with our audited financial statements for the period from October 10, 2005 (inception) to March 31, 2006 and our unaudited financial statements for the three months ended June 30, 2006, including the notes to those financial statements, and the section entitled “Plan of Operation” beginning on page 22 of this prospectus. The financial statements for the fiscal year ended March 31, 2006, have been audited by Peterson & Co., LLP, Certified Public Accountants. Peterson & Co’s report on the financial statements for the fiscal period from October 10, 2005 (inception) to March 31, 2006,

4

which appear elsewhere herein, include explanatory paragraphs which describe an uncertainty about our company’s ability to continue as a going concern.

All dollar amounts refer to US dollars.

| | For the three

month period

ended

June 30, 2006 | For the period from

October 10, 2005

(inception) to

March 31, 2006 |

|

|

|

|

| Sales | $0 | $0 |

| Net Loss | $12,651 | $2,134 |

| Working Capital | $89,215 | $101,866 |

| Total Assets | $98,975 | $106,866 |

| Total Number of Issued Shares of Common Stock | 6,000,000 | 6,000,000 |

| Total Stockholders’ Equity | $89,215 | $101,866 |

We currently have $98,975 cash. We will require approximately $181,000 in additional funds to continue our operations for the next twelve months. We plan to obtain that money through the offering of additional equity securities of our company.

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are not the only ones facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to our Company

1.We have not generated any revenue from our business and we will need to raise additional funds in the near future. If we are not able to obtain future financing when required, we might be forced to discontinue our business.

Because we have not generated any revenue from our business and we cannot anticipate when we will be able to generate revenue from our business, we will need to raise additional funds for the further development of our wireless broadband network and to respond to unanticipated requirements or expenses. We anticipate that we will need to raise further financing in the approximate amount of $181,000 for the 12 month period. We plan to raise this money through additional equity financing. We do not currently have any arrangements for financing and we can provide no assurance to investors we will be able to find such financing if required. Any sale of share capital will result in dilution to existing shareholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay our future indebtedness or that we will not default on our future debts, jeopardising our business viability. Finally, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct business and develop our wireless broadband network, which might result in the loss of some or all of your investment in our common stock.

2.The fact that we have not earned any revenues since our incorporation raises substantial doubt about our ability to continue as a going concern.

We have not generated any revenues since our incorporation and we will, in all likelihood, incur operating expenses without revenues until our wireless broadband networks are fully developed and operational. We had cash in the amount of $98,975 as of June 30, 2006 Beginning in November, 2006, we estimate our average monthly operating

5

expenses will be approximately $25,000 each month. As a result, we need to generate significant revenues from our operations or acquire financing. We cannot assure that we will be able to successfully earn or acquire enough money to develop our wireless broadband network and as a result we may be forced to discontinue our business. These circumstances raise substantial doubt about our ability to continue as a going concern.

3.We have no operating history on which to base an evaluation of our business and prospects.

We were incorporated on October 10, 2005 and have not yet commenced our proposed business operations or realized any revenues. As we have no operating history, we cannot evaluate our financial performance and prospects at this moment. We anticipate that we will incur increased operating costs without realizing any revenues during the period when we are establishing our network and developing a client base. For the next twelve months, we expect to spend approximately $280,000 on the operation of our company. We therefore expect to incur significant losses into the foreseeable future. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

4.Our current directors and officers do not have experience developing wireless broadband networks therefore we will need to hire additional employees with the requisite technological knowledge or we will not be able to advance our business plan.

Our current directors and officers do not have experience developing wireless broadband networks. Therefore, we are currently looking to hire additional employees and management with the requisite technological knowledge. Competition for qualified personnel is intense and we may not be able to hire or retain qualified personnel. If we are not able to find and retain such qualified personnel, we may not be able to continue the development of our business and we will likely have to cease operations.

5.Our business depends in part on the internet functioning efficiently and the belief of our customers that they can rely on the internet. If the internet does not function efficiently or there is a loss of confidence in the internet, our business could fail and investors could lose their entire investment.

Our company was formed to provide wireless broadband internet access in northern Mexico and south-western California, starting in Tijuana, Mexico with plans to expand to Mexicali, Mexico and other cities in the region. If the internet itself does not function efficiently or public perception is that it may not function efficiently, we may lose or be unable to obtain customers. If we lose or do not attract more customers, then we may never be able to achieve profitable operations and we may go out of business. If we go out of business, investors may lose their entire investment.

Risks Related to our Business

6.WiMAX technology is still in the trial and testing phase and as a result may not live up to given expectations. The WiMAX technology is not guaranteed to work for us in the way we want it to. As a result, our business could fail and investors could lose their entire investment.

We plan to adopt WiMAX technology as a main component for our wireless broadband network. WiMAX refers to broadband wireless networks that are based on the Institute of Electrical and Electronics Engineers (IEEE) 802.16 standard, the goal of which is to ensure compatibility and interoperability between broadband wireless access equipment. WiMAX technology is still in the trial and testing phase in various markets around the world. There is no guarantee that WiMAX technology will be capable of transmitting data rates at the speeds or distances that we anticipate. If the WiMAX technology does not operate as we expect, any customers that we do obtain could be dissatisfied with our services and not continue to subscribe to them. If this happens, our business could fail and investors could lose their entire investment.

6

7.We need government approval and must conform with governmental regulations in order to establish a wireless broadband network in Tijuana, Mexico. If Mexican government approval is not given, or we can not conform under Mexican governmental regulations, then there is a risk that our company could possibly cease operation and investors could lose their entire investment.

We are required to comply with Mexican governmental regulations regarding the provision of internet services in Tijuana, which is our initial target area for our future services. If we can not comply with these regulations then there is a risk that our company could possibly cease operations and investors could lose their entire investment. We have begun the application process for the necessary government permits but have not yet completed our applications. We expect the process to be finalized in the next two months. Once the permit-stage is finalized, we will apply to the Federal Communication Commission of Mexico for final regulatory approval.

8.Flaws in our future technology and systems could cause delays or interruptions of service, damage our reputation, cause us to lose customers and limit our growth or cause our business to fail.

Our services may be disrupted by technological problems, such as software or hardware malfunctions or the overloading of our network. As a result or such disruptions, we may lose customers and our business may suffer or fail, causing investors to lose their investment.

9.As a wireless broadband internet service company, we are in an intensely competitive industry and failure to timely implement our business plan could diminish or suspend our development and possibly cease our operations.

The provision of internet services is a highly competitive industry. We can provide no assurance that additional competitors and improved technologies will not enter the marketplace or that existing companies will not take over large portions of the market. For example, there are numerous other wireless broadband companies that currently offer competing services, which have established customer bases and are significantly larger than our company and have access to greater capital. If we are unable to efficiently and effectively institute our business plan as a result of intense competition or a saturated market, we may not be able to continue the development of our network. If we cannot develop our network, we may be forced to cease operations and cause investors to lose their entire investment.

10.Our industry is characterised by rapid technological change and if we fail to develop and market new technologies rapidly, we may not become profitable in the future.

The internet, including wireless broadband, industry is characterised by rapid technological change that could render our intended services obsolete. The development of our business entails significant technical and business risks. We can give no assurance that we will successfully use new technologies effectively or adapt our services to customer requirements or needs. If our management is unable, for technical, legal, financial, or other reasons, to adapt in a timely manner to changing market conditions or customer requirements, we may never become profitable, which may result in the loss of investments in our Company.

Risks Related to our Securities

11. Because there has never been a public trading market for our common stock, you may not be able to resell your stock.

There is not, nor has there ever been, a public trading market for our common stock. Therefore there is no central place, such as a stock exchange or an electronic trading system, to resell your shares. You may not be able to resell your shares. There is no established market for the common stock being registered. We intend to apply to the OTC Bulletin Board for the trading of our common stock after this registration statement is declared effective by the Securities and Exchange Commission. This process, if completed, takes approximately three months and the application must be made on our behalf by a market maker. We have not yet engaged a market maker to make the application on our behalf and there is no assurance that we will find a market maker that is willing to make the application on our behalf. If our common stock does become listed and a market for the stock develops, the actual

7

price of the shares will be determined by prevailing market prices at the time of sale. Trading of securities on the OTC Bulletin Board is often sporadic and investors may have difficulty buying and selling or obtaining market quotations, which may have a depressive effect on the market price for our common stock. Accordingly, you may have difficulty reselling any shares you purchase from the selling stockholders.

12.Since our common stock has never been traded and, if a market ever develops for our common stock, the price of our common stock is likely to be highly volatile and may decline after the offering. If this happens, investors may have difficulty selling their securities and may not be able to sell their securities at all.

There is no public market for our common stock and we cannot assure you that a market will develop or that any stockholder will be able to liquidate his investment without considerable delay, if at all. A trading market may not develop in the future, and if one does develop, it may not be sustained. If an active trading market does develop, the market price of our common stock is likely to be highly volatile. The market price of our common stock may also fluctuate significantly in response to the following factors, most of which are beyond our control:

- variations in our quarterly operating results;

- changes in securities analysts estimates of our financial performance;

- changes in general economic conditions and in the telecommunications industry;

- changes in market valuations of similar companies;

- announcements by us or our competitors of significant new products or services; and,

- the loss of key management.

The equity markets have, on occasion, experienced significant price and volume fluctuations that have affected the market prices for many companies’ securities and that have often been unrelated to the operating performance of these companies. Any such fluctuations may adversely affect the market price of our common stock, regardless of our actual operating performance. As a result, stockholders may be unable to sell their shares, or may be forced to sell them at a loss.

13. The terms of any future financing may adversely affect your interest as stockholders

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in our Company. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of our business more difficult because the lender’s consent will be required before we take certain actions. Similarly the terms of any equity securities we issue will likely be senior with regard to the payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in our company, which may decrease the value of your investment

14.We do not intend to pay dividends and there will be fewer ways in which you can obtain a return on any investment in our Company.

We have never paid cash dividends and currently do not intend to pay cash dividends for the foreseeable future. Because we do not intend to declare dividends, any gain on an investment in our Company will need to come through appreciation of the price of our common stock. There can be no assurance that the price of our common stock will increase.

15.Trading of our stock is restricted by the SEC’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose

8

additional sales practice requirements on brokers or dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker or dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardised risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker or dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker or dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker or dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of brokers or dealers to trade our securities. We believe that the penny stock rules will discourage investor interest in and limit the marketability of our common stock. This may limit your ability to buy and sell our stock and cause the price of the shares to decline.

16. NASD sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the National Association of Securities Dealers (NASD) has adopted rules that require that in recommending an investment to a customer, a broker or dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, brokers or dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for brokers or dealers to recommend that their customers buy our common stock, which may prevent you from reselling your shares and may cause the price of the shares to decline.

17.Because the majority of our assets and at least one of our Directors and Officers are located outside the United States of America, it may be difficult for an investor to enforce within the United States any judgments obtained against our property and our Directors and Officers.

The majority of our present and future assets are and will continue be located in Mexico and at least one of our directors and officers is a resident of Mexico and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for an investor to effect service of process or enforce within the United States any judgments obtained against our officers or directors or that portion of our assets located outside the United States, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Mexico and other jurisdictions would recognize or enforce judgments of United States courts obtained against our Mexican assets or our directors and officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in Mexico or other jurisdictions against us or our directors and officers predicated upon the securities laws of the United States or any state thereof.

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by this prospectus is accurate as of any date other than the date on the front of this prospectus.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”,

9

“expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” beginning on page 4 of this prospectus, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The safe harbor for forward-looking statements provided in the Private Securities Litigation Reform Act of 1995 does not apply to the offering made in this prospectus.

SECURITIES AND EXCHANGE COMMISSION’S PUBLIC REFERENCE

Any member of the public may read and copy any materials filed by us with the Securities and Exchange Commission at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

THE OFFERING

This prospectus covers the resale by the selling stockholders named in this prospectus of up to 2,000,000 shares of common stock which were issued pursuant to private placement offerings made by our company pursuant to Regulation S promulgated under the Securities Act.

USE OF PROCEEDS

We will not receive any proceeds from the resale of shares of common stock by the selling stockholders.

DETERMINATION OF OFFERING PRICE

The selling stockholders may sell their shares of our common stock at a price of $0.20 per share until shares of our common stock are quoted on the OTC Bulletin Board, or listed for trading or quoted on any public market and thereafter at prevailing market prices or privately negotiated prices. The offering price of $0.20 per share has been set arbitrarily by our directors and does not have any relationship to any established criteria of value, such as book value or earning per share. Additionally, the price of the common stock is not based on past earnings, nor is the price of the common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business. Our common stock is not now, nor has ever been, traded on any market or securities exchange and we have not applied for listing or quotation on any public market.

DILUTION

The common stock to be sold by the selling stockholders is the 2,000,000 shares of common stock that are currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

SELLING STOCKHOLDERS

All of the shares of common stock being offered by the selling stockholders are listed in the table below. We issued the 2,000,000 shares of common stock in private placement transactions exempt from registration under the Securities Act pursuant to Regulation S.

10

The selling stockholders may offer and sell, from time to time, any or all of their common stock. Because the s selling stockholders may offer all or only some portion of the shares of common stock listed in the table, no exact estimate can be given as to the amount or percentage of these shares of common stock that will be held by the selling stockholders upon termination of the offering.

The following table sets forth certain information regarding the beneficial ownership of shares of common stock by the selling stockholders as of August 31, 2006, and the number of shares of common stock covered by this prospectus. The number of shares in the table represents an estimate of the number of shares of common stock to be offered by the selling stockholders.

Other than the relationships described below, none of the selling stockholders had or have any material relationship with us. None of the selling stockholders to our knowledge is a broker-dealer or an affiliate of a broker-dealer.

Name of Selling

Stockholder and Position,

Office or Material

Relationship with Hola

Communications Inc. |

Common

Shares owned

by the Selling

Stockholder(1) |

Total Number of

Shares

Registered | Number of Shares Owned

by Selling Stockholder After

Offering and Percent of Total

Issued and Outstanding |

|

|

|

| # of Shares | % of Class |

| Juan Martinez(2) | 40,000 | 40,000 | 0 | 0 |

| Blanca Adriana Padilla Gomez | 20,000 | 20,000 | 0 | 0 |

| Ester Hernadez Espinoza | 20,000 | 20,000 | 0 | 0 |

| Raquel Villegas | 20,000 | 20,000 | 0 | 0 |

| Raul Perez Castro | 20,000 | 20,000 | 0 | 0 |

| Jose Luis Ugalde | 20,000 | 20,000 | 0 | 0 |

| Sergio Salinas | 20,000 | 20,000 | 0 | 0 |

| Isacc Perez | 20,000 | 20,000 | 0 | 0 |

| Asuncion Cruz | 20,000 | 20,000 | 0 | 0 |

| Roberto Meza Antonio | 20,000 | 20,000 | 0 | 0 |

| Enrique Segovia | 20,000 | 20,000 | 0 | 0 |

| Guadalupe Flores | 20,000 | 20,000 | 0 | 0 |

| Julian Vazquez Arango | 20,000 | 20,000 | 0 | 0 |

| Rafael Santillan Rodriguez | 20,000 | 20,000 | 0 | 0 |

| Rene Guevara Mila | 20,000 | 20,000 | 0 | 0 |

| Elvia Bertha Borboa Mendoza(3) | 20,000 | 20,000 | 0 | 0 |

| Marlene Josefina Gutierrez Mendoza(3) | 20,000 | 20,000 | 0 | 0 |

| Aracelia Quezada Maturino | 20,000 | 20,000 | 0 | 0 |

| Alfonso Castillo(4) | 20,000 | 20,000 | 0 | 0 |

| Cecilia Morales Castillo(4) | 20,000 | 20,000 | 0 | 0 |

| Juan Cesar Guipzot Moreno | 20,000 | 20,000 | 0 | 0 |

| Cynthia Perdomo Pacheco | 200,000 | 200,000 | 0 | 0 |

| Mauricio Beltran | 200,000 | 200,000 | 0 | 0 |

11

Name of Selling

Stockholder and Position,

Office or Material

Relationship with Hola

Communications Inc. |

Common

Shares owned

by the Selling

Stockholder(1) |

Total Number of

Shares

Registered |

Number of Shares Owned

by Selling Stockholder After

Offering and Percent of Total

Issued and Outstanding |

|

|

|

|

| # of Shares | % of Class |

| Jose Gonzalez(5) | 120,000 | 120,000 | 0 | 0 |

| Lorena Peralta(6) | 220,000 | 220,000 | 0 | 0 |

| Ernesto Ramirez | 100,000 | 100,000 | 0 | 0 |

| Roxanne Ojeda | 200,000 | 200,000 | 0 | 0 |

| Migdelia Mendivil | 100,000 | 100,000 | 0 | 0 |

| Antonia Lavalle(7) | 120,000 | 120,000 | 0 | 0 |

| Miguel Angel Amador | 100,000 | 100,000 | 0 | 0 |

| Antonio Cano | 200,000 | 200,000 | 0 | 0 |

| Total | 2,000,000 | 2,000,000 | 0 | 0 |

| (1) | Assumes all of the shares of common stock offered are sold. There are 6,000,000 common shares issued and outstanding as of August 31, 2006 |

| |

| (2) | 20,000 of these shares are registered in the name of Julio Martinez. |

| |

| (3) | Elvia Bertha Borboa Mendoza and Marlene Josefina Gutierrez Mendoza are not related. |

| |

| (4) | Cecilia Morales Castillo and Alfonso Castillo are not related. |

| |

| (5) | 20,000 of these shares are registered in the name of Jose Angel Gonzalez. |

| |

| (6) | 20,000 of these shares are registered in the name of Lorena L. Quevedo Peralta. |

| |

| (7) | 20,000 of these shares are registered in the name of Juana Lavalle. |

| |

We may require the selling stockholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in these documents in order to make statements in those documents not misleading.

PLAN OF DISTRIBUTION

All of the stock owned by the selling stockholders will be registered by the registration statement of which this prospectus is a part. The selling stockholders may sell some or all of their shares immediately after they are registered. Until our shares of common stock are quoted on the OTC Bulletin Board, the selling stockholders may from time to time sell their shares, at the fixed price of $0.20, by themselves or through pledgees, donees, transferees, successors in interest, brokers, dealers or underwriters. Brokers, dealers or underwriters may act solely as agents or may acquire shares as principals.

After the shares of our common stock are quoted on the OTC Bulletin Board, the selling stockholders may sell at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices. The shares of common stock being offered for resale by this prospectus may be sold by the selling stockholders by one or more of the following methods, without limitation:

| 1. | block trades in which the broker or dealer so engaged will attempt to sell the shares of common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

| 2. | purchases by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this prospectus; |

| |

| 3. | an exchange distribution in accordance with the rules of the exchange; |

| |

12

| 4. | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| |

| 5. | privately negotiated transactions; |

| |

| 6. | market sales (both long and short to the extent permitted under the federal securities laws); |

| |

| 7. | at the market to or through market makers or into an existing market for the shares; and |

| |

| 8. | a combination of any aforementioned methods of sale. |

| |

Any shares of common stock covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

We will not receive any proceeds from the sale of the shares of the selling stockholders pursuant to this prospectus. All expenses of the registration statement including, but not limited to, legal, accounting, printing and mailing fees are and will be borne by us. These expenses are estimated to be approximately $50,000. Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the shares of common stock will be borne by the selling stockholders, the purchasers participating in such transaction or both.

In the event of the transfer by any selling stockholder of his or her shares to any pledgee, donee or other transferee, we will amend this prospectus and the registration statement of which this prospectus forms a part by the filing of a post-effective amendment in order to have the information relating to the pledgee, donee or other transferee in place of that for the selling stockholder who has transferred his or her shares.

In effecting sales, brokers and dealers engaged by the selling stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from the selling stockholders or, if any of the brokers or dealers act as an agent for the purchaser of such shares, from the purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Brokers or dealers may agree with the selling stockholders to sell a specified number of the shares of common stock at a stipulated price per share. Such an agreement may also require the broker or dealer to purchase as principal any unsold shares of common stock at the price required to fulfil the broker or dealer commitment to the selling stockholders if such broker or dealer is unable to sell the shares on behalf of the selling stockholders. Brokers or dealers who acquire shares of common stock as principal may thereafter resell the shares of common stock from time to time in transactions which may involve block transactions and sales to and through other brokers or dealers, including transactions of the nature described above. Such sales by a broker or dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such resales, the broker or dealer may pay to or receive from the purchasers of the shares, commissions as described above.

The selling stockholders and any brokers, dealers or agents that participate with the selling stockholders in the sale of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the brokers, dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

From time to time, the selling stockholders may pledge their shares of common stock pursuant to the margin provisions of their customer agreements with their brokers. Upon a default by a selling stockholder, the broker may offer and sell the pledged shares of common stock from time to time. Upon a sale of the shares of common stock, the selling stockholders intend to comply with the prospectus delivery requirements, under the Securities Act, by delivering a prospectus to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities Act which may be required in the event any selling stockholder defaults under any customer agreement with brokers.

To the extent required under the Securities Act, a post effective amendment to this registration statement will be filed, disclosing, the name of any brokers or dealers, the number of shares of common stock involved, the price at

13

which the common stock is to be sold, the commissions paid or discounts or concessions allowed to such brokers or dealers and, where applicable, that such brokers or dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus and other facts material to the transaction.

We and the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as the selling stockholders are distribution participants and we, under certain circumstances, may be a distribution participant, under Regulation M. All of the foregoing may affect the marketability of the common stock.

All expenses of the registration statement including, but not limited to, legal, accounting, printing and mailing fees are and will be borne by us. Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the shares of common stock will be borne by the selling stockholders, the purchasers participating in such transaction, or both.

TRANSFER AGENT AND REGISTRAR

The transfer agent and registrar for our common stock is The Nevada Agency and Trust Company, 50 West Liberty Street, Suite 880, Reno Nevada 89501. Their telephone number is (775) 322-0626 and their fax number is (775) 322-5623.

LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

All directors of our company hold office until the next annual meeting of the stockholders or until their successors have been elected and qualified. The officers of our company are appointed by our board of directors and hold office until their death, resignation or removal from office. As of August 31, 2006, our directors and executive officers, their ages, positions held, and duration as such, were as follows:

Name

| Position Held with the

Company | Age

| Date First Elected

or Appointed |

|

| Carlos Alfonso Bustamante | President, Chief Executive Officer and Director | 40 | October 10, 2005 |

| Jose Carlos Davalos Cerda | Secretary, Treasurer and Director | 42 | October 10, 2005 |

Business Experience

The following is a brief account of the education and business experience during at least the past five years of each director, executive officer and key employee, indicating the principal occupation during that period, and the name and principal business of the organization in which such occupation and employment were carried out:

Carlos Bustamante

Carlos Alfonso Bustamante has served as the President, Chief Executive Officer and Director of Hola Communications Inc. from October 10th, 2005 (inception) to present. Mr. Bustamante also serves as the Executive Vice President of Grupo Bustamante, which encompasses an array of industries in Baja California, Mexico, including a real estate development company, a construction company, three industrial parks, two hotels, a cable television channel, a cable television network, a payroll and accounting outsourcing service company, and an

14

aircraft maintenance facility. Mr. Bustamante also serves as a General Director for the Inmobiliaria C.B.A. S.AdeC.V, which owns three industrial parks in Tijuana and he is on the Board of Directors of Grupo Posadas, which owns more than 90 hotels across Mexico. Mr Bustamante is also an active member of various associations; he is a member of CANACINTRA (National Chamber of Industry), the State Council of Development of Baja California, the DEITAC (Tijuana Economic Development) the AMPIP (Mexican Association of Private Industrial Parks) and the Board of the Association of Businessmen of Baja California. He is also a former Vice President of the Tijuana Convention & Visitors Bureau.

Jose Carlos Davalos Cerda

Jose Carlos Davalos Cerda has served as the Secretary, Treasurer and Director of Hola Communications Inc. from October 10th, 2005 (inception) to present. Mr. Cerda also serves as a human resource manager with Cable California, where his responsibilities include reviewing licenses and permit renewal and solicitation as well as overseeing the Human Resources Department. Mr. Cerda served as an Administrative and Human Resource Director from April 1996 to present with Matrix Aeronautica, where his responsibilities included labor relations, training and development, recruitment, compensation and benefits and safety and environmental issues.

Family Relationships

There are no family relationships among our directors or officers.

Involvement in Certain Legal Proceedings

Our directors, executive officers and control persons have not been involved in any of the following events during the past five years:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or, |

| |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Committees of the Board

All proceedings of the board of directors for the fiscal year ended March 31, 2006 were conducted by resolutions consented to in writing by the sole director and filed with the minutes of the proceedings of the director. Our company currently does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes that the functions of such committees can be adequately performed by the board of directors.

Our company does not have any defined policy or procedure requirements for shareholders to submit recommendations or nominations for directors. The board of directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating

15

such nominees. The board of directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our President and Chief Executive Officer, Carlos Alfonso Bustamante, at Suite #103 - 3065 Beyer Boulevard, San Diego, California, U.S.A. 92154.

Audit Committee Financial Expert

Our board of directors has determined that we do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 401(e) of Regulation S-B, nor do we have a board member that qualifies as “independent” as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the NASD Rules.

We believe that our board of directors is capable of analysing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The board of directors of our company does not believe that it is necessary to have an audit committee because management believes that the functions of an audit committee can be adequately performed by the board of directors. In addition, we believe that retaining an independent director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact the we have not generated any positive cash flows from operations to date.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

We have set forth in the following table certain information regarding our common stock beneficially owned on March 31, 2006 for (i) each shareholder we know to be the beneficial owner of 5% or more of our outstanding common stock, (ii) each of our executive officers and directors, and (iii) all executive officers and directors as a group. In general, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within 60 days.

Name and Address of Beneficial Owner | Amount and Nature of

Beneficial Ownership | Percentage

of Class(1) |

|

Carlos Alfonso Bustamante

53 Aruba Bend

Coronado, California, U.S.A. 92118 |

3,000,000

|

50%

|

|

|

Jose Carlos Davalos Cerda

Calle Roman No. 100 Col, El Escondida

Tijuana, B.C. Mexico 22440 |

1,000,000

|

16.6%

|

|

|

| Directors and Executive Officers as a Group | 4,000,000 | 66.6% |

(1) Based on 6,000,000 shares of common stock issued and outstanding as of August 31, 2006.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Except as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable.

16

Changes in Control

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change of control of our company.

DESCRIPTION OF SECURITIES

Overview

We are authorized to issue up to 50,000,000 common shares with a par value of $0.001 and 1,000,000 preferred shares with a par value of $0.001. As of August 31 2006, there were 6,000,000 shares of common stock issued and outstanding and no shares of preferred stock outstanding. Each stockholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders, including the election of directors

Common Stock

We are authorized to issue up to 50,000,000 common shares with a par value of $0.001. Upon liquidation, dissolution or winding up of the corporation, the holders of common stock are entitled to share ratably in all net assets available for distribution to stockholders after payment to creditors. The common stock is not convertible or redeemable and has no pre-emptive, subscription or conversion rights. Each outstanding share of common stock is entitled to one vote on all matters submitted to a vote of stockholders. There are no cumulative voting rights.

The holders of outstanding shares of common stock are entitled to receive dividends out of assets legally available therefore at such times and in such amounts as our board of directors may from time to time determine. Holders of common stock will share equally on a per share basis in any dividend declared by the board of directors. We have not paid any dividends on our common stock and do not anticipate paying any cash dividends on such stock in the foreseeable future. In the event of a merger or consolidation, all holders of common stock will be entitled to receive the same per share consideration.

Penny Stock Rules

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on brokers or dealer who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker or dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardised risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker or dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker or dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker or dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of brokers or dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

17

INTEREST OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents, subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

EXPERTS

The financial statements of our Company for the period from October 10, 2005 (inception) to March 31, 2006 appearing in this prospectus and registration statement have been audited by Peterson & Co., LLP, independent auditors, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about our company’s ability to continue as a going concern as described in Note 1 to the financial statements) appearing elsewhere herein, and are included in reliance upon such report given on the authority of such firm as experts in auditing and accounting.

DISCLOSURE OF SEC POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of our company under Nevada law or otherwise, our company has been advised that the opinion of the Securities and Exchange Commission is that such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

DESCRIPTION OF BUSINESS

General Overview

We were incorporated under the name of Hola Communications Inc. under the laws of the State of Nevada on October 10, 2005. Our principal executive office is located at Suite #103 - 3065 Beyer Boulevard, San Diego, California, U.S.A. 92154. Our telephone number is 619-661-2171. We maintain a website at www.hola-communications.com Information contained on our website does not form part of this prospectus.

Our Company was formed to provide wireless broadband internet access in northern Mexico and south-western California, starting in Tijuana, Mexico, with plans to expand to Mexicali, Mexico and other cities in the region. Adopting WiMAX technology, we plan to provide customers a wide coverage, high capacity and cost effective internet service. We are in the development stage of operations, as at August 31, 2006 we have not commenced operations and our activities have been limited to organization, raising capital, and development of our business plan. To implement our business plan, significant additional financing will be required.

During the period October 10, 2005 (inception) to June 30, 2006, no revenue was generated, and we incurred a net loss of $14,785. During this period we raised an aggregate of $104,000 through a private placement of our common stock, receiving $5,000 from the issuance of a note payable to a related party. As of June 30, 2006, we have a working capital balance of approximately $89,215. During the next 12 months we intend to raise additional equity financing to fund future operations.

18

Technology Overview

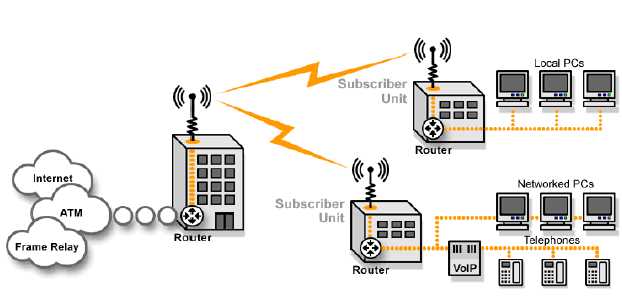

Many wireless broadband networks are currently based on WiFi technology, also known as the 802.11 standard. A WiFi network provides internet access to users by transmitting data through radio frequencies. A WiFi network works in the following way; a router or access point that is connected to a broadband internet connection receives data and translates it into radio frequencies. The router or access point transmits the data using a small antenna, to computers that are equipped with wireless adapters. A connection is established between the router or access point and the computer, allowing users to access the internet by receiving and transfering data. The router is able to provide internet coverage to users up to radius of 30 meters. Many businesses and residences use WiFi technology to establish what are known as “hot zones”, whereby any user whose computer contains a WiFi compatible wireless adapter is able to access the internet as long as they are within the router’s range. A diagram illustrating the process is as follows.

A WiFi wireless broadband network is an easy and cost effective way to provide internet access to users, but it is limited because it can only provide internet coverage to users within a relatively small radius.

WiMAX Wireless Broadband Networks

WiMAX, also known as the 802.16 standard, is a emerging technology that, like WiFi, provides internet access to users by transmitting data through radio frequencies.

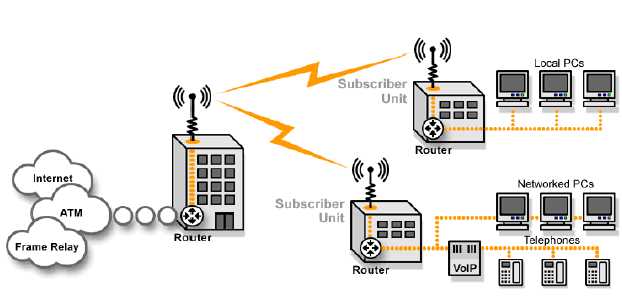

A WiMAX wireless broadband network works in the following way; a base station that is connected to a fixed broadband internet connection receives data and translates it into radio frequencies. The base station sends the data, using a large antenna, to computers that are equipped with a subscriber unit. A connection is established between the base station and the subscriber unit and users are able to access the internet by receiving and transferring data. The data received and transferred between the base station and the subscriber unit uses encrypted data keys to prevent unauthorised users from stealing access. A diagram illustrating the process is as follows:

19

ATM stands for “Asynchronous Transfer Mode”, a high bandwidth, High speed, controlled-delay fixed-size packet switching and transmission system integrating multiple data types (voice, video, and data). ATM Uses fixed-size packets also known as “cells,” so ATM is also often referred to as “cell relay”.

Frame Relay refers to a high-speed packet switching protocol popular in networks, including WANs, LANs, and LAN-to-LAN connections across vast distances.

The organization that is responsible for overseeing the standardisation of WiMAX technology is the WiMAX Forum. The WiMAX Forum is an organization of more than 350 leading internet service providers and communications component and equipment companies. The WiMAX Forum’s mandate is to promote and certify the compatibility and interoperability of broadband wireless access equipment that conforms to the 802.16 standard. The WiMAX Forum was established to help remove barriers to wide scale wireless broadband access technology, since a standard alone is not enough to incite mass adoption of a technology. Along these lines, the WiMAX Forum works closely with internet service providers and regulators to ensure that WiMAX Forum Certified systems meet customer and government requirements.

The ultimate goal of the WiMAX Forum is to accelerate the introduction of cost effective broadband wireless internet services into the marketplace and increase its capacity for volume, speed and effective radius, although the technology is not proven.

It is expected that WiMAX technology will allow entire cities to become zones where portable outdoor broadband wireless internet access is available throughout.

For busineses, in places like Mexico, we hope that WiMAX will provide a cost-effective broadband access alternative. Since most businesses are not zoned for cable, their only option for broadband service is from the local telecommunications provider, creating a monopoly situation for the current internet providers. The ease of deployment for WiMAX Forum Certified systems can benefit enterprises by bringing new competition into the marketplace and lowering prices, or by enabling enterprises to set up their own private networks. This is especially relevant for industries like gas, mining, agriculture, transportation, construction and others that operate in remote locations.

For some residential customers in suburban and rural areas (where DSL or cable modem service is not available), WiMAX can provide the ability to finally have the broadband access they need. This is particularly true in developing countries, such as Mexico, where traditional telecom infrastructure is not readily accessible.

20

WiMAX and Wi-Fi are expected to coexist and become increasingly complementary technologies for their respective applications.

Currently, wireless broadband networks using WiMAX technology are in the trial and testing phase in a number of different locations across the world. Currently nine different companies have received certification from the WiMAX Forum to begin selling their hardware, they include; Airspan, Aperto Networks, Axxcelera Broadband Wireless, Proxim Wireless, Redline Communications, SEQUANS Communications, Siemens and WaveSat. We intend to obtain our hardware from one of these suppliers. We do not, as of yet, have agreements for the supply of hardware from any of these companies.

Business Overview

We have leased space on three existing tall buildings where we will install and maintain our base stations. The base stations will be connected to the internet through a wired connection called a backhaul. We plan to purchase access to the internet through various primary suppliers depending on the area. We further plan to re-sell this internet access to businesses who desire to access the internet through our broadband wireless network. Users will be required to rent or purchase a subscriber unit from us in order to connect to our service. We intend to use one of the following frequencies; 2.4, 5.2 to 5.8MHz.

Pricing

We plan on charging customers the following fee’s for our services

| · | Basic installation fee between $250 and $1000, depending on the complexity of the installation. |

| |

| · | Monthly equipment rental fee between $50 and $75 |

| |

| · | Monthly bandwidth fee between $300 and $500 |

| |

| · | Usage fee of $5 per gigabyte – if the customer exceeds given bandwidth |

Competition

In the north western region of Mexico, there are currently four companies, Axtel, Telnor, G-Tel and TelMex who offer fixed broadband internet access. Telnor and G-Tel also provide local phone service, long distance and cellular services in the area.

In addition, major multi national telecommunication companies are currently in the development and testing phases of WiMAX wireless broadband networks in various locations around the world. These companies have significant income and capital resources and we would not likely be able to compete effectively against them at this time if they expanded into the Mexican market. However, these companies have focussed their attention on North America, Europe and Asia. We believe that we may be able to establish ourselves in north western Mexico before these larger companies attempt to do so. In that way, we hope to maintain a competitive advantage in this area.

No assurance can be given that our competitors will not develop new technologies or enhancements to existing products or services or introduce new products and services that will offer superior price or performance features. We expect our competitors to offer new and existing products and services at prices necessary to gain or retain market share. Some of our competitors have substantial financial resources, which may enable them to withstand sustained price competition or a market downturn better than us. There can be no assurance that we will be able to compete successfully in the pricing of our products and services, or otherwise, in the future.

Competitive Advantages

We believe that our wireless broadband network will have the following advantages

| · | Cost Effectiveness: We plan on offering cost-effective internet access because of our lower infrastructure and deployment costs. We anticipate that the installation costs for our network will be less than fixed broadband |

| |

21

internet access, which often requires extensive installation time to lay cables and, in some instances, ripping up of buildings or streets.

| · | Reliability:Our network is designed to allow a higher level of reliability and quality of service than other internet options in Mexico. We plan on having multiple base stations, which will allow us to shift traffic from one area to another in case of system failure. |

| |

| · | Symmetrical High Speed Connections: We intend to develop a symmetrical network, which may allow customers to send and receive information at the same high speed even during peak network usage periods. |

| |

| · | Quick Installation Times:Our network will take less time to install compared to traditional modem or cable based internet connections. As a result we can complete installation within days, not weeks or months. |

| |

| · | Rapid Scalability–We plan to develop a network that has the potential to increase capacity on demand, within seconds, if a customer needs increased bandwidth, |

| |

| · | Access to Exclusive Rooftop Contracts: We have entered into exclusive, multi-year, renewable contracts with owners of tall buildings or towers to ensure that we have the best locations to place our transmitting stations. |

| |

| | These contracts will also act as a barrier to competition towards other companies who may wish to establish their own wireless broadband networks. |

Target Market

Our target market is potentially any business that requires an internet connection. However we will initially seek out businesses with whom our directors and officers already have business relationships to develop our customer base.

Sales, Marketing and Promotional Strategies

In order to sell and promote our network we plan to implement the following sales, marketing and promotional strategies.

| · | Direct Sales Model:We plan to use a direct sales model. This will involve hiring sales people and having them sell our services directly to businesses. Leads will be generated through our marketing programs. |

| |

| · | Referral Program:We plan to implement a referral program for businesses and individuals who recommend our services. |

| |

| · | Real Estate Agents/Developers Program:We plan on creating a program that will allow us to build relationships with real estate agents, property owners and developers. Through these relationships, we will receive information on new tenant leases, so that our sales staff can contact potential customers. |

| |

| · | Reseller Alliance Program:We plan to develop a reseller alliance program permitting other telecommunication companies to purchase connections from Hola Communications wholesale and resell the services as their own. |

| |

| | The resellers will then be responsible for front-line technical support. |

| |

| · | Free, Limited Access to Network;We plan to offer free, but limited, access to our wireless broadband network throughout downtown Tijuana. Individuals using the network will be directed to general information about our products and services. This free service will be separate from the enhanced wireless broadband network which will offer paying subscribers higher bandwidths, a secure connection, along with a number of other services. |

| |

| · | Sponsorship Program:We plan to provide both immediate and temporary high bandwidth solutions to events such as conferences, trade shows and sporting events. |

| |

22

Government regulations on business

To operate an internet service business in Mexico, we first must obtain government approval in order to establish the required wireless broadband network. We have begun the application process for the necessary government permits but have not yet completed our applications. We expect the process to be finalized in the next two months and we cannot at this time estimate how much it will cost because the process and fee schedule are undergoing modifications. Once the permit-stage is finalized, we will apply to the Federal Communication Commission of Mexico for final regulatory approval.

Employees

We currently have no employees other than our President and Chief Executive Officer Carlos Alfonso Bustamante and our Secretary and Treasurer, Jose Carlos Davalos Cerda. Mr. Bustamante intends to devote 40 to 60 hours of his time per month to our business operations and Mr. Cerda intends to devote 40 to 60 hours of his time per month on business operations.

PLAN OF OPERATION

You should read the following discussion of our financial condition and plan of operation together with the audited and unaudited financial statements and the notes to those financial statements included elsewhere in this filing. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those anticipated in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this registration statement, particularly in the section entitled “Risk Factors” beginning on page 4 of this prospectus.

General Overview

We were formed to provide wireless broadband internet access in northern Mexico and south-western California, starting in Tijuana, Mexico with plans to expand to Mexicali, Mexico and other cities in the region. Adopting WiMAX technology as a main component of our network, we plan to provide customers a wide coverage, high capacity and cost effective internet service.

We are in the development stage and through August 31, 2006 we have not commenced operations. Our activities have been limited to organization, raising capital, and development of our business plan. We have executed three (3) lease agreements with companies who own buildings in Tijuana. The lease agreements will provide us access to rooftops to place our base stations and subscriber units. The companies with whom we have formed these three lease agreements are Sintesis TV , Cable California, S.A. de C.V. and Plaza Aguacaliente, S.A. de C.V. The form of lease agreement is attached as an exhibit to the registration statement of which this prospectus forms a part.

We will require additional funds to implement our growth strategy. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Further, we may continue to be unprofitable.

Over the next twelve months we intend to use our available funds to fund our working capital requirements, as follows:

| 1. | We intend to purchase one base station and two subscriber units from WiMAX Forum Certified suppliers. The anticipated cost will be approximately $25,000. |

| |

| 2. | We have signed three separate lease agreements with building owners that will allow us access to rooftops to place the base stations and subscriber units. The rent will be approximately $500 per month per rooftop, for a total cost of $6,000 over the next twelve months. |

| |

23

| 3. | We intend to enter into an agreement with a internet service provider in Tijuana to provide an internet connection to our base station. We anticipated the cost to initially be $1,000 a month, for a total cost of $12,000 over the next twelve months. |

| |

| 4. | We intend to lease an office in Tijuana, which will serve as a base of operations for our wireless broadband network. The anticipated rent will be approximately $1,000 per month, for a total cost of $12,000 over the next twelve months. |

| |

| 5. | We plan to hire up to four employees, including one computer technician, one salesperson, and two service installers. The anticipated cost will be approximately $8,500 per month, for a total cost of $102,000 over the next twelve months. |

| |