As filed with the Securities and Exchange Commission on November 15, 2012

Registration No. 333-182532

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

____________________________

FORM S-1/A

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Amendment No. 4 )

_____________________________

3DICON CORPORATION

(Name of registrant in its charter)

| Oklahoma | | 3679 | | 73-1479206 |

(State or other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

6804 South Canton Avenue, Suite 150

Tulsa, OK 74136

(918) 494-0505

(Address and telephone number of principal executive offices and principal place of business)

John M. O’Connor, Esq.

Newton, O’Connor, Turner & Ketchum, a Professional Corporation

15 W. Sixth Street, Suite 2700

Tulsa, OK 74119

(Name, address and telephone number of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Jay Yamamoto, Esq.

Timothy O’Brien, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Flr.

New York, New York 10006

(212) 930-9700

(212) 930-9725 (fax)

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer¨ | Accelerated filer¨ |

| Non-accelerated filer¨ | Smaller reporting companyx |

| (Do not check if a smaller reporting company) | |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | | Amount To Be

Registered | | Proposed

Maximum

Aggregate

Price Per

Share | | | Proposed

Maximum

Aggregate

Offering Price

(1) | | | Amount of

Registration

Fee | |

| Units (2) | | 2,000 units | | $ | 1,000 | | | $ | 2,000,000 | | | $ | 272.80 | |

| 6% Series A convertible preferred shares | | 2,000 shares | | | — | | | | — | | | | — | (4) |

| Common stock issuable upon conversion of 6% Series A convertible preferred shares(3) | | Up to 30,770,000 | | $ | — | | | $ | — | | | $ | — | (4) |

| Common stock issuable in lieu of cash payment of dividends on the 6% Series A convertible preferred shares | | | | $ | — | | | $ | — | | | $ | — | (4) |

| Series A Warrants to purchase common stock(3) | | | | $ | — | | | $ | — | | | $ | — | (4) |

| Series B Warrants to purchase common stock (3) | | | | $ | | __ | | | | __ | | | — | (4) |

| Common stock issuable upon exercise of warrants | | Up to 30,770,000 | | $ | — | | | $ | — | | | $ | — | (4) |

| Common Stock, $0.0002 par value (5) | | 12,301,725 shares | | $ | — | | | $ | 738,104 | | | $ | 100.68 | (6) |

| Total | | | | | | | | $ | 2,738,104 | | | $ | 373.48 | (7) |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of common stock as may be issuable with respect to the shares being registered hereunder as a result of share splits, share dividends, anti-dilution provisions, or similar transactions. No additional registration fee is being paid for these shares. |

| (2) | Units sold in this offering will consist of (1) one Series A preferred share which is convertible into 15,385 shares of our common stock at an assumed conversion price of $0.065 per share of common stock, (2) one Class A Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, exercisable at any time after the closing date at an assumed exercise price of $0.065 per share of common stock and (3) one Class B Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, exercisable at any time after the closing date at an assumed exercise price of $0.065 per share of common stock. |

| (3) | No additional consideration is payable upon conversion of the Convertible Preferred Shares or upon issuance of the warrants. |

| (4) | No fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

| (5) | Represents 12,301,725 shares to be offered by the Selling Stockholders. |

| (6) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and Rule 457(g) under the Securities Act of 1933, using the average of the high and low price as reported on the Over-The- Counter Bulletin Board on November 14, 2012, which was $0.06 per share. |

| (7) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION | DATED NOVEMBER 15 , 2012 |

2,000 6% Series A Convertible Preferred Shares

(and up to 30,770,000 Common Stock underlying the 6% Series A Convertible Preferred Shares)

up to 15,385,000 Series A Warrants

up to 15,385,000 Series B Warrants

(and up to 30,770,000 Common Stock underlying the Warrants)

12,301,725 Shares of Common Stock

We are offering up to 2,000 6% Series A convertible preferred shares (the “Series A preferred shares”) and warrants to purchase up to 30,770,000 common stock to purchasers in this offering. We are also offering up to 30,770,000 of our common stock issuable upon conversion of the Series A preferred shares and up to 30,770,000 of our common stock issuable upon exercise of the warrants. The Series A preferred shares and warrants will be sold in units for a purchase price equal to $1,000 per unit. Each unit will consist of (1) one Series A preferred share which is convertible into 15,385 shares of our common stock at a conversion price of $0.065 per share of common stock, (2) one Class A Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, exercisable at any time after the closing date at an exercise price of $0.065 per share of common stock and (3) one Class B Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, exercisable at any time after the closing date at an exercise price of $0.065 per share of common stock.

Until the three year anniversary of the issuance date of the Series A preferred shares, the Series A preferred shares will have a stated dividend rate of 6% per annum, payable quarterly in cash or, at our election and subject to certain conditions described in this prospectus, in our common stock, which are also being offered by this prospectus. Thereafter, each holder of Series A preferred shares will be entitled to receive dividends equal, on an as-if-converted to common stock basis, to and in the same form as dividends actually paid on common stock when, as, and if such dividends are paid on common stock. The Company has never paid dividends on its common stock and does not intend to do so for the foreseeable future. The conversion of the Series A preferred shares and the exercise of the warrants are subject to certain ownership limitations described in this prospectus. If certain conditions described in the prospectus are met, we may, at our option, redeem the Series A preferred shares for cash or require the holders to convert the Series A preferred shares into common stock. For a more detailed description of the Series A preferred shares, the warrants, and our common stock, see the section entitled “Description of Securities” beginning on page 29 of this prospectus.

This prospectus also relates to the resale of up to 12,301,725 shares of common stock, par value $0.0002 per share (the “Common Stock”), of the Company by the Selling Stockholders. The total amount of shares consists of 12,301,725 shares of Common Stock underlying convertible promissory notes. We will not receive any of the proceeds from the sale of Common Stock by the selling stockholders. The Selling Stockholders may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions.

Our common stock is quoted on the OTC Bulletin Board under the symbol “TDCP.OB”. On November 14, 2012, the last reported sale price for our common stock was $0.06 per share. There is no established public trading market for the Series A preferred shares or the warrants being sold in this offering and we do not expect such a market to develop.

We have retained Moody Capital Solutions, Inc. (the “Placement Agent”) to act as our exclusive Placement Agent in connection with this offering until the expiration date of the offering, a date not to exceed 60 days from the date of this prospectus. We intend to enter into a Placement Agency Agreement with the Placement Agent, relating to the units offered by this prospectus. The Placement Agent is not purchasing or selling any of our units pursuant to this prospectus but will use its best efforts to sell the maximum number of units being offered, however we are requiring that the Placement Agent place a minimum purchase of $500,000 worth of units to consummate this offering and in such capacity is deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act. Therefore, we will enter into a purchase agreement directly with investors in connection with this offering and, upon entering into purchase agreements to sell a minimum of $500,000 worth of units, confirmations and definitive prospectuses will be delivered, or otherwise made available, to all purchasers who agree to purchase units, informing the purchasers of the closing date as to such units. We intend to hold all monies collected pursuant to purchase agreements in an escrowed bank account until the total amount of $500,000 has been received or until the expiration date of the offering. We have agreed to pay the Placement Agent a placement agent fee equal to 9% of the aggregate gross proceeds to us from the sale of the units. See “Plan of Distribution” beginning on page 61 of this prospectus for more information regarding this arrangement.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus for more information.

The following is a chart detailing the offering price, placement agent fees and proceeds to us if 25, 50, 75, and 100 percent of the units offered are sold.

| | | 25% | | | 50% | | | 75% | | | 100% | |

| Public offering price | | $ | 500,000 | | | $ | 1,000,000 | | | $ | 1,500,000 | | | $ | 2,000,000 | |

| Placement agent fees (1) | | $ | 45,000 | | | $ | 90,000 | | | $ | 135,000 | | | $ | 180,000 | |

| Proceeds, before expenses, to us (2) | | $ | 455,000 | | | $ | 910,000 | | | $ | 1,365,000 | | | $ | 1,880,000 | |

(1) For the purpose of estimating the Placement Agent’s fees, we have assumed that they will receive their maximum commission on all sales made in the offering. In addition, we have agreed to issue to the Placement Agent warrants to purchase up to an aggregate of 5% of the number of shares of common stock to which the Series A Convertible Preferred shares are convertible that are sold in this offering and to pay to the Placement Agent a non-accountable expense allowance equal to 1% of the aggregate the gross proceeds raised in the offering.

(2) We estimate total expenses of this offering, excluding the Placement Agent’s fees and expenses, will be approximately $175,000. For information concerning our obligation to reimburse the Placement Agent for certain of its expenses see “Plan of Distribution” beginning on page 61 of this prospectus.

This offering expires on the earlier of (i) the date upon which all of the units being offered have been sold, or (ii) 60 days from the date of this prospectus. We expect that delivery of the units being offered pursuant to this prospectus will be made to purchasers on or about 60 days after the date of this prospectus. In either event, the offering may be closed without further notice to you.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Moody Capital Solutions, Inc.

The date of this prospectus is , 2012

TABLE OF CONTENTS

| Prospectus Summary | | 5 |

| The Offering | | 10 |

| Risk Factors | | 14 |

| Use of Proceeds | | 23 |

| Determination of Offering Price | | 23 |

| Dilution | | 24 |

| Dividend Policy | | 25 |

| Capitalization | | 26 |

| Selling Stockholders | | 27 |

| Description of Securities | | 28 |

| Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | | 34 |

| Business | | 35 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 44 |

| Properties | | 54 |

| Legal Proceedings | | 54 |

| Management | | 54 |

| Executive and Director Compensation | | 57 |

| Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | | 59 |

| Plan of Distribution | | 60 |

| Material U.S. Federal Income Tax Considerations | | 64 |

| Legal Matters | | 68 |

| Experts | | 68 |

| Index to Financial Statements | | F-1 |

No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the offer contained in this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us.

Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances create an implication that there has been no change in our affairs since the date hereof. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities other than those specifically offered hereby or of any securities offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies.

This prospectus has been prepared based on information provided by us and by other sources that we believe are reliable. This prospectus summarizes certain documents and other information in a manner we believe to be accurate, but we refer you to the actual documents, if any, for a more complete understanding of what we discuss in this prospectus. In making a decision to invest in the common stock, you must rely on your own examination of us and the terms of the offering and securities offered in this prospectus, including the merits and risks involved.

We are not making any representation to you regarding the legality of an investment in the securities offered in this prospectus under any legal investment or similar laws or regulations. You should not consider any information in this prospectus to be legal, business, tax or other advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding an investment in our common stock.

Cautionary Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements that are based on current expectations, estimates, forecasts and projections regarding management’s beliefs and assumptions about the industry in which we operate. Such statements include, in particular, statements about our plans, strategies and prospects under the headings “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” When used in this prospectus, the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” and similar expressions identify forward-looking statements.

Forward-looking statements are not a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause actual outcomes and results to differ materially from what is expressed or forecasted in such forward-looking statements.

Except as required by applicable law, we assume no obligation to update any forward-looking statements publicly or to update the reasons why actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information other than that contained in this prospectus. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale of these securities is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front of this prospectus only. Our business, prospects, results of operation and financial condition may have changed since that date. This prospectus will be updated as required by law.

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements.

References in this prospectus to “3DIcon,” “the Company,” “we,” “us” or “our” refer to 3DIcon Corporation.

3DICON CORPORATION

3DIcon is a public company that is further developing a patented volumetric (full 360° view as illustrated in Figure 1 below) 3D display technology that was developed by and with the University of Oklahoma (the “University” or “OU”) under a Sponsored Research Agreement. The development to date has resulted in multiple new technologies, a working laboratory prototype (Lab Proto 1), and seven provisional patents; six of the sevenprovisional patents have been combined and converted to four utility patents. Under the Sponsored Research Agreement, the Company has obtained the exclusive worldwide marketing rights to these 3D display technologies.

Figure 1 - Lab Proto 1 Image

On May 26, 2009, the United States Patent and Trademark Office ("USPTO") approved the pending patent called "Volumetric Liquid Crystal Display" for rendering a three-dimensional image and converted it to US patent No. 7,537,345. On December28, 2010, USPTO approved the pending patent called “Light Surface Display for Rendering a Three-Dimensional Image,” and issued the United States Patent No. 7,858,913. On August 21, 2012, the USPTO approved a continuation patent called “3D Volumetric Display” and issued the US Patent No. 8,247,755. These patents describe what we are calling our CSpace®™ technology (“CSpace”).

Our Growth Strategy

Volumetric 3D Strategy

The Company plans to commercialize the CSpace volumetric 3D technology through customer funded research and development contracts and technology licensing agreements with companies like Boeing, Lockheed Martin, Siemens, and General Electric for high value applications like air traffic control, design visualization, and medical imaging. Although we do not have any definitive agreement in place that provides for such funding or licensing arrangements, we believe such companies would be interested in entering into such arrangements based on past and existing discussions our management has had with such companies. For example, Boeing provided letters of support for certain government grants that we have applied for, with the proviso in the letters that if the grant were to be awarded they would have an interest in working with us on the specific project. Representatives of Boeing have visited our facilities in Tulsa and viewed our original lab prototype and have indicated an interest in having our next level of prototype presented to their management group in St. Louis. We have no formal agreements or commitments from Boeing beyond these ongoing discussions. Lockheed Martin has inquired about our technology through the University of Oklahoma, however, we have no ongoing discussions taking place with the company. Mr. Aroesty, a director on our Board of Directors, sold a company to Siemens and believes we could use his contacts at Siemens to market our technologies. Furthermore, we have had general discussions with a number of similar companies, such as Honeywell, General Electric, ShuffleMaster, regarding our CSpace technology. It is our plan to hire a dedicated business development person with existing relationships and credibility with these and other similar companies and to leverage our management’s industry contacts to market our technologies to these companies. The above commercialization plan depends on our ability to convince potential customers that products based on our technology will meet their requirements and that the technical risk in developing products based on our technology will be acceptable to these potential customers. We are targeting high value applications that typically require products to be customized to the customer’s application. Since we understand the capabilities and limitations of CSpace better than potential customers, it is not unusual for this type of customer to ask the technology developer (in this case 3DIcon) to do most or part of the product development for or with the customer in exchange for funding by the customer. In 2013, we plan to solicit companies to enter into customer funded development contracts to develop our technology for or with those companies. Our goal is to generate sufficient funding from such arrangements that would meet or exceed the incremental costs of developing product prototypes for or with customers. If we are successful in completing the initial product prototypes, we anticipate generating licensing revenues from our CSpace technology begin in mid-2014. The Company believes that it has an experienced display industry and public company management team with a proven track record of successfully commercializing multiple display technologies to move our CSpace technology strategy forward.

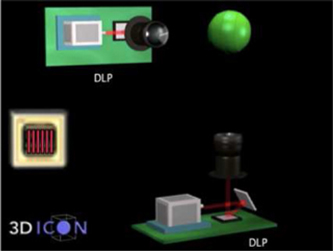

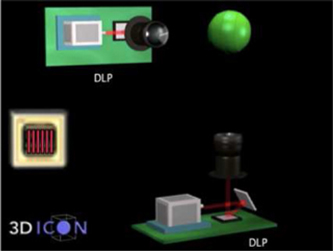

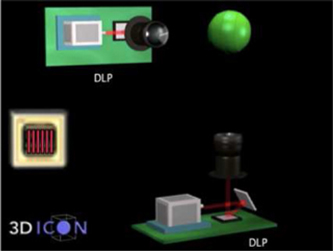

Figure 2 - CSpace Architecture

In March of 2012 the Company implemented a new evolutionary, step-by-step commercialization strategy for the CSpace volumetric display technology. Under this strategy we are developing multiple staged prototypes (laboratory and trade show) with successively higher performance (brightness, resolution, and image size). Since then, we have made better than expected progress on the second laboratory prototype, which we call Lab Proto 2. Working off the CSpace architecture illustrated in Figure 2 above, Dr. Refai and Dr. Melnik have already increased brightness by 50 times (50x) that of Lab Proto 1 so that the images displayed by Lab Proto 2 can be easily seen in typical office lighting. Our technical team has also increased resolution by approximately five times (5x) that of Lab Proto 1.

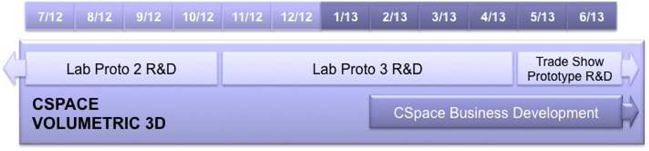

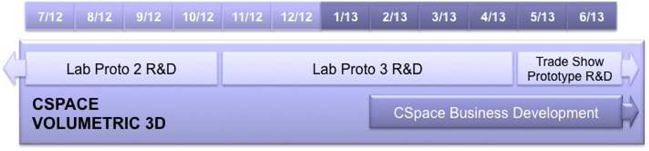

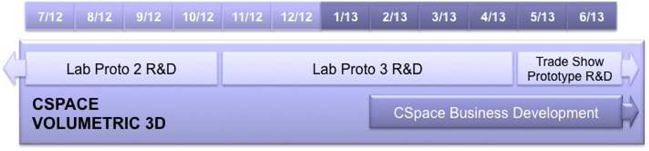

Figure 3 - CSpace Timeline

Lab Proto 2 is a working prototype with significant improvements over Lab Proto 1 and was completed in October 2012. Our technical team is has increased the image size of Lab Proto 2 by a factor of eight (8x) and the brightness of the image by a factor of four (4x). Taken together with the 50 times higher brightness already achieved, Lab Proto 2 is 200 times (200x) brighter than Lab Proto 1. Because of the larger image size and the much higher brightness we achieved much higher resolution as well.

With Lab Proto 2 completed, the Company plans to develop a third generation laboratory prototype, Lab Proto 3. The goals for Lab Proto 3 are to develop a lower cost and more scalable image chamber material (plastic or glass plus phosphor), to enhance imagine brightness by ten (10x) by utilizing a new scanning system, and to use that new material to construct an even larger image chamber than we are building for Lab Proto 2. As illustrated in the CSpace Timeline (Figure 3 above), the Company plans to complete Lab Proto 3 by March of 2013 and believes that Lab Proto 3 should be the last laboratory prototype we will need to build.

We believe that Lab Proto 3 will enable the Company to credibly engage with potential customers and secure customer funded development contracts to develop even larger and higher resolution product prototypes. If we are successful in securing customer funded development contracts, we anticipate the development of various product prototypes, the first of which we have been calling the Trade Show Prototype. It is likely that in exchange for funding of the Trade Show Prototype, our initial customer will require an exclusive license to the technology in a particular field of use (e.g. civilian air traffic control). The Company believes that any such exclusive license will be based on a set period of time during product and/or market development and based on performance thereafter. Failure by the customer to meet agreed upon performance criteria would most likely result in the license becoming non-exclusive. Any such exclusive license agreement would preclude the Company from working with other customers in that field of use during the period of the exclusive license. The Company does not believe that this strategy for funding the Tradeshow Prototype will significantly impact the revenue potential of the technology given the number of potential applications (fields of use). If successfully developed, the Trade Show Prototype, which is illustrated as an artist concept in Figure 4 below, will be fully packaged and portable so that it can be used for trade shows and on-site customer demonstrations. We believe that the Trade Show prototype will enable the Company to market and secure licensing agreements with large government contract ors and large medical or industrial products companies. The Company plans to hire a full time business development person with existing management relationships with potential CSpace customers in order to secure these customer funded development contracts and technology license agreements.

Figure 4 - Artist Concept Of CSpace Trade Show Prototype

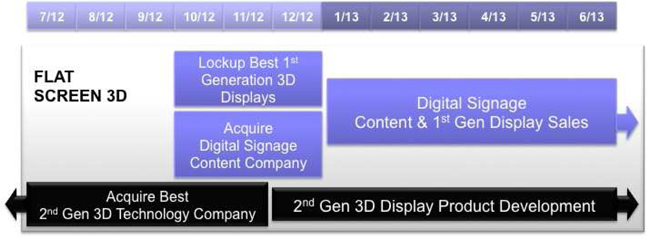

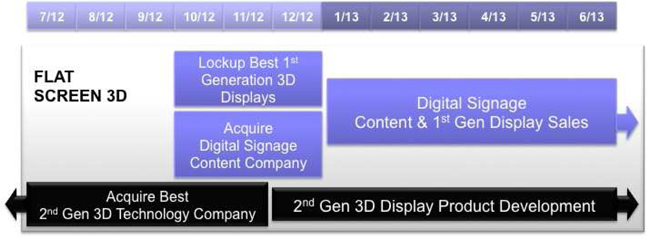

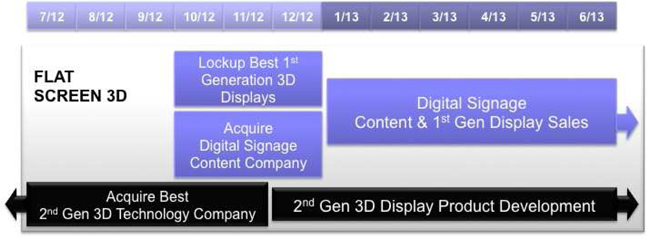

Flat Screen 3D Strategy

In order to generate revenue sooner than the CSpace technology will allow, the Company plans to use stock to purchase small private companies that will provide it with significant advantages and immediate revenue in the $15B digital signage market.

Since March of 2012, the Company has been evaluating a number of second-generation glasses-free flat screen 3D display technologies and the companies that are developing these technologies. Our goal was to identify a new technology that could deliver significantly better performance (3D impact and image quality) than current large area multiple-viewer glasses-free 3D flat screen displays without compromising resolution and brightness, as do current displays. The ideal company would also have a great technical team, a broad patent portfolio, and a credible technology roadmap to ensure that these competitive advantages are sustainable into the future.

As a result of the above evaluation process, the Company has recently signed a non-binding Letter of Intent to acquire Dimension Technologies, Inc. (DTI)www.dti3d.com located in Rochester, NY. Based on our analysis to date, DTI appears to meet all of our requirements and in addition appears to be reasonably self-sufficient since its founding primarily due to its continued success at securing government funded research grants. The DTI management team also recognizes the value of the display industry veterans that make up the core of the 3DIcon management team. Please keep in mind that while the Letter of Intent does detail some terms of the acquisition, it is subject to the completion of an audit of DTI’s financial statements and confirmatory due diligence by both parties and therefore is not legally binding. Over the next 60-90 days it is our intent to complete that due diligence and once completed to our satisfaction, we intend to consummate the acquisition as soon as possible.

The DTI acquisition or another similar acquisition, if completed, will be the cornerstone of our flat screen 3D display business just like CSpace is the cornerstone of our volumetric 3D display business. Given how far along DTI is in developing products, we estimate that initial products based on their technology can be delivered to market in approximately 12 months. If the acquisition is completed, we intend to make and sell products based on the DTI technology for commercial and industrial markets (e.g. digital signage) and license the DTI technology to large Asian display companies for use in consumer products like televisions, desktop monitors, laptop computers, tablets, and smart phones.

In addition to the above flat screen 3D display company acquisition, the Company has begun initial discussions with candidates for a complimentary acquisition: a digital signage content company. This acquisition will provide immediate revenue and complement / drive demand for and showcase the capabilities of the flat screen 3D displays that could be developed if we acquire DTI. Based on primary market research conducted by the Company, the lack of high quality content (in particular advertising) is currently and has been the top adoption barrier for companies considering the deployment of digital signage. This is particularly true for 3D digital signage content where there are very few digital signage focused content companies (creative firms) that have experience in creating high quality 3D content. It is our intent to acquire one of the top private 2D digital signage content companies and then to develop 3D content creation capabilities within that company. We believe that high quality 3D content tailored to the 3D displays of DTI will drive demand for these displays and at the same time provide the Company with an annuity revenue stream tied to the 3D displays.

Currently, we do not have any agreements in place that would allow entry into the flat screen segment of the glasses-free 3D display industry or digital signage industry and no assurances can be made that such an agreement will ever be consummated. However, even if any acquisitions or partnerships are consummated, no assurances can be made that the Company could successfully bring to market such technologies.

Where You Can Find More Information

Our common stock is quoted on the OTC Bulletin Board under the symbol “TDCP.OB”. On November 14, 2012, the last reported sale price for our common stock was $0.060 per share.

Our principal executive offices are located at 6804 South Canton Avenue, Suite 150, Tulsa, OK 74136. Our telephone number is (918) 494-0505. Our website address is www.3dicon.net. Our website and the information contained on our website are not incorporated into this prospectus or the registration statement of which it forms a part. Further, our references to the URLs for these websites are intended to be inactive textual references only.

We have filed a registration statement on Form S-1 (Registration No. 333-182532) with the SEC under the Securities Act with respect to the securities offered by this prospectus. This prospectus, which is a part of such registration statement, does not include all of the information contained in the registration statement and its exhibits. For further information regarding us and our securities, you should consult the registration statement and its exhibits. The registration statement and its exhibits, as well as our other reports filed with the SEC, can be inspected and copied at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information about the operation of the public reference room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a web site at http:// www.sec.govwhich contains the Form S-1 and other reports, proxy and information statements and information regarding issuers that file electronically with the SEC.

Statements contained in this prospectus concerning the provisions of any documents are summaries of those documents, and we refer you to the documents filed with the SEC for more information. The registration statement and any of its amendments, including exhibits filed as a part of the registration statement or an amendment to the registration statement, are available for inspection and copying as described above.

The Offering

| Issuer | | 3DIcon Corporation |

| | | |

| Units | | Each unit consists of (1) one Series A convertible preferred share which is convertible into 15,385 shares of common stock; (2) one Class A Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit; and (3) one Class B Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit. |

| | | |

| Common Stock offered by selling stockholders | | Up to 12,301,725 shares of our Common Stock issuable upon conversion of outstanding promissory notes. |

| | | |

| Unit Price | | $1,000 per unit. |

| | | |

| Offering Period | | The units are being offered for a period not to exceed 60 days. In the event we do not sell the minimum offering proceeds of $500,000 before the expiration date of the offering period, all funds raised will be promptly returned to the investors, without interest or deduction. |

| | | |

| Series A Preferred Shares | | Each unit includes one Series A preferred share. Each Series A preferred share is convertible at the option of the holder into 15,385 shares of our common stock, has a stated value and liquidation preference of $1,000 per share, and is redeemable at the option of the Company so long as certain conditions described in this prospectus are met. The Company also has the right to require the holders to convert the Series A preferred shares in certain circumstances described in this prospectus. Until the three year anniversary of the issuance date of the Series A preferred shares, the Series A preferred shares will have a stated dividend rate of 6% per annum, payable quarterly in cash or, subject to certain conditions, in common stock or a combination of cash and common stock, at our election. After the three year anniversary of the issuance date of the Series A preferred shares, the Series A preferred shares will participate in any dividends payable upon our common stock on an "as converted" basis. The Series A preferred shares will not have voting rights, except as may be provided by Oklahoma law. See the section entitled "Description of Series A Preferred Shares" beginning on page 29 of this prospectus. |

| | | |

| Dividends and Make-Whole Payment | | Until the three year anniversary of the issuance date of the Series A preferred shares, each holder of the Series A preferred shares is entitled to receive dividends at the rate of 6% per annum of the stated value for each preferred share held by such holder payable quarterly on January 1, April 1, July 1 and October 1, beginning on the first such date after the original issue date, and on each conversion date. Except in limited circumstances (including a failure to meet the Equity Conditions), we can elect to pay the dividends in cash or in duly authorized, validly issued, fully paid and non-assessable common stock, or a combination thereof. If the Equity Conditions are not met, we must pay the dividends in cash. If the Equity Conditions have been met and we choose to pay the dividends in common stock, the common stock used to pay the dividends will be valued at 90% of the average volume weighted average price of our common stock for the 20 consecutive trading days ending on the trading day immediately prior to the applicable dividend payment date. From and after the three year anniversary of the issuance date of the Series A preferred shares, each holder of Series A preferred shares will be entitled to receive dividends equal, on an as-if-converted to common stock basis, to and in the same form as dividends actually paid on common stock when, as, and if such dividends are paid on common stock. We have never paid dividends on our common stock and we do not intend to do so for the foreseeable future. |

| | | |

| | | In the event a holder converts his, her or its Series A preferred shares prior to the three year anniversary of the issuance date of the Series A preferred shares, we must also pay to the holder in cash, or at our option, subject to satisfaction of the Equity Conditions, in common stock valued as described above, or a combination of cash and common stock, with respect to the Series A preferred shares so converted, an amount equal to $180 per $1,000 of the stated value of the Series A preferred shares, less the amount of any dividends paid in cash or in common stock on such Series A preferred shares on or before the date of conversion. |

| Assumed Conversion Price of Series A preferred shares | | $0.065 per share, subject to adjustment as described in this prospectus. See the section entitled "Description of Series A Preferred Shares" beginning on page 29 of this prospectus. |

| | | |

| Common stock underlying Series A preferred shares | | Based on the assumed conversion price of $0.065 per share, each Series A preferred share is convertible into 15,385 of our common stock and all 2,000 Series A preferred shares offered hereby would be converted into 30,770,000 of our common stock. |

| Class A Warrant terms | | Each unit includes a Class A Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, which equals 50% of the common stock underlying each Series A preferred share. Class A Warrants will entitle the holder to purchase common stock for an assumed exercise price equal to $0.065 per share, subject to adjustment as described in this prospectus. Class A Warrants are exercisable immediately after the date of issuance and expire five years after the date of issuance. See the section entitled "Description of Warrants" beginning on page 31 of this prospectus. |

| | | |

| Class B Warrant terms | | Each unit includes a Class B Warrant to purchase 0.5 of our common stock for every share of common stock underlying the preferred share included in such unit, which equals 50% of the common stock underlying each Series A preferred share. Class B Warrants will entitle the holder to purchase common stock for an assumed exercise price equal to $0.065 per share, subject to adjustment as described in this prospectus. Class B Warrants are exercisable immediately after the date of issuance and expire one year after the date of issuance. See the section entitled "Description of Warrants" beginning on page 31 of this prospectus. |

| | | |

| Common stock outstanding before this offering | | Approximately 45,552,335 shares. |

| | | |

| Common stock to be outstanding after this offering including common stock underlying Series A Preferred Shares included in units | | Approximately 88,624,060 shares, including the 12,301,725 shares issuable to and offered by the selling stockholders and excluding shares issuable upon exercise of the warrants and shares issuable in lieu of cash dividend or make-whole payments. |

| | | |

| Use of Proceeds | | Assuming all units are sold, we estimate that the net proceeds to us from this offering will be approximately $1,645,000 million. We expect to use any proceeds received from this offering for repayment of debt and general corporate purposes, such as research and development, business development, working capital and capital expenditures. We will not receive any proceeds from the sale of shares by the selling stockholders. |

| | | |

| | | For a more complete description of our anticipated use of proceeds from this offering, see “Use of Proceeds.” |

| | | |

| Limitations on Exercise or Conversion | | Notwithstanding anything herein to the contrary, the Company will not permit the conversion of the preferred shares or exercise of the warrants of any holder, if after such conversion or exercise such holder would beneficially own more than 4.99% (or 9.99% as elected by the holder pursuant to the terms of the Series A preferred shares or the warrants, as applicable) of the common stock then outstanding. |

| | | |

| Liquidation Preference: | | In the event of any liquidation or winding up of the Company, the holders of the Preferred Stock shall be entitled to receive, prior and in preference to the holders of Common Stock and any series of preferred stock ranked junior to the Preferred Stock, an amount (the “Liquidation Amount”) equal to the original purchase price per share of Preferred Stock then held by such holders, plus all accrued but unpaid dividends. |

| | | |

| Risk Factors | | You should carefully read and consider the information set forth under "Risk Factors," together with all of the other information set forth in this prospectus, before deciding to invest in the units offered by this prospectus. |

The number of shares of our common stock to be outstanding after this offering is based on 45,552,335 shares of common stock outstanding as of November 14, 2012 (reflecting a 1-for-35 reverse stock split of our common stock effected on April 27, 2012) and excludes as of that date:

| | · | an aggregate of 2,960,275 shares of common stock issuable upon the exercise of stock options outstanding as of November 14, 2012 at a weighted average exercise price of $0.54 per share; |

| | · | an aggregate of 2,916,882 additional shares reserved for future issuance under the 3DIcon Corporation 2012 Equity Incentive Plan; |

| | · | an aggregate of 242,602 shares of our common stock issuable upon exercise of warrants with expiration dates between May 2014 and June 2015 at exercise prices ranging from $3.15 to $381.50 per share; and |

| | · | an aggregate of 156,355,652 shares of our common stock issuable upon conversion of convertible debentures including shares of common stock that may be issuable in the future if we elect to pay all interest due under the terms of the convertible debentures in shares of common stock. |

Unless we specifically state otherwise, the share information in this prospectus is as of November 14, 2012 and reflects or assumes no exercise of outstanding options or warrants to purchase shares of our common stock or the conversion of convertible debentures into our common stock.

Related Transaction

June-August 2012 Financings

5% Convertible Promissory Note

On June 6, 2012 (the “Effective Date”), the Company issued and sold a convertible promissory note (the "Note") in the principal amount of $275,000 to JMJ Financial (“JMJ”). The Note includes a $25,000 original issue discount (the “OID”) that will be prorated based on the advances actually paid to the Company. JMJ advanced $50,000 upon execution of the Note and collected $4,000 OID. Subsequently, JMJ advanced $25,000 and collected $2,000 OID on the Note. Pursuant to the terms of the Note, JMJ may, at its election, convert all or a part of the Note into shares of the Company's common stock at a conversion rate equal to the lesser of (i) $0.35 or (ii) 70% of the lowest trade price during the twenty-five trading days prior to JMJ’s election to convert. In addition, pursuant to the terms of the Note, the Company agreed to include on the next registration statement filed by the Company with the SEC all shares issuable upon conversion of the Note. Failure to do so will result in liquidated damages of 25% of the outstanding principal balance of the Note. If the Company repays the Note on or before ninety days from the Effective Date, the interest rate will be zero percent. If the company does not repay the Note on or before ninety days from the Effective Date, a one-time interest charge of 5% shall be applied to the principal sum of $275,000. The principal of the Note is due one year from the date of each of the principal amounts advanced.

5% Convertible Promissory Note #2

On August 1, 2012 (the “Note #2 Effective Date”), the Company issued and sold a convertible promissory note #2 (the “Note #2") in the principal amount of $140,000 to JMJ. The Note #2 includes a $15,000 original issue discount (the “OID”) that will be prorated based on the advances actually paid to the Company. JMJ advanced $100,000 upon execution of the Note and collected $8,000 OID. In addition to the OID, the Note #2 provides for a one-time interest charge of 5% to be applied to the principal sum advanced. Pursuant to the terms of the Note #2, JMJ may, at its election, convert all or a part of the Note #2 into shares of the Company's common stock at a conversion rate equal to the lesser of (i) $0.15 or (ii) 70% of the lowest trade price during the twenty-five trading days prior to JMJ’s election to convert. In addition, pursuant to the terms of the Note #2, the Company agreed to include on the next registration statement filed by the Company with the SEC all shares issuable upon conversion of the Note #2. Failure to do so will result in liquidated damages of 25% of the outstanding principal balance of the Note #2. The principal of the Note #2 is due one year from the date of each of the principal amounts advanced.

The notes are subject to a Mandatory Registration Agreement (the “Registration Agreement”) whereby no later than August 31, 2012, the Company agreed to file, at its own expense, an amendment (the “Amendment”) to the S-1 Registration Statement (the “Registration Statement”) the Company filed with the SEC on July 3, 2012, to include in such Amendment 4,750,000 shares of common stock issuable under the Notes and the Note #2. The Company agreed, thereafter, to use its best efforts to cause such Registration Statement to become effective as soon as possible after such filing but in no event later than one hundred and twenty (120) days from the date of the Registration Agreement. Failure to file the Amendment by August 31, 2012 will result in a penalty/liquidated damages of $10,000. In addition, failure to have the Registration Statement declared effective within 120 days of the date of the Registration Agreement will result in a penalty/liquidated damages of $25,000. Any such penalties/liquidated damages will be added to the balance of either the Note or the Note #2 at the Holder’s discretion.

Convertible Bridge Notes

On August 24, 2012, August 28, 2012 and September 10, 2012, the Company issued and sold to accredited investors Convertible Bridge Notes (the “Bridge Notes”) in the aggregate principal amount of $438,000. The note sold on September 10, 2012 was purchased by Victor Keen, a director of the Company. The Notes included a $73,000 original issue discount. Accordingly, the Company received $365,000 gross proceeds from which the Company paid legal fees of $25,000 and placement agent fees of $27,675. The Bridge Notes mature in 90 days from their date of issuance and, other than the original issue discount, the Bridge Notes do not carry interest. However, in the event the Bridge Notes are not paid on maturity, all past due amounts will accrue interest at 15% per annum. Upon maturity of the Bridge Notes, the holders of the Bridge Notes may elect to convert all or any portion of the outstanding principal amount of the Bridge Notes into units sold pursuant to this Prospectus at the offering price or shares of Common Stock at a conversion price equal to the lesser of 100% of the Volume Weighted Average Price (VWAP), as reported for the 5 trading days prior to (a) the date of issuance of the Bridge Notes, (b) the maturity date of the Bridge Notes, or (c) the first closing date of the securities sold pursuant to this Prospectus. In the event that the holders of the Bridge Notes elect to convert into units sold pursuant to this Prospectus, the Placement Agent agreed not to charge a placement agent fee for such purchases of units. Furthermore, in the event that the Registration Statement on Form S-1 filed by the Company on July 3, 2012, or amendments thereto, is not declared effective 90 days from the date of the issuance of the Bridge Notes, the Company agreed to register the Common Stock into which the Bridge Notes are convertible.

Summary Historical Financial Information

The following table summarizes our financial data. We have derived the following summary of our statements of operations data for the nine months ended September 30, 2012 and 2011 from our unaudited financial statements appearing elsewhere in this prospectus and the summary of our balance sheet data as of September 30, 2012 and 2011 from our unaudited financial statements appearing elsewhere in this prospectus. We have derived the following summary of our statements of operations data for the fiscal years ended December 31, 2011 and 2010 from our audited financial statements appearing elsewhere in this prospectus and the summary of our balance sheet data as of December 31, 2011 and 2010 from our audited financial statements appearing elsewhere in this prospectus. The following summary of our financial data set forth below should be read together with our financial statements and the related notes to those statements, as well as the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus.

| | | Nine Months Ended

September 30, | | | Year Ended

December 31, | |

| | | (Unaudited) | | | | |

| | | 2012 | | | 2011 | | | 2011 | | | 2010 | |

| Statement of Operations Data: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenues | | $ | 63,668 | | | $ | 83,323 | | | $ | 89,323 | | | $ | 106,059 | |

| Research and development costs | | | 414,149 | | | | 534,737 | | | | 942,240 | | | | 469,408 | |

| General and administrative costs | | | 1,120,660 | | | | 979,638 | | | | 1,430,365 | | | | 1,084,419 | |

| Interest | | | 40,597 | | | | 35,315 | | | | 37,187 | | | | 75,969 | |

| Total expenses | | | 1,575,406 | | | | 1,549,690 | | | | 2,409,792 | | | | 1,629,796 | |

| | | | | | | | | | | | | | | | | |

| Net loss attributable to common stockholders | | $ | (1,511,737 | ) | | $ | (1,466,367 | ) | | $ | (2,320,469 | ) | | $ | (1,523,737 | ) |

| | | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Current assets | | | 80,071 | | | | 348,108 | | | | 70,101 | | | | 395,964 | |

| Working capital (deficit) | | | (664,937 | ) | | | 230,836 | | | | (659,560 | ) | | | (753,607 | ) |

| Total assets | | | 215,748 | | | | 361,838 | | | | 82,225 | | | | 413,988 | |

| Long term debt, including current portion | | | 605,353 | | | | 164,804 | | | | 113,444 | | | | 808,443 | |

| Total stockholders’ equity (deficit) | | | (1,090,094 | ) | | | (702,775 | ) | | | (1,246,529 | ) | | | (1,626,230 | ) |

Risk Factors

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, prospects, results of operation and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Relating to Our Business

We have a limited operating history, as well as a history of operating losses.

We have a limited operating history. We cannot assure you that we can achieve revenue or sustain revenue growth or profitability in the future. We have a cumulative net loss of $17,932,857 for the period from inception (January 1, 2001) to September 30, 2012. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. Unanticipated problems, expenses, and delays are frequently encountered in establishing a new business and marketing and developing products. These include, but are not limited to, competition, the need to develop customers and market expertise, market conditions, sales, marketing and governmental regulation. Our failure to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail our operations. Revenues and profits, if any, will depend upon various factors. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on our business.

We may not be able to achieve the target specifications for the second and third generation CSpace laboratory prototypes.

The process of developing new highly technical products and solutions is inherently complex and uncertain. It requires accurate anticipation of customer's changing needs and emerging technological trends. We must make long-term investments and commit significant resources before knowing whether these investments will eventually result in products that achieve customer acceptance and generate the revenues required to provide desired returns. If we fail to achieve and meet our target specifications in the development of the second and third generation CSpace laboratory prototypes, we could lose market position and customers to our competitors and that could have a material adverse effect on our results of operations and financial condition.

We may not be able to secure the customer funding necessary to develop the CSpace Trade Show Prototype.

Although Lab Proto 2 is complete and an important part of our business strategy moving forward is the development of our Lab Proto 3. While we believe this prototype will enable us to secure customer funded development contracts whereby our customer would provide part or all of the funding necessary to develop products for or with the customer and to secure technology licensing agreements, there can be no assurances that this will occur. If we are unable to secure customer funded development contracts and technology licensing agreements we will likely not be able to develop our CSpace Trade Show Prototype. Without the CSpace Trade Show Prototype we will not be able to successfully implement our business strategy for our Volumetric 3D Display products, which could cause harm to our competitive position and financial condition.

We may not be able to successfully license the CSpace technology to customers.

A significant portion of our expected future revenues will be generated through licensing our CSpace technology to third parties such as Boeing, Lockheed Martin, Siemens, and General Electric. However, there is no guarantee we will be able to successfully license our CSpace technology to such companies or to other third parties. If we fail to successfully license our CSpace technology it could negatively impact our revenue stream and financial condition.

We may not be able to acquire a digital signage content company required for credible entry into the digital signage industry.

The Company intends to acquire a digital content signage company in order to generate immediate revenue and increase demand for 3D display technology. There can be no guarantee that the Company will be able to successfully acquire one or both of the targeted digital signage content companies with which we have engaged acquisition discussions. If the Company were to fail to acquire one or both of its target acquisitions it would negatively impact the Company’s chances of entering the digital content signage industry and decrease short-term revenue potential.

We may not be able to acquire DTI, which is required for entry into the glasses-free flat screen 3D display industry and to provide a sustainable advantage in the digital signage market.

Even though the Company has entered into a Letter of Intent to acquire DTI, which details the material terms of a potential acquisition by the Company of DTI, it is not legally binding and does not consummate the acquisition. The Company’s acquisition of DTI remains contingent upon completion of confirmatory due diligence on behalf of both parties as well as official execution of an acquisition agreement. There can be no guarantee that such an acquisition agreement will be executed. If the Company fails to acquire DTI or a similarly advantaged flat screen 3D display technology company or fails to secure an exclusive license to glasses-free flat screen 3D display technology it will likely prohibit our entry into the glasses-free flat screen 3D display industry. In addition, if the Company is unsuccessful in acquiring DTI, a similarly advantaged company or an exclusive license to such technology, the Company’s long term goal to enter and maintain a significant and sustainable advantage in the digital signage market could be compromised because, if the Company successfully acquires a digital signage company or assets, without the glasses-free flat screen 3D display technology, the digital signage content alone will not have long term sustainability.

We may not be able to secure a private label distribution agreement with the target 1st generation glasses-free flat screen 3D display company at all or under terms that we would find acceptable.

If the Company is successful in acquiring a target company with 1st generation glasses-free flat screen 3D display technology, it plans to enter into a private label (3DIcon brand) distribution agreement in order to resell such 1st generation glasses-free 3D display technology under the 3DIcon brand and immediately generate revenues for the Company. However, there can be no assurance that the Company will be able to secure such private label distribution agreements with favorable terms or terms which the Company finds acceptable. Without such agreements the Company will not be able to secure a revenue stream from the resale of 1st generation glasses-free flat screen 3D display technology.

Furthermore, in order for the Company to successfully secure and perform under such distribution agreements, it anticipates approximate expenditures equal to $350,000 in capital in order to market and sell such merchandise. Should the Company fail to sell all or part of its inventory of 1st generation glasses-free flat screen 3D display technology, this initial investment could be lost.

We may not be able to develop a 2nd generation glasses-free flat screen 3D display based on the DTI technology within one year.

The Company plans to develop and sell 2nd generation glasses-free flat screen 3D display products based upon its potential acquisition of DTI within 12 months, however, there can be no assurances that either DTI or the Company will be able to develop the technology necessary to market these products within the estimate 12 month time frame. If we are unable to develop and market these products in the next 12 months we will generate less short term revenue which will negatively impact implementation of our business plans. Furthermore, in the long run the market conditions and technological trends may make such technology unneeded or unwanted and no assurances can be made that the Company will ever generate revenues from a 2nd generation glasses-free flat screen 3D display product.

We may not be able to compete successfully.

Although the volumetric 3D imaging and display technology that we are attempting to develop is new, and although at present we are aware of only a limited number of companies that have publicly disclosed their attempts to develop similar technology, we anticipate a number of companies are or will attempt to develop technologies/products that compete or will compete with our technologies. Further, even if we are the first to market with a technology of this type, and even if the technology is protected by patents or otherwise, because of the vast market and communications potential of such a product, we anticipate the market will be flooded by a variety of competitors (including traditional display companies), many of which will offer a range of products in areas other than those in which we compete, which may make such competitors more attractive to prospective customers. In addition, many if not all of our competitors and potential competitors will initially be larger and have greater financial resources than we do. Some of the companies with which we may now be in competition, or with which we may compete in the future, have or may have more extensive research, marketing and manufacturing capabilities and significantly greater technical and personnel resources than we do, even given our relationship to the University, and may be better positioned to continue to improve their technology in order to compete in an evolving industry. Further, technology in this industry may evolve rapidly once an initially successful product is introduced, making timely product innovations and use of new technologies essential to our success in the marketplace. The introduction by our competitors of products with improved technologies or features may render any product we initially market obsolete and unmarketable. If we or our partners are not able to deliver to market products that respond to industry changes in a timely manner, or if our products do not perform well, our business and financial condition will be adversely affected.

The technologies being developed may not gain market acceptance.

The products that we are currently developing utilize new technologies. As with any new technologies, in order for us to be successful, these technologies must gain market acceptance. Since the technologies that we anticipate introducing to the marketplace will exploit or encroach upon markets that presently utilize or are serviced by products from competing technologies, meaningful commercial markets may not develop for our technologies.

In addition, the development efforts of 3DIcon and the University on the 3D technology are subject to unanticipated delays, expenses or technical or other problems, as well as the possible insufficiency of funding to complete development. Our success will depend upon the ultimate products and technologies meeting acceptable cost and performance criteria, and upon their timely introduction into the marketplace. The proposed products and technologies may never be successfully developed, and even if developed, they may not satisfactorily perform the functions for which they are designed. Additionally, these may not meet applicable price or performance objectives. Unanticipated technical or other problems may occur which would result in increased costs or material delays in their development or commercialization.

If we are unable to successfully retain existing management and recruit qualified personnel having experience in our business, we may not be able to continue our operations.

Our success depends to a significant extent upon the continued services of our Board of Directors, management officers and our Chief Technology Officer. Our success also depends on our ability to attract and retain other key executive officers.

Our auditors have expressed substantial doubt about our ability to continue as a going concern. If we do not continue as a going concern, investors will lose their entire investment.

In their report dated April 6, 2012, our auditors have expressed substantial doubt about our ability to continue as a going concern. These concerns arise from the fact that we are a development stage organization with insufficient revenues to fund development and operating expenses. If we are unable to continue as a going concern, you could lose your entire investment in us.

We will need significant additional capital, which we may be unable to obtain.

Our capital requirements in connection with our development activities and transition to commercial operations have been and will continue to be significant. We will require approximately $2.1 million additional funds through December 2013 to continue research, development and testing of our technologies, to obtain intellectual property protection relating to our technologies when appropriate, and to improve and market our technologies. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all.

Risks Related to Our Intellectual Property

If we fail to establish, maintain and enforce intellectual property rights with respect to our technology and/or licensed technology, our financial condition, results of operations and business could be negatively impacted.

Our ability to establish, maintain and enforce intellectual property rights with respect to our technology and the University’s ability to establish, maintain and enforce intellectual property rights with respect to our exclusively licensed technology, once successfully developed into 3D display technology that we intend to market, will be a significant factor in determining our future financial and operating performance. We seek to protect our intellectual property rights by relying on a combination of patent, trade secret and copyright laws. We also use confidentiality and other provisions in our agreements that restrict access to and disclosure of its confidential know-how and trade secrets.

Outside of our pending patent applications, we seek to protect our technology as trade secrets and technical know-how. However, trade secrets and technical know-how are difficult to maintain and do not provide the same legal protections provided by patents. In particular, only patents will allow us to prohibit others from using independently developed technology that are similar. If competitors develop knowledge substantially equivalent or superior to our trade secrets and technical know-how, or gain access to our knowledge through other means such as observation of our technology that embodies trade secrets at customer sites which we do not control, the value of our trade secrets and technical know-how would be diminished.

While we strive to maintain systems and procedures to protect the confidentiality and security of our trade secrets and technical know-how, these systems and procedures may fail to provide an adequate degree of protection. For example, although we generally enter into agreements with our employees, consultants, advisors, and strategic partners restricting the disclosure and use of trade secrets, technical know-how and confidential information, we cannot provide any assurance that these agreements will be sufficient to prevent unauthorized use or disclosure. In addition, some of the technology deployed at customer sites in the future, which we do not control, may be readily observable by third parties who are not under contractual obligations of non-disclosure, which may limit or compromise our ability to continue to protect such technology as a trade secret.

While we are not currently aware of any infringement or other violation of our intellectual property rights, monitoring and policing unauthorized use and disclosure of intellectual property is difficult. If we learned that a third party was in fact infringing or otherwise violating our intellectual property, we may need to enforce our intellectual property rights through litigation. Litigation relating to our intellectual property may not prove successful and might result in substantial costs and diversion of resources and management attention.

If our technology is licensed to customers at some point in the future, the strength of the intellectual property under which we would to grant licenses can be a critical determinant of the value of such potential licenses. If we are unable to secure, protect and enforce our intellectual property now and in the future, it may become more difficult for us to attract such customers. Any such development could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may face claims that we are violating the intellectual property rights of others.

Although we are not aware of any potential violations of others’ intellectual property rights, we may face claims, including from direct competitors, other companies, scientists or research universities, asserting that our technology or the commercial use of such technology infringes or otherwise violates the intellectual property rights of others. We cannot be certain that our technologies and processes do not violate the intellectual property rights of others. If we are successful in developing technologies that allow us to earn revenues and our market profile grows we could become increasingly subject to such claims.

We may also face infringement claims from the employees, consultants, agents and outside organizations we have engaged to develop our technology. While we have sought to protect ourselves against such claims through contractual means, we cannot provide any assurance that such contractual provisions are adequate, and any of these parties might claim full or partial ownership of the intellectual property in the technology that they were engaged to develop.

If we were found to be infringing or otherwise violating the intellectual property rights of others, we could face significant costs to implement work-around methods, and we cannot provide any assurance that any such work-around would be available or technically equivalent to our potential technology. In such cases, we might need to license a third party’s intellectual property, although any required license might not be available on acceptable terms, or at all. If we are unable to work around such infringement or obtain a license on acceptable terms, we might face substantial monetary judgments against us or an injunction against continuing to use or license such technology, which might cause us to cease operations.

In addition, even if we are not infringing or otherwise violating the intellectual property rights of others, we could nonetheless incur substantial costs in defending ourselves in suits brought against us for alleged infringement. Also, if we are to enter into a license agreement in the future and it provides that we will defend and indemnify our customer licensees for claims against them relating to any alleged infringement of the intellectual property rights of third parties in connection with such customer licensees’ use of such technologies, we may incur substantial costs defending and indemnifying any customer licensees to the extent they are subject to these types of claims. Such suits, even if without merit, would likely require our management team to dedicate substantial time to addressing the issues presented. Any party bringing claims might have greater resources than we do, which could potentially lead to us settling claims against which we might otherwise prevail on the merits.

Any claims brought against us or any customer licensees alleging that we have violated the intellectual property of others could have negative consequences for our financial condition, results of operations and business, each of which could be materially adversely affected as a result.

At this time, we do not own any intellectual property in Volumetric Liquid Crystal Display or Light Surface Display for Rendering Three-Dimensional Images, and, apart from the Sponsored Research Agreement with the University and the exclusive worldwide marketing rights thereto, we have no contracts or agreements pending to acquire the intellectual property.

Although we have obtained exclusive worldwide marketing rights to “Volumetric Liquid Crystal Display” and “Light Surface Display for Rendering Three-Dimensional Images”, two technologies vital to our business and growth strategy, we do not own any intellectual property in these technologies. Although our exclusive worldwide marketing rights to these technologies stand alone and are independent of the Sponsored Research Agreement, outside of our Sponsored Research Agreement with the University, we have no pending agreements to obtain or purchase ownership over such intellectual property. Should the University lose their rights in such technologies or we are otherwise unable to utilize the rights obtained in such agreements it would be difficult to successfully implement our business strategy going forward and our stock value would likely decrease.

Risks Relating to Our Current Financing Arrangements:

There are a large number of shares underlying our convertible debentures, and warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

As of November 14, 2012, we had 45,552,335 shares of common stock issued and outstanding and convertible debentures outstanding that may be converted into an estimated 169,447,176 shares of common stock at current market prices. The number of shares of common stock issuable upon conversion of the outstanding convertible debentures may increase if the market price of our stock declines. We also have outstanding warrants issued to Golden State Equity Investors, Inc. f/k/a Golden Gate Investors ("Golden State") to purchase 21,217 shares of common stock at an exercise price of $381.50. The sale of the shares underlying the convertible debentures and warrants may adversely affect the market price of our common stock.

Our obligation to issue shares upon conversion of our convertible debentures is essentially limitless.

The conversion price of our convertible debentures is continuously adjustable, which could require us to issue a substantially greater number of shares, which will cause dilution to our existing stockholders.

The following is an example of the amount of shares of our common stock that are issuable, upon conversion of our 4.75% $100,000 convertible debenture (excluding accrued interest) issued to Golden State on November 3, 2006, based on the remaining principal balance of $74,265 and market prices 25%, 50% and 75% below the market price as of November 14, 2012 of $0.0.06.

% Below

Market | | | Price Per

Share | | | Effective

Conversion

Price | | | Number

of Shares

Issuable(1) | | | % of

Outstanding

Stock | |

| | 25 | % | | $ | 0.045 | | | $ | 0.036 | | | | 269,275,718 | | | | 591 | % |

| | 50 | % | | $ | 0.030 | | | $ | 0.024 | | | | 404,355,657 | | | | 888 | % |

| | 75 | % | | $ | 0.015 | | | $ | 0.012 | | | | 809,595,474 | | | | 1,777 | % |

(1) Shares issuable exclude 21,217 shares underlying the remaining warrants exercisable at $381.50 per share.

As illustrated, the number of shares of common stock issuable upon conversion of our convertible debentures will increase if the market price of our stock declines, which will cause dilution to our existing stockholders.

The continuously adjustable conversion price feature of our convertible debentures may encourage investors to make short sales in our common stock, which could have a depressive effect on the price of our common stock.