Exhibit 99.2

NYSE MKT: URG • TSX: URE Ur - Energy Third Quarter 2015 Teleconference and Webcast

NYSE MKT: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s ability to maintain steady state and improve production rates, associated costs and timing to make product deliveries ; the technical and economic viability of Lost Creek (including the production and cost projections contained in the preliminary economic analysis of the Lost Creek Property) ; whether higher - than - expected headgrades will continue to be realized throughout Lost Creek ; the ability to complete additional favorable uranium sales agreements and ability to reduce exposure to volatile market ; the potential of exploration targets throughout the Lost Creek Property (including the continuing ability to expand resources) ; completion of (and timing for) regulatory approvals and other development at Shirley Basin ; whether additional financing may become necessary . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed March 2 , 2015 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . John Cooper, Ur - Energy Senior Geologist, P . Geo . , SME Registered Member and Qualified Person as defined by National Instrument 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

NYSE MKT: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2) ▪ Lost Creek ISR – our 100% Owned Uranium Production Facility – Initiated Production 3Q 2013 • Produced 1,000,000 th pound of U 3 0 8 2Q 2015 • State of the art flagship project • Results demonstrate that Lost Creek is a reliable, low cost production center – “steady state” production ▪ Resource Growth – First 2015 Update • MU1 gross increase of 2.31 million lbs measured resource • Resources from exploration drilling: 100,000lbs Measured &Indicated; 300,000lbs Inferred ▪ Pathfinder - Shirley Basin, our Next Development • PEA Completed in January 2015 • Applications for permits anticipated 4Q 2015 ▪ Realizing better sales prices through long - term sales agreements

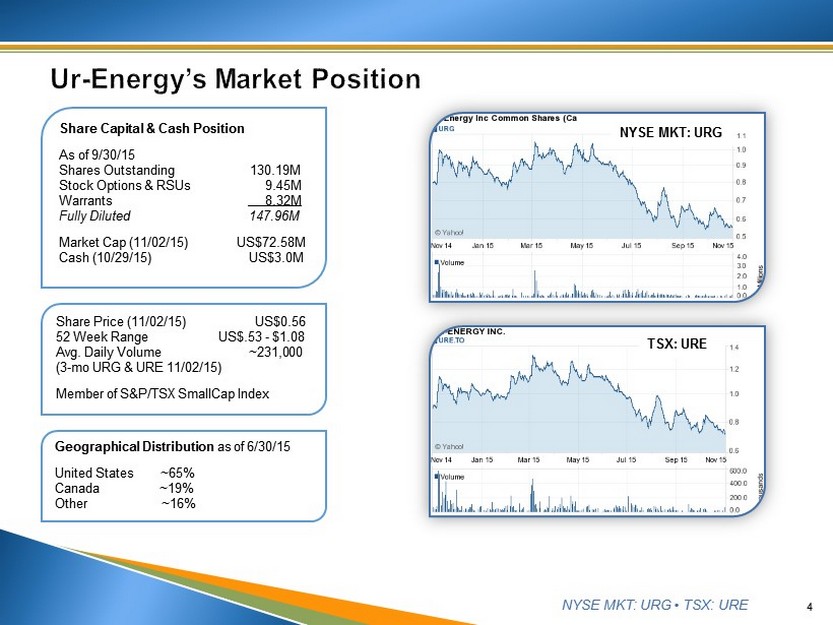

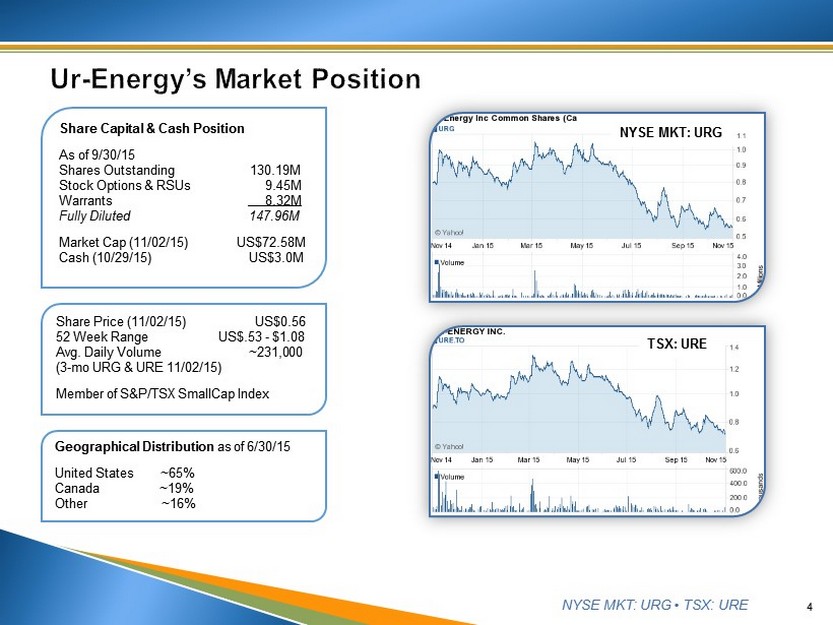

NYSE MKT: URG • TSX: URE 4 Share Capital & Cash Position As of 9/30/15 Shares Outstanding 130.19M Stock Options & RSUs 9.45M Warrants 8.32M Fully Diluted 147.96M Market Cap (11/02/15) US$72.58M Cash (10/29/15) US$3.0M Share Price (11/02/15) US$0.56 52 Week Range US$.53 - $1.08 Avg. Daily Volume ~231,000 (3 - mo URG & URE 11/02/15) Member of S&P/TSX SmallCap Index Geographical Distribution as of 6/30/15 United States ~65% Canada ~19% Other ~16% NYSE MKT: URG TSX: URE

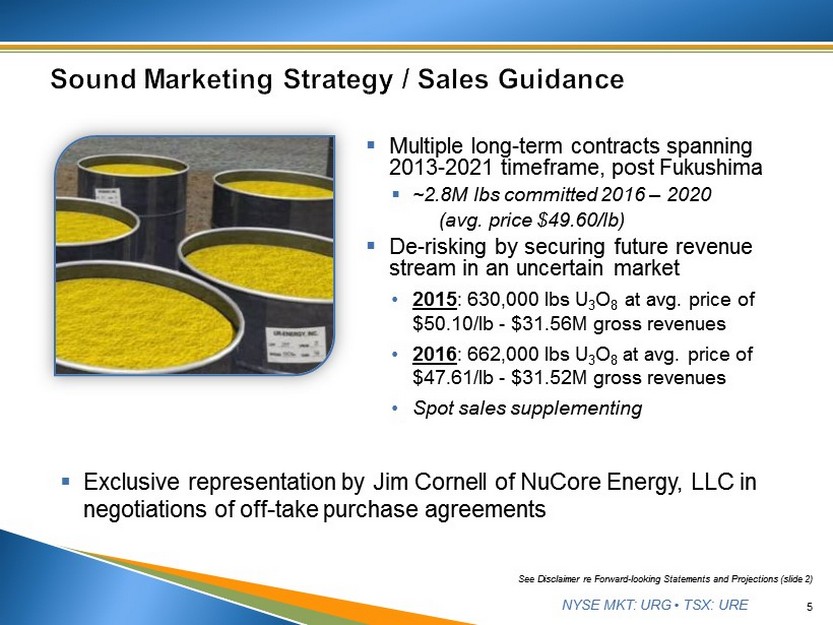

NYSE MKT: URG • TSX: URE ▪ Multiple long - term contracts spanning 2013 - 2021 timeframe, post Fukushima ▪ ~2.8M lbs committed 2016 – 2020 (avg. price $49.60/lb) ▪ De - risking by securing future revenue stream in an uncertain market • 2015 : 630,000 lbs U 3 O 8 at avg. price of $50.10/lb - $31.56M gross revenues • 2016 : 662,000 lbs U 3 O 8 at avg. price of $47.61/lb - $31.52M gross revenues • Spot sales supplementing 5 ▪ Exclusive representation by Jim Cornell of NuCore Energy, LLC in negotiations of off - take purchase agreements See Disclaimer re Forward - looking Statements and Projections (slide 2)

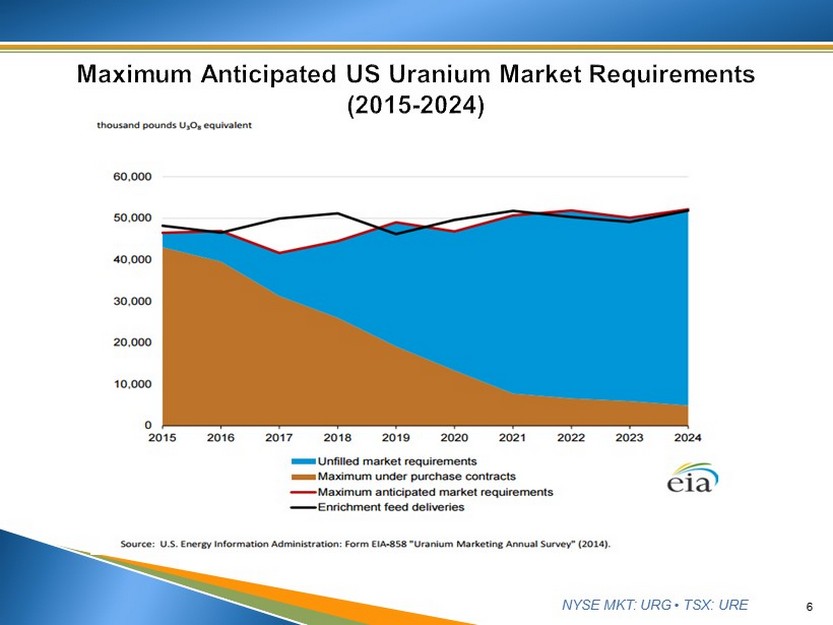

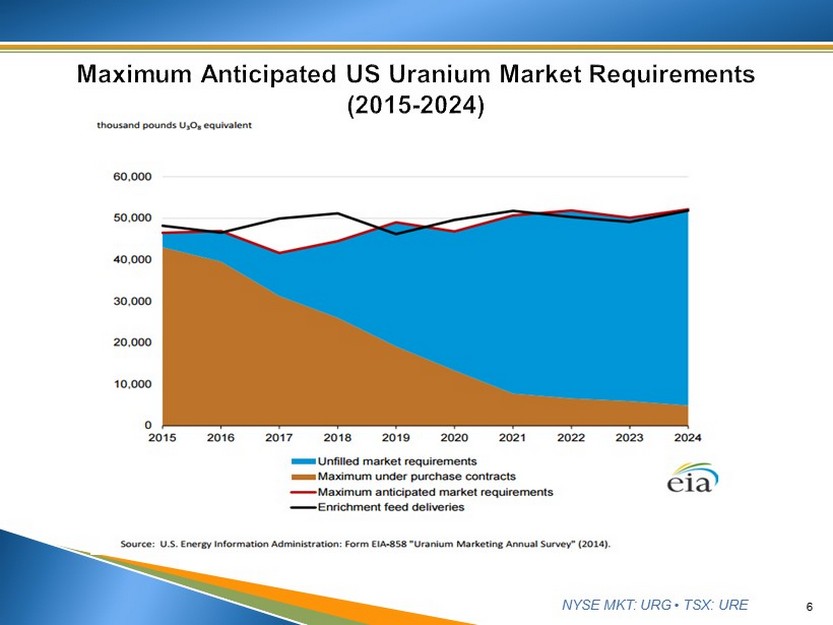

NYSE MKT: URG • TSX: URE 6

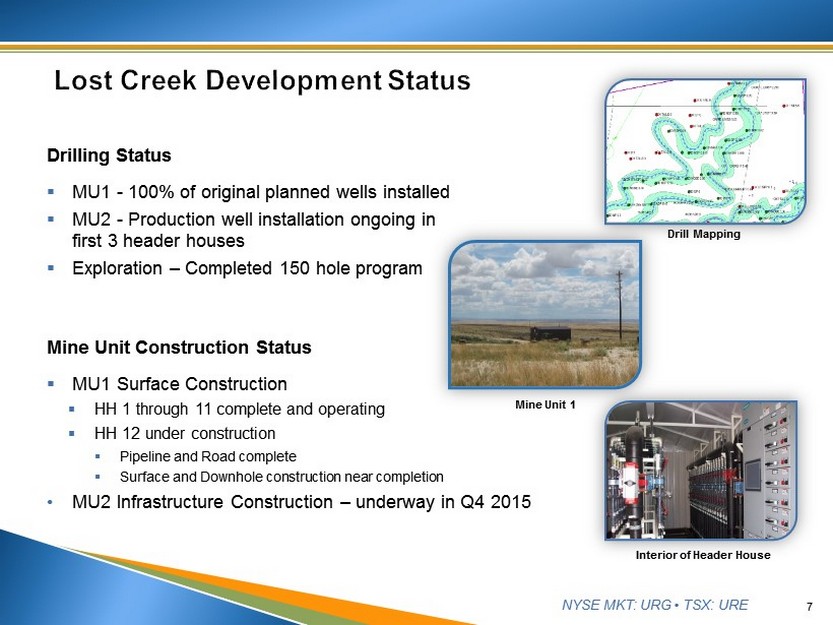

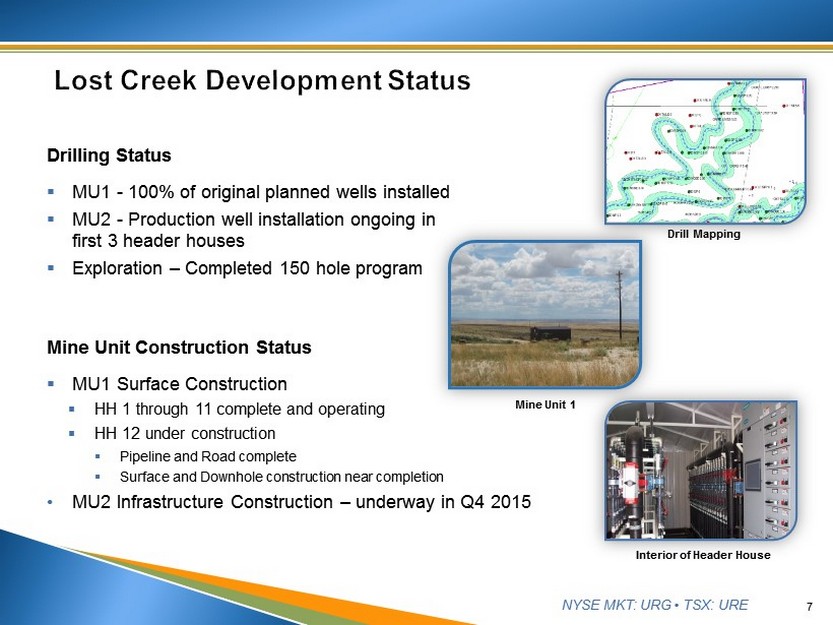

NYSE MKT: URG • TSX: URE 7 Drilling Status ▪ MU1 - 100% of original planned wells installed ▪ MU2 - Production well installation ongoing in first 3 header houses ▪ Exploration – Completed 150 hole program Mine Unit 1 Interior of Header House Mine Unit Construction Status ▪ MU1 Surface Construction ▪ HH 1 through 11 complete and operating ▪ HH 12 under construction ▪ Pipeline and Road complete ▪ Surface and Downhole construction near completion • MU2 Infrastructure Construction – underway in Q4 2015 Drill Mapping

NYSE MKT: URG • TSX: URE 8 2014 Q4 2015 Q1 2015 Q2 2015 Q3 YTD Through October 28, 2015 Captured Lbs. 150k 192k 207k 172k 635k Drummed Lbs. 117k 177k 184k 177k 602k Shipped Lbs. 102k 172k 180k 184k 609k HHs Operating 7 9 10 11 11 Avg. Grade 123 ppm 110 ppm 108 ppm 86 ppm 100 ppm U 3 O 8 Production ▪ All plant systems functional with maintenance occurring as necessary. ▪ RO is idle until flow rates are elevated or restoration is initiated. ▪ Waste Water ▪ All 3 disposal wells are available and utilized as necessary. ▪ Storage ponds utilized as necessary for waste water storage Lost Creek Plant

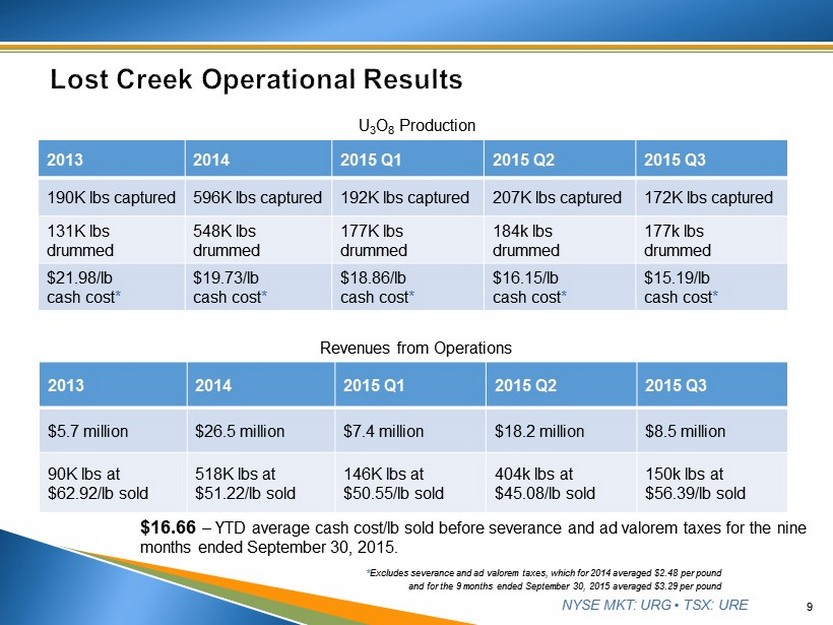

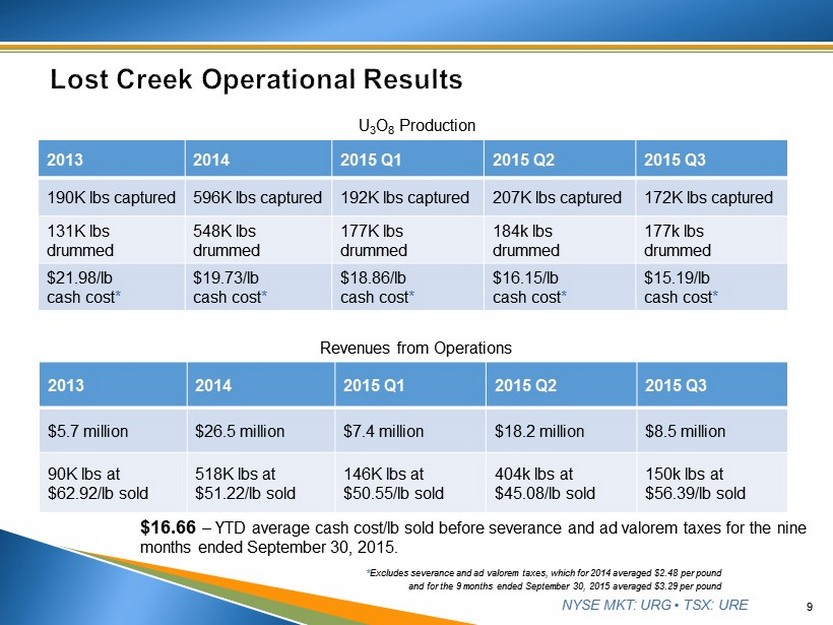

NYSE MKT: URG • TSX: URE 9 2013 2014 2015 Q1 2015 Q2 2015 Q3 190K lbs captured 596K lbs captured 192K lbs captured 207K lbs captured 172K lbs captured 131K lbs drummed 548K lbs drummed 177K lbs drummed 184k lbs drummed 177k lbs drummed $21.98/lb cash cost * $19.73/lb cash cost * $18.86/lb cash cost * $16.15/lb cash cost * $15.19/lb cash cost * U 3 O 8 Production 2013 2014 2015 Q1 2015 Q2 2015 Q3 $5.7 million $26.5 million $7.4 million $18.2 million $8.5 million 90K lbs at $62.92/lb sold 518K lbs at $51.22/lb sold 146K lbs at $50.55/lb sold 404k lbs at $45.08/lb sold 150k lbs at $56.39/lb sold Revenues from Operations $16.66 – YTD average cash cost/lb sold before severance and ad valorem taxes for the nine months ended September 30, 2015. * Excludes severance and ad valorem taxes, which for 2014 averaged $2.48 per pound and for the 9 months ended September 30, 2015 averaged $3.29 per pound

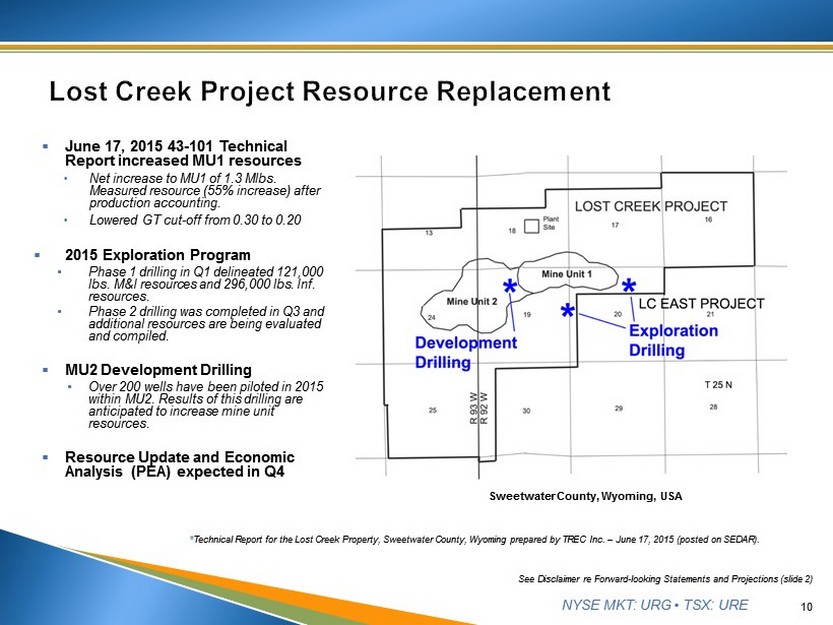

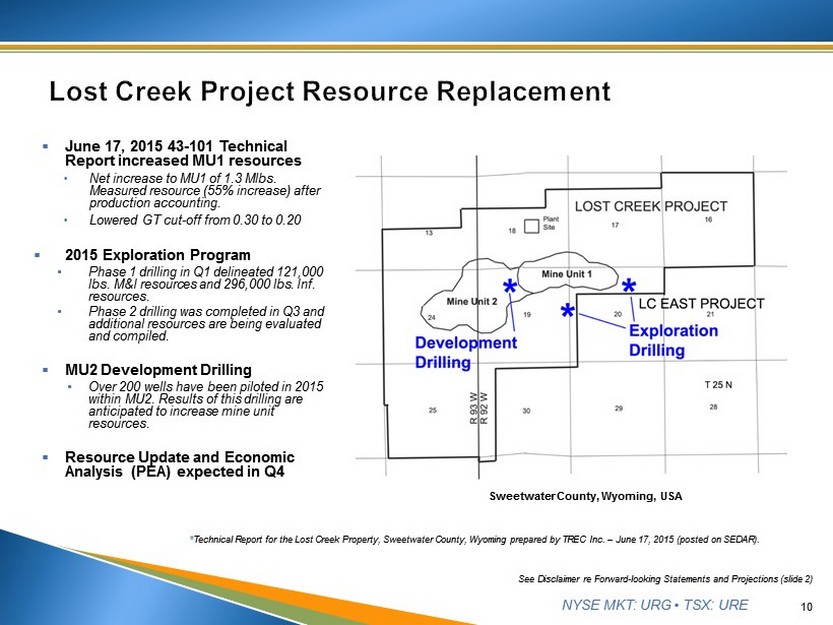

NYSE MKT: URG • TSX: URE ▪ June 17, 2015 43 - 101 Technical Report increased MU1 resources Net increase to MU1 of 1.3 Mlbs. Measured resource (55% increase) after production accounting. Lowered GT cut - off from 0.30 to 0.20 ▪ 2015 Exploration Program • Phase 1 drilling in Q1 delineated 121,000 lbs. M&I resources and 296,000 lbs. Inf. resources. • Phase 2 drilling was completed in Q3 and additional resources are being evaluated and compiled. ▪ MU2 Development Drilling • Over 200 wells have been piloted in 2015 within MU2. Results of this drilling are anticipated to increase mine unit resources. ▪ Resource Update and Economic Analysis (PEA) expected in Q4 10 See Disclaimer re Forward - looking Statements and Projections (slide 2) Sweetwater County, Wyoming, USA * Technical Report for the Lost Creek Property, Sweetwater County, Wyoming prepared by TREC Inc. – June 17, 2015 (posted on SEDAR) .

NYSE MKT: URG • TSX: URE ▪ Purchase closed in December 2013 ▪ On patented mining claims – we own the ground ▪ NI 43 - 101 Preliminary Economic Assessment published January 27, 2015 ▪ 8.8 million pounds, shallow, high grade roll front deposit ▪ ISR amenable mineralization ▪ Permit applications nearing completion 11 See Disclaimer re Forward - looking Statements and Projections (slide 2) * Preliminary Economic Assessment Shirley Basin Uranium Project, Carbon County, Wyoming prepared by Western Water Consultants, Inc ., d/b/a WWC Engineering – January 27, 2015 (posted on SEDAR).

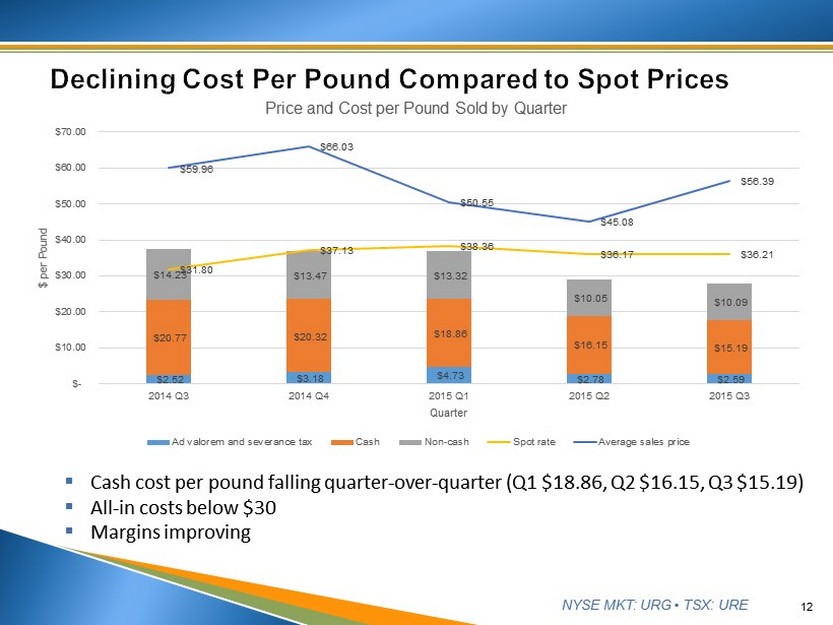

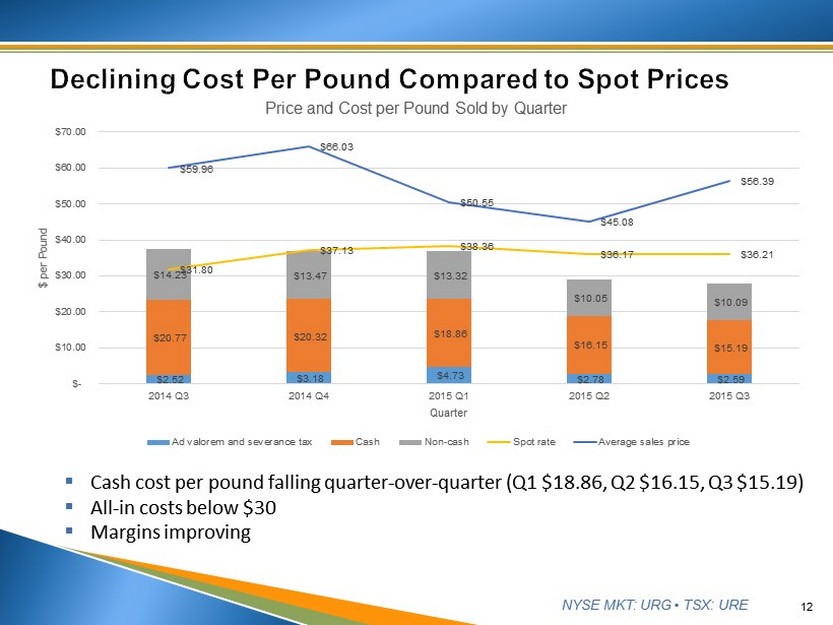

NYSE MKT: URG • TSX: URE 12 ▪ Cash cost per pound falling quarter - over - quarter (Q1 $18.86, Q2 $16.15, Q3 $15.19) ▪ All - in costs below $30 ▪ Margins improving $2.52 $3.18 $4.73 $2.78 $2.59 $20.77 $20.32 $18.86 $16.15 $15.19 $14.23 $13.47 $13.32 $10.05 $10.09 $31.80 $37.13 $38.36 $36.17 $36.21 $59.96 $66.03 $50.55 $45.08 $56.39 $- $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 $ per Pound Quarter Price and Cost per Pound Sold by Quarter Ad valorem and severance tax Cash Non-cash Spot rate Average sales price

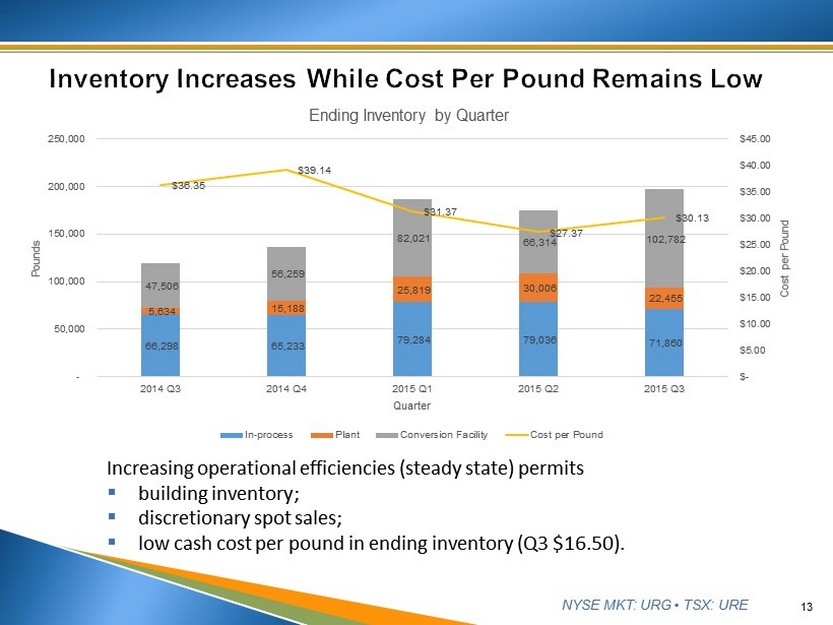

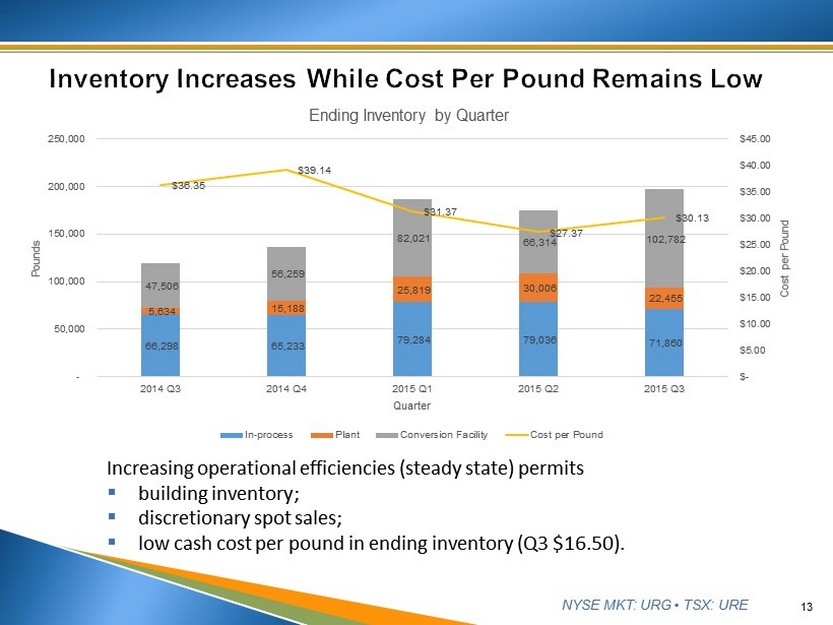

NYSE MKT: URG • TSX: URE 13 Increasing operational efficiencies (steady state) permits ▪ b uilding inventory; ▪ d iscretionary spot sales; ▪ low cash cost per pound in ending inventory (Q3 $16.50). 66,298 65,233 79,284 79,036 71,860 5,634 15,188 25,819 30,006 22,455 47,506 56,259 82,021 66,314 102,782 $36.35 $39.14 $31.37 $27.37 $30.13 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 - 50,000 100,000 150,000 200,000 250,000 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 Cost per Pound Pounds Quarter Ending Inventory by Quarter In-process Plant Conversion Facility Cost per Pound

NYSE MKT: URG • TSX: URE ▪ Continued focus to attain company - wide cost savings ▪ Long - term s ales a greements • Multiple contracts t hrough 2021 • Very selective as to pricing that we will accept ▪ M & A activities ▪ No equity financing ▪ Q4 corporate priorities • Lost Creek: continue at steady - state; greater efficiencies • Complete Lost Creek resource update and PEA • Submit Shirley Basin applications for permits / licenses 14

NYSE MKT: URG • TSX: URE For more information, please contact: Jeff Klenda , Board Chairman & Executive Director Rich Boberg , Senior Director of Investor and Public Relations By Mail: Ur - Energy Corporate Office 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com rich.boberg@ur - energy.com 15