UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o |

Filed by a Party other than the Registrant x |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

| | |

| HAMPDEN BANCORP, INC. |

| (Name of Registrant as Specified In Its Charter) |

CLOVER PARTNERS, L.P. MHC MUTUAL CONVERSION FUND, L.P. CLOVER INVESTMENTS, L.L.C. MICHAEL C. MEWHINNEY JOHNNY GUERRY GAROLD R. BASE |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

Filed by Clover Partners, L.P. and Others

A copy of a letter to be sent to shareholders of Hampden Bancorp, Inc. is attached hereto. The letter is being filed herewith under Rule 14a-12 of the Securities Exchange Act of 1934, as amended.

AN IMPORTANT MESSAGE

FOR FELLOW STOCKHOLDERS OF HAMPDEN BANCORP, INC.

FROM MHC MUTUAL CONVERSION FUND, L.P.

September 18, 2014

Dear Fellow Hampden Bancorp, Inc. Stockholder:

At some point in the near future, you should receive a proxy statement from Hampden Bancorp, Inc. (“Hampden Bancorp” or the “Company”), in connection with its upcoming 2014 Annual Meeting of Stockholders. In the Company’s proxy statement, we anticipate that the Company will, among other things, seek your vote for the director nominees handpicked by the current board of directors of Hampden Bancorp. We are asking you not to vote until you also read and consider the alternative nominees being offered by MHC Mutual Conversion Fund, L.P., the largest outside shareholder of Hampden Bancorp (9.1%). You have a real choice this year!!

WHY ARE WE PROPOSING OUR OWN NOMINEES?

We believe that not all of the incumbents deserve to be re-elected and that a change is needed because under the leadership of the incumbent directors the Company’s share price has continued to languish. So, we are submitting two nominees for election at the meeting. Under the current directors’ tenure the following has occurred:

● | Until we filed our initial Schedule 13D on October 17, 2012, Hampden Bancorp’s share price languished. This is evidenced by the fact that from its initial trading day on January 17, 2007 until October 16, 2012, the share price increased by a mere 1.6%. The Company would have shareholders believe that recent share price gains are predicated on the bank’s operational performance. As evidenced in the chart below, the bank’s share price consistently responds to our involvement. For example,(1) after advancing almost 40% after our initial 13-D filing, the bank’s shares fell approximately 9% after our 2013 campaign was unsuccessful; and (2) the share price increased after we announced our nominations to the board of directors for the 2014 election. |

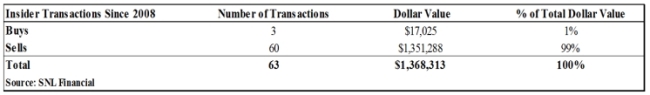

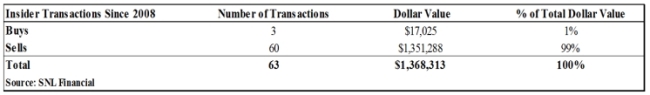

● | Management and Board interests are misaligned with shareholders. As we pointed out last year, from 2008-October of 2013, there had been 63 insider transactions. Of the 63, only 3 have been insider purchases, while there have been 60 sales. Furthermore, the dollar value of those purchases totaled $17,025, while the dollar value of the sales totaled $1,351,288 (see chart below). |

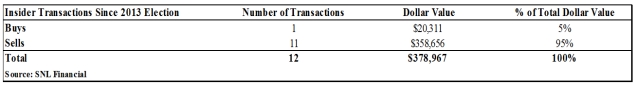

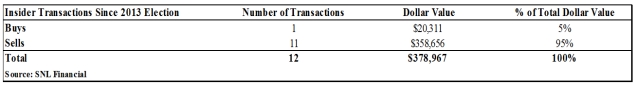

● | After the Company touted operational improvements in its filings last year and spent almost $300,000 of shareholders’ money on the proxy contest, why haven’t insiders purchased stock with their own money? You might expect insiders to have been active purchasers of the Company’s stock upon winning last year’s election. After almost a 10% decline in the stock price, we would have expected the shares to have been a compelling purchase for managerment. However, as shown in the chart below, insiders responded to their victory by selling approximately $359,000 of stock and options over 11 transactions with only one purchase for $20,000. It appears insiders may not believe the operational improvements that they so emphatically sold shareholders on last year will actually translate into share price appreciation. |

While insiders have continued to sell shares post the 2013 election, we have been actively acquiring shares, and we believe this aligns our interests with those of other shareholders. Since the 2013 election, we have acquired over 50,000 shares, bringing our total to 9.1% of the Company’s shares.

We urge you to read our proxy materials (along with the Company’s proxy materials) before you vote. The proxy materials will contain background information on all of the director candidates and information on how to vote.

We urge you to vote on the WHITE PROXY CARD FOR JOHNNY GUERRY AND GAROLD R. BASE. We expect to mail our proxy materials to you in late September or early October. These materials will contain biographical information on Mr. Guerry and Mr. Base and detailed reasons why we believe they should be elected to Hampden Bancorp’s board of directors at the upcoming 2014 Annual Meeting. In the meantime, please feel free to contact us using the contact information noted below.

Best regards,

Johnny Guerry

MHC Mutual Conversion Fund, L.P.

100 Crescent Court, Suite 575

Dallas, Texas 75201

(214) 273-5200

(214) 273-5199 (fax)

JGuerry@cloverpartners.com

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Garold R. Base as nominees to the board of directors of Hampden Bancorp Inc. (the “Company”) and intends to solicit votes for the election of Mr. Guerry and Mr. Base as members of the board. MHC Mutual Conversion Fund, L.P. will send a definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Base at the Company’s 2014 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and WHITE proxy card when they become available, because they will contain important information about the participants in the solicitation, Mr. Guerry and Mr. Base, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and WHITE proxy card (when available) and other documents filed by MHC Mutual Conversion Fund, L.P. with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement (when available) and other related SEC documents filed by MHC Mutual Conversion Fund, L.P. with the SEC may also be obtained free of charge from the MHC Mutual Conversion Fund.

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. currently consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Michael C. Mewhinney, Johnny Guerry and Garold R. Base. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the Notice of Intent to Nominate Directors and Submit Nominees for Election that MHC Mutual Conversion Fund, L.P. sent to the Company on August 4, 2014, as filed under cover of Rule 14a-12 on August 4, 2014, which is incorporated herein by reference.