Exhibit 1.01

Super Micro Computer, Inc.

Conflict Minerals Report

For the Calendar Year Ended December 31, 2019

I. Introduction

This report for the year ended December 31, 2019 has been prepared pursuant to Rule 13p-1 and the Specialized Disclosure Report on Form SD ("Form SD") under the Securities Exchange Act of 1934, as amended (collectively, the "Rule"). The Rule was adopted by the Securities and Exchange Commission (the "SEC") to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"). The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals which are necessary to the functionality or production of their products. Conflict minerals are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold ("3TG").

If a registrant determines that conflicts minerals are necessary to the functionality or production of products manufactured or contracted by the registrant to be manufactured, the registrant must submit a Form SD which describes the reasonable country of origin inquiry (“RCOI”) that it undertook to determine whether such necessary conflicts minerals originated from the Democratic Republic of the Congo or an adjoining country (collectively, the “Covered Countries”).

If, on the basis of its RCOI, a registrant knows or has reason to believe that any of the necessary conflicts minerals in its supply chain may have originated in any of the Covered Countries and knows they are not, or has reason to believe that they may not be, from recycled or scrap sources, the issuer must exercise due diligence on the conflict minerals source and chain of custody and submit a Conflict Minerals Report to the SEC that includes a description of those due diligence measures.

This report has been prepared by Super Micro Computer, Inc. (herein referred to as “Super Micro” the “Company,” “we,” “us,” or “our”). The information contained in this report includes the activities of all of the Company's majority-owned subsidiaries and variable interest entities that are required to be consolidated. This Report has not been subject to an independent private sector audit.

II. Company Overview

We are a leading provider of application-optimized high performance and high-efficiency server and storage systems. We develop and provide end-to-end green computing solutions to the cloud computing, data centers, enterprise, big data, artificial intelligence ("AI"), High-Performance Computing ("HPC"), edge computing and Internet of Things/embedded (“IoT”) markets. Our solutions range from complete server, storage, modular blade servers, blades and workstations to full racks, networking devices, server management software, server sub-systems and global support and services.

We conduct our operations principally from our Silicon Valley headquarters in California and subsidiaries in Taiwan and the Netherlands. Our sales and marketing activities are conducted through a combination of our direct sales force and indirect sales channel partners. In our indirect sales channels, we work with distributors, value added resellers, system integrators, and original equipment manufacturers ("OEMs") to market and sell our optimized solutions to their end customers.

III. Supply Chain Overview

Our supply chain operations for our server products include sourcing, order management, manufacturing, delivery, and return. We procure components from the following four major types of suppliers:

| |

| • | Manufacturers or direct suppliers; |

| |

| • | Contract manufacturers producing items to match specifications and standards set by us, that in some cases source independently; |

| |

| • | Distributors or resellers of manufactured components for other manufacturers; and |

| |

| • | Customers providing us certain parts and materials to be used to fulfill their orders. |

Logistics and service providers were excluded from the RCOI and due diligence measures discussed below because we have

concluded that they do not provide us with any products within the scope of the Rule.

As explained further below, we rely upon our suppliers and third parties to provide information on the origin, source and chain of custody of the 3TG contained in product components and materials. We commenced 3TG due diligence in 2013.

Based on representations from our suppliers, we have determined that 3TG minerals sourcing is most frequently from smelters that procure ore from mines, and in a small number of instances from smelters that use recycled minerals. To our knowledge, no more than 4% of suppliers source gold from scrap or recycling, while no more than 2% of suppliers source tin, tantalum or tungsten from scrap or recycling.

IV. Conflict Minerals Program

We are committed to complying with Section 1502 of the Dodd-Frank Act and achieving the goal of confirming that the materials used in our products are procured from conflict-free sources. We have considered the Rule’s requirements and related due diligence recommendations from the Organization for Economic Cooperation and Development (the “OECD”), and we expect our suppliers to comply with the Code of Conduct of the Responsible Business Alliance (“RBA”) and conduct their business in accordance with our supply chain responsibility expectations, as documented in our Conflict Minerals Policy (the “CM Policy”) at http://www.supermicro.com/about/policies/Supermicro_Conflict_Minerals_Statement.pdf.

In support of this program, we will:

| |

| a. | Exercise due diligence with suppliers for products containing or suspected to contain 3TG (collectively referred to as “in-scope” suppliers), consistent with the OECD's Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, 3rd Edition and the related supplements on 3TG (the “OECD Guidance”), and encourage our suppliers to do likewise with their suppliers; |

| |

| b. | Provide, and expect our suppliers to cooperate in providing, due diligence information to confirm that the t3TG in our supply chain are procured from conflict-free sources; |

| |

| c. | Utilize common tools that allow successful organization and reporting on use of minerals, such as the Conflict Minerals Reporting Template (“CMRT”) and Cobalt Reporting Template (“CRT”) developed by the Responsible Minerals Initiative (“RMI”). |

| |

| d. | Collaborate with our suppliers and multi-stakeholder groups, including maintaining membership in the RMI and its Due Diligence Workgroup, to participate in new solutions for responsible minerals sourcing; |

| |

| e. | Educate our staff and suppliers to the RBA Code of Conduct, and continue to offer conflict minerals trainings to staff and suppliers; and |

| |

| f. | Immediately bring to the attention of suppliers any reported smelters or refiners that are not third party conformant according to the Responsible Minerals Assurance Process (“RMAP”) process, or actively seeking RMAP assessment, and ask for alternative sourcing until those smelters or refiners become conformant. |

The results of our RCOI and due diligence on the source and chain of custody of our necessary 3TG are the product of our iterative and advancing data collection and dialogue process with our in-scope suppliers. This process is designed to obtain information regarding the smelters and refiners from which suppliers source such 3TG minerals and to confirm the status of such smelters or refiners as verified by the RMI as a method of assessing the mine and location of origin of such 3TG.

For the 2019 reporting year, we asked suppliers that were in-scope for 3TG, as well as suppliers of other products our staff believed may contain cobalt, to complete CRTs if cobalt is used in the product or production process. This request resulted in completion of more than 30 supplier CRTs showing sourcing from 25 refiners. Third party audits are being completed for cobalt refiners like those for 3TG, which companies like Super Micro can use for due diligence. We plan to refine a list of suppliers in-scope for cobalt, and continue requests for CRTs in future years, to push for responsible sourcing of all minerals with mining and supply chain practices that pose risk to conflict and human rights.

V. Reasonable Country of Origin Inquiry and Results

To help establish our supply chain sourcing programs, we have adopted the CMRT and launched a RCOI survey using the CMRT for in-scope suppliers, which to the best of our knowledge represent 100% of our total 2019 sourcing of 3TG. The suppliers surveyed represent more than 95% of spending on our direct material/part suppliers. Only direct suppliers we confirmed do not use 3TG are not part of the survey. The percentage of CMRTs received from our in-scope suppliers during 2019 was 95%, compared with 99% in 2018 and 82% in 2017. The data on which we relied to determine the country of origin of the minerals was obtained through the survey of our suppliers, our membership in the RMI, as well as evidence from independent reports, such as Mining the Disclosures (Responsible Sourcing Network, 2019) and Time to Dig Deeper (Global Witness, 2017).

Our in-scope supplier responses included 37% declaring 3TG mineral sourcing from Covered Countries, 7% indicating 3TG sourcing from Covered Countries is unknown, and 3% indicating they used smelters of 3TG located in Covered Countries. This was relatively consistent between the 2018 and 2019 reporting years. In addition, continuing challenges in chain of custody verification

surrounding 3TG, notably with gold, create mineral source uncertainty. Therefore, after conducting our RCOI, we determined it is likely the country of origin for some of the 3TG contained in our products are Covered Countries. Given this result, we determined that the Rule requires us to exercise due diligence on the source and chain of custody of the 3TG contained in our products, using a framework that conforms to a nationally or internationally recognized due diligence framework.

VI. Due Diligence Inquiry and Results

| |

| a. | Due Diligence Framework |

We have exercised due diligence on the source and chain of custody of the necessary 3TG used in our products to identify minerals originating from the Covered Countries that are not from scrap or recycled sources. The design of our due diligence processes has been developed to conform to the five-step framework proposed by the OECD Guidance and the related supplements for 3TG. Our due diligence process utilizes our tracing and review efforts, the efforts of in-scope suppliers from which we collect sourcing information, and the efforts of the RMI other organizations that conduct third-party audits of smelters and refiners.

| |

| b. | Limitations on Due Diligence Measures |

Our due diligence measures can provide only reasonable, not absolute, assurance regarding the source and chain of custody of the necessary 3TG. Our due diligence processes are based on the necessity of seeking data from our direct suppliers and those suppliers seeking similar information within their supply chains to identify the original sources of the necessary 3TG. We also rely, to a large extent, on information collected and provided by independent third-party audit programs. Such sources of information, as well as our smelters, may yield inaccurate or incomplete information.

| |

| c. | Conformance with OECD Due Diligence Guidance |

| |

| (i) | Establishment of Strong Company Management Systems: |

We have established a management system for complying with applicable conflict minerals reporting and disclosure rules. Our management system includes a Conflict Minerals Oversight Committee led by our Senior VP of Operations, Senior VP and Chief Financial Officer and Chief Compliance Officer, and a team of subject matter experts (“Conflict Minerals Committee") is responsible for implementing our Conflict Minerals Program. The Conflict Minerals Oversight Committee is briefed periodically about the results of our due diligence efforts and reports periodically to the Audit Committee of our Board of Directors.

We maintain our CM Policy that states our position on the use of conflict minerals. Our CM Policy has been communicated to all existing suppliers and was provided to new suppliers as part of our supplier "onboarding" process. We have provided training to our related team members. Additionally, our policy is prominently posted on our public facing website.

| |

| (ii) | Identification and Assessment of Risks in the Supply Chain: |

To address risk of report inaccuracy, we have made reasonable efforts to identify all in-scope suppliers by conducting a supply chain survey using the CMRT; requesting our in-scope suppliers to identify smelters and refiners and countries of origin of the 3TG in products they supply to us; comparing smelters and refiners identified by our supply chain survey against the list of facilities that are identified by RMI as conformant with the RMAP assessment protocols; looking for incomplete, inaccurate or outdated information on CMRTs; and seeking clarified or updated CMRTs from suppliers where we think corrected or further due diligence is needed. We saw a reduction in reporting of smelters without a current RMAP assigned identity number from forty-one in 2018 to four in 2019. This is evidence that suppliers are more astute to the standardized methods of organizing and tracking 3TG smelters and refiners, suggesting lower risk of error in reporting. To address risk of conflict minerals in our products, we ask all suppliers to avoid using non-compliant or non-active smelters until they can obtain compliance or are actively seeking compliance status. We look at the various categories of smelters beyond RMAP “compliant” and determine whether incremental progress is being made, or whether smelters appear to be avoiding audit. We have made updates to our policy to minimize the potential of onboarding any new suppliers who are not conformant with the RMAP assessment protocols, and thus not in alignment with our objective of sourcing from conflict-free suppliers. In addition, beginning in reporting year 2020, we will request all smelters in our supply chain to perform a Risk Readiness Assessment (RMAP tool) if not already completed, and ask our suppliers who reported use of those smelters to do the same.

| |

| (iii) | Strategic Response to Identified Risks: |

We have implemented a risk mitigation response to monitor and track suppliers, smelters and refiners identified as not meeting the requirements set forth in our CM Policy or contractual requirements to determine their progress in meeting those requirements. We will continuously make reasonable efforts to encourage suppliers who are sourcing from non-compliant smelters to move towards

the use of compliant smelters. If a supplier fails to remedy the risks identified by our compliance risk assessment, we will escalate the matter to the Conflict Minerals Oversight Committee to determine whether to approve or reject the supplier based on the following factors: a cost and benefit analysis; evaluation of potential risk factors; any existing competitive bids; and whether the supplier is a single source supplier to the Company. If the Oversight Committee decides to continue a business relationship with a non-compliant supplier due to inherent limitations of our supply chain, we will use reasonable efforts to follow up with the supplier for its correction plan, and encourage the supplier to work with smelters that are conformant with the RMAP assessment protocols. We also provide periodic compliance updates or reports to our Conflict Minerals Oversight Committee summarizing our risk mitigation efforts.

(iv) Independent 3rd Party Audit of Smelter/Refiner’s Due Diligence Practices:

We do not independently perform direct audits of smelters or refiners. As an alternative, we consider information collected and provided by independent third-party audit programs, such as RMAP, the London Bullion Market Exchange (“LBME”), and the Responsible Jewelry Council. Additionally, we participate in industry efforts, including through the RMI, to influence smelters and refiners to voluntarily undergo the validation process under the RMAP. We have updated our Conflict Minerals Program based on the availability and thoroughness of third-party sources.

(v) Report Annually on Supply Chain Due Diligence

A Form SD and a Conflict Minerals Report as an exhibit thereto are filed annually with the SEC. The Form SD and Conflict Minerals Report are also available on our website at https://ir.supermicro.com/financial-information/sec-filings.

d. Due Diligence Results

Based on the responses that we received from our suppliers, we identified the following types of smelters and refiners in our supply chain for the 2019 reporting year:

| |

| • | 345 smelters and refiners as potential sources of 3TG minerals that were reported to be in our supply chain, |

| |

| • | 275 have been verified by the RMI to be conformant with the RMAP assessment protocols, |

| |

| • | 10 are active (meaning they are in the process of being audited or have committed to the audit process), |

| |

| • | 7 were not eligible but conformant (not operating during part of 2019), |

| |

| • | 60 are eligible smelters or refiners, which are either: |

| |

| ◦ | Due diligence vetting process (do not meet RMAP requirements to participate) (2) |

| |

| ◦ | Due diligence review - unable to proceed (not met threshold for due diligence vetting) (3) |

| |

| ◦ | Communication suspended - not interested (5) |

| |

| ◦ | Not conformant (after RMAP audit) (7) |

| |

| • | 2 were not eligible and non-conformant (not operating during part of 2019). |

Table 1 below presents, by mineral, the total number of smelters and refiners identified that are RMAP-conformant or actively seeking conformance for reporting year 2019. The percentage of conformant or in-process smelters is relatively similar between our 2019 and 2018 reporting, with the majority of smelters not conformant falling under the “outreach required” category. Sixteen of nineteen smelters and refiners in the problematic categories are gold smelters, meaning assessments have been rejected or avoided, or assessments show non-conformance. We are emphasizing with suppliers the need to communicate upstream about these problematic smelters as well as alternatives to using them.

Table 1 - Smelters and refiners verified as RMAP-conformant or actively seeking conformance by mineral for reporting year 2019.

|

| | | |

| | Total Smelters and Refiners by Mineral | | Number Conformant or In Process |

| Gold | 158 | | 107 |

| Tantalum | 42 | | 42 |

| Tin | 92 | | 82 |

| Tungsten | 53 | | 50 |

See Appendix I for a list, by name, of smelters and refiners verified as conformant with the RMAP assessment protocols.

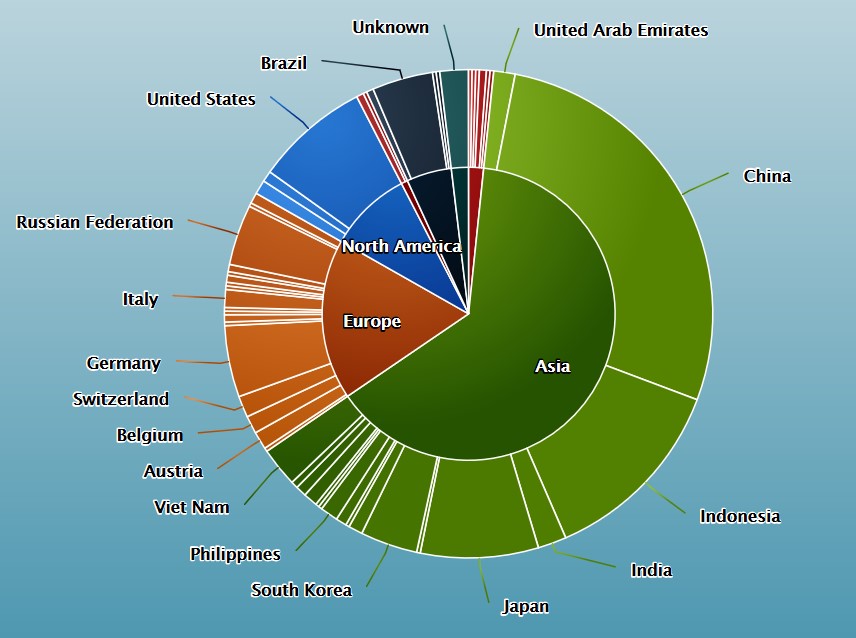

Chart 1 below indicates the countries where smelters and refiners of 3TG within our supply chain are located. With continued illegal trading of minerals like gold in and out of Covered Countries according to multiple media reports, questions raised about efficacy of mineral trade due diligence by independent groups like Global Witness, and the fact that more than a third of our suppliers may include minerals sourced from Covered Countries, the risk exists of illicit minerals entering our supply chain, as with most every company sourcing electronic parts. This risk is why downstream companies must, where possible, participate in traceability efforts further upstream, even if most of our identified smelters are far from the Covered Countries.

Chart 1 - Countries where smelters and refiners of 3TG within our supply chain are located.

VII. Conclusion

The smelters and refiners listed in Appendix I represent our best effort to collect information on the source of 3TG used in our products or production process. The third-party audits supporting the RMAP process, information our suppliers obtain and report in their CMRTs, and reporting by companies with common smelters in their supply chain that are capable of due diligence upstream from smelters and refiners, establish our best understanding of the source of minerals in our supply chain further upstream for smelters and refiners. We have reasonable belief some 3TG used in our products come from Covered Countries given the number of suppliers reporting 3TG sourcing from that region, and though we cannot say with certainty whether any of those are conflict minerals that directly or indirectly benefit armed groups in the Covered Countries, we have no reason to believe they are based on evidence we receive. Our status toward the goal of being “Conflict Free” is undeterminable for this reporting year.

VIII. Due Diligence Process Improvement Efforts

We plan to continue improvements efforts within our Conflict Minerals Program, due to the level of complexity of our products,

our downstream position in the supply chain, and continuing risk of conflict minerals. We intend to take the following steps to continue to improve our due diligence measures and to further mitigate the risk that trade in the conflict minerals contained in our products could benefit armed groups in Covered Countries:

| |

| a. | In May 2020, the OECD issued a “Call to Action” recognizing gains made in 3TG supply chain due diligence could be lost given the COVID-19 pandemic is interrupting normal supply chain operations, including in mining operations, leaving a vacuum for illicit actors. We will participate in reasonable activities to increase upstream due diligence as a result. |

| |

| b. | In February 2020, we hosted an internal presentation by the Responsible Sourcing Blockchain Network (“RSBN”). The presentation offered information on what RSBN, and the blockchain technology it employs, can do for upstream due diligence. Our plan is to review different blockchain programs like RSBN, and decide whether participation will add visibility to upstream mineral transactions that advance due diligence. |

| |

| c. | Continuing to focus our efforts on collaborating with industry peers through our membership in the RMI to improve the systems of transparency and control in our supply chain, including through our use of the latest revision of the CMRT in connection with our RCOI of our supply chain. |

| |

| d. | Continuing to partner with others on joint-trainings in an effort to collaboratively increase knowledge of conflict minerals, alternatives to non-compliant smelters, and new transparency initiatives like RSBN. |

| |

| e. | Enhancing our engagement with our relevant first-tier suppliers in order to further build their knowledge and capacity so they are able to provide more complete and accurate information on the source and chain of custody of conflict minerals in our supply chain. |

| |

| f. | Encouraging our supply chain to source conflict minerals from smelters that are conformant to the RMAP. Continuously review the terms and conditions of our vendor/supplier documents and policies to emphasize further our goal of achieving a conflict-free supply chain. |

| |

| g. | Continuing our work to refine the process for conducting follow-up with our surveyed suppliers to more effectively resolve incomplete, inaccurate or outdated responses in their surveys. |

FORWARD LOOKING STATEMENTS

This Specialized Disclosure Report on Form SD and any exhibits hereto contain “forward-looking statements” about our plans, intentions, forecasts and other expectations concerning the Company's future actions to engage suppliers, to identify to the extent possible the source of conflicts minerals in their products and to take other actions regarding their product sourcing. The Company's actual actions or results may differ materially from those expected or anticipated in the forward-looking statements due to both known and unknown risks and uncertainties. These forward-looking statements and other information are based on our beliefs as well as assumptions made by us using information currently available. In some cases, you can identify forward-looking statements by terminology including “would,” “could,” “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of these terms or other comparable terminology. Risks and uncertainties that could cause actual actions or results to differ include, without limitation, risks and uncertainties associated with the progress of industry and other supply chain transparency and smelter or refiner validation programs for conflict minerals, the possibility of inaccurate information, fraud and other irregularities, inadequate supplier education and knowledge, limitations on the ability or willingness of suppliers to provide more accurate, complete and detailed information and limitations on our ability to verify the accuracy or completeness of any supply chain information provided by suppliers, third-party audit programs or others. In addition, you should specifically consider various factors contained in our filings with the SEC, including those factors discussed under the caption “Risk Factors” in such filings. These factors may cause our actual results to differ materially from those anticipated or implied in the forward-looking statements. Our reporting obligations under the conflict minerals rules may change in the future and our ability to implement certain processes or obtain information from our suppliers may differ materially from those anticipated or implied in this report. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

DOCUMENTS INCORPORATED BY REFERENCE

Unless otherwise expressly stated herein, no documents, third-party materials or references to websites (including Super Micro's) are incorporated by reference in, or to be considered to be a part of, this Conflict Minerals Report.

Appendix I

Smelters and Refiners Reported by Suppliers

|

| | |

| Metal | Smelter Name as Provided by Supplier | Country Location |

| Tantalum | Asaka Riken Co., Ltd. | JAPAN |

| Tantalum | CP Metals Inc. | United States |

| Tantalum | Changsha South Tantalum Niobium Co., Ltd. | CHINA |

| Tantalum | D Block Metals, LLC | United States |

| Tantalum | Exotech Inc. | United States |

| Tantalum | F&X Electro-Materials Ltd. | CHINA |

| Tantalum | FIR Metals & Resource Ltd. | CHINA |

| Tantalum | Global Advanced Metals Aizu | JAPAN |

| Tantalum | Global Advanced Metals Boyertown | United States |

| Tantalum | Guangdong Rising Rare Metals-EO Materials Ltd. | CHINA |

| Tantalum | Guangdong Zhiyuan New Material Co., Ltd. | CHINA |

| Tantalum | H.C. Starck Co., Ltd. | THAILAND |

| Tantalum | H.C. Starck Hermsdorf GmbH | GERMANY |

| Tantalum | H.C. Starck Inc. | United States |

| Tantalum | H.C. Starck Ltd. | JAPAN |

| Tantalum | H.C. Starck Smelting GmbH & Co. KG | GERMANY |

| Tantalum | H.C. Starck Tantalum and Niobium GmbH | GERMANY |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | CHINA |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | Jiangxi Tuohong New Raw Material | CHINA |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | CHINA |

| Tantalum | Jiujiang Janny New Material Co., Ltd. | CHINA |

| Tantalum | Jiujiang Tanbre Co., Ltd. | CHINA |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | KEMET Blue Metals | MEXICO |

| Tantalum | KEMET Blue Powder | United States |

| Tantalum | LSM Brasil S.A. | BRAZIL |

| Tantalum | Metallurgical Products India Pvt., Ltd. | INDIA |

| Tantalum | Mineracao Taboca S.A. | BRAZIL |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | JAPAN |

| Tantalum | NPM Silmet AS | ESTONIA |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | CHINA |

| Tantalum | PRG Dooel | Macedonia, The Former Yugoslav Republic of |

| Tantalum | QuantumClean | United States |

| Tantalum | Resind Industria e Comercio Ltda. | BRAZIL |

| Tantalum | Solikamsk Magnesium Works OAO | RUSSIAN FEDERATION |

| Tantalum | Taki Chemical Co., Ltd. | JAPAN |

| Tantalum | Telex Metals | United States |

| Tantalum | Ulba Metallurgical Plant JSC | KAZAKHSTAN |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | CHINA |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | CHINA |

| Tantalum | Yichun Jin Yang Rare Metal Co., Ltd. | CHINA |

| Tin | Alpha | United States |

| Tin | An Vinh Joint Stock Mineral Processing Company | VIET NAM |

| Tin | CV Ayi Jaya | INDONESIA |

| Tin | CV Dua Sekawan | INDONESIA |

|

| | |

| Tin | CV Gita Pesona | INDONESIA |

| Tin | CV United Smelting | INDONESIA |

| Tin | CV Venus Inti Perkasa | INDONESIA |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | CHINA |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | CHINA |

| Tin | China Tin Group Co., Ltd. | CHINA |

| Tin | Dongguan CiEXPO Environmental Engineering Co., Ltd. | CHINA |

| Tin | Dowa | JAPAN |

| Tin | EM Vinto | Bolivia, Plurinational State of |

| Tin | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | VIET NAM |

| Tin | Estanho de Rondonia S.A. | BRAZIL |

| Tin | Fenix Metals | POLAND |

| Tin | Gejiu City Fuxiang Industry and Trade Co., Ltd. | CHINA |

| Tin | Gejiu Fengming Metallurgy Chemical Plant | CHINA |

| Tin | Gejiu Jinye Mineral Company | CHINA |

| Tin | Gejiu Kai Meng Industry and Trade LLC | CHINA |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | CHINA |

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | CHINA |

| Tin | Gejiu Zili Mining And Metallurgy Co., Ltd. | CHINA |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | CHINA |

| Tin | Guanyang Guida Nonferrous Metal Smelting Plant | CHINA |

| Tin | HuiChang Hill Tin Industry Co., Ltd. | CHINA |

| Tin | Huichang Jinshunda Tin Co., Ltd. | CHINA |

| Tin | Jiangxi Nanshan | China |

| Tin | Jiangxi New Nanshan Technology Ltd. | CHINA |

| Tin | Luna Smelter, Ltd. | RWANDA |

| Tin | Ma'anshan Weitai Tin Co., Ltd. | CHINA |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | BRAZIL |

| Tin | Malaysia Smelting Corporation (MSC) | MALAYSIA |

| Tin | Melt Metais e Ligas S.A. | BRAZIL |

| Tin | Metallic Resources, Inc. | United States |

| Tin | Metallo Belgium N.V. | BELGIUM |

| Tin | Metallo Spain S.L.U. | SPAIN |

| Tin | Mineracao Taboca S.A. | BRAZIL |

| Tin | Minsur | PERU |

| Tin | Mitsubishi Materials Corporation | JAPAN |

| Tin | Modeltech Sdn Bhd | MALAYSIA |

| Tin | Nghe Tinh Non-Ferrous Metals Joint Stock Company | VIET NAM |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | THAILAND |

| Tin | O.M. Manufacturing Philippines, Inc. | PHILIPPINES |

| Tin | Operaciones Metalurgicas S.A. | Bolivia, Plurinational State of |

| Tin | PT ATD Makmur Mandiri Jaya | INDONESIA |

| Tin | PT Aries Kencana Sejahtera | INDONESIA |

| Tin | PT Artha Cipta Langgeng | INDONESIA |

| Tin | PT Babel Inti Perkasa | INDONESIA |

| Tin | PT Babel Surya Alam Lestari | INDONESIA |

| Tin | PT Bangka Prima Tin | INDONESIA |

| Tin | PT Bangka Serumpun | INDONESIA |

| Tin | PT Bangka Tin Industry | INDONESIA |

|

| | |

| Tin | PT Belitung Industri Sejahtera | INDONESIA |

| Tin | PT Bukit Timah | INDONESIA |

| Tin | PT DS Jaya Abadi | INDONESIA |

| Tin | PT Eunindo Usaha Mandiri | INDONESIA |

| Tin | PT Inti Stania Prima | INDONESIA |

| Tin | PT Karimun Mining | INDONESIA |

| Tin | PT Kijang Jaya Mandiri | INDONESIA |

| Tin | PT Lautan Harmonis Sejahtera | INDONESIA |

| Tin | PT Menara Cipta Mulia | INDONESIA |

| Tin | PT Mitra Stania Prima | INDONESIA |

| Tin | PT Panca Mega Persada | INDONESIA |

| Tin | PT Premium Tin Indonesia | INDONESIA |

| Tin | PT Prima Timah Utama | INDONESIA |

| Tin | PT Rajawali Rimba Perkasa | INDONESIA |

| Tin | PT Rajehan Ariq | INDONESIA |

| Tin | PT Refined Bangka Tin | INDONESIA |

| Tin | PT Sariwiguna Binasentosa | INDONESIA |

| Tin | PT Stanindo Inti Perkasa | INDONESIA |

| Tin | PT Sukses Inti Makmur | INDONESIA |

| Tin | PT Sumber Jaya Indah | INDONESIA |

| Tin | PT Timah Tbk Kundur | INDONESIA |

| Tin | PT Timah Tbk Mentok | INDONESIA |

| Tin | PT Tinindo Inter Nusa | INDONESIA |

| Tin | PT Tirus Putra Mandiri | INDONESIA |

| Tin | PT Tommy Utama | INDONESIA |

| Tin | Pongpipat Company Limited | MYANMAR |

| Tin | Precious Minerals and Smelting Limited | INDIA |

| Tin | Resind Industria e Comercio Ltda. | BRAZIL |

| Tin | Rui Da Hung | Taiwan |

| Tin | Soft Metais Ltda. | BRAZIL |

| Tin | Super Ligas | BRAZIL |

| Tin | Thai Nguyen Mining and Metallurgy Co., Ltd. | VIET NAM |

| Tin | Thaisarco | THAILAND |

| Tin | Tin Technology & Refining | United States |

| Tin | Tuyen Quang Non-Ferrous Metals Joint Stock Company | VIET NAM |

| Tin | White Solder Metalurgia e Mineracao Ltda. | BRAZIL |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | CHINA |

| Tin | Yunnan Tin Company Limited | CHINA |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | CHINA |

| Gold | 8853 S.p.A. | ITALY |

| Gold | AU Traders and Refiners | SOUTH AFRICA |

| Gold | Abington Reldan Metals, LLC | United States |

| Gold | Advanced Chemical Company | United States |

| Gold | African Gold Refinery | UGANDA |

| Gold | Aida Chemical Industries Co., Ltd. | JAPAN |

| Gold | Al Etihad Gold Refinery DMCC | UNITED ARAB EMIRATES |

| Gold | Allgemeine Gold-und Silberscheideanstalt A.G. | GERMANY |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | BRAZIL |

| Gold | Argor-Heraeus S.A. | SWITZERLAND |

| Gold | Asahi Pretec Corp. | JAPAN |

|

| | |

| Gold | Asahi Refining Canada Ltd. | CANADA |

| Gold | Asahi Refining USA Inc. | United States |

| Gold | Asaka Riken Co., Ltd. | JAPAN |

| Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | TURKEY |

| Gold | Aurubis AG | GERMANY |

| Gold | Bangalore Refinery | INDIA |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES |

| Gold | Boliden AB | SWEDEN |

| Gold | C. Hafner GmbH + Co. KG | GERMANY |

| Gold | CCR Refinery - Glencore Canada Corporation | CANADA |

| Gold | CGR Metalloys Pvt Ltd. | INDIA |

| Gold | Caridad | MEXICO |

| Gold | Cendres + Metaux S.A. | SWITZERLAND |

| Gold | Chimet S.p.A. | ITALY |

| Gold | Chugai Mining | JAPAN |

| Gold | DODUCO Contacts and Refining GmbH | GERMANY |

| Gold | DS PRETECH Co., Ltd. | KOREA, REPUBLIC OF |

| Gold | DSC (Do Sung Corporation) | KOREA, REPUBLIC OF |

| Gold | Daejin Indus Co., Ltd. | KOREA, REPUBLIC OF |

| Gold | Daye Non-Ferrous Metals Mining Ltd. | CHINA |

| Gold | Degussa Sonne / Mond Goldhandel GmbH | GERMANY |

| Gold | Dijllah Gold Refinery FZC | UNITED ARAB EMIRATES |

| Gold | Dowa | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. East Plant | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. North Plant | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. West Plant | JAPAN |

| Gold | Emirates Gold DMCC | UNITED ARAB EMIRATES |

| Gold | Fidelity Printers and Refiners Ltd. | ZIMBABWE |

| Gold | Fujairah Gold FZC | UNITED ARAB EMIRATES |

| Gold | GCC Gujrat Gold Centre Pvt. Ltd. | INDIA |

| Gold | Geib Refining Corporation | United States |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | CHINA |

| Gold | Great Wall Precious Metals Co., Ltd. of CBPM | CHINA |

| Gold | Guangdong Jinding Gold Limited | CHINA |

| Gold | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | CHINA |

| Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | CHINA |

| Gold | HeeSung Metal Ltd. | KOREA, REPUBLIC OF |

| Gold | Heimerle + Meule GmbH | GERMANY |

| Gold | Heraeus Metals Hong Kong Ltd. | CHINA |

| Gold | Heraeus Precious Metals GmbH & Co. KG | GERMANY |

| Gold | Hunan Chenzhou Mining Co., Ltd. | CHINA |

| Gold | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | CHINA |

| Gold | HwaSeong CJ CO., LTD. | KOREA, REPUBLIC OF |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | CHINA |

| Gold | International Precious Metal Refiners | UNITED ARAB EMIRATES |

| Gold | Ishifuku Metal Industry Co., Ltd. | JAPAN |

| Gold | Istanbul Gold Refinery | TURKEY |

| Gold | Italpreziosi | ITALY |

|

| | |

| Gold | JSC Ekaterinburg Non-Ferrous Metal Processing Plant | RUSSIAN FEDERATION |

| Gold | JSC Uralelectromed | RUSSIAN FEDERATION |

| Gold | JX Nippon Mining & Metals Co., Ltd. | JAPAN |

| Gold | Japan Mint | JAPAN |

| Gold | Jiangxi Copper Co., Ltd. | CHINA |

| Gold | KGHM Polska Miedz Spolka Akcyjna | POLAND |

| Gold | Kaloti Precious Metals | UNITED ARAB EMIRATES |

| Gold | Kazakhmys Smelting LLC | KAZAKHSTAN |

| Gold | Kazzinc | KAZAKHSTAN |

| Gold | Kennecott Utah Copper LLC | United States |

| Gold | Kojima Chemicals Co., Ltd. | JAPAN |

| Gold | Korea Zinc Co., Ltd. | KOREA, REPUBLIC OF |

| Gold | Kyrgyzaltyn JSC | KYRGYZSTAN |

| Gold | Kyshtym Copper-Electrolytic Plant ZAO | RUSSIAN FEDERATION |

| Gold | L'Orfebre S.A. | ANDORRA |

| Gold | L'azurde Company For Jewelry | SAUDI ARABIA |

| Gold | LS-NIKKO Copper Inc. | KOREA, REPUBLIC OF |

| Gold | Lingbao Gold Co., Ltd. | CHINA |

| Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | CHINA |

| Gold | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | CHINA |

| Gold | MMTC-PAMP India Pvt., Ltd. | INDIA |

| Gold | Marsam Metals | BRAZIL |

| Gold | Materion | United States |

| Gold | Matsuda Sangyo Co., Ltd. | JAPAN |

| Gold | Metalor Technologies (Hong Kong) Ltd. | CHINA |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | SINGAPORE |

| Gold | Metalor Technologies (Suzhou) Ltd. | CHINA |

| Gold | Metalor Technologies S.A. | SWITZERLAND |

| Gold | Metalor USA Refining Corporation | United States |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | MEXICO |

| Gold | Mitsubishi Materials Corporation | JAPAN |

| Gold | Mitsui Mining and Smelting Co., Ltd. | JAPAN |

| Gold | Modeltech Sdn Bhd | MALAYSIA |

| Gold | Morris and Watson | NEW ZEALAND |

| Gold | Morris and Watson Gold Coast | AUSTRALIA |

| Gold | Moscow Special Alloys Processing Plant | RUSSIAN FEDERATION |

| Gold | NH Recytech Company | KOREA, REPUBLIC OF |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | TURKEY |

| Gold | Navoi Mining and Metallurgical Combinat | UZBEKISTAN |

| Gold | Nihon Material Co., Ltd. | JAPAN |

| Gold | OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet) | RUSSIAN FEDERATION |

| Gold | OJSC Novosibirsk Refinery | RUSSIAN FEDERATION |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | AUSTRIA |

| Gold | Ohura Precious Metal Industry Co., Ltd. | JAPAN |

| Gold | PAMP S.A. | SWITZERLAND |

| Gold | PT Aneka Tambang (Persero) Tbk | INDONESIA |

|

| | |

| Gold | PX Precinox S.A. | SWITZERLAND |

| Gold | Pease & Curren | United States |

| Gold | Penglai Penggang Gold Industry Co., Ltd. | CHINA |

| Gold | Planta Recuperadora de Metales SpA | CHILE |

| Gold | Prioksky Plant of Non-Ferrous Metals | RUSSIAN FEDERATION |

| Gold | QG Refining, LLC | United States |

| Gold | REMONDIS PMR B.V. | NETHERLANDS |

| Gold | Rand Refinery (Pty) Ltd. | SOUTH AFRICA |

| Gold | Refinery of Seemine Gold Co., Ltd. | CHINA |

| Gold | Republic Metals Corporation | United States |

| Gold | Royal Canadian Mint | CANADA |

| Gold | SAAMP | FRANCE |

| Gold | SAFINA A.S. | CZECH REPUBLIC |