Confidential © 2016 Supermicro First Quarter Fiscal 2017 Earnings Conference Presentation October 27, 2016

Confidential CY’ Q1’ Q4’ 2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate, among other things, to our expected financial and operating results, our ability to build and grow Supermicro, the benefit of our products and our ability to achieve our goals, plans and objectives. Such forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties that could cause our actual results to differ materially from those anticipated. These include, but are not limited to: our dependence on continued growth in the markets for X86 based servers, blade servers and embedded applications, increased competition, difficulties of predicting timing of new product introductions, customer acceptance of new products, poor product sales, difficulties in establishing and maintaining successful relationships with our distributors and vendors, shortages or price fluctuations in our supply chain, our ability to protect our intellectual property rights, our ability to control the rate of expansion domestically and internationally, difficulty managing rapid growth and general political, economic and market conditions and events. For a further list and description of risks and uncertainties, see the reports filed by Supermicro with the Securities and Exchange Commission. Supermicro disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Supplemental information, condensed balance sheets and statements of operations follow. All monetary amounts are stated in U.S. dollars.

Confidential CY’ Q1’ Q4’ 3 Non-GAAP Financial Measures Non-GAAP gross margin in this presentation excludes stock-based compensation expense. Non- GAAP net income and net income per share in this presentation exclude stock-based compensation expense and the related tax effect of the applicable items. Management presents non-GAAP financial measures because it considers them to be important supplemental measures of performance. Management uses the non-GAAP financial measures for planning purposes, including analysis of the Company's performance against prior periods, the preparation of operating budgets and to determine appropriate levels of operating and capital investments. Management also believes that the non-GAAP financial measures provide additional insight for analysts and investors in evaluating the Company's financial and operating performance. However, these non-GAAP financial measures have limitations as an analytical tool, and are not intended to be an alternative to financial measures prepared in accordance with GAAP. Pursuant to the requirements of SEC Regulation G, detailed reconciliations between the Company's GAAP and non-GAAP financial results is provided at the end of the press release that was issued announcing the Company’s operating and financial results for the quarter ended September 30, 2016. In addition, a reconciliation from GAAP to non-GAAP results is contained in the financial summary attached to today’s presentation and is available in the Investor Relations section of our website at www.supermicro.com in the Events and Presentations section. Investors are advised to carefully review and consider this information as well as the GAAP financial results that are disclosed in the Company's SEC filings.

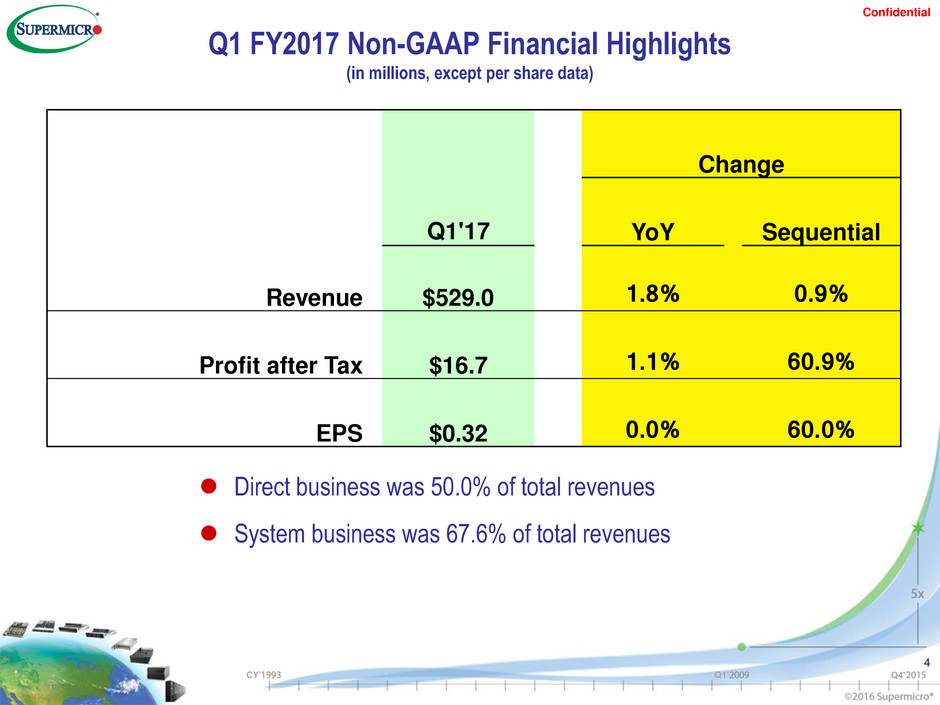

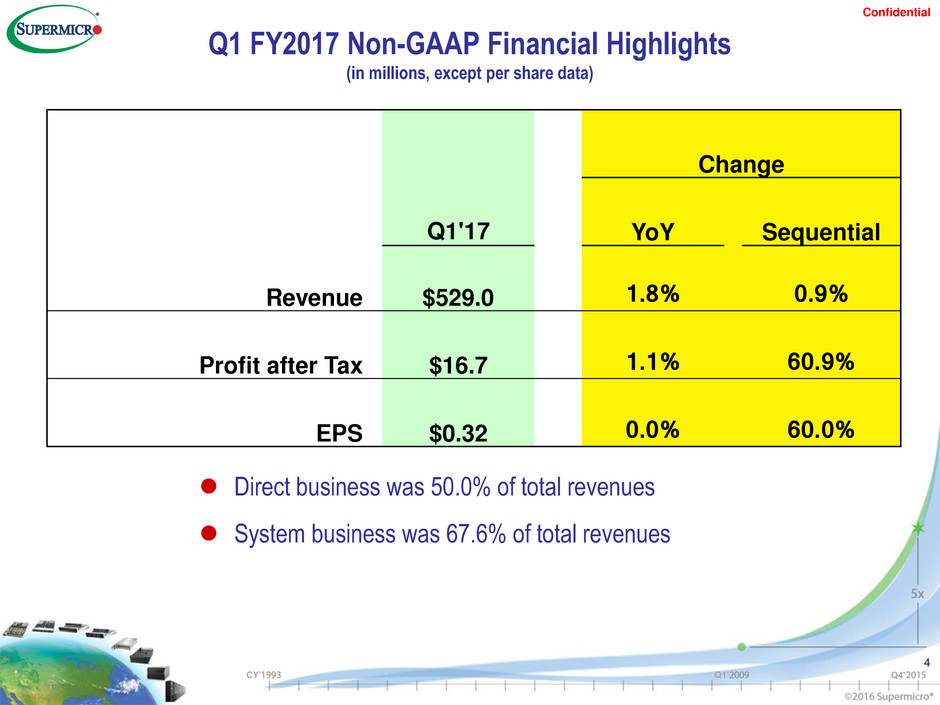

Confidential CY’ Q1’ Q4’ 4 Q1 FY2017 Non-GAAP Financial Highlights (in millions, except per share data) Direct business was 50.0% of total revenues System business was 67.6% of total revenues Change Q1'17 YoY Sequential Revenue $529.0 1.8% 0.9% Profit after Tax $16.7 1.1% 60.9% EPS $0.32 0.0% 60.0%

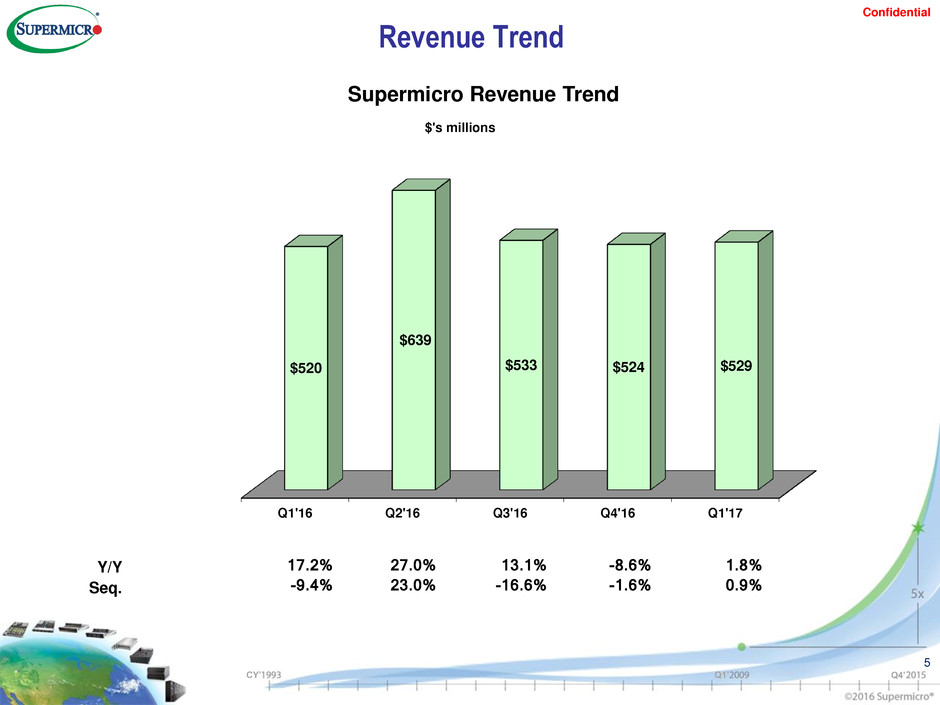

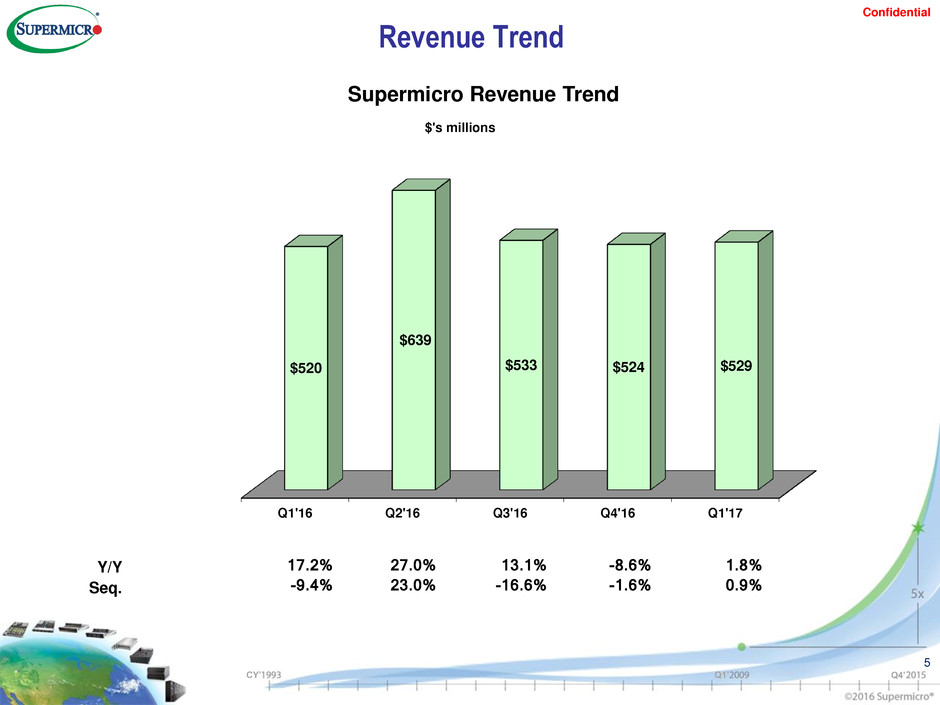

Confidential CY’ Q1’ Q4’ 5 Revenue Trend Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 $520 $639 $533 $524 $529 $'s millions Supermicro Revenue Trend Y/Y 17.2% 27.0% 13.1% -8.6% 1.8% Seq. -9.4% 23.0% -16.6% -1.6% 0.9%

Confidential CY’ Q1’ Q4’ 6 Revenue Analysis Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 $163 $185 $160 $181 $171 $356 $454 $372 $343 $357 $'s millions Supermicro Subsystems/System Revenue Subsystems Systems

Confidential CY’ Q1’ Q4’ Q1 FY2017 Major Markets Datacenter/Cloud 12.8% of Total Revenue -47.2% YoY Storage 23.5% of Total Revenue 10.4% YoY Growth 7

Confidential CY’ Q1’ Q4’ 8 Q1 FY2017 Revenue by Geography Other – 4.4% United States 55.9% Europe 21.5% Asia 18.2%

Confidential CY’ Q1’ Q4’ IoT/Embedded 10.7% of Total Revenue 12.9% YoY Growth 9

Confidential CY’ Q1’ Q4’ The Ultra 1U and 2U Broadwell Product Lines 24 DIMM, 160W Xeon CPU, Flexible I/O, NVMe support 3 to 10% Less power consumption than competition The Twin Architecture: TwinPro, FatTwin and BigTwin Most optimized for Hyper-converged and HPC Applications Best performance/watt and price/performance ratio SuperBlade, MicroBlade and MicroCloud Densest computing nodes, 0.05U/0.1U/0.2U per node 95% less cable, easy maintenance, and cost effectiveness GPU and Xeon Phi/KNL Product lines KNL optimized platforms with 100G OPA connectivity 170 TFlops with 8x Pascal GPUs in 4U Lowest latency of data access and transfer 90 Bay/60 Bay, JBOD, Storage Server & 2U All-Flash Storage Array 24 DIMM DP redundant node and 200W+ CPU support Up to 48 hot-swap dual-port NVMe/SAS3 in 2U Big Data and Software Defined Storage Solutions Embedded /IoT Product lines Integrated compute, storage, and networking Optimized for Small Business, Education, Hybrid IT, Edge Computing Application Rack Scale Design (SRSD) and Management Software World’s Best Server/Storage Product Lines NEW! 10 NEW!

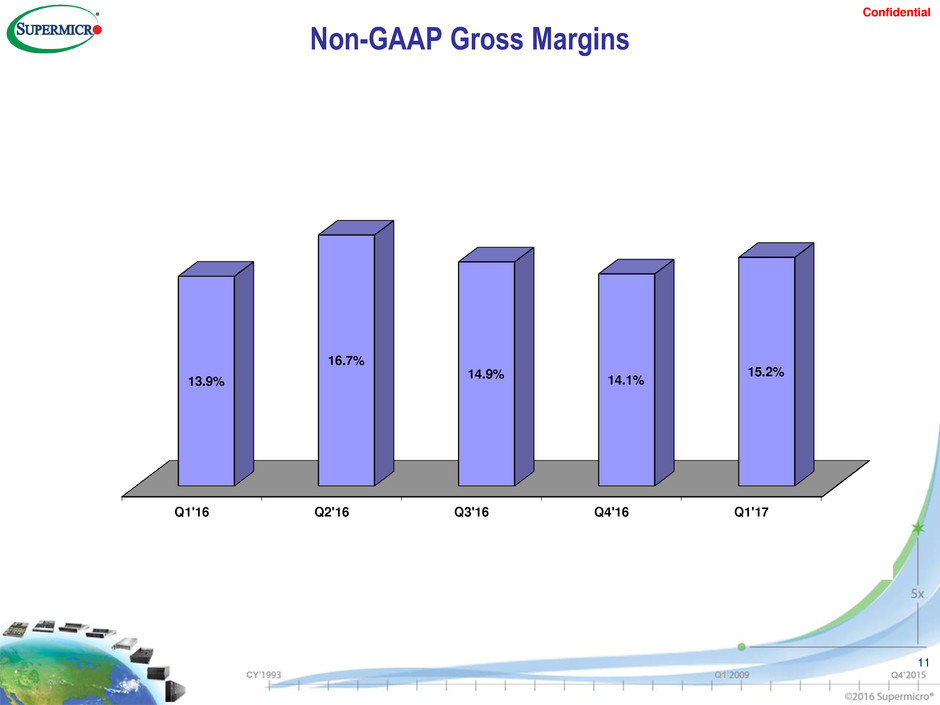

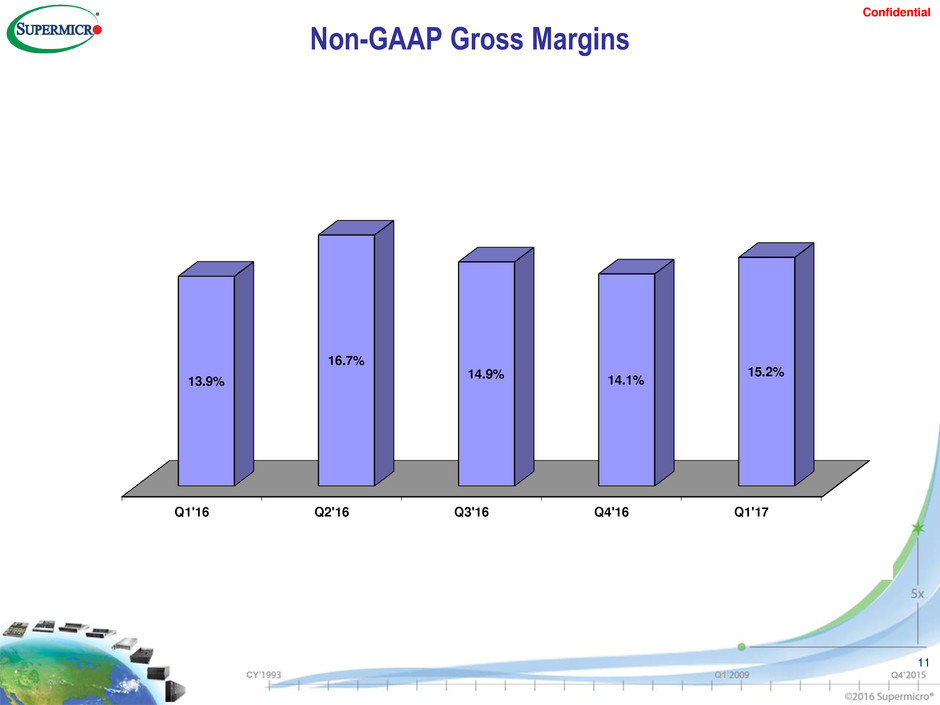

Confidential CY’ Q1’ Q4’ 11 Non-GAAP Gross Margins Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 13.9% 16.7% 14.9% 14.1% 15.2%

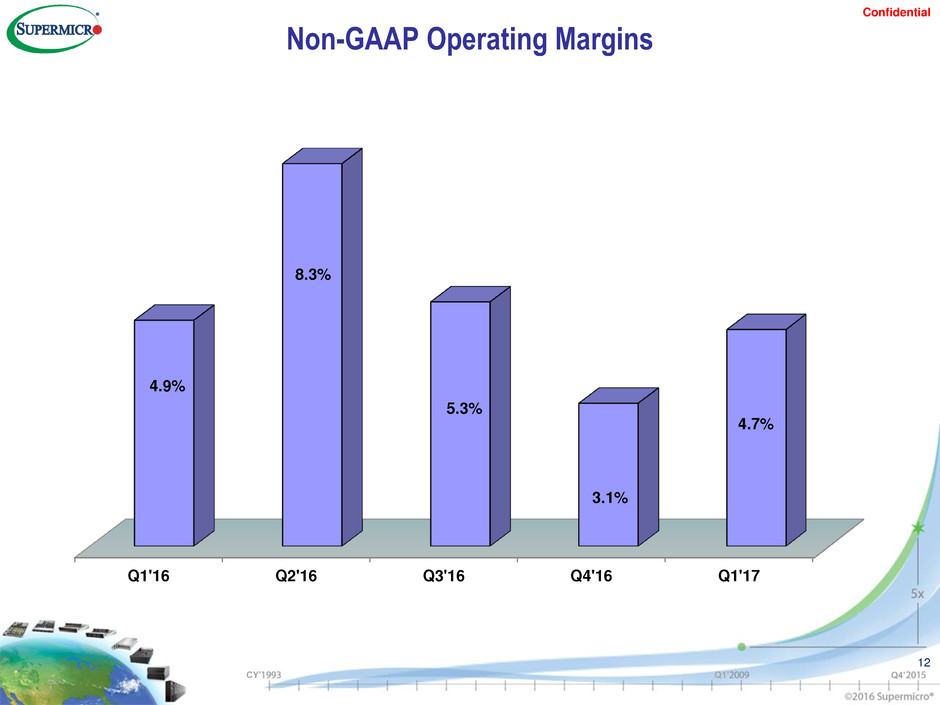

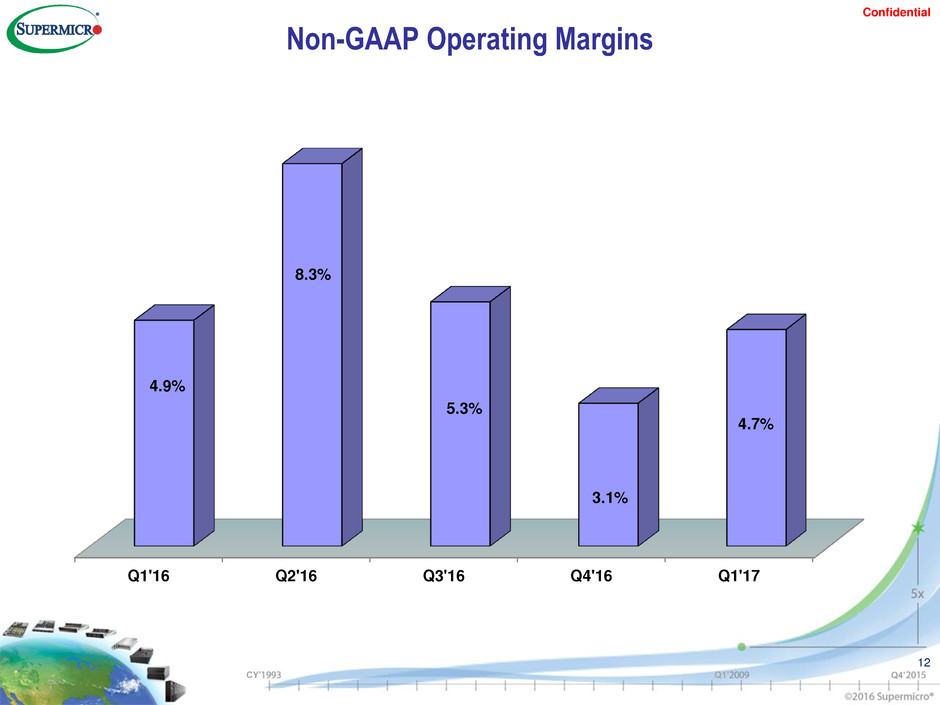

Confidential CY’ Q1’ Q4’ 12 Non-GAAP Operating Margins Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 4.9% 8.3% 5.3% 3.1% 4.7%

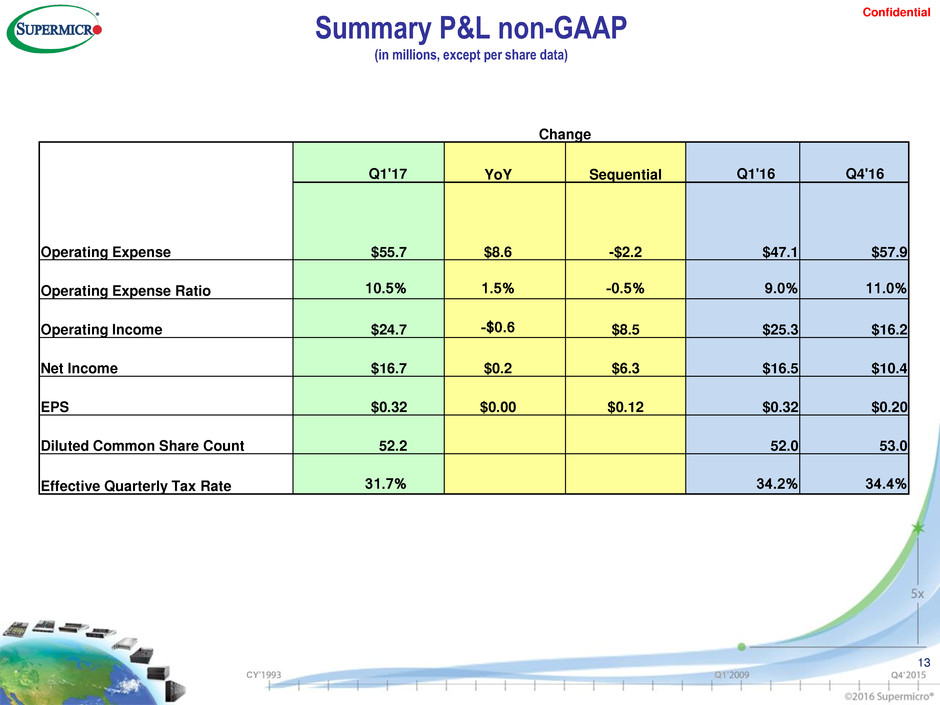

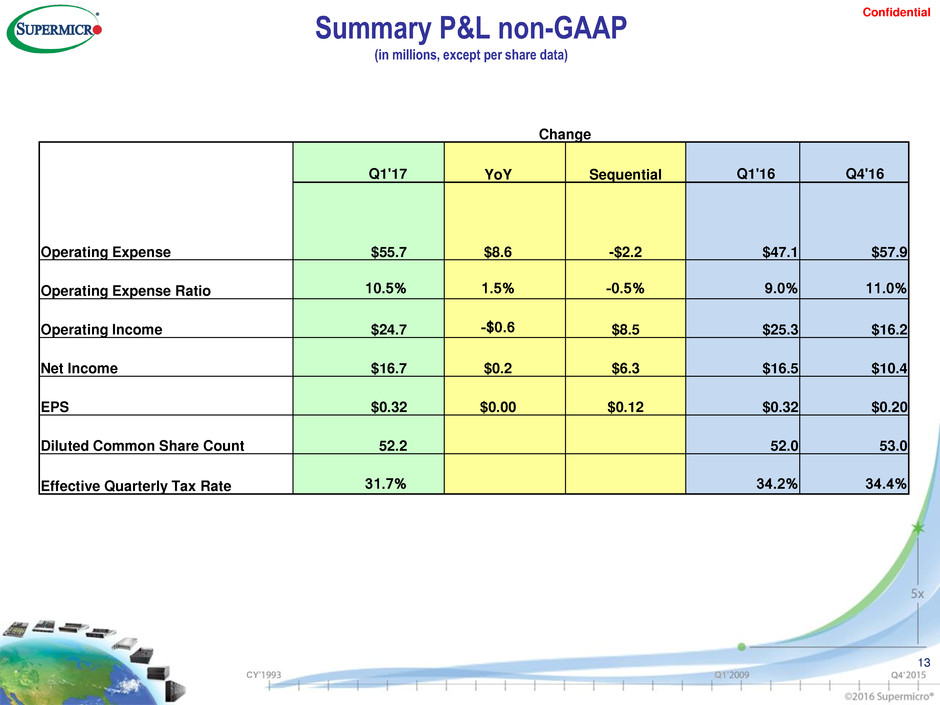

Confidential CY’ Q1’ Q4’ 13 Summary P&L non-GAAP (in millions, except per share data) Change Q1'17 YoY Sequential Q1'16 Q4'16 Operating Expense $55.7 $8.6 -$2.2 $47.1 $57.9 Operating Expense Ratio 10.5% 1.5% -0.5% 9.0% 11.0% Operating Income $24.7 -$0.6 $8.5 $25.3 $16.2 Net Income $16.7 $0.2 $6.3 $16.5 $10.4 EPS $0.32 $0.00 $0.12 $0.32 $0.20 Diluted Common Share Count 52.2 52.0 53.0 Effective Quarterly Tax Rate 31.7% 34.2% 34.4%

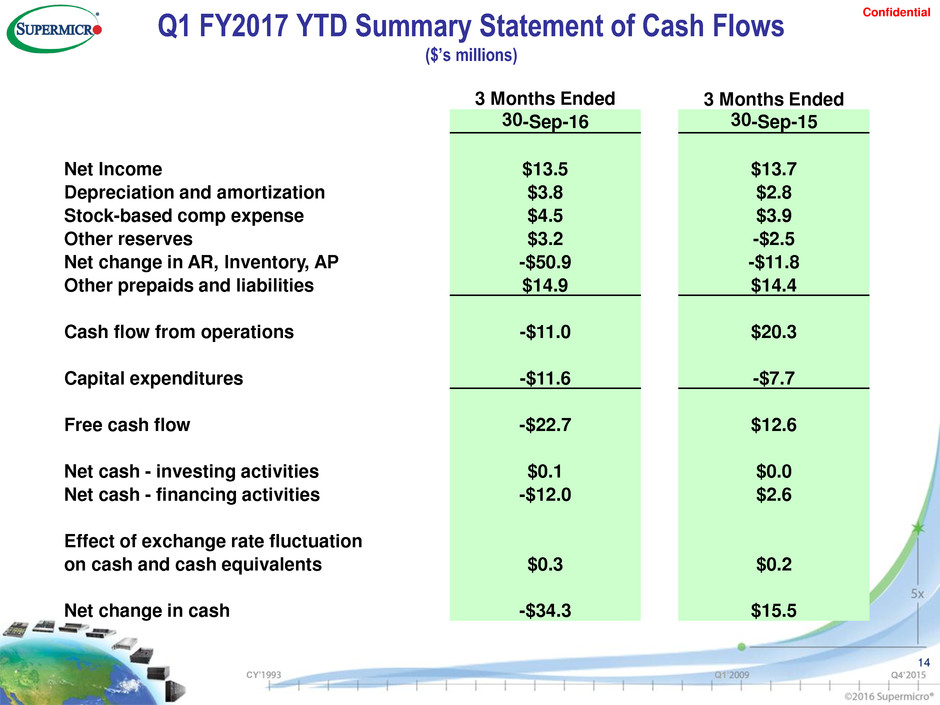

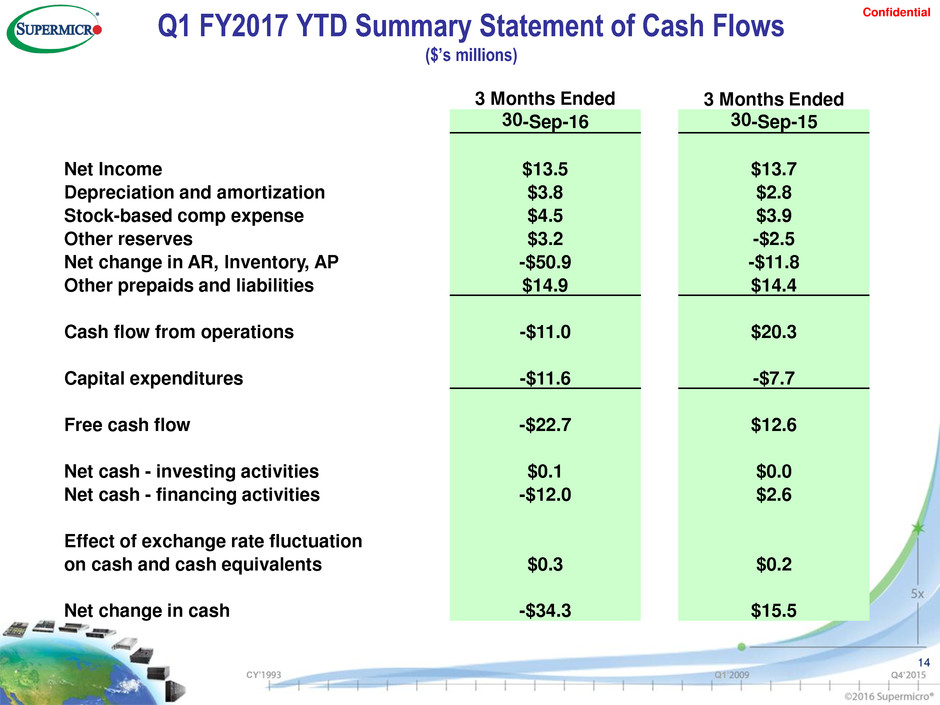

Confidential CY’ Q1’ Q4’ 14 Q1 FY2017 YTD Summary Statement of Cash Flows ($’s millions) 3 Months Ended 3 Months Ended 30-Sep-16 30-Sep-15 Net Income $13.5 $13.7 Depreciation and amortization $3.8 $2.8 Stock-based comp expense $4.5 $3.9 Other reserves $3.2 -$2.5 Net change in AR, Inventory, AP -$50.9 -$11.8 Other prepaids and liabilities $14.9 $14.4 Cash flow from operations -$11.0 $20.3 Capital expenditures -$11.6 -$7.7 Free cash flow -$22.7 $12.6 Net cash - investing activities $0.1 $0.0 Net cash - financing activities -$12.0 $2.6 Effect of exchange rate fluctuation on cash and cash equivalents $0.3 $0.2 Net change in cash -$34.3 $15.5

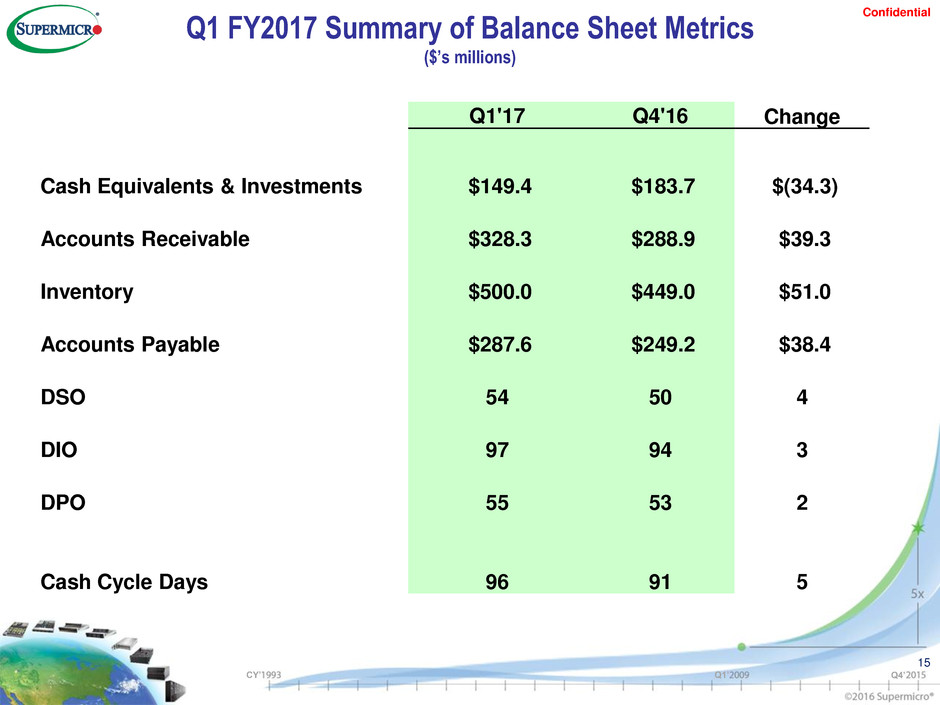

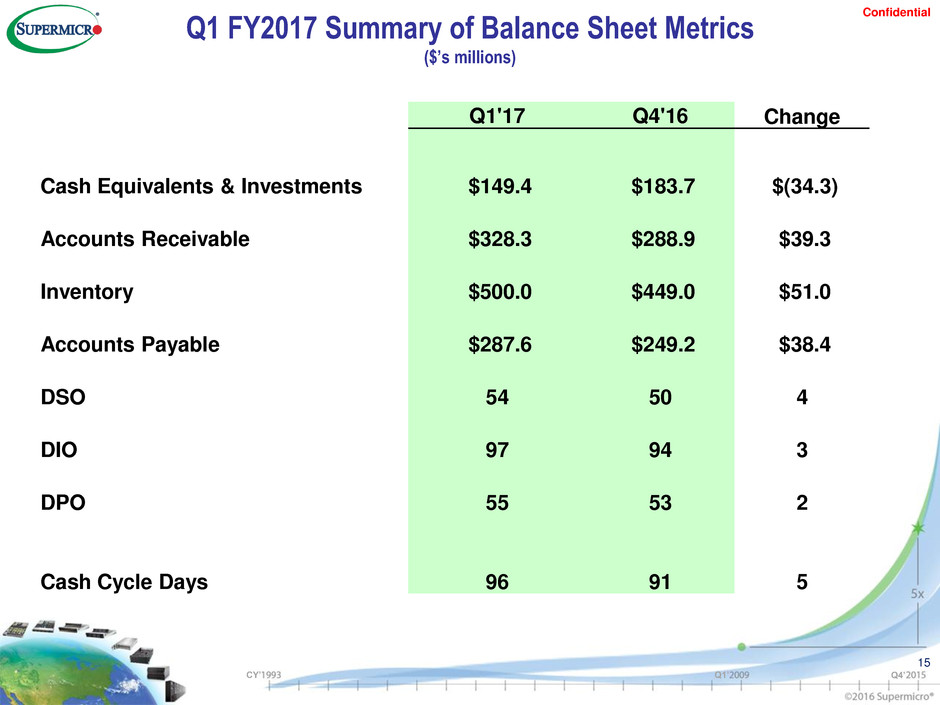

Confidential CY’ Q1’ Q4’ Q1 FY2017 Summary of Balance Sheet Metrics ($’s millions) 15 Q1'17 Q4'16 Change Cash Equivalents & Investments $149.4 $183.7 $(34.3) Accounts Receivable $328.3 $288.9 $39.3 Inventory $500.0 $449.0 $51.0 Accounts Payable $287.6 $249.2 $38.4 DSO 54 50 4 DIO 97 94 3 DPO 55 53 2 Cash Cycle Days 96 91 5

Confidential CY’ Q1’ Q4’ 16 Supplemental Financials First Quarter Fiscal 2017 Ended September 30, 2016

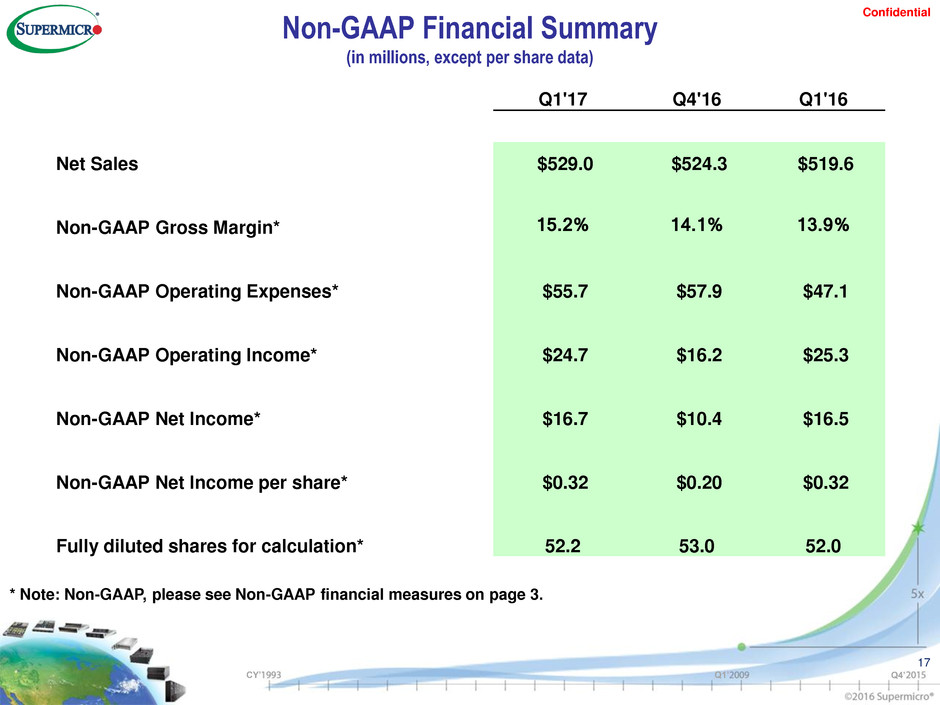

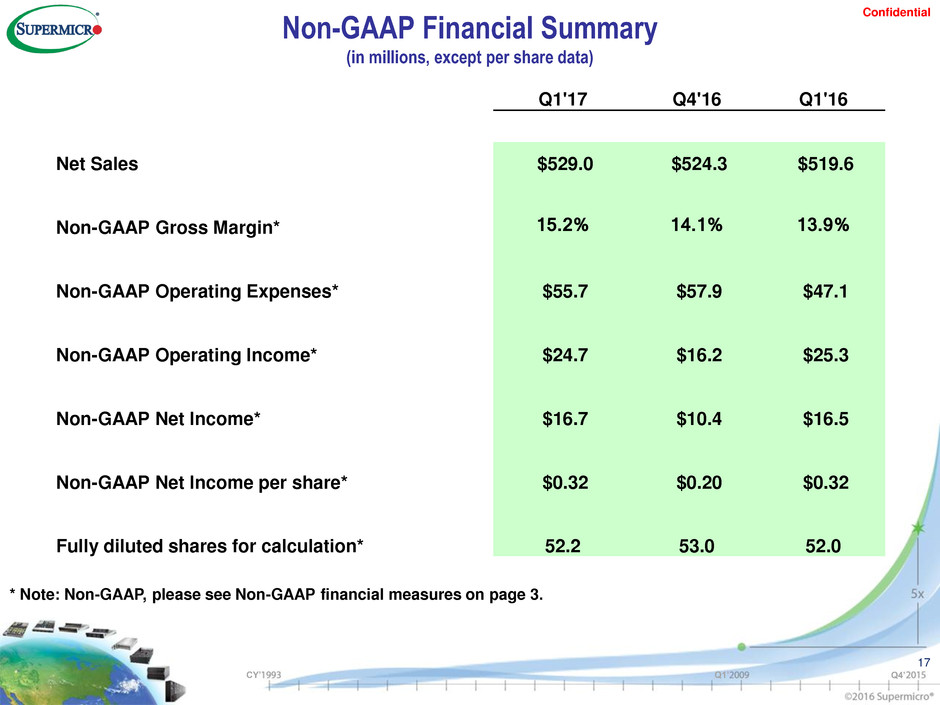

Confidential CY’ Q1’ Q4’ 17 Non-GAAP Financial Summary (in millions, except per share data) Q1'17 Q4'16 Q1'16 Net Sales $529.0 $524.3 $519.6 Non-GAAP Gross Margin* 15.2% 14.1% 13.9% Non-GAAP Operating Expenses* $55.7 $57.9 $47.1 Non-GAAP Operating Income* $24.7 $16.2 $25.3 Non-GAAP Net Income* $16.7 $10.4 $16.5 Non-GAAP Net Income per share* $0.32 $0.20 $0.32 Fully diluted shares for calculation* 52.2 53.0 52.0 * Note: Non-GAAP, please see Non-GAAP financial measures on page 3.

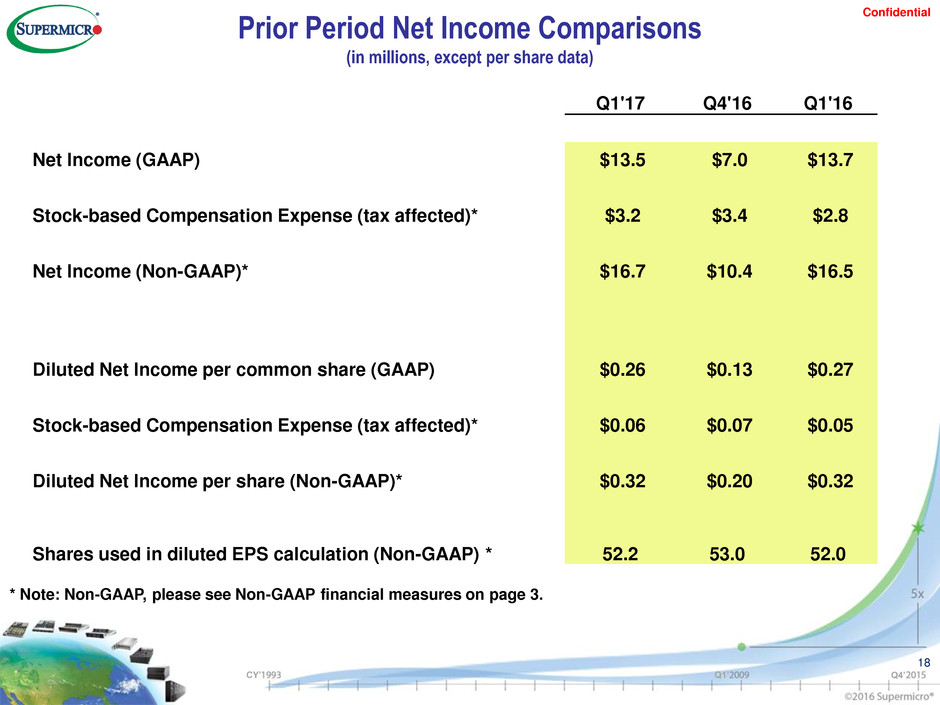

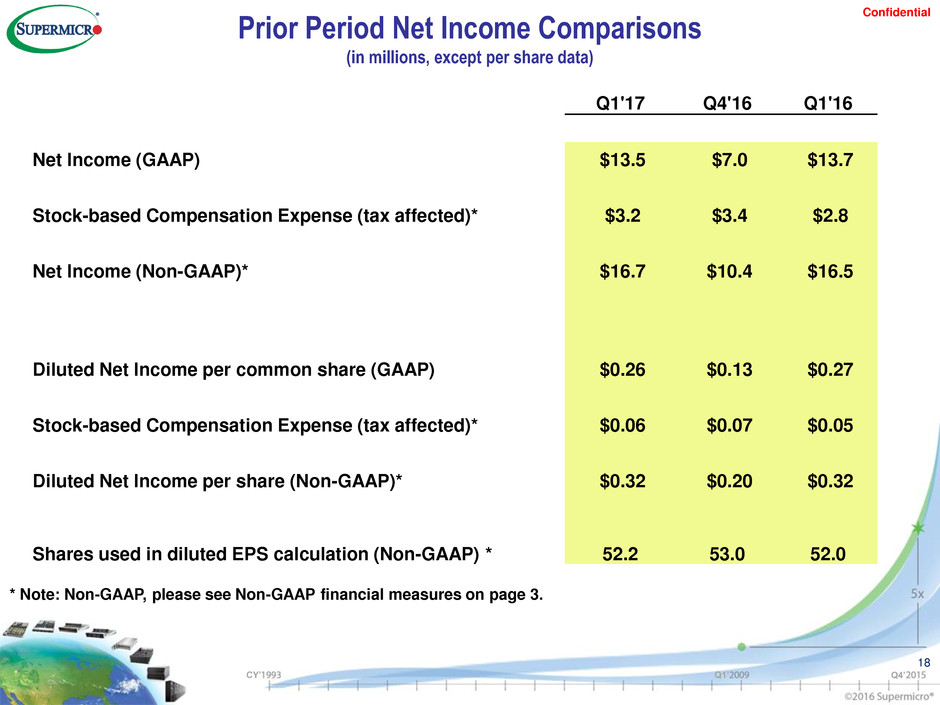

Confidential CY’ Q1’ Q4’ 18 Prior Period Net Income Comparisons (in millions, except per share data) * Note: Non-GAAP, please see Non-GAAP financial measures on page 3. Q1'17 Q4'16 Q1'16 Net Income (GAAP) $13.5 $7.0 $13.7 Stock-based Compensation Expense (tax affected)* $3.2 $3.4 $2.8 Net Income (Non-GAAP)* $16.7 $10.4 $16.5 Diluted Net Income per common share (GAAP) $0.26 $0.13 $0.27 Stock-based Compensation Expense (tax affected)* $0.06 $0.07 $0.05 Diluted Net Income per share (Non-GAAP)* $0.32 $0.20 $0.32 Shares used in diluted EPS calculation (Non-GAAP) * 52.2 53.0 52.0

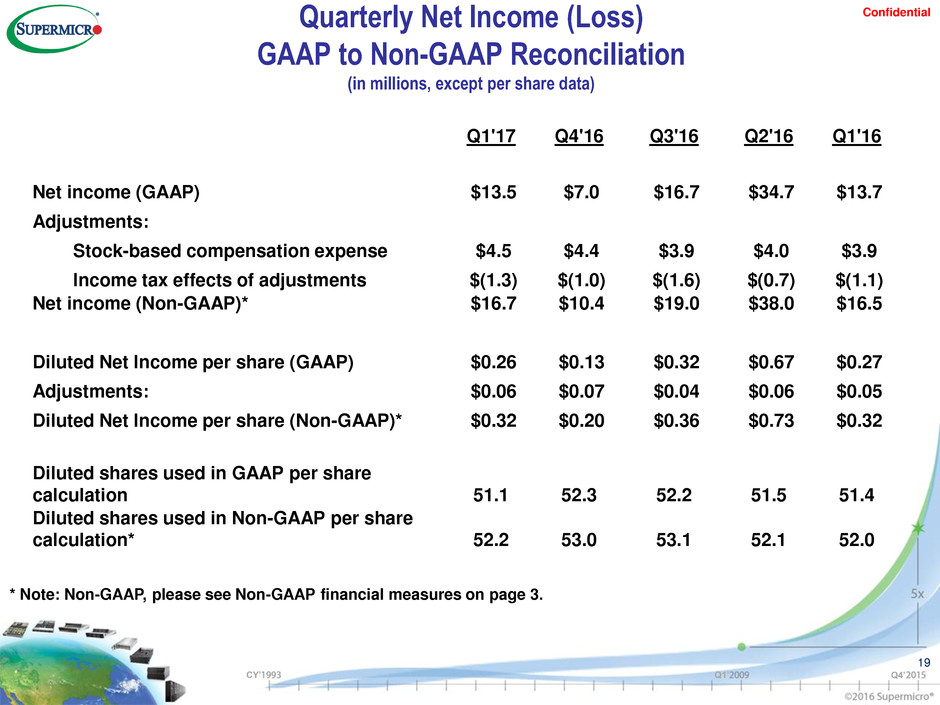

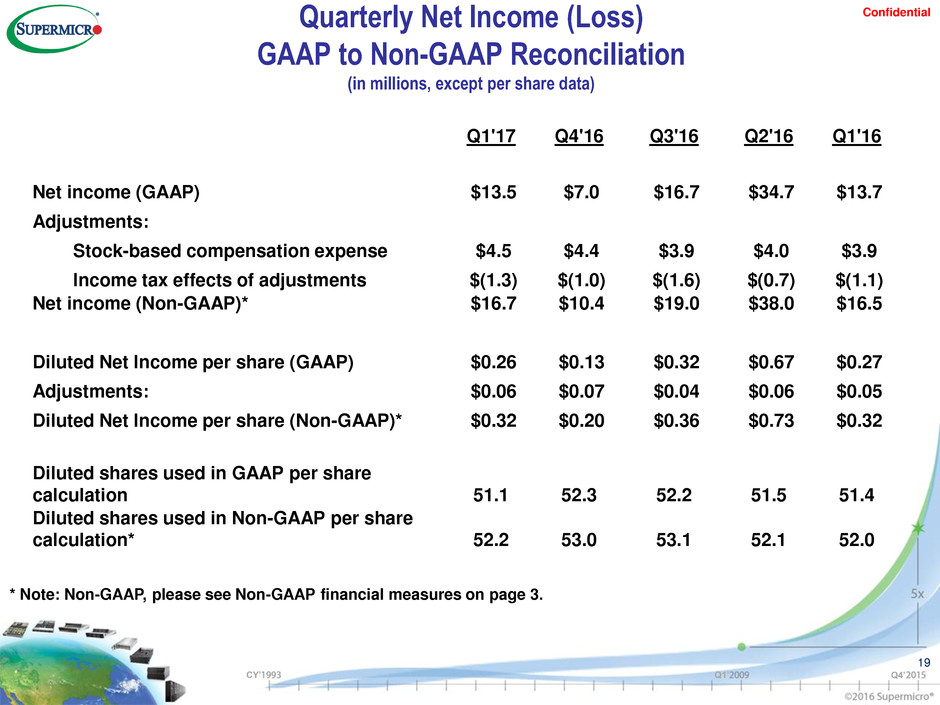

Confidential CY’ Q1’ Q4’ 19 Quarterly Net Income (Loss) GAAP to Non-GAAP Reconciliation (in millions, except per share data) * Note: Non-GAAP, please see Non-GAAP financial measures on page 3. Q1'17 Q4'16 Q3'16 Q2'16 Q1'16 Net income (GAAP) $13.5 $7.0 $16.7 $34.7 $13.7 Adjustments: Stock-based compensation expense $4.5 $4.4 $3.9 $4.0 $3.9 Income tax effects of adjustments $(1.3) $(1.0) $(1.6) $(0.7) $(1.1) Net income (Non-GAAP)* $16.7 $10.4 $19.0 $38.0 $16.5 Diluted Net Income per share (GAAP) $0.26 $0.13 $0.32 $0.67 $0.27 Adjustments: $0.06 $0.07 $0.04 $0.06 $0.05 Diluted Net Income per share (Non-GAAP)* $0.32 $0.20 $0.36 $0.73 $0.32 Diluted shares used in GAAP per share calculation 51.1 52.3 52.2 51.5 51.4 Diluted shares used in Non-GAAP per share calculation* 52.2 53.0 53.1 52.1 52.0