Exhibit 99.01

Exhibit 99.01

Guidance™

SOFTWARE

Transforming Digital Investigations

Investor Presentation

November 2007 NASDAQ: GUID

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Investors are cautioned that forward-looking statements in this presentation involve risks and uncertainties that could cause actual results to differ materially from current expectations. There can be no assurance that demand for the company’s products will continue at current or greater levels, or that the company will continue to grow revenues, or be profitable.

There are also risks that the company’s pursuit of providing network security and eDiscovery technology might not be successful, or that if successful, it will not materially enhance the company’s financial performance; that the company could fail to retain key employees; that changes in customer requirements and other general economic and political uncertainties could impact the company’s relationship with its customers; and that delays in product development, competitive pressures or technical difficulties could impact timely delivery of next-generation products; and other risks and uncertainties that are described from time to time in Guidance Software’s periodic reports and registration statements filed with the Securities and Exchange Commission.

The company specifically disclaims any responsibility for updating these forward-looking statements.

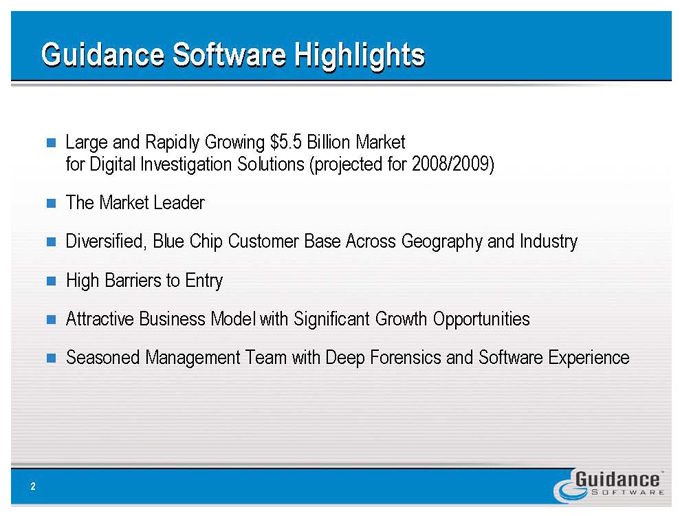

Guidance Software Highlights

Large and Rapidly Growing $5.5 Billion Market

for Digital Investigation Solutions (projected for 2008/2009)

The Market Leader

Diversified, Blue Chip Customer Base Across Geography and Industry

High Barriers to Entry

Attractive Business Model with Significant Growth Opportunities

Seasoned Management Team with Deep Forensics and Software Experience

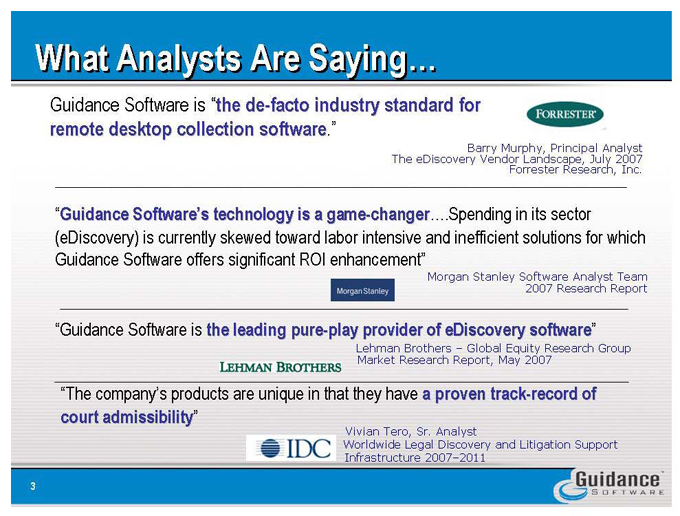

What Analysts Are Saying.

Guidance Software is “the de-facto industry standard for remote desktop collection software.”

FORRESTER

Barry Murphy, Principal Analyst

The eDiscovery Vendor Landscape, July 2007

Forrester Research, Inc.

“Guidance Software’s technology is a game-changer.Spending in its sector (eDiscovery) is currently skewed toward labor intensive and inefficient solutions for which Guidance Software offers significant ROI enhancement”

Morgan Stanley Software Analyst Team

2007 Research Report

Morgan Stanley

“Guidance Software is the leading pure-play provider of eDiscovery software”

Lehman Brothers—Global Equity Research Group Lehman Brothers Market Research Report, May 2007

“The company’s products are unique in that they have a proven track-record of court admissibility”

IDC

Vivian Tero, Sr. Analyst

Worldwide Legal Discovery and Litigation Support Infrastructure 2007-2011

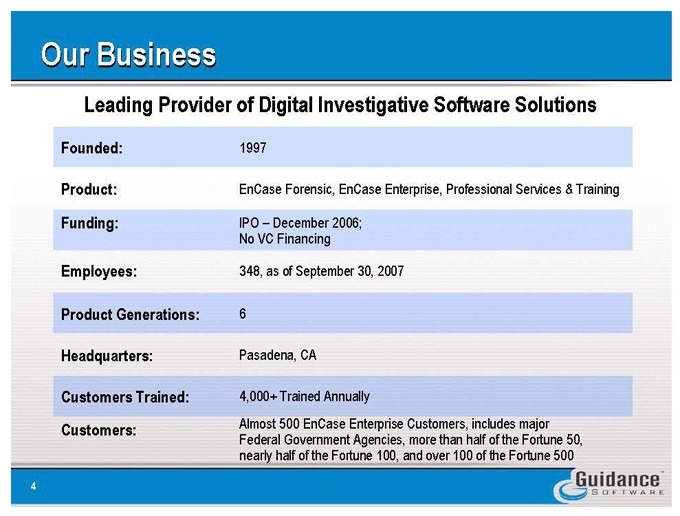

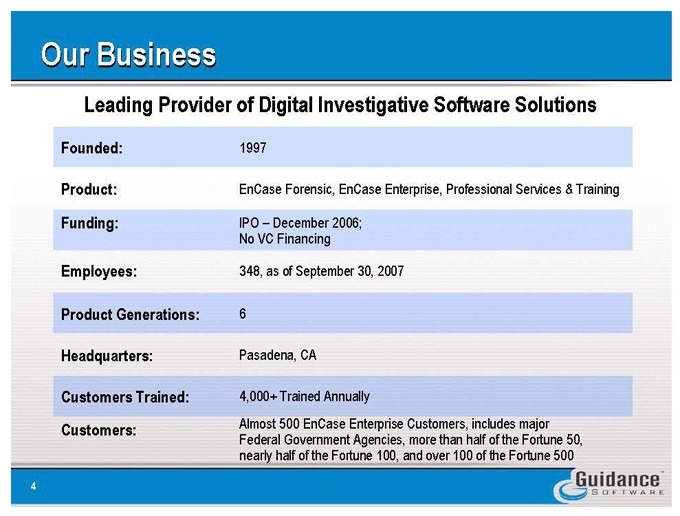

Our Business

Leading Provider of Digital Investigative Software Solutions

Founded: 1997

Product: EnCase Forensic, EnCase Enterprise, Professional Services & Training

Funding: IPO-December 2006; No VC Financing

Employees: 348, as of September 30, 2007

Product Generations: 6

Headquarters: Pasadena, CA

Customers Trained: 4, 000 + Trained Annually

Customers: Almost 500 EnCase Enterprise Customers, includes major Federal Government Agencies, more than half of the Fortune 50, nearly half of the Fortune 100, and over 100 of the Fortune 500

Corporate Risks Today Require Digital Investigations

eDiscovery Requests

Regulatory Inquiries

UBS

Morgan Stanley

PHILIP MORRIS

INTERNATIONAL

Carporate Internal Investigations

BROADCOM.

The Need to Search, Collect and Preserve Data in a Timely and Cost Effective Manner, with Court Admissibillity

at&t

SBC

COMVERSE

MERCURY

UnitedHealthcare

IT Breaches

ChoicePoint

DSW

Companies Identified Based on Publicly Available Information, Such as Media Reports or Court Filings.

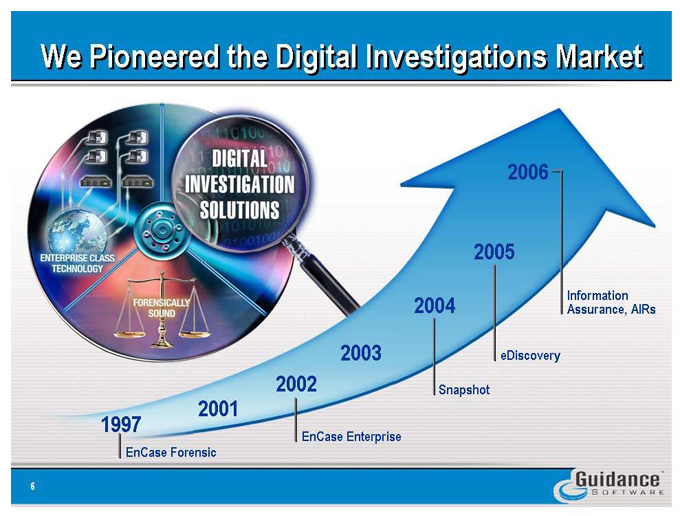

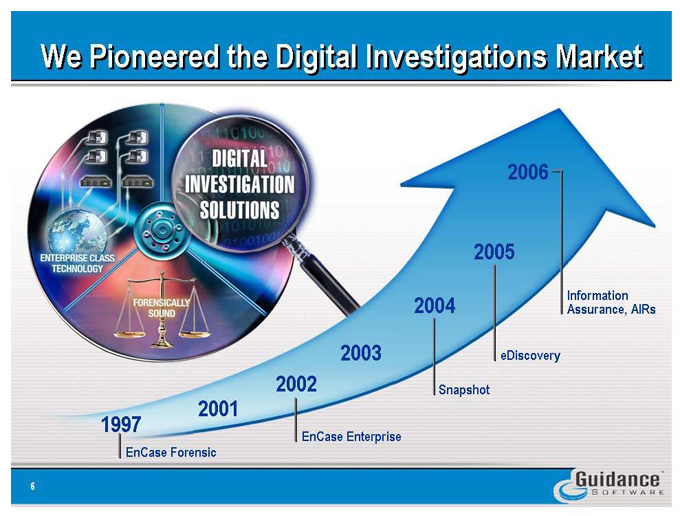

We Pioneered the Digital Investigations Market

DIGITAL INVESTIGATION SOLUTIONS

ENTERPRISE CLASS

TECHNOLOGY

2006-

2005

2004

Information Assurance, AIRs

2003

eDiscovery

2001

1997

EnCase Forensic

2002

EnCase Enterprise

Snapshot

Enterprise Investigative Infrastructure

Enterprise Investigative Infrastructure

Internal Investigations

Computer Related Incident Response

eDiscovery

Fraud/HR Investigations

Policy & Regulatory Compliance

IDS Alerts

Compromise Assessment

Info Assurance

Litigation Support

M&A

EnCase Enterprise Software & Services

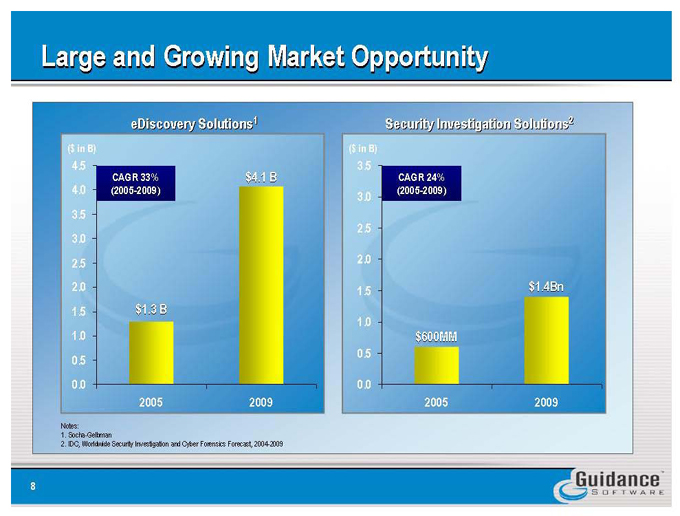

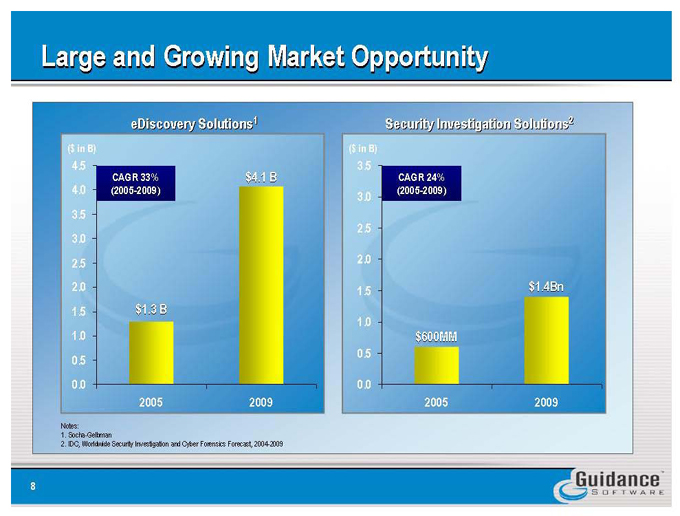

Large and Growing Market Opportunity

eDiscovery Solutions1

Security Investigation Solutions2

CAGR33% (2005-2009)

CAGR24% (2005-2009)

$1.3B

$1.4Bn

$600MM

$4.1B

2005

2009

2005

2009

Notes:

Socha-Geltman

IDC, Worldwide Security Investigation and Cyber Forensics Forecast, 200+2009

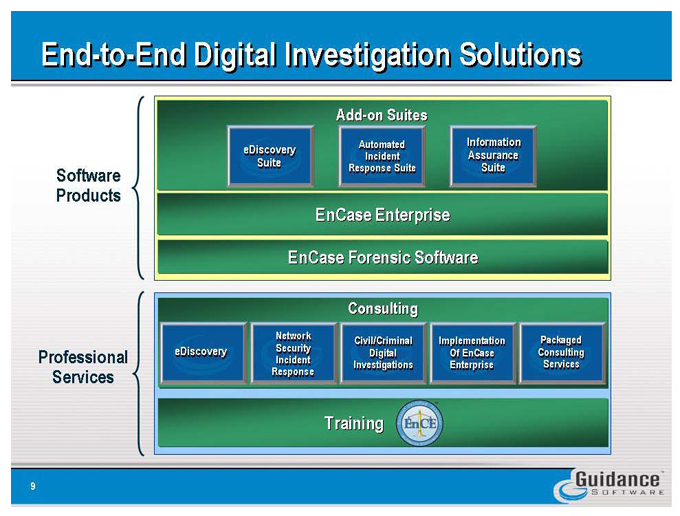

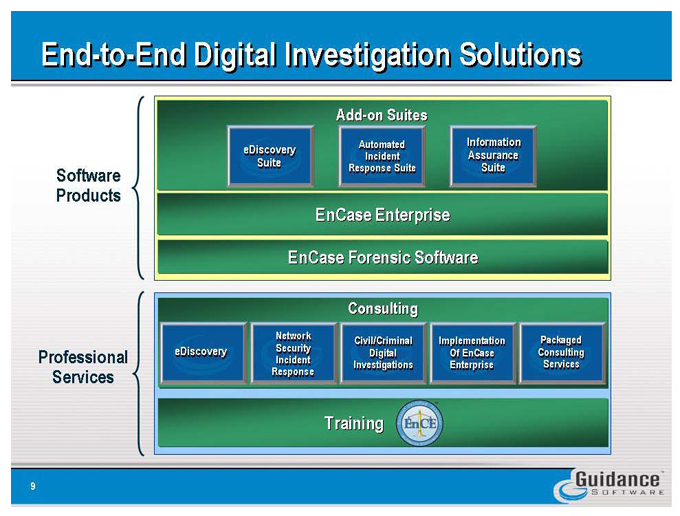

End-to-End Digital Investigation Solutions

Add-on Suites

Software Products

Software Products

eDiscovery Suite

Automated

Incident

Response Suite

EnCase Enterprise

Information

Assurance

Suite

En Case Forensic Software

Professional Services

Consulting

Professional Services

eDiscovery

Network Security Incident Response

Civil/Criminal

Digital Investigations

Implementation Of EnCase Enterprise

Packaged

Consulting

Services

Training

9

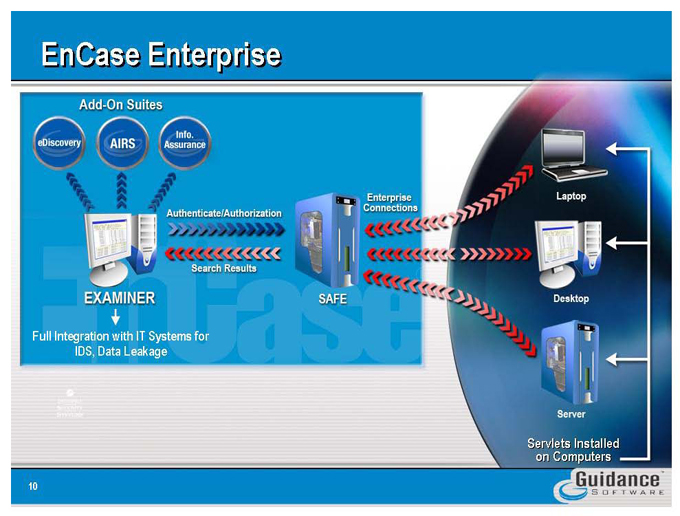

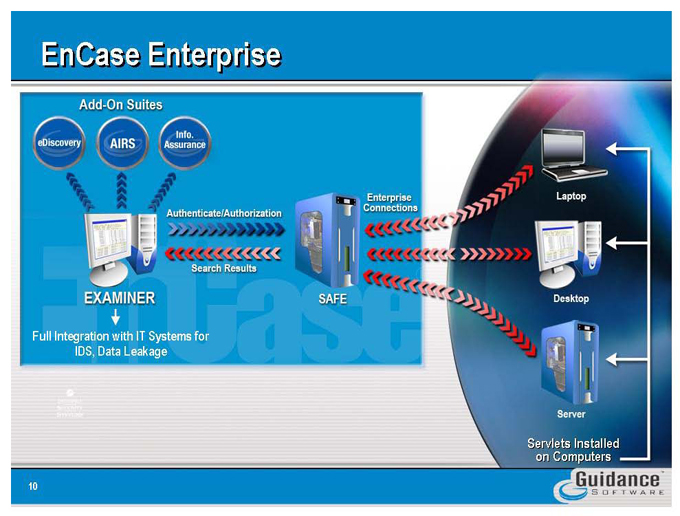

EnCase Enterprise

Add-On Suites

eDiscovery

AIRS

Info. Assurance

Authenticate/Authorization

Enterprise Connections

Laptop

Desktop

Server

Servlets Installed on Computers

Search Results

EXAMINER

Full Integration with IT Systems for IDS, Data Leakage

SAFE

10

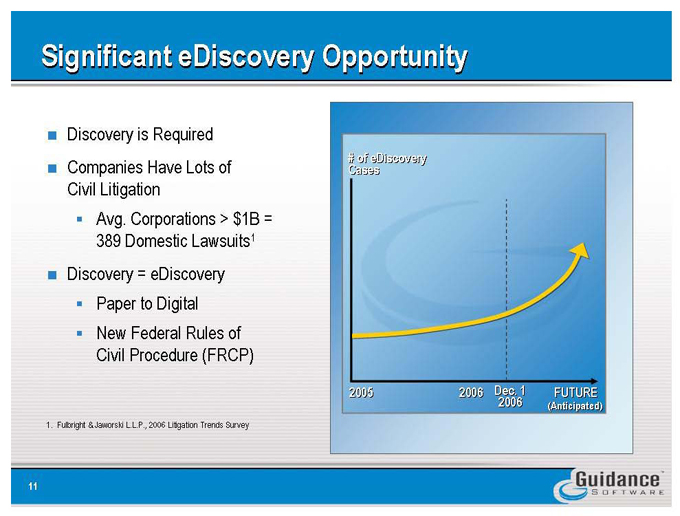

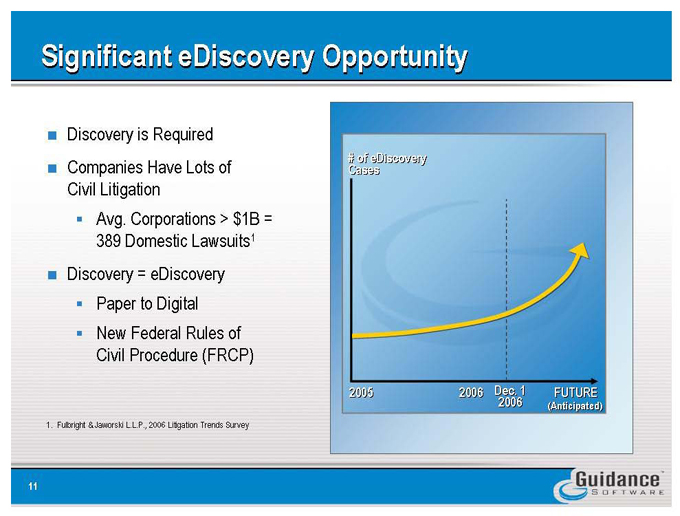

Significant eDiscovery Opportunity

Discovery is Required

Companies Have Lots of Civil Litigation

Avg. Corporations > $1B = 389 Domestic Lawsuits1

Discovery = eDiscovery

Paper to Digital

New Federal Rules of Civil Procedure (FRCP)

1. Fulbright & Jaworski L.L.P., 2006 Litigation Trends Survey

2005 2006 Dec. 1 2006 FUTURE

(Anticipated)

11

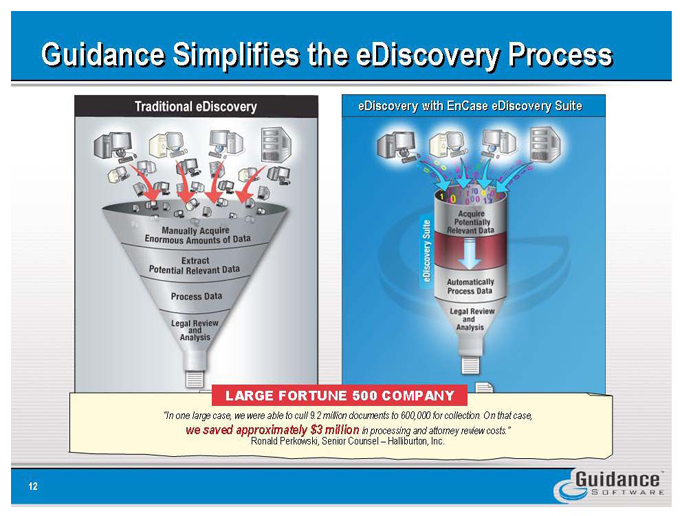

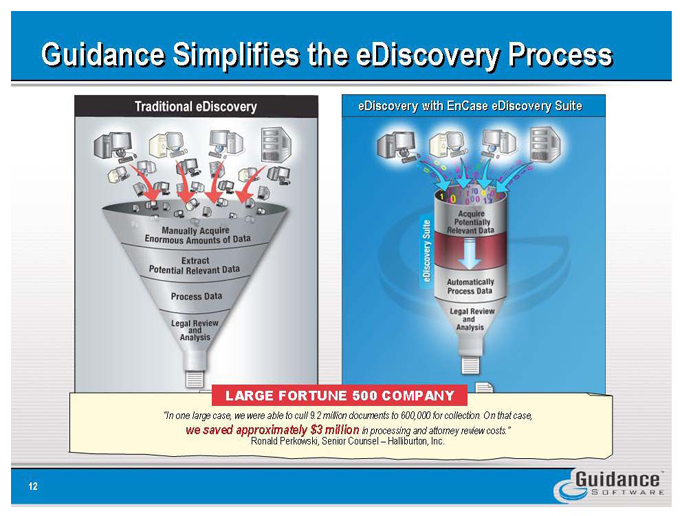

Guidance Simplifies the eDiscovery Process

Traditional eDiscovery

Manually Acquire Enormous Amounts of Data

Extract Potential Relevant Data

Process Data

Legal Review

and Analysis

eDiscovery with EnCase eDiscovery Suite

Acquire Potentially Relevant Data

Automatically Process Data

Legal Review and Analysis

LARGE FORTUNE 500 COMPANY

“In one large case, we were able to cull 9.2 million documents to 600,000 for collection. On that case,

we saved approximately $3 million in processing and attorney review costs.” Ronald Perkowski, Senior Counsel—Halliburton, Inc.

12

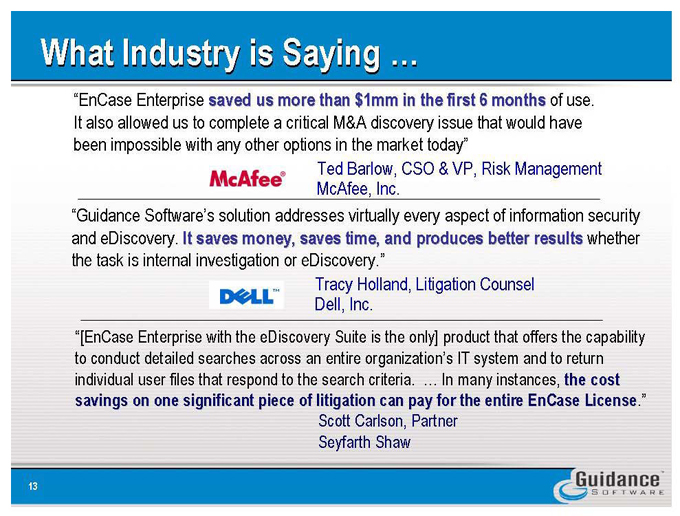

What Industry is Saying .

“EnCase Enterprise saved us more than $1mm in the first 6 months of use. It also allowed us to complete a critical M&A discovery issue that would have been impossible with any other options in the market today”

Ted Barlow, CSO S VP, Risk Management McAfee, Inc.

“Guidance Software’s solution addresses virtually every aspect of information security and eDiscovery. It saves money, saves time, and produces better results whether the task is internal investigation or eDiscovery.”

Tracy Holland, Litigation Counsel

Dell, Inc.

“[EnCase Enterprise with the eDiscovery Suite is the only] product that offers the capability to conduct detailed searches across an entire organization’s IT system and to return individual user files that respond to the search criteria. . In many instances, the cost savings on one significant piece of litigation can pay for the entire EnCase License.”

Scott Carlson, Partner

Seyfarth Shaw

13

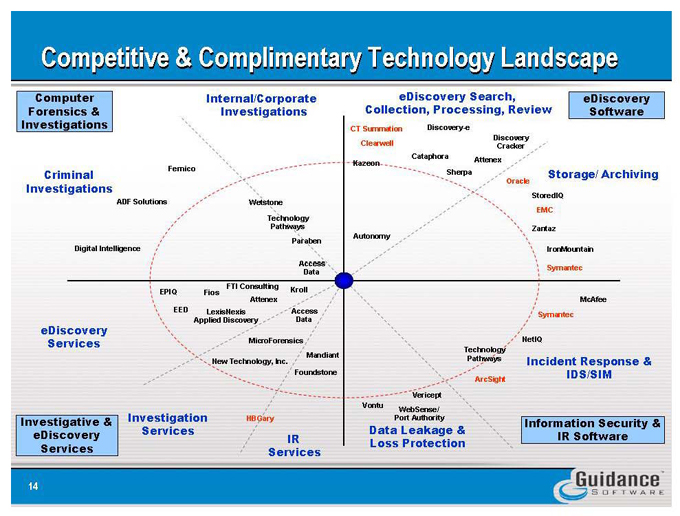

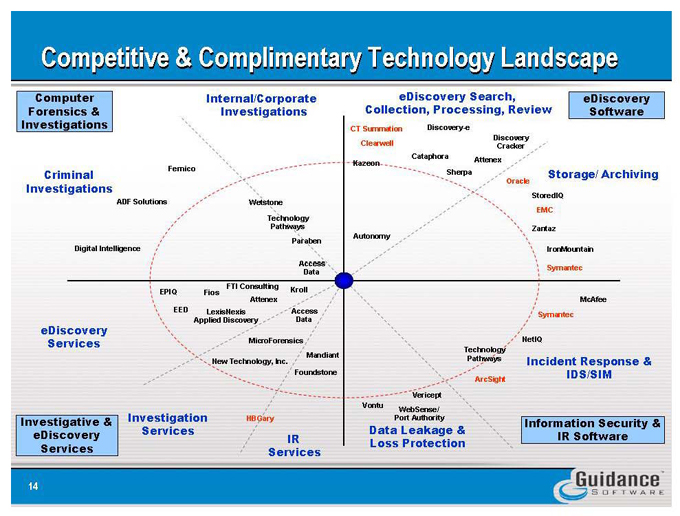

Competitive & Complimentary Technology Landscape

Computer

Forensics &

Investigations

Criminal Investigations

I nternal C orporate Investigations

eDiscovery Search, Collection, Processing, Review

CT Summation Storage/Archiving

eDiscovery Services

Investigative &

eDiscovery

Services

Investigation Services

IR Services

Data Leakage & Loss Protection

Information Security & IR Software

14

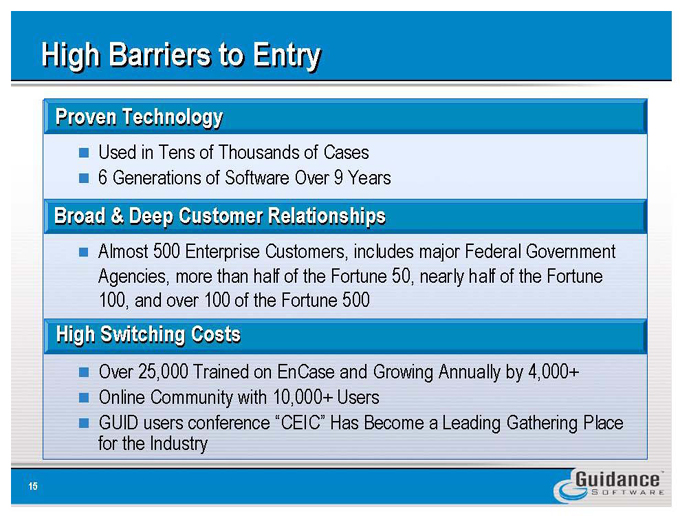

High Barriers to Entry

Proven Technology

Used in Tens of Thousands of Cases i 6 Generations of Software Over 9 Years

Broad & Deep Customer Relationships

Almost 500 Enterprise Customers, includes major Federal Government Agencies, more than half of the Fortune 50, nearly half of the Fortune 100, and over 100 of the Fortune 500

High Switching Costs

Over 25,000 Trained on EnCase and Growing Annually by 4,000+ Online Community with 10,000+Users

GUID users conference “CEIC” Has Become a Leading Gathering Place for the Industry

Significant Leverage in Financial Model

Significant Annual and Y-o-Y Quarterly Revenue Growth Largely Operating Cash Flow Positive Since Inception Diversified Customer Base Across Industry and Geography Pricing Model Provides Significant Future Upsell Opportunities

Significant Proportion of Business From Recurring / Predictable Revenue Components

16

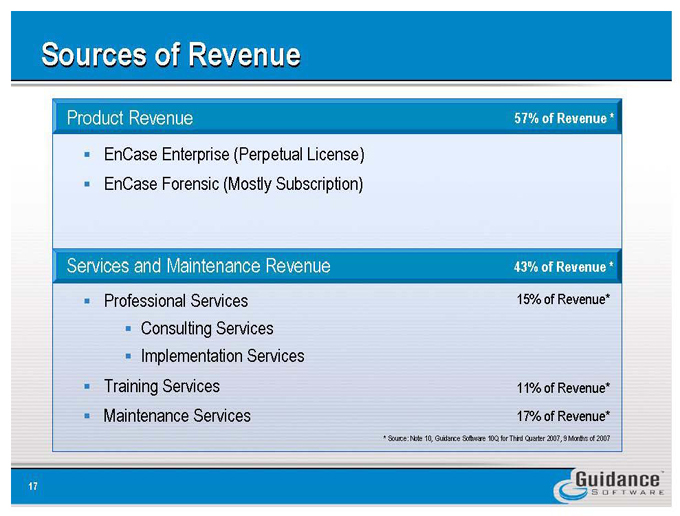

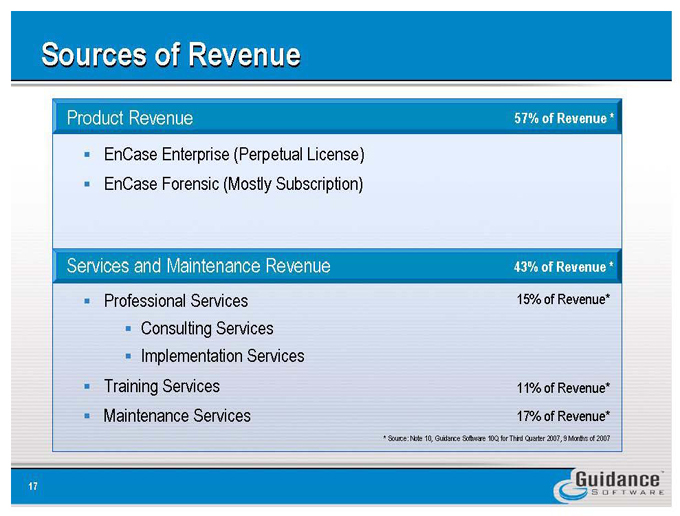

Sources of Revenue

Product Revenue 57% of Revenue*

EnCase Enterprise (Perpetual License) EnCase Forensic (Mostly Subscription)

Services and Maintenance Revenue 43% of Revenue *

Professional Services 15% of Revenue*

Consulting Services Implementation Services

Training Services Maintenance Services

11% of Revenue* 17% of Revenue*

* | | Source: Note 10, Guidance Software 10Q for Third Quarter 2007, 9 Montha of 2007 |

17

Annual Revenue Growth

Revenue ($MM)

WM

CAGR 39% (2005-2007)

100 90 80 70 60 50 40 30 20 10 0 $5.6

$10.5

$17.7

$27.6

$39.5

$55.9

$74-$76 Estimated

$94-$99 Estimated

2001

2002

2003

2004

2005

2006

2007

2008

Product Revenue Consulting, Training & Maintenance Revenue

18

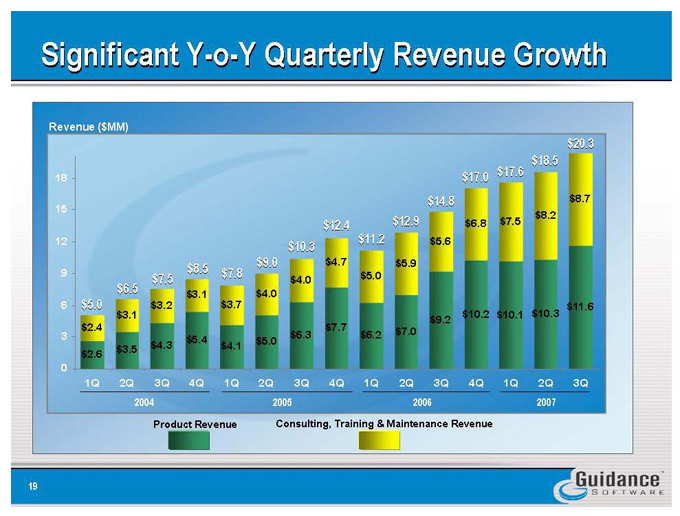

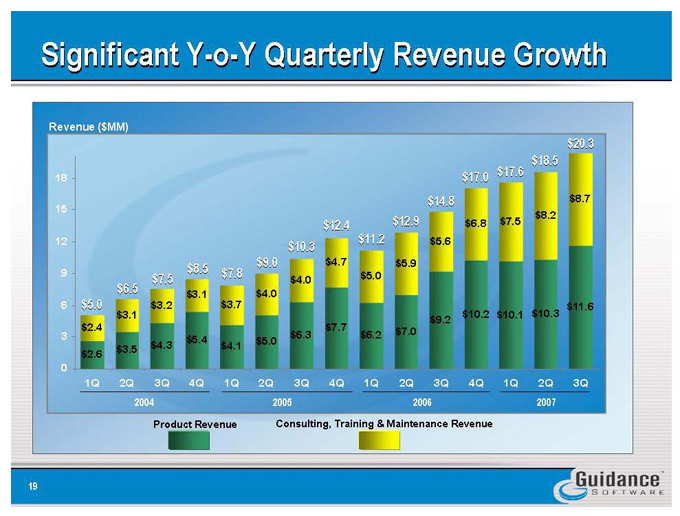

Significant Y-o-Y Quarterly Revenue Growth

Revenue ($MM)

18 15 12 9 6 3 0

$5.0 $6.5 $7.5 $8.5 $7.8 $9.0 $10.3 $12.4 $11.2 $12.9 $14.8 $17.0 $17.6 $18.5 $20.3

$2.4

$2.6

$3.1

$3.2

$3.1

$3.7

$4.0

$4.0

$7.7

$5.0

$6.2

$7.0

5.6

$9.2

$6.3

$10.2

$7.5

$8.2

$10.3

$8.7

$11.6

1Q 2Q 3Q 4Q

1Q 2Q 3Q 4Q

1Q 2Q 3Q 4Q

1Q 2Q 3Q

2004 2005 2006 2007

Product Revenue Consulting, Training & Maintenance Revenue

19

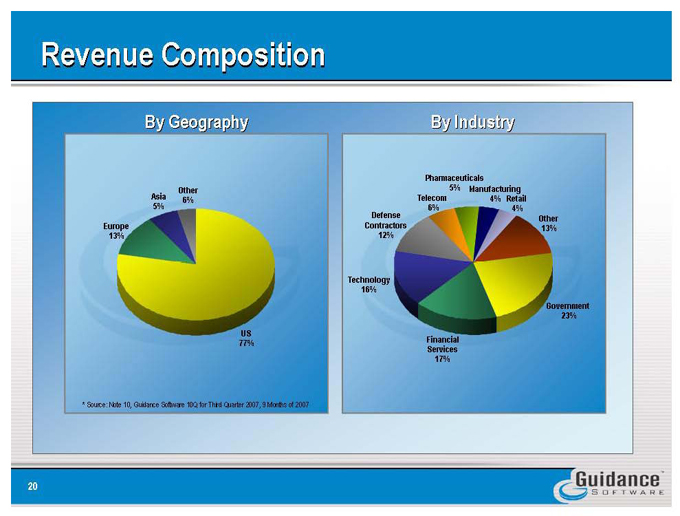

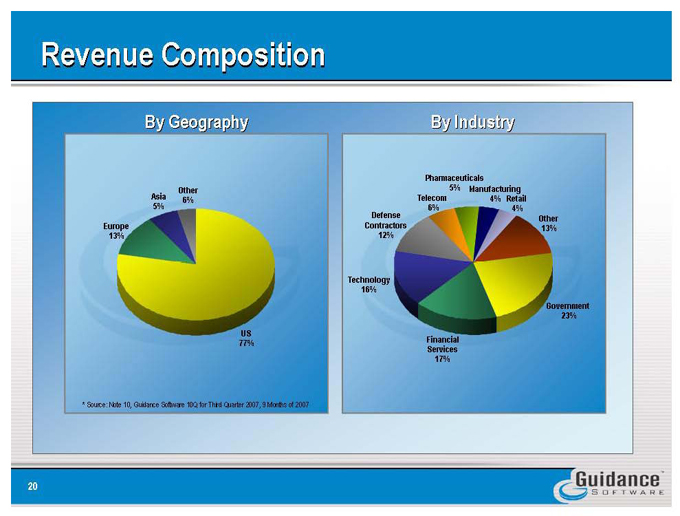

Revenue Composition

By Geography By Industry

Europe 13%

Asia

5%

Other 6%

Defense

Contractors

12%

Pharmaceuticals 5%

Manufacturing 4%

Telecom

6%

Retail 4%

Other

13%

Technology

16%

Government

23%

US

77%

Financial Services

17%

* | | Source: Me 10, Guidance Softoire 1CIQ tor Thid Quarter 2007, 9 Months of 2007 |

20