UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JULY 31. 2015 |

Commission File Number 000-52392

Amazing Energy Oil and Gas, Co.

(Exact name of registrant as specified in its charter)

| Nevada | 82-0290112 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

701 South Taylor Street

Suite 470, LB 113

Amarillo, TX 79101

(Address of principal executive offices)

Registrant's telephone number, including area code: (806) 322-1922

| Securities registered pursuant to Section 12(b) of the Act: | Securities registered pursuant to section 12(g) of the Act: |

| NONE | COMMON STOCK |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-accelerated Filer (Do not check if a smaller reporting company) | ☐ | Smaller Reporting Company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on January 31, 2015, based on the last reported trading price of the registrant's common stock on the OTC-Markets was $33,987,361.

At November 12, 2015, 53,441,528 shares of the registrant's common stock were outstanding.

TABLE OF CONTENTS

| Page | ||

| 3 | ||

| 6 | ||

| Business. | 6 | |

| Risk Factors. | 15 | |

| Unresolved Staff Comments. | 15 | |

| Properties. | 16 | |

| Legal Proceedings. | 16 | |

| Mine Safety Disclosures. | 21 | |

| 22 | ||

| Market for the Registrant's Common Equity, Related Stockholders Matters and Issuer Purchases of Equity Securities. | 22 | |

| Selected Financial Data. | 23 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operation. | 23 | |

| Quantitative and Qualitative Disclosures About Market Risk. | 30 | |

| Financial Statements and Supplementary Data. | 30 | |

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 49 | |

| Controls and Procedures. | 50 | |

| Other Information. | 51 | |

| 51 | ||

| Directors, Executive Officers and Corporate Governance. | 51 | |

| Executive Compensation. | 55 | |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 56 | |

| Certain Relationships and Related Transactions, and Director Independence. | 57 | |

| Principal Accountant Fees and Services. | 58 | |

| 59 | ||

| Exhibits and Financial Statement Schedules. | 59 | |

| 61 | ||

| 62 | ||

The following is a description of the meanings of some of the oil and gas industry terms used in this report.

| Basin | A large natural depression on the earth's surface in which sediments generally brought by water accumulate. | |

| Bbl | One stock tank barrel, of 42 U.S. gallons liquid volume, used to reference oil, condensate or NGLs. | |

| Boe | Barrel of oil equivalent, determined using the ratio of six Mcf of gas to one Boe, and one Bbl of NGLs to one Boe. | |

| Completion | The installation of permanent equipment for production of oil or gas, or, in the case of a dry well, for reporting to the appropriate authority that the well has been abandoned. | |

| Developed oil and gas reserves | Has the meaning given to such term in Rule 4-10(a)(6) of Regulation S-X, as follows: | |

| Developed oil and gas reserves are reserves of any category that can be expected to be recovered: | ||

| (i) | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and | |

| (ii) | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. | |

| Dry hole or well | An exploratory, development or extension well that proved to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. | |

| Hydraulic fracturing | The technique designed to improve a well's production rates by pumping a mixture of water and sand (in our case, over 99% by mass) and chemical additives (in our case, less than 1% by mass) into the formation and rupturing the rock, creating an artificial channel. | |

| Lease operating expenses | The expenses of lifting oil or gas from a producing formation to the surface, and the transportation and marketing thereof, constituting part of the current operating expenses of a working interest, and also including labor, superintendence, supplies, repairs, short-lived assets, maintenance, allocated overhead costs and other expenses incidental to production, but excluding lease acquisition or drilling or completion expenses. | |

| Mbo | Thousand barrels of oil or other liquid hydrocarbons. | |

| Mboe | Thousand barrels of oil equivalent, determined using the ratio of six Mcf of gas to one Boe, and one Bbl of NGLs to one Boe. | |

| Mcf | Thousand cubic feet of natural gas. | |

| Mmcf | Million cubic feet of gas. | ||

| Play | A set of known or postulated oil and/or gas accumulations sharing similar geologic, geographic and temporal properties, such as source rock, migration pathways, timing, trapping mechanism and hydrocarbon type. | ||

| Productive well | An exploratory, development or extension well that is not a dry well. | ||

| Proved developed producing reserves | Proved developed oil and gas reserves that are expected to be recovered: | ||

| (i) | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and | ||

| (ii) | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. | ||

| Proved oil and gas reserves | Has the meaning given to such term in Rule 4-10(a)(22) of Regulation S-X, as follows: | ||

| Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geosciences and engineering data, can be estimated with reasonable certainty to be economically producible — from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations — prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. | |||

| (i) | The area of the reservoir considered as proved includes: | ||

| (A) | The area identified by drilling and limited by fluid contacts, if any, and | ||

| (B) | Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geosciences and engineering data. | ||

| (ii) | In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geosciences, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. | ||

| (iii) | Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geosciences, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. | ||

| (iv) | Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: | ||

| (A) | Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and | ||

| (v) | Existing economic conditions include prices and costs at which economic viability from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an un-weighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. | ||

| PV-10 | An estimate of the present value of the future net revenues from proved oil and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of federal income taxes. The estimated future net revenues are discounted at an annual rate of 10% to determine their "present value." The present value is shown to indicate the effect of time on the value of the revenue stream and should not be construed as being the fair market value of the properties. Estimates of PV-10 are made using oil and gas prices and operating costs at the date indicated and held constant for the life of the reserves. | ||

| Reserve life | This index is calculated by dividing year-end 2014 estimated proved reserves by 2014 production of 5 MMBoe to estimate the number of years of remaining production. | ||

| Standardized measure | The present value of estimated future net revenues to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the SEC (using prices and costs in effect as of the period end date) without giving effect to non-property related expenses such as general and administrative expenses, debt service and future income tax expenses or to depletion, depreciation and amortization and discounted using an annual discount rate of 10%. Standardized measure does not give effect to derivative transactions. | ||

| Working interest | The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and receive a share of production. | ||

This annual report on Form 10-K, includes forward-looking statements. Our forward-looking statements include our current expectations and projections about future results, performance, results of litigation, prospects and opportunities. We have tried to identify these forward-looking statements by using words such as "may," "will," "expect," "anticipate," "believe," "intend," "feel," "plan," "estimate," "project," "forecast" and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to Amazing Energy Oil and Gas, Co. ("AMAZ" or "the Company") or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Whether as a result of new information, future events or otherwise (except as required by federal securities laws), we do not intend to update or revise any forward-looking statements.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered a penny stock and such safe harbors set forth under Section 21E are unavailable to us.

These forward-looking statements are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management's assumptions about future events may prove to be inaccurate. We caution all readers that the forward-looking statements contained in this report are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements. All forward-looking statements speak only as of the date of this report. We disclaim any obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, unless required by law. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. The risks, contingencies and uncertainties relate to, among other matters, the following:

| · | Uncertainties in drilling, exploring for and producing oil and gas; |

| · | Oil and gas prices; |

| · | Overall United States and global economic and financial market conditions; |

| · | Domestic and foreign demand and supply for oil, gas and the products derived from such hydrocarbons; |

| · | The willingness and ability of the Organization of Petroleum Exporting Countries ("OPEC") to set and maintain oil price and production controls; |

| · | Our ability to obtain additional financing necessary to fund our operations and capital expenditures and to meet our other obligations; |

| · | The effects of government regulation and permitting and other legal requirements, including laws or regulations that could restrict or prohibit hydraulic fracturing; |

| · | Disruption of credit and capital markets; |

| · | Disruptions to, capacity constraints in or other limitations on the pipeline systems that deliver our oil, and gas and other processing and transportation considerations; |

| · | Marketing of oil and gas; |

| · | High costs, shortages, delivery delays or unavailability of drilling and completion equipment, materials, labor or other services; |

BUSINESS DEVELOPMENT

Amazing Energy Oil and Gas, Co. ("We," "Us", "the Company" or "Amazing Energy Oil and Gas Co.") is incorporated in the State of Nevada. Through its primary subsidiary, Amazing Energy, Inc., also a Nevada corporation, the main business of the Company is the exploration, development, and production of oil and gas in the Permian Basin of West Texas. On October 7, 2014, the Company entered into a change in control agreement with certain shareholders of Amazing Energy, Inc. The change in control agreement was the first step in a reverse merger process whereby the shareholders of Amazing Energy, Inc. would control about 95% of the shares of common stock of Amazing Energy Oil and Gas, Co., and Amazing Energy Oil and Gas, Co. would own 100% of the outstanding shares of common stock of Amazing Energy, Inc. This entire reverse merger process was completed in July of 2015.

Amazing Energy, Inc. (AEI) was formed in 2010 as a Texas corporation and re-domociled to Nevada in 2011. The Company owns interests in oil and gas properties located in Texas. The Company is primarily engaged in the acquisition, exploration and development of oil and gas properties and the production and sale of oil and natural gas. Amazing Energy, LLC was formed in December 2008 as a Texas Limited Liability Company. In December of 2010, Amazing Energy, Inc. and Amazing Energy, LLC were combined as commonly controlled entities.

The Company is still marginally involved in the gold exploration business through another wholly owned subsidiary; Kisa Gold Mining, Inc. Kisa controls or has interests in two consolidated claim blocks consisting of 88 Alaska mining claims covering 13,840 acres which comprise the Company's Southwest Kuskokwim project. The claims consist of exploration properties in Southwest Alaska approximately 90 miles east of the village of Bethel. On March 28, 2011, Kisa executed a master earn-in agreement with North Fork, LLC, an Alaskan limited liability company. This agreement calls for North Fork to explore for gold deposits on Kisa's claim blocks. On September 2, 2014, Gold Crest Mines, Inc. entered into an option agreement to sell 100% of the outstanding shares of common stock of Kisa to Afranex Gold Limited ("Afranex") for $400,000. This option agreement expires on December 31, 2015.

Amazing Energy Oil and Gas, Co. has been in the process since October, 2014, of transitioning from a mineral exploration company to an oil and gas exploration, development and producing company. The Company has been aggressively pushing Afranex to exercise its option to purchase the Kisa stock prior to the expiration of the option period.

The following table shows the wholly owned subsidiaries of Amazing Energy Oil and Gas, Co.

| State of | Ownership | Principal | |||||

| Name of Subsidiary | Incorporation | Interest | Activity | ||||

| Amazing Energy, Inc. | Nevada | 100 | % | Oil and gas exploration, development, and | |||

| products | |||||||

| Amazing Energy, LLC | Texas LLC | 100 | % | Ownership oil and gas leases | |||

| Kisa Gold Mining, Inc. | Alaska | 100 | % | Mining exploration | |||

Any bankruptcy, receivership or similar proceedings

There have been no bankruptcy, receivership or similar proceedings.

OUR BUSINESS

General Description of the Business

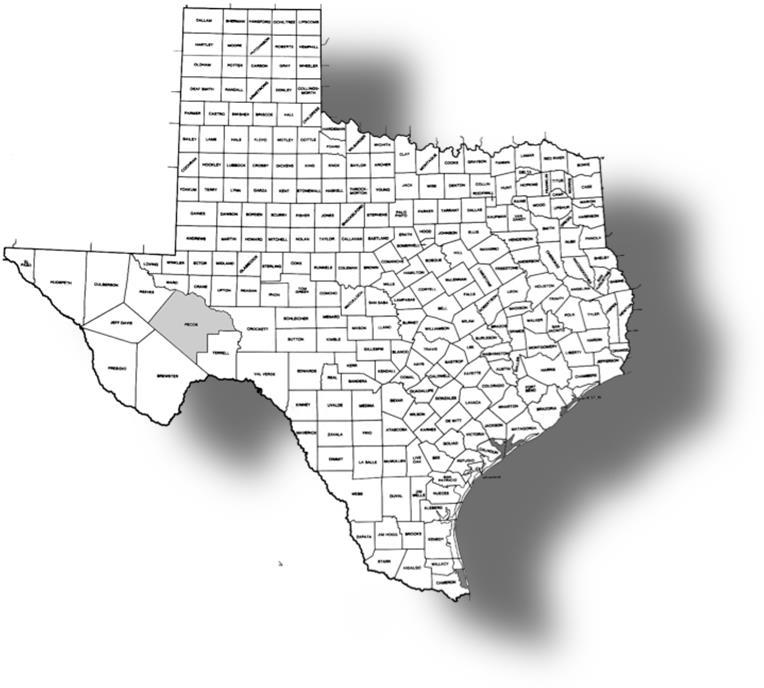

We are in the business of exploration, development, and production of oil and gas in the Permian Basin of West Texas. The Company has leasehold rights within approximately 70,000 acres in Pecos County, Texas as of July 31, 2015. We believe that our concentrated acreage position provides us with an opportunity to achieve cost, operating and recovery efficiencies in the development of our drilling inventory. We are currently developing resource potential from the Queens formation. Additional drilling targets could include the Greyburg, San Andreas and Devonian zones. On August 10, 2015, we entered into an agreement with Jed Miesner, our president, to acquire all of his interest (100% of the total outstanding shares of common stock) of Jilpetco, Inc., a Texas corporation ("Jilpetco") in exchange for 500,000 restricted shares of our common stock. Jilpetco is engaged in the business of operating and providing oilfield services to oil and gas properties. As a result, Jilpetco will become our wholly owned subsidiary corporation. This acquisition will offer the Company an opportunity to increase profits by providing services to oil and gas properties through contract operator services, as well as field services. Closing of this transaction has not occurred and there is no assurance that it will close in the future.

At July 31, 2015, our estimated net proved reserves were 576,040 barrels of oil equivalent ("BOE"). Important characteristics of our proved reserves at July 31, 2015 include:

| · | 62% oil and 38% gas; |

| · | 79% proved developed; |

| · | Reserve life of approximately 26.5 years : |

| · | Standardized measure of non-discounted future net cash flows of $ 17,568,310 |

| · | and PV-10 of $ 12,635,730 |

PV-10 is our estimate of the present value of future net revenues from proved oil, and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates for future income taxes. Estimated future net revenues are discounted at an annual rate of 10% to determine their present value. PV-10 is a financial measure that is not determined in accordance with accounting principles generally accepted in the United States ("GAAP"), and generally differs from the Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future cash flows. PV-10 should not be considered as an alternative to the Standardized Measure, as computed under GAAP.

At July 31, 2015 we owned 19 producing oil and gas wells in the Permian Basin. During the fiscal year ended July 31, 2015, we produced 22,976 BOE (Net). Production for the fiscal year ended July 31, 2014 was 28,117 BOE (Net).

Our Business Strategy

We intend to increase the value of the Company by increasing reserves and production in a cost-efficient manner by pursuing the following strategies:

Continue to drill and develop our shallow drilling play.

We believe that our current acreage position (leasehold rights to approximately 70,000 acres) provides us with the ability to continue to increase reserves and production by drilling shallow, low cost wells with joint venture investors. Typically, we strive to structure an offering in which participants/investors will "carry" (that is, bear the financial responsibility) for 25% of 8/8ths Working Interests in proportion to their participation in the offering. A "Carried Working Interest" is defined as a working interest which is expense-free through the stages of drilling, testing and completing a well to first sales or plugging and abandoning a well as a dry hole. Participants/investors will bear the cost and expenses attributable to the Carried Working Interest of the Company. The Company typically offers 75% of 8/8ths Working Interest in a drilling offering with a net revenue interest of 75%. The Carried Working Interest that the Company receives varies on the participation levels for each drilling offering. For example, if there is full participation, the Company will receive a 25% Carried Working Interest. The Company is constantly reviewing other potential acreage acquisitions, or other potential alliances with industry partners.

Our Competitive Strengths

| · | Drilling and producing in lower risk, lower cost, shallow formations versus drilling in higher risk, higher cost, deep formations. Given the current relative low price for oil, we believe that we have a competitive advantage over higher risk, high cost, and deeper shale drilling operations. Most of our current wells are drilled and completed for around $400,000 at depths of around 2,000 feet. |

| · | Experienced management team and low overhead expenses. Our management team has many years of experience in the oil and gas industry throughout Texas. Also, the Company strives to keep drilling, completion, operating expenses and general overhead to a minimum, while also providing quality services. |

Fiscal 2015 Activity

Our fiscal year 2015 activity focused on conventional drilling in the Queens formation in Pecos County, Texas. We spudded 3 conventional wells and completed 2 of them in fiscal 2015, compared to drilling and completing 2 conventional wells in fiscal 2014. We plan to continue to develop the Greyburg and Queens formations in Pecos County, Texas during fiscal 2016. The rate of drilling wells would depend, to some degree, on oil and gas prices. Our overall accomplishments in fiscal 2015 include:

| · | Completion of the reverse merger between Amazing Energy Oil and Gas, Co. (formerly Gold Crest Mines, Inc.) and Amazing Energy, Inc. Also we listed the Company's stock for trading on the OTCQX Exchange. |

| · | Production growth. Gross production for fiscal 2015 totaled 37,460 BOE, compared to 36,003 BOE in fiscal 2014, a 4% increase. Production for fiscal 2015 was 55% oil and 45% natural gas. |

| · | Reserve growth. In fiscal 2015, our estimated net proved reserves increased 26.5%, or 120,665 BOE to 576,040 BOE from 455,375 BOE. Our proved reserves at fiscal year-end 2015 were 62% oil and 38% natural gas, compared to 61% oil and 39% natural gas at year-end 2014. |

Plan for Fiscal 2016

During the fiscal year ending July 31, 2016, the Company plans to raise funds to continue drilling shallow oil and gas wells on the 70,000 acres that it has leasehold rights to in Pecos County in order to develop additional reserves and production. We anticipate raising such funds through joint ventures working interest holder participation, whereby the company would retain a carried working interest participation because of its existing lease ownership. In order to keep the leasehold in good standing, the Company adheres to the Continuous Drilling Clause for each respective lease and meets the requirements found therein. Capital expenditures and thus drilling activity for fiscal 2016 depend, to a significant extent, on the future market prices for oil.

Markets and Customers

The revenues generated by our operations are highly dependent upon the prices and supplies and demand for oil and natural gas. Oil and natural gas are commodities, and therefore, we are subject to market-based pricing. Since our oil is sour, we receive somewhat less per barrel than the published WTI market prices, and since our natural gas is a sour gas, we are limited to selling through a sour gas transmission line and therefore are subject to a percent of proceeds (POP) gas contract with the purchaser. Overall, the price that we receive for our oil and gas production depends on numerous factors beyond our control, including seasonality, the status of domestic and global economies political conditions in other oil and gas producing countries, and the extent of domestic production and imports of oil.

For the fiscal year ended July 31, 2015, sales to Sunoco, Inc. and to Trans-Pecos Natural Gas Company, LLC accounted for approximately 84% and 16%, respectively, of our total sales of oil and gas.

Title to Properties

Management believes the Company has satisfactory title to all of its properties in accordance with standards generally accepted in the oil and gas industry. The properties are subject to customary royalty interests, liens for current taxes and other burdens, which management believes does not materially interfere with the use of or affect the value of such properties. Prior to acquiring undeveloped properties, the Company performs a title investigation that is thorough but less vigorous than that conducted prior to drilling, which is consistent with standard practice in the oil and gas industry. Before the Company commences drilling operations, it conducts a thorough title examination and performs curative work with respect to significant defects. The Company has performed thorough title examination with respect to the sections of land that has been drilled upon. As drilling operations are implemented in a different section of land, the Company will initiate the title examination process.

Oil and Gas Leases

The typical oil and natural gas lease agreement covering our acreage position in Pecos County provides for the payment of royalties to the mineral owners for all oil and natural gas produced form any wells drilled on the leased premises. The lessor royalties and other leasehold burdens on our properties generally range from 20% to 25%, resulting in a net revenue interest to the Working Interest owners generally ranging from 75% to 80%.

Competition

The oil and gas industry is highly competitive, and we compete with a substantial number of other companies that have greater resources and have extensive leasehold interests in the Permian Basin. We also face competition from alternative fuel sources, including coal, heating oil, imported LNG, nuclear and other nonrenewable fuel sources, and renewable fuel sources such as wind, solar, geothermal, hydropower and biomass. Competitive conditions may also be substantially affected by various forms of energy legislation and/or regulation considered from time-to-time by the United States government. It is not possible to predict whether such legislation or regulation may ultimately be adopted or its precise effects upon our future operations. Such laws and regulations may, however, substantially increase the costs of exploring for, developing or producing oil, and gas and may prevent or delay the commencement or continuation of our operations.

Regulation

The oil and gas industry in the United States is subject to extensive regulation by federal, state and local authorities. At the federal level, various federal rules, regulations and procedures apply, including those issued by the U.S. Department of Interior, the U.S. Department of Transportation (the "DOT") (Office of Pipeline Safety) and the U.S. Environmental Protection Agency (the "EPA"). At the state and local level, various agencies and commissions regulate drilling, production and midstream activities. For the state of Texas the regulatory agency is the Texas Railroad Commission. These federal, state and local authorities have various permitting, licensing and bonding requirements. Various remedies are available for enforcement of these federal, state and local rules, regulations and

procedures, including fines, penalties, revocation of permits and licenses, actions affecting the value of leases, wells or other assets, suspension of production, and, in certain cases, criminal prosecution. As a result, there can be no assurance that we will not incur liability for fines, penalties or other remedies that are available to these federal, state and local authorities. However, we believe that we are currently in material compliance with federal, state and local rules, regulations and procedures, and that continued substantial compliance with existing requirements will not have a material adverse effect on our financial position, cash flows or results of operations.

Transportation and Sale of Oil

Sales of crude oil are negotiated with Sunoco, Inc. via a crude oil purchase agreement which is subject to a month to month term, and a 30-day notice termination clause. The agreement specifies the pricing terms and transportation deductions, amongst other terms. Our sales of crude oil are affected by the availability, terms and cost of transportation.

Regulation of Production

Oil and gas production is regulated under a wide range of federal and state statutes, rules, orders and regulations. State and federal statutes and regulations require permits for drilling operations, drilling bonds and reports concerning operations. The state in which we operate, Texas, has regulations governing conservation matters, including provisions for the unitization or pooling of oil and gas properties, the establishment of maximum rates of production from oil and gas wells, the regulation of spacing, and requirements for plugging and abandonment of wells. Also, Texas imposes a severance tax on production and sales of oil, and gas within its jurisdiction. The failure to comply with these rules and regulations can result in substantial penalties. Our competitors in the oil and gas industry are subject to the same regulatory requirements and restrictions that affect our operations.

Environmental Laws and Regulations

In the United States, the exploration for and development of oil and gas and the drilling and operation of wells, fields and gathering systems are subject to extensive federal, state and local laws and regulations governing environmental protection as well as discharge of materials into the environment. These laws and regulations may, among other things:

| · | Require the acquisition of various permits before drilling begins; |

| · | Require the installation of expensive pollution controls or emissions monitoring equipment; |

| · | Restrict the types, quantities and concentration of various substances that can be released into the environment in connection with oil and gas drilling, completion, production, transportation and processing activities; |

| · | Suspend, limit or prohibit construction, drilling and other activities in certain lands lying within wilderness, wetlands, endangered species habitat and other protected areas; and |

| · | Require remedial measures to mitigate and remediate pollution from historical and ongoing operations, such as the closure of waste pits and plugging of abandoned wells. |

These laws, rules and regulations may also restrict the rate of oil and gas production below the rate that would otherwise be possible. The regulatory burden on the oil and gas industry increases the cost of doing business in the industry and consequently affects profitability.

Governmental authorities have the power to enforce compliance with environmental laws, regulations and permits, and violations are subject to injunction, as well as administrative, civil and criminal penalties. The effects of existing and future laws and regulations could have a material adverse impact on our business, financial condition and results of operations. The clear trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment. Any changes in environmental laws and regulations or re-interpretations of enforcement policies that result in more stringent and costly waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our business, financial condition or

results of operations. Moreover, accidental releases or spills and ground water contamination may occur in the course of our operations, and we may incur significant costs and liabilities as a result of such releases, spills or contamination, including any third-party claims for damage to property, natural resources or persons. While we believe that we are in substantial compliance with existing environmental laws and regulations and that continued compliance with current requirements would not have a material adverse effect on us, there is no assurance that this will continue in the future.

The following is a summary of some of the existing environmental laws, rules and regulations that apply to our business operations.

Hazardous Substance Release

The Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA"), also known as the Superfund law, and comparable state statutes impose strict liability, and under certain circumstances, joint and several liability, on classes of persons who are considered to be responsible for the release of a hazardous substance into the environment. These persons include the owner or operator of the site where the release occurred, and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. Under CERCLA, such persons may be subject to strict, joint and several liabilities for the costs of investigating releases of hazardous substances, cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third-parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. Crude oil and fractions of crude oil are excluded from regulation under CERCLA. Nevertheless, many chemicals commonly used at oil and gas production facilities fall outside of the CERCLA petroleum exclusion. While we generate materials in the course of our operations that may be regulated as hazardous substances, we have not received notification that we may be potentially responsible for cleanup costs under CERCLA.

Waste Handling

The Resource Conservation and Recovery Act ("RCRA") and comparable state statutes regulate the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes. Under the auspices of the EPA, the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. Drilling fluids, produced water and most of the other wastes associated with the exploration, development and production of oil or gas are currently regulated under RCRA's non-hazardous waste provisions. However, it is possible that certain oil and gas exploration and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. Any such change could increase our operating expenses, which could have a material adverse effect on our business, financial condition and results of operations.

Air Emissions

The federal Clean Air Act and comparable state laws regulate emissions of various air pollutants through air emissions permitting programs and other requirements. In addition, the EPA has developed, and continues to develop, stringent regulations governing emissions at specified sources. In particular, on April 18, 2012, the EPA issued new regulations under the New Source Performance Standards ("NSPS") and National Emission Standards for Hazardous Air Pollutants ("NESHAP"). The new regulations are designed to reduce volatile organic compound ("VOC") emissions from hydraulically fractured natural gas wells, storage tanks and other equipment. Under the regulations, since January 1, 2015, owners and operators of hydraulically fractured natural gas wells (wells drilled principally for the production of natural gas) have been required to use so-called "green completion" technology to recover natural gas that formerly would have been flared or vented. We do not expect that the NSPS or NESHAP will have a material adverse effect on our business, financial condition or results of operations. However, any future laws and their implementing regulations may require us to obtain pre-approval for the expansion or modification of existing facilities or the construction of new facilities expected to produce air emissions, impose stringent air permit requirements or use specific equipment or technologies to control emissions. Our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations and, potentially, criminal enforcement actions. We believe that we currently are in substantial compliance with all air emissions regulations and that we hold all necessary and valid construction and operating permits for our current operations.

Greenhouse Gas Emissions

While Congress has, from time-to-time, considered legislation to reduce emissions of GHGs, there has not been significant activity in the form of adopted legislation to reduce GHG emissions at the federal level in recent years. In the absence of such federal legislation, a number of states have taken legal measures to reduce emissions of GHGs through the planned development of GHG emission inventories and/or regional GHG cap-and-trade programs or other mechanisms. Most cap-and-trade programs work by requiring major sources of emissions, such as electric power plants, or major producers of fuels such as refineries and gas processing plants, to acquire and surrender emission allowances corresponding with their annual emissions of GHGs. The number of allowances available for purchase is reduced each year until the overall GHG emission reduction goal is achieved. As the number of GHG emission allowances declines each year, the cost or value of allowances is expected to escalate significantly. Many states have enacted renewable portfolio standards, which require utilities to purchase a certain percentage of their energy from renewable fuel sources.

In response to findings that emissions of carbon dioxide, methane and other GHGs present an endangerment to human health and the environment, the EPA has adopted regulations under existing provisions of the federal Clean Air Act. The EPA has adopted two sets of rules regarding possible future regulation of GHG emissions under the Clean Air Act, one of which purports to regulate emissions of GHGs from motor vehicles and the other of which would regulate emissions of GHGs from large stationary sources of emissions, such as power plants or industrial facilities. The motor vehicle rule was finalized in April 2010 and became effective in January 2011, but it does not require immediate reductions in GHG emissions. In March 2012, the EPA proposed GHG emissions standards for fossil fuel-powered electric utility generating units that would require new plants to meet an output- based standard of 1,000 pounds of carbon dioxide equivalent per megawatt-hour. The EPA issued a new proposed rule in September 2013, which retained the 1,000 pounds of carbon dioxide equivalent per megawatt-hour standard for large gas-fired power plants. The new proposal includes a standard of 1,100 pounds of carbon dioxide equivalent per megawatt-hour for small, gas-fired turbines and coal-fired turbines. In June 2014, the EPA proposed a regulation affecting existing fossil fuel power plants, which would seek to reduce carbon emissions from the power sector to 30% less than the 2005 level of emissions by 2030. If the proposed regulations are adopted, they could have a significant impact on the electrical generation industry and may favor the use of natural gas over other fossil fuels such as coal in new plants. The EPA has also indicated that it will propose new GHG emissions standards for refineries, but we do not know when the agency will issue specific regulations.

In December 2010, the EPA enacted final rules on mandatory reporting of GHGs. In 2011, the EPA published amendments to the rule containing technical and clarifying changes to certain GHG reporting requirements and a six-month extension for reporting GHG emissions from petroleum and natural gas industry sources. Under the amended rule, certain onshore oil and natural gas production, processing, transmission, storage and distribution facilities are required to report their GHG emissions on an annual basis. Our operations in the Permian Basin are subject to the EPA's mandatory reporting rules, and we believe that we are in compliance with such rules. We do not expect that the EPA's mandatory GHG reporting requirements will have a material adverse effect on our business, financial condition or results of operations.

The adoption of additional legislation or regulatory programs to monitor or reduce GHG emissions could require us to incur increased operating costs, such as costs to purchase and operate emissions control systems, acquire emissions allowances or comply with new regulatory requirements. In addition, the EPA has stated that the data collected from GHG emissions reporting programs may be the basis for future regulatory action to establish substantive GHG emissions factors. Any GHG emissions legislation or regulatory programs applicable to power plants or refineries could increase the cost of consuming, and thereby reduce demand for, the oil and natural gas we produce. Consequently, legislation and regulatory programs to reduce GHG emissions could have an adverse effect on our future business, financial condition and results of operations.

Water Discharges

The Federal Water Pollution Control Act (the "Clean Water Act") and analogous state laws impose restrictions and strict controls on the discharge of pollutants and fill material, including spills and leaks of oil and other substances into regulated waters, including wetlands. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA, an analogous state agency, or, in the case of fill material, the United States Army Corps of Engineers. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations.

In October 2011, the EPA announced its intent to develop national standards for wastewater discharges produced by natural gas extraction from shale and coal bed methane formations. The EPA is expected to issue proposed regulations establishing wastewater discharge standards for coal bed methane wastewater and shale gas wastewater in 2015. For shale gas wastewater, the EPA will consider imposing pre-treatment standards for discharges to a wastewater treatment facility. Produced and other flowback water from our current operations in the Permian Basin is typically re-injected into underground formations that do not contain potable water. To the extent that re-injection is not available for our operations and discharge to wastewater treatment facilities is required, new standards from the EPA could increase the cost of disposing wastewater in connection with our operations.

The Safe Drinking Water Act, Groundwater Protection and the Underground Injection Control Program

Fluids associated with oil and gas production result from operations on the Company's properties and are disposed by injection in underground disposal wells. The federal Safe Drinking Water Act ("SDWA") and the Underground Injection Control program (the "UIC program") promulgated under the SDWA and state programs regulate the drilling and operation of salt water disposal wells. The EPA has delegated administration of the UIC program in Texas to the Railroad Commission of Texas ("RRC"). Permits must be obtained before drilling salt water disposal wells, and casing integrity monitoring must be conducted periodically to ensure the casing is not leaking saltwater to groundwater. Contamination of groundwater by oil and gas drilling, production and related operations may result in fines, penalties and remediation costs, among other sanctions and liabilities under the SDWA and state laws. In addition, third-party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages and bodily injury.

Hydraulic Fracturing

Hydraulic fracturing is the subject of significant focus among some environmentalists, regulators and the general public. Concerns over potential hazards associated with the use of hydraulic fracturing and its impact on the environment have been raised at all levels, including federal, state and local, as well as internationally. There have been claims that hydraulic fracturing may contaminate groundwater, reduce air quality or cause earthquakes. Hydraulic fracturing requires the use and disposal of water, and public concern has been growing over the adequacy of water supply.

The Energy Policy Act of 2005, which exempts hydraulic fracturing from regulation under the SDWA, prohibits the use of diesel fuel in the fracturing process without a UIC permit. In the past, legislation has been introduced in, but not passed by, Congress that would amend the SDWA to repeal this exemption. Specifically, the FRAC Act has been introduced in each Congress since 2008 to accomplish these purposes, and we expect similar legislation to be introduced in the current Congress. If legislation repealing the exemption were enacted, it could require hydraulic fracturing operations to meet permitting and financial assurance requirements, adhere to certain construction specifications, fulfill monitoring, reporting and recordkeeping obligations and meet plugging and abandonment requirements.

In 2010, the EPA asserted federal regulatory authority over hydraulic fracturing involving diesel additives under the UIC program by posting a requirement on its website that requires facilities to obtain permits to use diesel fuel in hydraulic fracturing operations. Following a legal challenge by industry groups and a subsequent settlement, in February 2014, the EPA issued revised guidance on the use of diesel in hydraulic fracturing operations. Under the guidance, EPA broadly defined "diesel" to include fuels such as kerosene that have not traditionally been considered diesel. The EPA's continued assertion of its regulatory authority under the SDWA could result in extensive requirements that could cause additional costs and delays in the hydraulic fracturing process.

In addition to the above actions of the EPA, certain members of Congress have, in the past, called upon government agencies to investigate various aspects of hydraulic fracturing. Federal agencies that have been involved in hydraulic fracturing research include the White House Council on Environmental Quality, the Department of Energy, the Department of Interior and the Energy Information Administration. The EPA has also begun a study of the potential environmental impacts of hydraulic fracturing on water resources. The EPA issued a progress report in December 2012, and final results are expected in 2015. These ongoing or proposed investigations and studies, depending on their degree of pursuit and any meaningful results obtained, could facilitate initiatives to further regulate hydraulic fracturing.

Some states have adopted, and other states are considering adopting, regulations that could restrict hydraulic fracturing in certain circumstances or otherwise require the public disclosure of chemicals used in hydraulic fracturing. For example, pursuant to legislation adopted by the State of Texas in June 2011, the RRC enacted a rule in December 2011, requiring disclosure to the RRC and the public of certain information regarding additives, chemical ingredients, concentrations and water volumes used in hydraulic fracturing. In addition to state law, local land use restrictions, such as city ordinances, may directly or indirectly restrict or prohibit drilling and hydraulic fracturing. For example, in November 2014, the City of Denton, Texas, enacted an ordinance banning hydraulic fracturing. While the City of Denton ordinance is currently the subject of a lawsuit, other local governments may enact similar legislation in the future. If these or any other new laws or regulations that significantly restrict hydraulic fracturing are adopted, it could become more difficult or costly for the Company to drill and produce oil and gas from shale and tight sands formations and become easier for third parties opposing hydraulic fracturing to initiate legal proceedings. In addition, if hydraulic fracturing is regulated at the federal level, fracturing activities could become subject to delays, additional permitting and financial assurance requirements, more stringent construction specifications, increased monitoring, reporting and recordkeeping obligations, plugging and abandonment requirements and higher costs. These new laws or regulations could cause us to incur substantial delays or suspensions of operations and compliance costs and could have a material adverse effect on our business, financial condition and results of operations.

Compliance

We believe that we are in compliance with all existing environmental laws and regulations that apply to our current operations and that our ongoing compliance with existing requirements will not have a material adverse effect on our business, financial condition or results of operations. We did not incur any material capital expenditures for remediation or pollution control activities for the year ended July 31, 2015. In addition, as of the date of this report, we are not aware of any environmental issues or claims that will require material capital or operating expenditures during fiscal 2016. However, the passage of additional or more stringent laws or regulations in the future could have a negative effect on our business, financial condition and results of operations, including our ability to develop our undeveloped acreage.

Threatened and Endangered Species, Migratory Birds and Natural Resources

Various state and federal statutes prohibit certain actions that adversely affect endangered or threatened species and their habitat, migratory birds, wetlands and natural resources. These statutes include the Endangered Species Act, the Migratory Bird Treaty Act, the Clean Water Act and CERCLA. The United States Fish and Wildlife Service may designate critical habitat and suitable habitat areas that it believes are necessary for survival of threatened or endangered species. A critical habitat or suitable habitat designation could result in further material restrictions to federal land use and private land use and could delay or prohibit land access or development.

Where takings of, or harm to, species or damages to wetlands, habitat or natural resources occur or may occur, government entities or at times private parties may act to prevent oil and gas exploration activities or seek damages for harm to species, habitat or natural resources resulting from drilling or construction or releases of oil, wastes, hazardous substances or other regulated materials, and may seek natural resources damages and, in some cases, criminal penalties.

OSHA and Other Laws and Regulations

We are subject to the requirements of the federal Occupational Safety and Health Act ("OSHA") and comparable state statutes. The OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of CERCLA and similar state statutes require that we organize and/or disclose information about hazardous materials used or produced in our operations. These laws also require the development of risk management plans for certain facilities to prevent accidental releases of pollutants. We believe that we are in substantial compliance with these applicable requirements and with other OSHA and comparable requirements.

Employees

As of July 31, 2015, we had 3 full-time employees. We regularly use independent contractors and consultants to perform various drilling and other services. None of our employees are represented by a labor union or covered by any collective bargaining agreement.

Insurance Matters

We will not insure fully against all risks associated with our business either because such insurance is not available or because premium costs are considered prohibitive. A loss not fully covered by insurance could have a material adverse effect on our business, financial condition and results of operations.

Available Information

We maintain an Internet website under the name www.amazingenergy.com. We file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, proxy statements and other documents with the SEC under the Exchange Act. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The public can obtain any document we file with the SEC at www.sec.gov.

MINING OPERATIONS:

We were in the business of exploration, development, and if warranted the mining of properties containing valuable mineral deposits. The focus of our exploration programs was directed at precious metals, primarily gold. We no longer continue to identify, investigate and acquire potential properties for future exploration and development when warranted. We have suspended all of our mining operations in lieu of our oil and gas operations.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

|

Pecos County, Texas – The Company has leasehold rights within approximately 70,000 gross acres in Pecos County, Texas, which lies within the Permian Basin. The property is located in the Northeast region of the County. The Pecos leasehold is positioned west of the Yates Field (Approximately 1.6 Billion BO produced) and east of the Taylor Link Field (Approximately 15 million BO produced). Our leasehold also lies within the White & Baker Field (Approximately 5 million BO produced) and portions of the Walker Field (Approximately 10 million BO produced). The Pecos leasehold is comprised of multiple leases. Our acreage position in the Permian Basin is characterized by several commercial hydrocarbon formations which begin around 1,300 ft. down to around 10,000 ft. The formations in the area include the Yates, Seven Rivers, Greyburg, Queens (Upper and Lower), San Adreas, Strawn, Devonian and Ellenburger. The Company began drilling operations in October 2010 to target the Greyburg and Queens formation. Since then the Company has drilled 19 wells throughout the property of which 8-13 wells are producing intermittently and 6 wells are shut-in. At the fiscal year end, the Company was drilling the 20th well which reached total depth on August 4th, 2015, and is currently awaiting the next phase of completion. All the wells that the Company has drilled have been to a depth of approximately 2,000 ft.

The following table summarizes our estimated proved oil and gas reserves for the fiscal years ended July 31, 2015 July 31, 2014 and 2013.

| Proved Reserves (BOE) | ||||||||||||

| July 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Proved developed | 457,852 | 329,785 | 698,791 | |||||||||

| Proved undeveloped | 118,188 | 125,590 | 231,221 | |||||||||

| Total | 576,040 | 455,375 | 930,012 | |||||||||

| Precent of total proved resources | 100% | 100% | 100% | |||||||||

Proved oil and gas reserves

The following table sets forth information regarding our estimated proved reserves as of July 31, 2015. See Note 13 to our consolidated financial statements in this report for additional information.

| Summary of oil and gas reserves as of July 31, 2015 | ||||||||||||||||||||

| Proved Reserves | ||||||||||||||||||||

| Oil | Natural Gas | Total | Percent | PV-10 | ||||||||||||||||

| (Bbl) | (Mcf) | (BOE) | (%) | |||||||||||||||||

| Proved developed | 262,740 | 1,170,670 | 457,852 | 79 | % | $ | 9,773,290 | |||||||||||||

| Proved undeveloped | 94,550 | 141,820 | 118,188 | 21 | % | $ | 2,862,440 | |||||||||||||

| Total proved reserves | 357,290 | 1,312,490 | 576,040 | 100 | % | $ | 12,635,730 | |||||||||||||

Reconciliation of PV-10 to Standardized Measure

PV-10 is our estimate of the present value of future net revenues from proved oil and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. PV-10 is a non-GAAP, financial measure and generally differs from the Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future cash flows. PV-10 should not be considered as an alternative to the Standardized Measure as computed under GAAP.

We believe PV-10 to be an important measure for evaluating the relative significance of our oil and gas properties and that the presentation of PV-10 provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating our company. We believe that most other companies in the oil and gas industry calculate PV-10 on the same basis.

The following table provides a reconciliation of PV-10 to the Standardized Measure of discounted future net cash flows at July 31, 2015:

| July 31, | ||||

| 2015 | ||||

| PV-10 | $ | 12,635,730 | ||

| Present value of future income tax discounted at 10% | (4,786,023 | ) | ||

| Standardized measure of discounted future net cash flows | $ | 7,849,707 | ||

Proved Undeveloped Reserves

As of July 31, 2015, we had 118,188 BOE of undeveloped ("PUD") reserves, which is a decrease of 7,402 BOE, compared with 125,590 BOE of PUD reserves at July 31, 2014.

Preparation of Proved Reserves Estimates

Our policies regarding internal controls over the recording of reserve estimates require reserve estimates to be in compliance with SEC rules, regulations and guidance and prepared in accordance with "Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information (Revision as of February 19, 2007)" promulgated by the Society of Petroleum Engineers ("SPE standards"). Our proved reserves are estimated at the property level and compiled for reporting purposes by our corporate reservoir engineering staff, all of whom are independent of our operations team. We maintain our internal evaluations of our reserves in a secure reserve engineering database. The corporate reservoir engineering staff interacts with Company Management and with accounting employees to obtain the necessary data for the reserves estimation process. Our Management staff works closely with our external engineers to ensure the integrity, accuracy and timeliness of data that is furnished to them for their reserve estimation process. All of the reserve information maintained in our secure reserve engineering database is provided to the external engineers. In addition, other pertinent data is provided such as seismic information, geologic maps, well logs, production tests, material balance calculations, well performance data, operating procedures and relevant economic criteria. We make available all information requested, including our pertinent personnel, to the external engineers as part of their evaluation of our reserves. For the years ended July 31, 2015, and July 31, 2014, we engaged Mire & Associates, Inc., an independent petroleum engineer, to prepare independent estimates of the extent and value of the proved reserves associated with certain of our oil and gas properties.

Oil and Gas Production, and Prices

The following table sets forth summary information regarding net oil and gas production for the last three fiscal years. We determined the BOE using the ratio of six MCF of natural gas to one BOE.

| Years Ended July 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Production | ||||||||||||

| Oil (Bbls) | 12,127 | 11,631 | 4,642 | |||||||||

| Gas (MCF) | 65,096 | 98,915 | 11,999 | |||||||||

| Total BOE | 22,976 | 28,117 | 6,642 | |||||||||

| Total average barrels of oil per day | 63 | 77 | 18 | |||||||||

| Average prices | ||||||||||||

| Oil (Bbls) | $ | 57.06 | $ | 93.57 | $ | 90.00 | ||||||

| Gas (Mcf) | $ | 2.09 | $ | 3.50 | $ | 4.00 | ||||||

| Total per BOE | $ | 57.41 | $ | 94.15 | $ | 90.67 | ||||||

Drilling Activity – Past Three Years

The following table sets forth information on our drilling activity for the last three fiscal years. The information should not be considered indicative of future performance nor should it be assumed that there is necessarily any correlation between the numbers of productive wells drilled, quantities of reserves found or economic value.

| Years Ended July 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Development wells: | ||||||||||||

| Productive | 2 | 2 | 7 | |||||||||

| Dry | - | - | 1 | |||||||||

The following table sets forth the wells, working interest percentage, and status of all the wells that the Company owned at the fiscal year end July 31, 2015:

| Well | Working | ||||

| Name | Interest | Status | |||

| WWJD 1 | 100.00% | Shut in: Awaiting re-frac | |||

| WWJD 4 | 100.00% | Producing well | |||

| WWJD 5 | 100.00% | Producing well | |||

| WWJD 6 | 100.00% | Shut in: Awaiting re-frac | |||

| WWJD 7 | 100.00% | Shut in: Awaiting re-frac | |||

| WWJD 8 | 100.00% | Producing well | |||

| WWJD 9 | 100.00% | Producing well | |||

| WWJD 10 | 100.00% | Shut in: Awaiting re-frac | |||

| WWJD 11 | 100.00% | Producing well | |||

| WWJD 12 | 100.00% | Producing well | |||

| WWJD 13 | 40.00% | Producing well | |||

| WWJD 14 | 40.00% | Producing well | |||

| WWJD B-1 | 49.50% | Producing well | |||

| WWJD B-2 | 49.50% | Producing well | |||

| WWJD B-3 | 49.50% | Producing well | |||

| WWJD C-1 | 50.00% | Producing well | |||

| WWJD C-2 | 50.00% | Producing well | |||

| WWJD C-3 | 50.00% | Producing well | |||

| WWJD C-4 | 50.00% | Producing well | |||

| Producing wells | 15 | ||||

| Shut-in wells | 4 | ||||

| Total wells | 19 | ||||

ALASKA PROPERTIES

SOUTHWEST KUSKOKWIM PROJECT

Summary

The Company's wholly owned subsidiary Kisa, controls or has interests in two claim blocks consisting of 88 Alaska mining claims covering 13,840 acres which comprise the Company's Southwest Kuskokwim Project. The claims consist of exploration properties in southwest Alaska approximately 90 miles east of the village of Bethel in the consolidated claim groups known as Luna and Kisa within the Kuskokwim Mineral Belt. Previous workers located and prospected several significant precious metal showings in this remote, highly prospective portion of the Kuskokwim Mineral Belt nearly 20 years ago. The samples show many similarities in mineralization style, alteration and general geologic characteristics to Nova Gold Resources and Barrick's Donlin Creek project and other major Kuskokwim Mineral Belt gold deposits.

Prior to October 7, 2014 the Company had owned a total of 274 claims totaling 42,280 acres with a carrying value of $11,373. On October 1, 2014, the Company made the decision to abandon all of our Alaska claims except our Luna and Kisa claims. The Company abandoned a total of 186 claims covering 28,440 acres with a carrying value of $8,059. This write-off was recorded on October 1, 2014 prior to the change of control agreement. The net balance sheet carrying value of the mineral properties as of July 31, 2015, was $3,314.

Afranex Option Agreement

On September 2, 2014, the Company entered into an Option Agreement (the "Agreement") with Afranex Gold Limited, an Australian corporation ("Afranex"); our wholly owned subsidiary Kisa; and, North Fork LLC, ("North Fork") an Alaska limited liability company whereby the Company and Kisa granted Afranex an exclusive option to acquire, at the election of Afranex, either: (1) 100% of the issued and outstanding stock of Kisa; or, (2) 100% of Kisa's right, title and interest in certain mining permits and associated assets. The option expires on December 31, 2015 if not exercised by then. Afranex was obligated to pay a non-refundable fee of US$20,000 within 5 days of the execution of the Agreement which has been received by the Company and recorded as a deposit on option agreement. The Agreement is subject to additional terms, warranties, and conditions among Kisa, North Fork, Afranex and us. Upon exercise of the option, Afranex will pay US$380,000 for either the Kisa shares or the Kisa assets.

As of the date hereof, Afranex has provided loans to us totaling approximately US$80,000 under a loan facility agreement entered into on July 26, 2012 with several subsequent deeds of variations. The final variation to the Loan increased the Loan amount from $80,000 to $100,000 and after several expiration date extensions with the last one out to September 30, 2014.

As of April 30, 2015, the Company had received approximately $80,000 on the Loan and recorded the funds as a current liability. The funds were intended to be deducted from the $100,000 consideration per the Afranex terms sheet but on September 2, 2014 the Company entered into a new Option Agreement with Afranex and as part of the terms, the Loan will be extended out until December 31, 2015.

Location and Access

The Southwest Kuskokwim Project area is situated in a mountainous, high relief area located approximately 100 miles east of Bethel, Alaska and approximately 120 miles southwest of Donlin Creek and 40 miles west of the Shotgun Deposit. The project area lies along the boundary between the Bristol Bay, Kuskokwim and Bethel Recording Districts in southwest Alaska on State of Alaska lands. Bethel is the nearest community with full, year-round services. The effective work season in the project area is from July through September. The lakes in the immediate area typically remain frozen and snow covers ridges and upper slopes until late June or early July. Currently, personnel and equipment access to the area is limited to float planes capable of landing on lakes, via helicopter or via small fixed wing aircraft equipped with tundra tires.

Geologic Setting and Deposit Types

The properties are situated in the Kuskokwim Mineral Belt in the southern portion of the Aniak-Tuluksak and southeastern portion of the Bethel Mining Districts. Historically the Kuskokwim Mineral Belt has been a major placer and lode gold producer as well as the major source of mercury in Alaska since the turn of the twentieth century. There have been recent discoveries of major gold deposits throughout the northern and central portion of the belt, including the largest known deposit in the belt, the Donlin Creek deposit located approximately 120 miles to the northeast.

Previous Work by the Company

| · | On March 28, 2011 the Company executed a Master Earn-In agreement with North Fork to explore for gold deposits on Kisa's claim blocks. Work completed by North Fork over the 2010 through 2014 seasons comprised the following; |

| · | Rock chip and soil sampling, as well as mapping at Luna |

| · | Re-assay of drill core from Kisa |

| · | Work on compiling data for a National Instrument 43-101. |

| · | The following is work that is proposed by North Fork for the 2014 exploration season; |

| · | Complete detailed geophysical surveys at Luna |

| · | Grid soil geochemistry at Luna |

| · | Diamond drilling under high grade mineralization at Luna and also testing the parallel structures |

| · | Mapping and prospecting on claim blocks such as Kisa, Gold Lake and AKO |

Future outlook for the Southwest Kuskokwim Project

With the entering into of the Change of Control Agreement with Amazing Energy, Inc. in October of 2014, the Company's focus is now moving away from its exploration mining claims in Alaska and turning towards the business of oil and gas exploration, development and production and its leasehold rights within approximately 70,000 acres in the Permian Basin in West Texas.

As of July 31, 2015, the Company was not a party to any litigation.

Not applicable.

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company's stock trades under the category OTCQX on the OTC Markets system. The Company's trading symbol is "AMAZ".

The Company changed its name from Gold Crest Mines, Inc. to Amazing Energy Oil and Gas, Co. and its trading symbol from "GCMN" to "AMAZ" on January 21, 2015. The Company also underwent a 40 to 1 reverse stock split. The following stock quotes reflect the reverse stock split. The Company also changed its fiscal year end in conjunction with the reverse acquisition from December 31st to July 31st. All quarters presented below reflect the fiscal year change to July 31st.

The following table sets forth for our common stock, the high and low closing bid quotations per share, taken from the internet, for our common stock for each quarter for the periods indicated. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Price Per Share | ||||||||

| High Bid | Low Bid | |||||||

| Fiscal Year Ending July 31, 2015 | ||||||||

| First quarter | $ | 1.40 | $ | 0.52 | ||||

| Second quarter | 1.99 | 0.80 | ||||||

| Third quarter | 2.80 | 0.88 | ||||||

| Fourth quarter | 1.34 | 0.90 | ||||||

| Fiscal Year Ending July 31, 2014 | ||||||||

| First quarter | $ | 0.80 | $ | 0.40 | ||||

| Second quarter | 0.80 | 0.34 | ||||||

| Third quarter | 0.60 | 0.28 | ||||||

| Fourth quarter | 0.96 | 0.40 | ||||||

Shareholders

As of July 31, 2015 there were approximately 660 shareholders of record of the Company's common stock as furnished to the Company by its transfer agent and does not account for shares owned through clearing houses.

Dividend Policy

The Company has never paid any dividends and does not anticipate the payment of dividends in the foreseeable future.

Transfer Agent

The transfer agent for the Company's common stock is Columbia Stock Transfer Company, 1869 East Seltice Way, Suite 292, Post Falls, Idaho, 83854.

Unregistered Sales of Equity Securities

During the year ended July 31, 2015, the company had the following unregistered sales of equity securities:

On June 11, 2014 the Company began a private placement offering up to a maximum of 3,000,000 shares at $0.01 per share for a maximum of $30,000 in proceeds. The offering was scheduled to end on August 15, 2014. On August 15, 2014 the Company extended the deadline for the private placement out until September 30, 2014 and increased the maximum shares to 13,000,000 at $0.01 per share for a maximum of $130,000 in proceeds. During the fiscal year ended July 31, 2014, 2,200,000 shares of common stock were sold for a total cash amount of $22,000. Subsequently, during the ensuing fiscal year ended July 31, 2015, the company sold the balance of 10,800,000 shares of stock for a total cash amount of $108,000. The shares were being offered and sold by officers and directors of the Company who received no remuneration for the sale of the shares. The shares were sold pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the "Act"), in a private non-public transaction and deemed restricted securities which may not be publicly resold absent registration under the Act or an exemption from registration.

All shares above were issued without registration under the Securities Act by reason of the exemption from registration afforded by the provisions of Section 4(2), and Rule 506 promulgated by the SEC, and Section 4(6) thereof, as a transaction by an issuer not involving any public offering. Each participant was an accredited investor at the time of the issuance. They delivered appropriate investment representations with respect to the issuance of the shares and consented to the imposition of a restrictive legend upon the certificate representing their shares. They represented that they had not entered into the transaction with us as a result of or subsequent to any advertisement, article, notice, or other communication published in any newspaper, magazine, or similar media or broadcast on television or radio, or presented at any seminar or meeting. They represented that they had been afforded the opportunity to ask questions of our management and to receive answers concerning the terms and conditions of the share purchase. No underwriting discounts or commissions were paid in connection with these transactions.

Also, during October of the fiscal year ended July 31, 2015, the subsidiary corporation, Amazing Energy, Inc., sold 2,500,000 shares of its common stock at $.60 per share for a net proceed amount of $1,500,000. In December of 2014, Amazing Energy, Inc. sold 28,000 shares of common stock at $.83 per share for a total cash raise of $23,325.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

The following discussion is intended to assist in understanding our results of operations and our financial condition. Our consolidated financial statement and the accompanying notes included elsewhere in this report contain additional information that should be referred to when reviewing this material. Statements in this discussion may be forward-looking. These forward looking statements involve risks and uncertainties, which could cause actual results to differ from those expressed. See "Cautionary Statement Regarding Forward- Looking Statements" at the beginning of this report for additional discussion of some of these factors and risks.

Safe Harbor Provision