UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JULY 31, 2019 |

Commission File Number 000-52392

| Amazing Energy Oil and Gas, Co. |

| |

(Exact name of registrant as specified in its charter)

| Nevada | 82-0290112 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

5700 West Plano Parkway

Suite 3600

Plano, TX 75093

(Address of principal executive offices)

Registrant’s telephone number, including area code:(972) 233-1244

| Securities registered pursuant to Section 12(b) of the Act: | Securities registered pursuant to section 12(g) of the Act: |

| NONE | COMMON STOCK |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YESo NOx

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: YESo NOx

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YESx NOo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YESx NOo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Accelerated Filer | o |

| Non-accelerated Filer(Do not check if a smaller reporting company) | o | Smaller Reporting Company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YESo NOx

The aggregate market value of the Common Stock held by non-affiliates (as affiliates are defined in Rule 12b-2 of the Exchange Act) of the registrant, computed by reference to the average of the high and low sale price onJanuary 31, 2019was$24,962,107.

At November 13, 2019, 97,876,232 shares of the registrant’s common stock were outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always using words or phrases such as “believes”, “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates”, or “intends”, or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| ● | Risks related to some of the Company’s properties being in the exploration stage; |

| ● | Risks related to the Company’s operations being subject to government regulation; |

| ● | Risks related to the Company’s ability to obtain additional capital to develop the Company’s resources, if any; |

| ● | Risks related to exploration and development activities; |

| ● | Risks related to reserve and production estimates; |

| ● | Risks related to the Company’s insurance coverage for operating risks; |

| ● | Risks related to the fluctuation of prices for oil and gas; |

| ● | Risks related to the competitive industry of oil and gas; |

| ● | Risks related to the title and rights in the Company’s properties; |

| ● | Risks related to the possible dilution of the Company’s common stock from additional financing activities; |

| ● | Risks related to potential conflicts of interest with the Company’s management; |

| ● | Risks related to the Company’s shares of common stock; |

This list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Risk Factors and Uncertainties”, “Description of Business” and “Management’s Discussion and Analysis” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Amazing Energy Oil & Gas, Co. disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law. The Company advises readers to carefully review the reports and documents filed from time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

As used in this Annual Report, the terms “We,” “Us,” “Our,” “Amazing Energy” and the “Company”, mean Amazing Energy Oil & Gas, Co., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

Management’s Discussion and Analysis is intended to be read in conjunction with the Company’s consolidated financial statements and the integral notes (“Notes”) thereto for the fiscal year ending July 31, 2019. The following statements may be forward-looking in nature and actual results may differ materially.

GLOSSARY AND SELECTED ABBREVIATIONS

The following is a description of the meanings of some of the oil and gas industry terms used in this report.

| Basin | A large natural depression on the earth’s surface in which sediments generally brought by water accumulate. |

| | |

| Bbl | One stock tank barrel, of 42 U.S. gallons liquid volume, used to reference oil, condensate or NGLs. |

| | |

| Boe | Barrel of oil equivalent, determined using the ratio of six Mcf of gas to one Boe, and one Bbl of NGLs to one Boe. |

| | |

| Completion | The installation of permanent equipment for production of oil or gas, or, in the case of a dry well, for reporting to the appropriate authority that the well has been abandoned. |

| | |

| Developed oil and gas reserves | Has the meaning given to such term in Rule 4-10(a)(6) of Regulation S-X, as follows: |

| | |

| | Developed oil and gas reserves are reserves of any category that can be expected to be recovered: |

| | |

| | (i) | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and |

| | | |

| | (ii) | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

| | | |

| | |

| Dry hole or well | An exploratory, development or extension well that proved to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. |

| | |

| Hydraulic fracturing | The process of creating and preserving a fracture or system of fractures in a reservoir rock typically by injecting a fluid under pressure through a wellbore and into the targeted formation. |

| | |

| Lease operating expenses | The expenses of lifting oil or gas from a producing formation to the surface, and the transportation and marketing thereof, constituting part of the current operating expenses of a working interest, and including labor, superintendence, supplies, repairs, short-lived assets, maintenance, allocated overhead costs and other expenses incidental to production, but excluding lease acquisition or drilling or completion expenses. |

| | |

| Mbo | Thousand barrels of oil or other liquid hydrocarbons. |

| | |

| Mboe | Thousand barrels of oil equivalent, determined using the ratio of six Mcf of gas to one Boe, and one Bbl of NGLs to one Boe. |

| | |

| Mcf | Thousand cubic feet of natural gas. |

| | |

| Mmcf | Million cubic feet of gas. |

| | |

| Mineral interests | The interests in ownership of the resource and mineral rights, giving an owner the right to profit from the extracted resources. |

| | |

| Net Revenue Interest | An owner’s interest in the revenues of a well after deducting proceeds allocated to royalty and overriding interests. |

| | |

| Oil and Natural Gas Properties | Tracts of land consisting of properties to be developed for oil and natural gas resource extraction. |

| | |

| Operator | The individual or company responsible for the exploration and/or production of an oil or natural gas well or lease. |

| | |

| Play | A set of known or postulated oil and/or gas accumulations sharing similar geologic, geographic and temporal properties, such as source rock, migration pathways, timing, trapping mechanism and hydrocarbon type. |

| Productive well | An exploratory, development or extension well that is not a dry well. |

| | |

Proved developed producing reserves | Proved developed oil and gas reserves that are expected to be recovered: |

| | | |

| | (i) | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and |

| | | |

| | (ii) | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

| | | |

| Proved oil and gas reserves | Has the meaning given to such term in Rule 4-10(a)(22) of Regulation S-X, as follows: |

| | |

| | Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geosciences and engineering data, can be estimated with reasonable certainty to be economically producible — from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations — prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. |

| | |

| | (i) | The area of the reservoir considered as proved includes: |

| | | |

| | (A) | The area identified by drilling and limited by fluid contacts, if any, and |

| | | |

| | (B) | Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geosciences and engineering data. |

| | | |

| | (ii) | In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geosciences, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. |

| | | |

| | (iii) | Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geosciences, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. |

| | | |

| | (iv) | Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: |

| | | |

| | | (A) | Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and |

| | | |

| | (v) | Existing economic conditions include prices and costs at which economic viability from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an un-weighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. |

| Proved Undeveloped Reserves | Proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion. |

| | |

| PUD | Proved undeveloped |

| | |

PV-10 | An estimate of the present value of the future net revenues from proved oil and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of federal income taxes. The estimated future net revenues are discounted at an annual rate of 10% to determine their “present value.” The present value is shown to indicate the effect of time on the value of the revenue stream and should not be construed as being the fair market value of the properties. Estimates of PV-10 are made using oil and gas prices and operating costs at the date indicated and held constant for the life of the reserves. |

| | |

| Reserves | Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and natural gas or related substances to the market and all permits and financing required to implement the project. Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations). |

| | |

| Royalty Interest | An interest that gives an owner the right to receive a portion of the resources or revenues without having to carry any costs of development or operations. |

| | |

Standardized measure | The present value of estimated future net revenues to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the SEC (using prices and costs in effect as of the period end date) without giving effect to non-property related expenses such as general and administrative expenses, debt service and future income tax expenses or to depletion, depreciation and amortization and discounted using an annual discount rate of 10%. Standardized measure does not give effect to derivative transactions. |

| | |

| Working interest | The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and receive a share of production. |

PART I

BUSINESS DEVELOPMENT

Amazing Energy Oil and Gas, Co. is incorporated in the State of Nevada. Through its primary subsidiaries, Amazing Energy, LLC., a Texas Limited Liability Company, and Amazing Energy Holdings, LLC, also a Texas limited liability company, the Company operates its main business of exploration, development, and production of oil and gas in the Permian Basin of West Texas and Southeastern New Mexico. On October 7, 2014, the Company entered into a change in control agreement with certain shareholders of Amazing Energy, Inc. The change in control agreement was the first step in a reverse merger process whereby the shareholders of Amazing Energy, Inc. would control about 95% of the shares of common stock of Amazing Energy Oil and Gas, Co., and Amazing Energy Oil and Gas, Co. would own 100% of the outstanding shares of common stock of Amazing Energy, Inc. This entire reverse merger process was completed in July of 2015.

Amazing Energy, LLC, a wholly-owned subsidiary of the Company was formed in December 2008 as a Texas Limited Liability Company and owns interests in oil and gas properties located in Texas. Amazing Energy Holdings, LLC, also a wholly-owned subsidiary of Amazing Energy Oil and Gas, Co., was formed in Texas in 2019. The Company owns interests in oil and gas properties located in New Mexico. Both companies are primarily engaged in the acquisition, exploration and development of oil and gas properties and the production and sale of oil and natural gas. Amazing Energy, Inc. (“AEI”), a wholly-owned subsidiary of Amazing Energy Oil and Gas, Co., was formed in 2010 as a Texas corporation and re-domiciled to Nevada in 2011. In December of 2010, Amazing Energy, Inc. and Amazing Energy, LLC were combined as commonly controlled entities.

The following table shows the wholly-owned subsidiaries of Amazing Energy Oil and Gas, Co. engaged in the oil and gas business:

| Name of Subsidiary | | State of

Incorporation | | Ownership

Interest | | Principal Activity |

| Amazing Energy, Inc. | | Nevada | | 100% | | Oil and gas exploration, development, and products |

| | | | | | | |

| Amazing Energy, LLC | | Texas | | 100% | | Ownership oil and gas leases |

| | | | | | | |

| Amazing Energy Holdings, LLC | | Texas | | 100% | | Ownership of oil and gas leases in New Mexico |

| | | | | | | |

| Jilpetco, Inc. | | Texas | | 100% | | Operator |

Any bankruptcy, receivership or similar proceedings

There have been no bankruptcy, receivership or similar proceedings.

OUR BUSINESS

We are in the business of exploration, development, and production of oil and gas in the Permian Basin of West Texas and in Lea County, New Mexico.The Permian basin, which is one of the major producing basins in the United States, is characterized by an extensive production history, a favorable operating environment, mature infrastructure, long reserve life, multiple producing horizons, enhanced recovery potential and a large number of operators. The Permian Basin is characterized by high oil and liquids rich natural gas, multiple vertical and horizontal target horizons, extensive production history, long-lived reserves and high drilling success rates. As of July 31, 2019, the Company has leasehold rights located within an area of mutual interest (AMI) of approximately 70,000 acres in Pecos County, Texas and 5,385 acres in Lea County, New Mexico. We believe that our concentrated acreage position provides us with an opportunity to achieve cost, operating and recovery efficiencies in the development of our drilling inventory. Our activities in Pecos County, Texas are primarily focused on vertical development of the Queen formation over the Central Basin platform, which separates the Midland Basin from the Delaware Basin, while our activities in Lea County, New Mexico are focused exclusively on the San Andres formation in the Northwest Shelf, all of which are part of an area known in general terms as the Permian Basin. Additional drilling targets could include the Greyburg, San Andres and Devonian zones.

At July 31, 2019 our estimated net proved reserves were 499,666 barrels of oil equivalent (“BOE”). Additionally, probable undeveloped reserves total 210,167 BOE, and possible undeveloped reserves total 827,500 BOE as of July 31, 2019. Important facts of our proved and probable and possible reserves at July 31, 2019 include:

| ● | 33% proved developed and undeveloped; |

| ● | Reserve life of approximately 22.0 years; |

| ● | Non-discounted future net cash flows of $22,185,000; |

| ● | and PV-10 of $11,350,000 |

PV-10 is our estimate of the present value of future net revenues from proved oil, and gas reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates for future income taxes. Estimated future net revenues are discounted at an annual rate of 10% to determine their present value. PV-10 is a financial measure that is not determined in accordance with accounting principles generally accepted in the United States (“GAAP”), and generally differs from the Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future cash flows. PV-10 should not be considered as an alternative to the Standardized Measure, as computed under GAAP.

At July 31, 2019, we owned 26 oil and gas wells in the Permian Basin and 7 oil wells in Lea County, New Mexico. During the fiscal year ended July 31, 2019, we produced 11,740 BOE (Net). Production for the fiscal year ended July 31, 2018 was 11,177 BOE (Net).

Our Business Strategy

We intend to increase the value of the Company by increasing reserves and production in a cost-efficient manner by pursuing the following strategies:

| ● | Grow production and reserves by developing our oil-rich resource base.We intend to drill and develop our acreage base to maximize its value and resource potential. Through the conversion of our undeveloped reserves to developed reserves, we will seek to increase our production, reserves and cash flow while generating favorable returns on invested capital. |

| ● | Continue to drill and develop our shallow drilling play. We believe that our current acreage position within our approximately 70,000 acres AMI in Pecos County, Texas and 5,385 acre position that we have under lease in Lea County, New Mexico provides us with the ability to continue to increase reserves and production by drilling shallow, low cost wells with joint venture investors. Typically, we strive to structure an offering in which participants/investors will “carry” the Company (that is, bear the financial responsibility) for 25% of 8/8ths Working Interests. Each participant/investor is responsible for their pro-rata share of the Working Interest expenses. A “Carried Working Interest” is defined as a working interest which is expense-free through the stages of drilling, testing and completing a well to first sales or plugging and abandoning a well as a dry hole; participants/investors bear the portion of those costs and expenses attributable to the Carried Working Interest of the Company. The Company typically offers 75% of 8/8ths Working Interest in a drilling offering with a net revenue interest of 75%. The Carried Working Interest that the Company receives varies on the participation levels for each drilling offering. For example, if there is full participation, the Company will receive a 25% Carried Working Interest. The Company is constantly reviewing other potential acreage acquisitions, or other potential alliances with industry partners. |

Our Competitive Strengths

We believe that the following strengths will help us achieve our business goals:

| ● | Economically efficient drilling. Given the current relative low price for oil, we believe that we have a competitive advantage over higher risk, higher cost, and deeper shale drilling operations. Most of our current wells are drilled and completed for around $275,000 or less at depths of around 2,000 feet. |

| ● | Oil rich resource base in one of North America’s leading resource plays.All our leasehold acreage is located in one of the most prolific oil plays in North America, the Permian Basin in West Texas and Southeastern New Mexico. |

| ● | Favorable operating environment.We have focused our drilling and development operations in the Permian Basin, one of the longest operating hydrocarbon basins in the United States, with a long and well-established production history and developed infrastructure. We believe that the geological and regulatory environment of the Permian Basin is more stable and predictable, and that we are faced with less operational risks in the Permian Basin as compared to emerging hydrocarbon basins. |

| ● | Experienced, incentivized and proven management team.Our management team has many years of experience in the oil and gas industry throughout Texas and other oil producing states. Also, the Company strives to keep drilling, completion, operating expenses and general overhead to a minimum. |

| ● | High degree of operational control.We are currently the operator of 100% of our Permian Basin acreage. This operating control allows us to better execute on our strategies of enhancing returns through operational and cost efficiencies and increasing ultimate hydrocarbon recovery by seeking to continually improve our drilling techniques, completion methodologies and reservoir evaluation processes. Additionally, as the operator of all our acreage, we retain the ability to increase or decrease our capital expenditure program based on commodity price outlooks. This operating control also enables us to obtain data needed for efficient exploration of our prospects. |

Markets and Customers

The revenues generated by our operations are highly dependent upon the prices, supplies and demand for oil and natural gas. Oil and natural gas are commodities, and therefore, we are subject to market-based pricing. Since our oil is sour, we receive somewhat less per barrel than the published WTI market prices, and since our natural gas is a sour gas, we are limited to selling through a sour gas transmission line and therefore are subject to a percent of proceeds (POP) gas contract with the purchaser. Overall, the prices that we receive for our oil and gas production depend on numerous factors beyond our control, including seasonality, the status of domestic and global economies, political conditions in other oil and gas producing countries, and the extent of domestic production and imports of oil.

Title to Properties

As is customary in the oil and natural gas industry, we initially conduct only a cursory review of the title to our properties. When we decide to conduct drilling operations on those properties, we conduct a thorough title examination and perform curative work, if needed, with respect to significant defects prior to commencement of drilling operations. To the extent title opinions or other investigations reflect title defects on those properties, we are typically responsible for curing any title defects at our expense. We generally will not commence drilling operations on a property until we have cured any material title defects on such property. We have obtained title opinions on substantially all our producing properties and believe that we have satisfactory title to our producing properties in accordance with standards generally accepted in the oil and natural gas industry. Prior to completing an acquisition of producing oil and natural gas leases, we perform title reviews on the most significant leases and, depending on the materiality of properties, we may obtain a title opinion, obtain an updated title review or opinion or review previously obtained title opinions. Our oil and natural gas properties are subject to customary royalty and other interests, liens for current taxes and other burdens which we believe do not materially interfere with the use of or affect our carrying value of the properties.

Oil and Gas Leases

The typical oil and natural gas lease agreement covering our acreage positions in Pecos County, Texas and Lea County, New Mexico. provides for the payment of royalties to the mineral owners for all oil and natural gas produced form any wells drilled on the leased premises. The lessor royalties and other leasehold burdens on our properties generally range from 20% to 25%, resulting in a net revenue interest to the Company working interest generally ranging from 75% to 80%.

Competition

The oil and natural gas industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also carry on midstream and refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive oil and natural gas properties and exploratory prospects or to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low oil and natural gas market prices. Our larger or more integrated competitors may be able to absorb the burden of existing, and any changes to, federal, state and local laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing oil and natural gas properties. Further, oil and natural gas compete with other forms of energy available to customers, primarily based on price. These alternate forms of energy include electricity, coal and fuel oils. Changes in the availability or price of oil and natural gas or other forms of energy, as well as business conditions, conservation, legislation, regulations and the ability to convert to alternate fuels and other forms of energy may affect the demand for oil and natural gas.

Patents and Trademarks

The Company does not own, either legally or beneficially, any patents or registered trademarks.

Regulation

The oil and gas industry in the United States is subject to extensive regulation by federal, state and local authorities. At the federal level, various federal rules, regulations and procedures apply, including those issued by the U.S. Department of Interior, the U.S. Department of Transportation (the “DOT”) (Office of Pipeline Safety) and the U.S. Environmental Protection Agency (the “EPA”). At the state and local level, various agencies and commissions regulate drilling, production and midstream activities. For the state of Texas, the regulatory agency is the Texas Railroad Commission. For the State of New Mexico, the governing regulatory agency is the Oil Conservation Division of New Mexico Energy, Minerals and Natural Resources Department. These federal, state and local authorities have various permitting, licensing and bonding requirements. Various remedies are available for enforcement of these federal, state and local rules, regulations and procedures, including fines, penalties, revocation of permits and licenses, actions affecting the value of leases, wells or other assets, suspension of production, and, in certain cases, criminal prosecution. As a result, there can be no assurance that we will not incur liability for fines, penalties or other remedies that are available to these federal, state and local authorities. However, we believe that we are currently in material compliance with federal, state and local rules, regulations and procedures, and that continued substantial compliance with existing requirements will not have a material adverse effect on our financial position, cash flows or results of operations.

Transportation and Sale of Oil

Sales of crude oil and natural gas are negotiated with purchasers via crude oil purchase agreements which are subject to a month to month term, and a 30-day notice termination clause. The agreements specify the pricing terms and transportation deductions, among other terms. Our sales of crude oil are affected by the availability, terms and cost of transportation.

Regulation of Production

Oil and gas production are regulated under a wide range of federal and state statutes, rules, orders and regulations. State and federal statutes and regulations require permits for drilling operations, drilling bonds and reports concerning operations. The states in which we operate, Texas and New Mexico, have regulations governing conservation matters, including provisions for the unitization or pooling of oil and gas properties, the establishment of maximum rates of production from oil and gas wells, the regulation of spacing, and requirements for plugging and abandonment of wells. Also, Texas and New Mexico impose a severance tax on production and sales of oil, and gas within its jurisdiction. Failure to comply with these rules and regulations can result in substantial penalties. Our competitors in the oil and gas industry are subject to the same regulatory requirements and restrictions that affect our operations.

Environmental Matters and Regulation

Our oil and natural gas exploration, development and production operations are subject to stringent laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Numerous federal, state and local governmental agencies, such as the EPA, issue regulations that often require difficult and costly compliance measures that carry substantial administrative, civil and criminal penalties and may result in injunctive obligations for non-compliance. These laws and regulations may require the acquisition of a permit before drilling commences; restrict the types, quantities and concentrations of various substances that can be released into the environment in connection with drilling and production activities; limit or prohibit construction or drilling activities on certain lands lying within wilderness, wetlands, ecologically or seismically sensitive and other protected areas; require action to prevent or remediate pollution (from current or former operations), such as plugging abandoned wells or closing pits; take action resulting in the suspension or revocation of necessary permits, licenses and authorizations; and/or require that additional pollution controls be installed and impose substantial liabilities for pollution resulting from our operations or related to our owned or operated facilities. Liability under such laws and regulations is often strict (i.e., no showing of “fault” is required) and can be joint and several. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent and costly pollution control or waste handling, storage, transport, disposal or cleanup requirements could materially adversely affect our operations and financial position, as well as the oil and natural gas industry in general. Our management believes that we are in substantial compliance with applicable environmental laws and regulations and we have not experienced any material adverse effect from compliance with these environmental requirements. This trend, however, may not continue in the future.

Waste Handling.The Resource Conservation and Recovery Act, as amended, and comparable state statutes and regulations promulgated thereunder, affect oil and natural gas exploration, development and production activities by imposing requirements regarding the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes. With federal approval, the individual states administer some or all the provisions of the Resource Conservation and Recovery Act, sometimes in conjunction with their own, more stringent requirements. Although most wastes associated with the exploration, development and production of crude oil and natural gas are exempt from regulation as hazardous wastes under the Resource Conservation and Recovery Act, such wastes may constitute “solid wastes” that are subject to the less stringent non-hazardous waste requirements. Moreover, the EPA or state or local governments may adopt more stringent requirements for the handling of non-hazardous wastes or categorize some non-hazardous wastes as hazardous for future regulation. Indeed, legislation has been proposed from time to time in Congress to re-categorize certain oil and natural gas exploration, development and production wastes as “hazardous wastes.” Any such changes in the laws and regulations could have a material adverse effect on our capital expenditures and operating expenses.

Administrative, civil and criminal penalties can be imposed for failure to comply with waste handling requirements. We believe that we are in substantial compliance with applicable requirements related to waste handling, and that we hold all necessary and up-to-date permits, registrations and other authorizations to the extent that our operations require them under such laws and regulations. Although we do not believe the current costs of managing our wastes, as presently classified, to be significant, any legislative or regulatory reclassification of oil and natural gas exploration and production wastes could increase our costs to manage and dispose of such wastes.

Remediation of Hazardous Substances.The Comprehensive Environmental Response, Compensation and Liability Act, as amended, which we refer to as CERCLA or the “Superfund” law, and analogous state laws, generally impose liability, without regard to fault or legality of the original conduct, on classes of persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the current owner or operator of a contaminated facility, a former owner or operator of the facility at the time of contamination, and those persons that disposed or arranged for the disposal of the hazardous substance at the facility. Under CERCLA and comparable state statutes, persons deemed “responsible parties” are subject to strict liability that, in some circumstances, may be joint and several for the costs of removing or remediating previously disposed wastes (including wastes disposed of or released by prior owners or operators) or property contamination (including groundwater contamination), for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. During our operations, we use materials that, if released, would be subject to CERCLA and comparable state statutes. Therefore, governmental agencies or third parties may seek to hold us responsible under CERCLA and comparable state statutes for all or part of the costs to clean up sites at which such “hazardous substances” have been released.

Water Discharges.The Federal Water Pollution Control Act of 1972, as amended, also known as the “Clean Water Act,” the Safe Drinking Water Act, the Oil Pollution Act and analogous state laws and regulations promulgated thereunder impose restrictions and strict controls regarding the unauthorized discharge of pollutants, including produced waters and other gas and oil wastes, into navigable waters of the United States, as well as state waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or the state. Spill prevention, control and countermeasure plan requirements under federal law require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. The Clean Water Act and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including jurisdictional wetlands, unless authorized by an appropriately issued permit. The EPA has also adopted regulations requiring certain oil and natural gas exploration and production facilities to obtain individual permits or coverage under general permits for storm water discharges. In addition, on June 28, 2016, the EPA published a final rule prohibiting the discharge of wastewater from onshore unconventional oil and gas extraction facilities to publicly owned wastewater treatment plants, which regulations are discussed in more detail below under the caption “–Regulation of Hydraulic Fracturing.” Costs may be associated with the treatment of wastewater or developing and implementing storm water pollution prevention plans, as well as for monitoring and sampling the storm water runoff from certain of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions.

The Oil Pollution Act is the primary federal law for oil spill liability. The Oil Pollution Act contains numerous requirements relating to the prevention of and response to petroleum releases into waters of the United States, including the requirement that operators of offshore facilities and certain onshore facilities near or crossing waterways must develop and maintain facility response contingency plans and maintain certain significant levels of financial assurance to cover potential environmental cleanup and restoration costs. The Oil Pollution Act subjects owners of facilities to strict liability that, in some circumstances, may be joint and several for all containment and cleanup costs and certain other damages arising from a release, including, but not limited to, the costs of responding to a release of oil to surface waters.

Non-compliance with the Clean Water Act or the Oil Pollution Act may result in substantial administrative, civil and criminal penalties, as well as injunctive obligations. We believe we are in material compliance with the requirements of each of these laws.

Air Emissions.The Federal Clean Air Act, as amended, and comparable state laws and regulations, regulate emissions of various air pollutants through the issuance of permits and the imposition of other requirements. The EPA has developed, and continues to develop, stringent regulations governing emissions of air pollutants at specified sources. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to obtain additional permits and incur capital costs to remain in compliance. For example, on August 16, 2012, the EPA published final regulations under the federal Clean Air Act that establish new emission controls for oil and natural gas production and processing operations, which regulations are discussed in more detail below in “–Regulation of Hydraulic Fracturing.” Also, on May 12, 2016, the EPA issued a final rule regarding the criteria for aggregating multiple small surface sites into a single source for air-quality permitting purposes applicable to the oil and gas industry. This rule could cause small facilities, on an aggregate basis, to be deemed a major source, thereby triggering more stringent air permitting processes and requirements. These laws and regulations may increase the costs of compliance for some facilities we own or operate, and federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with air permits or other requirements of the federal Clean Air Act and associated state laws and regulations. We believe that we are in substantial compliance with all applicable air emissions regulations and that we hold all necessary and valid construction and operating permits for our operations. Obtaining or renewing permits has the potential to delay the development of oil and natural gas projects.

Climate Change.In December 2009, the EPA issued an Endangerment Finding that determined that emissions of carbon dioxide, methane and other greenhouse gases present an endangerment to public health and the environment because, according to the EPA, emissions of such gases contribute to warming of the earth’s atmosphere and other climatic changes. In May 2010, the EPA adopted regulations establishing new greenhouse gas emissions thresholds that determine when stationary sources must obtain permits under the Prevention of Significant Deterioration, or PSD, and Title V programs of the Clean Air Act. On June 23, 2014, inUtility Air Regulatory Group v. EPA, the Supreme Court held that stationary sources could not become subject to PSD or Title V permitting solely because of their greenhouse gas emissions. The Court ruled, however, that the EPA may require installation of best available control technology for greenhouse gas emissions at sources otherwise subject to the PSD and Title V programs. On August 26, 2016, the EPA proposed changes needed to bring the EPA’s air permitting regulations in line with the Supreme Court’s decision on greenhouse gas permitting. The proposed rule was published in the Federal Register on October 3, 2016 and the public comment period closed on December 2, 2016.

Additionally, in September 2009, the EPA issued a final rule requiring the reporting of greenhouse gas emissions from specified large greenhouse gas emission sources in the U.S., including natural gas liquids fractionators and local natural gas distribution companies, beginning in 2011 for emissions occurring in 2010. In November 2010, the EPA expanded the greenhouse gas reporting rule to include onshore and offshore oil and natural gas production and onshore processing, transmission, storage and distribution facilities, which may include certain of our facilities, beginning in 2012 for emissions occurring in 2011. In October 2015, the EPA amended the greenhouse gas reporting rule to add the reporting of greenhouse gas emissions from gathering and boosting systems, completions and workovers of oil wells using hydraulic fracturing, and blowdowns of natural gas transmission pipelines.

The EPA has continued to adopt greenhouse gas regulations applicable to other industries, such as its August 2015 adoption of three separate, but related, actions to address carbon dioxide pollution from power plants, including final Carbon Pollution Standards for new, modified and reconstructed power plants, a final Clean Power Plan to cut carbon dioxide pollution from existing power plants, and a proposed federal plan to implement the Clean Power Plan emission guidelines. Upon publication of the Clean Power Plan on October 23, 2015, more than two dozen states as well as industry and labor groups challenged the Clean Power Plan in the D.C. Circuit Court of Appeals. On February 9, 2016, the Supreme Court stayed the implementation of the Clean Power Plan while legal challenges to the rule proceed. Because of this continued regulatory focus, future greenhouse gas regulations of the oil and gas industry remain a possibility. In addition, the U.S. Congress has from time to time considered adopting legislation to reduce emissions of greenhouse gases and almost one-half of the states have already taken legal measures to reduce emissions of greenhouse gases primarily through the planned development of greenhouse gas emission inventories and/or regional greenhouse gas cap and trade programs. Although the U.S. Congress has not adopted such legislation at this time, it may do so in the future and many states continue to pursue regulations to reduce greenhouse gas emissions. Most of these cap and trade programs work by requiring major sources of emissions, such as electric power plants, or major producers of fuels, such as refineries and gas processing plants, to acquire and surrender emission allowances corresponding with their annual emissions of greenhouse gases. The number of allowances available for purchase is reduced each year until the overall greenhouse gas emission reduction goal is achieved. As the number of greenhouse gas emission allowances declines each year, the cost or value of allowances is expected to escalate significantly.

In December 2015, the United States participated in the 21st Conference of the Parties of the United Nations Framework Convention on Climate Change in Paris, France. The resulting Paris Agreement calls for the parties to undertake “ambitious efforts” to limit the average global temperature, and to conserve and enhance sinks and reservoirs of greenhouse gases. The Agreement went into effect on November 4, 2016. The Agreement establishes a framework for the parties to cooperate and report actions to reduce greenhouse gas emissions. Also, on June 29, 2016, the leaders of the United States, Canada and Mexico announced an Action Plan to, among other things, boost clean energy, improve energy efficiency, and reduce greenhouse gas emissions. The Action Plan specifically calls for a reduction in methane emissions from the oil and gas sector by 40% to 45% by 2025. On June 1, 2017 President Trump announced the United States would withdraw from the Paris Agreement, which by its terms cannot happen prior to November 4, 2020.

Restrictions on emissions of methane or carbon dioxide that may be imposed could adversely affect the oil and natural gas industry. At this time, it is not possible to accurately estimate how potential future laws or regulations addressing greenhouse gas emissions would impact our business. It also remains unclear whether and how the results of the 2016 U.S. election could impact the regulation of greenhouse gas emissions at the federal and state level.

In addition, claims have been made against certain energy companies alleging that greenhouse gas emissions from oil and natural gas operations constitute a public nuisance under federal and/or state common law. As a result, private individuals may seek to enforce environmental laws and regulations against us and could allege personal injury or property damages. While our business is not a party to any such litigation, we could be named in actions making similar allegations. An unfavorable ruling in any such case could significantly impact our operations and could have an adverse impact on our financial condition.

Moreover, there has been public discussion that climate change may be associated with extreme weather conditions such as more intense hurricanes, thunderstorms, tornadoes and snow or ice storms, as well as rising sea levels. Another possible consequence of climate change is increased volatility in seasonal temperatures. Some studies indicate that climate change could cause some areas to experience temperatures substantially colder than their historical averages. Extreme weather conditions can interfere with our production and increase our costs and damage resulting from extreme weather may not be fully insured. However, at this time, we are unable to determine the extent to which climate change may lead to increased storm or weather hazards affecting our operations.

Regulation of Hydraulic Fracturing

Hydraulic fracturing is a common practice that is used to stimulate production of hydrocarbons from tight formations, including shales. The process involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. The federal Safe Drinking Water Act (“SDWA”) regulates the underground injection of substances through the Underground Injection Control (“UIC”) program. Hydraulic fracturing is generally exempt from regulation under the UIC program, and the hydraulic fracturing process is typically regulated by state oil and gas commissions and not at the federal level, as the SDWA expressly excludes regulation of these fracturing activities (except where diesel is a component of the fracturing fluid, as further discussed below). Legislation to amend the SDWA to repeal the exemption for hydraulic fracturing from the definition of “underground injection” and require federal permitting and regulatory control of hydraulic fracturing has been proposed in past legislative sessions but has not passed.

The EPA has issued guidance on permitting hydraulic fracturing that uses fluids containing diesel fuel under the UIC program, specifically as “Class II” UIC wells. In December 2016, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources “under some circumstances,” including water withdrawals for fracturing in times or areas of low water availability; surface spills during the management of fracturing fluids, chemicals or produced water; injection of fracturing fluids into wells with inadequate mechanical integrity; injection of fracturing fluids directly into groundwater resources; discharge of inadequately treated fracturing wastewater to surface waters; and disposal or storage of fracturing wastewater in unlined pits. Additionally, on June 28, 2016, the EPA published a final rule prohibiting the discharge of wastewater from onshore unconventional oil and natural gas extraction facilities to publicly owned wastewater treatment plants.

On June 3, 2016, the EPA adopted regulations under the federal Clean Air Act that establish new air emission controls for oil and natural gas production and natural gas processing operations. Specifically, the EPA’s regulations included New Source Performance Standards (“NSPS”) for hydraulically fractured natural gas and oil wells to address emissions of sulfur dioxide, volatile organic compounds (“VOCs”) and methane, with a separate set of emission standards to address hazardous air pollutants frequently associated with oil and natural gas production and processing activities. The final rule sought to achieve a 95% reduction in VOCs and methane emitted by requiring the use of reduced emission completions or “green completions” on all new hydraulically fractured, or refractured, gas and oil wells. The rules also established new requirements on emissions from production related equipment, including, but not limited to, compressors, controllers, dehydrators, storage tanks and other production equipment. On October 15, 2018, the EPA published a proposed rule that would make a series of revisions to the 2016 NSPS; these revisions have yet to be finalized.

Several states, including Texas, and some municipalities, have adopted, or are considering adopting, regulations that could restrict or prohibit hydraulic fracturing in certain circumstances and/or require the disclosure of the composition of hydraulic fracturing fluids. For example, Texas law requires that the well operator disclose the list of chemical ingredients subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) for disclosure on a website and also file the list of chemicals with the Texas Railroad Commission with the well completion report. The total volume of water used to hydraulically fracture a well must also be disclosed to the public and filed with the Texas Railroad Commission. Additionally, some states, localities and local regulatory districts have adopted or have considered adopting regulations to limit, and in some cases impose a moratorium on, hydraulic fracturing or other restrictions on drilling and completion operations, including requirements regarding casing and cementing of wells; testing of nearby water wells; or restrictions on access to, and usage of, water.

Other Regulation of the Oil and Natural Gas Industry

The oil and natural gas industry is extensively regulated by numerous federal, state and local authorities. Legislation affecting the oil and natural gas industry is under constant review for amendment or expansion, frequently increasing the regulatory burden. Also, numerous departments and agencies, both federal and state, are authorized by statute to issue rules and regulations that are binding on the oil and natural gas industry and its individual members, some of which carry substantial penalties for failure to comply. Although the regulatory burden on the oil and natural gas industry increases our cost of doing business and, consequently, affects our profitability, these burdens generally do not affect us any differently or to any greater or lesser extent than they affect other companies in the industry with similar types, quantities and locations of production.

The availability, terms and cost of transportation significantly affect sales of oil and natural gas. The interstate transportation and sale for resale of oil and natural gas is subject to federal regulation, including regulation of the terms, conditions and rates for interstate transportation, storage and various other matters, primarily by FERC. Federal and state regulations govern the price and terms for access to oil and natural gas pipeline transportation. FERC’s regulations for interstate oil and natural gas transmission in some circumstances may also affect the intrastate transportation of oil and natural gas.

Although oil and natural gas prices are currently unregulated, Congress historically has been active in oil and natural gas regulation. We cannot predict whether new legislation to regulate oil and natural gas might be proposed, what proposals, if any, might actually be enacted by Congress or the various state legislatures, and what effect, if any, the proposals might have on our operations. Sales of condensate and oil and natural gas liquids are not currently regulated and are made at market prices.

Drilling and Production.Our operations are subject to various types of regulation at the federal, state and local level. These types of regulation include requiring permits for the drilling of wells, drilling bonds and reports concerning operations. The states, and some counties and municipalities, in which we operate also regulate one or more of the following:

| ● | the location of the wells |

| ● | the method of drilling and casing wells; |

| ● | the timing of construction or drilling activities, including season wildlife closures; |

| ● | the rates of production or “allowables”; |

| ● | the surface use and restoration of properties upon which wells are drilled; |

| ● | the plugging and abandoning of wells; and |

| ● | notice to, and consultation with, surface owners and other third parties. |

State laws regulate the size and shape of drilling and spacing units or proration units governing the pooling of oil and natural gas properties. Some states allow forced pooling or integration of tracts to facilitate exploration while other states rely on voluntary pooling of lands and leases. In some instances, forced pooling or unitization may be implemented by third parties and may reduce our interest in the unitized properties. In addition, state conservation laws establish maximum rates of production from oil and natural gas wells, generally prohibit the venting or flaring of natural gas and impose requirements regarding the ratability of production. These laws and regulations may limit the amount of oil and natural gas we can produce from our wells or limit the number of wells or the locations at which we can drill. Moreover, each state generally imposes a production or severance tax with respect to the production and sale of oil, natural gas and natural gas liquids within its jurisdiction. States do not regulate wellhead prices or engage in other similar direct regulation, but we cannot assure you that they will not do so in the future. The effect of such future regulations may be to limit the amounts of oil and natural gas that may be produced from our wells, negatively affect the economics of production from these wells or to limit the number of locations we can drill.

Federal, state and local regulations provide detailed requirements for the abandonment of wells, closure or decommissioning of production facilities and pipelines and for site restoration in areas where we operate. The U.S. Army Corps of Engineers and many other state and local authorities also have regulations for plugging and abandonment, decommissioning and site restoration. Although the U.S. Army Corps of Engineers does not require bonds or other financial assurances, some state agencies and municipalities do have such requirements.

Natural Gas Sales and Transportation.Historically, federal legislation and regulatory controls have affected the price of the natural gas we produce and the manner in which we market our production. FERC has jurisdiction over the transportation and sale for resale of natural gas in interstate commerce by natural gas companies under the Natural Gas Act of 1938 and the Natural Gas Policy Act of 1978. Since 1978, various federal laws have been enacted which have resulted in the complete removal of all price and non-price controls for sales of domestic natural gas sold in “first sales,” which include all of our sales of our own production. Under the Energy Policy Act of 2005, FERC has substantial enforcement authority to prohibit the manipulation of natural gas markets and enforce its rules and orders, including the ability to assess substantial civil penalties.

FERC also regulates interstate natural gas transportation rates and service conditions and establishes the terms under which we may use interstate natural gas pipeline capacity, which affects the marketing of natural gas that we produce, as well as the revenues we receive for sales of our natural gas and release of our natural gas pipeline capacity. Commencing in 1985, FERC promulgated a series of orders, regulations and rule makings that significantly fostered competition in the business of transporting and marketing gas. Today, interstate pipeline companies are required to provide nondiscriminatory transportation services to producers, marketers and other shippers, regardless of whether such shippers are affiliated with an interstate pipeline company. FERC’s initiatives have led to the development of a competitive, open access market for natural gas purchases and sales that permits all purchasers of natural gas to buy gas directly from third-party sellers other than pipelines. However, the natural gas industry historically has been very heavily regulated; therefore, we cannot guarantee that the less stringent regulatory approach currently pursued by FERC and Congress will continue indefinitely into the future nor can we determine what effect, if any, future regulatory changes might have on our natural gas related activities.

Under FERC’s current regulatory regime, transmission services are provided on an open-access, non-discriminatory basis at cost-based rates or negotiated rates. Gathering service, which occurs upstream of jurisdictional transmission services, is regulated by the states onshore and in state waters. Although its policy is still in flux, FERC has in the past reclassified certain jurisdictional transmission facilities as non-jurisdictional gathering facilities, which has the tendency to increase our costs of transporting gas to point-of-sale locations.

Oil Sales and Transportation.Sales of crude oil, condensate and natural gas liquids are not currently regulated and are made at negotiated prices. Nevertheless, Congress could reenact price controls in the future.

Our crude oil sales are affected by the availability, terms and cost of transportation. The transportation of oil in common carrier pipelines is also subject to rate regulation. FERC regulates interstate oil pipeline transportation rates under the Interstate Commerce Act and intrastate oil pipeline transportation rates are subject to regulation by state regulatory commissions. The basis for intrastate oil pipeline regulation, and the degree of regulatory oversight and scrutiny given to intrastate oil pipeline rates, varies from state to state. Insofar as effective interstate and intrastate rates are equally applicable to all comparable shippers, we believe that the regulation of oil transportation rates will not affect our operations in any materially different way than such regulation will affect the operations of our competitors.

Further, interstate and intrastate common carrier oil pipelines must provide service on a non-discriminatory basis. Under this open access standard, common carriers must offer service to all shippers requesting service on the same terms and under the same rates. When oil pipelines operate at full capacity, access is governed by prorationing provisions set forth in the pipelines’ published tariffs. Accordingly, we believe that access to oil pipeline transportation services generally will be available to us to the same extent as to our competitors.

State Regulation.Texas and New Mexico regulate the drilling for, and the production, gathering and sale of, oil and natural gas, including imposing severance taxes and requirements for obtaining drilling permits. Texas currently imposes a 4.6% severance tax on oil production and a 7.5% severance tax on natural gas production, while New Mexico imposes an effective tax rate of 7.3% on both oil and gas production. States also regulate the method of developing new fields, the spacing and operation of wells and the prevention of waste of oil and natural gas resources. States may regulate rates of production and may establish maximum daily production allowable from oil and natural gas wells based on market demand or resource conservation, or both. States do not regulate wellhead prices or engage in other similar direct economic regulation, but we cannot assure you that they will not do so in the future. The effect of these regulations may be to limit the amount of oil and natural gas that may be produced from our wells and to limit the number of wells or locations we can drill.

The petroleum industry is also subject to compliance with various other federal, state and local regulations and laws. Some of those laws relate to resource conservation and equal employment opportunity. We do not believe that compliance with these laws will have a material adverse effect on us.

OSHA and Other Laws and Regulations

We are subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes. The OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of CERCLA and similar state statutes require that we organize and/or disclose information about hazardous materials used or produced in our operations. These laws also require the development of risk management plans for certain facilities to prevent accidental releases of pollutants. We believe that we are in substantial compliance with these applicable requirements and with other OSHA and comparable requirements.

Employees

As of July 31, 2019, we had 5 full-time employees. We regularly use independent contractors and consultants to perform various drilling and other services. None of our employees are represented by a labor union or covered by any collective bargaining agreement.

Facilities

Our corporate headquarters are located in Plano, Texas. We believe that our facilities are adequate for our current operations.

Insurance Matters

The oil and natural gas industry involves a variety of operating risks, including the risk of fire, explosions, blow outs, pipe failures and, in some cases, abnormally high-pressure formations which could lead to environmental hazards such as oil spills, natural gas leaks and the discharge of toxic gases. If any of these should occur, we could incur legal defense costs and could be required to pay amounts due to injury, loss of life, damage or destruction to property, natural resources and equipment, pollution or environmental damage, regulatory investigation and penalties and suspension of operations.We are not insured fully against all risks associated with our business either because such insurance is not available or because premium costs are considered prohibitive. A loss not fully covered by insurance could have a material adverse effect on our business, financial condition and results of operations.

We reevaluate the purchase of insurance, policy terms and limits annually. Future insurance coverage for our industry could increase in cost and may include higher deductibles or retentions. In addition, some forms of insurance may become unavailable in the future or unavailable on terms that we believe are economically acceptable. No assurance can be given that we will be able to maintain insurance in the future at rates that we consider reasonable and we may elect to maintain minimal or no insurance coverage. We may not be able to secure additional insurance or bonding that might be required by new governmental regulations. This may cause us to restrict our operations, which might severely impact our financial position. The occurrence of a significant event, not fully insured against, could have a material adverse effect on our financial condition and results of operations.

Available Information

We maintain an Internet website under the name www.amazingenergy.com. We file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, proxy statements and other documents with the SEC under the Exchange Act. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The public can obtain any document we file with the SEC atwww.sec.gov.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B.

| UNRESOLVED STAFF COMMENTS. |

Not applicable.

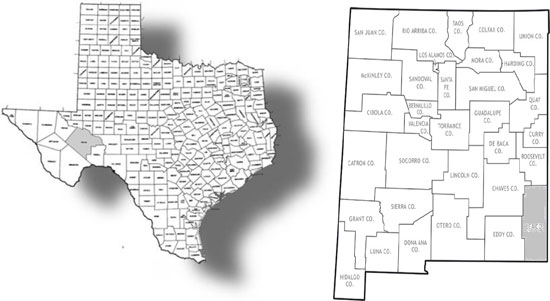

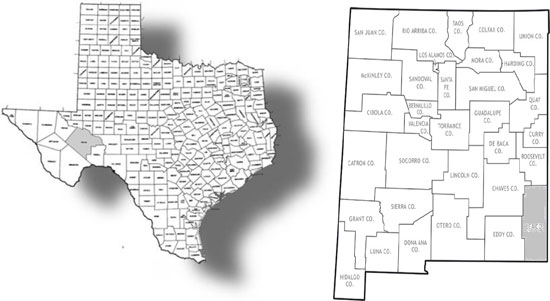

| ITEM 2. | OIL and GAS PROPERTIES – TEXAS and NEW MEXICO |

Pecos County, Texas – The Company has leasehold rights within an AMI of approximately 70,000 gross acres in Northeast Pecos County, Texas. The acreage lies within the Central Basin Platform of the Permian Basin. The subject leasehold acreage is positioned west of the Yates Field (which has produced approximately 1.6 billion BO to date) and east of the Taylor Link Field (which has produced approximately 17 million BO to date). More specifically, our leasehold acreage lies within the White & Baker Field (which has produced approximately 5 million BO to date) and portions of the Walker Field (which has produced approximately 10 million BO to date). The Pecos County, Texas leasehold acreage is comprised of multiple leases and is characterized by several commercial hydrocarbon bearing formations which begin around 1,300 ft deep and extend to a depth of around 10,000 feet. Potential hydrocarbon bearing formations within the leasehold acreage include the Yates, Seven Rivers, Greyburg, Queen (upper and lower), San Andres, Strawn, Wolfcamp, Devonian and Ellenburger. The Company began drilling operations on the subject acreage in October, 2010 to target the Greyburg and Queen formations. As of June 30, 2019, the Company had drilled twenty (26) wells throughout the property of which sixteen (16) wells are producing intermittently, eight (8) wells are shut in awaiting further evaluation and two (2) wells are permanently shut-in. During the fiscal year ended July 31, 2018, the WWJD #31 well was drilled to approximately 4,000 feet and the Company administered several types of testing to the wellbore, including the gathering 26 sets of sidewall cores. After evaluating the results of the various wellbore administered tests, the Company decided to reenter the well in fiscal year 2018-2019 and drill horizontally into the San Andres formation (approximately 2,035 feet deep). The well was successfully completed in early 2019 and is currently undergoing an extended de-watering process. Management is hopeful that continued de-watering of the formation will lead to higher oil cuts.

Lea County, New Mexico – During the fiscal year ended July 31, 2019, the Company acquired several producing properties, constituting 5,385 gross acres and 4,682 net acres in Lea County, New Mexico. The properties are also located in the Northeastern Shelf of the Permian Basin. The Company currently operates seven (7) producing oil and gas wells and three (3) saltwater disposal wells on the subject properties. Moreover, as of July 31, 2019, the Company had enough undeveloped acreage under lease to allow for the drilling of approximately twelve (12) additional wells with one (1) mile lateral deviations. The primary drilling target in Lea County, New Mexico will continue to be the San Andres zone.

In July, 2019, the Company entered into a saltwater disposal agreement with Manzano, LLC (Manzano) whereby Manzano agreed to pay the Company (and the surface owner) a fair market fee (on a per barrel basis) to inject its produced water into one of the Company owned saltwater disposal wells. Under the terms of the agreement, the disposal fee shall be adjusted upward/downward based on the increase/decrease in the average monthly spot price for a barrel of oil as published by the U.S. Energy Information Administration, for West Texas Intermediate Crude delivered to Cushing, Oklahoma or similar location within close proximity to the New Mexico region. Additionally, the Company shall be entitled to receive the proceeds from the sale of any skim oil extracted during the disposal process. Manzano was responsible for the payment of all costs associated with delivering the produced water to the Company’s saltwater disposal facilities (e.g. laying of water transmission lines, securing right-of-ways, paying any surface use/damages, installation of additional saltwater storage holding tanks, etc.).

The following table summarizes our estimated proved and probable oil and gas reserves for the fiscal years ended July 31, 2019 and 2018.

| | | Proved and Probable Reserves (BOE) | |

| | | July 31, | |

| | | 2019 | | | 2018 | |

| Proved developed | | | 190,833 | | | | 40,090 | |

| Proved undeveloped | | | 308,833 | | | | 358,218 | |

| Total proved | | | 499,666 | | | | 398,308 | |

| | | | | | | | | |

| Probable undeveloped | | | 210,167 | | | | 211,355 | |

| | | | | | | | | |

| Total reserves | | | 709,833 | | | | 609,663 | |

| | | | | | | | | |

| Percent of total proved reserves | | | 70.39 | % | | | 65.33 | % |

Proved and probable, and possible oil and gas reserves

The following table sets forth information regarding our estimated proved reserves as of July 31, 2019. See Note 14 to our consolidated financial statements in this report for additional information.

Summary of oil and gas reserves as of July 31, 2019

| | | Proved and Probable Reserves | |

| | | Oil | | | Natural Gas | | | Total | | | Percent | | | PV-10 | |

| | | (Bbl) | | | (Mcf) | | | (BOE) | | | (%) | | | ($) | |

| Proved developed | | | 151,450 | | | | 239,220 | | | | 190,833 | | | | 26.88 | % | | $ | 1,580,000 | |

| Proved undeveloped | | | 212,790 | | | | 575,680 | | | | 308,833 | | | | 43.51 | % | | $ | 4,663,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total proved | | | 364,240 | | | | 814,900 | | | | 499,666 | | | | 70.39 | % | | $ | 6,243,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Probable undeveloped | | | 154,000 | | | | 337,000 | | | | 210,167 | | | | 29.61 | % | | $ | 2,347,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Proved and Probable Reserves | | | 518,240 | | | | 1,151,900 | | | | 709,833 | | | | 100.00 | % | | $ | 8,590,000 | |

Additionally, possible undeveloped reserves totaling 827,500 BOE with a PV-10 value of $2,760,000 were computed by our Reserve Engineer.

Reconciliation of PV-10 to Standardized Measure