John H. Lively The Law Offices of John H. Lively & Associates, Inc . A member firm of The 1940 Act Law Group 2041 West 141st Terrace, Suite 119 Leawood, KS 66224 Phone: 913.660.0778 Fax: 913.660.9157 john.lively@1940actlawgroup.com |

FOIA CONFIDENTIAL TREATMENT REQUESTED

June 17, 2010

VIA EDGAR

Ms. Deborah O’Neal-Johnson U.S. Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549 |

| | Re: | DGHM Investment Trust (the “Trust”) |

SEC File Numbers: 333-137775 and 811-21958

To Ms. O’Neal-Johnson:

On April 15, 2010, the Trust filed with the Securities and Exchange Commission (the “Commission”) Post-Effective Amendment No. 4 to the Trust’s registration statement under the Securities Act of 1933, as amended (the “Securities Act”), and Amendment No. 6 under the Investment Company Act of 1940, as amended, each on Form N-1A (the “Amendment”). On May 26, 2010, you provided comments to me relating to the Amendment. This letter responds to your comments. For your reference, your comments are reflected in this letter and then the Trust’s response has been presented below each comment. The Trust intends to file another amendment to its registration statement to incorporate its responses to your comments as described herein and to update or complete certain other information required by Form N-1A.

General

| 1. | Comment: | You noted that the Commission’s accounting staff had reviewed the Trust’s most recent filing on Form N-CSR that was made on May 10, 2010. You commented that in the annual report of the Trust’s series portfolio, the DGHM All-Cap Value Fund, the growth of $10,000 chart and the graphical depiction of the All-Cap Value Fund’s portfolio holdings were missing from the filing. You instructed that the Trust should re-file the Form N-CSR with those graphic disclosures. |

| Response: | On June 15, 2010, the Trust re-filed the Form N-CSR with the graphical disclosures described in your comment. |

Summary Section – Fees and Expenses (All-Cap Value Fund)

| 2. | Comment: In the fee table, revise the term “Net Expenses” to a term that is suggested by Form N-1A. |

Response: The Trust has revised the disclosure as you have requested.

| 3. | Comment: Delete the second footnote to the fee table. |

Response: The Trust has revised the disclosure as you have requested.

| 4. | Comment: In the third footnote to the fee table, describe who may terminate the expense limitation agreement and under what circumstances. |

Response: The Trust has revised the disclosure as you have requested.

| 5. | Comment: Delete the fourth footnote to the fee table. |

Response: The Trust has revised the disclosure as you have requested.

| 6. | Comment: Confirm that the one-year expense figure in the expense example for the Class C Shares will reflect the effect of the contingent deferred sales charge. |

Response: The Trust hereby confirms that the one-year expense figure in the expense example for the Class C Shares will reflect the effect of the contingent deferred sales charge.

Summary Section – Principal Investment Strategies (All-Cap Value Fund)

| 7. | Comment: Verify that the use of exchange trade funds is a part of the principal investment strategies of the All-Cap Value Fund. If so, verify that the Fund had less than 1 basis point in “acquired fund fees and expenses”. If that Fund had more than 1 basis point in “acquired fund fees and expense,” adjust the fee table in accordance with the requirements of Form N-1A |

Response: The Trust herby verifies that the use of exchange trade funds is not a part of the principal investment strategies; the Trust has revised the principal investments strategies disclosure in the summary section of the prospectus to delete reference to this strategy. The Trust also confirms that during the last fiscal year, the Fund incurred less than 1 basis point in acquired fund fees and expenses.

Summary Section – Principal Risks (All-Cap Value Fund)

| 8. | Comment: In connection with the disclosure that the Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, advise whether the Fund’s prospectus will be supplemented to explain the risks of such a strategy if the Fund does, in fact, invest a significant portion of its assets in one or more sectors of the equity securities market. |

Response: The principal risks section for the Fund discloses that the Fund is subject to “sector risks.” The Trust believes that the current risk disclosures are appropriate and adequate. The Trust, with the advice of legal counsel, intends to supplement the disclosures contained in its prospectus and statement of additional information where the circumstances warrant supplemental disclosure.

Summary Section – Performance (All-Cap Value Fund)

| 9. | Comment: In a correspondence filing submitted prior to submitting an update to the Trust’s registration statement pursuant to Rule 485(b) under the Securities Act, please provide a copy of the prospectus with the bar chart that is required pursuant to Item 4(b)(2). |

Response: The Trust has included with this correspondence letter a copy of the prospectus which is revised to reflect the comments described in this correspondence letter and it has updated the prospectus to include the bar chart.

| 10. | Comment: If up-to-date performance information for the Fund is available via a toll-free telephone number, please include disclosure to that effect in the narrative disclosure preceding the bar chart and adjacent to the disclosure regarding obtaining updated performance information at www.dghm.com. |

Response: The Trust has added disclosure as you have instructed regarding a toll-free telephone number where investors can obtain up-to-date performance information.

| 11. | Comment: In the disclosure before the table provided in response to Item 4(b)(2)(iii), delete the clause after the term December 31, 2009. |

Response: The Trust has revised the disclosure as you have requested.

| 12. | Comment: Change the term “Since Inception” in the table provided in response to Item 4(b)(2)(iii) to “Life of Fund.” At the option of the Trust, disclosure of the date of inception may be provided adjacent to the term, “Life of Fund.” |

Response: The Trust has revised the disclosure as you have requested.

| 13. | Comment: In the table provided in response to Item 4(b)(2)(iii), change the word, “Redemptions” to “Sale of Fund Shares.” |

Response: The Trust has revised the disclosure as you have requested.

| 14. | Comment: Beside the term, “Russell 3000® Value Index,” add the following disclosure: “(reflects no deduction for fees, expenses or taxes)”. |

Response: The Trust has revised the disclosure as you have requested.

Summary Section - Portfolio Managers (All Cap Value Fund)

| 15. | Comment: Add the title and length of service of each individual identified in the section of the prospectus, Summary Section – Portfolio Managers. |

Response: The Trust has revised the disclosure as you have requested.

Summary Section – Fees and Expenses (Small Cap Value Fund)

| 16. | Comment: In the fee table, delete the footnote reference #3 in the line items “Annual Fund Operating Expenses” and “Total Annual Fund Operating Expenses.” |

Response: The Trust has revised the disclosure as you have requested.

| 17. | Comment: In the fee table, revise the term “Net Expenses” to a term that is suggested by Form N-1A. |

Response: The Trust has revised the disclosure as you have requested.

| 18. | Comment: In the third footnote to the fee table, describe who may terminate the expense limitation agreement and under what circumstances. |

Response: The Trust has revised the disclosure as you have requested.

| 19. | Comment: Confirm that the one-year expense figure in the expense example for the Class C Shares will reflect the effect of the contingent deferred sales charge. |

Response: The Trust hereby confirms that the one-year expense figure in the expense example for the Class C Shares will reflect the effect of the contingent deferred sales charge.

Summary Section – Principal Investment Strategies (Small Cap Value Fund)

| 20. | Comment: Add the phrase, “plus the amount of borrowings for investment purposes” after the term “net assets” in the third paragraph. |

Response: The Trust has revised the disclosure as you have requested.

| 21. | Comment: In the correspondence letter responding to the Commissions staff’s comments, advise of the current market capitalization of the Russell 2000® Index. |

Response: As of May 31, 2010, the largest company represented in the Russell 2000® Index had a market capitalization of $4.639 billion and the median market capitalization of companies represented in that index was $1.024 billion.

| 22. | Comment: In connection with the disclosure that the Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, advise whether the Fund’s prospectus will be supplemented to explain the risks of such a strategy if the Fund does, in fact, invest a significant portion of its assets in one or more sectors of the equity securities market. |

Response: The principal risks section for the Fund discloses that the Fund is subject to “sector risks.” The Trust believes that the current risk disclosures are appropriate and adequate. The Trust, with the advice of legal counsel, intends to supplement the disclosures contained in its prospectus and statement of additional information where the circumstances warrant supplemental disclosure.

Summary Section – Performance (Small Cap Value Fund)

| 23. | Comment: If up-to-date performance information for the Fund is available via an internet website, please include disclosure to that effect in the narrative disclosure. |

Response: The Trust has added appropriate disclosure regarding the availability of the Fund’s up-to-date performance information on an internet website, as well as by call a toll-free number.

Summary Section – Purchase and Sale of Fund Shares

| 24. | Comment: Delete the second sentence of the first paragraph. |

Response: The Trust has revised the disclosure as you have requested.

| 25. | Comment: Delete the third sentence of the second paragraph. |

Response: The Trust has revised the disclosure as you have requested.

Additional Information About the Fund’s Principal Investment Strategies– DGHM All-Cap Value Fund

| 26. | Comment: Add the phrase, “plus the amount of borrowings for investment purposes” after the term “net assets” in the first paragraph. |

Response: The Trust has revised the disclosure as you have requested.

Additional Information About the Funds’ Principal Risks

| 27. | Comment: Insert the word “principal” in the last sentence of the introductory paragraph. |

Response: The Trust has revised the disclosure as you have requested.

| 28. | Comment: In connection with the disclosure that the Funds may invest a significant portion of their assets in one or more sectors of the equity securities market and therefore be subject to “sector risks,” advise whether the Funds’ prospectus will be supplemented to explain the risks of such a strategy if a Fund does, in fact, invest a significant portion of its assets in one or more sectors of the equity securities market. |

Response: The principal risks section for the Funds discloses that the Funds are subject to “sector risks.” The Trust believes that the current risk disclosures are appropriate and adequate. The Trust, with the advice of legal counsel, intends to supplement the disclosures contained in its prospectus and statement of additional information where the circumstances warrant supplemental disclosure.

General Information - The Funds’ Investment Advisor – Historical Performance of Accounts Similar to the Small Cap Value Fund and the All-Cap Value Fund

| 29. | Comment: Advise in your correspondence letter that the accounts represented in the “DGHM All-Cap Composite” and the “DGHM Small Cap Value Composite” are all of the accounts that were advised by the Adviser during the periods presented that utilized objectives and strategies that are (or will be in the case of the Small Cap Value Fund) utilized in managing the Funds or that the exclusion of any accounts not included would not cause the performance disclosure of the composites to be misleading. |

Response: The Adviser has advised the Trust that the DGHM All-Cap Value Composite consists of all of the accounts that were advised by the Adviser during the periods presented that utilize objectives and strategies that are utilized by that Fund. The Adviser has also advised the Trust that the DGHM Small Cap Value Composite consists of all of the accounts that were advised by the Adviser during the periods presented that utilize objectives and strategies that will be utilized by that Fund.

| 30. | Comment: Provide disclosure to the effect that the DGHM Small Cap Composite and DGHM All-Cap Value Composite are presented net of fees and expenses and they reflect the reinvestment of dividends and distributions. |

Response: The Trust has revised the disclosure as you have requested.

General Information - the Funds’ Investment Advisor – the Advisor’s Compensation

| 31. | Comment: Add the disclosure required by Item 10(a)(1)(iii) of Form N-1A in the first paragraph. |

Response: The Trust has revised the disclosure as you have requested.

General Information - Distributor

| 32. | Comment: Provide the address of the Distributor. |

Response: The Trust has revised the disclosure as you have requested.

Statement of Additional Information

| 33. | Comment: Add the ticker symbols for the various classes of the DGHM Small Cap Value Fund and the DGHM All-Cap Value Fund to the cover page. |

Response: The Trust has revised the disclosure as you have requested.

| 34. | Comment: The Trust is reminded of the new Item 17 disclosure related to the board of trustees of the Trust. Please provide a copy of the Trust’s statement of additional information with this correspondence letter. |

Response: The Trust has revised its statement of additional information to include the disclosures required by Item 17 of Form N-1A. The revised statement of additional information is included with this correspondence filing.

* * *

The Trust acknowledges the following:

| · | Should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| · | The action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the fund from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| · | The Trust may not assert this action as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions regarding this correspondence letter, please contact me at (913) 660-0778

Sincerely,

/s/ John H. Lively

John H. Lively

Dalton, Greiner, Hartman, Maher & CO, LLC

DGHM INVESTMENT TRUST

On Behalf Of Its Series,

DGHM ALL-CAP VALUE FUND

Investor Class Ticker: DGHMX

Institutional Class Ticker: DGAIX

Class C Ticker: DGACX

DGHM SMALL CAP VALUE FUND

Investor Class Ticker: DGSMX

Institutional Class Ticker: DGIVX

Class C Ticker: DGSVX

PROSPECTUS

JUNE 28, 2010

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Page

| v | Summary – DGHM All-Cap Value Fund 1 |

| v | Summary - DGHM Small Cap Value Fund 6 |

| v | General Summary Information 10 |

| v | Additional Information About The Funds’ Principal Investment Strategies 11 |

| v | Additional Information About The Funds’ Principal Risks 14 |

| v | Investing In The Funds 20 |

| v | Other Important Investment Information 29 |

| v | How To Get More Information Back Cover |

Summary

DGHM ALL-CAP VALUE FUND

Investment Objective

The investment objective of the DGHM All-Cap Value Fund (the “All-Cap Value Fund”) is long-term capital appreciation.

Fees and Expenses of the All-Cap Value Fund

This table describes the fees and expenses you may pay if you buy and hold shares of the All-Cap Value Fund.

Shareholder Fees (fees paid directly from your investment) | Investor Class Shares | Institutional Class Shares4 | Class C Shares |

| Maximum Sales Charge (Load) Imposed On Purchases (as a percentage of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of amount purchased or redeemed, whichever is lower) | None | None | 1.00% |

| Redemption Fee | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

Management Fees1 | 0.65% | 0.65% | 0.65% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.00% | 1.00% |

| Other Expenses | 0.71% | 0.71% | 0.71% |

Total Annual Fund Operating Expenses2 | 1.61% | 1.36% | 2.36% |

Fee Waivers and/or Expense Reimbursements2 | | | |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements2 | 1.61% | 1.36% | 2.36% |

| 1. | Effective March 1, 2010, Dalton, Greiner, Hartman, Maher & Co., LLC (the “Advisor”), the All-Cap Value Fund’s investment advisor, and the Board of Trustees of the All-Cap Value Fund agreed to amend the All-Cap Value Fund’s investment advisory agreement to lower the rate of compensation payable to the Advisor to 0.65%. |

| 2. | The Advisor has agreed to waive or reduce its fees and to assume other expenses of the All-Cap Value Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the All-Cap Value Fund’s business, dividend expense on short sales, and expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the 1940 Act, If applicable) to not more than 1.50% of the average daily net assets of the All-Cap Value Fund, through June 30, 2011. The Trust or the Advisor may terminate this expense limitation agreement by mutual written consent. |

Example:

The following example is intended to help you compare the cost of investing in the All-Cap Value Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the All-Cap Value Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the All-Cap Value Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Period Invested | 1 Year | 3 Years | 5 Years | 10 Years |

| Investor Class Shares | $164 | $508 | $876 | $1,911 |

| Institutional Class Shares | $138 | $431 | $745 | $1,635 |

| Class C Shares | $339 | $737 | $1,260 | $2,696 |

Portfolio Turnover

The All-Cap Value Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when All-Cap Value Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the All-Cap Value Fund’s performance. During the most recent fiscal year, the All-Cap Value Fund’s portfolio turnover rate was 101.89% of the average value of its portfolio.

Principal Investment Strategies

To achieve its investment objective, the All-Cap Value Fund invests primarily in a diversified portfolio of publicly traded equity securities of domestic companies of any market capitalization and may be unseasoned or established companies. Under normal circumstances, at least 80% of the value of its net assets is invested in publicly traded equity securities, including common stocks, preferred stocks, convertible securities, and similar instruments of various issuers. The Fund may also invest in exchange traded funds (“ETFs”).

Dalton, Greiner, Hartman, Maher & Co., LLC, the All-Cap Value Fund’s investment advisor, uses a bottom-up selection process to attempt to identify equity securities of companies that appear to be selling at a discount relative to the Advisor’s assessment of their potential value. In identifying securities to be held by the All-Cap Value Fund, the Advisor will utilize a proprietary valuation model combined with in-depth industry and company specific research developed by the Advisor. The Advisor focuses on the cash flows historical profitability, projected future earnings, and financial condition of individual companies in identifying which securities the Fund may purchase. The Advisor may weigh other factors against a company’s valuation in deciding which companies may appear attractive for investment. These factors may include the following:

| o | quality of the business franchise, |

| o | economic or market conditions, |

| o | deployment of capital, and |

| o | reputation, experience, and competence of the company’s management. |

Generally, securities are sold when the characteristics and factors used to select the security change or the security has appreciated to the point where it is no longer attractive for the All-Cap Value Fund to hold the security in its portfolio of investments. In pursuit of its investment objective, the All-Cap Value Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, such as healthcare, technology, natural resources, etc. In implementing the investment strategy of the All-Cap Value Fund, the Advisor invests with a multi-year investment horizon rather than focusing on the month or quarter end data.

Principal Risks

An investment in the All-Cap Value Fund is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the All-Cap Value Fund will be successful in meeting its investment objective. The Advisor’s ability to choose suitable investments has a significant impact on the ability of the All-Cap Value Fund to achieve its investment objective. Generally, the All-Cap Value Fund will be subject to the following additional risks:

| · | Market Risk: Market risk refers to the risk that the value of securities in the All-Cap Value Fund’s portfolio may decline due to daily fluctuations in the securities markets generally. |

| · | Small-Cap and Mid-Cap Securities: Investing in the securities of small-cap and mid-cap companies generally involves substantially greater risk than investing in larger, more established companies. |

| · | Large-Cap Securities”. Prices of securities of larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the All-Cap Value Fund’s value may not rise as much as the value of funds that emphasize companies with smaller market capitalizations. |

| · | Management Style Risk: Because the All-Cap Value Fund invests primarily in value stocks (stocks that the Advisor believes are undervalued), the All-Cap Value Fund’s performance may at times be better or worse than the performance of stock funds that focus on other types of stock strategies (e.g. growth stocks), or that have a broader investment style. |

| · | Sector Risk: Sector risk is the possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If the All-Cap Value Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically affect that sector. |

| · | Issuer Risk: The value of any of the All-Cap Value Fund’s portfolio securities may decline for a number of reasons, which directly relate to the issuer, such as management performance, financial leverage, and reduced demand for the issuer’s goods or services. |

| · | Portfolio Turnover Risk: The All-Cap Value Fund may sell portfolio securities without regard to the length of time they have been held in order to take advantage of new investment opportunities or changing market conditions. As portfolio turnover may involve brokerage commissions and other transaction costs, there could be additional expenses for the All-Cap Value Fund. High rates of portfolio turnover may also result in the realization of short-term capital gains. |

Fund’s Past Performance

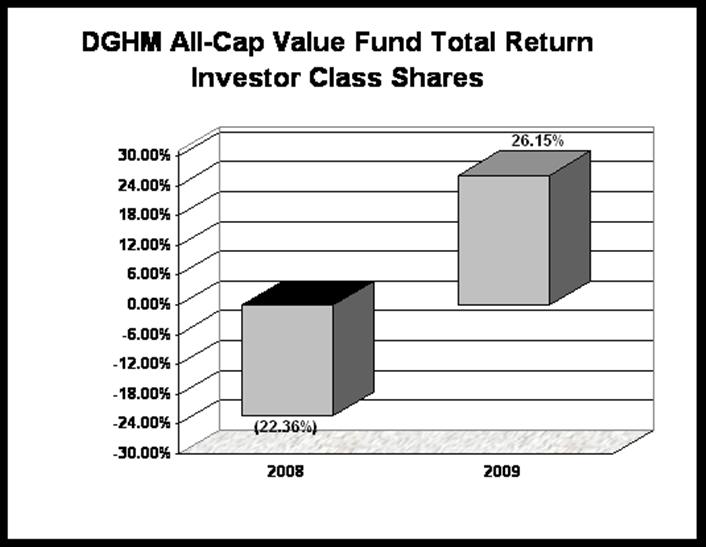

The bar chart and performance table below illustrate the variability of the All-Cap Value Fund’s returns. The All-Cap Value Fund’s past performance (before and after taxes) does not necessarily indicate how the All-Cap Value Fund will perform in the future. The information provides some indication of the risks of investing in the All-Cap Value Fund by showing changes in its performance from year to year and by showing how its average annual returns for 1 year and since inception periods compare with those of a broad measure of market performance. Updated information on the All-Cap Value Fund’s results can be obtained by visiting www.dghm.com or by calling toll-free at 1-800-653-2839.

For the periods included in the bar chart:

| Best Quarter | 17.36%, 2nd Quarter, 2009 |

| Worst Quarter | -19.52%, 4th Quarter, 2008 |

| | Year-To-Date (as of March 31, 2010) 5.64% |

Average Annual Total Return as of December 31, 2009.

| | 1 Year | Life of Fund (inception date: June 20, 2007) |

Return Before Taxes | 26.15% | -2.24% |

Return After Taxes on Distribution | 26.04% | -2.30% |

Return After Taxes on Distribution and Sale of Fund Shares | 17.00% | -1.93% | |

Russell 3000® Value Index (reflects no deduction for fees, expenses or taxes) | 19.76% | -12.77% | |

After-tax returns are calculated using the historical highest federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their All-Cap Value Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Management

Dalton, Greiner, Hartman, Maher & Co., LLC is the investment adviser to the All-Cap Value Fund.

Portfolio Managers

The Advisor’s management team that is primarily responsible for the day-to-day management of the All-Cap Value Fund is comprised of the following individuals:

| · | Timothy G. Dalton, Portfolio Manager since the All-Cap Value Fund’s inception. |

| · | Bruce H. Geller, Portfolio Manager since the All-Cap Value Fund’s inception. |

| · | Peter A. Gulli, Portfolio Manager since July 2010. |

| · | Jeffrey C. Baker, Portfolio Manager since the All-Cap Value Fund’s inception. |

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 9 of the prospectus.

Summary

DGHM SMALL CAP VALUE FUND

Investment Objective

The investment objective of the DGHM Small Cap Value Fund (the “Small Cap Value Fund”) is long-term capital appreciation.

Fees and Expenses of the Small Cap Value Fund

This table describes the fees and expenses you may pay if you buy and hold shares of the Small Cap Value Fund.

Shareholder Fees (fees paid directly from your investment) | Investor Class Shares | Institutional Class Shares | Class C Shares |

| Maximum Sales Charge (Load) Imposed On Purchases (as a percentage of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of amount purchased or redeemed, whichever is lower) | None | None | 1.00% |

| Redemption Fee | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.80% | 0.80% | 0.80% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.00% | 1.00% |

Other Expenses2 | 0.75% | 0.75% | 0.75% |

Total Annual Fund Operating Expenses1 | 1.80% | 1.55% | 2.55% |

Fee Waivers and/or Expense Reimbursements1,2 | | | |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1,2 | 1.80% | 1.55% | 2.55% |

| 1. | The Advisor has agreed to waive or reduce its fees and to assume other expenses of the Small Cap Value Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Small Cap Value Fund’s business, dividend expense on short sales, and expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the 1940 Act, If applicable) to not more than 1.65% of the average daily net assets of the Small Cap Value Fund through Jun 30, 2011. The Trust or the Advisor may terminate this expense limitation agreement by mutual written consent. |

| 2. | Because the Small Cap Value Fund has not commenced operations, expenses are estimated. |

Example:

The following example is intended to help you compare the cost of investing in the Small Cap Value Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the Small Cap Value Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Small Cap Value Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Period Invested | 1 Year | 3 Years |

| Investor Class Shares | $183 | $566 |

| Institutional Class Shares | $158 | $490 |

| Class C Shares | $358 | $794 |

Portfolio Turnover

The Small Cap Value Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Small Cap Value Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Small Cap Value Fund’s performance.

Principal Investment Strategies

To achieve its investment objective, the Small Cap Value Fund invests primarily in a diversified portfolio of publicly traded equity securities of domestic companies that the Advisor believes are undervalued. The companies will be characterized as small capitalization and may be unseasoned or established companies. As a matter of investment policy, the Small Cap Value Fund will generally invest so that, under normal circumstances, at least 80% of the value of its net assets, plus the amount of borrowings for investment purposes, are invested in publicly traded equity securities, including common stocks, preferred stocks, convertible securities, and similar instruments of various issuers. The Small Cap Value Fund considers a company to be a small capitalization company if its market capitalization is within a range of the Russell 2000® Index.

The Advisor uses a bottom-up selection process to attempt to identify equity securities of companies that appear to be selling at a discount relative to the Advisor’s assessment of their potential value. In identifying securities to be held by the Small Cap Value Fund, the Advisor will utilize a proprietary valuation model combined with in-depth industry and company specific research developed by the Advisor. The Advisor focuses on the cash flows historical profitability, projected future earnings, and financial condition of individual companies in identifying which securities the Small Cap Value Fund may purchase. The Advisor may weigh other factors against a company’s valuation in deciding which companies may appear attractive for investment. These factors may include the following:

| o | quality of the business franchise, |

| o | economic or market conditions, |

| o | deployment of capital, and |

| o | reputation, experience, and competence of the company’s management. |

Generally, securities are sold when the characteristics and factors used to select the security change or the security has appreciated to the point where it is no longer attractive for the Small Cap Value Fund to hold the security in its portfolio of investments. In pursuit of its investment objective, the Small Cap Value Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, such as healthcare, technology, natural resources, etc. In implementing the investment strategy of the Small Cap Value Fund, the Advisor invests with a multi-year investment horizon rather than focusing on the month or quarter end data.

The Small Cap Value Fund may also purchase ETFs in accordance with applicable requirements of the 1940 Act.

Principal Risks

An investment in the Small Cap Value Fund is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Small Cap Value Fund will be successful in meeting its investment objective. The Advisor’s ability to choose suitable investments has a significant impact on the ability of the Small Cap Value Fund to achieve its investment objective. Generally, the Small Cap Value Fund will be subject to the following additional risks:

| · | Market Risk: Market risk refers to the risk that the value of securities in the Small Cap Value Fund’s portfolio may decline due to daily fluctuations in the securities markets generally. |

| · | Small-Cap Securities: Investing in the securities of small-cap companies generally involves substantially greater risk than investing in larger, more established companies. |

| · | Management Style Risk: Because the Small Cap Value Fund invests primarily in value stocks (stocks that the Advisor believes are undervalued), the Small Cap Value Fund’s performance may at times be better or worse than the performance of stock funds that focus on other types of stock strategies (e.g. growth stocks), or that have a broader investment style. |

| · | Sector Risk: Sector risk is the possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If the Small Cap Value Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically affect that sector. |

| · | Issuer Risk: The value of any of the Small Cap Value Fund’s portfolio securities may decline for a number of reasons, which directly relate to the issuer, such as management performance, financial leverage, and reduced demand for the issuer’s goods or services. |

| · | Illiquidity: The Small Cap Value Fund may purchase securities for which there is a lack of liquidity in the markets. |

| · | ETF Risks: An investment in an ETF generally presents the same primary risks as an investment in a conventional registered mutual fund (i.e., one that is not exchange traded), including the risk that the general level of stock prices, or that the prices of stocks within a particular sector, may increase or decrease, thereby affecting the value of the shares of an ETF. In addition, all ETFs will have costs and expenses that will be passed on to the Fund and these costs and expenses will in turn increase the Small Cap Value Fund’s expenses. |

| · | Portfolio Turnover Risk: The Small Cap Value Fund may sell portfolio securities without regard to the length of time they have been held in order to take advantage of new investment opportunities or changing market conditions. As portfolio turnover may involve brokerage commissions and other transaction costs, there could be additional expenses for the Small Cap Value Fund. High rates of portfolio turnover may also result in the realization of short-term capital gains. |

Fund’s Past Performance

The Small Cap Value Fund has not yet commenced operations and therefore, does not have a performance history. Once available, the Small Cap Value Fund’s performance data will be available by visiting www.dghm.com or by calling toll-free at 1-800-653-2839. Information relating to the investment performance of the Advisor managing separate accounts in a manner that is substantially similar to the manner in which the Small Cap Value Fund will be managed is provided under the heading, “The Funds’ Investment Advisor - Historical Performance of Accounts Similar to the Small Cap Value Fund”, later in this prospectus.

Management

Dalton, Greiner, Hartman, Maher & Co., LLC is the investment adviser to the Small Cap Value Fund.

Portfolio Managers

The Advisor’s management team that is primarily responsible for the day-to-day management of the Small Cap Value Fund is comprised of the following individuals:

| · | Timothy G. Dalton, Portfolio Manager since the Small Cap Value Fund’s inception. |

| · | Bruce H. Geller, Portfolio Manager since the Small Cap Value Fund’s inception. |

| · | Peter A. Gulli, Portfolio Manager since the Small Cap Value Fund’s inception. |

| · | Jeffrey C. Baker, Portfolio Manager since the Small Cap Value Fund’s inception. |

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 9 of the prospectus.

General Summary Information

Purchase and Sale of Fund Shares

The minimum initial investment in each series portfolio of the Trust – the All-Cap Value Fund and the Small Cap Value Fund (each a “Fund” and collectively the “Funds”) – is $2,500 for the Investor Class Shares, $100,000 for the Institutional Class Shares and $1,000 for the Class C Shares, and $500 for subsequent investments, with the exception of continuous investment plans. A redemption resulting from this minimum investment policy will be made upon thirty days (30) written notice to the shareholder unless the balance is increased to an amount in excess of $2,000. In the event that a shareholder’s account falls below $1,000 due to market fluctuation, the Fund will not redeem the account.

You may redeem shares of the Funds at any time by writing to or calling the Funds’ transfer agent. You may also redeem shares by contacting any broker-dealer authorized to take orders for the Funds. Under this arrangement, you must elect to have all your dividends and distributions reinvested in shares of the Fund. Your withdrawals under this plan may be monthly or quarterly.

Tax Information

You will generally be subject to federal income tax each year on dividend and distribution payments, as well as on any gain realized when you sell (redeem) or exchange your Fund shares. If you hold Fund shares through a tax-deferred account (such as a retirement plan), you generally will not owe tax until you receive a distribution from the account.

Financial Intermediary Compensation

If you purchase shares of a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

ADDITIONAL INFORMATION ABOUT THE FUNDS’ PRINCIPAL INVESTMENT STRATEGIES

INVESTMENT OBJECTIVE

The investment objective of the All-Cap Value Fund and the Small Cap Value Fund is long-term capital appreciation. Each Fund’s investment objective may be changed without shareholder approval.

The All-Cap Value Fund and the Small Cap Value Fund may each be referred to generally throughout this document as a “Fund” or collectively, as the “Funds”.

DGHM All-Cap Value Fund

To achieve its investment objective, the All-Cap Value Fund invests primarily in a diversified portfolio of publicly traded equity securities of domestic companies that the Advisor believes are undervalued. The companies may be of any market capitalization and may be unseasoned or established companies. As a matter of investment policy, the All-Cap Value Fund will invest so that, under normal circumstances, at least 80% of the value of its net assets, plus the amount of borrowings for investment purposes, are invested in publicly traded equity securities, including common stocks, preferred stocks, convertible securities, and similar instruments of various issuers. This investment policy may be changed without shareholder approval upon 60-days’ prior notice to All-Cap Value Fund shareholders.

In identifying securities to be held by the All-Cap Value Fund, the Advisor will utilize a proprietary valuation model combined with in-depth industry and company specific research developed by the Advisor. In identifying securities to be held by the All-Cap Value Fund, the Advisor uses the following methods:

| · | The Advisor uses a bottom-up selection process to attempt to identify equity securities of companies that appear to be selling at a discount relative to the Advisor’s assessment of their potential value. The Advisor focuses on the cash flows historical profitability, projected future earnings, and financial condition of individual companies in identifying which securities the All-Cap Value Fund may purchase. The Advisor may weigh other factors against a company’s valuation in deciding which companies may appear attractive for investment. These factors may include the following: |

| o | quality of the business franchise, |

| o | economic or market conditions, |

| o | deployment of capital, and |

| o | reputation, experience, and competence of the company’s management. |

| · | The Advisor believes that equity securities purchased at prices below their potential value not only protect capital, but offer significant price appreciation once the market recognizes the particular security’s potential value. |

| · | Generally, securities are sold when the characteristics and factors used to select the security change or the security has appreciated to the point where it is no longer attractive for the All-Cap Value Fund to hold the security in its portfolio of investments. |

| · | In pursuit of its investment objective, the All-Cap Value Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, such as healthcare, technology, natural resources, etc. |

In implementing the investment strategy of the All-Cap Value Fund, the Advisor invests with a multi-year investment horizon rather than focusing on the month or quarter end data. The Advisor does not attempt to make macroeconomic calls (i.e., predict economic growth, interest rates, currency levels, commodity prices etc.). Additionally, the Advisor does not predict the direction of the stock market.

The All-Cap Value Fund may also purchase exchange-traded funds (ETFs) in accordance with applicable requirements of the Investment Company Act of 1940, as amended (“1940 Act”). An ETF is a fund that holds a portfolio of common stocks or bonds designed to track the performance of a securities index or sector of an index, such as the S&P 500. ETFs are traded on a securities exchange (e.g., the American Stock Exchange) based on their market value. An ETF portfolio holds the same stocks or bonds as the index it tracks, so its market price reflects the value of the index at any given time. ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustee fees, and marketing expenses. Therefore, if the All-Cap Value Fund were to become a shareholder in an ETF, the All-Cap Value Fund would be required to pay its proportionate share of the expenses of the ETF.

DGHM Small Cap Value Fund

To achieve its investment objective, the Small Cap Value Fund invests primarily in a diversified portfolio of publicly traded equity securities of domestic companies that the Advisor believes are undervalued. The companies will be characterized as small capitalization and may be unseasoned or established companies. As a matter of investment policy, the Small Cap Value Fund will generally invest so that, under normal circumstances, at least 80% of the value of its net assets, plus the amount of borrowings for investment purposes, are invested in publicly traded equity securities, including common stocks, preferred stocks, convertible securities, and similar instruments of various issuers. The Fund considers a company to be a small capitalization company if its market capitalization is within a range of the Russell 2000® Index As of May 31, 2010, the largest company represented in the Russell 2000® Index had a market capitalization of $4.639 billon. This investment policy may be changed without shareholder approval upon 60-days’ prior notice to Small Cap Value Fund shareholders.

In identifying securities to be held by the Small Cap Value Fund, the Advisor will utilize a proprietary valuation model combined with in-depth industry and company specific research developed by the Advisor. More specifically, the Advisor utilizes the following methods:

| · | The Advisor uses a bottom-up selection process to attempt to identify equity securities of companies that appear to be selling at a discount relative to the Advisor’s assessment of their potential value. The Advisor focuses on the cash flows historical profitability, projected future earnings, and financial condition of individual companies in identifying which securities the Small Cap Value Fund may purchase. The Advisor may weigh other factors against a company’s valuation in deciding which companies may appear attractive for investment. These factors may include the following: |

| o | quality of the business franchise, |

| o | economic or market conditions, |

| o | deployment of capital, and |

| o | reputation, experience, and competence of the company’s management. |

| · | The Advisor believes that equity securities purchased at prices below their potential value not only protect capital, but offer significant price appreciation once the market recognizes the particular security’s potential value. |

| · | Generally, securities are sold when the characteristics and factors used to select the security change or the security has appreciated to the point where it is no longer attractive for the Small Cap Value Fund to hold the security in its portfolio of investments. |

| · | In pursuit of its investment objective, the Small Cap Value Fund may invest a significant portion of its assets in one or more sectors of the equity securities market, such as healthcare, technology, natural resources, etc. |

In implementing the investment strategy of the Small Cap Value Fund, the Advisor invests with a multi-year investment horizon rather than focusing on the month or quarter end data. The Advisor does not attempt to make macroeconomic calls (i.e., predict economic growth, interest rates, currency levels, commodity prices etc.). Additionally, the Advisor does not predict the direction of the stock market.

The Small Cap Value Fund may also purchase ETFs in accordance with applicable requirements of the 1940 Act. An ETF is a fund that holds a portfolio of common stocks or bonds designed to track the performance of a securities index or sector of an index, such as the S&P 500. ETFs are traded on a securities exchange (e.g., the American Stock Exchange) based on their market value. An ETF portfolio holds the same stocks or bonds as the index it tracks, so its market price reflects the value of the index at any given time. ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustee fees, and marketing expenses. Therefore, if the Small Cap Value Fund were to become a shareholder in an ETF, the Small Cap Value Fund would be required to pay its proportionate share of the expenses of the ETF.

Other Investments and Temporary Defensive Positions

While each of the Funds’ primary focus is investment in equity securities, each Fund has flexibility to invest in other types of securities when the Advisor believes they offer more attractive opportunities or as a temporary defensive measure in response to adverse market, economic, political, or other conditions, or to meet liquidity, redemption, and short-term investing needs. Each of the Funds may from time to time determine that market conditions warrant investing in investment-grade bonds, U.S. government securities, bank certificates of deposit, bankers’ acceptances, commercial paper, money market instruments, and to the extent permitted by applicable law and the Funds’ investment restrictions, shares of other investment companies. Under such circumstances, the Advisor may invest up to 100% of a Fund’s assets in these investments. To the extent a Fund invests in money market funds or other investment companies, shareholders of that Fund would indirectly pay both that Fund’s expenses and the expenses relating to those other investment companies with respect to the Fund’s assets invested in such investment companies. To the extent a Fund is invested in short-term investments, it will not be pursuing and may not achieve its investment objective. Under normal circumstances, however, each of the Funds will also hold money market instruments or similar type investments for funds awaiting investment, to accumulate cash for anticipated purchases of portfolio securities, to allow for shareholder redemptions, and to provide for funds to pay for operating expenses.

ADDITIONAL INFORMATION ABOUT THE FUNDS’ PRINCIPAL RISKS

An investment in the Funds is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that either of the Funds will be successful in meeting its investment objective. The Advisor’s ability to choose suitable investments has a significant impact on the ability of each Fund to achieve its investment objective. Generally, the Funds will be subject to the following additional principal risks:

| · | Market Risk: Market risk refers to the risk that the value of securities in a Fund’s portfolio may decline due to daily fluctuations in the securities markets generally. A Fund’s performance per share will change daily based on many factors, including fluctuation in interest rates, the quality of the instruments in a Fund’s investment portfolio, national and international economic conditions, general equity market conditions, and other factors and conditions beyond the Advisor’s control. In a declining stock market, stock prices for all companies (including those in a Fund’s portfolio) may decline, regardless of their long-term prospects. Increases or decreases in value of stocks are generally greater than for bonds and other investments. |

| · | Small-Cap and Mid-Cap Securities: Investing in the securities of small-cap and mid-cap companies generally involves substantially greater risk than investing in larger, more established companies. This greater risk is, in part, attributable to the fact that the securities of these companies usually have more limited marketability and, therefore, may be more volatile than securities of larger, more established companies or the market averages in general. Because these companies normally have fewer shares outstanding than larger companies, it may be more difficult to buy or sell significant amounts of such shares without an unfavorable impact on prevailing prices. Another risk factor is that these companies often have limited product lines, markets, or financial resources and may lack management depth. Additionally, these companies are typically subject to greater changes in earnings and business prospects than are larger, more established companies. These companies may not be well-known to the investing public, may not be followed by the financial press or industry analysts, and may not have institutional ownership. These factors affect the Advisor’s access to information about the companies and the stability of the markets for the companies’ securities. These companies may be more vulnerable than larger companies to adverse business or economic developments; the risk exists that the companies will not succeed; and the prices of the companies’ shares could dramatically decline in value. Therefore, an investment in a Fund may involve a substantially greater degree of risk than an investment in other mutual funds that seek capital growth by investing in more established, larger companies. This risk may be particularly greater for the Small Cap Value Fund than the All-Cap Value Fund. |

| · | Large-Cap Securities: Companies with large market capitalizations go in and out of favor based on various market and economic conditions. Prices of securities of larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, a Fund’s value may not rise as much as the value of funds that emphasize companies with smaller market capitalizations. |

| · | Management Style Risk: Different types of securities tend to shift into and out of favor with stock market investors depending on market and economic conditions. Because the Funds invest primarily in value stocks (stocks that the Advisor believes are undervalued), the Funds’ performance may at times be better or worse than the performance of stock funds that focus on other types of stock strategies (e.g. growth stocks), or that have a broader investment style. |

| · | Sector Risk: Sector risk is the possibility that securities within the same group of industries will decline in price due to sector-specific market or economic developments. If a Fund invests more heavily in a particular sector, the value of its shares may be especially sensitive to factors and economic risks that specifically affect that sector. As a result, a Fund’s share price may fluctuate more widely than the value of shares of a mutual fund that invests in a broader range of industries. Additionally, some sectors could be subject to greater government regulation than other sectors. Therefore, changes in regulatory policies for those sectors may have a material effect on the value of securities issued by companies in those sectors. The sectors in which a Fund may invest more heavily will vary. |

| · | Issuer Risk: The value of any of a Fund’s portfolio securities may decline for a number of reasons, which directly relate to the issuer, such as management performance, financial leverage, and reduced demand for the issuer’s goods or services. |

| · | Illiquidity: The Small Cap Value Fund may purchase securities for which there is a lack of liquidity in the markets. If adverse market conditions were to develop during any period in which the Small Cap Value Fund is unable to sell its illiquid holdings, the Small Cap Value Fund may suffer losses as a result of this illiquidity. |

| · | ETF Risks: An investment in an ETF generally presents the same primary risks as an investment in a conventional registered fund (i.e., one that is not exchange traded), including the risk that the general level of stock prices, or that the prices of stocks within a particular sector, may increase or decrease, thereby affecting the value of the shares of an ETF. In addition, all ETFs will have costs and expenses that will be passed on to a Fund and these costs and expenses will in turn increase a Fund’s expenses. ETFs are also subject to the following risks that often do not apply to conventional funds: (1) the market price of the ETF’s shares may trade at a discount to the ETF’s net asset value; as a result, ETFs may experience more price volatility than other types of portfolio investments and such volatility could negatively impact a Fund’s net asset value; (2) an active trading market for an ETF’s shares may not develop or be maintained at a sufficient volume; (3) trading of an ETF’s shares may be halted if the listing exchange deems such action appropriate; and (4) ETF shares may be delisted from the exchange on which they trade, or “circuit breakers” (which are tied to large decreases in stock prices) used by the exchange may temporarily halt trading in the ETF’s stock. ETFs are also subject to the risks of the underlying securities or sectors that the ETF is designed to track. Finally, there may be legal limitations and other conditions imposed by Securities and Exchange Commission (“SEC”) rules on the amount of ETF shares that a Fund may acquire. |

| · | Portfolio Turnover Risk: A Fund may sell portfolio securities without regard to the length of time they have been held in order to take advantage of new investment opportunities or changing market conditions. As portfolio turnover may involve brokerage commissions and other transaction costs, there could be additional expenses for a Fund. High rates of portfolio turnover may also result in the realization of short-term capital gains. The payment of taxes on these gains could adversely affect a Fund’s performance. Any distributions resulting from such gains will be considered ordinary income for federal income tax purposes. Although each Fund is subject to portfolio turnover risk, this risk may be particularly higher for the Small Cap Value Fund. See the “Financial Highlights” section of this Prospectus for the All-Cap Value Fund’s portfolio turnover rates for prior periods. |

See also “Risk Factors,” and “Investment Policies,” and “Investment Restrictions” discussed in the Statement of Additional Information that is incorporated herein by reference and made a part hereof.

The Funds’ Investment Advisor

The Funds’ investment advisor is Dalton, Greiner, Hartman, Maher & Co., LLC, a Delaware limited liability company, whose address is 565 Fifth Avenue, Suite 2101, New York, New York 10017. The Advisor serves in this capacity pursuant to an investment advisory agreement with the Trust with respect to each Fund. Subject to the authority of the Board of Trustees of the Trust (“Trustees”), the Advisor provides guidance and policy direction in connection with its daily management of each Fund’s assets. The Advisor is also responsible for the selection of broker-dealers for executing portfolio transactions, subject to the brokerage policies established by the Trustees, and the provision of certain executive personnel to the Funds.

The Advisor was organized in 1982 as Dillon Read Capital, the money management subsidiary of Dillon, Read & Co., Inc., formerly an investment bank. The Advisor is currently 80% owned by Boston Private Financial Holdings, Inc., which is organized as a bank holding company focusing on wealth management through private banking and investment services. The remaining 20% interest in the Advisor is employee owned. As of December 31, 2009, the Advisor had approximately $1.1 billion in assets under management.

Historical Performance of Accounts Similar to the All-Cap Value Fund. The table in this section shows supplemental performance data for DGHM All-Cap Value Composite (“DGHM All-Cap Value Composite”), which is intended to assist prospective investors in making informed investment decisions. The table contained does not show performance data for the All-Cap Value Fund. The DGHM All-Cap Value Composite is composed of accounts that are managed by the Advisor and that have investment objectives, strategies, and policies substantially similar to the All-Cap Value Fund. The DGHM All-Cap Value Composite is presented net of fees and expenses and reflects the reinvestment of dividends and distributions.

The DGHM All-Cap Value Composite performance is not the All-Cap Value Fund’s performance, nor should it be considered a substitute for the All-Cap Value Fund’s performance. The DHGM All-Cap Value Composite performance is not intended to predict or suggest the return that will be experienced by the All-Cap Value Fund or the return one might achieve by investing in the All-Cap Value Fund. The All-Cap Value Fund’s performance may be different than the performance of the DGHM All-Cap Value Composite due to, among other things, differences in fees and expenses, investment limitations, diversification requirements, and tax restrictions. The overall expenses of the accounts comprising the DGHM All-Cap Value Composite are generally lower than those of the All-Cap Value Fund and, accordingly, expenses generally have less of an adverse effect on the performance of the DGHM All-Cap Value Composite. Also, the accounts that comprise the DGHM All-Cap Value Composite are not registered mutual funds and are not subject to certain investment limitations, diversification requirements, and other restrictions imposed on mutual funds by the 1940 Act and the Internal Revenue Code, which, if applicable, could adversely affect the performance of the DGHM All-Cap Value Composite.

Average Annual Total Returns Periods Ended December 31, 2009 | Past 1 Year | Past 3 Years | Past 5 Years | Past 10 Years |

| DGHM All-Cap Value Composite | 28.93 | 1.30 | 5.48 | 9.36 |

| Russell 3000® Value Index* | 19.76 | -8.90 | -0.24 | 2.88 |

| * | The Russell 3000® Value Index is generally considered to be representative of the performance of unmanaged common stocks that comprise the broad value segment of the U.S. securities markets. You cannot invest directly in this index. This index does not have an investment advisor and does not pay any commissions, expenses, or taxes. If this index did pay commissions, expenses, or taxes, its returns would be lower. |

Historical Performance of Accounts Similar to the Small Cap Value Fund. The table in this section shows supplemental performance data for DGHM Small Cap Value Composite (“DGHM Small Cap Value Composite”), which is intended to assist prospective investors in making informed investment decisions. The table does not show performance data for the Small Cap Value Fund. The DGHM Small Cap Value Composite is composed of accounts that are managed by the Advisor and that have investment objectives, strategies, and policies substantially similar to the Small Cap Value Fund. The DGHM Small Cap Value Composite is presented net of fees and expenses and reflects the reinvestment of dividends and distributions.

The DGHM Small Cap Value Composite performance is not the Small Cap Value Fund’s performance, nor should it be considered a substitute for the Small Cap Value Fund’s performance. The DHGM Small Cap Value Composite performance is not intended to predict or suggest the return that will be experienced by the Small Cap Value Fund or the return one might achieve by investing in the Small Cap Value Fund. The Small Cap Value Fund’s performance may be different than the performance of the DGHM Small Cap Value Composite due to, among other things, differences in fees and expenses, investment limitations, diversification requirements, and tax restrictions. The overall expenses of the accounts comprising the DGHM Small Cap Value Composite are generally lower than those of the Small Cap Value Fund and, accordingly, expenses generally have less of an adverse effect on the performance of the DGHM Small Cap Value Composite. Also, the accounts that comprise the DGHM Small Cap Value Composite are not registered mutual funds and are not subject to certain investment limitations, diversification requirements, and other restrictions imposed on mutual funds by the 1940 Act and the Internal Revenue Code, which, if applicable, could adversely affect the performance of the DGHM Small Cap Value Composite.

Average Annual Total Returns Periods Ended December 31, 2009 | Past 1 Year | Past 3 Years | Past 5 Years | Past 10 Years |

| DGHM Small Cap Value Composite | 21.21 | -0.75 | 3.00 | 10.59 |

| Russell 2000® Value Index* | 20.58 | -8.21 | -0.01 | 8.26 |

| * | The Russell 2000® Value Index measures the small-capitalization value sector of the U.S. equity market. It is a subset of the Russell 2000 Index. The Russell 2000® Value Index is capitalization –weighted and consists of those companies, or portion of a company, with lower price-to-book ratios and lower forecasted growth within the Russell 2000 Index. You cannot invest directly in this index. This index does not have an investment advisor and does not pay any commissions, expenses, or taxes. If this index did pay commissions, expenses, or taxes, its returns would be lower. |

Brokerage Practices. In selecting brokers and dealers to execute portfolio transactions, the Advisor may consider research and brokerage services furnished to the Advisor or its affiliates. The Advisor may not consider sales of shares of a Fund as a factor in the selection of brokers and dealers, but may place portfolio transactions with brokers and dealers that promote or sell a Fund’s shares so long as such transactions are done in accordance with the policies and procedures established by the Trustees that are designed to ensure that the selection is based on the quality of execution and not on sales efforts. When placing portfolio transactions with a broker or dealer, the Advisor may aggregate securities to be sold or purchased for the Fund with those to be sold or purchased for other advisory accounts managed by the Advisor. In aggregating such securities, the Advisor will average the transaction as to price and will allocate available investments in a manner that the Advisor believes to be fair and reasonable to the Fund and such other advisory accounts. An aggregated order will generally be allocated on a pro rata basis among all participating accounts, based on the relative dollar values of the participating accounts, or using any other method deemed to be fair to the participating accounts, with any exceptions to such methods involving the Trust being reported to the Trustees.

The Advisor’s Compensation. Under the investment advisory agreements for the Funds, the Advisor is entitled to receive monthly compensation based on each Fund’s average daily net assets at the annual rates of 0.65% for the All-Cap Value Fund and 0.80% for the Small Cap Value Fund. Prior to March 1, 2010, the investment advisory agreement for the All-Cap Value Fund provided for compensation to the Advisor at the annual rate of 0.75%. For the fiscal year ended February 28, 2010, the Advisor received its full compensation at the annual rate of 0.75%. A discussion regarding the basis for the Board of Trustees approving the investment advisory agreement for the All-Cap Value Fund is available in that Fund’s annual report for the period ending February 28, 2010. A discussion regarding the basis for the Board of Trustees approving the investment advisory agreement for the Small Cap Value Fund will be available in that Fund’s semi-annual report for the period ending August 31, 2010 once that report is produced.

Expense Limitation Agreement. The Advisor has entered into an Expense Limitation Agreement with the Trust, with respect to each Fund, under which the Advisor has agreed to waive or reduce its fees and to assume other expenses of the Funds, if necessary, in an amount that limits "Total Annual Fund Operating Expenses" (exclusive of interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of a Fund’s business, dividend expense on short sales and, expenses incurred under a plan of distribution adopted pursuant to Rule 12b-1 under the 1940 Act, if applicable) to not more than 1.50% and 1.65% of the average daily net assets of All-Cap Value Fund and the Small Cap Value Fund, respectively, through June 30, 2011. In determining a Fund’s total operating expenses, expenses that the Fund would have incurred but did not actually pay because of expense offset or brokerage services arrangements shall be added to the aggregate expenses so as not to benefit the Advisor. Additionally, fees reimbursed to a Fund relating to brokerage/services arrangements shall not be taken into account in determining a Fund’s total operating expenses so as to benefit the Advisor. Finally, the Expense Limitation Agreement excludes any "acquired fund fees and expenses." In addition, the Advisor may be entitled to reimbursement of fees waived or remitted by the Advisor to the Funds. The total amount of reimbursement shall be the sum of all fees previously waived or reduced by the Advisor and all other payments remitted by the Advisor to a Fund during any of the previous three fiscal years, less any reimbursement previously paid by a Fund to the Advisor with respect to such waivers, reductions and payments. Amounts reimbursed may not cause a Fund to exceed its expense limit. It is expected that the Expense Limitation Agreement will continue from year-to-year with respect to each Fund provided such continuance is specifically approved by a majority of the Trustees who are not "interested persons" of the Trust or any other party to the Expense Limitation Agreement, as such term is defined in the 1940 Act. The Trust may terminate the Expense Limitation Agreement at any time with respect to either Fund. The Advisor may also terminate the Expense Limitation Agreement with respect to either Fund at the end of the then-current term upon not less than 90-days’ notice to the Trust.

The Funds’ Portfolio Managers

The Advisor utilizes a management team approach with respect to each Fund and the management team is primarily responsible for the day-to-day management of each Fund. The management team is comprised of various professional investment personnel of the Advisor. The individuals on the management team that have the most significant responsibility for the day-to-day management of each of the Funds are Timothy G. Dalton, Bruce H. Geller, Jeffrey C. Baker and Peter A. Gulli.

Mr. Dalton is the Advisor’s Chairman and has served in this role since 1990. Mr. Dalton was the Advisor’s Chief Investment Officer from 1990 to 2005. Mr. Geller is the Advisor’s Chief Executive Officer and served as the Advisor’s Co-President since 2005 and was the Advisor’s Executive Vice President from 2000 to 2005. Mr. Baker has served as the Advisor’s Executive Vice President since 2005 and became the Advisor’s Chief Investment Officer in 2006. Mr. Baker was the Advisor’s Senior Vice President from 2002 to 2005 and Vice President from 2000 to 2002. Mr. Baker also serves as a Trustee and President of the Trust and as the Trust’s Principal Executive Officer with respect to the All-Cap Value Fund. Mr. Gulli joined the Advisor in 1999 and is a Senior Vice President. Each of the aforementioned individuals serves as a sector analyst and is responsible for stock selection within their defined sectors and each carries the Certified Financial Analyst (CFA) designation. The management team members (other than Mr. Gulli) have served as portfolio managers for the All-Cap Value Fund since that fund’s inception in 2007. The management team members have served as portfolio managers for the Small Cap Value Fund since that fund’s inception in 2010

The Funds’ SAI provides additional information about the portfolio managers’ compensation, other assets managed by the portfolio managers, and the portfolio managers’ ownership of securities in the Funds.

Board of Trustees

The Funds are series portfolios of the Trust, an open-end management investment company organized as a Delaware statutory trust on July 27, 2006. The Trustees supervise the operations of the Funds according to applicable state and federal law, and the Trustees are responsible for the overall management of the Funds’ business affairs.

Administrator

Commonwealth Shareholder Services, Inc. (the "Administrator") assists the Trust in the performance of its administrative responsibilities to the Fund, coordinates the services of each vendor of the Funds, and provides the Funds with certain administrative and compliance services. In addition, the Administrator makes available the office space, equipment, personnel, and facilities required to provide these services to the Funds.

Transfer Agent

Commonwealth Fund Services, Inc. (the "Transfer Agent") serves as the transfer agent and dividend-disbursing agent of the Funds. As indicated later in this Prospectus under the caption "Investing in the Fund," the Transfer Agent handles orders to purchase and redeem shares of the Funds and disburses dividends paid by the Funds.

Distributor

First Dominion Capital Corp. (the "Distributor"), the offices of which are located at 8730 Stony Point Pkwy, Ste, Richmond, VA 23235, is the principal underwriter and distributor of the Funds’ shares and serves as the Funds’ exclusive agent for the distribution of the Funds’ shares. The Distributor may sell the Funds’ shares to or through qualified securities dealers or other approved entities.

Each of the Funds has adopted Distribution Plans in accordance with Rule 12b-1 under the 1940 Act. Pursuant to each of the Distribution Plans, the Funds compensate the Distributor for services rendered and expenses borne in connection with activities primarily intended to result in the sale of each Fund’s shares (this compensation is commonly referred to as "12b-1 fees"). The Distribution Plans provide that the Funds will pay the annual rate of up to 0.25% of the average daily net assets of each Fund’s Investor Class Shares and 1.00% of the average daily net assets of each Fund’s Class C Shares for activities primarily intended to result in the sale of those shares. These activities include reimbursement to entities for providing distribution and shareholder servicing with respect to each Fund’s shares. The 0.25% fee for the Investor Class Shares is a service fee. The 1.00% fee for the Class C Shares is comprised of a 0.25% service fee and a 0.75% distribution fee. Because the 12b-1 fees are paid out of the Funds’ assets on an on-going basis, these fees, over time, will increase the cost of your investment and may cost you more than paying other types of sales charges. The Institutional Class Shares are sold without the imposition of 12b-1 fees.

Other Expenses.

In addition to the 12b-1 fees and the investment advisory fees, the Funds pay all expenses not assumed by the Advisor, including, without limitation, the following: the fees and expenses of its independent accountants and legal counsel; the costs of printing and mailing to shareholders annual and semi-annual reports, proxy statements, prospectuses, statements of additional information, and supplements thereto; the costs of printing registration statements; bank transaction charges and custodian’s fees; any proxy solicitors’ fees and expenses; filing fees; any federal, state, or local income or other taxes; any interest; any membership fees of the Investment Company Institute and similar organizations; fidelity bond and Trustees’ liability insurance premiums; and any extraordinary expenses, such as indemnification payments or damages awarded in litigation or settlements made.

Portfolio Holdings

A description of the Funds’ policies and procedures with respect to the disclosure of the Funds’ portfolio securities is available in the Funds’ Statement of Additional Information. Complete holdings (as of the dates of such reports) are available in reports on Form N-Q and Form N-CSR filed with the SEC.

Purchase Options

The Funds offer three different classes of shares through this Prospectus. Fund shares may be purchased by any account managed by the Advisor and any other institutional investor or any broker-dealer authorized to sell shares in the Funds. The share classes available to an investor may vary depending on how the investor wishes to purchase shares of the Funds. The following is a summary of each share class.

Investor Class Shares

| · | No front-end sales charge or contingent deferred sales charge. |

| · | Distribution and service plan (Rule 12b-1) fees of 0.25%. |

| · | $2,500 minimum investment ($2,500 for IRAs). |

| · | $500 minimum additional investments ($100 for those participating in an automatic investment plan). |

| · | No maximum purchase per transaction. |

Institutional Class Shares

| · | No front-end sales charge or contingent deferred sales charge. |

| · | No distribution and service plan (Rule 12b-1) fees. |

| · | $100,000 minimum investment. |

| · | $500 minimum additional investments ($100 for those participating in an automatic investment plan). |

| · | No maximum purchase per transaction. |

Class C Shares

| · | No front-end sales charge. |

| · | A 1.00% contingent deferred sales charge on shares redeemed within one year of purchase. |

| · | Distribution and service plan (Rule 12b-1) fees of 1.00%. |

| · | $1,000 minimum investment ($1,000 for IRAs). |

| · | $500 minimum additional investments ($100 for those participating in an automatic investment plan). |

| · | No maximum purchase per transaction. |

| · | Automatic conversion to Investor Class Shares seven years after purchase. |