QuickLinks -- Click here to rapidly navigate through this documentAs Filed with the Securities and Exchange Commission on April 6, 2007

Registration No. 333-138425

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

MXENERGY HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

| |

| |

|

|---|

| Delaware | | 4924 | | 20-2930908 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

595 Summer Street, Suite 300

Stamford, CT 06901

(203) 356-1318

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

SEE TABLE OF ADDITIONAL REGISTRANTS

| |

|

|---|

JEFFREY MAYER

President and Chief Executive Officer

595 Summer Street, Suite 300

Stamford, CT 06901

(203) 356-1318

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent For Service) | | Copies to:

MICHAEL CHERNICK, ESQ.

Paul, Hastings, Janofsky & Walker LLP

75 E. 55th Street

New York, NY 10022

(212) 318-6000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number on the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date, as the Commission, acting pursuant to said Section 8(a), may determine.

MXENERGY HOLDINGS INC.

TABLE OF ADDITIONAL REGISTRANTS

NAME

| | STATE OF

INCORPORATION/

FORMATION

| | PRIMARY STANDARD

INDUSTRIAL

CLASSIFICATION

CODE NUMBER

| | IRS EMPLOYER

IDENTIFICATION NO.

|

|---|

| MxEnergy Capital Holdings Corp | | DE | | 4924 | | 20-3288717 |

| MxEnergy Capital Corp | | DE | | 4924 | | 20-3288797 |

| MxEnergy Gas Capital Holdings Corp | | DE | | 4931 | | 20-3288871 |

| MxEnergy Electric Capital Holdings Corp. | | DE | | 4931 | | 20-3288943 |

| MxEnergy Gas Capital Corp. | | DE | | 4924 | | 20-3288904 |

| MxEnergy Electric Capital Corp. | | DE | | 4931 | | 20-3289101 |

| MxEnergy Inc. | | DE | | 4924 | | 06-1543530 |

| MxEnergy Electric Inc. | | DE | | 4931 | | 05-0572938 |

| Total Gas & Electricity (PA), Inc. | | FL | | 4931 | | 65-0841209 |

| Online Choice Inc. | | DE | | 7380 | | 30-0146844 |

| MxEnergy Services Inc. | | DE | | 9995 | | 20-2931858 |

| Infometer.com Inc. | | DE | | 4932 | | 06-1559733 |

The address, including zip code and telephone number, including area code, of the principal offices of the additional registrants listed above is: 595 Summer Street, Suite 300, Stamford, CT 06901 and the telephone number at that address is (203) 356-1318.

Subject to Completion, dated April 6, 2007

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Prospectus

$190,000,000

Offer to Exchange

Floating Rate Senior Notes due 2011,

which have been registered under the Securities Act of 1933,

for any and all outstanding

Floating Rate Senior Notes due 2011,

which have not been registered under the Securities Act of 1933,

of

MxEnergy Holdings Inc.

- •

- We will exchange all original notes that are validly tendered and not withdrawn before the end of the exchange offer for an equal principal amount of new notes that we have registered under the Securities Act of 1933.

- •

- The new notes are substantially identical to the original notes except that, unlike the original notes, the new notes will have no transfer restrictions or registration rights.

- •

- This exchange offer expires at 5:00 p.m., New York City time, on , 2007, unless extended.

- •

- No public market exists for the original notes or the new notes. We do not intend to list the new notes on any securities exchange or to seek approval for quotation through any automated quotation system.

- •

- The new notes will be general unsecured obligations and will rank equally with all of our existing and future unsecured debt.

- •

- All of our domestic restricted subsidiaries will fully and unconditionally guarantee the new notes on a senior basis. The new guarantees will be unsecured obligations of our subsidiary guarantors ranking equally with all their existing and future unsecured senior debt.

- •

- The new notes and the new guarantees will be effectively subordinated to all of our and our subsidiary guarantors' secured debt to the extent of the value of the assets securing such debt.

See "Risk Factors" beginning on page 11 for a discussion of the risks that holders should consider prior to making a decision to exchange original notes for new notes.

Each broker-dealer that receives the new notes pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with the resale of the new notes. If the broker-dealer acquired the original notes as a result of market making or other trading activities, the broker-dealer may use the prospectus for the exchange offer, as supplemented or amended, in connection with the resale of the new notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

This prospectus incorporates important business and financial information about the company that is not included in or delivered with this prospectus. Such information is available without charge to security holders upon written or oral request. Please send written requests to the General Counsel at MxEnergy Holdings Inc., 595 Summer Street, Suite 300, Stamford, Connecticut 06901 or call (203) 356-1318. To obtain timely delivery, security holders must request the information no later than , 2007 which is five business days before the expiration date of the exchange offer.

TABLE OF CONTENTS

| Market and Industry Data | | i |

| Prospectus Summary | | 1 |

| Risk Factors | | 11 |

| Special Note Regarding Forward-Looking Statements | | 23 |

| The Exchange Offer | | 25 |

| Use of Proceeds | | 35 |

| Capitalization | | 36 |

| Unaudited Pro Forma Condensed Consolidated Financial Statements | | 37 |

| Selected Historical Financial and Other Data of MXenergy | | 46 |

| Selected Historical Financial and Other Data of SESCo | | 49 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 50 |

| Industry Overview | | 76 |

| Business | | 79 |

| Management | | 96 |

| Security Ownership of Certain Beneficial Owners and Management | | 109 |

| Certain Relationships and Related Transactions | | 113 |

| Description of Other Indebtedness | | 115 |

| Description of New Notes | | 118 |

| Material U.S. Federal Income Tax Consequences | | 150 |

| Plan of Distribution | | 156 |

| Legal Matters | | 157 |

| Experts | | 157 |

| Where You Can Find More Information | | 157 |

| Index to Consolidated Financial Statements and Financial Statement Schedule | | F-1 |

MARKET AND INDUSTRY DATA

Market and industry data and other statistical information and forecasts used in this prospectus, including information relating to our relative position in our industry, is based on publicly available industry and government publications. Some of the data, statistical information and forecasts are also based on our good faith estimates, which are derived from management's review of internal surveys, and other independent sources and publicly available information. Market share data and other market capacity data are generally based upon information from customers and internal estimates derived from information gathered by our sales and marketing force in connection with their roles, although occasionally local distribution companies have disclosed relative market shares of participants.

i

PROSPECTUS SUMMARY

This summary highlights information appearing in other sections of this prospectus. This summary is not complete and may not contain all of the information you should consider prior to making a decision to exchange original notes for new notes. You should read this entire prospectus carefully, including the "Risk Factors" section beginning on page 11 and the financial statements and related notes included elsewhere in this prospectus.

In this prospectus, the term "Issuer" refers to MxEnergy Holdings Inc., a Delaware corporation and the issuer of the original notes and the new notes, the term "MXenergy" refers to the Issuer and its subsidiaries before giving effect to the acquisition of the assets of Shell Energy Services Company, L.L.C., a Delaware limited liability company which is referred to herein as "SESCo," which acquisition took place on August 1, 2006. Unless the context requires otherwise, the terms "Company," "we," "us," "our," or similar terms, refer to MXenergy after giving effect to the acquisition of the SESCo assets.

References in this prospectus to "RCEs" refer to residential customer equivalents, each of which represents a natural gas customer with a standard consumption of 100 MMBtus per year or an electricity customer with a standard consumption of 10 MWhrs per year. This represents the approximate amount of natural gas or power used by a typical household in the northeastern United States. "MMBtu" refers to a million British thermal units, a standard unit of heating equivalent measure for natural gas. A unit of heat equal to 1,000,000 Btus, or 1 MMBtu, is the thermal equivalent of almost 1,000 cubic feet of natural gas. "MWhrs" refers to a million watt hours or a thousand kilowatt hours, which is the amount of electric energy produced or consumed in one hour expressed in megawatts.

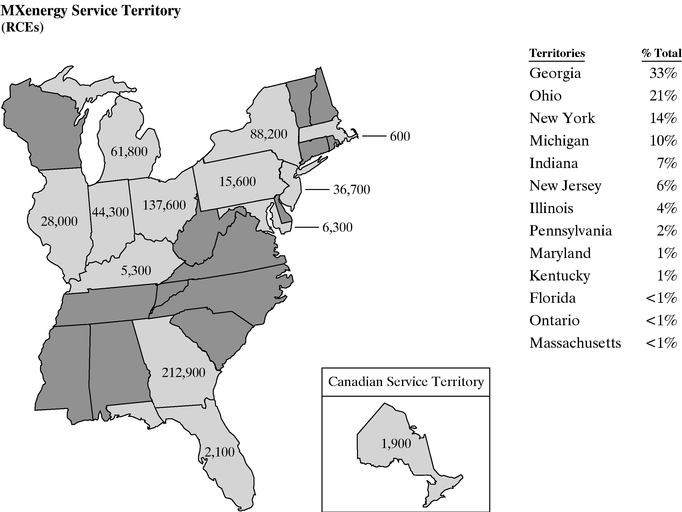

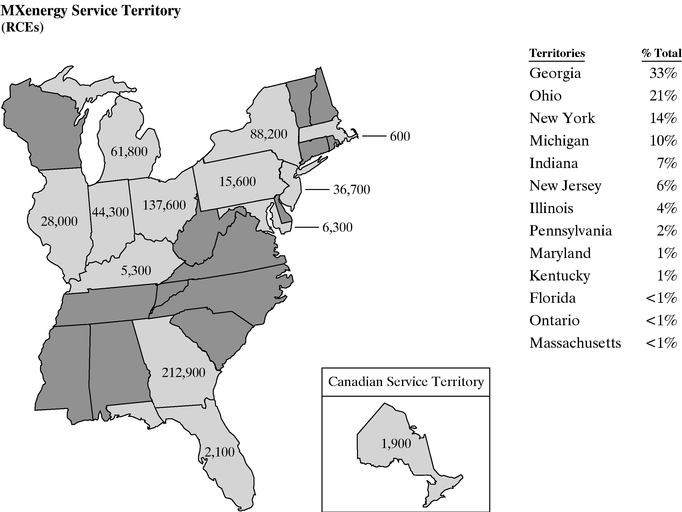

The Company

We are an independent energy provider of retail natural gas and electric power to residential and commercial customers in deregulated markets in the U.S. and Canada. We serve natural gas customers located in 28 market areas across 11 states and Ontario, Canada, and electricity customers in six market areas in Massachusetts and New York.

We provide customers a choice in natural gas and electricity supply with alternative price structures. We principally market two products: (i) fixed price contracts with terms of up to three years that provide consumers with price protection against fluctuations in natural gas and electricity prices and (ii) variable price contracts that are usually priced competitively with the price offered by the region's incumbent utility. We derive margin or gross profit from the difference between the price at which we are able to sell natural gas or electricity to customers and the price at which we purchase the offsetting volumes. Both natural gas and electricity are supplied to the consumer using the distribution infrastructure of the respective local distribution company, or LDC, which is the natural gas distributor for a particular geographic franchise area.

It is our policy to match the estimated requirements of fixed price customers by purchasing or hedging offsetting volumes of natural gas and electricity in advance of entering into a fixed price contract with our customers. Due to the price volatility of natural gas and electricity, we believe it more prudent to purchase anticipatory hedges in line with short term marketing estimates for sales of fixed price contracts to residential and small commercial customers instead of purchasing hedges after such sales are made. Any unused anticipatory hedges are typically sold within a short period of time or the volumes are applied toward fixed price customers whose contracts come up for renewal. In addition, our forward hedged volumes are reduced by the amount of attrition we expect to realize over the customers' contract terms. By following a policy of purchasing or hedging all estimated fixed price customer supply obligations in advance, we are able to achieve more stable and predictable cash flows.

1

We have grown both organically and through acquisitions, having completed six acquisitions since 1999 not including the acquisition of SESCo's assets (see discussion below).

On August 1, 2006, MXenergy acquired substantially all of the assets of SESCo, a wholly owned subsidiary of Shell Oil Company, serving primarily residential and small commercial markets. As of August 1, 2006, SESCo supplied natural gas to approximately 315,000 residential and small commercial residential customer equivalents, or RCEs, in the deregulated markets of Georgia and Ohio. Such transaction is referred to herein as the SESCo acquisition. In addition to expanding MXenergy's relationships with customers in two LDC markets it already serves in Ohio, the SESCo acquisition also expanded MXenergy's operations in Ohio to include customers in the service territory of Vectren Energy Delivery of Ohio, or Vectren, and added Georgia to the list of states in which MXenergy operates. We consummated the SESCo acquisition with the proceeds from a $190.0 million senior unsecured loan, referred to herein as the bridge loan. On August 4, 2006, we sold $190.0 million aggregate principal amount of Floating Rate Senior Notes due 2011, referred to herein as the notes, in a Rule 144A offering. The net proceeds from the sale of the notes were used to repay the bridge loan. The aggregate consideration payable in connection with the purchase equaled $125.5 million, subject to certain post closing adjustments. See Note 14 to our June 30, 2006 consolidated financial statements included elsewhere in this prospectus.

Concurrently with the closing of the SESCo acquisition, we entered into a committed exclusive hedge facility with Société Générale, referred to herein as the hedge facility. The hedge facility has an initial term of two years with subsequent one year renewal terms. The hedge facility provides us with the ability to enter into financial swaps based on settlement prices of the New York Mercantile Exchange, or NYMEX, natural gas contract for the Henry Hub delivery point as well as basis swaps settled against widely published indices for a tenor of up to 39 months. The hedge facility is secured by a first lien on customer contracts and a second lien on substantially all other assets of the Company. We will continue to procure physical supply for customers in LDC markets where MXenergy operated prior to the SESCo acquisition under our agreement with Virginia Power Energy Marketing, or VPEM, through the end of its term (June 30, 2007). We will purchase physical supply for customers in Georgia, the Vectren LDC market in Ohio and any new LDC market we may enter from a portfolio of energy suppliers under standard North American Energy Standards Board contracts.

Concurrently with the SESCo acquisition, we amended and restated our existing credit facility with Société Générale and a syndicate of lenders. The amended and restated revolving credit facility, which is referred to herein as the revolving credit facility, provides up to $280.0 million of borrowing availability and is secured by a second priority lien on customer contracts and a first priority lien on substantially all of our and our subsidiaries' other existing and future assets.

In this prospectus, the offering of the notes, the funding and repayment of the bridge loan, the SESCo acquisition and the payment of related fees and expenses are referred to as the Transactions.

Competitive Strategies

Our retail energy sales depend upon our ability to identify and enter profitable, deregulated, retail energy markets, manage the cost of customer acquisitions, integrate acquired businesses successfully, retain customers and attract new customers in our existing markets. The principal components of our strategy are to:

- •

- offer a competitively priced product;

- •

- maintain prudent and proven hedging and risk management policies;

- •

- build and maintain an excellent commodity supply team;

- •

- pursue organic growth and opportunistic acquisitions;

- •

- maintain a low cost operating structure;

- •

- uphold high customer service standards; and

- •

- leverage our investment in information systems.

Our principal executive offices are located at 595 Summer Street, Stamford, CT 06901, and our telephone number is (203) 356-1318. Our website address iswww.mxenergy.com. The information on our website is not deemed to be part of this prospectus.

2

The Exchange Offer

The summary below describes the principal terms of the new notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of New Notes" section of this prospectus contains a more detailed description of the terms and conditions of the new notes.

| The Exchange Offer | | We are offering to exchange up to $190,000,000 aggregate principal amount of our new floating rate senior notes due 2011 for up to $190,000,000 aggregate principal amount of our original floating rate senior notes due 2011, which are currently outstanding. Original notes may only be exchanged in $1,000 principal increments. In order to be exchanged, an original note must be properly tendered and accepted. All original notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer will be exchanged promptly upon such expiration. Any original notes not accepted for tender for any reason will be returned promptly after termination or expiration of the exchange offer. |

Resales Without Further Registration |

|

We believe that the new notes issued pursuant to the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act of 1933, as amended, or the Securities Act, provided that: |

|

|

• |

you are acquiring the new notes issued in the exchange offer in the ordinary course of your business; |

|

|

• |

you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, the distribution of the new notes issued to you in the exchange offer in violation of the provisions of the Securities Act; and |

|

|

• |

you are not our "affiliate," as defined under Rule 405 of the Securities Act. |

|

|

Each broker-dealer that receives new notes for its own account in exchange for original notes, where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, may be deemed to be a statutory underwriter within the meaning of the Securities Act and must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. |

|

|

The letter of transmittal states that, by so acknowledging that it will deliver and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed to use our reasonable best efforts to make this prospectus, as amended or supplemented, available to any broker-dealer for a period of 90 days after the date of this prospectus for use in connection with any such resale. See "Plan of Distribution." |

|

|

|

|

3

Expiration Date |

|

5:00 p.m., New York City time, on , 2007, unless we extend the exchange offer. |

Accrued Interest on the New Notes and Original Notes |

|

The new notes will bear interest from August 4, 2006 or the last interest payment date on which interest was paid on the original notes surrendered in exchange therefor. Holders of original notes that are accepted for exchange will be deemed to have waived the right to receive any payment in respect of interest on such original notes accrued to the date of issuance of the new notes. |

Conditions to the Exchange Offer |

|

The exchange offer is subject to certain customary conditions which we may waive. See "The Exchange Offer—Conditions." |

Procedures for Tendering Original Notes |

|

Each holder of original notes wishing to accept the exchange offer must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal; or if the original notes are tendered in accordance with the book-entry procedures described in this prospectus, the tendering holder must transmit an agent's message to the exchange agent at the address listed in this prospectus. You must mail or otherwise deliver the required documentation together with the original notes to the exchange agent. |

Special Procedures for Beneficial Holders |

|

If you beneficially own original notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your original notes in the exchange offer, you should contact such registered holder promptly and instruct them to tender on your behalf. If you wish to tender on your own behalf, you must, before completing and executing the letter of transmittal for the exchange offer and delivering your original notes, either arrange to have your original notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

Guaranteed Delivery Procedures |

|

You must comply with the applicable guaranteed delivery procedures for tendering if you wish to tender your original notes and: |

|

|

• |

your original notes are not immediately available; or |

|

|

• |

time will not permit your required documents to reach the exchange agent prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer; or |

|

|

• |

you cannot complete the procedures for delivery by book-entry transfer prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

| | | | |

4

Withdrawal Rights |

|

You may withdraw your tender of original notes at any time prior to 5:00 p.m., New York City time, on the date the exchange offer expires. |

Failure to Exchange Will Affect You Adversely |

|

If you are eligible to participate in the exchange offer and you do not tender your original notes, you will not have further exchange or registration rights and your original notes will continue to be subject to restrictions on transfer under the Securities Act. Accordingly, the liquidity of the original notes will be adversely affected. |

Material United States Federal Income Tax Consequences |

|

The exchange of original notes for new notes pursuant to the exchange offer will not result in a taxable event. Accordingly, we believe that: |

|

|

• |

no gain or loss will be realized by a United States holder upon receipt of a new note; |

|

|

• |

holder's holding period for the new notes will include the holding period of the original notes; and |

|

|

• |

the adjusted tax basis of the new notes will be the same as the adjusted tax basis of the original notes exchanged at the time of such exchange. |

|

|

See "Material U.S. Federal Income Tax Consequences." |

Exchange Agent |

|

Deutsche Bank Trust Company Americas is serving as exchange agent in connection with the Exchange Offer. Deliveries by hand, registered, certified, first class or overnight mail should be addressed to DB Services Tennessee, Inc., Reorganization Unit, P.O. Box 292737, Nashville, TN 37229-2737, Reference: MxEnergy Holdings Inc. Exchange. For information with respect to the Exchange Offer, contact the Exchange Agent at telephone number (800) 735-7777 or facsimile number (615) 835-3701. |

Use of Proceeds |

|

We will not receive any proceeds from the exchange offer. See "Use of Proceeds." |

5

Summary of Terms of New Notes

The exchange offer constitutes an offer to exchange up to $190,000,000 million aggregate principal amount of the new notes for up to an equal aggregate principal amount of the original notes. The new notes will be obligations of MxEnergy Holdings Inc. evidencing the same indebtedness as the original notes, and will be entitled to the benefit of the same indenture. The form and terms of the new notes are substantially the same as the form and terms of the original notes except that the new notes have been registered under the Securities Act. See "Description of New Notes."

Terms of New Notes

| Issuer | | MxEnergy Holdings Inc. |

Notes Offered |

|

The form and terms of the new notes will be the same as the form and terms of the original notes except that: |

|

|

• |

the new notes will bear a different CUSIP number from the original notes; |

|

|

• |

the new notes have been registered under the Securities Act and, therefore, will not bear legends restricting their transfer; and |

|

|

• |

you will not be entitled to any exchange or registration rights with respect to the new notes. |

|

|

The new notes will evidence the same debt as the original notes. They will be entitled to the benefits of the indenture governing the original notes and will be treated under the indenture as a single class with the original notes. We refer to the new notes and the original notes collectively as the notes in this prospectus. |

Maturity Date |

|

August 1, 2011. |

Interest Rate |

|

The notes will bear interest at a rate of LIBOR plus 7.5%. Interest on the notes will be reset semi-annually. |

Interest Payment Dates |

|

Interest will be paid on each February 1 and August 1. The first interest payment date on the new notes will be August 1, 2007. |

Subsidiary Guarantees |

|

Each of the Issuer's domestic subsidiaries will jointly and severally, fully and unconditionally guarantee the notes on a senior basis. |

Ranking |

|

The original notes are, and the new notes will be: |

|

|

• |

senior unsecured obligations of the Issuer, |

|

|

• |

rank equally in right of payment with the Issuer's existing and future senior unsecured obligations, |

|

|

• |

senior to all of the Issuer's existing and future subordinated indebtedness, and |

|

|

• |

effectively subordinated to any of the Issuer's existing and future secured debt, to the extent of the value of the assets securing such debt, which debt would include amounts outstanding under our revolving credit facility. |

| | | | |

6

|

|

The subsidiaries' guarantees of the original notes ranked, and the subsidiaries' guarantees of the new notes will rank: |

|

|

• |

equally with existing and future senior unsecured obligations of such subsidiaries, |

|

|

• |

senior to all existing and future subordinated indebtedness of such subsidiaries, and |

|

|

• |

effectively subordinated to any of such subsidiaries' existing and future secured debt, to the extent of the value of the assets securing such debt. |

|

|

At December 31, 2006, we had $11 million of borrowings outstanding under our Sowood credit facility in addition to the debt outstanding under the notes. |

Optional Redemption |

|

Except as described below, the Issuer cannot redeem the notes prior to maturity. |

Optional Redemption After Equity Offerings |

|

At any time (which may be more than once) on or before August 1, 2009, the Issuer may redeem up to 35% of the outstanding notes with money we raise in one or more equity offerings, as long as: |

|

|

• |

the Issuer pays 100% of the principal amount of the notes plus a premium equal to the rate per annum on the notes on the date on which the notice of redemption is given, plus accrued and unpaid interest to the redemption date; |

|

|

• |

the Issuer redeems the notes within 90 days of completing the equity offering; and |

|

|

• |

at least 65% of the aggregate principal amount of notes issued remains outstanding afterwards. |

Original Issue Discount |

|

The original notes were issued with original issue discount for U.S. federal income tax purposes. Thus, holders of the notes will generally be required to include the amounts representing the original issue discount in gross income for U.S. federal income tax purposes on a constant yield basis in advance of receipt of cash payments to which such income is attributable. See "Material U.S. Federal Income Tax Consequences." |

Change of Control |

|

If a change of control occurs, we must give holders of the notes the opportunity to sell us their notes at 101% of their face amount, plus accrued interest. |

Asset Sale Proceeds |

|

If the Issuer or its subsidiaries engage in an asset sale, we generally must either invest the net cash proceeds from such sales in our business within a period of time, prepay senior secured debt or make an offer to purchase a principal amount of the notes equal to the excess net cash proceeds. The purchase price of the notes will be 100% of their principal amount, plus accrued interest. |

| | | | |

7

Certain Covenants |

|

The indenture governing the notes contains certain covenants that, among other things, limit the Issuer's (and most or all of its subsidiaries') ability to: |

|

|

• |

incur additional indebtedness or issue certain preferred shares; |

|

|

• |

pay dividends on, redeem or repurchase our capital stock or make other restricted payments; |

|

|

• |

make investments; |

|

|

• |

create certain liens; |

|

|

• |

sell certain assets; |

|

|

• |

enter into agreements that restrict the ability of the Issuer's subsidiaries to make dividend or other payments to the Issuer; |

|

|

• |

guarantee indebtedness; |

|

|

• |

engage in transactions with affiliates; |

|

|

• |

prepay, repurchase or redeem the notes; |

|

|

• |

create or designate unrestricted subsidiaries; and |

|

|

• |

consolidate, merge or transfer all or substantially all of the Issuer's or its subsidiaries' assets on a consolidated basis. |

|

|

These covenants are subject to a number of important limitations and exceptions. See "Description of New Notes—Certain Covenants." |

No Listing on any Securities Exchange |

|

We do not intend to list the new notes on any securities exchange or to seek approval for quotation through any automated system. |

Risk Factors |

|

You should carefully consider the information under "Risk Factors" beginning on page 11 of this prospectus and all other information included in this prospectus prior to making a decision to exchange original notes for new notes. |

For additional information regarding the notes, see the "Description of New Notes" section of this prospectus.

8

Comparison with Original Notes

| Freely Transferable | | The new notes will be freely transferable under the Securities Act by holders who are not restricted holders. Restricted holders are restricted from transferring the new notes without compliance with the registration and prospectus delivery requirements of the Securities Act. The new notes will be identical in all material respects (including interest rate, maturity and restrictive covenants) to the original notes, with the exception that the new notes will be registered under the Securities Act. See "The Exchange Offer." |

Registration Rights |

|

The holders of the original notes currently are entitled to certain registration rights pursuant to the registration rights agreement entered into on the issue date of the original notes by and among the Issuer, the subsidiary guarantors named therein and the initial purchasers named therein, including the right to cause the Issuer to register the original notes for resale under the Securities Act if the exchange offer is not consummated prior to the 300th day after August 4, 2006. However, pursuant to the registration rights agreement, such registration rights will expire upon consummation of the exchange offer. Accordingly, holders of original notes who do not exchange their original notes for new notes in the exchange offer will not be able to reoffer, resell or otherwise dispose of their original notes unless such original notes are subsequently registered under the Securities Act or unless an exemption from the registration requirements of the Securities Act is available. |

9

Ratio of Earnings to Fixed Charges

The following table sets forth MXenergy's historical ratios of earnings to fixed charges for the periods indicated. The historical ratios are prepared on a consolidated basis in accordance with GAAP and, therefore, reflect all consolidated earnings and fixed charges.

The ratio of earnings to fixed charges for each of the periods is determined by dividing earnings by fixed charges. Earnings consist of income (loss) from operations before income taxes, amortization of previously capitalized interest and fixed charges, exclusive of capitalized interest cost. Fixed charges consist of interest incurred, unrealized losses on interest rate swaps and amortization of deferred loan costs and hedge facility fees.

| | Three Months

Ended

December 31,

2006

| | Six Months

Ended

December 31,

2006

| | Year Ended June 30,

| |

|---|

(dollars in thousands)

| |

|---|

| | 2006

| | 2005

| | 2004

| | 2003

| | 2002

| |

|---|

| Earnings before fixed charges: | | | | | | | | | | | | | | | | | | | | | | |

| | Income (loss) before income taxes | | $ | (5,529 | ) | $ | (68,708 | ) | $ | (66,783 | ) | $ | 41,230 | | $ | 50,293 | | $ | 22,460 | | $ | 5,504 | |

| | Interest and other debt expense | | | 8,705 | | | 27,426 | | | 4,261 | | | 3,472 | | | 3,219 | | | 2,270 | | | 1,416 | |

| | Estimated interest portion of rental expense | | | 200 | | | 292 | | | 176 | | | 130 | | | 56 | | | 41 | | | 22 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | Earnings (loss) before fixed charges | | $ | 3,376 | | $ | (40,990 | ) | $ | (62,346 | ) | $ | 44,832 | | $ | 53,568 | | $ | 24,771 | | $ | 6,942 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Fixed charges: | | | | | | | | | | | | | | | | | | | | | | |

| | Interest and other debt expense | | $ | 8,705 | | | 27,426 | | $ | 4,261 | | $ | 3,472 | | $ | 3,219 | | $ | 2,270 | | $ | 1,416 | |

| | Estimated interest portion of rental expense | | | 200 | | | 292 | | | 176 | | | 130 | | | 56 | | | 41 | | | 22 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | Total fixed charges | | $ | 8,905 | | $ | 27,718 | | $ | 4,437 | | $ | 3,602 | | $ | 3,275 | | $ | 2,311 | | $ | 1,438 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Ratio of earnings to fixed charges(1)(2) | | | — | | | — | | | — | | | 12.45 | x | | 16.36 | x | | 10.72 | x | | 4.83 | x |

- (1)

- The ratio of earnings to fixed charges was less than one-to-one for the three and six months ended December 31, 2006 and the year ended June 30, 2006. Earnings for such periods were insufficient to cover fixed charges by $5.5 million, $68.7 million and $66.8 million, respectively.

- (2)

- On a pro forma basis after giving effect to the Transactions, the ratio of earnings to fixed charges would have been less than one-to-one for the six months ended December 31, 2006 and the year ended June 30, 2006. Earnings for such periods would have been insufficient to cover fixed charges by $63.4 million and $92.2 million, respectively.

10

RISK FACTORS

You should consider carefully the following risks and other information in this prospectus before you decide whether or not to exchange original notes for new notes. Any of the following risks could materially adversely affect our business, financial condition and operating results. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or which we currently deem to be immaterial may also materially and adversely affect our business, financial condition and operating results.

Risks Related To Our Business

We may not fully hedge our commodity supply or other market positions against changes in commodity prices and consumption volumes, and our risk management policies and hedging procedures may not work as planned, which would adversely affect our business.

To provide energy to our customers, we purchase the relevant commodity in the wholesale energy markets, which are often highly volatile. It is our policy to match estimated requirements of our customers by purchasing offsetting volumes of natural gas and electricity. To lower our financial exposure related to commodity price fluctuations and changes in consumption volumes, we routinely enter into contracts to hedge our fixed price sale commitments, fuel requirements and inventory of natural gas.

We have contractual obligations to many of our customers to provide fuel requirements service and as a result, our hedging procedures require constant monitoring and adjustment. Failure to continue to use valid assumptions may lead to inappropriate hedging positions. In addition, there are a number of factors that are beyond our control, such as risk of loss from counterparties' nonperformance, volumetric risks related to customer demand and seasonal fluctuations. Although we try to purchase anticipatory hedges that represent volume we expect to sell to residential and small commercial customers for up to one month of projected marketing, we are exposed to the risk of a shortfall in marketing that could result in our purchases exceeding our supply commitments to those customers. We cannot fully protect ourselves against these factors and if our risk management policies are insufficient, this will have a detrimental effect on our business.

Our customers may terminate their contracts at any time, and the resulting attrition can result in a cost of cover for previously purchased fixed price hedges and physical supplies, which could have a negative impact on our financial results.

Customers are subject to the terms of written contracts which are governed by the tariff rules of utilities and LDCs as well as regulations administered by public service commissions. Although our fixed price contracts with residential customers may have terms of up to three years, those customers may terminate their contracts at any time for a termination fee that, in most cases, is relatively modest and does not bear any relation to our costs or lost profit with respect to the remainder of the contract. Our small and mid-market commercial customers cannot terminate their fixed price contracts without triggering a damages provision designed to cover the cost related to the termination of those contracts. However, seeking to enforce contracts for relatively small volumes is often impractical. As a result, we depend on our hedging strategies to cover the costs related to terminations by residential and small commercial customers. To hedge effectively against terminations, we must, at the inception of the contracts, attempt to accurately forecast the number of residential and small commercial customers that will terminate their contracts prior to the end of their term. If we are not able to replace terminating customers with new customers, or if we experience an unusually high number of cancellations, our financial results may be negatively impacted.

11

We may not have sufficient liquidity to hedge market risks effectively or conduct our business which would adversely affect our financial condition.

We enter into physical hedges, and MXenergy historically entered into financial hedges for its supply obligations, under agreements with VPEM, a wholly owned subsidiary of Dominion Resources Inc. Under our new hedge facility, we will enter into financial hedges for our supply with Société Générale. To date, we have been successful at negotiating arrangements that do not require us to provide cash margining for changes in the market value of forward positions. Under the hedge facility, we have posted an initial $25.0 million of collateral, but no additional amounts would be required for changes in market prices of the commodity unless our forward hedged positions exceed 65,000 MMBtu. These hedging arrangements are for a limited duration and typically need to be renegotiated or replaced every two to five years. We may not be able to replace these agreements upon expiration under similar terms and may be required to provide guarantees, letters of credit, or additional cash collateral to protect counterparties against the risk of our default or insolvency.

In addition, our contractual agreements with LDCs require us to maintain restricted cash balances or letters of credit as collateral for the performance risk associated with the future delivery of natural gas. These collateral requirements may increase as we grow our customer base. Additionally, we must post letters of credit with our natural gas and electricity supply providers. The amount of such credit support that must be provided typically is based on the volume of the commodity purchased in any given month. Significant movements in market prices can result in our being required to provide cash collateral and letters of credit in very large amounts. The effectiveness of our operations may be dependent on the amount of collateral available to enter into or maintain these contracts, and liquidity requirements may be greater than we anticipate or are able to meet. Without a sufficient amount of working capital to post as collateral in support of performance guarantees or as cash margin, we may not be able to manage price volatility effectively or to implement our strategy. An increase in demands from our counterparties to post letters of credit or cash collateral may negatively affect our liquidity position and financial condition.

Our financial results may fluctuate on a seasonal and quarterly basis and are susceptible to changing weather conditions and commodity price fluctuations.

Our business is affected by weather. Consequently, our overall operating results may fluctuate substantially on a seasonal basis, and the pattern of this fluctuation may change depending on the nature and location of any customer we acquire and the terms of any contract to which we become a party. Weather conditions directly influence the demand for electricity and natural gas and affect the price of energy commodities.

Generally, demand for electricity peaks in the summer and demand for gas peaks in the winter. Recent growth in natural gas-fired electric generation has introduced a secondary peak for natural gas in the summer. Typically, when winters are warmer than expected and summers are cooler than expected, demand for energy is lower, resulting in less electric and gas consumption than forecasted. Likewise, when winters are colder than expected or summers warmer, consumption may be greater than we have hedged and greater than we are able to meet with storage, swing supply or full requirements contracts that we have negotiated. Depending on prevailing market prices for electricity and gas, these and other unexpected conditions may reduce our sales or increase our costs and negatively impact our results of operations. We may experience lower consumption volumes and, therefore, lower sales. We may experience losses from the purchase of additional volumes at higher prices or the sale of excess volumes at prices below acquisition cost. Our failure to anticipate changing weather demands or to effectively manage our supply in response to changing demands could negatively impact our financial results.

12

In addition, our marketing efforts may be hindered in a market where our offers are less competitive relative to price offerings of the utilities or other marketers. Utilities historically react more slowly to changing commodity prices, whereas our products generally reflect the prevailing market prices. These factors may result in less effective marketing or higher than anticipated attrition.

Integration of the SESCo assets into our operations may not be successful and our pro forma financial results may not reflect our results after such integration. If we are unable to successfully integrate the SESCO assets into our business, it may adversely affect our financial performance.

The SESCo acquisition is the largest acquisition we have undertaken. In order to accommodate the new customers, we purchased and utilize the systems used by SESCo in Georgia and Ohio and moved MXenergy's existing Ohio customers onto such systems, as well. If we are unable to utilize successfully the SESCo systems or maintain the SESCo employees' expertise through the transition, our results of operations could suffer. We have never arranged physical supply for Georgia which is the first market in which we have had primary responsibility for direct customer billing of our commodity and LDC distribution charges. Prior to the closing of the SESCo acquisition, each SESCo residential customer in Georgia had the option not to continue the customer contract with us without penalty. As a result, we have experienced higher than usual customer attrition, which could have a negative impact on our financial results. Attrition for the three and six months ended December 31, 2006 was approximately 7% and 15%, respectively, resulting in an annualized rate of 28% and 30%, respectively. January and February 2007 results continue to be impacted by above average annualized attrition of approximately 30%.

The accounting for our hedging activities may increase the volatility in our quarterly and annual financial results.

We engage in price-risk management activities related to our natural gas and electricity purchases in order to economically hedge our exposure to commodity price risk. Through the use of financial and physical derivative contracts, we attempt to balance our physical and financial purchases and sales commitments. These derivatives are accounted for in accordance with Statement of Financial Accounting Standards, or SFAS, No. 133, "Accounting for Derivative Instruments and Hedging Activities," as amended and interpreted. SFAS No. 133 requires us to record all derivatives on the balance sheet at fair value. Changes in the fair value of a derivative as a result of fluctuations in the underlying commodity price, are recognized immediately in earnings, unless the derivative qualifies for hedge accounting treatment. Since MXenergy has not designated the derivative instruments as hedges for accounting purposes under SFAS No. 133, changes in forward prices of natural gas and electricity will cause volatility in our earnings. As a result, we are unable to fully anticipate the impact that our risk management decisions may have on our quarterly and annual operating results.

We depend on our billing systems and the utilities with whom we have billing service agreements, and we bear the related credit risk for certain customers. If these customers fail to pay their bills as they become due, it may adversely affect our financial condition.

We are responsible for the billing and collection functions for all of our customers in Georgia and our mid-market commercial customers in our New York, New Jersey and Ohio markets. This group of customers represents approximately 38% of our total volumes. In these markets we bear the risk of customers' failure to pay their utility bills. With the exception of customers in Georgia, we only have the ability to terminate our agreement with customers for non-payment, not to terminate their electric or gas service. Even if we terminate service to customers who fail to pay their utility bill, we remain liable to our suppliers of electricity and natural gas for the cost of those commodities. Furthermore, in the Georgia market, we are responsible for billing the distribution charges for the local utility and are

13

at risk for these charges, in addition to the cost of the commodity, in the event customers fail to pay their bills. The failure of our customers to pay their bills or our failure to maintain adequate billing and collection procedures could materially adversely affect our business.

For approximately 57% of our RCEs, we have billing service agreements with utilities that require the utilities to prepare and send a bill to our customers and collect the cost of energy supply from customers before remitting the proceeds to us. The majority of these utilities have guaranteed the payment of the energy supply portion of customer bills net of a pre-determined discount. We rely on the utilities to perform timely and accurate billing under these agreements. As we grow, the proportion of customers we serve that are billed by utilities could increase. The bankruptcy of a utility could result in a default in the utilities' payment obligations to us.

The number of territories within which we provide natural gas and electricity supply poses a constant challenge that demands considerable personnel, management time and resources. Each territory requires unique and often varied electronic data interface systems. Rules that govern the exchange of data may be changed by LDCs. In certain instances, we must rely on manual processes and procedures and from time to time we have had difficulties uploading new customer files, contract rates and changes on a timely basis. Our failure to provide the local utilities with accurate billing information to include on the customer bills could negatively impact our results of operations.

We depend on local transportation and transmission facilities of third parties to supply our customers. Our financial results may be harmed if transportation and transmission availability are limited or unreliable.

We depend on transportation and transmission facilities owned and operated by utilities and other energy companies to deliver the electricity and natural gas we sell to customers. Under the regulatory structures adopted in most jurisdictions, we are required to enter into agreements with local incumbent utilities for use of the local distribution systems and to establish functional data interfaces necessary to serve our customers. Any delay in these negotiations or our inability to enter into reasonable agreements could delay or negatively impact our ability to serve customers in those jurisdictions, which could have a materially negative impact on our business, results of operations, and financial condition.

We also depend on local utilities for maintenance of the infrastructure through which we deliver electricity and natural gas to our customers. We are limited in our ability to control the level of service the utilities provide to our customers. Any infrastructure failure that interrupts or impairs delivery of electricity or natural gas to our customers could cause customer dissatisfaction, which could materially adversely affect our business.

If transportation or transmission is disrupted, or transportation or transmission capacity is inadequate, our ability to sell and deliver products may be hindered. Such disruptions could also hinder our providing electricity or natural gas to our customers and materially adversely affect our financial results.

Regulations in many markets require that meter reading and the billing and collection processes be retained by the local utility. In those states, we also are required to rely on the local utility to provide us with our customers' information regarding energy usage. Our inability to confirm information received from the utilities may negatively impact our sales and results of operations.

14

We depend on continued state and federal regulation to permit us to operate in deregulated segments of the electric and gas industries. If competitive restructuring of the electric or gas utility industries is altered, reversed, discontinued or delayed, our business prospects and financial results could be materially adversely affected.

The regulatory environment applicable to the electric and gas LDC distribution systems has undergone substantial change over the past several years as a result of restructuring initiatives at both the state and federal levels. These initiatives have had a significant impact on the nature of the electric and gas LDCs. We have targeted the deregulated segments of the electric and gas markets created by these initiatives. Regulations may be revised or reinterpreted or new laws and regulations may be adopted or become applicable to us or our operations. Such changes may have a detrimental effect on our business.

In certain deregulated electricity markets, proposals have been made by governmental agencies and/or other interested parties to re-regulate areas of these markets. Other proposals to re-regulate may be made and legislated or other attention to the electric and gas restructuring process may delay or reverse the deregulation process or interfere with our ability to do business. If competitive restructuring of the electric and gas markets is altered, reversed, discontinued or delayed, our business prospects and financial results would be negatively impacted.

We have identified a material weakness in the design and operation of our internal controls as of June 30, 2006, which, if not properly remediated, could result in material misstatements in our financial statements in future periods.

In connection with the audit of MXenergy's financial statements for the year ended June 30, 2006, we and MXenergy's independent auditors reported to the audit committee of the board of directors that certain significant deficiencies in internal controls, when evaluated in the aggregate, resulted in a material weakness in the design and operation of our internal controls as of June 30, 2006.

A material weakness is defined as a significant deficiency, or a combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected.

In connection with the audit of MXenergy's financial statements for the year ended June 30, 2006, MXenergy's independent auditors communicated to the audit committee of MXenergy's board of directors that MXenergy has inadequate staffing levels in the accounting department which results in the lack of a proper segregation of duties at the Controller level and that the overall supervision and review of the daily accounting function and the accounting for transactions may not operate at a level which could detect errors of significance and that improved monitoring of transactions with the LDCs was appropriate. In addition, MXenergy's independent auditors advised MXenergy's audit committee that the lack of formalization of MXenergy's policies and procedures pertaining to change management controls and logical security over its information technology systems results in an ineffective information technology general controls environment. We further communicated to the audit committee that we had identified billing errors specific to one of our customer relationship management systems. The billing errors affected customers within a variety of LDCs and principally related to under-billing customers during fiscal 2006. The billing errors arose due to improper controls surrounding the customer sales price renewal process.

15

In response to these identified control deficiencies, we have implemented certain disclosure control enhancements, policies and procedures, including:

- •

- adding personnel to our accounting team, including a director of financial reporting, treasury manager, an accounts payable clerk, a tax manager, and an accounting systems manager, as well as the core group of well-qualified and experienced accounting personnel that joined us in connection with the SESCo acquisition;

- •

- purchasing and implementing an accounting system designed to facilitate reconciliation and reporting of transactions;

- •

- initiating a process whereby the Controller and/or the Chief Financial Officer sign-off on the review and approval of significant accounting entries;

- •

- purchasing and implementing a risk management system designed to help better track our risks and to facilitate reconciliation and reporting of transactions and risks and, in the interim, centralizing the risk management reporting function to a risk manager and initiating monthly meetings between supply and operations and the accounting team to ensure that all transactions are appropriately recorded;

- •

- employing a risk oversight committee, chaired by a member of the board of directors, which has adopted policies and guidelines regarding the management of our supply portfolio and hedging instruments;

- •

- implementing various controls throughout the customer sales price renewal process to timely identify and address pricing errors;

- •

- initiating the process to add additional personnel to the office of the General Counsel; and

- •

- implementing information technology policies and procedures, including increased regulation of network access, enhanced database management and added segregation of responsibilities.

The remediation process has not yet been completed and there can be no assurance that the measures we have taken or will take to remediate the identified control deficiencies will result in adequate controls over our financial processes and reporting in the future. If we are unable to establish appropriate internal controls over financial reporting, it could cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements.

Risks Related To Our Indebtedness

Our substantial debt obligations could adversely affect our financial health and prevent us from fulfilling such obligations, including our obligations under the notes, and we might have difficulty obtaining more financing.

We have a substantial amount of indebtedness in relation to our equity. As of December 31, 2006, we had $189.0 million total outstanding indebtedness and $151.3 million in issued letters of credit (plus an additional $27.6 million of unused availability under our revolving credit facility and $1.0 million of unused availability under our credit facility with Sowood Commodity Partners Fund LP, or Sowood, referred to herein as the Sowood credit facility). Our substantial debt obligations could have important consequences to holders of the notes. For example, they could:

- •

- make it more difficult for us to satisfy our obligations with respect to the notes;

- •

- increase our vulnerability to general adverse economic and industry conditions;

16

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our debt obligations, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the markets in which we operate;

- •

- place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limit our ability to borrow additional funds.

We may incur substantial additional indebtedness in the future. The terms of the indenture governing the notes and our credit facilities will allow us to incur additional debt subject to certain limitations. If new debt is added to current debt levels, the related risks described above could intensify. If such debt financing is not available when required or is not available on acceptable terms, we may be unable to grow our business, take advantage of business opportunities, respond to competitive pressures or refinance maturing debt, any of which could have a material adverse effect on our operating results and financial condition.

Our interest expense would increase if interest rates increase which would have a negative impact on our financial performance.

As of December 31, 2006, we had $178.0 million of outstanding floating rate debt and the ability to incur up to $27.6 million of floating rate debt under our revolving credit facility. In August 2006, we entered into interest rate swaps to hedge the floating rate interest expense on the notes. The swaps are fixed-for-floating and settle against the six month LIBOR rate. The fixed rates under the swaps range from 5.68% to 5.72%. The total notional amount of the interest rate swaps is $130 million with an average term of five years. Any increase in short-term interest rates would result in higher interest costs which would increase our interest expense. A 1% change in LIBOR, after taking into account the average outstanding notional amount of our interest rate swap agreements, would result in our interest expense fluctuating approximately $0.4 million per year based on our average monthly balance for the twelve month period ended December 31, 2006. While we may utilize interest rate swaps to hedge portions of our floating rate exposure, we may not be successful in renewing or obtaining additional hedges on acceptable terms or at all, which could have a material adverse effect on our ability to service our outstanding indebtedness, including the notes.

We will require a significant amount of cash to service our debt obligations. Our ability to generate cash depends on many factors beyond our control, including cash flow from our operating subsidiaries. If certain of our subsidiaries cannot make distributions to us, or such distributions decrease, we may not be able to make payments on the notes.

Our ability to make payments on and to refinance our debt, including the notes, and to fund planned capital expenditures and expansion efforts and any strategic acquisitions we may make in the future, if any, will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive and other factors that are beyond our control.

We have no operations except for those conducted through our operating subsidiaries. Accordingly, our only material source of cash, including cash to make payments on or to redeem the notes, comes from distributions with respect to our ownership interests in our operating subsidiaries that are derived from the earnings and cash flow generated by such operating subsidiaries. Distributions to us from our operating subsidiaries will depend on:

- •

- the financial performance of our operating subsidiaries;

17

- •

- covenants contained in our debt agreements, including the agreements governing our revolving credit facility;

- •

- covenants contained in other agreements to which we or our subsidiaries are or may become subject;

- •

- business and tax considerations; and

- •

- applicable law, including laws regarding the payment of distributions.

Based on the current level of operations of our subsidiaries, we believe that our cash flow from operations, together with available cash and available borrowings under our credit facilities, would be adequate to meet liquidity needs for at least the next twelve months. However, there can be no assurance that our business will generate sufficient cash flow from operations in the future, that our currently anticipated growth in net sales and cash flow will be realized on schedule or that future borrowings will be available to us in an amount sufficient to enable us to repay indebtedness, including the notes, or to fund other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the notes, on or before maturity. There can be no assurance that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all.

The interests of our significant stockholders may conflict with your interests.

Our significant stockholders own the majority of our outstanding capital stock. Accordingly, the significant stockholders may exercise a controlling influence over our business and affairs and will have the power to determine all matters submitted to a vote of our stockholders. Circumstances may occur in which the interests of the significant stockholders could be in conflict with the interests of holders of the notes. In addition, the significant stockholders may have an interest in pursuing acquisitions, divestitures or other transactions that, in their judgment, could enhance their equity investment. This could occur even though such transactions might increase risks to the holders of the notes if the transactions resulted in our being more leveraged or significantly changed the nature of our business operations or strategy. In addition, if we encounter financial difficulties, or we are unable to pay our debts as they mature, the interests of our stockholders might conflict with those of the holders of the notes. In that situation, for example, the holders of the notes might want us to raise additional equity from the significant stockholders or other investors to reduce our leverage and pay our debts, while the significant stockholders might not want to increase their investment in us or have their respective ownership diluted and may instead choose to take other actions, such as selling our assets. Additionally, the significant stockholders and certain of their respective affiliates are in the business of making investments in companies and may, from time to time in the future, acquire interests in businesses engaged in the energy industry that directly or indirectly compete with certain portions of our business.

Risks Related to the Notes, the Offering and the Exchange

A holder's right to receive payments on the notes is effectively subordinated to the rights of our existing and future secured creditors. Further, the guarantees of the notes by the subsidiary guarantors are effectively subordinated to the subsidiary guarantors' existing and future secured debt.

Holders of our secured debt and the secured debt of the subsidiary guarantors will have claims that are superior to the claims of holders of the notes to the extent of the value of the assets securing that other debt. Notably, we and certain of our subsidiaries, including the subsidiary guarantors, are parties to credit facilities, which are secured by liens on, among other things, our accounts receivable, inventory and some fixed assets. In addition, our obligations under the Hedge Facility are secured by a lien on our assets. The notes will be effectively subordinated to all such secured obligations. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization or other bankruptcy proceeding, holders of secured debt will have prior

18

claim to our assets that constitute their collateral. Holders of the notes will participate ratably with all holders of our senior unsecured debt, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. We may apply proceeds of certain asset sales to reduce our secured debt or other secured obligations, but such application will not permanently reduce our ability to incur secured debt and other secured obligations under the indenture governing the notes in the future. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of the notes may receive less, ratably, than holders of secured debt. As of December 31, 2006, we and our subsidiary guarantors had no borrowings outstanding under our revolving credit facility and $151.3 million in issued letters of credit plus an additional $27.6 million of unused availability under our revolving credit facility and $1.0 million of unused availability under the Sowood credit facility.

If we default on our obligations to pay our indebtedness, we may not be able to make payments on the notes.

Any default under the agreements governing our indebtedness, including a default under our revolving credit facility, that is not waived by the required lenders, and the remedies sought by the holders of such indebtedness, could prevent us from paying principal, premium, if any, and interest on the notes and substantially decrease the market value of the notes. If we are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we otherwise fail to comply with the various covenants, including financial and operating covenants, in the instruments governing our indebtedness (including covenants in our revolving credit facility and the indenture governing the notes), we could be in default under the terms of the agreements governing such indebtedness, including our revolving credit facility and the indenture governing the notes. In the event of such default, the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the lenders under our revolving credit facility could elect to terminate their commitments thereunder, cease making further loans and institute foreclosure proceedings against our assets, and we could be forced into bankruptcy or liquidation. If our operating performance declines, we may in the future need to obtain waivers from the required lenders under our revolving credit facility to avoid being in default. If we breach our covenants under our revolving credit facility and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under our revolving credit facility, the lenders could exercise their rights as described above, and we could be forced into bankruptcy or liquidation.

The terms of our indebtedness contain covenants that will restrict our ability to engage in certain transactions and may impair our ability to respond to changing business and economic conditions. Our failure to comply with these covenants could result in defaults under our debt instruments even though we may be able to meet our debt service obligations.

The terms of our outstanding indebtedness impose operating and financial restrictions on us and our subsidiaries. The restrictions that will be imposed under these debt instruments will include, among other things, limitations on our ability to:

- •

- incur additional debt or issue certain preferred shares;

- •

- pay dividends on, redeem or repurchase our capital stock or make other restricted payments;

- •

- make investments;

- •

- create certain liens;

- •

- sell certain assets;

- •

- enter into agreements that restrict the ability of our subsidiaries to make dividend or other payments to us;

19

- •

- guarantee indebtedness;

- •

- engage in transactions with affiliates;

- •

- prepay, repurchase or redeem the notes;

- •

- create or designate unrestricted subsidiaries; and

- •

- consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries on a consolidated basis.

These restrictive covenants may limit our ability to expand our operations, pursue our business strategies and react to events and opportunities as they unfold or present themselves. If we are unable to capitalize on future business opportunities, our business may be harmed.

Our ability to comply with these provisions may be affected by general economic conditions, industry conditions and other events beyond our control. As a result, we cannot assure you that we will be able to comply with these covenants. Our failure to comply with the covenants contained in our revolving credit facility, the Sowood credit facility or the indenture governing the notes, including failure as a result of events beyond our control, could result in an event of default, which could materially and adversely affect our operating results and our financial condition.

Under specific circumstances, federal and state laws may allow courts to void guarantees and require noteholders to return payments received from guarantors.

Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee could be voided, or claims in respect of a guarantee could be subordinated to all other debts of that guarantor if, among things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

- •

- received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; and

- •

- was insolvent or rendered insolvent by reason of such incurrence; or

- •

- was engaged in a business or transaction for which the guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature.

In addition, any payment by that guarantor pursuant to its guarantee could be voided and required to be returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, was greater than the then fair saleable value of all of its assets; or

- •

- the present fair saleable value of its assets is less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they became absolute and mature; or

- •

- it cannot pay its debts as they became due.

20

You will be required to include original issue discount in your U.S. federal taxable income, which may exceed the amount of interest paid on the notes in cash.

For U.S. federal income tax purposes, the notes will be treated as issued with original issue discount. As a result, interest will accrue from the issue date of the notes on a constant yield to maturity basis, and a holder will be required to include such accrued amounts in taxable income as original issue discount. Holders of the notes will generally be required to include original issue discount in gross income in advance of the receipt of cash payments attributable to that income (but will not be taxed again when such cash is received). See "Material U.S. Federal Income Tax Consequences."

There is no established trading market for the new notes, which means there are uncertainties regarding the ability of a holder to dispose of the new notes and the potential sale price.