0 3rd Quarter 2014 Earnings Report October 30, 2014

1 Forward Looking Statements This presentation should be reviewed in conjunction with CVR Energy, Inc.’s Third Quarter earnings conference call held on October 30, 2014. The following information contains forward-looking statements based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors. You are cautioned not to put undue reliance on such forward-looking statements (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited to (i) those set forth under “Risk Factors” in CVR Energy, Inc.’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Energy, Inc. makes with the Securities and Exchange Commission, (ii) those set forth under “Risk Factors” in CVR Refining, LP’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Refining, LP makes with the Securities and Exchange Commission, and (iii) those set forth under “Risk Factors” in the CVR Partners, LP Annual Report on form 10-K, Quarterly Reports on form 10-Q and any other filings CVR Partners, LP makes with the Securities and Exchange Commission. CVR Energy, Inc. assumes no obligation to, and expressly disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by law.

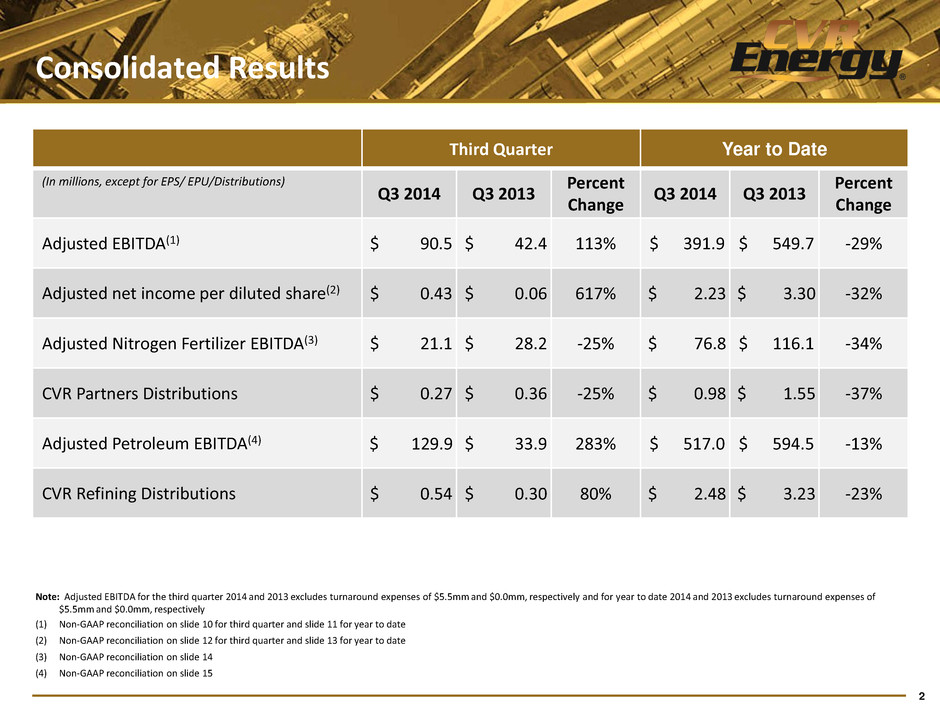

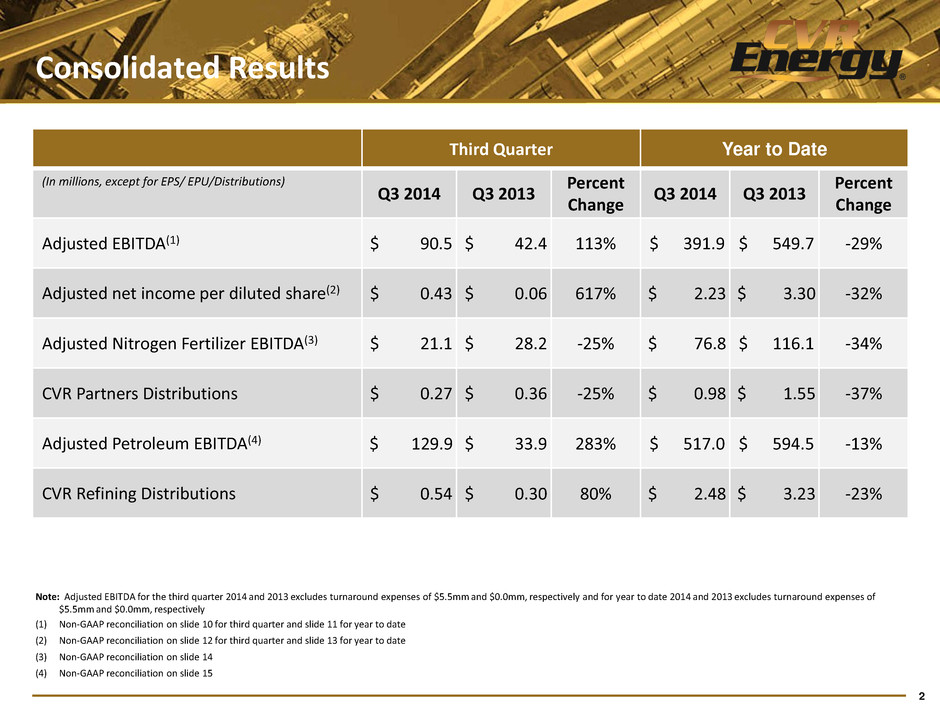

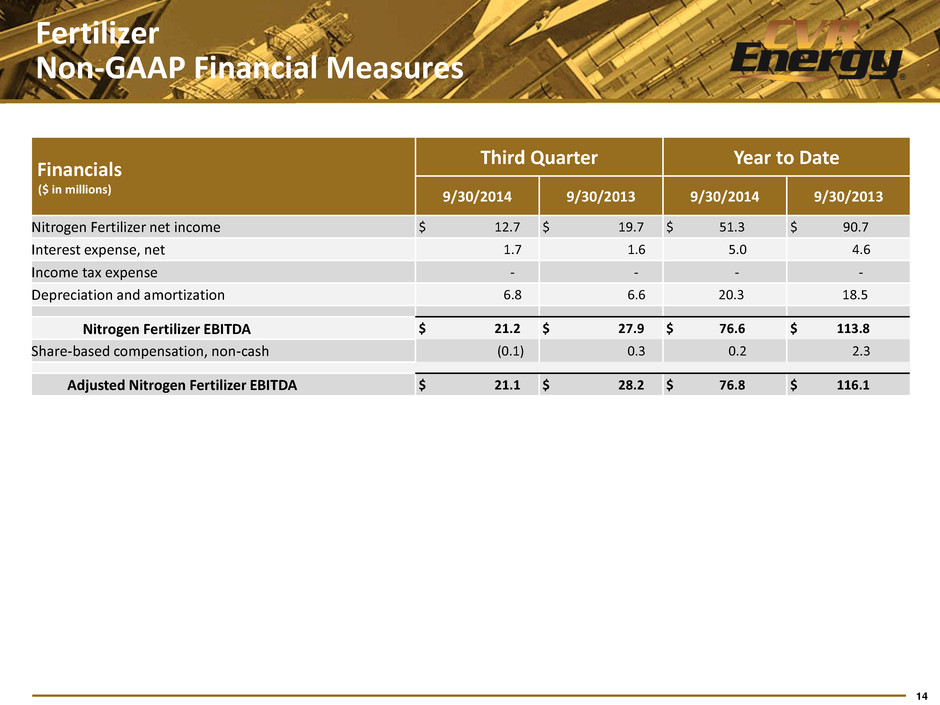

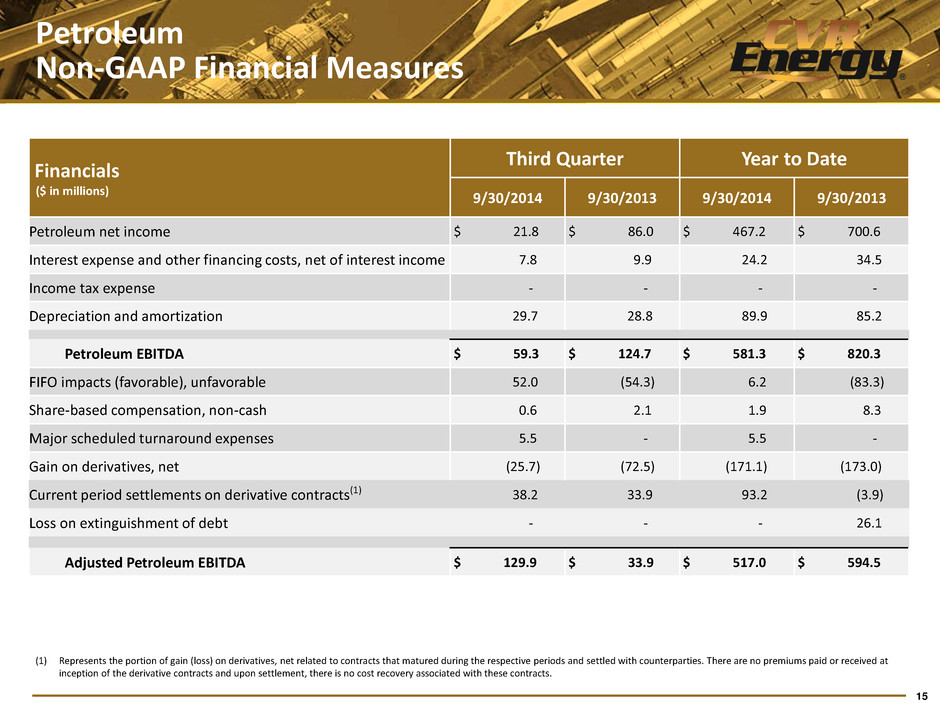

2 Consolidated Results Note: Adjusted EBITDA for the third quarter 2014 and 2013 excludes turnaround expenses of $5.5mm and $0.0mm, respectively and for year to date 2014 and 2013 excludes turnaround expenses of $5.5mm and $0.0mm, respectively (1) Non-GAAP reconciliation on slide 10 for third quarter and slide 11 for year to date (2) Non-GAAP reconciliation on slide 12 for third quarter and slide 13 for year to date (3) Non-GAAP reconciliation on slide 14 (4) Non-GAAP reconciliation on slide 15 Third Quarter Year to Date (In millions, except for EPS/ EPU/Distributions) Q3 2014 Q3 2013 Percent Change Q3 2014 Q3 2013 Percent Change Adjusted EBITDA(1) $ 90.5 $ 42.4 113% $ 391.9 $ 549.7 -29% Adjusted net income per diluted share(2) $ 0.43 $ 0.06 617% $ 2.23 $ 3.30 -32% Adjusted Nitrogen Fertilizer EBITDA(3) $ 21.1 $ 28.2 -25% $ 76.8 $ 116.1 -34% CVR Partners Distributions $ 0.27 $ 0.36 -25% $ 0.98 $ 1.55 -37% Adjusted Petroleum EBITDA(4) $ 129.9 $ 33.9 283% $ 517.0 $ 594.5 -13% CVR Refining Distributions $ 0.54 $ 0.30 80% $ 2.48 $ 3.23 -23%

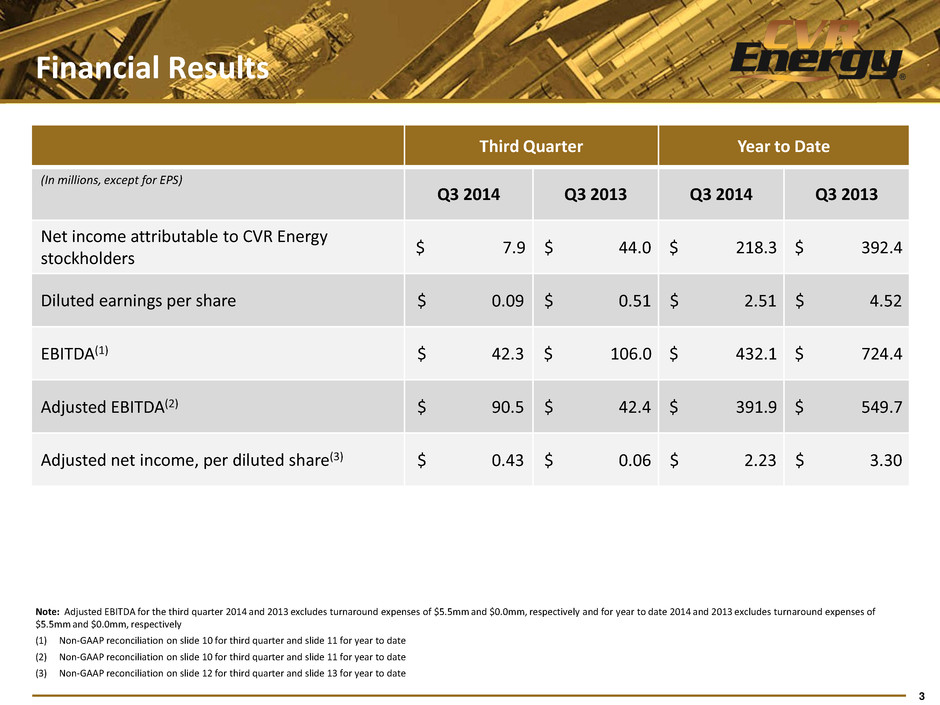

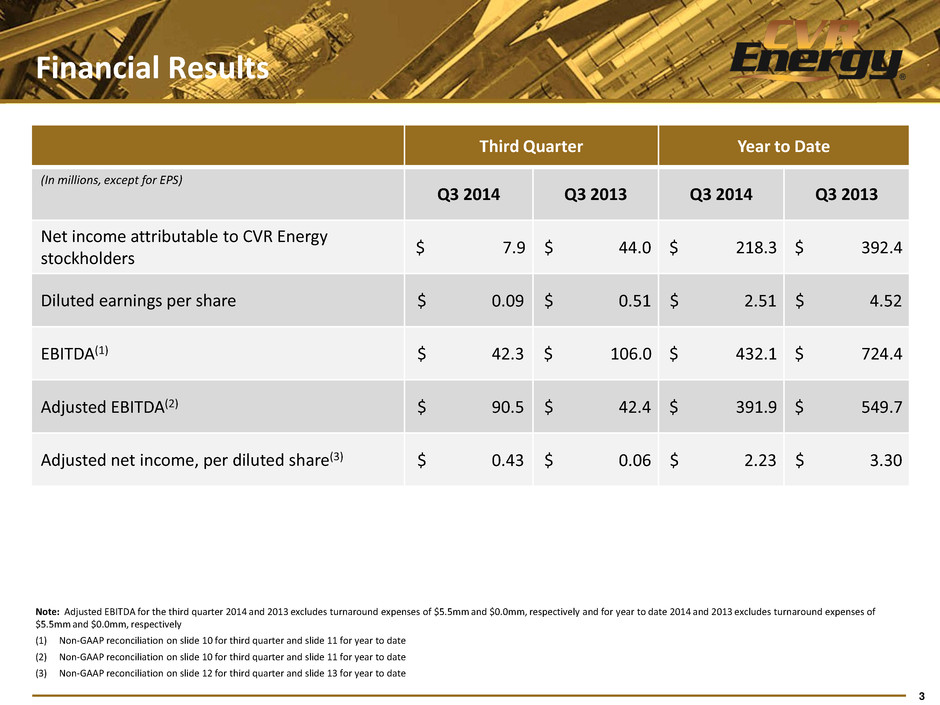

3 Financial Results Note: Adjusted EBITDA for the third quarter 2014 and 2013 excludes turnaround expenses of $5.5mm and $0.0mm, respectively and for year to date 2014 and 2013 excludes turnaround expenses of $5.5mm and $0.0mm, respectively (1) Non-GAAP reconciliation on slide 10 for third quarter and slide 11 for year to date (2) Non-GAAP reconciliation on slide 10 for third quarter and slide 11 for year to date (3) Non-GAAP reconciliation on slide 12 for third quarter and slide 13 for year to date Third Quarter Year to Date (In millions, except for EPS) Q3 2014 Q3 2013 Q3 2014 Q3 2013 Net income attributable to CVR Energy stockholders $ 7.9 $ 44.0 $ 218.3 $ 392.4 Diluted earnings per share $ 0.09 $ 0.51 $ 2.51 $ 4.52 EBITDA(1) $ 42.3 $ 106.0 $ 432.1 $ 724.4 Adjusted EBITDA(2) $ 90.5 $ 42.4 $ 391.9 $ 549.7 Adjusted net income, per diluted share(3) $ 0.43 $ 0.06 $ 2.23 $ 3.30

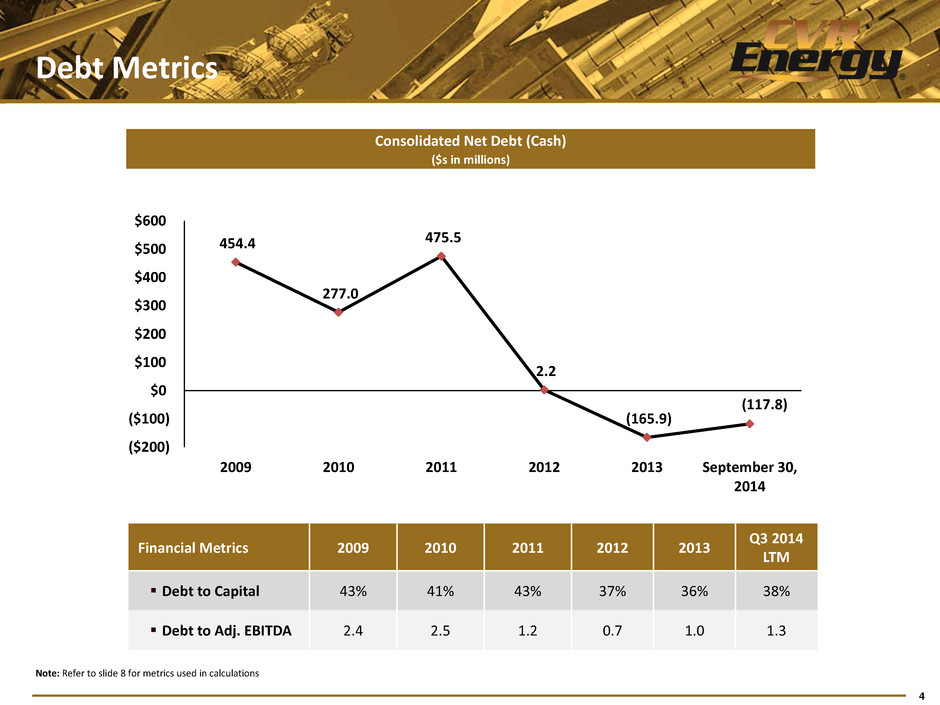

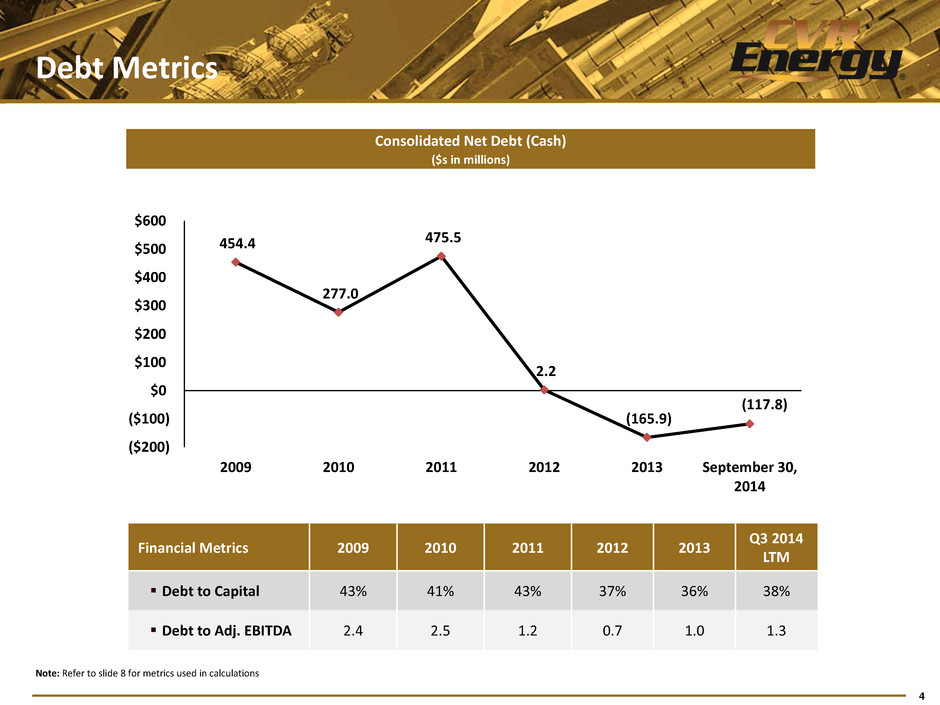

4 Debt Metrics Note: Refer to slide 8 for metrics used in calculations Consolidated Net Debt (Cash) ($s in millions) Financial Metrics 2009 2010 2011 2012 2013 Q3 2014 LTM Debt to Capital 43% 41% 43% 37% 36% 38% Debt to Adj. EBITDA 2.4 2.5 1.2 0.7 1.0 1.3 454.4 277.0 475.5 2.2 (165.9) (117.8) ($200) ($100) $0 $100 $200 $300 $400 $500 $600 2009 2010 2011 2012 2013 September 30, 2014

Appendix

6 Non-GAAP Financials Measures To supplement the actual results in accordance with GAAP for the applicable periods, the Company also uses non- GAAP measures as discussed below, which are reconciled to GAAP-based results. These non-GAAP financial measures should not be considered an alternative for GAAP results. The adjustments are provided to enhance an overall understanding of the Company’s financial performance for the applicable periods and are indicators management believes are relevant and useful for planning and forecasting future periods.

7 Non-GAAP Financials Measures Petroleum and Nitrogen Fertilizer EBITDA and Adjusted EBITDA. EBITDA by operating segment represents net income before (i) interest expense and other financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA by operating segment represents EBITDA by operating segment adjusted for FIFO impacts (favorable) unfavorable; share-based compensation, non-cash; major scheduled turnaround expenses; loss on extinguishment of debt; loss on disposition of fixed assets; (gain) loss on derivatives, net; and current period settlements on derivative contracts. We present Adjusted EBITDA by operating segment because it is the starting point for CVR Refining’s and CVR Partners' calculation of available cash for distribution. Adjusted EBITDA by operating segment is not a recognized term under GAAP and should not be substituted for operating income as a measure of performance. Management believes that Adjusted EBITDA by operating segment enables investors to better understand CVR Refining’s and CVR Partners' ability to make distributions to their common unitholders, helps investors evaluate our ongoing operating results and allows for greater transparency in reviewing our overall financial, operational and economic performance. Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently. EBITDA and Adjusted EBITDA. EBITDA represents net income before (i) interest expense and other financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted for FIFO impacts (favorable) unfavorable, share-based compensation, major scheduled turnaround expenses, loss on disposition of fixed assets, (gain) loss on derivatives, net, current period settlements on derivative contracts, loss on extinguishment of debt and expenses associated with the Gary-Williams acquisition. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management believes that EBITDA and Adjusted EBITDA enable investors to better understand and evaluate our ongoing operating results and allow for greater transparency in reviewing our overall financial, operational and economic performance. EBTIDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently. Adjusted net income is not a recognized term under GAAP and should not be substituted for net income as a measure of our performance but rather should be utilized as a supplemental measure of financial performance in evaluating our business. Management believes that adjusted net income provides relevant and useful information that enables external users of our financial statements, such as industry analysts, investors, lenders and rating agencies, to better understand and evaluate our ongoing operating results and allow for greater transparency in the review of our overall financial, operational and economic performance.

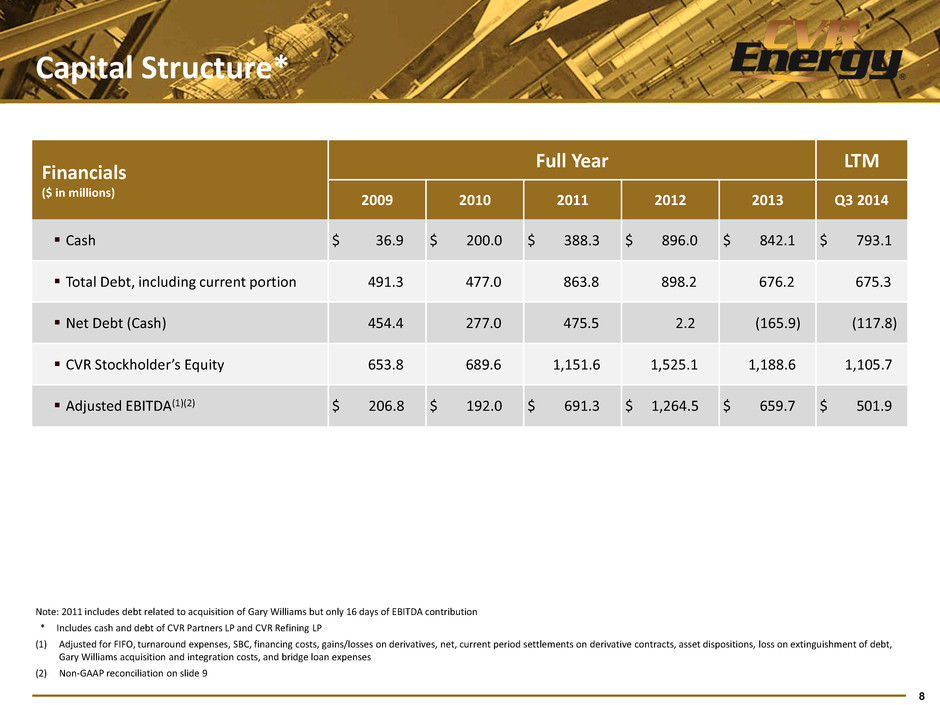

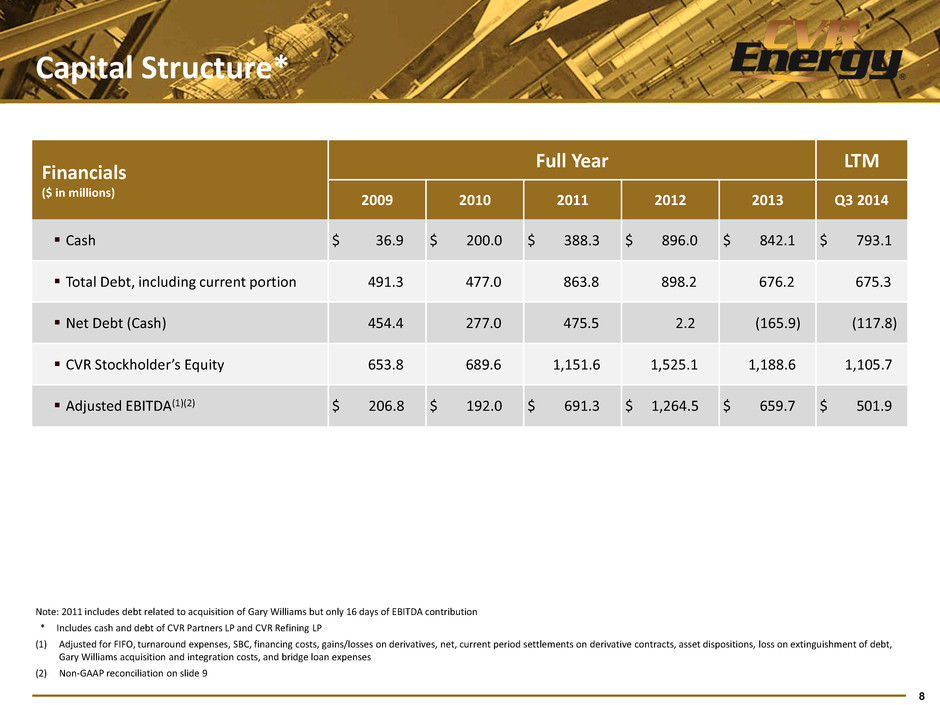

8 Capital Structure* Note: 2011 includes debt related to acquisition of Gary Williams but only 16 days of EBITDA contribution * Includes cash and debt of CVR Partners LP and CVR Refining LP (1) Adjusted for FIFO, turnaround expenses, SBC, financing costs, gains/losses on derivatives, net, current period settlements on derivative contracts, asset dispositions, loss on extinguishment of debt, Gary Williams acquisition and integration costs, and bridge loan expenses (2) Non-GAAP reconciliation on slide 9 Financials ($ in millions) Full Year LTM 2009 2010 2011 2012 2013 Q3 2014 Cash $ 36.9 $ 200.0 $ 388.3 $ 896.0 $ 842.1 $ 793.1 Total Debt, including current portion 491.3 477.0 863.8 898.2 676.2 675.3 Net Debt (Cash) 454.4 277.0 475.5 2.2 (165.9) (117.8) CVR Stockholder’s Equity 653.8 689.6 1,151.6 1,525.1 1,188.6 1,105.7 Adjusted EBITDA(1)(2) $ 206.8 $ 192.0 $ 691.3 $ 1,264.5 $ 659.7 $ 501.9

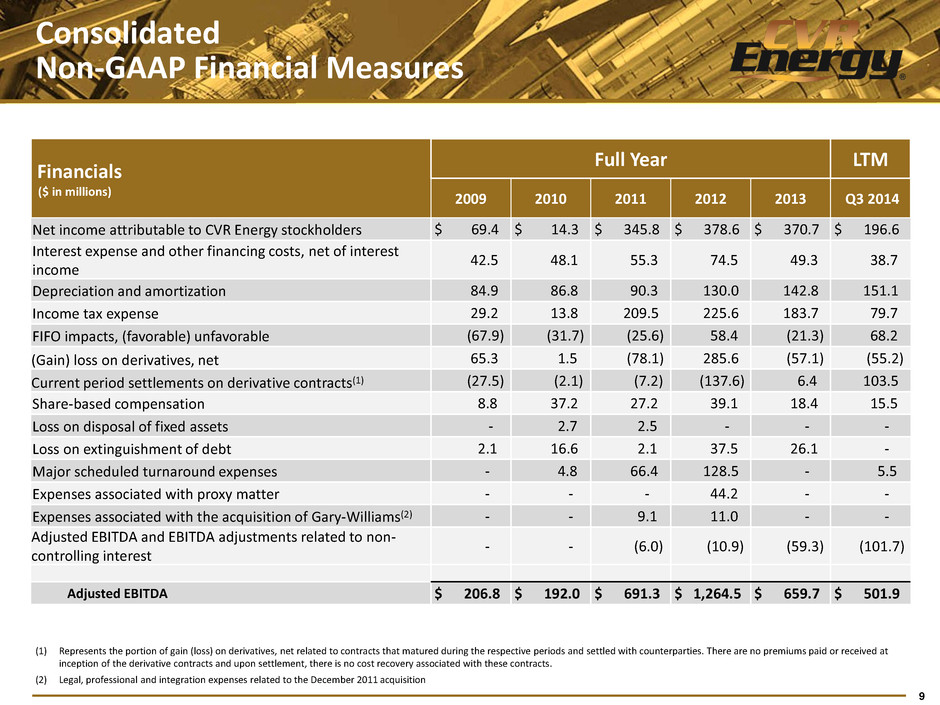

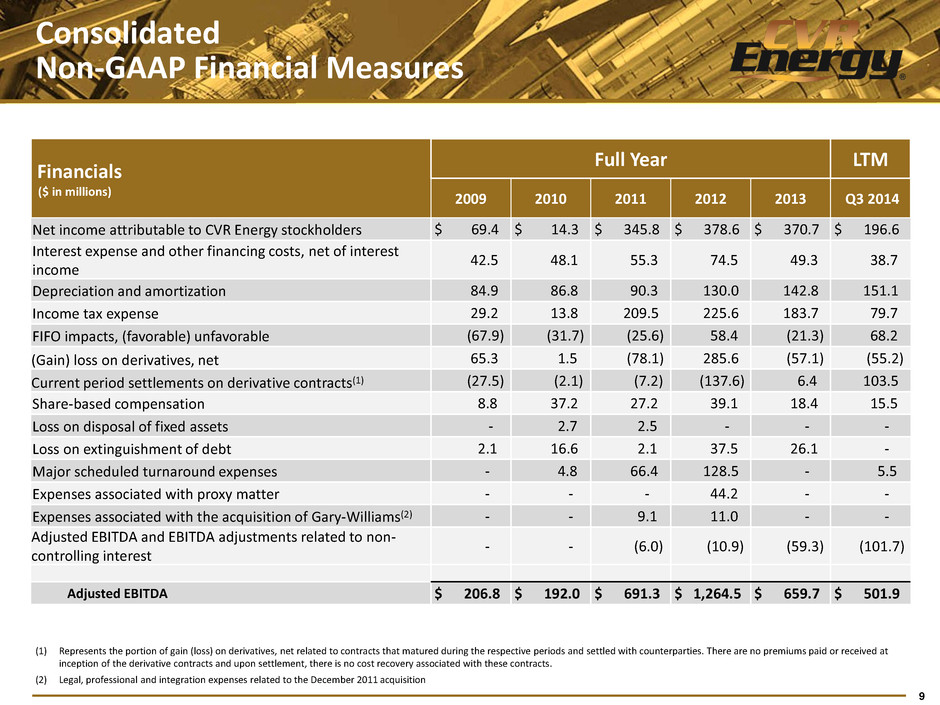

9 Consolidated Non-GAAP Financial Measures (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. (2) Legal, professional and integration expenses related to the December 2011 acquisition Financials ($ in millions) Full Year LTM 2009 2010 2011 2012 2013 Q3 2014 Net income attributable to CVR Energy stockholders $ 69.4 $ 14.3 $ 345.8 $ 378.6 $ 370.7 $ 196.6 Interest expense and other financing costs, net of interest income 42.5 48.1 55.3 74.5 49.3 38.7 Depreciation and amortization 84.9 86.8 90.3 130.0 142.8 151.1 Income tax expense 29.2 13.8 209.5 225.6 183.7 79.7 FIFO impacts, (favorable) unfavorable (67.9) (31.7) (25.6) 58.4 (21.3) 68.2 (Gain) loss on derivatives, net 65.3 1.5 (78.1) 285.6 (57.1) (55.2) Current period settlements on derivative contracts(1) (27.5) (2.1) (7.2) (137.6) 6.4 103.5 Share-based compensation 8.8 37.2 27.2 39.1 18.4 15.5 Loss on disposal of fixed assets - 2.7 2.5 - - - Loss on extinguishment of debt 2.1 16.6 2.1 37.5 26.1 - Major scheduled turnaround expenses - 4.8 66.4 128.5 - 5.5 Expenses associated with proxy matter - - - 44.2 - - Expenses associated with the acquisition of Gary-Williams(2) - - 9.1 11.0 - - Adjusted EBITDA and EBITDA adjustments related to non- controlling interest - - (6.0) (10.9) (59.3) (101.7) Adjusted EBITDA $ 206.8 $ 192.0 $ 691.3 $ 1,264.5 $ 659.7 $ 501.9

10 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Consolidated Non-GAAP Financial Measures Financials ($ in millions) Third Quarter 9/30/2014 9/30/2013 Net income attributable to CVR Energy stockholders $ 7.9 $ 44.0 Interest expense and other financing costs, net of interest income 9.1 11.4 Depreciation and amortization 37.8 36.2 Income tax expense 4.2 29.5 EBITDA adjustments included in noncontrolling interest (16.7) (15.1) EBITDA $ 42.3 $ 106.0 FIFO impacts, (favorable) unfavorable 52.0 (54.3) Gain on derivatives, net (25.7) (72.5) Current period settlement on derivative contracts(1) 38.2 33.9 Share-based compensation 2.0 3.4 Major scheduled turnaround expenses 5.5 - Adjustments included in noncontrolling interest (23.8) 25.9 Adjusted EBITDA $ 90.5 $ 42.4

11 Consolidated Non-GAAP Financial Measures (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Financials ($ in millions) Year to Date 9/30/2014 9/30/2013 Net income attributable to CVR Energy stockholders $ 218.3 $ 392.4 Interest expense and other financing costs, net of interest income 28.1 38.7 Depreciation and amortization 113.7 105.4 Income tax expense 118.8 222.8 EBITDA adjustments included in noncontrolling interest (46.8) (34.9) EBITDA $ 432.1 $ 724.4 FIFO impacts, (favorable) unfavorable 6.2 (83.3) Gain on derivatives, net (171.1) (173.0) Current period settlement on derivative contracts(1) 93.2 (3.9) Share-based compensation 10.8 13.7 Loss on extinguishment of debt - 26.1 Major scheduled turnaround expenses 5.5 - Adjustments included in noncontrolling interest 15.2 45.7 Adjusted EBITDA $ 391.9 $ 549.7

12 Consolidated Non-GAAP Financial Measures (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Financials ($ in millions, except for per share data) Third Quarter 9/30/2014 9/30/2013 Income before income tax expense $ 25.5 $ 107.7 FIFO impact (favorable) unfavorable 52.0 (54.3) Share-based compensation 2.0 3.4 Major scheduled turnaround expenses 5.5 - Gain on derivatives, net (25.7) (72.5) Current period settlement on derivative contracts(1) 38.2 33.9 Adjusted net income before income tax expense and noncontrolling interest $ 97.5 $ 18.2 Adjusted net income attributed to noncontrolling interest (37.3) (8.3) Income tax expense, as adjusted (23.2) (4.7) Adjusted net income attributable to CVR Energy stockholders $ 37.0 $ 5.2 Adjusted Net Income per diluted share $ 0.43 $ 0.06

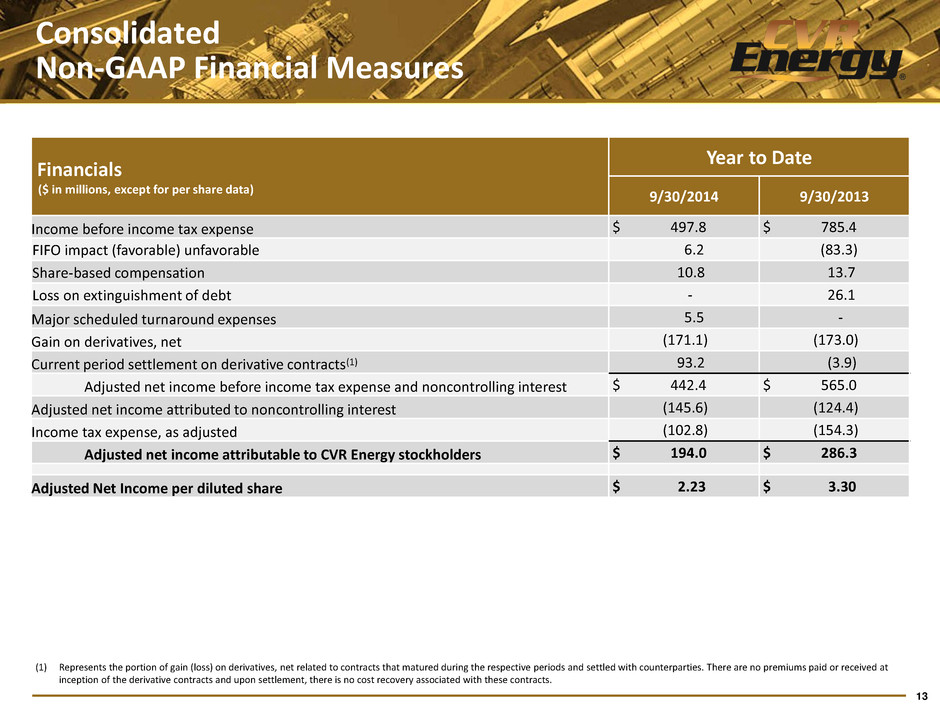

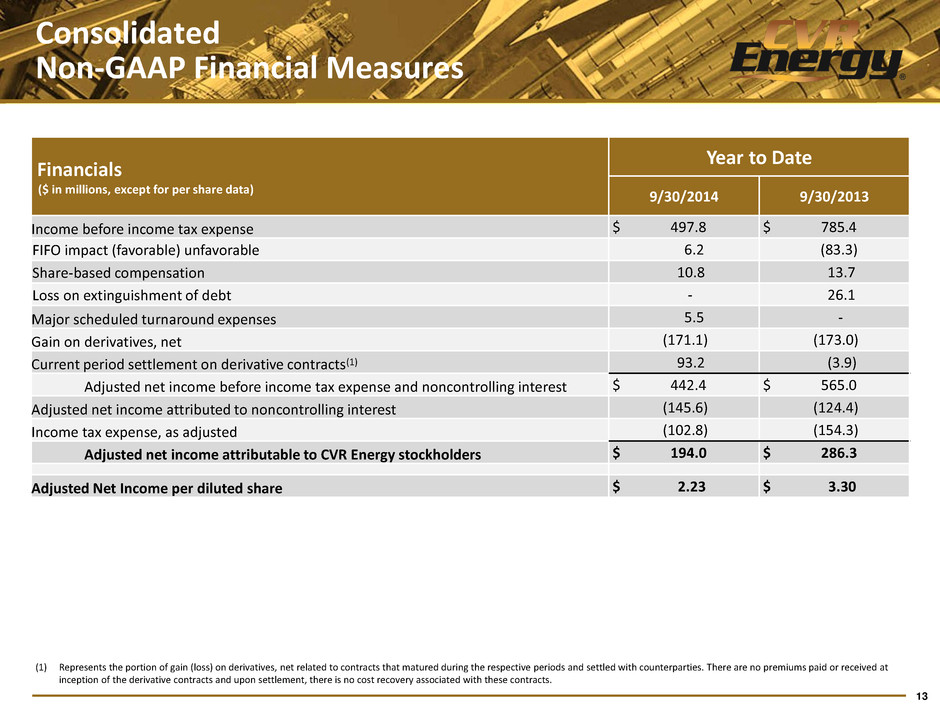

13 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Consolidated Non-GAAP Financial Measures Financials ($ in millions, except for per share data) Year to Date 9/30/2014 9/30/2013 Income before income tax expense $ 497.8 $ 785.4 FIFO impact (favorable) unfavorable 6.2 (83.3) Share-based compensation 10.8 13.7 Loss on extinguishment of debt - 26.1 Major scheduled turnaround expenses 5.5 - Gain on derivatives, net (171.1) (173.0) Current period settlement on derivative contracts(1) 93.2 (3.9) Adjusted net income before income tax expense and noncontrolling interest $ 442.4 $ 565.0 Adjusted net income attributed to noncontrolling interest (145.6) (124.4) Income tax expense, as adjusted (102.8) (154.3) Adjusted net income attributable to CVR Energy stockholders $ 194.0 $ 286.3 Adjusted Net Income per diluted share $ 2.23 $ 3.30

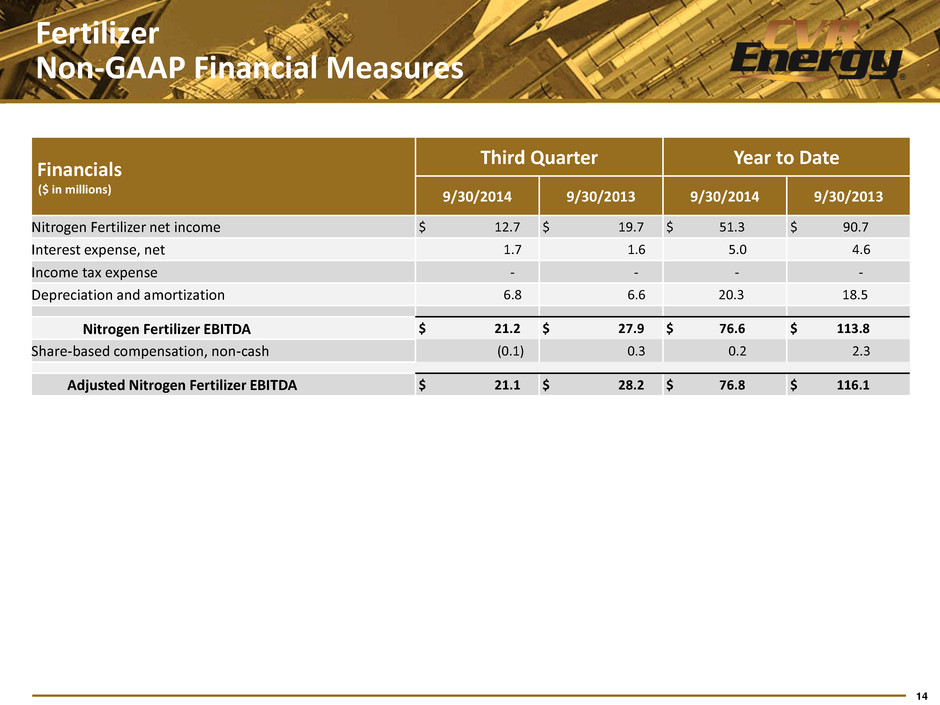

14 Fertilizer Non-GAAP Financial Measures Financials ($ in millions) Third Quarter Year to Date 9/30/2014 9/30/2013 9/30/2014 9/30/2013 Nitrogen Fertilizer net income $ 12.7 $ 19.7 $ 51.3 $ 90.7 Interest expense, net 1.7 1.6 5.0 4.6 Income tax expense - - - - Depreciation and amortization 6.8 6.6 20.3 18.5 Nitrogen Fertilizer EBITDA $ 21.2 $ 27.9 $ 76.6 $ 113.8 Share-based compensation, non-cash (0.1) 0.3 0.2 2.3 Adjusted Nitrogen Fertilizer EBITDA $ 21.1 $ 28.2 $ 76.8 $ 116.1

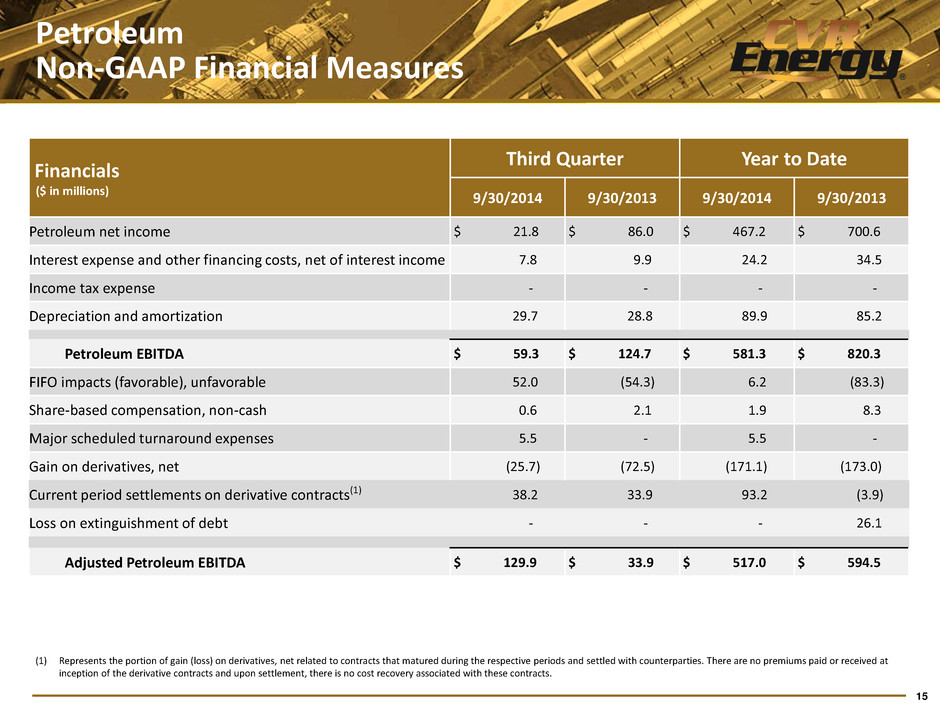

15 Petroleum Non-GAAP Financial Measures Financials ($ in millions) Fourth Quarter Full Year 12/31/2013 12/31/2012 12/31/2013 12/31/2012 Operating income $ 14.9 $ 121.3 $ 603.0 $ 1,012.5 FIFO impacts (favorable) unfavorable 62.0 12.9 (21.3) 58.4 Share-based compensation, non-cash 1.2 4.7 9.5 13.5 Major scheduled turnaround expenses - 89.1 - 123.7 Current period settlements on derivative contracts(1) 10.3 (57.1) 6.4 (137.6) Depreciation and amortization 29.1 27.3 114.3 107.6 Other income, net - - 0.1 0.8 Adjusted EBITDA $ 117.5 $ 198.2 $ 712.0 $ 1,178.9 (1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts. Third Quarter Year to Date 9/30/2014 9/30/2013 9/30/2014 9/30/2013 Petroleum et income $ 21.8 $ 86.0 $ 467.2 $ 700.6 Interest expense and other inancing costs, net of interest income 7.8 9.9 24.2 34.5 Income tax expens - - - - Depreciation an amortization 29.7 28.8 89.9 85.2 Petroleum EBITDA $ 59.3 $ 124.7 $ 581.3 $ 820.3 FIFO impacts (favorable), unfavorable 52.0 (54.3) 6.2 (83.3) Share-based compensation, non-cash 0.6 2.1 1.9 8.3 Major scheduled turnaround expenses 5.5 - 5.5 - Gain on derivatives, net (25.7) (72.5) (171.1) (173.0) Current period settlements on derivative contracts(1) 38.2 33.9 93.2 (3.9) Loss on extinguishment of debt - - - 26.1 Adjusted Petroleum EBITDA $ 129.9 $ 33.9 $ 517.0 $ 594.5