Exhibit 99.2 Q3:22 Financial Results November 2, 2022 1

Disclaimer & Cautionary Statements This presentation includes forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Such forward-looking statements include statements regarding: • future sales or sales growth; • the effectiveness of amniotic tissue as a therapy for any particular indication or condition; • estimates of potential market size for theCompany’s current and future products; • plans for expansion outside of the U.S.; • theCompany’s expectations regarding its mdHACMproduct’s potential use as a safe and effective treatment option, and that it may be an effective treatment for persons battling inflammatory conditions; the Company’s plans for meetings with the U.S. Food & Drug Administration (FDA), and planned biologics license application (BLA) submissions to the FDA, and their timing; plans for future clinical trials, including the Company’s decision to pursue or not pursue, and their timing; • expected spending on clinical trials and research and development; • theCompany’s long-term strategy for value creation, the status of its pipeline products, expectations for future products, and expectations for future growth; 2

Disclaimer & Cautionary Statements Additional forward-looking statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: • future sales are uncertain and are affected by competition, access to customers, patient access to healthcare providers, and many other factors; • whether there is full access to hospitals and healthcare provider facilities, as a continuation or escalation of access restrictions or lockdown orders resulting from the ongoing COVID-19 pandemic; and • the future market for theCompany’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than theCompany’s products, market acceptance of theCompany’s products, and adequate reimbursement for such therapies; • the process of obtaining regulatory clearances or approvals to market a biological product or medical device from the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable products depends on negotiations with third parties which may not be forthcoming; • the results of a clinical trial or trials may not demonstrate that the product is safe or effective, or may have little or no statistical value; the Company may change its plans due to unforeseen circumstances, and delay or alter the timeline for future trials, analyses, or public announcements; the timing of any meeting with the FDA depends on many factors and is outside of theCompany’s control, and the results from any meeting are uncertain; a BLA submission requires a number of prerequisites, including favorable study results and statistical support, and completion of a satisfactory FDA inspection of the Company’s manufacturing facility or facilities; plans for future clinical trials depend on the results of pending clinical trials, discussion with the FDA, and other factors; and conducting clinical trials is a time- consuming, expensive, and uncertain process; • expected spending can depend in part on the results of pending clinical trials; The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward- looking statements speak only as of the date of this press release and the Company assumes no obligation to update any forward-looking statement. 3

Todd Newton Interim CEO 4 4

Four Key Priorities / Goals* Grow Revenue Above Market Expand Operating Margins Execute on R&D Pipeline Exercise Financial Discipline Organization Focused on Capitalizing on These Opportunities 5 *Priorities / Goals are not intended to serve as company guidance. Actual results may differ

New Product & Market Progress Japan Offers superior handling Versatile placental-derived Secured reimbursement characteristics, providing particulate product available approval for EPIFIX surgeons with the capability for use in a wide range of First patients treated with EPIFIX to secure tissue in place with applications in the Surgical in Q3 sutures when needed for Recovery setting surgical wounds Continue to ramp commercial activity in this ~$500 million market Encouraging early feedback from users of these new products 6

Q3:22 End Market Trends July & August September Q3 Lower procedure volumes Demand rebounded, First year/year total sales & increased customer resulting in strong month growth quarter since vacation travel of sales Q2:21 7

Pete Carlson CFO 8 8

Business Units to be Reported as Segments Wound & Surgical • Continuing product portfolio • Related Sales & Marketing expense • Near-term product development initiatives Goal of providing visibility into our business units and Regenerative Medicine expense base as we seek to • Primarily focused on our micronized dehydrated human improve profitability amnion chorion membrane (mdHACM) product candidate for knee osteoarthritis (KOA) Corporate & Other • Corporate overhead expense • Also includes revenue from an expiring contract 9

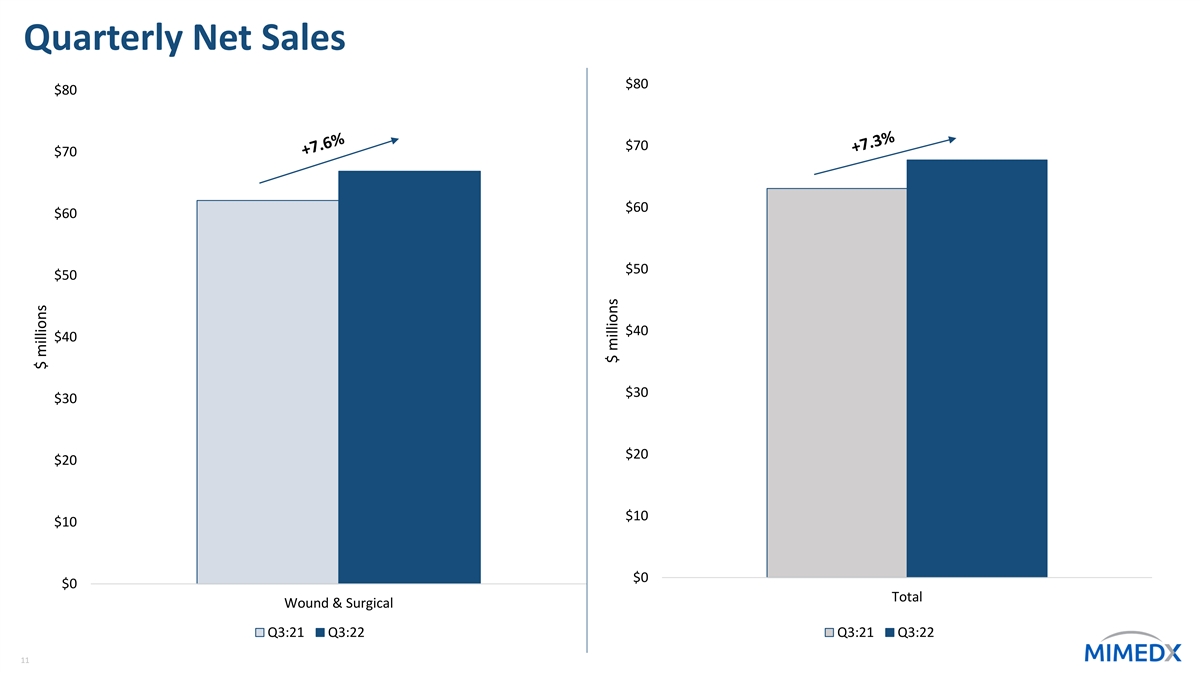

Segment Reporting* Wound & Surgical Regenerative Medicine Corporate & Other ($000s) Q3:22 Q3:21 % yoy Q3:22 Q3:21 % yoy Q3:22 Q3:21 % yoy - $76 nm Net Sales $66,873 $62,138 7.6% $816 $860 -5.1% Cost of Sales - 16 nm 11,159 8,924 25.0% 1,029 1,189 -13.5% Operating 4,273 4,230 1.0% 37,211 33,527 11.0% 18,119 13,093 38.4% Expense Segment $18,503 $19,687 -6.0% ($4,273) ($4,170) 2.5% Contribution As percent of total company 27.3% 31.2% -6.3% -6.6% net sales *For a reconciliation of segment contribution, which does not include Investigation, restatement and related expense, to consolidated GAAP operating loss, 10 please refer to Form 10-Q for the period ended September 30, 2022

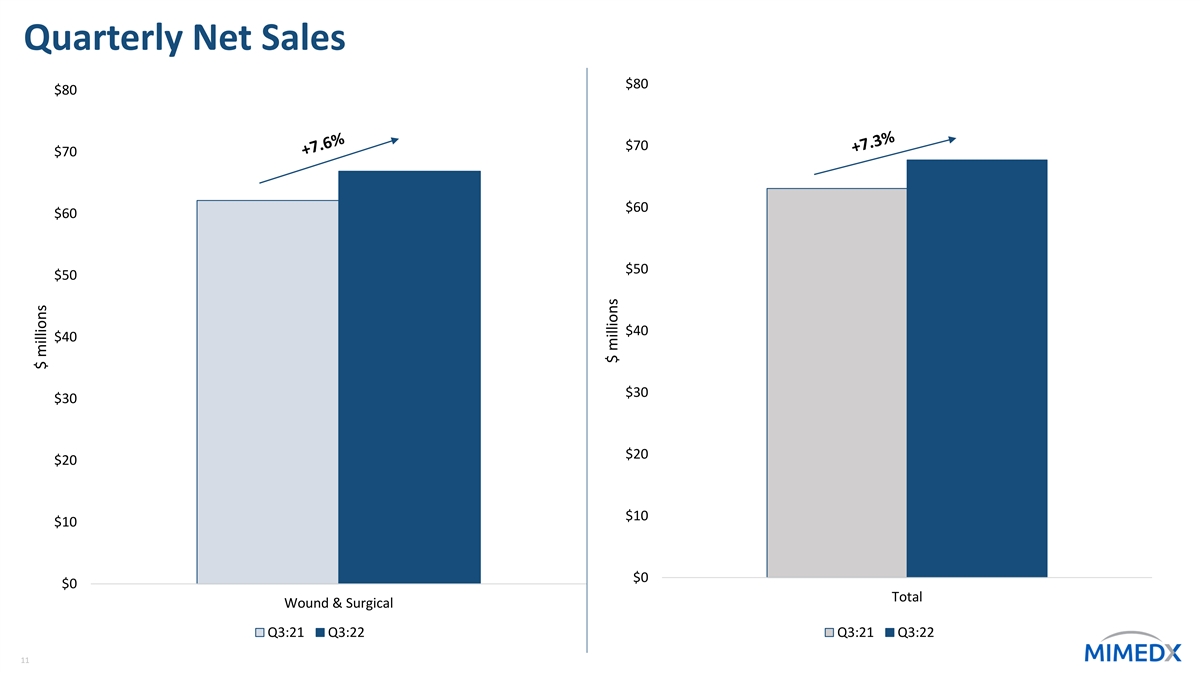

Quarterly Net Sales $80 $80 $70 $70 $60 $60 $50 $50 $40 $40 $30 $30 $20 $20 $10 $10 $0 $0 Total Wound & Surgical Q3:21 Q3:22 Q3:21 Q3:22 11 $ millions $ millions

Gross Profit & Margins Gross Profit Gross Margin $55.5 83.9% 82.0% $52.9 Q3:21 Q3:22 Q3:21 Q3:22 12 $ millions

Q3 Operating Expenses Q3:21 vs. Q3:22 Operating Expenses 70 $62.6 60 $54.0 50 40 30 20 10 0 Q3:21 Q3:22 SG&A R&D Investigation, restatement and related Amortization of intangible assets 13 $ millions

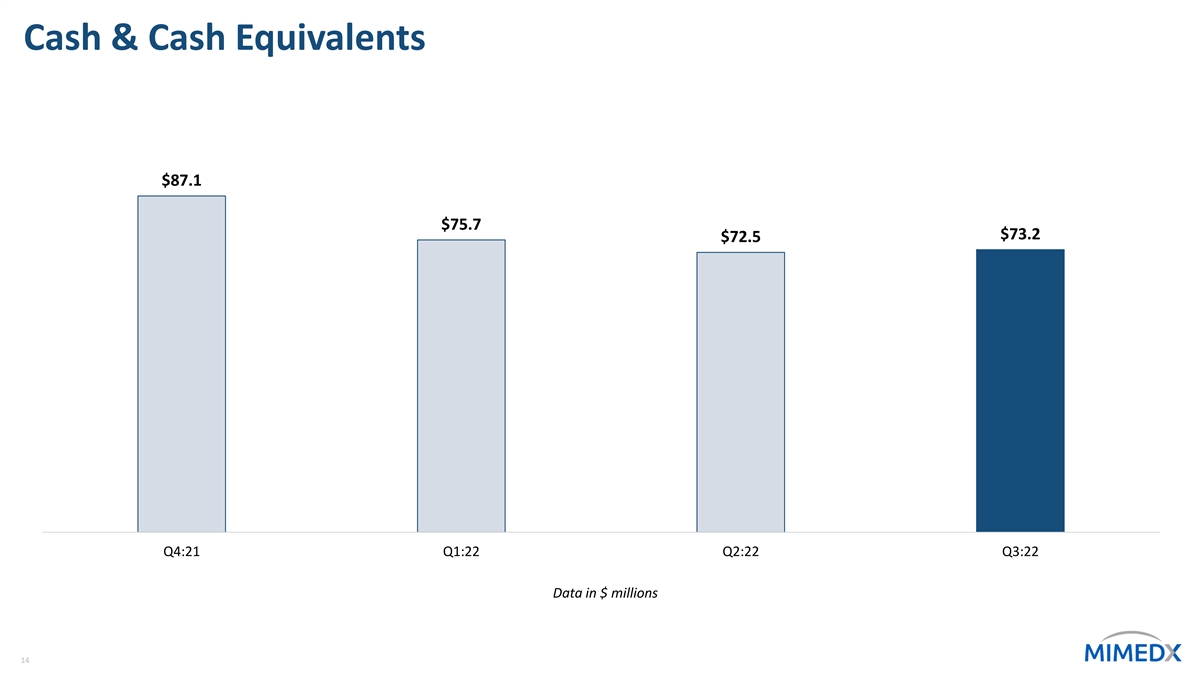

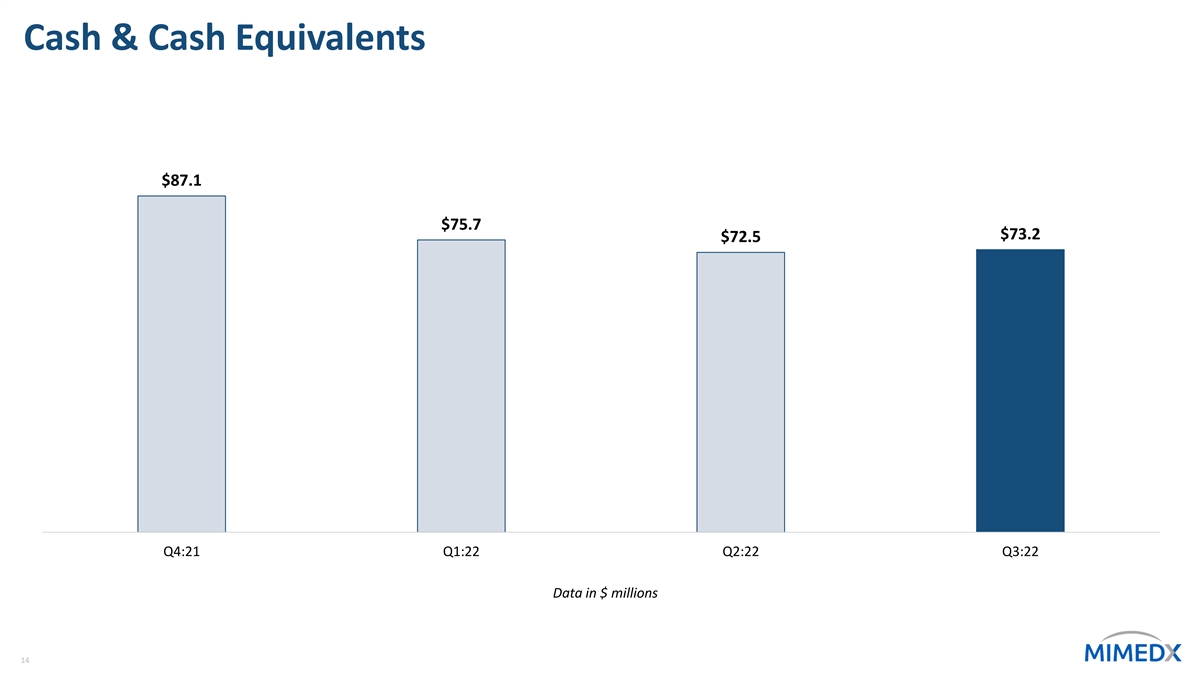

Cash & Cash Equivalents $87.1 $75.7 $73.2 $72.5 Q4:21 Q1:22 Q2:22 Q3:22 Data in $ millions 14

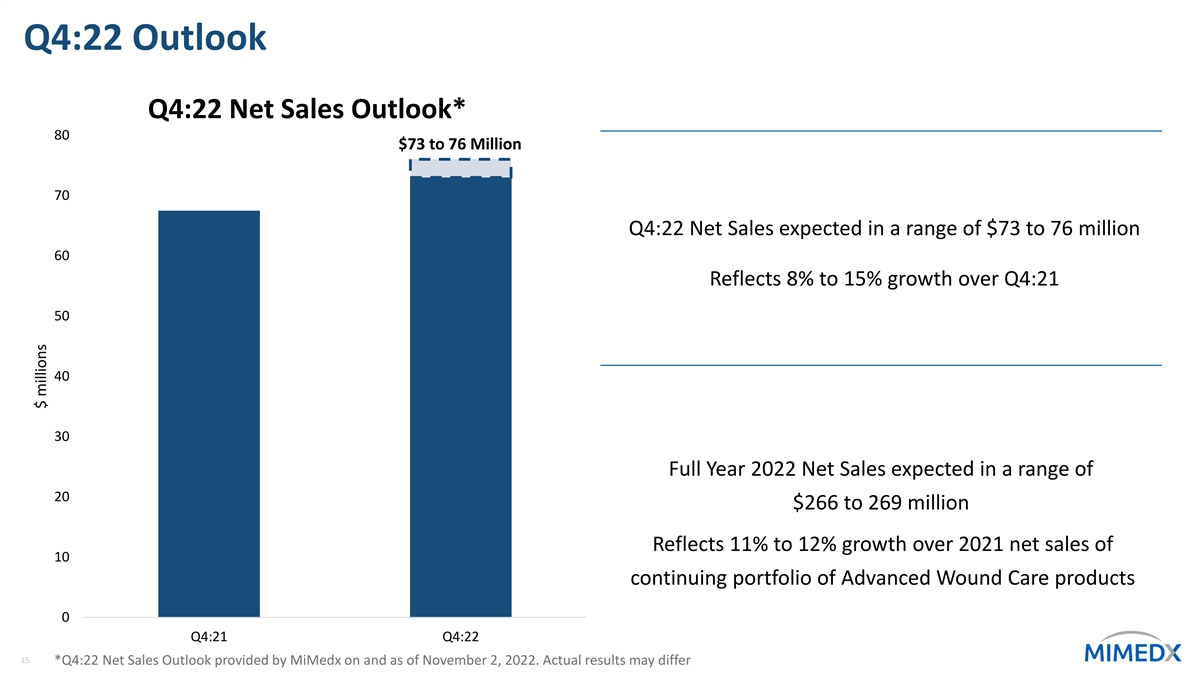

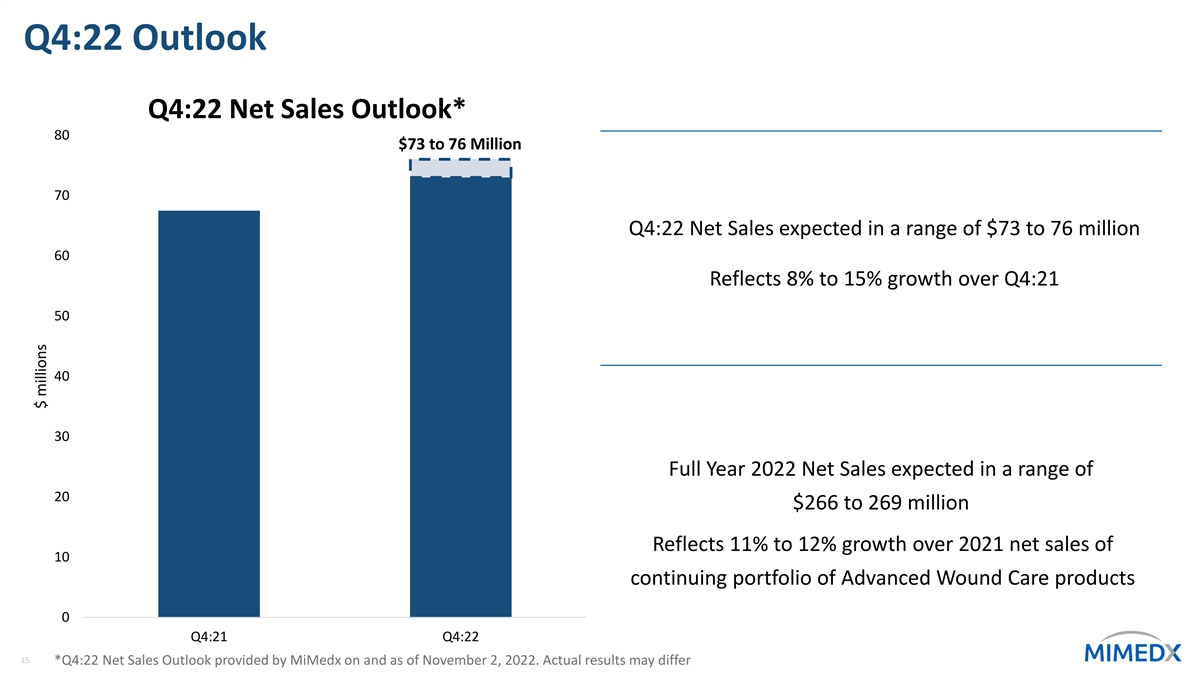

Q4:22 Outlook Q4:22 Net Sales Outlook* 80 $73 to 76 Million 70 Q4:22 Net Sales expected in a range of $73 to 76 million 60 Reflects 8% to 15% growth over Q4:21 50 40 30 Full Year 2022 Net Sales expected in a range of 20 $266 to 269 million Reflects 11% to 12% growth over 2021 net sales of 10 continuing portfolio of Advanced Wound Care products 0 Q4:21 Q4:22 15 *Q4:22 Net Sales Outlook provided by MiMedx on and as of November 2, 2022. Actual results may differ $ millions

Todd Newton Interim CEO 16 16

KOA Update Recent FDA Interactions Type B RMAT meeting Submission of clinical protocol Filing of CMC amendments Study Status Resolving FDA protocol comments Readying for enrollment 17

Conclusion Q3:22 included several important achievements New segment reporting highlights: underlying revenue trends cost structure progress against our growth and profitability initiatives We have sufficient capital to execute our business plans 18

Q&A 19 19