UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

| | |

R | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR |

£ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 001-33446

VAUGHAN FOODS, INC.

(Exact name of registrant as specified in its charter)

| | |

Oklahoma

(State or other jurisdiction of

incorporation or organization) | | 73-1342046

(I.R.S. Employer

Identification No.) |

216 N.E. 12th Street, Moore, OK

(Address of principal executive offices) | | 73160

(Zip Code) |

(405) 794-2530

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange

on which registered |

Common Stock, $0.001 par value per share | | The NASDAQ Stock Market LLC and Boston Stock Exchange |

Class A Common Stock Purchase Warrants | | The NASDAQ Stock Market LLC and Boston Stock Exchange |

Class B Common Stock Purchase Warrants | | The NASDAQ Stock Market LLC and Boston Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ Accelerated filer £ Non-accelerated filer £ Smaller reporting company t>R

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes £ No R

As of June 29, 2007, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $13.9 million, based on the closing price on such date of the registrant’s common stock on the Nasdaq Capital Market.

Number of shares outstanding of the registrant’s common stock, as of March 15, 2008:

| | |

Class | | Shares Outstanding |

Common Stock, $0.001 par value per share | | | | 4,623,077 | |

EXPLANATORY NOTE

This Amendment No. 1 to our Annual Report on Form 10-K for the year ended December 31, 2007 (the “Annual Report”), originally filed on March 21, 2008 amends and restates our Annual Report in its entirety. The amendments in this filing are made so as to include Part III, Items 10, 11, 12, and 14, and parts of Item 13 in the text of the Form 10-K rather than incorporating those items by reference from our 2008 annual meeting proxy statement, the filing of which will be delayed beyond 120 days after December 31, 2007. No other material changes have been made to our Annual Report.

VAUGHAN FOODS, INC.

Form 10-K

For the fiscal year ended December 31, 2007

TABLE OF CONTENTS

| | | | |

| | | | | Page |

| | | | |

| | PART I | | |

Item 1. | | Business | | 1 |

Item 1A. | | Risk Factors | | 6 |

Item 1B. | | Unresolved Staff Comments | | 11 |

Item 2. | | Properties | | 11 |

Item 3. | | Legal Proceedings | | 11 |

Item 4. | | Submission of Matters to a Vote of Security Holders | | 11 |

| | PART II | | |

Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securites | | 12 |

Item 6. | | Selected Financial Data | | 13 |

Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 14 |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 20 |

Item 8. | | Financial Statements and Supplementary Data | | 21 |

Item 9. | | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | | 44 |

Item 9A. | | Controls and Procedures | | 44 |

Item 9B. | | Other Information | | 44 |

| | PART III | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | 45 |

Item 11. | | Executive Compensation | | 47 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 48 |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 51 |

Item 14. | | Principal Accountant Fees and Services | | 52 |

| | PART IV | | |

Item 15. | | Exhibits and Financial Statement Schedules | | 53 |

| | | SIGNATURES | | 55 |

INDEX TO EXHIBITS | | 56 |

Certification Pursuant to 18 U.S.C. Section 1350 | | |

PART 1

ITEM 1—BUSINESS

Overview

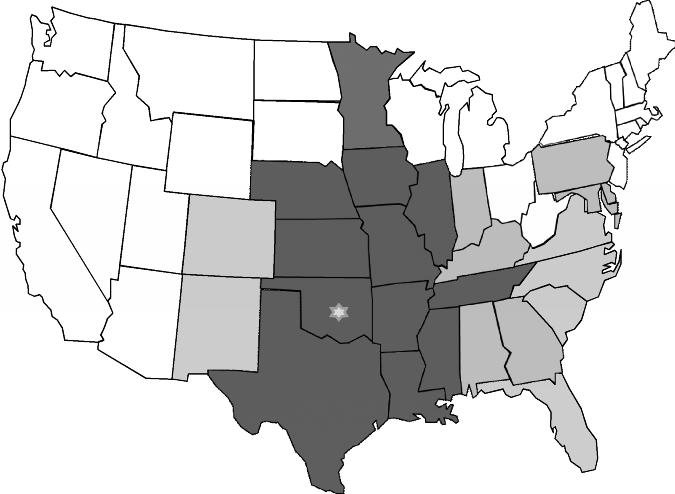

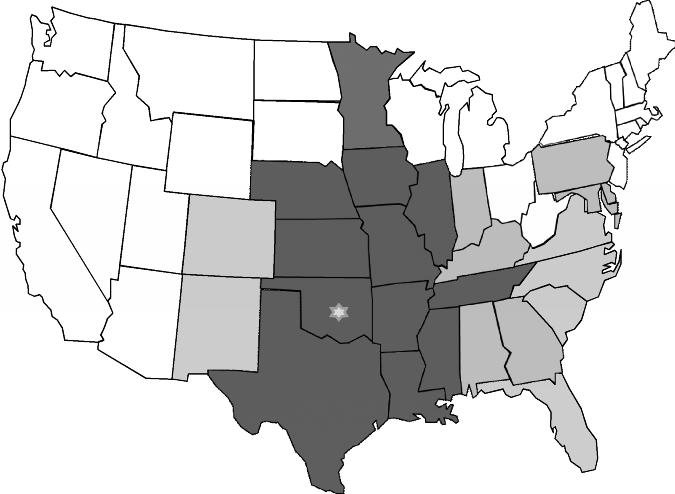

We process and package value-added refrigerated foods which we distribute to our customers three or more times per week in our fleet of refrigerated trucks and trailers. We sell primarily to food service distributors, restaurants, and retail chains. Our products consist of fresh-cut fruits and vegetables, refrigerated prepared salads, and refrigerated soups and sauces. Before 2002, our product line consisted primarily of fresh-cut produce which we packaged and sold to food service customers, such as restaurants. In 2002, we expanded our operations into a more diverse line of refrigerated foods, to provide opportunities for greater profit margins. Initially, we added a limited number of refrigerated, prepared salads. Our fresh-cut vegetable and prepared salads facilities are operated within our production facility in Moore, Oklahoma. Our prepared salads operation uses our fresh-cut produce in its operations. The following represents our current distribution area:

All Products

Prepared Foods Only (shelf life >30 days)

1

History

We were organized in 1989 under the laws of the state of Oklahoma as a successor to a family business that commenced operations in 1961. In March 2003, three of our officers, together with our current Chairman and Chief Executive Officer, Herb Grimes, founded Allison’s Gourmet Kitchens, LP (“Allison’s”), to manufacture a line of refrigerated, prepared salads for retail outlets, our historical food service customers and restaurant chains. In June of 2006, Allison’s acquired Wild About Foods, Inc. (“Wild”), a processor of soups, stews, sauces and side dishes, located in Fort Worth, Texas. Allison’s was acquired as a wholly owned subsidiary in connection with the successful completion of our initial public offering in July 2007.

Segment Reporting

The Company operates in a single reportable operating segment that consists of selling various ready-to-eat food products procured and processed in a vertically integrated manner through its own distribution channel.

Processing, Packaging and Delivery

Our fresh-cut produce is processed and packaged in refrigerated production rooms. Vegetables are inspected, defective items are removed and the remaining vegetables are then cut, washed and sanitized in chilled chlorinated water. This washing process helps to increase shelf life and minimize the risk micro-organisms that might cause food-borne illnesses. Produce is then spin-dried and elevated to an automatic scale and form-fill and seal packaging machine. Finally, finished products are packed in sizes that fit customer’s needs, and boxed to insure that delicate items arrive at the customer’s door in good condition. Most items are made to order daily for maximum freshness, shelf-life and quality. Orders are pulled and palletized in a finished goods cooler, with each pallet tagged by customer and contents to assure delivery to the proper destination.

The degree of freshness of our products is dependent upon distance to market and delivery schedules of our foodservice distributor customers. In order to ensure freshness of product, we maintain a fleet of 30 trucks and 34 fifty-three foot refrigerated trailers, running 55 outbound routes per week. Trucks are pre-cooled before being loaded from our refrigerated loading dock. We deliver cut-to-order products three or more times a week, and up to six times a week to foodservice distributors. While our frequent delivery schedule is expensive, we believe that it helps our marketing efforts by emphasizing the freshness and quality of our products. To assure freshness to the ultimate consumer, we urge our customers to use first-in/first-out inventory control.

We observe “Good Manufacturing Practices,” as established by the U.S. Food and Drug Administration and the U.S. Department of Agriculture, and we are audited by several independent inspection groups to assure that production operations meet or exceed safety standards. We believe these controls assure our customers of consistently high quality products.

Products

Our principal products fall into two categories: (a) refrigerated prepared salads, soups and side dishes, which includes beans, cole slaw, dessert salads, dips, meat salads, pasta salads, potato salads, soups and sauces; and (b) fresh-cut produce, which includes lettuce, cabbage, tomatoes, onions, peppers, fruits, a variety of other vegetables and blends of vegetables. We produce fresh-cut products in a variety of food service and retail package sizes, including custom vegetable mixes and custom sized packages for our large volume customers. Fresh-cut products are sold primarily to restaurant chains, food service businesses, institutional users and, to a lesser extent, retail chains while the bulk of our refrigerated prepared salads are sold to grocery store deli departments, food service distributors and regional restaurant chains.

2

Delivery System and Hauling Services

We reduce the costs of our delivery system and also generate revenue from our transportation assets by hauling product for others, either by backhauling or Third-Party Logistics (3PL). In backhauling we find freight for our empty trucks at or near the termination points of our own routes, then transport that freight back to the vicinity of our facility. Backhauls produce lucrative “Less- Than-Truckload” rates for our regional business. In 3PL we warehouse and transport other firms’ goods that have similar distribution requirements to our own products. Though lucrative, our 3PL service is limited by insufficient warehouse space. However, our national growth plans call for increased 3PL capability through renting of additional warehouse space and increasing the ratio of refrigerated trailers to trucks.

We have invested heavily in our delivery system because it is the key element that ties our product lines together. Our products are perishable and have shelf lives ranging from a few days to a maximum of 45 days. To ensure the freshness and quality of our products we distribute them three times per week, or for some large customers, daily, in our own fleet of 30 trucks and 34 fifty-three foot refrigerated trailers. Our delivery system is flexible and responsive to our customers’ needs and meets the current consumer demand for high quality, fresh food items. Our pattern of frequent delivery also builds strong customer loyalty.

Agricultural and Other Supplies

We purchase fresh produce from approximately 50 suppliers in five growing regions of California, Arizona, Colorado, Florida and Mexico. Purchasing produce from a number of different growing regions helps keep cost in control and protects our supply chain against adverse growing factors and seasonal variability in production. This supplier and geographic diversity also reduces our risk of shortfalls in supplies due to natural disasters, labor disruptions and other supply interruptions in any one area. We purchase other ingredients for our processed refrigerated prepared salad line and packaging material from a limited number of suppliers, but believe that all of these ingredients and other supplies are generally available in the marketplace at competitive prices. To keep costs down and maintain quality we have long-term established relationships with many of our suppliers and purchase an important part of our fresh produce pursuant to seasonal buying contracts. All produce is purchased directly from growers to further ensure consistent supply and quality.

Our quality assurance department inspects each incoming load to insure that it meets our standards. All raw product is stored in our temperature monitored, refrigerated warehouse prior to use. We track all items from the field to the customer and adhere to a strict first-in/first-out inventory control system.

We believe that our raw produce costs are higher than those of our major West Coast processor competitors. We are seeking to reduce our costs through coordinated buying programs with other regional processors with quality standards similar to our own. However, we may not be able to reach agreement with these other processors and coordinated buying may not lower our cost of raw produce.

The availability of raw produce, specifically lettuce, is subject to short-term fluctuations in quality and price primarily due to weather conditions and growing seasons. The effects of increases in cost, shortages of supply and decreases in quality may have material, adverse effects on our profitability. Lettuce purchases comprise 11% of our total cost of sales. See also Item 1A–Risk Factors.

Marketing and Sales

Fresh-cut produce products are marketed and sold to restaurant chains, food service businesses, institutional users and, to a lesser extent, to retail stores and their suppliers. Refrigerated prepared salads are marketed and sold primarily to grocery store deli departments and food service distributors. Our products are currently provided to approximately 186 end-user recurring revenue accounts throughout the Plains States, Southwest, Southeast and recently in the Northeast.

3

Consistent demand enables us to enter into regular supply contracts with growers, helping to insure consistent sourcing.

We offer our customers a wide range of ready-to-order quality products in convenient packaging types and sizes. We also provide added value by creating custom vegetable mixes and custom sized produce cuts to fill special needs of large volume customers. Unlike some of our larger national competitors, we can produce and deliver these customized “cut-to-order” fresh-cut products to distributors in less than two days. Our wide product mix enables our distributors to differentiate our products from those of our competitors when selling to their restaurant and institutional accounts.

In marketing our products we emphasize their freshness and quality. We also highlight our ability to package products in a wide variety of styles and sizes to meet customer demand. We can also quickly satisfy private labeling or recipe requirements, special packaging needs, frequent delivery schedules and can tailor pricing and promotional programs in coordination with customer programs.

We also promote our products by providing vital educational information to foodservice distributors and their end-user customers. Our marketing materials stress the benefits of fresh-cut produce and emphasize how fresh-cut produce meets the needs of restaurant and institutional food service professionals. We also plan to provide our distributors with information regarding yield and cost comparisons between whole produce and our fresh-cut products, food safety facts obtained from government and research groups, such as the Center for Disease Control, the need for the products which are sanitized of harmful micro-organisms that can cause food-borne illnesses and the freshness of our cut-to-order products when compared to those delivered from the West Coast, emphasizing shelf-life at the time of delivery. Proposed additional regional advertising will focus attention on the benefits of a regional fresh-cut processor. We believe that the training, marketing materials and high level of customer support which we provide are important components of our marketing efforts.

Competition

In our fresh-cut produce business we compete against large national processors, regional processors and local “chop shops.” The national processors typically have production facilities on the West Coast near the farms that grow much of the produce that they process. We believe that the national processors may enjoy cost advantages in buying produce. They have significantly greater financial and human resources and, in some cases have established, or are seeking to establish, regional processing facilities outside the West Coast to move closer to their customers. We compete successfully with these processors based upon the quality and freshness of our product, our ability to have speedy delivery within our primary market area and our ability and willingness to configure and package our product to meet the needs of our customers. We compete with our regional processor competitors on the same basis, but also on price. Price and quality are also particularly important in our competition with store based or local processors, often referred to as “chop shops.” If we and other regional competitors increase our market share, the major national processors may offer special pricing promotions aimed at retaining business or seek to acquire regional processors in order to supply a fresher product to local market and gain the other advantages of a local presence. We believe that we can compete with all categories of competition.

In our refrigerated prepared salad business we believe we compete successfully on the basis of the quality of our products, our customer service and our record for frequent, on-time, delivery.

We believe that we have a number of competitive strengths that in combination contribute to our ability to compete with major national and regional processors of fresh-cut produce and refrigerated prepared salads, particularly:

|

• | | | | Frequent deliveries. We deliver our perishable and short shelf life products three or more times per week. Our frequent deliveries coupled with our assistance to customers on how to handle our products on a “first in—first out” basis insure the freshness of our product to the ultimate consumer. |

|

• | | | | Distribution capability. We maintain a fleet of 30 trucks and 34 refrigerated trailers giving us rapid delivery capabiltiy and strong logistical control. |

4

|

• | | | | Diverse and customized products. We offer a diverse range of ready-to-eat quality products in convenient packaging types and sizes. We can also deliver customized “cut-to-order” fresh-cut produce to distributors in less than two days. |

|

• | | | | Single source supplier.As a single source supplier of both packaged fresh-cut salads and refrigerated prepared salads and soups, we allow customers the opportunity to consolidate their sources of supply. |

|

• | | | | Diverse sources of supply. We purchase raw materials from multiple suppliers in multiple geographic growing regions. In 2007, we started a program to contract directly with growers of lettuce to further ensure our supply of raw materials. |

|

• | | | | Broad customer base. No individual customer (or distinct purchasing unit of a consolidated national distributor) accounts for greater than 10 percent of our gross sales. |

Intellectual Property

We hold rights to the following brand names and United States trademarks:

|

• | | | | “Fresh Fixins®” |

|

• | | | | “Allison’s Gourmet Kitchens and Design™” |

|

• | | | | “Vaughan Foods™” |

|

• | | | | “Serve Fresh Kits™” |

|

• | | | | “Wild About Food and Design™” |

|

• | | | | “Greenlight™ Ag Safety” |

We believe that brand name recognition and the product quality associated with our brands are key factors in the success of our products. We rely on a combination of trademark and, with respect to our proprietary recipes, trade secret law to protect our intellectual property rights. We are not currently aware of any material challenge to our ownership of our major trademarks.

Government Regulation

We are subject to extensive regulation by the U.S. Food and Drug Administration, the U.S. Department of Agriculture, the U.S. Environmental Protection Agency, the U.S. Department of Transportation and state and local authorities in jurisdictions where our products are processed or sold. Among other things, these regulations govern the processing, packaging, storage, distribution and labeling of our products. Our processing facility and products are also subject to periodic and surprise compliance inspections by federal, state and local authorities. We are also subject to environmental regulations governing the discharge of air emissions, water and food waste, and the generation, handling, storage, transportation, treatment and disposal of waste materials. Amendments to existing statutes and regulations, adoption of new statutes and regulations, increased production at our facility as well as our expansion into new operations and jurisdictions may require us to obtain additional licenses and permits and could require us to adapt or alter methods of operations at costs that could be substantial. Compliance with applicable laws and regulations may adversely affect our business. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as possible criminal sanctions, which could have a material adverse effect on our business.

In March 2007 the FDA issued draft final guidance containing non-binding recommendations for the operation of fresh-cut fruit and vegetable processing facilities. The guidance addresses worker health, hygiene and training, sanitary facility design and maintenance, building and equipment design, processing techniques, recall procedures and other matters. We participated in the comment process leading to the final draft guidelines and believe we are already in substantial compliance with these suggested guidelines as a result of our investment in quality assurance programs and the food safety aspects of our business.

In response to recent elevated consumer concern over food safety involving fresh produce, we have initiated a pre-harvest program, called “Greenlight Ag Safety” that focuses on the safety and

5

quality of produce before purchase and shipment into our facilities. Under this program we conduct onsite surveys assessing potential sources of contamination, including well and irrigation water, and site analysis pertaining to nearby animal husbandry operations, animal infestations, field drainage and soil amendments. We take physical samples of produce prior to harvest and evaluate these samples for pathogenic organisms in a mobile testing facility at or near the crop location. This program is in a start-up phase and full implementation with all major raw materials is not expected until the third quarter 2008.

We are licensed under the Federal Perishable Agricultural Commodities Act, or “PACA,” which specifies standards for the sale, shipment, inspection and rejection of agricultural products, and governs our relationships with our fresh food suppliers with respect to the grading and commercial acceptance of product shipments. As a licensed commodity supplier under PACA, we are treated as a priority creditor in the event of the bankruptcy of our customers and are entitled to be paid out of PACA trust assets (produce inventory, products derived from that produce and cash and receivables generated from the sale of produce) prior to payments to other general creditors. We are also subject to regulation by state authorities for the accuracy of our weighing and measuring devices.

The Surface Transportation Board and the Federal Highway Administration regulate our trucking operations. In addition, interstate motor carrier operations are subject to safety requirements prescribed by the U.S. Department of Transportation and other relevant federal and state agencies. Such matters as weight and dimension of equipment are also subject to federal and state regulations. We believe that we are in substantial compliance with applicable regulatory requirements relating to our motor carrier operations. Failure to comply with the applicable motor carrier regulations could result in substantial fines or revocation of our operating permits.

Employees

As of December 31, 2007, we employed 430 people at our Moore, Oklahoma and Fort Worth, Texas facilities, of which 11 were corporate employees and 429 are full time employees. None of our employees are unionized. From time to time, we employ additional personnel on a part-time basis in manufacturing operations. We do not have collective bargaining agreements with respect to any of our employees. We believe that relations with our employees are satisfactory.

ITEM 1A—RISK FACTORS

In addition to the factors discussed elsewhere in the Report, the following risks and uncertainties could materially and adversely affect the Company’s business, financial condition and results of operations. Additional risks and uncertainties not presently known to the Company also may impair the Company’s business operations and financial condition.

If our products become contaminated or are mislabeled, we may be subject to product liability claims, product recalls and increased scrutiny by regulators, any of which could adversly affect our business.

Refrigerated products are vulnerable to contamination by organisms producing food-borne illnesses. These organisms are generally found in the environment, and, as a result, there is a risk that, as a result of food processing, they could be found in our products. Once contaminated products have been shipped for distribution, illness and death may result if the disease causing organisms are not eliminated by processing at the foodservice or consumer level. Also, products purchased from others for packing or distribution may contain contaminants that we are unable to identify. The risk can be controlled, but not eliminated, by use of good manufacturing practices and finished product testing. We may also encounter the same risks if a third party tampers with our products or if our products are inadvertently mislabeled. Shipment of adulterated products, even if inadvertant, is a violation of law and may lead to product liability claims, product recalls and increased scrutiny by federal and state regulatory agencies, any of which could have a material adverse effect on our reputation, business, prospects, results of operations and financial condition. Typically, when we purchase certain products or critical raw materials that we use in production, we

6

require a “certificate of analysis” from the vendor showing that the product is free of certain bacteria. Nevertheless, in mid 2005, as a result of our routine internal product testing, we discovered possible contamination by listeria moncytogenes in three different products, produced on various different dates over a period of 25 days. We immediately recalled a total of 23,435 pounds of these products at a total cost to us of $65,000. The USDA Food Safety and Inspection Service has received no complaints of illness associated with consumption of those products.

Volatile agricultural commodity costs could increase faster than we can recover them, which could adversly affect our financial condition and operating results.

Our ability to process and distribute our products depends, in large part, on the availability and affordability of fresh produce. The prices for high quality fresh produce can be volatile and supplies may be restricted due to adverse weather conditions, plant disease and changes in agricultural production levels. The amount and quality of available produce can vary greatly from season to season, or within a season, and our suppliers may not be able to meet their contractual obligations, particularly during periods of severe shortages. Limitations of supply, or the poor quality of produce available under our season-long contracts, could force us to buy produce on the open market during periods of rapid price increases, thus significantly increasing our costs. We can sometimes pass these higher costs on to customers, but a number of factors, including price increases that are faster or more severe than we anticipate may result in cost increases that we are not able to fully recover. We were particularly adversely affected during the second quarter of 2006 when adverse growing conditions in Southern California reduced the supply of lettuce at a time when alternative supplies from other growing regions were not yet available and forced us to buy lettuce on the open market during a period of rapidly rising prices. We maintained customer goodwill by continuing to supply them with lettuce under our sale and supply contracts, though at a cost of significantly reduced gross profit and overall losses. We experienced adverse market conditions again in October 2007 for a period of three weeks, when our cost to purchase lettuce increased approximately $392,000. We were able to pass a portion of the increased cost on to our customers, partially offsetting the increased cost by $234,000. We expect that such conditions will recur from time to time and may have an adverse effect on our operating results when and if they do occur.

Increases in input costs, such as packaging materials and fuel costs, could adversely affect us.

The costs of packaging materials and fuel have varied widely in recent years, and future changes in such costs may cause our results of operations and our operating margins to fluctuate significantly. Fuel costs, which represent the most significant factor affecting transportation costs have generally increased over the last twenty-four months.

Changes in the prices of our products may lag behind changes in the costs of our materials. Competitive pressures also may limit our ability to quickly raise prices in response to increased packaging and fuel costs. Accordingly, if we are unable to increase our prices to offset increased packaging and fuel costs, our operating profits and margins could be adversely affected.

A material disruption at our processing plant could seriously harm our financial condition and operating results.

We process a majority of our products at our Moore, Oklahoma plant. Since we do not have operations elsewhere which could support our current volume of processed products, a material disruption at this plant would seriously limit our ability to deliver products to our customers. Such disruption could be caused by a number of different events, including: maintenance outages; prolonged power failures; equipment failure; a chemical spill or release; widespread contamination of our equipment; fires, floods, earthquakes, tornadoes or other natural disasters; or other operational problems. Any of these events would adversely affect our business, financial condition and operating results. In April 2006 we had to shut down the plant for 21/2 days due to an ammonia leak. We estimate that this occurrence cost us approximately $200,000.

A decline in the demand for fresh-cut salads, or in the consumption of refrigerated prepared salads, would have a material adverse effect on our business, financial condition and operating results.

The food industry is subject to changing consumer trends, demands and preferences. Medical studies detailing the healthy attributes of particular foods affect the purchase patterns, dietary trends

7

and consumption preferences of consumers. From time to time, weight loss and control plans that emphasize particular food groups have been popular and have affected consumer preferences. Adverse publicity relating to health concerns and the nutritional or dietary value of our products could adversely affect consumption and, consequently, demand for our products. In addition, as all of our operations consist of the production and distribution of processed food products, a change in consumer preferences relating to processed food products or in consumer perceptions regarding the nutritional value of processed food products could significantly reduce our sales volume. A reduction in demand for our products caused by these factors would have a material adverse effect on our business, financial condition and operating results.

Competition in our industry is intense and we may not be able to compete successfully. An inability to compete successfully could lead to the failure of our business.

The food processing industry is intensely competitive. In the fresh-cut produce business we compete against large national processors, many with production facilities near farms that grow much of the produce supplying the United States markets, regional processors and store based or local processors often referred to as “chop shops.” The national processors have substantially greater financial and other resources than we do and some may enjoy cost advantages in buying produce. If we and other regional competitors increase our market share, the major national processors could respond by offering special pricing promotions aimed at retaining business or seek to acquire or build regional processing capacities, any of which could hamper our expansion plans.

In the refrigerated prepared salad business we compete against the largest company in this business and smaller regional processors. Our principal competitor has greater financial and other resources than we do. We expect similar competition in other markets in which we may seek to expand. If we cannot compete successfully against our competitors we will not be able to grow and expand our business and may not, if our competitive failures are severe enough, continue in operation.

Managing our growth may be difficult and our growth rate may decline, which may expose us to the risk that we cannot meet our obligations or service indebtedness. If we cannot compete successfully against our competitors we will not be able to grow and expand our business and may not, if our competitive failures are severe enough, continue in operation.

We have rapidly expanded our operations since 2000. This growth has placed, and continued growth will continue to place, significant demands on our administrative, operational and financial resources. There can be no assurance that this growth or the current rate of growth will continue. However, to the extent that our growth continues at a high rate, we expect it to place a significant demand on our managerial, administrative, operational and financial resources. Our future performance and results of operations will depend, in part, on our ability to successfully implement enhancements to our business management systems and to adapt those systems as necessary to respond to changes in our business. Similarly, our growth has created a need for expansion of our facilities and processing capacity. As we near maximum utilization of our facility or maximize our processing capacity, operations may be constrained, which could adversely affect our operating results, unless the facility is expanded, volume is shifted to another facility, or additional processing capacity is added. Conversely, as we add additional facilities or expand existing operations or facilities, excess capacity may be created. Any excess capacity would add to our overhead burden and also create inefficiencies which would adversely affect our operating results. We can provide no assurance that we will be able to successfully implement our growth plan. If our plan is not successful, we will have incurred significant obligations and ongoing expenses, which we may not be able to service from our existing cash flow. If we cannot service our debt from our then-existing cash flow and if we cannot obtain additional financing to service that debt we would be forced to curtail or terminate operations.

Our business operations could be disrupted if our information technology systems fail to perform adequately.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications, supply chain, order entry and fulfillment, and other business processes. The failure of our

8

information technology systems to perform as we anticipate could disrupt our business and could result in transaction errors, processing inefficiencies, and the loss of sales and customers, causing our business and results of operations to suffer. In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including among other things, fire, natural disasters, systems failures, security breaches, and viruses. Any such damage or interruption could have a material adverse effect on our business.

Government regulation could increase our costs of production and increase our legal and regulatory expenditures.

We are subject to extensive regulation by the U.S. Food and Drug Administration, the U.S. Department of Agriculture, the U.S. Environmental Protection Agency, the U.S. Department of Transportation and state and local authorities in jurisdictions where our products are processed or sold. Among other things, these regulations govern the processing, packaging, storage, distribution and labeling of our products. Our processing facility and products are subject to periodic compliance inspections by federal, state and local authorities. We are also subject to environmental regulations governing the discharge of air emissions, water and food waste, and the generation, handling, storage, transportation, treatment and disposal of waste materials. Amendments to existing statutes and regulations, adoption of new statutes and regulations, increased production at our facility as well as our expansion into new operations and jurisdictions may require us to obtain additional licenses and permits and could require us to adapt or alter methods of operations at costs that could be substantial. Compliance with applicable laws and regulations may adversely affect our business. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as possible criminal sanctions, which could have a material adverse effect on our business, which may expose us to the risk that we cannot pay obligations or service debt incurred in attempting to expand. Many of the fines and penalties can be assessed on the basis of the number of occurrences of a particular violation and, therefore, are not possible to meaningfully predict. We estimate that the expense of compliance with existing regulations of the U.S. Food and Drug Administration, U.S. Department of Agriculture, U.S. Environmental Protection Agency and U.S. Department of Transportation and related state and local authorities exceeds $100,000, annually.

Seizure of our workers, strikes, changes in immigration laws or increased labor costs could adversely affect our business.

As of December 31, 2007, we had 430 employees, none of whom are unionized. We believe that a substantial number of our factory workers are immigrants. Though we require all workers to provide us with documentation showing that they can be legally employed in the United States of America, some of our workers may have, without our knowledge, provided improper documentation. Improperly documented workers can be subject to seizure and deportation. Various immigration reform bills have been introduced to the U.S. Congress in the recent past. We cannot accurately predict the effect, if any, on our work force of any immigration reform actions that may become law. Effective November 1, 2007, Oklahoma State House Bill 1804 became law making it illegal for any person or organization to knowingly harbor or transport illegal immigrants. Our responsibilities under this bill will increase on July 1, 2008, when we will be required to document an electronic verification process of prospective new employees with the Social Security Administration. Following the November 1, 2007 effective date of the bill, we have experienced a decline in the number of qualified applicants seeking employment. Any material labor disruption, as a result of seizure of our workers, strikes or changes in immigration law, or significantly increased labor costs at our facilities in the future, could have a material adverse effect on our business, financial condition and operating results.

We depend upon the continued services of certain members of our senior management team, without whom our business operations would be significantly disrupted.

Our success depends, in part, on the continued contributions of our executive officers and other key employees. Our management team has significant industry experience and would be difficult to replace. We believe that the expertise and knowledge of these individuals in our industry, and in their respective fields, is a critical factor to our continued growth and success. We have not entered

9

into an employment agreement with any of these individuals. The loss of the services of any of these individuals could have a material adverse effect on our business and prospects if we are unable to identify a suitable candidate to replace any such individual. Our success is also dependent upon our ability to attract and retain additional qualified marketing, technical and other personnel.

Our insurance and indemnification agreements may be inadequate to cover all the liabilities we may incur.

We face the risk of exposure to product liability claims and adverse public relations in the event that the consumption of our products causes injury, illness or death. If a product liability claim is successful, our insurance contracts may not be adequate to cover all liabilities we may incur, including harm to our reputation, and we may not be able to continue to maintain such insurance, or obtain comparable insurance at a reasonable cost, or at all. We generally seek contractual indemnification and insurance coverage from our suppliers, but this indemnification or insurance coverage is limited by the creditworthiness of the indemnifying party and their insurance carriers, if any, as well as the insured limits of any insurance provided by those suppliers. If we do not have adequate insurance coverage or contractual indemnification available, product liability claims relating to defective products could have a material adverse effect on our financial condition and operating results.

The consolidation of and market strength among our retail and foodservice customers may put pressure on our operating margins.

In recent years, the trend among our retail and foodservice customers, such as foodservice distributors, has been toward consolidation. These factors have resulted in increased negotiating strength among many of our customers, which has and may continue to allow them to exert pressure on us with respect to pricing terms, product quality and the introduction of new products. To the extent our customer base continues to consolidate, competition for the business of fewer customers may intensify. If we cannot continue to negotiate favorable contracts, whether upon renewal or otherwise, with these customers, implement appropriate pricing and introduce new product offerings acceptable to our customers, or if we lose our existing large customers, our potential for profitability could decrease.

The loss of a major customer could adversely impact our business.

We have supply arrangements with two certain distributors, representing 17 percent and 12 percent of its gross revenues, respectively. Both distributors are composed of numerous distinct purchasing units. No individual purchasing unit of either distributor represents greater than 4 percent of gross revenues. A change in these customer relationships could adversely affect our consolidated financial position, results of operations and cash flows.

Our capital structure includes long-term indebtedness, which could limit financing and other options.

As of December 31, 2007, we had total debt and capital lease obligations of $12.8 million. Our debt instruments contain certain financial covenants and if we fail to comply with these requirements, our ability to obtain additional or alternative financing may be adversely affected. Our level of indebtedness may limit our ability to obtain additional financing for working capital, capital expenditures and acquisitions, and may also limit our flexibility to adjust to changing business and market conditions which could make us more vulnerable to a downturn in general economic conditions or a recession.

Our growth may depend on our ability to complete acquisitions and integrate operations of acquired businesses.

Our growth strategy includes acquisitions of other businesses. We may not be able to make acquisitions in the future and any acquisitions we do make may not be successful. Furthermore, future acquisitions may have a material adverse effect upon our operating results, particularly in periods immediately following the consummation of those transactions when the operations of the acquired businesses are being integrated into our operations.

Achieving the benefits of acquisitions depends on the timely, efficient and successful execution of a number of post-acquisition events, including integrating the business of the acquired company

10

into our purchasing programs, distribution network, marketing programs and reporting and information systems. We may not be able to successfully integrate the acquired company’s operations or personnel or realize the anticipated benefits of the acquisition. Our ability to integrate acquisitions may be adversely affected by many factors, including the relatively large size of a business and the allocation of our limited management resources among various integration efforts. The integration of acquisitions may also require a disproportionate amount of our management’s time and attention and distract our management from running our legacy businesses.

In connection with the acquisitions of businesses in the future, we may decide to consolidate the operations of any acquired business with our existing operations or make other changes with respect to the acquired business, which could result in special charges or other expenses. Our results of operations also may be adversely affected by expenses we incur in making acquisitions, by amortization of acquisition-related intangible assets with definite lives and by additional depreciation expense attributable to acquired assets. Any of the businesses we acquire may also have liabilities or adverse operating issues, including some that we fail to discover before the acquisition, and our indemnity for such liabilities may be limited. Additionally, our ability to make any future acquisitions may depend upon obtaining additional financing. We may not be able to obtain additional financing on acceptable terms or at all. To the extent that we seek to acquire other businesses in exchange for our Common Stock, fluctuations in our stock price could have a material adverse effect on our ability to complete acquisitions.

ITEM 1B—UNRESOLVED STAFF COMMENTS

None.

ITEM 2—PROPERTIES

Our principal executive office are located at 216 N.E. 12th Street, Moore, Oklahoma in a 156,238 square foot office, plant and cold storage facility which we own. We also own and operate a manufacturing facility at 500 E. Central Avenue, Fort Worth, Texas and lease refrigerated warehouse space near our Moore facility.

ITEM 3—LEGAL PROCEEDINGS

We are involved in various claims, lawsuits and proceedings arising in the ordinary course of business. There are uncertainties inherent in the ultimate outcome of such matters and it is difficult to determine the ultimate costs that we may incur. We believe the resolution of such uncertainties and the incurrence of such costs will not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

ITEM 4—SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted by us during the reporting period of 2007 to a vote of security holders, through the solicitation of proxies or otherwise.

11

PART 11

ITEM 5—MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock began trading on the Boston Stock Exchange and the NASDAQ Capital Market with the ticker symbol “FOOD” on July 30, 2007 with an opening price of $5.00 per share. Prior to July 30, 2007, and following effectiveness of our registration statement for our initial public offering on June 27, 2007, our common stock traded as a component of a unit (“FOODU”) combined with our Class A warrants and Class B warrants, which became separately tradable on July 30, 2007 under the symbols “FOODW” and “FOODZ”. Additional information on the Company’s warrants may be found in our registration statement on Form S-1/A filed with the Securities and Exchange Commission on June 6, 2007, and made effective on June 27, 2007. The following table sets forth for the periods indicated the high and low sales prices of our common stock on the Nasdaq Capital Market:

| | | | |

| | High | | Low |

Year Ended December 31, 2007: | | | | |

Fourth Quarter | | | $ | | 4.62 | | | | $ | | 2.50 | |

Third Quarter | | | $ | | 6.05 | | | | $ | | 3.75 | |

The following table sets forth for the periods indicated the high and low sales prices of our Class A warrant on the Nasdaq Capital Market:

| | | | |

| | High | | Low |

Year Ended December 31, 2007: | | | | |

Fourth Quarter | | | $ | | 0.72 | | | | $ | | 0.11 | |

Third Quarter | | | $ | | 0.79 | | | | $ | | 0.05 | |

The following table sets forth for the periods indicated the high and low sales prices of our Class B warrant on the Nasdaq Capital Market:

| | | | |

| | High | | Low |

Year Ended December 31, 2007: | | | | |

Fourth Quarter | | | $ | | 0.75 | | | | $ | | 0.16 | |

Third Quarter | | | $ | | 0.65 | | | | $ | | 0.40 | |

As of February 27, 2008, we had approximately 28 holders of record of our common stock, although we believe that there are a larger number of beneficial owners. Information regarding securities authorized for issuance under our equity compensation plan will be included under Item 12 (See Part III).

Our transfer agent as of December 31, 2007 was Continental Stock Transfer & Trust Company.

The Company has never paid a cash dividend on its common stock and anticipates that for the foreseeable future any earnings will be retained for use in its business and, accordingly, does not anticipate the payment of cash dividends.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

In the last three years, we sold the following unregistered securities:

|

• | | | | In September 2006 we sold $2.0 million aggregate principal amount of our 10% secured subordinated promissory notes due June 30, 2007 to 18 accredited investors. In July 2007 the 18 accredited investors received, in partial satisfaction of these notes, $1.125 million of units based on the initial public offering price per unit. |

|

• | | | | In August 2006 we issued to Paulson Investment Company an unsecured promissory note in the aggregate principal amount of $1.0 million, bearing interest at 10% per annum. The original principal amount and accrued interest was repaid on January 24, 2008. |

The foregoing securities were issued in reliance upon the exemptions from the registration requirements of the securities Act of 1933, as amended, provided in Sections 4(2), 4(6) and

12

Regulation D thereof, as a transaction by an issuer not involving a public offering. The registrant reasonably believed that each purchaser had such knowledge and experience in financial and business matters to be capable of valuating the merits and risks of the investment, each purchaser represented an intention to acquire the securities for investment only and not with a view to distribution thereof and appropriate legends were affixed to the secured and unsecured notes and will be added to the shares and warrants when issued.

Use of Proceeds from Public Offering of Common Stock

On June 27, 2007, our registration statement (No. 333-137861) on Form S-1 was declared effective for our initial public offering, pursuant to which we registered the offering and sale of an aggregate of 2,150,000 units, each consisting of one share of common stock, one Class A Warrant, and one Class B Warrant, at a public offering price of $6.50 per unit.

The offering, which closed on July 3, 2007, did not terminate until after the sale of all of the shares registered on the registration statement. The managing underwriters were Paulson Investment Company, Inc., Capital Growth Financial, LLC, I-Bankers Securities, Inc., and Capital West Securities, Inc. As a result of the offering, we received net proceeds of $11.2 million, after deducting underwriting discounts and commissions of $1.0 million and additional offering-related expenses of $1.7 million. No payments for such expenses were made directly or indirectly to (i) any of our officers or directors or their associates, (ii) any persons owning 10 percent or more of any class of our equity securities, or (iii) any of our affiliates.

Based on our current cash and cash equivalents balances, we expect that we will have sufficient resources to fund our operations for the next twelve months. We have used the proceeds of our initial public offering as follows:

| | | | |

Use of Proceeds | | Amount | | Percentage |

Acquisition of Allison’s | | | $ | | 1,500,000 | | | | | 13.4 | % | |

Payment of short-term borrowings incurred in connection with expansion of the existing facility | | | | 2,000,000 | | | | | 17.9 | % | |

Repayment of debt, excluding accrued interest | | | | 2,821,304 | | | | | 25.3 | % | |

Working capital | | | | 2,150,169 | | | | | 19.2 | % | |

Temporary investments (money market account with bank) | | | | 2,708,288 | | | | | 24.2 | % | |

Total | | | $ | | 11,179,761 | | | | | 100.0 | % | |

On January 24, 2008, we repaid a $1.0 million, 10 percent non-secured promissory note, plus accrued interest with amounts held as temporary investments on December 31, 2007.

ITEM 6—SELECTED FINANCIAL DATA

The selected financial data set forth below should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as presented in Item 7. The consolidated statements of operations data for each of the five-year periods and the consolidated balance sheet data dated December 31, 2007 and 2006 are derived from our financial statements which have been audited by Cole & Reed, P.C. certified public accountants. Historical results are not necessarily indicative of future results.

13

| | | | | | | | | | |

Consolidated statements of operations data:

(in thousands) | | | | | | | | | | |

| | Year Ended December 31, |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Net Sales | | | $ | | 67,173 | | | | $ | | 51,277 | | | | $ | | 44,730 | | | | $ | | 36,133 | | | | $ | | 29,369 | |

Cost of Sales | | | | 60,491 | | | | | 47,557 | | | | | 40,203 | | | | | 31,614 | | | | | 26,348 | |

| | | | | | | | | | |

Gross profit | | | | 6,682 | | | | | 3,720 | | | | | 4,527 | | | | | 4,519 | | | | | 3,021 | |

Selling, General and administrative expenses | | | | 6,213 | | | | | 4,005 | | | | | 4,206 | | | | | 3,697 | | | | | 2,510 | |

| | | | | | | | | | |

Income (loss) from operations | | | | 469 | | | | | (285 | ) | | | | | 321 | | | | | 822 | | | | | 511 | |

Interest expense | | | | (2,072 | ) | | | | | (1,617 | ) | | | | | (1,106 | ) | | | | | (496 | ) | | | | | (414 | ) | |

Other income | | | | 490 | | | | | 390 | | | | | 384 | | | | | 208 | | | | | 142 | |

| | | | | | | | | | |

Income (loss) before provisions for taxes | | | | (1,113 | ) | | | | | (1,512 | ) | | | | | (401 | ) | | | | | 534 | | | | | 239 | |

Income tax expense (benefit) | | | | (207 | ) | | | | | (307 | ) | | | | | (160 | ) | | | | | 192 | | | | | 71 | |

| | | | | | | | | | |

Net income (loss) | | | $ | | (906 | ) | | | | $ | | (1,205 | ) | | | | $ | | (241 | ) | | | | $ | | 342 | | | | $ | | 168 | |

| | | | | | | | | | |

Net income (loss) per share | | | $ | | (0.26 | ) | | | | $ | | (0.52 | ) | | | | $ | | (0.10 | ) | | | | $ | | 0.15 | | | | $ | | 0.07 | |

Weighted average number of shares outstanding—basic and diluted | | | | 3,462 | | | | | 2,300 | | | | | 2,300 | | | | | 2,300 | | | | | 2,300 | |

| | | | |

Consolidated balance sheet data:

(in thousands) | | | | |

| | December 31, 2007 | | December 31, 2006 |

Current assets | | | $ | | 11,684 | | | | $ | | 5,726 | |

Working capital (deficit) | | | | 1,578 | | | | | (7,208 | ) | |

Total assets | | | | 30,447 | | | | | 21,002 | |

Total current liabilities | | | | 10,106 | | | | | 12,934 | |

Total long-term liabilities | | | | 9,693 | | | | | 8,667 | |

Stockholders’ equity (deficiency) | | | | 10,648 | | | | | (599 | ) | |

Our acquisition of Allison’s on June 30, 2007 increased our current assets $4.0 million, total assets $8.6 million, current liabilities $3.8 million and long-term liabilities $2.0 million at the date of acquisition. The closing of our initial public offering on July 3, 2007 increased our working capital $9.7 million and increased our stockholder’s equity $12.2 million. Refer to financial footnotes for more information on the acquisition of Allison’s and our initial public offering.

ITEM 7—MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-looking Statements

Certain written and oral statements set forth below or made by the Company with the approval of an authorized executive officer constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “intend,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which convey the uncertainty of future events and generally are not historical in nature. All statements which address operating performance, events or developments that we expect or anticipate will occur in the future, including statements relating to the business, expansion and marketing strategies of the Company, industry projections or forecasts, the impact on our financial statements of inflation, legal action, future debt levels, sufficiency of cash flow from operations and borrowings and statements expressing general optimism about future operating results, are forward-looking statements. Such statements are based upon our management’s current estimates, assumptions and expectations, which are based on information available at the time of the disclosure, and are subject to a number of factors and uncertainties, including, but not limited to:

|

• | | | | Our future operating results and the future value of our common stock; |

|

• | | | | whether our assumptions turn out to be materially correct; |

|

• | | | | our ability to attain such estimates and expectations; |

14

|

• | | | | our ability to execute our strategy; |

|

• | | | | a downturn in market conditions in any industry, including the economic state of the food industry; |

|

• | | | | the effects of, or changes in, economic and political conditions in the United States of America and the markets in which we serve; |

|

• | | | | our ability to reasonably forecast prices of the commodities we purchase; |

|

• | | | | our ability to timely forecast and meet customer demand for fresh-cut salads and refrigerated prepared salads; |

|

• | | | | our ability to respond to changing consumer spending patterns; and |

|

• | | | | our ability to attract and retain quality employees and control our labor costs. |

Any of the foregoing factors and uncertainties, as well as others, could cause actual results to differ materially from those described herein. We undertake no obligation to affirm, publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The following discussion should be read in conjunction with the consolidated financial statements of the Company and the related notes thereto appearing elsewhere in this report.

General

We process and package value-added, refrigerated foods which we distribute to our customers three or more times per week in our fleet of refrigerated trucks and trailers. Our products consist of fresh-cut fruits and vegetables, refrigerated prepared salads and refrigerated soups and sauces. Refrigerated prepared salads generate higher gross profit margins than our fresh-cut produce.

We produce products in a variety of food service and retail package sizes, including custom vegetable mixes and custom sized packages for our large volume customers. Salads and salad mixes are sold primarily to restaurant chains, food service businesses, institutional users and, to a lesser extent, retail chains while the bulk of our refrigerated prepared salads are sold to grocery store deli departments, food service distributors and regional restaurant chains.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United States of America requires management to make judgments, assumptions and estimates that effect the amounts reported in the Company’s consolidated financial statements and accompanying notes. We base our estimates and judgments on historical experience and on various other assumptions that we believe are reasonable under the circumstances. However, future events are subject to change and our estimates, assumptions and judgments routinely require adjustment. The amounts of our assumptions regarding assets and liabilities reported in our consolidated balance sheets and the amounts of revenues and expenses reported for each of our fiscal periods are affected by the critical estimates and assumptions which are used for, but not limited to, the accounting for inventory, rebates, impairment of long-lived assets, and allowance for credit losses. Actual results could differ from these estimates and such differences could be material.

Inventory. Inventory purchases and purchase commitments are based upon forecasts of demand. Our inventory is stated at the lower of average cost (which approximates first-in, first-out) or market. Inventory turns rapidly due to the nature of our fresh products and, accordingly, we do not generally experience material inventory valuation issues. However, in the instance where we may believe that demand no longer allows us to sell certain inventory above cost or at all, then we revalue that particular inventory to market or charge-off excess inventory levels. If customer demand subsequently differs from our forecasts, requirements for inventory revaluations and charge-offs could differ from our estimates. We have not historically experienced any material inventory

15

revaluations or charge-offs and manage inventory levels of both perishable and non-perishable supplies to minimize the effects of any revaluations.

Customer Rebates. Estimates and reserves for rebates are based on specific rebate programs, expected usage and historical experience. Actual results could differ from these estimates. With respect to some programs, we make a provision for rebates based on anticipated purchase volume. Greater than anticipated volume under a program would result in an additional charge to earnings. We have not historically experienced any material charges to earnings under our rebate programs; however, we could experience such charges in the future.

Allowance for Credit Losses. The allowance for credit losses is based on our assessment of the collectibility of specific customer accounts and an assessment of political and economic risk as well as the aging of the accounts receivable. If there is a change in a customer’s creditworthiness or actual defaults differ from our historical experience, our estimates of recoverability of amounts due us will be affected. We continually monitor customer accounts for indications of a customer’s inability to pay. Overdue accounts get special attention. Our recent losses on charged-off accounts have not been material.

Long-lived Assets.Long-lived assets such as property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not ultimately be recoverable. Determination of recoverability is based on an estimate of undiscounted future cash flows resulting from the use of the asset and its ultimate disposition. Cash flow estimates used in evaluating for impairment represent management’s best estimates using appropriate assumptions and projections at the time. We have not experienced any write downs due to impairment for equipment in use. The depreciation lives of these assets are short (generally 5 to 7 years), resulting in relatively low net book values. Equipment not in use is depreciated in full or held for sale at its estimated recovery value.

Intangible Assets. We evaluate the recoverability of intangible assets annually or more frequently if impairment indicators arise. Under SFAS No. 144, Accounting for the Impairment and Disposal of Long-Lived Assets, intangible assets are evaluated whenever events or changes in circumstances indicate that the carrying value exceeds its fair value, which is determined based upon the estimated undiscounted future cash flows expected to result from the use of the asset, including disposition. Cash flow estimates used in evaluating for impairment represent management’s best estimates using appropriate assumptions and projections at the time. We believe that accounting for intangible assets is a critical accounting policy due to the requirement to estimate the value in accordance with SFAS No. 144. Our intangible assets consist primarily of customer relationship intangibles of purchased entities.

Comparison of 2007 and 2006

We recorded a net loss for 2007 of $906,000 or $0.26 per share compared to a net loss of $1,205,000 or $0.52 per share in 2006. In 2007, we successfully completed our initial public offering and acquisition of Allison’s. We incurred additional administrative expenses as a result of operating as a public company, most of which are recurring. Operating results were adversely affected by a settlement with a supplier in the amount of $200,000 in the second quarter and by excessive raw material net costs of $158,000 related to production of our lettuce products in the fourth quarter. We also incurred unusual items in the fourth quarter of 2007 of $244,000 related to recruiting costs for a new Chief Financial Officer and a new General Manager of Fresh Cut Produce, and the effects of rising energy costs.

Net sales.Net sales increased $15.9 million in 2007 to $67.2 million from $51.3 million in 2006. Our acquisition of Allison’s represents $12.9 million or 81 percent of the increase. The amount of credit memos processed for returns of lettuce decreased in 2007 compared to 2006 due primarily to higher quality raw materials available in 2007. Our fresh-cut vegetable business shipped 4.4 million fewer pounds of product in 2007 compared to 2006. The decline in pounds shipped was substantially all in the lettuce category, as demand for lettuce decreased in 2007 as a result of public concern over lettuce-borne pathogens.

16

Gross profit.Our gross profit percentage was 9.9 percent in 2007 compared to 7.3 percent in 2006. The inclusion of Allison’s due to acquisition increased our gross margin from 8.8 percent to 9.9 percent in the current year. The increase in gross margin excluding Allison’s is due to overall higher prices resulting primarily from changes in product mix, and production efficiencies in both labor and raw material costs resulting from higher quality raw materials. Labor cost efficiencies result from higher quality raw material due to less time required to handle and trim the raw materials.

Fuel costs during 2007, related to our inbound delivery of raw materials and outbound delivery of finished goods to our customers, continued to rise from the high levels encountered in 2006.

Selling, general and administrative expenses.Our selling, general and administrative expenses amounted to $6.2 million or 9.2 percent of net sales in 2007 compared to $4.0 million or 7.8 percent of net sales in 2006. The acquisition of Allison’s represents $1.4 million of the increase. General and administrative expenses including administrative salaries, legal and consulting fees, directors and officers insurance and travel expenses increased due to operating as a public company by $1.0 million. We expect that these increased expenses will recur as we continue to operate as a public company. We experienced a decrease in salesperson salaries and commissions of $0.2 million in 2007 due to a reduction in commission rates and the addition of certain non-commission based sales.

Other income and expense.Other income and expense amounted to a net expense of $1,582,000 in 2007 compared to a net expense of $1,227,000 in 2006. The increase is due to an increase in interest expense of $455,000, a decrease in rent expense of $119,000, partially offset by an increase in interest income of $114,000 and a gain on sale of the company airplane of $123,000, partially offset by a loss on the sale of property. Prior to our acquisition of Allison’s we collected rents for use of our manufacturing facility. Subsequent to the acquisition, those rents are eliminated in our consolidated statements of operations. Our initial public offering provided cash balances which were held in short-term investments, earning interest income.

Interest expense totaled $2,072,000 in 2007 compared to $1,617,000 in 2006. The higher interest costs in 2007 were primarily attributable to higher levels of indebtedness resulting from bridge loans outstanding, which were retired during the third quarter of 2007 with use of proceeds from the initial public offering.

Income tax expense (benefit).We recognized an income tax benefit of $207,000 in 2007 attributable to an operating loss partially offset by amortization of equity transactions, which represents a permanent difference in tax and book income amounts. In 2006, we recognized an income tax benefit of $307,000 due primarily to an operating loss, and utilization of net operating loss carryforwards.

Comparison of 2006 and 2005

Net Sales.Net sales in 2006 increased by $6.6 million (14.8 percent) to $51.3 million from $44.7 million in 2005. The increase was due primarily to increased volume from 20 new customers and, to a lesser extent, increased volume from some food distributors and other existing customers.

Our average selling price for all products (exclusive of backhaul revenue) decreased from $0.67 per pound in 2005 to $0.66 per pound in 2006. The net $6.6 million increase in product sales (exclusive of backhaul revenue) from 2005 to 2006 reflects a $7.5 million increase in sales due to the higher average volume, offset by an $800,000 decrease in sales due to lower average prices. Lower average prices in 2006 resulted primarily from customer credits granted in connection with lower quality lettuce as described below.

Gross profit.Gross profit in 2006 declined by $800,000 to $3.7 million from $4.5 million in 2005. The gross profit percentage in 2006 declined to 7.2 percent from 10.1 percent in 2005. Approximately $330,000 of the decrease in gross profit was due to increased costs associated with poor quality lettuce and increased fuel costs, and approximately $200,000 was due to excess cost of sales related to an ammonia leak in the processing plant. Depreciation expense increased by $70,000 due to the purchase of additional processing equipment. Maintenance and repair expenses primarily related to facilities, contributed approximately $200,000 to the decline in gross profit. Poor quality

17

lettuce reduced our yields of finished product and also required increased handling and trimming. Poor quality lettuce was a result of unusual weather conditions during the spring growing season in a number of regions.

Higher fuel costs increased our cost of inbound freight which was a significant factor in our increased cost of sales for the year ended December 31, 2006 compared to 2005. Fuel costs related to freight out to customers as a percentage of sales increased from 3.2 percent in the year ended December 31, 2005 to 3.5 percent in the year ended December 31, 2006.

Our plant is refrigerated using liquid ammonia, which is pumped through our cooling system by a network of high-pressure pipes. In early April 2006, one of the pumps developed a leak in one of its seals. The amount of ammonia discharged was large enough to force evacuation of our plant and the immediate surrounding area, and we were not able to resume operation until the discharged ammonia had dissipated, the pump had been replaced, and our facility had again been cooled back to our normal operating temperature range of 35-40 degrees Fahrenheit. This evacuation resulted in decreased revenue for this time period, as we lost 2.5 days of production, and incurred a one-time expense of an ammonia consulting firm, which was employed to provide assurance that an incident such as this would not recur. We have since implemented a maintenance and prevention plan for our ammonia system to ensure we are fully operational at all times. Additionally, we have trained the majority of our maintenance and management staff to perform maintenance, detection, and prevention of leaks and malfunctions. Due to the ammonia leak, we incurred additional costs of sales expenses of approximately $200,000; consisting of $50,000 in credits and returns, $50,000 in additional plant payroll, $20,000 in late delivery fees, $20,000 in cleanup and supplies, and $60,000 in other expenses.

Selling, General, and Administrative Expenses.Selling, general, and administrative expenses for the years ended December 31, 2006 and 2005 were $4.0 million and $4.2 million, respectively; an decrease of approximately $200,000 or 4.8 percent. Expenses in 2006 relating to our initial public offering have been capitalized, and expenses related to previous unsuccessful equity financing projects through December 31, 2005, were expensed.

Income (loss) from Operations.Operating income or loss for the years ended December 31, 2006 and 2005 was a loss of $285,000 and a profit of $321,000, respectively. The 2006 decrease in profitability of approximately $500,000 was due to lower lettuce yields related to spring crop failures and the ammonia leak.

Other income (expense).Other income (expense) for the years ended December 31, 2006 and 2005 was a net expense of $1,227,000 and $722,000, respectively, an increase of $505,000 or 70 percent. The primary reason for the increased 2006 expense was an increase of $620,000 of amortization of bridge loan asset (treated as interest expense, but included in depreciation and amortization in the Company’s Consolidated Statement of Cash Flows), a decline in interest income of $13,000 due to lower balances in interest bearing restricted cash accounts, a loss on disposal of assets compared to a gain on disposal of assets in 2005, and increased rental income of $44,000. Interest expense on short-term borrowings related to the building expansion was capitalized in the amount of $220,000. The net effect of the increased interest expense less the amount of interest expense capitalized was $511,000.

Earnings (loss) before income taxes.Earnings (loss) before income taxes for the years ended December 31, 2006 and 2005 was a loss of $1.5 million and a loss of $401,000, respectively, for a decrease in profitability of $1.1 million. The decrease was principally caused by the decrease in gross profit of approximately $600,000 and increased interest expense of approximately $500,000. In addition, higher revenue was offset by a decreased gross profit due to low quality lettuce and the ammonia leak and an increase in interest expense related to the expansion of our facility.

Income Taxes.The income tax benefit for the years ended December 31, 2006 and 2005 was $307,000 and $160,000, respectively. The income tax benefit was due to the net operating loss and state tax job credits. Our effective tax rates for the years ended December 31, 2006 and 2005 were 20 percent and 40 percent respectively. The increase in the effective rate is due to non-deductibility of amortization of bridge loan asset treated as interest.

18

Net Income (loss).Net income (loss) for the years ended December 31, 2006 and 2005 was a loss of approximately $1.2 million and $241,000, respectively. The increase of approximately $1 million in net loss was due to the $1.1 million loss in earnings before income taxes offset by a $147,000 increase in income tax benefit.

Pro-forma Results

The following pro-forma results include the following major assumptions:

|