As filed with the Securities and Exchange Commission on October 27, 2006

Registration No. 333-138009

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HUGHES NETWORK SYSTEMS, LLC

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 4899 | | 11-3735091 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

11717 Exploration Lane

Germantown, MD 20876

(301) 428-5500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

HNS FINANCE CORP.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 4899 | | 56-2571546 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

11717 Exploration Lane

Germantown, MD 20876

(301) 428-5500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

GUARANTORS LISTED ON SCHEDULE A HERETO

Dean Manson, Esq.

Hughes Network Systems, LLC

11717 Exploration Lane

Germantown, MD 20876

Telephone: (301) 428-5500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Rosa A. Testani, Esq.

Akin Gump Strauss Hauer & Feld LLP

590 Madison Avenue

New York, NY 10022

Telephone: (212) 872-1000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SCHEDULE A

| | | | | | | | |

Exact name of registrant as

specified in its charter | | State or other jurisdiction of incorporation or organization | | Primary standard industrial classification code number | | I.R.S. employer identification No. | | Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices |

Hughes Network Systems International Service Company | | Delaware | | 4899 | | 52-1691571 | | 11717 Exploration Lane Germantown, MD 20876 (301) 428-5500 |

| | | | |

| HNS Real Estate, LLC | | Delaware | | 4899 | | 20-2712714 | | 11717 Exploration Lane Germantown, MD 20876 (301) 428-5500 |

| | | | |

| HNS-India VSAT, Inc. | | Delaware | | 4899 | | 52-1755631 | | 11717 Exploration Lane Germantown, MD 20876 (301) 428-5500 |

| | | | |

| HNS-Shanghai, Inc. | | Delaware | | 4899 | | 52-1720113 | | 11717 Exploration Lane Germantown, MD 20876 (301) 428-5500 |

The information in this prospectus is not complete and may be changed. We may not complete the Exchange Offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

Subject to completion, dated October 27, 2006

Hughes Network Systems, LLC

HNS Finance Corp.

Offer to Exchange

$450,000,000 aggregate principal amount of 9 1/2% Senior Notes due 2014, which have been registered under the Securities Act of 1933,

for

$450,000,000 aggregate principal amount of outstanding 9 1/2% Senior Notes due 2014.

We hereby offer, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal (which together constitute the “Exchange Offer”), to exchange up to $450,000,000 aggregate principal amount of our registered 9 1/2% Senior Notes due 2014, which we refer to as the Exchange Notes, for a like principal amount of our outstanding 9 1/2% Senior Notes due 2014, which we refer to as the Old Notes. We refer to the Old Notes and the Exchange Notes collectively as the Notes. The terms of the Exchange Notes are identical to the terms of the Old Notes in all material respects, except for the elimination of some transfer restrictions, registration rights and liquidated damages provisions relating to the Old Notes.

Interest on the Exchange Notes, like the Old Notes, will be payable semiannually on April 15 and October 15. The Exchange Notes will mature on April 15, 2014. We may redeem some or all of the Exchange Notes at any time after April 15, 2010 at the redemption prices set forth in this prospectus. In addition, prior to April 15, 2009, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes using net proceeds from certain sales of equity. Prior to April 15, 2010, we may redeem some or all of the Exchange Notes at the “make whole” price set forth in this prospectus.

The Exchange Notes and guarantees thereof, like the Old Notes and guarantees thereof, will be our and the applicable guarantor’s senior unsecured obligations and will rank equally in right of payment to all of our and the applicable guarantor’s existing and future senior indebtedness ($487.5 million as of June 30, 2006, including the Notes), senior in right of payment to all of our and the applicable guarantor’s future subordinated indebtedness, be effectively subordinated in right of payment to our and the applicable guarantor’s secured indebtedness to the extent of the value of the assets securing such indebtedness (approximately $37.5 million as of June 30, 2006), and be effectively subordinated to all obligations, including trade payables, of each of our and the applicable guarantor’s existing and future subsidiaries that are not guarantors (approximately $46.2 million as of June 30, 2006).

We will exchange any and all Old Notes that are validly tendered and not validly withdrawn prior to 5:00 p.m., New York City time, on November 29, 2006, unless extended.

We have not applied, and do not intend to apply, for listing the notes on any national securities exchange or automated quotation system.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, if requested in writing by such a broker dealer, for a period of up to 180 days after the consummation of the Exchange Offer, we will make this prospectus, as amended or supplemented, available to any broker dealer for use in connection with any such resale. See “Plan of Distribution.”

You should carefully consider therisk factors beginning on page 20 of this prospectus before participating in this Exchange Offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October , 2006.

TABLE OF CONTENTS

You should rely only on the information contained in this document. We have not authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. The delivery of this prospectus does not, under any circumstances, mean that there has not been a change in our affairs since the date of this prospectus. Subject to our obligation to amend or supplement this prospectus as required by law and the rules of the Securities and Exchange Commission, or the SEC, the information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of these securities.

Until January 25, 2007 (90 days after the date of this prospectus), all dealers effecting transactions in the Exchange Notes, whether or not participating in the Exchange Offer, may be required to deliver a prospectus.

WHERE YOU CAN FIND MORE INFORMATION

We will be required to file annual and quarterly reports and other information with the SEC after the registration statement described below is declared effective by the SEC. You may read and copy any reports, statements and other information that we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E. Room 1580, Washington, D.C. 20549. You may request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call 1-800-SEC-0330 for further information on the public reference rooms. Our filings will also be available to the public from commercial document retrieval services and at the web site maintained by the SEC at http://www.sec.gov.

We have filed a registration statement on Form S-4 to register with the SEC the Exchange Notes to be issued in exchange for the Old Notes and guarantees thereof. This prospectus is part of that registration statement. As allowed by the SEC’s rules, this prospectus does not contain all of the information you can find in the registration statement or the exhibits to the registration statement. You should note that where we summarize in the prospectus the material terms of any contract, agreement or other document filed as an exhibit to the registration statement, the summary information provided in the prospectus is less complete than the actual contract, agreement or document. You should refer to the exhibits filed to the registration statement for copies of the actual contract, agreement or document.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes estimates of market share and industry data and forecasts that we obtained from industry publications and surveys and internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources, including Broadband Satellite Markets—A Worldwide Analysis of Industry Trends and Market Forecasts from 2005 to 2010 (5th Edition, February 2006) by Northern Sky Research, The VSAT Report 2005 by Communication System Limited, or COMSYS, or the 2005 COMSYS VSAT Report, and Broadband and the Role of Satellite Services (2004) by Frost and Sullivan nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

i

SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus and may not contain all of the information that is important to you. You should read this prospectus in its entirety, including “Risk Factors” and our financial statements and the related notes. As used in this prospectus, unless the context otherwise requires or as is otherwise indicated, the words “we,” “us,” “our” and words of similar import refer to Hughes Network Systems, LLC and its subsidiaries on a consolidated basis after the April 2005 Acquisition (as defined below in “The Transactions”), and, prior to the April 2005 Acquisition, to the businesses of DTV Network Systems, Inc. (formerly known as Hughes Network Systems, Inc.) and its subsidiaries that were acquired in the April 2005 Acquisition.

Our Company

We are the world’s leading provider of broadband satellite network equipment and services to the very small aperture terminal, or VSAT, enterprise market and the largest satellite Internet access provider to the North American consumer market. According to the 2005 COMSYS VSAT Report, we had a worldwide market share of 55% in 2004 as measured by terminals shipped. Our invention of VSATs, small satellite dishes generally 1.8 meters or less wide, over 20 years ago enables us to provide large enterprises highly reliable, end-to-end communications with guaranteed quality of service regardless of the number of sites or their geographic location. Our networks are used for a variety of applications such as Intranet and Internet access; voice services; connectivity to suppliers, franchisees and customers; credit authorization; inventory management; content delivery and video distribution. We often customize the applications for particular markets. We currently serve more than 200 large companies, many of them in the Fortune 1000, mainly in businesses which have numerous widely dispersed operating units, such as gas service stations (Royal Dutch Shell plc, Exxon Mobil Corporation, BP Amoco Group and Chevron Corporation), automotive dealerships (Volkswagen AG) and retailers (Wal-Mart Stores, Inc., Lowe’s Companies, Inc. and Kmart Corporation). We have leveraged our experience with such customers and adapted our technologies to expand into other growing market segments, such as small and medium businesses and other business users such as small office and home office users, which we collectively refer to as SMBs, and consumers. We are currently the largest satellite broadband Internet access provider to consumers and small businesses in North America, with approximately 300,200 subscribers as of June 30, 2006. For the six months ended June 30, 2006 on a pro forma basis, we generated revenue of $405.3 million and incurred a net loss of $6.7 million. For the year ended December 31, 2005 on a pro forma basis, we generated revenue of $806.9 million, net income of $12.1 million and Adjusted EBITDA of $114.6 million. For our definition of Adjusted EBITDA, see note (10) in “—Summary Historical and Pro Forma Financial Data.”

We are a leading provider of satellite network equipment and services for enterprises that require consistent, high-quality broadband connectivity across every site, regardless of location. We provide large enterprises globally with a complete turnkey solution, both hardware and recurring communications service, which includes program management, installation, and training and support services. We believe that this fully integrated product and service offering distinguishes us from our competitors and cannot be replicated easily. We have had relationships with some of our enterprise customers for over 15 years. Our enterprise customers typically enter into long-term contracts with us with an average length of three to five years, and renewal/rollovers are common. Based on management estimates, the renewal rate for our enterprise customers was approximately 92% in 2005. In the expanding Consumer/SMB markets, we distinguish ourselves by packaging services normally reserved for large enterprises into a comprehensive solution. We believe that our solutions are consistently more reliable and cost-effective over time across a range of enterprise applications compared with terrestrial alternatives. Over the last 15 years, we have sold more than one million VSATs to customers in over 100 countries. As of December 31, 2005, we had a revenue backlog (which we define as our expected future revenue under our customer contracts that are non-cancelable) of approximately $583.6 million.

1

As part of our drive for less costly and more efficient technological solutions, we plan to launch our next-generation SPACEWAY 3 satellite in early 2007 and introduce service in North America on SPACEWAY’s network later in 2007. With SPACEWAY, we will be able to offer our customers faster communication rates and expect to reduce our operating costs substantially. We intend to leverage SPACEWAY’s increased communication rates and enhanced functionality to grow our market penetration in all market sectors including the large enterprise sector and the rapidly expanding North American Consumer/SMB markets, which have historically been serviced by terrestrial alternatives, to further increase our subscriber base. By owning our own satellite, we will reduce our need to lease third-party satellite transponder capacity, thereby reducing costs as new and renewing customers migrate onto our SPACEWAY 3 satellite.

Our VSAT Markets

Historically, our VSAT market was built on the need of large enterprises for low-cost data communication over geographically dispersed sites with mission critical reliability standards, with particular applications such as inventory control and credit card authorizations. Our VSAT market has grown as hardware and service costs have declined and Internet use has expanded. Today, our VSAT market extends from the largest enterprises to smaller businesses and individual consumers.

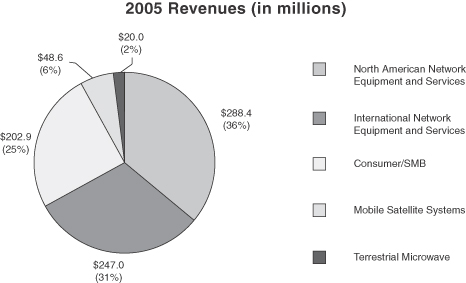

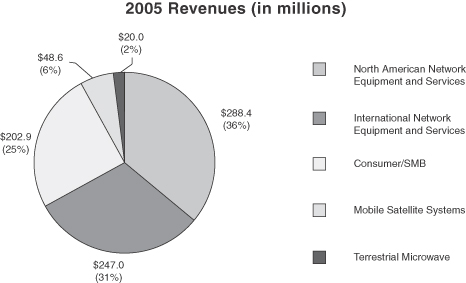

Network Equipment and Services. Our Network Equipment and Services market consists of large enterprises, many of which in our North American business are Fortune 1000 companies with geographically dispersed operations that need to be interconnected. Representative large enterprise customers include Blockbuster, Inc., BP Amoco Group, Cendant Corporation, Chevron Corporation, Edward D. Jones & Co. L.P., Exxon Mobil Corporation, GTECH Corporation, Royal Dutch Shell plc, Teléfonos de México, S.A. de C.V. and Volkswagen AG. Revenues from our North American Network Equipment and Services business and International Network Equipment and Services business accounted for approximately 61% of our 2005 revenues.

Consumer/SMB. Our Consumer/SMB market consists of subscribers in North America who desire high-speed Internet access but typically are not served by either DSL or cable. Our market includes all categories of small and medium sized businesses including small office and home office users as well as professional users and consumers. It is estimated that there are between 10 and 15 million households in North America (Northern Sky Research, February 2006) and 3 million businesses (Frost and Sullivan, 2004) in the United States underserved by DSL or cable. As of December 31, 2005, we had approximately 274,400 satellite broadband Internet access Consumer/SMB subscribers. Revenues from our Consumer/SMB business accounted for approximately 31% of our 2005 revenues.

2

Our Telecom Systems Markets

We have further leveraged our existing VSAT technology expertise to develop communications equipment for other end markets. We are able to serve these markets efficiently as we share with our core VSAT business common infrastructure such as engineering and research and development.

Mobile Satellite Systems. This market consists of various operators who offer mobile satellite-based voice and data services. We develop and supply turnkey networking and terminal systems to these operators, typically through large multi-year contracts. Representative customers include ICO Global Communications, Inmarsat plc, or Inmarsat, Thuraya Satellite Telecommunications Company, or Thuraya. Revenues from our Mobile Satellite Systems business accounted for approximately 6% of our 2005 revenues.

Terrestrial Microwave. This market consists of cellular mobile operators and alternative telecommunications providers otherwise known as emerging competitive local exchange carriers, or CLECs. We supply microwave-based networking equipment to cellular mobile operators for transporting their data from cellular telephone sites to switching centers. Representative customers include Nokia Corporation, T-Mobile Czech Republic and Nextlink/XO Communications, Inc. Revenues from our Terrestrial Microwave business accounted for approximately 2% of our 2005 revenues.

Our Services and Products

We provide a variety of satellite-based network equipment, systems and broadband services. In our principal market of North America, we typically provide a bundled offering of hardware and communication services so that our revenue is derived from both periodic hardware sales and recurring monthly service fees. In other parts of the world, we may provide either the bundled service or hardware only.

Network Services

Our service revenue is derived from the provision of a variety of network solutions as detailed below. In some markets, most notably in North America, services are delivered using not only satellite transport platforms, but also using terrestrial transport platforms such as DSL and frame relay:

| | • | | managed network services for large enterprise customers; |

| | • | | IP-based Virtual Private Networks, or IP VPNs, that provide highly secure, remote network solutions that support point-of-sale transactions and inventory management applications; |

| | • | | two-way, always-on, high-speed Internet access; |

| | • | | Digital Media Services including the delivery of high-quality, full screen, full-motion video and audio for digital signage and online training applications; |

| | • | | ISP services and other hosted applications including e-mail, web hosting and online payments; and |

| | • | | Highly Available Networks using a combination of satellite and wireline technologies and including satellite backup for terrestrial networks. |

We differentiate ourselves by providing a one-stop turnkey suite of these bundled services that include network design, implementation planning, provisioning, rollout and installation, ongoing network operations, help desk and onsite maintenance. Managed network services also include program management, installation management, network and application engineering services, proactive network management, network operations, field maintenance and customer care. As of June 30, 2006, we had approximately 555,000 sites in service based on management’s estimate.

3

Network Equipment

Our hardware systems revenue is derived from the sale or lease of VSAT and other terrestrial network equipment, consisting of Customer Premise Equipment, or CPE, and Network Operations Control, or NOC, hardware and software. In 2005, we shipped approximately 226,000 VSAT terminals globally up from 194,600 VSAT terminals in 2004, supplied equipment for 38 new central hub sites and generated $381.5 million in total hardware sales. This hardware is either sold under separate equipment supply contracts where customers are responsible for operating their networks, or is packaged into services contracts where the customer pays a recurring fee for a fixed term for use of our hardware and for our network services.

Our Strengths

Leading global VSAT Provider with Large Installed Customer Base. Over the last 15 years, we have sold more than one million VSATs to customers in over 100 countries. According to the 2005 COMSYS VSAT Report, in 2004, our global market share was approximately 55%, based on the number of terminals shipped. This large installed base provides excellent opportunities for new and incremental sales for our services and products.

Global Blue-Chip Customer Base with History of High Renewals. Our Network Equipment and Services customers include Fortune 1000 companies, and are leaders in the retail, energy, financial, hospitality, automotive and services industries. These customers generally have long-term contracts with an average length of three to five years that contribute to a significant revenue backlog, which as of December 31, 2005, was approximately $583.6 million. We have had contracts for equipment and services with some of our customers for over 15 years.

Provider of Highly Reliable, End-to-End Communications Networks. We are a leading network provider for enterprises that require consistent, high-quality broadband connectivity across every site, regardless of location. Since we control our entire network from end to end, we are able to offer highly secure and robust communication services. We utilize reliable components and employ redundancy and backup at multiple stages of our network. We also believe that we are able to deploy our services more rapidly than both our terrestrial and satellite competitors. Our automation and installation support systems, together with our network of independent contractors, enable us to install thousands of sites per month for network-wide deployment in North America.

Market Leader in Technology and Innovation. We have been a leader in pioneering major advances in satellite data communications technology for more than 20 years to both increase service capabilities and reduce the cost of service, which enables us to expand our addressable markets. Our integrated product and service model allows us close proximity to our clients’ business and data network service requirements. This allows us to efficiently identify our customers’ needs and develop technological solutions that are critical to extending our VSAT applications to existing clients and new markets. For example, our next generation products, including the DW7000 series introduced in 2005 and the HN7000 series introduced in 2006, have increased in-route data speeds from our past offering of 256 Kbps to up to 1.6 Mbps, which we believe is comparable to current DSL and cable offerings, and offer additional features such as increased throughput with greater bandwidth efficiency. Furthermore, our in-house engineering capabilities have enabled us to design one of the most technologically advanced satellite broadband services platforms called SPACEWAY. We expect that both the HN7000 series and SPACEWAY will enable us to expand and better serve all our markets by offering increased speeds and enhanced functionality at competitive prices.

Common Architecture Platform Across our End Markets Gives Us Operating Leverage. We have engineered a common platform for all our VSAT markets, which reduces costs for research and development, manufacturing, maintenance, customer support and network operations. Our common platform has allowed us to develop solutions for different end markets such as Consumers and SMBs, utilizing a shared infrastructure. Our

4

network platform includes multi-use terminals with downloadable software components to tailor our services to customer requirements. Common VSAT terminals are now used on a global basis for large enterprises and Consumer/SMBs, which allows us to reduce costs while improving the overall quality of our products and services.

Diversified Revenue Stream. We benefit from the fact that our revenue stream is diversified geographically and consists of a mix of services and hardware sales. We generated approximately 68% of our 2005 revenues in the United States and 32% internationally. In 2005, we derived approximately 53% of our global revenues by providing services, and 47% via hardware sales and leases. We expect service revenues to continue to exceed hardware revenues in the foreseeable future. Within the VSAT segment, our customer concentration is low, with our top 10 VSAT customers accounting for 17.2% of our revenues in 2005. We also have achieved a leading market position in the provision of satellite Internet access for Consumers and SMBs in North America with approximately 300,200 customers as of June 30, 2006. We expect this market to experience continued growth and we believe that we are well positioned to benefit from this growth.

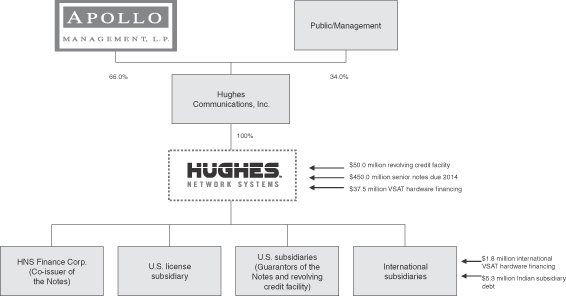

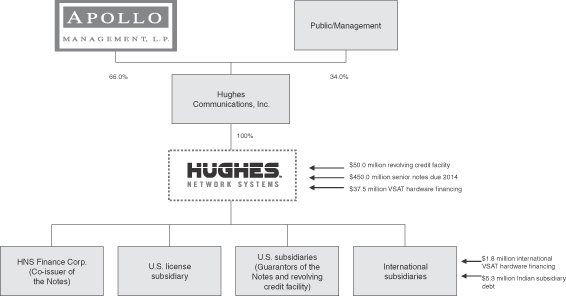

Experienced Senior Management Team and Strong Sponsorship. Our senior management team has extensive experience in the satellite communications industry, with average industry experience of 23 years. Our management team is supported by approximately 452 engineers and a marketing and sales force of approximately 125 persons who have an average tenure of approximately 11 years with us. We are controlled by various investment vehicles that are affiliated with Apollo Advisors IV, L.P., or Apollo, through their controlling interest in our parent, Hughes Communications, Inc., or Hughes Communications. Apollo is a leading private equity investment firm with significant expertise in the satellite sector.

Business Strategy

We intend to seek complementary opportunities to strengthen our business and support its growth. In addition, we intend to organically grow our leading market share by continuing to leverage our position as a technologically advanced and cost-effective provider of services and products. The principal elements of this strategy are to:

| | • | | maintain our position as a technology leader by developing new products with higher speeds and enhanced functionality; |

| | • | | remain a low-cost supplier by leveraging our common architecture and integrated platform for multiple market segments; |

| | • | | grow our customer base by increasing our offerings and expanding into underserved markets; |

| | • | | expand our market penetration in the Network Equipment and Services sector by developing a broader range of managed network services utilizing satellite, wireline and wireless technologies; |

| | • | | increase Consumer/SMB market penetration via the introduction of low-cost, higher speed broadband products such as the DW7000 series product line launched in 2005 and the HN7000 series product line launched in 2006, followed by the SPACEWAY platform which we expect will be launched in 2007; |

| | • | | expand our international footprint by offering services directly in larger markets and indirectly in the rest of the world via hardware sales to third-party operators; |

| | • | | improve cash flow by leveraging operational efficiencies and further cost reduction initiatives; and |

| | • | | develop additional strategic relationships for distribution channels both domestically and internationally. |

5

Recent Developments

On March 27, 2006, we introduced our new HughesNet™ brand, replacing our old DIRECWAY® brand. Our new HughesNet brand encompasses all broadband solutions and services from our company, bridging satellite and terrestrial technologies. These include managed network services, digital media and enhanced broadband offerings for our large enterprise customers, as well as high-speed satellite Internet access for Consumers/SMBs.

The Transactions

As used in this prospectus, the term “Transactions” means, collectively, the April 2005 Acquisition, the January 2006 Acquisition, the offering of the Old Notes and the application of the proceeds from the Old Notes. The April 2005 Acquisition and the January 2006 Acquisition are both described below.

The April 2005 Acquisition

On April 22, 2005, SkyTerra Communications, Inc., or SkyTerra, completed the acquisition of 50% of our Class A membership interests from DTV Network Systems, Inc., a wholly owned subsidiary of The DIRECTV Group, Inc., or DIRECTV, for $50.0 million in cash and 300,000 shares of SkyTerra’s common stock. The acquisition occurred pursuant to a contribution and membership interest purchase agreement, or contribution agreement, among us, SkyTerra, DIRECTV and DTV Network Systems, Inc., dated December 3, 2004, as amended. Immediately prior to the acquisition, DTV Network Systems, Inc. contributed to us substantially all of the assets and certain liabilities of its very small aperture terminal, mobile satellite and terrestrial microwave business, as well as certain portions of its SPACEWAY Ka-band satellite communications platform. This includes the SPACEWAY 3 satellite which is currently being manufactured by The Boeing Company, or Boeing, certain network operations center facilities, certain other ground facilities and equipment and intellectual property rights as well as rights to purchase an additional SPACEWAY satellite to be manufactured by Boeing in the future. DIRECTV has retained the SPACEWAY 1 and 2 satellites for use in its direct-to-home video entertainment business, and we have entered into a reciprocal agreement with DIRECTV whereby each party provides certain technical assistance services to the other in connection with the operation of their respective satellites. See “Certain Relationships and Related Transactions—Relationship with DIRECTV—SPACEWAY Services Agreement.” These transactions are collectively referred to in this prospectus as the “April 2005 Acquisition.”

In connection with the closing of the April 2005 Acquisition, the parties to the contribution agreement entered into agreements governing certain relationships between and among the parties after the closing of the April 2005 Acquisition. These agreements include a limited liability company agreement, an investor rights agreement, a transition services agreement, a DIRECWAY advertising agreement, a SPACEWAY services agreement, an intellectual property agreement, a management services agreement and a non-competition agreement. For a more detailed description of these agreements, see “Certain Relationships and Related Transactions—Ancillary Agreements to the Contribution Agreement” and “Certain Relationships and Related Transactions—Relationship with DIRECTV.”

The January 2006 Acquisition

Hughes Communications acquired 100% of our Class A membership interests pursuant to two transactions on December 31, 2005 and January 1, 2006, respectively. On December 31, 2005, Hughes Communications acquired a 50% Class A membership interest from SkyTerra pursuant to a separation agreement under which SkyTerra contributed to Hughes Communications certain of SkyTerra’s assets and liabilities, including the 50% Class A membership interest in our company owned at that time by SkyTerra. On January 1, 2006, Hughes Communications acquired the remaining 50% of our Class A membership interests from DTV Network Systems, Inc. for $100.0 million in cash. These transactions are collectively referred to in this prospectus as the “January 2006 Acquisition.”

6

The Hughes Communications/SkyTerra Separation

On February 21, 2006, SkyTerra and our parent, Hughes Communications, separated into two publicly owned companies when SkyTerra, which then owned all of the outstanding shares of Hughes Communications’ common stock, distributed those shares to each holder of SkyTerra’s common, non-voting common and preferred stock and its Series 1-A and 2-A warrants. Following the distribution, SkyTerra no longer owns any Hughes Communications stock and accordingly no longer has an equity interest in our company. Hughes Communications is now a separate publicly-owned company (NASDAQ: HUGH) operating the businesses transferred to it under the December 31, 2005 separation agreement. As a result of the distribution, Apollo, the controlling stockholder of SkyTerra, became the controlling stockholder of Hughes Communications.

The Hughes Communications Rights Offering

Immediately following the distribution by SkyTerra of Hughes Communications’ common stock in the spin-off, Hughes Communications distributed at no charge to the holders of its common stock non-transferable subscription rights to purchase up to an aggregate of 7,843,141 shares of Hughes Communications’ common stock at a cash subscription price of $12.75 per share. In total, approximately 97.4% of the rights were subscribed for as a result of the basic subscription privilege, with the remainder sold to shareholders exercising their oversubscription privileges. As a result of the rights offering which closed on March 17, 2006, Apollo invested an additional $68.4 million in Hughes Communications and, as of September 14, 2006 owned approximately 66.0% of Hughes Communications’ common stock. In addition, other stockholders invested an additional $31.6 million and, as of September 14, 2006, owned approximately 34.0% of Hughes Communications’ common stock.

Repayment of Term Loans and Amendment of Revolving Credit Facility

We used the majority of the proceeds from the sale of the Old Notes to repay our then existing term loans, plus accrued interest. In connection with the sale of the Old Notes, we amended certain covenants and pricing terms of our $50.0 million revolving credit facility pursuant to an amendment and restatement of the credit agreement governing this credit facility.

Our Equity Sponsor

We are controlled by Apollo, through its ownership interest in Hughes Communications. Apollo Management, L.P. was founded in 1990 and is among the most active and successful private investment firms in the United States in terms of both number of investment transactions completed and aggregate dollars invested. Since its inception, Apollo Management, L.P. and affiliates have managed in excess of $13 billion in equity capital, in a wide variety of industries, both domestically and internationally, and is currently managing its latest fund, Apollo Investment Fund, VI, L.P., with total committed capital of over $10 billion. Apollo has significant expertise in the satellite sector through investments in us, Intelsat, Ltd., Sirius Satellite Radio Inc. and SkyTerra Communications, Inc. Companies owned or controlled by Apollo Management, L.P. and affiliates or in which Apollo Management L.P. and affiliates have a significant equity investment include, among others, AMC Entertainment, Inc., Educate, Inc., General Nutrition Centers, Inc., Hexion Specialty Chemicals, Inc., Metals USA, Inc., Nalco Company and UAP Holding Corp.

7

Our Organizational Structure

The following chart summarizes our current ownership and capital structure as of June 30, 2006. For a description of the indebtedness referred to below, see “Description of Notes” and “Description of Other Indebtedness.”

Our principal executive offices are located at 11717 Exploration Lane, Germantown, Maryland 20876. Our telephone number is (301) 428-5500.

8

Summary of the Terms of the Exchange Offer

In connection with the offering of the Old Notes, we and the guarantors of the Old Notes entered into a registration rights agreement with the initial purchasers of the Old Notes. Under that agreement, we agreed to use commercially reasonable efforts to consummate the exchange of Old Notes for Exchange Notes within 360 days after April 13, 2006.

The registration statement of which this prospectus forms a part was filed in compliance with the obligations under this registration rights agreement.

You are entitled to exchange in this Exchange Offer your Old Notes for Exchange Notes which are identical in all material respects to the Old Notes except that:

| | • | | the Exchange Notes have been registered under the Securities Act and will be freely tradable by persons who are not affiliated with us; |

| | • | | the Exchange Notes are not entitled to registration rights which are applicable to the Old Notes under the registration rights agreement; and |

| | • | | our obligation to pay liquidated damages on the Old Notes as described in the registration rights agreement does not apply to the Exchange Notes. |

For purposes of this and other sections in this prospectus, we refer to the Old Notes and the Exchange Notes together as the “Notes.”

Senior Notes | We are offering to exchange up to $450,000,000 aggregate principal amount of our 9 1/2% Senior Notes due 2014 which have been registered under the Securities Act for up to $450,000,000 aggregate principal amount of our Old Notes which were issued on April 13, 2006. Old Notes may be exchanged only in denominations of $2,000 and integral multiples of $1,000 in excess of $2,000. |

Resales | Based on interpretations by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the Exchange Notes issued pursuant to this Exchange Offer in exchange for Old Notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration provisions of the Securities Act, provided that you |

| | • | | are acquiring the Exchange Notes in the ordinary course of business, and |

| | • | | have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the Exchange Notes. |

| | Each participating broker-dealer that receives Exchange Notes for its own account pursuant to this Exchange Offer in exchange for the Old Notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the Exchange Notes. See “Plan of Distribution.” |

9

| | • | | does not acquire the Exchange Notes in the ordinary course of business, or |

| | • | | tenders in this Exchange Offer with the intention to participate, or for the purpose of participating, in a distribution of Exchange Notes |

| | cannot rely on the position of the staff of the SEC expressed in Exxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated or similar no-action letters and, in the absence of an exemption, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of the Exchange Notes. |

Expiration; Withdrawal of Tenders | This Exchange Offer will expire at 5:00 p.m., New York City time, November 29, 2006, or such later date and time to which we extend it. We do not currently intend to extend the expiration date. A tender of Old Notes pursuant to this Exchange Offer may be withdrawn at any time prior to the expiration date. Any Old Notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of this Exchange Offer. |

Delivery of the Exchange Notes | The Exchange Notes issued pursuant to this Exchange Offer will be delivered to the holders who tender Old Notes promptly following the expiration date. |

Conditions to this Exchange Offer | This Exchange Offer is subject to customary conditions, some of which we may waive. See “The Exchange Offer—Certain Conditions to this Exchange Offer.” |

Procedures for Tendering Old Notes | If you wish to accept this Exchange Offer, you must complete, sign and date the accompanying letter of transmittal, or a copy of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or the copy, together with the Old Notes and any other required documents, to the exchange agent at the address set forth on the cover of the letter of transmittal. If you hold Old Notes through The Depository Trust Company (“DTC”) and wish to participate in this Exchange Offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal. |

| | By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

| | • | | any Exchange Notes that you will receive will be acquired in the ordinary course of your business; |

| | • | | you have no arrangement or understanding with any person or entity to participate in the distribution of the Exchange Notes; |

| | • | | if you are a broker-dealer that will receive Exchange Notes for your own account in exchange for Old Notes that were acquired as a result of market-making activities, that you |

10

| | will deliver a prospectus, as required by law, in connection with any resale of such Exchange Notes; and |

| | • | | you are not our “affiliate” as defined in Rule 144 under the Securities Act. |

Guaranteed Delivery Procedures | If you wish to tender your Old Notes and your Old Notes are not immediately available or you cannot deliver your Old Notes, the letter of transmittal or any other documents required by the letter of transmittal or if you cannot comply with the applicable procedures under DTC’s Automated Tender Offer Program prior to the expiration date, you must tender your Old Notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Old Notes | As a result of the making of, and upon acceptance for exchange of all validly tendered Old Notes pursuant to the terms of, this Exchange Offer, we will have fulfilled a covenant contained in the registration rights agreements and, accordingly, liquidated damages on the Old Notes, if any, shall no longer accrue and we will no longer be obligated to pay liquidated damages as described in the registration rights agreement. If you are a holder of Old Notes and do not tender your Old Notes in this Exchange Offer, you will continue to hold such Old Notes and you will be entitled to all the rights and limitations applicable to the Old Notes in the indenture, except for any rights under the registration rights agreement that by their terms terminate upon the consummation of this Exchange Offer. |

Consequences of Failure to Exchange | All untendered Old Notes will continue to be subject to the restrictions on transfer provided for in the Old Notes and in the indenture governing the Old Notes. In general, the Old Notes may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with this Exchange Offer, or as otherwise required under certain limited circumstances pursuant to the terms of the registration rights agreement, we do not currently anticipate that we will register the Old Notes under the Securities Act. |

Certain United States Federal Income Tax Considerations |

The exchange of Old Notes for Exchange Notes in this Exchange Offer will not be a taxable event for United States Federal income tax purposes. See “Certain United States Federal Income Tax Considerations.”

|

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Exchange Notes in this Exchange Offer. |

Exchange Agent | Wells Fargo Bank, National Association is the exchange agent for this Exchange Offer. The address and telephone number of the exchange agent are set forth in the section captioned “The Exchange Offer—Exchange Agent.” |

11

Summary of the Terms of the Exchange Notes

Issuers | Hughes Network Systems, LLC and HNS Finance Corp., a wholly owned subsidiary of Hughes Network Systems, LLC. |

Exchange Notes Offered | $450,000,000 aggregate principal amount of 9 1/2% Senior Notes due 2014. |

Maturity Date | April 15, 2014. |

Interest Payment Dates | April 15 and October 15 of each year, commencing October 15, 2006. |

Guarantees | The Exchange Notes, like the Old Notes, will be guaranteed on a senior unsecured basis by all of our existing and future subsidiaries other than our international subsidiaries and our FCC license subsidiaries. The guarantees will be unsecured senior indebtedness of our subsidiary guarantors and will have the same ranking with respect to indebtedness of our subsidiary guarantors as the notes will have with respect to our indebtedness. For the six months ended June 30, 2006, our non-guarantor subsidiaries represented approximately 13% of our total revenues, generated an operating loss of $1.8 million, as compared to a total operating profit of $12.7 million and represented approximately 5% of our EBITDA. For the year ended December 31, 2005, our non-guarantor subsidiaries represented approximately 16% of our total revenues, approximately 20% of our operating income and approximately 18% of our EBITDA. |

Ranking | The Exchange Notes, like the Old Notes, will be our and the guarantors’ unsecured senior obligations. They will rank equally in right of payment with all of our and the guarantors’ existing and future senior unsecured indebtedness, and will rank senior rank senior to all of our and the guarantors’ future senior subordinated and subordinated indebtedness. The Exchange Notes will be effectively subordinated to all of our and the guarantors’ existing and future secured indebtedness to the extent of the collateral securing such indebtedness. They will be structurally junior to all of the existing and future liabilities (including trade payables) of each of our subsidiaries that do not guarantee the notes. At June 30, 2006, we had approximately $494.6 million of total indebtedness. Of the $494.6 million, we had $5.3 million secured indebtedness and $39.3 million of VSAT hardware financing. In addition, we had commitments under our revolving credit facility available to us of $35.6 million (after giving effect to the issuance of $14.4 million of letters of credit); and our non-guarantor subsidiaries had $46.2 million of total liabilities (including trade payables but excluding intercompany liabilities), all of which would have been structurally senior to the Exchange Notes. |

Optional Redemption | Like the Old Notes, we may, at our option, redeem some or all of the Exchange Notes at any time on or after April 15, 2010, at the redemption prices listed under “Description of Notes—Optional Redemption.” |

12

| | In addition, prior to April 15, 2009, we may, at our option, redeem up to 35% of the Notes with the proceeds of certain sales of equity at the redemption price listed under “Description of Notes—Optional Redemption.” We may make the redemption only if, after the redemption, at least 65% of the aggregate principal amount of the Notes issued remains outstanding. |

| | Like the Old Notes, prior to April 15, 2010, we may, at our option, redeem some or all of the Exchange Notes at the “make-whole” price set forth under “Description of Notes—Optional Redemption.” |

Mandatory Repurchase Offer | If we sell certain assets or experience specific kinds of changes in control, we must offer to repurchase the Exchange Notes at the prices listed under “Description of Notes—Change of Control” and “—Certain Covenants—Asset Sales.” |

Certain Covenants | The indenture governing the Exchange Notes and the Old Notes contains certain covenants that, among other things, restrict our ability and the ability of our restricted subsidiaries to: |

| | • | | incur, assume or guarantee additional debt; |

| | • | | issue redeemable stock and preferred stock; |

| | • | | repurchase capital stock; |

| | • | | make other restricted payments including, without limitation, paying dividends and making investments; |

| | • | | redeem debt that is junior in right of payment to the Notes; |

| | • | | create liens without securing the Notes; |

| | • | | sell or otherwise dispose of assets, including capital stock of subsidiaries; |

| | • | | enter into agreements that restrict dividends from subsidiaries; |

| | • | | merge, consolidate and sell, or otherwise dispose of substantially all our assets; |

| | • | | enter into transactions with affiliates; |

| | • | | guarantee indebtedness; and |

| | • | | enter into new lines of business. |

| | In addition, the indenture requires that we obtain certain satellite insurance subject to certain limitations. |

| | These covenants are subject to a number of important exceptions and qualifications. For more details, see “Description of Notes—Certain Covenants.” |

13

Summary Historical and Pro Forma Financial Data

Set forth below are our summary historical and pro forma financial data. The summary historical statement of operations data for the years ended December 31, 2003 through 2005 and the summary historical balance sheet data as of December 31, 2004 and 2005 set forth below are derived from our audited financial statements and the notes thereto included elsewhere in this prospectus. The summary historical statement of operations data for the year ended December 31, 2002 and the summary historical balance sheet data as of December 31, 2002 and 2003 set forth below are derived from our audited financial statements and the notes thereto not included elsewhere in this prospectus. The summary historical balance sheet data as of December 31, 2001 set forth below is derived from our unaudited financial information not included elsewhere in this prospectus. The summary historical consolidated statement of operations data for the six months ended June 30, 2005 and 2006 and the summary historical balance sheet data as of June 30, 2006 are derived from our unaudited financial statements included elsewhere in this prospectus and, in the opinion of management, include all adjustments (consisting only of normal recurring accruals) necessary for a fair presentation of the financial position and results of operations as of the dates and for the periods indicated. The results for periods of less than a full year are not necessarily indicative of the results to be expected for any interim period or for a full year.

The statement of operations data below does not include summary historical statement of operations data for the year ended December 31, 2001. A combination of factors result in our inability to provide the 2001 summary historical statement of operations, including revenue, information without unreasonable effort and expense. These factors are: (1) a statement of operations of DTV Network Systems, Inc., the accounting predecessor to Hughes Network Systems, LLC, or the Predecessor, for 2001 was not prepared and does not exist, (2) the Predecessor replaced its accounting system during 2001 and information in the Predecessor’s prior accounting system is not readily available and could not be restored without unreasonable effort or expense, and (3) in order to prepare a 2001 statement of operations for the Predecessor, we would need to obtain certain financial information from the Predecessor’s former parent company, The DIRECTV Group, Inc., and it would be impractical to obtain such information. We believe that the omission of the selected statement of operations data for 2001 would not have a material impact on a reader’s understanding of our financial results and related trends.

The summary unaudited pro forma statement of operations data presented below for the six months ended June 30, 2006 has been derived from, and should be read in connection with, our unaudited financial information included elsewhere in this prospectus, and give effect to the offering of the Old Notes as if it had occurred on January 1, 2006. The summary unaudited pro forma financial data presented below for the year ended December 31, 2005 has been derived from, and should be read in connection with, our audited historical financial information for the year ended December 31, 2005 included elsewhere in this prospectus and give effect to the Transactions as if they occurred on January 1, 2005. The unaudited pro forma financial data does not purport to represent what our results of operations or financial position would have been if the Transactions had occurred as of the dates indicated or what such results will be for future periods.

You should read the summary information contained below in conjunction with “The Transactions,” “Selected Historical Financial Data,” “Unaudited Pro Forma Consolidated Financial Information,” “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited and unaudited historical financial statements and the accompanying notes thereto included elsewhere in this prospectus.

14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | Pro forma | |

| | | Year ended December 31, | | | Six months ended

June 30, | | | Year ended

December 31, 2005 | | | Six months

ended June 30, 2006 | |

(Dollars in thousands) | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2005 | | | 2006 | | | |

Statement of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Services | | $ | 313,672 | | | $ | 328,989 | | | $ | 383,519 | | | $ | 425,384 | | | $ | 203,549 | | | $ | 212,802 | | | $ | 425,384 | | | $ | 212,802 | |

Hardware sales (1)(2) | | | 409,469 | | | | 422,159 | | | | 405,831 | | | | 381,525 | | | | 174,611 | | | | 192,493 | | | | 381,525 | | | | 192,493 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 723,141 | | | | 751,148 | | | | 789,350 | | | | 806,909 | | | | 378,160 | | | | 405,295 | | | | 806,909 | | | | 405,295 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of services | | | 287,876 | | | | 299,796 | | | | 290,365 | | | | 297,318 | | | | 144,108 | | | | 147,324 | | | | 294,561 | | | | 147,324 | |

Cost of hardware products sold (2) | | | 378,394 | | | | 389,513 | | | | 338,650 | | | | 292,898 | | | | 139,630 | | | | 163,018 | | | | 282,720 | | | | 163,018 | |

Research and development | | | 40,041 | | | | 34,073 | | | | 55,694 | | | | 37,296 | | | | 24,251 | | | | 14,246 | | | | 36,304 | | | | 14,246 | |

Sales and marketing | | | 89,910 | | | | 75,420 | | | | 72,564 | | | | 74,185 | | | | 39,545 | | | | 39,837 | | | | 73,983 | | | | 39,837 | |

General and administrative | | | 89,955 | | | | 89,887 | | | | 85,538 | | | | 56,615 | | | | 33,013 | | | | 25,934 | | | | 54,587 | | | | 25,934 | |

Restructuring costs (3) | | | 10,336 | | | | 4,113 | | | | 10,993 | | | | 3,068 | | | | 1,625 | | | | — | | | | 3,068 | | | | — | |

Amortization of intangibles | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,265 | | | | 4,529 | | | | 2,265 | |

SPACEWAY impairment provision (4) | | | — | | | | — | | | | 1,217,745 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Asset impairment provision (5) | | | — | | | | — | | | | 150,300 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating costs and expenses | | | 896,512 | | | | 892,802 | | | | 2,221,849 | | | | 761,380 | | | | 382,172 | | | | 392,624 | | | | 749,752 | | | | 392,624 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | (173,371 | ) | | | (141,654 | ) | | | (1,432,499 | ) | | | 45,529 | | | | (4,012 | ) | | | 12,671 | | | | 57,157 | | | | 12,671 | |

Interest expense (2) | | | (8,726 | ) | | | (12,197 | ) | | | (7,466 | ) | | | (24,375 | ) | | | (6,605 | ) | | | (19,740 | ) | | | (47,956 | ) | | | (22,166 | ) |

Other income (expense), net (6) | | | (10,077 | ) | | | (3,175 | ) | | | 6,481 | | | | 2,894 | | | | 389 | | | | 2,835 | | | | 2,894 | | | | 2,835 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before cumulative effect of accounting change | | | (192,174 | ) | | | (157,026 | ) | | | (1,433,484 | ) | | | 24,048 | | | | (10,228 | ) | | | (4,234 | ) | | | 12,095 | | | | (6,660 | ) |

Cumulative effect of accounting change (7) | | | (15,968 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (208,142 | ) | | $ | (157,026 | ) | | $ | (1,433,484 | ) | | $ | 24,048 | | | $ | (10,228 | ) | | $ | (4,234 | ) | | $ | 12,095 | | | $ | (6,660 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Historical | | | Pro forma | |

| | | Year ended December 31, | | | Six months

ended June 30,

2006 | | | Year ended

December 31, 2005 | | | Six months

ended June 30, 2006 | |

(Dollars in thousands) | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | | |

Balance sheet data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents (8) | | $ | 62,283 | | | $ | 71,180 | | | $ | 41,965 | | | $ | 14,807 | | | $ | 113,267 | | | $ | 141,171 | | | | | | | | | |

Working capital (8)(9) | | | 207,775 | | | | 256,249 | | | | 155,740 | | | | 72,893 | | | | 219,487 | | | | 287,467 | | | | | | | | | |

Receivables, net | | | 315,226 | | | | 299,706 | | | | 213,024 | | | | 173,013 | | | | 200,982 | | | | 176,106 | | | | | | | | | |

Total assets (8) | | | 2,010,803 | | | | 2,326,360 | | | | 2,316,940 | | | | 586,884 | | | | 756,524 | | | | 856,056 | | | | | | | | | |

Total liabilities | | | 497,507 | | | | 421,429 | | | | 362,704 | | | | 318,058 | | | | 585,338 | | | | 673,439 | | | | | | | | | |

Total equity | | | 1,507,181 | | | | 1,898,342 | | | | 1,947,056 | | | | 261,498 | | | | 164,592 | | | | 175,969 | | | | | | | | | |

Statement of cash flows data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | $ | (134,041 | ) | | $ | 50,572 | | | $ | 87,736 | | | $ | 40,756 | | | $ | 21,464 | | | | | | | | | |

Net cash used in investing activities | | | | | | | (465,959 | ) | | | (216,819 | ) | | | (122,819 | ) | | | (108,647 | ) | | | (93,609 | ) | | | | | | | | |

Net cash provided by financing activities | | | | | | | 607,254 | | | | 135,795 | | | | 7,060 | | | | 163,506 | | | | 99,945 | | | | | | | | | |

Other data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA (10) | | | | | | $ | (84,030 | ) | | $ | (48,791 | ) | | $ | (1,329,785 | ) | | $ | 87,324 | | | $ | 30,367 | | | $ | 90,686 | | | $ | 30,367 | |

Adjusted EBITDA (10) | | | | | | | | | | | | | | | 110,128 | | | | 114,604 | | | | | | | | 114,604 | | | | | |

Capital expenditures (11) | | | | | | | 468,049 | | | | 215,529 | | | | 138,831 | | | | 92,750 | | | | 46,718 | | | | | | | | | |

Depreciation and amortization (12) | | | | | | | 97,472 | | | | 94,839 | | | | 96,973 | | | | 40,943 | | | | 17,216 | | | | 32,677 | | | | 17,216 | |

Ratio of earnings to fixed charges (13) | | | | | | | — | | | | — | | | | — | | | | 1.8 | x | | | — | | | | 1.2 | x | | | — | |

Total terminals shipped (14) | | | | | | | | | | | 161,700 | | | | 194,600 | | | | 226,000 | | | | 125,400 | | | | | | | | | |

Total enterprise terminals shipped (14) | | | | | | | | | | | 47,000 | | | | 78,600 | | | | 95,000 | | | | 51,100 | | | | | | | | | |

Total North American enterprise terminals shipped | | | | | | | | | | | 29,700 | | | | 37,600 | | | | 36,000 | | | | 24,100 | | | | | | | | | |

Total sites in service | | | | | | | | | | | 406,000 | | | | 459,000 | | | | 525,000 | | | | 555,000 | | | | | | | | | |

Total enterprise sites in service | | | | | | | | | | | 226,000 | | | | 235,000 | | | | 250,000 | | | | 255,000 | | | | | | | | | |

15

| (1) | Includes hardware sales totaling $55.3 million, $55.8 million, $58.0 million, $55.4 million, $25.1 million, $21.7 million, $55.4 million and $21.7 million, representing annual revenues under VSAT hardware operating leases with customers which are funded by third-party financial institutions and for which we have retained a financial obligation to the financial institution, for the years ended December 31, 2002, 2003, 2004 and 2005, for the six months ended June 30, 2005 and 2006, for the pro forma year ended December 31, 2005 and for the pro forma six months ended June 30, 2006, respectively. |

| (2) | For a description of our customer equipment financing arrangements and the impact on our financial statements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting Our Results of Operations—Customer Equipment Financing Arrangements.” |

| (3) | Restructuring costs represent employee headcount reductions, facilities closings, and other infrastructure-related costs. These restructuring activities relate principally to our domestic operations and primarily consist of cost reduction and downsizing actions intended to respond to market conditions in the principal markets served by us. Additionally, in 2004, the realignment of the SPACEWAY program in the third quarter of 2004 contributed to the need for additional downsizing activities and in 2005 the decision to close one of our network operations centers related to SPACEWAY resulted in charges for the cancellation of equipment leases and other costs. |

| (4) | In the third quarter of 2004, DIRECTV determined that it would no longer continue to pursue the business plan of the SPACEWAY program as it was originally contemplated and that two of the SPACEWAY satellites and certain support equipment would be retained by DIRECTV. These decisions triggered the need to perform an asset impairment analysis on the carrying amount of the SPACEWAY assets since the ultimate use of these assets differed from their original intended purpose. The impairment provision reflected the result of the impairment analysis and represented the excess of the previously capitalized costs over the fair values as determined by the analysis. |

| (5) | As a result of the April 2005 Acquisition, we performed an impairment analysis on the carrying value of our net assets. Based on the purchase price for the assets in the April 2005 Acquisition, we determined that the fair value of our net assets was $150.3 million less than the carrying amount of our net assets at the date of the contribution agreement. Accordingly, we recognized an impairment provision in the fourth quarter of 2004 relating to the excess of the carrying amount of our net assets over their fair value. |

| (6) | Other income (expense), net consists of the following: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | Pro forma | |

| | | Year ended December 31, | | | Six months

ended

June 30, | | | Year ended

December 31, 2005 | | | Six months

ended June 30, 2006 | |

(Dollars in thousands) | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2005 | | | 2006 | | | |

Equity in earnings (losses) of affiliates (a) | | $ | (7,773 | ) | | $ | (1,298 | ) | | $ | — | | | $ | 57 | | | $ | 82 | | | $ | 54 | | | $ | 57 | | | $ | 54 | |

Minority interests’ share of subsidiary (earnings) losses (b) | | | (358 | ) | | | (678 | ) | | | (64 | ) | | | 597 | | | | 92 | | | | (54 | ) | | | 597 | | | | (54 | ) |

Interest income | | | 1,171 | | | | 1,000 | | | | 772 | | | | 2,915 | | | | 649 | | | | 3,342 | | | | 2,915 | | | | 3,342 | |

Gain on sale of real estate | | | — | | | | — | | | | 5,805 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Foreign income tax expense | | | (3,117 | ) | | | (2,199 | ) | | | (32 | ) | | | (873 | ) | | | (434 | ) | | | (987 | ) | | | (873 | ) | | | (987 | ) |

Other | | | — | | | | — | | | | — | | | | 198 | | | | — | | | | 480 | | | | 198 | | | | 480 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense), net | | $ | (10,077 | ) | | $ | (3,175 | ) | | $ | 6,481 | | | $ | 2,894 | | | $ | 389 | | | $ | 2,835 | | | $ | 2,894 | | | $ | 2,835 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Represents accounting under the equity method for investments of which we own less than a majority. |

| | (b) | Represents the percentage of earnings from our subsidiaries not wholly-owned by us. |

| (7) | Effective January 1, 2002, we changed our method of accounting for goodwill and other intangible assets to conform to Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets.” As a result of adopting SFAS No. 142, we recorded a $16.0 million charge representing our share of the goodwill impairment of an equity method investee. This charge is reflected as a “Cumulative effect of accounting change” in the statement of operations in 2002. |

| (8) | We expect to utilize a significant portion of the cash available at June 30, 2006 for the completion and launch of our SPACEWAY satellite. As of June 30, 2006, we are forecasting approximately $102.9 million for such purpose. See “The Transactions” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” |

| (9) | Defined as current assets less current liabilities for the respective period. |

| (10) | EBITDA is defined as earnings (loss) before interest, income taxes, depreciation and amortization. Adjusted EBITDA is used in calculating covenant compliance under our credit agreement and the indenture governing the Notes. Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain adjustments, including the net costs of SPACEWAY for 2004 and the first quarter of 2005 to reflect the effects of the implementation of the SPACEWAY services agreement with DIRECTV as if it had occurred on January 1, 2004. EBITDA and Adjusted EBITDA are not recognized terms under GAAP. EBITDA and Adjusted EBITDA do not represent net income or cash flows from operations, as these terms are defined under GAAP, and should not be considered as alternatives to net income as an indicator of our operating performance or to cash flows as a measure of liquidity. |

Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of cash flow available to management for discretionary use, as such measures do not consider certain cash requirements such as capital expenditures (including expenditures on VSAT operating lease hardware and capitalized software development costs), tax payments, and debt service requirements (including VSAT operating lease hardware). EBITDA and Adjusted EBITDA as presented herein are not necessarily comparable to similarly titled measures reported by other companies. For example, EBITDA and Adjusted EBITDA reflect (i) the add-back relating to depreciation of VSAT operating lease hardware leased to customers under our historical leasing arrangements and (ii) the add-back of interest expense relating to VSAT operating lease hardware under our historical leasing arrangements. We have included information concerning EBITDA and Adjusted EBITDA because we will use such information in our review of the performance of our management and in our review of the performance of our business. We have also included information concerning Adjusted EBITDA because it reflects important components included in the financial covenants under the indenture and our revolving credit facility. For a description of our customer equipment financing arrangements and the impact on our financial statements, see “Management’s Discussion and Analysis of Financial Condition

16

and Results of Operations—Factors Affecting Our Results of Operations—Customer Equipment Financing Arrangements.” Set forth below is a reconciliation of pro forma income (loss) before cumulative effect of accounting change to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | |

| | | Historical | | | Pro forma Year ended

December 31,

2005 | |

| | | Year ended December 31, | | |

(Dollars in thousands) | | 2002 | | | 2003 | | | 2004 | | | 2005 | | |

Net income (loss) | | $ | (208,142 | ) | | $ | (157,026 | ) | | $ | (1,433,484 | ) | | $ | 24,048 | | | $ | 12,095 | |

Add: | | | | | | | | | | | | | | | | | | | | |

Cumulative effect of accounting change | | | 15,968 | | | | — | | | | — | | | | — | | | | — | |

Interest expense (a) | | | 8,726 | | | | 12,197 | | | | 7,466 | | | | 24,375 | | | | 47,956 | |

Foreign income tax expense | | | 3,117 | | | | 2,199 | | | | 32 | | | | 873 | | | | 873 | |

Depreciation and amortization (b) | | | 97,472 | | | | 94,839 | | | | 96,973 | | | | 40,943 | | | | 32,677 | |

Less: | | | | | | | | | | | | | | | | | | | | |

Interest income | | | (1,171 | ) | | | (1,000 | ) | | | (772 | ) | | | (2,915 | ) | | | (2,915 | ) |

| | | | | | | | | | | | | | | | | | | | |

EBITDA (c) | | $ | (84,030 | ) | | $ | (48,791 | ) | | $ | (1,329,785 | ) | | $ | 87,324 | | | $ | 90,686 | |

Add (Subtract): | | | | | | | | | | | | | | | | | | | | |

Facilities costs (d) | | | | | | | | | | | 6,268 | | | | 2,363 | | | | — | |

Transaction costs (e) | | | | | | | | | | | — | | | | 1,469 | | | | — | |

Restructuring costs (f) | | | | | | | | | | | 10,993 | | | | 3,068 | | | | 3,068 | |

SPACEWAY impairment (g) | | | | | | | | | | | 1,217,745 | | | | — | | | | — | |

Asset impairment (h) | | | | | | | | | | | 150,300 | | | | — | | | | — | |

Gain on sale of real estate (i) | | | | | | | | | | | (5,805 | ) | | | — | | | | — | |

Writeoff of receivable and capitalized software (j) | | | | | | | | | | | 3,500 | | | | — | | | | — | |

Elimination of payroll and benefits reflective of headcount reductions (k) | | | | | | | | | | | 21,642 | | | | 5,418 | | | | 5,418 | |

Assumed net reduction of SPACEWAY operating costs (l) | | | | | | | | | | | 16,042 | | | | 4,542 | | | | 4,542 | |

Benefits programs (m) | | | | | | | | | | | 18,075 | | | | 7,349 | | | | 7,349 | |

Insurance programs (n) | | | | | | | | | | | 1,448 | | | | 248 | | | | 248 | |

Legal expenses (o) | | | | | | | | | | | 218 | | | | 2,178 | | | | 2,178 | |

Equity incentive plan compensation (p) | | | | | | | | | | | — | | | | 115 | | | | 115 | |

Management fee (q) | | | | | | | | | | | — | | | | 690 | | | | 1,000 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | | | | | | | | | $ | 110,641 | | | $ | 114,764 | | | $ | 114,604 | |

| | | | | | | | | | | | | | | | | | | | |

| | (a) | Includes $3.6 million, $6.8 million, $5.7 million, $5.7 million and $3.9 million of interest expense related to VSAT operating lease hardware for the years ended December 31, 2002, 2003, 2004, and 2005 and the pro forma year ended December 31, 2005, respectively. The pro forma change in 2005 is due to an excess of the fair value of certain hardware finance arrangements over the carrying value in accordance with purchase accounting related to the January 2006 Acquisition. |

| | (b) | Includes $38.9 million, $39.7 million, $42.9 million, $33.4 million and $9.6 million of depreciation expense related to VSAT operating lease hardware for the years ended December 31, 2002, 2003, 2004, and 2005 and the pro forma year ended December 31, 2005, respectively. The decrease in total depreciation expense from 2004 to 2005 primarily is a result of an asset impairment provision we recorded in the fourth quarter of 2004. See footnote (h) below. |

| | (c) | For 2005 and pro forma 2005, includes $3.9 million of EBITDA generated by Hughes Communications India Limited (formerly known as Hughes Escorts Communications Ltd.), our Indian subsidiary. However, such subsidiary may be restricted from paying us dividends pursuant to the terms of its debt agreements in the event of an event of default, which currently does not exist. |

| | (d) | Reflects the elimination of rent and certain other direct costs associated with facilities that were retained by DIRECTV following the April 2005 Acquisition. For the pro forma year ended December 31, 2005, this item is already reflected in EBITDA as it represents a pro forma adjustment. See footnote (1) to the Unaudited Pro Forma Consolidated Statement of Operations for the year ended December 31, 2005. |

| | (e) | Reflects elimination of legal and other advisory fees incurred in connection with contemplated offerings of senior debt securities to fund, in part, the purchase of assets from DTV Network Systems, Inc. For the pro forma year ended December 31, 2005, this item is already reflected in EBITDA as it represents a pro forma adjustment. See footnote (5) to the Unaudited Pro Forma Consolidated Statement of Operations for the year ended December 31, 2005. |

| | (f) | The 2004 adjustment reflects the elimination of the severance expense that was charged to restructuring costs relating to a staff reduction of 164 personnel announced in connection with the April 2005 Acquisition and the realignment of the SPACEWAY program. The 2005 adjustment reflects the elimination of $1.6 million of severance expense that was charged to restructuring costs relating to a staff reduction of 16 personnel. Also reflects a one-time charge of $1.5 million for cancellation of equipment leases relating to the closure of one of our SPACEWAY network operations centers. |