Allied Nevada Announces Accelerated Mining Plan With Production

Expected to Reach Over 250,000 Ounces by 2012 at an Average Cost of

$425 - - $450 Per Ounce Sold1

Sulfide Scoping Study Provides Encouraging View of Future Potential at Hycroft

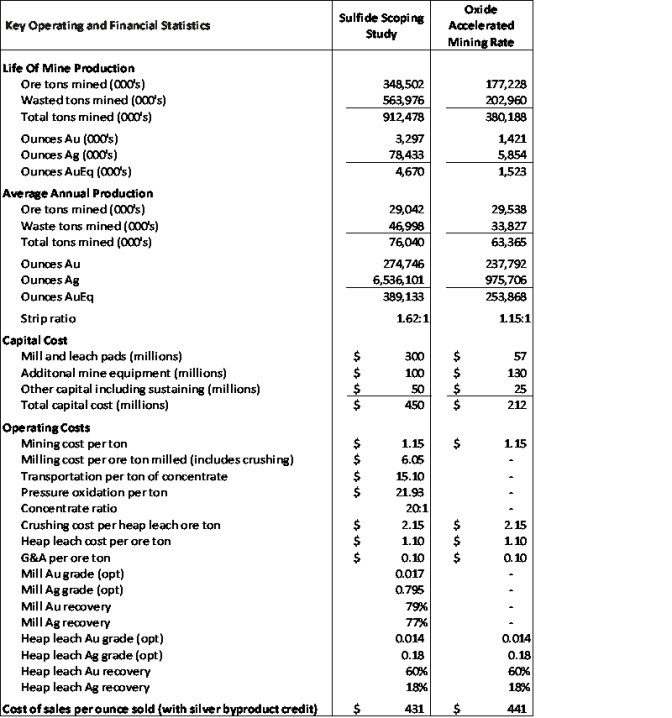

Reno, Nevada, April 5, 2010 – Allied Nevada Gold Corp. (“Allied Nevada” or the “Company”) (TSX: ANV; NYSE-A: ANV) is pleased to announce that the Company plans to implement, subject to approval by its Board of Directors, an accelerated oxide mining plan at the Company’s wholly owned Hycroft mine (“Hycroft”) located near Winnemucca, Nevada. Average annual gold production is expected to increase to approximately 250,000 ounces by 2012, with the peak years producing in excess of 300,000 ounces in 2013 and 2014. Average annual silver production is expected to be in excess of 1 million ounces. Cost of sales per ounce of gold sold1, assuming silver as a byproduct credit, is expected to average between $425 and $450 per ounce. The life of mine average strip ratio has declined to 1.15:1 compared with 1.27:1 in the life of mine case presented in the May 2009 technical report. Further optimization opportunities, such as in pit backfilling and a conveying system, may be implemented should a review provide positive results.

In addition, a Sulfide Scoping Study was developed by Scott E. Wilson Consulting, Inc. which shows expected average annual production of 275,000 ounces of gold and 6.5 million ounces of silver at an average cost of sales per ounce of gold sold1, assuming silver as a byproduct credit, of between $425 and $450 per ounce. It is anticipated that the oxide and sulfide mineralization would be mined concurrently, upon completion of a sulfide milling facility.

“We are excited about the positive developments of these organic growth opportunities at Hycroft,” said Scott Caldwell, President & CEO. “The success of our ongoing exploration program has allowed us to evaluate alternatives to optimize production rates and maximize cash flow. The encouraging results of the sulfide scoping study present a positive step to building Hycroft into a significant mining operation in Nevada.”

Accelerated Oxide Mine Plan

This new mine plan is designed to accelerate extraction of the updated oxide reserves of 2.4 million ounces of gold and 32.3 million ounces of silver (177.2 million tons grading 0.014 opt gold and 0.18 opt silver), as announced April 1, 2010. It is expected that this accelerated mining rate would be phased in over the next two years, with expected production increasing from approximately 100,000 ounces in 2010 to over 250,000 ounces of gold in 2012 and peaking at

________________________________

1 "Cost of sales per ounce of gold sold" is a non-GAAP measure. We believe the measure, along with sales, to be a key indicator of a company's ability to generate operating earnings and cash flow from its mining operations. Costs of sales per ounce of gold sold presented do not have a standardized meaning prescribed by GAAP and may not be comparable to similar measures presented by other mining companies. It should not be considered isolation as a substitute for measures of performance prepared in accordance with GAAP. A reconciliation of the calculation of this non-GAAP measure is presented at the end of this press release.

over 300,000 ounces in each of 2013 and 2014. Average annual production from 2011 to 2015 is expected to be over 260,000 ounces of gold and over 1 million ounces of silver at an average cost of sales per ounce of gold sold1, assuming silver as a byproduct credit, of between $425 and $450 per ounce. The current oxide reserve, announced April 1, 2010, is sufficient to support this mining rate until 2015, however, management is confident that ongoing exploration will continue to convert oxide resources, extending mine life.

This accelerated plan assumes an average mining rate of 80 million tons per year will be achieved by 2012, and includes 37 million tons of ore and 43 million tons of waste with approximately 30% of the ore being crushed.

The total capital required, over the life of the mine, to implement this accelerated mining plan is expected to be approximately $212 million. This is favourable in comparison with the $221 million in capital required over the current life of the mine, if we were to continue mining the 2.4 million ounces of oxide reserves at our current rate. The initial capital of approximately $180 million, spent over the first three years, is for the inclusion of a larger capacity mining fleet ($130 million), leach pad expansions ($20 million), mobile crushing units ($14 million) and modifications to existing infrastructure such as the process plant and refinery ($12 million). It is expected that the mobile mining fleet may be purchased with capital lease financing through the equipment manufacturer.

The sulfide scoping study, prepared by Scott E. Wilson Consulting, Inc. on behalf of Allied Nevada, outlines an initial development scenario for the large sulfide resource located directly beneath the oxide resource. Allied Nevada announced measured and indicated sulfide resources of 2.5 million ounces of gold and 103.0 million ounces of silver (143.9 million tons grading 0.018 opt Au and 0.72 opt Ag) on April 1, 2010. Life of mine production is expected to be 3.3 million ounces of gold and 78.4 million ounces of silver with average annual production of 275,000 ounces of gold and 6.5 million ounces of silver and a mine life of approximately 12 years. Average cost of sales per ounce of gold sold1, assuming silver as a byproduct credit, is expected to be between $425 and $450 per ounce.

Hycroft hosts a large measured and indicated sulfide resource with a low strip ratio. The scoping study is based on the recently announced measured and indicated sulfide resources and it indicates that, in the opinion of Scott Wilson, the sulfide project is economically viable. Hycroft’s sulfide inferred resources do not form part of the scoping study, however, management is confident that resources will

continue to be upgraded through additional drilling and metallurgical work.

________________________________

2 The scoping study relates to the economic potential of the sulfide mineralization at the Hycroft property and is not part of, and should be distinguished from, the current oxide mining operation. The sulfide scoping study is based solely on the measured and indicated sulfide resources defined on the property. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The reader is cautioned that a scoping study is very preliminary in nature and accordingly subject to a high degree of uncertainty. A preliminary and/or definitive feasibility study will be required to further evaluate project economics.

Oxide Accelerated Mine Plan and Sulfide Scoping Study - 2

The study indicates that a large scale bulk tonnage open pit mining operation is the most economic method to extract the sulfide resource while simultaneously mining the oxide ore reserve. The ore would be processed at either the oxide (heap leach) processing facility or at the sulfide/oxide milling facility. A 30,000 ton per day milling and flotation process facility is preferred, at an estimated capital cost of $260 million, and is comprised of a primary crusher, semi-autogenous grinding mill, two ball mills and a flotation circuit. On average, approximately 1,500 tons of concentrate per day would be produced and would be shipped off-site for final processing. The annualized mining rate is expected to be approximately 76 million tons, including approximately 29 million tons of ore and approximately 47 million tons of waste.

The sulfide mineralization contains a high pyrite/marcasite mass, which would produce an exothermic reaction in both a pressure oxidation and smelting plant. This reaction has shown in similar operations to reduce the energy and fuel required to operate these plants, reducing overall process costs.

The Company believes that the favorable result of the Hycroft sulfide scoping study warrants the continuation of work and expenditures on the project. Management estimates that a feasibility study related to the sulfide measured and indicated resources can be completed in the first half of 2011. The estimated total cost to complete the feasibility study including metallurgical test work, environmental studies, mine and plant engineering work and other ancillary costs, is $10 million and will be spent over the next 12 to 18 months.

Management envisions that the oxide and sulfide mineralization would be mined concurrently. As such, management is currently reviewing the benefit of milling oxide material with the intention of improving gold and, more specifically, silver recoveries through metallurgical testing. Should the results of the metallurgical testing result in a positive outcome, management believes reviewing the addition of a larger milling scenario able to accommodate both oxide and sulfide material may be warranted. It is expected that, based on North American industry average costs, the capital required to build an 80,000 ton per day mill would be approximately $680 million. Operating costs are expected to be similar to those presented in the sulfide scoping study case. For oxide mineralization, eliminating the costs to produce, transport and oxidize the concentrate would reduce operating costs to be partially offset by the costs associated with a leaching circuit.

Allied Nevada will file a National Instrument 43-101 compliant technical report encompassing the recently announced mineral reserve and resource update, which will include further details on the accelerated mining plan and sulfide scoping study including risks and uncertainties associated with both scenarios.

For further information on Allied Nevada, please contact:

Scott Caldwell Tracey Thom

President & CEO Vice President, Investor Relations

(775) 358-4455 (416) 409-6007

or visit the Allied Nevada website at www.alliednevada.com.

Oxide Accelerated Mine Plan and Sulfide Scoping Study - 3

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934 (and the equivalent under Canadian securities laws), that are intended to be covered by the safe harbor created by such sections. Such forward-looking statements include, without limitation, statements regarding the Company’s expectation of the projected timing, costs and outcome of engineering studies; expectations regarding the conclusions of the Sulfide Scoping Study and the Company’s projections as a result of such study; expectations regarding potential growth opportunities and the timing, benefits and costs associated with the implementation of an accelerated oxide mining plan at Hycroft; expectations regarding sulfide mineralization at Hycroft and the Company’s sulfide development plan; reserve and resource estimates; cost estimates, estimates of gold and silver grades; estimates of recovery rates; expectations regarding the life of the Hycroft mine and the timing and rate of mining at Hycroft; expectations regarding the location of processing ore in the future; expectations regarding the amount of capital necessary to build an 80,000 ton per day mill; and other statements that are not historical facts. Forward-looking statements address activities, events or developments that Allied Nevada expects or anticipates will or may occur in the future, and are based on current expectations and assumptions. Although Allied Nevada management believes that its expectations are based on reasonable assumptions, it can give no assurance that these expectations will prove correct. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks relating to Allied Nevada’s lack of operating history; risks that Allied Nevada’s acquisition, exploration and property advancement efforts will not be successful; risks relating to fluctuations in the price of gold and silver; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resource estimates; availability of outside contractors in connection with Hycroft and other activities; uncertainties relating to obtaining approvals and permits from governmental regulatory authorities; and availability and timing of capital for financing the Company’s exploration and development activities, including uncertainty of being able to raise capital on favorable terms or at all; as well as those factors discussed in Allied Nevada’s filings with the U.S. Securities and Exchange Commission (the “SEC”) including Allied Nevada’s latest Annual Report on Form 10-K and its other SEC filings (and Canadian filings) including, without limitation, its latest Quarterly Report on Form 10-Q. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources

This press release uses the terms “measured”, “indicated” and “inferred” “resources.” We advise U.S. investors that while these terms are recognized and required by Canadian regulations, the SEC does not recognize them. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of “inferred mineral resources” may not form the basis of a feasibility study or prefeasibility studies, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute “reserves” as in-place tonnage and grade without reference to unit measures. The term “contained gold ounces” used in this press release is not permitted under the rules of the SEC. U.S. investors are cautioned not to assume that any part or all of a measured, indicated or inferred resource exists or is economically or legally mineable.

The mineral reserve and resource estimate has been prepared under the supervision of Mr. Scott Wilson of Scott E. Wilson Mining, who is a Qualified Person as defined by National Instrument 43-101. Scott Wilson is an independent consultant for Allied Nevada and has reviewed and verified the technical information contained in this news release.

Commodity prices assumed for the accelerated oxide mining case and the sulfide scoping study were $800 per ounce for gold and $14.00 per ounces for silver. The ratio used to calculate gold equivalent ounces was 54.17:1.

Oxide Accelerated Mine Plan and Sulfide Scoping Study - 4

Oxide Accelerated Mine Plan and Sulfide Scoping Study - 5