UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-33119

ALLIED NEVADA GOLD CORP.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 20-5597115 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

9600 Prototype Court, Reno Nevada 89521

(775) 358-4455

(Address and telephone number of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value | | NYSE-Alternext U.S. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-accelerated Filer ¨ Smaller Reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting Common Stock held by non-affiliates as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, was $272,470,122 based on the last reported sale price of the Common Stock on the American Stock Exchange on that date.

Number of shares outstanding of the registrant’s Common Stock as of March 10, 2009: 57,433,144

Documents Incorporated by Reference:

To the extent specifically referenced in Part III, portions of the registrant’s definitive Proxy Statement on Schedule 14A for the 2009 Annual Meeting of Stockholders are hereby incorporated by reference into this report. See Part III.

TABLE OF CONTENTS

Note Regarding Forward-Looking Statements

In addition to historical information, this Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein and in press releases and public statements by our officers or representatives, that address activities, events or developments that management of Allied Nevada expects or anticipates will or may occur in the future, are forward-looking statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths, expansion and growth of our business, plans for reactivation of the Hycroft Mine including anticipated scheduling and production estimates, as well as estimated capital and other costs, technical risks associated with the Hycroft reactivation project, the availability of outside contractors, results of exploration drilling programs at Hycroft, current estimates of gold oxide mineralized material, potential for upgrading and expanding oxide gold mineralized material and extension of life of the oxide project, results of evaluation of underlying sulfide mineralization at Hycroft, future gold prices, availability and timing of capital, anticipated cash flows, estimated completion dates, estimated exploration expenditures, operations, proven or probable reserves, mineralized material, current working capital, and cash operating costs.

These statements can be found under “Part I—Item 1. Business”, Part I—Item 1A. Risk Factors”, Part I—Item 2. Properties”, Part I—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and elsewhere throughout this Annual Report on Form 10-K. The words “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe”, “target”, “budget”, “may”, “schedule” and similar words or expressions identify forward-looking statements. These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on current expectations. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others:

| | • | | Business-related risks including: |

| | • | | Risks related to our limited operating history; |

| | • | | Risks relating to the reactivation and operation of the Hycroft Mine including: |

| | • | | uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities; |

| | • | | risks of shortages of equipment or supplies; and |

| | • | | risks of inability to achieve anticipated production volume or manage cost increases; |

| | • | | Risks that our acquisition, exploration and evaluation activities will not be commercially successful; |

| | • | | Risks relating to fluctuations in the price of gold; |

| | • | | The inherently hazardous nature of mining activities; |

| | • | | Uncertainties concerning estimates of reserves and mineralized material; |

| | • | | Uncertainty of being able to raise additional capital on favorable terms or at all; |

| | • | | Risks relating to intense competition within the mining industry; |

| | • | | Our dependence on outside sources to place mineral properties into production; |

| | • | | Potential effects on our operations of U.S. federal and state governmental regulation, including environmental regulation and permitting requirements; |

| | • | | Risks of significant cost increases; |

i

| | • | | Uncertainties concerning availability of equipment and supplies; |

| | • | | Risks relating to our dependence on third parties that are responsible for exploration and development on some of our properties; |

| | • | | Risks that we may lose key personnel or fail to attract and retain personnel; |

| | • | | Risks that we may experience difficulty in managing our growth; |

| | • | | Potential challenges to title in our mineral properties; |

| | • | | Risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval; and |

| | • | | Risks related to the heap leaching process, including but not limited to gold recovery rates, gold extraction rates, and the grades of ore placed on our leach pads. |

| | • | | Risks related to our common stock, including: |

| | • | | Potential volatility in the trading price and volume of our common stock; |

| | • | | Risks inherent in accurately valuing our common stock; and |

| | • | | Potential adverse effect of future sales of our common stock on the trading price of our common stock. |

For a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those in such forward-looking statements, please see those factors discussed in this Form 10-K and other filings with the SEC. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate as actual results and future events could differ materially from those anticipated in the statements. We assume no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

PART I

History of Allied Nevada

Allied Nevada is a gold mining company that operates the Hycroft Mine and has a large number of prospective exploration claims in the State of Nevada. Based on management’s belief and current life of mine plans, the Hycroft Mine is expected to reach normal annualized production rates of approximately 90,000 ounces of gold per year by the middle of 2009. These plans indicate that the Hycroft Mine should produce gold from the proven and probable ore reserves at these rates for approximately seven years. At the Hycroft Mine, we will focus our exploration efforts on identifying additional oxide ore reserves that can extend the mine life and to continue to assess the economic potential of the sulfide mineralization that has been identified. In addition to the Hycroft Mine, we have six properties which have reported other mineralized material and more than 100 other early stage exploration properties. On an ongoing basis, we evaluate our exploration portfolio to determine ways to increase the value of these properties. Allied Nevada Gold Corp. was incorporated under the laws of Delaware on September 14, 2006. Until May 10, 2007 we were a wholly-owned subsidiary of Vista Gold Corp. (“Vista”), a corporation incorporated under the laws of the Yukon Territory, Canada.

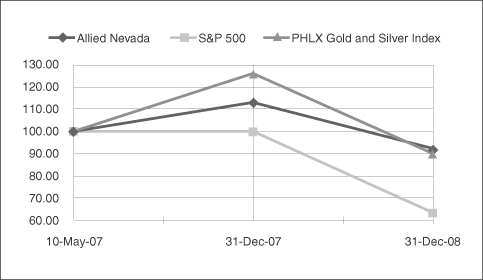

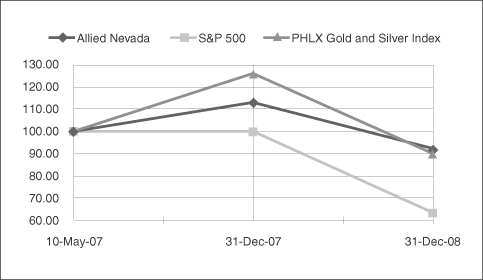

We commenced our operations on May 10, 2007, following Vista’s transfer to us of its Nevada-based mining properties and related assets, along with cash, and the transfer to us by Carl Pescio and Janet Pescio, (together, the “Pescios”) of their interests in certain Nevada mining properties and related assets. These transfers to us were made in exchange for shares of our common stock and cash, under the terms of an Arrangement and Merger Agreement (“Arrangement Agreement”) that we entered into with Vista and the Pescios on September 22, 2006, as amended. Before the Arrangement Agreement transactions were completed, we had no properties or property interests, were not yet conducting business operations and had no shareholders other than Vista.

Pursuant to the terms of the Arrangement Agreement, the parties completed a transaction that resulted in Vista’s transfer of the Vista Nevada Assets to Allied Nevada along with cash, and the Pescios’ transfer to Allied Nevada of the Pescio Nevada Assets, all pursuant to the provisions of theBusiness Corporations Act(Yukon Territory). Allied Nevada issued 38,933,055 shares of common stock as part of the transaction, of which 12,000,000 were issued to the Pescios as partial consideration for the acquisition of the Pescio Nevada Assets and 26,933,055 were issued to Vista in accordance with the Arrangement Agreement. In addition to the stock consideration, Allied Nevada paid the Pescios $15 million for the acquisition of the Pescio Nevada Assets. The new common shares of Allied Nevada common stock began trading on May 10, 2007, on the American Stock Exchange, which is now known as the NYSE Alternext US LLC (“NYSE Alternext US” or “NYSE-A”), and the Toronto Stock Exchange.

In September 2007, the Board of Directors approved the re-opening of the Hycroft Mine (“Hycroft Development Program”). The Hycroft Development Program involved re-opening the Hycroft Open Pit Mine which had been placed on a care and maintenance program, due to low gold prices, since 1998. The required capital and development spending was scheduled for 2008 with the objective of producing gold in the fourth quarter of 2008.

General Development of the Business during 2008

During 2008, the Hycroft Development Program was completed with the production of gold in December 2008. The major activities that occurred during 2008 were the following:

| | • | | In March 2008, we purchased a used mining fleet consisting of five 200-ton haul trucks, two 26-yard wheel loaders, two blasthole drills and various pieces of support equipment. During 2008, this equipment was reassembled at the Hycroft Mine and was fully operational by the end of the year. We |

1

| | also purchased additional production and ancillary equipment as required by the Hycroft Development Program. |

| | • | | In April 2008, we completed a cross-border public offering of stock that consisted of a primary offering of 12,500,000 common shares and the exercise of an over-allotment option consisting of an additional 1,875,000 common shares. Net proceeds of this offering were approximately $69 million. The net proceeds of this offering were utilized primarily to fund activities in connection with the Hycroft Development Program, oxide and sulfide exploration activities on the Hycroft property, as well as additional working capital and reclamation bonding. |

| | • | | The Hycroft Development Program required us to strip waste overburden in the Brimstone open pit to allow access to the ore. This stripping program was completed in the third quarter of 2008. |

| | • | | We completed the initial 1.1 million square foot expansion of the Brimstone leach pad system. We placed this expanded Brimstone leach pad system under leach during 2008. |

| | • | | Total production for December 2008 was approximately 1,000 ounces of gold and 3,000 ounces of silver which was a combination of doré and metal on carbon. This doré will be refined into gold and silver bullion which will then be sold in the normal course of business. |

| | • | | By the end of 2008, the mine operations are operating at the planned production levels of 2.1 million tons of material per month. During the first of five mining phases, we are utilizing a contractor to increase our mining output by approximately 500,000 tons of material per month. This additional capacity will allow us to accelerate ore production from the Brimstone open pit mine. |

| | • | | We are now in the start-up phase of operation and, based on current life of mine plans, management believes we will attain annualized production rates of approximately 90,000 ounces by July 2009. Over the six-month start-up period, production will progressively increase as we continue to leach existing ore and place new ore on the leach pad. |

On October 18, 2008, we completed a sulfide resource update and an oxide reserve and resource update for the Hycroft Mine. These updates were based upon an analysis of historical drill hole assay results and recent drill hole assay results from holes that had been drilled as part of the Hycroft Mine oxide and sulfide exploration drilling program. These recent holes were drilled as part of an ongoing program to expand the Hycroft gold and silver sulfide resource in the Brimstone and Silver Camel areas as well as to define areas for potential gold and silver oxide reserves in other areas at the Hycroft Mine. During 2008, we drilled a total of 341 mine development and exploration drill holes that totaled approximately 240,000 feet of drilling.

Segment Information

We have operating segments of Hycroft Mine, Exploration properties, and other. The Hycroft Mine operating segment contains the exploration and operational activities at our wholly-owned Hycroft mine located in Nevada. The exploration properties segment contains the exploration and development activities on the remaining mineral properties owned by the Company. The other operating segment primarily contains the corporate overhead functions of the Company. Please see Note 17 to our Consolidated Financial Statements for information related to our business segments.

General Description of the Business of Allied Nevada

Allied Nevada was incorporated in the state of Delaware on September 14, 2006 and is domiciled in the United States of America and its corporate headquarters is located in Reno, Nevada.

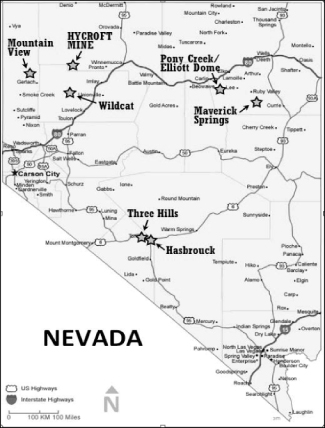

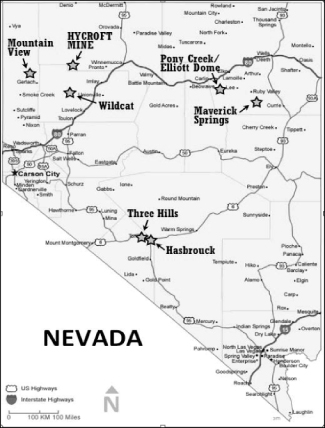

We own the Hycroft Open Pit Mine, Maverick Springs (a 45% joint venture with Silver Standard Resources Inc. “Silver Standard”), Mountain View, Hasbrouck, Three Hills and Wildcat projects, the Contact property and other Nevada properties previously owned by Vista, and Pony Creek/Elliot Dome property package and the exploration rights to more than a hundred other earlier-stage exploration properties. See “Part I—Item 2. Properties”. All of these properties are located in the state of Nevada.

2

We operate the wholly-owned Hycroft Mine which is located 54 miles west of Winnemucca, Nevada. The Hycroft Mine is an open pit, heap leach gold mine that is expected to produce silver as a byproduct of the gold recovery process. All currently identified ore reserves will be mined by open pit methods with a typical drill, blast, load, and haul cycle from two pits; the Brimstone Pit and the Cut-5 pit. All ore-grade material placed on the leach pad will be run-of-mine. The pregnant solution will be processed using a Carbon in leach solution recovery process (“CIL process”) and a Merrill-Crowe zinc-precipitation process (“Merrill-Crowe process”) that has been maintained in good operating condition since it was shut down in 1998. Based on our current life of mine operations plans, management believes that the Hycroft Mine will attain full production capacity by the middle of 2009 and expects to produce gold at an annual production rate of approximately 90,000 ounces of gold per year thereafter. Management also believes that the mining of the current proven and probable reserves will permit the Company to produce gold at these production levels for each of the next seven years. Management intends to continue its oxide exploration program with the objective of identifying additional proven and probable reserves that can extend the current mine life. Management also intends to continue its exploration of the sulfide mineralization and its economic evaluation of the feasibility of bringing a sulfide mine into production. Please refer to “Item 2. Properties and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for more information”.

In addition to operating the Hycroft Mine, Allied Nevada is engaged in the evaluation, acquisition, exploration and advancement of gold exploration and development projects in the state of Nevada. Our management searches for opportunities to improve the value of the gold projects that we own or control through exploration drilling, introducing technological innovations and developing properties into operating mines. We expect that emphasis on gold project acquisition and development will continue in the future.

Principal Products

Allied Nevada had no gold sales during 2008. The Company is a production stage company that sold its first gold in 2009. We will generally sell our gold at the prevailing market price during the month in which the gold is delivered to the customer. We will recognize revenue from a sale when the price is determinable, the gold has been delivered, the title has been transferred to the customer and collection of the sales price is reasonably assured.

Most of our revenue will come from the sale of refined gold in the international market. The end product at our gold operations, however, is generally doré bars. Doré is an alloy consisting of gold, silver and other metals. Doré is sent to refiners to produce bullion that meets the required market standard of 99.95% pure gold. Under the terms of our refining agreements, the doré bars are refined for a fee, and our share of the refined gold and the separately-recovered silver are credited to our account or delivered to our buyers. In our Doré, we expect that the contained value of the gold will be approximately 25 times more than the contained value of the silver. As such, we consider gold to be a principal product and silver to be a byproduct of the gold recovery process.

Gold Uses. Gold has two main categories of use: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry.

Gold Supply. The supply of gold consists of a combination of current production from mining and the draw-down of existing stocks of gold held by governments, financial institutions, industrial organizations and private individuals.

3

Gold Price. The following table presents the annual high, low and average afternoon fixing prices for gold over the past ten years, expressed in US dollars per ounce, on the London Bullion Market.

| | | | | | | | | |

| | | Gold Price (USD) on the

London Bullion Market |

Year | | High | | Low | | Average |

1999 | | $ | 326 | | $ | 253 | | $ | 279 |

2000 | | | 313 | | | 264 | | | 279 |

2001 | | | 293 | | | 256 | | | 271 |

2002 | | | 349 | | | 278 | | | 310 |

2003 | | | 416 | | | 320 | | | 363 |

2004 | | | 454 | | | 375 | | | 410 |

2005 | | | 536 | | | 411 | | | 444 |

2006 | | | 725 | | | 525 | | | 604 |

2007 | | | 841 | | | 608 | | | 695 |

2008 | | | 1,011 | | | 713 | | | 872 |

2009 (Through March 10, 2009) | | | 990 | | | 810 | | | 902 |

Source: London Metal Exchange

On March 10, 2009, the afternoon fixing price for gold on the London Bullion Market was $902 per ounce.

Business Strategy

Our business plan was developed with the overriding goal of maximizing shareholder value through the operation of the Hycroft Mine, the exploration and development of our mineral properties, and through strategic partnerships. To achieve this goal, our business plan focuses on three strategic areas:

| | • | | Hycroft Exploration Drilling Program |

| | • | | Mergers and Acquisitions |

Until we start generating sufficient cash flow from gold production and production royalties, we are dependent on our working capital, funding from external sources and cash from advanced minimum royalty (“AMR”) payments received with respect to interests in certain Nevada-based mining properties.

The Hycroft Open Pit Mine, which we also refer to as the “Hycroft Mine” in this Annual Report on Form 10-K, is located 54 miles west of Winnemucca, Nevada along the border of Humboldt and Pershing Counties, and covers approximately 48,000 acres of mineral rights.

During 2008, Allied Nevada completed the capital construction and development phases of the Hycroft Development Program. We are currently in the start-up phase and, based on our current life of mine operating plans, management believes we will reach an annualized production rate of approximately 90,000 ounces of gold per year by mid-year 2009.

At full production, based upon our current assumptions and life of mine plan, the mine is expected to employ 142 workers and will mine approximately 25 million tons of material per annum. The mining will be accomplished by open pit mining methods and the run-of-mine heap leach process will be used to recover gold

4

from the ore. Silver will be produced as a byproduct of the gold extraction process. Solutions from the heap leach process will be further processed using CIL process and Merrill-Crowe process methods. The final product of this process will be a doré which will contain gold and silver precious metals. The doré will be refined by a third-party refinery which will produce gold and silver bullions.

Our operating objective at the Hycroft Mine is to mine the deposit in a profitable, safe, and environmentally friendly manner. To attain this goal, we have focused on recruiting and retaining experienced executives, managers, and employees. The team that has been formed by Allied Nevada has extensive specific experience in managing and operating mines utilizing the specific mining and processing methods used by the Company. This team has identified the appropriate technologies and developed the appropriate production management, health and safety programs and environmental management, monitoring, and protection programs.

See “Part I—Item 2. Properties—Operating Properties—Hycroft Open Pit Mine Operation”.

| | • | | Hycroft Exploration Drilling Program |

Increase of Oxide Reserves

One of the objectives of the Hycroft exploration drilling program is to further expand the existing oxide reserves on the Hycroft property. Allied Nevada has completed the initial phase of an oxide ore reserve delineation program at Hycroft and announced expanded reserves during 2008. In the future, we plan to continue exploration drilling targeted at identifying additional oxide ore reserves to increase the proven and probable reserves and extend the current mine life at the property.

Allied Nevada completed an oxide ore reserve delineation program at Hycroft during the first half of 2008. An updated reserve tabulation was released in the fourth quarter of 2008. The details of this reserve report are included in the business section, see “Part I-Item 2. Operating Properties-Hycroft Open Pit Mine Operation”. Additional holes, targeting oxide mineralization, were drilled in the second half of 2008. An updated reserve calculation is expected to be completed during the first half of 2009.

Testing of Sulfide Gold and Silver Mineralization

The second objective of the Hycroft exploration drilling program is to continue testing the economic viability of the sulfide gold and silver mineralization on the Hycroft property. During 2008, an exploration drill program was completed to provide initial estimates of the sulfide mineralization at the Hycroft Mine. We are currently assessing the results of this drilling and expect to release an updated sulfide resource update in the first half of 2009. During 2008, the Company began the metallurgical test work to focus on estimating the gold and silver recovery that could be attained from the sulfide material. Preliminary results are encouraging and we plan to continue with the metallurgical test work in 2009. In 2009, we will also begin the engineering work required to complete a pre-feasibility study in 2010.

Any expansion of the Hycroft Mine necessary to exploit any additional reserves that may be established through our Hycroft exploration drilling program that are not located within our current mine plan, will require us to obtain all permits, approvals and consents of regulatory agencies responsible for the use and development of mines in Nevada.

For further discussions concerning these programs, see “Part I—Item 2. Properties—Development Properties—Hycroft Open Pit Mine—Hycroft Exploration Drilling Program”.

Exploration Properties

Our Exploration Properties portfolio consists of six advanced properties in Maverick Springs (45% joint venture interest with Silver Standard), Mountain View, Hasbrouck, Three Hills, Wildcat, and Pony Creek/ Elliot Dome and more than 100 earlier-stage exploration properties. Evaluation of these properties will be completed to

5

determine each property’s economic potential. Based on this evaluation, we will develop exploration programs, enter into joint venture exploration agreements, sell or dispose of these properties.

During 2008, we completed initial broad scale mapping and geochemical sampling on all of our exploration properties. Additionally, Silver Standard completed an exploration program at our Maverick Springs joint venture, the details of which are included in “Part II—Item 2. Properties—Exploration Properties—Maverick Springs”.

For further discussions concerning our exploration properties, please see information concerning each property under “Part I—Item 2. Properties”.

Mergers and Acquisitions

We routinely review merger and acquisition opportunities. Our primary focus will be on those opportunities involving precious metal production or near-term production with a secondary focus on other resource-based opportunities. Potential acquisition targets would include private and public companies or individual properties. Although our preference would be for acquisition candidates located in the United States, Allied Nevada will consider opportunities located in other countries where the geopolitical risk is acceptable.

Formation of Allied Nevada

Initial Corporate Organization

Allied Nevada Gold Corp. commenced operations in May 2007. We were incorporated under the laws of Delaware on September 14, 2006 and until May 10, 2007 we were a wholly-owned subsidiary of Vista Gold Corp. (“Vista”), a corporation incorporated under the laws of the Yukon Territory, Canada.

We commenced our operations on May 10, 2007, following Vista’s transfer to us of its Nevada-based mining properties and related assets, along with cash, and the transfer to us by Carl Pescio and Janet Pescio (the “Pescios”) of their interests in certain Nevada mining properties and related assets. These transfers to us were made in exchange for shares of our common stock and cash, under the terms of an Arrangement and Merger Agreement that we entered into with Vista and the Pescios on September 22, 2006, as amended (the “Arrangement Agreement”) as summarized below. In this document, we sometimes use the terms “Vista Nevada Assets” and “Pescio Nevada Assets” to refer to, respectively, Vista’s Nevada-based mining properties and related assets, and the Pescios’ interests in certain Nevada mining properties and related assets that were transferred to us pursuant to the Arrangement Agreement. Before the Arrangement Agreement transactions were completed, we had no properties or property interests, were not yet conducting business operations and had no shareholders other than Vista.

Arrangement Agreement

Pursuant to the terms of the Arrangement Agreement, the parties completed a transaction that resulted in Vista’s transfer of the Vista Nevada Assets to Allied Nevada along with cash, and the Pescios’ transfer to Allied Nevada of the Pescio Nevada Assets, all pursuant to an arrangement (which we refer to as the “Arrangement Agreement” in this document) under the provisions of theBusiness Corporations Act(Yukon Territory).

Among other things, pursuant to the Arrangement Agreement:

| | • | | Vista reorganized its business to split the Vista Nevada Assets from its other properties and related assets and ensured that all of the Vista Nevada Assets were held by its wholly-owned subsidiary, Vista Gold Holdings Inc. (“Vista U.S.”) or subsidiaries wholly-owned by Vista U.S.; |

| | • | | Vista subsequently transferred all issued and outstanding shares of Vista U.S. and $25.0 million in cash to Allied Nevada (less approximately $0.5 million owed to Vista in connection with loans that Vista made to Vista U.S. pursuant to the Arrangement Agreement) in return for 26,933,055 shares of Allied Nevada common stock; |

6

| | • | | The Pescios transferred their interests in the Pescio Nevada Assets to Allied Nevada Gold Holdings LLC, a limited liability company incorporated under the laws of Nevada with Allied Nevada as its sole member, in return for 12,000,000 shares of Allied Nevada common stock and $15.0 million in cash from Allied Nevada; and |

| | • | | Holders of Vista options exchanged their options for options to acquire Allied Nevada shares. |

The new common shares of Vista and the shares of Allied Nevada common stock began trading on May 10, 2007, on the NYSE-A (f/k/a AMEX), and the TSX.

The issuance of securities by Allied Nevada to Vista security holders pursuant to the Arrangement Agreement was not registered under the Securities Act or the securities laws of any state of the United States and was affected in reliance upon the exemption from registration under the Securities Act provided by Section 3(a)(10) thereof. Section 3(a)(10) of the Securities Act exempts from registration a security that is issued in exchange for outstanding securities where the terms and conditions of such issuance and exchange are approved, after a hearing upon the fairness of such terms and conditions at which all persons to whom it is proposed to issue securities in such exchange have the right to appear, by a court or by a governmental authority expressly authorized by law to grant such approval. The Supreme Court of the Yukon Territory, an authorized court, approved the Arrangement Agreement by a Final Order granted on November 29, 2006. The Final Order accordingly constituted a basis for the exemption from the registration requirements of the Securities Act with respect to the issuance of the securities of Allied Nevada to Vista security holders pursuant to the Arrangement Agreement.

Financial Information Included in This Document

This Annual Report on Form 10-K includes financial and other information for the years ended December 31, 2004-2008. Prior to May 10, 2007, we were still a wholly-owned subsidiary of Vista. Consistent with our past filings, the financial statements, related discussion and analysis and other financial information in this document were prepared as relates to the subsidiaries of Vista that held Nevada-based mining properties and related assets that were transferred to Allied Nevada as part of the Arrangement Agreement. In our filings prior to the completion of the Arrangement Agreement, we referred to these subsidiaries as “Vista Gold Corp.—Nevada exploration properties” or “Vista Nevada”. Our financial statements do not include any historical financial information on the property interests acquired by Allied Nevada from the Pescios, because that acquisition was considered an asset purchase and not a purchase of a business. Accordingly, the financial statements for periods prior to the completion of the Arrangement Agreement as presented in this Annual Report on Form 10-K are those of Vista Nevada, as so termed, and are not indicative of results of operations of Allied Nevada as it is now constituted.

For further information concerning financial information included in this document, please see “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Notes to Consolidated Financial Statements—Note 1.

Employees

Allied Nevada has 142 employees, most of whom are currently employed at the Hycroft Open Pit Mine. As required, Allied Nevada uses consultants with specific skills to assist with various aspects of its project evaluation drill program management, due diligence, acquisition initiatives, corporate governance and property management.

Competition

Allied Nevada competes with other mining companies in connection with the acquisition of gold properties. There is competition for the limited number of gold acquisition opportunities, some of which is with companies

7

having substantially greater financial resources than Allied Nevada. As a result, Allied Nevada may have difficulty acquiring attractive gold projects at reasonable prices.

Allied Nevada also competes with other mining companies for skilled employees and from time-to-time certain production inputs have been in short supply. When shortages of production supplies occur, this would rarely lead to serious issues for the operation, but would require us to either substitute with lower quality supplies or to ship these supplies from longer distances. These substitutions and changes would therefore result in minor production inefficiencies or additional costs. We have not experienced any material shortages in production inputs of this nature.

Management of Allied Nevada believes that no single company has sufficient market power to affect the price or supply of gold in the world market.

Allied Nevada does not have any major customers for its gold production that would adversely affect the Company should they fail.

Please see “Part I—Item 1A. Risk Factors—Risks Relating to Our Company—We face intense competition in the mining industry”, for additional discussion related to our current and potential competition.

Available Information

Allied Nevada maintains an internet web site atwww.alliednevada.com. Allied Nevada makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 filings and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. Allied Nevada’s Corporate Governance Guidelines, the charters of key committees of its Board of Directors and its Code of Business Ethics and Conduct are also available on the web site.

Government Regulation of Mining-Related Activities

Property Interests and Mining Claims

Our exploration activities are conducted in the state of Nevada. Mineral interests may be owned in Nevada by (a) the United States, (b) the state itself, or (c) private parties. Where prospective mineral properties are owned by private parties, or by the state, some type of property acquisition agreement is necessary in order for Allied Nevada to explore or develop such property. Generally, these agreements take the form of long-term mineral leases under which we acquire the right to explore and develop the property in exchange for periodic cash payments during the exploration and development phase and a royalty, usually expressed as a percentage of gross production or net profits derived from the leased properties if and when mines on the properties are brought into production. Other forms of acquisition agreements are exploration agreements coupled with options to purchase and joint venture agreements. Where prospective mineral properties are held by the United States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. If the statutory requirements for the location of a mining claim are met, the locator obtains a valid possessory right to develop and produce minerals from the claim. The right can be freely transferred and, provided that the locator is able to prove the discovery of locatable minerals on the claims, is protected against appropriation by the government without just compensation. The claim locator also acquires the right to obtain a patent or fee title to his claim from the federal government upon compliance with certain additional procedures (NOTE: Since October 1994, the U.S. Bureau of Land Management (BLM) has been prohibited by Acts of Congress from accepting any new mineral patent applications.).

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of

8

unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by the BLM or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised when a patent application is submitted or when the government seeks to include the land in an area to be dedicated to another use.

Reclamation

We generally are required to mitigate long-term environmental impacts by stabilizing, contouring, resloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Allied Nevada’s principal reclamation liability is at the Hycroft Mine. At December 31, 2008, we have posted reclamation bonds totaling $14.3 million. These reclamation bonds are supported by an insurance-backed financial assurance program and a surety bond. Please see Note 7-Restricted Cash to our consolidated financial statements for more information.

Government Regulation

Mining operations and exploration activities are subject to various national, state and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our exploration and other programs. We believe that Allied Nevada is in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Nevada and the United States and in any other jurisdiction in which we will operate. We are not aware of any current orders or directions relating to Allied Nevada with respect to the foregoing laws and regulations.

Environmental Regulation

Our gold projects are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. It is our policy to conduct business in a way that safeguards public health and the environment. We believe that Allied Nevada’s operations are and will be conducted in material compliance with applicable laws and regulations.

Changes to current state or federal laws and regulations in Nevada, where we operate currently, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

During 2006, 2007, and 2008, there were no material environmental incidents or non-compliance with any applicable environmental regulations on the properties now held by Allied Nevada. Allied Nevada did not incur material capital expenditures for environmental control facilities during 2006, 2007, or 2008.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this prospectus before deciding to invest or to continue holding your investment in our common stock. The risks described below are not the only ones facing us or

9

otherwise associated with an investment in our common stock. Additional risks not presently known to us or which we currently consider immaterial may also adversely affect our business. We have attempted to identify the major factors under the heading “Risk Factors” that could cause differences between actual and planned or expected results, and we have included these material risk factors. If any of the following risks actually happen, our business, financial condition and operating results could be materially adversely affected. In this case, the trading price of our common stock could decline, and you could lose part or all of your investment. See “Forward-Looking Statements” above.

Risks Relating to Our Company

We are at an early stage of production and have minimal operating history as an independent company. Our future revenues and profits are uncertain.

We are a production-stage venture with minimal operating history as an independent company. We were incorporated in September 2006 and commenced operations in May 2007 with properties and other mineral assets formerly held by Vista and the Pescios. None of these properties is currently producing gold in commercial quantities and there can be no assurance that these properties, or others that may be acquired by us in the future, will produce gold in commercial quantities or otherwise generate operating earnings. Although our properties include the Hycroft Mine, operations at the Hycroft Mine were suspended in December 1998, and the site was placed on a care and maintenance program. Our Board of Directors approved the reactivation of the Hycroft Open Pit Mine in September 2007 and we are now in the start-up phase of operations. Even though mining activities at the Hycroft Mine have re-commenced or if development activity on other properties is commenced, we may continue to incur losses beyond the period of commencement of such activity. There is no certainty that we will produce revenue, operate profitably or provide a return on investment in the future. If we are unable to generate revenues or profits, investors might not be able to realize returns on their investment in our common stock or keep from losing their investment. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

The reactivation of the Hycroft Open Pit Mine is subject to risks including delays in completion and we may be unable to achieve anticipated production volume or manage cost increases.

Completion of the reactivation of the Hycroft Mine is subject to various factors, including the availability and performance of our engineering and construction contractors, suppliers and consultants and receipt and maintenance of required governmental approvals. Any delay in the performance of any one or more of the contractors, suppliers, consultants or other persons on which we depend, or to receive or maintain required governmental approvals, could delay or prevent the reactivation of the Hycroft Mine as currently planned. There can be no assurance:

| | • | | that amount of funds we raised in April 2008 will be sufficient to finance development activities and Company operations through the start-up phase; |

| | • | | whether the resulting operations will achieve the anticipated production volume; or |

| | • | | that the reactivation costs and ongoing operating costs associated with the development of the Hycroft Mine will not be higher than anticipated. |

Although most of our executive management team has experience in developing and operating mines, Allied Nevada, as a newly-formed independent company, has never developed or operated a mine or managed a significant mine development project. We cannot assure you that the reactivation of the Hycroft Mine will be completed at the cost and on the schedule predicted, or that gold grades and recoveries, production rates or anticipated capital or operating costs will be achieved.

Although we believe that we have obtained sufficient funds to complete the reactivation of the Hycroft Mine, we cannot provide assurance of this. Furthermore, if the actual cost to complete the project is significantly

10

higher than currently expected, there can be no assurance that we will have sufficient funds to cover these costs or that we will be able to obtain alternative sources of financing to cover these costs. Unexpected cost increases, reduced gold prices or the failure to obtain necessary additional financing on acceptable terms to complete the reactivation of the Hycroft Mine on a timely basis, or to achieve anticipated production capacity, could have a material adverse effect on our future results of operations, financial condition and cash flows.

We may not achieve our production estimates.

We prepare estimates of future production for our operations. We develop our estimates based on, among other things, mining experience, reserve estimates, assumptions regarding ground conditions and physical characteristics of ores (such as hardness and presence or absence of certain metallurgical characteristics) and estimated rates and costs of mining and processing. In the past, our actual production from time to time has been lower than our production estimates and this may be the case in the future.

Each of these factors also applies to future development properties not yet in production and to the Hycroft Mine. In the case of mines we may develop in the future, we do not have the benefit of actual experience in our estimates, and there is a greater likelihood that the actual results will vary from the estimates. In addition, development and expansion projects are subject to unexpected construction and start-up problems and delays.

We cannot be certain that our acquisition, exploration and evaluation activities will be commercially successful.

Although we have recently commenced activities in connection with our reactivation of the Hycroft Mine, we currently have no properties that produce gold in commercial quantities. Substantial expenditures are required to acquire existing gold properties, to establish ore reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. We cannot provide assurance that any gold reserves or mineralized material acquired or discovered will be in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis. Whether income will result from the Hycroft Mine depends on the successful re-establishment of mining operations. Factors including costs, actual mineralization, consistency and reliability of ore grades and commodity prices affect successful project development. The reactivation and efficient operation of processing facilities, the existence of competent operational management and prudent financial administration, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development which, in turn, could have a material adverse effect on our future results of operations.

The price of gold is subject to fluctuations, which could adversely affect the realizable value of our assets and potential future results of operations and cash flow.

Our principal assets are gold reserves and mineralized material. We intend to attempt to acquire additional properties containing gold reserves and mineralized material. The price that we pay to acquire these properties will be, in large part, influenced by the price of gold at the time of the acquisition. Our potential future revenues are expected to be, in large part, derived from the mining and sale of gold from these properties or from the outright sale or joint venture of some of these properties. The value of these gold reserves and mineralized material, and the value of any potential gold production therefrom, will vary in proportion to variations in gold prices. The price of gold has fluctuated widely, and is affected by numerous factors beyond our control, including, but not limited to, international, economic and political trends, expectations of inflation, currency exchange fluctuations, central bank activities, interest rates, global or regional consumption patterns and speculative activities. The effect of these factors on the price of gold, and therefore the economic viability of any of our projects, cannot accurately be predicted. Any drop in the price of gold would adversely affect our asset values, cash flows, potential revenues and profits.

11

Mining exploration, development and operating activities are inherently hazardous.

Mineral exploration involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of gold and other metals, any of which could result in work stoppages, damage to property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or, that we could elect not to insure Allied Nevada against such liabilities due to high premium costs or other reasons, in which event, we could incur significant costs that could have a material adverse effect on our financial condition.

Reserve calculations are estimates only, subject to uncertainty due to factors including metal prices, inherent variability of the ore and recoverability of metal in the mining process.

There is a degree of uncertainty attributable to the calculation of reserves and corresponding grades dedicated to future production. Until reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and ore may vary depending on metal prices. Any material change in the quantity of reserves, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

We may be unable to raise additional capital on favorable terms.

The exploration and development of our development properties will require significant capital investment to achieve commercial production. We may have to raise additional funds from external sources in order to maintain and advance our existing property positions and to acquire new gold projects. There can be no assurance that additional financing will be available at all or on acceptable terms and, if additional financing is not available to us, we may have to substantially reduce or cease operations.

We face intense competition in the mining industry.

The mining industry is intensely competitive in all of its phases. As a result of this competition, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than ours, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. This, in turn, may adversely affect our financial condition and our future results of operations. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully attract and retain qualified employees, our exploration and development programs may be slowed down or suspended. In addition, we compete with other gold companies for capital. If we are unable to raise sufficient capital, our exploration and development programs may be jeopardized or we may not be able to acquire, develop or operate gold projects.

We will depend on outside sources to place our mineral deposit properties into production.

Our ability to place our properties into production will be dependent upon using the services of appropriately experienced personnel or contractors and purchasing additional equipment, or entering into agreements with other major resource companies that can provide such expertise or equipment. There can be no assurance that we will have available to us the necessary expertise or equipment when and if we place our mineral deposit properties into production. If we are unable to successfully retain such expertise and equipment, our development and growth could be significantly curtailed.

12

Our operations are subject to numerous governmental permits which are difficult to obtain and we may not be able to obtain or renew all of the permits we require, or such permits may not be timely obtained or renewed.

In the ordinary course of business we are required to obtain and renew governmental permits for our operations, including operation and expansion of the Hycroft Mine. Obtaining or renewing the necessary governmental permits is a complex and time-consuming process involving costly undertakings by Allied Nevada. The duration and success of our efforts to obtain and renew permits are contingent upon many variables not within our control including the interpretation of applicable requirements implemented by the permitting authority. We may not be able to obtain or renew permits that are necessary to our operations, or the cost to obtain or renew permits may exceed our estimates. Failure to comply with applicable environmental and health and safety laws and regulations may result in injunctions, fines, suspension or revocation or permits and other penalties. There can be no assurance that we have been or will at all times be in full compliance with all such laws and regulations and with our environmental and health and safety permits or that we have all required permits. The costs and delays associated with compliance with these laws, regulations and permits and with the permitting process could stop us from proceeding with the operation or development of the Hycroft Mine or increase the costs of development or production and may materially adversely affect our business, results of operations or financial condition.

Our exploration and development operations are subject to environmental regulations, which could result in the incurrence of additional costs and operational delays.

All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in some jurisdictions in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our projects. We will be subject to environmental regulations with respect to our properties in Nevada, under applicable federal and state laws and regulations. Production at our Hycroft mine involves the use of sodium cyanide which is a toxic material. Should sodium cyanide leak or otherwise be discharged from the containment system then Allied may become subject to liability for cleanup work that may not be insured. While appropriate steps will be taken to prevent discharges of pollutants into the ground water and the environment, Allied Nevada may become subject to liability for hazards that it may not be insured against.

Our properties in Nevada occupy private and public lands. The public lands include unpatented mining claims on lands administered by the BLM Nevada State Office. These claims are governed by the laws and regulations of the U.S. federal government and the state of Nevada.

U.S. Federal Laws

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Our mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended (CERCLA) imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. The groups who could be found liable include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of

13

properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to our properties.

Nevada Laws

At the state level, mining operations in Nevada are also regulated by the Nevada Department of Conservation and Natural Resources, Division of Environmental Protection. Nevada state law requires the Hycroft Mine to hold Nevada Water Pollution Control Permits, which dictate operating controls and closure and post-closure requirements directed at protecting surface and ground water. In addition, we are required to hold Nevada Reclamation Permits required under NRS 519A.010 through 519A.170. These permits mandate concurrent and post-mining reclamation of mines and require the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, required changes to operating constraints, technical criteria, fees or surety requirements.

Legislation has been proposed that would significantly affect the mining industry.

Members of the U.S. Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Although it is impossible to predict at this point what any legislated royalties might be, enactment could adversely affect the potential for development of such mining claims and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our financial performance.

Increased costs could affect our financial condition.

We anticipate that costs at the Hycroft Mine, as well as other properties that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

The global financial crisis may have impacts on our business and financial condition that we currently cannot predict.

The continued credit crisis and related instability in the global financial system has had, and may continue to have, an impact on our business and our financial condition. We may face significant challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be severely restricted at a time when we would like, or need, to access such markets, which could have an impact on our flexibility to react to changing economic and business conditions. The credit crisis could have an impact on any potential lenders or on our customers, causing them to fail to meet their obligations to us.

Difficult conditions in the global capital markets and the economy generally may materially adversely affect our business and results of operations and we do not expect these conditions to improve in the near future.

Our results of operations are materially affected by conditions in the domestic capital markets and the economy generally. The stress experienced by domestic capital markets that began in the second half of 2007 has continued and substantially increased during the third quarter of 2008. Recently, concerns over inflation, energy

14

costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market and a declining real estate market in the U.S. have contributed to increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil and gas prices, declining business and consumer confidence and increased unemployment, have precipitated an economic slowdown and fears of a possible recession. In addition, the fixed-income markets are experiencing a period of extreme volatility which has negatively impacted market liquidity conditions.

Initially, the concerns on the part of market participants were focused on the subprime segment of the mortgage-backed securities market. However, these concerns have since expanded to include a broad range of mortgage-and asset-backed and other fixed income securities, including those rated investment grade, the U.S. and international credit and interbank money markets generally, and a wide range of financial institutions and markets, asset classes and sectors. As a result, capital markets have experienced decreased liquidity, increased price volatility, credit downgrade events, and increased probabilities of default. These events and the continuing market upheavals may have an adverse effect on us because our liquidity and ability to fund our capital expenditures is dependent in part upon our bank borrowings and access to the public capital markets. Our revenues are likely to decline in such circumstances. In addition, in the event of extreme prolonged market events, such as the global credit crisis, we could incur significant losses. Even in the absence of a market downturn, we are exposed to substantial risk of loss due to market volatility.

Factors such as business investment, government spending, the volatility and strength of the capital markets, and inflation all affect the business and economic environment and, ultimately, the profitability of our business. In an economic downturn characterized by higher unemployment, lower corporate earnings and lower business investment, our operations could be negatively impacted. Purchasers of our gold production may delay or be unable to make timely payments to us. Adverse changes in the economy could affect earnings negatively and could have a material adverse effect on our business, results of operations and financial condition. The current mortgage crisis has also raised the possibility of future legislative and regulatory actions in addition to the recent enactment of the Emergency Economic Stabilization Act of 2008 (the “EESA”) that could further impact our business. We cannot predict whether or when such actions may occur, or what impact, if any, such actions could have on our business, results of operations and financial condition.

There can be no assurance that actions of the U.S. Government, Federal Reserve and other governmental and regulatory bodies for the purpose of stabilizing the financial markets will achieve the intended effect.

In response to the financial crises affecting the banking system and financial markets and going concern threats to investment banks and other financial institutions, on October 3, 2008, President Bush signed the EESA into law. Pursuant to the EESA, the U.S. Treasury has the authority to, among other things, purchase up to $700 billion of mortgage-backed and other securities from financial institutions for the purpose of stabilizing the financial markets. The Federal Government, Federal Reserve and other governmental and regulatory bodies have taken or are considering taking other actions to address the financial crisis. There can be no assurance as to what impact such actions will have on the financial markets, including the extreme levels of volatility currently being experienced. Such continued volatility could materially and adversely affect our business, financial condition and results of operations, or the trading price of our common stock.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

We are dependent on third parties that are responsible for exploration and development on some of our properties.

Our success may be dependent on the efforts and expertise of third parties with whom we have contracted. A number of the properties in which Allied Nevada holds interests are subject to third party contracts. Third parties are responsible for exploration and discovery with respect to certain of Allied Nevada’s mineral

15

properties and related assets. Such third parties are not under Allied Nevada’s control or direction. We are dependent on such third parties for accurate information with respect to our mining properties and related assets and the progress and development of such properties and assets. The third parties control the time of exploration and, if warranted, the development of certain of Allied Nevada’s mining properties and related assets. A third party may be in default of its agreement with Allied Nevada, without our knowledge, which may put the property and related assets at risk.

If we lose key personnel or are unable to attract and retain additional personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of key management employees, namely, Robert Buchan, our Executive Chairman, Scott Caldwell, our President and Chief Executive Officer, Hal Kirby, our Vice President and Chief Financial Officer, Mike Doyle, our Vice President of Technical Services, and other key employees that we hire in the future. Although we have entered into employment agreements with key employees as determined by Allied Nevada, we do not have and currently have no plans to obtain key man insurance with respect to any of our key employees. As well, we will need to recruit and retain other qualified managerial and technical employees to build and maintain our operations. If we are unable to successfully recruit and retain such persons, our development and growth could be significantly curtailed.

Our lack of operating experience may cause us difficulty in managing our growth.

We commenced operations on May 10, 2007 as an independent entity and are establishing operating procedures for evaluating, acquiring and developing properties, and negotiating, establishing and maintaining strategic relationships. Our ability to manage our growth, if any, will require us to improve and expand our management and our operational and financial systems and controls. If our management is unable to manage growth effectively, our business and financial condition would be materially harmed. In addition, if rapid growth occurs, it may strain our operational, managerial and financial resources.

There may be challenges to our title to our mineral properties.

Our U.S. mineral properties consist of private mineral rights, leases covering state and private lands, leases of patented mining claims, and unpatented mining claims. Many of our mining properties in the U.S. are unpatented mining claims to which we have only possessory title. Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper posting and marking of boundaries and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining in the U.S. now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry.

The present status of our unpatented mining claims located on public lands allows us the exclusive right to mine and remove valuable minerals, such as precious and base metals. We also are allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the land remains with the U.S. We remain at risk that the mining claims may be forfeited either to the U.S. or to rival private claimants due to failure to comply with statutory requirements.

There may be challenges to title to the mineral properties in which we hold a material interest. If there are title defects with respect to any properties, we might be required to compensate other persons or perhaps reduce our interest in the affected property. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing exploration and development programs.

16

Our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval, which could delay or prevent a change in corporate control or result in the entrenchment of management or the board of directors, possibly conflicting with the interests of our other stockholders.

Carl and Janet Pescio own approximately 16.2% of the issued and outstanding shares of Allied Nevada. In addition to being a major stockholder, Mr. Pescio is a director of Allied Nevada. Because of the Pescios’ major shareholding and Mr. Pescio’s position on the Allied Nevada Board, the Pescios could exert significant influence in determining the outcome of corporate actions requiring stockholder approval and otherwise control our business. This control could have the effect of delaying or preventing a change in control of us or entrenching our management or the board of directors, which could conflict with the interests of our other stockholders and, consequently, could adversely affect the market price of our common stock.

Some of our directors may have conflicts of interest as a result of their involvement with other natural resource companies.

Some of our directors are directors or officers of other natural resource or mining-related companies, or may be involved in related pursuits that could present conflicts of interest with their roles at Allied Nevada. These associations may give rise to conflicts of interest from time to time. In the event that any such conflict of interest arises, a director who has such a conflict is required to disclose the conflict to a meeting of the directors of the Company in question and to abstain from voting for or against approval of any matter in which such director may have a conflict. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict.

Risks Relating to Our Common Stock

Our common stock has limited trading history and the market price of our shares may fluctuate widely.

Our common stock began trading in May 2007 and there can be no assurance that an active trading market for Allied Nevada common stock will be sustained in the future. We cannot predict the prices at which Allied Nevada common stock may trade. The market price of the common stock may fluctuate widely, depending upon many factors, some of which may be beyond the control of Allied Nevada including, but not limited to, fluctuations in the price of gold; announcements by us or competitors of significant acquisitions or dispositions; and overall market fluctuations and general economic conditions. Stock markets in general have experienced volatility that has often been unrelated to the operating performance of a particular company. These broad market fluctuations may adversely affect the trading price of our common stock.

Investors may be unable to accurately value our common stock.

Investors often value companies based on the stock prices and results of operations of other comparable companies. Currently, we do not believe another public gold exploration company exists that is directly comparable to our size and scale. Further, the Pescios’ assets had previously been privately held. Prospective investors, therefore, have limited historical information about certain of the properties held by Allied Nevada upon which to base an evaluation of Allied Nevada’s performance and prospects and an investment in our common stock. As such, investors may find it difficult to accurately value our common stock.

Future sales of our common stock in the public or private markets could adversely affect the trading price of our common stock and our ability to raise funds in new stock offerings.

Future sales of substantial amounts of our common stock or equity-related securities in the public or private markets, or the perception that such sales could occur, could adversely affect prevailing trading prices of our common stock and could impair our ability to raise capital through future offerings of equity or equity-related securities. As of March 9, 2009, 57,433,144 shares of our common stock were outstanding. We cannot predict the effect, if any, that future sales of our common stock, or the availability of our shares for future sale, will have on the trading price of our common stock.

17

Allied Nevada may be considered a “foreign investment entity” which may have adverse Canadian tax consequences for its Canadian investors.