SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

| ¨ | Filed by a Party other than the Registrant |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ALLIED NEVADA GOLD CORP.

(Name of Registrant As Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | |

| | Allied Nevada Gold Corp. 9600 Prototype Court Reno, Nevada 89521 Phone: (775) 358-4455 Facsimile: (775) 358-4458 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN THAT the 2009 Annual Meeting of Stockholders (the “Meeting”) of Allied Nevada Gold Corp., a Delaware corporation (the “Company”), will be held at 50 W. Winnemucca Blvd., Winnemucca, NV 89445 on June 17, 2009, at 4:00 p.m. (PST), for the following purposes:

| | 1. | To elect directors to hold office until the next annual meeting of stockholders; |

| | 2. | To ratify the appointment of Ehrhardt, Keefe, Steiner, & Hottman PC as our independent registered public accounting firm for the fiscal year ending December 31, 2009; |

| | 3. | To approve concurrent amendments to the Allied Nevada 2007 Stock Option Plan and the Allied Nevada Restricted Share Plan; and |

| | 4. | To transact such other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

All stockholders are cordially invited to attend the meeting. The Board of Directors urges you to date, sign and return promptly the enclosed proxy to give voting instructions with respect to your Common Stock. The proxies are solicited by the Board of Directors. The return of the proxy will not affect your right to vote in person if you do attend the Meeting.

By order of the Board of Directors,

/s/ Scott A. Caldwell

Scott A. Caldwell

President and Chief Executive Officer

TABLE OF CONTENTS

ALLIED NEVADA GOLD CORP.

9600 Prototype Court

Reno, Nevada 89521

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Allied Nevada Gold Corp., a Delaware corporation (the “Company”, “Allied Nevada”, “we”, “our”, or “us”), for use at the Annual Meeting of Stockholders (the “Meeting”) to be held on June 17, 2009, at 4:00 p.m. (PST), at 50 W. Winnemucca Blvd., Winnemucca, NV 89445 and any adjournment or adjournments thereof. The cost of this solicitation will be borne by the Company. This Proxy Statement, the foregoing notice and the enclosed proxy are first being mailed to stockholders on or about May 18, 2009. The Company will publish the final results of the voting of the meeting in the Company’s Quarterly Report on Form 10-Q for the second quarter of 2009, which will be filed with the Securities and Exchange Commission (the “SEC”) and onhttp://www.sedar.com.

The Board of Directors does not intend to bring any matters before the Meeting other than the matters specifically referred to in the foregoing notice, nor does the Board of Directors know of any matter which anyone else proposes to present for action at the Meeting. However, if any other matters properly come before the Meeting, the persons named in the accompanying proxy or their duly constituted substitutes acting at the meeting will be deemed authorized to vote or otherwise act thereon in accordance with their judgment on such matters.

When your proxy card is returned properly signed, the shares represented will be voted in accordance with your directions. In the absence of instructions, the shares represented at the Meeting by the enclosed proxy will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Stockholders. Any proxy may be revoked at any time prior to its exercise by notifying the Company in writing, Attention: Hal D. Kirby, Chief Financial Officer, by delivering a duly executed proxy bearing a later date or by attending the Meeting and voting in person.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

On April 30, 2009, the record date for the determination of stockholders entitled to notice of and to vote and the Meeting, there were outstanding and entitled to vote 57,471,556 shares of our Common Stock, par value $.001 per share (the “Common Stock”). Each share is entitled to one vote on each matter.

Under our By-laws, the holders of at least thirty-three and one-third percent (33 1/3%) of the Common Stock issued and outstanding and entitled to vote at the Meeting shall constitute a quorum for the transaction of business at the meeting.

The affirmative vote of a plurality of the votes cast in person or by proxy at the Meeting is required for election of directors. All other matters require the affirmative vote of a majority of the votes cast at the Meeting.

1

Principal Stockholders

The following table sets forth certain information regarding beneficial ownership of the Company’s Common Stock, as of April 15, 2009, by each person known by us to be the beneficial owner of more than 5% of the Company’s outstanding Common Stock. The percentage of beneficial ownership is based on 57,471,556 shares of the Company’s Common Stock outstanding as of April 15, 2009.

| | | | | |

| | | Common Stock | |

Name and Address of Beneficial Owner | | Number of Allied

Nevada Shares

Beneficially Owned(1) | | Percentage

of Class | |

Carl Pescio and Janet Pescio(2) | | 9,366,665 | | 16.3 | % |

Royce & Associates, LLC(4) | | 5,336,079 | | 9.3 | % |

Goodman & Company, Investment Counsel Ltd.(3) | | 5,248,000 | | 9.1 | % |

Beutel, Goodman & Company Ltd.(5) | | 4,565,700 | | 7.9 | % |

(1) | In accordance with Rule 13d-3(d)(1) under the Exchange Act, the applicable ownership total for each person is based on the number of shares of Common Stock held by such person as of April 15, 2009, plus any securities held by such person exercisable for or convertible into Common Stock within 60 days after April 15, 2009. Unless otherwise noted, each of the persons is the record owner of the Common Stock beneficially held by such person. |

(2) | Carl Pescio is a director of the Company. The address Carl and Janet Pescio is c/o Allied Nevada Gold Corp., 9600 Prototype Court, Reno, Nevada 89521. |

(3) | The address of Goodman & Company, Investment Counsel Ltd. is One Adelaide Street East, 29th Floor, Toronto, Ontario, Canada, M5C 2V9. |

(4) | The address of Royce & Associates LLC is 1414 Avenue of the Americas, New York, New York 10019. |

(5) | The address of Beutel, Goodman & Company Ltd. is 20 Eglinton Ave. W., Suite 2000, Toronto, Ontario, M4R 1K8, Canada. |

2

Security Ownership of Management

The following table sets forth certain information regarding beneficial ownership of Common Stock, as of April 15, 2009, by (i) each of the Company’s executive officers, directors and nominees, individually and (ii) the Company’s executive officers and directors, as a group. The percentage of beneficial ownership is based on 57,471,556 shares of Common Stock outstanding as of April 15, 2009.

| | | | | | |

| | | Common Stock | |

Name and Address of Beneficial Owner | | Number of Allied

Nevada Shares

Beneficially Owned(1) | | | Percentage

of Class | |

Carl Pescio(2) | | 9,366,665 | (2) | | 16.3 | % |

| | |

Robert M. Buchan Chairman of the Board and Director | | 2,781,466 | (3) | | 4.8 | % |

| | |

Scott A. Caldwell President and Chief Executive Officer and Director | | 624,666 | (4) | | 1.1 | % |

| | |

Hal D. Kirby Vice President and Chief Financial Officer | | 293,333 | (5) | | * | |

| | |

Mike Doyle Vice President of Technical Service | | 166,000 | (6) | | * | |

| | |

Rick H. Russell Former Vice President of Exploration | | — | (7) | | * | |

| | |

W. Durand Eppler Director | | 163,434 | (8) | | * | |

| | |

John W. Ivany Director | | 59,999 | (9) | | * | |

| | |

Cameron A. Mingay Director | | 49,999 | (9) | | * | |

| | |

Terry M. Palmer Director | | 49,999 | (9) | | * | |

| | |

Michael B. Richings Director | | 164,599 | (10) | | * | |

| | |

D. Bruce Sinclair Director | | 49,999 | (9) | | * | |

| | |

Robert G. Wardell Director | | 49,999 | (9) | | * | |

| | | | | | |

All executive officers and directors as a group (13 persons) | | 13,820,158 | | | 24.0 | % |

| | | | | | |

| * | Represents less than 1% of the outstanding Common Stock. |

(1) | In accordance with Rule 13d-3(d)(1) under the Exchange Act, the applicable ownership total for each person is based on the number of shares of Common Stock held by such person as of April 15, 2009, plus any securities held by such person exercisable for or convertible into Common Stock within 60 days after April 15, 2009. Unless otherwise noted, each of the persons is the record owner of the Common Stock beneficially held by such person. |

3

(2) | Shares are beneficially owned by Carl Pescio and his wife, Janet Pescio. Includes 66,667 shares underlying options that are exercisable within 60 days of April 15, 2009. Excludes 83,333 shares underlying options unexercisable within 60 days of April 15, 2009. |

(3) | Includes 870,000 shares issuable upon exercise of warrants acquired in the Company’s July 2007 private placement (the “Private Placement”). Includes 116,666 shares underlying options that are ]exercisable within 60 days of April 15, 2009. Excludes 233,334 shares underlying options unexercisable within 60 days of April 15, 2009. Includes 100,000 shares issuable pursuant to RSUs that are exercisable within 60 days of April 15, 2009 and excludes 200,000 shares issuable pursuant to RSUs, none of which vest within 60 days of April 15, 2009. |

(4) | Includes 110,000 shares issuable upon exercise of warrants acquired in the Private Placement. Includes 366,667 shares underlying options that are exercisable within 60 days of April 15, 2009. Excludes 583,333 shares underlying options unexercisable within 60 days of April 15, 2009. |

(5) | Includes 50,000 shares issuable upon exercise of warrants acquired in the Private Placement. Includes 183,333 shares underlying options that are exercisable within 60 days of April 15, 2009. Excludes 291,667 shares underlying options unexercisable within 60 days of April 15, 2009. |

(6) | Includes 33,000 shares issuable upon exercise of warrants acquired in the Private Placement. Includes 100,000 shares underlying options that are exercisable within 60 days of April 15, 2009. Excludes 125,000 shares underlying options unexercisable within 60 days of April 15, 2009. |

(7) | Mr. Russell retired effective February 1, 2009. Accordingly, 140,000 unvested options were forfeited at that time and 61,100 vested options were forfeited 30 days later. As a result, no shares underlying options are exercisable within 60 days of April 15, 2009. |

(8) | Includes 10,000 shares issuable upon exercise of warrants acquired in the Private Placement and 105,022 shares underlying options that are exercisable within 60 days of April 15, 2009, of which 10,023 are shares underlying options under the Special Stock Option Plan. Excludes 100,001 shares underlying options unexercisable within 60 days of April 15, 2009. Includes 45,000 shares issuable upon exercise of options held by Sierra Partners II, LLC (“Sierra”). Mr. Eppler currently serves as President and CEO and is holder of a 50% equity interest in Sierra. Mr. Eppler disclaims beneficial ownership of the securities held by Sierra, except to the extent of his pecuniary interest therein. |

(9) | Includes 49,999 shares underlying options that are exercisable within 60 days of April 15, 2009. Excludes 100,001 shares underlying options unexercisable within 60 days of April 15, 2009. |

(10) | Includes 128,553 shares underlying options that are exercisable within 60 days of April 15, 2009, of which 78,554 are shares underlying options under the Special Stock Option Plan. Excludes 100,001 shares underlying options unexercisable within 60 days of April 15, 2009. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires our executive officers, directors, and persons who own more than 10% of a registered class of equity securities to file reports of ownership and changes in ownership with the SEC and to furnish the Company with copies of these reports.

Based solely on a review of the reports received by the SEC, furnished to the Company, or written representations from reporting persons that all reportable transaction were reported, the Company believes that during the fiscal year ended December 31, 2008 the Company’s officers, directors and greater than ten percent owners timely filed all reports they were required to file under Section 16(a); except that twenty reports, covering a total of twenty four transactions were filed late. Messrs. Doyle, Ivany, Mingay, Palmer, Pescio, Richings, Sinclair and Wardell filed late one report each relating to one transaction, Messrs. Caldwell, Kirby and Russell filed late two reports each relating to two transactions, Mr. Eppler filed late one report relating to two transactions, and Mr. Buchan filed late five reports relating to eight transactions.

4

PROPOSAL ONE

ELECTION OF DIRECTORS

Pursuant to the Company’s By-laws, the Board of Directors is required to fix, from time to time, the number of directors which shall constitute the whole board. By resolution dated May 13, 2009, the Board of Directors has elected to fix the number of directors which constitute the whole board at eight directors. Accordingly, the Board of Directors proposes the following eight nominees for election as directors to hold office until the Annual Meeting of Stockholders to be held in 2010 or until their successors, if any, have been duly elected and qualified. Each is currently a director and has agreed to serve if elected:

Should the nominees become unavailable to accept nomination or election as a director, the persons named in the enclosed proxy will vote the shares which they represent for the election of such other person as the Board of Directors may recommend, unless the Board of Directors reduces the number of directors.

Information Concerning Nominees and Executive Officers

The following table sets out the names of the current directors and executive officers of Allied Nevada, their ages as of April 15, 2009, current positions with Allied Nevada, jurisdictions of residence, principal occupations within the five preceding years, and periods during which each director has served as a director of Allied Nevada.

Each of our directors is elected to serve until the next Annual Meeting of Stockholders, or until his successor, if any, is duly elected and qualified.

| | | | |

Name, Age | | Principal Occupation, Business or

Employment(1) | | Director of Allied Nevada Since |

ROBERT M. BUCHAN 61 | | Businessman; Executive Chairman of the Board of Allied Nevada from June 2007 to present (Chairman from April 2007 to June 2007); Director of Quest Capital Corp. from April 2005 to present (Executive Chairman from April 2005 to January 2008); Chief Executive Officer of Kinross Gold Corporation from January 1993 to April 2005. | | March 1, 2007 |

| | |

SCOTT A. CALDWELL 52 | | President and Chief Executive Officer of Allied Nevada from September 2006 to present (Chief Financial Officer of Allied Nevada from September 2006 to April 2007), consultant to Vista Gold Corp. (“Vista”); formerly with Kinross Gold Corporation as Executive Vice President and Chief Operating Officer from March 2003 to August 2006. | | September 22, 2006 |

5

| | | | |

Name, Age | | Principal Occupation, Business or

Employment(1) | | Director of Allied Nevada Since |

JAMES M. DOYLE 55 | | Vice President of Technical Services of Allied Nevada from April 2007 to present; formerly with Kinross Gold Corporation from December 2003 to August 2006 as Senior Vice President of Operations; not employed from August 2006 to April 2007. | | |

| | |

JOHN W. IVANY(3)(4) 64 | | Retired executive; Advisor to Genuity Capital Markets from February 2007 to present; Executive Vice President of Kinross Gold Corporation from June 1995 to May 2006. | | June 27, 2007 |

| | |

HAL D. KIRBY 41 | | Vice President and Chief Financial Officer of Allied Nevada from April 2007 to present; financial and accounting consultant to Allied Nevada from January 2007 to April 2007; not employed from August 2006 to January 2007; formerly with Kinross Gold Corporation as Vice President and Controller from June 2005 to August 2006 and as Director of Special Projects from October 2004 to June 2005. | | |

| | |

CAMERON A. MINGAY(4) 57 | | Lawyer; Partner, Cassels Brock & Blackwell LLP from July 1999 to present. | | March 22, 2007 |

| | |

TERRY M. PALMER(5) 64 | | Accountant; Principal, Marrs, Sevier & Company LLC from January 2003 to present; director of Apex Silver Mines Limited from October 2004 to March 2009, Director of Golden Minerals Company (successor to Apex Silver Mines Limited) from March 2009 to present; Partner and Certified Public Accountant with Ernst & Young from September 1979 to October 2002. | | September 22, 2006 |

| | |

CARL PESCIO(2) 57 | | Self-employed mining prospector since 1991. | | March 1, 2007 |

| | |

D. BRUCE SINCLAIR(3)(5) 58 | | Retired executive; Chief Executive Officer and director of WaveRider Communications Inc. from June 1998 to June 2005 (director until March 2006). | | June 27, 2007 |

6

| | | | |

Name, Age | | Principal Occupation, Business or

Employment(1) | | Director of Allied Nevada Since |

ROBERT G. WARDELL(3)(4)(5) 64 | | Accountant; Vice-President, Finance and Chief Financial Officer of Victory Nickel Inc. from February 2007 to January 2009; self-employed accounting and finance consultant from June 2006 to February 2007; Senior Partner, Deloitte & Touche LLP, from 1986 to May 2006. | | June 27, 2007 |

| | |

WARREN WOODS 52 | | General Manager of the Hycroft Open Pit Mine from January 2008 to present; General Manager of Nome Operations for NovaGold Resources-Alaska Gold from September 2005 to December 2007; Mine Manager for Eagle Picher Minerals from September 2002 to October 2005. | | |

(1) | Includes occupations for the five preceding years. |

(2) | Denotes member of Health, Safety and Environmental Committee. Carl Pescio is the Chair of the Health, Safety and Environmental Committee. |

(3) | Denotes member of Compensation Committee. Mr. Sinclair is the Chair of the Compensation Committee. |

(4) | Denotes member of Corporate Governance Committee. Mr. Mingay is the Chair of the Corporate Governance Committee. |

(5) | Denotes member of Audit Committee. Mr. Palmer is the Chair of the Audit Committee. |

There are no family relationships among any of the above directors or executive officers of Allied Nevada. The following directors of Allied Nevada are also directors of issuers with a class of securities registered under Section 12 of the Exchange Act (or which otherwise are required to file periodic reports under the Exchange Act): Robert Buchan is Chairman of Extract Resources Limited and of Phoenix Coal and a director of Polyus Gold. Terry M. Palmer is a director of Apex Silver Mines Limited and its successor, Golden Minerals Company. John Ivany is a director of Breakwater Resources Ltd., Eurogas International Ltd., and of B2Gold Corp. Robert G. Wardell is a director of Phoenix Coal, Nuinsco Resources Limited, and Katanga Mining Limited. Carl Pescio may pursue ventures with mining properties other than those held by Allied Nevada.

None of the above directors or executive officers has entered into any arrangement or understanding with any other person pursuant to which he was, or is to be, elected as a director or executive officer of Allied Nevada or a nominee of any other person.

Code of Ethics

The Company has adopted a Code of Conduct and Ethics that applies to all directors, officers and employees of the Company, including our CEO, CFO, principal accounting officer and persons performing similar functions. The Code of Conduct and Ethics is located on the Company’s internet website athttp://www.alliednevada.com. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Proxy Statement.

7

Vote Required and Board of Directors Recommendation

Directors must be elected by a plurality of the votes cast. This means those nominees receiving the ten highest number of votes at the Meeting will be elected, even if such votes do not constitute a majority of the votes cast. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal. Proxies executed on the enclosed form will be voted, in absence of other instructions, “FOR” the election of the persons named above.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR”

THE ELECTION OF THE NOMINEES FOR DIRECTOR

8

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is composed entirely of directors who are not officers or employees of the Company or any of its subsidiaries, and are independent, as defined in the listing standards of the NYSE Amex Equities (“NYSE Amex”, f/k/a American Stock Exchange) and the Company’s Corporate Governance Guidelines. The Compensation Committee has adopted a Charter that describes its responsibilities in detail and the Compensation Committee and Board review and assesses the adequacy of the Charter on a regular basis. The Compensation Committee has the responsibility of taking the leadership role with respect to the Board’s responsibilities relating to compensation of the Company’s key employees, including the Chief Executive Officer, the Chief Financial Officer and the other executive officers. Additional information about the Compensation Committee’s role in corporate governance can be found in the Compensation Committee’s Charter, available on the Company’s web site atwww.alliednevada.comunder the Corporate Responsibility section. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Proxy Statement.

The Compensation Committee has reviewed and discussed with management the Company’s Compensation Discussion and Analysis section of this Proxy Statement. Based on such review and discussions, the Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

Submitted by the following members of the Compensation Committee of the Board of Directors:

D. Bruce Sinclair

John W. Ivany

Robert G. Wardell

9

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The following contains a description of our executive compensation programs and objectives. Because we are a new company and have recently commenced operations, we are in the process of refining our compensation policies and anticipate that this will be an ongoing process as our company develops.

Compensation Program Objectives

Our compensation program has the following long-term goals and objectives:

| | • | | Attraction and retention of key talent; |

| | • | | Aligning the interests of our executive officers with the interests of the Company’s stockholders; and |

| | • | | Leveraging individual performance by linking executive compensation to individual performance and overall business performance. |

How Executive Compensation is Determined

Compensation Committee’s Process for Arriving at Compensation Decisions. The Compensation Committee is supported by the executive officers and employees of the Company, who provide the Compensation Committee with data and analyses to support decision making. The Compensation Committee meets both with and without the presence of the Chief Executive Officer and the Chief Financial Officer. When management is present, the Compensation Committee will generally hold a session without management present at the end of each meeting, at the discretion of the Compensation Committee. The Chairman of the Compensation Committee sets the agenda for each meeting in consultation with management representatives and other Compensation Committee members.

Management is responsible for keeping the minutes of Compensation Committee meetings and the Chairman provides regular reports to the Board of Directors regarding actions and discussion at Compensation Committee meetings. The Board of Directors or Compensation Committee makes all decisions regarding the Chief Executive Officer’s compensation in executive session.

Company management uses, and provides to the Compensation Committee, mining industry and general industry benchmark data provided by an independent compensation consultant, Coopers Consulting. Coopers Consulting provides a competitive analysis of similarly situated companies and provides other data for the Compensation Committee to consider in its compensation decisions with respect to our executive officers. The Compensation Committee also communicates directly from time to time with Coopers Consulting. In the future, we expect external compensation experts to be much more intimately involved in the development of the Company’s compensation strategies and that such consultants will be invited to attend from time-to-time for consultation regarding specific topics. In response to specific questions posed by the Compensation Committee, management from time to time is asked to consider publicly available compensation data from other peer companies to provide additional information for decisions about compensation.

When making compensation decisions for Named Executive Officers, the Compensation Committee considers factors beyond market data. Based upon input from management, the Compensation Committee also considers the individual’s performance, tenure and experience, the performance of the Company overall, any retention concerns, the individual’s historical compensation and the compensation of the individual’s peers in the Company. There is no mandatory framework that determines which of these additional factors may be more or less important, and the emphasis placed on any of these additional factors may vary among the executive officers. While the Compensation Committee does have certain guidelines, goals, and tools that it uses to make its decisions, as explained below, the compensation process is not driven by a formula and does incorporate the

10

judgment of the Compensation Committee. In making decisions for executives other than the Chief Executive Officer, the input and perspective of the Chief Executive Officer has a significant influence on the Compensation Committee’s decisions.

Compensation Components and Alignment to Compensation Goals

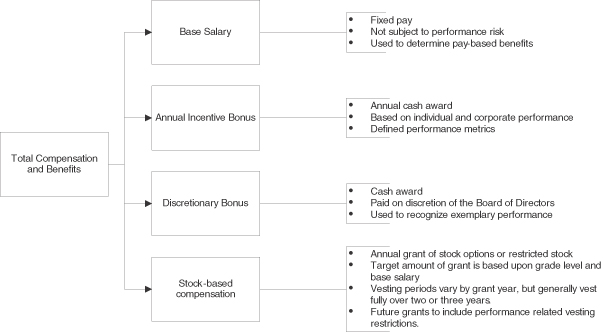

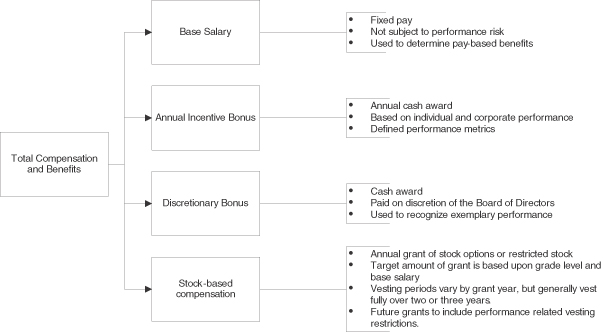

Compensation Components. For 2008, the executive compensation program contained four basic elements and a package of benefit plans:

Each of the compensation components above are specifically designed to accomplish one or more of the Company’s three goals: 1) Attracting and retaining key talent; 2) Aligning the interests of our executive officers with the interests of the Company’s stockholders; and, 3) Leveraging individual performance by linking executive compensation to individual performance and overall business performance.

Attraction and Retention of Key Talent.The compensation package meets the goal of attracting and retaining key talent in a highly competitive mining environment through the following elements:

| | • | | A competitive cash compensation program, consisting of base salary and bonus opportunity, which is comparable to similar opportunities offered in the marketplace for executive talent; |

| | • | | A package of competitive benefits; and |

| | • | | Two and Three-year vesting on stock option grants and vesting of stock unit awards in the second and third years from the beginning of the performance period. |

Aligning the interests of our executive officers with the interests of the Company’s stockholders.The compensation package meets the goal of aligning the interests of the Company’s stockholders through the following elements:

| | • | | Enhanced emphasis on Company performance in 2008; |

| | • | | Stock options and restricted stock unit grants to motivate performance aligned with the interest of the Company’s stockholders; and |

11

| | • | | The development of management’s goals and objectives with the involvement of the Board of Directors and the use of these objectives to determine Annual Incentive Bonus awards requires management and the Board of Directors to align these goals and objectives with the interests of our stockholders. |

Leveraging individual performance by linking executive compensation to individual performance and overall business performance.By linking management’s goals and objectives to the payment of annual incentive awards, the compensation strategy motivates the executives to meet both their individual goals and objectives but also those of the Company in general.

Methodology for Determining Compensation Levels

Determination of Target Total Compensation

Target Pay Levels Relative to Market. The Company is currently a production stage enterprise, having completed the development of the Hycroft Mine during calendar year 2008. As a small mining company, we need to attract and retain qualified executives capable of responding to a broad range of issues that would be handled by specific functional groups in a larger organization. As a result, the Compensation Committee seeks to target a total compensation program (including base salary, target annual incentive, and the grant value of equity incentives, but exclusive of benefits) at a level that is the average of comparable market practices. This results in our executives being compensated greater than the 50th percentile (“median”) and less than the 75th percentile. In the view of the Compensation Committee, these compensation levels are the proper level to target because the market for executive talent in the mining industry is exceptionally competitive. In addition, other natural resource and materials companies are typically more diversified than Allied Nevada and therefore face lower potential volatility in performance results. The Compensation Committee believes that an average market pay positioning strategy at target is appropriate to compensate for the additional performance risk of being tied exclusively to gold at a small mining company.

Competitive Benchmarking Analysis. In order to assess competitive pay levels, the Compensation Committee reviews benchmark data for the mining industry for all of its Named Executive Officers. Using Coopers Consulting data, the Compensation Committee reviewed the median, the average, and the 75th percentile of total compensation for the mining industry. Considering that many of the organizations listed in the following sample group were larger mining companies with multiple operating mines in multiple jurisdictions and are competitors for executive talent, the Compensation Committee believes that the average compensation would be the best benchmark for Allied Nevada.

Participants in the mining industry survey used to determine the 2008 compensation levels are:

| | | | |

Anatolia Minerals Development Ltd. | | Idaho General Mines Inc. | | Rio Tinto Energy North America |

Apex Silver Mines Limited | | Kennecott Minerals Company | | Rio Tinto Minerals |

Arch Coal Inc. | | Kennecott Utah Copper Corporation | | Stillwater Mining Co. |

Centerra Gold Inc. | | Kinross Gold Corporation | | Teck Cominco Limited |

Cleveland Cliffs Inc. | | Langeloth Metallurgical Company LLC | | The Doe Run Company |

Coeur d’Alene Mines Corporation | | Mercator Minerals Ltd. | | Thomson Creek Metals Company Inc. |

Freeport-McMoran Copper & Gold Inc. | | Newmont Mining Corporation | | Yukon Nevada Gold Corporation |

Frontera Copper Corporation | | NovaGold Resources Inc. | | |

Golden Star Resources Ltd. | | Oglebay Norton Company | | |

Graymont Limited | | Phelps Dodge Corporation | | |

Hecla Mining Company | | Quadra Mining Ltd. | | |

12

Involvement of Management.The Chief Executive Officer, at the request of the Compensation Committee, makes a recommendation related to the total compensation for the Named Executives, excluding himself. This recommendation is based upon his analysis of the Competitive Benchmarking and other considerations including the individual’s performance, tenure and experience, the performance of the Company overall, any retention concerns, the individual’s historical compensation and the compensation of the individual’s peers in the Company. The Chief Executive Officer does not provide any recommendations or participates in any discussion of compensation elements related to his position.

Determination of the Size of Each Component of Target Total Compensation.The Compensation Committee targets total compensation, excluding benefits, at average levels of comparable market practices. Salaries for the Chief Executive Officer are targeted below the average levels of comparable market practices for the position and the at-risk cash bonus was increased to bring total compensation to the required levels. For the remaining Named Executives, total compensation and at-risk cash bonus were managed so that the total package adds to the desired average levels in comparison to the benchmarks. For all Named Executives, the stock-based compensation grants were determined in relation to their level in the organization. In general, these stock-based compensation grants were calculated so that the estimated grant date fair value of the awards would total between 73% and 100% of the executive’s salary.

For 2008, the Compensation Committee generally sought to balance the target compensation components based upon the short term components which include the salaries and annual target incentive bonus, and the long term components related to the stock-based compensation awards. For the Named Executive Officers, the Compensation Committee generally tried to target 66% short term compensation and 34% long term compensation.

The target pay positioning of the average of the applicable benchmark as stated above for each position is intended to be a guideline, and the Compensation Committee makes its decisions within the context of market practices. However, this is not intended to be formula driven. Other factors such as an individual’s performance, tenure and experience, the performance of the Company overall, any retention concerns and the individual’s historical compensation and comparisons to peers at the Company impact the decision-making process. The Compensation Committee does not weigh any of these factors more heavily than others and does not use any formula to assess these factors, but rather considers each factor in its judgment and at its discretion.

Short Term Compensation – Salary and Bonus. In constructing a compensation program that seeks to target the average, the Compensation Committee first sets base salary. In 2008, the Compensation Committee targeted base salary for the Chief Executive Officer to be 50% of the total short term compensation. For the other Named Executives, the Compensation Committee targeted salaries to comprise between 70% and 75% of short term compensation and for the bonus to comprise 25% to 30% of the total short term compensation. The goal is to set base salary and cash bonus so that the sum of the two is close to the average of the relevant benchmark, assuming that the Company and individual accomplish target results.

Long Term Compensation – Equity. After setting salary and cash bonus as described above, and considering previous equity awards, the Compensation Committee sets target option grants. In 2008, the Compensation Committee targeted total long-term incentives (stock options) as a percent of base salary for each currently-serving Named Executive Officer so that the value granted was approximately 100% of the Chief Executive Officer’s base salary and between 73% and 84% of the other Named Executive Officer base salaries. In 2008, the stock option grants to Named Executive Officers were granted with immediate vesting of a third of the grant, followed by the vesting of an additional third of each grant on the first and second anniversaries of the award.

Other Compensation – Discretionary Bonus.The Compensation Committee and the Board of Directors may on its own discretion decide to reward situations during the year where employees provide exemplary service above that anticipated in the individual goals and objectives.

Material Differences Between Named Executive Officers.During 2008, there were no material differences between actual compensation and the compensation planned by the Compensation Committee.

13

Executive Pay Mix and the Emphasis on “At Risk” Pay.The Compensation Committee believes that “at risk” pay is an important component of the compensation strategy. “At Risk” pay is important as it helps align the actions of management with the interests of the shareholders. The following table illustrates the percentages of total compensation that are “at risk” for each of the Named Executive Officers.

| | | | | | |

Name | | % of Total

Compensation Not

“At Risk” | | | % of total

compensation

“At Risk” | |

Scott A. Caldwell | | 32 | % | | 68 | % |

Hal D. Kirby | | 41 | % | | 59 | % |

James M. Doyle | | 66 | % | | 34 | % |

Rick H. Russell | | 63 | % | | 37 | % |

Warren Woods | | 64 | % | | 36 | % |

The Use of Tally Sheets and Wealth Accumulation Analysis. Annually, the Committee reviews tally sheets that show each element of compensation for an individual. For each Named Executive Officer, base salaries, incentive plan payments, equity awards, equity exercises, and perquisites are included on tally sheets. The Company’s accounting department prepares the tally sheets. To date, the Committee’s use of tally sheets has provided verification that executive compensation is internally equitable and proportioned according to the Committee’s expectations with regard to “at risk” compensation.

Perquisites and Other Personal Benefits.The Company’s executives are not entitled to significant perquisites or other personal benefits not generally offered to our employees other than as disclosed in the Summary Compensation Table. The Company has approved a qualified tax-deferred savings plan in accordance with the provisions of Section 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”).

Compensation of Named Executive Officers for Fiscal Year 2008

Our named executive officers for 2008 were Scott Caldwell, President and Chief Executive Officer, Hal Kirby, Vice President and Chief Financial Officer, Mike Doyle, Vice President of Technical Services, Rick Russell, Vice President of Exploration and Warren Woods, Hycroft Mine General Manager. Warren Woods joined our company in January of 2008 as the Hycroft Mine General Manager.

Base Salary. In setting salaries of the Named Executive Officers, the Compensation Committee and Board of Directors reviewed Coopers Consulting mining industry benchmark data for the Named Executive Officers. Based on the foregoing review, as well as consideration of the individual’s performance, tenure and experience, the performance of the Company overall, any retention concerns, the individual’s historical compensation and input from other Board members, the Compensation Committee set the base salaries for the Named Executive Officers.

On January 11, 2008, we entered into an employment agreement with Mr. Caldwell that provided for an annual base salary of $330,000 and Mr. Caldwell is eligible to be considered for an annual performance-based award of up to 100% of base salary, in the discretion of the Compensation Committee. After reviewing the Competitive Benchmarking Analysis and other factors, the Board of Directors approved an increase in Mr. Caldwell’s base salary to $360,000 effective May 8, 2008.

On January 11, 2008, we entered into an employment agreement with Mr. Kirby that provided for an annual base salary of $225,000 and Mr. Kirby is eligible to be considered for an annual performance-based award of up to 40% of base salary, in the discretion of the Compensation Committee. After reviewing the Competitive Benchmarking Analysis, the recommendation of the Chief Executive Officer and other factors, the Board of Directors approved an increase in Mr. Kirby’s base Salary to $250,000 effective May 8, 2008.

On January 11, 2008, we entered into an employment agreement with Mr. Doyle that provided for an annual base salary of $200,000 and Mr. Doyle is eligible to be considered for an annual performance-based award of up

14

to 35% of his base salary. After reviewing the Competitive Benchmarking Analysis, the recommendation of the Chief Executive Officer and other factors, the Board of Directors approved an increase in Mr. Doyle’s base Salary to $225,000 effective May 8, 2008. At the same time, the Board of Directors changed the eligibility for the annual performance-based award to up to 40% of his base salary.

On January 11, 2008, we entered into an employment agreement with Mr. Russell that provided for an annual base salary of $200,000 and Mr. Russell was eligible to be considered for an annual performance-based award of up to 35% of his base salary. After reviewing the Competitive Benchmarking Analysis, the recommendation of the Chief Executive Officer and other factors, the Board of Directors approved an increase in Mr. Russell’s base Salary to $205,000 effective May 8, 2008.

On January 7, 2008, the Company hired Warren Woods as the Hycroft Mine General Manager. The terms of employment for Mr. Woods provide for an annual base salary of $175,000 and Mr. Woods is eligible to be considered for an annual performance-based award of up to 35% of his base salary.

Short-Term Non-Equity Incentive Compensation.Short-term non-equity incentive compensation includes the annual incentive bonus and the discretionary bonus. The annual incentive bonus is expressed as a percentage of base salary while the discretionary bonus amount is determined at the sole discretion of the board of directors.

Annual Incentive Bonus: The annual incentive bonus for the Named Executive Officers is based primarily upon the corporate goals and objectives. These corporate goals and objectives are developed by management in conjunction with the board of directors. The goals and objectives for 2008 were approved prior to the start of the fiscal year. Once the corporate goals and objectives are determined, functional goals for the Hycroft Mine, the finance and accounting function, and the exploration function are developed.

The corporate goals and objectives for 2008 included the following elements:

Health, safety and environmental performance. The 2008 goals and objectives were to have no lost time incidents or environmental notices of violation. During the year we had one lost time incident and received no notices of violation for environmental matters.

Complete any necessary debt or equity financings. In 2007, our Board made the decision to reactivate the Hycroft Mine. The reactivation program for the Hycroft Mine and our internal budgets indicated that in order to successfully reopen the mine, we needed to raise additional funds. These funds were successfully raised by the Company through the completion of the CDN$27.0 million Ionic Credit Facility and the initial public offering of stock in April of 2008 for net proceeds of approximately $69.3 million.

Increase shareholder value.The 2008 goals and objectives included a goal of increasing the awareness of the Company in order to increase the trading volume of our stock and the return to our shareholders. During the year, the liquidity crisis in the fourth quarter resulted in general instability of all stocks, including ours. This unforeseen event resulted in greater volatility in our share price than we had experienced historically and made it difficult to truly assess the performance on this goal.

Become a producer. With the 2007 decision to reopen the Hycroft Mine, a primary goal of the Company was to complete the capital and development program in 2008 and become a gold mining company by the end of the year. We were successful in completing the program, produced gold in December of 2008, and became a production stage enterprise.

Expand the mineral resource at the Hycroft mine. During the setting of goals and objectives for 2008, we envisioned an exploration drill program to assess the oxide and sulfide mineralization at the mine. The objective of this drill program was to identify additional oxide and sulfide mineralization at the property to increase the potential value to our shareholders. During the year, we completed the drill program and determined two reserve

15

and resource updates. Both updates increased the proven and probable reserves and increased the other mineralized material identified at the property. In addition, the Company also reported an estimate of the silver other mineralized material.

Based on these primary goals and objectives and the performance of the Company, the Compensation Committee determined that the performance was in line with its expectations for the year. As such, the Compensation Committee recommended to the Board that the Named Executive Officers (excluding Rick H. Russell) be awarded 75% of their individual target bonuses now and another 25% of their individual target bonuses on attainment of commercial production, defined as two consecutive months of 6,000 ounces or more of production, at the Hycroft Mine. Rick H. Russell had notified us of his intent to retire in September of 2008. In order to arrange an orderly transition, we agreed to maintain Mr. Russell’s salary until January 31, 2008 and agreed that he would not be eligible for the annual incentive bonus payments. Since Warren Woods started with us early in 2008, his bonus eligibility was reduced to 98% from 100%. Based on this determination, the following table indicates the bonus determination:

2008 Incentive Bonus Payments

| | | | | | | | | | | | | | |

Name | | Base Salary

($) | | Bonus Eligibility

(%) | | | Target Payout

(%) | | | Total Payout

($) | | Paid

April 3, 2009

($) | | Paid,

conditional on

attainment of

commercial

production

($) |

Scott A. Caldwell | | 360,000 | | 100 | % | | 100 | % | | 360,000 | | 270,000 | | 90,000 |

| | | | | | |

Hal D. Kirby | | 250,000 | | 40 | % | | 100 | % | | 100,000 | | 75,000 | | 25,000 |

| | | | | | |

James M. Doyle | | 225,000 | | 40 | % | | 100 | % | | 90,000 | | 67,500 | | 22,500 |

| | | | | | |

Rick H. Russell | | 205,000 | | 35 | % | | 0 | % | | -0- | | -0- | | -0- |

| | | | | | |

Warren Woods | | 175,000 | | 35 | % | | 98 | % | | 60,000 | | 45,000 | | 15,000 |

Discretionary Bonus.The Compensation Committee and the Board of Directors may on its own discretion decide to reward situations during the year where employees provide exemplary service above that anticipated in the individual goals and objectives. In April 2008, the board decided to award a “closing bonus” of $22,000 to Hal Kirby, $11,000 to Mike Doyle, and $6,000 to Rick Russell in recognition of the additional effort and work required to close the public offering we completed raising net proceeds of approximately $69.3 million. This bonus was paid to reflect the completion of the offering during a period when the Company was completing the audit of its first annual financial statements and the completion of a detailed reserve and resource update.

Long-Term Compensation – Equity. The 2008 equity awards were determined by the Compensation Committee by considering the position of the employee, the expected cost of the option award, and the performance of the individuals towards corporate and individual goals and objectives. Options with a five-year term to expiration were granted to the Messrs. Caldwell, Kirby, Doyle, and Russell with vesting terms under which one third of the grant vested on the grant date, a second third vested on the first anniversary of the grant date, and the final third granted on the second anniversary of the grant date.

Warren Woods was employed by us on January 7, 2008. As part of his compensation package, he was granted 50,000 options which had a five-year term to expiration with a vesting schedule under which one third of the grant vested on the first anniversary of the grant date, a second third will vest on the second anniversary of the grant date, and the final third will vest on the third anniversary of the grant date. On May 8, 2008, Mr. Woods was granted 18,000 options with a five-year term to expiration, with vesting terms under which one third of the grant vested on the grant date, a second third will vest on the first anniversary of the grant date, and the final third will vest on the second anniversary of the grant date. As Mr. Woods was not a Named Executive Officer at the

16

time, this option grant was approved by the Board of Directors on the recommendation of the Chief Executive Officer. The grant was reduced to 50% of the annual grant that normally would have been granted to this position to reflect that Mr. Woods had recently begun employment with the Company.

The following table summarizes these awards:

2008 Grants of Plan Based Awards

| | | | | | | | |

Name | | Grant Date | | Number of Options

(#) | | Exercise Price

($) | | Total grant

date fair value

of option award

($) |

Scott A. Caldwell | | May 14, 2008 | | 150,000 | | 5.58 | | 459,000 |

| | | | |

Hal D. Kirby | | May 14, 2008 | | 75,000 | | 5.58 | | 229,500 |

| | | | |

James M. Doyle | | May 14, 2008 | | 75,000 | | 5.58 | | 229,500 |

| | | | |

Rick H. Russell | | May 14, 2008 | | 60,000 | | 5.58 | | 183,600 |

| | | | |

Warren Woods | | January 21, 2008 May 14, 2008 | | 50,000 18,000 | | 5.05 5.58 | | 107,000 55,080 |

Effects of Regulatory Requirements on Executive Compensation

Section 409A of the Code affects the granting of most forms of deferred compensation pursuant to our compensation program. Our compensation program is intended to comply with the final regulations of the U.S. Internal Revenue Service and other guidance with respect to Section 409A of the Code, and we anticipate that our Compensation Committee will continue to design and administer our compensation programs accordingly.

Various rules under current generally accepted accounting practices will impact the manner in which Allied Nevada accounts for future grants of stock options and other equity-based compensation to employees, including executive officers, on our financial statements. The Compensation Committee will review the effect of these rules (including SFAS 123(R)) when determining the form and timing of future grants of stock options and other equity-based compensation to our employees, including executive officers; however, this analysis will not necessarily be the determinative factor in any such decision regarding the form and timing of grants.

Policy with Respect to Section 162(m)

Section 162(m) of the Internal Revenue Code generally prohibits the Company from deducting certain compensation over $1 million paid its chief executive officer and certain other executive officers unless such compensation is based on performance objectives meeting certain criteria or is otherwise excluded from the limitation. The Company strives whenever possible to structure its compensation plans such that they are tax deductible and believes that a substantial portion of compensation paid under its current program (including the annual incentives and stock option grants described above) satisfies the requirements under Section 162(m). However, the Company reserves the right to design programs that recognize a full range of performance criteria important to its success, even where the compensation paid under such programs may not be deductible. For 2007 and 2008, the Company believes that no portion of its tax deductions for compensation paid to its named executive officers will be disallowed under Section 162(m).

17

Summary Compensation Table

| | | | | | | | | | | | | | | |

Name and principal position | | Year | | Salary

($) | | Bonus

($) | | Option

awards(1)

($) | | Non-equity

incentive

plan

compensation

($) | | All other

compensation

($) | | | Total

($) |

| | | | | | | |

Scott A. Caldwell, President and Chief Executive Officer(3) | | 2007

2008 | | 233,750

349,442 | | —

— | | 303,780

856,185 | | 297,000

360,000 | | 56,625

8,400 | (4)

(2) | | 891,155

1,574,027 |

| | | | | | | |

Hal D. Kirby, Vice President and Chief Financial Officer(4) | | 2007

2008 | | 159,375

241,202 | | —

22,000 | | 149,612

418,979 | | 57,375

100,000 | | 65,679

19,216 | (5)

(8) | | 432,041

801,397 |

| | | | | | | |

James M. Doyle, Vice President of Technical Services | | 2007

2008 | | 141,667

216,202 | | —

11,000 | | 56,959

124,312 | | 44,625

90,000 | | —

5,690 |

(2) | | 243,251

447,204 |

| | | | | | | |

Rick H. Russell, Vice President of Exploration | | 2007

2008 | | 100,000

203,241 | | —

6,000 | | 31,500

207,450 | | 31,639

— | | 11,445

5,023 | (6)

(2) | | 174,584

421,714 |

| | | | | | | |

Warren Woods, Hycroft Mine General Manager | | 2007

2008 | | —

172,813 | | —

— | | —

65,502 | | —

60,000 | | —

17,921 |

(7) | | —

316,236 |

(1) | The amounts shown do not reflect compensation actually received by the named executive officers, but represent total compensation cost for the years ended December 31, 2007 and 2008, calculated in accordance with SFAS 123R using a lattice pricing model. The assumptions used to calculate these amounts are set forth in Note 13 to our financial statements included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 16, 2009 and amended on April 14, 2009. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeiture related to service-based vesting conditions. |

(2) | All other compensation includes matching contributions paid by the Company pursuant to the Allied Nevada Gold Corp. 401(k) Plan. Perquisites and other personal benefits for the most recently completed financial year do not exceed $10,000 for any of the Named Executive Officers unless otherwise noted. |

(3) | Mr. Caldwell also served as Chief Financial Officer of Allied Nevada until April 16, 2007, the effective date of appointment of Hal Kirby as Vice President and Chief Financial Officer of Allied Nevada. |

(4) | Represents amounts paid by Vista Gold Corp. for consulting services provided by Mr. Caldwell pursuant to the consulting agreement between Vista Gold Corp. and Mr. Caldwell. Amounts reflect cash compensation only and do not include any reimbursement for out-of-pocket expenses. |

(5) | Amount includes $22,200 paid by Allied Nevada for consulting services provided by Mr. Kirby pursuant to the consulting agreement between Vista Gold Corp. and Mr. Kirby, $34,870 for a relocation allowance and reimbursement of relocation expenses for Mr. Kirby, and $8,609 relating to legal and other costs associated with the immigration of Mr. Kirby’s spouse to the United States. |

(6) | Represents amounts paid by Allied Nevada for consulting services provided by Mr. Russell pursuant to the consulting agreement between Allied Nevada and Mr. Russell. Amounts reflect cash compensation only and do not include any reimbursement for out-of-pocket expenses. See “Compensation Discussion and Analysis — Compensation of Named Executive Officers.” |

(7) | Amount includes $8,841 for reimbursement of housing costs, $4,997 for personal use of a Company provided automobile, and $4,083 of matching contributions paid by the Company pursuant to the Allied Nevada Gold Corp. 401(k) Plan. |

(8) | Amount includes $12,503 of legal and other costs associated with immigration and work visa of Mr. Kirby and of Mr. Kirby’s spouse to the United States and $6,713 matching contributions paid by the Company pursuant to the Allied Nevada Gold Corp. 401(k) Plan. |

18

Grants of Plan-Based Awards

| | | | | | | | | | | | | | | | |

Name | | Grant

date | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards | | All Other

Option

Awards: Number

of Shares of Stock

or Units (#) | | All other Stock

Awards: Number

of Securities

Underlying

Options(1)(3)

(#) | | Exercise or

Base Price

of Option

Awards(2)

($/Share) | | Grant Date

Fair Value of

Option

Awards ($) |

| | | Threshold

($) | | Target

($) | | Maximum

($) | | | | |

Scott A. Caldwell | | 3-Jul-07

14-May-08 | | 180,000 | | 360,000 | | 360,000 | | —

— | | 800,000

150,000 | | 4.35

5.58 | | 1,768,000

459,000 |

| | | | | | | | |

Hal D. Kirby | | 3-Jul-07

14-May-08 | | 50,000 | | 100,000 | | 100,000 | | —

— | | 400,000

75,000 | | 4.35

5.58 | | 884,000

229,500 |

| | | | | | | | |

James M. Doyle | | 3-Jul-07

14-May-08 | | 45,000 | | 90,000 | | 90,000 | | —

— | | 150,000

75,000 | | 4.35

5.58 | | 331,500

229,500 |

| | | | | | | | |

Rick H. Russell | | 18-Sep-07

14-May-08 | | 35,875 | | 71,750 | | 71,750 | | —

— | | 150,000

60,000 | | 4.35

5.58 | | 324,000

183,600 |

| | | | | | | | |

Warren Woods | | 21-Jan-08

14-May-08 | | 30,625 | | 61,250 | | 61,250 | | —

— | | 50,000

18,000 | | 5.05

5.58 | | 107,000

55,080 |

(1) | All options vest in equal annual installments over a period of two to three years. None of the shares of Common Stock subject to options granted to the named executive officers were vested as of December 31, 2007. One-third of the options granted in 2008 and one-third of the options granted in 2007 were vested as of December 31, 2008. |

(2) | Pursuant to the terms of the Allied Nevada 2007 Stock Option Plan (the “Plan”), the exercise price for shares of Common Stock underlying options awarded under the Plan is the closing market price of the Common Stock on either the Toronto Stock Exchange (“TSX”) or NYSE Amex as of the date of grant. |

(3) | Options granted in 2008 to the named executive officers were one-third vested at time of grant. |

Option Exercises and Stock Vested

| | | | |

| | | Option Awards |

Name | | Number of Shares

Acquired on Exercise

(#) | | Value Realized on

Exercise

($) |

Scott A. Caldwell | | — | | — |

Hal D. Kirby | | — | | — |

James M. Doyle | | — | | — |

Rick H. Russell | | 8,900 | | 16,020 |

Warren Woods | | — | | — |

19

Outstanding Equity Awards at Fiscal Year-End

| | | | | | | | |

| | | Options awards |

Name | | Number of

securities

underlying

unexercised

options(1)

(#)

exercisable | | Number of

securities

underlying

unexercised

options(2)(3)

(#)

unexercisable | | Option

exercise

price(4)

($) | | Option

expiration

date |

Scott A. Caldwell | | 266,666 | | 533,334 | | 4.35 | | 3-Jul-18 |

| | 50,000 | | 100,000 | | 5.58 | | 14-May-13 |

Hal D. Kirby | | 133,333 | | 266,667 | | 4.35 | | 3-Jul-18 |

| | 25,000 | | 50,000 | | 5.58 | | 14-May-13 |

James M. Doyle | | 50,000 | | 100,000 | | 4.35 | | 3-Jul-18 |

| | 25,000 | | 50,000 | | 5.58 | | 14-May-13 |

Rick H. Russell | | 50,000 | | 100,000 | | 4.35 | | 3-Jul-18 |

| | 20,000 | | 40,000 | | 5.58 | | 14-May-13 |

Warren Woods | | — | | 50,000 | | 5.05 | | 21-Jan-13 |

| | 6,000 | | 12,000 | | 5.58 | | 14-May-13 |

(1) | All options are either ten year, non-qualified stock options or five year, non-qualified stock options. |

(2) | All options vest in equal annual installments over a two to three year period. |

(3) | The terms of the employment agreements between the Company and Messrs. Caldwell, Kirby, and Doyle, respectively, provide for (i) immediate vesting of all previously granted options and/or restricted share units upon a change of control event affecting the Company and their subsequent involuntary termination during the one year period thereafter, and (ii) continued vesting for a period of two (2) years in the event their employment with the Company is terminated by the Company other than for cause or by the individuals for good reason. |

(4) | Pursuant to the terms of the Allied Nevada 2007 Stock Option Plan, the exercise price for shares of Common Stock underlying options awarded under the Plan is the closing market price of the Common Stock on either the TSX or NYSE Amex as of the date of grant. |

Employment Agreements

Employment Agreement with Scott A. Caldwell

On January 11, 2008, Allied Nevada entered into an employment agreement with Scott A. Caldwell, our President and Chief Executive Officer. Pursuant to the terms of his employment agreement, Mr. Caldwell’s employment began effective as of April 16, 2007, and he continues to be employed by the Company on an “at-will” basis.

Pursuant to his employment agreement, Mr. Caldwell receives an annual base salary in the amount of $330,000, as well as a discretionary bonus up to a maximum amount of 100% of his base salary in any calendar year, based upon the achievement by Mr. Caldwell of pre-determined performance targets set by our Board of Directors. Grant of any such bonus shall be in the sole discretion of the Board of Directors and any bonus shall be earned only after grant thereof by the Board of Directors. Mr. Caldwell’s eligibility to receive such bonus is conditioned upon his continued employment, both at the time the Board of Directors considers the grant of bonuses and at the time such bonuses are actually granted and paid. Mr. Caldwell is also entitled to participate in any benefit plans and policies (including, medical, dental, disability, insurance, retirement savings plans or other fringe benefit plans or policies) as we may make available to, or have in effect for, our senior executives.

Mr. Caldwell was also granted an option to purchase 800,000 shares of Common Stock of the Company in accordance with the Company’s Stock Option Plan. See “—Outstanding Equity Awards at 2008 Fiscal Year End Table” for a description of vesting and other terms applicable to this option award.

20

Employment Agreement with Hal Kirby

On January 11, 2008, Allied Nevada entered into an employment agreement with Hal Kirby, our Vice President and Chief Financial Officer. Pursuant to the terms of his employment agreement, the term of Mr. Kirby’s employment began effective as of April 16, 2007, and he shall continue to be employed by the Company on an “at-will” basis.

Pursuant to the terms of his employment agreement, Mr. Kirby receives an annual base salary in the amount of $225,000, as well as a discretionary bonus up to a maximum amount of 40% of his base salary in any calendar year, based upon the achievement by Mr. Kirby of pre-determined performance targets set by the our President and Chief Executive Officer and approved by our Board of Directors. Grant of any such bonus shall be in the sole discretion of the Board of Directors and any bonus shall be earned only after grant thereof by the President and Chief Executive Officer and approved by the Board of Directors. Mr. Kirby’s eligibility to receive such bonus is conditioned upon his continued employment, both at the time our Board of Directors considers the grant of bonuses and at the time such bonuses are actually granted and paid. Mr. Kirby is also entitled to participate in any benefit plans and policies (including, medical, dental, disability, insurance, retirement savings plans or other fringe benefit plans or policies) as we may make available to, or have in effect for, our senior executives.

Pursuant to his employment agreement, Mr. Kirby was reimbursed for relocation from his residence in Toronto, Ontario, Canada.

In addition, Mr. Kirby was granted an option to purchase 400,000 shares of Common Stock in accordance with the Company’s Stock Option Plan. See “—Outstanding Equity Awards at 2008 Fiscal Year-End Table” for a description of vesting and other terms applicable to Mr. Kirby’s option award.

Employment Agreement with Mike Doyle

On January 11, 2008, Allied Nevada entered into an employment agreement with Mike Doyle, our Vice President of Technical Services. Pursuant to the terms of his employment agreement, the term of Mr. Doyle’s employment began effective as of April 16, 2007, and he shall continue to be employed by the Company on an “at-will” basis.

Pursuant to the terms of his employment agreement, Mr. Doyle receives an annual base salary in the amount of $200,000, as well as a discretionary bonus up to a maximum amount of 35% of his base salary in any calendar year, based upon the achievement by Mr. Doyle of pre-determined performance targets set by our President and Chief Executive Officer and approved by the Board of Directors. Grant of any such bonus shall be in the sole discretion of the Board of Directors and any bonus shall be earned only after grant thereof by our President and Chief Executive Officer and approved by the Board of Directors. Mr. Doyle’s eligibility to receive such bonus is conditioned upon his continued employment, both at the time our Board of Directors considers the grant of bonuses and at the time such bonuses are actually granted and paid. Mr. Doyle is also entitled to participate in any benefit plans and policies (including, medical, dental, disability, insurance, retirement savings plans or other fringe benefit plans or policies) as we may make available to, or have in effect for, our senior executives.

In addition, Mr. Doyle was granted an option to purchase 150,000 shares of Common Stock in accordance with the Company’s Stock Option Plan. See “—Outstanding Equity Awards at 2008 Fiscal Year-End Table” for a description of vesting and other terms applicable to Mr. Doyle’s option.

Employment Agreement with Rick H. Russell

On January 11, 2008, Allied Nevada entered into an employment agreement with Rick H. Russell, our Vice President of Exploration. Pursuant to the terms of his employment agreement, the term of Mr. Russell’s employment began effective as of July 1, 2007, and he was employed by the Company on an “at-will” basis. As disclosed in our Current Report on Form 8-K dated February 1, 2009, Mr. Russell retired effective February 1, 2009. Mr. Russell passed away on April 6, 2009.

21

Prior to Mr. Russell’s retirement, pursuant to the terms of his employment agreement, Mr. Russell received an annual base salary in the amount of $200,000, as well as a discretionary bonus up to a maximum amount of 35% of his base salary in any calendar year, based upon the achievement by Mr. Russell of pre-determined performance targets set by our President and Chief Executive Officer and approved by the Board of Directors. Grant of any such bonus was in the sole discretion of the Board of Directors and any bonus was earned only after grant thereof by our President and Chief Executive Officer and approved by the Board of Directors. Mr. Russell’s eligibility to receive such bonus was conditioned upon his continued employment, both at the time our Board of Directors considers the grant of bonuses and at the time such bonuses are actually granted and paid. Mr. Russell was also entitled to participate in any benefit plans and policies (including, medical, dental, disability, insurance, retirement savings plans or other fringe benefit plans or policies) as we may make available to, or have in effect for, our senior executives.

Mr. Russell was granted an option to purchase 150,000 shares of Common Stock in accordance with the Company’s Stock Option Plan. See “—Outstanding Equity Awards at 2007 Fiscal Year-End Table” for a description of vesting and other terms applicable to Mr. Russell’s option.

Employment Agreement with Warren Woods

On March 16, 2009, Allied Nevada entered into an employment agreement with Warren Woods, our General Manager of Hycroft Operations. Pursuant to the terms of his employment agreement, the term of Mr. Woods’s employment began effective as of January 7, 2008, and he shall continue to be employed by the Company on an “at-will” basis.

Pursuant to the terms of his employment agreement, Mr. Woods receives an annual base salary in the amount of $185,000, as well as a discretionary bonus up to a maximum amount of 35% of his base salary in any calendar year, based upon the achievement by Mr. Woods of pre-determined performance targets set by our President and Chief Executive Officer and approved by the Board of Directors. Grant of any such bonus shall be in the sole discretion of the Board of Directors and any bonus shall be earned only after grant thereof by our President and Chief Executive Officer and approved by the Board of Directors. Mr. Woods’s eligibility to receive such bonus is conditioned upon his continued employment, both at the time our Board of Directors considers the grant of bonuses and at the time such bonuses are actually granted and paid. Mr. Woods is also entitled to participate in any benefit plans and policies (including, medical, dental, disability, insurance, retirement savings plans or other fringe benefit plans or policies) as we may make available to, or have in effect for, our senior executives.

In addition, Mr. Woods was granted an option to purchase 50,000 shares of Common Stock in accordance with the Company’s Stock Option Plan. See “—Outstanding Equity Awards at 2007 Fiscal Year-End Table” for a description of vesting and other terms applicable to Mr. Woods’s option.

As a condition to their employment with Allied Nevada and their receipt of the compensation and benefits described above, as well as under the following heading “Payments Upon Termination or Change of Control”, each of Messrs. Caldwell, Kirby, Doyle, Russell, and Woods were required to execute and deliver a Employee Nondisclosure, Noncompetition, Nonsolicitation and Inventions Agreement, a form of which was attached to their individual employment agreements. Under the latter agreement, each of these executives has agreed that during his employment and for one year following termination of his employment with Allied Nevada, he will not carry on business in the State of Nevada which is similar to or in any way competitive with our mineral property-related business, including business conducted with potential joint venture partners with which Allied Nevada is or was actively pursuing a potential business relationship during the applicable period.

22

Payments Upon Termination or Change in Control

The following table provides executive benefits upon termination or change of control:

| | | | | | |

Name | | Termination not for

cause

($) | | Change of control

($) | | Termination after

change of control

($) |

Scott A. Caldwell | | | | | | |

Salary | | 720,000 | | 720,000 | | 720,000 |

Target bonus payout | | 720,000 | | 720,000 | | 720,000 |

Medical benefit continuation | | 36,000 | | 36,000 | | 36,000 |

Equity acceleration | | — | | 378,667 | | 378,667 |

| | | | | | |

Total | | 1,476,000 | | 1,854,667 | | 1,854,667 |

| | | | | | |

Hal D. Kirby | | | | | | |

Salary | | 500,000 | | 500,000 | | 500,000 |

Target bonus payout | | 200,000 | | 200,000 | | 200,000 |

Medical benefit continuation | | 36,000 | | 36,000 | | 36,000 |

Equity acceleration | | — | | 189,334 | | 189,334 |

| | | | | | |

Total | | 736,000 | | 925,334 | | 925,334 |

| | | | | | |

James M. Doyle | | | | | | |

Salary | | 225,000 | | 337,500 | | 337,500 |

Target bonus payout | | 90,000 | | 135,000 | | 135,000 |

Medical benefit continuation | | 18,000 | | 18,000 | | 18,000 |

Equity acceleration | | — | | 71,000 | | 71,000 |

| | | | | | |

Total | | 333,000 | | 561,500 | | 561,500 |

| | | | | | |

Rick H. Russell | | | | | | |

Salary | | 205,000 | | 307,500 | | 307,500 |

Target bonus payout | | 71,750 | | 107,625 | | 107,625 |

Medical benefit continuation | | 18,000 | | 18,000 | | 18,000 |

Equity acceleration | | — | | 71,000 | | 71,000 |

| | | | | | |

Total | | 294,750 | | 504,125 | | 504,125 |

| | | | | | |

Warren Woods | | | | | | |

Salary | | — | | 175,000 | | 175,000 |

Target bonus payout | | — | | 61,250 | | 61,250 |

Medical benefit continuation | | — | | 9,000 | | 9,000 |

Equity acceleration | | — | | 500 | | 500 |

| | | | | | |

Total | | — | | 245,750 | | 245,750 |

| | | | | | |

Payments Upon Termination

Each of the employment agreements entered into between Allied Nevada and Messrs. Caldwell, Kirby, Doyle, Russell, and Woods contain provisions which entitle each of them to payments following termination of their employment in certain circumstances, as described below.

Termination by Allied Nevada Without Cause or by the Executive for Good Reason

Each of the employment agreements between us and Messrs. Caldwell, Kirby, Doyle, Russell, and Woods provide that, in the event their employment is terminated by Allied Nevada other than for “cause” (as defined below), or is terminated by any of them for “good reason” (as defined below), they are entitled to receive payment, when due, of unpaid base salary, expense reimbursements and vacation days accrued prior to the date

23

of such termination and will also receive, in exchange for execution and delivery to Allied Nevada of a separation agreement and general release, the following severance benefits:

| | • | | Pursuant to the employment agreements with Messrs. Caldwell and Kirby, (a) a lump sum severance equal to (i) 2 times their respective base salary then in effect, plus (ii) 2 times their respective target bonus for the year in which employment is so terminated, in each case payable promptly following the tenth day after delivery to Allied Nevada of an executed separation agreement and general release, (b) payment of premiums for continuation of health insurance coverage under COBRA (or state equivalent) up to a maximum amount of $36,000, and (c) continued vesting for a 2 year period of any unvested options and/or restricted share units granted previously to either of them, consistent with and subject to the terms and conditions of the RSU Plan and the Company’s Stock Option Plan. |

| | • | | Pursuant to the employment agreements with Messrs. Doyle and Russell, (a) a lump sum severance equal to (i) 12 months of their respective base salary then in effect, plus (ii) their respective target bonus for the year in which employment is so terminated, in each case payable promptly following the tenth day after delivery to Allied Nevada of an executed separation agreement and general release, (b) payment of premiums for continuation of health insurance coverage under COBRA (or state equivalent) up to a maximum amount of $18,000, and (c) continued vesting for a 2 year period of any unvested options and/or RSUs granted previously to either of them, consistent with and subject to the terms and conditions of the RSU Plan and the Company’s Stock Option Plan. |

“Good Reason” is defined under each employment agreement as termination by any of Messrs. Caldwell, Kirby, Doyle, or Russell of their employment not later than one year following the occurrence of any of the following events:

| | i. | A substantial reduction in their respective duties or responsibilities or a material change in their respective reporting responsibilities or title, except those changes generally affecting all members of Allied Nevada’s management; |

| | ii. | A substantial reduction by Allied Nevada in their respective annual compensation then in effect, except those changes generally affecting all members of Allied Nevada’s management; or |