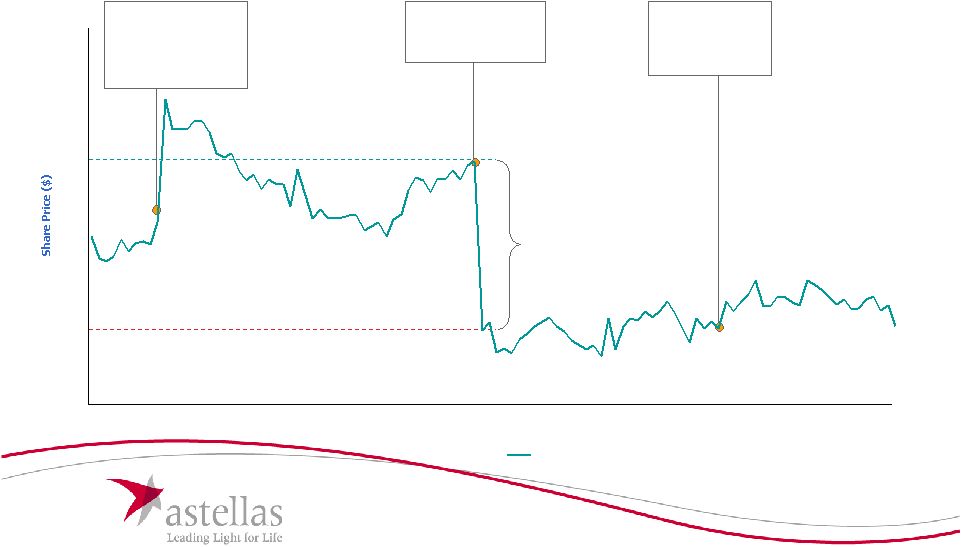

6 Wall Street Commentary on Tarceva Maintenance • • Astellas' offer attributes value to all of the potential label expansions for Astellas' offer attributes value to all of the potential label expansions for Tarceva, including maintenance approval. Wall Street research analysts Tarceva, including maintenance approval. Wall Street research analysts generally do not see significant value associated with maintenance generally do not see significant value associated with maintenance approval approval "The EU approval of Tarceva as first-line maintenance therapy (FLMT) is a positive surprise given the negative FDA ODAC panel...The commercial hurdle would likely be high for Tarceva, if approved....We estimate the sales potential of FLMT in the EU to be about $100-150 mm, representing about $1-$2 per share in NPV.” Goldman Sachs – March 19, 2010 "While today's news is an incremental positive, we see maintenance as a niche opportunity with peak potential of $50M to $100M in Europe...we estimate this could be worth an incremental $1.00/share to base business....We don't think this announcement supports a materially higher bid from current levels.” JP Morgan – March 19, 2010 “OSIP's confidence in its valuation is based on its discussions with FDA for the maintenance indication and ongoing clinical trials. We already have a high level of confidence that the FDA will approve Tarceva in the maintenance setting but believe there is likely only modest impact to sales as a result.” RBC – March 15, 2010 “We do remain skeptical on the maintenance setting, however, and believe that even under a best-case scenario, the FDA...gives Tarceva a restricted label that contraindicates use in the squamous cell and EGFR mutant populations – at which point, any competitive differentiation relative to Alimta, which has better data in non-squamous patients, becomes difficult.” Thomas Weisel – February 24, 2010 Source: Wall Street research. Note: Permission to use quotations was neither sought nor obtained. |