United States Securities and Exchange Commission

Washington, DC 20549-0306

Division of Corporate Finance

Mail Stop 3561

Re: Cavitation Technologies, Inc.

Form 10-K for Fiscal Year Ended June 30, 2009

Forms 10-Q for the Quarterly Periods Ended September 30, 2009 and December 31, 2009

Registration Statement File No. 0-29901

August 11, 2010

Ladies and Gentlemen,

This letter is in response to your supplemental comment letter dated July 26, 2010. Our responses to your letter are as follows below. Changes from our original response are marked

Item 1- Business, page 2

Introduction, page 2

Comment 1 (previously comment 1)

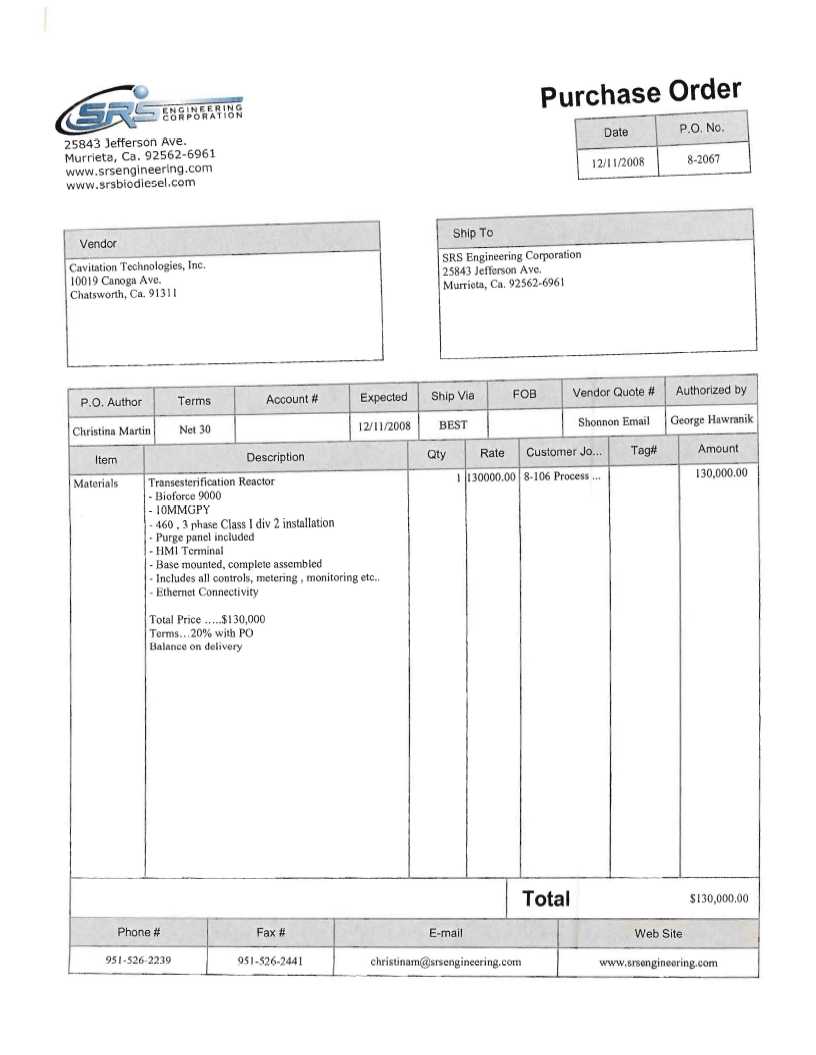

The installation of the unit in the Moberly, Missouri plant was accomplished through the sale of our unit to SRS Engineering, Inc. pursuant to a standard purchase order. The total purchase price for the unit was $130,000.00 The material terms of the purchase order are a 20% ($26,000) down- payment and the 80% balance ($104,000) due upon delivery of the unit. We have received a $26,000 deposit from SRS Engineering, Inc. but have not received the balance payment due and accordingly, are unable to book the placement of the unit as revenue. We do not know when or if we will receive this amount due. The purchase order is attached as an exhibit to this supplemental response and will be attached to our amended 10K filing as a material contract.

In addition, the 10k amendment will not include statements from our customer, SRS Engineering claiming “a high yield of high quality bio-diesel”

Comment 2

We had previously attached the Desmet Ballestra Group agreement as a material contract to our 3rd quarter 10Q (January 1- March 31, 2010). The agreement with Desmet Ballestra was not entered into until January 15, 2010 which is outside both the time period covered by our 10K filing period which ended June 30, 2009 as well as our actual filing date for our 10K which was filed on September 29, 2009. With respect to the Minnesota vegetable refining plant, this agreement was executed on April 9, 2010. This time period is also outside of the June 30, 2009 10K reporting period as well as the filing date of September 29, 2009. We will be disclosing the agreement in our June 30, 2010 10K filing as a material contract.

Comment 3

The sources of information are set forth below:

“Crude soybean lecithin contains about 70% AI” M.L. Nollet “The Handbook for Food Analysis: Physical Characterization and Nutrient Analysis” page 350.

“AI% in dried gums – 65- 70%”, Logan, Andrew and Laval, Alfa Degumming and Centrifuge Selection, Optimization and Maintenance pages 10 and 13.

Orthoefer, Frank T. “Cold -Water Dispersible Lecithin Concentrates” U.S. Patent #4,200,551 issued April 29, 1980. The releveant portion of the patent confirms “A commercial lecithin product is then obtained by drying the wet gum. Such commercial lecithin products generally have acetone insoluble (A.I) of at least 50 and are most typically within about the 60 to about 65 A.I. range”.

Comment 4

Our original comment erroneously stated that biodiesel was produced based on 14kWh. The correct number is 8.02KwH and the basis for our statement follows:

Internal tests were conducted at Cavitation Technologies, Inc. using our 24 gallon/minute Bioforce 9000 which uses an 11 horsepower motor. According to the US Energy Administration Administration’s Independent Statistics and Analysis, the average retail price of electricity for an industrial user in the US in April 2010 was 6.57 cents/kilowatt hour (online reference at http://www.eia.doe.gov/electricity/epm/table5_6_a.html#_ftnref1). Our 24GPM system uses an 11 horsepower motor which uses about 8.20 kilowatts in one hour (1 HP=0.7457 kilowatts) and therefore requires 53.9 cents to run one hour (8.20kWh X 6.57 cents/kWh = 53.9 cents. Since the system produces 1,440 gallons of biodiesel in one hour, the energy cost is about 0.0374 cents/ gallon (53.9cents/1,440).

Comment 5

The lab reports which were attached were prepared for Cavitation Technologies, Inc. at private laboratories at the request of Cavitation Technologies, Inc. Accordingly, there are no public reports. Please disregard any stray notes or astererisks on the lab reports. The lab report should be read in conjunction with the response to comment #3.

Comment 6

The target market for our Green D System includes approximately 300 major worldwide vegetable oil refiners. The global demand for processed vegetable oils has grown consistently over the past eight years from 90 million metric tons in 2000/01 to about 118 million metric tons in 2007/08.

The global demand for petroleum-based diesel is about 345 billion gallons/year. We have been impacted by the downturn in the worldwide economy and the slowdown in the demand for biodiesel. Factors which can spur the demand for biodiesel and our products include legislation which mandates increased use of biodiesel, a reduction in the cost of raw materials (feedstock) used in the production of biodiesel, and an increase in the price of competitive products such as petroleum-based diesel fuel. These adverse economic conditions may continue to negatively affect our revenues and profitability over the near term. Nevertheless, we intend to sell our products through a global distribution network of strategic partners who are recognized leaders in their field.

We have a variety of competitors, large and small. The biodiesel market and other markets in which we compete are highly competitive markets offering essentially commodity products. While the biodiesel market itself is mature, there are new niche industries being developed such as mining and marine/estuary areas where biodiesel provides for better spill mitigation than competitive diesel technologies. There are a number of competitors in the biodiesel industry, many of which have a longer operating history and stronger financial capabilities than we do, and there is at least one other company which professes to offer hydrodynamic cavitation technology. Other companies use rotor-stator and ultrasonic cavitation technologies. Competitors in the edible oil refining industry include well-known companies which have longer operating histories and stronger financial capabilities than we do.

We differentiate ourselves by the designs, processes, and applications described in our patents pending applications. We compete by offering solutions that we believe can reduce operating expenses vis-à-vis current technology. To date the company has sold no products and recognized no revenue.

Comment 7

Unregistered Sales of Equity Securities and Use of Proceeds, page 5

We have amended our disclosure to reflect that all the securities sold were sold in reliance on Section 4(2) of the Securities Act of 1933, as amended, and that the Hydro Dynamic shares sold on October 3, 2010 were sold to fewer than 5 accredited, non-affiliated investors, each of whom had a pre-existing relationship with the Company or its management. The shares were not offered via general solicitation to the public but rather in a limited manner to a limited number of accredited investors. No sales commissions or other remuneration was paid in connection with these sales.

With respect to the April 22, 2009 and June 2009, issuance, those shares and warrants were sold to service providers of the Company as well as to existing accredited investors who desired to make an additional investment in the Company.

“On October 3, 2008, the Company issued 210,000 units comprised of five shares of its Series A-1 Preferred Stock (total of 1,050,000 preferred shares) and one warrant to purchase one share of common stock at $0.75 per share for total proceeds of $525,000 which were placed in escrow. Upon the closing of escrow on October 3, 2008, $400,000 was used to purchase 50.5% of the outstanding shares of Bio (see Note 2 to the consolidated financial statements), and the remaining $125,000 was distributed to the Company. The shares of Company stock were sold in compliance with Section 4(2) of the Securities Act of 1933, as amended to less than 5 accredited,, non-affliated investors who had a pre-existing relationship with the Company’s management. Those purchasers were Barhnart Holdings, Ltd., GDK Investments, Gregory Shukman, Tatiana Tessmer and Lyudmilla Yeschenko. The shares were issued in reliance on Section 4(2) of the Securities Act of 1933, as amended. The shares were not offered via general solicitation to the public but solely to a limited number of accredited investors who had a pre-existing relationship with the Company. No sales commissions or other remuneration was paid in connection with these sales.

On October 24, 2008, the Company entered into a share exchange agreement with Bio in which Bio acquired all of the outstanding shares of the Company’s stockholders. Bio Energy, Inc. issued 18,750,000 shares of its common stock to the stockholders of Hydrodynamic Technology, Inc. in exchange for all the outstanding shares of Hydrodynamic Technology, Inc. Under the terms of the share exchange agreement, Bio performed a 7.5-to-1 forward stock split of its outstanding shares of common stock.

On October 24, 2008, in connection with the reverse merger, all shares of Series A-1 Preferred Stock were converted to common shares of Bio. The accompanying financial statements have retroactively shown the recapitalization for all periods presented. As a result of the merger with Bio, the Company no longer has any Series A-1 Preferred Stock authorized or issued. In connection with the Bio transaction, 410,000 warrants to purchase 410,000 shares of Common Stock of Hydro converted into 279,800 warrants to purchase 279,800 shares of Common Stock of Bio.

On March 17, 2009, the Company filed Amended and Restated Articles of Incorporation, which authorized the Company to issue up to 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock, of which 5,000,000 shares are designated as Series A Preferred Stock and 5,000,000 shares are designated Series B Preferred Stock, with the rights, preferences and privileges of the Series B Preferred Stock to be designated by the Board of Directors. Each share of Common Stock and Preferred Stock has a par value of $0.001.

On March 17, 2009 the Company issued 111,111 shares of Series A Convertible Preferred Stock to Barnhart Holdings, Ltd., a foreign non-affiliated investor at a purchase price of $0.90 per share for a total purchase price of $100,000. Each share of Series A Preferred Stock is convertible at the owner’s option into 1.125 shares of common stock. The preferred shares are convertible into shares of Common Stock of the Company at any time at the election of the holder but will automatically convert to Common Stock on March 17, 2012. The shares were issued in reliance on Section 4(2) of the Securities Act of 1933, as amended. The shares were not offered via general solicitation to the public but solely to Barnhart Holdings, Ltd. No sales commissions or other remuneration was paid in connection with these sales.

On April 22, 2009, the Company issued 166,666 shares of common stock at $0.60 per share and 66,666 warrants to purchase 66,666 shares of Common Stock at an exercise price of $1.50 per share for a total consideration of $100,000 to San Francisco Securities Inc, a non-affiliated accredited investor. The warrants vest immediately and have a contractual life of 3 years. The total value of the warrants issued amounted to $0. The value was determined using the Black-Scholes valuation model with input assumptions of (1) volatility of 64%, (2) expected life of 1.5 years, (3) risk free rate of 0.76%, and (4) expected dividends of zero. The shares were issued in reliance on Section 4(2) of the Securities Act of 1933, as amended. The shares were not offered via general solicitation to the public but solely to San Francisco Securities, Inc. No sales commissions or other remuneration was paid in connection with these sales.

In June 2009, the Company issued 366,666 shares of common stock at prices ranging from $0.50 to $0.60 per share along with warrants to purchase 396,666 shares of Common Stock at exercise prices ranging from $0.60 to $1.25 per share, for a total consideration of $200,000. The shares and warrants were issued to service providers of the Company as well as to existing shareholders who desired to make an additional investment in the Company. The warrants vest immediately and have a contractual life ranging from 3 to 5 years. The total value of the warrants issued amounted to $5,678. The value was determined using the Black-Scholes valuation model with input assumptions of (1) volatility of 64%, (2) expected life ranging from 3 to 5 years, (3) risk free rate ranging from 0.85% to 1.55%, and (4) expected dividends of zero. Those shares and warrants were issued to Boris Zheleznyak, San Francisco Securities, Inc, and GDK Investments, all of whom are accredited investors. None of Boris Zheleznyak, San Francisco Securities, Inc. and GDK Investment are affiliated with the Company. The shares were issued in reliance on Section 4(2) of the Securities Act of 1933, as amended. The shares were not offered via general solicitation to the public but solely to San Francisco Securities, Inc. No sales commissions or other remuneration was paid in connection with these sales.

In summary, for fiscal 2009 we issued 661,303 shares of common stock valued at $639,673 to service providers who provided advertising and marketing services. We also received $300,000 in cash in exchange for 533,332 common shares. In fiscal 2009, we also issued 111,111 preferred shares for $100,000. In 2008, we issued 3,456,550 shares of common stock valued at $1,823,400 to service providers who supported our research and development activities. In fiscal 2008, we also issued 1,000,000 shares of preferred stock for $500,000. Further, for fiscal 2009, we issued warrants to purchase 1,374,421 shares of Common Stock with exercise prices ranging from $0.60 to $1.75 per share. The warrants vest immediately and have a contractual life ranging from 1.5 to 5 years. The total value of the warrants issued amounted to $303,123. The value was determined using the Black-Scholes valuation model with input assumptions of (1) volatility of 64% - 148%, (2) expected life ranging from 1.5 to 2.5 years, (3) risk free rate ranging from 0.85% to 1.55%, and (4) expected dividends of zero.”

Comment 8

The Company has adopted its code of ethics on August 6, 2010. We are unable to include the code of ethics in the 10K amendment for the period ended June 30, 2009 because it was not in effect during such period nor was it in effect prior to the September 28th 2009 filing date. We will include the code of ethics in our June 30, 2010 10k filing, however.

Comment 9

We will attach the following table.

(1) Includes accrued salary of $224,542 and $28,000 as of June 30, 2009 and 2008, respectively.

Comment 10

Narrative Disclosure to Summary Compensation Table.

Roman Gordon, Igor Gorodnitsky and R.L. Hartshorn are our sole officers and directors. The only officer and director who are on payroll are Roman Gordon and Igor Gorodnitsky. Mr. Gordonitsky has accrued his salary because of the inability of the Company to generate the revenues to pay his salary. The Company has no bonus, annuity, pension, retirement or other compensation programs in place at this time.

CAVITATION TECHNOLOGIES, INC.

| | By: s/Roman Gordon/ Chief Executive Officer |