U.S. BANK NATIONAL ASSOCIATION

repurchased for cash without exercise by any holders thereof, upon such final redemption or repurchase (x) the Conversion Rate shall be readjusted as if such rights or warrants had not been issued and (y) the Conversion Rate shall then be again readjusted to give effect to such distribution, deemed distribution or Trigger Event, as the case may be, as though it were a cash distribution, equal to the per share redemption or repurchase price received by a holder or holders of Common Stock with respect to such rights or warrants (assuming such holder had retained such rights or warrants), made to all holders of Common Stock as of the date of such redemption or repurchase, and (B) in the case of such rights or warrants that shall have expired or been terminated without exercise by any holders thereof, the Conversion Rate shall be readjusted as if such rights and warrants had not been issued.

For the purposes of this clause (d) and clauses (b) and (c) of this Section 5.07, any dividend or distribution to which this clause (d) applies which also includes one or both of:

(A) a dividend or distribution of shares of Common Stock to which clause (b) would, but for clause (i) above, apply (the “Clause B Distribution”);

(B) a dividend or distribution of rights or warrants to which clause (c) would, but for clause (i) above, apply (the “Clause C Distribution”),

then (1) such dividend or distribution, other than the Clause B Distribution and the Clause C Distribution, shall be deemed to be a dividend or distribution to which this clause (d) applies (the “Clause D Distribution”) and any Conversion Rate adjustment required by this clause (d) with respect thereto shall then be made, and (2) the Clause B Distribution and Clause C Distribution shall be deemed to immediately follow the Clause D Distribution and any Conversion Rate adjustment required by clauses (b) and (c) with respect thereto shall then be made, except, if determined by the Company, (I) the “Ex-Date” of the Clause B Distribution and the Clause C Distribution shall be deemed to be the Ex-Date of the Clause D Distribution and (II) any shares of Common Stock included in the Clause B Distribution or Clause C Distribution shall be deemed not to be “outstanding immediately prior to the open of business on the Ex-Date for such dividend or distribution or the effective date of such share split or combination, as the case may be” within the meaning of clause (b) or “outstanding immediately prior to the open of business on the Ex-Date for such distribution” within the meaning of clause (c).

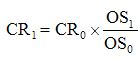

(e) In case the Company shall pay cash dividends or make cash distributions to all or substantially all holders of the Common Stock, the Conversion Rate shall be increased based on the following formula:

where,

| | CR1 | = | the Conversion Rate in effect immediately after the open of business on the Ex-Date for such distribution; |

| | | | |

| | CR0 | = | the Conversion Rate in effect immediately prior to the open of business on the Ex-Date for such distribution; |

| | | | |

| | SP0 | = | the average of the Last Reported Sale Prices of the Common Stock over the 10 consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Date for such distribution; and |

| | | | |

| | C = | | the amount in cash per share the Company distributes to holders of Common Stock in such distribution. |

Such adjustment shall become effective immediately after the open of business on the Ex-Date for such dividend or distribution. If the portion of the cash so distributed applicable to one share of the Common Stock is equal to or greater than “SP0” as set forth above, in lieu of the foregoing adjustment, adequate provision shall be made so that each Holder of Securities shall receive on the date on which such cash dividend is distributed to holders of Common Stock, for each $1,000 principal amount of Securities, the amount of cash such holder would have received had such Holder owned a number of shares equal to the Conversion Rate on the Ex-Date for such distribution, without being required to convert the Securities. If such dividend or distribution is not so paid or made, the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

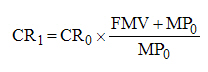

(f) In case the Company or any of its Subsidiaries makes a payment in respect of a tender offer or exchange offer for all or any portion of the Common Stock, to the extent that the cash and value of any other consideration included in the payment per share of Common Stock exceeds the Last Reported Sale Price of the Common Stock on the Trading Day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), the Conversion Rate shall be increased based on the following formula:

| | CR1 = CR0 x | AC+ (SP1 x OS1) | |

| | OS0 x SP1 | |

where,

| | CR1 = | the Conversion Rate in effect immediately after the open of business on the Trading Day next succeeding the date such tender or exchange offer expires; |

| | | |

| | CR0 = | the Conversion Rate in effect immediately prior to the open of business on the Trading Day next succeeding the date such tender or exchange offer expires; |

| | | |

| | AC = | the aggregate value of all cash and any other consideration (as determined by the Board of Directors) paid or payable for shares purchased in such tender or exchange offer; |

| | | |

| | SP1 = | the average of the Last Reported Sale Prices of the Common Stock over the 10 consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires (the“Averaging Period”); |

| | | |

| | OS1 = | the number of shares of Common Stock outstanding immediately after the close of business on the date such tender or exchange offer expires (after giving effect to such tender offer or exchange offer); and |

| | | |

| | OS0 = | the number of shares of Common Stock outstanding immediately prior to the date such tender or exchange offer expires (prior to giving effect to such tender offer or exchange offer). |

Such adjustment shall be made immediately prior to the open of business on the day following the last day of the Averaging Period, but shall be given effect as of the open of business on the Trading Day next succeeding the date such tender or exchange offer expires. To the extent that the final day of the Observation Period for any converted Securities occurs during the Averaging Period, the Company shall satisfy the Conversion Obligation with respect to such Securities on the third Business Day immediately following the last day of the Averaging Period.

If the Company or its Subsidiary is obligated to purchase shares of Common Stock pursuant to any such tender or exchange offer, but the Company or its Subsidiary is permanently prevented by applicable law from effecting all or any such purchases or all or any portion of such purchases are rescinded, the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such tender or exchange offer had not been made or had only been made in respect of the purchases that had been effected.

(g) For purposes of this Section 5.07 the term “record date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of shareholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board of Directors or by statute, contract or otherwise).

(h) For the avoidance of doubt, for purposes of clauses (b), (c), (d), (e) and (f) of this Section 5.07 in the event of any reclassification of the Common Stock, as a result of which the Securities become convertible into more than one class of Common Stock, if an adjustment to the Conversion Rate is required pursuant to any of clauses (b), (c), (d), (e) and (f), references in those clauses to one share of Common Stock or Last Reported Sale Price of one share of Common Stock shall be deemed to refer to a unit or to the price of a unit consisting of the number of shares of each class of Common Stock into which the Securities are then convertible equal to the numbers of shares of such class issued in respect of one share of Common Stock in such reclassification. The above provisions of this paragraph shall similarly apply to successive reclassifications.

(i) In addition to those required by clauses (b), (c), (d), (e) and (f) of this Section 5.07, and to the extent permitted by applicable law and the rules of The New York Stock Exchange or any other securities exchange or market on which the Common Stock is then listed, the Company from time to time may, in its sole discretion, increase the Conversion Rate by any amount for a period of at least 20 Business Days if the Board of Directors determines that such increase would be in the Company’s best interest. Whenever the Conversion Rate is increased pursuant to the preceding sentence, the Company shall mail to the Holder of each Security at his last address appearing on the Register provided for in Section 1.07 a notice of the increase at least 20 Business Days prior to the date the increased Conversion Rate takes effect, and such notice shall state the increased Conversion Rate and the period during which it will be in effect. In addition, the Company may also (but is not required to) increase the Conversion Rate to avoid or diminish any income tax to holders of Common Stock or rights to purchase Common Stock in connection with any dividend or distribution of shares (or rights to acquire shares) or similar event.

(j) Without limiting the foregoing, no adjustment to the Conversion Rate need be made

(i) upon the issuance of shares of Common Stock to stockholders of Magnum Coal Company pursuant to the Merger Agreement as such Merger Agreement is in effect on the Issue Date;

(ii) upon the issuance of any shares of Common Stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on securities of the Company and the investment of additional optional amounts in shares of Common Stock under any plan;

(iii) upon the issuance of any shares of Common Stock or options or rights to purchase shares of Common Stock pursuant to any present or future employee, director or consultant benefit plan or program or stock purchase plan of or assumed by the Company or any of its Subsidiaries;

(iv) upon the issuance of any shares of Common Stock pursuant to any option, warrant, right or exercisable, exchangeable or convertible security not described in clause (iii) above and outstanding as of the date of this Indenture;

(v) for a change in the par value of the Common Stock; or

(vi) for accrued and unpaid interest (including any Additional Interest).

(k) The Company shall not make any adjustment to the Conversion Rate under clauses (b), (c), (d), (e) and (f) of this Section 5.07 unless the adjustments would result in a change of at least 1% in the Conversion Rate. However, the Company will carry forward any adjustment that it would otherwise have to make and take that adjustment into account in any subsequent adjustment. In addition, regardless of whether the aggregate adjustment is less than 1%, the Company will make such carried-forward adjustments not otherwise effected with respect to any Security (i) upon conversion of a Security, (ii) within one year of the first date upon which an adjustment would otherwise have been made, and (iii) otherwise, on February 15, 2013, except to the extent such adjustment has already been made.

(l) All calculations and other determinations under this Article 5 shall be made by the Company and shall be made to the nearest cent or to the nearest 1/10,000th of a share, as the case may be.

(m) If, in respect of any VWAP Trading Day within the Observation Period for a converted Security:

(i) shares of Common Stock are deliverable to settle the Daily Share Amount for such VWAP Trading Day;

(ii) any event has occurred that requires an adjustment to the Conversion Rate under any of clauses (b), (c), (d), (e) and (f) of this

Section 5.07, but such adjustment has not been made to the Conversion Rate as of such VWAP Trading Day; and

(iii) the shares of Common Stock the Holder of such Security shall receive in respect of such VWAP Trading Day are not entitled to participate in the distribution or transaction giving rise to such adjustment event because, pursuant to the terms of Section 5.05(g), such shares were not held by such Holder on the record date corresponding to such distribution or transaction,

then the Company will adjust the daily share amount for such VWAP trading day to reflect such adjustment event.

(n) For purposes of this Section 5.07, the number of shares of Common Stock at any time outstanding shall not include shares held in the treasury of the Company but shall include shares issuable in respect of scrip certificates issued in lieu of fractions of shares of Common Stock.

Section 5.08. Notice of Adjustments of Conversion Rate.

(a) Whenever the Conversion Rate is adjusted as herein provided:

(i) the Company shall compute the adjusted Conversion Rate in accordance with Section 5.07 and shall prepare a certificate signed by an Officer setting forth the adjusted Conversion Rate and showing in reasonable detail the facts upon which such adjustment is based, and such certificate shall promptly be filed with the Trustee and with each Conversion Agent (if other than the Trustee); and

(ii) as soon as reasonably practicable after each such adjustment, the Company shall provide a notice to all Holders stating that the Conversion Rate has been adjusted and setting forth the adjusted Conversion Rate.

(b) Neither the Trustee nor any Conversion Agent shall be under any duty or responsibility with respect to any such certificate or the information and calculations contained therein, except to exhibit the same to any Holder of Securities desiring inspection thereof at its office during normal business hours.

Section 5.09. Company To Reserve Common Stock.

The Company shall at all times reserve and keep available, free from preemptive rights, out of its authorized but unissued Common Stock, for the purpose of effecting the conversion of Securities, the full number of shares of Common Stock then issuable upon the conversion of all Outstanding Securities.

Section 5.10. Certain Covenants.

Before taking any action which would cause an adjustment reducing the Conversion Rate below the then par value, if any, of the shares of Common Stock issuable upon conversion of the Securities, the Company shall take all corporate action which it reasonably determines may be necessary in order that the Company may validly and legally issue shares of such Common Stock at such adjusted Conversion Rate.

Section 5.11. Cancellation of Converted Securities.

All Securities delivered for conversion shall be delivered to the Trustee or its agent and canceled by the Trustee as provided in Section 2.15.

Section 5.12. Effect of Reclassification, Consolidation, Merger or Sale.

(a) If there shall be:

(i) any reclassification or change of the outstanding shares of Common Stock (other than a change in par value, or from par value to no par value, or from no par value to par value, or as a result of a split, subdivision or combination);

(ii) a consolidation, binding share exchange, recapitalization, reclassification, merger, combination or other similar event; or

(iii) any sale or conveyance to another Person of all or substantially all of the property and assets of the Company (excluding a pledge of securities issued by any of the Company’s subsidiaries),

in any case as a result of which holders of Common Stock shall be entitled to receive cash, securities or other property or assets with respect to or in exchange for such Common Stock (any such event described in clauses (i) through (iii), a “Reorganization Event”), then at the effective time of such Reorganization Event, the right to convert each $1,000 principal amount of Securities shall be changed to a right to convert such Securities by reference to the kind and amount of cash, securities or other property or assets that a holder of a number of shares of Common Stock equal to the Conversion Rate immediately prior to such transaction would have owned or been entitled to receive (the “Reference Property”).

(b) From and after the effective time of a Reorganization Event, upon conversion of a Security:

(i) the portion of the Daily Settlement Amount payable in cash shall continue to be payable in cash; and

(ii) the portion, if any, of each Daily Settlement Amount payable in shares of Common Stock shall be payable in units of Reference Property based upon the Daily Conversion Value of such Reference Property.

The Daily Conversion Value shall be calculated based on the value of a unit of Reference Property corresponding to the amount of Reference Property that a holder of one share of the Common Stock would have received in the Reorganization Event. The Daily VWAP and the Last Reported Sale Price shall be calculated with respect to a unit of Reference Property corresponding to the amount of Reference Property that a holder of one share of the Common Stock would have received in the Reorganization Event.

(c) For purposes of determining the constitution of Reference Property, the type and amount of consideration that a holder of Common Stock would have been entitled to in the case of reclassifications, consolidations, mergers, sales or conveyance of assets or other transactions that cause the Common Stock to be converted into the right to receive more than a single type of consideration (determined based in part upon any form of stockholder election) shall be deemed to be the (i) weighted average of the types and amounts of consideration received by the holders of Common Stock that affirmatively make such an election or (ii) if no holders of Common Stock affirmatively make such election, the types and amounts of consideration actually received by such holders.

(d) The Company or the successor or purchasing Person, as the case may be, shall execute with the Trustee a supplemental indenture permitted under Section 12.01 providing for the conversion and settlement of the Securities as set forth in this Indenture. Such supplemental indenture shall provide for adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Article 5 and the Trustee may conclusively rely on the determination by the Company of the equivalency of such adjustments.

(e) In the event a supplemental indenture is executed pursuant to this Section 5.12, the Company shall promptly file with the Trustee an Officers’ Certificate briefly stating the reasons therefor, the kind or amount of cash, securities or property or assets that will constitute the Reference Property after any such Reorganization Event, any adjustment to be made with respect thereto and that all conditions precedent have been complied with, and shall promptly mail notice thereof to all Holders. Failure to deliver such notice shall not affect the legality or validity of such supplemental indenture.

(f) The Company shall not become a party to any such transaction unless its terms are consistent with this Section 5.12. None of the foregoing provisions shall affect the right of a holder of Securities to convert its Securities in

accordance with the provisions of this Article 5 prior to the effective date of a Reorganization Event.

(g) The provisions of this Section 5.12 shall similarly apply to successive Reorganization Events.

Section 5.13. Responsibility of Trustee for Conversion Provisions.

(a) The Trustee, subject to the provisions of Article 9, and any Conversion Agent, shall not at any time be under any duty or responsibility to any Holder of Securities or to the Company to determine whether any facts exist which may require any adjustment of the Conversion Rate, or with respect to the nature or extent of any such adjustment when made, or with respect to the method employed, herein or in any supplemental indenture provided to be employed, in making the same, or whether a supplemental indenture need be entered into.

(b) Neither the Trustee, subject to the provisions of Article 9, nor any Conversion Agent shall be accountable with respect to the validity or value (or the kind or amount) of any Common Stock, or of any other securities or property or cash, which may at any time be issued or delivered upon the conversion of any Securities, and it or they do not make any representation with respect thereto. Neither the Trustee, subject to the provisions of Article 9, nor any Conversion Agent shall be responsible for any failure of the Company to make or calculate any cash payment or to issue, transfer or deliver any shares of Common Stock or share certificates or other securities or property or cash upon the surrender of any Security for the purpose of conversion; and the Trustee, subject to the provisions of Article 9, and any Conversion Agent shall not be responsible for any failure of the Company to comply with any of the covenants of the Company contained in this Article 5.

Section 5.14. Stockholder Rights Plan. To the extent shares of Common Stock traded on the Relevant Exchange trade with rights, if any, as may be provided by the terms of any stockholder rights plan adopted by the Company, as the same may be amended from time to time, each share of Common Stock issued upon conversion of Securities pursuant to this Article 5 shall be entitled to receive the appropriate number of such rights and the certificates representing the Common Stock issued upon such conversion shall bear such legends, if any, in each case as may be provided by the terms of any such stockholder rights plan adopted by the Company, as the same may be amended from time to time. If prior to any conversion, however, such rights have separated from the shares of Common Stock in accordance with the provisions of the applicable stockholder rights agreement, the Conversion Rate shall be adjusted at the time of separation as if the Company distributed to all holders of the Common Stock, shares of the Company’s Capital Stock, evidences of indebtedness, assets, property, rights or

warrants as described in Section 5.07(d), subject to readjustment in the event of the expiration, termination or redemption of such rights.

Section 5.15. Company Determination Final. Any determination that the Company or the Board of Directors must make pursuant to this Article 5 shall be conclusive if made in good faith, absent manifest error.

Section 5.16. Exchange in Lieu of Conversion.

(a) Notwithstanding anything herein to the contrary, when a Holder surrenders Securities for conversion, the Company may direct the Conversion Agent to surrender, prior to the commencement of the applicable Observation Period, such Securities to a financial institution designated by the Company for exchange in lieu of conversion.

(b) In order to accept any Securities surrendered for conversion, the designated institution must agree to deliver to the Conversion Agent for delivery to such Holder, in exchange for such Securities to be delivered to such designated institution by the Conversion Agent, all cash or a combination of cash and shares of Common Stock equal to the consideration otherwise due upon conversion, as provided under this Article 5 (assuming for this purpose and for the purpose of determining the related Observation Period that the date such Holder surrenders such Securities for conversion is the Conversion Date for such Securities) at the sole option of the designated institution and as is designated to the Conversion Agent by the Company.

(c) By the close of business on the Trading Day immediately preceding the start of the Observation Period, the Company will notify the Holder surrendering Securities for conversion that it has directed the designated financial institution to make an exchange in lieu of conversion and such designated institution will be required to notify the Conversion Agent, who will then notify the Holder, whether it will deliver, upon exchange, all cash or a combination of cash and shares of Common Stock (by specifying a Cash Percentage as provided under this Article 5).

(d) If the designated institution accepts any such Securities, it will deliver cash and, if applicable, the appropriate number of shares of Common Stock to the Conversion Agent on the date such cash and shares of Common Stock, if any, would otherwise be due as set forth in this Article 5 and the Conversion Agent will promptly deliver the cash and those shares to Holders. Any Securities exchanged by the designated institution will remain outstanding. If the designated institution agrees to accept any Securities for exchange but does not timely deliver the cash consideration, or if such designated financial institution does not accept the Securities for exchange, the Company shall, no later than the third Business Day immediately following the last day of the related

Observation Period, convert the Securities into cash and shares of Common Stock, if any, in accordance with this Article 5 (based on such assumed Conversion Date as described above and the specified Cash Percentage as described above).

(e) The Company’s designation of an institution to which the Securities may be submitted for exchange does not require the institution to accept any Securities.

ARTICLE 6

REDEMPTION OF THE SECURITIES

Section 6.01. Redemption Upon Termination Of Merger Agreement.

(a) The Securities shall be redeemable at the Company’s option in accordance with this Article 6, in whole or in part, at any time on or before December 31, 2008 if the Merger Agreement has been terminated.

(b) The Company may elect to redeem any Securities pursuant to this Section 6.01 by providing notice to each Holder of such Securities in accordance with Section 6.05 not less than 10 days nor more than 30 days prior to the Redemption Date for such Securities.

Section 6.02. Other Redemption Rights.

(a) The Securities shall be redeemable at the Company’s option in accordance with this Article 6:

(i) in whole or in part, at any time on or after May 31, 2011, if the Last Reported Sale Price of the Common Stock for 20 or more Trading Days in a period of 30 consecutive Trading Days ending on the Trading Day prior to the date the Company provides a Redemption Notice in accordance with this Article 6 exceeds 130% of the Conversion Price in effect on each such Trading Day; and

(ii) in whole but not in part, at any time if less than $20,000,000 aggregate principal amount of Securities are then Outstanding.

(b) The Company may elect to redeem any Securities pursuant to this Section 6.02 by providing notice to each Holder of such Securities in accordance with Section 6.05 not less than 25 Scheduled Trading Days nor more than 60 days prior to the Redemption Date for such Securities.

Section 6.03. Redemption Price.

(a) The “Redemption Price” for any Securities redeemed shall be:

(i) in the case of Securities redeemed pursuant to Section 6.01:

(A) an amount in cash equal to 100% of the principal amount of the Securities being redeemed, plus any accrued and unpaid interest to the Redemption Date; and

(B) an amount in shares of Common Stock, for each $1,000 principal amount of the Securities being redeemed, equal to the lesser of:

(1) a number of shares of Common Stock equal to (I) the sum of $20 plus 80% of the amount, if any, by which the Redemption Conversion Value exceeds the Initial Conversion Value of such Securities, divided by (II) the Average Redemption VWAP for such Securities; and

(2) 26.6221 shares of Common Stock, subject to adjustment in the same manner as the Conversion Rate is adjusted under Section 5.07; and

(ii) in the case of Securities redeemed pursuant to Section 6.02, an amount in cash equal to 100% of the principal amount of the Securities being redeemed, plus any accrued and unpaid interest to the Redemption Date.

(b) If the Redemption Date for any Security falls after a Record Date for the payment of interest and on or prior to the corresponding Interest Payment Date, the Company shall pay the full amount of accrued and unpaid interest payable on such Interest Payment Date to the holder of record at 5:00 p.m., New York City time, on such Record Date and the cash portion of the Redemption Price shall not include such accrued and unpaid interest.

Section 6.04. Selection of Securities to be Redeemed.

(a) If less than all the Securities are to be redeemed, the particular Securities to be redeemed shall be selected not more than 60 days prior to the Redemption Date by the Trustee, from the Outstanding Securities not previously called for redemption, by lot, on a pro rata basis or in accordance with such other method as the Trustee shall deem fair and appropriate; provided that the unredeemed portion of the principal amount of any Security shall be in a denomination (which shall not be less than the minimum authorized denomination) for such Security.

(b) The Trustee shall promptly notify the Company in writing of the Securities selected for partial redemption and the principal amount thereof to be redeemed. For all purposes of this Indenture, unless the context otherwise requires, all provisions relating to the redemption of Securities shall relate, in the case of any Security redeemed or to be redeemed only in part, to the portion of the principal amount of such Security that has been or is to be redeemed.

(c) If the Trustee selects a portion of a Holder’s Security for partial redemption and such Holder converts a portion of the same Security, the converted portion shall be deemed to be from the portion selected for redemption.

Section 6.05. Redemption Notice.

(a) Notice of redemption (a “Redemption Notice”) shall be given by first-class mail, postage prepaid, to each Holder of Securities to be redeemed, at the address of such Holder as it appears in the Securities Register.

(b) The Redemption Notice for any Securities to be redeemed shall state:

(i) the Redemption Date;

(ii) the Redemption Price or, if the Redemption Price cannot be calculated prior to the time the Redemption Notice is required to be sent, a statement of how the Redemption Price will be calculated;

(iii) if less than all Outstanding Securities are to be redeemed, the identification (and, in the case of partial redemption, the respective principal amounts) of the particular Securities to be redeemed;

(iv) that on the Redemption Date, the Redemption Price will become due and payable upon each such Security or portion thereof, and that interest thereon, if any, shall cease to accrue on and after said date; and

(v) the place or places where such Securities are to be surrendered for payment of the Redemption Price.

(c) A Redemption Notice shall be given by the Company or, at the Company’s request, by the Trustee in the name and at the expense of the Company; provided that the Company shall have delivered to the Trustee, at least five Business Days before the Redemption Notice is required to be mailed (or such shorter period agreed to by the Trustee), an Officers’ Certificate requesting that the Trustee give such notice and setting forth the complete form of such notice and the information to be stated in such notice.

(d) A Redemption Notice shall not be irrevocable.

(e) A Redemption Notice, if mailed in the manner herein provided, shall be conclusively presumed to have been duly given, whether or not the Holder receives such notice. In any case, a failure to give such Redemption Notice by mail or any defect in the Redemption Notice to the Holder of any Security designated for redemption as a whole or in part shall not affect the validity of the proceedings for the redemption of any other Security.

Section 6.06. Payment of Securities Called for Redemption.

(a) If any Redemption Notice has been given in respect of any Securities in accordance with Section 6.05, such Securities or portion of such Securities shall become due and payable on the Redemption Date at the place or places stated in the Redemption Notice and at the applicable Redemption Price. On presentation and surrender of such Securities at the place or places stated in the Redemption Notice, such Securities or the portions thereof specified in the Redemption Notice shall be paid and redeemed by the Company at the applicable Redemption Price.

(b) On or prior to 11:00 a.m., New York City time, on the Redemption Date, the Company shall deposit with the Paying Agent (or, if the Company is acting as its own Paying Agent, set aside, segregate and hold in trust) an amount of money and shares of Common Stock, if any, sufficient to pay the Redemption Price of all of the Securities to be redeemed on such Redemption Date. Subject to receipt of funds and Common Stock, if any, by the Paying Agent, payment for the Securities to be redeemed shall be made promptly after the later of:

(i) the Redemption Date for such Securities; and

(ii) the time of presentation of such Security to the Trustee (or other Paying Agent appointed by the Company) by the Holder thereof in the manner required by this Section 6.06.

The Paying Agent shall, promptly after such payment and upon written demand by the Company, return to the Company any funds in excess of the Redemption Price.

(c) If the Paying Agent holds money and, if applicable, shares of Common Stock sufficient to pay the Redemption Price for all the Securities or portions thereof that are to be redeemed as of the Business Day immediately following the Redemption Date, then on and after the Redemption Date (i) such Securities shall cease to be outstanding, (ii) interest shall cease to accrue on such Securities, and (iii) all other rights of the Holders of such Securities shall terminate (other than the right to receive the Redemption Price in respect of such

Securities), in each case, whether or not such Securities have been presented for redemption or the Securities have been delivered to the Paying Agent.

(d) Any cash amounts due upon redemption in respect of Securities presented for redemption shall be paid by the Company to such Holder, or such Holder’s nominee or nominees. In addition, the Company shall issue, or shall cause to be issued, any shares of Common Stock due upon redemption to such Holder, or such Holder’s nominee or nominees, certificates or a book-entry transfer through the Depositary (together with any cash in lieu of fractional shares).

(e) A Holder of Securities redeemed pursuant to Section 6.01 shall be deemed to be a holder of record of the shares of Common Stock, if any, issuable as a result of the redemption of such Securities as of the date such Holder presents such Securities for redemption or such Securities have been delivered to the Trustee or Paying Agent.

(f) Upon presentation of any Security redeemed in part only, the Company shall execute and, upon receipt of an Officer’s Certificate, the Trustee shall authenticate and deliver to the Holder thereof, at the expense of the Company, a new Security or Securities, of authorized denominations, in aggregate principal amount equal to the unredeemed portion of the Security so presented and having the same Issue Date, Stated Maturity and terms. If a Global Security is so surrendered, such new Security (subject to Section 2.08) will also be a new Global Security.

Section 6.07. Fractions of Shares.

(a) No fractional shares of Common Stock shall be issued upon redemption of any Security pursuant to Section 6.01.

(b) If more than one Security of the same Holder shall be called for redemption pursuant to Section 6.01 at one time, the number of full shares of Common Stock which shall be issuable upon redemption thereof shall be computed on the basis of the aggregate principal amount of the Securities (or specified portions thereof) so called.

(c) Instead of any fractional share of Common Stock that would otherwise be issuable upon redemption of any Securities (or specified portions thereof), the Company shall calculate and pay a cash adjustment in respect of such fraction (calculated to the nearest 1/100th of a share) in an amount equal to the same fraction of the Average Redemption VWAP for such Securities.

Section 6.08. Restrictions On Redemption.

The Company may not redeem any Security on any date if the principal amount of the Securities has been accelerated in accordance with the terms of this Indenture, and such acceleration has not been rescinded on or prior to such date.

ARTICLE 7

EVENTS OF DEFAULT; REMEDIES

Section 7.01. Events of Default.

An “Event of Default” means any one of the following events with respect to the Securities (whatever the reason for such event or whether it shall be voluntary or involuntary or be effected by operation of law or pursuant to any judgment, decree or order of any court or any order, rule or regulation of any administrative or governmental body):

(a) default in any payment of interest on any Security when due and payable and the default continues for a period of 30 days; or

(b) default in the payment of principal of any Security when due and payable at the Stated Maturity Date, upon redemption, upon required repurchase, upon acceleration or otherwise; or

(c) failure by the Company to comply with its obligation to convert the Securities into cash and, if applicable, shares of Common Stock upon exercise of a Holder’s conversion right and such failure continues for five days; or

(d) failure by the Company to comply with its obligations under Article 8; or

(e) default in the performance, or breach of any covenant or agreement by the Company under this Indenture (other than a covenant or agreement otherwise described as a separate “Event of Default” hereunder) and continuance of such default or breach by the Company for 60 days after written notice (a “Notice of Default”) has been given, by registered or certified mail, to the Company from the Trustee or to the Company and the Trustee from the Holders of at least 25% principal amount of the Securities then Outstanding, which written notice shall specify such default or breach and requiring it to be remedied and stating that such notice is a “Notice of Default” under this Indenture; or

(f) failure by the Company to comply with its obligation to issue a Fundamental Change Repurchase Right Notice in accordance with Section 4.01, or to comply with its notice obligations under Section 5.01(e) or Section 5.03(b); or

(g) failure by the Company or any of its Subsidiaries to make any payment by the end of the applicable grace period, if any, after the maturity date or required repurchase date of any indebtedness for borrowed money where the aggregate principal amount to which such failure relates is more than $25 million, or acceleration of any indebtedness for borrowed money due to a default with respect to such indebtedness where the aggregate principal amount accelerated is more than $25 million and such indebtedness is not discharged or such acceleration is not cured, waived, rescinded or annulled, in either case, for a period of 30 days after written notice to the Company by the Trustee or to the Company and the Trustee by holders of at least 25% in aggregate principal amount of the notes then outstanding; or

(h) one or more judgments or orders for the payment of money are entered against the Company or any of its Subsidiaries in an aggregate uninsured amount exceeding $25 million that are not vacated, discharged, stayed or bonded pending appeal within 60 days; or

(i) the Company or any Significant Subsidiary of the Company, pursuant to or within the meaning of any Bankruptcy Law:

(i) commences a voluntary case; or

(ii) consents to the entry of an order for relief against the Company or such Significant Subsidiary in an involuntary case, as the case may be; or

(iii) consents to the appointment of a Bankruptcy Custodian of the Company or such Significant Subsidiary, or of all or substantially all of the property of the Company or such Significant Subsidiary, as the case may be; or

(iv) makes a general assignment for the benefit of creditors of the Company or such Significant Subsidiary, as the case may be; or

(j) a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that:

(i) is for relief against the Company or a Significant Subsidiary of the Company in an involuntary case; or

(ii) appoints a Bankruptcy Custodian of the Company or a Significant Subsidiary of the Company, or of all or substantially all of the property of the Company or a Significant Subsidiary of the Company; or

(iii) orders the liquidation of the Company or a Significant Subsidiary of the Company and the order or decree remains unstayed and in effect for 60 days.

Section 7.02. Acceleration of Maturity; Rescission and Annulment.

(a) If an Event of Default (other than an Event of Default specified in Section 7.01(i) or Section 7.01(j)) occurs and is continuing, then in every such case (except as provided in the immediately following paragraph) the Trustee or the Holders of not less than 25% in principal amount of the Outstanding Securities may declare the principal of all such Securities to be due and payable immediately, by a notice in writing to the Company (and to the Trustee if given by the Holders), and upon any such declaration such principal shall become immediately due and payable.

(b) If an Event of Default specified in Section 7.01(i) or Section 7.01(j) occurs, the principal of, and accrued interest on, all of the Securities shall become immediately due and payable without any declaration or other Act of the Holders or any act on the part of the Trustee.

(c) At any time following an Event of Default and after such a declaration of acceleration has been made, the Holders of a majority in aggregate principal amount of the Outstanding Securities, by written notice to the Company and the Trustee, may rescind and annul such declaration and its consequences (other than with respect to an Event of Default under Sections 7.01(a), Section 7.01(b), Section 7.01(c), Section 7.01(i) or Section 7.01(j)) if:

(i) such rescission and annulment will not conflict with any judgment or decree of a court of competent jurisdiction; and

(ii) all Events of Default, other than the non-payment of the principal amount plus accrued and unpaid interest on Securities that have become due solely by such declaration of acceleration, have been cured or waived as provided in Section 7.13.

No such rescission shall affect any subsequent default or impair any right consequent thereon.

Section 7.03. Default Additional Interest.

(a) Notwithstanding Section 7.02, if the Company so elects, the sole remedy of Holders for an Event of Default specified in Section 7.01(e) relating to the failure by the Company to comply with its obligations under Section 10.03 shall, for the first 365 days after the occurrence of such an Event of Default (which shall be the 60th day after written notice is provided to the Company in accordance with Section 7.01(e)) consist exclusively of the right to receive

additional interest (“Default Additional Interest”) at an annual rate equal to 0.25% per annum of the principal amount of the Outstanding Securities for each day of such 365-day period during which time such Event of Default continues. The Company may elect to pay Default Additional Interest as the sole remedy under this Section 7.03(a) by giving notice to the Holders, the Trustee and Paying Agent of such election on or before the close of business on the date on which such Event of Default occurs. If the Company fails to timely give such notice or pay Default Additional Interest, the Securities will be immediately subject to acceleration as provided in Section 7.02. If such Event of Default has not been cured or waived prior to the 366th day after its occurrence, then the Securities shall be subject to acceleration in accordance with Section 7.02.

(b) Default Additional Interest shall be payable on all Outstanding Securities from and including the date on which the relevant Event of Default under Section 7.01(e) first occurs. Default Additional Interest shall be payable in arrears on each Interest Payment Date following the occurrence of such Event of Default in the same manner as regular interest on the Securities.

(c) If Default Additional Interest is payable under this Section 7.03, the Company shall deliver to the Trustee a certificate to that effect stating that Default Additional Interest is payable and the date upon which such Default Additional Interest shall begin to accrue. Unless and until a Responsible Officer of the Trustee receives at the Corporate Trust Office such a certificate, the Trustee may assume without inquiry that Default Additional Interest is not payable. If Default Additional Interest has been paid by the Company directly to the Persons entitled to it, the Company shall deliver to the Trustee a certificate setting forth the particulars of such payment.

Section 7.04. Collection of Indebtedness and Enforcement by Trustee.

(a) The Company covenants that if a Default is made in the payment of the principal amount and accrued and unpaid interest at the Maturity thereof or in the payment of the Fundamental Change Repurchase Price in respect of any Security, the Company shall, upon demand of the Trustee, pay to it, for the benefit of the Holders of such Securities, the whole amount then due and payable on such Securities, and, in addition thereto, such further amounts required pursuant to Section 7.08.

(b) If an Event of Default occurs and is continuing, the Trustee may, but shall not be obligated to, pursue any available remedy to collect the payment of the principal amount, plus accrued but unpaid interest on the Securities or to enforce the performance of any provision of the Securities or this Indenture. The Trustee may maintain a proceeding even if the Trustee does not possess any of the Securities or does not produce any of the Securities in the proceeding. A delay or omission by the Trustee or any Holder in exercising any right or remedy accruing

upon an Event of Default shall not impair the right or remedy or constitute a waiver of, or acquiescence in, the Event of Default. No remedy is exclusive of any other remedy. All available remedies are cumulative.

Section 7.05. Trustee May File Proofs of Claim.

(a) In case of any judicial proceeding relative to the Company (or any other obligor upon the Securities), its property or its creditors, the Trustee shall be entitled and empowered, by intervention in such proceeding or otherwise, to take any and all actions authorized under the Trust Indenture Act in order to have claims of the Holders and the Trustee allowed in any such proceeding. In particular, the Trustee shall be authorized to collect and receive any moneys or other property payable or deliverable on any such claims and to distribute the same; and any custodian, receiver, assignee, trustee, liquidator, sequestrator or other similar official in any such judicial proceeding is hereby authorized by each Holder to make such payments to the Trustee and, in the event that the Trustee shall consent to the making of such payments directly to the Holders, to pay to the Trustee any amount due it for the reasonable compensation, expenses, disbursements and advances of the Trustee, its agents and counsel and any other amounts due the Trustee under Section 9.07.

(b) No provision of this Indenture shall be deemed to authorize the Trustee to authorize or consent to or accept or adopt on behalf of any Holder any plan of reorganization, arrangement, adjustment or composition affecting the Securities or the rights of any Holder thereof or to authorize the Trustee to vote in respect of the claim of any Holder in any such proceeding.

Section 7.06. Application of Money Collected. Any money collected by the Trustee pursuant to this Article shall be applied in the following order, at the date or dates fixed by the Trustee and, in case of the distribution of such money to Holders, upon presentation of the Securities and the notation thereon of the payment if only partially paid and upon surrender thereof if fully paid:

FIRST: To the payment of all amounts due the Trustee under Section 9.07;

SECOND: To the payment of the amounts then due and unpaid on the Securities for the principal amount, Fundamental Change Repurchase Price, Redemption Price or interest, as the case may be, in respect of which or for the benefit of which such money has been collected, ratably, without preference or priority of any kind, according to the amounts due and payable on such Securities; and

THIRD: To the payment of the remainder, if any, to the Company or any other Person lawfully entitled thereto.

Section 7.07. Limitation on Suits.

No Holder of any Security shall have any right to institute any proceeding, judicial or otherwise, with respect to this Indenture, or for the appointment of a receiver or trustee, or for any other remedy hereunder (other than in the case of an Event of Default specified in Section 7.01(a), Section 7.01(b) or Section 7.01(c)), unless:

(a) such Holder has previously given written notice to the Trustee of a continuing Event of Default;

(b) the Holders of at least 25% in aggregate principal amount of the Outstanding Securities shall have made written request to the Trustee to pursue such remedy in its own name as Trustee hereunder;

(c) such Holder or Holders have provided to the Trustee security or indemnity reasonably satisfactory to the Trustee against the expenses, losses and liabilities to be incurred in compliance with such request;

(d) the Trustee, for 60 days after its receipt of such notice, request and provision of adequate security or indemnity, has failed to institute any such proceeding; and

(e) no direction, in the opinion of the Trustee, inconsistent with such written request has been given to the Trustee during such 60-day period by the Holders of a majority in aggregate principal amount of the Outstanding Securities,

it being understood and intended that no one or more Holders shall have any right in any manner whatever by virtue of, or by availing itself of, any provision of this Indenture to affect, disturb or prejudice the rights of any other Holders, or to obtain or to seek to obtain priority or preference over any other Holders or to enforce any right under this Indenture, except in the manner herein provided and for the equal and ratable benefit of all the Holders.

Section 7.08 . Unconditional Right of Holders To Receive Payment.

Notwithstanding any other provision of this Indenture, the right of any Holder to receive payment of the principal amount, Fundamental Change Repurchase Price, Redemption Price or accrued and unpaid interest in respect of the Securities held by such Holder, on or after the respective due dates expressed in the Securities or any Fundamental Change Repurchase Date, as applicable, and to convert the Securities in accordance with Article 5, or to bring suit for the enforcement of any such payment on or after such respective dates or the right to convert, shall not be impaired or affected adversely without the consent of such Holder.

Section 7.09. Restoration of Rights and Remedies. If the Trustee or any Holder has instituted any proceeding to enforce any right or remedy under this

Indenture and such proceeding has been discontinued or abandoned for any reason, or has been determined adversely to the Trustee or to such Holder, then and in every such case, subject to any determination in such proceeding, the Company, the Trustee and the Holders shall be restored severally and respectively to their former positions hereunder and thereafter all rights and remedies of the Trustee and the Holders shall continue as though no such proceeding had been instituted.

Section 7.10. Rights and Remedies Cumulative. Except as otherwise provided with respect to the replacement or payment of mutilated, destroyed, lost or stolen Securities in the last paragraph of Section 2.12, no right or remedy herein conferred upon or reserved to the Trustee or to the Holders is intended to be exclusive of any other right or remedy, and every right and remedy shall, to the extent permitted by law, be cumulative and in addition to every other right and remedy given hereunder or now or hereafter existing at law or in equity or otherwise. The assertion or employment of any right or remedy hereunder shall not prevent the concurrent assertion or employment of any other appropriate right or remedy.

Section 7.11. Delay or Omission Not Waiver. No delay or omission of the Trustee or of any Holder of any Security to exercise any right or remedy accruing upon any Event of Default shall impair any such right or remedy or constitute a waiver of any such Event of Default or an acquiescence therein. Every right and remedy given by this Article or by law to the Trustee or to the Holders may be exercised from time to time, and as often as may be deemed expedient, by the Trustee or by the Holders, as the case may be.

Section 7.12. Control by Holders. The Holders of a majority in principal amount of the Outstanding Securities shall have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Trustee or exercising any trust or power conferred on the Trustee, provided that:

(i) such direction shall not be in conflict with any rule of law or with this Indenture; and

(ii) the Trustee may refuse to follow any such direction that the Trustee determines is unduly prejudicial to the rights of any other Holder or that would involve the Trustee in personal liability.

Section 7.13. Waiver of Past Defaults.

(a) The Holders of not less than a majority in principal amount of the Outstanding Securities may on behalf of the Holders of all the Securities waive any past Default hereunder and its consequences, except a Default:

(i) described in Section 7.01(a), Section 7.01(b), Section 7.01(c), Section 7.01(i) or Section 7.01(j); or

(ii) in respect of a covenant or provision hereof which under Section 12.03 cannot be modified or amended without the consent of the Holder of each Outstanding Security affected.

(b) Upon any such waiver, such Default shall cease to exist, and any Event of Default arising therefrom shall be deemed to have been cured, for every purpose of this Indenture, but no such waiver shall extend to any subsequent or other Default or impair any right consequent thereon.

Section 7.14. Undertaking for Costs. In any suit for the enforcement of any right or remedy under this Indenture or in any suit against the Trustee for any action taken or omitted by it as Trustee, in either case in respect of the Securities, a court may require any party litigant in such suit to file an undertaking to pay the costs of the suit, and the court may assess reasonable costs, including reasonable attorney’s fees and expenses, against any party litigant in the suit having due regard to the merits and good faith of the claims or defenses made by the party litigant; but the provisions of this Section 7.14 shall not apply to any suit instituted by the Company, to any suit instituted by the Trustee, to any suit instituted by any Holder, or group of Holders, holding in the aggregate more than 10% in principal amount of the Outstanding Securities, or to any suit instituted by any Holder for the enforcement of the payment of the principal amount on any Security on or after Maturity of such Security or the Fundamental Change Repurchase Price.

Section 7.15. Waiver of Stay or Extension Laws. The Company covenants (to the extent that it may lawfully do so) that it will not at any time insist upon, or plead, or in any manner whatsoever claim or take the benefit or advantage of, any stay, extension or usury law or other law which would prohibit or forgive the Company from paying all or any portion of the principal of or interest on the Securities as contemplated herein, wherever enacted, now or at any time hereafter in force, or which may affect the covenants or the performance of this Indenture; and the Company (to the extent that it may lawfully do so) hereby expressly waives all benefit or advantage of any such law and covenants that it will not hinder, delay or impede the execution of any power herein granted to the Trustee, but will suffer and permit the execution of every such power as though no such law had been enacted.

Section 7.16. Violations of Certain Covenants. A violation of any covenant or agreement in this Indenture that expressly provides that a violation of such covenant or agreement shall not constitute an Event of Default may only be enforced by the Trustee by instituting a legal proceeding against the Company for enforcement of such covenant or agreement.

ARTICLE 8

CONSOLIDATION, MERGER, CONVEYANCE, TRANSFER OR LEASE

Section 8.01. Company May Consolidate, Etc., Only on Certain Terms.

(a) The Company shall not consolidate with or merge with or into any other Person or, transfer all or substantially all its assets to another Person (excluding a pledge of securities issued by any of the Company’s subsidiaries), unless:

(i) the resulting, surviving or transferee person (the “Successor Company”) assumes by supplemental indenture all of the Company’s obligations under the Securities and this Indenture;

(ii) immediately after giving effect to such transaction, no Default or Event of Default shall have occurred and be continuing;

(iii) if the Securities become convertible into common stock or other securities issued by a Person other than the Successor Company as a result of such transaction, such Person shall fully and unconditionally guarantee all obligations of the Successor Company under the Securities and this Indenture; and

(iv) the Company shall have delivered to the Trustee an Officers’ Certificate and an Opinion of Counsel, each stating that such consolidation, merger or transfer and, if a supplemental indenture is required in connection with such transaction, such supplemental indenture, comply with this Article 8.

(b) For purposes of the foregoing, the transfer (by assignment, sale or otherwise) of the properties and assets of one or more Subsidiaries (other than to the Company or another Subsidiary), which, if such assets were owned by the Company, would constitute all or substantially all of the properties and assets of the Company and its Subsidiaries, taken as a whole, shall be deemed to be the transfer of all or substantially all of the properties and assets of the Company.

Section 8.02. Foreign Jurisdiction Transactions. If the Successor Company in any merger, consolidation, or transfer is not organized and existing under the laws of the United States, any state thereof or the District of Columbia (any such merger, consolidation or transfer, a “Foreign Jurisdiction Transaction”), then in addition to the conditions set forth in Section 8.01, the Company shall also deliver to the Trustee:

(a) an Opinion of Counsel to the effect that the Holders will not recognize income, gain or loss for United States Federal income tax purposes as a result of such transaction and will be subject to United States Federal income tax

on the same amounts and at the same times as would have been the case if such transaction had not occurred; and

(b) an Opinion of Counsel in the jurisdiction of the Successor Company to the effect that:

(i) any payment of interest, principal, or any other payment or amount delivered under the Securities under or with respect to the Securities will, after giving effect to such transaction, be exempt from any withholding or deduction for or on account of any present or future tax, duty, levy, impost, assessment or other governmental charge of whatever nature imposed or levied by or on behalf of any jurisdiction from or through which payment is made or in which the payor is organized, resident or engaged in business for tax purposes; and

(ii) no transfer taxes, stamp taxes, or taxes on income (including capital gains) will be payable by a Holder of Securities under the laws of any jurisdiction where the Successor Company is or becomes organized, resident or engaged in business for tax purposes in respect of the acquisition, ownership or disposition of the Securities, including the receipt of interest or principal thereon, provided that such Holder does not use or hold, and is not deemed to use or hold the Securities in carrying on a business in the jurisdiction where the Successor Company is or becomes organized, resident or engaged in business for tax purposes, provided that the Holder will not be deemed to use or hold the Securities in carrying on a business in such jurisdiction solely as a result of the Holder’s ownership of the Securities.

Section 8.03. Effectiveness of Consolidation, Merger or Transfer.

(a) Upon satisfaction of all applicable conditions in Section 8.01 and Section 8.02, all such obligations of the Company or such other predecessor corporation shall be terminated.

(b) The Successor Company formed by such consolidation or into which the Company is merged or the Successor Company to which such conveyance, transfer, lease or other disposition is made shall succeed to, and be substituted for, and may exercise every right and power of, the Company under this Indenture with the same effect as if such successor had been named as the Company herein; and thereafter, except in the case of a conveyance, transfer or lease of all or substantially all the Company’s assets (in which case the Company will not be discharged from the obligation to pay the principal amount of the Securities and interest, including any Additional Interest) and except for obligations, if any, that the Company may have under a supplemental indenture, the Company shall be discharged from all obligations and covenants under this

Indenture and the Securities. Subject to Section 12.04, the Company, the Trustee and the Successor Company shall enter into a supplemental indenture to evidence the succession and substitution of such Successor Company and such discharge and release of the Company.

ARTICLE 9

THE TRUSTEE

Section 9.01. Duties and Responsibilities of Trustee.

(a) The Trustee, prior to the occurrence of an Event of Default and after the curing of all Events of Default which may have occurred, undertakes to perform such duties and only such duties as are specifically set forth in this Indenture and no implied covenants or obligations shall be read into this Indenture against the Trustee. If an Event of Default has occurred and is continuing, the Trustee shall exercise such of the rights and powers vested in it by this Indenture, and use the same degree of care and skill in their exercise, as a prudent person would exercise or use under the circumstances in the conduct of his or her own affairs.

(b) No provision of this Indenture shall be construed to relieve the Trustee from liability for its own negligent action, its own negligent failure to act or its own willful misconduct, except that:

(i) prior to the occurrence of an Event of Default and after the curing or waiving of all Events of Default which may have occurred:

(A) the duties and obligations of the Trustee shall be determined solely by the express provisions of this Indenture, and the Trustee shall not be liable except for the performance of such duties and obligations as are specifically set forth in this Indenture and no implied covenants or obligations shall be read into this Indenture against the Trustee; and

(B) in the absence of bad faith and willful misconduct on the part of the Trustee, the Trustee may conclusively rely as to the truth and accuracy of the statements and the correctness of the opinions expressed therein, upon any certificates or opinions furnished to the Trustee and conforming to the requirements of this Indenture; but, in the case of any such certificates or opinions which by any provisions hereof are specifically required to be furnished to the Trustee, the Trustee shall be under a duty to examine the same to determine whether or not they conform to the requirements of this Indenture (but need not confirm or

investigate, and shall not be responsible for, the accuracy of any mathematical calculations or other facts stated therein);

(ii) the Trustee shall not be liable for any error of judgment made in good faith by a Responsible Officer or Officers of the Trustee, unless the Trustee was negligent in ascertaining the pertinent facts;

(iii) the Trustee shall not be liable with respect to any action taken or omitted to be taken by it in good faith in accordance with the written direction of the Holders of not less than a majority in principal amount of the Securities at the time Outstanding in accordance with Section 1.05 relating to the time, method and place of conducting any proceeding for any remedy available to the Trustee, or exercising any trust or power conferred upon the Trustee, under this Indenture;

(iv) whether or not therein provided, every provision of this Indenture relating to the conduct or affecting the liability of, or affording protection to, the Trustee shall be subject to the provisions of this Section 9.01;

(v) the Trustee shall not be liable in respect of any payment (as to the correctness of amount, entitlement to receive or any other matters relating to payment) or notice effected by the Company or any other Paying Agent or any records maintained by the Security Registrar with respect to the Securities; and

(vi) if any party fails to deliver a notice relating to an event the fact of which, pursuant to this Indenture, requires notice to be sent to the Trustee, the Trustee may conclusively rely on its failure to receive such notice as reason to act as if no such event occurred.

(c) None of the provisions contained in this Indenture shall require the Trustee to expend or risk its own funds or otherwise incur personal financial liability in the performance of any of its duties or in the exercise of any of its rights or powers, if there is reasonable ground for believing that the repayment of such funds or adequate indemnity against such risk or liability is not reasonably assured to it.

Section 9.02. Notice of Defaults.

(a) If a Default occurs and is continuing and is actually known to a Responsible Officer of the Trustee, the Trustee shall give the Holders notice of thereof within 90 days after it occurs, unless such Default has been cured or waived.

(b) Notwithstanding Section 9.02(a), the Trustee shall be protected in withholding notice of a Default, except in the case of any Default in the payment of principal amount or interest on any of the Securities or Fundamental Change Repurchase Price, if and so long as the Board of Directors or a committee of Responsible Officers of the Trustee in good faith determines that the withholding of such notice is in the interest of the Holders of Securities.

Section 9.03. Reliance on Documents, Opinions, Etc. Except as otherwise provided in Section 9.01:

(a) the Trustee may conclusively rely and shall be protected in acting upon any resolution, certificate, statement, instrument, opinion, report, notice, request, consent, order, bond, debenture, note, coupon or other paper or document (whether in its original or facsimile form) believed by it in good faith to be genuine and to have been signed or presented by the proper party or parties;

(b) any request, direction, order or demand of the Company mentioned herein shall be sufficiently evidenced by an Officers’ Certificate (unless other evidence in respect thereof be herein specifically prescribed), and any resolution of the Board of Directors may be evidenced to the Trustee by a copy thereof certified by the Secretary or an Assistant Secretary of the Company;

(c) the Trustee may consult with counsel of its own selection and any advice or Opinion of Counsel shall be full and complete authorization and protection in respect of any action taken or omitted by it hereunder in good faith and in accordance with such advice or Opinion of Counsel;

(d) the Trustee shall be under no obligation to exercise any of the rights or powers vested in it by this Indenture at the request, order or direction of any of the Holders pursuant to the provisions of this Indenture, unless such Holders shall have provided to the Trustee security or indemnity reasonably satisfactory to the Trustee against the costs, expenses and liabilities which may be incurred therein or thereby;

(e) the Trustee shall not be bound to make any investigation into the facts or matters stated in any resolution, certificate, statement, instrument, opinion, report, notice, request, direction, consent, order, bond, debenture or other paper or document, but the Trustee, in its discretion, may make such further inquiry or investigation into such facts or matters as it may see fit, and, if the Trustee shall determine to make such further inquiry or investigation, it shall be entitled to examine the books, records and premises of the Company, personally or by agent or attorney (at the reasonable expense of the Company and the Trustee shall incur no liability of any kind by reason of such inquiry or investigation);

(f) the Trustee shall be under no obligation to review, ascertain or confirm the Company’s compliance with, or breach of, any representation, warranty or covenant made in this Indenture;

(g) the Trustee may execute any of the trusts or powers hereunder or perform any duties hereunder either directly or by or through agents or attorneys and the Trustee shall not be responsible for any misconduct or negligence on the part of any agent or attorney appointed by it with due care hereunder;

(h) the Trustee shall not be liable for any action taken, suffered, or omitted to be taken by it in good faith and reasonably believed by it to be authorized or within the discretion or rights or powers conferred upon it by this Indenture;

(i) in no event shall the Trustee be responsible or liable for special, indirect, or consequential loss or damage of any kind whatsoever (including, but not limited to, loss of profit) irrespective of whether the Trustee has been advised of the likelihood of such loss or damage and regardless of the form of action;

(j) the Trustee shall not be deemed to have notice of any Default or Event of Default unless a Responsible Officer of the Trustee has actual knowledge thereof or unless written notice of any event which is in fact such a default is received by the Trustee at the Corporate Trust Office of the Trustee, and such notice references the Securities and the Indenture;

(k) the rights, privileges, protections, immunities and benefits given to the Trustee, including, without limitation, its right to be indemnified, are extended to, and shall be enforceable by, the Trustee in each of its capacities hereunder, and each agent, custodian and other Person employed to act hereunder;

(l) the Trustee may request that the Company deliver a certificate setting forth the names of individuals and/or titles of officers authorized at such time to take specified actions pursuant to this Indenture;

(m) the Trustee shall not be required to give any bond or surety in respect of performance of its powers and duties under this Indenture; and

(n) the permissive rights of the Trustee to do things enumerated in this Indenture shall not be construed as duties.

Section 9.04. No Responsibility for Recitals, Etc. The recitals contained herein and in the Securities (except in the Trustee’s certificate of authentication) shall be taken as the statements of the Company, and the Trustee or any authenticating agent assumes no responsibility for the correctness of the same. The Trustee makes no representations as to the validity or sufficiency of this Indenture or of the Securities. The Trustee or any authenticating agent shall not

be accountable for the use or application by the Company of any Securities or the proceeds of any Securities authenticated and delivered by the Trustee or any authenticating agent in conformity with the provisions of this Indenture.

Section 9.05. Trustee, Security Registrar and Agents May Own Securities.

The Trustee, any Paying Agent, any Conversion Agent or Security Registrar, in its individual or any other capacity, may become the owner or pledgee of Securities with the same rights it would have if it were not Trustee, Paying Agent, Conversion Agent or Security Registrar.

Section 9.06. Monies To Be Held in Trust. Subject to the provisions of Section 11.04, all monies and properties received by the Trustee shall, until used or applied as herein provided, be held in trust for the purposes for which they were received. Money held by the Trustee in trust hereunder need not be segregated from other funds except to the extent required by law. The Trustee shall have no liability for interest on any money received by it hereunder except as may be agreed in writing from time to time by the Company and the Trustee.

Section 9.07. Compensation and Expenses of Trustee.

(a) The Company shall pay to the Trustee from time to time, and the Trustee shall be entitled to, reasonable compensation for all services rendered by it hereunder in any capacity (which shall not be limited by any provision of law in regard to the compensation of a trustee of an express trust) as mutually agreed to from time to time in writing between the Company and the Trustee, and the Company will pay or reimburse the Trustee upon its request for all reasonable out-of-pocket expenses, disbursements and advances reasonably incurred or made by the Trustee in accordance with any of the provisions of this Indenture (including the reasonable compensation and the expenses and disbursements of its counsel and of all Persons not regularly in its employ) except any such expense, disbursement or advance as may arise from its gross negligence, willful misconduct or bad faith.

(b) The Company shall indemnify the Trustee or any predecessor Trustee (and all officers, directors and employees of the Trustee or any predecessor Trustee), in any capacity under this Indenture and its agents and any authenticating agent for, and to hold each of them harmless against, any and all loss, damage, liability, claim or expense, including taxes (other than taxes based upon, measured by or determined by the income of the Trustee) incurred without negligence, willful misconduct or bad faith on the part of the Trustee or such officer(s), director(s), employee(s) and agent(s) or authenticating agent, as the case may be, and arising out of or in connection with the acceptance or administration of this trust or in any other capacity hereunder, including the costs and expenses of defending themselves against any claim of liability in the premises.

(c) The obligations of the Company under this Section 9.07 to compensate or indemnify the Trustee and to pay or reimburse the Trustee for expenses, disbursements and advances shall be secured by a lien prior to that of the Securities upon all property and funds held or collected by the Trustee as such, except funds held in trust for the benefit of the Holders of particular Securities. The obligation of the Company under this Section 9.07 shall survive the satisfaction and discharge of this Indenture and the resignation or removal of the Trustee.

(d) When the Trustee and its agents and any authenticating agent incur expenses or render services after an Event of Default specified in Section 7.01(i) or Section 7.01(j) with respect to the Company occurs, the expenses and the compensation for the services are intended to constitute expenses of administration under any Bankruptcy Law.

Section 9.08. Officers’ Certificate as Evidence. Except as otherwise provided in Section 9.01, whenever in the administration of the provisions of this Indenture the Trustee shall deem it necessary or desirable that a matter be proved or established prior to taking or omitting any action hereunder, such matter (unless other evidence in respect thereof be herein specifically prescribed) may, in the absence of negligence or willful misconduct on the part of the Trustee, be deemed to be conclusively proved and established by an Officers’ Certificate delivered to the Trustee.

Section 9.09. Conflicting Interests of Trustee. If the Trustee has or shall acquire a conflicting interest within the meaning of the Trust Indenture Act, the Trustee shall either eliminate such interest or resign, to the extent and in the manner provided by, and subject to the provisions of, the Trust Indenture Act and this Indenture.

Section 9.10. Eligibility of Trustee. There shall at all times be a Trustee hereunder which shall be a Person that is eligible pursuant to the Trust Indenture Act to act as such and has a combined capital and surplus of at least $50,000,000 (or if such Person is a member of a bank holding company system, its bank holding company shall have a combined capital and surplus of at least $50,000,000). If such Person publishes reports of condition at least annually, pursuant to law or to the requirements of any supervising or examining authority, then for the purposes of this Section 9.10 the combined capital and surplus of such Person shall be deemed to be its combined capital and surplus as set forth in its most recent report of condition so published. If at any time the Trustee shall cease to be eligible in accordance with the provisions of this Section 9.10, it shall resign immediately in the manner and with the effect hereinafter specified in this Article.

Section 9.11. Resignation or Removal of Trustee.