PROXY STATEMENT OF THE COMPANY

Exhibit (a)-(1)

February 23, 2016

Shareholders of Homeinns Hotel Group

Re: Notice of Extraordinary General Meeting of Shareholders

Dear Shareholder:

You are cordially invited to attend an extraordinary general meeting of shareholders of Homeinns Hotel Group, an exempted company with limited liability incorporated under the laws of the Cayman Islands (the “Company”), to be held on March 25, 2016 at 10:00 a.m. (local time). The meeting will be held at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China. The accompanying notice of the extraordinary general meeting and proxy statement provide information regarding the matters to be acted on at the extraordinary general meeting, including at any adjournment or postponement thereof.

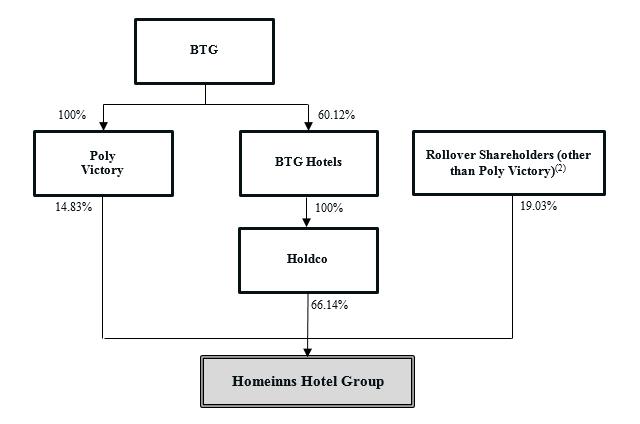

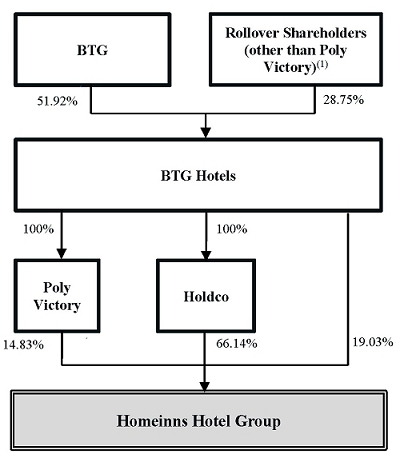

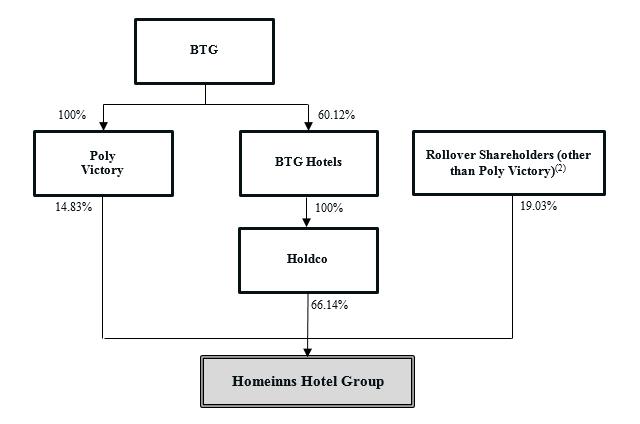

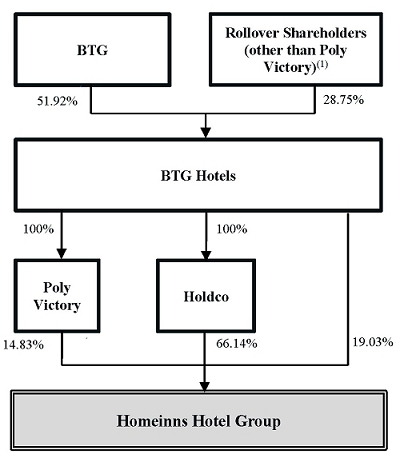

The Company entered into the Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 6, 2015, with BTG Hotels Group (HONGKONG) Holdings Co., Limited (“Holdco”), a wholly owned subsidiary of BTG Hotels (Group) Co., Ltd., a PRC joint stock company that is listed on the Shanghai Stock Exchange and principally engaged in the management of hotels and tourism destinations (“BTG Hotels” or “Parent”), BTG Hotels Group (CAYMAN) Holding Co., Ltd (“Merger Sub”), a wholly owned subsidiary of Holdco, and solely for the purposes of certain sections thereof, BTG Hotels. Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Company (the “Merger”), with the Company continuing as the surviving company (the “surviving company”). Pursuant to the Merger Agreement, the Company will be acquired by BTG Hotels and, following the closing of the Merger, beneficially owned by BTG Hotels and the Rollover Shareholders described below, each of which is an existing shareholder, director and/or officer of the Company or an affiliate of the foregoing, as applicable. The purpose of the extraordinary general meeting is for you and the other shareholders of the Company to consider and vote upon, among other proposals, a proposal to authorize and approve the Merger Agreement, the plan of merger required to be filed with the Registrar of Companies of the Cayman Islands (the “Cayman Registrar”) in connection with the Merger (the “Plan of Merger”), and the transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the “Transactions”), including the Merger. Copies of the Merger Agreement and the Plan of Merger are attached as Annex A and Annex B, respectively, to the accompanying proxy statement.

Merger Sub and Holdco were formed solely for the purpose of the Merger. BTG Hotels is the sole shareholder of Holdco. If the Merger is completed, the Company will continue its operations as a privately held company and will be beneficially owned by Holdco and Poly Victory Investments Limited, a company organized and existing under the laws of the British Virgin Islands (“Poly Victory”), which is wholly owned and controlled by Beijing Tourism Group Co., Ltd., a company organized and existing under the laws of the PRC (“BTG”), Ctrip Travel Information Technology (Shanghai) Co., Ltd., a limited liability company established and existing under the laws of the People’s Republic of China (the “PRC”) (“Ctrip Shanghai”), Neil Nanpeng Shen, co-founder, co-chairman of the board of directors, and an independent director of the Company (“Mr. Shen”), Smart Master International Limited, a company organized and existing under the laws of the British Virgin Islands owned and controlled by Mr. Shen and his spouse (“Smart Master”), Mr. David Jian Sun, the chief executive officer and a director of the Company (“Mr. Sun”), Peace Unity Investments Limited, a company organized and existing under the laws of the British Virgin Islands indirectly owned and controlled by Mr. Sun (“Peace Unity”), Jason Xiangxin Zong, the chief operating officer of the Company (“Mr. Zong”), and Wise Kingdom Group Limited, a company organized and existing under the laws of the British Virgin Islands wholly owned and controlled by Ms. Chung Lau (“Ms. Lau”), the spouse of Mr. James Jianzhang Liang, co-founder and independent director of the Company (“Mr. Liang”) (“Wise Kingdom”, together with Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, and Mr. Zong, the “Rollover Shareholders”). As of the date of the accompanying proxy statement, the Rollover Shareholders collectively beneficially own approximately 34.5% of the Company’s issued and outstanding ordinary shares, par value US$0.005 per share (each, a “Share”) (excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company). As the result of the Merger, the Company’s American depositary shares (“ADSs”), each representing two Shares, will no longer be listed on the NASDAQ Global Market (“NASDAQ”) and the American depositary shares program (“ADS program”) for the Shares will terminate.

If the Merger is completed, each Share issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), other than the Rollover Shares, the Excluded Shares, and the Dissenting Shares, each as described below, will be cancelled and cease to exist and will be converted into and exchanged for the right to receive US$17.90 per Share and each ADS issued and outstanding immediately prior to the Effective Time, other than ADSs representing Rollover Shares or Excluded Shares, will represent the right to surrender the ADS in exchange for US$35.80 per ADS (less cancellation fees of US$0.05 per ADS pursuant to the terms of the Deposit Agreement, dated as of October 31, 2006, among the Company, The Bank of New York Mellon, in its capacity as the ADS depositary (the “ADS Depositary”), and the holders and beneficial owners of ADSs issued thereunder (the “Deposit Agreement”)), in each case, in cash, without interest and net of any applicable withholding taxes. If the Merger is completed, the following Shares (including Shares represented by ADSs) will be cancelled and cease to exist at the Effective Time but will not be converted into the right to receive the consideration described in the immediately preceding sentence:

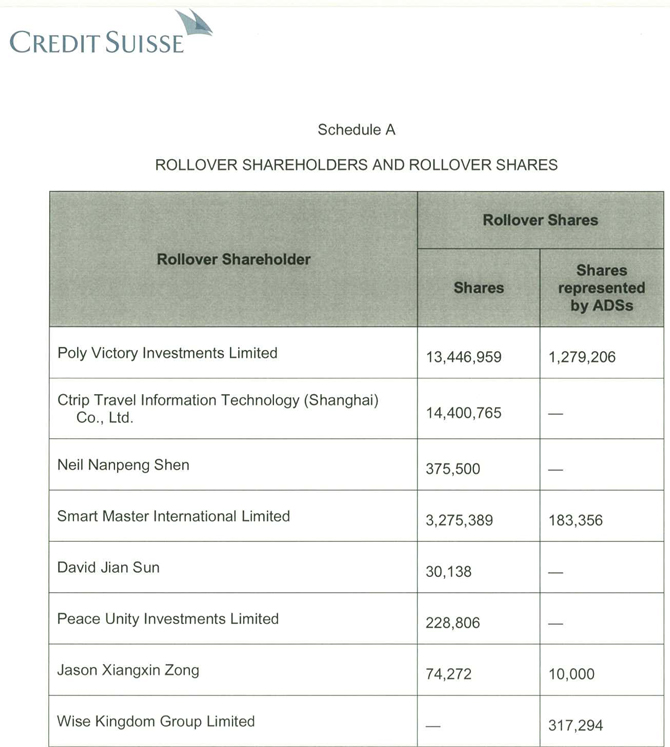

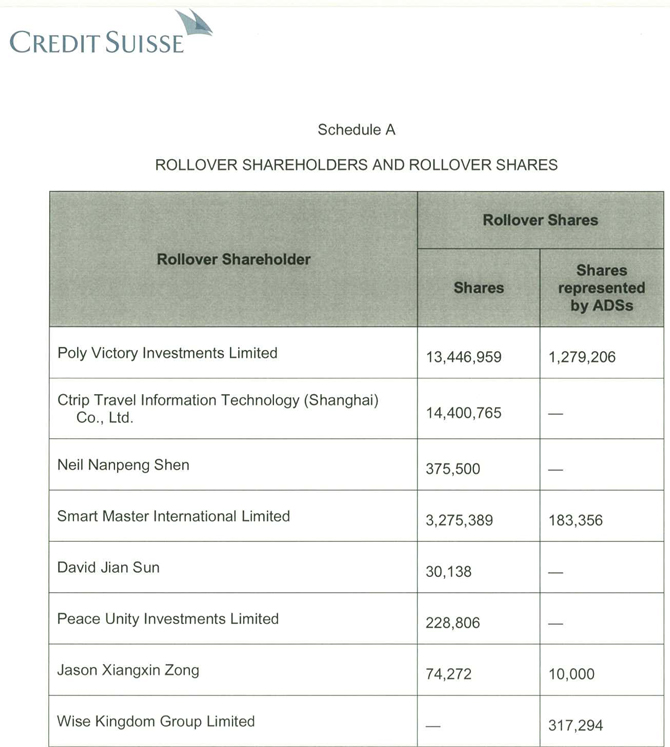

(a) each of 13,446,959 Shares and 1,279,206 Shares represented by ADSs held by Poly Victory, 14,400,765 Shares held by Ctrip Shanghai, 375,500 Shares held by Mr. Shen, 3,275,389 Shares and 183,356 Shares represented by ADSs held by Smart Master, 30,138 Shares held by Mr. Sun, 228,806 Shares held by Peace Unity, 74,272 Shares and 10,000 Shares represented by ADSs held by Mr. Zong, and 317,294 Shares represented by ADSs held by Wise Kingdom (collectively, the “Rollover Shares”), issued and outstanding immediately prior to the Effective Time will be converted into and become one validly issued, fully paid and non-assessable ordinary share, par value US$0.005 each, of the surviving company;

(b) each of (i) the Shares held by the Company or any of its subsidiaries and (ii) the Shares (including ADSs representing such Shares) held by the ADS Depositary and reserved for issuance and allocation pursuant to the Company’s Amended and Restated 2006 Share Incentive Plan (the “Share Incentive Plan”) (collectively, the “Excluded Shares”), and ADSs representing the Excluded Shares, in each case, issued and outstanding immediately prior to the Effective Time, will be cancelled and cease to exist without payment of any consideration or distribution therefor; and

(c) each of the Shares that are issued and outstanding immediately prior to the Effective Time and held by shareholders who have validly exercised and not effectively withdrawn or lost their right to dissent from the Merger in accordance with the Cayman Islands Companies Law (2013 Revision) (the “Cayman Islands Companies Law”) (collectively, the “Dissenting Shares”), will be cancelled and each holder thereof will be entitled to receive only the payment of the fair value of such Dissenting Shares held by them in accordance with the Cayman Islands Companies Law.

In addition to the foregoing, at the Effective Time, (i) each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive, as soon as practicable after the Effective Time, an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, (ii) except as provided under the arrangement with respect to options held by certain directors, officers and employees of the Company described below, each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall not have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such option, as soon as practicable after the Effective Time, in an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, and (iii) except as provided under the arrangement with respect to restricted share units held by certain directors, officers and employees of the Company described below, each restricted share unit awarded under the Share Incentive Plan immediately prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such restricted share unit, as soon as practicable after the Effective Time, in an amount equal to the product of (a) US$17.90 and (b) the total number of Shares underlying such restricted share unit, without interest and net of any applicable withholding taxes. In the case that the exercise price per Share of any option is not lower than US$17.90, such option will be cancelled for no consideration. The restricted cash awards which (i) would vest within two (2) years after the Effective Time and are issued to certain directors, officers and employees of the Company who have executed and delivered to BTG Hotels and Holdco, prior to the closing of the Merger, a letter agreement relating to certain confidentiality, non-competition and employment undertakings (the “Selected Key Employees”), (ii) would vest within two (2) years after the Effective Time and are issued to Yi Liu, Mr. Shen, Min Bao, Mr. Liang and Yunxin Mei, a former director of the Company appointed by Poly Victory to the Board (collectively, the “Buyer Group Directors”), and (iii) are issued to the members of the Special Committee, in each case, will be fully vested and payable when issued, and the surviving company will pay all amounts owed under such restricted cash awards to the holders thereof as soon as practicable after closing of the Merger.

A special committee (the “Special Committee”) of the board of directors of the Company (the “Board”), composed solely of directors who are unaffiliated with Parent, Holdco, Merger Sub, any of the Rollover Shareholders or any member of the management of the Company, reviewed and considered the terms and conditions of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. The Special Committee, after consultation with its financial advisor and legal counsel and due consideration, unanimously (a) determined that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to and in the best interest of the Company and its shareholders (other than shareholders who are affiliates of the Company, including the Rollover Shareholders) (such shareholders are referred to herein as the “Unaffiliated Security Holders”), (b) declared it advisable for the Company to enter into the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and (c) recommended that the Board authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger.

At a meeting on December 5, 2015, the Board, acting upon the unanimous recommendation of the Special Committee and after each director duly disclosed his interests in the Transactions, including the Merger, as required by the memorandum and articles of association of the Company as amended to date and the Cayman Islands Companies Law, unanimously (a) determined that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to, and in the best interests of, the Company and its shareholders (other than the Rollover Shareholders) and declared it advisable for the Company to enter into the Transactions, including the Merger, (b) authorized and approved the execution, delivery and performance of the Merger Agreement, the Plan of Merger and the consummation of the Transactions, including the Merger, (c) directed that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, be submitted to the shareholders of the Company for authorization and approval, and (d) subject to the terms of the Merger Agreement, resolved to recommend the approval of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, to the shareholders of the Company.

The Board unanimously recommends that you vote FOR the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger and, upon the Merger becoming effective, the amendment and restatement of the memorandum and articles of association of the Company (as the surviving company) in the form attached to the Plan of Merger, FOR the proposal to authorize each director or officer of the Company to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

In considering the recommendation of the Special Committee and the Board, you should be aware that some of the Company’s directors and executive officers have interests in the Merger that are different from, and/or in addition to, the interests of the Company’s shareholders generally. The Special Committee and the Board were aware of these potential conflicts of interest and considered them, among other matters, in reaching their decisions and recommendations with respect to the Merger Agreement and related matters. As of the date of the accompanying proxy statement, the Rollover Shareholders collectively beneficially own approximately 34.5% of the Company’s issued and outstanding Shares (excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company). Pursuant to the terms of a support agreement (the “Support Agreement”), dated December 6, 2015, among BTG Hotels, Holdco and the Rollover Shareholders, each Rollover Shareholder agrees (i) to vote any and all of their Shares in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and the transaction contemplated by the Merger Agreement, including the Merger, and to appoint BTG Hotels or any person designated by BTG Hotels as proxy and attorney-in-fact to vote their Shares; (ii) to receive no cash consideration with respect to the Rollover Shares; and (iii) that all of the Rollover Shares will be converted into ordinary shares of the surviving company at the Effective Time, in each case, upon the terms and subject to the conditions of the Support Agreement. In addition, the Special Committee and the Board were aware that certain directors and officers of the Company hold the Rollover Shares, which, pursuant to the terms of an agreement of asset purchase by share issue, dated December 6, 2015, among BTG Hotels, BTG and the Rollover Shareholders (other than Poly Victory), will be exchanged for a certain number of common shares of BTG Hotels at the completion of the share exchange transaction contemplated by such agreement and have entered into certain other transactions with the members of the Buyer Group or their affiliates.

The accompanying proxy statement provides detailed information about the Merger and the extraordinary general meeting. We encourage you to read the entire document and all of the attachments and other documents referred to or incorporated by reference herein carefully. You may also obtain more information about the Company from documents the Company has filed with the United States Securities and Exchange Commission (the “SEC”), which are available for free at the SEC’s website www.sec.gov.

Regardless of the number of Shares that you own, your vote is very important. The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, are authorized and approved by (i) a special resolution (as defined in the Cayman Islands Companies Law), which requires an affirmative vote of shareholders representing at least two-thirds of the Shares present and voting in person or by proxy as a single class at the extraordinary general meeting of the Company’s shareholders, and (ii) so long as the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy at the extraordinary general meeting of the Company’s shareholders exceed 50% of all of the issued and outstanding Shares of the Company as of the close of business on the Share Record Date, the affirmative vote of holders of Shares representing more than 50% of the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy as a single class at such meeting (the “Majority of Minority Vote Requirement”).

Assuming the Rollover Shareholders comply with their voting undertakings under the Support Agreement, based on the number of Shares expected to be issued and outstanding and entitled to vote as of the close of business in the Cayman Islands on March 4, 2016, the record date for voting Shares at the extraordinary general meeting (the “Share Record Date”), in order for the proposal to be authorized and approved:

| (a) | assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least 31,374,565 Shares other than the Shares held by the Rollover Shareholders must be voted in favor of the special resolutions to be proposed at the extraordinary general meeting, including the special resolution to approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger; and |

| (b) | in order to satisfy the Majority of Minority Vote Requirement, assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least 31,946,345 Shares held by the Company’s shareholders other than the Rollover Shareholders must be voted in favor of the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. |

Voting at the extraordinary general meeting will take place by poll voting, as the chairman of the Board has undertaken to demand poll voting at the meeting. Whether or not you plan to attend the extraordinary general meeting, please complete the accompanying proxy card, in accordance with the instructions set forth on the proxy card, as promptly as possible. The deadline to lodge your proxy card is March 23, 2016 at 10:00 a.m. (Shanghai time). Each shareholder has one vote for each Share held as of the close of business in the Cayman Islands on the Share Record Date.

Completing the proxy card in accordance with the instructions set forth on the proxy card will not deprive you of your right to attend the extraordinary general meeting and vote your Shares in person. Please note, however, that if your Shares are held of record by a broker, bank or other nominee and you wish to vote at the extraordinary general meeting in person, you must obtain from the record holder a proxy issued in your name. If you submit a signed proxy card without indicating how you wish to vote, the Shares represented by your proxy card will be voted FOR the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger and, upon the Merger becoming effective, the amendment and restatement of the memorandum and articles of association of the Company (as the surviving company) in the form attached to the Plan of Merger, FOR the proposal to authorize each director or officer of the Company to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

As the record holder of the Shares represented by ADSs, the ADS Depositary will endeavor to vote (or will endeavor to cause the vote of) the Shares it holds on deposit at the extraordinary general meeting in accordance with the voting instructions timely received from holders of ADSs at the close of business in New York City on February 23, 2016 (the “ADS Record Date”). The ADS Depositary must receive such instructions no later than 5:00 p.m. (New York City time) on March 21, 2016. The ADS Depositary has advised us that, pursuant to Section 4.7 of the Deposit Agreement, it will not vote or attempt to exercise the right to vote any Shares other than in accordance with signed voting instructions from the relevant ADS holder and, accordingly, Shares represented by ADSs for which no timely voting instructions are received by the ADS Depositary will not be voted. If you hold your ADSs in a brokerage, bank or other nominee account, you must rely on the procedures of the broker, bank or other nominee through which you hold your ADSs if you wish to vote.

Holders of ADSs will not be able to attend the extraordinary general meeting unless they cancel their ADSs and become holders of Shares prior to the close of business in the Cayman Islands on March 4, 2016, the Share Record Date. ADS holders who wish to cancel their ADSs need to make arrangements to deliver the ADSs (or to the extent ADSs are certificated, the certificates evidencing such ADSs) to the ADS Depositary for cancellation before 5:00 p.m. (New York City time) on March 1, 2016 together with (a) delivery instructions for the corresponding Shares (including the name and address of the person who will be the registered holder of such Shares), (b) payment of the ADS cancellation fees (US$0.05 for each ADS) to be cancelled pursuant to the terms of the Deposit Agreement and any applicable taxes, and (c) a certification that the ADS holder either (i) held the ADSs as of the ADS Record Date and has not given, and will not give, voting instructions to the ADS Depositary as to the ADSs being cancelled, or has given voting instructions to the ADS Depositary as to the ADSs being cancelled but undertakes not to vote the corresponding Shares at the extraordinary general meeting or (ii) did not hold the ADSs as of the ADS Record Date and undertakes not to vote the corresponding Shares at the extraordinary general meeting. If you hold your ADSs in a brokerage, bank or other nominee account, please contact your broker, bank or other nominee to find out what actions you need to take to instruct the broker, bank or other nominee to cancel the ADSs on your behalf. Upon cancellation of the ADSs, the ADS Depositary will transfer registration of the Shares to the former ADS holder (or a person designated by the former ADS holder). If after the registration of Shares in your name you wish to receive a certificate evidencing the Shares registered in your name, you will need to request the Cayman Registrar of Shares, Maples Corporate Services Limited, to issue and mail a certificate to your attention. If the Merger is not completed, the Company would continue to be a public company in the United States and ADSs would continue to be listed on NASDAQ. Shares are not listed and cannot be traded on any stock exchange other than NASDAQ, and in such case only in the form of ADSs. As a result, if you have cancelled your ADSs to attend the extraordinary general meeting and the Merger is not completed and you wish to be able to sell your Shares on a stock exchange, you would need to deposit your Shares into the Company’s ADS program for the issuance of the corresponding number of ADSs, subject to the terms and conditions of applicable law and the Deposit Agreement, including, among other things, payment of relevant fees of the ADS Depositary for the issuance of ADSs and applicable share transfer taxes (if any) and related charges pursuant to the Deposit Agreement.

Shareholders who dissent from the Merger in accordance with Section 238 of the Cayman Islands Companies Law will have the right to receive payment of the fair value of their Shares if the Merger is completed, but only if they deliver to the Company, before the vote to authorize and approve the Merger is taken at the extraordinary general meeting, a written objection to the Merger and subsequently comply with all procedures and requirements of Section 238 of the Cayman Islands Companies Law for the exercise of dissenters’ rights, which is attached as Annex D to the accompanying proxy statement. The fair value of your Shares as determined under the Cayman Islands Companies Law could be more than, the same as or less than the merger consideration you would receive pursuant to the Merger Agreement if you do not exercise dissenters’ rights with respect to your Shares.

ADS HOLDERS WILL NOT HAVE THE RIGHT TO EXERCISE DISSENTERS’ RIGHTS AND RECEIVE PAYMENT OF THE FAIR VALUE OF THE SHARES UNDERLYING THEIR ADSs. THE ADS DEPOSITARY WILL NOT ATTEMPT TO EXERCISE ANY DISSENTERS’ RIGHTS WITH RESPECT TO ANY OF THE SHARES THAT IT HOLDS, EVEN IF AN ADS HOLDER REQUESTS THE ADS DEPOSITARY TO DO SO. ADS HOLDERS WISHING TO EXERCISE DISSENTERS’ RIGHTS MUST SURRENDER THEIR ADSs TO THE ADS DEPOSITARY, PAY THE ADS DEPOSITARY’S FEES REQUIRED FOR THE CANCELLATION OF THEIR ADSs, PROVIDE INSTRUCTIONS FOR THE REGISTRATION OF THE CORRESPONDING SHARES IN THE COMPANY’S REGISTER OF MEMBERS, CERTIFY THAT THEY HAVE NOT GIVEN, AND WILL NOT GIVE, VOTING INSTRUCTIONS AS TO THEIR ADSs (OR, ALTERNATIVELY, THAT THEY WILL NOT VOTE THE CORRESPONDING SHARES) BEFORE 5:00 P.M. (NEW YORK CITY TIME) ON MARCH 1, 2016 AND BECOME REGISTERED HOLDERS OF SHARES BEFORE THE VOTE ON THE MERGER IS TAKEN AT THE EXTRAORDINARY GENERAL MEETING. THEREAFTER, SUCH FORMER ADS HOLDERS MUST COMPLY WITH THE PROCEDURES AND REQUIREMENTS FOR EXERCISING DISSENTERS’ RIGHTS WITH RESPECT TO THE SHARES UNDER SECTION 238 OF THE CAYMAN ISLANDS COMPANIES LAW. IF THE MERGER IS NOT COMPLETED, THE COMPANY WOULD CONTINUE TO BE A PUBLIC COMPANY IN THE UNITED STATES AND ADSs WOULD CONTINUE TO BE LISTED ON NASDAQ. SHARES ARE NOT LISTED AND CANNOT BE TRADED ON ANY STOCK EXCHANGE OTHER THAN NASDAQ, AND IN SUCH CASE ONLY IN THE FORM OF ADSs. AS A RESULT, IF A FORMER ADS HOLDER HAS CANCELLED HIS, HER OR ITS ADSs TO EXERCISE DISSENTERS’ RIGHTS AND THE MERGER IS NOT COMPLETED AND SUCH FORMER ADS HOLDER WISHES TO BE ABLE TO SELL HIS, HER OR ITS SHARES ON A STOCK EXCHANGE, SUCH FORMER ADS HOLDER WOULD NEED TO DEPOSIT HIS, HER OR ITS SHARES INTO THE COMPANY’S ADS PROGRAM FOR THE ISSUANCE OF THE CORRESPONDING NUMBER OF ADSs, SUBJECT TO THE TERMS AND CONDITIONS OF APPLICABLE LAW AND THE DEPOSIT AGREEMENT, INCLUDING, AMONG OTHER THINGS, PAYMENT OF RELEVANT FEES OF THE ADS DEPOSITARY FOR THE ISSUANCE OF ADSs AND APPLICABLE SHARE TRANSFER TAXES (IF ANY) AND RELATED CHARGES PURSUANT TO THE DEPOSIT AGREEMENT.

Neither the SEC nor any state securities regulatory agency has approved or disapproved the Merger, passed upon the merits or fairness of the Merger or passed upon the adequacy or accuracy of the disclosure in this letter or in the accompanying notice of the extraordinary general meeting or proxy statement. Any representation to the contrary is a criminal offense.

If you have any questions or need assistance voting your Shares, please call MacKenzie Partners, Inc., the Company’s proxy solicitor, toll-free at 1-800-322-2885 (or +1-212-929-5500 outside of the United States) (call collect) or via email at homeinns@mackenziepartners.com.

Thank you for your cooperation and continued support.

| Sincerely, | Sincerely, | Sincerely, |

| | | |

| /s/ Kenneth Gaw | /s/Yi Liu | /s/Neil Nanpeng Shen |

| Kenneth Gaw | Yi Liu | Neil Nanpeng Shen |

| On behalf of the Special Committee | Co-Chairman of the Board | Co-Chairman of the Board |

The accompanying proxy statement is dated February 23, 2016, and is first being mailed to the Company’s shareholders and ADS holders on or about February 26, 2016.

HOMEINNS HOTEL GROUP

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON

MARCH 25, 2016

Dear Shareholder:

Notice is hereby given that an extraordinary general meeting of the shareholders of Homeinns Hotel Group (referred to herein alternately as “the Company,” “us,” “we” or other terms correlative thereto), will be held on March 25, 2016 at 10:00 a.m. (local time) at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China.

Only registered holders of ordinary shares of the Company, par value US$0.005 per share (each, a “Share”), at the close of business in the Cayman Islands on March 4, 2016 (the “Share Record Date”) or their proxy holders are entitled to vote at this extraordinary general meeting or any adjournment thereof. At the extraordinary general meeting, you will be asked to consider and vote upon the following resolutions:

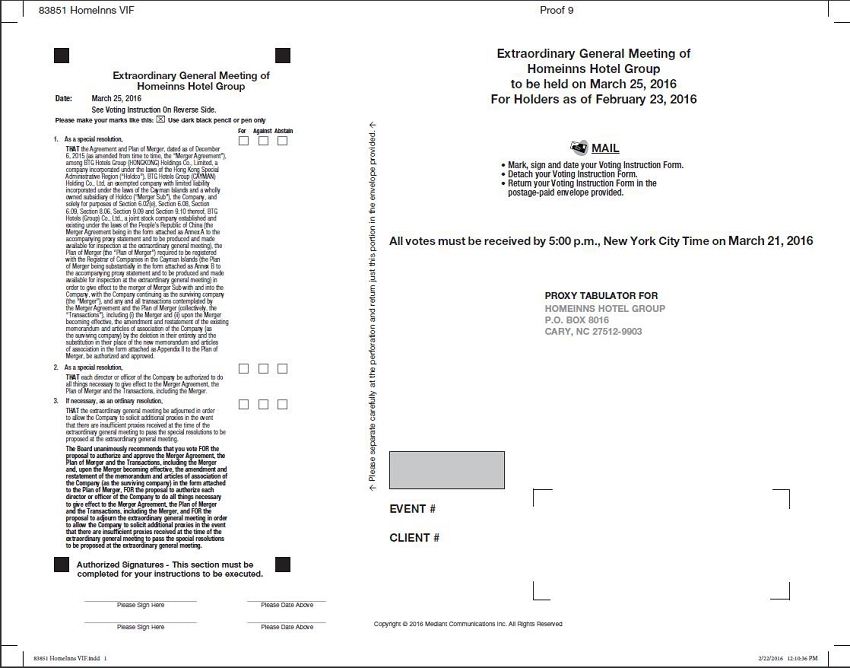

THAT the Agreement and Plan of Merger, dated as of December 6, 2015 (as amended from time to time, the “Merger Agreement”), among BTG Hotels Group (HONGKONG) Holdings Co., Limited, a company incorporated under the laws of the Hong Kong Special Administrative Region (“Holdco”), BTG Hotels Group (CAYMAN) Holding Co., Ltd, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of Holdco (“Merger Sub”), the Company and, solely for purposes of Section 6.02(e), Section 6.08, Section 6.09, Section 8.06, Section 9.09 and Section 9.10 thereof, BTG Hotels (Group) Co., Ltd., a joint stock company established and existing under the laws of the People’s Republic of China (the Merger Agreement being in the form attached as Annex A to the accompanying proxy statement and to be produced and made available for inspection at the extraordinary general meeting), the Plan of Merger (the “Plan of Merger”) required to be registered with the Registrar of Companies in the Cayman Islands (the Plan of Merger being substantially in the form attached as Annex B to the accompanying proxy statement and to be produced and made available for inspection at the extraordinary general meeting) in order to give effect to the merger of Merger Sub with and into the Company, with the Company continuing as the surviving company (the “Merger”), and any and all transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the “Transactions”), including (i) the Merger, and (ii) upon the Merger becoming effective, the amendment and restatement of the existing memorandum and articles of association of the Company (as the surviving company) by the deletion in their entirety and the substitution in their place of the new memorandum and articles of association in the form attached as Appendix II to the Plan of Merger, be authorized and approved;

THAT each director or officer of the Company be authorized to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger; and

| · | if necessary, as an ordinary resolution: |

THAT the extraordinary general meeting be adjourned in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

Please refer to the accompanying proxy statement, which is attached to and made a part of this notice. A list of the Company’s shareholders will be available at its principal executive offices at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China, during ordinary business hours for the two business days immediately prior to the extraordinary general meeting.

After careful consideration and upon the unanimous recommendation of a special committee (the “Special Committee”) of the board of directors of the Company (the “Board”), composed solely of directors who are unaffiliated with Parent, Holdco, Merger Sub, any of the Rollover Shareholders or any member of the management of the Company, the Board, acting upon the unanimous recommendation of the Special Committee and after each director duly disclosed his interests in the Transactions, including the Merger, as required by the memorandum and articles of association of the Company as amended to date and the Cayman Islands Companies Law (2013 Revision) (the “Cayman Islands Companies Law”), unanimously (a) determined that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to, and in the best interests of, the Company and its shareholders (other than the Rollover Shareholders) and declared it advisable for the Company to enter into the Transactions, including the Merger, (b) authorized and approved the execution, delivery and performance of the Merger Agreement, the Plan of Merger and the consummation of the Transactions, including the Merger, (c) directed that the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, be submitted to the shareholders of the Company for authorization and approval, and (d) subject to the terms of the Merger Agreement, resolved to recommend the approval of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, to the shareholders of the Company.

The Board unanimously recommends that you vote FOR the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger and, upon the Merger becoming effective, the amendment and restatement of the memorandum and articles of association of the Company (as the surviving company) in the form attached to the Plan of Merger, FOR the proposal to authorize each director or officer of the Company to do all things necessary to give effect to the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, and FOR the proposal to adjourn the extraordinary general meeting in order to allow the Company to solicit additional proxies in the event that there are insufficient proxies received at the time of the extraordinary general meeting to pass the special resolutions to be proposed at the extraordinary general meeting.

Pursuant to the terms of a support agreement (the “Support Agreement”), dated December 6, 2015, among BTG Hotels, Holdco, Poly Victory Investments Limited, a company organized and existing under the laws of the British Virgin Islands (“Poly Victory”), Ctrip Travel Information Technology (Shanghai) Co., Ltd., a limited liability company established and existing under the laws of the PRC (“Ctrip Shanghai”), Neil Nanpeng Shen, co-founder, co-chairman of the Board, and an independent director of the Company (“Mr. Shen”), Smart Master International Limited, a company organized and existing under the laws of the British Virgin Islands owned and controlled by Mr. Shen and his spouse (“Smart Master”), Mr. David Jian Sun, the chief executive officer and a director of the Company (“Mr. Sun”), Peace Unity Investments Limited, a company organized and existing under the laws of the British Virgin Islands indirectly owned and controlled by Mr. Sun (“Peace Unity”), Jason Xiangxin Zong, the chief operating officer of the Company (“Mr. Zong”), and Wise Kingdom Group Limited, a company organized and existing under the laws of the British Virgin Islands (“Wise Kingdom”, together with, Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, and Mr. Zong, the “Rollover Shareholders”), each of the Rollover Shareholders agrees (i) to vote any and all of their Shares in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and the transaction contemplated by the Merger Agreement, including the Merger, and appoint BTG Hotels or any person designated by BTG Hotels as proxy and attorney-in-fact to vote their Shares; (ii) to receive no cash consideration with respect to the Rollover Shares; and (iii) that all of the Rollover Shares will be converted into ordinary shares of the surviving company at the effective time of the Merger, in each case, upon the terms and subject to the conditions of the Support Agreement. As of the date of the accompanying proxy statement, the Rollover Shareholders collectively beneficially own approximately 34.5% of the Company’s issued and outstanding Shares (excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company).

Regardless of the number of Shares that you own, your vote is very important. The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, are authorized and approved by (i) a special resolution (as defined in the Cayman Islands Companies Law), which requires an affirmative vote of shareholders representing at least two-thirds of the Shares present and voting in person or by proxy as a single class at the extraordinary general meeting of the Company’s shareholders, and (ii) so long as the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy at the extraordinary general meeting of the Company’s shareholders exceed 50% of all of the issued and outstanding Shares of the Company as of the close of business on the Share Record Date, the affirmative vote of holders of Shares representing more than 50% of the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy as a single class at such meeting (the “Majority of Minority Vote Requirement”).

Assuming the Rollover Shareholders comply with their voting undertakings under the Support Agreement, based on the number of Shares expected to be issued and outstanding and entitled to vote on the Share Record Date, in order for the proposal to be authorized and approved:

| (a) | assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least 31,374,565 Shares other than the Shares held by the Rollover Shareholders must be voted in favor of the special resolutions to be proposed at the extraordinary general meeting, including the special resolution to approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger; and |

| (b) | in order to satisfy the Majority of Minority Vote Requirement, assuming all issued and outstanding Shares expected to be issued and outstanding and entitled to vote at the meeting are present in person or by proxy and voting at the meeting, at least 31,946,345 Shares held by the Company’s shareholders other than the Rollover Shareholders must be voted in favor of the proposal to authorize and approve the Merger Agreement, the Plan of Merger and the Transactions, including the Merger. |

Even if you plan to attend the extraordinary general meeting in person, we request that you submit your proxy in accordance with the instructions set forth on the proxy card as promptly as possible. To be valid, your proxy card must be completed, signed and returned to the Company’s principal executive offices at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China, Attention: Ethan Ruan, no later than March 23, 2016 at 10:00 a.m. (local time). The proxy card is the “instrument of proxy” as referred to in the Company’s articles of association. Voting at the extraordinary general meeting will take place by poll voting as the chairman of the Board has undertaken to demand poll voting at the meeting. Each shareholder has one vote for each Share held as of the close of business in the Cayman Islands on the Share Record Date. If you receive more than one proxy card because you own Shares that are registered in different names, please vote all of your Shares shown on each of your proxy cards in accordance with the instructions set forth on the proxy card.

Completing the proxy card in accordance with the instructions set forth on the proxy card will not deprive you of your right to attend the extraordinary general meeting and vote your Shares in person. Please note, however, that if your Shares are registered in the name of a broker, bank or other nominee and you wish to vote at the extraordinary general meeting in person, you must obtain from the record holder a proxy issued in your name.

If you abstain from voting, fail to cast your vote in person, fail to complete and return your proxy card in accordance with the instructions set forth on the proxy card, or fail to give voting instructions to your broker, bank or other nominee, your vote will not be counted.

When proxies are properly dated, executed and returned by holders of Shares, the Shares they represent will be voted at the extraordinary general meeting in accordance with the instructions of the shareholders. If no specific instructions are given by such shareholders, such Shares will be voted “FOR” the proposals as described above, unless you appoint a person other than the chairman of the meeting as proxy, in which case the Shares represented by your proxy card will be voted (or not submitted for voting) as your proxy determines.

If you own ADSs as of the close of business in New York City on February 23, 2016 (the “ADS Record Date”) (and do not cancel such ADSs and become a registered holder of the Shares underlying such ADSs as explained below), you cannot vote at the extraordinary general meeting directly, but you may instruct The Bank of New York Mellon, in its capacity as the ADS depositary (the “ADS Depositary”) and the holder of the Shares underlying your ADSs, how to vote the Shares underlying your ADSs. The ADS Depositary must receive your instructions no later than 5:00 p.m. (New York City time) on March 21, 2016 in order to ensure the Shares underlying your ADSs are properly voted at the extraordinary general meeting. If you hold your ADSs in a brokerage, bank or other nominee account, you must rely on the procedures of the broker, bank or other nominee through which you hold your ADSs if you wish to vote. Alternatively, if you own ADSs as of the close of business in New York City on the ADS Record Date, you may vote at the extraordinary general meeting directly if you cancel your ADSs and become a registered holder of the Shares underlying your ADSs prior to the close of business in the Cayman Islands on March 4, 2016, the Share Record Date. If you wish to cancel your ADSs for the purpose of voting Shares directly, you need to make arrangements to deliver your ADSs to the ADS Depositary for cancellation before the 5:00 p.m. (New York City time) on March 1, 2016 together with (a) delivery instructions for the corresponding Shares (name and address of person who will be the registered holder of such Shares), (b) payment of the ADS cancellation fees (US$0.05 for each ADS) to be cancelled pursuant to the terms of the Deposit Agreement, dated as of October 31, 2006, among the Company, the ADS Depositary and the holders and beneficial owners of ADSs issued thereunder (the “Deposit Agreement”) and any applicable taxes and (c) a certification that you either (i) held the ADSs as of the ADS Record Date and have not given, and will not give, voting instructions to the ADS Depositary as to the ADSs being cancelled or have given voting instructions to the ADS Depositary as to the ADSs being cancelled but undertake not to vote the corresponding Shares at the extraordinary general meeting or (ii) did not hold the ADSs as of the ADS Record Date and undertakes not to vote the corresponding Shares at the extraordinary general meeting. If you hold your ADSs in a brokerage, bank or other nominee account, please contact your broker, bank or other nominee to find out what actions you need to take to instruct the broker, bank or other nominee to cancel the ADSs on your behalf.

Shareholders who dissent from the Merger in accordance with Section 238 of the Cayman Islands Companies Law will have the right to receive payment of the fair value of their Shares if the Merger is completed, but only if they deliver to the Company, before the vote to authorize and approve the Merger is taken at the extraordinary general meeting, a written objection to the Merger and subsequently comply with all procedures and requirements of Section 238 of the Cayman Islands Companies Law for the exercise of dissenters’ rights, which is attached as Annex D to the accompanying proxy statement. The fair value of their Shares as determined under the Cayman Islands Companies Law could be more than, the same as or less than the merger consideration they would receive pursuant to the Merger Agreement if they do not exercise dissenters’ rights with respect to their Shares.

ADS HOLDERS WILL NOT HAVE THE RIGHT TO EXERCISE DISSENTERS’ RIGHTS AND RECEIVE PAYMENT OF THE FAIR VALUE OF THE SHARES UNDERLYING THEIR ADSs. THE ADS DEPOSITARY WILL NOT ATTEMPT TO EXERCISE ANY DISSENTERS’ RIGHTS WITH RESPECT TO ANY OF THE SHARES THAT IT HOLDS, EVEN IF AN ADS HOLDER REQUESTS THE ADS DEPOSITARY TO DO SO. ADS HOLDERS WISHING TO EXERCISE DISSENTERS’ RIGHTS MUST SURRENDER THEIR ADSs TO THE ADS DEPOSITARY, PAY THE ADS DEPOSITARY’S FEES REQUIRED FOR THE CANCELLATION OF THEIR ADSs, PROVIDE INSTRUCTIONS FOR THE REGISTRATION OF THE CORRESPONDING SHARES IN THE COMPANY’S REGISTER OF MEMBERS, CERTIFY THAT THEY HAVE NOT GIVEN, AND WILL NOT GIVE, VOTING INSTRUCTIONS AS TO THEIR ADSs (OR, ALTERNATIVELY, THAT THEY WILL NOT VOTE THE CORRESPONDING SHARES) BEFORE 5:00 P.M. (NEW YORK CITY TIME) ON MARCH 1, 2016 AND BECOME REGISTERED HOLDERS OF SHARES BEFORE THE VOTE ON THE MERGER IS TAKEN AT THE EXTRAORDINARY GENERAL MEETING. THEREAFTER, SUCH FORMER ADS HOLDERS MUST COMPLY WITH THE PROCEDURES AND REQUIREMENTS FOR EXERCISING DISSENTERS’ RIGHTS WITH RESPECT TO THE SHARES UNDER SECTION 238 OF THE CAYMAN ISLANDS COMPANIES LAW. IF THE MERGER IS NOT COMPLETED, THE COMPANY WOULD CONTINUE TO BE A PUBLIC COMPANY IN THE UNITED STATES AND ADSs WOULD CONTINUE TO BE LISTED ON NASDAQ. SHARES ARE NOT LISTED AND CANNOT BE TRADED ON ANY STOCK EXCHANGE OTHER THAN NASDAQ, AND IN SUCH CASE ONLY IN THE FORM OF ADSs. AS A RESULT, IF A FORMER ADS HOLDER HAS CANCELLED HIS, HER OR ITS ADSs TO EXERCISE DISSENTERS’ RIGHTS AND THE MERGER IS NOT COMPLETED AND SUCH FORMER ADS HOLDER WISHES TO BE ABLE TO SELL HIS, HER OR ITS SHARES ON A STOCK EXCHANGE, SUCH FORMER ADS HOLDER WOULD NEED TO DEPOSIT HIS, HER OR ITS SHARES INTO THE COMPANY’S ADS PROGRAM FOR THE ISSUANCE OF THE CORRESPONDING NUMBER OF ADSs, SUBJECT TO THE TERMS AND CONDITIONS OF APPLICABLE LAW AND THE DEPOSIT AGREEMENT, INCLUDING, AMONG OTHER THINGS, PAYMENT OF RELEVANT FEES OF THE ADS DEPOSITARY FOR THE ISSUANCE OF ADSs AND APPLICABLE SHARE TRANSFER TAXES (IF ANY) AND RELATED CHARGES PURSUANT TO THE DEPOSIT AGREEMENT.

PLEASE DO NOT SEND YOUR SHARE CERTIFICATES OR CERTIFICATES EVIDENCING ADSs AT THIS TIME. IF THE MERGER IS COMPLETED, YOU WILL BE SENT INSTRUCTIONS REGARDING THE SURRENDER OF YOUR SHARE CERTIFICATES OR ADRs.

If you have any questions or need assistance voting your Shares, please call MacKenzie Partners, Inc., the Company’s proxy solicitor, toll-free at 1-800-322-2885 (or +1-212-929-5500 outside of the United States) (call collect) or via email at homeinns@mackenziepartners.com.

The Merger Agreement, the Plan of Merger and the Transactions, including the Merger, are described in the accompanying proxy statement. Copies of the Merger Agreement and the Plan of Merger are included as Annex A and Annex B, respectively, to the accompanying proxy statement. We urge you to read the entire accompanying proxy statement carefully.

Notes:

| 1. | In the case of joint holders, the vote of the senior holder who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the votes of the joint holders. For this purpose, seniority will be determined by the order in which the names stand in the register of members of the Company. |

| 2. | The instrument appointing a proxy must be in writing under the hand of the appointer or of his or her attorney duly authorized in writing or, if the appointer is a corporation, either under seal or under the hand of an officer or attorney duly authorized. |

| 3. | A proxy need not be a member (registered shareholder) of the Company. |

| 4. | The chairman of the extraordinary general meeting may at his or her discretion direct that a proxy card will be deemed to have been duly deposited where sent by email or telefax upon receipt of email or telefax confirmation that the signed original thereof has been sent. A proxy card that is not deposited in the manner permitted will be invalid. |

| 5. | Votes given in accordance with the terms of a proxy card will be valid notwithstanding the previous death or insanity of the principal or revocation of the proxy or of the authority under which the proxy was executed, or the transfer of the Shares in respect of which the proxy is given, provided that no intimation in writing of such death, insanity, revocation or transfer was received by the Company at the principal executive offices of the Company at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China at least two hours before the commencement of the extraordinary general meeting, or adjourned meeting at which such proxy is used. |

| | BY ORDER OF THE BOARD OF DIRECTORS, | |

| | | |

| | /s/ Yi Liu | /s/Neil Nanpeng Shen |

| | Yi Liu | Neil Nanpeng Shen |

| | Co-Chairman of the Board | Co-Chairman of the Board |

| | February 23, 2016 | February 23, 2016 |

PROXY STATEMENT

Dated February 23, 2016

SUMMARY VOTING INSTRUCTIONS

Ensure that your shares of Homeinns Hotel Group can be voted at the extraordinary general meeting by submitting your proxy or contacting your broker, bank or other nominee.

If your shares are registered in the name of a broker, bank or other nominee: check the voting instruction card forwarded by your broker, bank or other nominee to see which voting options are available or contact your broker, bank or other nominee in order to obtain directions as to how to ensure that your shares are voted at the extraordinary general meeting.

If your shares are registered in your name: submit your proxy as soon as possible by signing, dating and returning the accompanying proxy card in the enclosed postage-paid envelope, so that your shares can be voted at the extraordinary general meeting unless you appoint a person other than the chairman of the meeting as proxy, in which case the shares represented by your proxy card will be voted (or not submitted for voting) as your proxy determines.

If you submit your proxy card without indicating how you wish to vote, the shares represented by your proxy will be voted in favor of the resolutions to be proposed at the extraordinary general meeting.

If your ADSs are registered in the name of a broker, bank or other nominee: check the ADS voting instructions card forwarded by your broker, bank or other nominee to see which voting options are available or contact your broker, bank or other nominee in order to obtain directions as to how to ensure that the shares represented by your ADSs are voted at the extraordinary general meeting.

If your ADSs are registered in your name: submit your ADS voting instructions card as soon as possible by signing, dating and returning the enclosed ADS voting instructions card in the enclosed postage-paid envelope, so that the shares represented by your ADSs can be voted at the extraordinary general meeting on behalf of the ADS Depositary, as the registered holder of the shares represented by your ADSs.

If you have any questions or need assistance voting your Shares, please call MacKenzie Partners, Inc., the Company’s proxy solicitor, toll-free at 1-800-322-2885 (or +1-212-929-5500 outside of the United States) (call collect) or via email at homeinns @mackenziepartners.com.

TABLE OF CONTENTS

SUMMARY TERM SHEET

This “Summary Term Sheet” and the “Questions and Answers About the Extraordinary General Meeting and the Merger” highlight selected information contained in this proxy statement regarding the Merger (as defined below) and may not contain all of the information that may be important to your consideration of the Merger and other transactions contemplated by the Merger Agreement (as defined below). You should carefully read this entire proxy statement and the other documents to which this proxy statement refers for a more complete understanding of the matters being considered at the extraordinary general meeting. In addition, this proxy statement incorporates by reference important business and financial information about the Company. You are encouraged to read all of the documents incorporated by reference into this proxy statement and you may obtain such information without charge by following the instructions in “Where You Can Find More Information” beginning on page 109. In this proxy statement, the terms “the Company,” “us,” “we” or other terms correlative thereto refer to Homeinns Hotel Group. All references to “dollars” and “US$” in this proxy statement are to U.S. dollars, and all references to “RMB” in this proxy statement are to Renminbi, the lawful currency of the People’s Republic of China (the “PRC”).

The Parties Involved in the Merger

The Company

We are a leading economy hotel chain in China, based on the number of our hotels, the number of our hotel rooms and the geographic coverage of our hotel chain. We develop and operate hotels across China under our Homeinn, Homeinn Plus, Motel, Yitel and Fairyland brands. Since we commenced operations in 2002, we have become one of the best-known economy hotel chains in China. We offer a consistent product and high-quality services to serve primarily the fast growing population of value-conscious individual business and leisure travelers who demand clean, comfortable and convenient lodging.

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands. Our principal executive offices are located at No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China. Our telephone number at this address is +86 21 3337-3333 and our fax number is +86 21 6483-5661.

For a description of our history, development, business and organizational structure, see our Annual Report on Form 20-F for the year ended December 31, 2014, filed with the United States Securities and Exchange Commission (the “SEC”) on April 24, 2015, which is incorporated herein by reference. See “Where You Can Find More Information” beginning on page 109 for a description of how to obtain a copy of our Annual Report.

BTG Hotels

BTG Hotels (Group) Co., Ltd. (“BTG Hotels” or “Parent”) is a joint stock company established and existing under the laws of the PRC. BTG Hotels is listed on the Shanghai Stock Exchange and principally engaged in the management of hotels and tourism destinations. The business address of 51 Fuxingmen Avenue, Xicheng District, Beijing 100031, People’s Republic of China.

Holdco

BTG Hotels Group (HONGKONG) Holdings Co., Limited (“Holdco”) is a company incorporated under the laws of the Hong Kong Special Administrative Region (“Hong Kong”) and a wholly owned subsidiary of BTG Hotels. Holdco is a holding company formed solely for the purpose of holding the equity interest in Merger Sub (as defined below) and arranging the related financing transactions in connection with the Merger (as defined below). The business address of Holdco is c/o BTG Hotels (Group) Co., Ltd., 51 Fuxingmen Avenue, Xicheng District, Beijing 100031, People’s Republic of China.

Merger Sub

BTG Hotels Group (CAYMAN) Holding Co., Ltd is an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of Holdco (“Merger Sub”). Merger Sub was formed by Holdco solely for the purpose of effecting the Merger (as defined below). The business address of Merger Sub is c/o BTG Hotels (Group) Co., Ltd., 51 Fuxingmen Avenue, Xicheng District, Beijing 100031, People’s Republic of China.

Beijing Tourism Group Co., Ltd.

Beijing Tourism Group Co., Ltd. (“BTG”) is a tourism service group with subsidiaries that are engaged in dining, lodging, transportation, travel, shopping, entertainment and other businesses in the PRC and abroad. BTG is a state-owned enterprise organized and existing under the laws of the PRC. BTG holds a 60.12% equity interest in BTG Hotels. The principal business address of BTG is No. 10 Yabao Road, Chaoyang District, Beijing 100020, People’s Republic of China.

Poly Victory Investments Limited

Poly Victory Investments Limited is a British Virgin Islands business company with limited liability (“Poly Victory”) and a wholly owned subsidiary of BTG. The business address of Poly Victory is Room 3406, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong.

Ctrip Travel Information Technology (Shanghai) Co., Ltd.

Ctrip Travel Information Technology (Shanghai) Co., Ltd. (“Ctrip Shanghai”) is a company established and existing under the laws of the PRC and is principally engaged in the research, development and provision of travel software and related information and technology consulting services. Ctrip Shanghai is indirectly wholly owned and controlled by Ctrip.com International, Ltd. (“Ctrip”), a leading travel service provider of accommodation reservation, transportation ticketing, packaged tours and corporate travel management in China. The business address of Ctrip Shanghai is c/o 968 Jin Zhong Road, Shanghai 200335, People’s Republic of China.

Mr. Neil Nanpeng Shen

Mr. Neil Nanpeng Shen (“Mr. Shen”) is our co-founder, co-chairman of the board of directors, and one of our independent directors. Mr. Shen has been our company’s director since our inception and our independent director since 2007. Mr. Shen is a permanent resident of the Hong Kong Special Administrative Region. The business address of Mr. Shen is c/o Suite 3613, 36/F, Two Pacific Place, 88 Queensway, Hong Kong.

During the last five years, Mr. Shen has not been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining Mr. Shen from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Smart Master International Limited

Smart Master International Limited (“Smart Master”), a business company with limited liability incorporated under the laws of the British Virgin Islands, is owned and controlled by Mr. Shen and his spouse. The business address of Smart Master is c/o Suite 3613, 36/F, Two Pacific Place, 88 Queensway, Hong Kong.

Mr. David Jian Sun

Mr. David Jian Sun (“Mr. Sun”) is our chief executive officer and one of our directors. Mr. Sun has served as our director and chief executive officer since 2004. Mr. Sun is a PRC citizen. The business address of Mr. Sun is c/o No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China.

During the last five years, Mr. Sun has not been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining Mr. Sun from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Peace Unity Investments Limited

Peace Unity Investments Limited (“Peace Unity”), a business company with limited liability incorporated under the laws of the British Virgin Islands, is indirectly wholly owned and controlled by Mr. Sun. The business address of Peace Unity is c/o No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China.

Jason Xiangxin Zong

Jason Xiangxin Zong (“Mr. Zong”) is our president and chief operating officer. Mr. Zong has been our president and chief operating officer since January 2014 and served as our chief operating officer from 2008 through 2013. Mr. Zong is a PRC citizen. The business address of Mr. Zong is c/o No. 124 Caobao Road, Xuhui District, Shanghai 200235, People’s Republic of China.

During the last five years, Mr. Zong has not been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining Mr. Zong from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

James Jianzhang Liang

Mr. James Jianzhang Liang (“Mr. Liang”) is co-founder and independent director of the Company. Mr. Liang has been our director since its inception and is co-founder, chairman of the board of directors and chief executive officer of Ctrip. Mr. Liang is a citizen of Saint Kitts and Nevis. The business address of Mr. Liang is c/o 968 Jin Zhong Road, Shanghai 200335, People’s Republic of China.

During the last five years, Mr. Liang has not been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining Mr. Liang from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Wise Kingdom Group Limited

Wise Kingdom Group Limited (“Wise Kingdom”), a business company with limited liability incorporated under the laws of the British Virgin Islands, is wholly owned and controlled by Ms. Chung Lau (“Ms. Lau”), the spouse of Mr. Liang. The business address of Wise Kingdom is c/o 968 Jin Zhong Road, Shanghai 200335, People’s Republic of China.

Throughout this proxy statement, Poly Victory, Ctrip Shanghai, Mr. Shen, Smart Master, Mr. Sun, Peace Unity, Mr. Zong and Wise Kingdom are collectively referred to as the “Rollover Shareholders,” BTG Hotels, Holdco, Merger Sub, BTG, Mr. Liang and the Rollover Shareholders are collectively referred to as the “Buyer Group,” and BTG Hotels, Poly Victory, Ctrip, Mr. Shen, Mr. Liang and Ms. Sun are collectively referred to as the “Proposal Parties.” Additional information regarding the parties to the Merger (as defined below) is set forth in Annex F, which is attached hereto and incorporated herein by reference.

The Merger Agreement (Page 83)

The Company entered into an agreement and plan of merger (the “Merger Agreement”), dated as of December 6, 2015, with Holdco, Merger Sub, and solely for the purposes of certain sections thereof, BTG Hotels. Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Company (the “Merger”), with the Company continuing as the surviving company (the “surviving company”).

You are being asked to vote upon, among other proposals, a proposal to authorize and approve the Merger Agreement, the plan of merger required to be filed with the Registrar of Companies of the Cayman Islands (the “Cayman Registrar”) in connection with the Merger (the “Plan of Merger”), and the transactions contemplated by the Merger Agreement and the Plan of Merger (collectively, the “Transactions”), including the Merger.

Pursuant to the terms of the Merger Agreement, once the Merger Agreement, the Plan of Merger, and the Transactions, including the Merger, are authorized and approved by the requisite vote of the shareholders of the Company and the other conditions to completion of the Merger are satisfied or waived in accordance with the terms of the Merger Agreement, the following will occur:

| · | the Company will file the Plan of Merger with the Cayman Registrar and the Merger will be effective on the date specified in the Plan of Merger; and |

| · | the surviving company will be beneficially owned by Holdco and the Rollover Shareholders. |

Following completion and as a result of the Merger:

| · | the Company, as the surviving company, will continue to do business under the name “Homeinns Hotel Group”; and |

| · | the Company’s American depositary shares program (“ADS program”) for the Shares will be terminated and ADSs will cease to be listed on the NASDAQ Global Market (“NASDAQ”), and price quotations with respect to sales of ADSs in the public market will no longer be available. |

Copies of the Merger Agreement and the Plan of Merger are attached as Annex A and Annex B, respectively, to this proxy statement. You should read the Merger Agreement and the Plan of Merger in their entirety because they, and not this proxy statement, are the legal documents that govern the Merger.

Merger Consideration (Page 83)

Under the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each Share issued and outstanding immediately prior to the Effective Time, other than the Rollover Shares, the Excluded Shares, and the Dissenting Shares, each as described below, will be cancelled and cease to exist and will be converted into and exchanged for the right to receive US$17.90 per Share (the “Per Share Merger Consideration”) and each ADS issued and outstanding immediately prior to the Effective Time, other than ADSs representing Rollover Shares or Excluded Shares, will represent the right to surrender the ADS in exchange for US$35.80 per ADS (the “Per ADS Merger Consideration”) (less cancellation fees of US$0.05 per ADS pursuant to the terms of the Deposit Agreement, dated as of October 31, 2006, among the Company, The Bank of New York Mellon, in its capacity as the ADS depositary (the “ADS Depositary”), and the holders and beneficial owners of ADSs issued thereunder (the “Deposit Agreement”)), in each case, in cash, without interest and net of any applicable withholding taxes. If the Merger is completed, the following Shares (including Shares represented by ADSs) will be cancelled and cease to exist at the Effective Time but will not be converted into the right to receive the consideration described in the immediately preceding sentence:

| (a) | each of 13,446,959 Shares and 1,279,206 Shares represented by ADSs held by Poly Victory, 14,400,765 Shares held by Ctrip Shanghai, 375,500 Shares held by Mr. Shen, 3,275,389 Shares and 183,356 Shares represented by ADSs held by Smart Master, 30,138 Shares held by Mr. Sun, 228,806 Shares held by Peace Unity, 74,272 Shares and 10,000 Shares represented by ADSs held by Mr. Zong, and 317,294 Shares represented by ADSs held by Wise Kingdom (collectively, the “Rollover Shares”), issued and outstanding immediately prior to the Effective Time will be converted into and become one validly issued, fully paid and non-assessable ordinary share, par value US$0.005 each, of the surviving company; |

| (b) | each of (i) the Shares held by the Company or any of its subsidiaries and (ii) the Shares (including ADSs representing such Shares) held by the ADS Depositary and reserved for issuance and allocation pursuant to the Company’s Amended and Restated 2006 Share Incentive Plan (the “Share Incentive Plan”) (collectively, the “Excluded Shares”), and ADSs representing the Excluded Shares, in each case, issued and outstanding immediately prior to the Effective Time, will be cancelled and cease to exist without payment of any consideration or distribution therefor; and |

| (c) | each of the Shares that are issued and outstanding immediately prior to the Effective Time and held by shareholders who have validly exercised and not effectively withdrawn or lost their right to dissent from the Merger in accordance with the Cayman Islands Companies Law (2013 Revision) (the “Cayman Islands Companies Law”) (collectively, the “Dissenting Shares”), will be cancelled and each holder thereof will be entitled to receive only the payment of the fair value of such Dissenting Shares held by them in accordance with the Cayman Islands Companies Law. |

At the Effective Time, each ordinary share, par value US$0.0005 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time will be converted into one validly issued, fully paid and non-assessable ordinary share, par value US$0.005 per share, of the surviving company.

Treatment of Share Options (Page 84)

At the Effective Time, (i) each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive, as soon as practicable after the Effective Time, an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes, and (ii) except as provided under the arrangement with respect to options held by certain directors, officers and employees of the Company described below, each option to purchase Shares granted under the Share Incentive Plan that is issued and outstanding immediately prior to the Effective Time and shall not have become vested on or prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such option, as soon as practicable after the Effective Time, in an amount equal to the product of (a) the total number of Shares issuable under such option immediately prior to the Effective Time multiplied by (b) the excess of US$17.90 over the exercise price payable per Share under such option, if any, in cash, without interest and net of any applicable withholding taxes. In the case that the exercise price per Share of any option is not lower than US$17.90, such option will be cancelled for no consideration.

The restricted cash awards which (i) would vest within two (2) years after the Effective Time and are issued to certain directors, officers and employees of the Company who have executed and delivered to BTG Hotels and Holdco, prior to the closing of the Merger, a letter agreement relating to certain confidentiality, non-competition and employment undertakings (the “Selected Key Employees”), (ii) would vest within two (2) years after the Effective Time and are issued to Yi Liu, Mr. Shen, Min Bao, Mr. Liang and Yunxin Mei, a former director of the Company appointed by Poly Victory to the Board (collectively, the “Buyer Group Directors”), and (iii) are issued to the members of the Special Committee, in each case, will be fully vested and payable when issued, and the surviving company will pay all amounts owed under such restricted cash awards to the holders thereof as soon as practicable after closing of the Merger.

At the Effective Time, theShare Incentive Plan and all relevant award agreements applicable to the Share Incentive Plan will be terminated. In addition, each option, whether or not vested, and restricted share unit that is outstanding and unexercised, at the Effective Time will be cancelled.

Treatment of Restricted Share Units (Page 84)

At the Effective Time, except as provided under the arrangement with respect to restricted share units held by certain directors, officers and employees of the Company described below, each restricted share unit awarded under the Share Incentive Plan immediately prior to the Effective Time will be cancelled and converted into the right to receive a restricted cash award subject to the same vesting conditions and schedules applicable to such restricted share unit, as soon as practicable after the Effective Time, in an amount equal to the product of (a) US$17.90 and (b) the total number of Shares underlying such restricted share unit, without interest and net of any applicable withholding taxes. In the case that the exercise price per Share of any option is not lower than US$17.90, such option will be cancelled for no consideration.

The restricted cash awards which (i) would vest within two (2) years after the Effective Time and are issued to the Selected Key Employees, (ii) would vest within two (2) years after the Effective Time and are issued to the Buyer Group Directors, and (iii) are issued to the members of the Special Committee, in each case, will be fully vested and payable when issued, and the surviving company will pay all amounts owed under such restricted cash awards to the holders thereof as soon as practicable after closing of the Merger.

Record Date and Voting Information (Page 77)

You are entitled to attend and vote at the extraordinary general meeting if you have Shares registered in your name at the close of business in the Cayman Islands on March 4, 2016, the record date for voting Shares at the extraordinary general meeting (the “Share Record Date”). If you own Shares at the close of business in the Cayman Islands on the Share Record Date, the deadline for you to lodge your proxy card and vote is March 23, 2016 at 10:00 a.m. (Shanghai time).

If you own ADSs as of the close of business in New York City on February 23, 2016 (the “ADS Record Date”) (and do not cancel such ADSs and become a registered holder of the Shares underlying such ADSs, as explained below), you cannot vote directly nor are you able to attend the extraordinary general meeting, but you may instruct the ADS Depositary (as the holder of the Shares underlying your ADSs) on how to vote the Shares underlying your ADSs. The ADS Depositary must receive your instructions no later than 5:00 p.m. (New York City time) on March 21, 2016 in order to ensure the Shares underlying your ADSs are properly voted at the extraordinary general meeting.

Alternatively, you may vote at the extraordinary general meeting if you cancel your ADSs by the close of business in New York City on March 1, 2016 and become a holder of Shares by the close of business in the Cayman Islands on the Share Record Date. In addition, if you hold your ADSs through a broker, bank or nominee, you must rely on the procedures of the financial intermediary through which you hold your ADSs if you wish to vote at the extraordinary general meeting.

Each outstanding Share on the Share Record Date entitles the holder to one vote on each matter submitted to the shareholders for authorization and approval at the extraordinary general meeting and any adjournment thereof. We expect that, as of the Share Record Date, there will be 97,554,374 Shares entitled to be voted at the extraordinary general meeting.

Shareholder Vote Required to Approve the Merger Agreement and the Plan of Merger (Page 78)

The Merger cannot be completed unless the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, are authorized and approved by (i) a special resolution (as defined in the Cayman Islands Companies Law), which requires an affirmative vote of shareholders representing at least two-thirds of the Shares present and voting in person or by proxy as a single class at the extraordinary general meeting of the Company’s shareholders, and (ii) so long as the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy at the extraordinary general meeting of the Company’s shareholders exceed 50% of all of the issued and outstanding Shares of the Company as of the close of business on the Share Record Date, the affirmative vote of holders of Shares representing more than 50% of the Shares (excluding the Shares held by the Rollover Shareholders) present and voting in person or by proxy as a single class at such meeting (the “Majority of Minority Vote Requirement”).

As of the date of this proxy statement, the Rollover Shareholders collectively beneficially own an aggregate of 33,661,685 Shares, which represents approximately 34.5% of the total issued and outstanding Shares (excluding, for purposes of this calculation, Shares issuable to the Rollover Shareholders upon the exercise of options of the Company). Pursuant to the terms of the Support Agreement, these Shares will be voted in favor of the authorization and approval of the Merger Agreement, the Plan of Merger and the Transactions, including the Merger, at the extraordinary general meeting.