Filed by Comcast Corporation

(Commission File No.: 001-32871)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Time Warner Cable Inc.

Commission File No. for Registration Statement

on Form S-4 filed by Comcast Corporation: 333-194698

The following Joint Written Statement was posted by Comcast on its website:

JOINT WRITTEN STATEMENT BY

DAVID L. COHEN

EXECUTIVE VICE PRESIDENT

COMCAST CORPORATION

AND

ROBERT D. MARCUS

CHAIRMAN & CHIEF EXECUTIVE OFFICER

TIME WARNER CABLE INC.

TO THE

REGULATORY REFORM, COMMERCIAL AND

ANTITRUST LAW SUBCOMMITTEE

OF THE U.S. HOUSE OF REPRESENTATIVES JUDICIARY COMMITTEE

OVERSIGHT HEARING ON

“COMPETITION IN THE VIDEO AND BROADBAND MARKETS: THE PROPOSED

MERGER OF COMCAST AND TIME WARNER CABLE”

MAY 8, 2014

| | | | | | |

| TABLE OF CONTENTS |

| |

| | | | | | Page |

| Summary of Joint Written Statement | 1 |

| | |

| I. | Overview Of The Transaction | 5 |

| | | |

| | A. | Comcast-TWC Combination | 5 |

| | | | |

| | B. | Charter-SpinCo Transaction | 7 |

| | | | |

| II. | The Transaction Is Pro-Consumer, Pro-Competitive, And Will Generate | |

| | Substantial Public Interest Benefits | 8 |

| | | |

| | A. | Greater Scale Is Essential To Compete In Today’s Dynamic, Multi- | |

| | | Faceted Marketplace. | 8 |

| | | | |

| | B. | Consumers Will Benefit From Accelerated Broadband Deployment And | |

| | | Expanded Broadband Adoption | 11 |

| | | | |

| | | 1 | . | The Transaction Will Bring Faster Internet Speeds And Next- | |

| | | | | Generation Broadband Products And Services To TWC | |

| | | | | Customers. | 11 |

| | | | | | |

| | | 2 | . | The Transaction Will Accelerate Other Broadband Network | |

| | | | | Investments And Improvements That Benefit Consumers. | 14 |

| | | | | | |

| | | 3 | . | The Transaction Will Drive Greater Broadband Adoption Across | |

| | | | | The Combined Company’s Footprint. | 15 |

| | | | | | |

| | C. | The Transaction Will Provide Innovative Video Products And Services To | |

| | | Millions Of Consumers | 19 |

| | | | |

| | D. | The Transaction Will Enhance Competition For Voice Services. | 24 |

| | | | |

| | E. | The Transaction Will Enhance Competition In The Markets For Business | |

| | | Communications And Wireless Backhaul Services | 25 |

| | | | |

| | F. | The Transaction Will Accelerate The Deployment And Adoption Of Next-Generation Cable Advertising Technologies That Will Benefit Advertisers And Consumers. | 29 |

| | | | |

| | G. | The Transaction Will Generate Other Significant Public Interest Benefits | 31 |

| | | | |

| III. | Promises Made And Promises Kept – Our Record | 37 |

| | | |

| IV. | The Transaction Will Not Harm Competition. | 39 |

- i -

| | | | | | | |

| | A. | This Is Not A Horizontal Transaction, And There Will Be No Reduction | |

| | | In Consumer Choice In Any Market | 39 |

| | | | |

| | B. | There Will Be No Vertical Harms From The Transaction | 40 |

| | | | |

| | | 1 | . | The Internet Ecosystem | 40 |

| | | | | | |

| | | | | a. | Comcast Has A Long Record Of Working Cooperatively | |

| | | | | | With Other Companies On Interconnection, Peering, And | |

| | | | | | Transit | 40 |

| | | | | | | |

| | | | | b. | The Transaction Will Spur Competition For Broadband | |

| | | | | | Services | 43 |

| | | | | | | |

| | | 2 | . | Video Services | 50 |

| | | | | | |

| | | | | a. | Comcast Will Have About The Same National Market | |

| | | | | | Share Of MVPD Subscribers As In Prior Cable | |

| | | | | | Transactions. | 50 |

| | | | | | | |

| | | | | b. | The Combined Company’s Programming Will Be | |

| | | | | | Available To MVPDs And OVDs Alike | 52 |

| | | | | | | |

| | | | | c. | Comcast Carries Huge Amounts Of Unaffiliated | |

| | | | | | Programming And Will Continue To Do So Post- | |

| | | | | | Transaction | 53 |

| | | | | | | |

| | | 3 | . | Advertising Markets | 54 |

| | | | | | |

| V. | Conclusion | | | | 55 |

- ii -

Mr. Chairman, Ranking Member, and Members of the Subcommittee, thank you for inviting us to testify today. We welcome this opportunity to discuss the proposed transaction between Comcast Corporation (“Comcast”) and Time Warner Cable Inc. (“TWC”), and the numerous and substantial pro-consumer, pro-competitive, and public interest benefits that it will generate.

Summary of Joint Written Statement

The combination of Comcast and TWC will create a world-class communications, media, and technology company to help meet the insatiable consumer demand for advanced digital services on multiple devices in homes, workplaces, and on the go. Comcast has a proven record of investing in new technologies, facilities, and customer support to provide the best in broadband Internet access, video, and digital voice services. Similarly, TWC has made significant strides in offering a diverse array of video, broadband, and voice services to its customers.

Competing to provide these products and services and other highly desirable services in today’s increasingly dynamic and national marketplace requires significant capital and R&D investments and technological expertise. The transaction will enable Comcast to build on each company’s successes and strengths and extend Comcast’s industry-leading communications and information services, as well as its substantial commitments to serve the public interest, to millions of additional consumers and businesses, with no risk of harm to competition or the public interest.

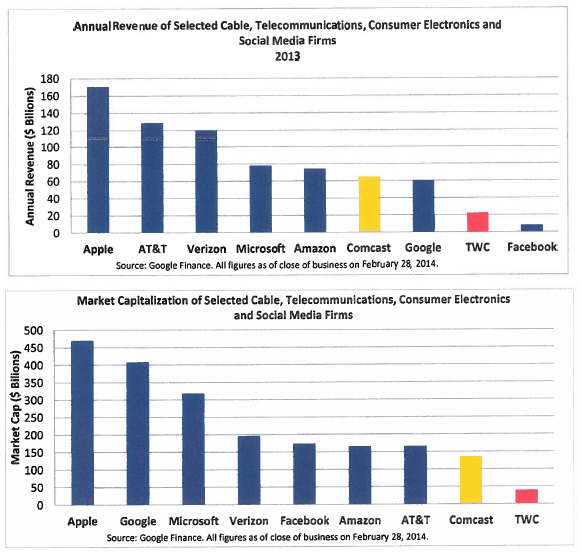

It is important to put this transaction in the proper competitive context. The decision of the companies to combine reflects the increasing rivalry and experimentation among national and global companies, including such powerful companies as AT&T, Verizon, DirecTV, Dish, Amazon, Apple, Samsung, Sony, Google, Netflix, and Facebook in competing for consumer attention and loyalty across the broadband ecosystem. The robust broadband connectivity that Comcast and TWC deliver to American consumers has enabled some of these and other companies to become global powerhouses, with many of them eclipsing both Comcast and TWC in annual revenues and market capitalization. Increasingly, these powerhouses are pursuing new businesses in which they compete with us – and we are doing the same thing. Google, for example, is leveraging its global role in content aggregation to compete with us in many areas, and is rapidly deploying fiber optic networks to serve dozens of major markets, including many that we serve; Netflix has built a larger U.S. base of video customers than our combined companies and is becoming a major originator of content; Apple has extended its platform into the full range of wired and wireless devices to compete in the delivery of content and services; and Samsung is developing its own operating system to implement a common platform among all Samsung consumer products, including its mobile and television appliances.

All of this competition is great for American consumers. We have seen the emergence of an unprecedented “broadband value circle” that provides consumers with abundant choices of content, platforms, devices, and providers. And the success of these companies has given them the massive scale and resources necessary to compete in this capital intensive, rapidly evolving industry, where continued innovation and research and development are essential.

- 1 -

By combining with TWC, Comcast can also achieve the increased coverage and economies of scale necessary to invest the billions of dollars required for next-generation technologies, greater service reliability, secure networks, and faster Internet speeds. This will let us drive more innovative products and services into the marketplace, allowing us to meet the needs of American consumers, businesses, and institutions in ways better than the two companies could do separately.

Combining the two companies’ complementary strengths will accelerate the deployment of next-generation broadband Internet, video, and voice services across the new company’s footprint. For example, TWC customers will benefit from Comcast’s commitment to invest continuously in high-speed data services, as well as Comcast’s next-generation products like the acclaimed X1 operating platform. And we can explore how TWC’s next-generation products, like its “Start Over” and “Look Back” VOD technologies, may benefit Comcast customers.

With larger scale and network coverage, Comcast will also have the capability to deploy other new products and technologies more quickly and efficiently than either company could do on its own – including the best in-home Wi-Fi, expanded availability of Wi-Fi “hotspots” across the combined footprint (which will provide mobile access to Internet content), faster deployment of IP cable and related technologies, more accessible services and features for disabled Americans, and advanced network security.

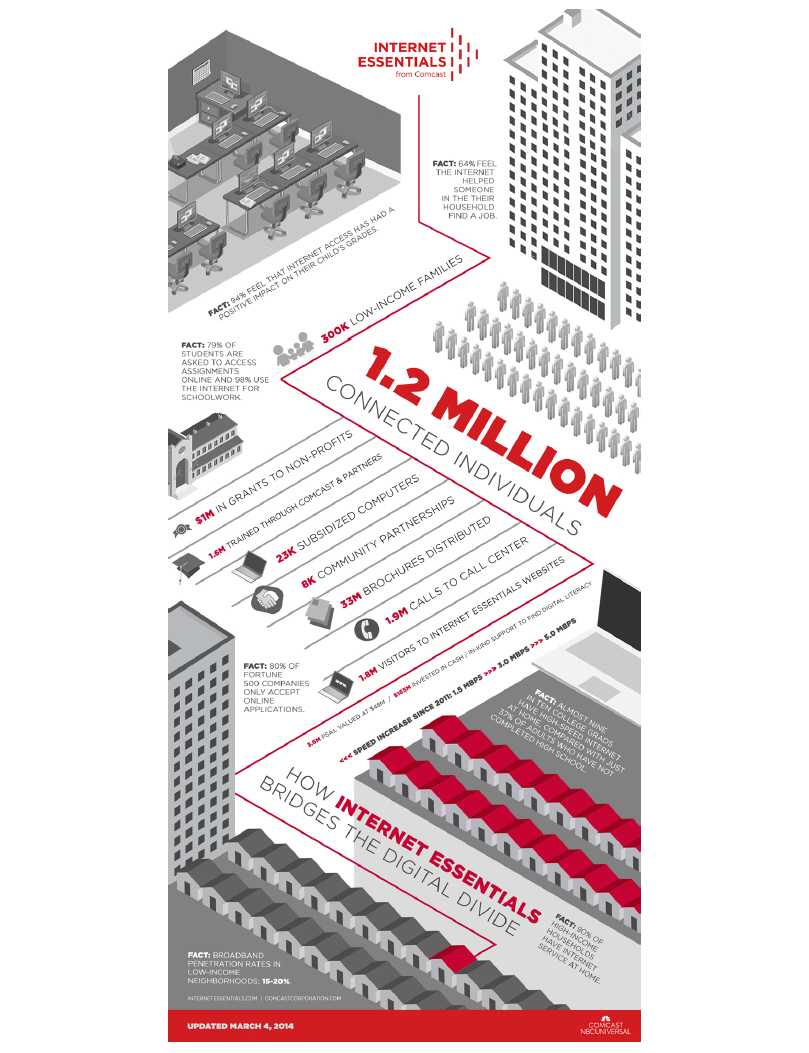

Low-income households will benefit from the transaction through the extension of Comcast’s industry-leading Internet Essentials program that supports broadband adoption by families with students eligible to participate in the National School Lunch Program. In just two and a half years, over 300,000 families, representing some 1.2 million low-income consumers, have been connected to the transformative power of the Internet thanks to this program. The transaction will extend this vital program to millions more Americans in the areas currently served by TWC.

Schools and libraries will benefit, too. Comcast and TWC already provide high-speed connectivity to thousands of schools and libraries. A larger footprint will enable the new Comcast to compete more effectively with ILECs and other legacy providers to provide better, lower-priced broadband and other services to more of these institutions – a national priority under President Obama’s ConnectED initiative.

As part of the transaction, Comcast also proposes to extend many public interest commitments from the NBCUniversal Order to the acquired TWC systems, such as making available diverse and children’s programming on various platforms, and guaranteeing carriage of non-commercial educational stations that have must-carry rights and have relinquished their broadcast spectrum. And Comcast will bring its best-in-class diversity programs to the combined company as well, covering diversity in governance, employment, suppliers, programming, and community investment, and extending the oversight of Comcast’s unique external Joint Diversity Advisory Council to TWC systems.

Congress and the public can count on our commitment to deliver these competitive and public interest benefits. Comcast has a stellar record from past transactions. The company has previously shown how each of these past transactions would allow Comcast to invest and

- 2 -

innovate in ways that benefit consumers and promote increased competition. Comcast promised it would, and it did. And Comcast will do it again here.

We also recognize that this transaction will be closely scrutinized by Congress, the DOJ, the FCC, and others for potential competitive issues. We welcome that review because there are several factors about the transaction that should allay any reasonable concerns.

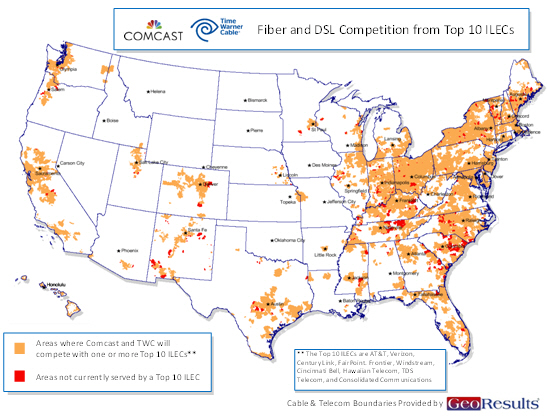

First, Comcast and TWC do not compete for customers in any market – either for broadband, video, or voice services. The transaction will not reduce competition or consumer choice at all. Comcast and TWC serve separate and distinct geographic areas. This simple but critically important fact has been lost on many who would criticize our transaction, but it cannot be ignored – competition simply will not be reduced. Rather, the transaction will enhance competition in key market segments, including advanced business services1 and advertising.2

Second, when this transaction was announced, Comcast said that it was prepared to reduce the combined company’s subscriber counts by approximately three million, so that Comcast’s managed residential subscribers would represent less than 30 percent of the total MVPD market. On April 28, 2014, Comcast announced an agreement with Charter, which includes divestiture transactions that more than meet this statement of intention. These transactions will reduce the combined company’s managed residential subscribers by nearly four million – leaving Comcast with approximately 29 million managed residential subscribers. Comcast’s share of MVPD subscribers will remain about what it was after both the AT&T Broadband and Adelphia transactions in 2002 and 2006, respectively. This subscriber share is also below the 30 percent “ownership cap” that the FCC had justified as necessary to prevent a cable operator from wielding bottleneck control or “monopsony” power over programming. Significantly, the D.C. Circuit twice overturned this cap after finding the dramatic growth of MVPD competition eliminated any risk that a cable operator could dominate with a 30 percent or even higher share of subscribers. And of course, MVPD competition has increased significantly since these court rulings.

1 Medium-sized businesses and institutions, as well as regional, and super-regional businesses, will be among those who will benefit from more competition. The only options for many of these businesses and institutions have been slower, expensive data and voice services offered by incumbent local exchange carriers (“ILECs”) and other legacy providers. Comcast and TWC have made modest – but important – strides, within their current footprints, in offering faster, lower-cost advanced digital services. Where each company has been able to enter these underserved market segments, the ILECs and other legacy providers have quickly responded with dramatic price reductions and service improvements. The transaction will give Comcast the additional coverage and scale necessary to compete with ILECs and others for these customers, as well as for backhaul services to wireless carriers.

2 Similarly, the advertising marketplace will benefit from enhanced competition. The combination of the two companies’ complementary advertising platforms and channels will allow Comcast to provide seamless access to major designated market areas (“DMAs”) like New York and Los Angeles, where we can provide broader and more innovative packages and options to advertisers, like dynamic ad insertion and “addressable advertising” for use in VOD and other cable and online advertising.

- 3 -

Third, the transaction will spur additional broadband competition from other well-funded providers, using fiber, copper, wireless, and satellite technologies. These companies will have every incentive to respond to consumer demands with their own investments and innovations. As AT&T’s CEO Randall Stephenson stated, the Comcast-TWC transaction “puts a heightened sense of urgency” on broadband providers to “very, very aggressive[ly]” invest capital in their networks and improve the quality of their services. This is not just open-ended speculation – just last month, AT&T announced a major initiative to expand its ultra-fast fiber network to up to 100 cities and municipalities nationwide, including 21 major metropolitan areas. That type of positive competitive response will, in turn, trigger other broadband providers to respond and innovate, just as traditional cable providers responded to the entry of DBS providers in the MVPD marketplace. This is a highly desirable outcome for the American economy, and it will drive accelerated investment in both fixed and wireless broadband.

Fourth, Comcast and TWC have enabled the development of online video by providing ever-faster broadband speeds and higher bandwidth services. Our singular goal has been to enhance customers’ online experiences. We have no interest in degrading our broadband services to disadvantage edge providers. That would harm the attractiveness of our high-speed data business, which is Comcast’s fastest-growing business. Besides being illogical, there are safeguards already in place. As part of the NBCUniversal transaction, Comcast agreed to be bound by the FCC’s Open Internet rules until 2018. These protections will now extend to the acquired TWC systems, giving the FCC ample time to adopt (and, if necessary, to defend) legally enforceable Open Internet rules applicable to the entire industry.

Fifth, as FCC Chairman Wheeler recently reaffirmed, the Open Internet rules do not apply to the interconnection arrangements that help make up the Internet “backbone,” such as Comcast’s recent interconnect agreement with Netflix, despite the efforts by some special interests to conflate these issues. The net neutrality rules address how an Internet service provider (“ISP”) treats traffic over its last mile network, which delivers content to consumers’ homes. Backbone interconnect agreements, including transit and peering agreements, address how traffic is transported across the backbone to an ISP’s network; this involves a different set of business arrangements and a distinct marketplace for Internet content exchange – one that has functioned effectively and efficiently for over two decades without government intervention.3

Finally, access by competitors to the combined company’s programming will remain unchanged. The limited number of TWC-owned programming networks that Comcast will acquire will be subject to well-established FCC rules and antitrust laws, along with the relevant terms of the NBCUniversal Order, to ensure that MVPDs and OVDs continue to have access to Comcast/NBCUniversal content after the transaction.

The TWC transaction is a unique and important opportunity for Comcast as it continues to compete in today’s increasingly dynamic and global marketplace. We are confident that an objective review of the transaction will confirm the many benefits it will generate for consumers, businesses, and the public interest, as well as the lack of any competitive or other harms.

3 As more fully discussed in Part IV.B.1 below, the Comcast-Netflix interconnect agreement is neither novel nor unusual. It was an entirely voluntary, commercially negotiated agreement that is one of the many, many options content providers have to send their content to Comcast's network.

- 4 -

| I. | Overview Of The Transaction |

| | A. | Comcast-TWC Combination |

This is a friendly transaction in which Comcast will acquire 100 percent of TWC’s equity and approximately 11 million TWC customers. It is a stock-for-stock transaction. TWC will become a direct, wholly owned subsidiary of Comcast.

Comcast and TWC operate in entirely separate and distinct geographic areas, as the map below illustrates.4

4 The fact that Comcast and TWC do not compete reflects what one industry expert has described as “a kind of accident of history, namely that the rewarding of [cable] franchises is done by local communities (or states, in the few instances where that is applicable) and not by the federal government.” Daniel Brenner et al., Cable Television and Other Nonbroadcast Video, § 3.01 (1993). This led to a “frantic race for franchises” in the early stages of the industry. Id. In many local communities, franchise grants were exclusive (de facto if not de jure) to a single operator. Id. §§ 2.01; 3.02[6]. Although the 1992 Cable Act expressly prohibited exclusive franchises, id. at § 3.02[6], the two national direct broadcast satellite providers (i.e., DirecTV, Dish) began offering competing MVPD services to most areas, and then telephone companies (e.g., AT&T, Verizon) began using their networks and new technologies to deliver competing video services. As a consequence, competition among cable operators has been limited throughout the cable industry’s history. And most cable companies today have determined that their investments are better spent on building out their existing areas with state-of-the-art networks, offering more innovative services, and working to improve existing services, rather than diverting their limited capital to the challenges of building new networks in communities that may already be served by two satellite providers, an established cable operator, a telephone company, and perhaps one of the few overbuilders, such as RCN or Google.

- 5 -

Consumers in Comcast’s territories cannot subscribe to TWC for broadband, video, or phone services. And TWC customers cannot switch to Comcast.5 For that reason, this is not a horizontal transaction under merger review standards, and there will be no reduction in competition or consumer choice.6 Comcast’s and TWC’s many traditional competitors, including numerous broadband providers, MVPDs, and telcos will still be competing post-transaction, with no fewer firms in each relevant market than there are today.

5 Among the two companies’ more than 33 million customers, approximately 2,800 Comcast residential or small or medium-sized business customers are located in zip+4 areas where TWC services residential or small business customers (and the number of TWC customers is similar). These customers are sprinkled across various zip+4 areas, none of which has more than 500 Comcast customers, and it is quite possible that Comcast and TWC are not even providing overlapping services in some of these fringe areas but rather just have facilities that fall within the same zip+4 area. Comcast and TWC also analyzed all business services (Ethernet, backhaul, wholesale, voice, etc.), and found either no overlap or only a small number (approximately 215 Comcast and TWC customers in common zip codes).

6 The Department of Justice and Federal Trade Commission define “horizontal transactions” as those between “actual or potential competitors.” See U.S. Dep’t of Justice & FTC, Horizontal Merger Guidelines, at 1 (Aug. 19, 2010).

- 6 -

| | B. | Charter-SpinCo Transaction |

On April 28, 2014, Comcast announced that it has reached an agreement with Charter Communications (“Charter”) to divest and exchange certain Comcast and TWC systems. The systems that will be sold to or exchanged with Charter are already fairly well integrated into geographic regions that fit well within the Charter footprint. As part of the transaction, certain pre-merger TWC systems will also be exchanged with Charter for certain of its systems. In addition, Comcast will transfer certain systems to a new, independent, publicly-traded MVPD (“SpinCo”) in which Comcast shareholders, including the former Time Warner Cable shareholders, will hold two-thirds of the equity while Charter will hold a minority share of 33 percent and provide certain supportive operating services.7

The divestitures will be executed, subject to the completion of the Comcast-TWC transaction, in three buckets:

| | · | First, Comcast will divest systems serving approximately 1.4 million existing TWC subscribers directly to Charter for cash. |

| | · | Second, Comcast and Charter will exchange systems serving approximately 1.6 million existing TWC and Charter subscribers each, rationalizing the geographic presence of both companies, which will lead to greater operational efficiencies and the rationalization of both companies’ footprints, thereby enhancing the customer experience. |

| | · | Finally, Comcast will form and then spin off to its shareholders a new, independent, publicly traded company (“SpinCo”) that will operate systems serving approximately 2.5 million existing Comcast subscribers, mostly in the Midwest. Comcast shareholders, including former TWC shareholders, will directly own approximately 67 percent of SpinCo, while a new holding company formed by Charter will directly own approximately 33 percent of SpinCo. The Charter holding company will acquire its interest in SpinCo by issuing stock to Comcast shareholders (including former Time Warner Cable shareholders). SpinCo will have a nine-member Board of Directors that will include six independent directors and three directors appointed by Charter (who are expected to be Charter executives or directors, including Charter CEO Tom Rutledge, who is expected to serve as chairman of SpinCo). Comcast will hold no ownership interest in SpinCo (or Charter) and will have no role in managing the SpinCo systems. Charter will provide substantial operational support for the SpinCo systems under a services agreement, although SpinCo will have its own expert, independent management team that is unaffiliated with Charter or Comcast. |

As a result of these transactions, Comcast’s total number of managed residential subscribers will be approximately 29 million – less than 30 percent of the total number of MVPD

7 See Exhibit 1 (showing designated market areas (“DMAs”) involved in divestiture transactions).

- 7 -

subscribers in the United States, approximately the same as Comcast’s subscriber share after its completion of both the 2002 AT&T broadband transaction and the 2006 Adelphia transaction, and below the FCC’s 30 percent “ownership cap” that the agency had adopted based on a stated intention of preventing a cable operator from exercising bottleneck or monopsony control over programmers. That ownership limit was twice rejected by federal courts.

| II. | The Transaction Is Pro-Consumer, Pro-Competitive, And Will Generate Substantial Public Interest Benefits. |

The combination of Comcast and TWC will create a world-class communications, media, and technology company that can provide consumers and businesses the advanced services they want now and will need in the future. The transaction will also spur other companies to innovate and invest in new technologies and services, helping to keep America at the forefront of technology and innovation. The mere announcement of this transaction had just such a positive effect, giving competitors like AT&T “a heightened sense of urgency” to invest in their networks and improve their services – including, for example, the company's recent announcement to expand its VIP, 1 Gig service to up to 100 new cities.8 That is a highly desirable outcome for consumers and for our economy.

| | A. | Greater Scale Is Essential To Compete In Today’s Dynamic, Multi-Faceted Marketplace. |

The media and communications industry has changed dramatically over the past two decades, and today has evolved into a vastly larger, more complex, and multi-faceted communications, media, and technology ecosystem, in which a host of sophisticated companies with national and even global footprints, like AT&T, Verizon, DirecTV, Dish, Amazon, Apple, Sony, Google, Netflix, and Facebook are increasingly competing against one another for customer attention and loyalty. Many of these powerhouses have eclipsed Comcast and TWC in annual revenues, market capitalization, and/or customers:

8 See Randall Stephenson, Chairman & CEO, AT&T, Inc., Morgan Stanley Technology, Media & Telecom Conference, Tr. at 3 (Mar. 6, 2014).

- 8 -

The major telephone companies have the benefit not only of robust wireline footprints, but also national wireless broadband platforms, which they are increasingly leveraging as complementary offerings to residential and business customers.9 Direct satellite providers are likewise evolving and aggressively expanding their national services and product offerings.10

9 See, e.g., Joan Engebretson, AT&T Leverages Landline, Wireless Assets for Free U-verse Promotion, telecompetitor, Mar. 18, 2014, http://www.telecompetitor.com/att-leverages-landline-wireless-assets-for-free-u-verse-promotion/ (“Having wireless and landline network assets could be AT&T’s and Verizon’s secret weapon in both the wireless and landline broadband markets.”). Verizon has also announced plans to acquire Intel Corporation’s OnCue technology in order to “accelerate the availability of next-generation video services” on its networks. The technology would give Verizon’s wireless customers the ability to stream live and on-demand television programming and to watch videos across multiple screens and comes after Verizon’s purchases of EdgeCast, a content delivery network company and of video uploading and encoding technology from upLynk. Hayley Tsukayama, Verizon Buys Intel’s Cloud TV Service, Wash. Post, Jan. 21, 2014, available at

- 9 -

And new digital platform providers, with their roots in software and hardware, are using the robust Internet connectivity provided by Comcast, TWC, and our competitors to grow into global powerhouses. These companies are increasingly pursuing new businesses that compete with ours. As one industry expert has observed, “broadband connectivity is the glue that permits multiple firms, once walled off from one another in distinct product market categories, to compete, cooperate, buy, and supply products and services from one another in order to satisfy customers that are able to buy from any one of them.”11

For example, Google increasingly competes as a network, video, and technology provider while providing core search and advertising functionalities for Comcast’s and TWC’s broadband businesses. Netflix has built a customer base larger than our combined companies and is the originator of original content and offering national subscription VOD (“SVOD”). Apple has extended its platform into the full range of wired and wireless devices, competing in the delivery of content and services to consumers. Microsoft just announced that it will feature ads on the Xbox One, creating a new video advertising platform. Amazon continues to leverage its unequaled sales platform and family of competitive tablets to promote its burgeoning Prime Instant Video business, and just last week announced the rollout of its own advanced video set-top box.12 Samsung is developing its own operating system, Tizan, to implement a common platform throughout all of its consumer products, including mobile and television appliances, as well as releasing its own apps, such as a free music streaming service.13 AT&T, Sony, and Dish are each planning to launch over-the-top video services in the near future.14 Verizon is considering offering an over-the-top wireless video service. As Verizon’s CFO recently observed, “[Verizon is] the fifth largest cable company now. I also have something that cable

http://www.washingtonpost.com/business/technology/verizon-buys-intels-cloud-tv-service/2014/01/21/67e94336-82a5-11e3-9dd4-e7278db80d86_print.html.

10 See, e.g., Press Release, Sprint Corp., Sprint and Dish to Trial Fixed Broadband Service (Dec. 17, 2013), http://newsroom.sprint.com/news-releases/sprint-and-dish-to-trial-fixed-wireless-broadband-service.htm.

11 See Jonathan Sallet, The Creation of Value: The Broadband Value Circle and Evolving Market Structures, at 3 (Apr. 4, 2011); see also Jonathan Sallet & Steven Weber, Behold the Broadband Value Circle, Bloomberg Businessweek, Jan. 11, 2008, available at http://www.businessweek.com/stories/2008-01-11/behold-the-broadband-value-circlebusinessweek-business-news-stock-market-and-financial-advice (“In the era of the Broadband Value Circle, everyone can compete in everyone else’s market. Your supplier today may be your competitor tomorrow, and you may find that you are simultaneously that company’s supplier.”).

12 See Greg Bensinger, Amazon Unveils Video Streaming Device Fire TV, Wall St. J., Apr. 2, 2014,

http://online.wsj.com/news/articles/SB10001424052702304441304579477283348851844?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702304441304579477283348851844.html.

13 See Yun-Hee Kim & Jonathan Krim, Samsung Is Developing Its Own Platform, Apps, Wall St. J., Apr. 20, 2014.

14 See Todd Spangler, AT&T, Chernin Group Invest $500 Million in Over-The-Top Video Venture, Variety, Apr. 22, 2014, available at

http://variety.com/2014/digital/news/att-chernin-group-invest-500-million-to-form-over-the-top-tv-venture-1201160876/#; Jeff Baumgartner, Report: Dish Eyeing Summer Launch of OTT TV Service, Multichannel News, Apr. 23, 2014, available at http://www.multichannel.com/news/technology/report-dish-eyeing-summer-launch-ott-tv-service/374044.

- 10 -

doesn’t have, which is 100 million eyeballs on wireless devices.”15 And even Yahoo is “plunging” into “the increasingly competitive world of high-quality digital video” by developing two original TV-length comedy series and partnering with Live Nation to live-stream concerts over Yahoo’s websites and apps.16

To meet these challenges, Comcast has fundamentally transformed itself from a regional cable company into a leading communications, media, and technology company. By investing heavily in talent, research and development, and the infrastructure needed to facilitate creativity and invention, Comcast has created a culture of innovation from top to bottom. Comcast now employs over 1,000 developers and engineers – a pool of technical talent unprecedented in the history of cable – and competes for new technology talent with Google, Apple, Netflix, and many others.17

This highly dynamic, rapidly evolving industry requires constant innovation and investment in R&D and in physical infrastructure, making increased scale not only desirable but essential. The greater scale, expanded network coverage, and operating efficiencies resulting from the transaction will enable Comcast to invest the billions of dollars necessary to bring next-generation technologies, more secure networks, faster Internet speeds, enhanced video and voice services, and greater service reliability to millions of residential and business consumers across the country.

| | B. | Consumers Will Benefit From Accelerated Broadband Deployment And Expanded Broadband Adoption. |

| | 1. | The Transaction Will Bring Faster Internet Speeds And Next- Generation Broadband Products And Services To TWC Customers. |

Comcast is widely recognized for its technological expertise and willingness to invest in advanced broadband services.18 Building on the investments TWC has made in its broadband network, Comcast will bring faster Internet services and next-generation products to millions of TWC’s customers.

Broadband Speed Innovation: Comcast has increased its Internet speeds 13 times in the last 12 years. Comcast’s fastest residential downstream broadband speeds have increased more than 30-fold in the last six years to 505 Mbps and are among the highest in the industry. Last

15 Fran Shammo, EVP & CFO, Verizon, Deutsche Bank Media, Internet and Telecom Conference, Tr. at 17 (Mar. 10, 2014).

16 See Vindu Goel & Bill Carter, Yahoo to Offer TV-Style Comedy Series on the Web, N.Y. Times, Apr. 28, 2014, available at

http://www.nytimes.com/2014/04/29/technology/yahoo-to-offer-two-tv-length-comedy-series-on-web.html?emc=edit_tnt_20140428&nlid=37308674&tntemail0=y&_r=1.

17 Comcast’s research and development efforts involve highly talented individuals at its technology centers around the country, including in Seattle, Silicon Valley, Denver, Washington, D.C., and Philadelphia.

18 Comcast was recently rated number one by Frost & Sullivan in 2013 for “Technology Innovation” in the North American Broadband Market.

- 11 -

year, Comcast showed that its residential network is capable of delivering 3 Gigabits per second (or “Gigs”).19 And Comcast successfully trialed the first One Terabit20 connection on a network segment from Ashburn, Va. to Charlotte, N.C.21 To our knowledge, this was the first time live data traffic has ever been carried at Terabit speeds on an existing commercial network.22

Comcast is also doubling its broadband network capacity every 18 months to keep up with customers’ increasing demands for Internet services on multiple devices. This was enabled by Comcast’s decision, over five years ago, to convert its networks to “all-digital,” which freed up the bandwidth required to increase broadband speeds, add channels, and provide more HD programming.

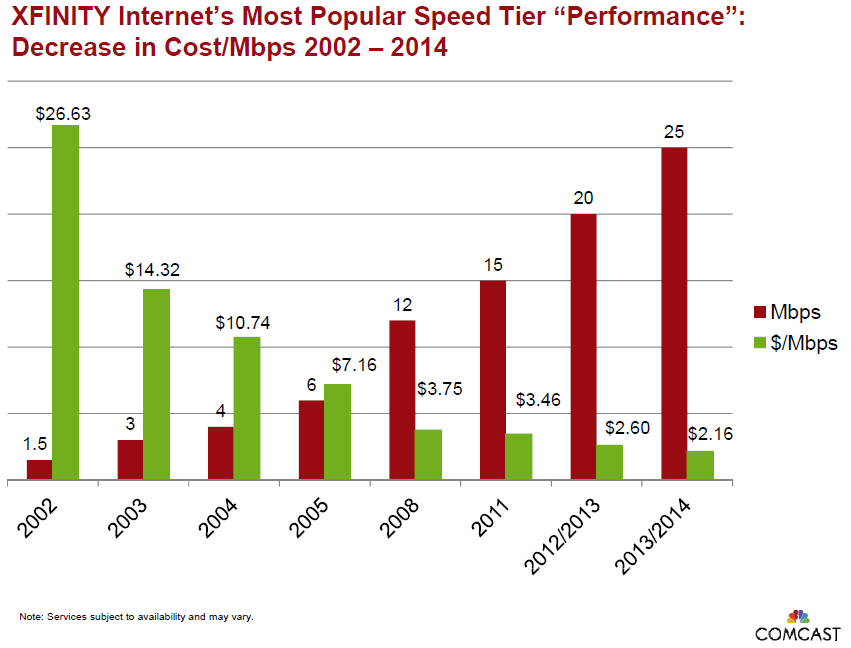

These investments are providing unparalleled value to Comcast customers. Comcast customers pay 92 percent less per megabit of Internet speed on our network today than they paid in 2002.23

TWC took a different approach to free up bandwidth on its network by adopting switched digital video (SDV) technology. Now, TWC is transitioning to an all-digital platform to free up additional bandwidth needed to provision faster Internet speeds, but its transition is complete in only a small number of systems.24

Post-transaction, Comcast intends to make substantial incremental upgrades to TWC’s systems to migrate them to all-digital, freeing up bandwidth to deliver greater speeds. For example, Comcast typically bonds 8 QAM channels together in its systems, and Comcast’s most popular broadband service tier offers speeds of 25 Mbps downstream/5 Mbps upstream across its footprint. In comparison, TWC bonds 4 QAM channels in nearly half of its systems, and its most commonly purchased service tier offers speeds of 15 Mbps/1 Mbps. Comcast’s fastest residential broadband tier offers speeds of 505 Mbps/100 Mbps; TWC’s current top speeds are

19 See Press Release, Comcast Corp., The Future of Broadband Speed and 4K Ultra HD Video (June 11, 2013), http://corporate.comcast.com/news-information/news-feed/comcast-demonstrates-the-future-of-broadband-speed-and-4k-ultra-hd-video.

20 That is, 1012 bits of data. |

21 See Press Release, Ciena Corp., Comcast Conducts Industry’s First Live 1 Terabit Network Trial with Ciena’s 6500 Converged Packet Optical Solution (Oct. 22, 2013), http://www.ciena.com/about/newsroom/press-releases/Comcast-Conducts-Industrys-First-Live-1Terabit-Network-Trial-with-Cienas-6500-Converged-Packet-Optical-Solution.html. |

22 Id. |

23 See Exhibit 2 (chart showing increasing speeds/decreasing per megabit costs). |

24 See Ian Olgeirson, Charter, Time Warner Cable Lag in All-Digital Push to Convert CapEx into Capacity, SNL Kagan (Jan. 17, 2014) (“Time Warner Cable is estimated to have made the [digital] transition in 17% of its homes passed, including markets in its New York cluster. The MSO has indicated plans to expand in 2014, but . . . is not expected to complete the effort this year.”). TWC has migrated to all-digital only in New York City; Augusta, Maine; parts of Kentucky and Indiana; and portions of Los Angeles. |

- 12 -

100 Mbps/5 Mbps. Comcast’s investments in the TWC systems will also improve network reliability, network security, and convenience to TWC customers.

Comcast will soon be increasing Internet speeds further with the deployment of DOCSIS 3.1. DOCSIS 3.1 is the next generation cable broadband technology and is capable of delivering Internet speeds of several Gigs; it is the most advanced broadband architecture in the marketplace. Comcast is already preparing to deploy DOCSIS 3.1 in its existing footprint. The broader scale resulting from the transaction will now allow us to deploy DOCSIS 3.1 across the combined company’s footprint, giving Comcast and TWC customers access to ultra-fast broadband capability more quickly and efficiently than either company could do on its own.

Better In-Home Wi-Fi: The transaction will similarly speed the availability of advanced Wi-Fi equipment in consumers’ homes. The quality of broadband service depends not only on the “last-mile” infrastructure but also the delivery of the signal over the last few yards. Comcast has led the entire broadband industry in rolling out advanced gateway Wi-Fi routers to approximately 8 million households and small businesses, giving these customers faster speeds (up to 270 Mbps downstream as compared to 85 Mbps downstream from the prior generation devices) and better performance over their home and business wireless networks. In contrast, TWC only recently began deploying advanced in-home Wi-Fi routers. With the greater purchasing power and economies of scale resulting from the transaction, Comcast can not only offer TWC customers access to today’s best routers, but also invest in and deploy next-generation router technologies for all of the combined company’s customers.

Expanded Internet Access On The Go: Americans are increasingly using Wi-Fi as a primary way to connect to the Internet outside of the home. To serve this growing demand, Comcast is building one of the largest and most robust Wi-Fi networks in the country. These Wi-Fi “hotspots” currently come in three different categories: outdoor (e.g., suspended from a cable wire); as part of the broadband service provided to small and medium-sized businesses; and “home as hotspot” (i.e., a Comcast subscriber’s home network is supplemented using a dual router that creates a new public Wi-Fi pathway).25 In less than three years, Comcast has deployed over one million Xfinity WiFi access points in its footprint – and seen a significant spike in usage. And, on April 30, 2014, Comcast unveiled plans to reach eight million Xfinity WiFi hotspots in major cities coast to coast by the end of this year.26 In comparison, TWC has deployed only 29,000 Wi-Fi access points in its footprint.

25 Through the neighborhood hotspots initiative Comcast announced last year, Comcast sends a separate Wi-Fi signal from Comcast-issued home equipment that enables anyone within range to get online. Entire residential blocks then show as hotspots on the Xfinity Wi-Fi mobile app. The initiative began in Philadelphia. With the significant expansion in Chicago in 2013, Comcast . . . [is] paving the way toward a national Wi-Fi network. See Robert Channick, Comcast Turning Chicago Homes into Public Wi-Fi Hot Spots, Chi. Trib., Mar. 5, 2014, available at http://articles.chicagotribune.com/2014-03-05/business/chi-chicago-public-wifi-comcast-20140304_1_xfinity-wifi-moffettnathanson-public-wi-fi-hot-spots.

26 See Press Release, Comcast Corp., Comcast to Reach Eight Million Xfinity Wi-Fi Hotspots in 2014 (Apr. 30, 2014), http://corporate.comcast.com/news-information/news-feed/comcast-to-reach-8-million-xfinity-wifi-hotspots-in-2014. This expanded deployment plan includes Atlanta, Baltimore, Boston, Chicago, Denver, Detroit, Hartford, Houston, Indianapolis, Miami, Minneapolis, Nashville, Philadelphia, Pittsburgh, Portland, Sacramento, Salt Lake City, San Francisco, Seattle, and Washington, D.C.

- 13 -

Comcast customers now transmit nearly 2 million gigabytes (or nearly 2 petabytes27) of data through Comcast’s Wi-Fi hotspots each month. Approximately 13 percent of this traffic is transmitted through outdoor hotspots, 11 percent is transmitted through small and medium business (or “SMB”) hotspots, 51 percent is transmitted through hotspots in customers’ own homes, and 24 percent is transmitted through hotspots in other customers’ homes. Public awareness of the benefits of this early-stage initiative is increasing, and usage is steadily growing. In fact, users connecting to residential neighborhood hotspots utilize them for longer periods of time, with their sessions lasting three times as long as sessions on outdoor hotspots and with users consuming almost three times as much data.

To complement these efforts, Comcast has partnered with TWC and other cable companies in a “CableWiFi” initiative that allows each company’s customers to use the other companies’ Wi-Fi hotspots. But this partnership has not created the incentives or structure necessary to significantly expand Wi-Fi availability in the ways that Comcast envisions for its customers.

The transaction will give Comcast the geographic reach, economies of scale, customer density, and return on investment needed to massively expand Wi-Fi hotspots across the combined company’s footprint, including in the Midwest, South, and West, particularly in areas like Cleveland/Pittsburgh, the Carolinas, Texas, and California, where there will be greater density and clustering of systems. Our goal is to provide greater Wi-Fi availability that allows the combined company’s customers to access the Internet in more places, more conveniently, and at no additional charge.

| | 2. | The Transaction Will Accelerate Other Broadband Network Investments And Improvements That Benefit Consumers. |

The transaction will also enable Comcast to invest in network expansions and last-mile improvements that provide an even stronger foundation for innovative applications, including education, healthcare, the delivery of government services, and home security and energy management. And with greater coverage and density of systems, Comcast will also have the ability and incentive to build out and make available interconnection points in more geographic regions. This will be especially beneficial to companies like Google, Netflix, and Amazon, which aggregate massive data traffic when they deliver their own and others’ services to consumers.

These network upgrades will promote other critical investments, at the edge of the network, in exciting new applications and services for consumers.28 In its Open Internet Order, the FCC described this dynamic as:

27 This is equivalent to nearly half a million DVDs worth of data each month. See Visual Networking Index IP Traffic Chart, Cisco, http://www.cisco.com/cdc_content_elements/networking_solutions/service_provider/ visual_networking_ip_traffic_chart.html.

28 See Peter Grant & Bruce Orwall, After Internet’s Big Bust, Broadband Shift Went On, Wall St. J., Jan. 8, 2003, available at http://online.wsj.com/news/articles/SB1041979000108173904 (John Doerr of Kleiner Perkins:

- 14 -

a virtuous circle of innovation in which new uses of the network –including new content, applications, services, and devices – lead to increased end-user demand for broadband, which drives network improvements, which in turn lead to further innovative network uses.... Streaming video and e-commerce applications, for instance, have led to major network improvements such as fiber to the premises, VDSL, and DOCSIS 3.0. These network improvements generate new opportunities for edge providers, spurring them to innovate further.29

This competitive dynamic has given consumers a more abundant and diverse choice of content, platforms, and providers than ever before. The transaction will enable the combined company to continue to contribute to this dynamic ecosystem more effectively than either company could do alone.

| | 3. | The Transaction Will Drive Greater Broadband Adoption Across The Combined Company’s Footprint. |

One of the most pressing challenges facing this country is the significant broadband adoption gap – known as the “digital divide.” The combination of Comcast and TWC will substantially advance the goal of bringing all Americans into the digital communications age by extending Comcast’s landmark Internet Essentials broadband adoption program to TWC’s territories.

The primary barriers to broadband adoption have been identified as including a perceived lack of relevance of the Internet to the lives of individual consumers, a lack of “digital literacy” in consumers’ understanding how to use the technology, and, for some, the price of getting online. Working with the FCC, community partners, and local elected officials, Comcast developed Internet Essentials to respond directly to all of these challenges. Internet Essentials provides low-income households with broadband service for $9.95 a month, along with the option to purchase an Internet-ready computer for under $150, and multiple options for accessing free digital literacy training in print, online, and in person.30 Families with children eligible to

“There’s no question that broadband enables paid-for-content business models.”); id. (Disney Internet Group President Steve Wadsworth on why ABC and ESPN websites were launching new video technology in 2003 as compared to the Dot Com bust: “We’re getting to critical mass in broadband.”); Josephine Moulds, Boom, boom. Dotcoms Are Back in the Frame, Telegraph, Apr. 20, 2007, available at http://www.telegraph.co.uk/finance/markets/2807599/Boom-boom.-Dotcoms-are-back-in-the-frame.html (Judy Gibbons of Accel: “A whole industry infrastructure has been established, there are millions of users, people are consuming online versus offline. It’s become very mainstream and therefore there are still lots of opportunities to both transform existing business and create new applications that are only possible with broadband internet, like social networking.”); see also Hearing on The American Clean Energy Security Act of 2009: Before the Subcomm. on Energy & Env’t of the H. Comm. on Energy & Commerce, 111th Cong. 1245 (Apr. 24, 2009) (“[I]n 1996, we went from a point where not one home in America had broadband in 1996, not one home, to a point where, 10 years later, there is a whole new vocabulary, YouTube, Google, eBay, Amazon, Hulu, thousands of companies, millions of new jobs. They didn’t exist because the market wasn’t there before 1996 for broadband. It was all narrowband.”) (Rep. Edward Markey).

29 See Preserving the Open Internet; Broadband Industry Practices, Report and Order, 25 FCC Rcd 17905 14 (2010). |

30 See Getting Started with the Internet, Internet Essentials, http://learning.internetessentials.com/ tour/getting-started-internet (last visited May 4, 2014).

- 15 -

receive free or reduced-price school lunches through the National School Lunch Program can qualify for this program.

Internet Essentials is achieving real results.31 In the first 30 months of the program, Comcast connected more than 300,000 families, representing an estimated 1.2 million low-income Americans, to the power of the Internet at home. Over the past three years, Comcast also has provided in-person digital literacy training to more than 1.6 million individuals.32

Helping people successfully cross the digital divide requires ongoing outreach. To increase awareness of the Internet Essentials program, Comcast has made significant and sustained efforts within local communities. To date, those outreach efforts have included:

| | · | Distributing over 33 million free brochures to school districts and community partners for (available in 14 different languages). |

| | · | Broadcasting more than 3.6 million public service announcements with a combined value of nearly $48 million. |

| | · | Forging more than 8,000 partnerships with community-based organizations, government agencies, and elected officials at all levels of government. |

Other significant milestones for Comcast’s Internet Essentials program include:

| | · | Offering Internet Essentials in more than 30,000 schools and 4,000 school districts in 39 states and the District of Columbia to spread the word and help bring more families online. |

| | · | Investing more than $165 million in cash and in-kind support to help fund digital literacy initiatives nationally, reaching more than 1.6 million people through Comcast’s non-profit partners. |

| | · | Fielding 1.9 million phone calls to the Internet Essentials call center. |

| | · | Welcoming 1.8 million visitors to the Internet Essentials websites, which supply information in both English and Spanish, and the Online Learning Center. |

31 See Charisse Lillie, Comcast Ranks Among Top 50 Companies for Commitment to Community, Comcast Voices (Dec. 5, 2013), http://corporate.comcast.com/comcast-voices/comcast-ranks-among-top-50-companies-for-commitment-to-community; see also 2013 Results, The Civic 50, http://www.civic50.org/2013_results.php (last visited May 4, 2014); Applications of Comcast Corporation, General Electric Company, and NBC Universal, Inc. for Consent to Assign Licenses and Transfer Control of Licenses, Memorandum Opinion and Order, 26 FCC Rcd 4238, 4514-15 (2011) (Statement of Commissioner Clyburn) (explaining that “[t]he adoption initiative . . . is well-crafted, ambitious, and has enormous potential. By offering the possibility of affordable, high-speed broadband to families . . . not only will school-age children be able to explore the infinite worlds of the web, but the others in their homes will be able to join them.”).

32 See Exhibit 3 (Internet Essentials graphic). |

- 16 -

| | · | Providing IE customers with more than 23,000 subsidized computers at less than $150 each.33 |

In addition, Comcast recently made grants totaling more than $1 million to 15 communities to create “Internet Essentials Learning Zones.” The grants are part of Comcast’s multi-faceted Gold Medal Recognition Program for communities that have done the most to help close the digital divide. Learning Zones will bring together the non-profit community, schools, and Comcast to create a continuum of connectivity during the day, after school, and at home. As part of these efforts, Comcast offered an opportunity for all eligible families in these communities to receive free Internet Essentials service for six months if they registered with the program during a three-week period in March.34 More than 4,300 new low-income families have been connected to the Internet under this promotional offer.35

And the program has not remained static. As Comcast has gained insights from hands-on experience, it has consistently implemented significant enhancements to Internet Essentials along the way. As a result, the program has grown well beyond the company’s original commitment in the NBCUniversal transaction. These enhancements include:

| | · | Eligibility criteria expanded – Comcast has expanded eligibility criteria for Internet Essentials twice, first by extending it to families with children eligible to receive reduced price school lunches, and then by offering it to parochial, private, cyberschool, and homeschooled students. As a result, nearly 2.6 million families nationwide are now eligible for Internet Essentials, an increase of approximately 30 percent from the original eligible base. |

33 See, e.g., Press Release, Comcast Corp., Comcast Extends National Broadband Adoption Program for Low-Income Families (Mar. 4, 2014), http://corporate.comcast.com/news-information/news-feed/internet-essentials-2014.

35 TWC also has undertaken broadband adoption efforts in recent years. TWC has offered an entry-level, “Everyday Low Price” broadband access service for $14.95 per month, as well as its Starter Internet program targeted to schools in several areas in its footprint, which provided eligible families a basic tier of broadband service for two years for $10 per month. See Mike Robuck, Time Warner Boots Up Wi-Fi Hotspots, Starter Internet Tier in K.C., CED, Nov. 30, 2012, available at http://www.cedmagazine.com/news/2012/11/time-warner-boots-up-wi-fi-hotspots-starter-internet-tier-in-kc. Ultimately, 486 schools participated in the pilot program, which ended in January 2013. TWC also has been actively engaged in a variety of other broadband adoption and digital literacy efforts through partnerships with non-profit and community organizations. For example, in partnership with the nation’s largest civil rights organizations, TWC carried $1 million worth of PSAs in key markets throughout 2012-2013 to promote the importance of broadband. The PSAs were carried in English, Spanish, and five other languages and were prepared by the Broadband Opportunity Coalition (“BBOC”). BBOC’s members include: National Urban League, NAACP, National Council of La Raza, Asian American Justice Center, and LULAC. TWC has also partnered with the McCain Internet Empowerment Project, a non-profit initiative that brings broadband service and computer accessibility to senior citizens. TWC has provided computers and broadband connectivity at the Wilson Senior Center and eight other assisted-living facilities in the area to expand digital literacy among senior citizens.

- 17 -

| | · | Broadband speeds increased – Comcast increased the program’s broadband speeds twice in less than two years (from 1.5 to 3 to 5 Mbps upstream), and Internet Essential families now receive downstream speeds of 5 Mbps and upstream speeds of 1 Mbps. |

| | · | Instant approval process expanded – Comcast expanded its instant approval process for families whose students attend schools with 70 percent or more National School Lunch Program participation (previously, the threshold was 80 percent), which enhanced participation rates. |

| | · | Online support enhanced – Comcast created an online application tool on the program’s English- and Spanish-language websites to make applications easier and faster. |

| | · | Partner support facilitated – Comcast’s community partners now may help connect low-income families to the Internet by purchasing “Opportunity Cards” that help defray the cost of the service. And Comcast launched a program that gives third parties such as schools and community-based organizations the ability to purchase Internet Essentials service and equipment in bulk for families in their community. |

| | · | Registration process expanded – Comcast conducts on-site registration during Internet Essentials events all over the country. |

| | · | Residential moves supported – Comcast updated the “transfer of service” process for Internet Essentials customers, which now allows customers to move their accounts to a new home address in a Comcast service area without having to reapply for the program. |

| | · | Extended the program – Comcast has extended the program indefinitely beyond its initial three-year term, which was scheduled to expire in Summer 2014. |

Thanks to all of these efforts, Internet Essentials is doing exactly what it was designed to do, as confirmed by two surveys compiled from families who participate in the program. Approximately 98 percent of program participants report that their children use the Internet access for homework (with 94 percent reporting their kids are doing better in school as a result); and 62 percent are using it for job searching, with 57 percent of those reporting that it helped with finding someone in their household a job.36 These are the kind of important, real-world benefits that bridging the broadband adoption gap can provide to American families.

Comcast’s voluntary broadband adoption commitment under the NBCUniversal Order expires this summer, when the program completes three full years. But Comcast’s

36 See David L. Cohen, Year Three Internet Essentials Progress Report, Comcast Voices (Mar. 4, 2014), http://corporate.comcast.com/comcast-voices/year-three-internet-essentials-progress-report?rid=776739735&mid=EMC_20140304_CAB_IE_Partner.

- 18 -

commitment to this cause is stronger than ever. That is why Comcast recently announced that it will extend the Internet Essentials program indefinitely.37

When this transaction is approved, Internet Essentials will become available in all the communities in the retained TWC markets – including major new metropolitan areas such as Los Angeles, New York, and Dallas/Fort Worth, which collectively have over 500,000 eligible students from 250,000 families – thereby significantly extending the program’s reach.38 Thus, another tangible and far-reaching benefit of this transaction will be to make the power of broadband and the Internet available to many more low-income families and to help reduce the country’s unacceptable digital divide.

| | C. | The Transaction Will Provide Innovative Video Products And Services To Millions Of Consumers. |

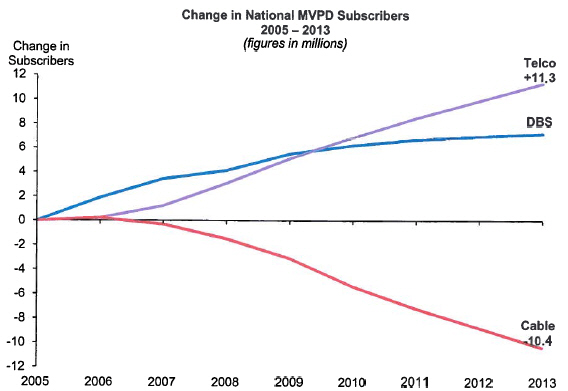

Competition for traditional video services has never been fiercer or more challenging. Over the past five years, the two nationwide DBS providers have added another 1.7 million subscribers and the telco video providers have added another 6.2 million subscribers, while traditional cable operators have lost 7.3 million video subscribers. In the last year alone, telco providers gained over 1.4 million subscribers.39 And if one goes back to 2005, as shown in the graph below, the increase in MVPD competition is even more pronounced.

37 See Press Release, Comcast Corp., Comcast Extends National Broadband Adoption Program for Low-Income Families (Mar. 4, 2014), http://corporate.comcast.com/news-information/news-feed/internet-essentials-2014.

38 Because Comcast will no longer control the cable systems in the markets being divested, it will no longer be able to support Internet Essentials in those communities, although SpinCo could choose to continue the program.

39 Recent data shows that this trend is continuing. The top nine cable companies lost about 1,735,000 video subscribers in 2013, while the top telephone providers added 1,460,000 subscribers and satellite TV providers added 170,000 subscribers in the same year. See Press Release, Leichtman Research Group, Major Multi-Channel Video Providers Lost About 105,000 Subscribers in 2013 (Mar. 14, 2014), http://www.leichtmanresearch.com/press/031414release.html.

- 19 -

Source: SNL Kagan; SEC filings; FCC Video Competition Reports

Moreover, in 2011, 98.6 percent of homes had access to at least three multichannel video providers, and 35.3 percent had access to at least four.40

Most of the systems that Comcast is acquiring from TWC, including the largest ones in New York City, Los Angeles, and Dallas/Fort Worth, are in local MVPD markets that the FCC already has found to be effectively competitive. Online businesses like Netflix, Apple, Google, Amazon, Hulu have also entered the online video space, which – along with potential entrants like Dish, Verizon, and AT&T – are putting additional competitive pressures on cable and other MVPDs.41

All of this competition has compelled Comcast to continuously improve its content, user interfaces, and customer support. Comcast is now the industry leader in offering premium video services for great value. As one industry analyst recently observed:

40 See Annual Assessment of the Status of Competition in the Market for the Delivery of Video Programming, Fifteenth Report, 28 FCC Rcd 10496 ¶ 36 (2013).

41 Several online companies are producing original and exclusive programming, such as Netflix’s House of Cards series, or purchasing exclusive windows of content from other third-party programming suppliers, such as Amazon Prime’s exclusive SVOD rights to FX’s Justified. These growing content options make it more critical than ever for Comcast to offer its customers the best programming available.

- 20 -

Today, Comcast’s [operating] platform is the video industry’s best product.

Their VOD service is the video industry’s best library. Their network, their customer service, and even their marketing have improved by lightyears. Their positive video subscriber result, coming as it does when their video penetration of homes passed has fallen to just 40.3 percent, is testament not to a “good quarter” but instead to a good half-decade of hard work and heavy lifting.42

As a result of these efforts, “the reality is that when you really look at Comcast’s network and services, and even its pricing, compared to Time Warner Cable’s services, an argument can be made that Time Warner Cable customers may have a lot to gain from being converted to Comcast customers.”43

Another analyst similarly commented, “Comcast has really focused on investing in its network. Time Warner Cable has been reacting to changes in the market too, but not with the same speed” as Comcast.44 For video services, “there’s no question that Comcast has a better offering compared with what Time Warner Cable offers today. From its video-on-demand catalog to its TV Everywhere service to a cloud-based user interface it’s been developing the past couple of years, Comcast has invested heavily in revamping its TV service, and it shows.”45

Post-transaction, Comcast is committed to providing TWC customers the best value in video services – not just to keep current TWC customers, but also to attract new ones by outdoing the competition and offering better, more innovative video experiences. And Comcast can also add TWC innovations to current Comcast customers, creating an increased value proposition footprint-wide.46

Best Entertainment Operating Systems: The transaction will give millions of TWC customers access to Comcast’s cutting-edge and nationally acclaimed X1 entertainment operating system (including system upgrades), as well as access to more content on a variety of devices inside and outside the home.

The X1 platform provides an unmatched interactive TV experience featuring a state-of-the-art user interface and other product features that transform our customers’ viewing

42 See MoffettNathanson Research, Comcast Q4 2013: Boardwalk Empire, at 2 (Jan. 28, 2014) (emphasis added).

43 See Marguerite Reardon, Why a Comcast Merger Could Be Good for TWC Customers, CNET, Mar. 15, 2014, http://news.cnet.com/8301-1023_3-57620361-93/why-a-comcast-merger-could-be-good-for-twc-customers/ (quoting Craig Moffett).

44 Id. (quoting IHS analyst Erik Brannon). |

45 Id. |

46 In Fortune’s recent World’s Most Admired Companies List 2014, Comcast was named the number one Cable and Satellite Provider by industry executives, directors, and analysts. In this industry category, Comcast also ranked number one in innovation, people management, use of corporate assets, social responsibility, quality of management, financial soundness, and long-term investment. The World’s Most Admired Companies, Fortune, Mar. 17, 2014.

- 21 -

experiences. These new features can only be fully appreciated by trying out the system,47 and include: (1) integrated search (across TV, Xfinity On Demand, and DVR) with instant play; (2) enhanced personalization and recommendations; (3) access to the Internet and TV-enabled apps like Facebook, Pandora, and others; (4) the X1 remote app, which offers a new remote control experience by letting customers use their smartphones and tablets to control their TVs with a simple tap, swipe, and shake, or use voice commands to easily navigate the programming guide; and (5) in certain markets, the ability to instantly send any website from a smartphone, tablet, or PC to the TV.48

Comcast has also just launched its new X1 DVR with cloud technology, which enables customers to watch their DVR recordings on PCs, Macs, and mobile devices in the home, and to download recorded content to take on-the-go. In addition, Comcast has offered a live in-home streaming feature that allows customers on the X1 platform to stream practically their entire TV channel lineup to computers and mobile devices in the home at no extra cost.

TWC has likewise offered innovative DVR functionalities to its customers, including its “Start Over” and “Look Back” technologies. The transaction will allow Comcast to explore how best to combine these features for all of the combined company’s customers.

More Cable Channels and VOD: Comcast has also led the cable industry in going all-digital, dramatically improving the video experience while simultaneously freeing up valuable bandwidth for enhanced data, video, and voice services. Comcast customers now have more cable channel viewing and Xfinity On Demand choices, offering over 55,000 programming choices, including the most current TV shows and movies (80 percent of this content is free of charge).49 Xfinity On Demand also has the best new release movies from all the major studios, and one of the broadest selections of independent films.

47 See Entertainment Operating System X1, Comcast Corp., http://www.comcast.com/x1 (including video demonstration of the X1 platform). Comcast is now beginning a phased rollout of an enhanced version of the X1 platform, which is sometimes referred to as “X2.” In addition, on April 29, 2014, Comcast announced that X1 triple-play customers will soon be able to live stream personal video from their mobile devices, over the Internet, directly to the television. For example, a mom could live stream a daughter’s soccer game in Philadelphia to her grandparents’ television in San Francisco. Press Release, Comcast Corp., Comcast Brings Advanced Communications, More Personal Media to the TV (Apr. 29, 2014), http://corporate.comcast.com/news-information/news-feed/ncta-2014-x1.

48 Praise for the value and innovation of the X1 platform has been widespread. See, e.g., Todd Bishop, Xfinity X1: How Comcast Roped Me Back in to Cable, GeekWire, Aug. 22, 2013, http://www.geekwire.com/2013/xfinity-x1/ (“I have been testing this sleek black cable box for the past three weeks, but to call it a cable box really doesn’t do it justice. It is a nice blend of Internet content, live television, apps, a multi-tuner DVR and on-demand programming, in one of the cleanest user interfaces that you’ll find from a cable company.”); Tim Carmody, Comcast’s New X1 UI Integrates Real-time and Streaming TV with News and Social Apps, The Verge, May 21, 2012, http://www.theverge.com/2012/5/21/3033972/comcast-ui-platforms-video-news-social-apps (“[X1] feels like a genuinely 21st-century way to use a widescreen television set – like a smart TV inside your cable box.”); John McDuling, The American Cable Industry’s Cunning Plan to Save Itself: Make TV Work Like It Should, Quartz, Feb. 4, 2014, http://qz.com/172533/the-american-cable-industrys-cunning-plan-to-save-itself-make-tv-work-like-it-should/ (quoting Netflix CEO Reed Hastings describing the X1 as a “great product.”).

49 Xfinity On Demand averages 400 million views each month. Since the service launched in 2003, there have been 32 billion views. Comcast has also launched a competitive SVOD service, Streampix, that provides customers additional choices of library TV and movie content.

- 22 -

Although TWC originally used SDV technology to free up bandwidth on its network and provide increased high-quality content, it has likewise begun migrating its systems to all-digital. Post-transaction, Comcast will use its expertise and experience to accelerate digital migration of TWC’s systems, enabling Comcast to re-purpose bandwidth where needed to support more channels and VOD choices, bringing TWC customers the enhanced video experience that Comcast customers already enjoy, and winning back customers in the face of increasingly widespread and rigorous competition for customers’ time and attention.

Superior TV Everywhere Services: Comcast has also focused on adding value to its video service for customers by securing comprehensive digital rights from programmers like Disney, Fox, AMC, and Viacom, enabling Comcast to offer TV Everywhere and other streaming services to its customers. Through XfinityTV.com and Xfinity TV mobile apps, for example, Comcast cable customers can access over 50 live TV channels, and over 25,000 movies and TV shows,50 that can be watched anytime, anywhere,51 including by downloading programming to watch offline later. With this transaction, TWC customers will now enjoy the expanded content offerings that Comcast already makes available to its customers.

Even more, Xfinity content can be accessed in a variety of ways both at home and on the go. The Xfinity TV Go app allows users to access live and on-demand content across a range of devices, including iPhones, iPads, Android smartphones and tablets, and Amazon Kindle Fire tablets. Customers can also view this content directly from laptops and desktops by visiting XfinityTV.com. And customers can access their Xfinity on-demand content at home through an Xbox 360 rather than through a set-top box.

Faster Deployment Of IP Cable And Other Pro-Consumer Technologies: The combined company will also be strongly positioned to help advance the IP cable transition. As the FCC has observed, “[m]odernizing communications networks can dramatically reduce network costs, allowing providers to serve customers with increased efficiencies that can lead to improved and innovative product offerings and lower prices.”52

Accelerating the IP cable transition will yield a number of consumer and public interest benefits. IP cable:

50 In comparison, TWC customers can view up to 29 live channels and 6,500 hours of video content. |

51 See Press Release, Comcast Corp., Xfinity TV Go Network Roster Tops 50 with Latest Update (Mar. 19, 2014), http://corporate.comcast.com/news-information/news-feed/comcast-customers-can-now-stream-more-than-50-live-channels-anytime-anywhere.

52 See Technology Transitions, Order, Report and Order, and Further Notice of Proposed Rulemaking, Report and Order, Order and Further Notice of Proposed Rulemaking, Proposal for Ongoing Data Initiative, GN Docket No. 13-5, FCC No. 14-5 ¶ 2 (rel. Jan. 31, 2014).

- 23 -

| | · | Enables consumers to access their cable and advanced video services in their homes on a wide variety of IP-enabled retail devices – video game consoles, tablets and other connected devices;53 |

| | · | Shifts more of the network intelligence to the cloud, thereby allowing the combined company to rapidly roll out new functionalities to consumers; |

| | · | Reduces costs by allowing the combined company to simplify its existing distribution networks by relying on IP technology to transport all of its services and relying on innovative off-the-shelf IP-based retail devices and reducing its home equipment and inventory costs; and |

| | · | Dramatically reduces energy consumption for consumer set-top boxes. |

Comcast and TWC have each made significant investments in IP infrastructure, devices, and applications. Post-transaction, Comcast is committed to speeding the IP cable transition throughout the combined company’s expanded footprint, creating even greater value for customers.

Extension of NBCUniversal Commitments: As part of the transaction, Comcast will also extend several video service commitments from the NBCUniversal Order to all of the acquired TWC systems. These include Comcast’s commitments to diverse programming; children’s programming; broadcast station protections for local market integrity and retransmission consent negotiations; guaranteed carriage of non-commercial educational stations (that have must-carry rights and have relinquished their broadcast spectrum); and news neighborhood requirements.54

| | D. | The Transaction Will Enhance Competition For Voice Services. |

The availability of voice services from cable companies has had significant pro-competitive and pro-consumer benefits, including lower prices and better service.55 Our voice

53 See, e.g., Yaron Raz, Migrating to IP in the Cable TV Environment: Benefits, Challenges, and Resolutions, CED, Oct. 16, 2013, available at http://www.cedmagazine.com/articles/2013/10/migrating-to-ip-in-the-cable-tv-environment-benefits-challenges-and-resolutions; Cable Edges to an IP Future, Digital TV Europe (July 3, 2013), http://www.digitaltveurope.net/74622/cable-edges-to-an-ip-future/ (“IP is seen as a desirable platform for video services as it will enable them to deliver multiroom and multiscreen services much more economically.”).

54 See Exhibit 4 (Day One Undertakings Memorandum, dated Feb. 13, 2014). |

55 See, e.g., Press Release, FCC, FCC Approves Merger of AT&T Inc. and BellSouth Corporation, at 2 (Dec. 29, 2006) (noting that “the rapid growth of intermodal competitors – particularly cable telephony providers . . . is an increasingly significant competitive force in this market”); Connect America Fund, Report and Order and Further Notice of Proposed Rulemaking, 26 FCC Rcd 17663, App. I ¶ 5 n.11 (2011); Michael D. Pelcovits & Daniel E. Haar, Microeconomic Consulting & Research Associates, Inc., Consumer Benefits from Cable-Telco Competition, at ii, iii (Nov. 2007) (Cable-telco competition brought “direct consumer benefits of $4.0 billion to the cable companies’ customers and $19.5 billion in indirect consumer benefits due to the competitive response of the ILECs, for a total of $23.5 billion of consumer benefits.” It also projected that the total consumer benefits of such competition would be “more than $111 billion” between 2008 and 2012).

- 24 -

services have increasingly given residential and small business customers competitive alternatives for basic telephone service in the areas served by Comcast and TWC.

Comcast offers “Xfinity Voice” service to residential customers throughout the vast majority of its service territory, and as of December 2013, 10.7 million Comcast customers subscribed. Xfinity Voice offers users a long list of enhanced features made possible by Comcast’s industry-leading IP network, such as caller ID provided over a television, laptop, or mobile device, and Readable Voicemail. Similarly, Comcast’s Business VoiceEdge offers an even more robust voice platform for business users, and offers an important competitive choice for small, medium-sized, and larger enterprise businesses.

TWC has also made substantial strides in creating a robust voice service to compete with other voice providers. TWC was the first multiple system operator to introduce a mass-market, facilities-based digital voice service, and has now deployed digital voice throughout its geographic footprint. TWC serves approximately 5.3 million residential and business voice customers.

The transaction will bring together the best aspects of both companies’ digital voice services, creating best-in-class voice services for residential and business customers alike, and making Comcast a more effective competitor for voice services with ILECs and other providers.

| | E. | The Transaction Will Enhance Competition In The Markets For Business Communications And Wireless Backhaul Services. |

Comcast and TWC are both upstart competitors in the market for business services in their respective service areas. Comcast has been actively signing up small and medium-sized businesses and institutions in its footprint for the past several years.56 TWC has also entered the small business marketplace, and has more experience providing advanced services to medium-sized businesses and some national accounts in its footprint.57 Comcast and TWC estimate that they have reached about 10 to 15 percent penetration of the local small and medium-sized business market, and a de minimis share of national business, in their respective geographic areas. The transaction will give the combined company the greater scale, coverage, and operating efficiencies necessary to compete more aggressively in these segments of the economy, especially for medium-sized, regional, and “super-regional” businesses.