UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report:

(Date of earliest event reported)

May 13, 2010

ATHERONOVA INC.

(Exact name of registrant as specified in charter)

Delaware

(State or other Jurisdiction of Incorporation or Organization)

0-52315 (Commission File Number) | | 20-1915083 (IRS Employer Identification No.) |

| | 2301 Dupont Drive, Suite 525 Irvine, CA 92612 (Address of Principal Executive Offices and zip code) | |

(949) 842-8989

(Registrant’s telephone

number, including area code)

Trist Holdings, Inc.

P.O. Box 4198

Newport Beach, CA 92661

(949) 903-0468

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Information included in this Form 8-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AtheroNova Inc. (“AtheroNova”) and AtheroNova Operations, Inc. (formerly Z&Z Medical Holdings, Inc.) (“Operations”) (collectively, AtheroNova and Operations are referred to herein as the “Companies”) to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.&# 160; Forward-looking statements, which involve assumptions and describe future plans, strategies and expectations of the Companies, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections or other expectations included in any forward-looking statements will come to pass. The actual results of the Companies could differ materially from those expressed or implied by the forward-looking statements as a result of various factors. Except as required by applicable laws, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On May 13, 2010, we entered into a Securities Purchase Agreement with W-Net Fund I, L.P. (“W-Net”), Europa International, Inc. (“Europa”) and MKM Opportunity Master Fund, Ltd. (“MKM” and together with W-Net and Europa, the “Purchasers”), pursuant to which the Purchasers, on May 13, 2010, purchased from us (i) 2.5% Senior Secured Convertible Notes (the ��Notes”) for a cash purchase price of $1,500,000, and (ii) Common Stock Purchase Warrants pursuant to which the Purchasers may purchase up to 381,759,427 shares (before the Reverse Split (as defined below)) of our common stock at an exercise price equal to the $0.001965 per share (before the Reverse Split) (the “Warrants”) (the “Capital Raise Transaction”). A portion of the p roceeds from the Capital Raise Transaction were used to pay $250,000 owed by us to the two principal holders of our common stock, W-Net and Europa, and to reimburse them for legal and accounting fees and other expenses incurred by them and our company in connection with the Merger (as defined below) and the Capital Raise Transaction. The net proceeds available to us for our operations will be reduced by such payments.

The Notes pay 2.5% interest per annum with a maturity of 4 years after the closing of the Capital Raise Transaction. No cash interest payments are required, except that accrued and unconverted interest shall be due on the maturity date and on each conversion date with respect to the principal amount being converted, provided that such interest may be added to and included with the principal amount being converted. If there is an uncured event of default (as defined in the Notes), the holder of each Note may declare the entire principal and accrued interest amount immediately due and payable. Default interest will accrue after an event of default at an annual rate of 12%. If there is an acceleration, a mandatory default amount equal to 120% of the unpaid Note principal plus accrued interest may be payable.

The Warrants may be exercised on a cashless basis under which a portion of the shares subject to the exercise are not issued in payment of the purchase price, based on the then fair market value of the shares.

On May 13, 2010, we also entered into a Security Agreement and an Intellectual Property Security Agreement with the Purchasers and Operations, pursuant to which all of our obligations under the Notes are secured by first priority security interests in all of our assets and the assets of Operations, including intellectual property. Upon an event of default under the Notes or such agreements, the Note holders may be entitled to foreclose on any of such assets or exercise other rights available to a secured creditor under California and Delaware law. In addition, under a Subsidiary Guarantee, Operations will guarantee all of our obligations under the Notes.

Each Note is convertible at any time into common stock at a specified conversion price, which will initially be $0.001965 per share (before the Reverse Split). Immediate conversion of the Notes would result in the holders receiving 763,518,854 shares (before the Reverse Split) of our common stock.

The Notes may not be prepaid, or forced by us to be converted in connection with an acquisition of our company, except in a limited case more than a year after the Note issuance where the average of our stock trading price for 30 days on a national trading market other than the OTC Bulletin Board (“OTCBB”) is at least three times the conversion price, in which event, and subject to the satisfaction of certain other requirements, the Note holders may elect to receive at least double the unpaid principal amounts in cash and other requirements are satisfied. In such a limited case acquisition, there could also be a forced cashless exercise of the Warrants subject to similar requirements and optional cash payments to the Warrant holders of at least double the exercise prices of their Warrants.

The Note conversion price and the Warrant exercise price will be subject to specified adjustments for certain changes in the numbers of outstanding shares of our common stock, including conversions or exchanges of such. If additional shares of our capital stock are issued, except in specified exempt issuances, for consideration which is less than the then existing Note conversion or Warrant exercise price, then such conversion or warrant price will be reduced by anti-dilution adjustments. For the first $400,000 of such “Dilutive Issuances,” the reduction will be made on a weighted average basis, taking into account the relative magnitudes of any Dilutive Issuance relative to the total number of outstanding shares. However, any further Dilutive Issuance would be subject to a more detrimental “full ratchet” adjustment that generally reduces the conversion or exercise price to equal the price in the Dilutive Issuance, regardless of the size of the Dilutive Issuance.

The Notes will greatly restrict the ability of our company or Operations to issue indebtedness or grant liens on our or its respective assets without the Note holders’ consent. They will also limit and impose financial costs on our acquisition by any third party.

On May 13, 2010 and in connection with the Capital Raise Transaction, we entered into a Registration Rights Agreement with the Purchasers pursuant to which we agreed, at our expense (other than to pay the initial filing expense which will be paid by the Purchasers), generally to promptly file, process and keep open a registration statement under the Securities Act covering all shares that are or may be issued upon conversions of the Notes or exercises of the Warrants, and to qualify resales of such shares under certain state securities laws. If the registration statement is not timely filed, it does not become effective within a specified time or its effectiveness is not maintained as specified in the agreement, we may owe liquidated damage amounts to the Purchasers.

Under the Securities Purchase Agreement, if we meet three specified operating benchmarks during the first twelve months after the closing of the first Note purchase, an additional $1,500,000 in Note purchases (without Warrants) can be requested by us from the Purchasers. The determination of whether we have met the benchmarks is solely at the discretion of the Purchasers. If the benchmarks are determined to have been achieved, then we can require the Purchasers to make the additional $1,500,000 of Note purchases. If such benchmarks are not attained in the 12-month period, then the Purchasers, in their discretion, during the next two months may elect to purchase up to $1,500,000 of Notes (without Warrants) having an initial conversion price which is 25% higher than the conversion pric e in the original Notes.

Except for the Securities Purchaser Agreement and the transactions contemplated by that agreement, and except as disclosed above, none of the Purchasers had any material relationship with our company.

The Notes and Warrants were issued in a private placement, exempt from the Securities Act registration requirements, to purchasers that are accredited investors.

Section 2 – Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets.

On March 26, 2010, we entered into an Agreement and Plan of Merger (“Merger Agreement”) with Z&Z Merger Corporation, a Delaware corporation and our wholly-owned subsidiary (“MergerCo”), and Z&Z Medical Holdings, Inc., a Delaware corporation (“Z&Z”). The closing (the “Closing”) of the transactions contemplated by the Merger Agreement (the “Merger”) occurred on May 13, 2010. At the Closing, (i) MergerCo was merged with and into Z&Z, whose name was concurrently changed to AtheroNova Operations, Inc.; (ii) Z&Z, as Operations, become our wholly-owned subsidiary; (iii) all of Operations’ shares, warrants and options outstanding prior to the Merger were exchanged (or assumed, in the case of warrants and options) for comparable securities of our company; and (iv) approximately 98% of our fully-diluted shares (excluding the shares issuable in the Capital Raise Transaction) were owned by Operations’ former stockholders, warrant holders and option holders. At the Closing, we issued to Operations’ former stockholders, in exchange for the 9,837,050 shares of Operations’ common stock outstanding prior to the Merger, 88,575,048 shares of our Super-Voting Common Stock, par value $0.0001 per share (the “Super-Voting Common Stock”), which are convertible into approximately 4,428,752,409 shares of our common stock (before the Reverse Split) (the “Conversion Shares”). As a result of the Merger we are solely engaged in Operations’ business, Operations’ officers became our officers and three of Operations’ directors became members of our seven-member board of directors (which currently has two vacancies).

On May 14, 2010, we filed a press release announcing the Closing, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.3.

Except for the Merger Agreement and the transactions contemplated by that agreement, neither Operations, nor its directors, officers and stockholders had any material relationship with our company.

We are presently authorized under our certificate of incorporation, as amended to date, to issue 2,000,000,000 shares of common stock, par value $0.0001 per share, of which 124,467,350 shares are designated Super-Voting Common stock. As of the Closing, we had 107,272,730 shares (before the Reverse Split) of common stock issued and outstanding and 88,575,048 shares of Super-Voting Common Stock issued and outstanding.

Under the terms of the Merger Agreement, all of the outstanding shares of capital stock held by Operations’ former stockholders were exchanged for 88,575,048 shares of Super-Voting Common Stock. Each share of Super-Voting Common Stock will be convertible into 50 shares of our common stock (the “Conversion Rate”), subject to rounding to the nearest whole share for fractional shares. Accordingly, as a result of the Merger, Operations’ former stockholders own approximately 4,428,752,409 shares (before the Reverse Split) of our common stock on an as-converted basis, and our existing stockholders own 107,272,730 shares (before the Reverse Split) of our common stock. The shares of Super-Voting Common Stock will immediately and automatically be converted into shares of our common stock (the “Mandatory Conversion”), and the Super-Voting Common Stock will cease to be designated as a separate series of common stock, upon the filing with the Delaware Secretary of State of an amendment and restatement of our certificate of incorporation to effect a 1 for 200 reverse stock split of our outstanding common stock (“Reverse Split”).

The holders of shares of Super-Voting Common Stock are entitled to vote together with the holders of our common stock, as a single class, upon all matters submitted to holders of common stock for a vote. Each share of Super-Voting Common stock will carry a number of votes equal to the number of shares of common stock issuable as if converted at the record date. As such, immediately following the Closing, Operations’ former stockholders and our existing stockholders hold approximately 97.6% and 2.4%, respectively, of the total combined voting power of all classes of our stock entitled to vote.

In the event of any liquidation, dissolution or winding up of our company, the assets available for distribution to stockholders will be distributed among the holders of Super-Voting Common Stock and the holders of our common stock, pro rata, on an as-converted-to-common-stock basis. The holders of Super-Voting Common Stock are entitled to dividends in the event that we pay cash or other dividends in property to holders of outstanding shares of our common stock, which dividends would be made pro rata, on an as-converted-to-common-stock basis.

Upon Mandatory Conversion of the shares of Super-Voting Common Stock, and subject to an adjustment of the Conversion Rate as a result of the Reverse Split, Operations’ former stockholders will, in the aggregate, receive approximately 22,143,763 shares of our common stock, representing approximately 97.6% of the outstanding shares of our common stock immediately following the Mandatory Conversion. Our existing stockholders will, following the Mandatory Conversion and Reverse Split, own approximately 536,364 shares of our common stock, representing approximately 2.4% of the outstanding shares of our common stock. The shares of our common stock received in the Reverse Split will be subject to rounding to the nearest whole number for fractional shares.

The ownership interests of Operations’ former stockholders and our existing stockholders are subject to dilution for Operations’ previously outstanding options and warrants assumed by us in connection with the Merger, and the shares issuable upon conversion of the Notes and Warrants. Accordingly, upon Mandatory Conversion of the Super-Voting Common Stock, Operations’ former stockholders and the former holders of Operations’ options and warrants will collectively own approximately 80.8% of our common stock on a fully-diluted basis, the Purchasers will collectively own approximately 17.6% of our common stock on a fully-diluted basis (accounting solely for shares issuable upon conversion of the Notes and exercise of the Warrants) and our existing stockholders will own approximately 1. 6% of our common stock on a fully-diluted basis.

In connection with the Reverse Split, our board of directors may, in its discretion, provide special treatment to certain stockholders to preserve round lot holders (i.e., holders owning at least 100 shares prior to the Reverse Split) after the Reverse Split. Our board of directors may elect, in its discretion, to provide such special treatment to the record holders of our common stock only on a per certificate basis or more generally to the beneficial holders of our common stock. For example, if our board determines to provide such special treatment to record holders only, the record holders of our common stock holding a certificate representing 20,000 or fewer shares of common stock but at least 100 shares of common stock would receive 100 shares of common stock after the Reverse Split with r espect to each such certificate, and record holders holding a certificate representing less than 100 shares of common stock would not be affected and would continue to hold a certificate representing the same number of shares as such stockholders held before the Reverse Split. In the alternative, if our board determines to provide such special treatment to beneficial holders generally, the beneficial holders of our common stock beneficially holding 20,000 or fewer shares of common stock but at least 100 shares of common stock would receive 100 shares of our common stock after the Reverse Split, and persons beneficially holding less than 100 shares of our common stock would not be affected by the Reverse Split and would continue to hold the same number of shares as such stockholders held before the Reverse Split. The terms and conditions of special treatment afforded to stockholders to preserve round lot stockholders, if any, including the record dates for determining which stockholders may be eligible for such special treatment, will be established in the discretion of our board of directors.

Effective as of the Closing, Eric Stoppenhagen resigned from his positions as our Interim President and Secretary, Lee Mendelson resigned as a director and we appointed the following persons as our executive officers and directors:

| Name | | Age | | Position |

| Thomas Gardner | | 56 | | Chief Executive Officer, President and Director |

| Mark Selawski | | 54 | | Chief Financial Officer and Secretary |

| Filiberto Zadini, MD | | 65 | | Director |

| Boris Ratiner, MD | | 42 | | Director |

| Chaim Davis | | 30 | | Director |

| Gary Freeman (1) | | 42 | | Director |

(1) Mr. Freeman continued as a director of our company following the Closing.

Additionally, as a condition to the Closing, Filiberto Zadini, Giorgio Zadini, Thomas Gardner, Boris Ratiner (together, the “Z&Z Shareholders”), Europa, W-Net and MKM entered into a Voting Agreement (“Voting Agreement”) pursuant to which such parties became obligated, for four years, to vote for the directors determined as described below. The authorized number of directors will be seven. Those initially include three persons who before the Closing were members of Operations’ board of directors—Thomas Gardner, Boris Ratiner and Filiberto Zadini—whose replacements will be determined under the terms of the Voting Agreement by the holders of a majority of the shares held by the Z&Z Shareholders. Two other directors are Gary Freeman, who before the Closing was a member of our board of directors, and Chaim Davis, and their replacements will be determined under the Voting Agreement by the holders of a majority of the shares held by the Purchasers. The final two directors, and their replacements, will be determined jointly by the holders of a majority of the shares held by the Z&Z Shareholders and the holders of a majority of the shares held by the Purchasers.

On April 1, 2010, in our Current Report on Form 8-K dated March 26, 2010, we reported the execution of the Merger Agreement and included a copy of the Merger Agreement therein as Exhibit 2.1. On April 13, 2010, we filed an Information Statement on Schedule 14f-1 reporting the proposed acquisition of Operations and a pending change of control of our company at the Closing.

Description of the Business

Immediately prior to the Closing, we were a public “shell” company with nominal assets. As a result of the Merger, we are solely engaged in Operations’ business. With respect to this discussion, the terms “we,” “us,” “our” and “our company” refer to AtheroNova Inc., a Delaware corporation and its wholly-owned subsidiary AtheroNova Operations, Inc., a Delaware corporation.

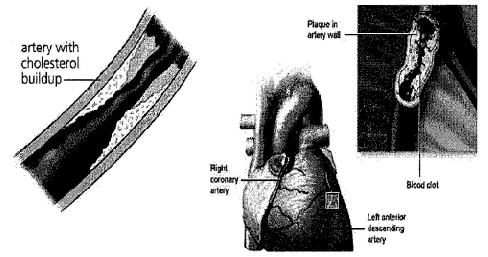

We have developed intellectual property (“IP”), covered by our pending patent applications, which uses certain pharmalogical compounds uniquely for the treatment of atherosclerosis, which is the primary cause of various cardiovascular diseases. Atherosclerosis occurs when cholesterol or fats are deposited and harden as plaques in the walls of arteries. This hardening reduces the space within the arteries through which blood can flow. The plaque can also rupture and greatly restrict or block altogether blood flow. Through a process called delipidization, such compounds dissolve the plaques so they can be eliminated through normal body processes and avoid such rupturing. Such compounds may be used both to treat and prevent atherosclerosis.

In the near future, we plan to continue studies and trials to demonstrate the efficacy our IP. Ultimately, we plan to license our technology to various licensees throughout the world who may use it in treating or preventing atherosclerosis and other medical conditions or sublicense the IP to other such users. Our licensees may also produce, market or distribute products which utilize or add our compounds and technology in such treatment or prevention.

Atherosclerosis

Atherosclerosis (from the Greek words “athero” (gruel or paste) and “sclerosis” (hardness)) is a common disease of the arteries. It occurs when organic materials, primarily cholesterol (the waxy, fat-like material found in all parts of the body) or fats, are deposited and harden in the walls of arteries. This may occur when such materials accumulate under a fibrotic cap or at a tear in the inner lining of an artery.

As the deposits harden, they can restrict and occlude the area through which the blood can flow through an artery, thereby reducing the amount of blood made available to organs and other parts of the body. Restricted blood flow in the arteries, such as to the heart muscle, can lead to symptoms such as chest pain. It also can cause tissues to receive inadequate oxygen, which is directly related to a number of circulatory disorders. For example, arteriosclerosis of the extremities is a disease of the peripheral blood vessels that is characterized by narrowing and hardening of the arteries that supply the arms, legs and feet. The narrowing of the arteries causes a decrease or cessation in blood flow. Symptoms include pain, numbness, cold tissues and hypoxia resulti ng in cellular death.

Hardened plaques can also rupture and dislodge from an artery’s walls, and then greatly restrict or block altogether blood flow through that or other arteries. This can lead to heart attacks and other severe disorders. For example, strokes can be caused when ruptured plaques in a neck artery impede the flow of blood to parts of the brain and decrease brain functions.

Cardiovascular disease is the leading cause of morbidity, disability and mortality in industrialized countries, and atherosclerosis is its main underlying pathology.

Our Technology

Our company has developed technology, covered by our patent applications, which uses certain pharmalogical compounds for the treatment of atherosclerosis. Through a process called delipidization, such compounds dissolve plaques in artery walls so they are removed through normal body processes. The compounds go through the atherosclerotic fibrous cap and, through delipidization, cause rapid reduction in the size of the deposits of soft vulnerable plaque in an artery’s walls. We also believe that the artery walls, once delipidized, will undergo a marked reduction in inflammation and ultimately undergo a significant restoration of their integrity. The compounds can be used to reverse the effects of existing atherosclerosis by widening the area in an artery through which the blood flows and avoiding the rupturing and dislodging of chunks of the hardened plaque. The compounds can also be used to prevent significant plaque buildups in arteries from occurring.

Our intellectual property for treating atherosclerosis began with the ideas and research of our two largest shareholders, Dr. Giorgio Zadini and Dr. Filiberto Zadini, who assigned their related IP rights to Z&Z Medical Holdings, Inc., a Nevada corporation and Operations’ predecessor (“Z&Z Nevada”), in December 2006. That IP was supplemented by subsequent research and unique in vitro (nonliving) experiments which demonstrated that our chosen compounds, through delipidization, cause substantial rapid regression of artherosclerotic plaques. Such demonstration was the confirmation of a long process of critical reasoning and evaluation of the properties of various compounds suspected to be effective on the basis of a thorough medical literature search. Indeed, th ere is much clinical evidence accumulated to date in the world medical literature that supports our clinical premise. Our research experiments are unique in the sense that we have found no record in medical literature of equivalent experiments demonstrating substantial regression of atherosclerotic plaques in vitro being achieved, let alone utilizing a virtually non-toxic compound or class of compounds such as is used in our technology.

The compounds used in our technology have a history of approval for use in humans by regulatory government agencies in a large number of developed countries throughout the world, including Germany, England, France, and Italy, and have been used in humans throughout the world, including in the USA, for their medical indications. The existing human safety record for this class of compounds, at higher concentrations than we required in our initial research, is well established for uses other than those which we have claimed in our IP. Use of the compounds in such other medical configurations, though approved, is limited to non-competing clinical applications that cannot be diverted or used off-label for the uses covered by our patent applications.

Our objective is to conduct animal and clinical trials of our technology at leading academic research centers under the supervision of recognized researchers and clinicians. We are currently in the final stages of documenting the results of our first laboratory study of our atherosclerosis technology, a proof-of-concept animal study performed at the University of California at Los Angeles (“UCLA”) in its Atherosclerosis Research Laboratory. We feel that the results are significant in demonstrating the positive effects recognized in our prior research and experiments. We shortly plan to commence two progressive laboratory studies of the technology at Cedars-Sinai Medical Center in Los Angeles, California and in cooperation with UCLA. These studies are expected t o cost approximately $400,000 and take 6-8 months to complete, and an additional 3–4 months to determine the final results.

Over time, we have approached a number of well known physician/scientist atherosclerosis researchers regarding our ideas for treating atherosclerosis and our technology. We entered into non-disclosure agreements with them and their institutions. Several of these researchers have joined our Medical Advisory Board.

As noted above, the delipidization properties of our chosen pharmacological compounds have been demonstrated in various scientific papers. But we have filed several applications seeking patents in the United States and under the international Patent Cooperation Treaty for our uses of such compounds to cause delipidization of atherosclerotic plaques based on those being “Novel Uses.” Those applications include known existing delivery methods for such uses of the compounds as well as several novel delivery methods. Our applications also extend to potential new synthesized derivatives of any of such pharmacological compounds. Our phytochemical (substances appearing naturally in plants) patent applications apply to, cover and protect “novel use” of an e ntire class of phytochemical compounds and new combinations of phytochemical preparations, as well as the delivery methods included and covered in our IP.

To protect our IP, we have entered into, and will enter into, confidentiality agreements with persons to whom we disclose confidential aspects of our technology who are not required by law to protect such confidentiality. We further have obtained, and will obtain, covenants from persons involved in the development of our technology, not only to maintain its confidentiality, but also to assign or license related IP rights to us.

Other Possible Medical Applications

Besides applications in atherosclerosis, delipidization has significant applications in other medical fields. The delipidization of subcutaneous fat has been scientifically demonstrated by researchers at a leading U.S. academic institution, and was achieved utilizing one of the compounds determined by us to be an effective delipidizing compound. This has possibly significant implications for use in the field of clinical cosmesis, for which we have developed certain IP for delipidization application to unwanted subcutaneous fat through transdermal delivery.

There are other promising potential areas of application for our IP that merit further exploration and testing. We believe that systemic application of our delipidizing pharmacological compounds may have beneficial effects in the treatment of obesity and some of the disorders associated with obesity such as hypertension, diabetes, etc. We also believe that cleansing the lipid buildup from the small peripheral vessels in the body via delipidization will have beneficial effects on overall human physiology and well-being.

Business Plan

As noted above, cardiovascular disease is the leading cause of morbidity, disability and mortality in industrialized countries, and atherosclerosis is its main underlying pathology. Atherosclerosis-related disease occurs in all age and socio-economic groups, with approximate equivalent distribution between the sexes, but with higher rates of prevalence and severity in minority populations. Treatments available to date have only barely slowed the growth rate of this disease. We believe our technology has the potential to significantly reduce the incidence and severity of atherosclerosis and that there is a vast potential market for its applications.

We plan to exploit our IP primarily by entering into various licenses with strategically selected licensees throughout the world. Such licensees may use our compounds and technology in treating or preventing atherosclerosis and other medical conditions or sublicense the IP to other such users. Such compounds are expected to be suitable for various delivery methods including parenteral, oral, transdermal and in-loco (through intra-arterial catherization). Our licensees may also produce, market or distribute products which utilize or add our compounds and technology in such treatment or prevention. Also, we anticipate that some of our licensees may couple our pharmacological compounds within their current commercial offerings to extend their patent lives with existing statin therapeutics or in-loco drug cluting technologies. We believe that, through such licensing, we can achieve significant revenues while maintaining modest staffing and infrastructure.

Many clinical uses by licensees of our technology will require regulatory approvals that will require further animal or clinical trials. However, uses by our licensees in less regulated over-the-counter markets, such as in phytochemical or neutraceutical products, may commence sooner.

The ultimate target audience for applications of our technology will include both prescribing physicians and other health providers and patient consumers. Such consumers will include patients who have symptoms of atherosclerosis as well as persons who do not have such symptoms but have high risk profiles to develop atherosclerosis. Such consumers may be key potential influencers and advocates for uses of our technology.

Competition

The global medical industry presently, through many large and small health care providers and other vendors of goods and services, generates substantial cash flows directly related to the treatment of symptomatic atherosclerotic disease. The clinical applications of our IP are expected to be a novel class of pharmacological compounds for treating and preventing atherosclerosis, suitable for parenteral, oral, transdermal and in-loco methods of delivery. The therapeutic applications of our IP within such a variety of clinical modalities are likely to be both synergistic and disruptive to the types of clinical care presently applied within the atherosclerosis-related markets. The technology or service companies involved in such markets may be diminished, substantially disrupted, and in some cases obviated by our technology. We anticipate that the most heavily affected companies may be prime targets for the licensing of our IP.

Existing markets sectors, with their approximate annual cash flows, which may be subject to obviation or disruption by our technology include Serum Screening ($3 Billion), Imaging ($12 Billion), Diagnostic Catheterizations ($12 Billion), Statin Drug Therapies ($10 Billion) and Drug Eluting Stents ($6 Billion). In addition, incalculable investment dollars are applied to emerging therapeutic technologies for cardiovascular diseases.

Government Regulation

Pharmaceutical companies are subject to extensive regulation by national, state and local agencies in the countries in which they do business. Of particular importance is the Food and Drug Administration (“FDA”) in the U.S. The FDA has jurisdiction over the pharmaceutical business and administers requirements covering the testing, safety, effectiveness, manufacturing, labeling, marketing, advertising, and post-marketing surveillance of pharmaceutical products. In addition, we or our licensees may be subject to the jurisdiction of various other federal regulatory and enforcement departments and agencies, such as the Department of Health and Human Services, the Federal Trade Commission and the Department of Justice. Individual states, acting through their attorne ys general, have become active as well, seeking to regulate the marketing of prescription drugs under state consumer protection and false advertising laws. The FDA and other governing regulatory bodies could enact new regulations or take actions which are against the industry or our IP applications in the medical and pharmaceutical industries, or otherwise adversely affect our licensees or our business.

Principal Executive Offices

Our principal executive offices following the Closing are located at 2301 Dupont Drive, Suite 525, Irvine, California 92612. As of May 1, 2010, Operations entered into a-month-to-month sublease of approximately 1,200 square feet of office space at that address, for which Operations will pay approximately $2,100 per month. The sublease is between Operations and PhyGen LLC, an unrelated medical device company for which Mr. Thomas W. Gardner, our Chief Executive Officer, also serves as Chief Executive Officer. Our telephone number is (949) 842-8989.

Employees

As of May 13, 2010, we had 1 full-time employee and no part-time employees. Since inception, we have never had a work stoppage, and our employee is not represented by a labor union. We consider our relationship with our employee to be positive.

Legal Proceedings

We are not currently party to any legal proceedings, the adverse outcome of which, in management’s opinion, individually or in the aggregate, would have a material adverse effect on our results of operations or financial position.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This discussion summarizes the significant factors affecting the operating results, financial condition and liquidity and cash flows of Operations for the fiscal years ended December 31, 2009 and 2008 and three months ended March 31, 2010 and 2009. The discussion and analysis that follows should be read together with the Financial Statements of Operations and the notes to the Financial Statements included elsewhere in this Current Report on Form 8-K. Except for historical information, the matters discussed in this Management’s Discussion and Analysis of Financial Condition and Results of Operations are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond our control.

Overview

We have developed IP, covered by our pending patent applications, which uses certain pharmalogical compounds uniquely for the treatment of atherosclerosis, which is the primary cause of various cardiovascular diseases. Atherosclerosis occurs when cholesterol or fats are deposited and harden as plaques in the walls of arteries. This hardening reduces the space within the arteries through which blood can flow. The plaque can also rupture and greatly restrict or block altogether blood flow. Through a process called delipidization, such compounds dissolve the plaques so they can be eliminated through normal body processes and avoid such rupturing. Such compounds may be used both to treat and prevent atherosclerosis.

In December 2006, Z&Z Medical Holdings, Inc. was formed as a Nevada corporation with the contributed intellectual property from Giorgio Zadini and Filiberto Zadini. During 2007, Z&Z Nevada sought various sources of working capital via an offering memorandum first prepared in November 2007, in which up to 1,500,000 shares were offered at $0.50 per share while it continued to perfect the patent applications previously filed. Concurrently, Z&Z Nevada was designing its clinical trial protocol and held discussions with various institutions about conducting a clinical animal study to test Z&Z Nevada’s conclusions reached in unique in vitro experiments.

During 2008, Z&Z Nevada signed an agreement with the University of California, Los Angeles and Dr. Aldons “Jake” Lusis for the initial clinical study in vivo. The cost of the study was set at $200,000 for all work associated with the trial. A clinical protocol was established and the study spanned a period of 30 weeks, with the trial concluding in October, 2009. We expect the publication of the results of the study sometime in the 3rd quarter of 2010.

Also during 2008, Z&Z Nevada raised working capital of $225,000 from sales of securities pursuant to its offering memorandum from various private sources at $0.50 per share to start its operations, intellectual property work and clinical research.

During 2009, Z&Z Nevada continued its research and intellectual property work and raised an additional $100,000 from various private sources from sales of securities pursuant to its offering memorandum at $0.50 per share. From 2007 through 2009 Z&Z Nevada attempted to obtain larger amounts of working capital without success. Certain potential investors expressed dissatisfaction with Z&Z Nevada’s status as a Nevada corporation. As a result Z&Z Nevada’s board of directors chose to reincorporate in Delaware pursuant to a merger with and into Operations in 2010.

During late 2009 Z&Z Nevada was introduced to KOM Capital Management, LLC, a private equity fund based in New York City (“KOM”), and on November 4, 2009 Z&Z Nevada and KOM signed a Letter of Intent for the company to merge with a subsidiary of our company whereby a) the holders of Z&Z Nevada’s securities would obtain approximately 98% of our outstanding shares and b) KOM would purchase $3,000,000 of our 2.5% Senior Secured Convertible Notes with an additional $3,000,000 purchasable if certain operating benchmarks were achieved in the ensuing 24 months, and would receive in connection therewith, warrants to purchase 100% of the shares of our common stock issuable upon conversion of such notes.

In 2010, during the due diligence period, Z&Z Nevada raised additional working capital of $225,000 from the final sales of its securities pursuant to the offering memorandum at $0.50 per share.

Events within the capital markets and internal to KOM resulted in the amendment of the Letter of Intent with KOM to reduce the initial purchase of 2.5% Senior Secured Convertible Notes to $1,500,000 with 50% warrant coverage, with an additional $1,500,000 (without warrants) purchasable for up to 14 months following the initial purchase of such notes. As a result of subsequent negotiations, Operations consummated the Capital Raise Transaction with the Purchasers.

General

Operating expenses consist primarily of payroll and related costs and corporate infrastructure costs. We expect that our operating expenses will increase as we finalize clinical testing and continue executing our business plan, in addition to the added costs of operating as a public company.

Historically, we have funded our working capital needs primarily through the sale of shares of our capital stock.

The Merger was accounted for as a reverse merger (recapitalization) with Operations deemed to be the accounting acquirer, and our company deemed to be the legal acquirer. Accordingly, the following discussing represents a discussion of the operations of our wholly-owned subsidiary, AtheroNova Operations, Inc. for the periods presented.

Results of Operations

Year Ended December 31, 2009 Compared with Year Ended December 31, 2008

Revenue

Operations did not recognize any revenue for the years ended December 31, 2009 and 2008, respectively.

Cost of Sales

Operations did not recognize any revenue for the years ended December 31, 2009 and 2008, therefore, did not record any cost of sales in those years, respectively.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $12,453 and $175,182 for the years ended December 31, 2009 and 2008, respectively. The decrease in selling, general and administrative expenses was due to a large progress payment made in 2008 upon the signing of the clinical trial contract and reversal of operating expenses in 2009 due to the forgoing of expense debentures originally recorded in 2008.

Interest Income, Net

Interest income declined to $130 in 2009 compared to $1,560 in 2008 due to a decline in cash held in an interest earning saving account.

Three Months Ended March 31, 2010 Compared with Three Months Ended March 31, 2009

Revenue

Operations did not recognize any revenue for the three months ended March 31, 2010 and 2009, respectively.

Cost of Sales

Operations did not recognize any revenue for the three months ended March 31, 2010 and 2009, therefore, did not record any cost of sales in those three-month periods, respectively.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $32,633 and $3,163 for the three months ended March 31, 2010 and 2009, respectively.

Interest Income, Net

Interest income declined to $6 in the three months ended March 31, 2010 compared to $108 in the three months ended March 31, 2009 due to a decline in cash held in an interest earning saving account.

Liquidity and Capital Resources

Net cash provided by operating activities was $961 and $24,954 in the years ended December 31, 2009 and 2008, respectively. The decrease in the amount of cash provided was largely due to increasing balances in accounts payables.

Net cash used in operating activities the three months ended March 31, 2010 was $230,770 due to the operating loss and the cancellation of the Note payable to related parties, which was a non-cash transaction. Net cash provided in operations in the three months ended March 31, 2009 was $14,268 due to the operating loss.

Net cash used by investing activities was $214,284 and $158,584 in 2009 and 2008, respectively as the Company continued to use funds do develop and solidify its intellectual property position.

Net cash used by investing activities was $1,042 and $52,323 in the three months ended March 31, 2010 and 2009, respectively as the Company purchased equipment in the current year and used funds to develop intellectual property in 2009.

Net cash provided by financing activities was $150,000 and $225,000 in 2009 and 2008, respectively. Cash provided by financing activities in both years include funds raised by Operations from working capital stock sale activity. In 2009, professional services with a value of $50,000 were provided in exchange for common stock.

Net cash provided by financing activities was $327,500 and $0 in the three months ended March 31, 2010 and 2009 respectively. Cash provided by financing activities in 2010 include funds raised by Operations from working capital stock sale activity in the amount of $225,000 and compensation for professional services in exchange for common stock in the amount of $102,500. No financing activity occurred in the three months ended March 31, 2009.

Operations has suffered recurring losses from operations and has an accumulated deficit of $385,945 and $373,622 in 2009 and 2008, respectively. As a development stage company, we are in need of generating significant cash resources to achieve our future strategic plan. We consequently consummated the Capital Raise Transaction on May 13, 2010. Part of the cost of the Capital Raise Transaction include costs associated with becoming and remaining a public company and filing and maintaining Registration Statements necessary to comply with our covenants in the Capital Raise Transaction. Even with the proceeds we generated from the Capital Raise Transaction, we anticipate that our existing cash and cash equivalents will not be sufficient to fund our business needs for more than 15 months and expect to have to raise significant additional capital. Our ability to continue our operations may prove to be more expensive than we currently anticipate and we may incur significant additional costs and expenses in connection therewith.

Going Concern Uncertainties

As of the date of Operations’ annual report, there is doubt regarding our ability to continue as a going concern as we have not generated sufficient cash flow to fund our business operations and loan commitments. Our future success and viability, therefore, are dependent upon our ability to generate capital financing. The failure to generate sufficient revenues or raise additional capital may have a material and adverse effect upon Operations and our shareholders.

Off-Balance Sheet Arrangements

Operations currently does not have any off-balance sheet arrangements or financing activities with special purpose entities.

Critical Accounting Policies and Estimates

This Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses Operations’ financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. To prepare these financial statements, management must make estimates and assumptions that affect the reported amounts of assets and liabilities. These estimates also affect its reported revenues and expenses. On an ongoing basis, management evaluates its estimates and judgment, including those related to revenue recognition, accrued expenses, financing operations and contingencies and litigation. Management bases its estimates and judgment on historical experience and on various other factors that are believed to b e reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of Operations’ critical accounting policies, defined as those policies that it believes are the most important to the portrayal of its financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

Research and Development Costs

Research and development costs consist of expenditures for the research and development of new products and technology. Research and development costs are expensed as incurred.

Intangible and Long-Lived Assets

In accordance with ASC 350-30 (formerly SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets), Operations evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that their net book value may not be recoverable. When such factors and circumstances exist, Operations compares the projected undiscounted future cash flows associated with the related asset or group of assets over their estimated useful lives against their respective carrying amount. Impairment, if any, is based on the excess of the carrying amount over the fair value, based on market value when available, or discounted expected cash flows, of those assets and is recorded in the period in which the determination is made. Operations’ management currently believes there is no impairment of its long-lived assets. There can be no assurance, however, that market conditions will not change or demand for its products under development will continue. Either of these could result in future impairment of long-lived asset.

Common Stock and Common Stock Warrants

Operations uses the fair value recognition provision of ASC 718, “Compensation-Stock Compensation,” which requires Operations to expense the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of such instruments. Operations uses the Black-Scholes option pricing model to calculate the fair value of any equity instruments on the grant date. Operations also uses the provisions of ASC 505-50, “Equity Based Payments to Non-Employees,” to account for stock-based compensation awards issued to non-employees for services. Such awards for services are recorded at either the fair value of the services rendered or the instruments issued in exchange for such services, whichever is more readily determinable, using the measurement date guidelines enumerated in ASC 505-50.

Recent Accounting Pronouncements

Note 2 to Operations’ financial statements for the years ended December 31, 2009 and 2008 sets forth certain accounting pronouncements that are applicable to its financial statements.

Description of Property

Our offices are currently located at 2301 Dupont Drive, Suite 525, Irvine, California 92612. It is from this facility that we conduct all of our executive and administrative functions. Such space consists of approximately 1,200 square feet which is subleased on a month-to-month basis, for approximately $2,100 per month, from PhyGen LLC, an unrelated medical device company for which Mr. Thomas W. Gardner, our Chief Executive Officer, also serves as Chief Executive Officer.

RISK FACTORS

YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS AND ALL OTHER INFORMATION CONTAINED IN THIS REPORT BEFORE PURCHASING SHARES OF OUR COMMON STOCK. INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. IF ANY OF THE FOLLOWING EVENTS OR OUTCOMES ACTUALLY OCCURS, OUR BUSINESS OPERATING RESULTS AND FINANCIAL CONDITION WOULD LIKELY SUFFER. AS A RESULT, THE TRADING PRICE OF OUR COMMON STOCK COULD DECLINE, AND YOU MAY LOSE ALL OR PART OF THE MONEY YOU PAID TO PURCHASE OUR COMMON STOCK.

Risks Relating to Our Business

We will continue to need additional financing to carry out our business plan. The net proceeds from the Capital Raise Transaction available to fund our business will be reduced by the required payments and reimbursements to stockholders to whom we are indebted and other transaction costs incurred by Operations. Although we estimate that the net funds from the Capital Raise Transaction will be sufficient to fund our planned activities for up to a year, we will need thereafter or sooner to obtain significant additional funding successfully to continue our business. Such additional funds may not be readily available or may not be available on terms acceptable to us.

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability. We have a history of operating losses and may not achieve or sustain profitability. We cannot guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may not be able to sustain or increase profitability and our failure to do so would adversely affect our business, including our ability to raise additional funds.

We may not be able to effectively manage our growth. Our strategy envisions growing our business. We plan to expand our technology, sales, administrative and marketing organizations. Any growth in or expansion of our business is likely to continue to place a strain on our management and administrative resources, infrastructure and systems. As with other growing businesses, we expect that we will need to further refine and expand our business development capabilities, our systems and processes and our access to financing sources. We also will need to hire, train, supervise and manage new employees. These processes are time consuming and expensive, will increase management respo nsibilities and will divert management attention. We cannot assure you that we will be able to:

| | · | expand our systems effectively or efficiently or in a timely manner; |

| | · | allocate our human resources optimally; |

| | · | identify and hire qualified employees or retain valued employees; or |

| | · | incorporate effectively the components of any business or product line that we may acquire in our effort to achieve growth. |

Our inability or failure to manage our growth and expansion effectively could harm our business and materially and adversely affect our operating results and financial condition.

Technology changes may make the products we are planning to bring to market obsolete. We believe that the methods for treating and preventing atherosclerosis of the pharmacological compounds we intend to bring to market enjoy certain competitive advantages, including superior performance and cost-effectiveness. Although we are not aware of any other treatments or methods currently being developed that would compete with the methods we intend to employ, there can be no assurance that future developments in technology or pharmacological compounds will not make our technology non-competitive or obsolete, or significantly reduce our operating margins or the demand for our offerings, or otherwise negatively impact our profit ability.

We may not be able to protect our intellectual property. We and our licensees may be unable to obtain IP rights to effectively protect our technology. Patents and other proprietary rights are an important part of our business plans. The ability to compete effectively may be affected by the nature and breadth of our IP rights. We intend to rely on a combination of patents, trade secrets and licensing arrangements to protect our technology. While we intend to defend against any threats to our IP rights, there can be no assurance that any of our patents, patent applications, trade secrets, licenses or other arrangements will adequately protect our interests.

Although we have pending patent applications in the United States and under the international Patent Cooperation Treaty covering uses of our technology, we have not received, and may never receive, any patent protection for our technology. We cannot guarantee any particular result or decision by the U.S. Patent and Trademark Office or a U.S. court of law, or by any patent office or court of any country in which we have sought patent protection. If we are unable to secure patent protection for our technology, our revenue and earnings, financial condition, or results of operations would be adversely affected. There can also be no assurance that any patent issued to or licensed by us in the future will not be challenged or circumvented by competitors, or that any patent issued to or lic ensed by us will be found to be valid or be sufficiently broad to protect us and our technology. A third party could also obtain a patent that may require us to negotiate a license to conduct our business, and there can be no assurance that the required license would be available on reasonable terms or at all.

We do not warrant any opinion as to patentability or validity of any pending patent application. We do not warrant any opinion as to non-infringement of any patent, trademark, or copyright by us or any of our affiliates, providers, or distributors. Nor do we warrant any opinion as to invalidity of any third-party patent or unpatentability of any third-party pending patent application.

We may also rely on nondisclosure and non-competition agreements to protect portions of our technology. There can be no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, that third parties will not otherwise gain access to our trade secrets or proprietary knowledge, or that third parties will not independently develop the technology.

IP litigation would be costly and could adversely impact our business operations. We may have to take legal action in the future to protect our technology or to assert our IP rights against others. Any legal action could be costly and time consuming to us, and no assurances can be made that any action will be successful. The invalidation of any patent or IP rights that we may own, or an unsuccessful outcome in lawsuits to protect our technology, could have a material adverse effect on our business, financial position, or results of operations.

We operate and compete in an industry that is characterized by extensive IP litigation. In recent years, it has been common for companies in the medical product and pharmaceutical businesses to aggressively file patent-infringement and other intellectual-property litigation in order to prevent the marketing of new or improved medical products, treatments, or pharmaceuticals. IP litigation can be expensive, complex, and protracted. Because of such complexity, and the vagaries of the jury system, IP litigation may result in significant damage awards and/or injunctions that could prevent the manufacture, use, distribution, importation, exportation, and sale of products or require us and/or any of our licensing partners to pay significant royalties in order to continue to manufacture, us e, distribute, import, export, or sell products. Furthermore, in the event that our right to license or to market our technology is successfully challenged, and if we and/or our licensing partners fail to obtain a required license or are unable to design around a patent held by a third party, our business, financial condition, or results of operations could be materially adversely affected. We believe that the patents we have applied for, if granted, would provide valuable protection for our intellectual property, but there nevertheless could be no assurances that they would be respected or not subject to infringement by others.

We are operating in a highly competitive industry. We are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods or approaches, who may have far greater resources, more experience, and personnel perhaps more qualified than we do. There can be no assurance that we will be able to successfully compete against these other entities.

We and our licensees will be subject to federal and state regulation. We and our potential licensing partners are subject to many laws and regulations, and any adverse regulatory action may affect our ability to exploit our IP. Developing, manufacturing, and marketing regulated medical products and pharmaceuticals are subject to extensive and rigorous regulation by numerous government and regulatory agencies, including the FDA and comparable foreign agencies. Under the Federal Food, Drug, and Cosmetic Act (the “FDA Act”), regulated medical devices must receive FDA clearance and approval before they can be commercially marketed in the U.S. Markets outside the U.S. require similar clearance and appr oval before a medical product or pharmaceutical can be commercially marketed. We cannot guarantee that we will be able to obtain, directly or through our licensees, marketing clearance from the FDA and other governing agencies for any new products, or modifications or enhancements to existing products, which we depend on for royalty revenues. Furthermore, if FDA clearance is obtained, such clearance could (a) take a significant amount of time; (b) require the expenditure of substantial resources; (c) involve rigorous pre-clinical and clinical testing; (d) require modifications to, or replacements of products; and/or (e) result in limitations on the proposed uses of products.

Even after regulated medical products or pharmaceuticals have received marketing clearance, approvals by the FDA can be withdrawn due to failure to comply with regulatory standards or the occurrence of unforeseen issues following initial approval. Failure to comply with regulatory standards or subsequent discovery of unknown problems with a regulated medical product could result in fines, suspensions of regulatory approvals, seizures or recalls of devices, operating restrictions, and/or criminal prosecution. There can be no assurance that any FDA approval will not be subsequently withdrawn. Any adverse regulatory action by the FDA or another regulatory agency may restrict us and our licensees from effectively marketing and selling our IP applications in medical products. I n addition, foreign laws and regulations have become more stringent and regulated medical products may become subject to increased regulation by foreign agencies in the future. Penalties for our licensees for any of their noncompliance with foreign governmental regulations could be severe, including revocation or suspension of their business licenses and criminal sanctions. Any foreign law or regulation imposed on our IP applications may materially affect our projected operations and revenues, by adverse impact on the distribution and sale of regulated medical products in foreign jurisdictions through our intended licensees.

Our licensees may not sustain compliance with regulatory standards and laws applicable to medical products production, manufacturing, and quality processes. Our licensees, which are manufacturers of medical products or pharmaceuticals, will be subject to periodic inspection by the FDA for compliance with regulations that require manufacturers to comply with certain practices and standards, including testing, quality control and documentation procedures. In addition, federal medical device reporting regulations require them to provide information to the FDA whenever there is evidence that reasonably suggests that a medical product may have caused or contributed to a death or serious injury or, if a malfunction were to oc cur, could cause or contribute to a death or serious injury. Compliance with these requirements is subject to continual review and is rigorously monitored through periodic FDA inspections. In foreign markets, our licensing partners are required to obtain certain certifications in order to sell medical products and must undergo periodic inspections by regulatory bodies to maintain these certifications. If our licensees fail to adhere to any laws and standards applicable to medical product manufacturers, the marketing of products could be suspended, and such failure could, for our licensees, lead to fines, withdrawal of regulatory clearances, product recalls, or other consequences, any of which could in turn adversely affect our projected business operations, financial condition, or results of operations. Our licensees will also be subject to certain environmental laws and regulations. Our licensing partners’ manufacturing operations may involve the use of substances and materials regulated by various environmental protection agencies and regulatory bodies. We cannot guarantee that any licensee will sustain compliance with environmental laws, and that regulations will not have a material impact on our earnings, financial condition, or business operations.

Failure of our licensees to comply with laws and regulations relating to reimbursement of health care products may adversely impact our business operations. Medical products are subject to regulation regarding quality and cost by the United States Department of Health and Human Services, Centers for Medicare & Medicaid services and comparable state and foreign agencies that are responsible for payment and reimbursement of healthcare goods and services. In the U.S., healthcare laws apply to our licensing partners’ business operations when a reimbursement claim is submitted under a federal government funded healthcare program. Federal laws and regulations prohibit the filing of false or improper claim s for federal payment and unlawful inducements for the referral of business reimbursable under federally-funded healthcare programs (known as the anti-kickback laws). If a governmental agency or regulatory body were to conclude that our licensees were not in compliance with applicable laws and regulations regarding payment or reimbursement of medical products, they could be subject to criminal and civil penalties, including exclusion from participation as a supplier of products to beneficiaries covered by government healthcare programs. Such exclusions could negatively affect our distribution channels, financial condition or results of operations.

Quality problems with a licensee’s manufacturing processes could harm our reputation and affect demand for medical products using our technology. Ensuring the quality of products and manufacturing processes is critical for medical product companies due to the high cost and seriousness of product failures or malfunctions. If any of our licensees failed to meet adequate quality standards, its and our reputations could be damaged and our revenues could decline. In addition, production of medical products which utilize our technology may depend on our licensees’ abilities to engineer and manufacture precision components and assemble such components into intricate medical products and, if they fail to meet these requirements or fail to adapt to changing requirements, their and our reputations may suffer and demand for products implementing our technology could decline significantly.

Uncertainties regarding healthcare reimbursements may adversely affect our business. Healthcare cost containment pressures decrease the prices end-users are willing to pay for medical products, which could have an adverse effect on our royalty revenue. Products that may implement our technology may be purchased by hospitals or physicians, which typically bill governmental programs, private insurance plans and managed care plans for the healthcare devices and services provided to their patients. The ability of these customers to obtain reimbursement from private and governmental third-party payors for the products and services they provide to patients is critical to commercial success. The availabil ity of reimbursement affects which products customers purchase and the prices they are willing to pay. Reimbursement varies from country to country and can significantly impact the acceptance of new products and services. Although we and our licensees may have a promising new product, we and our licensees may find limited demand for the medical product unless reimbursement approval is obtained from private and governmental third-party payors. Even if reimbursement approval is obtained from private and governmental third-party payors, we may still find limited demand for the product for other reasons. In addition, legislative or administrative reforms to the U.S., or to international reimbursement systems, in a manner that significantly reduces reimbursement for products or procedures using our technology, or denial of coverage for those products or procedures, could have a material adverse effect on our business, financial condition or results of operations.

Major third-party payors for hospital services in the U.S. and abroad continue to work to contain healthcare costs. The introduction of cost containment incentives, combined with closer scrutiny of healthcare expenditures by both private health insurers and employers, has resulted in increased discounts and contractual adjustments to hospital charges for services performed and has shifted services between inpatient and outpatient settings. Initiatives to limit the increase of healthcare costs, including price regulation, are also ongoing in markets in which our licensees may do business. Hospitals or physicians may respond to these cost-containment pressures by insisting that our licensees lower prices, which may adversely affect our royalties.

In response to increasing healthcare costs, there has been and may continue to be proposals by legislators, regulators, and third-party payors to reduce these costs. If these proposals are approved and passed, limitations and/or reductions may be placed on the net or allowable price of products implementing our technology or the amounts of reimbursement available for these products from customers, governmental bodies, and third-party payors. These limitations and reductions on prices may have a material adverse effect on our financial position and results of operations.

We and our licensees will be required to attract and retain top quality talent to compete in the marketplace. We believe our future growth and success will depend in part on our and our licensees’ abilities to attract and retain highly skilled managerial, product development, sales and marketing, and finance personnel. There can be no assurance of success in attracting and retaining such personnel. Shortages in qualified personnel could limit our ability to increase sales of existing products and services and launch new product and service offerings.

Our forecasts are highly speculative in nature and we cannot predict results in a development stage company with a high degree of accuracy. Any financial projections, especially those based on ventures with minimal operating history, are inherently subject to a high degree of uncertainty, and their ultimate achievement depends on the timing and occurrence of a complex series of future events, both internal and external to the enterprise. There can be no assurance that potential revenues or expenses we project will, in fact, be received or incurred.

Our auditors have expressed going concern opinions on our financial statements. Primarily as a result of our recurring losses and lack of liquidity, the reports of the independent auditors to both our company and Operations regarding our respective audited financial statements at December 31, 2009 expressed substantial uncertainty as to our abilities to continue as going concerns.

We will be subject to evolving and expensive corporate governance regulations and requirements. Our failure to adequately adhere to these requirements or the failure or circumvention of our controls and procedures could seriously harm our business. As a publicly traded company, we are subject to various federal, state and other rules and regulations, including applicable requirements of the Sarbanes-Oxley Act of 2002. Compliance with these evolving regulations is costly and requires a significant diversion of management time and attention, particularly with regard to our disclosure controls and procedures and our internal control over financial reporting. Our internal controls and procedures may not be able to prevent errors or fraud in the future. Faulty judgments, simple errors or mistakes, or the failure of our personnel to adhere to established controls and procedures, may make it difficult for us to ensure that the objectives of the control system are met. A failure of our controls and procedures to detect other than inconsequential errors or fraud could seriously harm our business and results of operations.

Our limited senior management team size may hamper our ability to effectively manage a publicly traded company while developing our products and harm our business. Our management team has experience in the management of publicly traded companies and complying with federal securities laws, including compliance with recently adopted disclosure requirements on a timely basis. They realize it will take significant resources to meet these requirements while simultaneously working on licensing, developing and protecting our IP. Our management will be required to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements, and any failure to do so could lead to the imposition of fines and penalties and harm our business.

We may incur substantial liability associated with registration rights granted to investors in the Capital Raise Transaction. Within 60 days following the closing of the Capital Raise Transaction, we are obligated to file with the Securities and Exchange Commission (“SEC”) a registration statement covering the resale by investors of the shares represented by the Notes and Warrants purchased in the Capital Raise Transaction. If we fail to timely file this registration statement or if the registration statement does not become effective within 180 days (or 150 days if the SEC does not fully review the registration statement) following the closing of the Capital Raise due to our failure to satisfy our obligatio ns, we will be obligated to make certain payments as liquidated damages to the investors in the Capital Raise Transaction for each day that elapses after the closing of the Capital Raise Transaction before the registration statement is filed or becomes effective, as applicable. There can be no assurance that the registration statement will be declared effective by the SEC within 180 days following the closing of the Capital Raise Transaction. Similar penalties may apply if we are unable to maintain the effectiveness of the registration statement.

The issuance of the Notes in the Capital Raise Transaction has subjected us to possible remedies of a secured creditor and has limited our financing alternatives. Our obligations under the Notes will be debt obligations, secured by security interests in all of the assets of our company and its subsidiaries, including their intellectual property. If we default on our obligations under the Notes and related agreements, the Note holders will be entitled to all the remedies of secured creditors including (without limitation) the ability to accelerate the due date for the entire principal amount, charge default interest and penalties and foreclose on our assets.

Anti-dilution adjustments under the Notes and Warrants issued in the Capital Raise Transaction may dilute the interests of our stockholders. If we are forced in the future to issue shares for prices less than the conversion price of the Notes, that may trigger anti-dilution adjustments that increase the numbers of shares that are issuable on conversions of the Notes or exercises of the Warrants issued in the Capital Raise Transaction. Such adjustments, particularly possible “ratchet” adjustments not weighted by the relative magnitude of the particular low-price share issuance, may significantly dilute the holdings of stockholders other than the investors in the Capital Raise Transaction.

Restrictions in the Notes and related documents will likely restrict our ability to raise debt funding or be acquired. Restrictions and provisions in the Notes and related documents will restrict our ability to raise additional debt financing without the Note holders’ consents. Also, financial penalties in the Notes and Warrants may make it difficult to us to be acquired by a third party.

Our Chief Executive Officer will not be devoting his full-time efforts to us in the next stages of operation. His departure could be an event of default under the Notes. While it is believed that Thomas Gardner’s services will be available to us, he currently has a non-exclusive contractual agreement to perform the services of CEO of PhyGen LLC, which designs, manufactures and sells instruments and implants for spine surgery. He is committed to fulfill such contractual obligations until January 1, 2011. To assist in this transitional stage, our Chief Financial Officer, Mark Selawski, became a full-time employee as of April 1, 2010. Mr. Selawski has over 15 years experience in the healthcare f ield and has had a previous working relationship with Mr. Gardner. To supplement this arrangement, we have secured office space adjacent to Mr. Gardner’s current place of business in order to facilitate a proximal work environment for him and Mr. Selawski. We feel that the financial arrangements that we have made for Mr. Gardner, as well as our work toward a new employment agreement for him, should be sufficient to retain his services, but there are no assurances these arrangements will be effective and adequate at this stage in our development. If Mr. Gardner ceases to be an employee of our company (other than due to a termination without good cause), that will be an event of default under the Notes unless we obtain a reasonably acceptable full-time replacement for Mr. Gardner within 90 days after such termination.