UNITED STATESSECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the registrant þ Filed by a Party other than the Registrant o

Check the appropriate box:

| | o | Preliminary Proxy Statement | o | Confidential, For Use |

| | þ | Definitive Proxy Statement | | of the Commission Only |

| | | Definitive Additional Materials | | (as permitted by Rule |

| | o | Soliciting Material under Rule 14a-12 | | 14a-6(e)(2)) |

ATHERONOVA INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No Fee Required |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement no.: |

| | | |

| | (3) | Filing party: |

| | | |

| | (4) | Date filed: |

ATHERONOVA INC.

2301 Dupont Drive, Suite 525

Irvine, CA 92612

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 19, 2013

To the Holders of Common Stock of AtheroNova Inc.:

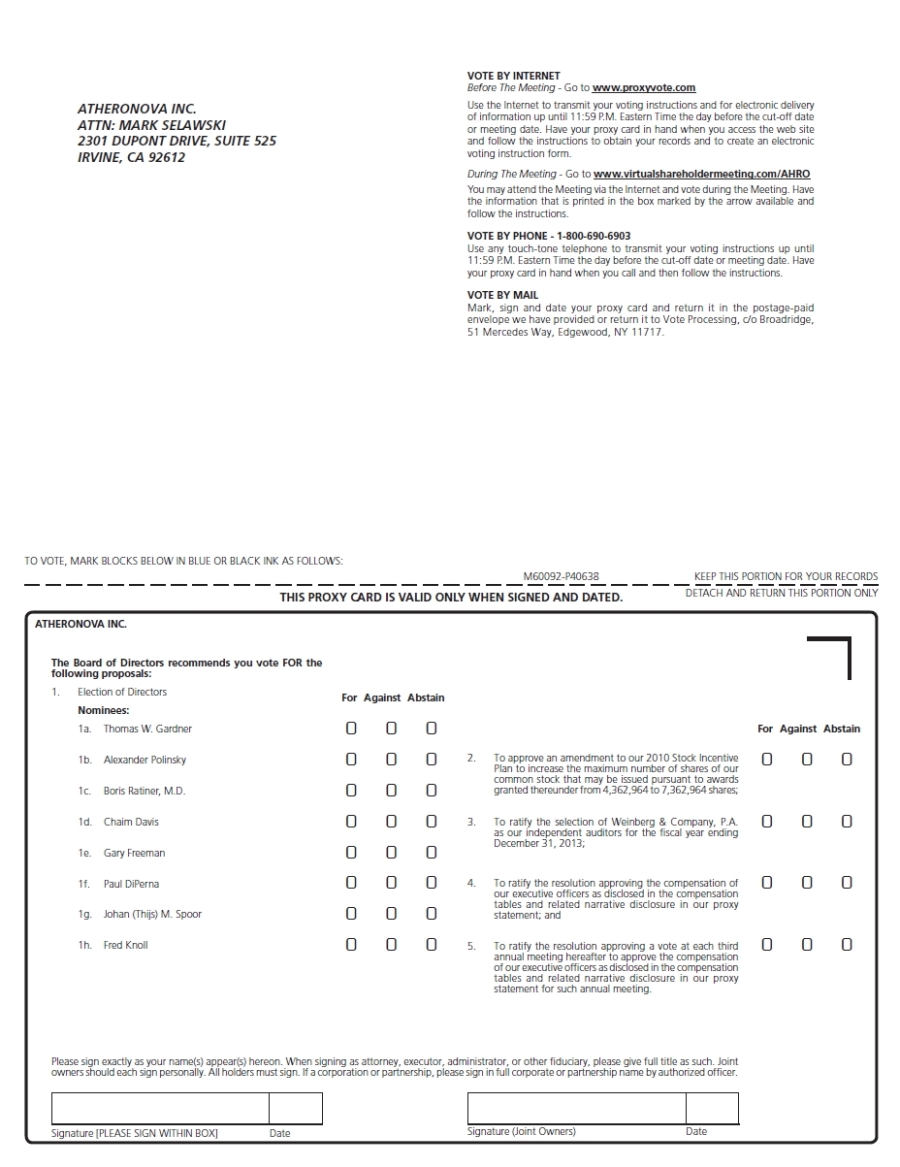

You are cordially invited to the Annual Meeting of Stockholders (“Annual Meeting”) of AtheroNova Inc., a Delaware corporation, to be held on June 19, 2013, beginning at 2:00 p.m. Pacific time. We will be hosting a virtual Annual Meeting. You may attend the Annual Meeting, vote your shares electronically and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/AHRO, using the 12-digit control number printed on the Notice Regarding the Availability of Proxy Materials we previously sent to you.

At the Annual Meeting, stockholders will be asked to consider and act upon the following matters:

| | 1. | To elect eight (8) members to our board of directors (“Board”) to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified, or until their earlier resignation or removal; |

| | 2. | To approve an amendment to our 2010 Stock Incentive Plan to increase the maximum number of shares of our common stock that may be issued pursuant to awards granted thereunder from 4,362,964 to 7,362,964 shares; |

| | 3. | To ratify the selection of Weinberg & Company, P.A. as our independent auditors for the fiscal year ending December 31, 2013; |

| | 4. | To hold an advisory vote on executive compensation; |

| | 5. | To hold an advisory vote on the frequency of the advisory vote on executive compensation; and |

| | 6. | To transact other business properly presented at the Annual Meeting or any postponement or adjournment thereof. |

Our Board has fixed April 23, 2013 as the record date for the determination of stockholders entitled to notice and to vote at the Annual Meeting and any postponement or adjournment thereof, and only stockholders of record at the close of business on that date are entitled to notice and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and at the offices of the Company for 10 days prior to the Annual Meeting.

All stockholders are cordially invited to attend the meeting. This year, we are using the Internet as our primary means of furnishing proxy materials to our stockholders. Accordingly, most stockholders will not receive paper copies of our proxy materials. We will instead send our stockholders a notice with instructions for accessing the proxy materials and voting electronically over the Internet. The notice also provides information on how stockholders may request paper copies of our proxy materials. You may access the proxy statement and our annual report on the Internet, both of which are available at “www.proxyvote.com.”

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. YOU ARE INVITED TO ATTEND THE ANNUAL MEETING IN PERSON, BUT WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE VOTE YOUR SHARES BY PROXY AS SOON AS POSSIBLE ELECTRONICALLY OVER THE INTERNET, BY TELEPHONE OR IF YOU RECEIVE A PROXY CARD OR VOTING INSTRUCTION FORM IN THE MAIL, BY MAILING THE COMPLETED PROXY CARD OR VOTING INSTRUCTION FORM. IF YOU DO ATTEND THE ANNUAL MEETING, YOU MAY, IF YOU PREFER, REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

| | By Order of the Board of Directors, /s/ Thomas W. Gardner Thomas W. Gardner, Chief Executive Officer and President |

| | |

Irvine, CA

May 7, 2013

ATHERONOVA INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 19, 2013

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of AtheroNova Inc., a Delaware corporation, for use at the annual meeting of Stockholders to be held on June 19, 2013, at 2:00 p.m. Pacific Time, or the Annual Meeting. We will be hosting a virtual Annual Meeting. You may attend the Annual Meeting, vote your shares electronically and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/AHRO, using the 12-digit control number printed on the Notice Regarding the Availability of Proxy Materials (the “Notice”) we previously sent to you. Accompanying this Proxy Statement is our board of directors’ proxy for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this Proxy Statement. You may submit your proxy via the Internet by visiting www.proxyvote.com (you will need your 12-digit control number printed on the Notice), via telephone by calling (800) 690-6903 (you will need your 12-digit control number printed on the Notice), or by mail if you receive a proxy card in the mail.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we are mailing a Notice Regarding the Availability of Proxy Materials instead of a paper copy of our Proxy Statement and Annual Report on Form 10-K to our stockholders who have not specified that they wish to receive paper copies of our proxy materials. The Notice also contains instructions on how to request a paper copy of our proxy materials, including our Proxy Statement, Annual Report on Form 10-K and a form of proxy card. The Notice will also instruct you as to how you may submit your proxy over the Internet. The Internet voting facilities will close at 11:59 p.m. Pacific Time, Tuesday, June 18, 2013 for purposes of tabulation. We will mail the Notice on or around May 7, 2013.

We will bear the expense of this solicitation of proxies. Solicitations will be made only by use of the mail except that, if deemed desirable, officers and regular employees of our company may solicit proxies by telephone, electronic mail or personal calls. We may also engage a proxy solicitation firm on terms and at costs reasonably acceptable to our board of directors. Brokerage houses, custodians, nominees and fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of the stock held of record by those persons and we will reimburse them for their reasonable expenses incurred in this regard.

The purpose of the Annual Meeting and the matters to be acted upon are set forth in the attached Notice of Annual Meeting. As of the date of this Proxy Statement, our board of directors knows of no other business that may be presented for consideration at the Annual Meeting. All proxies which are properly completed prior to the Annual Meeting and which have not been revoked will be voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A stockholder may revoke its proxy at any time before it is voted either by filing with our Secretary, at our principal executive offices, a written notice of revocation or by subsequently submitting a new proxy via the Internet, telephonically or by mail, or by attending the Annual Meeting and following the procedures required to submit a vote during the Annual Meeting, provided that if a stockholder holds its shares in street name, such stockholder may vote its shares at the Annual Meeting only if it obtains a proxy executed in its favor, from the record holder. If any other business properly comes before the Annual Meeting, votes will be cast pursuant to those proxies in respect of any other business in accordance with the judgment of the persons acting under those proxies.

Our principal executive offices are located at 2301 Dupont Drive, Suite 525, Irvine, CA 92612.

OUTSTANDING SECURITIES AND VOTING RIGHTS

The close of business on April 23, 2013, has been fixed as the record date for the determination of stockholders entitled to notice and to vote at the Annual Meeting or any postponement or adjournment thereof. As of the record date, we had outstanding 38,082,875 shares of common stock, par value $0.001 per share. Our common stock is our only outstanding voting security. As of the record date, we had 159 holders of record of our common stock.

A holder of common stock is entitled to cast one vote for each share held on the record date on all matters to be considered at the Annual Meeting. The nominees for director who receive a plurality of the votes cast by the holders of our common stock, in person or by proxy at the Annual Meeting, will be elected. Approval of the proposal to amend our 2010 Stock Incentive Plan to increase the maximum number of shares of our common stock that may be issued pursuant to awards granted thereunder from 4,362,964 to 7,362,964, approval of the proposal to ratify the appointment of Weinberg & Company, P.A., as our independent accountants for the fiscal year ending December 31, 2013, approval of the advisory vote on the resolution approving the compensation of our executives as disclosed in the compensation tables and related narrative disclosure herein, and approval of the advisory vote on setting the frequency of the advisory vote on executive compensation at three years, requires the favorable vote of a majority of shares voted at the Annual Meeting or by proxy.

A quorum, which is a majority of the outstanding shares as of April 23, 2013, must be present to hold the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending in person and by their proxy holders. Abstentions and broker non-votes will be included in the determination of shares present at the Annual Meeting for purposes of determining a quorum. Abstentions will be counted toward the tabulation of votes cast on proposals submitted to stockholders and will have the same effect as negative votes, while broker non-votes will not be counted as votes cast for or against these matters or deemed present or represented for determining whether stockholders have approved a proposal. Broker non-votes occur when a broker holding customer securities in street name has not received voting instructions from the customer on certain “non-routine” matters, such as director elections, and, therefore, is barred by the rules of the applicable securities exchange from exercising discretionary authority to vote those securities. Brokers may vote their clients’ shares on routine matters, such as the ratification of our independent registered public accounting firm.

Your vote is important. If your shares are registered in your name, you are a stockholder of record. If your shares are in the name of your broker or bank, your shares are held in street name. We encourage you to vote by proxy so that your shares will be represented and voted at the Annual Meeting even if you cannot attend. All stockholders can vote by proxy. Your submission of a proxy will not limit your right to vote at the Annual Meeting if you later decide to attend in person via the Internet at www.virtualshareholdermeeting.com/AHRO (you will need your 12-digit control number printed on the Notice to participate in the Annual Meeting via the Internet). If your shares are held in street name, you must obtain a proxy, executed in your favor, from the holder of record in order to be able to vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy at any time before the Annual Meeting either by filing with our Secretary, at our principal executive offices, a written notice of revocation or by subsequently submitting a new proxy via the Internet, telephonically or by mail, or by attending the Annual Meeting and following the procedures required to submit a vote during the Annual Meeting, provided that if your shares are held in “street name”, you must obtain a proxy, executed in your favor, from the holder of record in order to be able to vote at the Annual Meeting. All shares entitled to vote and represented by properly executed proxies received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no instructions are indicated on a properly executed proxy, the shares represented by that proxy will be voted as recommended by our board of directors.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Proposal 1 is the election of eight (8) directors to hold office until the next annual meeting of the shareholders or until their respective successors have been duly elected and qualified. Our Amended and Restated Bylaws provide that the number of directors of our company shall be fixed from time to time by resolution of our board of directors. On November 6, 2012, our board of directors fixed the number of directors at eight (8).

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the proxies will be voted for such other nominee(s) as shall be designated by the then current board of directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

Our board of directors proposes the election of the following nominees as directors:

Thomas W. Gardner

Alexander Polinsky

Boris Ratiner, M.D.

Chaim Davis

Gary Freeman

Paul DiPerna

Johan (Thijs) M. Spoor

Fred Knoll

If elected, the foregoing eight (8) nominees are expected to serve until the 2014 annual meeting of stockholders.

Required Vote

The nominees for director who receive a plurality of the votes cast by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal will be elected.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE.

CURRENT DIRECTORS/DIRECTOR NOMINEES

The following table sets forth the names, positions and ages of our current directors and director nominees as of April 23, 2013. All directors serve until the next annual meeting of stockholders or until their successors are elected and qualified.

| Name | | Age | | Position |

| Thomas W. Gardner | | 59 | | Chairman, Chief Executive Officer and President |

Alexander Polinsky (3) | | 57 | | Director |

Boris Ratiner, M.D. (3) | | 45 | | Director |

Chaim Davis (1) (2) | | 35 | | Director |

Gary Freeman (1) (2) | | 45 | | Director |

Paul DiPerna (2) | | 54 | | Director |

Johan (Thijs) M. Spoor (1) (3) | | 41 | | Director |

| Fred Knoll | | 57 | | Director |

| | (1) | Member of the Audit Committee. |

| | (2) | Member of the Compensation Committee. |

| | (3) | Member of the Medical Committee. |

Thomas W. Gardner has served as our Chairman, Chief Executive Officer and President since May 2010, and as the Chief Executive Officer, the President and a director of AtheroNova Operations since its formation in December 2009. He held the same positions with Z&Z Nevada, the predecessor in interest to AtheroNova Operations, from December 2006 until its merger into AtheroNova Operations in March 2010. Since September 2008, he also has been the President of PhyGen LLC, which designs, manufactures and sells instruments and implants for spine surgery. He is a senior medical industry executive with twenty-six years’ experience in healthcare. He has extensive hands-on experience with successful start-up ventures, having helped found six healthcare companies, three of them that were publicly traded. He has served as President/CEO of Urogen, a San Diego-based Biotech company, President of Endocare, an Orange County-based urologic products company; President/CEO of AutoCath, an Orange County based vascular access company, and Executive Vice President of Medstone International, an Orange County medical products company. Mr. Gardner’s twenty-six years of experience in the healthcare industry and his substantial experience with successful start-up ventures and public companies enables him to offer valuable perspectives on the operation of our business.

Gary Freeman Mr. Freeman has served as one of our directors since July 2007 and currently serves as the Chairman of the Audit Committee of our board of directors. Mr. Freeman is currently a Partner in Beach, Freeman, Lim & Cleland’s Audit and Accounting services division. In conjunction with various consulting engagements, Mr. Freeman has assumed interim senior level management roles at numerous public and private companies during his career, including Co-President and Chief Financial Officer of Trestle Holdings, Inc., Chief Financial Officer of Silvergraph International and Chief Financial Officer of Galorath Incorporated. Mr. Freeman served as a member of the board of directors of Blue Holdings, Inc., Trestle Holdings, Inc. and GVI Security Solutions. Mr. Freeman’s previous experience includes ten years with BDO Seidman, LLP, including two years as an Audit Partner. Mr. Freeman brings to our board his extensive experience in accounting and financial matters for public companies.

Boris Ratiner, M.D. has served as one of our director since May 2010 and currently serves as the Chairman of the Medical Committee of our board of directors. Dr. Ratiner has been a director of AtheroNova Operations since December 2009 and was a director of Z&Z Nevada from December 2006 until March 2010. He received an Advanced Bachelor’s degree in Chemistry at Occidental College in Los Angeles. He then attended Medical School at LSU in New Orleans, followed by an Internal Medicine Residency and Rheumatology Fellowship at the University of California San Francisco (UCSF). He is Board Certified in Internal Medicine and Rheumatology and is in private practice in Tarzana, California. He is the medical director and founder of Rheumatology Therapeutics, where he leads a team of 23 staff members that care for patients with Arthritis and Autoimmune Diseases. He also serves on the board of the San Fernando Valley Branch of the Arthritis Foundation and is the Program Director for the Southern California Rheumatism Society. He is a founder and active board member of 4Medica, a successful medical informatics company that he co-founded in 1999. He is also a Clinical Instructor of Medicine at the David Geffen School of Medicine at the University of California Los Angeles (UCLA), a teaching attendant with the Cedars-Sinai’s Division of Rheumatology and an instructor at the Northridge Family Medicine Teaching Program. He is an active clinical investigator and is actively involved in trials of new medications for gout, lupus, rheumatoid arthritis, osteoarthritis, psoriatic arthritis, ankylosing spondylitis and fibromyalgia. He is published in peer-reviewed papers, abstracts and textbooks. He is a frequent speaker at local hospitals to physicians on Rheumatology related diseases. He has authored several book chapters on osteoarthritis and research papers on Hepatitis C arthritis. Dr. Ratiner’s extensive experience in various aspects of medical practice and research provides valuable insights with respect to our research and development activities.

Paul DiPerna has served as a member of our board of directors since November 2010 and currently serves as the Chairman of the Compensation Committee of our board of directors. Mr. DiPerna is the Founder, Chief Technical Officer and a Board Member of Tandem Diabetes Care, a venture backed company that has raised $78 million. Tandem is developing technology to be used in the care of diabetes. In this venture Mr. DiPerna has over 18 patents issued and in process. Prior to forming Tandem, Mr. DiPerna worked at Baxter Healthcare for 14 years where he held progressive management positions as a Technologist for cell separation systems, Program Manager of the largest and most complex system Baxter had undertaken, Director of Business Develop in the corporate technology group creating new technologies and integrating acquisitions into Baxter and as the General Manager of Digital Dental Sciences, a CT-based startup within the organization. Mr. DiPerna had 10 patents issued at Baxter. Mr. DiPerna was also a Senior VP of Technology and Operations at Hepahope, a startup developing liver dialysis systems for end stage liver failure patients prior to funding of Tandem. Mr. DiPerna received a Masters in Engineering Management from Northeastern University and a BS in Mechanical Engineering from the University of Massachusetts Lowell. He is a member of the American Diabetes Association and the American Society of Clinical Oncology. Mr. DiPerna brings to our board of directors his extensive management experience in the healthcare industry.

Alexander Polinsky, Ph.D. has served as a member of our board of directors since October 2010. Dr. Polinsky received his Ph.D. in Physical Chemistry from Moscow University, Russia, in 1982, followed by post-doctoral training at the Institute for Biochemistry at the Russian Academy of Science. He was on the faculty at Moscow University for 5 years studying the mechanisms of action of synthetic vaccines. After moving to the U.S. in 1988, he spent 2.5 years as a Visiting Scientist at UCSD developing new methods for computer-aided drug design. In 1991, Dr. Polinsky co-founded the Alanex Corporation and built the company from scratch around novel computational and combinatorial chemistry technologies; he served as Alanex’s Chief Scientific Officer until it was acquired by Agouron in 1997. After the acquisition by Pfizer in 2000, Dr. Polinsky became Vice President, Head of Discovery Technologies, at the Pfizer La Jolla Labs. In 2001 he established Pfizer’s global chemistry outsourcing network and between 2001 and 2006, managed a $750 million investment in the creation of modern drug screening collection. In 2006, he moved into Pfizer Global Research Technology where he led the development of Pfizer External Research Network and Pharma Incubator concepts. In 2007, Dr. Polinsky established The Pfizer Incubator (TPI) and became its CEO, starting three biotechnology companies. He left Pfizer in 2008 to pursue his own entrepreneurial interests and in 2009 started a biotech company Tartis, Inc. developing oncology drugs, and joined Maxwell Biotech Venture Fund as its Managing Partner. Over the years, Dr. Polinsky invested and served on boards of several private biotech startups. Dr. Polinsky brings to our board of directors his extensive experience in the pharmaceutical industry.

Chaim Davis has served as one of our directors since May 2010. He is currently the Managing Partner of Revach Fund L.P., an investment fund focused on life science industries. He served as a Healthcare Analyst at The Garnet Group from April 2001 through June 2004. He received his bachelor’s degree from Columbia University. Mr. Davis’ experience in various aspects of life science and healthcare industry investments provides valuable insights with respect to capitalizing our operations.

Johan (Thijs) M. Spoor was appointed as a member of our board of directors on January 3, 2012. Mr. Spoor currently serves as the Chief Executive Officer and President, and is a director, of FluoroPharma Medical, Inc. He previously held the title of Chief Financial Officer for Sunstone BioSciences. Prior to joining Sunstone BioSciences, he worked as a consultant at Oliver Wyman focusing on helping pharmaceutical and medical device companies evaluate their global revenue potential given the complex interplay of regulatory approvals, the reimbursement environment, as well as the impact of physician preference within constantly evolving standards of care. He further specialized on the implications of healthcare reform on new product approval and health insurance reform. Mr. Spoor has also been an equity research analyst at J.P. Morgan and Credit Suisse covering the Biotechnology and Medical Device industries. He worked in the pharmaceutical industry spending 10 years with Amersham / GE Healthcare where he worked in seven countries in a variety of roles including setting up GMP facilities meeting ISO 9001 standards, accountability for the entire nuclear cardiology portfolio and most recently as the Director of New Product Opportunities leading the PET strategic plan. Mr. Spoor holds a Nuclear Pharmacy degree from the University of Toronto as well as an M.B.A. from Columbia University with concentrations in finance and accounting. He has been a guest lecturer at Columbia Business School, Kings College in London and the University of Newcastle in Australia and has presented at medical grand rounds and psychiatric grand rounds at various hospitals on the role of brain imaging. Mr. Spoor also serves as a member of the board of directors of MetaStat, Inc (MTST). Mr. Spoor’s experience managing a publicly traded company and his experience in the pharmaceutical and medical device industries provides valuable insights with respect to our operational activities.

Fred Knoll was appointed as a member of our board of directors on November 6, 2012. Since 1987, Mr. Knoll has been the principal and portfolio manager at Knoll Capital Management, an investment company managing funds over the last two decades in areas such as emerging growth companies, restructurings and China. During the 80’s and early 90’s, he was Chairman of the Board of Directors of Telos Corporation, a computer systems integration company, served as investment manager for General American Investors, was the United States representative on investments in leveraged buyouts and venture capital for Murray Johnstone, Ltd. of Glasgow, UK, and headed the New York investment group of Robert Fleming, Inc., at the time, a leading United Kingdom merchant bank subsequently acquired by JP Morgan, managing a venture capital fund and the U.S. research team. Mr. Knoll started his investment career as an investment analyst at Capital Research (Capital Group) in the early 80s and held positions in sales and marketing with Wang Inc. and Data General and software engineering with Computer Sciences Corporation in the late 70s. Mr. Knoll holds a Bachelor’s of Science in Electrical Engineering and Computer Science from Massachusetts Institute of Technology (M.I.T.), a Bachelor’s of Science in Management from the Sloan School at M.I.T., and a M.B.A. from Columbia University in Finance and was a member of the Columbia University International Fellows Program. Mr. Knoll’s experience as an investor provides valuable insights with respect to capitalizing our operations.

On May 13, 2010, Filiberto Zadini, Giorgio Zadini, Thomas W. Gardner and Boris Ratiner (collectively, the “Z&Z Shareholders”), and W-Net Fund I, L.P. (“W-Net”), Europa International, Inc. (“Europa”) and MKM Opportunity Master Fund, Ltd. (“MKM” and together with W-Net and Europa, the “Purchasers”), entered into a Voting Agreement, as amended on November 6, 2012, pursuant to which such parties became obligated, for four years, to vote to elect members of our board of directors as described below. The Voting Agreement provides that the authorized number of directors will be eight, consisting of three directors whose replacements will be determined under the terms of the Voting Agreement by the holders of a majority of the shares held by the Z&Z Shareholders, currently Thomas W. Gardner, Boris Ratiner, M.D. and Paul DiPerna, three directors whose replacements will be determined under the Voting Agreement by the holders of a majority of the shares held by the Purchasers, currently Gary Freeman, Chaim Davis and Fred Knoll, and two additional directors whose replacements will be determined jointly by the holders of a majority of the shares held by the Z&Z Shareholders and the holders of a majority of the shares held by the Purchasers, currently Alexander Polinsky, Ph.D. and Johan (Thijs) M. Spoor.

OTHER EXECUTIVE OFFICERS

The following table sets forth the name, age and position of each of our other executive officers as of April 23, 2013. Officers are appointed by our board of directors and their terms of office are, except to the extent governed by an employment contract, at the discretion of our board of directors.

| Name | | Age | | Position |

| Mark Selawski | | 57 | | Chief Financial Officer and Secretary |

Mark Selawski has served as our Chief Financial Officer and Secretary since May 2010. Mr. Selawski joined AtheroNova Operations and Z&Z Nevada in January 2010 as Chief Financial Officer. He became the Secretary of AtheroNova Operations in March 2010. From 2004 to 2009 he served as Chief Financial Officer of United Polychem, Inc., a privately held petrochemical distribution company. From 1988 to 2004, he held several positions at Medstone International, during the last 9 years being the Vice President-Finance, Chief Financial Officer and Corporate Secretary. Medstone was a NASDAQ-listed capital medical device manufacturer dedicated to urology products. Before joining Medstone, he held various financial positions with a number of manufacturing and high-tech companies in Southern California. He holds a Bachelor of Science in Accounting from Bowling Green State University.

BOARD MEETINGS AND COMMITTEES OF BOARD OF DIRECTORS

Board Leadership Structure and Role in Risk Oversight.

Mr. Gardner serves as both our Chief Executive Officer and Chairman, and we do not have a lead independent director. Our board of directors determined that Mr. Gardner’s service as both our Chief Executive Officer and Chairman is appropriate given that we are a development stage company and require effective and focused leadership to move our company out of the development phase. Our board of directors plays an active role, as a whole and also at the committee level, in overseeing management of our risks and strategic direction. Our board of directors regularly reviews information regarding our liquidity and operations, as well as the risks associated with each. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. Our Audit Committee oversees the process by which our senior management and relevant employees assess and manage our exposure to, and management of, financial risks. Our board of directors also manages risks associated with the independence of members of our board of directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed about such risks.

Director Independence

In conjunction with the preparation of this report, using the definition of “independence” established by the NASDAQ Stock Market, our board of directors has evaluated all relationships between each director and our company. Based on the foregoing definition, our board of directors has determined that five of our directors, Messrs. Freeman, Davis, Polinsky, DiPerna and Spoor, currently meet the definition of an “independent” director under the standards established by NASDAQ. Each of Messrs Freeman, Davis, DiPerna and Spoor serves on the Audit Committee and/or Compensation Committee of our board of directors. We do not have a separately designated nominating committee of our board of directors. Our board of directors will continually monitor the standards established for director independence under applicable law or listing requirements and will take all reasonable steps to assure compliance with those standards.

Board Meetings

Our board of directors held 4 meetings during fiscal 2012. All other actions by our board of directors were taken by unanimous written consent. Directors may be paid their expenses, if any, of attendance at a meeting of our board of directors, and may be paid a fixed sum for attendance at each meeting of our board of directors or a stated salary as a director. No such payment shall preclude any director from serving us in any other capacity and receiving compensation therefor except as otherwise provided under applicable law. While we do not require members of our board of directors to attend our annual meetings of stockholders, each director is encouraged to do so.

Audit Committee

Our Audit Committee currently consists of Messrs. Freeman (who serves as Chairman), Davis and Spoor. Our Audit Committee is responsible for selecting and engaging our independent accountant, establishing procedures for the confidential, anonymous submission by our employees of, and receipt, retention and treatment of concerns regarding accounting, internal controls and auditing matters, reviewing the scope of the audit to be conducted by our independent public accountants, and periodically meeting with our independent public accountants and our chief financial officer to review matters relating to our financial statements, our accounting principles and our system of internal accounting controls. Our Audit Committee reports its recommendations as to the approval of our financial statements to our board of directors. The role and responsibilities of our Audit Committee are more fully set forth in an amended and restated written charter adopted by our board of directors on June 17, 2010. Our Audit Committee reviews and reassesses the Audit Committee Charter annually and recommends any changes to our board of directors for approval. Our Audit Committee held four meetings during the year ended December 31, 2012.

We are not a “listed company” under SEC rules and are therefore not required to have an audit committee comprised of independent directors. Our board of directors has, however, determined that Messrs. Freeman, Davis and Spoor are “independent” as that term is defined in the applicable rules for companies traded on the NASDAQ Stock Market, and that Mr. Freeman is an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K. Our board of directors has also determined that each other member of our Audit Committee is able to read and understand fundamental financial statements and has substantial business experience that results in such member’s financial sophistication. Accordingly, our board of directors believes that each member of our Audit Committee has sufficient knowledge and experience necessary to fulfill such member’s duties and obligations on our Audit Committee.

Report of Audit Committee

In fulfilling its responsibilities for the financial statements for fiscal year 2012, our Audit Committee:

| | · | Reviewed and discussed the audited financial statements for the year ended December 31, 2012 with management; |

| | · | Discussed with Weinberg & Company, P.A., our independent auditors (“Weinberg”), the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| | · | Received the written disclosures and the letter from Weinberg required by applicable requirements of the Public Company Accounting Oversight Board regarding Weinberg’s communications with the Audit Committee concerning independence, and has discussed with Weinberg Weinberg’s independence. |

Based on our Audit Committee’s review of our audited financial statements and discussions with management and Weinberg, our Audit Committee recommended to our board of directors that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2012.

| | Audit Committee: Gary Freeman Chaim Davis Johan (Thijs) M. Spoor |

The information in this Audit Committee Report shall not be deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission or to be subject to Regulation 14A or 14C as promulgated by the Securities and Exchange Commission, or to the liabilities of Section 18 of the Exchange Act.

Compensation Committee

We have a Compensation Committee composed of Messrs. DiPerna (who serves as Chairman), Freeman and Davis. The Compensation Committee is responsible for assisting our board of directors in ensuring that a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management, and that compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and our company, discharging our board of directors’ responsibilities relating to compensation of our executive officers, evaluating our Chief Executive Officer and setting his remuneration package, and making recommendations to our board of directors with respect to incentive-compensation plans and equity-based plans. The role and responsibilities of our Compensation Committee are more fully set forth in a written charter adopted by our board of directors on June 17, 2010. Our Compensation Committee reviews and reassesses the Compensation Committee Charter annually and recommends any changes to our board of directors for approval. Our Compensation Committee held two meetings during the year ended December 31, 2012.

The policies underlying our Compensation Committee’s compensation decisions are designed to attract and retain the best-qualified management personnel available. We routinely compensate our executive officers through salaries. At our discretion, we may reward executive officers and employees through bonus programs based on profitability and other objectively measurable performance factors. Additionally, we use stock options to compensate our executives and other key employees to align the interests of our executive officers with the interests of our stockholders. In establishing executive compensation, our Compensation Committee evaluates compensation paid to similar officers employed at other companies of similar size in the same industry and the individual performance of each officer as it impacts our overall performance with particular focus on an individual’s contribution to the realization of operating profits and the achievement of strategic business goals. Our Compensation Committee further attempts to rationalize a particular executive’s compensation with that of other executive officers of our company in an effort to distribute compensation fairly among the executive officers. Although the components of executive compensation (salary, bonus and option grants) are reviewed separately, compensation decisions are made based on a review of total compensation.

Nominations

We do not have a nominations committee because our board of directors does not believe that a defined policy with regard to the consideration of candidates recommended by shareholders is necessary at this time because it believes that, given the limited scope of our operations, a specific nominating policy would be premature and of little assistance until our business operations are at a more advanced level. There are no specific, minimum qualifications that our board of directors believes must be met by a candidate recommended for our board of directors. Currently, the entire board of directors decides on nominees, based on the selections made under the terms of the Voting Agreement. We do not pay any fee to any third party or parties to identify or evaluate or assist in identifying or evaluating potential nominees. The Z&Z Shareholders and the Purchasers have agreed to vote to elect directors as set forth in the Voting Agreement.

Stockholder Communications

Holders of our securities can send communications to our board of directors via mail to our principal executive offices, Attention: Board of Directors, or by telephoning our Chief Financial Officer at our principal executive offices, who will then relay the communications to our board of directors.

DIRECTOR AND OFFICER COMPENSATION

Summary Compensation Table

The following table and related footnotes show the compensation paid during the fiscal years ended December 31, 2012 and 2011, to our named executive officers:

| Name and Principal | | Year | | Salary | | | Accrued Bonus | | | Option Awards | | | All Compensation | | | Total | |

| Position | | | | ($) | | | ($)(3) | | | ($) | | | ($) | | | ($) | |

| Thomas W. Gardner (1) | | 2012 | | | -- | | | | 48,000 | | | | -- | | | | 146,667 | | | | 194,667 | |

| Chairman, Chief Executive Officer and President | | 2011 | | | -- | | | | -- | | | | -- | | | | 149,417 | | | | 149,417 | |

| Mark Selawski (2) | | 2012 | | | 178,000 | | | | 50,400 | | | | -- | | | | -- | | | | 228,400 | |

| Chief Financial Officer and Secretary | | 2011 | | | 142,125 | | | | -- | | | | 39,900 | | | | -- | | | | 182,025 | |

| | (1) | Mr. Gardner serves as our Chairman, Chief Executive Officer and President under a Management Consulting Agreement dated August 30, 2010, the terms of which are described below, and has served in these capacities since May 2010. |

| | (2) | Mr. Selawski serves as our Chief Financial Officer and Secretary under an Employment Agreement dated August 30, 2010, as amended effective August 29, 2012, the terms of which are described below, and has served in these capacities since May 2010. The fair value of options granted to Mr. Selawski was estimated on the date of grant using the Black Scholes Model with the following weighted average assumptions: |

| Year | Risk Free Interest Rate | Volatility | Term | Dividends |

| 2011 | 1.68% | 136.00% | 6.25 years | -- |

| | (3) | Messrs. Gardner and Selawski accrued cash bonuses equal to 30% of their then current salary upon successful financing transactions of at least $3,500,000 during the terms of their employment agreements. Such financing benchmarks were achieved with the private placement financing consummated in October 2012. Payment of the bonuses will be within ten days of the completion of our annual audit for the 2012 fiscal year. |

Employment Contracts

On August 30, 2010, we entered into a Management Consulting Agreement (the “Management Agreement”) with Thomas W. Gardner, our Chairman, Chief Executive Officer and President. Under the terms of the Management Agreement, which has a term of three years unless earlier terminated as specified therein, we engaged Mr. Gardner to provide consulting and management services to us relating to the functions of chief executive officer, and agreed that he will have the full range of executive duties and responsibilities that are customary for public company chief executive officers, reporting to our board of directors. Mr. Gardner has been engaged through December 31, 2010 on a non-exclusive basis. Effective after January 1, 2011, our board of directors has the option, with 90 days written notice, to employ Mr. Gardner on a full-time basis as our chief executive officer. If Mr. Gardner declines such employment we may terminate the Management Agreement with 30 days written notice. We have not, as yet, exercised our option to employ Mr. Gardner on a full-time basis.

Under the Management Agreement, Mr. Gardner received an annual fee at an initial rate of $144,000, which then increased to $160,000 as of August 30, 2011. In the event Mr. Gardner is employed on a full-time basis, Mr. Gardner’s annual compensation will increase to $190,000 on the first anniversary of his employment date and to $240,000 on the second anniversary of his employment date. Notwithstanding the foregoing, in the event that we consummate a capital raise transaction of at least $3,500,000 (a “Funding”), Mr. Gardner’s annual compensation will increase to $190,000 if such Funding is consummated before August 30, 2012, and $240,000 if such Funding is consummated on or after August 30, 2012. Mr. Gardner is also entitled to receive an annual bonus equal to 30% of his then applicable annual compensation if we successfully complete a Funding and we realize certain operating benchmarks to be determined by our Compensation Committee in the respective fiscal year. In addition, Mr. Gardner was entitled to reimbursement of his reasonable legal fees (up to $10,000) incurred in connection with negotiating the Management Agreement. Payments under the Management Agreement will be grossed up to cover any taxes, interest and/or penalties incurred as a result of any payment under the Management Agreement being subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended.

The Management Agreement will terminate upon 30 days written notice by us if Mr. Gardner declines full time employment after we exercise our option to employ Mr. Gardner on a full-time basis, Mr. Gardner’s death or Disability (as defined in the Management Agreement), our termination of the Management Agreement for Cause (as defined in the Management Agreement) or without Cause, or Mr. Gardner’s termination of the Management Agreement for Good Reason (as defined in the Management Agreement) or without Good Reason. Upon the termination of the Management Agreement for any reason we have agreed to pay Mr. Gardner his then current annual base compensation then earned, accrued vacation (if any) and unpaid reimbursements due to Mr. Gardner for expenses incurred by Mr. Gardner prior to the date of termination, subject to the applicable provisions of the Management Agreement. Upon the termination of the Management Agreement as a result of Mr. Gardner’s death or as a result of our termination thereof without Cause or Mr. Gardner’s termination thereof for Good Reason, we have also agreed to pay Mr. Gardner a prorated annual bonus (based on his then current annual base compensation), to the extent earned. In addition, upon our termination of the Management Agreement without cause or upon Mr. Gardner’s termination of the Management Agreement for Good Reason, we have agreed to pay Mr. Gardner, subject the parties’ entry into a general release, a lump sum payment of one year’s then current annual base compensation as severance. The parties have agreed to resolve disputes under the Management Agreement through arbitration.

As an inducement material to Mr. Gardner’s decision to enter into the Management Agreement our Compensation Committee granted to Mr. Gardner options under our 2010 Stock Incentive Plan (the “2010 Plan”) to purchase 1,000,000 shares of our common stock (“Common Stock”). The options have a term of 7 years, a per share exercise price of $1.11 and vest 25% on the first anniversary of the date of grant and 6.25% on a quarterly basis thereafter until fully vested.

On August 30, 2010, we also entered into an Employment Agreement (the “Employment Agreement”) with Mark Selawski, our Chief Financial Officer and Secretary. The Employment Agreement replaced our existing employment agreement with Mr. Selawski. Under the terms of the Employment Agreement, which has a term of two years subject to earlier termination as specified therein, we employed Mr. Selawski as our Chief Financial Officer reporting to our Chief Executive Officer.

Mr. Selawski received an annual salary at an initial rate of $144,000 for the first year, with an increase to $168,000 on August 30, 2011. Notwithstanding the foregoing, in the event that we consummate a Funding Mr. Selawski’s annual salary will increase to $210,000 if such Funding is consummated on or after August 30, 2011. Mr. Selawski is also entitled to receive an annual bonus equal to 30% of his then applicable annual salary if we successfully complete a Funding and we realize certain operating benchmarks to be determined by our Compensation Committee in the respective fiscal year. Mr. Selawski will receive an automobile allowance of $300 per month, or with his consent, we may lease a vehicle for Mr. Selawski’s use in lieu of paying such automobile allowance, and will be entitled to three weeks annual paid vacation. Mr. Selawski is also entitled to reimbursement of his reasonable legal fees (up to $10,000) incurred in connection with negotiating the Employment Agreement. Payments under the Employment Agreement will be grossed up to cover any taxes, interest and/or penalties incurred as a result of any payment under the Employment Agreement being subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended.

The Employment Agreement will terminate upon Mr. Selawski’s death or Disability (as defined in the Employment Agreement), our termination of the Employment Agreement for Cause (as defined in the Employment Agreement) or without Cause, or Mr. Selawski’s termination of the Employment Agreement for Good Reason (as defined in the Employment Agreement) or without Good Reason. Upon the termination of the Employment Agreement for any reason we have agreed to pay Mr. Selawski his then current annual base salary then earned, accrued vacation and unpaid reimbursements due to Mr. Selawski for expenses incurred by Mr. Selawski prior to the date of termination, subject to the applicable provisions of the Employment Agreement. Upon the termination of the Employment Agreement as a result of Mr. Selawski’s Disability or as a result of our termination thereof without Cause or Mr. Selawski’s termination thereof for Good Reason, we have agreed to offer COBRA coverage without administrative markup for a period of 18 months, or the maximum term permitted by then applicable law, if Mr. Selawski is not covered by any other comprehensive insurance that provides a comparable level of benefits to those provided under our then effective health plan. Upon the termination of the Employment Agreement as a result of Mr. Selawski’s death we have agreed to pay Mr. Selawski a prorated annual bonus (based on his then current annual base salary) to the extent earned. In addition, upon our termination of the Employment Agreement without Cause or upon Mr. Selawski’s termination of the Employment Agreement for Good Reason, we have agreed to pay Mr. Selawski, subject the parties’ entry into a general release, a lump sum payment of one year’s then current annual base salary as severance. The parties have agreed to resolve disputes under the Employment Agreement through arbitration.

As an inducement material to Mr. Selawski’s decision to enter into the Employment Agreement our Compensation Committee granted to Mr. Selawski options under the 2010 Plan to purchase 250,000 shares of Common Stock. The options have a term of 7 years, a per share exercise price of $1.11 and vest 25% on the first anniversary of the date of grant and 6.25% on a quarterly basis thereafter until fully vested.

On November 29, 2012 our Compensation Committee approved the First Amendment to Mr. Selawski’s Employment Agreement, effective as of August 29, 2012, in which the term of the Employment Agreement was extended from two to three years in length and the lump sum payment due upon termination without Cause was reduced to six months of his then current base salary. All other terms and conditions remained unchanged.

Compensation of Directors

Independent directors are compensated at a base rate of $7,500 per year, paid in quarterly installments. Directors serving as chairman of a standing committee of our board of directors also receive an additional $5,000 per year, also paid in quarterly installments. Directors who are also employees or officers of our company do not receive any amounts over and above their compensation as an employee of our company. Each director has received cash compensation commensurate with their election to our board of directors. Each director also receives stock options upon his/her election to our board of directors and will receive annual option grants on the date of each successive stockholders’ meeting in which they are elected to serve a successive term. Such grants for committee chairmen is an initial grant of an option to purchase 75,000 shares of common stock on the date of election and a grant of an option to purchase 37,500 shares of common stock for each year of service thereafter. Directors not serving as the chairman of a committee receive an option to purchase 50,000 shares of common stock on the date of election and an option to purchase 25,000 shares of common stock for each year of service thereafter. Vesting on all non-employee director stock options is 25% upon the date of grant and 25% on each anniversary of the date of grant until fully vested. The options expire seven years after the grant date of the option.

The following table presents information regarding compensation paid to our non-employee directors for our fiscal year ended December 31, 2012.

| Name | | Fees Earned or Paid in Cash ($) | | | Option Awards ($) | | | Total ($) | |

| Gary Freeman (1) | | | 12,500 | | | | -- | | | | 12,500 | |

| Boris Ratiner (2) | | | 12,500 | | | | -- | | | | 12,500 | |

| Chaim Davis (3) | | | 7,500 | | | | -- | | | | 7,500 | |

| Alexander Polinsky (4) | | | 7,500 | | | | -- | | | | 7,500 | |

| Paul DiPerna (5) | | | 12,500 | | | | -- | | | | 12,500 | |

| Johan (Thijs) M. Spoor (6) | | | 7,500 | | | | 59,000 | | | | 66,500 | |

| Fred Knoll (7) | | | 1,250 | | | | 29,500 | | | | 30,750 | |

| (1) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 112,500. |

| (2) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 212,500. |

| (3) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 112,500. |

| (4) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 75,000. |

| (5) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 75,000 |

| (6) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 50,000. The fair value of options granted to Mr. Spoor was estimated on the date of grant using the Black Scholes Model with the following weighted average assumptions: |

| Year | Risk Free Interest Rate | Volatility | Term | Dividends |

| 2012 | 1.41% | 134.00% | 6.25 years | -- |

| (7) | The aggregate number of common shares reserved under option awards outstanding at fiscal year-end totaled 50,000. The fair value of options granted to Mr. Knoll was estimated on the date of grant using the Black-Scholes Model with the following weighted-average assumptions: |

| Year | Risk Free Interest Rate | Volatility | Term | Dividends |

| 2012 | 1.19% | 110.00% | 6.25 years | -- |

Outstanding Equity Awards at Fiscal Year-End

The following table provides information regarding outstanding options held by our named executive officers as of the end of our fiscal year ended December 31, 2012.

| | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($) (1) | | |

| Thomas W. Gardner (2) | | | 562,500 | | | | 437,500 | | | | 1.11 | | 08/30/17 |

| Mark Selawski (3) | | | 400,679 | | | | 148,819 | | | | 0.22 | | 01/06/17 |

| Mark Selawski (2) | | | 140,625 | | | | 109,375 | | | | 1.11 | | 08/30/17 |

| Mark Selawski (4) | | | 10,207 | | | | 24,793 | | | | 1.25 | | 10/11/18 |

| | (1) | Subject to certain conditions, the exercise price may be paid by delivery of already owned shares and the tax withholding obligations related to exercise may be paid by reduction of the underlying shares. |

| | (2) | The options granted vested 25% on the first anniversary of the grant date and 6.25% every three months thereafter until fully vested. The options are for a 7-year term, subject to earlier terminating in certain events related to termination of employment. The option vesting ceases if there is a termination of employment and the options are forfeited entirely if termination is for cause. The Compensation Committee retains discretion, subject to limits in the applicable stock incentive plan or stock option agreement, to modify the terms of outstanding options. |

| | (3) | The option granted vested 25% on the first anniversary of the grant date and 2.0833% every month thereafter until fully vested. The options are for a 7-year term, subject to earlier terminating in certain events related to termination of employment. The option vesting ceases if there is a termination of employment and the options are forfeited entirely if termination is for cause. The Compensation Committee retains discretion, subject to limits in the applicable stock incentive plan or stock option agreement, to modify the terms of outstanding options. |

| | (4) | The options granted vest 1/48th on the monthly anniversary date of the grant until fully vested. The options are for a 7-year term, subject to earlier terminating in certain events related to termination of employment. The option vesting ceases if there is a termination of employment and the options are forfeited entirely if termination is for cause. The Compensation Committee retains discretion, subject to limits in the applicable stock incentive plan or stock option agreement, to modify the terms of outstanding options. |

None of the executive officers listed in the above table exercised options during the fiscal year ended December 31, 2012.

Equity Compensation Plan Information

The following table sets forth information concerning our equity compensation plans as of December 31, 2012.

| Plan Category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by security holders (1) | | | | 4,057,500 | | | $ | 1.09 | | | 305,464 |

| Equity compensation plans not approved by security holders (2) | | | | 3,745,558 | | | $ | 0.22 | | | -- |

| Total | | | | 7,803,058 | | | $ | 0.67 | | | 305,464 |

| (1) | Consists of awards issued and issuable pursuant to the 2010 Plan. |

| (2) | Consists of options and warrants assumed in our acquisition of AtheroNova Operations. |

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO THE 2010 STOCK INCENTIVE PLAN

TO INCREASE AUTHORIZED SHARES

Proposal 2 is to approve an amendment to the AtheroNova Inc. 2010 Stock Incentive Plan, or the 2010 Plan, to increase from 4,362,964 to 7,362,964 the number of shares of our common stock available for issuance pursuant to equity awards granted under the 2010 Plan, or the Plan Amendment. A copy of the text of the Plan Amendment is attached to this Proxy Statement as Appendix A. The Plan Amendment is being submitted to our stockholders for approval.

Our board of directors believes that the continued growth of our company depends, in large part, upon its ability to attract and motivate key employees and directors, and that equity incentive awards are an important means of attracting, retaining and motivating talented employees and directors. As of April 23, 2013, approximately 77,964 shares of common stock were available for issuance under the 2010 Plan. In order to ensure that we may continue to attract key employees and directors who are expected to contribute to our success, on April 22, 2013, our board of directors approved the Plan Amendment.

Summary of the 2010 Plan

The following is a summary description of the salient terms, conditions and features of the 2010 Plan and is qualified by the text of the 2010 Plan.

General; Types of Awards; Number of Shares

The 2010 Plan provides for the grant of options to purchase shares of common stock, restricted stock, stock appreciation rights (“SARs”) and restricted stock units (rights to receive, in cash or stock, the market value of one share of our common stock). Incentive stock options (“ISOs”) may be granted only to employees. Nonstatutory stock options and other stock-based awards may be granted to officers, employees, non-employee directors and consultants.

Subject to certain adjustments, 4,362,964 shares of our common stock have been authorized for issuance under the 2010 Plan, and the Plan Amendment will increase that number to 7,362,964. Shares authorized under the 2010 Plan will be available for issuance pursuant to options or awards granted under the 2010 Plan.

Administration

The 2010 Plan will be administered by our board of directors or a committee of our board of directors (the “Administrator”), as provided in the 2010 Plan. The Administrator will have the authority to select the eligible participants to whom awards will be granted, to determine the types of awards and the number of shares covered and to set the terms, conditions and provisions of such awards, to cancel or suspend awards under certain conditions, and to accelerate the exercisability of awards. The Administrator will be authorized to interpret the 2010 Plan, to establish, amend, and rescind any rules and regulations relating to the 2010 Plan, to determine the terms of agreements entered into with recipients under the 2010 Plan, and to make all other determinations that may be necessary or advisable for the administration of the 2010 Plan. Our board of directors has delegated responsibility for administering the 2010 Plan to our Compensation Committee.

Eligibility

Options and other awards may be granted under the 2010 Plan to directors, officers, employees and consultants of our company and any of our subsidiaries, provided that the services of such consultants are not in connection with the offer or sale of securities in a capital-raising transaction and do not directly or indirectly promote or maintain a market for our securities. At the date of this Proxy Statement, all of our officers, directors, employees and consultants would have been eligible to receive awards under the 2010 Plan.

Stock Option and SAR Grants

The exercise price per share of our common stock purchasable upon exercise of any stock option (or option) or SAR will be determined by the Administrator, but cannot in any event be less than 100% of the fair market value of our common stock on the date the option or SAR is granted. The Administrator will determine the term of each stock option or SAR (subject to a maximum term of 10 years) and each option or SAR will be exercisable pursuant to a vesting schedule determined by the Administrator. The grants and the terms of ISOs will be restricted to the extent required for qualification as ISOs by the U.S. Internal Revenue Code of 1986, as amended. Subject to approval of the Administrator, options or SARs may be exercised by payment of the exercise price in cash, shares of common stock or pursuant to a “cashless exercise” through a broker-dealer under an arrangement approved by the Administrator. The Administrator may require the grantee to pay to us any applicable withholding taxes that we are required to withhold with respect to the grant or exercise of any option. The withholding tax may be paid in cash or, subject to applicable law, the Administrator may permit the grantee to satisfy these obligations by the withholding or delivery of shares of our common stock. We may withhold from any shares of our common stock that may be issued pursuant to an option or from any cash amounts otherwise due from us to the recipient of the option an amount equal to such taxes.

Restricted Stock Grants

Restricted shares may be sold or awarded for consideration determined by the Administrator, including cash, full-recourse promissory notes, as well as past and future services. Any award of restricted shares will be subject to a vesting schedule determined by the Administrator. Any restricted shares that are not vested will be subject to rights of repurchase, rights of first refusal or other restrictions as determined by the Administrator. In general, holders of restricted shares will have the same voting, dividend and other rights as our other stockholders.

Adjustments

In the event of any change affecting shares of our common stock by reason of any stock dividend or split, recapitalization, merger, consolidation, spin-off, combination or exchange of shares or other similar corporate change, or any distribution to stockholders other than cash dividends, the Administrator will make substitutions or adjustments in the aggregate number of shares that may be distributed under the 2010 Plan, and in the number and types of shares subject to, and the exercise prices under, outstanding awards granted under the 2010 Plan, in accordance with the provisions of the 2010 Plan.

Transferability

Unless otherwise permitted by the 2010 Plan and approved by the Administrator as permitted by the 2010 Plan, no award will be assignable or otherwise transferable by the grantee other than by will or the laws of descent and distribution and, during the grantee’s lifetime, an award may be exercised only by the grantee.

Amendment and Termination

Our board of directors may amend the 2010 Plan in any and all respects without stockholder approval, except as such stockholder approval may be required under applicable law or pursuant to the listing requirements of any national market system or securities exchange on which our equity securities may be listed or quoted, and except that shareholder approval shall be required for any amendment that would: (a) increase the maximum number of shares for which awards may be granted under the 2010 Plan; (b) reduce the price at which stock options or SARs may be granted; (c) extend the term of the 2010 Plan; or (d) change the class of persons eligible to be participants.

Unless sooner terminated by our board of directors, the 2010 Plan will terminate as to further grants of awards on May 20, 2020.

Tax Aspects of the 2010 Plan

Federal Income Tax Consequences

The following discussion summarizes the material federal income tax consequences to us and the participants in connection with the 2010 Plan under existing applicable provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and the regulations adopted pursuant to the Code. This discussion is general in nature and does not address issues relating to the income tax circumstances of any specific individual employee or holder. Also, the discussion is limited to the tax implications of options, but not other types of awards under the 2010 Plan. The discussion is subject to possible future changes in the law. The discussion does not address the consequences of state, local or foreign tax laws.

Nonqualified Stock Options

A recipient will not have any taxable income at the time a nonqualified stock option (“NSO”) is granted nor will we be entitled to a deduction at that time. When an NSO is exercised, the grantee will have taxable ordinary income (whether the option price is paid in cash or by surrender of already owned shares of common stock), and we will be entitled to a tax deduction, in an amount equal to the excess of the fair market value of the shares to which the option exercise pertains over the option exercise price.

Incentive Stock Options

A grantee will not have any taxable income at the time an ISO is granted. Furthermore, a grantee will not have income taxable for federal income tax purposes at the time the ISO is exercised. However, the excess of the fair market value of the shares at the time of exercise over the exercise price will be a tax preference item in the year of exercise that could create an alternative minimum tax liability for the year of exercise. If a grantee disposes of the shares acquired on exercise of an ISO after the later of two years after the grant of the ISO and one year after exercise of the ISO, the gain (i.e., the excess of the proceeds received over the option price), if any, will be long-term capital gain eligible for favorable tax rates under the Code.

If the grantee disposes of the shares within two years of the grant of the ISO or within one year of exercise of the ISO, the disposition is a “disqualifying disposition,” and the grantee will have taxable ordinary income in the year of the disqualifying disposition equal to the lesser of (a) the difference between the fair market value of the shares and the exercise price of the shares at the time of option exercise, or (b) the difference between the sales price of the shares and the exercise price of the shares. Any gain realized from the time of option exercise to the time of the disqualifying disposition would be long-term or short-term capital gain, depending on whether the shares were sold more than one year or up to and through one year respectively, after the ISO was exercised.

We are not entitled to a deduction as a result of the grant or exercise of an ISO. If the grantee has ordinary income taxable as compensation as a result of a disqualifying disposition, we will then be entitled to a deduction in the same amount as the grantee recognizes ordinary income.

The American Jobs Creation Act of 2004 added Section 409A to the tax code. Section 409A covers most programs that defer the receipt of compensation to a succeeding year. It provides rules for elections to defer (if any) and for timing of payouts. There are significant penalties placed on the individual employee for failure to comply with Section 409A. However, it does not affect our ability to deduct deferred compensation.

Section 409A does not apply to incentive stock options, non-qualified stock options (that are not issued at a discount), and restricted stock, provided that there is no deferral of income beyond the vesting date. As described above, awards granted under the 2010 Plan may qualify as “performance-based compensation” under Section 162(m) of the Code. To qualify, options and other awards must be granted under the 2010 Plan by a committee of our board of directors consisting solely of two or more “outside directors” (as defined under Section 162 of the Treasury Regulations promulgated under the Code) and satisfy the 2010 Plan’s limit on the total number of shares that may be awarded to any one participant during any calendar year. In addition, for awards other than options, the grant, issuance, vesting, or retention of the award must be contingent upon satisfying one or more of the performance criteria set forth in the 2010 Plan, as established and certified by a committee consisting solely of two or more “outside directors.”

New Plan Benefits

Because awards under the 2010 Plan are discretionary, benefits or amounts that will hereinafter be received by or allocated to our chief executive officer, the named executive officers, all current executive officers as a group, the directors as a group, and all employees who are not executive officers, are not presently determinable. No awards that are contingent upon obtaining stockholder approval of the Plan Amendment have been made under the 2010 Plan.

Required Vote

The approval of the Plan Amendment will require the affirmative vote of a majority of the shares of common stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE 2010 STOCK INCENTIVE PLAN.

PROPOSAL NO. 3

INDEPENDENT PUBLIC ACCOUNTANTS

Proposal 3 is to ratify the firm of Weinberg & Company, PA, or Weinberg, as our independent accountants for the year ending December 31, 2013. Our Audit Committee recommended and our board of directors has selected, subject to ratification by a majority vote of the stockholders at the Annual Meeting, Weinberg as our independent public accountant for the current fiscal year ending December 31, 2013. Representatives of Weinberg are expected to be present telephonically at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. In addition, at the Annual Meeting, representatives of Weinberg are expected to be available to respond to appropriate questions posed by our stockholders.

While there is no legal requirement that this proposal be submitted to stockholders, it will be submitted at the Annual Meeting nonetheless, as our board of directors believes that the selection of auditors to audit our consolidated financial statements is of sufficient importance to seek stockholder approval. If the majority of our stockholders present and entitled to vote at the Annual Meeting do not ratify the appointment of Weinberg as our auditors for the current fiscal year, Weinberg will continue to serve as our auditors for the current fiscal year, and our Audit Committee will engage in deliberations to determine whether it is in our best interest to continue Weinberg’s engagement as our auditors for fiscal 2013.

Weinberg is our principal independent public accounting firm. All audit work was performed by the full time employees of Weinberg. Our Audit Committee approves in advance, all services performed by Weinberg. Our board of directors has considered whether the provision of non-audit services is compatible with maintaining the principal accountant’s independence, and has approved such services.

Audit Fees

Fees for audit services totaled approximately $104,918 and $69,505 for the years ended December 31, 2012 and 2011, respectively, including fees associated with the annual audit, and reviews of our quarterly reports on Form 10-Q.

Audit-Related Fees

None.

Tax Fees

Fees were incurred totaling approximately $4,085 and $2,866 during the years ended December 31, 2012 and 2011, respectively for tax services, including for tax compliance, tax advice and tax planning.

All Other Fees

None.

Required Vote

Ratification of the appointment of Weinberg as our independent accountants for the year ending December 31, 2013 will require the affirmative vote of a majority of the shares of our common stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” RATIFYING THE APPOINTMENT OF WEINBERG & COMPANY, P.A. AS OUR INDEPENDENT AUDITORS.

PROPOSAL NO. 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), we are required to include in this Proxy Statement and present at the Annual Meeting a non-binding stockholder vote to approve the compensation of our executives, as described in this Proxy Statement, pursuant to the compensation disclosure rules of the SEC. Proposal 4, commonly known as a “say on pay” vote, gives stockholders the opportunity to endorse or not endorse the compensation of our executives as disclosed in this Proxy Statement. This proposal will be presented at the Annual Meeting as a resolution in substantially the following form:

RESOLVED, that the stockholders approve the compensation of the Company’s executives, as disclosed in the compensation tables and related narrative disclosure in the Company’s proxy statement for the Annual Meeting.

This vote will not be binding on our board of directors and may not be construed as overruling a decision by our board of directors or creating or implying any change to the fiduciary duties of our board of directors. The vote will not affect any compensation previously paid or awarded to any executive. Our Compensation Committee and our board of directors may, however, take into account the outcome of the vote when considering future executive compensation arrangements.

The purpose of our compensation programs is to attract and retain experienced, highly qualified executives critical to our long-term success and enhancement of stockholder value.

Required Vote

Endorsement of the compensation of our executive officers will require the affirmative vote of a majority of the shares of our common stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RESOLUTION APPROVING THE COMPENSATION OF OUR EXECUTIVES.

PROPOSAL NO. 5

ADVISORY VOTE ON THE FREQUENCY OF

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Act, in addition to providing stockholders with the opportunity to cast an advisory vote on executive compensation, we are required this year to include in this Proxy Statement and present at the Annual Meeting a non-binding stockholder vote on whether an advisory vote on executive compensation should be held every year, every two years or every three years. Our board of directors believes that holding an advisory vote on executive compensation every three years is the optimal interval for conducting and responding to a “say on pay” vote, so that stockholders may regularly express their views on our executive compensation program.