Exhibit 99.2

Management’s Discussion and Analysis

For the three months ended March 31, 2009

This management’s discussion and analysis has been prepared as of May 6, 2009 and should be read in conjunction with the Company’s interim consolidated financial statements for the three months ended March 31, 2009. Those financial statements are prepared in accordance with Canadian generally accepted accounting principles. The Company’s reporting currency is United States dollars. Reference herein of $ is to United States dollars. Reference of C$ is to Canadian dollars, reference to SEK is to Swedish krona and € refers to the Euro.

Additional information relating to the Company, including the Company’s Annual Information Form dated March 31, 2009 and subsequent press releases have been filed electronically through the System for Electronic Document Analysis and Retrieval (“SEDAR”) and are available online atwww.sedar.com.

The Company’s common shares (“Common Shares”) are listed on the Toronto Stock Exchange (the “TSX”) and its Swedish Depository Receipts are listed on the OMX Nordic Exchange under the trading symbols “LUN” and “LUMI”, respectively.

About Lundin Mining

Lundin Mining Corporation (“Lundin”, “Lundin Mining” or the “Company”) is a diversified base metals mining company with operations in Portugal, Spain, Sweden and Ireland, producing copper, nickel, lead and zinc. In addition, Lundin Mining holds a development project pipeline which includes expansion projects at its Zinkgruvan and Neves-Corvo mines along with its equity stake in the world class Tenke Fungurume copper/cobalt project in the Democratic Republic of Congo. The Company also holds an extensive exploration portfolio and interests in international mining and exploration ventures.

Cautionary Statement on Forward-Looking Information

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of the Ontario Securities Act or “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 of the United States. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks and uncertainties relating to foreign currency fluctuations; risks inherent in mining including environmental hazards, industrial accidents, unusual or unexpected geological formations, ground control problems and flooding; risks associated with the estimation of mineral resources and reserves and the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; the potential for and effects of labour disputes or other unanticipated difficulties with or shortages of labour or interruptions in production; actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations and uncertain political and economic environments; changes in laws or policies, foreign taxation, delays or the inability to obtain necessary governmental permits; and other risks and uncertainties, including those described under Risk Factors Relating to the Company’s Business in the Company’s Annual Information Form and in each management discussion and analysis. Forward-looking information is in addition based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long-term prices of copper, lead, nickel and zinc; that the Company can access financing, appropriate equipment and sufficient labour and that the political environment where the Company operates will continue to support the development and operation of mining projects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

1

Table of Contents

| Highlights | 3 |

| Financial Position and Financing | 5 |

| Outlook | 5 |

| Selected Quarterly Financial Information | 6 |

| Operating Results | 9 |

| Mining Operations | 11 |

| Production Overview | 11 |

| Neves-Corvo Mine | 12 |

| Zinkgruvan Mine | 13 |

| Aguablanca Mine | 14 |

| Galmoy Mine | 15 |

| Project Highlights | 16 |

| Tenke Fungurume Project (Lundin 24.75%, FCX 57.75%, Gécamines 17.5%) | 16 |

| Neves-Corvo – Lombador Copper/Zinc and Neves Zinc Expansion Projects | 16 |

| Zinkgruvan Copper Project | 16 |

| Exploration Highlights | 16 |

| Metal Prices, LME Inventories and Smelter Treatment and Refining Charges | 18 |

| Liquidity and Financial Condition | 19 |

| Changes in Accounting Policies | 20 |

| Managing Risks | 21 |

| Outstanding Share Data | 22 |

| Non-GAAP Performance Measures | 22 |

| Management’s Report on Internal Controls | 23 |

2

Highlights

Operational and Financial Highlights

- Operations continued to deliver a consistently strong performance. Total production is as follows:

Production Summary1

| Q1-09 | FY-08 | Q4-08 | Q3-08 | Q2-08 | Q1-08 | |

Copper (tonnes) | 24,240 | 98,148 | 25,297 | 24,433 | 23,478 | 24,940 |

Zinc (tonnes) | 34,277 | 167,844 | 33,768 | 44,605 | 46,452 | 43,019 |

Lead (tonnes) | 12,870 | 44,799 | 9,917 | 9,908 | 12,397 | 12,577 |

Nickel (tonnes) | 1,961 | 8,136 | 2,179 | 2,155 | 1,954 | 1,848 |

Sales for the quarter were $123.4 million, down 60% compared to sales in the first quarter of 2008 of $305.7 million. The decline is primarily price driven but also reflects the cessation of zinc production at Storliden and Neves-Corvo. While metal prices, with the exception of nickel, have moderately recovered from the December 31, 2008 levels, they still remain significantly lower than the prices that prevailed during the first quarter of the previous year. (see page 8 of this MD&A for discussion of realized metal prices)

Operating cost performance improved primarily due to cost control initiatives which involved a reduced number of contractors and lower materials costs. Total operating costs decreased by $28.2 million to $76.8 million from $105.0 million in the first quarter of 2008. The US dollar- denominated cash cost per pound2of metal produced was aided by a weakening of the Euro and Swedish krona.

Operating earnings3reduced by $144.7 million from $182.9 million in the first quarter of 2008 to $38.2 million in 2009. Price and price adjustments on previous concentrate sales accounted for a reduction of approximately $191 million, and this was partially offset by cost improvements at the operations and more favourable exchange rates.

The Company commenced the wind down of operations at the Galmoy mine, which is expected to cease mining in the second quarter, with the completion of milling operations to follow in the third quarter.

Cash flow from operations for the quarter was a cash outflow of $63.3 million, compared to a small inflow of $3.5 million in the first quarter of 2008. The Company paid $68.1 million to customers during the quarter for settlement of sales that occurred in previous periods. While the profit effect of these provisional pricing adjustments was reflected in the fourth quarter results for 2008, the cash was actually refunded during the current quarter. Provisional payments had been received when metal prices were higher and amounts were therefore re-paid at the date of final settlement.

Net loss for the quarter was $8.6 million, or $0.02 per share. The net loss includes a gain of $5.6 million, $0.01 per share, related to the disposal of Pirites Alentejanas SA, the Company that held the Aljustrel mine.

_____________________________

1 All production, including Aljustrel.

2 Cash cost per pound of payable metal sold is the sum of direct cash costs and inventory changes less by-product and royalties. See Non-GAAP Performance Measures on page 22 of this MD&A.

3 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

3

Corporate Highlights

On April 27ththe Company closed a bought-deal public offering for total gross proceeds of C$188.6 million ($155.8 million). The Company issued 92 million common shares of the Company at a price of C$2.05 per share.

During April, the Company entered into multiple option collar arrangements to protect against near-term decreases in the price of copper. The contracts establish a weighted average floor price of $1.87 per pound and a weighted average maximum price cap of $2.39 per pound. The contracts, which come due over the next 12 months, are for approximately 40,000 tonnes of copper. No cash premiums were paid or received under the net zero cost structures. Monthly cash settlements will be made where necessary for the contracts.

The Company announced the production of first copper was achieved during the quarter at the Tenke Fungurume copper-cobalt project in which the Company holds a 24.75% interest. This was followed shortly thereafter by the first shipment of copper cathode from the operation. The project is still expected to reach commercial production in the second half of 2009, targeting full production for Phase I of 115,000 tonnes per annum (“tpa”) copper and at least 8,000 tpa cobalt.

No cash payments were made during the quarter to fund the Company’s share of Tenke project expenditures (Q1-2008: $42.0 million). The Company’s proportionate share of costs for Phase I development for the current quarter, an amount of $85.4 million, was funded by Freeport McMoRan Copper and Gold Inc. (“FCX”) under the Excess Over-run Costs facility (“EOC facility”). The Company’s 2009 cash outlays are expected to be in the range of $40 - $50 million.

In March, the Company reported its Mineral Reserve and Resource estimates as at December 31, 2008. Notable items were: the replacement of mined reserves at the Company’s two key operations of Neves-Corvo and Zinkgruvan; an initial copper reserve at Zinkgruvan; large copper reserves at Tenke Fungurume. The full release can be found on the Company’s website atwww.lundinmining.com.

The Company completed the sale of the Aljustrel mine on February 5, 2009. While a small gain was reported on disposal, the actual cash effect was an outflow of $21.0 million, most of which represented an amount to cover environmental rehabilitation and other liabilities.

- In February, the Company agreed to terminate the plan of arrangement with HudBay Minerals Inc. (“HudBay”) that had been entered into in November of 2008. The termination agreement stipulates that:

| i. | As long as HudBay owns 10% or more of the outstanding common shares of the Company, HudBay shall be entitled to designate one nominee acceptable to the Company for inclusion on the management slate of nominees for election to the Board of Directors; |

| ii. | As long as HudBay owns 10% or more of the outstanding common shares of the Company, HudBay shall have the right to maintain its then current level of ownership of the common shares of Lundin Mining in connection with, and as a part, of any public offering or private placement of Lundin Mining common shares by Lundin Mining. HudBay was offered the right to participate in the April 2009 equity fundraising and elected to not participate; |

| iii. | For a period of six months following the date of the termination agreement, HudBay shall have a right of first offer in connection with any proposed sale or transfer of material assets of the Company. |

4

Financial Position and Financing

Net debt1 at March 31, 2009 was $259.5 million, as compared to a net debt of $145.5 at December 31, 2008 and a net cash position of $35.8 million at December 31, 2007. The increase in net debt during the quarter was primarily attributable to the cash outflow on the settlement of sales for which provisional payments had been previously received. Cash outflows from operations were $63.3 million for the three months ended March 31, 2009. In addition, there was a cash outlay of $21.0 million related to the sale of Aljustrel and the Company spent $33.6 million on capital expenditures.

The Company is not in compliance with the net tangible worth covenant under its revolving credit facility; however, this requirement has been waived by the banking syndicate for a period up to June 5, 2009 during which it will work with the syndicate to establish a permanent and restructured facility. The intention is to complete this restructure well before June 5, 2009. In the meantime, for the duration of the waiver period, there are certain changes in conditions including an increase in the interest rate to 4.5% over LIBOR and no further draw-downs are permitted on the facility. Due to the restriction on further draw-downs, the Company voluntarily reduced the level of the facility to the currently drawn amounts in order to eliminate standby charges that would accrue on the undrawn facility.

The Company’s intention is to restructure the revolving credit facility, in conjunction with other measures, to ensure adequate liquidity in the event that the present market volatility and depressed demand continue for the next two years.

Subsequent to the end of the quarter, the Company completed a bought equity financing, including the full amount of the underwriters’ over-allotment option, for aggregate gross proceeds of C$188.6 million. Immediately following the receipt of the funds, the Company paid down $55 million of the amount drawn on its credit facility and reduced the facility to $225 million. The Company plans to use the remaining net proceeds from the offering towards investment in the Tenke Fungurume project and for working capital and general corporate purposes.

Cash on hand at March 31, 2009 was $51.3 million. Cash on hand at May 4, 2009 was approximately $135.1 million.

Outlook

Production outlook for 2009 is unchanged from previous guidance at 90,000 tonnes of copper, 98,000 tonnes of zinc, 40,000 tonnes of lead and 6,800 tonnes of nickel. These amounts do not include any attributable production from Tenke Fungurume.

Market outlook remains uncertain. Although prices have recovered somewhat since December’s lows, physical metal markets lack transparency and the Company remains prepared for any directional changes in near-term metal prices. Operating plans for Neves-Corvo have been secured by the hedging arrangements for 40,000 tonnes of copper which ensures positive cash flow even if copper prices fall back to December’s lows of $1.30 per pound.

Cash costs per pound are still expected to be in the region of 10% below 2008 but are dependent on exchange rates.

Neves-Corvo and Zinkgruvan will continue to be free cash flow2 positive and large amounts payable to customers at year end which drained cash balances have now been settled. Aguablanca is cash flow positive at current prices and will continue to be monitored to ensure it remains viable.

Capital expenditures for the year are expected to be around $130 million which includes: $50 million of sustaining capital; $30 million of new investment in existing operations relating to the Zinkgruvan copper project and the Neves-Corvo zinc expansion; and in the range of $40 – $50 million for Tenke (covering pro rata working capital, exploration drilling, expansion studies and other minor costs).

________________________________

1 Net debt is a Non-GAAP measure defined as available unrestricted cash less financial debt, including capital leases and other debt related obligations. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Free cash flow is a Non-GAAP measure defined as cash flows from operations, less sustaining capital expenditures.

5

The Company expects that its consistent operational performance and the completion of the bought-deal financing for gross proceeds of C$188.6 million ($155.8) should assist in the satisfactory restructuring of the credit facility during the second quarter.

Selected Quarterly Financial Information

| Three months ended March 31 | ||||||

| (USD millions, except per share amounts) | 2009 | 2008 | ||||

| Sales | 123.4 | 305.7 | ||||

| Operating earnings1 | 38.2 | 182.9 | ||||

| Depletion, depreciation & amortization | (43.5 | ) | (52.9 | ) | ||

| General exploration and project investigation | (5.3 | ) | (10.1 | ) | ||

| Interest and bank charges | (4.0 | ) | (3.4 | ) | ||

| Foreign exchange loss | (7.2 | ) | (6.2 | ) | ||

| Loss on forward sales contracts | - | (1.2 | ) | |||

| Other income and expenses | 1.2 | 2.8 | ||||

| (Loss) earnings from continuing operations before discontinued operations and incometaxes | (20.6 | ) | 111.9 | |||

| Income tax recovery (expense) | 6.4 | (30.6 | ) | |||

| Net (loss) earnings after taxes before discontinued operations | (14.2 | ) | 81.3 | |||

| Net income (loss) from discontinued operations | 5.6 | (2.5 | ) | |||

| Net (loss) income | (8.6 | ) | 78.8 | |||

| Shareholders’ Equity | 2,580.4 | 3,750.0 | ||||

| Cash flow from operations | (63.3 | ) | 3.5 | |||

| Capital expenditures | (33.6 | ) | (79.3 | ) | ||

| Net debt2 | 259.5 | 104.2 | ||||

| Key Financial Data | Three months ended March 31 | |||||

| 2009 | 2008 | |||||

| Shareholders’ equity per share3 | 5.29 | 9.61 | ||||

| Basic (loss) earnings per share | (0.02 | ) | 0.20 | |||

| Basic (loss) earnings per share before discontinued operations | (0.03 | ) | 0.21 | |||

| Diluted (loss) earnings per share | (0.02 | ) | 0.20 | |||

| Diluted (loss) earnings per share before discontinued operations | (0.03 | ) | 0.21 | |||

| Dividends | Nil | Nil | ||||

| Equity ratio4 | 0.75 | 0.74 | ||||

| Shares outstanding: | ||||||

| Basic weighted average | 487,433,771 | 390,821,044 | ||||

| Diluted weighted average | 487,433,771 | 390,942,398 | ||||

| End of period | 487,433,771 | 390,413,431 | ||||

($ millions, except per share data) | Q1-09 | Q4-08 | Q3-08 | Q2-08 | Q1-08 | Q4-07 | Q3-07 | Q2-07 |

Sales | 123.4 | 43.5 | 191.9 | 294.1 | 305.7 | 253.1 | 292.8 | 319.9 |

Impairment charges (after tax)5 | - | (651.5) | (201.1) | (152.8) | - | (491.9) | - | - |

Net (loss) earnings | (8.6) | (728.5) | (199.0) | (108.4) | 78.8 | (436.6) | 76.6 | 153.8 |

(Loss) earnings per share, basic6 | (0.02) | (1.77) | (0.51) | (0.28) | 0.20 | (1.11) | 0.20 | 0.54 |

(Loss) earnings per share, diluted | (0.02) | (1.77) | (0.51) | (0.28) | 0.20 | (1.11) | 0.20 | 0.54 |

__________________________________

1 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of asset retirement obligation (“ARO”) and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Net debt/(surplus) is a Non-GAAP measure defined as available unrestricted cash less financial debt, including capital leases and other debt-related obligations. See page 22 of this MD&A for discussion of Non-GAAP measures.

3 Shareholders’ equity per share is a Non-GAAP measure defined as shareholders’ equity divided by total number of shares outstanding at end of period. See page 22 of this MD&A for discussion of Non-GAAP measures.

4 Equity ratio is a Non-GAAP measure defined as shareholders’ equity divided by total assets at the end of period. See page 22 of this MD&A for discussion of Non-GAAP measures.

5 Includes impairment from discontinued operations.

6 The (loss) earnings per share are determined for each quarter. As a result of using different weighted average number of shares outstanding, the sum of the quarterly amounts may differ from the year-to-date amount.

6

Sales Overview

Sales Volumes by Payable Metal

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |

| 2009 | 2008 | 2008 | 2008 | 2008 | 2008 | |

| Copper (tonnes) | ||||||

| Neves-Corvo | 20,108 | 86,748 | 23,104 | 23,087 | 23,051 | 17,506 |

| Storliden | - | 1,783 | - | 255 | 872 | 656 |

| Aguablanca | 1,563 | 5,905 | 1,490 | 1,477 | 1,669 | 1,269 |

21,671 | 94,436 | 24,594 | 24,819 | 25,592 | 19,431 | |

| Zinc (tonnes)1 |

|

|

|

|

|

|

| Neves-Corvo | - | 19,166 | 2,977 | 6,434 | 5,750 | 4,005 |

| Zinkgruvan | 16,468 | 55,985 | 11,399 | 14,279 | 13,475 | 16,832 |

| Storliden | - | 5,956 | - | 846 | 3,090 | 2,020 |

| Galmoy | 11,271 | 46,468 | 12,860 | 10,894 | 11,303 | 11,411 |

27,739 | 127,575 | 27,236 | 32,453 | 33,618 | 34,268 | |

| Lead (tonnes) |

|

|

|

|

|

|

| Zinkgruvan | 6,526 | 31,626 | 7,549 | 8,025 | 9,406 | 6,646 |

| Galmoy | 1,778 | 11,793 | 3,282 | 2,488 | 3,026 | 2,997 |

8,304 | 43,419 | 10,831 | 10,513 | 12,432 | 9,643 | |

| Nickel (tonnes) |

|

|

|

|

|

|

| Aguablanca | 2,045 | 7,210 | 1,935 | 1,822 | 1,850 | 1,603 |

2,045 | 7,210 | 1,935 | 1,822 | 1,850 | 1,603 |

First quarter sales decreased $182.3 million to $123.4 million compared with $305.7 million for the same quarter in 2008 mainly due to lower metal prices.

Sales | Three months ended March 31 | ||

(US$ millions) | 2009 | 2008 | Change |

Neves-Corvo | 73.5 | 169.2 | (95.7) |

Zinkgruvan | 20.4 | 48.6 | (28.2) |

Galmoy | 10.3 | 26.8 | (16.5) |

Aguablanca | 19.2 | 51.3 | (32.1) |

Storliden and other | - | 9.8 | (9.8) |

| 123.4 | 305.7 | (182.3) |

Sales are recorded using the metal price received for sales that settle during the reporting period. For sales that have not been settled, an estimate is used based on the month the sale is expected to settle and the forward price of the metal at the end of the reporting period. The difference between the estimate and the final price received is recognized by adjusting gross sales in the period in which the sale (finalization adjustment) is settled.

The finalization adjustment recorded for these sales depends on the actual price when the sale settles. Settlement dates typically are one to four months after shipment.

________________________________________________

1 Does not include zinc sold from Aljustrel. Aljustrel did not reach commercial production and, as such, any sales proceeds were applied to reduce the capital costs of development.

7

Sales volumes for copper and nickel were in excess of the sales volumes for the same period of the previous year, lead and zinc sales were somewhat lower. Sales values were significantly lower due to the decrease in metal prices when compared to the previous year. The average realized prices for the periods are as follows:

Reconciliation of realized prices

| Three months ended March 31, 2009 | |||

| Copper | Zinc | Nickel | Lead |

($000s) | ||||

Net sales | 79,737 | 20,272 | 9,880 | 8,777 |

Add back: TC/RC | 10,501 | 14,114 | 7,846 | 2,524 |

Sales before TC/RC | 90,238 | 34,386 | 17,726 | 11,301 |

| ||||

Payable metal (tonnes) | 21,671 | 27,739 | 2,045 | 8,304 |

Realized prices, $ per pound | 1.89 | 0.56 | 3.93 | 0.62 |

Realized prices, $ per tonne | 4,164 | 1,240 | 8,668 | 1,360 |

| ||||

| ||||

| Three months ended March 31, 2008 | |||

| Copper | Zinc | Nickel | Lead |

($000s) | ||||

Net sales | 178,483 | 58,360 | 36,465 | 25,191 |

Add back: TC/RC | 9,379 | 23,920 | 18,725 | 5,726 |

Sales before TC/RC ($ 000s) | 187,862 | 82,280 | 55,190 | 30,917 |

Payable metal (tonnes) | 19,431 | 34,268 | 1,603 | 9,643 |

| ||||

Realized prices, $ per pound | 4.40 | 1.11 | 15.62 | 1.45 |

Realized prices, $ per tonne | 9,701 | 2,437 | 34,435 | 3,204 |

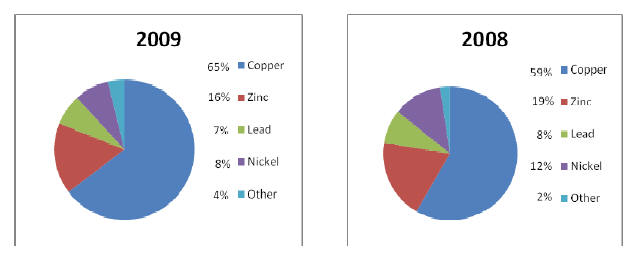

Sales Value by Metal

Copper revenues of $79.7 million (Q1-08: $178.5 million) comprise the largest component of net metal sales. Zinc sales were $20.3 million (Q1-08: $58.4 million) and nickel sales are the third highest contributor to revenues at $9.9 million (Q1-08: $36.5 million). Lead sales were $8.8 million (Q1-08: $25.2 million) while other metals accounted for $4.7 million (Q1-08: $7.2 million).

Composition of Net Sales by Metal

8

Operating Results

Operating Costs

Cost of mining operations were $76.8 million during the first quarter of 2009, compared with $105.0 million for the same period in 2008. The decrease was primarily attributable to lower treatment and refining charges of $22.8 million, as well as cost control initiatives including a reduction in contractor and material costs.

Costs are also lower resulting from a weaker € and SEK exchange rate. The costs are incurred in these currencies and are less when expressed in US dollars. During the first quarter of 2008, the average exchange rates were €1.00: $1.50 and SEK1.00: $0.16, whereas during the first quarter of 2009 the average exchange rates were €1.00: $1.30 and SEK1.00: $0.12.

Accretion of Asset Retirement Obligations and Other

Accretion of asset retirement obligation and provision for severance on mine closure totaled $2.0 million, compared to $2.5 million in the first quarter of 2008.

Depreciation, Depletion and Amortization

Depreciation, depletion and amortization decreased by $9.4 million to $43.5 million in the first quarter of 2009, compared with $52.9 million in the first quarter of 2008. This decrease was primarily due to decreases at Galmoy and Aguablanca. Both were subject to significant write downs at December 31, 2008, with Galmoy being written down to salvage value given its negative cash flows and in anticipation of closure in the first half of 2009. These reductions were offset by an increase in the depreciation and amortization at Neves-Corvo, where the Company used a revised estimate to reflect the suspension of zinc production at the mine.

| Three months ended March 31 | |||||||||

| Depreciation by operation ($ millions) | 2009 | 2008 | Change | ||||||

| Neves-Corvo | 33.1 | 22.3 | 10.8 | ||||||

| Zinkgruvan | 3.9 | 5.4 | (1.5 | ) | |||||

| Galmoy | - | 7.0 | (7.0 | ) | |||||

| Aguablanca | 6.1 | 17.9 | (11.8 | ) | |||||

| Other | 0.4 | 0.3 | 0.1 | ||||||

| 43.5 | 52.9 | (9.4 | ) | ||||||

General Exploration and Project Investigation Costs

General exploration and project investigation costs decreased to $5.3 million in the first quarter of 2009 from $10.1 million during the first quarter of 2008. The costs were primarily in Portugal where drilling continued on near mine exploration at Neves-Corvo ($4.1 million).

Other Costs

Other costs are as follows:

| Three months ended March 31 | |||||||||

($ millions) | 2009 | 2008 | Change | ||||||

Selling, general and administrative | 4.6 | 11.1 | (6.5 | ) | |||||

Stock-based compensation | 1.9 | 4.2 | (2.3 | ) | |||||

Other income and expenses | (1.2 | ) | (2.7 | ) | 1.5 | ||||

Interest and bank charges | 4.0 | 3.4 | 0.6 | ||||||

Foreign exchange loss | 7.2 | 6.2 | 1.0 | ||||||

Loss on forward sales contracts | - | 1.2 | (1.2 | ) | |||||

| 16.5 | 23.4 | (6.9 | ) | ||||||

9

Selling, General and Administration

Selling, general and administration costs were $4.6 million in the first quarter of 2009 compared with $11.1 million in the first quarter of 2008. The Company underwent restructuring during 2008, including a change in Chief Executive Officer, and the closing of its Stockholm and Vancouver offices. The head office of the Company was relocated from Vancouver to Toronto and a European administrative office was opened in Haywards Heath, UK. As a result, the Company incurred severance and recruitment costs as well as certain office closure costs.

Stock-Based Compensation

Stock based compensation costs were $1.9 million in the current quarter compared with $4.2 million for the same period last year. In the first quarter of 2008, the Company granted options with immediate vesting, resulting in the recognition of a $1.3 million expense. In addition, the Company recorded an expense of $0.9 million related to the accelerated vesting of certain options pursuant to a termination agreement. During the current period, there were no options granted.

Foreign Exchange Loss

Foreign exchange losses amounted to $7.2 million in the current quarter as compared to $6.2 million in the prior year quarter. Foreign exchange losses are primarily related to the weakening of the Euro and Swedish krona against the US dollar.

Current and Future Income Taxes

| Current Tax Expense | Three months ended March 31 | ||||||||

| ($ millions) | 2009 | 2008 | Change | ||||||

Neves-Corvo | 2.6 | 17.0 | (14.4 | ) | |||||

Zinkgruvan | 1.3 | 7.5 | (6.2 | ) | |||||

Galmoy | 0.3 | 0.3 | - | ||||||

Other | 0.1 | 5.4 | (5.3 | ) | |||||

| 4.3 | 30.2 | (25.9 | ) | ||||||

Current income tax expense for the first quarter of 2009 was $4.3 million, compared to $30.2 million in the first quarter of 2008. The decrease in current income tax expense is a reflection of lower earnings reported for the year. Earnings from continuing operations before taxes decreased by $132.5 million, from income of $111.9 million in the first quarter of 2008 to a loss of $20.6 million in the current quarter.

| Future Tax (Recovery) Expense | Three months ended March 31 | ||||||||

| ($ millions) | 2009 | 2008 | Change | ||||||

Neves-Corvo | (6.0 | ) | (0.8 | ) | (5.2 | ) | |||

Zinkgruvan | (0.3 | ) | (0.6 | ) | 0.3 | ||||

Galmoy | - | 0.5 | (0.5 | ) | |||||

Aguablanca | (1.0 | ) | 1.2 | (2.2 | ) | ||||

Other | (3.4 | ) | - | (3.4 | ) | ||||

| (10.7 | ) | 0.3 | (11.0 | ) | |||||

The corporate tax rates in the countries where the Company has mining operations range from 25% in Ireland to 30% in Spain.

10

Income (Loss) from Discontinued Operations

On February 5, 2009, the Company disposed of its wholly-owned subsidiary, Pirites Alentejanas SA (“PASA”), which owned the Aljustrel mine. The Company incurred a cash outlay of $21.0 million to satisfy the terms of the sales agreement. Upon the disposition of the shares of PASA, the Company recorded a non-cash gain on disposal of $5.6 million. In the first quarter of 2008, PASA had a loss of $2.5 million.

Upon disposal, the Company was relieved of the obligations associated with PASA. The mining assets of PASA were substantially written down during the second quarter of 2008, and the values that remained were the deferred revenue and associated deferred asset, and liabilities associated with the asset retirement obligation.

Mining Operations

Production Overview

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |||||||||||||

| 2009 | 20081 | 2008 | 2008 | 2008 | 2008 | |||||||||||||

| Copper (tonnes) | ||||||||||||||||||

| Neves-Corvo | 22,367 | 89,026 | 23,297 | 22,291 | 20,726 | 22,712 | ||||||||||||

| Storliden | - | 1,847 | - | 264 | 903 | 680 | ||||||||||||

| Aguablanca | 1,873 | 7,071 | 1,796 | 1,878 | 1,849 | 1,548 | ||||||||||||

| 24,240 | 97,944 | 25,093 | 24,433 | 23,478 | 24,940 | |||||||||||||

| Zinc (tonnes) | ||||||||||||||||||

| Neves-Corvo | - | 22,567 | 2,598 | 6,758 | 7,419 | 5,792 | ||||||||||||

| Zinkgruvan | 20,035 | 65,631 | 15,036 | 15,844 | 16,552 | 18,199 | ||||||||||||

| Storliden | - | 7,007 | - | 995 | 3,635 | 2,377 | ||||||||||||

| Galmoy | 14,242 | 55,952 | 14,772 | 13,470 | 14,016 | 13,694 | ||||||||||||

| 34,277 | 151,157 | 32,406 | 37,067 | 41,622 | 40,062 | |||||||||||||

| Lead (tonnes) | ||||||||||||||||||

| Zinkgruvan | 9,661 | 33,075 | 7,291 | 7,043 | 9,959 | 8,782 | ||||||||||||

| Galmoy | 3,209 | 11,724 | 2,626 | 2,865 | 2,438 | 3,795 | ||||||||||||

| 12,870 | 44,799 | 9,917 | 9,908 | 12,397 | 12,577 | |||||||||||||

| Nickel (tonnes) | ||||||||||||||||||

| Aguablanca | 1,961 | 8,136 | 2,179 | 2,155 | 1,954 | 1,848 | ||||||||||||

| 1,961 | 8,136 | 2,179 | 2,155 | 1,954 | 1,848 |

_______________________________

1Does not include Aljustrel production: zinc - 16,687 tonnes; copper - 204 tonnes

11

Neves-Corvo Mine

Neves-Corvo is an operating underground mine, 100 km north of Faro, in the western part of the Iberian Pyrite Belt. The mine access is provided by one vertical 5 metre diameter shaft, hoisting ore from the 700 metre level, and a ramp from the surface. The mine has been a significant producer of copper since 1989. The copper plant has treated in excess of 2.0 million tonnes per annum since upgrading in 2007. In 2006, the Company commenced treating zinc ores.

The mining and processing of zinc-rich ores remains suspended owing to the low zinc price. The zinc facility continued to treat copper ore and allowed for record tonnages of copper ore to be treated.

Production Statistics

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |||||||||||||

| 2009 | 2008 | 2008 | 2008 | 2008 | 2008 | |||||||||||||

| Ore mined, copper (tonnes) | 636,401 | 2,395,516 | 674,207 | 573,766 | 577,980 | 569,563 | ||||||||||||

| Ore mined, zinc (tonnes) | - | 407,046 | 34,509 | 106,488 | 138,728 | 127,321 | ||||||||||||

| Ore milled, copper (tonnes) | 671,480 | 2,409,966 | 675,599 | 550,182 | 588,875 | 595,310 | ||||||||||||

| Ore milled , zinc (tonnes) | - | 398,985 | 42,864 | 114,556 | 126,669 | 114,896 | ||||||||||||

| Grade per tonne | ||||||||||||||||||

| Copper (%) | 3.9 | 4.3 | 4.0 | 4.7 | 4.1 | 4.4 | ||||||||||||

| Zinc (%) | - | 7.3 | 7.7 | 7.6 | 7.5 | 6.6 | ||||||||||||

| Recovery | ||||||||||||||||||

| Copper (%) | 86 | 86 | 87 | 85 | 85 | 87 | ||||||||||||

| Zinc (%) | - | 78 | 78 | 78 | 79 | 77 | ||||||||||||

| Concentrate grade | ||||||||||||||||||

| Copper (%) | 24.8 | 24.3 | 24.4 | 24.5 | 24.4 | 23.8 | ||||||||||||

| Zinc (%) | - | 49.2 | 48.9 | 49.0 | 49.7 | 48.8 | ||||||||||||

| Production- tonnes (metal contained) | ||||||||||||||||||

| Copper | 22,367 | 89,026 | 23,297 | 22,291 | 20,726 | 22,712 | ||||||||||||

| Zinc | - | 22,567 | 2,598 | 6,758 | 7,419 | 5,792 | ||||||||||||

| Silver (oz) | 196,530 | 926,740 | 232,252 | 233,077 | 218,674 | 242,737 | ||||||||||||

| Sales ($000s) | 73,412 | 497,936 | 15,498 | 119,698 | 193,578 | 169,162 | ||||||||||||

| Operating earnings ($000s)1 | 35,223 | 291,829 | (20,228 | ) | 62,639 | 125,880 | 123,538 | |||||||||||

| Cash cost ($ per pound)2 | 1.01 | 1.07 | 1.05 | 1.06 | 1.15 | 1.02 |

Operating Earnings1

Operating earnings of $35.2 million for the first quarter of 2009 were $88.3 million (71%) below those of the same period in 2008. The decrease was attributable to price and price adjustments of $108 million, offset by the effects of a weaker Euro and lower operating costs.

Production

Copper ore mined and processed were 12% and 13% higher than in the first quarter or 2008 as a result of the suspension of zinc mining and processing and the associated resources being directed to copper production. Despite higher volumes of copper ore treated, a reduction in the head grades of treated ore resulted in a marginal decrease in production compared to the same period in 2008. Measures aimed at curtailing out-of-reserve mining will assist in increasing head grades during the balance of the year.

Cash Costs

Despite a drop of $0.19/lb in by-product credits due to the suspension of zinc production, cash costs have remained at the same level as the first quarter of 2008, due to favourable exchange rates of $0.13/lb and cost savings of $0.07/lb.

_______________________________________

1 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Cash cost per pound of payable copper sold is the sum of direct cash costs and inventory changes less by-product and royalties. See Non-GAAP Performance Measures on page 22 of this MD&A.

12

Zinkgruvan Mine

The Zinkgruvan mine is located approximately 250 km south-west of Stockholm, Sweden. Zinkgruvan has been producing zinc, lead and silver on a continuous basis since 1857.

The operation consists of an underground mine and processing facility with associated infrastructure and a present nominal production capacity of 900,000 tonnes of ore throughput. The mine has three shafts with current mining focused on the Burkland and Nygruvan ore bodies. One shaft is used for ore and waste handling; the other two are used for transportation of personnel and for emergency egress.

Production Statistics

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |||||||||||||

| 2009 | 2008 | 2008 | 2008 | 2008 | 2008 | |||||||||||||

| Ore mined (tonnes) | 261,753 | 900,387 | 250,638 | 193,953 | 212,156 | 243,640 | ||||||||||||

| Ore milled (tonnes) | 257,551 | 895,024 | 226,167 | 204,096 | 237,114 | 227,647 | ||||||||||||

| Grade per tonne | ||||||||||||||||||

| Zinc (%) | 8.3 | 7.9 | 7.2 | 8.3 | 7.5 | 8.5 | ||||||||||||

| Lead (%) | 4.4 | 4.3 | 3.8 | 4.0 | 4.8 | 4.5 | ||||||||||||

| Recovery | ||||||||||||||||||

| Zinc (%) | 93 | 93 | 93 | 94 | 93 | 94 | ||||||||||||

| Lead (%) | 86 | 86 | 84 | 87 | 88 | 86 | ||||||||||||

| Concentrate grade | ||||||||||||||||||

| Zinc (%) | 52.4 | 53.2 | 53.5 | 53.4 | 53.0 | 53.0 | ||||||||||||

| Lead (%) | 75.3 | 76.7 | 77.2 | 76.3 | 76.2 | 77.2 | ||||||||||||

| Production - tonnes(metal contained) | ||||||||||||||||||

| Zinc | 20,035 | 65,631 | 15,036 | 15,844 | 16,552 | 18,199 | ||||||||||||

| Lead | 9,661 | 33,075 | 7,291 | 7,043 | 9,959 | 8,782 | ||||||||||||

| Silver (oz) | 461,371 | 1,694,566 | 373,769 | 370,932 | 534,193 | 415,672 | ||||||||||||

| Sales ($000s) | 20,389 | 123,508 | 41,724 | 29,745 | 34,066 | 48,633 | ||||||||||||

| Operating earnings ($000s)1 | 8,309 | 57,237 | (2,137 | ) | 11,437 | 14,806 | 33,131 | |||||||||||

| Cash cost ($ per pound)2 | 0.31 | 0.30 | 0.40 | 0.35 | 0.33 | 0.18 |

Operating Earnings1

Operating earnings of $8.3 million for the first quarter of 2009 were $24.8 million (or 75%) below those of the same period in 2008. Although price and price adjustments accounted for $27 million of the decrease, this impact was partially offset by a weaker Swedish krona.

Production

The operations continued to achieve record levels for tonnes of ore mined and treated and for total lead and zinc production.

Cash Costs

Cash costs per pound of zinc are significantly higher than those in the same quarter of the previous year; however, they have reduced by 23% from the fourth quarter of 2008. When compared to the first quarter of 2008, the increase is attributable to lower lead by-product credits of $0.30/lb due to the lower lead price. Exchange rates and cost savings offset the lower by-product credits by $0.08/lb.

Copper Project

The Copper Project continues to be within budget and is on track for first copper production in 2010. Ramp development and the underground crusher are ahead of schedule, while preparations for the surface ore processing facilities are on target.

______________________________________

1 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Cash cost per pound of payable zinc sold is the sum of direct cash costs and inventory changes less by-product credits and royalties. See Non-GAAP Performance Measures on page 22 of this MD&A.

13

Aguablanca Mine

The Aguablanca nickel-copper sulfide deposit is located in the province of Badajoz, 80 km by road to Seville and 140 km from a major seaport at Huelva. The Aguablanca mine was acquired by the Company in July 2007, through its purchase of Rio Narcea Gold Mines. Commercial production started in January 2005.

Production Statistics

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |||||||||||||

| 2009 | 2008 | 2008 | 2008 | 2008 | 2008 | |||||||||||||

| Ore mined (tonnes) | 317,237 | 1,794,089 | 480,663 | 461,477 | 444,720 | 407,229 | ||||||||||||

| Ore milled (tonnes) | 484,095 | 1,825,212 | 492,681 | 475,893 | 451,265 | 405,373 | ||||||||||||

| Grade per tonne | ||||||||||||||||||

| Nickel (%) | 0.5 | 0.6 | 0.6 | 0.6 | 0.5 | 0.6 | ||||||||||||

| Copper (%) | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | ||||||||||||

| Recovery | ||||||||||||||||||

| Nickel (%) | 78 | 80 | 79 | 81 | 80 | 81 | ||||||||||||

| Copper (%) | 89 | 93 | 94 | 93 | 93 | 92 | ||||||||||||

| Concentrate grade | ||||||||||||||||||

| Nickel (%) | 6.3 | 7.0 | 7.1 | 7.0 | 6.9 | 7.0 | ||||||||||||

| Copper (%) | 6.1 | 6.1 | 5.9 | 6.1 | 6.5 | 5.9 | ||||||||||||

| Production-tonnes (metal contained) | ||||||||||||||||||

| Nickel | 1,961 | 8,136 | 2,179 | 2,155 | 1,954 | 1,848 | ||||||||||||

| Copper | 1,873 | 7,071 | 1,796 | 1,878 | 1,849 | 1,548 | ||||||||||||

| Sales ($000s) | 19,233 | 120,280 | 8,719 | 24,194 | 35,864 | 51,503 | ||||||||||||

| Operating earnings ($000s)1 | 769 | 22,328 | (13,915 | ) | 4,774 | 2,911 | 28,534 | |||||||||||

| Cash cost ($ per pound)2 | 3.62 | 5.50 | 5.07 | 4.94 | 5.01 | 7.24 |

Operating Earnings1

Operating earnings of $0.8 million for the first quarter of 2009 were significantly lower compared to the same period in the previous year. Substantially improved operating costs of $10 million have been offset by an estimated $43 million in lower metal price and price adjustments.

Production

Nickel production was up 6% over the first quarter of 2008 and copper increased by 21% when compared to the same quarter of last year. For the third consecutive quarter, mill throughput continued to exceed design capacity of 1.5 million tonnes per annum. In accordance with plan, tonnes mined were lower than in previous quarters, as partially oxidized surface ore stockpiles were blended with ROM production. The use of oxidized ore resulted in slightly decreased recovery rates.

Cash Costs

Cash costs per pound of nickel improved over the first quarter of 2008 primarily as a result of a fall in treatment and refining charges ($3.56/lb) related to price participation. This was offset in part by lower contributions from copper by-products credits ($2.12/lb) . Cost savings and favourable exchange rates further reduced the cash cost by $1.62/lb and $0.85/lb, respectively.

______________________________________

1 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Cash cost per pound of payable nickel sold is the sum of direct cash costs and inventory changes less by-product credits and royalties. During 2008, the numbers reported for cash cost per pound included royalties. In 2009, the Company amended the calculation to remove royalties, as defined in the Brook Hunt model, which is consistent with the method used in the Company’s other operations. See Non-GAAP Performance Measures.

14

Galmoy Mine

The Galmoy underground zinc mine is located in south-central Ireland in County Kilkenny and is approximately 30 km to the northwest of the city of Kilkenny. The Company announced in January 2009 that the mine would cease production activities in May 2009.

During the quarter, the Company began to wind down the operation in an orderly fashion. The operation is expected to cease mining operations in the second quarter and milling will cease in the third quarter of 2009.

Production Statistics

| Q1 | Total | Q4 | Q3 | Q2 | Q1 | |||||||||||||

| 2009 | 2008 | 2008 | 2008 | 2008 | 2008 | |||||||||||||

| Ore mined (tonnes) | 104,230 | 494,860 | 115,746 | 131,114 | 119,590 | 128,410 | ||||||||||||

| Ore milled (tonnes) | 105,338 | 496,953 | 122,394 | 112,776 | 131,768 | 130,015 | ||||||||||||

| Grade per tonne | ||||||||||||||||||

| Zinc (%) | 16.8 | 13.5 | 14.5 | 14.1 | 12.8 | 12.9 | ||||||||||||

| Lead (%) | 4.9 | 3.5 | 3.3 | 3.8 | 2.9 | 4.1 | ||||||||||||

| Recovery | ||||||||||||||||||

| Zinc (%) | 81 | 83 | 83.1 | 85 | 83 | 82 | ||||||||||||

| Lead (%) | 63 | 67 | 65.4 | 67 | 64 | 71 | ||||||||||||

| Concentrate grade | ||||||||||||||||||

| Zinc (%) | 51.5 | 52.5 | 52.4 | 51.8 | 53.4 | 52.3 | ||||||||||||

| Lead (%) | 65.7 | 65.2 | 66.3 | 65.8 | 65.7 | 63.7 | ||||||||||||

| Production- tonnes (metal contained) | ||||||||||||||||||

| Zinc | 14,242 | 55,952 | 14,772 | 13,470 | 14,016 | 13,694 | ||||||||||||

| Lead | 3,209 | 11,724 | 2,626 | 2,865 | 2,438 | 3,795 | ||||||||||||

| Silver | 31,448 | 134,120 | 20,546 | 27,124 | 27,344 | 59,106 | ||||||||||||

| Sales ($000s) | 10,346 | 69,831 | 7,938 | 15,549 | 19,536 | 26,808 | ||||||||||||

| Operating earnings ($000s)1 | 644 | (7,218 | ) | (20,347 | ) | 1,570 | 2,005 | 9,554 | ||||||||||

| Cash cost ($ per pound)2 | 0.56 | 0.70 | 0.69 | 0.66 | 0.76 | 0.69 |

Operating Earnings1

Operating earnings during the quarter of $0.6 million are 93% lower than the $9.6 million of operating earnings in the first quarter of 2008. Price and price adjustments accounted for a negative $13 million impact on operating earnings.

Production

While totals mined and milled were less than the first quarter of 2008, metal production exceeded the first quarter of the previous year owing to higher head grades being mined and processed. As the mine winds down, mining is selectively focused on higher grade areas.

Cash Costs

The cash cost per pound of payable zinc sold decreased by 19% to $0.56/lb compared to the first quarter of 2008. Lower lead by-product sales and price increased the cash cost by $0.22/lb. This increase was offset by lower operating costs of $0.18/lb, and favourable exchange rates of $0.08/lb.

1 Operating earnings is a Non-GAAP measure defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. See page 22 of this MD&A for discussion of Non-GAAP measures.

2 Cash cost per pound of payable zinc sold is the sum of direct costs and inventory changes less by-product credits and royalties. See Non-GAAP Performance Measures.

15

Project Highlights

Tenke Fungurume Project (Lundin 24.75%, FCX 57.75%, Gécamines 17.5%)

First copper cathode was produced during March of 2009, followed by first shipment of copper cathode in April. Construction activities are progressing well and the mine is expected to reach commercial production for Phase I of 115,000 tonnes per annum of copper and at least 8,000 tonnes per annum of cobalt.

During the first quarter of 2009, the Company made no cash contributions to the Tenke Fungurume Project, but FCX contributed $85.4 million to fund the Company’s proportionate share of Phase I costs under the EOC facility. The Company is protected from cost overruns on the initial Phase I project capital cost, whereby FCX is required to fund certain excess cost overruns through the EOC facility which is structured as loans to the project. The loans are non-recourse to Lundin and will be repaid to FCX by preferential sweeps from first available operating cash flows of the project.

Company funding of Tenke during 2009 is estimated to be in the range of $40 - $50 million including Lundin’s share of working capital, exploration and on-going expansion studies.

Project exploration continues and the Company released an updated resource estimate in compliance withNI 43-101 Standards of Disclosure for Mineral Projects (news release dated March 30, 2009).

Discussions continue with the Government of the DRC in respect of the review of the mining contracts in the country that was initiated in 2007. FCX, as operator has the lead role in the discussions with the government and continues to engage in dialogue in a co-operative manner. The process has not affected project development or production activities. However, until a resolution can be reached between the partners, the carrying value of the Company’s interest is subject to uncertainty.

Neves-Corvo – Lombador Copper/Zinc and Neves Zinc Expansion Projects

The Lombador project concept studies continued at a reduced rate pending market improvements. Project capital has been limited to continued exploration drilling and scoping studies.

Work on the Zinc Expansion Project also progressed minimally with all significant capital expenditures suspended pending market improvements.

Zinkgruvan Copper Project

Driving down of the daylight ramp access continued to advance along with the ramping up from the new underground copper crusher. The crusher is now in operation on zinc ores, improving zinc production flexibility. Design and procurement progressed on the surface copper concentrator. Aided by a weaker Swedish Kroner against the US dollar, the project remains on budget.

Exploration Highlights

Portugal

Neves-Corvo Mine Exploration (Copper, Zinc)

Exploration drilling for the first quarter of 2009 totaled 11,174 m, testing ten individual targets. Drilling was focused on discovering copper mineralization and was designed to test areas down-dip of the Corvo orebody and up-dip of the Lombador East footwall copper zone. New copper mineralization was intersected in both areas. Highlights included drillhole SC26 which intersected 6.9 m grading 4.5% copper at a location only 22 metres below the Corvo underground mine access. Three other drillholes (NF26C-1, NF26D and NF26D-1) intercepted significant copper mineralization within the recently identified Lombador East copper zone; assays pending.

16

Iberian Pyrite Belt Regional Exploration (Copper, Zinc)

Geophysical target definition work continued in the first quarter, focusing on targets within the peripheral parts of the Neves-Corvo mining lease and the adjacent Castro Verde exploration permit but also advancing more regional greenfield targets on the Albernoa, Alcoutim and Mertola exploration permits. Several strong conductive targets, many of which are coincident with gravimetric anomalies, have been defined for drill-testing. Expressions of interest have been received for the partnering of this regional exploration program.

Spain

Salave Project, northern Spain (Gold)

Offers are being received and considered for the divestment of this 1.6 million ounce gold project.

Toral Project, northern Spain (Zinc, Lead, Silver)

A purchase and sale agreement is being finalized with Goldquest Mining Corporation for Lundin Mining Exploration S.L., the 100%-owned subsidiary company that holds the Toral zinc-lead-silver project to sell its interest in the project.

Ossa Morena Regional Exploration Properties, southern Spain (Nickel, Copper, Gold)

Expressions of interest are being considered towards partnering/divesting of these properties.

Ireland

Clare JV Project (Zinc, Lead, Silver)

By the end of the first quarter of 2009, a total of 2,250 m of drilling had been completed in Ireland, including 1,258 m in three on-going holes at the Clare property in Co. Clare in southwestern Ireland. The Clare property is subject to an optional earn-in type joint venture agreement with Belmore Resources as announced on February 26, 2009.

Sweden

Zinkgruvan Mine Exploration (Zinc, Lead, Silver)

Ongoing compilation work is focused on detailed interpretation of significant mineralized intersections drilled in the Dalby area during 2008, and on planning follow-up exploration work for this area in 2010.

Sweden Regional Exploration Properties (Zinc, Lead, Silver; Copper, Gold; Iron)

Expressions of interest are being considered towards partnering/divesting of zinc-lead-silver, copper-zinc, copper-gold and iron property/data portfolios in the Bergslagen, Skellefte and Norrbotten districts.

17

Metal Prices, LME Inventories and Smelter Treatment and Refining Charges

During the first quarter of 2009, the average prices for copper, lead, zinc and nickel decreased by 13%, 7%, 1% and 4%, respectively, compared to the fourth quarter of 2008. The inventory levels of copper, lead, zinc and nickel on the London Metal Exchange (“LME”) all increased during the first quarter 2009 compared to the fourth quarter 2008. At the end of the first quarter 2009, the LME stocks of copper were 499,625 tonnes (Q4-08: 339,775 tonnes), lead 62,025 tonnes (Q4-08: 45,150 tonnes), zinc 345,700 tonnes (Q4-08: 253,500 tonnes) and nickel 106,698 tonnes (Q4-08: 78,390 tonnes).

| Three months ended March 31 | |||

(Average LME Prices) | 2009 | 2008 | Change | |

Copper | US$/pound | 1.56 | 3.52 | -56% |

| US$/tonne | 3,435 | 7,763 | -56% |

Lead | US$/pound | 0.53 | 1.31 | -60% |

| US$/tonne | 1,160 | 2,891 | -60% |

Zinc | US$/pound | 0.53 | 1.10 | -52% |

| US$/tonne | 1,174 | 2,426 | -52% |

Nickel | US$/pound | 4.74 | 13.09 | -64% |

| US$/tonne | 10,459 | 28,863 | -64% |

The spot treatment charge for copper concentrates decreased during the first quarter 2009. During the quarter the average spot treatment charge was $60 per dmt (Q4-08: $62) with a refining charge of $0.06 per payable pound of copper contained (Q4-08: $0.062) . During March the treatment and refining charges dropped substantially and reached $45 per dmt (TC) and $0.045 per payable pound of copper contained (RC). The terms for the annual contracts were settled early in the quarter at a TC of $75 per dmt of concentrates and a RC of $0.075 per payable pound of copper contained.

During the quarter the spot activity in China for zinc concentrates increased and spot treatment charges fell to $97 per dmt on a delivered basis compared to $150 at the end of the fourth quarter 2008. The negotiations of terms for the annual contracts continued during the first quarter and terms in Europe settled at a TC of approximately $198.50 per dmt of concentrates based on a zinc price of $1,250 per mt and with an escalation of 12-13% and a de-escalation of 10-12%. This TC is about $4 per dmt higher than the settlement in the Asian market.

The Chinese spot market for lead concentrates has also been very active and spot treatment charges for lead concentrates in China ended the quarter at $48 per dmt compared to $100-120 per dmt at the end of 2008. Terms for most of the annual contracts have also been agreed during the quarter and the TC ranges from $150 to $185 per dmt, depending on the quality of the lead concentrate. These TCs are based on a lead price of $1,000 per mt and have escalators of 10-12% and de-escalators of 5-10%.

The Company’s nickel concentrates are sold under multi-year contracts at fixed terms.

18

Liquidity and Financial Condition

Cash Reserves

As at March 31, 2009, the Company had net debt of $259.5 million compared with net debt of $145.5 million as at December 31, 2008. The Company defines net debt to be available unrestricted cash less financial debt, including capital leases and other debt-related obligations.

Cash and cash equivalents decreased by $118.4 million to $51.3 million as at March 31, 2009 from $169.7 million at December 31, 2008. There was net cash outflow of $118.4 million for the three months ended March 31, 2009, including operating cash outflow of $63.3 million. $68.1 million of the cash outflow related to the settlement of sales for which provisional payments had been previously received, and $33.6 million of cash was used to invest in mineral property, plant and equipment. In addition, a cash outlay of $21.0 million was incurred on the disposal of Aljustrel, pursuant to terms of the purchase and sale agreement.

As at December 31, 2008, the Company was not in compliance with the tangible net worth covenant under its $575 million revolving line of credit facility. However, pursuant to the terms of the Second Amending Agreement and Waiver (‘Second Amending Agreement’), dated March 6, 2009, this requirement has been waived by the banking syndicate until June 5, 2009. The total outstanding on the facility at March 31, 2009 is $274.3 million (including a letter of credit of $9.6 million).

The Second Amending Agreement also establishes that no further draw-downs are permitted on the facility. Due to the restriction on further draw-downs, the Company voluntarily reduced the level of the facility to the currently drawn amounts in order to eliminate standby charges that would accrue on the undrawn facility.

The intention is to restructure the reduced facility. The Company intends that the terms of the restructured facility will reflect a reduced tenor and also take into account the recent developments, including the Company’s decision to enter into hedging arrangements to secure future cash flows and the completion of an equity financing resulting in gross proceeds of C$188.6 million ($155.8) . The Company’s goal is to establish an appropriate revolving facility to ensure liquidity in the event of a prolonged low metal price environment.

Working Capital

At March 31, 2009, there is working capital deficiency of $232.7 million, compared to $215.3 million at December 31, 2008. Both cash and current liabilities decreased due to the settlement of sales for which provisional payments had been previously received. This deficiency reflects the fact that the amount owing under the revolving credit facility of $264.7 is recorded as a current liability. At such time as when the facility is renegotiated, management expects it will be reclassified as a long-term liability.

Deferred Revenues

The Company has an agreement with Silver Wheaton Minerals in respect of Zinkgruvan and an agreement with Silverstone in respect of Neves-Corvo, to sell all future silver production at a price of $3.90/oz or the market price if it is less than $3.90/oz. The Silverstone agreement is periodically adjusted for inflation. The up-front cash payments received have been deferred and are realized on the statement of operations when the actual deliveries of silver occur.

19

Shareholders’ Equity

Shareholders’ equity was $2.6 billion at March 31, 2009. Differences that result from the translation of the Company’s Iberian and Swedish net assets into US dollars will result in increases and decreases to the Company’s translated net assets, depending on the strength of the US dollar when compared to the € or SEK. These variances related to translation are recorded in Other comprehensive income. Translation differences resulted in a decrease in other comprehensive income of $24.3 million for the three month period ended March 31, 2009.

Long-term Debt

Owing to the Company only having a waiver of its non-compliance with the revolving credit facility covenant until June 5, 2009, the previously classified long-term debt is now classified as current.

Off-Balance Sheet Financing Arrangements

During the quarter an additional $85.4 million was contributed to the Tenke Fungurume Project under the EOC facility (see details on page 16 of this MD&A), bringing the total advanced under the facility to $148.3 million as at March 31, 2009.

Outstanding receivables (provisionally valued) as of March 31, 2009

Metal | Tonnes payable | Valued at$ price per tonne | Valued at$ price per lb |

Copper | 14,763 | 4,023 | 1.82 |

Zinc | 24,554 | 1,240 | 0.56 |

Nickel | 3,534 | 9,802 | 4.45 |

Lead | 14,796 | 1,126 | 0.51 |

Changes in Accounting Policies

International Financial Reporting Standards ("IFRS")

In 2008, the Company undertook an IFRS diagnostic study with a view to assessing the impact of the transition to IFRS on the Company’s accounting policies and to establish a project plan to implement IFRS. A number of key accounting areas where IFRS differs from current accounting policies and accounting alternatives in those and other key accounting areas were reviewed. The IFRS diagnostic study also identified key system and business process areas that will be addressed as part of the conversion project.

The Company currently has a preliminary project plan which will be formalized by end of second quarter of 2009.

In the next phase, the Company will perform detail assessments and in-depth technical analysis that will result in the understanding of potential impacts, decision on accounting policy choices and the drafting of accounting policies. In addition, this will result in identifying resource and training requirements, processes for preparing financial statements, establishing IT system requirements and preparing detailed transition plans. The Company expects to commence this phase in the second quarter of 2009. The Company continues to monitor standards development as issued by the International Accounting Standards Board and the Canadian Institute of Chartered Accountants Accounting Standards Board, as well as regulatory developments as issued by the Canadian Securities Administrators, which may affect the timing, nature or disclosure of the Company’s adoption of IFRS.

20

Critical Accounting Estimates

The application of certain accounting policies requires the Company to make estimates based on assumptions that may be undertaken at the time the accounting estimate is made. The Company’s accounting policies are described in Note 3 of the annual consolidated financial statements for the year ended December 31, 2008. For a complete discussion of accounting estimates deemed most critical by the Company, refer to the Company’s 2008 annual MD&A dated February 25, 2009.

Managing Risks

Risks and Uncertainties

The operations of Lundin Mining involve certain significant risks, including but not limited to credit risk, foreign exchange risk and derivative risk. For a complete discussion of the risks, refer to the Company’s 2008 Annual Information Form, available on the SEDAR website,www.sedar.com.

Credit Facility Risk

As at December 31, 2008 and at March 31, 2009, the Company was not in compliance with the tangible net worth covenant under its Credit Facility. The banking syndicate has waived, in favour of the Company, compliance with the requirements of the tangible net worth covenant until June 5, 2009.

In return for the waiver, the Company has agreed to, with effect on February 25, 2009 and for the duration of the waiver period, certain changes in conditions including: no further draw-downs on the Credit Facility; an increase in the interest rate to 4.5% over LIBOR; restrictions on cash distributions and asset sales; an inclusion of the Company’s interest in the Tenke Fungurume project in the security package; and a general security agreement over the Company’s assets. The intention is to restructure the Credit Facility to ensure adequate liquidity in the event that the present market volatility and depressed demand for base metals continue for the next two years. Future operations are dependent on the Company’s ability to access sufficient funding to meet its obligations. There are, however, no assurances that these negotiations will be successful.

In the event that a positive outcome is not achieved from negotiations between the Company and the lending syndicate and the Credit Facility is not restructured, the debt will be callable by the lenders, which would adversely impact the Company’s financial position and operations. There can be no assurance that alternative sources of financing will be available, and, if available, on acceptable terms.

Current Global Financial Condition

Current global financial conditions have been subject to increased volatility, with numerous financial institutions having either gone into bankruptcy or having to be rescued by government authorities. Access to financing has been negatively impacted by both sub-prime mortgages in the United States and elsewhere and the liquidity crisis affecting the asset-backed commercial paper market. As such, the Company is subject to counterparty risk and liquidity risk. The Company is exposed to various counterparty risks including, but not limited to: (i) through the Company’s lenders; (ii) through financial institutions that

hold the Company’s cash, and (iii) through the Company’s insurance providers. The Company is also exposed to liquidity risks in meeting its operating and capital expenditure requirements in instances where cash positions are unable to be maintained or appropriate financing is unavailable. These factors may impact the ability of the Company to obtain loans and other credit facilities in the future and, if obtained, on terms favourable to the Company. If these increased levels of volatility and market turmoil continue, the Company’s operations could be adversely impacted.

21

Backfill and Long-Term Mine Stability of the Galmoy Mine

The Irish Authorities that will endorse the final closure plan for Galmoy mine are expected to accept recommendations made by recognised rock mechanics consultants on the final backfill requirements. However, should the Authorities fail to reach a consensus view on the quantity of backfill to be placed underground, Galmoy may be obliged to place larger volumes at a considerable cost.

Outstanding Share Data

As at May 6, 2009, the Company had 579,433,771 common shares issued and outstanding, and 10,544,720 stock options and 306,720 stock appreciation rights outstanding under its stock-based incentive plans.

Non-GAAP Performance Measures

The Company uses certain performance measures in its analysis. These performance measures have no meaning within Canadian Generally Accepted Accounting Principles (“GAAP”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with Canadian GAAP. The following are Non-GAAP measures that the Company uses as key performance indicators.

Operating earnings

“Operating earnings” is a performance measure used by the Company to assess the contribution by mining operations to the Company’s net earnings or loss. Operating earnings is defined as sales, less operating costs, accretion of ARO and other provisions, selling, general and administration costs and stock-based compensation. The operating earnings are shown on the statement of operations as “Income from continuing operations before undernoted”.

Cash cost per pound

Zinc, copper and nickel cash costs per pound are key performance measures that management uses to monitor performance. Management uses these statistics to assess how well the Company’s producing mines are performing compared to plan and to assess overall efficiency and effectiveness of the mining operations.

Lundin provides cash cost information as it is a key performance indicator required by users of the Company’s financial information in order to assess the Company’s profit potential and performance relative to its peers. The cash cost figure represents the total of all cash costs directly attributable to the related mining operations after the deduction of credits in respect of by-product sales and certain royalties. Cash cost is not a GAAP measure and, although it is calculated according to accepted industry practice, the Company’s disclosed cash costs may not be directly comparable to other base metal producers. By-product credits, are an important factor in determining the cash costs. The cost per pound experienced by the Company will be positively affected by rising prices for by-products and adversely affected when prices for these metals are falling.

22

Cash costs can be reconciled to the Company’s operating costs as follows:

Reconciliation of unit cash costs of payable copper, zinc and nickel metal sold to the consolidated statements of operations

| Year ended March 31, 2009 | Year ended March 31, 2008 | |||||||

| Total | Pounds | Cost | Cash | Total | Pounds | Cost | Cash | |

| Tonnes | (000s) | $/lb | Operating | Tonnes | (000s) | $/lb | Operating | |

| Sold | Costs | Sold | Costs | |||||

| (000s) | (000s) | |||||||

Operation | ||||||||

Neves Corvo (cu) | 20,108 | 44,330 | 1.01 | 44,773 | 17,506 | 38,594 | 1.02 | 39,520 |

Zinkgruvan (zn) | 16,468 | 36,305 | 0.31 | 11,255 | 16,832 | 37,108 | 0.18 | 6,828 |

Aguablanca (ni) | 2,045 | 4,508 | 3.62 | 16,319 | 1,603 | 3,534 | 7.53 | 26,611 |

Galmoy (zn) | 11,271 | 24,848 | 0.56 | 13,915 | 11,411 | 25,157 | 0.69 | 17,459 |

Storliden (zn) | - | - | - | - | 2,020 | 4,453 | (0.11) | (490) |

| 86,262 | 89,928 | |||||||

| Add: By-product credits | 20,861 | 57,399 | ||||||

| Treatment costs | (31,788) | (48,993) | ||||||

| Royalties and other | 1,428 | 6,654 | ||||||

| Total Operating Costs | 76,763 | 104,988 | ||||||

Management’s Report on Internal Controls

Management’s Report on Disclosure Controls and Procedures

Management of the Company, under the supervision of the President and Chief Executive Officer and the Chief Financial Officer, is responsible for the design and operations of internal control over financial reporting. There have been no changes in the Company’s disclosure controls and procedures during the three months ended March 31, 2009.

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal controls over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and preparation of financial statements for external purposes in accordance with generally accepted accounting principles (“GAAP”). Any system of internal control over financial reporting, no matter how well designed, has inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

There have been no changes in the Company’s internal control over financial reporting during the three months ended March 31, 2009 that have materially affected, or is reasonably likely to materially affect, the internal control over financial reporting.

23