As filed with the Securities and Exchange Commission on November 13, 2007

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Power of the Dream Ventures, Inc.

(Name of small business issuer in its charter)

Delaware | | 8711 | | 51-0597895 |

| (State or Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

| 1095 Budapest | | Incorporating Services, Ltd. |

| Soroksari ut 94-96 | | 3500 South Dupont Highway |

| Hungary | | Dover, Delaware 29901 |

| | | |

Telephone: +36-1-456-6061 | | Telephone: (302) 531-0855 |

Facsimile: +36-1-456-6062 | | Facsimile: (302) 531-3150 |

| | | |

(Address and telephone number of principal executive offices) | | (Name, address and telephone number of agent for service) |

Copies of all communications and notices to:

Lloyd L. Rothenberg, Esq.

Loeb & Loeb LLP

345 Park Ave, 19th Floor

New York, New York 10154

Telephone: (212) 407-4937

Facsimile: (212) 656-1076

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this registration statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Calculation of Registration Fee

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

Shares of Common Stock Par Value $0.0001 per Share | 12,532,000(1) | $2.50(2) | $31,330,000 | $1,243.81 |

| | | | | |

| Total | 12,532,000 | $2.50 | $31,330,000 | $1,243.81 |

(1) These shares were issued in connection with various private placements completed by the Registrant prior to October 25, 2007. All of the shares are offered by the Selling Shareholders. Accordingly, this registration statement includes an indeterminate number of additional shares of common stock issuable for no additional consideration pursuant to any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration, which results in an increase in the number of outstanding shares of our common stock. In the event of a stock split, stock dividend or similar transaction involving our common stock, in order to prevent dilution, the number of shares registered shall be automatically increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act of 1933.

(2) Estimated solely for the purpose of computing the registration fee pursuant to Rule 457 under the Securities Act of 1933; it is not known how many shares, if any, will be purchased under this registration statement or at what price the shares will be purchased.

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED November 13, 2007

The information in this prospectus is not complete and may be changed. The Selling Shareholders may not sell these securities until this registration statement is declared effective by the United States Securities and Exchange Commission. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

Power of the Dream Ventures, Inc.

12,532,000 SHARES OF COMMON STOCK

This prospectus relates to the resale by certain of our shareholders named in this prospectus (the “Selling Shareholders”) of up to 12,532,000 shares of our common stock (the “Shares”). The Shares were purchased by the Selling Shareholders in private placement transactions pursuant to exemptions from the registration requirements of the Securities Act of 1933 (the “Securities Act”).

Although we will pay all the expenses incident to the registration of the Shares, we will not receive any proceeds from the sales, if any, by the Selling Shareholders.

The Selling Shareholders and any underwriter, broker-dealer or agent that participates in the sale of the Shares or interests therein may be deemed “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions, profit or other compensation any of them earns on any sale or resale of the Shares, directly or indirectly, may be underwriting discounts and commissions under the Securities Act. The Selling Shareholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

Our common stock is presently not traded or quoted for trading on any market or securities exchange. The Selling Shareholders may sell their Shares at $2.50 per share until our common stock is quoted on the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”) and, thereafter, at prevailing market prices or privately negotiated prices. No assurance can be given that our common stock will be quoted for trading on the OTC Bulletin Board or any other securities exchange or market. Please refer to“Plan of Distribution.”

The purchase of the Shares involves a high degree of risk. Please refer to “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Date Of This Prospectus Is November __, 2007

| | PAGE |

| 6 |

| 9 |

| 17 |

| 17 |

| 18 |

| 18 |

| 22 |

| 34 |

| 35 |

| 39 |

| 40 |

| 43 |

| 43 |

| 44 |

| 47 |

| 49 |

| 52 |

| 52 |

| 52 |

| 53 |

| | |

| F-1 |

You should rely only on the information contained in this prospectus or any supplement hereto. We have not authorized anyone to provide you with different information. If anyone provides you with different information you should not rely on it. We are not making an offer to sell the common stock in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus regardless of the date of delivery of this prospectus or any supplement hereto, or the sale of common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

We obtained statistical data and certain other industry forecasts used throughout this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical and industry data and forecasts and market research used herein are reliable, we have not independently verified such data. We have not sought the consent of the sources to refer to their reports or articles in this prospectus.

Until ninety days after the date this registration statement is declared effective, all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This summary contains material information about us and the offering, which is described in detail elsewhere in the prospectus. Since it may not include all of the information you may consider important or relevant to your investment decision, you should read the entire prospectus carefully, including the more detailed information regarding our company, the risks of purchasing our common stock discussed under “Risk Factors” on page 9, and our financial statements and the accompanying notes.

Unless the context otherwise requires, the terms “we,” “our,” “us,” the “Company” and “PDV” refer to Power of the Dream Ventures, Inc., a Delaware corporation and its wholly-owned subsidiaries, and not to the Selling Shareholders.

Our Corporate Information

We were incorporated in the State of Delaware on August 17, 2006 under the name Tia V, Inc. We were formed as a vehicle to identify, evaluate and complete a business combination with an operating company. We were deemed a “blank check” company. The Securities and Exchange Commission (“SEC”) defines such a company as “a development stage company that has no specific business plan or purpose, or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person and is issuing ‘penny stock,’ as defined in Rule 3a-51-1 under the Securities Exchange Act of 1934 (“Exchange Act”). We are a reporting company under Section 12(g) of the Exchange Act.

On April 10, 2007 we executed, delivered and consummated a Securities Exchange Agreement (the “Securities Exchange Agreement”) by and among ourselves, Mary Passalaqua, Vidatech, Kft (also know as Vidatech Technological Research and Development LLC) and all of the equity holders of Vidatech (the “Vidatech Equity Holders”) each of whom is a signatory to the Securities Exchange Agreement. Mrs. Passalaqua was, until April 10, 2007, our sole officer, director and shareholder. Pursuant to the terms of the Securities Exchange Agreement we acquired all of the outstanding equity interest in and to Vidatech from the Vidatech Equity Holders in exchange for an aggregate of 33,300,000 shares of our common stock (the “Securities Exchange Transaction”).

Following the consummation of the Securities Exchange Transaction, we completed on August 21, 2007 a private placement of 2,250,000 shares of our common stock at $0.34 per share or $765,000.00 in the aggregate. In addition, we issued an aggregate of 1,975,000 shares of our common stock pursuant to consulting arrangements and for professional services to a total of nine persons.

Subsequently, on October 25, 2007, we completed a second private placement of 104,000 shares of our common stock at $2.50 per share or $260,000 in the aggregate.

Our Business

We conduct our operations through our wholly-owned subsidiary, Vidatech. Vidatech is a development stage limited liability company formed under the laws of the Republic of Hungary focused on the acquisition, and development of intellectual property and technologies in Hungary for commercialization in Hungary and other international markets. Vidatech seeks to acquire rights to and interests in intellectual property and technologies through a variety of methods including, but not limited to, the direct acquisition of technologies, direct investment in or acquisition of entities owning or developing the intellectual property, licensing of the intellectual property or technology, or a joint venture arrangement to mutually develop and commercialize the intellectual property or technologies.

We maintain our principal corporate offices at 1095 Budapest, Soroksari ut 94-96, Hungary. Our telephone and facsimile numbers are, respectively, +36-1-456-6061 and +36-1-456-6062. The address of our website is http://www.powerofthedream.com. Information on our website is not part of this prospectus.

The former equity holders of Vidatech acquired approximately 93% of our issued and outstanding shares of common stock through the Securities Exchange Transaction, and, therefore, have control over our corporate affairs and operations. As a result, Vidatech is deemed to have been the acquiring company in the Securities Exchange Transaction for accounting purposes and the Securities Exchange Transaction is treated as a reverse acquisition with Vidatech as the acquirer and us as the acquired party.

The following summary balance sheet and statement of operations data are derived from our interim financial statements included at the end of this prospectus.

Balance Sheet Data

| | | September 30, 2007 (unaudited) | | | December 31, 2006 (audited) | |

| | | | | | | |

| Cash | | $ | 375,227 | | | $ | 28,735 | |

| Total Assets | | $ | 803,752 | | | $ | 91,198 | |

| Total Liabilities | | $ | 529,908 | | | $ | 12,047 | |

| Total Shareholders’ Equity | | $ | 273,844 | | | $ | 79,151 | |

| Deficit accumulated during development stage | | $ | (787,246 | ) | | $ | (35,100 | ) |

Statement of Operations Data

| | | For nine month period ended September 30, 2007 (unaudited) | | | From April 26, 2006 (inception) to September 30, 2007 (unaudited) | |

| | | | | | | |

| Other Income (Loss) | | $ | - | | | $ | - | |

| Expenses | | $ | (752,146 | ) | | $ | (787,246 | ) |

| Net Loss for the Period | | $ | (752,146 | ) | | $ | (787,246 | ) |

| Basic and Diluted Loss per Share | | $ | 0.02 | | | | | |

Risks Associated With Our Business

Our business is subject to numerous risks, as more fully described in the section of this prospectus entitled “Risk Factors” immediately following this prospectus summary. We have a limited operating history and have incurred substantial operating losses since inception. As of September 30, 2007 we had an accumulated deficit of $787,246. We have limited financial resources with which to accomplish our financial objectives. We are at the early stages of our business development.

The Offering

Selling Shareholders

The Selling Shareholders are existing shareholders of ours who acquired their Shares from us in either the Securities Exchange Transaction or pursuant to private placements completed by us prior to October 25, 2007. The issuance of the shares by us to the Selling Shareholders was exempt from the registration requirements of the Securities Act by virtue of exemptions afforded by Section 4(2) thereof as well as Regulations D and S as promulgated under the Securities Act. Please refer to “Selling Shareholders.”

Securities Being Offered

The Selling Shareholders named in this prospectus are offering for resale up to 12,532,000 shares of our common stock (representing, as of November 9, 2007, 30.44% of our total issued and outstanding shares of common stock), to the public by means of this prospectus. Although we are paying all of the expenses incident to the registration of the Shares, we will not receive any proceeds from the sales, if any, by the Selling Shareholders. The Selling Shareholders may sell none, some or all of their Shares immediately after they are registered. Please refer to“Plan of Distribution.”

The Shares do not constitute all of the shares of our common stock owned by the Selling Shareholders.

Offering Price

The Selling Shareholders may sell their Shares pursuant to this prospectus, at $2.50 per share until our common stock is quoted on the OTC Bulletin Board and, thereafter, at prevailing market prices or privately negotiated prices. Please refer to “Plan of Distribution” and “Determination of Offering Price.”

Number of Shares Outstanding

There were 41,165,000 shares of our common stock issued and outstanding as of November 9, 2007.

Duration of Offering

The offering will conclude upon the earlier to occur of:

| · | the sale of all of the shares of common stock being offered pursuant to this prospectus; |

| · | the second anniversary date of the effective date of this prospectus; or |

| · | at such time as the registered shares may be sold without restriction pursuant to Rule 144(k) of the Securities Act. |

Trading Market

There is no currently trading market for the shares of our common stock.

Use of Proceeds

We will incur all costs associated with this registration statement and prospectus. We will not receive any of the proceeds from the sale of the shares of our common stock being offered for sale by the Selling Shareholders.

You should carefully consider the risks described below before purchasing shares of our common stock. Our most significant risks and uncertainties are described below. If any of the following risks actually occur, our business, financial condition, trading market, if any, of our common stock, or results of operations could be materially adversely affected, the trading, if any, of our common stock could decline, and you may lose all or part of your investment therein. You should acquire shares of our common stock only if you can afford and are willing to lose your entire investment.

We have a limited operating history, which makes your evaluation of our business difficult. We have incurred losses in recent periods for start-up efforts and may incur losses in the future.

We were recently organized and only recently completed our acquisition of Vidatech, which itself has had limited operations. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of the technologies in which we invest, acquire or license. These factors raise substantial doubt that we will be able to continue as a going concern. From April 26, 2006 (inception) through September 30, 2007, we incurred aggregate losses of $787,246 and anticipate occurring additional losses for at least the next twelve (12) months.

We will require additional financing to sustain our operations and without it we will not be able to continue operations.

Our ability to obtain additional funding will determine our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We believe that we have sufficient financial resources and commitments to sustain our current level of research and development activities through the middle of 2008. Any expansion, acceleration or continuation (beyond mid-2008) of such activities will require additional capital, which may not be available to us, if at all, on terms and conditions that we find acceptable.

Although we are paying the expenses related to this registration statement, we will not receive any of the proceeds from the sale of the shares by the Selling Shareholders. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease research activities and investors could lose their entire investment. We have no arrangements or agreements with any person regarding any potential future financings.

Other than our right to market, sell and distribute the TothTelescope, from which we have not derived any meaningful revenues, we currently do not have, and may never develop or acquire any commercialized products for distribution and sale.

Other than the right to sell and distribute the TothTelescope product, from which we have not derived any meaningful revenues, we currently do not have any other commercialized products or any significant source of revenue. We have invested substantially all of our time and resources over the last two years in identification, research and development of technologies. The technologies, which are the subject of our ongoing research programs, will require additional development, clinical evaluation, regulatory approval, significant marketing efforts and substantial additional investment before they can provide us with any revenue. We cannot currently estimate with any accuracy the amount of funds that may be required because it may vary significantly depending on the results of our current research and development activities, product testing, costs of acquiring licenses, changes in the focus and direction of our research and development programs, competitive and technological advances, the cost of filing, prosecuting, defending and enforcing patent claims, the regulatory process, manufacturing, marketing and other costs associated with the commercialization of products following receipt of approval, if required, from regulatory bodies and other factors.

Our efforts may not lead to commercially successful products for a number of reasons, including:

| · | we may not be able to obtain regulatory approvals, if required, or the approved indication may be narrower than we seek; |

| · | our technologies or products, if any, derived from our research and development efforts may not prove to be safe and effective in clinical trials or testing; |

| · | any products that may be approved may not be accepted in the marketplace; |

| · | we may not have adequate financial or other resources to complete the development and commercialization of products derived from our research and development efforts; |

| · | we may not be able to manufacture our products in commercial quantities or at an acceptable cost; and |

| · | rapid technological change may make our technologies, and products derived from those technologies, obsolete. |

We expect to operate in a highly competitive market; we may face competition from large, well-established companies with significant resources, and against which we may not be able to effectively compete.

Our commercial success will depend on our ability and the ability of our sublicensees, if any, to compete effectively in product development, customer compliance, price, marketing and distribution. There can be no assurance that competitors will not succeed in developing products that are more effective than any products derived from our research and development efforts or that would render such products obsolete and non-competitive.

The technology sector is characterized by intense competition, rapid product development and technological change. We expect that most of the competition that we will encounter will come from companies, research institutions and universities who are researching and developing technologies and products similar to or competitive with any we may develop.

These companies may enjoy numerous competitive advantages, including:

| · | significantly greater name recognition; |

| · | established distribution networks; |

| · | additional lines of products, and the ability to offer rebates, higher discounts or incentives to gain a competitive advantage; |

| · | greater experience in conducting research and development, manufacturing, obtaining regulatory approval for products, and marketing approved products; and |

| · | greater financial and human resources for product development, sales and marketing, and patent litigation. |

As a result, we may not be able to compete effectively against these companies or their products.

The success of our research and development effort is uncertain and we expect to be engaged in research and development efforts for a considerable period of time before we will be in a position, if ever, to develop and commercialize products derived from our technologies.

We expect to continue our current research and development programs through at least the end of 2009. Research and development activities, by their nature, preclude definitive statements as to the time required and costs involved in reaching certain objectives. Actual costs may exceed the amounts we have budgeted and actual time may exceed our expectations. If our research and development requires more funding or time than we anticipate, then we may have to reduce technological development efforts or seek additional financing. There can be no assurance that we will be able to secure any necessary additional financing or that such financing would be available to us on favorable terms. Additional financings could result in substantial dilution to existing shareholders. Even if we are able to fully fund our research and development program, there is no assurance that, even upon successful completion of our program, we will ever be able to commercialize products, if any, derived from our research efforts or that we will be able to generate any revenues from operations.

Our research and development programs are in the preliminary development stage and the results we attain may not prove to be adequate for purposes of developing and commercializing any products or otherwise to support a profitable business venture.

Our research and development programs are in the preliminary development stage. We will require significant further research, development, testing and regulatory approvals and significant additional investment before we will be in a position to attempt to commercialize products derived from our research and development programs. We cannot currently estimate with any accuracy the amount of these funds because it may vary significantly depending on the results of our research and development activities, product testing, costs of acquiring licenses, changes in the focus and direction of our research and development programs, competitive and technological advances, the cost of filing, prosecuting, defending and enforcing patent claims, the regulatory process, manufacturing, marketing and other costs associated with commercialization of products following receipt of approval from regulatory bodies and other factors.

There can be no assurances that our early stage research will be successful. The ultimate results of our ongoing research programs may demonstrate that the technologies being researched by us may be ineffective, unsafe or unlikely to receive necessary regulatory approvals. If such results are obtained, we will be unable to create marketable products or generate revenues and we may have to cease operations.

We intend to conduct sales and marketing efforts internally, but lack sales and marketing experience. Additionally, we may rely on third party marketers, in which case, we will be dependent on their efforts.

We expect to market and sell or otherwise commercialize our technologies (or any products derived from the technologies) ourselves as well as through distribution, co-marketing, co-promotion or licensing arrangements with third parties. We have no experience in sales, marketing or distribution of such technologies or products and our current management and staff is not experienced or trained in these areas. Accordingly, if our attempts to market any products directly are not successful, our business may be adversely affected. To the extent that we enter into distribution, co-marketing, co-promotion or licensing arrangements for the marketing or sale of our technologies (or any products derived from the technologies) any revenues received by us will be dependent on the efforts of third parties. If such parties were to breach or terminate their agreement with us or otherwise fail to conduct marketing activities successfully and in a timely manner, the commercialization of our technologies (or any products derived from the technologies) would be delayed or terminated.

There are risks associated with our proposed operations in Hungary.

Special risks may be associated with our efforts to undertake operations in the Republic of Hungary. Such operations will be subject to political, economic and other uncertainties, including among other things, import, export and transportation regulations, tariffs, taxation policy, including royalty and tax increases and retroactive tax claims, exchange controls, currency fluctuations and other uncertainties arising out of the Republic of Hungary’s sovereignty over our operations.

Fluctuation in the value of the Hungarian Forint relative to other currencies may have a material adverse effect on our business and/or an investment in our shares.

We maintain our books in local currency: U.S. dollars for Power of the Dream in the United States and the Hungarian Forint for Vidatech in Hungary.

Our operations are conducted primarily outside of the United States through Vidatech, our wholly-owned subsidiary. As a result, fluctuations in currency exchange rates may significantly affect our sales, profitability and financial position when the foreign currencies, primarily the Hungarian Forint, of our international operations are translated into U.S. dollars for financial reporting. In addition, we are also subject to currency fluctuation risk with respect to certain foreign currency denominated receivables and payables. Although we cannot predict the extent to which currency fluctuations may or will affect our business and financial position, there is a risk that such fluctuations will have an adverse impact on our sales, profits and financial position. Because differing portions of our revenues and costs are denominated in foreign currency, movements could impact our margins by, for example, decreasing our foreign revenues when the dollar strengthens and not correspondingly decreasing our expenses. We do not currently hedge our currency exposure. In the future, we may engage in hedging transactions to mitigate foreign exchange risk.

Our management team has limited experience in public company matters, which could impair our ability to comply with legal and regulatory requirements.

Our management team has had limited experience managing a U.S. public company, which could impair our ability to comply with legal and regulatory requirements, such as the Sarbanes-Oxley Act of 2002 and applicable federal securities laws, including filing on a timely basis required reports and other required information. Our management may not be able to implement programs and policies in an effective and timely manner that adequately responds to increased legal or regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Investor confidence and the market price of our shares may be adversely impacted if we or our independent registered public accountants are unable to issue an unqualified opinion on the adequacy of our internal controls over our financial reporting.

We are subject to the reporting requirements of the U.S. Securities and Exchange Commission, or SEC. The SEC, as directed by Section 404 of the U.S. Sarbanes-Oxley Act of 2002, adopted rules requiring public companies to include a report of management on their internal control structure and procedures for financial reporting in their annual reports on Form 10-KSB that contain an assessment by management of the effectiveness of their internal controls over financial reporting. In addition, independent registered public accountants of these public companies must report on management’s assessment of, as well as form its own opinion of, and report on the effectiveness of such companies’ internal controls over financial reporting. These requirements will first apply to our annual report on Form 10-KSB for the fiscal year ending on December 31, 2007, however the independent public accountants’ report will not be required until the following year. We have experienced certain problems with our internal controls and reporting systems in the past. Our management may not conclude that our internal controls over financial reporting are effective. Any failure to implement effective controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Moreover, even if our management does conclude that our internal controls over financial reporting are effective, if our independent registered public accountants are not satisfied with our internal control structure and procedures, the level at which our internal controls are documented, designed, operated or reviewed, or if the independent registered public accountants interpret the requirements, rules or regulations differently from us, they may not concur with our management’s assessment or may not issue a report that is unqualified. Any of these possible outcomes could result in an adverse reaction in the financial marketplace due to a loss of investor confidence in the reliability of our financial statements, which could lead to a decline in the market price of our shares.

Concentration of ownership among our directors, executive officers and principal shareholders may prevent new investors from influencing significant corporate decisions.

Based upon beneficial ownership as of November 9, 2007, our directors, executive officers and holders of more than 5% of our common stock, alone or together with their affiliates own, in the aggregate, approximately 75.8 % of our outstanding shares of common stock. As a result, these shareholders, will be able to exercise a controlling influence over matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions, and will have significant control over our management and policies. Some of these persons or entities may have interests that are different from yours. For example, these shareholders may support proposals and actions with which you may disagree or which are not in your interests. The concentration of ownership could delay or prevent a change in control of our company or otherwise discourage a potential acquirer from attempting to obtain control of our company, which in turn could reduce the price of our common stock. In addition, these shareholders, some of whom have representatives sitting on our Board of Directors, could use their voting influence to maintain our existing management and directors in office, delay or prevent changes of control of our company, or support or reject other management and board proposals that are subject to stockholder approval, such as amendments to our employee stock plans and approvals of significant financing transactions.

We will need to hire additional employees as the number of technologies in which we have an interest increases.

We anticipate that it will be necessary for us to add employees with technology and management experience as well as support staff to accommodate the increasing number of technologies we acquire. We may also need to provide additional scientific, business, accounting, legal or investment training for our hires. There is competition for highly qualified personnel, and we may not be successful in our efforts to recruit and retain highly qualified personnel.

There is currently no trading market for our common stock and if a market for our common stock does not develop, you may be unable to resell any of the shares acquired by you from the Selling Shareholders.

There is currently no trading market for our common stock and such a market may not develop or be sustained. We currently intend to have our common stock quoted on the OTC Bulletin Board upon the effectiveness of this registration statement of which this prospectus forms a part. In order to do this, a registered broker/dealer must file a Form 15c-211 to allow the broker/dealer to make a market in our shares of common stock. At the date hereof, we have not discussed such a filing with any such broker/dealer and are not aware that any broker/dealer has any such intention. Therefore we cannot provide our investors with any assurance that our common stock will be quoted for trading on the OTC Bulletin Board or a listing service or stock exchange, or if so quoted or listed, that a public trading market will develop. Further, the OTC Bulletin Board is not a listing service or exchange, but is instead a dealer quotation service for subscribing members. If our common stock is not quoted on the OTC Bulletin Board or if a public market for our common stock does not develop, then you may be significantly limited in your ability to re-sell the shares of our common stock that you have purchased and may lose all of your investment. You may be required to retain ownership of your shares indefinitely.

If a trading market for our common stock is established, the market price of our common stock may be significantly affected by factors such as actual or anticipated fluctuations in our operation results, general market conditions and other factors. In addition, the stock market has from time to time experienced significant price and volume fluctuations that have particularly affected the market prices for the shares of developmental stage companies, which may materially adversely affect the market price of our common stock as well as your ability to re-sell the shares that you have acquired.

The initial offering price has been arbitrarily determined.

There has been no prior public market for our securities. The Selling Shareholders may offer the shares at a price of $2.50 per share, which reflects the price at which we completed our last private placement, until such time as our shares may be quoted for trading. The price bears no relationship to earnings, book value or any other recognized criteria of value. Accordingly, you should not assume that you will be able to re-sell your shares at that price, if at all. Moreover, our shares of common stock will have little value unless our business plan is successful. Please refer to “Determination of Offering Price.”

Sales of a substantial number of shares of our common stock into the public market by the Selling Shareholders may cause a reduction in the price of our stock and purchasers who acquire shares from the Selling Shareholders may lose some or all of their investment.

If a market for our shares develops, sales of a substantial number of shares of our common stock in the public market could cause a reduction in the price of our common stock. After this registration statement is declared effective, the Selling Shareholders may be reselling up to approximately 31% of the issued and outstanding shares of our common stock pursuant to this prospectus or otherwise. At that time, a substantial number of our shares of common stock that have been issued may be available for immediate resale, which could have an adverse effect on the price of our common stock. As a result of any such decreases in the price of our common stock, purchasers who acquire shares from the Selling Shareholders may lose some or all of their investment.

We do not intend to pay dividends for the foreseeable future.

We currently intend to retain future earnings, if any, to support the development and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our Board of Directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit or other agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase the shares offered by the Selling Shareholders pursuant to this prospectus.

We may conduct further offerings in the future, in which case your percentage interest in our Company will be diluted.

Since inception, we have relied on sales of our common stock to fund our operations. We may conduct further offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current shareholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, your percentage interest in us will be diluted and the value of your stock could be reduced.

We may issue preferred stock which may have greater rights than our common stock.

We are permitted in our Certificate of Incorporation to issue up to 10,000,000 shares of preferred stock. Currently no preferred shares are issued and outstanding; however, we can issue shares of our preferred stock in one or more series and can set the terms of the preferred stock without seeking any further approval from our common shareholders. Any preferred stock that we issue may rank ahead of our common stock in terms of dividend priority or liquidation premiums and may have greater voting rights than our common stock. In addition, such preferred stock may contain provisions allowing it to be converted into shares of common stock, which could dilute the value of common stock to current shareholders and could adversely affect the market price, if any, of our common stock.

Our common stock is a “penny stock,” and because “penny stock” rules will apply, you may find it difficult to sell the shares of our common stock you acquired in this offering.

Our common stock is a “penny stock” as that term is defined under Rule 3a51-1 of the Securities Exchange Act of 1934. Generally, a “penny stock” is a common stock that is not listed on a securities exchange and trades for less than $5.00 a share. Prices often are not available to buyers and sellers and the market for penny stocks may be very limited. Penny stocks in start-up companies are among the riskiest equity investments. Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by the SEC. The document provides information about penny stocks and the nature and level of risks involved in investing in the penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser’s written agreement to the purchase. Many brokers choose not to participate in penny stock transactions. Because of the penny stock rules, there is less trading activity in penny stocks and you are likely to have difficulty selling your shares.

Because our business assets, directors, and officers are located outside of the United States, our shareholders may be limited in their ability to enforce civil actions against our assets or our directors and officers.

We are incorporated under the laws of Delaware but, because we are headquartered in Hungary and all of our officers and directors reside in Hungary, our shareholders may have difficulty enforcing civil liabilities under the U.S. federal securities laws against our officers and directors. Because some of our assets are located outside the U.S., it may be difficult for an investor to succeed in an action, for any reason, against us or any of our directors or officers through U.S. jurisdictions. If an investor was able to obtain a judgment against us or any of our directors or officers in a U.S. court based on U.S. securities or other laws, it may be difficult to enforce such judgment in Hungary. We are uncertain as to the enforceability, in original actions in Hungarian courts, of liability based upon the U.S. federal securities laws and as to the enforceability in Hungarian courts of judgments of U.S. courts obtained in actions based upon the civil liability provisions of the U.S. federal securities laws.

Our compliance with changing laws and rules regarding corporate governance and public disclosure may result in additional expenses to us which, in turn, may adversely affect our ability to continue our operations.

Keeping abreast of, and in compliance with, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and, in the event we are ever approved for listing on either NASDAQ or a registered exchange, NASDAQ and stock exchange rules, will require an increased amount of management attention and external resources. We intend to continue to invest all reasonably necessary resources to comply with evolving standards, which may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. This could have a materially adverse effect on our ongoing operations.

Forward-Looking Statements

This prospectus contains statements that plan for or anticipate the future, called “forward-looking statements.” In some cases, you can identify forward- looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of those terms and other comparable terminology. These forward-looking statements include statements about:

| · | Expected activities and expenditures as we pursue our business plan; and |

| · | The adequacy of our available cash resources. |

These statements appear in a number of places in this prospectus and include statements regarding our intent, belief or current expectations, those of our directors or officers with respect to, among other things: (i) trends affecting our financial condition or results of operations, (ii) our business and growth strategies, and (iii) our financing plans. Although we believe that the expectations reflected in the forward-looking statement are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

The accompanying information contained in this prospectus, including the information discussed under the headings “Risk Factors,” “Plan of Operations” and “Description of Business and Property,” identify important factors that could adversely affect actual results and performance. All forward-looking statements attributable to us are expressly qualified in their entirety by the cautionary statement appearing above.

Determination Of Offering Price

The Selling Shareholders may sell their Shares at a price of $2.50 per share until our common stock is quoted on the Over-The-Counter Bulletin Board, or listed for trading or quoted on any public market and thereafter at prevailing market prices or privately negotiated prices. The offering price of $2.50 per share has been set based upon the price at which we completed our latest private placement and does not have any relationship to any established criteria of value, such as book value or earning per share. Additionally, because we have no significant operating history and have not generated any revenue to date, the price of the common stock is not based on past earnings, nor is the price of the common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business and potential business expansion.

Our common stock is presently not traded on any market or securities exchange and we have not applied for listing or quotation on any public market.

We will pay all costs associated with the preparation and filing of this registration statement and prospectus. We will not receive any of the proceeds from the sale of the shares of our common stock being offered for sale by the Selling Shareholders.

Management’s Discussion And Analysis Or Plan Of Operation

The following discussion of our financial condition and results of operations should be read in conjunction with the Financial Statements and Notes to those financial statements included in this Prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including but not limited to, those discussed under “Risk Factors” and elsewhere in this prospectus.

Overview

We were incorporated in Delaware on August 17, 2006 under the name Tia V, Inc. Since inception, and prior to our acquisition of Vidatech on April 10, 2007, we were engaged solely in organizational efforts and obtaining initial financing. Our sole business purpose was to identify, evaluate and complete a business combination with an operating company.

On April 10, 2007 we completed our acquisition of Vidatech, Kft. (also know as Vidatech Technological Research and Development LLC) a limited liability company formed under the laws of the Republic of Hungary. Vidatech is a development stage company formed for the purpose of investing in, acquiring, developing, licensing, and commercializing technologies developed in Hungary. In furtherance of its business, Vidatech provides research and development services to the companies from whom it acquires technologies or participation interests in such technologies. Prior to December 31, 2006 Vidatech was primarily focused on organizational and capital raising activities. To date, it has had only limited operations and has acquired rights or interests in six technologies.

Capital Resources and Liquidity

On August 21, 2007, we completed a private placement of 2,250,000 shares of our common stock at a price of $0.34 per share or $765,000.00 in the aggregate. The private placement was effected pursuant to Regulation S as promulgated under the Securities Act.

On October 25, 2007, we completed a second private placement of 104,000 shares of our common stock at a price of $2.50 per share or $260,000 in the aggregate. The private placement was effected pursuant to Regulation S as promulgated under the Securities Act.

On September 30, 2007, we had working capital of $58,615.

We plan on spending approximately $50,000 on general administrative expenses and $250,000 on continued development of our technologies.

To date all of our funding has been generated from sale of shares of our common stock and loans from our officers and directors. During the next six to twelve months we anticipate that we will have sufficient funds to proceed only with basic administrative operations and incremental operations with respect to RiverPower, eGlue, the Kalmar acquisitions (Fire-Proofing Liquid, Technology for utilizing Communal Waste as a concrete additive and Technology for Repairing Potholes with the use of recycled plastics), the desalination technology and the Toth Telescope; in addition to these we only have limited funds available to continue acquiring and developing the diverse number of technologies available to us, to continue research and development efforts with respect to our current technologies and to fully implement our business plan. If we do not obtain the funds necessary for us to continue our business activities we may need to curtail or cease our operations until such time as we have sufficient funds.

We currently have no arrangements for such financings and can give you no assurance that such financings will be available to us on terms that we deem acceptable or at all. We believe that if our securities commence trading on the over-the-counter marketplace, our ability to raise funds will be enhanced but this in itself will not guarantee that we will in fact be able to raise the capital required to implement our business strategy.

Going Concern and Management’s Plan

The financial statements included elsewhere in this prospectus have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate the continuation of the Company as a going concern and assume realization of assets and the satisfaction of liabilities in the normal course of business. We have incurred losses from operations since inception. We anticipates incurring additional losses in 2007. Further, we may incur additional losses thereafter, depending on its ability to generate revenues from the licensing or sale of its technologies and products, or to enter into any or a sufficient number of joint ventures. We have minimal revenue to date. There is no assurance that we can successfully commercialize any of its technologies and products and realize any revenues therefrom. Our technologies and products have never been utilized on a large-scale commercial basis and there is no assurance that any of its technologies or products will receive market acceptance. There is no assurance that we can continue to identify and acquire new technologies.

Since inception through September 30, 2007, we had a deficit accumulated during the development stage of $787,246 and net cash used in operations of $351,195. However, we believe that the recent funding from the private placement of the Company’s common shares will allow us to continue operations and execute its business plan.

We believe that we can raise adequate capital to keep us functioning during 2007. However, no assurance can be given that we can obtain additional working capital, or if obtained, that such funding will not cause substantial dilution to shareholders of the Company. If we are unable to raise additional funds, it may be forced to change or delay its contemplated marketing and business plan. Being a development stage company, we are subject to all the risks inherent in the establishment of a new enterprise and the marketing and manufacturing of a new product, many of which risks are beyond the control of the Company. All of the factors discussed above raise substantial doubt about our ability to continue as a going concern.

The condensed consolidated financial statements included elsewhere in this prospectus do not include any adjustments relating to the recoverability of recorded asset amounts that might be necessary as a result of the above uncertainty.

Critical Accounting Policies

Critical accounting policies are those that may have a material impact on our consolidated financial statements and also require management to exercise significant judgment due to a high degree of uncertainty at the time the estimate is made. We consider the following to be our most critical accounting policies and estimates that involve the judgment for the preparation of our consolidated financial statements.

Research and development and Investment and Advances to Non-Consolidated Entities:

In accordance with Statement of Financial Accounting Standards ("SFAS") No. 2 "Accounting for Research and Development Costs," all research and development ("R&D") costs are expensed when they are incurred, unless they are reimbursed under specific contracts. Assets used in R&D activity, such as machinery, equipment, facilities and patents that have alternative future use either in R&D activities or otherwise are capitalized. In connection with investments and advances in development-stage technology entities in which the company owns or controls less than a 50% voting interest, (see Note 5) where repayment from such entity is based on the results of the research and development having future economic benefit, the investment and advances are accounted for as costs incurred by the Company as research and development in accordance with SFAS No. 68 "Research and Development Arrangements".

Share-Based Payments:

In accordance with SFAS No. 123R “Share-Based Payment” all forms of share-based payment (“SBP”) awards including shares issued under employee stock purchase plans, stock options, restricted stock and stock appreciation rights result in a cost that is measured at fair value on the awards’ grant date, based on the estimated number of awards that are expected to vest. As the Company did not issue any employee SBP prior to September 30, 2007, there is no compensation cost recognized in the accompanied condensed consolidated financial statements.

The Company accounts for equity instruments issued to non-employees in accordance with the provisions of Emerging Issues Task Force (EITF) Issue No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services,” which requires that such equity instruments are recorded at their fair value on the measurement date. The measurement of stock-based compensation is subject to periodic adjustment as the underlying equity instrument vests. Non-employee stock-based compensation charges are amortized over the vesting period or period of performance of the services.

Recent Accounting Pronouncements

In July 2006, the FASB issued Interpretation (FIN) No. 48, Accounting for Uncertainty in Income Taxes -- an interpretation of FASB Statement No. 109, which clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with SFAS No. 109. FIN No. 48 prescribes a recognition threshold and measurement attribute for financial statement disclosure of tax positions taken or expected to be taken on a tax return. FIN No. 48 is effective for the Company beginning in January 1, 2007. Adoption of FIN No. 48 did not have a material impact on its consolidated financial position, results of operation or cash flows.

In September 2006, the FASB issued SFAS 157, Fair Value Measurement. The new standard applies whenever other standards require or permit assets or liabilities to be measured at fair value. This Statement defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007. The Company does not believe that the adoption of SFAS 157 will have a material impact on its financial position, results of operation or cash flows.

In September 2006, the staff of the SEC issued Staff Accounting Bulletin ("SAB") No. 108, which provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. SAB 108 becomes effective in fiscal 2007. Adoption of SAB 108 did not have a material impact on the Company's consolidated financial position, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159 "The Fair Value Option for Financial Assets and Financial Liabilities - Including an amendment of FASB Statement No. 115", which permits entities to choose to measure many financial instruments and certain other items at fair value. The fair value option established by this Statement permits all entities to choose to measure eligible items at fair value at specified election dates. A business entity shall report unrealized gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting date. Adoption is required for fiscal years beginning after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provisions of SFAS Statement No. 157, Fair Value Measurements. The Company is currently evaluating the expected effect of SFAS 159 on its consolidated financial statements and is currently not yet in a position to determine such effects.

Off Balance sheet Arrangements.

We do not have any off balance sheet arrangements that are reasonably likely to have a current or future effect on our consolidated financial condition, results of operations, liquidity or capital expenditures.

Description of our Business

Through Vidatech, we aim to provide pro-active support for ideas, research, start-up and expansion-stage technology companies having rights to technologies or intellectual properties which we believe to be potentially commercially viable, by offering a range of services designed to encourage and protect the continuing development and eventual commercialization of those technologies.

Our focus is on technologies and technology companies based in the Republic of Hungary. We believe that the availability of technologies for purchase or license, coupled with the lack of sufficient investment capital for such technologies in Hungary, present us with an opportunity to acquire technologies on terms and conditions which we deem advantageous.

Our strategy is to acquire majority interests in technologies through, among other things, direct investment in start-up and expansion stage technologies and technology companies; cooperative research and development agreements with such companies; direct licensing agreements; joint venture arrangements; or, direct acquisition of technologies and intellectual properties.

We also intend to provide services to assist in:

| · | the design of, research of, building of and testing of prototypes; |

| · | facilitation of preparation, filing and prosecution of patent applications with Hungarian and international patent attorneys; |

| · | financing of research and development activities; |

| · | the exposure of the technology to international markets; and |

| · | the commercialization and/or sale of the subject technology. |

We expect to obtain a majority participation interest in any given transaction involving idea, research, seed, start-up, and early stage technologies.

Employees and Facilities

We currently employ five people on a full time basis, including our Chief Executive Officer, Vice President, Chief Financial Officer, Chief Accounting Officer, Chief Technology Officer and a Technology Assistant. In addition to these full time employees, ten people provide various services as part of ongoing development and consultation agreements.

Our offices are located at 1095 Budapest, Soroksari ut 94-96, Hungary in an office building owned by Daniel Kun, Sr. father of our Vice President & Secretary, Daniel Kun, Jr. We pay approximately $1,375 dollars in rental fee for 1,000 square feet of office space. Our offices are newly remodeled and are made available to us on a month by month basis.

Acquisition Criteria

We currently have rights to seven technologies and expect to acquire rights in and to additional technologies. The evaluation and identification of technology acquisition will be done using the following characteristics:

Nature of the Technology

One of the most important factors in our determination of whether to seek to acquire any particular technology, in the assessment by our management, is the quality of the technology being offered; in making this determination our management will consider among other things:

| · | whether the technology may be capable of being marketed internationally; |

| · | whether the technology is patentable (or is already patented); |

| · | the particular technologies’ stage of development (preliminary, laboratory scale prototype, etc.); |

| · | the estimated cost of development and commercialization; and |

| · | whether the technology is one which cannot be readily replaced, replicated or circumvented. |

Capabilities and Historical Results of Management and Scientific Development Team

Our assessment of the management and or scientific team which initiated or which is currently developing the technologies.

Strength of the Technology

The rapid development of technologies in today’s markets makes it increasingly difficult to predict market affects on any particular technology. Therefore, we will focus on technologies that we believe can better sustain and survive market and technological changes. In this respect we will seek to acquire technologies which can not be readily replicated or circumvented and which have a high level of proprietary protection.

Current Technologies/Products

eGlue technology via equity purchase in ‘in4 Kft’.

On August 2, 2007 Vidatech Kft., our wholly owned Hungarian subsidiary, entered into a joint development agreement with the inventors/creators of eGlue, an online content organization and search application based on semantic web technology. In the transaction Vidatech received a 30% equity position in the newly formed in4 Kft (http://www.in4.hu), the owner and exclusive developer of eGlue technology, for HUF 900 thousand (approximately USD5,000). Up until May 31, 2009, Vidatech is expected to provide up to HUF 48 million (approximately USD271,000) in member loans to in4 Kft. to cover development expenses of eGlue.

As part of the agreement, Vidatech has the option of converting its HUF 48 million member loan into an additional 10% equity in in4 Kft. at the end of May, 2009. Over the course of the next four months final development work (programming) is expected to be accomplished and a public beta website established for the testing and evaluation of eGlue technology. It is anticipated that the final product will become available starting in the third quarter of 2008.

Following full deployment ‘In4 Kft.’ will aim to provide free and value added services of its eGlue product, generating revenue from subscribers, advertising fees and technology licenses. It is anticipated that the final product will be fully deployed in two to three years.

eGlue technology is composed of the following main building blocks:

Integrated content management

Content that has been created, or made accessible with eGlue, can be reused in any environment (e.g. at another site) and custom-tailored to user requirements. The semantic added value provided by the data structure enables a more versatile use of the created content than is possible with content management and search methods based on simple string matching.

Collaborative database building, community intelligence

The use of collaborative database building enhances the application with a relevance factor that relies on community intelligence; this in turn provides self-repair capability and also makes the suggestion function more efficient.

Modular structure

Owing to its modular structure, eGlue can be used to replace multiple data entry utilities, and users can even use its API (application programming interface) to develop program components themselves. This greatly improves the efficiency of data management and storage.

Purely online application, no installation needed

In contrast to traditional desktop applications, eGlue represents a new generation of programs that are used purely online. Accordingly, there is no need for updates, upgrades, or maintenance – the program is always available for use in its latest version. This results in significant cost savings in delivery, packaging, and distribution.

Platform-independent and browser-agnostic

The platform, developed using the JAVA programming language and the extensible markup language (XML), is platform-independent and browser-agnostic, can be run on any operating system, and is built on open standards. The fact that the application is completely independent from the program environment makes for cost-efficient operation.

Asynchronous data handling (AJAX)

Thanks to the integrated AJAX functions that use the latest technology, parts of the page can also be refreshed separately, users don’t need to download full pages while using the site, so this online application is as feature-rich as a desktop program while it also eliminates the slow response times frequently experienced with online applications. Compared to traditional (synchronous) methods that use full page downloads, this approach saves time and provides ease of use, which translates into significant savings in terms of work time.

Cross-domain web services using AJAX

One of eGlue’s highlights is that using plug-ins, users can call the application through external sites, which empowers any site with the search and content management capabilities of the source site. The integration of web service and AJAX technologies resulting in such a rich functionality is currently an unrivaled feature of this program.

Accurately targeted ads

Semantic data entry allows a more efficient use of ad space, avoiding the “banner graveyard” effect caused by untargeted ads. Ads based on the users’ activities significantly enhance ad efficiency, making the selling of these ad spaces more profitable.

Semantic web represents disruptive technology with the power to challenge today’s Internet titans. In4 Kft., in close working relationship with Vidatech, aims to be the premier developer and operator of next generation intelligent web sites.

Desalination technology

Pursuant to an invention transfer agreement dated October 26, 2007 by and between Vidatech and Otto Buresch, an individual residing at 2040 Budaörs, Ébner György köz 2/1., Hungary, Vidatech obtained exclusive rights to develop and commercialize a new desalination device. Prior to signing the agreement a thorough due diligence review was completed to establish the uniqueness and patentability of the technology by Pintz and Co., independent patent attorneys. We anticipate that a patent application will be filed on this technology by November 30, 2007. Vidatech is entitled to receive sixty (60)% of the revenues generated from the utilization of the technology.

Based on a market study conducted by Media Analytics Limited, the global desalination industry is anticipated to grow from 39.9 million cubic meters per day (m3/d) at the beginning of 2006 to 64.3 million m3/d in 2010, and to 97.5 million m3/d in 2015. This represents a 61% increase in capacity over a five-year period, and a 140% increase in capacity over a ten-year period. The compound annual growth rate of installed capacity is approximately 9%. The compound annual growth rate of the market for new capacity is approximately 13%.

This expansion of capacity will require capital investment totaling $25 billion by the end of 2010, or $56.4 billion by the end of 2015. Based on current trends, it is expected that more than half of this capital will come from the private sector. This means that desalination is more open to private sector participation than any other part of the water industry.

The increase in desalination capacity will require increased operating expenditures. Operating expenditures are expected to rise from $6.5 billion in 2006 to $9.9 billion in 2010, and to $14.8 billion in 2015. This suggests a total market value of $66 billion between the beginning of 2006 and the end of 2010, and a total market value of $126 billion by the end of 2015. The current annual value of the market (including capital and operating expenditure) is approximately $10.9 billion. These figures do not include the cost of capital.

The main driver of the growth of the market for desalination is increased water scarcity around the world. Scarcity is a function of growing demand for water in situations where there is limited availability of natural renewable resources. Water scarcity is exacerbated by population growth in areas of limited natural resources such as the Gulf region, southern Spain and the south west of the United States. Global warming has no predictable impact on overall scarcity, although it is believed to increase the risk of both floods and droughts. Water resources agencies must plan for these eventualities.

With a cost of approximately $0.55/m3, desalination remains an expensive solution to scarcity, in comparison to most existing water resources. However, as cheaper alternatives to desalination become fully exploited, desalination is increasingly becoming the next cheapest solution to water scarcity. It is acknowledged that two cheaper alternatives remain largely underexploited: water reuse and the reallocation of resources away from the agricultural sector.

Historically, the growth of the desalination industry has been seen to have been driven by the falling cost of the process, from more than $10/m3 40 years ago to a low price of $0.47/m3 today. This continuous downward trend cannot be expected to continue uninterrupted in future, however. With an energy consumption of 4.5kWh/m3 of product water (at a price of $0.05/kWh), energy costs represent approximately 50% of the total cost of reverse osmosis desalination. The greatest challenge for the industry is to increase the energy efficiency of the process faster than the price of generating electricity from fossil fuels rises.

The TothTelescope

Pursuant to an exclusive distributorship agreement dated June 15, 2006 by and between Vidatech and Attila Toth, an individual residing at 1237 Budapest, Nyír u. 30. 1/12., Hungary, Vidatech obtained the exclusive worldwide distribution rights to the TothTelescope. The Agreement covers all methods and extents of utilization of the TothTelescope and underlying technology for an initial one year period commencing on July 15, 2006. Vidatech is entitled to receive sixty (60%) of the revenues generated from the utilization of the technology. On June 15, 2007 we entered into an amendment of this agreement granting Vidatech rights to the exclusive distributorship of the TothTelescope for an additional period of two years.

The TothTelescope is an ultra-small, portable, yet high magnification monocular telescope that is equally suitable for microscopic, terrestrial and astronomical observations. Usable magnification ranges from 16x to 250x, with optional accessories 500x magnification is achievable for microscopy work. Because of its compact size (only 14 centimeters in length x 8 centimeters in diameter) and light weight (less than 500 grams) it can be used for a number of strategic applications such as military reconnaissance, wildlife observation from great distances, emergency observation, closed circuit security at great distances, and common every day tasks such as microscopy of up to 500x magnification, digital photography, bird spotting, hunting or even star gazing.

It is anticipated that the TothTelescope will also be available in infrared versions, a binocular version and a super high resolution version (expected to be available within 3 years).

Since June 15, 2006, and through the period ended September 30, 2007, we have sold and distributed 8 TothTelescopes and various accessories for an aggregate sales proceeds of $5,833. Since June 30, 2007 the telescope has not been available, as design revisions and manufacturing difficulties had to be resolved. During the next twelve (12) months, it is our plan to order enough components from our suppliers to assemble, at first, fifty (50) additional TothTelescopes for resale, update the TothTelescope e-commerce website to include additional functionality including customer feedback potential, and solicit additional resellers and design and implement an ongoing marketing campaign. We also intend to send sample products to a number of offline resellers worldwide where potential customers can inspect and try the benefits of the TothTelescope first hand. We believe this personal experience will be instrumental in driving sales over the next twelve to twenty four months.

In addition, we are also planning on providing test instruments to independent reviewers and trade publications for testing and expert review. These independent appraisals are crucial for the establishment of an optical instrument such as the TothTelescope. While we are confident that these independent reviews will be favorable there can not be any assurance that the people testing the instrument will in fact like the product and provide positive feedback. Review results can affect sales either in a positive or negative manner.

Market for the TothTelescope

According to a market study published by the ICON Group Ltd., the estimated world market for binoculars, monocular, optical telescopes and astronomical instruments, application fields in which the TothTelescope can be used, was approximately $921 million in 2007. China leads the list of producers (with exports worth $384 million) followed by Germany ($93 million) and the United States ($90 million). Hungary resided in 16th place with yearly sales of $8.6 million, beating such countries as Italy, Switzerland, and Spain. On the importers side the US lead with yearly imports of $304 million. Hungary placed 28th with $4.4 million, suggesting a $4.2 million surplus. Within that global marketplace, it is our intention to market, distribute and sell the TothTelescope internationally through our own e-commerce enabled website (http://www.tothtelecope.com), through domestic and international distributors and through special linked merchandising arrangements.

Competition

Competitors for the TothTelescope are fragmented into specific areas, depending on the application field. For astronomical observations well known names like Meade (USA), Celestron (USA), TeleVue (USA) and Orion (USA) exist. Our monocular and binoculars competitors include Nikon (Japanese), Bushnell (German), Swarovski (German) and Zeiss (USA); for microscopy use competitors include Olympus (Japanese), Zeiss (USA), Nikon (Japanese) Leica (USA) and others. Each of these competitors has greater operational, financial and managerial resources than we do and we may not be able to compete effectively with any one or more of them.

The advantage of the TothTelescope, as compared to the above listed instruments that operate in only one, or maybe two specific fields (a monocular can be used for terrestrial imaging and astronomy work but not for microscopy) is its multi-function use. An incredibly small and light weight high-precision instrument that can be used for both astronomical, terrestrial and microscopy applications. This unique attribute sets the TothTelescope apart from the competitors and distinguishes it as a singular instrument in the market place.

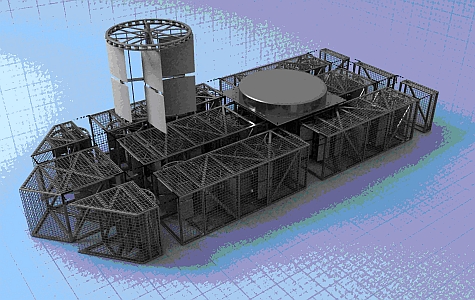

RiverPower Technology