UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Q ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2013

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| POWER OF THE DREAM VENTURES, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 001-52289 | 51-0597895 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| 1095 Budapest, Soroksari, ut 94-96, Hungary |

| (Address of principal executive offices, including zip code) |

| +36-1-456-6061 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes¨ Noþ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yesþ No¨

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

Yesþ No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesþ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes¨ Noþ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer¨ | Accelerated Filer¨ |

| | |

| Non-Accelerated Filer¨ | Smaller reporting companyþ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Noþ

Issuer’s revenues for its most recent fiscal year were approximately $0.

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 29, 2013, based on a closing price of $0.10 was approximately $3,500,000 As of April 14, 2014, the registrant had 46,500,896 shares of its common stock, par value $0.001 per share, outstanding.

Documents Incorporated By Reference: None.

POWER OF THE DREAM VENTURES, INC.

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2012

TABLE OF CONTENTS

| | | Page |

| PART I | | |

| | | |

| Item 1. | Business. | 5 |

| Item 1A. | Risk Factors. | 36 |

| Item 1B. | Unresolved Staff Comments. | 56 |

| Item 2. | Properties. | 56 |

| Item 3. | Legal Proceedings. | 56 |

| Item 4. | Mine Safety Disclosures. | 56 |

| | |

| PART II | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 57 |

| Item 6. | Selected Financial Data. | 58 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results Of Operations. | 58 |

| Item 7A. | Quantitative And Qualitative Disclosures About Market Risk. | 61 |

| Item 8. | Financial Statements and Supplementary Data. | 61 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 61 |

| Item 9A. | Controls and Procedures. | 61 |

| Item 9B. | Other Information. | 63 |

| | | |

| PART III |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 63 |

| Item 11. | Executive Compensation. | 64 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 65 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 66 |

| Item 14. | Principal Accounting Fees and Services. | 66 |

| | | |

| PART IV |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 67 |

FORWARD LOOKING STATEMENTS

Included in this Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

PART I

Item 1. Business.

Power of the Dream Ventures, Inc., a Delaware corporation (“PDV”, “We” or the “Company”) is a Hungarian-based holding company focused on technology acquisition and development enabling the delivery of revolutionary concepts and ready to market products to the international market place. We develop, acquire, license, or co-develop technologies that typically originate in Hungary that are in prototype stage based on existing patents; in prototype stage prior to patenting; existing products that require expansion capital to commercialize; emerging science and high-technology research projects that require help in patenting, developing the product and marketing, university spin-off technologies and ideas from the very early stages of what represents “disruptive technologies.”

We were incorporated in Delaware on August 17, 2006, under the name Tia V, Inc. Since inception, and prior to our acquisition of Vidatech on April 10, 2007, we were engaged solely in organizational efforts and obtaining initial financing. Our sole business purpose was to identify, evaluate and complete a business combination with an operating company.

On April 10, 2007, we completed our acquisition of Vidatech, Kft. (also known as Vidatech Technological Research and Development LLC) a limited liability company formed under the laws of the Republic of Hungary. Vidatech is a company formed for the purpose of investing in, acquiring, developing, licensing, and commercializing technologies developed in Hungary. In furtherance of its business, Vidatech provides research and development services to the companies from which it acquires technologies or participation interests in such technologies.

Through Vidatech, we aim to provide pro-active support for idea, research, start-up and expansion-stage technology companies having rights to technologies or intellectual properties which we believe to be potentially commercially viable, by offering a range of services designed to encourage and protect the continuing development and eventual commercialization of those technologies.

On September 28, 2012, the Company entered into an Acquisition Agreement and Plan of Merger, by and among the Company, as parent, Power of the Dream Ventures Acquisition Corp., a Delaware corporation and wholly-owned subsidiary of Parent (the “Merger Sub”) and Genetic Immunity, Inc., a Delaware corporation (“Genetic Immunity”), whereby, the Merger Sub merged with Genetic Immunity, and Genetic Immunity shall continue as a wholly-owned subsidiary of the Company (the “Merger”). The Merger became effective upon the filing of the Certificate of Merger with the Secretary of the State of Delaware on October 2, 2012.

OVERVIEW

The Company currently focuses on the operations of its wholly-owned subsidiary, Genetic Immunity, which is a clinical-stage biotechnology company focusing on the discovery, development and commercialization of a new class of immunotherapeutic biologics ("Immune Therapies" or "Therapeutic Vaccines") for the treatment of chronic viral infections, cancer and allergy. Our Immune Therapies are designed to intensify or boost specific immune responses to modify or control these presently incurable diseases. The Company’s main focus is completing Genetic Immunity’s clinical trials program and on commercialization tasks related to the Company’s lead product candidate DermaVir therapeutic HIV vaccine.

PRODUCTS

Our Lead Product Candidate – DermaVir HIV-specific Immune Therapy

| 1. | Summary of DermaVir Development Milestones |

We have been developing DermaVir for the treatment of HIV/AIDS.DermaVir is a patented Immune Therapy which, based on the Food and Drug Administration (“FDA”) classification, is a combination of our original biologic product (DermaVir) and our medical device (DermaPrep).DermaVir is administered topically with DermaPrep. DermaVir’s Active Pharmaceutical Ingredient (“API”) is a pDNA expressing the broadest HIV antigen repertoires and Virus-like Particles (“VLP”).

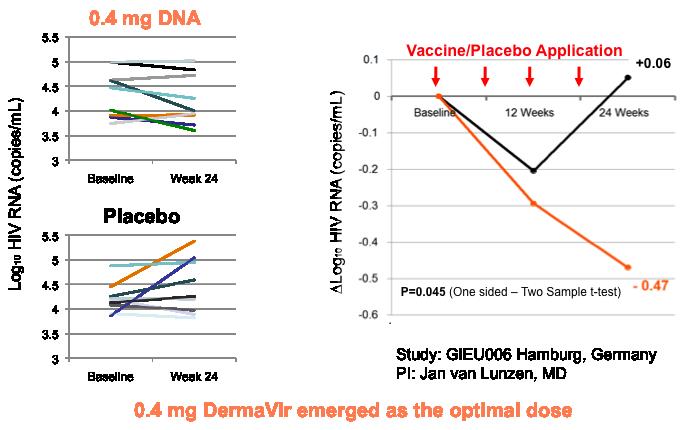

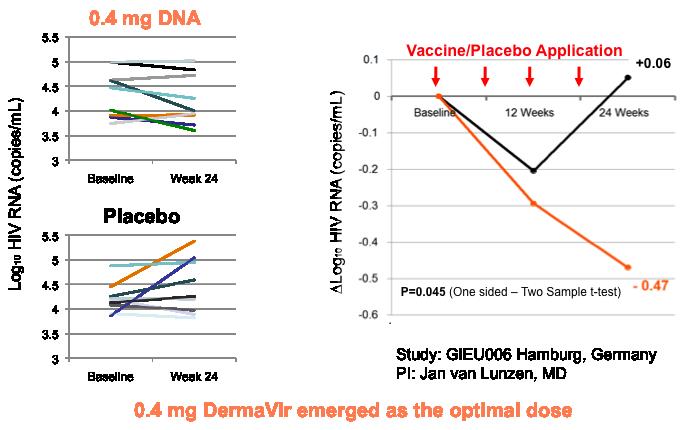

We demonstrated in Phase I and Phase II clinical tirals that DermaVir exhibits its specific pharmacologic effects by intensifying the patient’s own immune system to kill HIV-infected cells. Our clinical trials in approximate 70 HIV-infected patients demonstrated an excellent safety and tolerability in all doses. We found the optimal DermaVir dose for boosting HIV-specific T cell immune responses and demonstrated killing of HIV-infected cells by showing a statistically significant reduction of HIV-RNA in DermaVir treated patients compared to placebo.

DermaVir has a novel immunological mechanism of action different from antiretroviral drugs that kill the virus but cannot kill the infected cells. During effective Highly Active Antiretroviral Therapy (“HAART”), HIV-infected cells remain in the reservoirs. Even HAART intensification could not eliminate infected cells, decrease reservoirs or improve the immune system to fight against the virus. We believe that DermaVir treatments will reduce the amount of HIV-infected cells remaining in the reservoirs of HAART petients. This could provide additional treatment benefits by reducing the number of antiretroviral drugs that patients must take.

“Proof of concept” for the immunological and antiretroviral activities of our products was demonstrated in non-human primates with AIDS. This data showed that repeated DermaVir immunization resulted in a cumulative boosting of the HIV-specific cellular immunity without causing significant toxicities or adverse effects. After successful reconstitution of the monkey’s SIV-specific immune system, DermaVir immunized monkeys controlled their virus after interruption of HAART.

Among our animal studies, the non-human primate model is superior to other commonly used animal models (e.g., mice, rats, rabbits) because the disease progression and response to treatments in non-human primates is similar to the human disease. We believe that DermaVir has the potential to be the first Immune Therapeutic agent designed for the immune mediated control of viral replication by cytotoxic killing of HIV-infected cells. Currently, there are no approved Immune Therapy products on the market for HIV.

DermaVir was found to be safe and well tolerated at all doses in all clinical studies. A single treatment with DermaVir takes 20 minutes to apply, and left on the skin for three hours after which the patches are removed.. Our Phase I clinical results indicated an increase in the number of long-lived HIV-specific precursor T cells in all treated individuals in a dose-dependent manner. DermaVir-induced T cells remained in the body even after a one-year follow up, albeit at a lower level. These findings suggest that DermaVir boosted HIV-specific T cells similarly to that seen in primates. A separate Phase I/II study conducted by our collaborators in the US further confirmed the safety of repeated DermaVir vaccinations in combination with HAART (ACTG5176). We have recently completed Phase II clinical trial with DermaVir in Germany on a drug naïve patient population (36 HIV-infected individuals). These trials demonstrated excellent safety, immunogenicity and antiretroviral efficacy and have shown clinically significant median 70% viral load reduction in patients treated, as compared to placebo. This viral load reduction is the result of killing of HIV-infected cells that we could demonstrate even in the absence of HAART. Viral load suppression by DermaVir vaccinations occurs slowly, similarly to cancer vaccines as predicted by its mechanism of action, and that is different from antiretroviral drugs that kill the virus but do not kill HIV-infected cells. Consistent with our primate results, DermaVir immunizations alone did not suppress viral load to an undetectable level and did not increase CD4 T cell counts. These human clinical data appear to have confirmed and extended our pre-clinical results.

Although our clinical development program is not yet final, and the marketing approval has not yet been obtained, we believe that our preclinical and human studies performed to date support the Proof of Concept, which is a relationship between DermaVir-induced antiretroviral immune responses and clinical benefit. We believe that DermaVir may be most effective if it is initially administered every six weeks to intensify HIV-specific immunity then at every regular doctor’s visit (every three months) to maintain the immunity.

| 2. | Our DermaVir Family for Personalized Treatment |

DermaVir is based on HIV subtype-B that represents the majority of HIV infection within the major marketplaces including North America and Western Europe. In addition, we have developed an initial DermaVir Product Portfolio to provide optimal treatment for every HIV-infected patient by considering the diversity of the infected population.

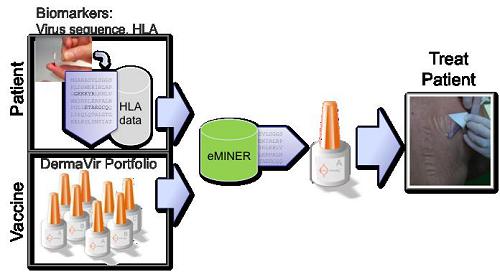

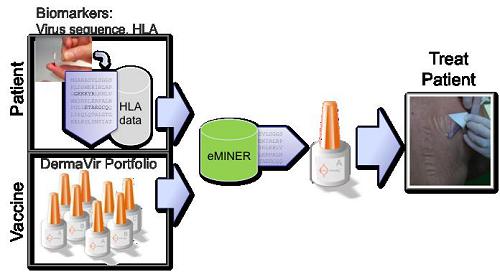

HIV is a highly variable virus. We found that the therapeutic effectiveness of DermaVir depends on the HIV sequence replicating in the patient and the patient’s genetic background. DermaVir contains related HIV-specific antigen sequences characteristic for the different Clades (subtypes) of the virus. To ensure the optimal therapeutic benefit for every patient, the treating physician will enter the information on the patient’s HIV sequences and genetic background (HLA) into our eMINER software. After analyzing the data, eMINER will select the optimal DermaVir product from the DermaVir Product Family and also calculate the specific T cell epitopes that will play a role in the immune boosting of the individual patient. The treating physician can then make an educated decision for personalized treatment of the patient and could also prescribe the proper immune monitoring based on the predicted T cell epitopes.

The targeted epidemics and our initial Product Portfolio are summarized in the Table below. According to UNAIDS, subtype-B represents approximately four million individuals (Europe, North, Central and South America, Caribbean, Australia). Our other product candidates can provide optimized treatment options for an additional 24.7 million HIV-infected individuals (2009 UNAIDS Report and HIV-1 Global Distribution, IAVI report Aug 2003).

| Present DermaVir Product Family | Targeted epidemics | Infected population |

| DermaVir B | Europe, America, Caribbean, Australia | 4 million |

| DermaVir C | Sub-Saharan Africa, South-Asia | 22.5 million |

| DermaVir BC | China | 0.77 million |

| DermaVir BF | South-America | 1.4 million |

| DermaVir AB | Eastern Europe | 10,000 |

We are pursuing the development of a DermaVir Product Family based on subtypes for the following reasons:

| · | DermaVir Product Family provides an individually-optimized Immune Therapy to boost the immune system against the specific HIV replicating in the patients. The availability of subtype-specific products permits “personalized treatment” with DermaVir Product Family. HIV subtype of the infected individual is diagnosed with available sequencing of the virus. The patient’s genetic background (HLA type) can also be diagnosed with routine methods. The subtype or recombinant form (HIV diversity) plus the patient’s genetic background for antigen processing (patient diversity) together define the best-matching Product from the Family. Based on these data our eMINER can suggest the personalized treatment for the patient. |

| · | DermaVir Product Family also supports different pricing in the various markets. Differential pricing of drugs manufactured by the same company has resulted in the illegal re-importation of the cheaper products to North America and Western Europe. The subtype-optimized DermaVir products will, by medical necessity, differ in HIV subtypes by geographical markets, product supplied to developing countries should not be diverted to other markets. |

| · | We intend to seek additional patent protection for the API in our subtype-specific DermaVir Product Family and method for treatment, also within the target regions. This will allow the granting of manufacturing and marketing licenses to specific countries based on unmet medical needs while providing additional protection against re-importation of third country-manufactured products to the United States and E.U. |

| · | Based on our technology platform, manufacturing and control of the DermaVir Product Family will not require additional methods or technology. The same manufacturing technology, control methods and facility can be used for cGMP manufacturing of all our products. |

Prior to human trials, regulatory agencies require the demonstration of their quality, safety and efficacy initially in appropriate animal models. To demonstrate the mechanism of action, first we established in human primary cellsin vitro and in macaquesex vivo that DermaVir-expressing dendritic cells prime naïve T cells and induce both HIV-specific helper and cytotoxic T cells. Preclinical animal studies conducted in mice, rabbits and macaques consistently demonstrated thatin vivo DermaVir immunization targets the pDNA immunogen to the dendritic cells of the lymph nodes that express the pDNA-encoded antigens. Importantly, immune responses followingin vivo DermaVir immunization were shown to be similar toex vivo immunization with cultured dendritic cells “DCs”. Bothex vivo andin vivo DermaVir immunizations employed lymph node dendritic cells, expressed similar amounts of pDNA-derived antigens, and induced Th1-type antigen-specific CD4 T helper and CD8 cytotoxic T cells. The induction of Th1-type cellular immune responses by DermaVir was also confirmed by delayed-type hypersensitivity skin reaction (DTH) tests. Additional experiments showed thatin vivo DermaVir immunization leads to the induction of antigen-specific memory/precursor T cells. Recent animal studies have demonstrated that generation of highly protective immunity against smallpox required a live virus delivered via skin scarification. For DermaVir we used our platform technology, the modern version of the smallpox vaccination approach by employing a pDNA nanomedicine expressing complex VLP+ instead of a live virus and DermaPrep administration instead of skin scarification.

To study the safety of DermaVir vaccination, repeated immunization studies in good laboratory practice “GLP” were performed in swine and rabbits. These preclinical studies demonstrated that the major side effect of DermaVir vaccinations was erythema caused primarily by the DermaPrep administration. The erythema was transient and provided a mild inflammation, a desired side effect resulting in the activation of the Langerhans cells to seek and capture DermaVir nanoparticles applied under the patch.

To study the reproductive toxicity of DermaVir another repeated dose study GLP was performed in Wistar rats from the premating period through implantation. No significant differences between DermaVir treated and control animals were observed in body weights, food consumption, estrus cycle, fertility and mating index, or mating days until Day 0 postcoitus. Because no adverse effects were seen, the Maximum Tolerated Dose (MTD) cannot be determined, but is considered to be greater than 0.33 mg pDNA.

We have assessed thein vivo stability of our nanomedicine product. We could visualize the nanoparticles in the epidermis by two-photon microscopy over 120 minutes and demonstrate that DermaPrep skin preparation is essential for the effective penetration of the nanomedicine into the epidermis. The half-life of the nanomedicine in the lymph nodes was 11-12 days. The half-life of the nanoparticles in the lymph nodes depends on the migration of nanoparticle-containing Langerhans cells to the lymph nodes, intracellular degradation of pDNA, cytotoxic killing of antigen-presenting dendritic cells and clearance of dendritic cells.

The immunogenicity of DermaVir was investigated in uninfected and Simian Immunodeficiency Virus (“SIV”)-infected rhesus macaques with a DermaVir product formulated with a relevant plasmid DNA construct based on Simian Human Immunodeficiency Virus. The API of DermaVir used in all macaque studies expresses a VLP+ with the gag and pol genes homologous to SIV and an HIV env. The method for topical administration and the dose per skin surface in the macaque studies were similar to human trials. Proof of Concept efficacy studies in chronically SIV-infected macaques, some of them with AIDS, suggested that repeated DermaVir immunizations, alone or in combination with antiretroviral drugs, result in viral load reduction and survival benefit (see data in Lisziewicz et al AIDS 2005). DermaVir administered in combination with HAART boosted SIV-specific T cells that possessed significant antiretroviral activity demonstrated by maintenance of undetectable viral load after interruption of HAART in both chronically infected and late stage macaques. DermaVir treatment alone doubled the median survival time of infected macaques. These primate experiments provided the rationale to investigate repeated DermaVir immunizations in combination with HAART in HIV-infected human subjects.

| ii. | Summary of the Clinical Trials to Date |

As DermaVir associated clinical benefits were first seen in primates receiving HAART, the first two human studies were designed for the treatment of HIV-infected subjects receiving stable, fully suppressive HAART.

GIHU004 Trial to Evaluate the Tolerability and Safety of DermaVir in HIV-Infected Subject Currently Under Treatment with HAART (EudraCT Number 2004-001585-41, ClinicalTrials.gov ID NCT00712530).

The objective of the trial was to provide data on the safety, tolerability and immunogenicity of one DermaVir treatment in individuals with chronic HIV-1 infection treated with fully suppressive HAART.

This Phase I clinical study demonstrates that DermaVir was found to be safe and well tolerated at all doses. Vaccination did not affect HIV RNA (all subjects remained less than 50 copies/mL) and CD4+ counts. However, this therapeutic vaccination broadened and significantly increased the HIV-specific memory/precursor T cell pool, measured as the PHPC count, in a dose-dependent manner. The durability of vaccine-induced T cell responses was demonstrated after one year following a single vaccination in all treated individuals, albeit in significantly lower quantities (Lisziewicz et al. CROI2008 - Poster #715). These findings suggest that DermaVir boosted HIV-specific T cells similarly to that seen in primates.

Trial ACTG A5176. A Phase I/II, Randomized, Double-Blind Study to Evaluate the Safety, Tolerability, and Immunogenicity of DermaVir, in HIV-1-Infected Subjects Currently Under Treatment with HAART. (ClinicalTrials.gov IDNCT00270205 ).

The trial, conducted under a US Investigational New Drug “IND” application was sponsored by the US government (NIAID, NIH) enrolled 26 HIV-infected individuals on fully suppressive HAART to three cohorts in four leading HIV clinics located in the US. Based on the design, dose escalation to the last cohort implied that no subject in the current or lower dose cohort experienced a primary safety endpoint (i.e., no more than one subject in any cohort exhibited an adverse event greater than Grade 3).

The primary objective of this randomized, double-blind, placebo-controlled trial was to evaluate the safety and tolerability of multiple DermaVir treatments. Secondary objectives were to explore the immunogenicity of DermaVir for the treatment of individuals with chronic HIV-1 infection and HAART-induced durable reduction of viral replication.

The trial population comprised 26 HIV-infected men and women 18 to 50 years of age. HAART regimens were fully reduced within the 12 weeks prior to trial entry (Screening plasma HIV-1 level of less than 50 copies/mL,and CD4+ cell count greater than 350 cells/mm3 within 12 weeks prior to trial entry and nadir CD4+ cell count greater than 250 cells/mm3). The total treatment duration was 61 weeks. Each cohort’s treatment schedule was administered over a 13-week period, with an additional 48 weeks of follow-up for safety evaluations.

Twenty-six subjects were enrolled in the study. The primary endpoint was any possibly or definitely vaccine-related grade ≥3 adverse event (AE) appearing up to 28 days after the final study vaccination. No primary safety endpoints or AE-related study treatment changes / discontinuations have occurred. AE incidence was similar across groups (Rodriguez B. et al. XVIII International AIDS Conference, 2010 - Abstract # A-240-0111-10145).

DermaVir administration was associated with a trend toward greater HIV-specific, predominantly central memory T-cell responses. The intermediate DermaVir dose tended to show the greatest immunogenicity, consistent with previous studies in different HIV-infected patient populations.

Phase II Trial

Repeated DermaVir immunizations in chronically infected macaques in the absence of HAART transiently suppressed virus replication leading to improvement of median survival time from 18 to 38 weeks compared to no treatment. These primate experiments provided the rationale to investigate repeated DermaVir immunizations prior to initiation of HAART in HIV-infected individuals. As DermaVir immunizations in combination with HAART did not show any product- or administration-related AEs higher than grade 2, we developed a Phase II protocol to evaluate the safety and to test the immunogenicity and antiretroviral efficacy of repeated DermaVir immunizations.

GIEU-006: Randomized, Placebo-Controlled, Multi-Center Trial to Evaluate the Safety, Tolerability, Immunogenicity, and Antiretroviral Activity of DermaVir in Treatment-Naïve HIV-1-Infected Patients (EudraCT number: 2007-001955-20, ClinicalTrials.gov IDNCT00711230)

This study was conducted in Germany in accordance with European Medicines Agency (“EMA”) approval and Current Good Clinical Practices “cGCP”. GIEU-006, a Phase II randomized, placebo-controlled, dose-finding, double-blinded study was conducted to assess the safety, tolerability, immunogenicity, and antiretroviral activity of DermaVir therapeutic vaccine, for the treatment of antiretroviral therapy naïve adults with HIV-infection.

The study population comprised of 36 antiretroviral treatment naïve HIV-infected men and women 18-50 years of age. The patients were randomized into one of the six treatment arms to receive either DermaVir or placebo. Four immunizations were administered over an 18-week period with an identical follow up schedule continuing until week 24; patients were followed for an additional 24 weeks for safety and immunogenicity evaluations. An additional 234-week safety follow up is being performed (every 26 weeks) including virology, immunology, chemistry and hematology assessments and physical examinations.

Immunizations were done on days 0, 42, 84, and 126. The total number of patches that a patient received throughout the study is 8, 16, or 32 in the low, medium, and high dose arms, respectively. The same skin sites were used for all immunizations.

The primary endpoint of the study was safety at week 24. Adverse events solely attributed to DermaPrep and were analyzed separately in the Local Reaction Assessment.

Out of the 36, 34 subjects have reached week 24 (visit 10), the time point of the analysis of primary and secondary endpoints of the study. The data of the two subjects that did not reach visit 10 were used according to the statistical section of the protocol. One of the subjects got arrested after visit 7 and discontinued from the study; the other subject decided to start antiretroviral therapy despite a stable CD4 count greater than 600/µl.

We did not observe any greater than grade 2 adverse events including signs/symptoms, lab toxicities, and/or clinical events possibly or definitely related to study treatment any time from the first day of study treatment until 42 days after the last DermaVir administration. There was no premature discontinuation of immunizations at the patient’s request for reasons having to do with the effects, or the perceived effects, of DermaVir or the DermaPrep administration procedure.

No patients required termination from any further immunizations due to toxicity attributable to DermaVir product, or due to tolerability failure. No patients experienced Grade 3 or higher toxicity to be discussed regardless of study treatment attribution.

The overall adverse event profile of the treatment was found to be consisting of grade 1 and grade 2 events. Most of the events were judged by the investigators to be not related to the study treatment. Only one grade 2 adverse events judged as possibly related to treatment (Positive Gaenslen's Test) in the 0.2 mg DermaVir group. We did not find any significant differences between study arms and treatment groups.

The Figure above demonstrates the efficacy results of the Phase II trial

Phase IV trials following marketing approval will be necessary if we intend to further study the efficacy of DermaVir in different patient populations. Presentations and publications of such trials are essential to successful marketing of DermaVir. Therefore, our strategy will be to obtain marketing approval within the shortest period of time and consequently continue the clinical trials for the establishment of a large safety and efficacy database. Please note that such a database on DermaVir is expected to facilitate the approval of pipeline products since the differences between products will be only in the sequence of the plasmid DNA.

| iv. | Our DermaVir Product Development and Registration Strategy |

Our clinical development and market approval strategy is focusing on immune intensification with DermaVir in Conditional Marketing Approval. We believe that patients treated with such Immune Intensification will maintain an undetectable HIV-RNA level and have an increased HIV-specific T cell frequency. Achieving optimal T cell responses and elimination the majority of HIV-infected cells from the reservoir might lead to remission (functional cure) in some HIV-infected people. These people would stop their antiretroviral drug treatment (if any) and receive only immune boosting DermaVir treatments during regular doctor visits.

In addition to the foregoing reasons, we believe that the treatment for HIV/AIDS with DermaVir may be desirable to physicians and patients for the following reasons:

| · | Effectiveness based upon boosted natural immunity; |

| · | Delayed disease progression; |

| · | No interference with current or future drug-treatment options; |

| · | Infrequent administration of a patch (only for three hours) during regular office visits; |

| · | No fear of the side effects and acquiring resistance of anti-HIV drugs; and |

| · | Reimbursement by insurance. |

According to Datamonitor (Future of HIV Market 2011), some patients may prefer a once-monthly administration (even intravenous drug infusion in the doctor’s office) over daily oral HIV treatment, which makes topical DermaVir treatment very attractive.

We believe that DermaVir, when approved, may meet the needs of these market opportunities due to favorable safety, tolerability and efficacy characteristics in comparison to currently prescribed drugs. The major toxicities of DermaVir are not systemic, but limited to local skin reactions. It is conveniently administered during regular doctor visits. The efficacy is based on the induction of HIV specific precursor T cells that are long lasting. DermaVir is expected to be introduced to the market for the treatment of HIV in combination with the presently available drugs since none of them can reconstitute HIV-specific immunity.

DermaVir has the potential to be the first Immune Therapy registered for the treatment of HIV/AIDS. To reach this objective we will use a strategy combining the experiences of registration of antiretroviral drugs and biologics. We have worked closely with the FDA on studies required for both the Biologics Master File “BMF” and the Investigational New Drug “IND” applications and will continue this effort. The FDA has expressed the desire to work with the pharmaceutical industry in the development of useful immune-based therapies for HIV/AIDS that may contribute to the body’s own defense against HIV and improve clinical outcome over drug therapy alone. We intend to develop effective and safe Immune Therapy products to delay HIV disease in HIV infected individuals not treated with antiretroviral drugs.

We had a preliminary meeting with the European Medicines Agency (“EMA”) to discuss the clinical development plan of DermaVir. EMA ensured us to fully support the development of DermaVir and suggested to organize an official Scientific Advisory Meeting to obtain approval for our clinical development and Chemistry, Manufacturing and Controls (“CMC”) strategy. We intend to propose the development of DermaVir for immune intensification in frame of a Conditional Marketing Approval. During the treatments we intend to use eMINER to match the patient with the best vaccine selected from our DermaVir Product Portfolio. After the DermaVir induction phase (3 treatments every 6 weeks) we expect DermaVir boosting of HIV-specific immunity compared to placebo. This is followed by the DermaVir maintenance phase (4 treatments every year). We believe that the maintenance not only maintains the high immune responses in the patients but also decreases the number of infected cells in the reservoir. This will be clinically demonstrated by maintenance of undetectable HIV-RNA after decreasing the number of drugs used in the HAART regimen. The primary endpoint of the pivotal trial will be non-inferiority between DermaVir + 1 Drug and HAART (standard of care). Additional treatment benefits include less toxicity in the DermaVir arm and lower pill burden.

We believe that we will get approval for our DermaVir Product Family together with our biomarker strategy and that regulatory agencies will not ask us to conduct separate clinical development programs with the different members in our DermaVir Product Family. The size of DermaVir Product Family initially will be less than 10, which is less than we envision to be expanded after emergence of new HIV variants, because it will provide optimal immunogenicity for selected HIV-infected patients, no difference in toxicities and all members in the DermaVir Product Family is produced by the same manufacturing and control methods. The future of HIV therapy, similar to several other indications, is already moving to personalized treatment. Pharmacogenetics screening is already used prior to initiation of some drug treatment in the US and EU (Datamonitor, Future of HIV Market 2011). We envision that our personalized DermaVir Immune Therapy will combine the scientific knowledge and our product portfolio to select the safest and most effective treatment of all HIV-infected patients.

According to EMA regulations, investigational drugs treating HIV infection with appropriate phase II clinical results, a favorable toxicity profile and good rationale for efficacy may receive Conditional Marketing Approval. Based on our clinical results with DermaVir parallel to the Conditional Marketing Approval process, we are planning to apply for Breakthrough Therapy Designation at the FDA.

Our Immune Therapy Technology Platform

The human immune system is well prepared to fight against diseases and most of the time does it successfully. In people with chronic diseases the immune system fights against such diseases but often cannot prevail. To live a better and longer life people boost their immune systems with vitamins, dietary supplements and herbs. We designed our Immune Therapy technology to specifically boost the patients’ own the immune system to focus on the target disease and win the battle.

The disease-modifying efficacy of our Immune Therapeutic products is based on the intensification or boosting of Th1-type cellular immunity. Based on the available preclinical and clinical data, we expect from this type of immune intensification to provide a therapeutic benefit that cannot be achieved by traditional drugs in patients with chronic infectious diseases, cancer or allergies.

There are four principal components that comprise our comprehensive Immune Therapy platform technology which are designed to work in conjunction to treat and/or control chronic infectious diseases, cancer and allergy, as follows:

| · | Our proprietary Active Pharmaceutical Ingredients (“API”):We have been designing (ANTIGENeering) our APIs to be specific, safe and effective. It consists of a single plasmid DNA (pDNA) immunogen ANTIGENeered to express several antigens, to contain molecular safety features and to release Virus Like Particles (VLP+) in the body of the patients. API with these crucial properties is not feasible with protein or peptide antigens. |

| · | Nanomedicine - our proprietary product platform:Our products are referred here as the “nanomedicine” according to their unique biophysical and biological features. Our APIs are formulated with our novel polymer excipient to synthetic “pathogen-like” nanoparticles. The nanomedicine formulation is essential to achieve potent antigen expression from the pDNA and antigen presentation by dendritic cells. This is critical for the intensification of antigen-specific immune responses in people with chronic diseases. |

| · | DermaPrep - our topical administration platform: We have developed the DermaPrep medical device for targetedin vivo delivery of our nanomedicine products to the dendritic cells of the lymph nodes via the Langerhans cells. We obtained the marketing approval in the European Union (CE Mark) for our DermaPrep device. |

| · | IT - Applied information technology:IT innovations have been supporting the discovery, development, manufacturing, and personalized treatment processes of Genetic Immunity. These include the rational antigen design, clinical trial and data management and matching the patients with the optimal Immune Therapy Product. |

Each of these components, as well as our lead product DermaVir, which has been developed using this platform technology, is described below in detail.

Our Proprietary Active Pharmaceutical Ingredients (“API”)

We have been designing (ANTIGENeering) our APIs to be specific, safe and effective. It consists of a single plasmid DNA (pDNA) immunogen ANTIGENeered to express several antigens, to contain molecular safety features and to release Virus Like Particles (“VLP+”) in the body of the patients. API with these crucial properties is not feasible with protein or peptide antigens.

In all our products, the specificity of immune boosting is determined by the nucleotide sequence of the pDNA that encodes several antigens. These antigens are specific to the causative agent of the disease. For chronic infectious diseases the recombinant antigens are derived from the target virus or intracellular bacteria to boost the immune system to eliminate the infected cells. For cancer, the antigens are derived from genes that specifically expressed in the cancer cells to boost the immune system to kill the cancer cells. For allergy, the antigens are derived from recombinant allergens to boost the immune system and balance the pathogenic immune responses.

We refer to our proprietary process for designing, preparing and testing pDNA-encoded antigens as “ANTIGENeering”. The API discovery program with ANTIGENeering technology supports a large proprietary product portfolio with long patent life.

Our Immune Therapies elicit potent Th1-type antigen-specific CD8 and CD4 T cell responses. The broadest antigen repertoire needs to be ANTIGENeered to boost polyclonal antigen-specific T cells to successfully fight the target disease.

Main steps of the ANTIGENeering process are:

| · | Establishment of anin silico database by collecting relevant scientific and patent information for the target disease; |

| · | Safety profile design of the API to completely eliminate antigen-related dangerous features (e.g., viral integration and replication) by molecular modifications using our proprietary ANTIGENeering software; |

| · | Immunological profile design of the API to express broad specificity CD4 and CD8 T cell epitopes using our proprietary eMINER software; and |

| · | In vitro testing of the new API candidates for antigen expression and antigen characterization with our standardized methods. |

The first example is the API in our lead DermaVir product. It is a single pDNA immunogen representing the broadest antigen repertoire among HIV vaccine candidates. This pDNA was ANTIGENeered for the regulated expression of thirteen complete and two non-functional HIV protein antigens. These proteins self-assemble into VLP+ structurally resembling the wild type HIV. We have introduced multiple irreversible safety features by genetic modifications including the complete impairment of integration, reverse transcription, the function of Nef and the 3’LTR. Our epitope analysis, validated with experimentally proven epitopes, predicted that DermaVir Product could present over 3,000 high-affinity T cell epitopes.In silico prediction of high-affinity epitopes revealed the importance of encoding multiple antigens in the pDNA.

The Figure below illustrate the mechanism of action of our API in the DermaVir (from Somogyi et al. Vaccine 2011)

We developed anin silico antigen-specific T cell epitope prediction method for reliable modeling of the immunological potential of our API candidates. Our analysis demonstrated that HIV protein antigens have important differences in the ability to boost CD4 and CD8 T cell responses and revealed the importance of including both structural and regulatory proteins in an HIV vaccine. The other unique advantage of encoding the above mentioned broad antigen repertoire is the formation of VLP+ that further boosts the immune responses.

We have also developed the specification and validated quality control methods for the API. We have licensed a pDNA manufacturing process suitable for in house API manufacturing (1g scale) and also identified several contract manufacturers capable of producing cGMP quality API according to our specification. We have also built our own GMP certified facility to manufacture our API and excipients to mitigate the dependency from the Contract Manufacturing Organization (“CMO”) and to deliver the necessary material for preclinical and clinical trials.

Nanomedicine – Our Proprietary Product Platform

Our products are referred here as the “nanomedicines” according to their unique biophysical and biological features. Our APIs are formulated with a novel polymer excipient to synthetic “pathogen-like” nanoparticles. The nanomedicine formulation is essential to achieve potent antigen expression from the pDNA (“API”) and antigen presentation by dendritic cells. This is critical for the intensification of antigen-specific immune responses in people with chronic diseases.

Our nanomedicine products consist of a pDNA (API) core that covered with a synthetic polymer (polyethylenimine mannose, PEIm). These synthetic “pathogen-like” nanoparticles have the size and the shape of spherical viruses that naturally evolved to deliver nucleic acids to the cells. These nanoparticles deliver the pDNA to the cells similarly to viruses, but much safer because replication cannot occur. The nanoparticles mimic the size, surface properties, cellular entry by endocytosis, endosomal escape, and gene expression of pathogens (eg, viruses), thus allowing direct targeting of the antigen presenting cells of the immune system. The table below compares the properties of our nanoparticles to one of the pathogens (viruses):

| Features | Our “pathogen-like” nanomedicines | Pathogens (virus) |

| Structure | Synthetic polymer coat (PEIm) and pDNA | Protein coat and genetic material |

| Size | 70 to 300 nm | 50 to 500 nm |

| Surface properties | Sugar residues | Glycoproteins |

| Entry into the cell | Endocytosis | Endocytosis and other mechanisms |

Delivery of genetic material to the nucleus | 1. Efficient endosomal escape promoted by PEIm buffering capacity (acts as proton sponge) 2. Intra-cytoplasmic trafficking determined by the degree of association of PEIm and pDNA | Viral protein-mediated mechanisms 1. efficient endosomal escape 2. intra-cytoplasmic trafficking |

| Gene expression | Authentic protein expression profile, Virus-like Particle (VLP+) assembly | Authentic virus protein expression profile, virion assembly |

The formation of “pathogen-like” nanoparticles is required not only for the targeting of dendritic cells, but also to protect the API from cellular degradation. These properties are essential for the efficient expression of the pDNA in dendritic cells of the lymphoid organs, which is required for the boosting of antigen specific T-cells and directing the immune responses to Th1-type. A naked pDNA without formulation to nanoparticles is susceptible to degradation both in extra- and intracellular space. Therefore, the biological activity of our nanomedicines is superior to the technologies which use pDNA without protection. Furthermore, to increase the efficiency of our nanomedicines we have inserted in our technology some targeting elements to ensure that the nanomedicines are targeted to the Langerhans/dendritic cells (mannosylation) and the API arrives at the place of antigen expression (nuclear targeting).

We have identified the key steps of the mechanism of action, supported byin vitro andin vivo experiments and developed a nanomedicine formulation that is optimal for both the intracellular stability and shelf life of our products. We have discovered a new biophysical property, the degree of association (measured by hyperchromicity) that determines the ability of the nanomedicine to escape from the endosome and to release the pDNA at the nuclear site. This parameter, which is in direct relation with the biological activity of the nanomedicine, can be controlled by the means of CMC methods like choosing the optimal ionic strength or pH. Optimizing the structure of these nanomedicines was warranted to improve their biological activity, develop stable formulations, and design an efficient, reproducible manufacturing technology.

The Figure below illustrates the experimentally-proven mechanism of action of our nanomedicine products inside the cells.

We have performed the detailed physico-chemical characterization of the nanomedicine according to the regulatory guidelines using our validated assays, and systematically investigated the variability of nanomedicine components and their relationship with the structure,in vitro biological activity and stability of nanomedicine(Tőke et al. IJP 2010).

The potent antigen expression of the nanoparticles depends on their size, their entry through endocytosis, their ability to escape from the endosome and the release of the plasmid DNA cargo at the nucleus.

We have not only exploited this novel formulation but also implemented “Quality-by-Design” (“QbD”) in our biologic product development, manufacturing and control processes. The FDA encourages companies to implement the concept of QbD into their processes. The focus of QbD is that quality should be built into a product with thorough characterization of the product and understanding the processes by which it is developed and manufactured along with a knowledge of the risks involved in manufacturing and how best to mitigate those risks. We have been developing commercial manufacturing processes and validated quality control methods based on our QbD processes and thorough knowledge on our nanomedicine.

DermaPrep – Our Topical Administration Platform

We have developed the DermaPrep medical device for targetedin vivo delivery of our nanomedicine products to the dendritic cells of the lymph nodes via the Langerhans cells. We obtained the Marketing Approval in the European Union (CE Mark) for our DermaPrep medical device.

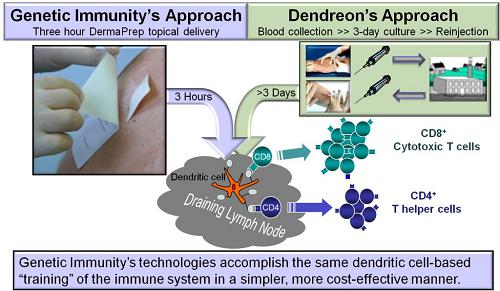

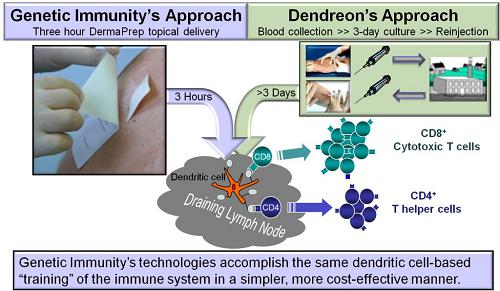

Provenge of Dendreon Corporation (“Provenge”) is the only antigen-specific Immune Therapy that is approved by the FDA. Provenge employs dendritic cells for antigen presentation to boost cellular immunity and eliminate prostate cancer cells. A prostate cancer-specific antigen is targeted to the patient’s own dendritic cells during theex vivo manufacturing processes that Provenge developed for personalized treatment. Earlier, we have successfully utilized a similarex vivo technology to target our nanomedicine into dendritic cells and boosted potent cellular immunity.

Dendritic cell targeting is very important for the efficacy of antigen-specific Immune Therapies. To improve the above described logistically cumbersomeex vivo immunization approach we developed DermaPrep the first dendritic cell-targeting administration device. Unlike thatex vivo technology, our Immune Therapy products can be manufactured in sizeable batches and administered topically with DermaPrep. One immunization procedure takes about 20 minutes and after three hours the patch is removed by the patient. Our filed patent application covers the new medical device for topical administration of liquid formulations. The figure below illustrates ourin vivo Immune Therapy compared to theex vivo technology of our competitors:

DermaPrep employs a skin preparation method that interrupts the stratum corneum facilitating the epidermal penetration of our nanomedicine product applied on the skin surface under our specially designed patch. The Langerhans cells, located in the skin under our patch, then look for pathogens and 800,000 of them has the chance to capture our “pathogen-like” nanomedicine and travel to the local lymph nodes. Here Langerhans cells mature to antigen-presenting dendritic cells. These cells secrete cytokines to induce Th1-polarized antigen-specific precursor/memory T cells that further differentiate into circulating effector or killer cells.

Several preclinical and clinical trials consistently demonstrated that DermaPrep administration was safe, well-tolerated, no greater than grade 2 events ever occurred. The main adverse event of DermaPrep vaccination is mild and transient erythema. The efficiency and reproducibility of the DermaPrep administration procedure was proven in the biodistribution study conducted on different cohorts of rabbits, where more than 50% of the absorbed nanomedicine was targeted to the lymph nodes.

Based on communication with the EMA and the FDA, we understood that there are currently no similar topical administration devices on the market. We obtained the Marketing Approval in the European Union (CE Mark) for our DermaPrep device.

IT - Applied Information Technology

IT innovations have been supporting the discovery, development, manufacturing, and personalized treatment processes of Genetic Immunity. These include the rational antigen design, clinical trial and data management, and matching the patients with the optimal Immune Therapy Product. We utilize the latest IT and physics including semantic web tools, ultrafast femtosecond laser technologies and embed the gathered knowledge in a broad portfolio of innovative, patient tailored therapeutics.

Our clinical development processes are supported by e-CRF solutions for managing Clinical Trials and eCTD conform solutions to optimize the clinical development processes, minimize the errors and time to submit different applications and reports to regulatory agencies word-wide. Our IT team also provides logistic support for the clinical trials by auditing the sites and identifying potential errors of measurements’ methods and errors in data collection and evaluation.

An electronic Labor Management System (“e-LMS”) supporting our processes in CMC provides a competitive advantage in product development by saving time and manpower. e-LMS supports our quality control tests using computerized Standard Operating Procedures (“SOP”). We electronically select the SOP and the required materials

and equipment from our storage. In some cases, experimental data are captured directly from the equipment and stored in our databases. Deviations from protocols are registered and the results are calculated and summarized in a table format. Detailed reports, required by regulatory agencies, can be either printed and filed or stored electronically. Our IT team continuously improves the software solutions to meet our emerging requirement.

The API discovery and documentation process is presently supported by two of our proprietary softwares. TheANTIGENeering software ‘collect and mine’ research data from different sources and publications to support the pre-decision making and to ensure safe and specific antigen design. TheeMINERsoftware is utilized for the determination of the immunological potential (high affinity epitopes) on different human leukocyte antigen (“HLA”) alleles. With greater than 85% probability, we canin silico predict the cellular immune responses of patients treated with our Immune Therapeutic products. We envision that the eMINER will help doctors to match patients with optimal Products and design specific immune diagnostic tools.

Using the above-described tools we have established a DermaVir Product Family to provide every HIV-infected individual an optimal Immune Therapy. HIV is a highly variable virus. We found that the therapeutic effectiveness of DermaVir depends on HIV sequence replicating in the patients and the patients’ genetic background. Our DermaVir Product Portfolio is a family of products containing related HIV-specific antigen sequences characteristic for the different Clades (subtypes) of the virus. To ensure the optimal therapeutic benefit for every patient the treating physician will enter the diagnostic information on the patient’s HIV sequences and genetic background (HLA) into our eMINER software. After analyzing the data the eMINER will select the optimal DermaVir product from the DermaVir Product Family and also calculate the specific T cell epitopes that will play a role in the immune boosting of the individual patient. This way the treating physician can then make an educated decision for selecting the optimal Product for personalized treatment for the patient and could also prescribe the immune monitoring.

Our competitive IT team consists of informaticians and mathematicians who are dedicated to support our business agenda. They are essential part of our patient-driven technology platform, providing us innovative solution to daily challenges including data capture, evaluation and storage of experimental data, website design, literature search, 3D visualization of the skin penetration of our nanomedicines based on fiber-integrated 2-photon microscopy and auditing the data management and data quality on clinical sites. We believe that our integration of bioinformatics and mathematics into our everyday workflow will significantly improve competitiveness because it provides efficient, accessible and high quality data and information collection and distribution throughout the entire research and development and commercialization processes. Our IT team develops project-based, customized services to improve upon the efficiency of our work being performed and to save time and eliminate errors caused by insufficient data management.

Pipeline Product Candidate

Our pipeline product candidate with animal proof of concept, for the treatment of Human Papilloma Virus (“HPV”) infection, is referred to as “HuPaDerm” and our allergen-specific immunotherapy is referred to as “DermAll”. We partnered with the German Cancer Research Center located in Heidelberg (“DKFZ”) to develop HuPaDerm. DKFZ is a world leading research center in tumor virology and Harald zur Hausen was awarded the Nobel Medicine Prize for his work on HPV caused cancer of the cervix. HuPaDerm animal trials are performed in Heidelberg. DermAll has decreased the allergic symptoms by balancing allergen-specific immune responses in mice experiments.

DermAll

Allergic diseases are caused by an immune response induced by different allergens. We believe that our DermAll products will suppress pathogenic immune responses in allergic people by boosting allergen-specific immune responses. This new mechanism is expected to restore a balanced immune response that is normally characteristic for people who do not have any allergic disease. The DermAll Product Portfolio will target several different allergies. The first target will be Egg Allergy (“EA”), since we have already collected preclinical animal data in this DermAll indication suggesting that DermAll-EA treatment can suppress allergic sneezing by balancing immunity. We expect clinical efficacy of specific Immune Therapy that not only suppress allergic rhinitis symptoms but also prevent progression to asthma or atopic dermatitis.

For allergic diseases Immune Therapy offers a vastly different treatment option with disease-modifying potential to traditional symptomatic treatments. In 2009, Grazax became the first Immune Therapy in Europe to gain approval as a ‘disease modifying treatment,’ representing a significant step towards the possibility of a cure. The major limitations of present Immune Therapy approaches include serious safety concerns and cost of treatment, therefore conventional symptomatic treatments continue to be the more popular option (Datamonitor 2010). DermAll Immune Therapy addresses both limitations using our proprietary API design to obtain products with clinically proven excellent safety features, and cost effective manufacturing technology.

HuPaDerm

Development of HuPaDerm Product Portfolio is targeting the treatment of the leading cause of cervical cancer as well as papillomatosis, genital warts and later cancer caused by the different HPVs. Our development strategy for the HuPaDerm Product Portfolio has already been discussed with the EMA. We partnered with DKFZ to develop the HuPaDerm product. DKFZ is a world leading research center in tumor virology. Harald zur Hausen was awarded the Nobel Medicine Prize for his work on HPV caused cancer of the cervix. Zur Hausen, former Scientific Director of DKFZ, is recognized for finding that cervical cancer is caused by viral infections. His research made it possible to develop a vaccine against one of the most frequent cancers in women. Zur Hausen shared the Nobel Prize for Medicine with Françoise Barré-Sinoussi and Luc Montagnier for discovering HIV, the virus that causes AIDS. HuPaDerm animal trials are performed in Heidelberg. DermAll decreased the allergic symptoms by balancing allergen-specific immune responses in mice experiments.

Immune Therapy for Cancer

ProstaDerm Immune Therapy against virus-based prostate cancer

We have also considered developing ProstaDerm Immune Therapy to provide anin vivo alternative to Provenge that is manufacturedex vivo from the patient’s blood. Xenotropic murine leukemia virus-related virus (“XMRV”) is an authentic, newly recognized human retrovirus first identified in prostate cancer tissue. Studies have detected XMRV at different rates in prostate cancer cases (up to 27%) and in patients with chronic fatigue syndrome (CFS; up to 67%) (Silverman et al. Nature 2010). Therefore a pDNA developed for expressing XMRV antigens might effectively be used for the treatment of XMRV-associated prostate cancer.

Immune Therapy against melanoma

Melanoma is a malignant tumor of melanocytes, pigment producing skin cells. Melanoma is less common than other skin cancers. However, it is much more dangerous and causes the majority (75%) of deaths related to skin cancer (Jerant et al. AAFP 2000). This cancer has well characterized and specific biomarker proteins (melanoma-associated antigens, MAGE) therefore melanoma is a possible target indication for our Immune Therapy Platform Technology. ANTIGENeering of a pDNA specific for these antigens could result in a product candidate for patients suffering from melanoma.

Immune Therapies for Emerging Infectious Diseases

A potential extension of our technology could be utilized to develop treatments for infectious diseases like Chlamydia, hepatitis C and B viruses and West Nile Virus where T-cell responses can be directed against cells harboring the intracellular pathogens. Opportunities are under consideration for initiating the development of some of these products at a later stage.

Immune Therapy against West Nile Virus

We are working together with a European Consortium (WINGs) to develop a prophylactic and therapeutic vaccine against the West Nile virus. The project is led by the Fraunhofer Institute IZI in Leipzig, Germany, and is funded from a $3.5M European Union grant.

Our role in the project is to provide the nanoformulation technology for the vaccine candidates and the transdermal delivery technology for the administration of the vaccine. As industrial partner of the consortium we are also responsible for the clinical development and the commercialization if the animal studies are successful.

GRANTS

In 2005 we received a $1 million grant from the EU, which funded Phase I clinical trials of DermaVir in Hungary. Since being awarded a $7 million grant from the Hungarian government in 2005, we have been applying the funds to develop product manufacturing technology in Hungary, build a pilot manufacturing facility and develop pipelines in collaboration with Hungarian academic institutions pursuant to a Consortium Agreement establishing the Vaccine Therapy Cluster, a collaboration between the Company and the University of Szeged. As a result, our product development, manufacturing, information technology, and clinical operations have been established in Budapest. The business, financial and commercial operations remain in the U.S. In 2009, the DVCLIN01 consortium we lead received an additional grant of $4.5 million to perform a Phase II clinical study with DermaVir in Germany. The results of this study were presented at the AIDS International Conference in Vienna July, 2010. In 2010, the FIBERSCN consortium led by R&D Ultrafast Lasers Kft. received a grant of $3 million to investigate DermaVir immunization technology with fiber integrated 2-photon microscopy. We investigated the penetration of DermaVir to the skin and uptake by epidermal Langerhans cells. The West Nile Shield project (“Wings”) consortium led by Fraunhofer Institute won a $3.5 million grant to develop novel approach for prophylactic and therapeutic vaccines against West Nile Virus. As an active member of this consortium we provide nanomedicine formulation and our DermaPrep device for transdermal delivery of potential West Nile Virus vaccine candidates.

Using the above funding, we have developed improved formulation and scalable manufacturing technology for our biological product portfolio; conducted preclinical animal studies to demonstrate that our proprietary technology is suitable for additional product development including DermAll and ChlamyDerm; developed regulatory strategy for obtaining Marketing Approval for our DermaVir Product Portfolio as personalized Immune Therapy; and designed an allergen-specific Immune Therapy Product Portfolio.

INTELLECTUAL PROPERTY

Protection of our intellectual property and proprietary technology is a strategic priority for our business. We rely on a combination of license agreements and patent, trademark, copyright and trade secret laws along with institutional know-how and continuing technological advancement to develop and maintain our competitive position. Our ability to protect and use our intellectual property rights in the continued development and commercialization of our technologies and products, operate without infringing the rights of others, and prevent others from infringing our rights, is crucial to our continued success. We will be able to protect our products and technologies from unauthorized use by third parties only to the extent that they are covered by valid and enforceable patents, trademarks or copyrights, or are effectively maintained as trade secrets, know-how or other proprietary information. Our policy is to seek U.S. and international patent protection for technological developments that we believe will enhance the market position of our product candidates and methods of using our product candidates.

Present patents protect DermaVir until 2020.Ourfilingsrepresent(1)ourHIVplasmidDNAmaterial;(2) theformulationofDermaVir;(3)thetopical deliveryofgenesintoantigen-presentingcellsoftheskin;and(4)thebroadertechnologyrelatedtoraisingan immuneresponseviaexpressionoftheDNA-encodedantigensinantigenpresentingcells.Thefirst ofourpatents expiresin2020.

For subtype-specific DermaVir Product Family we plan to file a new patent application for the API that would protect our DermaVir Products until 2031 when it is issued. Filing the new patent application on API designed with our ANTIGENeering technology is our strategy for all the pipeline products.

Tosupplementourpatentportfolio,wealsodependontheskill,knowledgeandexperienceofourscientific andtechnicalpersonnel,aswellasthatofouradvisors,consultants,andothercontractors.Tohelpprotectour proprietaryknow-howandinventionsforwhichpatentsmaybedifficulttoenforce,werelyon tradesecret protectionandconfidentialityagreementstoprotectourinterests.Werequireallemployees, consultants,advisors, andothercontractorstoenterintoconfidentialityagreementsthatprohibitdisclosureofconfidentialinformation and,whereapplicable,requiredisclosureandassignmenttousofideas,developments,discoveriesandinventions importanttoourbusiness.

WehaveaU.S.federaltrademarkregistrationfor“GeneticImmunity.”

MARKET OPPORTUNITIES

Therapeutic Vaccine Market for HIV/AIDS

According to the Joint United Nations Programme on HIV/AIDS (“UNAIDS”), about 33.3 million people are living with HIV/AIDS in the world, including 2.5 million children, with 2.3 million of them in North America and Europe. During 2009, 100,000 patients were newly infected and 35,000 patients were reported to have died from AIDS in North America and Europe. The rise in prevalence has been driven by a number of factors, including a growing number of heterosexual transmissions, immigration from countries with a high HIV prevalence, and a growth in high-risk sexual behavior. There is strong evidence of resurgent HIV epidemics among men who have sex with men in North America and in Western Europe. Immigrants living with HIV have become a growing feature of the epidemics in several countries in Europe. Heterosexual transmission accounts for about half of the people newly infected with HIV in Central Europe (2010 UNAIDS Report). There are significant emerging markets including Eastern Europe, Russia, India and China with significant income and are expected to take actions to slow down their fast growing HIV epidemics. Therefore, additional market opportunities for HIV/AIDS treatments are projected to emerge.

The patient population on HAART is already demanding simplification of treatment that can be achieved by combining several drugs into one pill. The development of novel original antiretroviral drugs will be more and more expensive and more difficult to get approved. In 2009, the HIV market generated sales of about $12 billion and is expected to grow up to $15.6 billion in 2015 (Datamonitor HIV market forecast (06/2010)). This growth has been driven by the launch of several new fixed-dose combinations such as Truvada and Epzicom™, and a new class of antiretrovirals known as the entry inhibitors. The combination of several drugs in one pill improves the tolerability of HAART.

When DermaVir enters the market, there will be greater than 28 generic antiretroviral drugs on the market providing treating physicians a diverse source of inexpensive and potent drugs for managing their patients. According to recent treatment recommendations, doctors will start treating their patients earlier with HAART and as a result, more HIV-infected patients will live a longer life. We expect that by 2016 a significantly larger patient population will be treated with HAART due to the inexpensive and potent generics. These patients will be eligible for DermaVir immune intensification and that might further increase the potential market for DermaVir.

Market opportunity for DermaVir

Market demand for DermaVir will be driven by the demand for (1) a cure and (2) simplified treatment options by HIV-infected patients. Such patients seek safe drug sparing treatment options that fully control their virus, decrease of toxicities, immune boosting and cure of HIV disease. We believe that the DermaVir immune intensification will be the first on the market offering significant therapeutic benefit over HAART and a potential cure (remission) for some of the patients who achieved the maximal immune intensification to control HIV disease. Due to decreasing costs and better access to generic HAART, the treated patient population will significantly grow. The new state of the art treatment will be DermaVir in combination with generic HAART. Doctors will use our eMINER to match patients with their optimally effective DermaVir selected from our product portfolio and prescribe the personalized diagnostic assay to monitor when the HAART can be simplified by dropping one, two or even all three components. We believe that the new, potent and expensive antiretroviral drugs will be very important for salvage and will be used for patients failing generic HAART.

We believe that after market entry, DermaVir Immune Therapy will be the new state of the art treatment. Since HIV drugs decrease immune responses and do not provide a cure, DermaVir immune boosting could be added to every HAART-treated patients. The minimum effect of DermaVir would be to boost the patients’ own immune system’s responses to eliminate infected cells from the body. But additional benefits expected for DermaVir treated patients are the decrease in the number of drugs and consequently such patient will suffer less toxicity. DermaVir treatment will provide a hope for cure; in some DermaVir-treated patients, immune boosting can result in remission allowing the patient to lead a healthy life in the absence of HIV drug treatment (for some years). If the HIV rebounds because the immune system cannot fight any longer, the patient resume to take the drugs and his/her life will not be in danger.

As a new state of the art immune boosting therapy, DermaVir treatment should be cost effective. Saving on drugs and cost of treatment could support insurance reimbursement. It is conservative to estimate that annual DermaVir treatment will be lower than the cost of HAART. We believe this can represent up to over $5 billion DermaVir sales for the seven major markets per year, based on 30% market penetration. In the event competitors for a cure enter into the market this figure will decrease. DermaVir is one of the best-characterized HIV therapeutic vaccine product candidates (solid randomized and controlled Phase II clinical data, commercial manufacturing methods and controls) and may have the highest chance to obtain first marketing approval.

We believe that in the not too distant future DermaVir will have significant sales outside of the major markets based on the high unmet need. These markets include the 22 million people, including children, in sub-Saharan Africa. However, developing countries such as Brazil, China, India and Russia could become significant markets.

The global HIV drug market size is expected to grow to $15.6 billion by 2015 with approximately 35 million people infected with the virus. Of this amount, Europe represents approximately 2.3 million HIV infected people. Russia, our next potential approval target, represents another 1 million infected people.

Initially we will aim to treat 5% of the European population, or approximately 130,000 individuals (of the 2.3 million total infected.) Current HAART based treatments cost approximately 12,000 EURO a year per patient. Based on our initial pricing model, and assuming a 5% market penetration, this represents a EURO 1 billion market opportunity per year for DermaVir in Europe alone.

Competition

In the field of HIV treatment, several immune therapies are under development because there is a substantial unmet medical need to find new treatment options for patients who have developed resistance to the current antiviral drugs and for patients who cannot tolerate life-long daily drug treatment. A description of such immune therapies follows:

| i. | Broad-Spectrum Immune Therapies |

The rationale of broad-spectrum Immune Therapy originated from the successful use of interferon-alpha for the treatment of another chronic infectious disease, hepatitis C. The best available current treatment for chronic hepatitis C (peg-interferon alpha plus ribavirin) leads to an overall sustained response rate of approximately 70%. In HIV infection, however, no viral load suppression after current drug treatment interruption can be achieved. The current, broad-spectrum immune therapies described below are not specific to any disease:

| · | Hemispherx Biopharma is evaluating the safety and activity of orally administered low dose interferon alfa to modulate general, nonspecific immune responses in subjects infected with HIV who have not yet demonstrated clinical symptoms of immune suppression. |

| · | Interleukin-2 (IL-2, Aldesleukin, Proleukin) is made by Novartis (Chiron) and Amgen. This drug is currently approved for the treatment of certain types of blood cell cancers (e.g., specific types of leukemia). It is considered an experimental drug for HIV-related therapy because the FDA has not yet evaluated it for the HIV indication. Two large efficacy trials in HIV patients (SILCAAT and ESPRIT) were conducted recently. However, despite a substantial and sustained increase in the CD4+ cell count, as compared with antiretroviral therapy alone, Interleukin-2 plus antiretroviral therapy yielded no clinical benefit in either study. |

| · | CYT107, Cytheris’s recombinant human Interleukin-7 developed as a general immune system booster. The company has four ongoing Phase I/II or Phase II studies with CYT107. According to the company’s latest press release, dated March 1, 2011, which reported the results of INSPIRE2 Phase IIa study, CYT107 was able to reconstitute CD4 T-cells in chronically HIV-1 infected patients whose CD4 T-cell counts remained low despite treatment with anti-retroviral-therapies (HAART). |

| · | Inovio has been developing a new DNA administration technology, called Electroporation, for the intracellular delivery of various immunotherapeutic DNA solutions. Resultant gene expression matched or exceeded that achieved using viral or lipid delivery methods, without side effects that hamper these approaches. The device is being tested in Phase I/II and Phase II trials. |

| ii. | HIV-Specific Immune Therapies |

The rationale for HIV-specific immune therapies is to amplify HIV-specific immune responses present during chronic infection to control viral replication. Such antiviral immune responses provide the balance between infection and the immune system and in some cases the immune system wins over the infection (e.g., most of the non-progressors), but in the majority of the cases, HIV overwhelms the immune system resulting in disease progression and AIDS. Immune Therapies have been developed for viral, parasitic, cancer, and allergic diseases. Antigen-specific immune therapeutic approaches are (1) based on antibodies that specifically bind the target antigens, and (2) T-cells that can eliminate HIV-infected cells from the body. Our competitors are the most promising therapeutic vaccines according to the Datamonitor report: R&D Trends: HIV (Reference Code: HC00083-007), published in March 2011. Each of our competitor’s products described below areex vivo or injected by needle and not topically delivered like DermaVir:

Phase II Immune Therapy candidates

| · | Vical, in collaboration with the NIH and Merck & Co., is developing a DNA vaccine, VRC DNA/rA, for the treatment and prevention of HIV using its naked DNA gene delivery technology. The vaccine is currently in Phase II clinical development (NCT00865566, 2011; www.clinicaltrials.gov) (Vical, 2011) |