City National Rochdale High Yield Alternative Strategies Master Fund LLC (the "Master Fund") is a closed-end, non-diversified management investment company that was organized as a limited liability company under the laws of the State of Delaware on September 11, 2006 and serves as a master fund in a master feeder structure. City National Rochdale High Yield Alternative Strategies Fund LLC and City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “Feeder Funds”) serve as the feeder funds in the master feeder structure. Interests in the Master Fund are issued solely in private placement transactions that do not involve any "public offering" within the meaning of Section 4(2) of the Securities Act of 1933, as amended (the "1933 Act"). Investments in the Master Fund may be made only by U.S. and foreign investment companies, common or commingled trust funds, organizations or trusts described in Sections 401(a) or 501(a) of the Internal Revenue Code of 1986, as amended, or similar organizations or entities that are "accredited investors" within the meaning of Regulation D under the 1933 Act. The Master Fund is a registered investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

City National Rochdale, LLC (the “Manager” or "Adviser") is the investment adviser to the Master Fund. City National Rochdale, LLC is a subsidiary of City National Bank, and each are wholly-owned subsidiaries of RBC USA Holdco Corporation, a wholly-owned indirect subsidiary of Royal Bank of Canada. The Manager delegated sub-investment advisory responsibilities to PineBridge Investments LLC (the “Sub-Adviser”) with respect to the Master Fund until December 31, 2016. After this date, the Manager became the sole investment adviser to the Master Fund.

The Master Fund seeks to achieve its objective by investing substantially all of its assets in the securities of privately placed investment vehicles, typically referred to as hedge funds (“Hedge Funds" or "Investment Funds”) that pursue a variety of high yield income generating strategies.

The Master Fund’s investment objective is to generate income from investments in higher yielding investments with lower credit quality and higher volatility than investment grade fixed income securities. “Lower credit quality” in this objective means investments rated below BBB, and “higher volatility” means the fluctuations in principal will be greater than the fluctuations in price associated with investment grade fixed income securities. Under normal circumstances, at least 80% of the Master Fund’s total assets will be invested either directly, or indirectly through Investment Funds, in a variety of high yield income generating investments.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Master Fund.

Basis of Presentation and Use of Estimates

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”). The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Investments Valuation

Investments in Investment Funds are stated and recorded at fair value as determined in good faith by the Fair Value Committee in accordance with US GAAP using the Net Asset Value (“NAV”) as reported by the management of each respective alternative investment fund. Financial Accounting Standards Board (FASB) guidance provides for the use of NAV as a “Practical Expedient” for estimating fair value of alternative investments which (a) do not have a readily determinable fair value and (b) either have the attributes of an investment company or prepare their financial statements consistent with the measurement principles of an investment company. Such values generally represent the Master Fund's proportionate share of the net assets of the Investment Funds as reported by the Hedge Fund Managers. Accordingly, the value of the investments in Investment Funds are generally increased by additional contributions to the Investment Funds and the Master Fund's share of net earnings from the Investment Funds, and decreased by distributions from the Investment Funds and the Master Fund's share of net losses from the Investment Funds.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 2. | Significant Accounting Policies (continued) |

Investment Valuations (continued)

The Sub-Adviser reviews the details of the reported information obtained from the Hedge Fund Managers and considers: (i) the measurement date of the NAV provided, (ii) the basis of accounting and, (iii) in instances where the basis of accounting is other than fair value, fair valuation information provided by the Hedge Fund Managers. The Sub-Adviser may make adjustments to the NAV of various Investment Funds to obtain the best estimate of fair value, which is consistent with the measurement principles of an investment company. Any determinations made by the Sub-Adviser will be reviewed and approved by the Adviser’s Fair-Value Committee, which has been designated by the Board to make all necessary fair value determinations.

The Master Fund has not maintained any positions in derivative instruments or directly engaged in hedging activities.

Fair Value Measurements

The Master Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Master Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 2. | Significant Accounting Policies (continued) |

Fair Value Measurements (continued)

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Master Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

Investments measured using the NAV as a practical expedient are not classified within the fair value hierarchy.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. See Note 3 – Investments.

Investment Income Recognition

Purchases and sales of securities are recorded on a trade-date basis. Realized gains and losses on Investment Funds are recognized using the specific identification method. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses are included in the determination of income.

Fund Expenses

The expenses of the Master Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; management fees; an incentive fee; costs of computing the Master Fund's net asset value; costs of insurance; registration expenses; due diligence, including travel and related expenses; expenses of meetings of the Board and officers; all costs with respect to communications to Members; and other types of expenses as may be approved from time to time by the Board.

Income Taxes

The Master Fund’s tax year end is December 31. The Master Fund is treated as a partnership for Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

The Master Fund has adopted authoritative guidance on uncertain tax positions. The Master Fund recognizes the effect of tax positions when they are more likely than not of being sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual or which could affect its liquidity or future cash flows. As of March 31, 2017, the Master Fund’s tax years 2014 through 2016 remain open and subject to examination by relevant taxing authorities.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 2. | Significant Accounting Policies (continued) |

Subsequent Events

The Master Fund has adopted financial reporting rules regarding subsequent events, which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. The Master Fund offered to purchase up to $12,000,000 of Members’ interests in the Master Fund properly tendered at a price equal to the net asset value of such interests as of April 30, 2017. For Members’ interests tendered, each security holder received a promissory note entitling the security holder to a cash amount equal to the net asset value of their interests calculated as of April 30, 2017, upon the terms and subject to the conditions set forth in the Offer to Purchase dated March 30, 2017. The offer terminated at 5:00 p.m., Eastern Time, on April 28, 2017. Pursuant to the Offer to Purchase, Members’ interests of approximately $7.2 million were tendered and accepted by the Master Fund.

Capital Accounts

Net profits or net losses of the Master Fund for each month are allocated to the capital accounts of Members as of the last day of each month in accordance with Members' respective investment percentages of the Master Fund. Net profits or net losses are measured as the net change in the value of the net assets of the Master Fund during a fiscal period, before giving effect to any repurchases of interest in the Master Fund, and excluding the amount of any items to be allocated to the capital accounts of the Members of the Master Fund, other than in accordance with the Members' respective investment percentages.

Prior to the end of each quarter, the Master Fund receives Member contributions with an effective subscription date of the first day of the following month.

The Master Fund, in turn, makes contributions to certain Hedge Funds, which have effective subscription dates of the first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

The following are the classes of investments grouped by the fair value hierarchy for those investments measured at fair value on a recurring basis at March 31, 2017:

| | | Quoted Prices in Active Markets for Identical Assets | | | Significant Other Observable Inputs | | | Significant Unobservable Inputs | | | | |

Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

| | | | | | | | | | | | | |

| Alternative Investment Funds ^ | | $ | - | | | $ | - | | | $ | - | | | $ | 30,319,938 | |

| Short-Term Investment - Money Market Funds | | | 7,566,001 | | | | - | | | | - | | | | 7,566,001 | |

| Total Investments | | $ | 7,566,001 | | | $ | - | | | $ | - | | | $ | 37,885,939 | |

| | | | | | | | | | | | | | | | | |

^ The alternative investments were valued using the practical expedient and have not been classified in the fair value hierarchy.

The Fund did not invest in any Level 3 securities and there were no transfers into or out of Level 1, Level 2 or Level 3 fair value measurements at March 31, 2017, as compared to their classification from the previous annual report.

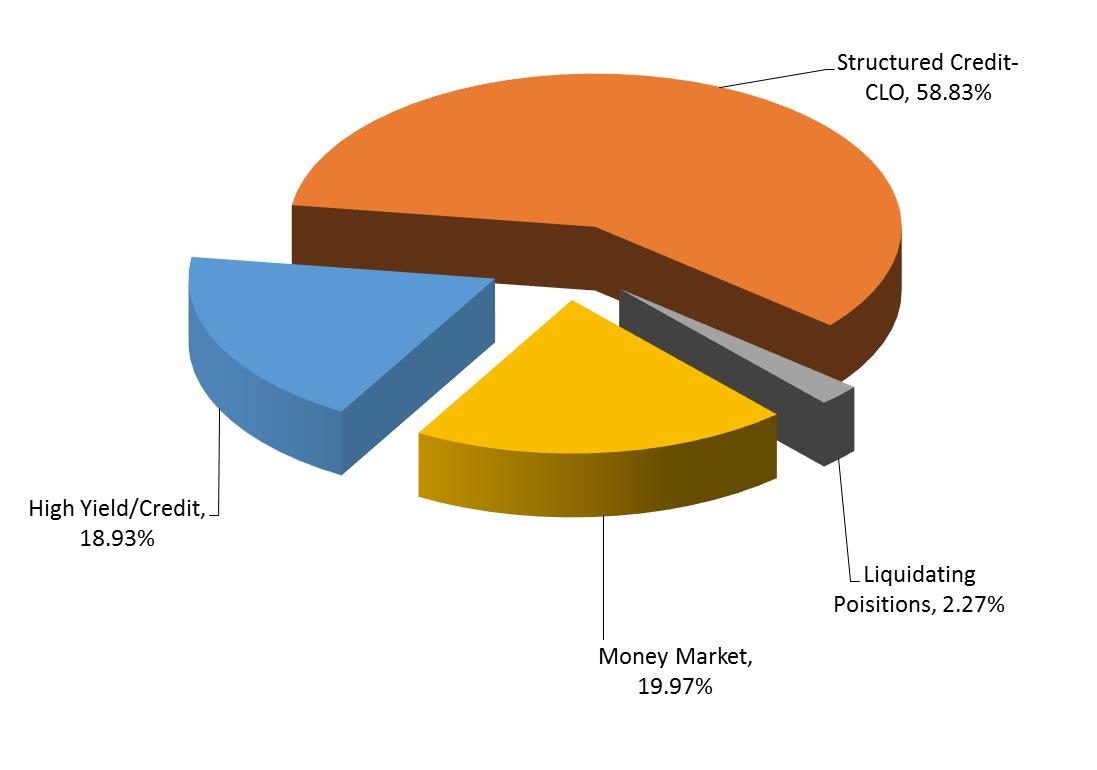

The following table presents additional information for investments measured using the NAV practical expedient:

Alternative Investment Funds | | Fair Value at March 31, 2017 | | | Unfunded Commitments | | | Redemption Frequency | | | Redemption Notice Period | |

| | | | | | | | | | | | | |

| High Yield / Credit | | $ | 7,170,593 | | | $ | - | | | Quarterly | | | | 90 | |

| Structured Credit – CLO | | | 12,650,441 | | | | - | | | Quarterly | | | | 90 | |

| Structured Credit – CLO | | | 9,639,561 | | | | - | | | | * | | | | * | |

| Liquidating Positions | | | 859,343 | | | | - | | | | ** | | | | ** | |

| Total | | $ | 30,319,938 | | | $ | - | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

* SEIX CLO Management LP has a five year re-investment period and a subsequent wind down. This investment is long-term and illiquid.

** A Special Investment has been established for GoldenTree Partners LP. This investment is long-term and illiquid.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 4. | Commitments and Other Related Party Transactions |

Management and Incentive Fees

Under the supervision of the Master Fund’s Board and pursuant to an investment management agreement (“Investment Management Agreement”), City National Rochdale LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, serves as the Manager for the Master Fund. The Manager is authorized, subject to the approval of the Master Fund’s Board, to retain one or more other organizations, including its affiliates, to provide any or all of the services required to be provided by the Manager to the Master Fund or to assist in providing these services.

The Manager engaged the Sub-Adviser to provide sub-investment advisory services from April 1, 2016 to through December 31, 2016. The Sub-Adviser had investment discretion to manage the assets of the Master Fund and was responsible for identifying prospective Hedge Funds, performing due diligence and review of those Hedge Funds and their Hedge Fund Managers, selecting Hedge Funds, allocating and reallocating the Master Fund’s assets among Hedge Funds, and providing risk management services, subject to the general supervision of the Manager.

From April 1, 2016 through December 31, 2016 the investment management fee was shared by the Manager and the Sub-Adviser, and the Master Fund paid the Manager an investment management fee at an annual rate equal to 1.25% of the Master Fund’s month-end net assets, including assets attributable to the Manager (or its affiliates) and before giving effect to any repurchases by the Master Fund of Member interests. On November 30, 2016 the Board voted to reduce the management fee rate to 0.75% effective January 1, 2017. The investment management fee is accrued monthly and paid to the Manager out of the Master Fund’s assets.

The Manager paid a fee to the Sub-Adviser at a rate equal to 40% of the amount of the fee earned by the Manager pursuant to the Sub-Investment Advisory Agreement effective from April 1, 2016 through December 31, 2016.

The Sub-Adviser was entitled to receive a performance-based incentive fee equal to 10% of each Member’s net profits (taking into account net realized and unrealized gains or losses and net investment income or loss), if any, in excess of the non-cumulative “Preferred Return,” subject to reduction of that excess for prior losses that have not been previously offset against net profits (the “Incentive Fee”). The Incentive Fee was calculated and paid at the Feeder Fund level. The Incentive Fee was accrued monthly and was generally payable annually on a calendar year basis. The Preferred Return was a non-cumulative, annual return equal to the weighted average returns of a composite benchmark consisting of 50% of the Barclays Capital U.S. Corporate High Yield Index (Total Return) and 50% of the Credit Suisse Institutional Leveraged Loan Index. Effective January 1, 2017 the Fund no longer charges an Incentive Fee given the Manager became the sole adviser to the Master Fund.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 4. | Commitments and Other Related Party Transactions (continued) |

Administration Fee

U.S. Bancorp Fund Services, LLC (the “Administrator”) acts as the Funds’ Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Funds; prepares reports and materials to be supplied to the Members of the Feeder Funds; monitors the activities of the Funds’ custodian, transfer agent and accountants; coordinates the preparation and payment of the Funds’ expenses and reviews the Funds’ expense accruals. For its services, the Administrator receives a monthly fee from the Master Fund at an annual rate of 0.12% for the first $150 million, 0.10% for the next $150 million and 0.08% thereafter of average net assets, with a minimum annual fee of $100,000.

Expense Reimbursement

The Manager has contractually agreed to waive and/or reimburse the Master Fund’s expenses to the extent needed to limit the Master Fund’s annual operating expenses combined with the annual operating expenses of the Feeder Funds. From April 1, 2016 through December 31, 2016 the annual operating expenses of each Feeder Fund were limited to 2.25% of net assets. Beginning January 1, 2017 the annual operating expenses of each Feeder Fund were limited to 1.75% of net assets. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. A Feeder Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed.

The following is a schedule of when fees may be recouped by the Manager with respect to the Feeder Funds:

| | City National Rochdale High Yield Alternative Strategies Fund LLC | | | City National Rochdale High Yield Alternative Strategies Fund TEI LLC | | | Expiration | |

| | $ | 8,893 | | | $ | 10,803 | | | March 31, 2018 | |

| | | 35,122 | | | | 37,704 | | | March 31, 2019 | |

| | | 33,547 | | | | 38,225 | | | March 31, 2020 | |

| | $ | 77,562 | | | $ | 86,732 | | | | |

| | | | | | | | | | | |

No accrual has been made for such contingent liability because of the uncertainty of the reimbursement from the Feeder Funds.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 5. | Investment Risks and Uncertainties |

Alternative Investments consist of non-traditional, not readily marketable investments, some of which may be structured as offshore limited partnerships, venture capital funds, hedge funds, private equity funds and common trust funds. The underlying investments of such funds, whether invested in stock or other securities, are generally not currently traded in a public market and typically are subject to restrictions on resale. Values determined by investment managers and general partners of underlying securities that are thinly traded or not traded in an active market may be based on historical cost, appraisals, a review of the investees’ financial results, financial condition and prospects, together with comparisons to similar companies for which quoted market prices are available or other estimates that require varying degrees of judgment.

Investments are carried at fair value provided by the respective alternative investment’s management. Because of the inherent uncertainty of valuations, the estimated fair values may differ significantly from the values that would have been used had a ready market for such investments existed or had such investments been liquidated, and those differences could be material.

| 6. | Concentration, Liquidity and Off-Balance Sheet Risk |

The Master Fund invests primarily in Hedge Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Hedge Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Hedge Funds may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Hedge Funds' net asset value.

Various risks are also associated with an investment in the Master Fund, including risks relating to the multi-manager structure of the Master Fund, risks relating to compensation arrangements and risks relating to limited liquidity, as described below.

Redemption restrictions exist for Hedge Funds whereby the Hedge Fund Managers may suspend redemptions either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuation issues or market conditions.

Redemptions are currently restricted for two Hedge Funds with fair value of $10,498,904 at March 31, 2017 as noted in the Schedule of Investments.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

March 31, 2017

| 6. | Concentration, Liquidity and Off-Balance Sheet Risk (continued) |

In the normal course of business, the Hedge Funds in which the Master Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swap contracts. The Master Fund's risk of loss in these Hedge Funds is limited to the value of its own investments reported in these financial statements by the Master Fund. The Master Fund itself does not invest directly in securities with off-balance sheet risk.

| 7. | Investment Transactions |

For the year ended March 31, 2017 (excluding short-term securities), the aggregate purchases and sales of investments were $10,000,000 and $15,952,695, respectively.

| 8. | New Accounting Pronouncement |

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the impact that the adoption of the amendments to Regulation S-X will have on the financial statements and related disclosures.